Form 10K - 04.30.13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| | |

R | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended April 30, 2013 |

OR |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from ______ to ______ |

Commission file number 01-34443

FLOW INTERNATIONAL CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

Washington | | 91-1104842 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

23500 64th Avenue South, Kent, WA | | 98032 |

(Address of principle executive offices) | | (Zip Code) |

| | |

Registrant's telephone number, including area code 253-850-3500 |

| | |

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, $0.01 Par Value, Common Share Purchase Rights | | NASDAQ Global Market |

| | |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes R No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

| | | |

Large accelerated filer o | Accelerated filer R | Non-accelerated filer o | Smaller reporting company o |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes o No R

The aggregate market value of the registrant's common stock held by non-affiliates of the registrant was approximately $152,261,857 as of October 31, 2012, the last business day of the registrant's most recently completed second fiscal quarter, based on a closing price of $3.32 per share as quoted by the NASDAQ Stock Market as of such date. The determination of affiliate status is not necessarily a conclusive determination for other purposes.

The registrant had 48,785,906 shares of Common Stock, $0.01 par value per share, outstanding as of July 23, 2013.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days of the end of the fiscal year ended April 30, 2013 (the “2013 Proxy Statement”). Portions of such proxy statement are incorporated by reference into Part III of this Form 10-K. With the exception of such portions of the 2013 Proxy Statement expressly incorporated by into this Annual Report on Form 10-K by reference, such document shall not be deemed filed as part of this Annual Report on Form 10-K.

FLOW INTERNATIONAL CORPORATION

INDEX

|

| | | | | | | | |

| | | | | | | | |

| | | | Page |

| | | | | | | | |

|

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

|

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

|

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

|

| | | | | | | | |

EX-21.1 |

EX-23.1 |

EX-31.1 |

EX-31.2 |

EX-32.1 |

EX-99.1 |

Forward-Looking Statements

Forward-looking statements in this report, including without limitation, statements relating to our plans, strategies, objectives, expectations, intentions, and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words "may," "expect," "believe," "anticipate," "estimate," "plan" and similar expressions are intended to identify forward-looking statements. These statements are no guarantee of future performance and involve certain risks, assumptions, and uncertainties that are difficult to predict. Therefore, actual outcome and results may differ materially from what is expressed or forecasted in such forward-looking statements.

We make forward-looking statements of our expectations which include but are not limited to the following examples:

| |

• | statements regarding the effects of global financial and economic conditions, credit and equity market volatility and continued fluctuations in the global economy and the impact this may have on our business and financial condition; |

| |

• | statements regarding our belief that the diversity of our products and geographic presence along with the expansion of our indirect sales channel will continue to minimize the impact that any one country or economy has on our consolidated results; |

| |

• | statements regarding our technological leadership position and our belief that our technological capabilities for developing products with superior characteristics provide us potential growth opportunities as well as a competitive advantage; |

| |

• | statements regarding our belief that we offer the broadest product line and provide a superior product at every price point; |

| |

• | statements regarding our continued investments in lead generation, product enhancements, new product development and in our employees which we believe are critical to achieving our strategic objectives; |

| |

• | statements regarding our belief that we are well positioned to continue growing our business organically over the long-term by enhancing our product offerings and expanding our customer base through our global channels of distribution; |

| |

• | statements regarding our expectation that our new products will have strong contributions to our results in fiscal year 2014 and beyond; |

| |

• | statements regarding our recently implemented plans to achieve approximately $13 million in annualized cost reductions, which includes targeted plans to reduce product costs and lower operating expenses, with the full annualized run rate of savings in place by the end of fiscal year 2014; |

| |

• | statements regarding our ability to mitigate the risk of higher commodity and fuel prices; |

| |

• | statements regarding our belief that our channels of distribution are unparalleled in our industry and our ability to effectively manage them; |

| |

• | statements regarding the reasons for variations in our segment revenues and gross margins; |

| |

• | statements regarding our use of cash, cash needs, generation of cash through operations, and ability to raise capital and/or use our Credit Facility; |

| |

• | statements regarding our belief that our existing cash and cash equivalents, along with the expected proceeds from our operations and available amounts under our Credit Facility, will provide adequate liquidity to fund our operations through at least the next twelve months; |

| |

• | statements regarding our ability to fund future capital spending through cash from operations and/or from external financing; |

| |

• | statements regarding our ability to repay our subordinated notes in future periods; |

| |

• | statements regarding our ability to meet our debt covenants in future periods; |

| |

• | statements regarding anticipated results of potential or actual litigation; |

| |

• | statements regarding our review of strategic alternatives to enhance shareholder value, including, among other things, the potential sale of the Company or other transaction; |

| |

• | statements regarding our belief that the we have been issuing restricted stock pursuant to our 2005 Equity Incentive Plan ("2005 Plan") under an exemption from registration under the 1933 Act, and our plan to file a registration statement on Form S-8 subsequent to filing this annual report on Form 10-K to register future exercises of stock options and future issuances of securities under the 2005 Plan; and |

| |

• | statements regarding the realizability of our deferred tax assets and our expectation that our unrecognized tax benefits will not change significantly within the next twelve months. |

There may be other factors not mentioned above or included in our SEC filings that may cause our actual results to differ materially from those in any forward-looking statement. You should not place undue reliance on these forward-looking

statements. We assume no obligation to update any forward-looking statements as a result of new information, future events or developments, except as required by federal securities laws.

PART I

Item 1. Business

General Business Overview

Flow International Corporation and its subsidiaries (hereinafter collectively referred to as “the Company”, “we”, or “our” unless the context requires otherwise) is a global technology-based manufacturing company committed to providing a world class customer experience. We offer technological leadership and exceptional waterjet performance to a wide-ranging customer base, benefiting many cutting and surface preparation applications, delivering profitable waterjet solutions, and dynamic business growth opportunities to our customers. Our ultrahigh-pressure water pumps generate pressures from 40,000 to over 94,000 pounds per square inch (psi) and power waterjet systems that are used to cut materials, remove coatings, and prepare surfaces for coating. Waterjet cutting and cleaning is a fast-growing alternative to traditional methods, such as lasers, saws, knives, shears, plasma, electrical discharge machining ("EDM"), routers, drills, soda blasting and abrasive blasting techniques, and has uses in many applications from food and paper products to steel and carbon fiber composites.

This portion of our Form 10-K provides detailed information about who we are and what we do. Unless otherwise specified, current information reported in this Form 10-K is as of, or for the fiscal year ended April 30, 2013.

Business Segments

We report our operating results to our Chief Executive Officer, who is the chief operating decision maker, based on market segments which is consistent with management's long-term growth strategy. Our reportable segments are Standard and Advanced. Segment results are measured based on revenue growth and gross margin.

Standard segment. Includes sales and cost of sales related to our cutting, surface preparation and cleaning systems using ultrahigh-pressure water pumps as well as parts and services to sustain these installed systems. Systems included in this segment do not require significant custom configuration.

Advanced segment. Includes sales and cost of sales related to our complex aerospace and automation systems which require specific custom configuration and advanced features, including robotics, to match unique customer applications.

Financial information about our segments is included in Note 14 - Business Segments and Geographic Information of the Notes to the Consolidated Financial Statements included in Item 8, Financial Statements and Supplementary Data.

Products and Services

Our mission is to provide the highest value customer-driven waterjet cutting and surface preparation solutions. We strive to improve our customers' profitability through the development of innovative products and services that expand our customers' markets and increase their productivity.

The primary components of our product line include versatile waterjet cutting and surface preparation systems which provide total system solutions for many materials including metal, stone, tile, composites, food, paper, rubber, structural foam and many more. We have a wide variety of customer types ranging from small job shops to major industrial companies.

Our ultrahigh-pressure technology has two broad applications: cutting and surface preparation.

Waterjet Cutting. The primary application of our ultrahigh-pressure water pumps is cutting. In cutting applications, ultra high-pressure pumps rated from 40,000 to 94,000 psi pressurize water and force it through a small orifice, generating a stream of water traveling at supersonic speeds. In order to cut metallic and other hard materials, an abrasive substance, such as garnet, is added to the waterjet stream creating an abrasive jet. Our cutting systems typically include a robotic manipulator that moves the cutting head, either 2-dimensionally or 3-dimensionally. Our systems may also combine waterjet with other applications such as material handling, conventional machining, routing inspection, assembly, and other automated processes. Our waterjet cutting systems cut virtually any shape in a single step with edge quality free of heat or mechanical stress and that usually requires no secondary finishing. Waterjets are proven to be very productive solutions for cutting a wide range of materials from 1/32 inch to over 24 inches thick. We offer two different pump technologies: ultrahigh-pressure intensifier and direct drive

pumps, ensuring our customers get the pump that is right for them and their unique application. Our intensifier pumps can deliver water continuously at up to 87,000 psi, and our direct drive pumps up to 55,000 psi.

Waterjet cutting is recognized as a more flexible, cost effective and accurate alternative to traditional cutting methods such as mills, routers, lasers, EDM, saws or plasma for many applications. It offers greater versatility in the types of products it can cut, and, because it cuts without creating heat or mechanical stress and often reduces or eliminates the need for secondary processing operations and special fixturing. Waterjet cutting has applications in many industries, including aerospace, defense, automotive, semiconductors, disposable products, food, glass, sign, metal cutting, marble, tile and other stone cutting, and paper slitting and trimming.

Surface Preparation and Industrial Cleaning Products. Our ultrahigh-pressure surface preparation and industrial cleaning systems are used for fast coating removal. These systems typically use direct drive pumps to create pressures in the range of 40,000 to 55,000 psi. Because only pure water is used to remove coatings, waterjetting can offer a lower total cost per project than grit blasting by eliminating the need for collection, containment, and disposal of abrasive materials. Removing coatings with water instead of grit allows other work to be done at the same time as the waterjet operation and reduces containment and cleanup issues. Welding, mechanical and electrical work, or painting, can be performed concurrently with waterjet industrial cleaning, which means projects are completed in less time and there are fewer environmental concerns than with traditional methods such as sandblasting.

Parts and Services. We also offer consumable parts and services. Consumables represent parts used by the pump and cutting head during operation, such as seals and orifices. Many of the consumable parts are proprietary in nature and are patent protected. We also sell various tools and accessories which incorporate ultrahigh-pressure technology.

Marketing and Customers

Our marketing emphasizes a consultative application-oriented sales approach and is centered on increased awareness of the capabilities of our technology as we believe that waterjet technology is still in the early adoption phase of its product life cycle. These efforts include presence at trade shows, advertising through online media, telemarketing and other product placements and demonstration/educational events as well as an increase in domestic and international sales representation, including those given by our agents and distributors. To enhance sales efforts, our marketing staff and sales force gather detailed information on applications and requirements in targeted market segments. This information is used to develop standardized and customized solutions using ultrahigh-pressure and robotics technologies.

We offer our consumable parts online at www.flowparts.com website in the U.S. and www.floweuropeparts.com in Europe. We strive to ensure that we are able to ship a large number of parts within 24 hours to our customers.

We have established strong relationships with a diverse set of customers. No single customer or group of customers under common control accounted for 10% or more of consolidated sales during the respective fiscal years ended April 30, 2013, 2012 and 2011.

We believe that the productivity-enhancing nature of our ultrahigh-pressure technology, the diversity of our markets along with the relatively early adoption phase of our technology, and the displacement of more traditional methods of machine tooling, fabricating and surface preparation will enable us to continue growing our market share in the machine tool cutting and surface preparation markets as global economic market conditions improve.

Competition in Our Markets

Flow products are sold worldwide into a variety of highly competitive markets. In all markets, we compete on the basis of product performance, customer service, quality and price. From time to time, the intensity of competition results in price discounting in a particular industry or region. Such price discounting puts pressure on margins and can negatively impact operating profit.

Within our major markets - both domestic and foreign - our products compete against other waterjet competitors as well as various other cutting technologies such as lasers, saws, plasma, shears, routers, drills, and abrasive blasting techniques. Waterjet cutting systems offer manufacturers many advantages over traditional cutting machines including an ability to cut or machine virtually any material, in any direction, with improved manufacturing times, and with minimal impact on the material being cut. These factors, in addition to the elimination of secondary processing in many circumstances, enhance the manufacturing productivity of our systems as compared to other processes. More than 100 firms, other than Flow, have developed tools for cleaning and cutting based on waterjet technology. Most of our waterjet competitors provide only portions of a waterjet system,

such as pumps or control systems. Other competitors integrate components from a variety of suppliers to provide a complete solution.

Broadest Product Line. We offer a broad product line that encompasses a complete array of capabilities, technologies and price points. We believe that the breadth of our product offering enables us to match a diverse base of customers' applications and budgets. Our product offerings range from large custom built composite machining solutions and turnkey shape-cutting systems to environmentally-friendly ultrahigh-pressure surface preparation systems. Our competitive strength in the high-end segment of the market stems from our leading-edge technological and engineering capabilities which enable us to deliver custom engineered solutions that revolutionize the machining and tooling industries. In the mid-tier segments of the waterjet cutting and surface preparation markets, we compete on the basis of product quality and innovation, distribution presence and capability, channel knowledge and expertise, geographic availability, breadth of product line, access speed and performance, reliability, and price competitiveness. We compete in the economy market segment, the lowest-tier in our market, on the basis of geographic availability, reliable segment-leading technology and product value.

Unmatched Customer Access in the Waterjet Industry. We believe our channels of distribution are unparalleled in the industry. With years of expertise, our direct sales force enhances customer experience by using a consultative sales approach. This direct channel of sales is augmented by our indirect sales partners who primarily focus on selling to mid-tier and economy product line customers.

In addition to pumps and systems, we sell consumable parts and services. We face competition from numerous other companies who sell non-proprietary replacement parts for our machines. While they generally offer a lower price, we believe the quality of our parts and on-time delivery, coupled with our technical service, makes us the value leader in consumable parts.

We estimate that the waterjet cutting solutions market opportunity exceeds $1 billion in annual revenue potential, or more than twice the current level. The total market potential continues to grow as new applications are developed. The rapidly increasing global market for waterjet solutions, while providing high growth opportunities, is also attracting new market entrants which will increase competition.

Sales Outside the United States

In fiscal year 2013, $150.2 million, or 58%, of our total consolidated sales were to customers outside the United States. The following table shows sales outside the U.S. by geography for the last three years.

|

| | | | | | | | | | | |

| Fiscal Year Ended April 30, |

Sales Outside The U.S. | 2013 | | 2012 | | 2011 |

| | | | | |

Exports from the U.S. | $ | 30,655 |

| | $ | 27,199 |

| | $ | 25,450 |

|

Sales from Europe, Middle East, and Africa | 50,704 |

| | 51,429 |

| | 42,929 |

|

Sales from Asia Pacific | 40,344 |

| | 41,119 |

| | 32,011 |

|

Sales from Latin America | 26,061 |

| | 28,365 |

| | 20,373 |

|

Sales from Other Locations | 2,400 |

| | 2,513 |

| | 2,329 |

|

Total | $ | 150,164 |

| | $ | 150,625 |

| | $ | 123,092 |

|

Percent of Total Sales | 58 | % | | 59 | % | | 57 | % |

Raw Materials

We source our raw materials, parts, subassemblies and manufactured components from suppliers both domestically and internationally. Principal materials used to make waterjet products include a variety of metal and plastic products and tubing. We also purchase many electrical and electronic components, fabricated metal parts, high-pressure fluid hoses, ball screws, roller pinions, seals and other items integral to our products. Suppliers are competitively selected based on quality, delivery and cost. Our suppliers' ability to provide timely and quality components affect our production schedules and contract profitability. Some of our business units purchase items locally from sole or limited source suppliers; however, we are currently able to source our raw materials in quantities sufficient to meet our requirements in each business unit, some of which may require longer lead times due to availability.

We use a variety of agreements with suppliers to protect our intellectual property and processes to monitor and mitigate risks of the supply base causing a business disruption. The risks monitored include supplier financial viability, the ability to

scale production levels, business continuity, quality, and delivery. We currently do not employ forward contracts or other financial instruments to hedge commodity price risk, although we continuously explore supply chain risk mitigation strategies.

Intellectual Property

We have a number of patents related to our processes and products both domestically and internationally. While in the aggregate our patents are of material importance to our business, we believe that no single patent or group of patents is of material importance to our business as a whole. We also rely on non-patented proprietary trade secrets and knowledge, confidentiality agreements, creative product development and continuing technological advancement to maintain a technological lead on our competitors.

Product Development

We strive to improve our competitive position in all of our segments by continuously investing in research and development to drive innovation in our products and manufacturing technologies. Our research and development investments support the introduction of new products and enhancements to existing products.

We have always placed an emphasis on product oriented research and development relating to the development of new or improved products. During the respective fiscal years ended April 30, 2013, 2012, and 2011 we invested $12.2 million, $10.9 million, and $10.1 million related to product research and development. Research and development expenses for the fiscal year ended April 30, 2013 of $11.4 million included the benefit of a reimbursement for certain research and engineering costs of $0.8 million. Research and development expenses as a percentage of revenue were between 4% and 5% during each of the respective fiscal years ended April 30, 2013, 2012, and 2011. We expect to continue significant investment in research and development activities in order to improve and sustain existing products and technologies, as well as create innovative next-generation products and maintain competitive advantages in the markets we serve.

Backlog

Our backlog increased from $44.7 million at April 30, 2012 to $50.4 million at April 30, 2013 based on the timing and volume of customer orders. The backlog at April 30, 2013 and 2012 represented 19% and 18% of our trailing twelve months sales as of April 30, 2013 and 2012, respectively.

Backlog includes firm orders for which written authorizations have been accepted and revenue has not yet been recognized. Generally, our products, exclusive of our Advanced segment systems, can be shipped within a four to 16 week period. Advanced segment systems typically have long lead times which may range from 12 to 24 months. Individual orders of our products and services can involve the delivery of several hundred thousand dollars of products or services at one time. Due to possible changes in customer delivery schedules and cancellation of orders, our backlog at any particular date is not indicative of actual sales for any succeeding period. Delays in delivery schedules and/or a reduction of backlog during any particular period could have a material adverse effect on our business and results of operations.

Employees

We had approximately 680 full-time employees as of April 30, 2013, of which 63% were located in the United States, and 37% were located in other foreign locations. Our success depends in part on our ability to attract and retain motivated and productive employees.

Available Information

We are subject to the reporting requirements of the Exchange Act and its rules and regulations. The Exchange Act requires us to file reports, proxy statements and other information with the U.S. Securities and Exchange Commission (“SEC”). All material we file with the SEC is publicly available at the SEC's Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 and may also be obtained by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains a Web site that contains reports, proxy statements and other information regarding issuers that file electronically with the SEC. These materials may be obtained electronically by accessing the SEC's Web site at www.sec.gov.

We make available, free of charge on our Web site, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q (including related filings in eXtensible Business Reporting Language ("XBRL") format), Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file these documents with, or furnish them to, the SEC. These documents are posted on our Web site at www.FlowWaterjet.com - select the “Investors” link and then the “Reports” link.

Shareholders may request a copy of the annual reports on Form 10-K and quarterly reports on Form 10-Q from:

Flow International Corporation

Attention: Investor Relations

23500 64th Avenue South

Kent, WA 98032

Item 1A. Risk Factors

Our business is subject to certain risks and events that, if they occur, could adversely affect our financial condition, results of operations, and the trading price of our common stock.

You should consider the following risk factors, in addition to the other information presented in this report and the matters described in our “Forward-Looking Statements” section, as well as other reports and registration statements we file from time to time with the SEC, in evaluating us, our business, and an investment in our securities.

Risks Related to our Business

Our results of operations and financial condition could be materially affected by changes in product mix or pricing.

Our overall profitability may not meet expectations if our products, customers or geographic mix or changes in customer requirements or specifications, in particular as it relates to our long-term contracts, are substantially different than anticipated or initially planned. Our profit margins vary among products, customers and geographic markets. Consequently, if our mix of any of these is substantially different from what is anticipated or planned in any particular period, our operating results may be negatively affected and our profitability lower than anticipated.

The global macroeconomic environment continues to be volatile and its impact on the credit markets could adversely affect our results of operations.

The macroeconomic environment continues to remain volatile and to the extent that it deteriorates it could:

| |

• | have an adverse effect on our customers and suppliers and their ability to purchase our products; |

| |

• | reduce our ability to take advantage of growth and expansion opportunities; |

| |

• | adversely affect our ability to access credit markets or raise capital on terms acceptable to us; |

| |

• | limit our capital expenditures for repair or replacement of existing facilities or equipment; and |

| |

• | adversely affect our ability to be in compliance with covenants under existing credit agreements. |

All of which could adversely affect our results of operations and financial position.

Failure to effectively manage our indirect sales channel and indirect technical service providers could adversely affect our results of operations and financial condition.

In order to increase sales and capture a leading market share globally, we have focused on expanding our indirect sales channel, through distributors and sales agents, to augment our existing direct sales force. Additionally, we have engaged indirect technical service partners to augment our technical service staff with installations and service calls as a result of the increase in demand for our products. Our success in integrating the indirect sales channel and indirect technical service providers into our business will be impacted by our ability to train and manage new and existing relationships with distributors, sales agents and service providers. If we are not able to effectively train and manage these indirect channels, we may not be able to achieve our operating result goals and this could have a negative effect on our operating results and financial condition.

Rising commodity and fuel prices may adversely affect our results of operations and financial condition.

We are a large buyer of steel, as well as other commodities required for the manufacture of our products. As a result, changes in commodity and fuel prices may have an adverse effect on our results of operations and financial condition through increased inventory and shipping costs by suppliers. Historically, we have been able to pass on increases in commodity and shipping prices to our customers; however, our success in doing so in future periods cannot be assured.

If we fail to technologically advance our products and successfully introduce new products, our future growth and financial results may be adversely affected.

Our ability to develop and introduce new products may affect our competitive position and often requires the investment of significant resources. Difficulties or delays in research, development or production of new products or failure to gain market acceptance of new products and technologies may reduce future revenues and adversely affect our competitive position and our financial results.

Foreign currency exchange rates may adversely affect our results of operations and financial condition.

We have substantial assets, liabilities, revenues and expenses denominated in currencies other than the U.S. dollar, and to prepare our consolidated financial statements, we must translate these items into U.S. dollars at the applicable exchange rates. We are therefore exposed to movements in foreign exchange rates against the U.S. Dollar. Of these, the most significant is currently the Euro. Substantially all of our sales to our customers and operating costs in Europe are denominated in Euro, creating an exposure to foreign currency exchange rates. Additionally, certain of our foreign subsidiaries make sales denominated in U.S. Dollars which expose them to foreign currency transaction gains and losses.

If we fail to obtain sufficient quantities of materials and components required for our manufacturing activities at competitive prices and quality and on a timely basis or fail to effectively adapt our cost structure to changing market conditions, our business and financial results will suffer.

We purchase materials and components from third parties for use in our manufacturing operations. Some of our business units purchase these items from sole or limited source suppliers. If we cannot obtain sufficient quantities of materials and components at competitive prices and quality and on a timely basis, we may not be able to produce sufficient quantities of product to satisfy market demand, product shipments may be delayed or our material or manufacturing costs may increase. In addition, because we cannot always immediately adapt our cost structures to changing market conditions, our manufacturing capacity may at times exceed our production requirements or fall short of our production requirements. Any or all of these problems could result in the loss of customers, provide an opportunity for competing products to gain market acceptance and otherwise adversely affect our business and financial results.

Our stock price has been and is likely to continue to be highly volatile.

The trading price of our common stock has been highly volatile. On July 23, 2013, the closing price of our common stock was $3.81. Our stock price could decline or be subject to wide fluctuations in response to factors such as the risks discussed in this section and the following:

| |

• | actual or anticipated fluctuations in our operating results or our competitors' operating results; |

| |

• | statements by us regarding the process to evaluate strategic alternatives to enhance shareholder value including, among other things, the potential sale of the Company or other transaction; |

| |

• | announcements by us or our competitors of new products; |

| |

• | capacity changes, significant contracts or changes to existing contracts, acquisitions, or strategic investments; |

| |

• | our growth rate and our competitors' growth rates; |

| |

• | changes in stock market analyst recommendations regarding us, our competitors, or our industry in general, or lack of analyst coverage of our common stock; |

| |

• | negative changes in global financial markets and economic conditions; |

| |

• | sales of our common stock by our executive officers, directors, and significant stockholders or sales of substantial amounts of common stock at one time; and |

| |

• | changes in accounting principles. |

In addition, there has been significant volatility in the market price and trading volume of our securities that is sometimes unrelated to our operating performance. Some companies that have had volatile market prices for their securities have been the target of a hostile takeover or subject to involvement by activist shareholders. If we were to become the target of such a situation, it could result in substantial costs and would divert management's attention and resources.

We have unresolved claims with the purchaser of Avure.

During fiscal year 2009, we were notified by the purchaser of our Avure Business (“Purchaser”), which we reported as a discontinued operation for the fiscal year ended April 30, 2006, that the Swedish tax authority was conducting an audit which includes periods during the time that we owned the subsidiary. Pursuant to our agreement with the Purchaser, we had made commitments to indemnify various liabilities and claims, including any tax matters relating to the periods when we owned the business. The Swedish tax authority concluded its audit and issued a final report in November 2009, initially asserting that Avure owes 19.5 million Swedish Krona, approximately $2.8 million at the initial date of assessment, in additional taxes, penalties and fines. In April 2010, we filed an appeal on behalf of Avure to contest the Swedish tax authority's assertion. Since the filing of our appeal, there has been a hearing before the Swedish district court regarding our appeal. In August 2012, we received notice that the Swedish district court issued a ruling in favor of the Swedish tax authority. We continue to contest the findings and filed an appeal with the Administrative Court of Stockholm in September 2012. We recorded a charge in fiscal year 2010 related to the periods during which we owned Avure and, as of April 30, 2013, the liability is approximately $1.3

million. The balance of the accrued liability will fluctuate period over period with changes in foreign currency rates until such time as the matter is ultimately resolved.

We have identified material weaknesses in our internal control over financial reporting and we may be unable to develop, implement, and maintain appropriate controls in future periods. Our failure to implement and maintain effective internal control over financial reporting could result in material misstatements in our financial statements which could require us to restate financial statements, cause investors to lose confidence in our reported financial information, and could have an adverse effect on our share price.

We have identified a material weakness in the control environment within our Brazilian operations and in our monitoring of these operations that resulted in design and operating control deficiencies including those related to the tracking and accounting for inventory and the preparation and review of income tax returns for our subsidiary in Brazil. Additionally, we determined we had a material weakness in the scope and conduct of investigations related to whistleblower allegations. As a result, our management concluded that disclosure controls and procedures and internal control over financial reporting were not effective as of April 30, 2013. See Item 9A - Controls and Procedures.

In the course of remediating the material weaknesses, we may find historical errors or discover new facts that cause us to reach different conclusions on our historical accounting or otherwise change our existing opinion of these matters. This could result in adverse adjustments to our previously reported financial results. In addition, we may be unable to meet our reporting obligations and cause investors to lose confidence in our reported financial information, leading to a decline in our share price.

We might fail to adequately protect our intellectual property rights or third parties might assert that our technologies infringe on their intellectual property.

Protecting our intellectual property is critical to our innovation efforts. We rely on a combination of patents, trade secrets, and trademarks to protect our intellectual property, but this protection might be inadequate. For example, our pending or future patent applications might not be approved or, if allowed, they might not be of sufficient strength or scope. Conversely, third parties, certain of whom have filed lawsuits against us in the past, might assert that our technologies infringe their proprietary rights. Any future related litigation to defend our intellectual property and/or defend ourselves from assertions of infringement could result in substantial costs and diversion of our efforts and could adversely affect our business, whether or not we are ultimately successful.

If we are unable to hire, retain and motivate highly qualified employees, including our key employees, we may not be able to successfully manage our business.

Our success depends on our ability to identify, attract, hire, retain and motivate highly skilled technical, managerial, sales and marketing, and corporate personnel. If we fail to successfully hire and retain a sufficient number of highly qualified employees, we may have difficulties in supporting our customers or expanding our business. The realignment of resources, reductions in workforce, and/or other operational decisions could create an unstable work environment that may have a negative effect on our ability to hire, retain, and motivate employees.

Our business and operations are substantially dependent on the performance of our key employees, all of whom are employed on an at-will basis. While none of our key personnel is irreplaceable, the loss of the services of any of these individuals may be disruptive to our business. There can be no assurance that any retention program we initiate will be successful at retaining employees, including key employees.

Changes in our income tax rates or exposure to additional income tax liabilities could affect our profitability. In addition, audits by tax authorities could result in additional tax payments for prior periods.

We are subject to income taxes in the U.S. and in various foreign jurisdictions. Domestic and international tax liabilities are subject to the allocation of income among various tax jurisdictions. Our effective tax rate can be affected by changes in the mix of earnings in countries with differing statutory tax rates, accruals related to unrecognized tax benefits, the results of audits and examinations of previously filed tax returns and changes in tax laws. Any of these factors may adversely affect our tax rate and decrease our profitability. The amount of income taxes we pay is subject to ongoing audits by U.S. federal, state and local tax authorities and by non-U.S. tax authorities. If these audits result in assessments different from our unrecognized tax benefits, our future results may include unfavorable adjustments to our tax liabilities.

Unexpected losses in future reporting periods may require the Company to adjust the valuation allowance against its deferred tax assets.

We evaluate our deferred tax assets for realizability based on all available evidence. This process involves significant assumptions that are subject to change from period to period based on changes in tax laws or variances between the future projected operating performance and our actual results. We are required to establish a valuation allowance for deferred tax assets if we determine, based on available evidence at the time the determination is made, that it is more likely than not that some portion or all of the deferred tax assets will not be realized. In determining the more-likely-than-not criterion, we evaluate all positive and negative available evidence as of the end of each reporting period. Future adjustments, either increases or decreases, to the deferred tax asset valuation allowance will be determined based upon changes in the expected realization of the net deferred tax assets. The realization of the deferred tax assets ultimately depends on the existence of sufficient taxable income in either the carry back or carry forward periods under the tax law. Due to significant estimates utilized in establishing the valuation allowance and the potential for changes in facts and circumstances, it is reasonably possible that we may be required to record adjustments to the valuation allowance in future reporting periods. Such a charge could have a material adverse effect on our results of operations and financial condition. As of April 30, 2013, we had $17.6 million of net deferred tax assets.

Any significant disruption in our information technology systems or those of third-parties that we utilize in our operations could adversely impact our business.

We utilize our own communications and computer hardware systems located either in our facilities or in that of a third-party web hosting provider. In addition, we utilize third-party Internet-based or “cloud” computing services in connection with our business operations. Our servers and those of third-parties we use in our operations are vulnerable to computer viruses, cyber attacks, physical or electronic break-ins and similar disruptions, which could lead to interruptions and delays in our operations as well as loss, misuse, or theft of data.

Our global presence subjects us to risk that may adversely affect our profitability, cash flow, and financial condition.

In fiscal year 2013, approximately 58% of our sales were derived outside the U.S. Since our growth strategy depends in part on our ability to further penetrate markets outside the U.S., we expect to continue to increase our sales outside the U.S., particularly in emerging markets. In addition, some of our sales distribution offices and many of our suppliers are located outside the U.S. Our international business is subject to risks that are customarily encountered in non-U.S. operations, including:

| |

• | interruption in the transportation of materials to us and finished goods to our customers; |

| |

• | changes in a specific country's or region's political or economic conditions; |

| |

• | trade protection measures; |

| |

• | import or export licensing requirements; |

| |

• | unexpected changes in laws or licensing and regulatory requirements, including negative consequences from changes in tax laws; |

| |

• | limitations on ownership and on repatriation of earnings; |

| |

• | difficulty in staffing and managing widespread operations; |

| |

• | differing employment practices and labor issues; |

| |

• | differing protection of intellectual property; and |

| |

• | natural disasters, security concerns, including crime, political instability, terrorist activities and the U.S. and international response thereto. |

Any of these risks could negatively affect our results of operations, cash flows, financial condition, and overall growth.

We may need to raise funds to finance our future capital and/or operating needs.

We may need to raise funds through public or private debt or sale of equity to achieve our current business strategy in future periods. The financing we need may not be available when needed. Even if this financing is available, it may be on terms that we deem unfavorable or are materially adverse to our shareholders' interests, and may involve substantial dilution to our shareholders. Our inability to obtain financing will inhibit our ability to implement our development strategy, and as a result, could require us to diminish or suspend our development strategy and possibly cease certain of our operations. If we require additional funds and are unable to obtain additional financing on reasonable terms, we could be forced to delay, scale back or eliminate certain product development programs and/or our capital projects. In addition, such inability to obtain additional financing on reasonable terms could have a negative effect on our business, operating results, or financial condition to such

extent that we are forced to restructure, sell assets or cease operations, any of which could put our shareholders' investment dollars at significant risk.

We may incur net losses in the future, and we may not be able to sustain profitability on a quarterly or annual basis.

We may incur net losses in the future including losses from our operations, the impairment of long-lived assets and restructuring charges. There can be no assurance that we will be able to conduct our business profitably in the future.

We may not be able to comply with the financial tests or ratios required in order to comply with covenant requirements under our Credit Facility which may impact our ability to draw funds and may result in the acceleration of the maturity of, and/or the termination of the Credit Facility.

Our Credit Facility agreement requires us to comply with or maintain certain financial tests and ratios and restrict our ability to:

| |

• | draw down on our existing line of credit or incur more debt; |

| |

• | make certain investments and payments; |

| |

• | fund additional letters of credit; |

| |

• | transfer or sell assets. |

Our ability to comply with these covenants is subject to various risks and uncertainties. In addition, events beyond our control could affect our ability to comply with and maintain the financial tests and ratios required by this indebtedness. Any failure by us to comply with and maintain all applicable financial tests and ratios and to comply with all applicable covenants could result in an event of default with respect to a substantial portion of our debt which would result in the acceleration of the maturity and/or the termination of our credit facility. Even if we are able to comply with all applicable covenants, the restrictions on our ability to operate our business in our sole discretion could harm our business.

Our operations may be impaired as a result of disasters, business interruptions or similar events.

Disasters and business interruptions such as earthquakes, flooding, fire, and electrical failure affecting our operating activities and major facilities could materially and adversely affect our operations, our operating results and financial condition. We have developed a disaster recovery plan to mitigate the negative results of such an occurrence; however, the implementation and execution of such plans may not be adequate.

If we are unable to complete the upgrades to our information technology systems that are currently in process, or our upgrades are unsuccessfully implemented, our future success may be negatively impacted.

In order to maintain our leadership position in the market and efficiently process increased business volume, we are making ongoing upgrades to our computer hardware, software and our Enterprise Resource Planning (“ERP”) systems. Should we be unable to continue to fund these upgrades, or should the system upgrades be unsuccessful or take longer to implement than anticipated, our ability to grow the business and our financial results could be adversely impacted.

Violations of the U.S. Foreign Corrupt Practices Act could subject us to civil or criminal liability.

As a global company, we are also subject to risks that our employees, representatives or agents could conduct our operations outside the U.S. in ways that may violate the U.S. Foreign Corrupt Practices Act or other similar anti-bribery laws. Although we have policies and procedures to comply with those laws, our employees, representatives and agents may take actions that violate our policies. Further, indirect sales representatives or other agents that help sell our products or provide other services may violate our anti-bribery policies and procedures as we do not have direct oversight into their conduct. Any such violations could result in fines and other penalties and could otherwise have a negative impact on our business.

There are uncertainties associated with the exploration and evaluation of strategic alternatives to enhance shareholder value.

On June 7, 2013, we announced that our Board of Directors initiated a process to evaluate strategic alternatives to enhance shareholder value, including, among other things, the potential sale of the Company or other transaction. The Board of Directors has retained a financial advisor to assist it in evaluating these alternatives. There is no set timetable for completion of the evaluation process, and we do not intend to provide updates or make any comments regarding the evaluation of strategic

alternatives, unless our Board of Directors has approved a specific transaction or otherwise deems disclosure appropriate. There can be no assurance that the exploration of strategic alternatives will result in any transaction or enhance shareholder value.

Risks Related to the Industries in Which We Operate

The markets we serve are highly competitive and some of our competitors may have resources superior to ours. The result of this competition could reduce our sales and operating margins.

We face competition in a number of our served markets as a result of the entry of new competitors and alternative technologies such as lasers, saws, plasma, shears, routers, drills and abrasive blasting techniques. Some of our competitors or potential competitors have substantially greater financial, technical and marketing resources, larger customer bases, longer operating histories, more developed infrastructures or more established relationships in the industry than we have. Our competitors may be able to adopt more aggressive pricing policies, develop and expand their product offerings more rapidly, take advantage of acquisitions and other opportunities more readily, achieve greater economies of scale, and devote greater resources to the marketing and sale of their products than we do. Our failure to compete effectively may reduce our revenues, profitability and cash flow, and pricing pressures may adversely impact our profitability.

Cyclical economic conditions may adversely affect our financial condition and results of operations or our growth rate could decline if the markets into which we sell our products decline or do not grow as anticipated.

Our products are sold in industries and end-user applications that have historically experienced periodic downturns, such as automotive, aerospace, job shops, stone and tile and surface preparation. Cyclical weaknesses in the industries that we serve have led and could lead to a reduced demand for our products and adversely affect our financial condition and results of operations. Any competitive pricing pressures, slowdown in capital investments or other downturn in these industries could adversely affect our financial condition and results of operations in any given period. Additionally, visibility into our markets is limited. Our quarterly sales and operating results depend substantially on the volume and timing of orders received during the quarter, which are difficult to forecast. Any decline in our customers' markets would likely result in diminished demand for our products and services and would adversely affect our growth rate and profitability.

Item 1B. Unresolved Staff Comments

There are no unresolved comments that were received from the SEC staff relating to our periodic or current reports under the Securities Exchange Act of 1934 as of April 30, 2013.

Item 2. Properties

We occupied approximately 353 thousand square feet of floor space on April 30, 2013 for manufacturing, warehousing, engineering, sales offices, and administration, of which approximately 58% was located in the United States.

The following table provides a summary of the floor space by reportable segment:

|

| | | | | |

| Owned | | Leased |

| (In square feet) |

Standard | 15,820 |

| | 280,778 |

|

Advanced | 40,245 |

| | 16,000 |

|

Total | 56,065 |

| | 296,778 |

|

We have operations in the following locations:

|

| |

Location | Purpose |

| |

Kent, Washington | Headquarters, and primary ultrahigh-pressure pump and component manufacturing facility for our Standard segment |

Jeffersonville, Indiana | Manufacturing facility for certain Standard system components and primary manufacturing facility for our Advanced segment systems |

| |

Other Sales Office and Operational Locations |

Nagoya, Japan | Bretten, Germany |

Tokyo, Japan | Birmingham, England |

Yokohama, Japan | Milan, Italy |

Shanghai, China | Madrid Spain |

Guangzhou China | Lyon, France |

Beijing, China | Brno, Czech Republic |

Bangalore, India | Dubai, UAE |

Hsinchu, Taiwan | Buenos Aires, Argentina |

Sao Paulo, Brazil |

We believe that our principal properties are adequate for our present needs and expect them to remain adequate for the foreseeable future.

Item 3. Legal Proceedings

Refer to Note 7 - Commitments and Contingencies of the Notes to Consolidated Financial Statements included in Item 8, Financial Statements and Supplementary Data for a summary of legal proceedings.

Item 4. Mine Safety Disclosures

Not applicable

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our stock is traded on the NASDAQ Stock Market under the symbol “FLOW”. The range of high and low sales prices for our common stock for the last two fiscal years, by quarter, is set forth in the following table:

|

| | | | | | | | |

| | Fiscal Year 2013 | | Fiscal Year 2012 |

| | Low | | High | | Low | | High |

First Quarter | | $2.70 | | $4.25 | | $2.98 | | $4.34 |

Second Quarter | | $3.02 | | $3.88 | | $1.90 | | $3.48 |

Third Quarter | | $2.85 | | $4.06 | | $2.26 | | $3.95 |

Fourth Quarter | | $3.31 | | $3.98 | | $3.64 | | $4.49 |

As of July 23, 2013, there were approximately 870 holders of record of our common stock.

Dividends

We have not paid dividends to common shareholders in the past. Our Board of Directors intends to retain future earnings to finance development and expansion of our business and reduce any debt and does not expect to declare dividends to common shareholders in the foreseeable future. Additionally, our ability to pay cash dividends is restricted under our Credit Facility Agreement. Refer to Note 6 - Debt to the Consolidated Financial Statements included in Item 8, Financial Statements and Supplementary Data, for further discussion on our Credit Facility.

Issuer Purchases of Equity Securities

None.

Unregistered Securities

The Company has been issuing restricted stock pursuant to its 2005 Equity Incentive Plan (the “2005 Plan”) under an exemption from registration under the 1933 Act. The Company plans to file a registration statement on Form S-8 subsequent to filing this annual report on Form 10-K to register future exercises of stock options and future issuances of securities under the 2005 Plan.

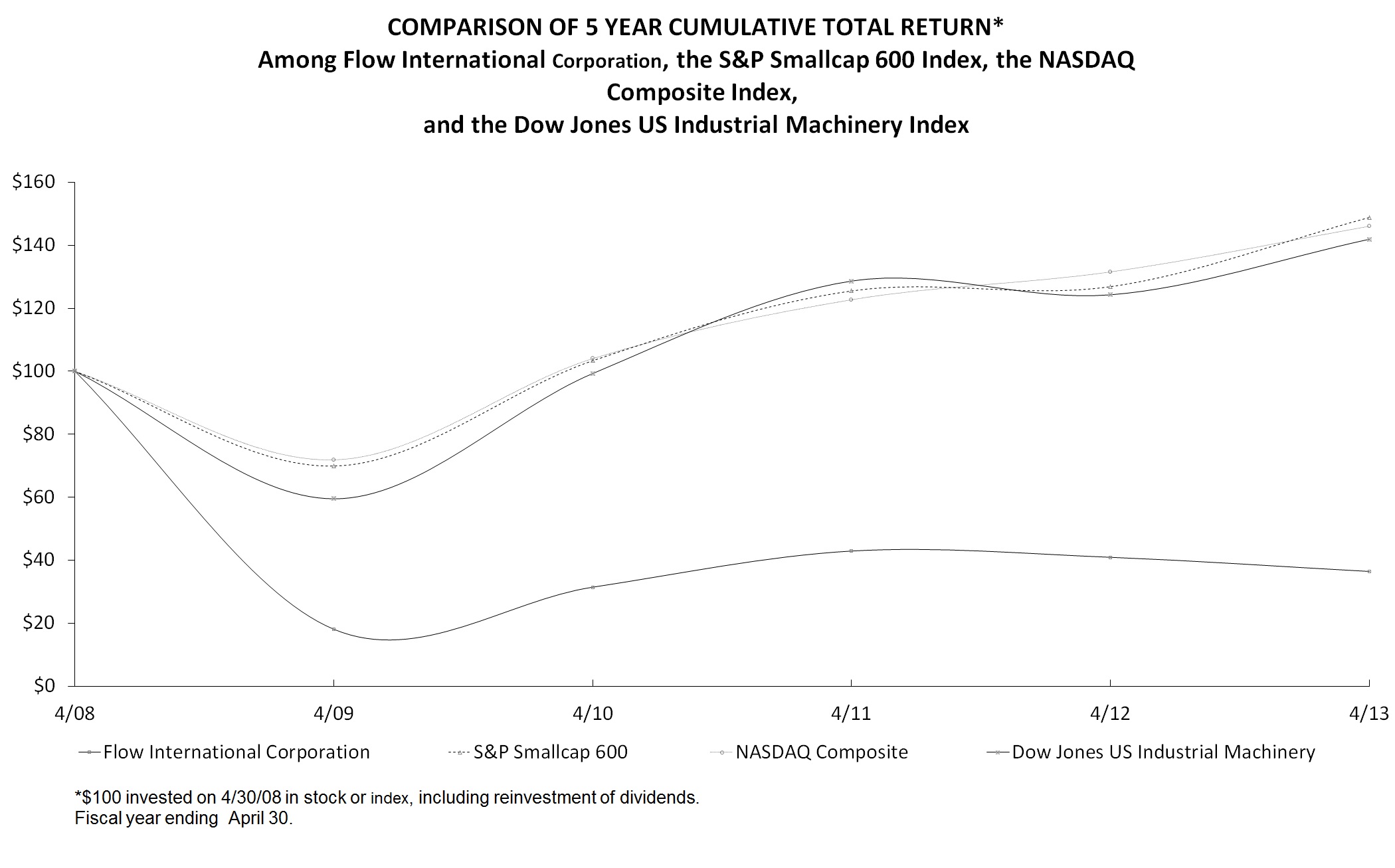

Comparison of Five-Year Cumulative Total Shareholder Return

The following graph compares the cumulative 5-year total return of holders of our common stock with the cumulative total returns of the S&P Smallcap 600 index, the NASDAQ Composite index, and the Dow Jones U.S. Industrial Machinery index. The graph below assumes a $100 investment in our common stock and in each index at April 30, 2008, that all dividends are reinvested, and that the measurement dates are the last trading day of the fiscal year shown. The stock price performance shown in the graph is not necessarily indicative of future price performance.

|

| | | | | | | | | | | | |

| 4/08 | 4/09 | 4/10 | 4/11 | 4/12 | 4/13 |

Flow International Corporation | 100.00 |

| 18.15 |

| 31.51 |

| 42.97 |

| 40.98 |

| 36.49 |

|

S&P Smallcap 600 | 100.00 |

| 69.95 |

| 103.37 |

| 125.52 |

| 126.86 |

| 148.83 |

|

NASDAQ Composite | 100.00 |

| 71.91 |

| 104.03 |

| 122.73 |

| 131.54 |

| 146.04 |

|

Dow Jones US Industrial Machinery | 100.00 |

| 59.54 |

| 99.29 |

| 128.64 |

| 124.28 |

| 141.91 |

|

Recent Sales of Unregistered Securities

None.

Item 6. Selected Financial Data

The following selected consolidated financial data should be read in conjunction with our audited consolidated financial statements, the related notes and Management's Discussion and Analysis of Financial Condition and Results of Operations, and Risk Factors, which are included in this Annual Report on Form 10-K.

|

| | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended April 30, |

| | 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

| | (In thousands, except per share data) |

Statement of Operations Data: | | | | | | | | | | |

Sales | | $ | 259,338 |

| | $ | 253,768 |

| | $ | 216,524 |

| | $ | 173,749 |

| | $ | 210,103 |

|

Income (Loss) From Continuing Operations | | 5,172 |

| | 9,389 |

| | 1,008 |

| | (7,389 | ) | | (23,086 | ) |

Net Income (Loss) | | 5,037 |

| | 9,449 |

| | 766 |

| | (8,484 | ) | | (23,819 | ) |

| | | | | | | | | | |

Basic and Diluted Income (Loss) Per Share: | | | | | | | | | | |

Income (Loss) From Continuing Operations | | 0.11 |

| | 0.20 |

| | 0.02 |

| | (0.17 | ) | | (0.61 | ) |

Net Income (Loss) | | 0.10 |

| | 0.20 |

| | 0.02 |

| | (0.19 | ) | | (0.63 | ) |

|

| | | | | | | | | | | | | | | | | | | | |

| | April 30, |

| | 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

| | (In thousands) |

Balance Sheet Data: | | | | | | | | | | |

Working Capital | | $ | 59,195 |

| | $ | 56,445 |

| | $ | 41,131 |

| | $ | 31,913 |

| | $ | 27,923 |

|

Total Assets | | 162,093 |

| | 167,066 |

| | 153,063 |

| | 131,209 |

| | 144,960 |

|

Short-Term Debt (i) | | 10,559 |

| | 21 |

| | 5,525 |

| | 411 |

| | 16,593 |

|

Long-Term Obligations (ii) | | — |

| | 9,631 |

| | 8,762 |

| | 7,972 |

| | 1,937 |

|

Shareholders' Equity | | 96,734 |

| | 91,048 |

| | 79,454 |

| | 75,624 |

| | 62,711 |

|

| |

i. | Short-Term Debt at April 30, 2013 includes subordinated notes and accrued interest of $10.6 million as the subordinated notes are classified as current. The principal balance and accrued interest on the subordinated notes will aggregate to $10.8 million when due in August 2013. |

| |

ii. | Long-Term Obligations at April 30, 2012, 2011, and 2010 include subordinated notes and accrued interest of $9.6 million, $8.7 million, and $8.0 million, respectively. |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

As you read this discussion and analysis, refer to our Consolidated Statements of Operations included in Item 8 - Financial Statements and Supplementary Data, which presents the results of our operations for the respective fiscal years ended April 30, 2013, 2012 and 2011. We analyze and explain the differences between the periods in the specific line items of our Consolidated Statements of Operations. This discussion and analysis has been organized as follows:

| |

• | Executive Summary, including overview and business strategy; |

| |

• | Results of operations beginning with an overview of our results, followed by a detailed review of those results by reporting segment; |

| |

• | Financial condition addressing liquidity position, sources and uses of cash, capital resources and requirements; commitments, and off-balance sheet arrangements; and |

| |

• | Critical accounting policies which require management's most difficult, subjective or complex judgment. |

Certain other statements in Management's Discussion and Analysis are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Our ability to fully implement our strategies and achieve our objective may be influenced by a variety of factors, many of which are beyond our control. These risks and uncertainties pertaining to our business are set forth in Part I, Item 1A - Risk Factors.

Executive Summary

Overview

We are a global technology-based manufacturing company committed to providing a world class customer experience. We offer technological leadership and exceptional waterjet performance to a wide-ranging customer base, benefiting many cutting and surface preparation applications, delivering profitable waterjet solutions and dynamic business growth opportunities to our customers.

Fiscal Year 2013 Highlights

During fiscal year 2013, we saw the achievement of all-time revenue records, in the aggregate, for our Standard segment and for our spare parts business, which is part of the Standard segment. This resulted in net income of $5.0 million, or earnings per share of $0.10, adjusted earnings before interest, tax and depreciation ("Adjusted EBITDA") of $21.2 million and cash from operations of $7.9 million for the fiscal year ended April 30, 2013.

On an annual basis:

| |

• | Overall revenues increased 2% to $259.3 million for fiscal year 2013, an all-time high, or an increase of $5.6 million from $253.8 million in the comparative prior year; |

| |

• | Standard segment revenue reached $239.4 million, a 4% improvement over the prior fiscal year, and an all-time high for the segment; |

| |

◦ | We achieved record annual sales from our global spare parts business at $86.2 million, an 8% growth over the prior fiscal year; |

| |

◦ | Sales of our recently introduced Mach 2c and Mach 4c systems represented approximately 26% of Standard segment system sales during fiscal year 2013; |

| |

• | Advanced segment systems sales were $19.9 million, which was 15% lower than fiscal year 2012, as expected, primarily due to the timing of contracts. Backlog for the Advanced segment was $30.7 million as of April 30, 2013, which will be realized over the next four to six quarters; |

| |

• | Our overall gross profit margins of 38% decreased by approximately 100 basis points when compared to the prior year, primarily as a result of product mix in our Standard segment and below normal gross margins from our Advanced segment; |

| |

• | Our operating income was $12.7 million or 5% of sales compared with operating income of $14.7 million or 6% of sales in the prior fiscal year; |

| |

• | We generated net income of $5.0 million or earnings per share of $0.10, compared to net income of $9.4 million or $0.20 per share in the comparative prior year; and |

| |

• | Our Adjusted EBITDA was $21.2 million for fiscal year 2013 as compared to $24.4 million in the prior year. Refer to reconciliation of Adjusted EBITDA, which is a Non-GAAP financial measure, to Net Income set forth below. |

Looking Ahead

Economic Climate. We continue to experience uneven order patterns based on the renewed uncertainty in the marketplace that we started seeing in the fourth quarter of fiscal year 2013. We anticipate that this uncertainly will impact us in a number of direct and indirect ways including: demand for our products based on confidence in the marketplace, differences in demand by geographic regions; pricing and product mix; potential changes in currency exchange rates; availability of credit; and inflation.

Cost Structure Changes. Management recently implemented plans to achieve approximately $13 million in cost reductions on an annualized basis, which includes targeted plans to reduce product costs and lower operating expenses. Approximately $4 million of the reductions are expected to be realized through gross margin improvements on our new products, while the remaining $9 million in savings will be realized through a combination of global staff reductions, optimization of our sales commission structure, and other efficiencies through process improvement. These reductions are anticipated to begin in the first quarter of fiscal year 2014 with the full annualized run rate of savings in place by the end of fiscal year 2014.

New Products. We continue to make strategic investments in research and development for existing products and new products and applications. We believe that delivering innovative and high-value solutions is critical to meeting our customer needs and achieving our future growth. We remain positive with regard to the global introduction of our Mach 2c and Mach 4c products. Sales of these systems approximated 26% of Standard segment systems revenue, at gross margin levels 10 points lower than those within our fleet of systems. As discussed above, we have plans underway to bring the gross profit margins up to normalized levels by the end of fiscal year 2014.

Management remains focused on creating long-term shareholder value. We believe that Adjusted EBITDA, which we define as net income, as determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”), excluding the effects of income taxes, depreciation, amortization of intangible assets, interest expense, and other non-cash charges, which includes stock-based compensation expense, foreign currency gains or losses, and other allowable add backs pursuant to our Credit Facility Agreement, is a good measure of our core performance in creating this value.

Reconciliation of Adjusted EBITDA to Net Income:

(in 000s)

|

| | | | | | | | | | | |

| Fiscal Year Ended April 30, |

| 2013 | | 2012 | | 2011 |

Net Income | $ | 5,037 |

| | $ | 9,449 |

| | $ | 766 |

|

Add Back: | | | | | |

Depreciation and Amortization | 5,919 |

| | 6,208 |

| | 6,302 |

|

Income Tax Provision | 5,129 |

| | 3,276 |

| | 2,895 |

|

Interest Charges | 1,573 |

| | 1,112 |

| | 1,776 |

|

Non-Cash Charges | 3,423 |

| | 4,377 |

| | 1,758 |

|

Other (i) | 105 |

| | (60 | ) | | 242 |

|

Adjusted EBITDA | $ | 21,186 |

| | $ | 24,362 |

| | $ | 13,739 |

|

|

| | | | | | | | |

(i) Allowable Add backs Pursuant to Credit Facility Agreement |

Adjusted EBITDA is a non-GAAP financial measure and the presentation of this non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial information presented in accordance with GAAP. The items excluded from this non-GAAP financial measure are significant components of our financial statements and must be considered in performing a comprehensive analysis of our overall financial results. We use this measure, together with our GAAP financial metrics, to assess our financial performance, allocate resources, evaluate our overall progress towards meeting our long-term financial objectives, and to assess compliance with our debt covenants. We believe that this non-GAAP financial measure is useful to investors and analysts in allowing for greater transparency with respect to the supplemental information used by us in our financial and operational decision making. Our calculation of Adjusted EBITDA may not be consistent with calculations of similar measures used by other companies.

Results of Operations

(Tabular amounts in thousands)

Summary Consolidated Results

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | 2013 vs 2012 | | 2012 vs 2011 |

| | Fiscal Year Ended April 30, | | Increase (Decrease) | | Increase (Decrease) |

| | 2013 | | 2012 | | 2011 | | $ | | % | | $ | | % |

| | (In thousands) |

Sales | | $ | 259,338 |

| | $ | 253,768 |

| | $ | 216,524 |

| | $ | 5,570 |

| | 2 | % | | $ | 37,244 |

| | 17 | % |

Gross Margin | | 97,922 |

| | 99,368 |

| | 84,461 |

| | (1,446 | ) | | (1 | )% | | 14,907 |

| | 18 | % |

Selling, General, and Administrative Expenses | | 85,255 |

| | 84,699 |

| | 79,574 |

| | 556 |

| | 1 | % | | 5,125 |

| | 6 | % |

Operating Income | | 12,667 |

| | 14,669 |

| | 4,887 |

| | (2,002 | ) | | (14 | )% | | 9,782 |

| | NM |

|

| | | | | | | | | | | | | | |

Expressed as a % of Sales: | | | | | | | | | | | | | | |

Gross Margin | | 38 | % | | 39 | % | | 39 | % | | | | (100) bpts |

| | | | 0 bpts |

|

Selling, General, and Administrative Expenses | | 33 | % | | 33 | % | | 37 | % | | | | 0 bpts |

| | | | (400) bpts |

|

Operating Income | | 5 | % | | 6 | % | | 2 | % | | | | (100) bpts |

| | | | 400 bpts |

|

| | | | | | | | | | | | | | |

bpts = basis points | | | | | | | | | | | | | | |

NM = not meaningful | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Consolidated Sales by Category | | | | | | | | | | | |

| | | | | | | | 2013 vs 2012 | | 2012 vs 2011 |

| | Fiscal Year Ended April 30, | | Increase (Decrease) | | Increase (Decrease) |

| | 2013 | | 2012 | | 2011 | | $ | | % | | $ | | % |

| | (In thousands) |

Standard System Sales | | $ | 153,202 |

| | $ | 150,456 |

| | $ | 117,721 |

| | $ | 2,746 |

| | 2 | % | | $ | 32,735 |

| | 28 | % |

Advanced System Sales | | 19,925 |

| | 23,358 |

| | 28,431 |

| | (3,433 | ) | | (15 | )% | | (5,073 | ) | | (18 | )% |

Consumable Parts Sales | | 86,211 |

| | 79,954 |

| | 70,372 |

| | 6,257 |

| | 8 | % | | 9,582 |

| | 14 | % |

| | $ | 259,338 |

| | $ | 253,768 |

| | $ | 216,524 |

| | $ | 5,570 |

| | 2 | % | | $ | 37,244 |

| | 17 | % |

Segment Results of Operations

We report our operating results to our Chief Executive Officer, who is our chief operating decision maker, based on market segments which is consistent with management's long-term growth strategy. Our reportable segments are Standard and Advanced. The Standard segment includes sales and cost of sales related to our cutting and surface preparation systems using ultrahigh-pressure water pumps as well as parts and services to sustain these installed systems. Systems included in this segment do not require significant custom configuration. The Advanced segment includes sales and cost of sales related to our complex aerospace projects which require specific custom configuration and advanced features, including robotics, to match unique customer applications.

This section provides a comparison of net sales and gross margin for each of our reportable segments for the last three fiscal years. For further discussion on our reportable segments, refer to Note 14 - Business Segments and Geographic Information of the Notes to the Consolidated Financial Statements included in Item 8, Financial Statements and Supplementary Data.

Standard Segment

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | 2013 vs 2012 | | 2012 vs 2011 |

| | Fiscal Year Ended April 30, | | Increase (Decrease) | | Increase (Decrease) |

| | 2013 | | 2012 | | 2011 | | $ | | % | | $ | | % |

| | (In thousands) |

Sales | | $ | 239,413 |

| | $ | 230,272 |

| | $ | 187,887 |

| | $ | 9,141 |

| | 4 | % | | $ | 42,385 |

| | 23 | % |

% of total company sales | | 92 | % | | 91 | % | | 87 | % | |

|

| | NM |

| |

|

| | NM |

|

Gross Margin | | 94,052 |

| | 93,843 |

| | 78,321 |

| | 209 |

| | — | % | | 15,522 |

| | 20 | % |

Gross Margin as % of sales | | 39 | % | | 41 | % | | 42 | % | | | | (200) bpts |

| | | | (100) bpts |

|

| | | | | | | | | | | | | | |

bpts = basis points | | | | | | | | | | | | | | |

NM = not meaningful | | | | | | | | | | | | | | |

Fiscal year 2013 compared to fiscal year 2012

Sales in our Standard segment increased $9.1 million or 4% over the prior year. Excluding the impact of foreign currency changes, sales in the Standard segment increased $14.7 million or 6% in fiscal year 2013 compared to the prior year.

The year over year increases were primarily driven by the following:

| |

• | Moderate growth in system sales volume across certain of our geographic regions tempered by the mix and timing of our new product roll-out for an aggregate growth of $2.7 million or 2% over the comparative prior year. |

| |