Free Writing Prospectus

Filed Pursuant to Rule 433

Dated July 1, 2014

Registration Statement No. 333-196933

Investor Presentation – Common Stock Offering July 1, 2014

Forward - Looking Statements This presentation contains forward - looking statements . Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward - looking . These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases . Accordingly, these statements are only predictions and involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them . Our actual results could differ materially from those anticipated in such forward - looking statements as a result of several factors more fully described under “Risk Factors” in our Annual Report on Form 10 - k, Item 1 A, and in the preliminary prospectus supplement and registration statement (including a base prospectus) filed with the Securities and Exchange Commission . Any or all of our forward - looking statements in this presentation may turn out to be inaccurate . The inclusion of this forward - looking information should not be regarded as a representation by us that the future plans, estimates or expectations contemplated by us will be achieved . We have based these forward - looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs . There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward looking statements including, but not limited to : ( 1 ) changes in general economic and financial market conditions ; ( 2 ) changes in the regulatory environment ; ( 3 ) economic conditions generally and in the financial services industry ; ( 4 ) changes in the economy affecting real estate values ; ( 5 ) our ability to achieve loan and deposit growth ; ( 6 ) the completion of our future acquisitions or business combinations and our ability to integrate the acquired business into our business model ; ( 7 ) projected population and income growth in our targeted market areas ; and ( 8 ) volatility and direction of market interest rates and a weakening of the economy which could materially impact credit quality trends and the ability to generate loans . All forward - looking statements are necessarily only estimates of future results and actual results may differ materially from expectations . You are, therefore, cautioned not to place undue reliance on such statements which should be read in conjunction with the other cautionary statements that are included elsewhere in this presentation . Further, any forward - looking statement speaks only as of the date on which it is made and we undertake no obligation to update or revise any forward - looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events . This presentation is for informational purposes only and does not constitute an offer to sell securities . The Corporation has filed a preliminary prospectus supplement and a registration statement (including a base prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates . Before you invest, you should read the preliminary prospectus supplement and the base prospectus, and other documents the Corporation has filed with the SEC for more complete information about the Corporation and this offering . You may get these documents for free by visiting EDGAR on the SEC website at www . sec . gov . Alternatively, copies of the preliminary prospectus supplement and the base prospectus may also be obtained from the Corporation or Keefe, Bruyette & Woods, Inc . the dealer - manager for the offering . 2

Transaction Overview 3 □ Common Stock (100% secondary shares) Type □ 2,365,000 Shares Offered □ ConnectOne Bancorp, Inc. (NASDAQ: CNOB ) (Formerly Center Bancorp, Inc., surviving corporation of merger with ConnectOne Bancorp, Inc., and name change effective July 1,2014) Issuer □ $45.5 million (1) Offering Size Market Capitalization Sole Bookrunner Expected Pricing □ Keefe, Bruyette & Woods, Inc. □ July 2, 2014 (Before market open) □ $ 571.5 million (1)(2) Selling Shareholder □ Lawrence Seidman , former Center board member and significant Center stakeholder, to sell down his position in the combined company to below 4.99%. He will not continue as a board m ember (1) Reflects CNOB share price of $19.23 as of 6/27/2014 (2) Based on 29,721,635 pro forma shares outstanding as estimated in S - 3 filed 6/20/2014 Lock - up Agreement □ 90 - days for remaining shares held by Lawrence Seidman and affiliates post offering

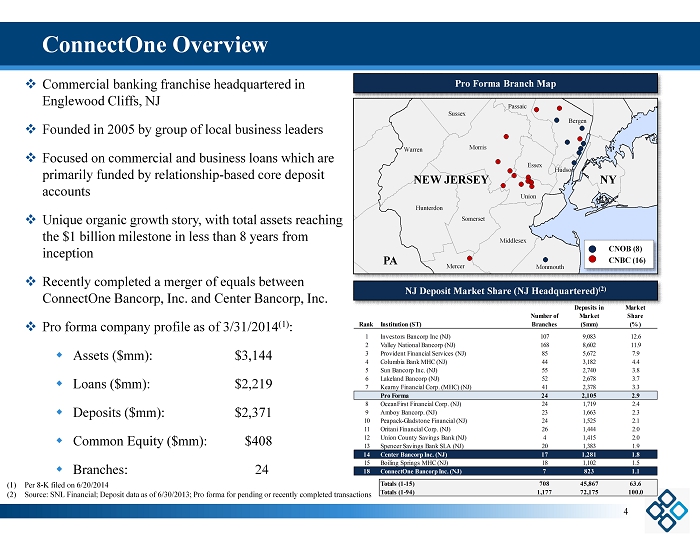

ConnectOne Overview □ Commercial banking franchise headquartered in Englewood Cliffs, NJ □ Founded in 2005 by group of local business leaders □ Focused on commercial and business loans which are primarily funded by relationship - based core deposit accounts □ Unique organic growth story, with total assets reaching the $1 billion milestone in less than 8 years from inception □ Recently completed a merger of equals between ConnectOne Bancorp, Inc . and Center Bancorp, Inc. □ Pro forma company profile as of 3/31/2014 (1) : Assets ($mm): $3,144 Loans ($mm): $2,219 Deposits ($mm) : $2,371 Common Equity ($mm) : $408 Branches: 24 4 • CNOB (8) • CNBC (16) Sussex Warren Hunterdon Mercer Somerset Middlesex Monmouth Union Essex Hudson Bergen Passaic Morris NEW JERSEY PA NY Rank Institution (ST) Number of Branches Deposits in Market ($mm) Market Share (%) 1 Investors Bancorp Inc (NJ) 107 9,083 12.6 2 Valley National Bancorp (NJ) 168 8,602 11.9 3 Provident Financial Services (NJ) 85 5,672 7.9 4 Columbia Bank MHC (NJ) 44 3,182 4.4 5 Sun Bancorp Inc. (NJ) 55 2,740 3.8 6 Lakeland Bancorp (NJ) 52 2,678 3.7 7 Kearny Financial Corp. (MHC) (NJ) 41 2,378 3.3 Pro Forma 24 2,105 2.9 8 OceanFirst Financial Corp. (NJ) 24 1,719 2.4 9 Amboy Bancorp. (NJ) 23 1,663 2.3 10 Peapack-Gladstone Financial (NJ) 24 1,525 2.1 11 Oritani Financial Corp. (NJ) 26 1,444 2.0 12 Union County Savings Bank (NJ) 4 1,415 2.0 13 Spencer Savings Bank SLA (NJ) 20 1,383 1.9 14 Center Bancorp Inc. (NJ) 17 1,281 1.8 15 Boiling Springs MHC (NJ) 18 1,102 1.5 18 ConnectOne Bancorp Inc. (NJ) 7 823 1.1 Totals (1-15) 708 45,867 63.6 Totals (1-94) 1,177 72,175 100.0 Pro Forma Branch Map NJ Deposit Market Share (NJ Headquartered ) (2) (1) Per 8 - K filed on 6/20/2014 (2) Source: SNL Financial; Deposit data as of 6/30/2013; Pro forma for pending or recently completed transactions

Executive Management Team 5 Frank Sorrentino III, Chairman and Chief Executive Officer □ Founding Chairman in 2005 and CEO since 2007 □ Recognized industry commentator, frequently appearing in public media including CNBC, Fox News, Forbes.Com , WSJ William S. Burns, Chief Financial Officer □ 34 years of experience in the financial services industry □ Former CFO of Somerset Hills Bancorp and The Trust Company of New Jersey Elizabeth Magennis , Chief Lending Officer □ 24 years of experience in the banking industry and CLO of the Company since 2007 Laura Criscione, Chief Compliance Officer □ 22 years of experience in the banking industry including former CFO of the Company Aditya Kishore, Chief Technology/Operations Officer □ 20 years of experience in the financial services and technology industries Richard Tappen , Chief Credit Officer □ 40 years experience in credit and lending, including former positions at Summit and United Trust Maria Gendelman , Chief Retail Officer □ 20 years experience in retail, including former positions at CapitalOne , Commerce and TD

Strategy and Vision 6 We position ourselves as “a better place to be” for customers, community, employees and shareholders by: □ Capitalizing on banking dislocation in our region □ Utilizing our exceptional market area to grow a high - quality, loyal customer base □ Offering high - quality, personal service vs. out - of - market competitors and minimizing turnover □ Operating with a “sense of urgency ” culture that differentiates us from our competitors □ Continued planning and investing in scalable infrastructure for the “future of banking” □ Maintaining solid asset quality through strong credit culture

Overview of Center / ConnectOne Merger ( As Disclosed in January 21, 2014 Investor Presentation) 7 □ Combines two high performing New Jersey banks situated in some of the most affluent markets in the nation □ Creates a $3 billion institution with a significantly enhanced platform for continued growth in middle market commercial business lending □ Combines Center’s robust core deposit base with ConnectOne’s strong organic loan generation □ Improves trading liquidity □ Expands ConnectOne’s loan platform for continued growth and increases legal lending limit □ Similar cultures and business focus, with demonstrated commitment and service to their communities □ Builds franchise value Strategically Compelling □ Center acted as legal acquiror ; combined company adopted ConnectOne’s name and brand □ 100% stock transaction; fixed exchange ratio of 2.6x Center common stock for each share of ConnectOne common stock □ Ownership: 54% Center / 46% ConnectOne □ Board Split: 6 Center / 6 ConnectOne □ Transaction closed July 1, with expected systems conversion by July 23 Transaction Overview

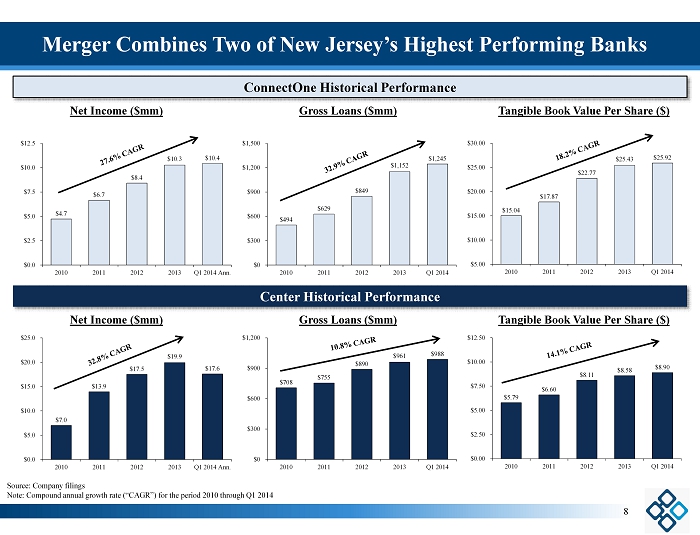

$7.0 $13.9 $17.5 $19.9 $17.6 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 2010 2011 2012 2013 Q1 2014 Ann. $4.7 $6.7 $8.4 $10.3 $10.4 $0.0 $2.5 $5.0 $7.5 $10.0 $12.5 2010 2011 2012 2013 Q1 2014 Ann. $708 $755 $890 $961 $988 $0 $300 $600 $900 $1,200 2010 2011 2012 2013 Q1 2014 $494 $629 $849 $1,152 $1,245 $0 $300 $600 $900 $1,200 $1,500 2010 2011 2012 2013 Q1 2014 $15.04 $17.87 $22.77 $25.43 $25.92 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 2010 2011 2012 2013 Q1 2014 $5.79 $6.60 $8.11 $8.58 $8.90 $0.00 $2.50 $5.00 $7.50 $10.00 $12.50 2010 2011 2012 2013 Q1 2014 Merger Combines Two of New Jersey’s Highest Performing Banks 8 Tangible Book Value Per Share ($) Source: Company filings Note: Compound annual growth rate (“CAGR”) for the period 2010 through Q1 2014 Net Income ($mm) Gross Loans ($mm) Tangible Book Value Per Share ($) Gross Loans ($ mm) Net Income ($mm) Center Historical Performance ConnectOne Historical Performance

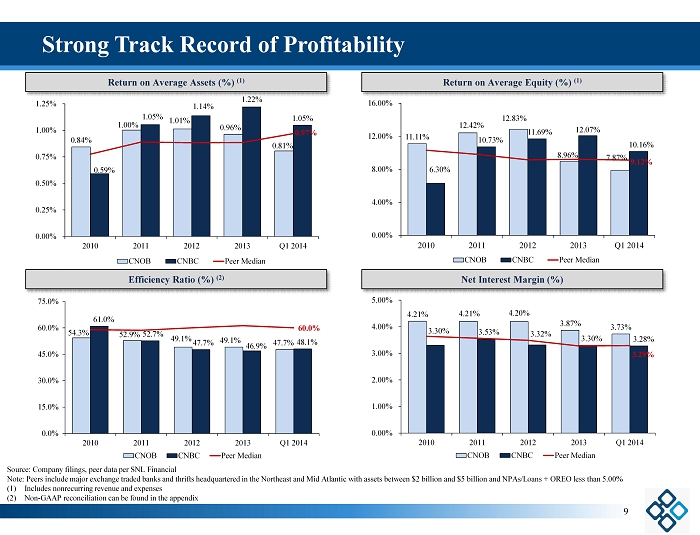

11.11% 12.42% 12.83% 8.96% 7.87% 6.30% 10.73% 11.69% 12.07% 10.16% 9.12% 0.00% 4.00% 8.00% 12.00% 16.00% 2010 2011 2012 2013 Q1 2014 CNOB CNBC Peer Median 0.84% 1.00% 1.01% 0.96% 0.81% 0.59% 1.05% 1.14% 1.22% 1.05% 0.97% 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 2010 2011 2012 2013 Q1 2014 CNOB CNBC Peer Median Strong Track Record of Profitability 9 Source: Company filings, peer data per SNL Financial Note : Peers include major exchange traded banks and thrifts headquartered in the Northeast and Mid Atlantic with assets between $2 billion and $5 billion and NPAs/Loan s + OREO less than 5.00 % (1) Includes nonrecurring revenue and expenses (2) Non - GAAP reconciliation can be found in the appendix Return on Average Assets (%) (1) Return on Average Equity (%) (1) Efficiency Ratio (%) (2) Net Interest Margin (%) 54.3% 52.9% 49.1% 49.1% 47.7% 61.0% 52.7% 47.7% 46.9% 48.1% 60.0% 0.0% 15.0% 30.0% 45.0% 60.0% 75.0% 2010 2011 2012 2013 Q1 2014 CNOB CNBC Peer Median 4.21% 4.21% 4.20% 3.87% 3.73% 3.30% 3.53% 3.32% 3.30% 3.28% 3.29% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2010 2011 2012 2013 Q1 2014 CNOB CNBC Peer Median

Construction 4.0% Residential R.E. 11.5% Commercial R.E. 55.5% Commercial & Industrial 25.3% Consumer & Other 3.8% Construction 5.6% Residential R.E. 6.7% Commercial R.E. 67.1% Commercial & Industrial 17.9% Consumer & Other 2.7% Cost of Total Deposits: 0.57% CNOB Stand Alone Total: Yield on Loans: 4.60% Total: $1,245mm $1,028mm Demand Deposits 23.0% NOW & Other Trans. Accts 3.5% MMDA & Other Savings 26.9% Time Deposits 46.5% Construction 4.9% Residential R.E. 8.8% Commercial R.E. 62.0% Commercial & Industrial 21.2% Consumer & Other 3.2% Commercially Oriented Loan Portfolio with Strong Core Funding Mix 10 Source: Company filings; Does not include purchase accounting adjustments; Yield on loans and cost of total deposits for the quarter end ed March 31, 2014 CNOB loan data as of 3/31/2014 per GAAP filings and deposit data as of 3/31/2014 per regulatory filings CNBC loan and deposit data as of 3/31/2014 per GAAP filings Deposit Mix Loan Mix Pro Forma Total: Total: $2,233mm $2,368mm Cost of Total Deposits: 0.39% CNBC Stand Alone Total: Yield on Loans: 4.24% Total: $988mm $1,340mm Demand Deposits 16.7% NOW & Other Trans. Accts 19.4% MMDA & Other Savings 52.2% Time Deposits 11.7% Demand Deposits 19.4% NOW & Other Trans. Accts 12.5% MMDA & Other Savings 41.3% Time Deposits 26.8%

Well Capitalized Institution with Strong Credit Quality 11 Tangible Common Equity / Tangible Assets (%) (1) Total Risk Based Capital Ratio (%) NPAs / Loans + OREO (%) NCOs / Average Loans (%) Source: Company filings, peer data per SNL Financial Note : Peers include major exchange traded banks and thrifts headquartered in the Northeast and Mid Atlantic with assets between $2 billion and $5 bi llion and NPAs/Loans + OREO less than 5.00 % Note: For comparative purposes, nonperforming assets (“NPAs”) are defined as nonaccrual loans, accruing troubled debt restruc tur ings and OREO (1) Non - GAAP reconciliation can be found in the appendix 5.60% 5.50% 7.76% 10.45% 9.85% 7.92% 7.61% 8.22% 8.48% 8.78% 8.93% 0.00% 2.50% 5.00% 7.50% 10.00% 12.50% 2010 2011 2012 2013 Q1 2014 CNOB CNBC Peer Median 0.82% 1.79% 1.34% 1.16% 1.01% 2.57% 1.97% 1.31% 0.95% 0.95% 1.59% 0.00% 0.60% 1.20% 1.80% 2.40% 3.00% 2010 2011 2012 2013 Q1 2014 CNOB CNBC Peer Median 11.41% 11.15% 10.52% 12.91% 12.20% 14.29% 12.89% 12.22% 12.90% 13.21% 14.59% 0.00% 3.50% 7.00% 10.50% 14.00% 17.50% 2010 2011 2012 2013 Q1 2014 CNOB CNBC Peer Median 0.06% 0.03% 0.05% 0.19% 0.08% 0.69% 0.24% (0.04%) 0.03% 0.13% 0.11% (0.10%) 0.10% 0.30% 0.50% 0.70% 0.90% 2010 2011 2012 2013 Q1 2014 CNOB CNBC Peer Median

Investment in Infrastructure 12 □ We are constantly investing and adapting our scalable infrastructure to strengthen our competitive position □ Our infrastructure’s strength is in state of the art technology as opposed to brick and mortar Smart investments in technology have enabled us to be competitive with even the largest banking institutions. Investments include, but not limited to: Mobile banking Remote deposit capture banking Cash management services/Electronic payment solutions Appropriate structural investments in key areas to ensure quality growth Credit processes Compliance and operations Maintaining and recruiting top talent

Organic Growth - What Sets Us Apart 13 □ Attractive Operating Area High growth area similar to New York City Bergen county one of the wealthiest in the Nation □ Our lending niche of $2 million to $10 million is underserved Most community banks not large enough to close loans in this size range □ Superior customer service Our “Sense of Urgency” culture is appreciated by clients Underwriting and closing process much faster than most banks Repeat customers and referrals □ Focused Marketing The ConnectOne message solidifies our reputation as banking industry experts

Non - Organic Growth Opportunities 14 □ Going public earlier last year gave us a “seat at the table”, something we never had before Merger between Center and ConnectOne provided immediate scale and more liquid trading currency □ We recognize that our industry is consolidating and that valuations, including ours, can benefit from economies of scale associated with correctly priced and well - executed M&A □ Our marketplace has many small banks with insufficient infrastructures trading at discounted pricing multiples □ Increasing investor acceptance of merger - of - equals transactions We will be opportunistic – Shareholder Value is our #1 consideration

Strategically compelling merger between two top performing NJ banks Highly attractive franchise with enhanced size, scale and geographic footprint in key markets in NJ Unique service culture: customer - centric, relationship - oriented banking approach Robust organic loan generator with history of strong credit quality Engaged and experienced management team and board Peer leading profitability; trading at a discounted price to earnings multiple x x x x x x Summary 15

Appendix