Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

| | | | | |

Filed by the Registrant x | | Filed by a Party other than the Registrant o | |

| | | | |

Check the appropriate box: | | | | |

| | | | |

x | Preliminary Proxy Statement | | | |

| | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| | | | |

o | Definitive Proxy Statement | | | |

| | | | |

o | Definitive Additional Materials | | |

| | | |

o | Soliciting Material Pursuant to §240.14a-12 | | |

ELECTRONIC ARTS INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

| | |

Payment of Filing Fee (Check the appropriate box): |

| |

x | No fee required. |

| |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| 1) | Title of each class of securities to which transaction applies: |

| | |

| 2) | Aggregate number of securities to which transaction applies: |

| | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| 4) | Proposed maximum aggregate value of transaction: |

| | |

| 5) | Total fee paid: |

| | |

| | |

o | Fee paid previously with preliminary materials. |

| |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| 1) | Amount Previously Paid: |

| | |

| 2) | Form, Schedule or Registration Statement No.: |

| | |

| 3) | Filing Party: |

| | |

| 4) | Date Filed: |

| | |

Electronic Arts Inc. Notice of 2019 Annual Meeting of Stockholders

| |

PLACE: | ELECTRONIC ARTS’ HEADQUARTERS |

Building 250*

209 Redwood Shores Parkway

Redwood City, CA 94065

* Please note: Building 250 is located on the headquarters’ campus at 250 Shoreline Drive

|

| | | |

MATTERS TO BE VOTED UPON: |

Agenda Item | | Board of Directors Recommendation |

1. | The election of nine members of the Board of Directors to hold office for a one-year term. | FOR ALL |

2. | Advisory vote on the compensation of our named executive officers. | FOR |

3. | Ratification of the appointment of KPMG LLP as our independent public registered accounting firm for the fiscal year ending March 31, 2020. | FOR |

4. | Approve our 2019 Equity Incentive Plan. | FOR |

5. | Amend and restate our Certificate of Incorporation to permit stockholders holding 25% or more of our common stock to call special meetings. | FOR |

6. | To consider and vote upon a stockholder proposal, if properly presented at the Annual Meeting, to enable stockholders holding 15% or more of our common stock to call special meetings. | AGAINST |

7. | Any other matters that may properly come before the meeting. | |

Any action on the items of business described above may be considered at the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed.

Stockholders of record as of the close of business on June 14, 2019 are entitled to notice of the Annual Meeting and to attend and vote at the Annual Meeting. A live audio webcast of the Annual Meeting will also be made available at http://ir.ea.com.

Your vote is important. You do not need to attend the Annual Meeting to vote if you have submitted your proxy in advance of the meeting. Whether or not you plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible, so that your shares may be represented at the Annual Meeting. You may vote on the Internet, in person, by telephone, or, if you requested to receive printed proxy materials, by mailing a proxy card or voting instruction card. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials (“Notice”) you received in the mail, the section titled “Commonly Asked Questions and Answers” beginning on page 62 of this Proxy Statement or, if you requested to receive printed proxy materials, your enclosed proxy card. Please note that this Proxy Statement, as well as our Annual Report on Form 10-K (the “Annual Report”) for fiscal year ended March 31, 2019, is available at http://ir.ea.com.

By Order of the Board of Directors,

|

| | | | |

| | | | |

Jacob J. Schatz Executive Vice President, General Counsel and Corporate Secretary | | | |

In this Proxy Statement, we may make forward-looking statements regarding future events or the future financial performance of the Company. We use words such as “anticipate,” “believe,” “expect,” “intend,” “estimate,” “plan,” “predict,” “seek,” “goal,” “will,” “may,” “likely,” “should,” “could” (and the negative of any of these terms), “future” and similar expressions to identify forward-looking statements. In addition, any statements that refer to projections of our future financial performance, trends in our business, projections of markets relevant to our business, uncertain events and assumptions and other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are not guarantees of future performance and reflect management’s current expectations. Our actual results could differ materially from those discussed in the forward-looking statements. Please refer to the Annual Report for a discussion of important factors that could cause actual events or actual results to differ materially from those discussed in this Proxy Statement. These forward-looking statements speak only as of the date of this Proxy Statement; we assume no obligation to revise or update any forward-looking statement for any reason, except as required by law.

2019 PROXY STATEMENT SUMMARY AND HIGHLIGHTS

This summary highlights information contained in this Proxy Statement, and it is qualified in its entirety by the remainder of this Proxy Statement which was distributed and/or made available via the Internet to stockholders on or about June [l], 2019 along with the Electronic Arts Inc. Notice of 2019 Annual Meeting of Stockholders, Annual Report and form of proxy. You are encouraged to read the entire Proxy Statement carefully before voting. In this Proxy Statement, the terms “EA,” “we,” “our” and “the Company” refer to Electronic Arts Inc.

FISCAL 2019 SUMMARY OF EA’S BUSINESS

Fiscal 2019 was a year of intense competition in the video game industry. While there were many achievements this year that we are proud of, after generating strong financial results and robust stockholder returns from fiscal 2014 through fiscal 2018, we did not perform to our expectations during fiscal 2019. Given the Company’s fiscal 2019 financial performance, and in order to maintain alignment with our pay-for-performance executive compensation philosophy, our CEO and his staff (including the NEOs) requested that they receive no performance cash bonus award for fiscal 2019. The Board (in the case of Mr. Wilson) and the Compensation Committee (in the case of the other NEOs) accepted this request. Likewise, as contemplated by the design of our performance-based restricted stock award (“PRSU”) program, due to the Company’s total shareholder return in fiscal 2019, none of the PRSUs granted in June 2018 vested with respect to the fiscal 2019 performance period.

While we are disappointed with our fiscal 2019 results, we understand the challenges we face, and we will continue to focus on how we can apply the strengths of our Company to capitalize on our opportunities.

Fiscal 2019 GAAP Financial Results and Operating Highlights

| |

• | We generated $4.95 billion of net revenue and $3.33 diluted earnings per share. |

| |

• | Our digital net revenue increased to $3.71 billion and represented 75% of our total net revenue. |

| |

• | We delivered net income of $1.02 billion and operating cash flow of $1.55 billion. |

| |

• | Operating profit margins were 20.1%. |

| |

• | We generated net bookings for the fiscal year of $4.94 billion. |

| |

• | FIFA 19 was the best-selling console game in Europe in calendar 2018. |

| |

• | We launched two new original IP titles, Apex Legends and Anthem. |

| |

• | We launched Firestorm battle royale in Battlefield V, the biggest Battlefield live service event ever. |

The financial performance, operational achievements and other fiscal year events summarized above provide context for the compensation decisions made by the Compensation Committee and Board of Directors, as well as the decision by the Company’s leadership team to decline bonuses in fiscal 2019.

EXECUTIVE COMPENSATION HIGHLIGHTS

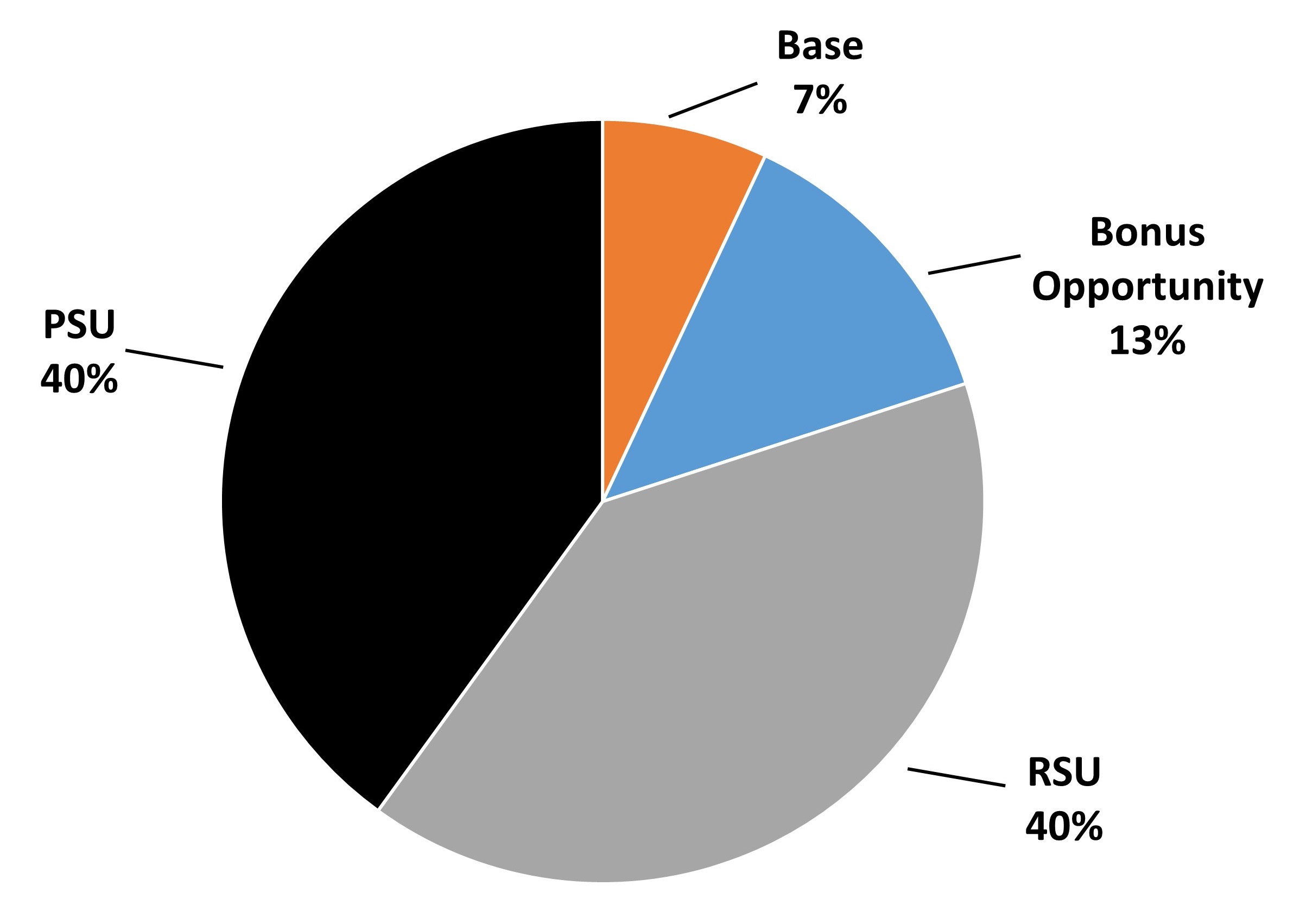

Compensation Principles — Promoting Pay-for-Performance

The design of our compensation programs is guided by a compensation philosophy based on three core principles intended to attract and retain high-performing executives and promote a pay-for-performance approach to executive compensation:

| |

• | Principle 1 — Cash Compensation: A significant portion of each NEO’s cash compensation should be at risk, based on the annual financial and operational performance of the Company, in addition to the NEO’s individual performance; |

| |

• | Principle 2 — Equity Compensation: A significant portion of each NEO’s total compensation should be provided in the form of long-term equity to enhance alignment between the interests of our NEOs and our stockholders and to promote long-term retention of a strong leadership team in an industry and geographic area that are highly competitive for executive talent; and |

| |

• | Principle 3 — Target Total Direct Compensation: The target total direct compensation package for each NEO should be consistent with market practices for executive talent and should reflect each NEO’s individual experience, responsibilities and performance. |

Our executive compensation programs are designed to align the interests of our executives with the interests of our stockholders.

|

| | | |

What We Do | What We Don’t Do |

þ | Incorporate both PRSUs and time-based restricted stock units (“RSUs”) | x | Have a “single-trigger” change in control plan |

þ | Require our executives to satisfy stock holding requirements | x | Provide excise tax gross-ups upon a change in control |

þ | Prohibit all employees from engaging in hedging transactions in EA stock and prohibit executive officers from pledging EA common stock | x | Have executive employment contracts (other than as required by local jurisdictions) |

þ | Conduct annual “say-on-pay” advisory votes | x | Reprice options without stockholder approval |

þ | Recover (clawback) equity compensation for misconduct in the event of a financial restatement | x | Provide excessive perquisites |

þ | Align performance-based equity vesting with stockholder interests | | |

þ | Independent compensation consultant input into the Compensation Committee’s decisions | | |

þ | Annual evaluation of peer group to ensure ongoing relevance of each member | | |

BOARD NOMINEES

The following table provides summary information about our director nominees, each of whom is a current director of the Company.

|

| | | | |

Name | Principal Occupation | Director Since | Independent | Committee Memberships |

Mr. Leonard S. Coleman | Former President of The National League of Professional Baseball Clubs | 2001 | X | NG, C |

Mr. Jay C. Hoag | Founding General Partner, Technology Crossover Ventures | 2011 | X | C (chair) |

Mr. Jeffrey T. Huber | Vice Chairman, GRAIL, Inc. | 2009 | X | A |

Mr. Lawrence F. Probst III (Chairman) | Former Chairman, United States Olympic Committee | 1991 | X | |

Ms. Talbott Roche | President and Chief Executive Officer, Blackhawk Network Holdings, Inc. | 2016 | X | A |

Mr. Richard A. Simonson | Advisor to the CEO, Sabre Corporation; Managing Director, Specie Mesa L.L.C. | 2006 | X | A (chair) |

Mr. Luis A. Ubiñas (Lead Director*) | Former President, Ford Foundation | 2010 | X | NG (chair) |

Ms. Heidi J. Ueberroth | President, Globicon | 2017 | X | C |

Mr. Andrew Wilson | Chief Executive Officer, Electronic Arts Inc. | 2013 | | |

| |

* | Elected by independent directors |

NG: Nominating and Governance Committee

C: Compensation Committee

A: Audit Committee

BOARD DIVERSITY AND REFRESHMENT

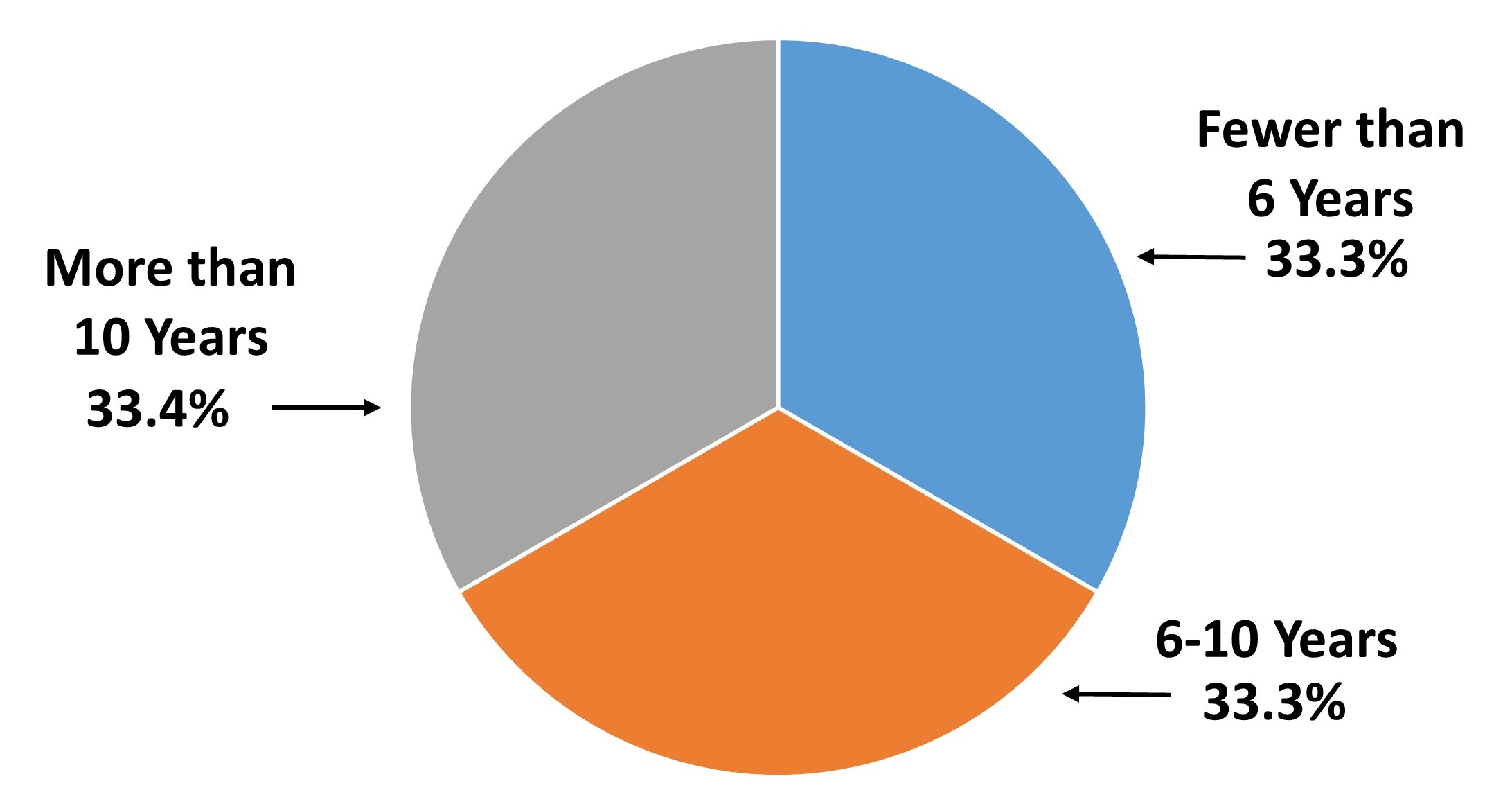

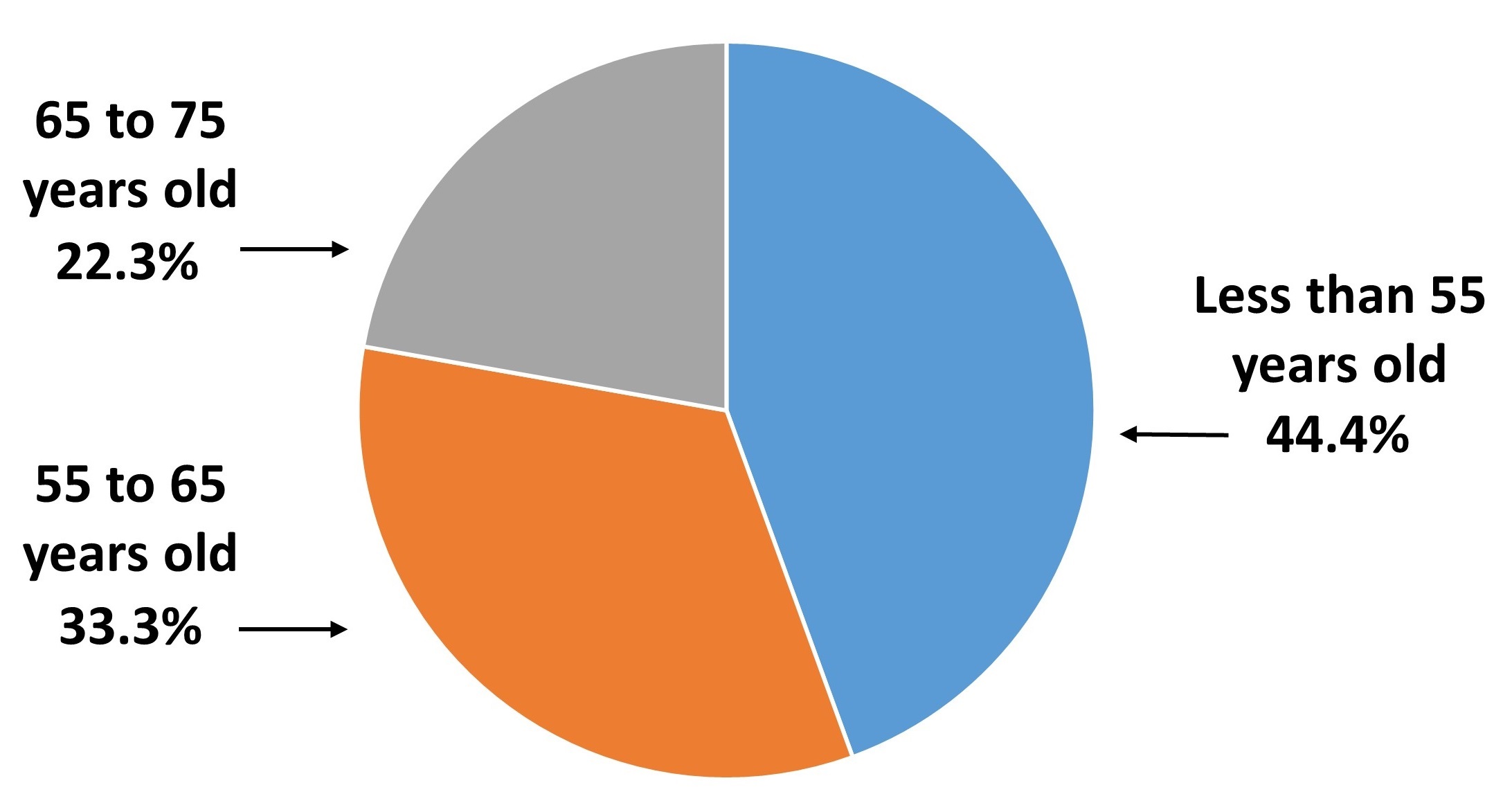

The Board of Directors routinely assesses its composition and believes that stockholder value can be driven by a board that balances the knowledge and understanding of the Company’s business that results from long-term service with the fresh perspective and ideas driven by the addition of new members. In addition, the Board of Directors believes that complementary and diverse perspectives, whether based on business experience, diversity of gender, ethnicity, culture or other factors, contribute to the Board of Directors’ effectiveness as a whole. The Board of Directors has regularly added new members — three of our nine director nominees have served for fewer than six years — and the two most recent additions to the Board of Directors, Ms. Talbott Roche and Ms. Heidi Ueberroth, represent an increase in the Board of Directors’ gender diversity.

|

| |

Director Tenure Median Tenure - 8 years Average Tenure - 10.2 years | Director Age Median Age - 56 years old Average Age - 57.3 years old |

| |

* Mr. Coleman, Ms. Roche, Mr. Ubiñas, Ms. Ueberroth

CORPORATE GOVERNANCE HIGHLIGHTS AND REPORT |

| |

Board Independence | |

Independent Director Nominees | 8 of 9 |

Independent Lead Director | Luis A. Ubiñas |

Independent Board Committees | All |

Conflict of Interest Policy | Yes |

Director Elections | |

Frequency of Board elections | Annual |

Voting standard for uncontested elections | Majority of votes cast |

Stockholder proxy access | Yes |

Board Operations |

Number of incumbent directors that attended at least 79% of all applicable meetings | 9 of 9 |

Board Evaluations | Annual |

Committee Evaluations | Annual |

Director stock ownership requirement | Yes, 5x annual retainer |

Chairman/CEO role | Split |

Stockholder Rights |

Voting rights for all shares | One-share, one-vote |

Poison Pill | No |

Supermajority Voting Provisions | None |

CORPORATE SOCIAL RESPONSIBILITY

People Practices. Attracting, developing and retaining the best creative and technical talent in the industry is critical to EA’s short and long-term success. We cultivate and maintain a healthy culture by:

| |

• | Providing timely feedback through meaningful one-on-one conversations between employees and their manager. These conversations are focused through our Managing for Results framework, which sets a cadence for establishing annual goals, regularly measuring progress against those goals, receiving actionable feedback and discussing career development. |

| |

• | Investing in programs to develop EA’s future generation of leaders. We provide training to current and future leaders to encourage growth in support of their teams and EA. We also provide job specific development training and materials to engage and grow our employees’ capabilities, including the creation of a catalog of learning tools for Frostbite, our proprietary game engine, that can be accessed by over 2,500 game developers. |

| |

• | Frequently soliciting feedback on our employees’ job satisfaction, including with respect to EA’s culture, career opportunities, compensation and benefits and management through our employee satisfaction surveys, the results of which are reviewed by executive management and shared with our employees. |

| |

• | Providing a comprehensive benefits and awards package that supports the needs and lifestyles of our employees, including competitive compensation (including bonus and equity opportunities that give employees an opportunity to share in EA’s financial success) retirement benefits, paid time off, leaves of absence in connection with significant life events, on-site fitness and daycare services, and more. |

Diversity and Inclusion. We believe in creating games and experiences for our global player community that reflect a diverse world. As we aim to inspire the world to play, a diverse and inclusive workforce enables us to deliver the games and experiences that inspire and delight our diverse player community. We are investing in internal and external initiatives that empower our employees, celebrate diversity and foster inclusion within EA and our communities, including employee resource groups and inclusion training courses.

Equal Pay for Equal Work. EA believes in equal pay for equal work, and we have made efforts across our global organization to promote equal pay practices. We are committed to continuing to assess pay equity and aim for equal pay for equal work across our global organization.

Sustainability. We aim to integrate environmental responsibility and sustainability into our operational and product strategies. We reduce our carbon footprint by the manner through which we bring our games and services to players and by making environmentally-conscious choices in our offices worldwide.

Our business is transforming as players increasingly engage with our games and services digitally instead of purchasing disc-based products through retailers. Delivering digital games to our players does not require the manufacturing, packaging, and distribution of physical discs, which reduces our carbon footprint and the waste generated by our operations. We recognize that reliably delivering digital products and operating our increasingly digital business has increased our reliance on data centers, and the associated energy consumption. As a result, we aim to manage a significant portion of our data center usage through partners that have made a commitment to increasing the amount of renewable energy in their electricity supply.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Each of the following directors has been nominated for re-election at the Annual Meeting. As set forth below, we believe each of these directors brings a valuable and unique perspective to the Board of Directors and has the necessary experience, skills and attributes to serve on the Board of Directors and contribute to its overall effectiveness, and the Board of Directors has concluded that each is qualified to serve as a director based on the experiences, qualifications and attributes set forth below.

Leonard S. Coleman

Director since 2001

Mr. Coleman, age 70, served as Senior Advisor to Major League Baseball from 1999 until 2005 and, from 2001 to 2002, was the Chairman of ARENACO, a subsidiary of Yankees/Nets. Mr. Coleman was President of The National League of Professional Baseball Clubs from 1994 to 1999. Mr. Coleman also serves on the board of directors of Avis Budget Group, Inc., Hess Corporation and Omnicom Group Inc. and has served as a director of Aramark and Churchill Downs Incorporated during the past five years.

Mr. Coleman brings a wealth of corporate governance, public sector and international experience to the Board of Directors from his years of service on the boards of directors for numerous large, public companies and his involvement in diverse public-service organizations, as well as his extensive knowledge of the sports industry.

Jay C. Hoag

Director since 2011

Mr. Hoag, age 61, co-founded Technology Crossover Ventures, a leading provider of growth capital to technology companies in 1995 and serves as its Founding General Partner. Mr. Hoag also serves on the board of directors of Netflix, Inc., TripAdvisor, Inc. and Zillow Group, Inc. and several private companies. Mr. Hoag also serves on the Boards of Trustees of Northwestern University and Vanderbilt University, and on the Investment Advisory Board of the University of Michigan. Mr. Hoag has served as a director of TechTarget, Inc. during the past five years. Mr. Hoag holds a B.A. from Northwestern University and an M.B.A. from the University of Michigan.

As a venture capital investor, Mr. Hoag brings strategic insight and financial experience to the Board of Directors. He has evaluated, invested in and served as a board member and compensation committee member at numerous companies, both public and private, and is familiar with a full range of corporate and board functions. His many years of experience in helping companies shape and implement strategy provide the Board of Directors with useful perspectives on matters such as risk management, compensation program structure and design, corporate governance, talent selection and management.

Jeffrey T. Huber

Director since 2009

Mr. Huber, age 51, is the Vice Chairman of GRAIL, Inc., a life sciences company. Previously, Mr. Huber served as Senior Vice President of Alphabet Inc. (formerly Google Inc.), where he worked from 2003 to 2016. From 2001 to 2003, Mr. Huber served as Vice President of Architecture and Systems Development at eBay Inc. Prior to joining eBay, Mr. Huber was Senior Vice President of Engineering at Excite@Home, where he worked from 1996 to 2001. Mr. Huber has served on the board of directors of Illumina, Inc. during the past five years. Mr. Huber holds a B.S. degree in Computer Engineering from the University of Illinois and a Masters degree from Harvard University. Mr. Huber serves as a visiting scholar at Stanford University.

Mr. Huber has extensive operational and management experience at companies that apply rapidly-changing technology. Mr. Huber’s experience at Alphabet and eBay, in particular, provide background and experience, including risk management experience, with respect to consumer online companies that deploy large-scale technological infrastructure.

Lawrence F. Probst III

Director since 1991, Chairman since 1994

Mr. Probst, age 69, has been our Chairman of the Board of Directors since July 1994. He was employed by EA from 1984 to 2008, as well as from March 2013 until December 2014, serving as our Chief Executive Officer from 1991 until 2007 and as our interim Chief Executive Officer from March 2013 until September 2013. Mr. Probst served as the Chairman of the board of directors of the U.S. Olympic Committee from 2008 to 2018 and was a member of the International Olympic Committee from 2013 to 2018. Mr. Probst has served as a director of Blackhawk Network Holdings, Inc. during the past five years. Mr. Probst holds a B.S. degree from the University of Delaware.

Mr. Probst served as the Company’s Chief Executive Officer for more than 15 years and has served as the Chairman of the Board of Directors for nearly 25 years. Mr. Probst contributes to the Board of Directors his deep understanding of the Company’s operational and strategic business goals through his direct experience with Company as well as valuable perspective on industry-specific opportunities and challenges.

Talbott Roche

Director since June 2016

Ms. Roche, age 52, has served as Chief Executive Officer and a member of the board of directors of Blackhawk Network Holdings, Inc., a leading prepaid payment network, since February 2016, and as President since November 2010. Ms. Roche has held several positions at Blackhawk Network Holdings since joining in 2001, including Senior Vice President, Marketing, Product and Business Development and Assistant Vice President. Prior to joining Blackhawk Network Holdings, Ms. Roche served as a Branding Consultant and Director of New Business Development for Landor Associates, a marketing consulting firm, and held executive positions at News Corporation, a media and marketing services company. Ms. Roche served as a member of the board of directors of publicly-traded Blackhawk Network Holdings, Inc. during the past five years and has also previously served as a member of the board of directors of the Network Branded Prepaid Card Association, a trade association. Ms. Roche holds a B.A. in economics from Stanford University.

Ms. Roche brings to the Board of Directors extensive operational and management experience as well as significant corporate governance and risk management experience as the Chief Executive Officer of a global organization, including during Blackhawk Network Holdings’ time as a public company. In addition, Ms. Roche’s understanding and experience with digital commerce, marketing and consumer trends provide the Board of Directors with valuable perspective.

Richard A. Simonson

Director since 2006

Mr. Simonson, age 60, has served as Senior Advisor to the CEO of Sabre Corporation and as Managing Partner of Specie Mesa L.L.C., an investment and advisory firm since July 2018. From March 2013 until July 2018, Mr. Simonson served as Executive Vice President and Chief Financial Officer of Sabre Corporation. Previously, Mr. Simonson served as President, Business Operations and Chief Financial Officer of Rearden Commerce from April 2011 through May 2012. From 2001 to 2010, Mr. Simonson held a number of executive positions at Nokia Corporation, including Executive Vice President, Head of Mobile Phones and Sourcing, Chief Financial Officer, and Vice President and Head of Customer Finance. Mr. Simonson also serves as Chairman of the Board of Trustees of the SMU Lyle School of Engineering. Mr. Simonson has served as a director of Silver Spring Networks, Inc. during the past five years. Mr. Simonson holds a B.S. degree from the Colorado School of Mines and an M.B.A. from Wharton School of Business at the University of Pennsylvania.

Mr. Simonson brings to the Board of Directors extensive financial expertise, corporate governance and risk management experience as a former public company Chief Financial Officer. He also has extensive experience with the strategic and operational challenges of leading a global company.

Luis A. Ubiñas

Director since 2010, Lead Director since 2015

Mr. Ubiñas, age 56, served as President of the Ford Foundation from 2008 to 2013. Prior to joining the Ford Foundation, Mr. Ubiñas spent 18 years with McKinsey & Company, where he held various positions, including Senior Partner of the firm’s west coast media practice working with technology, telecommunications and media companies. Mr. Ubiñas also serves on the board of directors of Boston Private Financial Holdings, Inc. and on the boards of several non-profit organizations. Mr. Ubiñas has served as a director of CommerceHub, Inc. during the past five years. He holds a B.A. degree from Harvard College and an M.B.A. from Harvard Business School, is a fellow of the American Academy of Arts and Sciences and a member of the Council on Foreign Relations.

Mr. Ubiñas has extensive experience in business management and operations from his years of overseeing more than $12 billion in assets and over $500 million in annual giving at the Ford Foundation. In addition, through his prior experience as a Senior Partner at McKinsey & Company, he has worked with technology, telecommunications and media companies in understanding the challenges and opportunities presented by digital distribution platforms and applications. Mr. Ubiñas has worked extensively with companies managing the transition from physical to digital distribution and business models.

Heidi J. Ueberroth

Director since 2017

Ms. Ueberroth, age 53, is the President of Globicon, a private investment and advisory firm focused on the media, sports, entertainment and hospitality industries. Prior to Globicon, Ms. Ueberroth served in several positions at the National Basketball Association between 1994 and 2013, including as President of NBA International from 2009 to 2013 and as President of Global Marketing Partnerships and International Business Operations from 2006 to 2009. Ms. Ueberroth also serves on the board of directors of the privately-held Four Seasons Hotels and Resorts, the privately-held Pebble Beach Company and on the boards of several non-profit organizations. Ms. Ueberroth has served as a director of Santander Consumer USA Holdings Inc. during the past five years. Ms. Ueberroth holds a B.A. degree from Vanderbilt University and serves on its Arts and Science Board of Visitors and is a member of the Council on Foreign Relations.

Ms. Ueberroth brings to the Board of Directors extensive global experience in the sports, media and entertainment industries, including with respect to developing and marketing products and services in Asian markets. In addition, Ms. Ueberroth’s past and present board service bring the experience of overseeing strategic and operational challenges of a global company.

Andrew Wilson

Director since 2013

Mr. Wilson, age 44, has served as EA’s Chief Executive Officer and as a director of EA since September 2013. Prior to his appointment as our Chief Executive Officer, Mr. Wilson held several positions within the Company since joining EA in May 2000, including Executive Vice President, EA SPORTS from August 2011 to September 2013 and Senior Vice President, EA SPORTS from March 2010 to August 2011. Mr. Wilson also serves as a director of Intel Corporation and is chairman of the board of the privately-held World Surf League.

Mr. Wilson has served as the Company’s Chief Executive Officer since September 2013 and has been employed by EA in several roles since 2000. In addition to Mr. Wilson’s extensive experience and knowledge of the Company and the industry, we believe it is crucial to have the perspective of the Company’s Chief Executive Officer represented on the Board of Directors to provide direct insight into the Company’s day-to-day operation and strategic vision.

DIRECTOR INDEPENDENCE

Our Board of Directors has determined that each of our non-employee directors qualifies as an “independent director” as that term is used in the NASDAQ Stock Market Rules and that each member of our standing committees is independent in accordance with those standards. Mr. Wilson, our CEO, does not qualify as independent. The NASDAQ Stock Market Rules have both objective tests and a subjective test for determining independence. The Board of Directors has not established categorical standards or guidelines to make these subjective determinations, but considers all relevant facts and circumstances.

In addition to the board-level standards for director independence, the directors who serve on the Nominating and Governance, Audit and Compensation Committees each satisfy standards established by the Securities and Exchange Commission (“SEC”) and the NASDAQ Stock Market to qualify as “independent” for the purposes of membership on those committees.

BOARD OF DIRECTORS, BOARD MEETINGS AND COMMITTEES

In fiscal 2019, the Board of Directors met 8 times and also acted by written consent. At regularly scheduled meetings, the independent members of the Board of Directors meet in executive session separately without management present.

Board of Directors Leadership Structure

Mr. Wilson serves as our CEO, and Mr. Probst serves as our Chairman. In addition, Mr. Ubiñas, our Lead Director, was elected by the independent directors and is responsible for chairing executive sessions of the Board of Directors and other meetings of the Board of Directors in the absence of the Chairman, serving as a liaison between the Chairman and the other independent directors, and overseeing the Board of Directors’ stockholder communication policies and procedures (including, under appropriate circumstances, meeting with stockholders). Mr. Ubiñas also may call meetings of the independent directors. Mr. Ubiñas has served as our Lead Director since 2015. Mr. Ubiñas’ current term ends at the Annual Meeting. Mr. Ubiñas was chosen by the independent directors to serve as Lead Director for an additional two-year term, ending with our 2021 annual meeting, subject to Mr. Ubiñas’ re-election to the Board of Directors.

The Board of Directors believes that this leadership structure with Mr. Wilson serving as CEO, Mr. Probst serving as Chairman and Mr. Ubiñas serving as Lead Director is the appropriate leadership structure for the Company. Mr. Probst, an independent director, was an employee of the Company for 25 years, more than 15 of which were in service as CEO and Executive Chairman. As a result of his many years of service to the Company, Mr. Probst has invaluable knowledge regarding the Company and the interactive entertainment industry and is uniquely positioned to lead the Board of Directors in its review of management’s strategic plans. Given Mr. Probst’s past service with the Company, the Board of Directors believes that a strong and empowered Lead Director provides an essential mechanism for independent viewpoints, and as the Chairman of the Nominating and Governance Committee, Mr. Ubiñas is well suited for this role because, among other things, he is not affiliated with the Company under any applicable rules or guidelines.

Board Committees

The Board of Directors currently has a standing Audit Committee, Compensation Committee and Nominating and Governance Committee. Each of these standing committees operates under a written charter adopted by the Board of Directors. These charters are available in the Investor Relations section of our website at http://ir.ea.com.

All members of these committees are independent directors. During fiscal 2019, all nine directors attended or participated in 79% or more of the aggregate of (1) the number of applicable meetings of the Board or Directors and (2) the number of applicable meetings held by each committee on which such director was a member. The members of our standing committees are set forth below: |

| |

Audit Committee: | Richard A. Simonson (Chair), Jeffrey T. Huber and Talbott Roche |

Nominating and Governance Committee: | Luis A. Ubiñas (Chair) and Leonard S. Coleman |

Compensation Committee: | Jay C. Hoag (Chair), Leonard S. Coleman and Heidi J. Ueberroth |

Audit Committee

The Audit Committee assists the Board of Directors in its oversight of the Company’s financial reporting and is directly responsible for the appointment, compensation and oversight of our independent auditors. The Audit Committee also is responsible for establishing and maintaining complaint procedures with respect to internal and external concerns regarding accounting or auditing matters, oversight of tax and treasury policies and practices and oversight of the Company’s internal audit function. The Audit Committee has the authority to obtain advice and assistance from outside advisors without seeking approval from the Board of Directors, and the Company will provide appropriate funding for payment of compensation to advisors engaged by the Audit Committee. The Audit Committee currently is comprised of three directors, each of whom in the opinion of the Board of Directors meets the independence requirements and the financial literacy standards of the NASDAQ Stock Market Rules, as well as the independence requirements of the SEC. While the Board of Directors retains ultimate risk management oversight with respect to privacy and cybersecurity issues, the Audit Committee is provided quarterly updates from EA’s information security team and reviews the steps taken by management to monitor and control these risks. The Board of Directors has determined that Mr. Simonson meets the criteria for an “audit committee financial expert” as set forth in applicable SEC rules. The Audit Committee met 8 times and also acted by written consent in fiscal 2019. For further information about the Audit Committee, please see the “Report of the Audit Committee of the Board of Directors” below.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for recommending to the Board of Directors nominees for director and committee memberships. The Nominating and Governance Committee also is responsible for reviewing developments in corporate governance, recommending formal governance standards to the Board of Directors, establishing the Board of Directors’ criteria for selecting nominees for director and for reviewing from time to time the appropriate skills, characteristics and experience required of the Board of Directors as a whole, as well as its individual members, including such factors as business experience and diversity. In addition, the Nominating and Governance Committee is responsible for reviewing the performance of the CEO. The Nominating and Governance Committee manages the process for emergency planning in the event the CEO is unable to fulfill the responsibilities of the role and also periodically evaluates internal and external CEO candidates for succession planning purposes. The Nominating and Governance Committee also reviews with management diversity, corporate responsibility and sustainability issues affecting the Company. The Nominating and Governance Committee currently is comprised of two directors, each of whom in the opinion of the Board of Directors meets the independence requirements of the NASDAQ Stock Market Rules. The Nominating and Governance Committee met 4 times in fiscal 2019.

Compensation Committee

The Compensation Committee is responsible for setting the overall compensation strategy for the Company, recommending the compensation of the CEO to the Board of Directors, determining the compensation of our other executive officers and overseeing the Company’s bonus and equity incentive plans and other benefit plans. For further information about the role of our executive officers in recommending the amount or form of executive compensation, please see “The Process for Determining our NEOs’ Compensation” in the “Compensation Discussion and Analysis” section of this Proxy Statement. In addition, the Compensation Committee is responsible for reviewing and recommending to the Board of Directors compensation for non-employee directors and compensation for employees that would qualify as a “Related Person Transaction” under our Related Person Transaction Policy. The Compensation Committee currently is comprised of three directors, each of whom in the opinion of the Board of Directors meets the independence requirements of the NASDAQ Stock Market Rules and the SEC rules. The Compensation Committee may delegate any of its authority and duties to subcommittees, individual committee members or management, as it deems appropriate in accordance with applicable laws, rules and regulations. During fiscal 2019, the Compensation Committee met 6 times and also acted by written consent.

The Compensation Committee has the authority to engage the services of outside advisors, after first conducting an independence assessment in accordance with applicable laws, regulations and exchange listing standards. During fiscal 2019, the Compensation Committee engaged and directly retained Compensia, Inc. (“Compensia”), a national compensation consulting firm, to assist with the Compensation Committee’s analysis and review of the compensation of our executive officers and other aspects of our total compensation strategy. Compensia performed no other services for the Company and its management team during fiscal 2019. The Compensation Committee has reviewed the independence of Compensia and determined that Compensia’s engagement did not raise any conflicts of interest.

ANNUAL BOARD AND COMMITTEE SELF-EVALUATIONS

Our Board of Directors and each of our committees conducts an annual evaluation, which includes a qualitative assessment by each director of the performance of the Board of Directors, as a whole, and the committee or committees on which each director sits. The evaluation is intended to determine whether the Board of Directors and each committee are functioning effectively, and to provide them with an opportunity to reflect upon and improve processes and effectiveness. The evaluations are led by Mr. Ubiñas, our Lead Director and Chairman of the Nominating and Governance Committee. A summary of the results is presented to the Nominating and Governance Committee and the Board of Directors on an aggregated basis, noting any themes or common issues.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During fiscal 2019, no member of the Compensation Committee was an employee or current or former officer of EA, nor did any member of the Compensation Committee have a relationship requiring disclosure by EA under Item 404 of Regulation S-K. No EA officer serves or has served since the beginning of fiscal 2019 as a member of the board of directors or the compensation committee of a company at which a member of EA’s Board of Directors and Compensation Committee is an employee or officer.

CONSIDERATION OF DIRECTOR NOMINEES

In evaluating nominees for director to recommend to the Board of Directors, the Nominating and Governance Committee will take into account many factors within the context of the characteristics and the needs of the Board of Directors as a whole. While the specific needs of the Board of Directors may change from time to time, all nominees for director are considered on the basis of the following minimum qualifications:

| |

• | The highest level of personal and professional ethics and integrity, including a commitment to EA’s purpose and beliefs; |

| |

• | Practical wisdom and mature judgment; |

| |

• | Broad training and significant leadership experience in business, entertainment, technology, finance, digital commerce, corporate governance, public interest or other disciplines relevant to EA’s long-term success; |

| |

• | The ability to gain an in-depth understanding of EA’s business; and |

| |

• | A willingness to represent the best interests of all EA stockholders and objectively appraise management’s performance. |

While there is no formal policy with regard to diversity, when considering candidates as potential members of the Board of Directors, the Nominating and Governance Committee considers the skills, background and experience of each candidate to evaluate his or her ability to contribute diverse perspectives to the Board of Directors. The goal of the Nominating and Governance Committee is to select candidates that have complementary and diverse perspectives, whether based on business experience, diversity of gender, ethnicity, culture, or other factors, which together contribute to the Board of Directors’ effectiveness as a whole. The primary consideration is to identify candidates who will best fulfill the Board of Directors’ and the Company’s needs at the time of the search. Therefore, the Nominating and Governance Committee does not believe it is appropriate to either nominate or exclude from nomination an individual based on gender, ethnicity, race, age, or similar factors.

The Nominating and Governance Committee will evaluate candidates proposed by our stockholders under similar criteria, except that it also may consider as one of the factors in its evaluation the amount of EA voting stock held by the stockholder and the length of time the stockholder has held such stock.

GLOBAL CODE OF CONDUCT AND CORPORATE GOVERNANCE GUIDELINES

We have adopted a Global Code of Conduct that applies to our directors, and all employees, including our principal executive officer, principal financial officer, principal accounting officer, and other senior financial officers, as well as Corporate Governance Guidelines. These documents, along with our organizational documents and committee charters, form the framework of our corporate governance. Our Global Code of Conduct, Corporate Governance Guidelines and committee charters are available in the Investor Relations section of our website at http://ir.ea.com. We post amendments to or waivers from our Global Code of Conduct in the Investor Relations section of our website.

OVERSIGHT OF RISK ISSUES

Board of Directors

Our Board of Directors oversees our risk management. The Board of Directors exercises this oversight responsibility directly and through its committees. The oversight responsibility of the Board of Directors and its committees is informed by reports from our management team that are designed to provide visibility into our key risks and our risk mitigation strategies. Material business and strategic risks are reviewed by the full Board of Directors. While the Board of Directors has ultimate risk oversight with respect to risks related to privacy and cybersecurity and receives periodic updates on these risks and mitigation strategies, the Audit Committee also receives quarterly updates from EA’s information security team that review the steps taken by management to monitor and control these risks.

Committees

Risks related to investments, financial reporting, internal controls and procedures, tax and treasury matters and compliance issues are reviewed regularly by the Audit Committee, which oversees the financial reporting, global audit and legal compliance functions. The Audit Committee also oversees our enterprise risk management program, which identifies and prioritizes material risks for the Company and the mitigation steps needed to address them. The Nominating and Governance Committee reviews risks related to director and CEO succession and monitors the effectiveness of our corporate governance policies. Compensation-related risks are reviewed by the Compensation Committee with members of management responsible for structuring the Company’s compensation programs. Each of the committees regularly report to the full Board of Directors on matters relating to the specific areas of risk that each committee oversees.

Compensation Committee

As part of their risk oversight efforts, the Compensation Committee evaluates our compensation programs to determine whether the design and operation of our policies and practices could encourage executives or employees to take excessive or inappropriate risks that would be reasonably likely to have a material adverse effect on the Company and have concluded that they do not.

In making that determination, the Compensation Committee considered the design, size and scope of our cash and equity incentive programs and program features that mitigate against potential risks, such as payout caps, equity award clawbacks, the quality and mix of performance-based and “at risk” compensation, and, with regard to our equity incentive programs, the stock ownership requirements applicable to our executives. The Compensation Committee reviewed the results of their evaluation with management and Compensia. The Compensation Committee has concluded that our compensation policies and practices strike an appropriate balance of risk and reward in relation to our overall business strategy, and do not create risks that are reasonably likely to have a material adverse effect on the Company.

The “Compensation Discussion and Analysis” section below generally describes the compensation policies and practices applicable to our named executive officers.

INSIDER TRADING, ANTI-HEDGING AND ANTI-PLEDGING POLICIES

We maintain an insider trading policy designed to promote compliance by our employees and directors with both federal and state insider trading laws. In addition, our insider trading policy prohibits our directors, executive officers, employees and family members of any director, executive officer or employee or others living in their respective households, from engaging in any hedging transaction with the Company’s securities, buying the Company’s securities on margin, or otherwise trading in any derivative of the Company’s securities (including put and/or call options, swaps, forwards or futures contracts, short sales or collars). Our directors and Section 16 officers also are prohibited from pledging our stock as collateral for any loan.

RELATED PERSON TRANSACTIONS POLICY

Our Board of Directors has adopted a written Related Person Transactions Policy that describes the procedures used to process, evaluate, and, if necessary, disclose transactions between the Company and its directors, officers, director nominees, greater than 5% beneficial owners, or an immediate family member of any of the foregoing. We review any transaction or series of transactions which exceeds $120,000 in a single fiscal year and in which any related person has a direct or indirect interest, as well as any transaction for which EA’s Global Code of Conduct or Conflict of Interest Policy would require approval of the Board of Directors.

Once a transaction has been identified, the Audit Committee (if the transaction involves an executive officer) or the Nominating and Governance Committee (if the transaction involves a director) will review the transaction at the next scheduled meeting of such committee. Transactions involving our CEO also will be reviewed by our independent Chairman or independent Lead Director if the Chairman is not independent. If it is not practicable or desirable to wait until the next scheduled meeting, the chairperson of the applicable committee considers the matter and reports back to the relevant committee at the next scheduled meeting. In determining whether to approve or ratify a transaction, the Audit Committee or Nominating and Governance Committee (or the relevant chairperson of such committee) considers all of the relevant facts and circumstances available and transactions are approved only if they are in, or not inconsistent with, the best interests of EA and its stockholders. No member of the Audit Committee or Nominating and Governance Committee may participate in any review, consideration or approval of any transaction if the member or their immediate family member is the related person.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Blackhawk Network Holdings

We enter into commercial dealings with Blackhawk Network Holdings, Inc., whereby Blackhawk Network Holdings offers EA-branded gift cards. During fiscal 2019, the aggregate amount involved in transactions with Blackhawk Network Holdings totaled approximately $3.5 million. Ms. Roche, one of our directors, is the Chief Executive Officer of Blackhawk Network Holdings. Ms. Roche has no involvement in Blackhawk Network Holdings’ commercial dealings with EA and has no material direct or indirect interest in these transactions. Therefore, we do not consider these transactions to be “related person transactions” within the meaning of applicable SEC rules. Our Board of Directors considered our dealings with Blackhawk Network Holdings in reaching its determination that Ms. Roche is an independent director.

DIRECTOR ATTENDANCE AT ANNUAL MEETING

Our directors are expected to make every effort to attend the Annual Meeting. Eight of the nine directors who were elected at the 2018 annual meeting of stockholders attended the meeting.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

EA stockholders may communicate with the Board of Directors as a whole, with a committee of the Board of Directors, or with an individual director by sending a letter to EA’s Corporate Secretary at Electronic Arts Inc., 209 Redwood Shores Parkway, Redwood City, CA 94065, or by sending an email to StockholderCommunications@ea.com. Our Corporate Secretary will forward to the Board of Directors all communications that are not commercial, frivolous or otherwise inappropriate for their consideration. For further information regarding the submission of stockholder communications, please visit the Investor Relations section of our website at http://ir.ea.com.

OTHER BUSINESS

The Board of Directors does not know of any other matter that will be presented for consideration at the Annual Meeting except as specified in the notice of the Annual Meeting. If any other matter does properly come before the Annual Meeting, or at any adjournment or postponement of the Annual Meeting, it is intended that the proxies will be voted in respect thereof in accordance with the judgment of the persons voting the proxies.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The following Report of the Audit Committee shall not be deemed to be “soliciting material” or to be “filed” with the SEC nor shall this information be incorporated by reference into any future filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent that EA specifically incorporates it by reference into a filing.

The Audit Committee of the Board of Directors operates under a written charter, which was most recently amended in May 2018. The Audit Committee is currently comprised of three non-employee directors, each of whom in the opinion of the Board of Directors meets the current independence requirements and financial literacy standards of the NASDAQ Stock Market Rules, as well as the independence requirements of the SEC. During fiscal 2019, the Audit Committee consisted of Richard A. Simonson, Jeffrey T. Huber, Talbott Roche (from August 2, 2018) and Denise F. Warren (until August 2, 2018). The Board of Directors has determined that Mr. Simonson meets the criteria for an “audit committee financial expert” as set forth in applicable SEC rules.

The Company’s management is primarily responsible for the preparation, presentation and integrity of the Company’s financial statements. EA’s independent registered public accounting firm, KPMG LLP (the “independent auditors”), is responsible for performing an independent audit of the Company’s (1) financial statements and expressing an opinion as to the conformity of the financial statements with U.S. generally accepted accounting principles, and (2) internal control over financial reporting in accordance with the auditing standards of the Public Company Accounting Oversight Board (the “PCAOB”) and issuing an opinion thereon.

The Audit Committee assists the Board of Directors in its oversight responsibility with respect to the integrity of EA’s accounting policies, internal control function and financial reporting processes. The Audit Committee reviews EA’s quarterly and annual financial statements prior to public earnings releases and submission to the SEC; oversees EA’s internal audit function; consults with the independent auditors and EA’s internal audit function regarding internal controls and the integrity of the Company’s financial statements; oversees tax and treasury matters; oversees EA’s enterprise risk management program; assesses the independence of the independent auditors; and is directly responsible for the appointment, retention, compensation and oversight of the independent auditors. In this context, the Audit Committee has met and held discussions with members of management, EA’s internal audit function and the independent auditors. Company management has represented to the Audit Committee that the Company’s consolidated financial statements for the most recently completed fiscal year were prepared in accordance with accounting principles generally accepted in the United States, and the Audit Committee has reviewed and discussed the consolidated financial statements with Company management and the independent auditors. Company management also has represented to the Audit Committee that the Company’s internal control over financial reporting was effective as of the end of the Company’s most recently completed fiscal year, and the Audit Committee has reviewed and discussed the Company’s internal control over financial reporting with management and the independent auditors. The Audit Committee also discussed with the independent auditors matters required to be discussed by the applicable requirements of the PCAOB, including the quality and acceptability of the Company’s financial reporting and internal control processes. The Audit Committee also has discussed with the Company’s independent auditors the scope and plans for their annual audit and reviewed the results of that audit with management and the independent auditors.

In addition, the Audit Committee received and reviewed the written disclosures and the letter from the independent auditors required by the applicable requirements of the PCAOB regarding their communications with the Audit Committee concerning independence, and has discussed with the independent auditors the auditors’ independence from the Company and its management. The Audit Committee also has considered whether the provision of any non-audit services (as described on page 47 of this Proxy Statement under the heading “Proposal Three: Ratification of the Appointment of KPMG LLP, Independent Registered Public Accounting Firm” — “Fees of Independent Auditors”) and the employment of former KPMG LLP employees by the Company are compatible with maintaining the independence of KPMG LLP.

The members of the Audit Committee are not engaged in the practice of auditing or accounting. In performing its functions, the Audit Committee necessarily relies on the work and assurances of the Company’s management and the independent auditors.

In reliance on the reviews and discussions referred to in this report and in light of its role and responsibilities, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements for fiscal 2019 be included for filing with the SEC in the Company’s Annual Report. The Audit Committee also has approved the selection of KPMG LLP as the Company’s independent auditors for fiscal 2020.

AUDIT COMMITTEE

Richard A. Simonson (Chairman)

Jeffrey T. Huber

Talbott Roche

DIRECTOR COMPENSATION AND STOCK OWNERSHIP GUIDELINES

Our Compensation Committee is responsible for reviewing and recommending to our Board of Directors the compensation paid to our non-employee directors. Our non-employee directors are paid a mix of cash and equity compensation for their service as directors.

Cash Compensation

The table below reflects the annualized components of cash compensation for non-employee directors that were in place during fiscal 2019. For more information regarding the specific compensation received by each non-employee director during fiscal 2019, see the “Fiscal 2019 Director Compensation Table” table below. |

| | | |

Compensation Component | | Amount ($) |

Annual Retainer | 60,000 |

|

Service on the Audit Committee | 15,000 |

|

Chair of the Audit Committee | 15,000 |

|

Service on the Compensation Committee | 12,500 |

|

Chair of the Compensation Committee | 12,500 |

|

Service on the Nominating and Governance Committee | 10,000 |

|

Chair of the Nominating and Governance Committee | 10,000 |

|

Chairman of the Board of Directors | 50,000 |

|

Service as Lead Director | 25,000 |

|

In addition, individual directors are eligible to earn up to $1,000 per day, with the approval of the Board of Directors, for special assignments, which may include providing oversight to management in areas such as sales, marketing, public relations, technology and finance (provided, however, no independent director is eligible for a special assignment if the assignment or payment for the assignment would prevent the director from being considered independent under applicable NASDAQ Stock Market or SEC rules). No directors earned any compensation for special assignments during fiscal 2019.

Our Compensation Committee reviews our non-employee director compensation every two years. Our Compensation Committee reviewed our non-employee director compensation in February 2018 in consultation with the Compensation Committee’s independent consultant, Frederick W. Cook & Co (“FWC”). FWC conducted a competitive analysis of our non-employee director compensation against our peer group (as defined in the “Compensation Discussion and Analysis” section below) and, based on the Compensation Committee’s review, no changes to the compensation paid to our non-employee directors were recommended to our Board of Directors. The Compensation Committee expects to conduct its next review of non-employee director compensation in 2020.

Stock Compensation

In fiscal 2019, each of our non-employee directors who were re-elected at the 2018 annual meeting of stockholders were granted RSUs with a grant date fair value of approximately $260,000. These RSUs will vest in their entirety on August 2, 2019.

Under our 2000 Equity Incentive Plan, as amended (the “2000 EIP”), non-employee directors may elect to receive all or part of their cash compensation in the form of common stock. As an incentive for our non-employee directors to increase their stock ownership in EA, non-employee directors making such an election receive shares of common stock valued at 110% of the cash compensation they would have otherwise received. These shares are awarded via the grant and immediate exercise of a stock option having an exercise price equal to the fair market value of our common stock on the date of grant, which is the first trading day of each quarter of the Board year. Mr. Hoag, Mr. Huber, Ms. Roche, Mr. Simonson, Mr. Ubiñas, Ms. Ueberroth and Ms. Warren received all or part of their cash compensation in the form of our common stock during fiscal 2019.

Other Benefits

Non-employee directors who are not employed with any other company are offered an opportunity to purchase certain EA health, dental and vision insurance while serving as a director. Participating directors pay 100% of their own insurance premiums.

Stock Ownership Guidelines

Each non-employee director is required, within five years of becoming a director, to own a number of shares of EA common stock having a value of at least five years’ annual retainer for service on our Board of Directors.

Non-employee directors are permitted to include the value of vested, but deferred, RSUs toward their ownership requirement. As of March 31, 2019, each of our directors had either fulfilled his or her ownership requirements or had not yet reached five years of service. Mr. Hoag is eligible to satisfy his ownership requirements through holdings of EA stock by Technology Crossover Ventures, where he serves as the Founding General Partner. Mr. Huber is eligible to satisfy his ownership requirements through holdings of EA stock through certain trusts over which Mr. Huber maintains investment control and pecuniary interest.

FISCAL 2019 DIRECTOR COMPENSATION TABLE

The following table shows compensation information for each of our non-employee directors during fiscal 2019. The compensation paid to Mr. Wilson is shown under “Fiscal 2019 Summary Compensation Table” found on page 31 of this Proxy Statement and the related explanatory tables. Mr. Wilson does not receive any compensation for his service as a member of our Board of Directors.

|

| | | | | | | | | | | | |

Name | | Fees Earned or Paid in Cash ($) | | Stock Awards ($)(1) | | Option Awards ($)(3) | | Total ($) |

Leonard S. Coleman | 82,500 |

| | 259,873 |

| | — |

| | 342,373 |

|

Jay C. Hoag | 85,000 |

| | 259,873 |

| | 8,501 |

| | 353,374 |

|

Jeffrey T. Huber | 75,000 |

| | 259,873 |

| | 7,475 |

| | 342,348 |

|

Lawrence F. Probst III | 110,000 |

| | 259,873 |

| | — |

| | 369,873 |

|

Talbott Roche | 74,375 |

| | 259,873 |

| | 7,534 |

| | 341,782 |

|

Richard A. Simonson | 90,000 |

| | 259,873 |

| | 9,036 |

| | 358,909 |

|

Luis A. Ubiñas | 105,000 |

| | 259,873 |

| | 10,526 |

| | 375,399 |

|

Heidi Ueberroth | 69,375 |

| | 259,873 |

| | 5,368 |

| | 334,616 |

|

Vivek Paul(2) | 35,000 |

| | — |

| | — |

| | 35,000 |

|

Denise F. Warren(2) | 37,500 |

| | — |

| | 3,763 |

| | 41,263 |

|

(1) For non-employee directors except for Mr. Paul and Ms. Warren, represents the aggregate grant date fair value of the annual equity award of RSUs granted to the non-employee directors and is calculated based on a closing price of $128.65 for our common stock on the date of grant, August 2, 2018. For additional information regarding the valuation methodology for RSUs, see Note 15, “Stock-Based Compensation and Employee Benefit Plans,” to the Consolidated Financial Statements in our Annual Report. Except for Mr. Paul and Ms. Warren, each of our non-employee directors held 2,020 unvested RSUs as of March 30, 2019 (the last day of fiscal 2019).

| |

(2) | Retired from EA’s Board as of August 2, 2018. |

| |

(3) | Non-employee directors may elect to receive all or part of their cash compensation in the form of common stock, and directors making such an election receive common stock valued at 110% of the cash compensation they would have otherwise received. These shares are awarded via the grant and immediate exercise of a stock option having an exercise price equal to the fair market value of our common stock on the date of grant. The values represent the premium received for shares in lieu of compensation. The following table presents information regarding the shares granted to each director during fiscal 2019, who elected to receive all or part of their cash compensation in the form of common stock: |

|

| | | | | | | | | | | | |

| Name | | Grant Date | | Exercise Price ($) | | Shares Subject to Immediately Exercised Stock Option Grants | | Grant Date Fair Value ($) |

| Jay C. Hoag | 5/1/2018 | | 119.83 |

| | 195 |

| | 23,367 |

|

| | 8/1/2018 | | 127.48 |

| | 183 |

| | 23,329 |

|

| | 11/1/2018 | | 94.20 |

| | 248 |

| | 23,362 |

|

| | 2/1/2019 | | 91.22 |

| | 257 |

| | 23,443 |

|

| | | | | | | | 93,501 |

|

| | | | | | | | |

| Jeffrey T. Huber | 5/1/2018 | | 119.83 |

| | 172 |

| | 20,611 |

|

| | 8/1/2018 | | 127.48 |

| | 161 |

| | 20,524 |

|

| | 11/1/2018 | | 94.20 |

| | 220 |

| | 20,724 |

|

| | 2/1/2019 | | 91.22 |

| | 226 |

| | 20,616 |

|

| | | | | | | | 82,475 |

|

| | | | | | | | |

| Talbott Roche | 5/1/2018 | | 119.83 |

| | 167 |

| | 20,012 |

|

| | 8/1/2018 | | 127.48 |

| | 162 |

| | 20,652 |

|

| | 11/1/2018 | | 94.20 |

| | 219 |

| | 20,630 |

|

| | 2/1/2019 | | 91.22 |

| | 226 |

| | 20,615 |

|

| | | | | | | | 81,909 |

|

| | | | | | | | |

| Richard A. Simonson | 5/1/2018 | | 119.83 |

| | 206 |

| | 24,685 |

|

| | 8/1/2018 | | 127.48 |

| | 195 |

| | 24,859 |

|

| | 11/1/2018 | | 94.20 |

| | 262 |

| | 24,680 |

|

| | 2/1/2019 | | 91.22 |

| | 272 |

| | 24,812 |

|

| | | | | | | | 99,036 |

|

| | | | | | | | |

| Luis A. Ubiñas | 5/1/2018 | | 119.83 |

| | 241 |

| | 28,879 |

|

| | 8/1/2018 | | 127.48 |

| | 226 |

| | 28,810 |

|

| | 11/1/2018 | | 94.20 |

| | 307 |

| | 28,919 |

|

| | 2/1/2019 | | 91.22 |

| | 317 |

| | 28,917 |

|

| | | | | | | | 115,525 |

|

| | | | | | | | |

| Heidi Ueberroth | 8/1/2018 | | 127.48 |

| | 156 |

| | 19,887 |

|

| | 11/1/2018 | | 94.20 |

| | 212 |

| | 19,970 |

|

| | 2/1/2019 | | 91.22 |

| | 218 |

| | 19,886 |

|

| | | | | | | | 59,743 |

|

| | | | | | | | |

| Denise F. Warren | 5/1/2018 | | 119.83 |

| | 172 |

| | 20,611 |

|

| | 8/1/2018 | | 127.48 |

| | 162 |

| | 20,652 |

|

| | | | | | | | 41,263 |

|

| | | | | | | | |

COMPENSATION DISCUSSION AND ANALYSIS

OVERVIEW

Our Compensation Discussion and Analysis describes and discusses the fiscal 2019 compensation paid to our named executive officers (“NEOs”), and is organized into six sections:

| |

• | Compensation Practices, Principles and Say on Pay Vote |

| |

• | The Process for Determining Our NEOs’ Compensation |

| |

• | Our NEOs’ Fiscal 2019 Compensation |

| |

• | Other Compensation Information |

For fiscal 2019, EA’s NEOs were:

| |

• | Andrew Wilson, Chief Executive Officer; |

| |

• | Blake Jorgensen, Chief Operating Officer and Chief Financial Officer; |

| |

• | Laura Miele, Chief Studios Officer; |

| |

• | Kenneth Moss, Chief Technology Officer; |

| |

• | Chris Bruzzo, Chief Marketing Officer; and |

| |

• | Patrick Söderlund, Former Chief Design Officer |

On August 14, 2018, EA announced that Patrick Söderlund, our Chief Design Officer, would be departing the Company effective October 30, 2018. No severance was paid to Mr. Söderlund in connection with his departure, and all of Mr. Söderlund’s unvested equity awards were cancelled without payment.

EXECUTIVE SUMMARY

Fiscal 2019 Summary of EA’s Business

Fiscal 2019 was a year of intense competition in the video game industry. While there were many achievements this year that we are proud of, after generating strong financial results and robust stockholder returns from fiscal 2014 through fiscal 2018, we did not perform to our expectations during fiscal 2019. Given the Company’s fiscal 2019 financial performance, and in order to maintain alignment with our pay-for-performance executive compensation philosophy, our CEO and his staff (including the NEOs) requested that they receive no performance cash bonus award for fiscal 2019. The Board (in the case of Mr. Wilson) and the Compensation Committee (in the case of the other NEOs) accepted this request. Likewise, as contemplated by the design of our PRSU program, due to the Company’s total shareholder return in fiscal 2019, none of the PRSUs granted in June 2018 vested with respect to the fiscal 2019 performance period.

While we are disappointed with our fiscal 2019 results, we understand the challenges we face, and we will continue to focus on how we can apply the strengths of our Company to capitalize on our opportunities.

Fiscal 2019 GAAP Financial Results and Operating Highlights

| |

• | We generated $4.95 billion of net revenue and $3.33 diluted earnings per share. |

| |

• | Our digital net revenue increased to $3.71 billion and represented 75% of our total net revenue. |

| |

• | We delivered net income of $1.02 billion and operating cash flow of $1.55 billion. |

| |

• | Operating profit margins were 20.1%. |

| |

• | We generated net bookings for the fiscal year of $4.94 billion. |

| |

• | FIFA 19 was the best-selling console game in Europe in calendar 2018. |

| |

• | We launched two new original IP titles, Apex Legends and Anthem. |

| |

• | We launched Firestorm battle royale in Battlefield V, the biggest Battlefield live service event ever. |

The financial performance, operational achievements and other fiscal year events summarized above provide context for the compensation decisions made by the Compensation Committee and Board of Directors, as well as the decision by the Company’s executive leadership team to decline bonuses in fiscal 2019.

COMPENSATION PRACTICES, PRINCIPLES AND SAY ON PAY VOTE

Compensation Design

Our executive compensation programs are designed to align the interests of our executives with the interests of our stockholders. |

| | | |

What We Do | What We Don’t Do |

þ | Incorporate both PRSUs and time-based restricted stock units (“RSUs”) | x | Have a “single-trigger” change in control plan |

þ | Require our executives to satisfy stock holding requirements | x | Provide excise tax gross-ups upon a change in control |

þ | Prohibit all employees from engaging in hedging transactions in EA stock and prohibit executive officers from pledging EA common stock | x | Have executive employment contracts (other than as required by local jurisdictions) |

þ | Conduct annual “say-on-pay” advisory votes | x | Reprice options without stockholder approval |

þ | Recover (clawback) equity compensation for misconduct in the event of a financial restatement | x | Provide excessive perquisites |

þ | Align performance-based equity vesting with stockholder interests | | |

þ | Independent compensation consultant input into the Compensation Committee’s decisions | | |

þ | Annual evaluation of peer group to ensure ongoing relevance of each member | | |

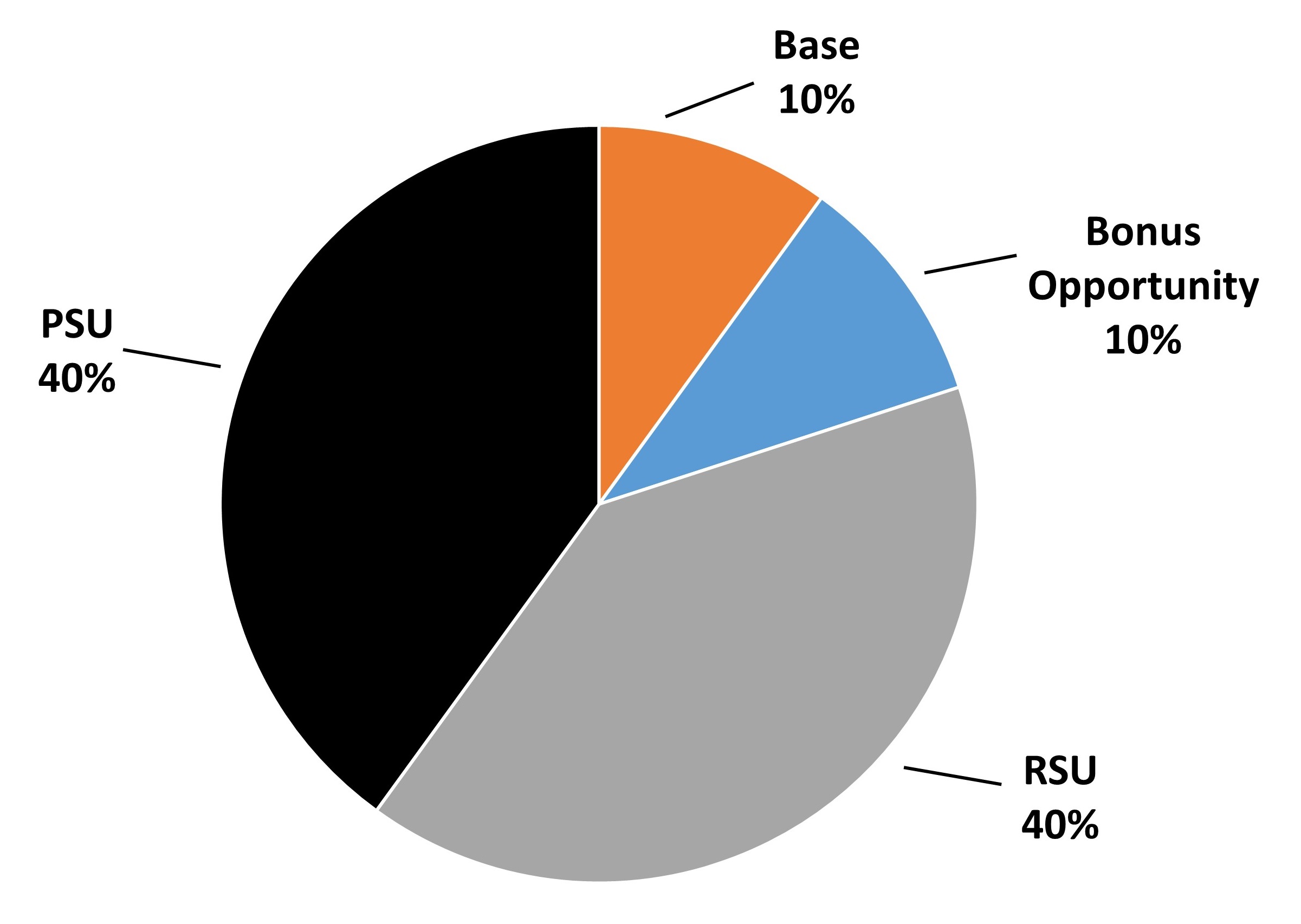

Compensation Principles — Promoting Pay-for-Performance

The design of our compensation programs is guided by a compensation philosophy based on three core principles intended to attract and retain high-performing executives and promote a pay-for-performance approach to executive compensation:

| |

• | Principle 1 — Cash Compensation: A significant portion of each NEO’s cash compensation should be at risk, based on the annual financial and operational performance of the Company, in addition to the NEO’s individual performance; |

| |

• | Principle 2 — Equity Compensation: A significant portion of each NEO’s total compensation should be provided in the form of long-term equity to enhance alignment between the interests of our NEOs and our stockholders and to promote long-term retention of a strong leadership team in an industry and geographic area that is highly competitive for executive talent; and |

| |

• | Principle 3 — Target Total Direct Compensation: The target total direct compensation package for each NEO should be consistent with market practices for executive talent, and reflect each NEO’s individual experience, responsibilities and performance. |

Fiscal 2018 Say On Pay Vote

We received a favorable 86% of votes cast for our annual say on pay advisory proposal at our 2018 annual meeting. EA’s management, the Compensation Committee and the Board of Directors are committed to maintaining a pay-for-performance alignment in our executive compensation programs and value the opinions of our stockholders regarding our programs.

THE PROCESS FOR DETERMINING OUR NEOS’ COMPENSATION

Role of the Board of Directors, Compensation Committee and Management

Our Board of Directors approves the target total direct compensation and makes compensation decisions for our CEO, in consultation with the Compensation Committee and the Compensation Committee’s independent compensation consultant, Compensia. The Compensation Committee approves the target total direct compensation and makes compensation decisions for all other NEOs after input, at the Compensation Committee’s request, from our CEO, our Chief People Officer, and Compensia. For information on the independence of Compensia, see the section of this Proxy Statement entitled “Compensation Committee” beginning on page 11.

Compensation decisions made by the Board of Directors and the Compensation Committee are based on several factors, including the Company’s financial performance, individual performance, market trends, and other factors unique to each individual. The impact of the Company’s financial performance and individual considerations in our fiscal 2019 compensation decisions are detailed in the section of this Compensation Discussion & Analysis entitled “Our NEOs’ Fiscal 2019 Compensation” beginning on page 26. The Compensation Committee and the Board of Directors also reference certain market-based considerations, such as peer group data, benchmarking and percentiles when making compensation decisions.

Selection and Use of Peer Group

To assess market compensation practices, each year the Compensation Committee selects a group of companies (“peer group”) comparable to us with respect to several quantitative factors, which may include revenue, market capitalization, total stockholder return (“TSR”), net income margin and number of employees, as well as qualitative factors including competition for talent, to use as a reference for compensation decisions.

As discussed in our fiscal 2018 Proxy Statement, the Compensation Committee selected the following peer group to use as a reference for fiscal 2019 compensation decisions. The Compensation Committee considered the Company’s significant market capitalization growth over the prior several fiscal years and its evolving business models, as well as other commonalities, including assessing companies similarly situated in the gaming and entertainment sector. The Compensation Committee added VMware, Take-Two Interactive Software, Nvidia, CBS and Netflix to our peer group. The Compensation Committee also removed Mattel and Lions Gate Entertainment from our peer group for fiscal 2019 due to our diverging business models. Based on public filings through June 4, 2019, the Company was at the 34th percentile with respect to annual revenues and at the 48th percentile with respect to market capitalization.

FISCAL 2019 PEER GROUP

|

| | | | | | |

Video Game | | Technology/Internet | | Entertainment | | Toys/Games |

Activision Blizzard | | Adobe Systems | | AMC Networks Inc. | | Hasbro |

Take-Two Interactive | | Autodesk | | CBS | | |

Software | | eBay | | Discovery Communications | | |

Zynga | | Expedia | | Netflix | | |

| | IAC/Interactive Corp. | | | | |

| | Intuit | | | | |

| | Nvidia | | | | |

| | Booking Holdings | | | | |

| | Salesforce.com | | | | |

| | Symantec | | | | |

| | VMware | | | | |