301 Sylvan Avenue

Englewood Cliffs, New Jersey 07632

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS |

To Be Held on May 21, 2024

To Our Shareholders:

We invite you to the Annual Meeting (the “Annual Meeting”) of ConnectOne Bancorp, Inc. (the “Company”), the holding company for ConnectOne Bank (the “Bank”), will be held via webcast on May 21, 2024 at 9:15 a.m. for the purpose of considering and voting upon the following matters, all of which are more completely set forth in the accompanying Proxy Statement:

|

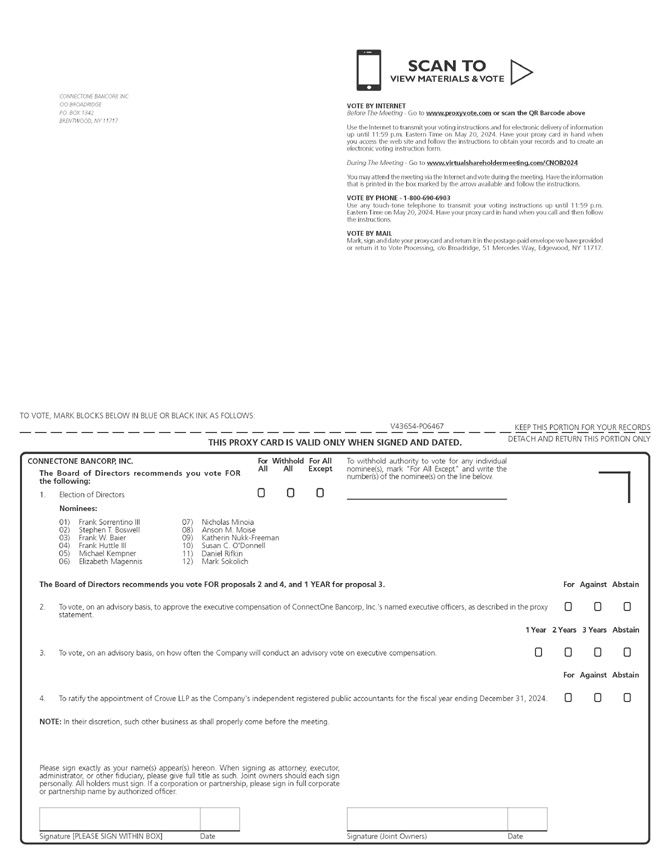

1. |

The election of twelve (12) directors of the Company, each to serve for the terms described in the proxy statement or until his or her successor is elected and shall qualify; |

|

2. |

To vote, on an advisory basis, to approve the executive compensation of the Company’s named executive officers, as described in this proxy statement; |

|

3. |

To vote, on an advisory basis, on how often the Company will conduct an advisory vote on executive compensation; |

|

4. |

To ratify the appointment of Crowe LLP as the Company’s independent registered public accountants for the fiscal year ending December 31, 2024; and |

|

5. |

Such other business as shall properly come before the Annual Meeting. |

This year's Annual Meeting will be a completely virtual meeting of shareholders, which will be conducted via a live webcast. You will be able to participate in the Annual Meeting, vote and submit your questions during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/CNOB2024.

Because the Annual Meeting is virtual and being conducted via live webcast, shareholders will not be able to attend the Annual Meeting in person. Details regarding how to participate in the meeting online and the business to be conducted at the meeting are more fully described in the accompanying proxy statement.

Only holders of record of shares of the Company’s common stock (the “Common Stock”) at the close of business on April 1, 2024 will be entitled to vote at the Annual Meeting.

|

|

Very truly yours,

FRANK SORRENTINO III Chairman of the Board of Directors |

If you are participating in the Annual Meeting by webcast, you may vote online during the meeting even if you have already returned your proxy.

Englewood Cliffs, New Jersey

April 11, 2024

|

i |