Exhibit 99.1

First Commonwealth

Mid-West Investor Meetings

November 9, 2009

FOX-PITT KELTON

COCHRAN CARONIA WALLER

Institutional Clients

Forward-looking Statements

This presentation contains forward-looking statements that describe our future plans, strategies and expectations. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.” All forward-looking statements are based on assumptions and involve risks and uncertainties, many of which are beyond our control and which may cause our actual results, performance or achievements to differ materially from the results, performance or achievements contemplated by the forward-looking statements. These risks and uncertainties include, among other things:

Continued weakness in economic and business conditions, nationally and in our market areas, which could increase credit- related losses and expenses and/or limit growth.

Further declines in the market value of investment securities that are considered to be other-than-temporary, which would negatively impact our earnings and capital levels.

Increases in defaults by borrowers and other delinquencies could result in increases in our provision for credit losses and related expenses.

Changes in legislative or regulatory requirements applicable to us and our subsidiaries could increase costs, limit certain operations and adversely affect results of operations.

Fluctuations in interest rates and market prices could reduce our net interest margin and asset valuations and increase our expenses.

Reduced wholesale funding capacity or higher borrowing costs due to capital constraints at the Federal Home Loan Bank, which would reduce our liquidity and negatively impact earnings and net interest margin.

Competitive pressures among depository and other financial institutions nationally and in our market areas may increase significantly.

Our inability to manage growth effectively, including the successful expansion of our customer support, administrative infrastructure and internal management systems, could adversely affect our results of operations and prospects.

The inability to successfully execute our strategic growth initiatives, which could limit further revenue and earnings growth.

Changes in tax requirements, including tax rate changes, new tax laws and revised tax law interpretations may increase our tax expense or adversely affect our customers’ businesses.

The consequences of continued bank acquisitions and mergers in our market areas, resulting in fewer but much larger and financially stronger competitors, could increase competition for financial services to our detriment.

Other risks and uncertainties described in this presentation and the other reports that First Commonwealth files with the Securities and Exchange Commission, including its most recent Annual Report on Form 10-K.

In light of these risks, uncertainties and assumptions, you should not place undue reliance on any forward-looking statements in this presentation. We undertake no obligation to publicly update or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise.

First Commonwealth

2

Company Information

NYSE: FCF

Headquartered in Indiana, PA

6th largest bank headquartered in PA

Assets: $6.5 billion

Current Market Data

Price: $5.25 (10/30/09)

Market Cap: $444 million

Avg. Volume (3 mo): 558k

41% Institutional Ownership (06/30/09)

Major Index Listings

~ Russell 2000

~ S&P Small Cap 600

~ KBW Regional Banking

Source(s):

SNL Financial and Management Reports

First Commonwealth

3

Summary of 3Q09 Earnings

Third Quarter 2009 2008 change

Net Interest Income $ 51.0 $ 47.9 $ 3.1

Provision for Loan Losses (23.0) (3.9) (19.1)

Net Interest Income (after provision) 28.0 44.0 (16.0)

Net Impairment Losses (11.9) (8.6) (3.3)

Other Income 12.9 14.9 (2.0)

Total Noninterest Income 1.0 6.3 (5.3) Credit-related* costs (1.4) (0.6) (0.8)

FDIC costs (2.0) (0.2) (1.8)

Other Noninterest Expense (38.6) (38.2) (0.4)

Total Noninterest Expense (42.0) (39.0) (3.0)

Tax Benefit (Expense) 7.1 (1.1) 8.2

Net Income (5.9) 10.2 (16.1)

EPS (diluted) $ (0.07) $ 0.14 $ (0.21)

Dividends Declared $ 0.03 $ 0.17 $ (0.14)

Reported a net loss of $5.9 million

Nonperforming loans increased 63% during the third quarter of 2009 to $134 million, or 2.88% of total loans

Provision for credit losses was $23 million stemming from weaknesses in out-of-market construction loan portfolio

Recorded impairment losses of $11.9 million relating to pooled trust preferred

*Collection and Repossession Expense

$ millions, except per share info Unaudited

4

First Commonwealth

Summary of Earnings YTD

September 30,

2009 2008 change

Net Interest Income $ 153.0 $ 135.9 $ 17.1

Provision for Loan Losses (79.5) (12.4) (67.1)

Net Interest Income (after provision) 73.5 123.5 (50.0)

Net Impairment Losses (30.5) (9.2) (21.3)

Other Income 41.0 42.0 (1.0)

Total Noninterest Income 10.5 32.8 (22.3)

Credit-related* costs (4.1) (2.0) (2.1)

FDIC costs (8.4) (0.4) (8.0)

Other Noninterest Expense (118.1) (114.3) (3.8)

Total Noninterest Expense (130.6) (116.7) (13.9)

Tax Benefit (Expense) 23.8 (5.4) 29.2

Net Income (22.8) 34.2 (57.0)

EPS (diluted) $ (0.27) $ 0.47 $ (0.74)

Dividends Declared $ 0.15 $ 0.51 $ (0.36)

Reported a net loss of $22.8 million

Provision for loan losses increased $67 million

Net impairment losses accounted for $(0.23) per share

Net Interest Income increased $17 million

FDIC costs increased $8 million

*Collection and Repossession Expense

$ millions, except per share info

Unaudited

5

First Commonwealth

Balance Sheet Summary

September 30,

2009 2008 change

Cash & Securities $ 1,403 $ 1,553 $ (150)

Commercial Loans 2,872 2,468 404

Consumer Loans 1,777 1,716 61

Allowance for Credit Losses (90) (45) (45)

Total Loans (net) 4,559 4,139 419

Other 549 512 37

Total Assets $ 6,511 $ 6,204 $ 307

Noninterest Bearing Deposits $ 600 $ 564 $ 36

Interest Bearing Deposits 3,897 3,697 200

Total Deposits 4,497 4,261 236

Short-term Borrowings 1,043 876 167

Long-term Debt 286 492 (206)

Other 42 43 (1)

Equity 643 532 111

Total Liabilities & Equity $ 6,511 $ 6,204 $ 307

Strong loan growth has been funded by low-cost deposits and short term borrowings

Consumer growth of $61 million is net of $103 million in traditional 1-4 family mortgage runoff

$115 million common equity offering during 4Q08 strengthened capital position

$ millions Unaudited

6

Strategic Outlook

Vision

Become the highest performing Pennsylvania bank, delivering locally as a responsible community bank

Continue to improve sales and service execution

Align individual goals with shareholder value

Balance Sheet Management

Continue core deposit growth, with a focus on small business segment, to reduce short-term borrowing dependency

Planned runoff of traditional 1-4 family mortgage and construction loans

Balance growth between consumer and middle-market commercial

Credit

Focus on building middle-market commercial relationships

Reduce out-of-market commercial real estate exposures

Scale down large individual credit relationships

Market Opportunities

Seize opportunity from market disruptions within our footprint

Increase households in a market with a declining population

Capital

Conservative approach to capital preservation including dividend payout ratio

Maintain a reasonable dividend payout ratio and build capital through retained earnings

First Commonwealth

7

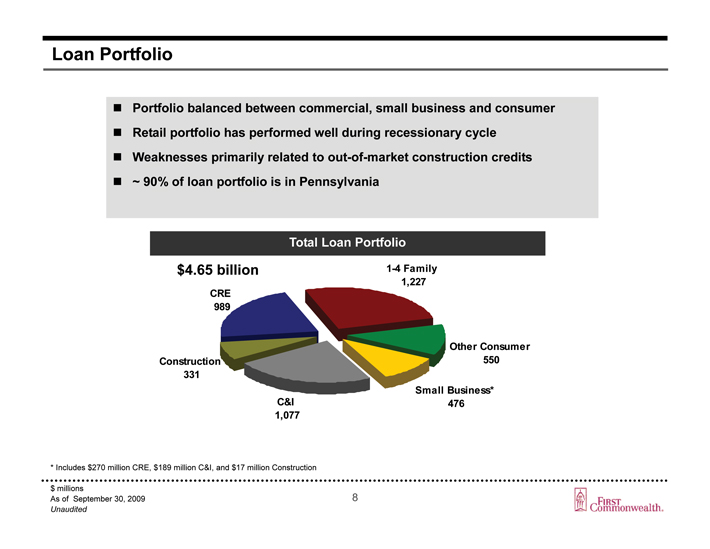

Loan Portfolio

Portfolio balanced between commercial, small business and consumer

Retail portfolio has performed well during recessionary cycle

Weaknesses primarily related to out-of-market construction credits

~ 90% of loan portfolio is in Pennsylvania

Total Loan Portfolio

$4.65 billion

CRE 989

1-4 Family

1,227

Construction 331

Other Consumer 550

C&I 1,077

Small Business* 476

* Includes $270 million CRE, $189 million C&I, and $17 million Construction

$ millions

As of September 30, 2009

Unaudited

8

First Commonwealth

Commercial Loan Portfolio

Commercial, Financial Agricultural and Other

Real Estate Construction

Real Estate Commercial

Total

Loans Past Due 90 Days and Still Accruing

Nonaccrual

Pennsylvania $1,026,258 $176,672 $1,126,332 $2,329,262 $0 $41,087

Ohio 59,277 11,893 20,656 91,826 0 3,004

Maryland 47,075 0 5,196 52,271 0 1,982

West Virginia 40,505 5,836 34,667 81,008 0 0

Virginia 27,274 0 0 27,274 0 0

New York 3,762 7,342 24,902 36,006 0 0

Florida 20,390 73,637 1,857 95,884 $543 mm 0 61,638 $85 mm

Nevada 0 8,200 0 8,200 0 8,200

Arizona 0 0 13,883 13,883 0 0

Texas 13,458 0 0 13,458 0 4,865

Illinois 0 5,000 0 5,000 0 5,000

Other 27,547 59,225 31,570 118,342 0 0

Total $1,265,546 $347,805 $1,259,063 $2,872,414 $0 $125,776

2009 commercial loan growth of $161 million was primarily driven by direct loans; only $6 million came from purchased syndications

19% ($543 million) of total commercial portfolio and 67% ($85 million) of nonaccrual commercial credits are located outside PA

$ thousands

As of September 30, 2009

Unaudited

9

First Commonwealth

Construction Portfolio

Pennsylvania Outside PA

Performing Nonaccrual Total Performing Nonaccrual Total

Office $48,489 $0 $48,489 $0 $0 $0

Retail/Malls 20,256 0 20,256 6,398 0 6,398

Residential/Multifamily 30,618 5,771 36,389 23,846 20,816 44,662

Student Housing 6,426 0 6,426 14,816 0 14,816

Hotels 17,081 0 17,081 25,731 5,000 30,731

Industrial/Warehouse/Storage 10,951 0 10,951 0 0 0

Land/Comm Res Development 3,099 2,337 5,436 19,651 49,022 68,673

Other 31,644 0 31,644 2,849 3,004 5,853

Total $168,564 $8,108 $176,672 $93,291 $77,842 $171,133

Construction loans represent 7.5% of total loan portfolio

65% of all nonaccrual loans are construction credits

Significant weakness with out-of-market relationships

Outstanding balances decreased $129 million during 3Q09 mainly due to transfers to CRE

Expecting ~$130 million of current balances to convert to perm in the next 6 months, eliminating construction risk as properties reach stabilization

$ thousands

As of September 30, 2009

Unaudited

10

Commercial Real Estate Portfolio

Pennsylvania Outside PA

Performing Nonaccrual Total Performing Nonaccrual Total

Office $251,768 $2,350 $254,118 $54,361 $0 $54,361

Retail/Malls 237,703 7,053 244,756 37,103 0 37,103

Residential/Multifamily 112,846 7,043 119,889 5,755 0 5,755

Student Housing 61,867 0 61,867 0 0 0

Hotels 56,948 0 56,948 13,887 0 13,887

Industrial/Warehouse/Storage 62,016 417 62,433 470 0 470

Waste Management Facilities 0 10,590 10,590 0 0 0

Other 315,731 0 315,731 21,155 0 21,155

Total $1,098,879 $27,453 $1,126,332 $132,731 $0 $132,731

CRE portfolio represents 27% of total loan portfolio

90% of properties are located in Pennsylvania

$ thousands

As of September 30, 2009

Unaudited

11

Investment Portfolio

No exposure to GSE preferred securities and private label CMO and MBS categories

Significant stress on pooled trust preferred securities portfolio

Net security losses are $30.5 million YTD

Total Investment Portfolio

U.S. Agency

Tax-Free / Tax Municipals

Pooled Trust Preferred

Single Issue Trust Preferred

Agency MBS, CMO’s Equity Securities

$1.3 billion

As of September 30, 2009 Unaudited

12

First Commonwealth

Pooled Trust Preferred Securities

Number

Book Fair Unrealized Moody’s/Fitch of Deferrals and Excess Defaults(1) Subordination(2) Deal Class Value Value Gain (Loss) Ratings Banks

Pre TSL I Senior $ 3,681 $ 3,203 $ (478) A1/A 32 19% 84% Pre TSL IV Mezzanine 1,830 692 (1,138) Ca/B 6 27% 19% Pre TSL V Mezzanine 456 174 (282) Ba3/A 4 66% 0% Pre TSL VI Mezzanine 340 166 (174) Caa1/CCC 5 61% 0% Pre TSL VII Mezzanine 5,591 1,975

(3,616) Ca/CC 20 57% 0% Pre TSL VIII Mezzanine 2,025 423 (1,602) Ca/CC 36 43% 0% Pre TSL IX Mezzanine 2,423 955 (1,468) Ca/CC 49 26% 0% Pre TSL X Mezzanine 1,918 408 (1,510) Ca/CC 58 37% 0% Pre TSL XII Mezzanine 7,809 2,671 (5,138) Ca/CC 78 24% 0% Pre TSL XIII Mezzanine 14,598 5,229 (9,369) Ca/CC 65 18% 0% Pre TSL XIV Mezzanine 15,690 6,066 (9,624) Ca/CC 64 15% 0% MMCap I Senior 8,731 7,182 (1,549) A3/A 29 9% 93% MMCap I Mezzanine 1,058 523 (535) Ca/CCC 29 9% 5% MM Comm IX Mezzanine 9,132 3,962 (5,170) Caa3/CC 34 37% 0% Total $ 75,282 $ 33,629 $ (41,653)

(1) as a percentage of current collateral

(2) as a percentage of current performing collateral

$ thousands

As of September 30, 2009

Unaudited

13

First Commonwealth

Asset Quality Ratios

NPAs / Loans + OREO NCOs / Average Loans

Reserves / Loans Reserves / NPLs

*Annualized

As of September 30, 2009

Source: SNL Financial and Management Reports

14

First Commonwealth

Other Operating Performances

Growing balance sheet and households in a market with a declining population

Strong performance in retail and small business franchise

Improved cross-selling and cash management function

YTD Net Interest Income increased $17 million (12.6%)

Net Interest Margin

Net Interest Margin on a fully taxable equivalent basis

As of September 30, 2009

Unaudited

15

First Commonwealth

Capital Position

Tangible Common Equity Ratio

Regulatory Ratios

Actual Regulatory Minimum

Total Capital to Risk Weighted Assets

First Commonwealth Financial Corporation

First Commonwealth Bank

Tier I Capital to Risk Weighted Assets

First Commonwealth Financial Corporation

First Commonwealth Bank

Tier I Capital to Average Assets

First Commonwealth Financial Corporation

First Commonwealth Bank

Capital Capital

Amount Ratio Amount Ratio

$649,072 11.5% $453,426 8.0% $596,400 10.6% $448,267 8.0%

$578,203 10.2% $226,713 4.0% $526,358 9.4% $224,133 4.0%

$578,203 9.2% $252,676 4.0% $526,358 8.4% $250,487 4.0%

$ thousands

Source: SNL Financial and Management Reports

As of September 30, 2009

16

First Commonwealth

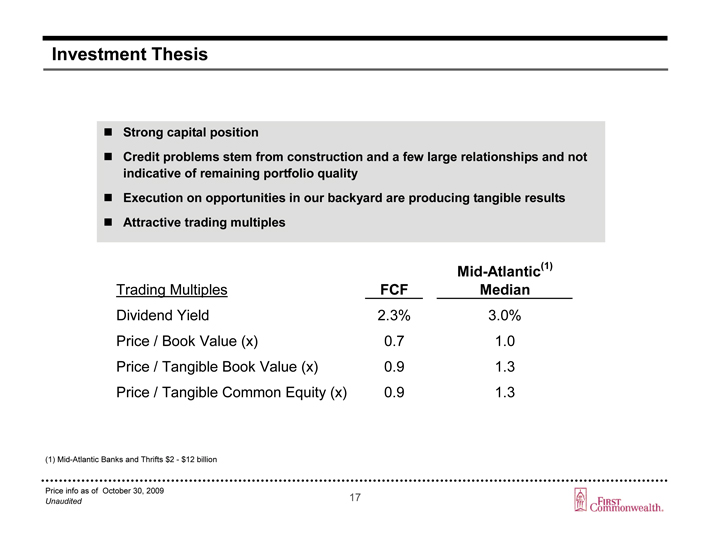

Investment Thesis

Strong capital position

Credit problems stem from construction and a few large relationships and not indicative of remaining portfolio quality

Execution on opportunities in our backyard are producing tangible results

Attractive trading multiples

Trading Multiples FCF Mid-Atlantic(1) Median

Dividend Yield 2.3% 3.0%

Price / Book Value (x) 0.7 1.0

Price / Tangible Book Value (x) 0.9 1.3

Price / Tangible Common Equity (x) 0.9 1.3

(1) Mid-Atlantic Banks and Thrifts $2 - $12 billion

Price info as of October 30, 2009

Unaudited

17

First Commonwealth

Supplemental Information

First Commonwealth

Deposit Growth

Core* Deposit Growth Y/Y

Average Median First Commonwealth Total Mid Atlantic Banks and Thrifts < $50B

Market conditions and improved retail banking strategy have facilitated core deposit growth

Realizing progress from retail banking initiatives, combined with the benefit of a weakened competitive landscape

Notes

Includes all data available for Mid Atlantic Banks and Thrifts with Total Assets less than $50 billion

Excludes growth/declines greater than 50% during any single period (acquisition adjustment)

Excludes Foreign and Brokered Deposits

*Total Transaction, MMDA and Savings Deposits

EOP Balance growth

Source: FR Y-9C

19

First Commonwealth

Deposit Growth

Third Quarter

2009 2008 change

Non-Interest Bearing DDA

$ 599 $ 558 7.4%

Interest Bearing DDA

604 624 -3.2%

Savings & MMDA

1,602 1,165 37.5%

Total Core* Deposits

$ 2,805 $ 2,347 19.5%

Retail CDs

1,351 1,413 -4.4%

Jumbo CDs

357 526 -32.1%

Total CDs

$ 1,708 $ 1,939 -11.9%

Total Deposits

$ 4,513 $ 4,286 5.3%

Total Core* deposits have increased ~ 20% year-over-year

Simultaneously managing down time deposit costs from single-service households

*Total Transaction, MMDA and Savings Deposits

Average balances

$ millions

Unaudited

20

First Commonwealth

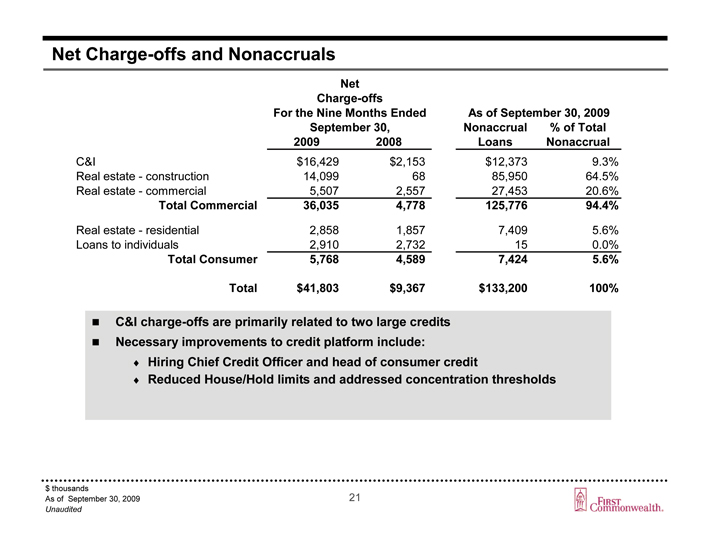

Net Charge-offs and Nonaccruals

Net Charge-offs

For the Nine Months Ended As of September 30, 2009 September 30, Nonaccrual % of Total 2009 2008 Loans Nonaccrual

C&I $16,429 $2,153 $12,373 9.3%

Real estate - construction 14,099 68 85,950 64.5%

Real estate - commercial 5,507 2,557 27,453 20.6%

Total Commercial 36,035 4,778 125,776 94.4%

Real estate - residential 2,858 1,857 7,409 5.6%

Loans to individuals 2,910 2,732 15 0.0%

Total Consumer 5,768 4,589 7,424 5.6% Total $41,803 $9,367 $133,200 100%

C&I charge-offs are primarily related to two large credits

Necessary improvements to credit platform include:

Hiring Chief Credit Officer and head of consumer credit

Reduced House/Hold limits and addressed concentration thresholds

$ thousands

As of September 30, 2009

Unaudited

21

First Commonwealth

Nonaccrual Loans by State

Commercial, Financial

Agricultural Real Estate Real Estate and Other Construction Commercial Consumer Total

Pennsylvania $5,526 $8,108 $27,453 $7,424 $48,511 Ohio 0 3,004 0 0 3,004 Maryland 1,982 0 0 0 1,982 Florida 0 61,638 0 0 61,638 Nevada 0 8,200 0 0 8,200 Texas 4,865 0 0 0 4,865 Illinois 0 5,000 0 0 5,000 Other 0 0 0 0 0 Total $12,373 $85,950 $27,453 $7,424 $133,200

$ thousands

As of September 30, 2009

Unaudited

22

First Commonwealth

Purchased Syndication Portfolio*

Commercial, Loans Past

Financial Due

Agricultural Real Estate Real Estate 90 Days and

and Other Construction Commercial Total Still Accruing Nonaccrual

Pennsylvania $375,255 $24,470 $19,142 $418,867 $0 $1,870

Ohio 59,276 5,495 19,445 84,216 0 3,004

Maryland 47,075 0 0 47,075 0 1,982

West Virginia 28,505 0 0 28,505 0 0

Virginia 27,274 0 0 27,274 0 0

New York 3,378 7,342 1,831 12,551 0 0

Florida 18,365 34,802 0 53,167 0 22,803

Arizona 0 0 13,883 13,883 0 0

Nevada 0 8,200 0 8,200 0 8,200

Texas 13,458 0 0 13,458 0 4,865

Illinois 0 5,000 0 5,000 0 5,000

Other 25,923 25,216 5,000 56,139 0 0

Total $598,509 $110,525 $59,301 $768,335 $0 $47,724

Syndication portfolio has remained flat since 12/31/08 6% of participations are on nonaccrual status 96% of nonaccrual syndication credits are outside PA

* Includes all Shared National Credits

$ thousands

As of September 30, 2009

Unaudited

23

Shared National Credit (SNC) Portfolio

Commercial,

Financial Loans Past Due

Agricultural Real Estate Real Estate 90 Days and

and Other Construction Commercial Total Still Accruing Nonaccrual

Pennsylvania $263,351 $6,911 $0 $270,262 $0 $0

Ohio 33,633 3,004 0 36,637 0 3,004

Maryland 47,075 0 0 47,075 0 1,982

West Virginia 9,850 0 0 9,850 0 0

Virginia 6,355 0 0 6,355 0 0

New York 3,378 7,342 1,831 12,551 0 0

Florida 18,365 22,803 0 41,168 0 22,803

Nevada 0 8,200 0 8,200 0 8,200

Arizona 0 0 0 0 0 0

Texas 13,458 0 0 13,458 0 4,865

Illinois 0 5,000 0 5,000 0 5,000

Other 22,138 5,598 5,000 32,736 0 0

Total $417,603 $58,858 $6,831 $483,292 $0 $45,854

SNCs represent 17% of commercial loan portfolio

All nonperforming SNCs are located outside of Pennsylvania

14% of SNC portfolio are Construction and CRE, yet represents 85% of nonaccrual SNCs

Did not originate any SNCs during 3Q09

$ thousands

As of September 30, 2009

Unaudited

24

Noninterest Expense Control

Noninterest Expenses

Expense initiative deployed in April 2009

Goal is to keep NIE flat year-over-year (excluding FDIC costs)

(1) Collection and Repossession Expense

$ millions

As of September 30, 2009

Unaudited

25

First Commonwealth

Contact Information

First Commonwealth Financial Corporation

Member NYSE: FCF

Old Courthouse Square

22 North Sixth Street

Indiana, Pennsylvania 15701

For More Information Contact:

Donald A. Lawry

Vice President / Investor Relations

First Commonwealth Financial Corporation

(724) 465-4660

26

First Commonwealth