Table of Contents

Subject to completion, as filed with the Securities and Exchange Commission on March 22, 2012

Registration No. 333-178869

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20546

Amendment No. 4

to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ACCO BRANDS CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 2780 | 36-2704017 | ||

| (State or other jurisdiction of incorporation) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

300 Tower Parkway

Lincolnshire, Illinois 60069

(847) 541-9500

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

Steven Rubin

Senior Vice President, Secretary and General Counsel

ACCO Brands Corporation

300 Tower Parkway

Lincolnshire, Illinois 60069

(847) 541-9500

(Name, address, including zip code, and telephone number, including are code, of agent for service)

Copies to:

| William R. Kunkel Skadden, Arps, Slate, Meagher 155 North Wacker Drive Chicago, Illinois 60606 (312) 407-0700 |

Wendell L. Willkie, II Senior Vice President, General MeadWestvaco Corporation 501 South 5th Street Richmond, Virginia 23219 (804) 444-1000 |

Gregory E. Ostling Wachtell, Lipton, Rosen & Katz 51 West 52nd Street New York, NY 10019 (212) 403-1000 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this registration statement and the satisfaction or waiver of all other conditions to the closing of the merger described herein.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered(1) |

Proposed maximum offering price per unit |

Proposed maximum aggregate offering price(2) |

Amount of registration fee(3) | ||||

| Common stock, par value $0.01 per share |

56,651,967 |

N/A | $524,600,000 | $60,119.16 | ||||

|

| ||||||||

|

| ||||||||

| (1) | This Registration Statement relates to shares of common stock, par value $0.01 per share, of ACCO Brands Corporation issuable to holders of common stock, par value $0.001 per share, of Monaco SpinCo, Inc. (“Spinco”) pursuant to the proposed merger of Augusta Acquisition Sub, Inc., a wholly owned subsidiary of ACCO, with and into Spinco. The amount of ACCO common stock to be registered represents the estimate of the maximum number of shares that ACCO will issue to holders of Spinco common stock upon consummation of the merger based on a formula set forth in the merger agreement, which requires ACCO to issue a number of shares equal to the number of shares of ACCO common stock issued and outstanding as of the effective time of the merger multiplied by 1.02020202. Because it is not possible to accurately state the number of shares of ACCO common stock that will be outstanding as of the effective time of the merger, this calculation is based on 55,530,146 shares of ACCO common stock outstanding as of March 16, 2012. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(f)(2) of the Securities Act. Pursuant to Rule 457(f)(2) of the Securities Act, the proposed maximum aggregate offering price of the registrant’s common stock was calculated based upon the book value of all shares of Spinco common stock (the securities to be cancelled in the merger) as of December 31, 2011, the most recent date for which such information is available. |

| (3) | Calculated pursuant to Section 6(b) of the Securities Act at a rate equal to $114.60 per $1,000,000 of the proposed maximum aggregate offering price. Filing fee has been previously paid by the registrant. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

ACCO Brands Corporation (“ACCO”) is filing this registration statement on Form S-4 to register shares of its common stock, par value $0.01 per share, that will be issued in connection with the merger of Augusta Acquisition Sub, Inc. (“Merger Sub”), which is a wholly owned subsidiary of ACCO, into Monaco SpinCo Inc. (“Spinco”), which is currently a wholly owned subsidiary of MeadWestvaco Corporation (“MWV”) but which will be spun off to MWV stockholders immediately prior to the merger. Pursuant to the instructions on Form S-4, the proxy statement/prospectus-information statement which forms a part of this registration statement is also deemed filed pursuant to ACCO’s obligations under Regulation 14A in connection with ACCO’s special meeting of ACCO stockholders to approve the issuance of shares of ACCO common stock in connection with the merger and to approve amendments to the 2011 Amended and Restated ACCO Brands Corporation Incentive Plan, including an amendment to increase the authorized number of shares of ACCO common stock reserved for issuance thereunder. The Incentive Plan amendments would not be effective, if approved by the stockholders, unless the issuance of shares in connection with the merger is also approved. In addition, Spinco will file a registration statement on Form 10 to register shares of its common stock, par value $0.001 per share, which will be distributed to MWV stockholders pursuant to a spin-off in connection with the merger. The shares of Spinco common stock will be immediately converted into shares of ACCO common stock in the merger.

Table of Contents

The information in this proxy statement/prospectus-information statement is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This proxy statement/prospectus-information statement is not an offer to sell or exchange securities and is not soliciting an offer to buy or exchange securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion Dated March 22, 2012

300 Tower Parkway

Lincolnshire, Illinois 60069

[—]

Dear Fellow Stockholders:

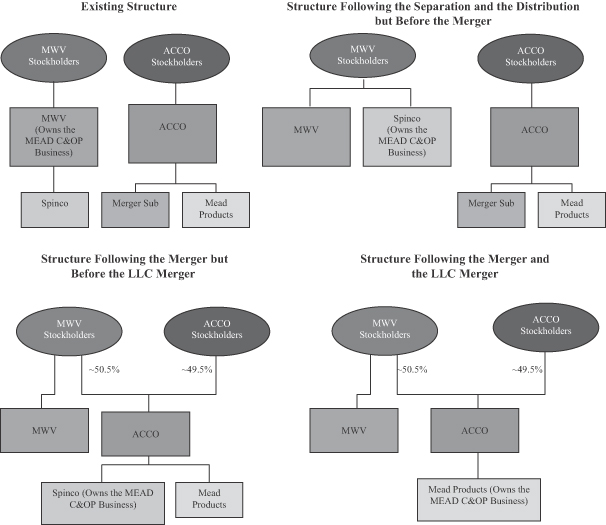

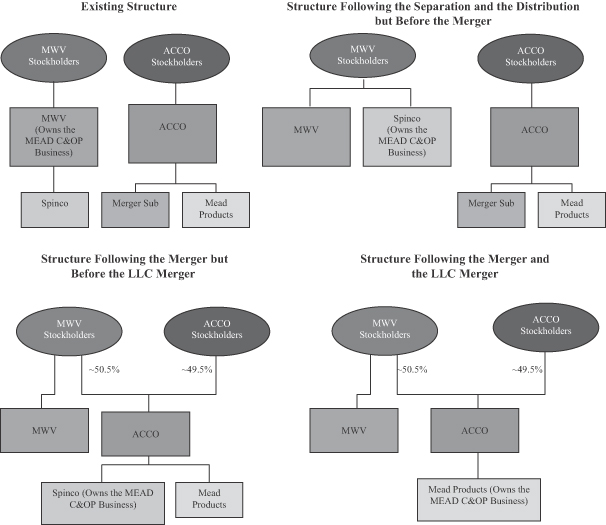

As previously announced, ACCO Brands Corporation, which we refer to as ACCO, and MeadWestvaco Corporation, which we refer to as MWV, have entered into a merger agreement under which ACCO will acquire MWV’s Consumer & Office Products business, which we refer to as the MEAD C&OP Business. The MEAD C&OP Business includes the following brands: Mead®, Five Star®, Trapper Keeper®, AT-A-GLANCE®, Cambridge®, Day Runner®, Tilibra®, Grafons® and Hilroy®, among others. Prior to the closing of the proposed merger, MWV will cause specified assets and liabilities used in the MEAD C&OP Business to be conveyed to its newly formed, wholly owned subsidiary, Monaco SpinCo Inc., which we refer to as Spinco. After such conveyance, MWV will spin off Spinco to MWV stockholders by distributing all of the Spinco common stock owned by MWV to MWV stockholders. Immediately after the spin-off, Augusta Acquisition Sub, Inc., a newly formed, wholly owned subsidiary of ACCO, will merge with and into Spinco, with Spinco surviving as a wholly owned subsidiary of ACCO, which we refer to as the Merger. As a result of the Merger, MWV stockholders will receive ACCO common stock instead of Spinco common stock. In connection with the Merger, we currently expect, based on the exchange ratio formula set forth in the merger agreement and the number of outstanding shares of ACCO common stock and MWV common stock as of March 16, 2012, that MWV stockholders, in addition to retaining their MWV common stock, will receive approximately 56,651,967 shares of ACCO common stock as a result of the transactions or approximately 0.33 shares of ACCO common stock for every one share of MWV common stock they own on the record date of the spin-off. However, no fractional shares of ACCO common stock will be issued in the Merger. At the close of the Merger, MWV stockholders will own approximately 50.5% of ACCO common stock and current ACCO stockholders will own approximately 49.5% of ACCO common stock. Following completion of the Merger, Spinco will merge with and into Mead Products LLC, a limited liability company the sole member of which is ACCO, which we refer to as Mead Products, with Mead Products continuing as the surviving entity. ACCO common stock is traded on the New York Stock Exchange under the ticker symbol “ABD.” On March 16, 2012, the closing price of ACCO common stock was $12.72 per share. In connection with the transactions, MWV will receive, from a special distribution from Spinco and in combination with the debt exchange transactions described further in the accompanying document, approximately $460.0 million in cash. Because the transactions are conditioned on the receipt of a private letter ruling from the IRS and a tax opinion from counsel, MWV expects that the $460.0 million in cash will be received on a tax-free basis.

After careful consideration, our Board of Directors has determined that the Merger is in the best interests of ACCO and its stockholders and has approved the merger agreement and the Merger. In order to complete the Merger, ACCO must obtain the approval of its stockholders for the issuance of ACCO common stock. You will be asked to vote on a proposal to approve the issuance of ACCO common stock in connection with the Merger, which we refer to as the “Share Issuance,” approve amendments to the 2011 Amended and Restated ACCO Brands Corporation Incentive Plan, including an amendment to increase the authorized number of shares of ACCO common stock reserved for issuance thereunder, which we refer to as the “incentive plan amendments” and approve the adjournment or postponement of the special meeting, if necessary or appropriate, to solicit additional proxies in the event there are not sufficient votes at the time of the special meeting to approve the Share Issuance, which we refer to as the “meeting adjournment proposal,” at a special meeting of ACCO stockholders to be held on [—] at ACCO’s headquarters located at 300 Tower Parkway Lincolnshire, IL 60069 at [—]. Our Board of Directors unanimously recommends that you vote FOR the proposal to approve the Share Issuance, FOR the proposal to approve the incentive plan amendments and FOR the meeting adjournment proposal.

Your vote is very important, regardless of the number of shares you own. We cannot complete the Merger unless the Share Issuance is approved by our stockholders at the special meeting. Only stockholders who owned shares of ACCO common stock at the close of business on March 22, 2012 will be entitled to vote at the special meeting. Whether or not you plan to be present at the special meeting, please complete, sign, date and return your proxy card in the enclosed envelope, or authorize the individuals named on your proxy card to vote your shares by calling the toll-free telephone number or by using the internet as described in the instructions included with your proxy card. If you hold your shares in “street name,” you should instruct your broker how to vote your shares in accordance with your voting instruction form.

This proxy statement/prospectus-information statement explains the Merger, the merger agreement and the transactions contemplated thereby and provides specific information concerning the special meeting. Please review this document carefully. You should carefully consider, before voting, the matters discussed under the heading “Risk Factors” beginning on page 31 of this proxy statement/prospectus-information statement.

On behalf of our Board of Directors, I thank you for your support and appreciate your consideration of this matter.

Cordially,

Robert J. Keller

Chairman and Chief Executive Officer

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved the transactions described in this proxy statement/prospectus-information statement, including the Merger, or the ACCO common stock to be issued pursuant to the merger agreement, or determined if this proxy statement/prospectus-information statement is accurate or adequate. Any representation to the contrary is a criminal offense.

The date of this proxy statement/prospectus-information statement is [—] and is being mailed to ACCO stockholders on or about [—].

Table of Contents

The information in this proxy statement/prospectus-information statement is not complete and may be changed. We may not issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This proxy statement/prospectus-information statement is not an offer to sell or exchange securities and is not soliciting an offer to buy or exchange securities in any jurisdiction where the offer or sale is not permitted.

Preliminary Proxy Statement/Prospectus-Information Statement—Subject to Completion Dated March 22, 2012

501 South 5th Street

Richmond, VA 23219-0501

[—]

To the Stockholders of MeadWestvaco Corporation:

On November 17, 2011, we announced that MeadWestvaco Corporation, which we refer to as MWV, entered into definitive agreements to spin off its Consumer & Office Products business and then combine it with ACCO Brands Corporation, which we refer to as ACCO. As an MWV stockholder, you are receiving this document as an information statement from MWV to inform you of the spin-off and from ACCO as a prospectus for the issuance of ACCO common stock in the proposed transactions.

The principal transactions described in this document include the following:

| • | Separation — MWV will convey the assets and liabilities of its Consumer & Office Products Business to a wholly owned subsidiary that we refer to as Spinco. In exchange, MWV will receive from Spinco and through certain debt exchange transactions approximately $460 million in cash. Because the transactions described in this document are conditioned on the receipt of a private letter ruling from the IRS and a tax opinion from counsel, MWV expects that the $460.0 million in cash will be received on a tax-free basis. |

| • | Distribution — MWV will distribute all of the outstanding common stock of Spinco to MWV shareholders as a dividend. |

| • | Merger — Immediately after the distribution, Spinco will merge with an ACCO subsidiary and continue as a wholly owned subsidiary of ACCO, and the Spinco common stock will be converted into ACCO common stock. Following completion of this merger, Spinco will merge with and into another ACCO subsidiary, Mead Products LLC, and Mead Products will continue as a wholly owned subsidiary of ACCO. ACCO will continue as a publicly traded company, owning both its current business and the Consumer & Office Products Business. We believe that the combination of ACCO and the Consumer & Office Products Business will create a company with a breadth and strength of product brands that is well positioned in key geographic markets, that can respond better to the competitive demand of large customers and that can realize potential cost reductions through careful integration and efficiencies. In addition, the transaction will extend MWV’s transformation into a global packaging leader, enabling us to sharpen our focus on profitable growth opportunities in global packaging markets. |

At the close of the proposed transactions, MWV stockholders will own approximately 50.5% of ACCO common stock and ACCO stockholders will own approximately 49.5% of ACCO common stock. We currently expect, based on the exchange ratio formula set forth in the merger agreement and the number of outstanding shares of ACCO common stock and MWV common stock as of March 16, 2012, that ACCO will issue, and MWV stockholders will receive (in addition to retaining their MWV common stock), approximately 56,651,967 shares of ACCO common stock as a result of the proposed transactions, or approximately 0.33 shares of ACCO for every share of MWV common stock they own on the record date of the distribution. The actual number of shares of ACCO common stock that MWV stockholders will receive will be determined based on the number of shares of MWV common stock entitled to Spinco common stock in the distribution and the number of shares of ACCO common stock outstanding at the time of the first merger described above. No fractional shares of ACCO common stock will be issued. While we expect that the receipt of ACCO common stock in the Merger will be tax-free to MWV stockholders for U.S. federal income tax purposes, they will be required to pay tax on any payment that they receive in cash in lieu of fractional shares. Holders of MWV common stock will retain all of their shares of MWV common stock and will not be required to pay for any shares of ACCO common stock they receive.

ACCO common stock is currently traded on the New York Stock Exchange under the ticker symbol “ABD.” On March 16, 2012, the closing price of ACCO common stock was $12.72 per share.

The boards of directors of each of ACCO and MWV have approved the proposed transactions, and MWV is expected to approve shortly the proposed transactions as the current sole stockholder of Spinco. MWV stockholders are not required to vote on the proposed transactions. MWV is not asking MWV stockholders for a proxy, and MWV stockholders are requested not to send MWV a proxy.

This document explains the proposed transactions, the definitive agreements entered into by MWV, and provides specific information about ACCO and MWV’s Consumer & Office Products business. Please review this document carefully, particularly the matters discussed under the heading “Risk Factors” beginning on page 31.

We look forward to completing the proposed transactions and to the exciting opportunities they present for our stockholders.

Sincerely,

John A. Luke, Jr.

Chairman and Chief Executive Officer

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved the merger described in this proxy statement/prospectus-information statement or the ACCO common stock to be issued pursuant to the merger agreement, or determined if this proxy statement/prospectus-information statement is accurate or adequate. Any representation to the contrary is a criminal offense.

The date of this proxy statement/prospectus-information statement is [—], 2012.

Table of Contents

ACCO BRANDS CORPORATION

300 Tower Parkway

Lincolnshire, Illinois 60069

NOTICE OF SPECIAL MEETING

To the Stockholders of ACCO Brands Corporation:

NOTICE IS HEREBY GIVEN of a special meeting of stockholders of ACCO Brands Corporation, a Delaware corporation (“ACCO”), which will be held at ACCO’s headquarters located at 300 Tower Parkway Lincolnshire, IL 60069, on [—], [—] at [—], local time, for the following purposes:

| 1. | to vote on a proposal to approve the issuance of ACCO common stock in connection with the Agreement and Plan of Merger, dated as of November 17, 2011 and amended as of March 19, 2012, among ACCO Brands Corporation, Augusta Acquisition Sub, Inc., MeadWestvaco Corporation and Monaco SpinCo Inc., which we refer to as the Share Issuance; |

| 2. | to approve amendments to the 2011 Amended and Restated ACCO Brands Corporation Incentive Plan, which we refer to as the Incentive Plan, including an amendment to increase the authorized number of shares of ACCO common stock reserved for issuance thereunder by 10,400,000 shares to a new total of 15,655,000 shares conditioned upon approval of the Share Issuance, which we refer to as the incentive plan amendments; and |

| 3. | to vote on a proposal to approve the adjournment or postponement of the special meeting, if necessary or appropriate, to solicit additional proxies in the event there are not sufficient votes at the time of the special meeting to approve the Share Issuance, which we refer to as the meeting adjournment proposal. |

The approval of the proposal set forth in item 1 above is required for completion of the merger. The proposal set forth in item 2 above is conditioned on approval of the proposal set forth in item 1. ACCO will transact no other business at the special meeting except such business as may properly be brought before the special meeting or any adjournment or postponement thereof.

The ACCO Board of Directors has fixed the close of business on March 22, 2012 as the record date for the special meeting. Only ACCO stockholders of record as of the record date are entitled to receive notice of, and to vote at, the special meeting or any adjournment or postponement thereof. A complete list of such stockholders will be available for inspection by any ACCO stockholder for any purpose germane to the special meeting during ordinary business hours for the ten days preceding the special meeting at ACCO’s offices at the address on this notice. The eligible ACCO stockholder list will also be available at the special meeting for examination by any stockholder present at such meeting.

THE ACCO BOARD OF DIRECTORS HAS UNANIMOUSLY APPROVED THE MERGER AGREEMENT AND THE MERGER AND UNANIMOUSLY RECOMMENDS THAT ACCO STOCKHOLDERS VOTE FOR THE SHARE ISSUANCE, FOR THE INCENTIVE PLAN AMENDMENTS AND FOR THE MEETING ADJOURNMENT PROPOSAL.

Your vote is very important. Whether or not you expect to attend the special meeting in person, to ensure your representation at the special meeting, we urge you to authorize the individuals named on your proxy card to vote your shares as promptly as possible by (1) accessing the internet site listed on the proxy card, (2) calling the toll-free number listed on the proxy card or (3) submitting your proxy card by mail by using the provided self-addressed, stamped envelope. If you hold your shares in “street name,” you should instruct your broker how to vote your shares in accordance with your voting instruction form. ACCO stockholders may revoke their proxy in the manner described in the accompanying proxy statement/prospectus-information statement before it has been voted at the special meeting.

By Order of the Board of Directors,

Steven Rubin

Senior Vice President, Secretary and General Counsel

Lincolnshire, Illinois

Table of Contents

WHERE YOU CAN FIND ADDITIONAL INFORMATION

This proxy statement/prospectus-information statement incorporates by reference important business and financial information about ACCO from documents filed with the SEC that have not been included herein or delivered herewith. ACCO files reports (including annual, quarterly and current reports which contain audited financial statements), proxy statements and other information with the SEC. Copies of ACCO’s filings with the SEC are available to investors without charge by request made to ACCO in writing, by telephone or by email with the following contact information or through ACCO’s website at www.accobrands.com:

ACCO Brands Corporation

Attn: Investor Relations Department

300 Tower Parkway

Lincolnshire, IL 60069

Telephone: (847) 484-3020

Email: Jennifer.Rice@acco.com

In order to receive timely delivery of these materials, you must make your requests no later than five business days before the date of the special meeting.

You may also obtain printer-friendly versions of ACCO’s SEC reports at http://ir.accobrands.com or MWV’s SEC reports at http://meadwestvaco.com/InvestorRelations. ACCO’s filings with the SEC are available to the public over the internet at the SEC’s website at www.sec.gov, or at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call 1-800-SEC-0330 for further information on the public reference facilities. You may also inspect reports, proxy statements and other information about ACCO or MWV at the offices of the NYSE, 20 Broad Street, New York, New York 10005.

The SEC allows certain information to be “incorporated by reference” into this proxy statement/prospectus-information statement. This means that ACCO can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this proxy statement/prospectus-information statement, except for any information superseded by information contained directly in this proxy statement/prospectus-information statement or in any document subsequently filed by ACCO that is also incorporated or deemed to be incorporated by reference. This proxy statement/prospectus-information statement incorporates by reference the documents set forth below that we have previously filed with the SEC and any future filings by ACCO under section 13(a), 13(c), 14 or 15(d) of the Exchange Act from the date of this proxy statement/prospectus-information statement to the date the ACCO special meeting is held, except, in any such case, for any information therein which has been furnished rather than filed, which shall not be incorporated herein. Subsequent filings with the SEC will automatically modify and supersede information in this proxy statement/prospectus-information statement. These documents contain important information about ACCO and its financial condition.

This proxy statement/prospectus-information statement, and the registration statement of which this proxy statement/prospectus-information statement forms a part, hereby incorporate by reference the following documents which ACCO has filed with the SEC:

| • | ACCO’s annual report on Form 10-K for the year ended December 31, 2011, filed with the SEC on February 23, 2012; |

| • | Amendment No. 1 to ACCO’s annual report on Form 10-K for the year ended December 31, 2011, filed with the SEC on March 15, 2012; |

| • | Amendment No. 2 to ACCO’s annual report on Form 10-K for the year ended December 31, 2011, filed with the SEC on March 20, 2012; |

| • | ACCO’s current report on Form 8-K, filed with the SEC on January 18, 2012; |

Table of Contents

| • | ACCO’s current report on Form 8-K, filed with the SEC on February 13, 2012; |

| • | ACCO’s current report on Form 8-K, filed with the SEC on February 21, 2012; |

| • | ACCO’s current report on Form 8-K, filed with the SEC on March 1, 2012; |

| • | ACCO’s current report on Form 8-K, filed with the SEC on March 22, 2012; and |

| • | The description of the terms, rights and provisions applicable to ACCO common stock contained in ACCO’s registration statement on Form 8-A12B (Reg. No. 333-124946) filed with the SEC on July 25, 2005, including any amendments or reports filed for the purpose of updating the description. |

If you are an ACCO stockholder and you have any questions about the proposed transactions, please contact ACCO’s Investor Relations Department at (847) 484-3020.

If you are a MWV stockholder and you have any questions about the proposed transactions, please contact MWV’s Shareholder Services Department at (866) 455-3115.

NONE OF ACCO, MERGER SUB, MWV OR SPINCO HAS AUTHORIZED ANYONE TO GIVE ANY INFORMATION OR MAKE ANY REPRESENTATION ABOUT THE PROPOSED TRANSACTIONS OR ABOUT ACCO, MERGER SUB, MWV OR SPINCO THAT DIFFERS FROM OR ADDS TO THE INFORMATION IN THIS PROXY STATEMENT/PROSPECTUS-INFORMATION STATEMENT OR THE DOCUMENTS THAT ACCO PUBLICLY FILES WITH THE SECURITIES AND EXCHANGE COMMISSION. THEREFORE, IF ANYONE GIVES YOU DIFFERENT OR ADDITIONAL INFORMATION, YOU SHOULD NOT RELY ON IT.

IF YOU ARE IN A JURISDICTION WHERE OFFERS TO EXCHANGE OR SELL, OR SOLICITATIONS OF OFFERS TO EXCHANGE OR PURCHASE, THE SECURITIES OFFERED BY THIS PROXY STATEMENT/PROSPECTUS-INFORMATION STATEMENT ARE UNLAWFUL, OR IF YOU ARE A PERSON TO WHOM IT IS UNLAWFUL TO DIRECT THESE TYPES OF ACTIVITIES, THEN THE OFFER PRESENTED IN THIS PROXY STATEMENT/PROSPECTUS-INFORMATION STATEMENT DOES NOT EXTEND TO YOU. IF YOU ARE IN A JURISDICTION WHERE SOLICITATIONS OF A PROXY ARE UNLAWFUL, OR IF YOU ARE A PERSON TO WHOM IT IS UNLAWFUL TO DIRECT THESE TYPES OF ACTIVITIES, THEN THE SOLICITATION PRESENTED IN THIS PROXY STATEMENT/PROSPECTUS-INFORMATION STATEMENT DOES NOT EXTEND TO YOU.

THE INFORMATION CONTAINED IN THIS PROXY STATEMENT/PROSPECTUS-INFORMATION STATEMENT SPEAKS ONLY AS OF ITS DATE UNLESS THE INFORMATION SPECIFICALLY INDICATES THAT ANOTHER DATE APPLIES. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS DOCUMENT IS ACCURATE AS OF ANY DATE OTHER THAN THE DATE HEREOF. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN ANY DOCUMENT INCORPORATED BY REFERENCE HEREIN IS ACCURATE AS OF ANY DATE OTHER THAN THE DATE OF SUCH DOCUMENT. ANY STATEMENT CONTAINED IN A DOCUMENT INCORPORATED OR DEEMED TO BE INCORPORATED BY REFERENCE INTO THIS DOCUMENT WILL BE DEEMED TO BE MODIFIED OR SUPERSEDED TO THE EXTENT THAT A STATEMENT CONTAINED HEREIN OR IN ANY OTHER SUBSEQUENTLY FILED DOCUMENT WHICH ALSO IS OR IS DEEMED TO BE INCORPORATED BY REFERENCE INTO THIS DOCUMENT MODIFIES OR SUPERSEDES THAT STATEMENT. ANY STATEMENT SO MODIFIED OR SUPERSEDED WILL NOT BE DEEMED, EXCEPT AS SO MODIFIED OR SUPERSEDED, TO CONSTITUTE A PART OF THIS DOCUMENT. NEITHER THE MAILING OF THIS DOCUMENT TO THE RESPECTIVE STOCKHOLDERS OF ACCO AND MWV, NOR THE TAKING OF ANY ACTIONS CONTEMPLATED HEREBY BY ACCO OR MWV AT ANY TIME WILL CREATE ANY IMPLICATION TO THE CONTRARY.

Table of Contents

ABOUT THIS DOCUMENT

MWV has supplied all information contained in this proxy statement/prospectus-information statement relating to MWV and Spinco. ACCO has supplied all information contained in or incorporated by reference into this proxy statement/prospectus-information statement relating to ACCO and Merger Sub. MWV and ACCO have both contributed information relating to the Transactions.

This proxy statement/prospectus-information statement forms a part of a registration statement on Form S-4 (Registration No. 333-178869) filed by ACCO with the SEC to register with the SEC shares of ACCO common stock to be issued pursuant to the Merger Agreement. It constitutes a prospectus of ACCO under Section 5 of the Securities Act of 1933, as amended, and the rules thereunder, with respect to the shares of ACCO common stock to be issued to MWV stockholders entitled to Spinco common stock in the Transactions. It also constitutes a proxy statement under Section 14(a) of the Exchange Act and a notice of meeting and action to be taken with respect to the ACCO special meeting of stockholders at which ACCO stockholders will consider and vote on the proposal to approve the issuance of shares of ACCO common stock in connection with the Merger Agreement and a proposal to approve amendments to the 2011 Amended and Restated ACCO Brands Corporation Incentive Plan. In addition, it constitutes an information statement relating to the Separation and the Distribution.

As allowed by the SEC rules, this proxy statement/prospectus-information statement does not contain all of the information you can find in ACCO’s registration statement or its exhibits. For further information pertaining to ACCO and the shares of ACCO common stock to be issued, reference is made to that registration statement and its exhibits. Statements contained in this document or in any document incorporated in this document by reference as to the contents of any contract or other document referred to within this document or other documents that are incorporated by reference are not necessarily complete and, in each instance, reference is made to the copy of the applicable contract or other document filed as an exhibit to the registration statement or otherwise filed with the SEC. Each statement contained in this document is qualified in its entirety by reference to the underlying documents. We encourage you to read the registration statement. You may obtain copies of the Form S-4 (and any amendments to those documents) by following the instructions under “Where You Can Find Additional Information.”

TRADEMARKS AND SERVICE MARKS

ACCO and MWV own or have the rights to various trademarks and trade names that they use in conjunction with the operation of their businesses. Prior to the Separation, certain trademarks and trade names, including “Mead®” as well as other trademarks used primarily by the MEAD C&OP Business will be transferred to, and become the property of, Spinco or its subsidiaries. MWV may continue to use “MeadWestvaco” as a trade name or business name or as a trademark for any goods or services offered by it or its subsidiaries at any time after the Separation, but MWV may not use the “Mead®” name as a trademark for specific goods or services (except as a matter of historical reference).

ACCO and MWV pursue registration of their important service marks and trademarks and vigorously oppose any infringement upon them. In this proxy statement/prospectus-information statement, we also refer to product names, trademarks, trade names and service marks that are the property of other companies. Each of the trademarks, trade names or service marks of other companies appearing in this proxy statement/prospectus-information statement belongs to its owner. The use or display of other parties’ trademarks, trade names or service marks is not intended to and does not imply a relationship with, or endorsement or sponsorship by either ACCO or MWV of, the product, trademark, trade name or service mark owner, unless we otherwise expressly indicate.

Table of Contents

| 1 | ||||

| 3 | ||||

| 6 | ||||

| 10 | ||||

| 13 | ||||

| SUMMARY HISTORICAL CONSOLIDATED FINANCIAL INFORMATION OF ACCO |

26 | |||

| SUMMARY HISTORICAL COMBINED FINANCIAL DATA OF THE MEAD C&OP BUSINESS |

27 | |||

| 28 | ||||

| 29 | ||||

| HISTORICAL MARKET PRICE AND DIVIDEND INFORMATION OF ACCO COMMON STOCK |

30 | |||

| 31 | ||||

| 31 | ||||

| 37 | ||||

| 42 | ||||

| 44 | ||||

| 44 | ||||

| 44 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 48 | ||||

| 48 | ||||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 53 | ||||

| 53 | ||||

| 58 | ||||

| MWV’s Reasons for the Separation, the Distribution and the Merger |

60 | |||

| 62 | ||||

| 62 | ||||

| 79 | ||||

| Certain Forecasts Prepared by MWV and the MEAD C&OP Business Management |

81 | |||

| 82 | ||||

| 82 | ||||

| 83 | ||||

| 86 | ||||

| 87 | ||||

| 87 | ||||

| 87 |

Table of Contents

| 88 | ||||

| MATERIAL U.S. INCOME TAX CONSEQUENCES OF THE SEPARATION, THE DISTRIBUTION AND THE MERGERS |

89 | |||

| 93 | ||||

| 93 | ||||

| 111 | ||||

| 121 | ||||

| 121 | ||||

| 123 | ||||

| 124 | ||||

| ADDITIONAL AGREEMENTS RELATED TO THE SEPARATION, THE DISTRIBUTION AND THE MERGER |

126 | |||

| 126 | ||||

| 127 | ||||

| 129 | ||||

| 130 | ||||

| 130 | ||||

| 130 | ||||

| 131 | ||||

| 132 | ||||

| 132 | ||||

| 133 | ||||

| 133 | ||||

| 134 | ||||

| 134 | ||||

| 134 | ||||

| 134 | ||||

| 135 | ||||

| 135 | ||||

| 137 | ||||

| 141 | ||||

| 142 | ||||

| 143 | ||||

| 143 | ||||

| 143 | ||||

| 144 | ||||

| 144 | ||||

| 144 | ||||

| 145 | ||||

| 145 | ||||

| 145 | ||||

| 145 | ||||

| 145 | ||||

| 145 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

| 147 |

ii

Table of Contents

iii

Table of Contents

In this document:

“ACCO” means ACCO Brands Corporation, a Delaware corporation. After the Transactions, ACCO will own and operate the combined businesses of the MEAD C&OP Business and ACCO.

“ACCO common stock” means the common stock, par value $.01 per share, of ACCO.

“ACCO Group” means ACCO and each of its subsidiaries including, after the completion of the Merger, the Spinco Group.

“Code” means the Internal Revenue Code of 1986, as amended.

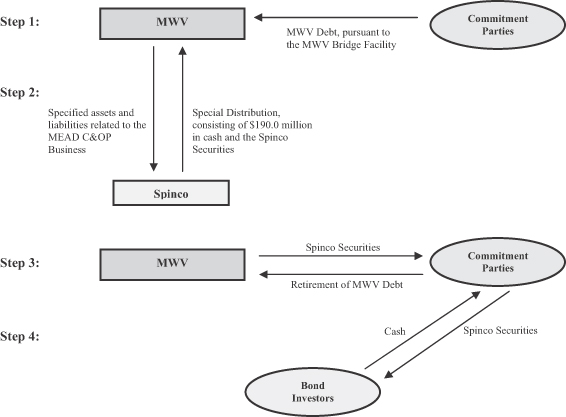

“Debt Exchange” means the exchange expected to be effected by MWV pursuant to which MWV will exchange the Spinco debt instruments received in the Special Distribution for debt obligations of MWV.

“DGCL” means the Delaware General Corporation Law.

“Distribution” means the distribution by MWV of all of the shares of Spinco common stock to MWV stockholders on a pro rata basis.

“Distribution Tax Opinion” means an opinion from MWV’s counsel to the effect that the Separation and the Distribution, taken together, will qualify as a reorganization under section 368(a)(1)(D) of Code.

“Employee Benefits Agreement” means the Employee Benefits Agreement, dated as of November 17, 2011 and amended as of March 5, 2012, by and among MWV, ACCO and Spinco and attached as Exhibit C to the Separation Agreement.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, together with the rules and regulations promulgated thereunder.

“GAAP” means U.S. generally accepted accounting principles.

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

“IRS” means the U.S. Internal Revenue Service or any successor thereto, including its agents, representatives and attorneys.

“LLC Merger” means the merger of Spinco with and into Mead Products, with Mead Products continuing as the surviving entity.

“MEAD C&OP Business” means the business currently held by MWV or its subsidiaries of manufacturing, sourcing, marketing and distribution of school supplies, office products, and planning and organizing tools in North America and Brazil. The products are marketed and sold through both retail and commercial channels under the following brands: Mead®, Five Star®, Trapper Keeper®, AT-A-GLANCE®, Cambridge®, Day Runner®, Tilibra®, Grafons® and Hilroy®, among others.

“Mead Products” means Mead Products LLC, a Delaware limited liability company of which ACCO is the sole member.

“Merger” means the merger of Merger Sub with and into Spinco, with Spinco continuing as the surviving company and as a wholly owned subsidiary of ACCO, as contemplated by the Merger Agreement.

“Merger Agreement” means the Agreement and Plan of Merger, dated as of November 17, 2011 and amended by Amendment No. 1 dated as of March 19, 2012, by and among MWV, Spinco, ACCO and Merger Sub.

1

Table of Contents

“Merger Sub” means Augusta Acquisition Sub, Inc., a Delaware corporation and wholly owned subsidiary of ACCO.

“Merger Tax Opinion” means an opinion from counsel to the effect that the Merger and the LLC Merger, taken together, will be treated as a reorganization within the meaning of section 368(a) of the Code.

“MWV” means MeadWestvaco Corporation, a Delaware corporation.

“MWV common stock” means the common stock, par value $.01 per share, of MWV.

“NYSE” means the New York Stock Exchange.

“Private Letter Ruling” means a private letter ruling from the IRS substantially to the effect that, among other things, (1) the Separation and the Distribution, taken together, will qualify as a reorganization under section 368(a)(1)(D) of the Code, and (2) MWV will not recognize gain or loss for U.S. federal income tax purposes in connection with the receipt of Spinco debt instruments or the consummation of the Debt Exchange.

“Rights Agreement” means the Rights Agreement, dated as of August 16, 2005 by and between ACCO and Wells Fargo, National Association, as rights agent.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the Securities Act of 1933, as amended, together with the rules and regulations promulgated thereunder.

“Separation” means the transfer by MWV of the specified assets and liabilities related to the MEAD C&OP Business to Spinco and its subsidiaries, as contemplated by the Separation Agreement.

“Separation Agreement” means the Separation Agreement, dated as of November 17, 2011 and amended by Amendment No. 1 dated as of March 19, 2012, between MWV and Spinco.

“Special Distribution” means the distribution made in connection with the Transactions by Spinco to MWV consisting of (1) $190.0 million in cash (which amount may be increased by MWV prior to the fifth day prior to the effective date of the Separation) and (2) debt instruments of Spinco in an amount that would satisfy in full debt of MWV having a principal amount equal to (a) $460.0 million less (b) the amount of cash distributed in the Special Distribution.

“Spinco” means Monaco SpinCo Inc., a Delaware corporation and wholly owned subsidiary of MWV, and, after the completion of the Merger, the surviving corporation in the Merger. At the time of the Distribution, Spinco will hold, through its subsidiaries, the assets and liabilities relating to the MEAD C&OP Business.

“Spinco Group” means Spinco and each of its subsidiaries.

“Spinco common stock” means the common stock, par value $0.001 per share, of Spinco.

“Tax Matters Agreement” means the Tax Matters Agreement to be entered into among MWV, Spinco and ACCO substantially in the form attached as Exhibit A to the Separation Agreement.

“Transactions” means the transactions contemplated by the Merger Agreement and the Separation Agreement, which provide, among other things, for the Separation, the Distribution and the Merger, as described in the section “The Transactions.”

“Transaction Agreements” means the Merger Agreement, the Separation Agreement, the Employee Benefits Agreement, the Transition Services Agreement and the Tax Matters Agreement.

“Transition Services Agreement” means the Transition Services Agreement to be entered into between MWV and Spinco substantially in the form attached as Exhibit B to the Separation Agreement.

2

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE TRANSACTIONS

The following are some of the questions that ACCO stockholders and MWV stockholders may have regarding the Transactions and brief answers to those questions. For more detailed information about the matters discussed in these questions and answers, see “The Transactions” beginning on page 48 and “The Transaction Agreements” beginning on page 93. These questions and answers, as well as the summary beginning on page 13, are not meant to be a substitute for the information contained in the remainder of this proxy statement/prospectus-information statement, and this information is qualified in its entirety by the more detailed descriptions and explanations contained elsewhere in this proxy statement/prospectus-information statement. Stockholders are urged to read this proxy statement/prospectus-information statement in its entirety. Additional important information is also contained in the annexes to this proxy statement/prospectus-information statement. You should pay special attention to the “Risk Factors” beginning on page 31 and “Cautionary Statement Regarding Forward-Looking Statements” beginning on page 42.

| Q: | What are the transactions described in this proxy statement/prospectus-information statement? |

| A: | References to the “Transactions” means the transactions contemplated by the Merger Agreement and the Separation Agreement, which provide, among other things, for the Separation of the MEAD C&OP Business from the other businesses of MWV, the Distribution of Spinco common stock to MWV stockholders and the Merger of Merger Sub with and into Spinco, as described in “The Transactions” and elsewhere in this proxy statement/prospectus-information statement. |

| Q: | What will happen in the Separation? |

| A: | Pursuant to and in accordance with the terms and conditions of the Separation Agreement, MWV will engage in a series of restructuring transactions in which specified assets and liabilities relating to the MEAD C&OP Business will be conveyed to Spinco and entities that will become Spinco subsidiaries. |

In consideration for the conveyance, Spinco will:

| • | issue to MWV shares of Spinco common stock; |

| • | make a distribution, which we refer to as the Special Distribution, to MWV consisting of (1) $190.0 million in cash (which amount may be increased by MWV) and (2) debt instruments of Spinco having a principal amount equal to (a) $460.0 million less (b) the amount of cash distributed in the Special Distribution. In combination with the contemplated Debt Exchange pursuant to which MWV expects to exchange the Spinco debt instruments received in the Special Distribution for debt obligations of MWV, the Special Distribution is expected to result in MWV receiving approximately $460.0 million in cash from the Transactions. Because the Transactions are conditioned on the receipt of a Private Letter Ruling and the Distribution Tax Opinion, MWV expects that the $460.0 million in cash will be received on a tax-free basis. For further information on the Debt Exchange, see “Debt Financing.” |

Spinco will consummate certain financing transactions to make the Special Distribution to MWV. For a more complete discussion of these financing transactions, see “Debt Financing.”

| Q: | What will happen in the Distribution? |

| A: | Pursuant to and in accordance with the terms and conditions of the Separation Agreement, after the Separation, MWV will distribute all of the shares of Spinco common stock it holds to its stockholders as of the record date of the Distribution on a pro rata basis by delivering the shares to the distribution agent for the Distribution. The distribution agent will hold such shares for the benefit of MWV stockholders that are entitled to the Spinco common stock. |

Pursuant to the Merger Agreement, at the effective time of the Merger (which will occur immediately after the Distribution), the shares of Spinco common stock delivered to the distribution agent will be converted into ACCO common stock. For further information on the Merger, see “Q: What will happen in the Merger?” Accordingly, in lieu of delivering shares of Spinco common stock to MWV stockholders that are entitled to the Spinco common stock in the Distribution, the distribution agent will distribute to MWV stockholders shares of ACCO common stock that the shares of Spinco common stock converted into at the

3

Table of Contents

effective time of the Merger and cash in lieu of fractional shares (if any). For further information on the amount of ACCO common stock and cash in lieu of fractional shares that MWV stockholders will receive, see “Q: What will MWV stockholders be entitled to receive pursuant to the Distribution and the Merger?”

| Q: | What will happen in the Merger? |

| A: | Pursuant to and in accordance with the terms and conditions of the Merger Agreement, in the Merger, Merger Sub will merge with and into Spinco. Spinco will survive the Merger as a wholly owned subsidiary of ACCO. Following completion of the Merger, Spinco will merge with and into Mead Products LLC, a Delaware limited liability company of which ACCO is the sole member, which we refer to as Mead Products, with Mead Products continuing as the surviving entity. We refer to the merger described in the immediately preceding sentence as the LLC Merger. Following completion of the Merger and the LLC Merger, ACCO will continue to be a separately traded public company and will own and operate the combined businesses of the MEAD C&OP Business and ACCO. |

At the close of the proposed transactions, MWV stockholders will own approximately 50.5% of ACCO common stock and current ACCO stockholders will own approximately 49.5% of ACCO common stock. We currently expect, based on the exchange ratio formula set forth in the Merger Agreement and the number of outstanding shares of ACCO common stock and MWV common stock as of March 16, 2012, that ACCO will issue, and MWV stockholders will receive (in addition to retaining their MWV common stock), approximately 56,651,967 shares of ACCO common stock as a result of the Transactions, or approximately 0.33 shares of ACCO for every one share of MWV common stock they own on the record date of the Distribution. The actual number of shares of ACCO common stock that MWV stockholders will receive will be determined based on the number of shares of MWV common stock entitled to Spinco common stock in the Distribution (subject to certain adjustments) and the number of shares of ACCO common stock outstanding at the time of the Merger. See “The Transaction Agreements—The Merger Agreement—Merger Consideration.”

| Q: | Who will serve on the ACCO Board of Directors following completion of the Merger? |

| A: | The directors of ACCO following the closing of the Merger are expected to be the directors of ACCO immediately prior to the closing of the Merger, except that, as soon as practicable following the 2012 annual meeting of ACCO stockholders, the ACCO Board of Directors will be increased by two members, and James A. Buzzard and E. Mark Rajkowski, who have been selected by MWV and approved by the ACCO Board of Directors, shall be elected by the ACCO Board of Directors to fill the vacancies created. If the Merger is completed following ACCO’s 2012 annual meeting, the two additional directors will be elected to the ACCO Board of Directors as soon as practicable following the Merger. |

| Q: | Will ACCO’s current senior management team manage the business of ACCO after the Transactions? |

| A: | Yes. ACCO anticipates that its senior management team will continue to manage the business of ACCO after the Transactions along with an executive of the MEAD C&OP Business. See “The Transactions—Board of Directors and Executive Officers of ACCO Following the Merger; Operations Following the Merger.” |

| Q: | Will ACCO and Spinco incur indebtedness in connection with the Separation, the Distribution and the Merger? |

| A: | Yes. Spinco will incur $460.0 million of indebtedness in connection with (i) the cash to be distributed to MWV as part of the Special Distribution (see “Summary—The Separation and the Distribution”) and the payment of fees and expenses in connection with the Transactions and (ii) the debt instruments having a principal amount equal to (a) $460.0 million less (b) the amount of cash distributed in the Special Distribution. After completion of the Merger, ACCO will be required to guarantee the debt incurred by Spinco in connection with the issuance of such Spinco debt instruments and cash to be distributed in the Special Distribution. ACCO currently intends to enter into a senior secured credit agreement which consists |

4

Table of Contents

| of a senior secured term loan A in an aggregate principal amount of approximately $95 million to ACCO, a senior secured term loan A in an aggregate principal amount of approximately $35 million to ACCO Brands Canada Inc., which we refer to as ACCO Brands Canada, a senior secured term loan B in an aggregate principal amount of approximately $450 million to ACCO and a senior secured term loan A to Spinco in an aggregate principal amount of approximately $190 million (the proceeds of which Spinco will use to finance the cash portion of the Special Distribution and which ACCO will guarantee after the Merger). See “Debt Financing—Senior Secured Credit Agreement.” Following completion of the Merger, ACCO will also continue to be obligated in respect of ACCO’s existing indebtedness which has not been refinanced in connection with the Transactions. |

| Q: | How will the rights of stockholders of MWV and ACCO change after the Merger? |

| A: | The rights of stockholders of MWV will remain the same as prior to the Merger, except that stockholders of MWV will receive shares of ACCO common stock and cash paid in lieu of fractional shares in the Merger. See “Description of Capital Stock of ACCO Before and After the Merger—Description of Capital Stock of ACCO.” |

The rights of stockholders of ACCO will not change as a result of the Merger. ACCO does not anticipate amending its restated certificate of incorporation or its bylaws in connection with the Merger.

| Q: | What are the material tax consequences to ACCO stockholders and MWV stockholders resulting from the Separation, the Distribution, the Merger and the LLC Merger? |

| A: | ACCO stockholders are not expected to recognize any gain or loss for U.S. federal income tax purposes as a result of the Merger and the LLC Merger (which we refer to collectively as the “Mergers”). MWV stockholders are not expected to recognize any gain or loss as a result of the Separation, the Distribution or the Mergers, except for any gain or loss attributable to the receipt of cash in lieu of a fractional share of ACCO common stock. The material U.S. federal income tax consequences of the Separation, the Distribution and the Mergers are described in more detail under “Material U.S. Federal Income Tax Consequences of the Separation, the Distribution and the Mergers.” |

| Q: | Does ACCO have to pay anything to MWV if the Share Issuance is not approved by the ACCO stockholders or if the Merger Agreement is otherwise terminated? |

| A: | Depending on the reasons for termination of the Merger Agreement, ACCO may have to pay MWV a termination fee of $15.0 million or reimburse MWV and Spinco for their expenses in connection with the Transactions not to exceed $5.0 million. For a discussion of the circumstances under which the termination fee is payable by ACCO or the requirement to reimburse expenses applies, see “The Transaction Agreements—The Merger Agreement—Termination Fee Payable in Certain Circumstances.” |

| Q: | Does MWV have to pay anything to ACCO if the Merger Agreement is terminated? |

| A: | Depending on the reasons for termination of the Merger Agreement, MWV may have to pay ACCO a termination fee of $7.5 million or $20.0 million. For a discussion of the circumstances under which the termination fee is payable by MWV, see “The Transaction Agreements—The Merger Agreement—Termination Fee Payable in Certain Circumstances.” |

| Q: | Are there risks associated with the Transactions? |

| A: | Yes. ACCO may not realize the expected benefits of the Transactions because of the risks and uncertainties discussed in the section entitled “Risk Factors” beginning on page 31 and the section entitled “Cautionary Statement Regarding Forward-Looking Statements” beginning on page 42. These risks include, among others, risks relating to the uncertainty that the Transactions will close, the uncertainty that ACCO will be able to integrate the MEAD C&OP Business successfully, and uncertainties relating to the performance of ACCO after the Transactions. |

| Q: | Can ACCO or MWV stockholders demand appraisal of their shares? |

| A: | No. Neither ACCO nor MWV stockholders have appraisal rights under Delaware law in connection with the Separation, the Distribution or the Mergers. |

| Q: | When will the Transactions be completed? |

| A: | We expect to complete the Transactions in the first half of 2012. |

5

Table of Contents

QUESTIONS AND ANSWERS FOR ACCO STOCKHOLDERS

The following are some of the questions that ACCO stockholders may have regarding the special meeting of ACCO stockholders, and brief answers to those questions. For more detailed information about the matters discussed in these questions and answers, see “The ACCO Special Meeting” beginning on page 44. These questions and answers, as well as the following summary, are not meant to be a substitute for the information contained in the remainder of this proxy statement/prospectus-information statement, and this information is qualified in its entirety by the more detailed descriptions and explanations contained elsewhere in this proxy statement/prospectus-information statement. ACCO urges its stockholders to read this proxy statement/prospectus-information statement in its entirety prior to making any decision. You should pay special attention to the “Risk Factors” beginning on page 31 and “Cautionary Statement Regarding Forward-Looking Statements” beginning on page 42.

| Q: | What are ACCO stockholders being asked to vote on at the special meeting? |

| A: | ACCO stockholders are being asked to approve the issuance of ACCO common stock in connection with the Merger, which we refer to as the Share Issuance. ACCO stockholder approval of the Share Issuance proposal is required under NYSE rules and is a condition to the completion of the Transactions. |

ACCO stockholders are also being asked to approve amendments to the 2011 Amended and Restated ACCO Brands Corporation Incentive Plan, which we refer to as the Incentive Plan, including an amendment to increase the authorized number of shares of ACCO common stock reserved for issuance thereunder by 10,400,000 shares to a new total of 15,665,000 shares, which we refer to as the incentive plan amendments. The incentive plan amendments proposal is conditioned on ACCO stockholder approval of the Share Issuance proposal.

ACCO stockholders are also being asked to approve the adjournment or postponement of the special meeting, if necessary or appropriate, to solicit additional proxies in the event there are not sufficient votes at the time of the special meeting to approve the Share Issuance, which we refer to as the meeting adjournment proposal. The approval by ACCO stockholders of the meeting adjournment proposal is not a condition to the completion of the Transactions.

| Q: | When and where is the special meeting of ACCO stockholders? |

| A: | The special meeting of ACCO stockholders will be held on [—], [—] at [—], local time, at ACCO’s headquarters located at 300 Tower Parkway Lincolnshire, IL 60069. |

| Q: | Who can vote at the special meeting of ACCO stockholders? |

| A: | Only stockholders who own ACCO common stock of record at the close of business on March 22, 2012 are entitled to vote at the special meeting. Each holder of common stock is entitled to one vote per share. There were [—] shares of ACCO common stock outstanding on [—]. |

| Q: | How does the ACCO Board of Directors recommend that ACCO stockholders vote? |

| A: | The ACCO Board of Directors has determined that the Merger and the Merger Agreement are advisable, fair to, and in the best interests of ACCO and its stockholders. Accordingly, the ACCO Board of Directors has unanimously approved the Merger Agreement and the Merger. The ACCO Board of Directors unanimously recommends that ACCO stockholders vote “FOR” the proposal to approve the Share Issuance, “FOR” the proposal to approve the incentive plan amendments and “FOR” the meeting adjournment proposal. |

6

Table of Contents

| Q: | What vote is required to approve each proposal? |

| A: | In accordance with the DGCL and ACCO’s governing documents, and, with respect to the incentive plan amendments, the Incentive Plan, the approval by ACCO stockholders of each of the Share Issuance proposal and the incentive plan amendments proposal requires the affirmative vote of the holders of a majority in interest of ACCO stockholders present or represented by proxy at the special meeting at which a quorum is present; provided that the votes cast (whether for or against the proposal) represent at least a majority of the shares entitled to vote on the proposal. The approval of the meeting adjournment proposal requires the affirmative vote of the holders of a majority of the shares of ACCO common stock present in person or represented by proxy at the special meeting and entitled to vote thereon, whether or not a quorum is present. |

| Q: | What is a quorum? |

| A: | The holders of a majority of the issued and outstanding common stock of ACCO present either in person or represented by proxy at the meeting will constitute a quorum. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the special meeting. |

| Q: | What should ACCO stockholders do now in order to vote on the proposals being considered at the ACCO special meeting? |

| A: | ACCO stockholders may submit a proxy by filling out the accompanying proxy card and returning it as instructed on the proxy card. ACCO stockholders can also authorize the individuals named on the proxy card to vote their shares by telephone or the internet by following the instructions printed on the proxy card. |

Submitting a proxy means that a stockholder gives someone else the right to vote his shares in accordance with his instructions. In this way, the stockholder ensures that his vote will be counted even if he is unable to attend the ACCO special meeting. If an ACCO stockholder executes a proxy, but does not include specific instructions on how to vote, the individuals named as proxies will vote the ACCO stockholders’ shares as follows:

| • | “FOR” the proposal to approve the Share Issuance; |

| • | “FOR” the proposal to approve the incentive plan amendments; and |

| • | “FOR” the meeting adjournment proposal. |

If an ACCO stockholder holds shares in “street name,” which means the shares are held of record by a broker, bank or nominee, please see “Q: If an ACCO stockholder’s shares are held in ‘street name’ by his broker, will the broker vote the shares for the stockholder?” below.

ACCO stockholders may also vote in person at the meeting. If an ACCO stockholder plans to attend the ACCO special meeting and wishes to vote in person, he will be given a ballot at the ACCO special meeting. Please note, however, that if an ACCO stockholder’s shares are held in “street name,” and he wishes to vote in person at the ACCO special meeting, the ACCO stockholder must bring a proxy from the record holder of the shares authorizing him to vote at the ACCO special meeting. Whether or not an ACCO stockholder plans to attend the ACCO special meeting, he is encouraged to authorize his proxy as described in this proxy statement/prospectus-information statement.

| Q: | What if I participate in the ACCO 401(k) plan? |

We also are making this proxy statement/prospectus-information statement available to and seeking voting instructions from participants in the ACCO 401(k) plan who hold shares of our common stock under such plan. The trustees of the plan, as record holders of the ACCO common stock held in the plan, will vote whole shares attributable to you in accordance with your directions given on your voting instruction card, by telephone or the internet. If you hold shares of ACCO common stock under the plan, please complete, sign and return your voting instruction card, or provide voting instructions by telephone or through the internet

7

Table of Contents

as described on the voting instruction card prior to [—] [—], 2012. The voting instruction card will serve as instructions to the plan trustees to vote the whole shares attributable to your interest in the manner you indicate on the card.

| Q: | If an ACCO stockholder is not going to attend the special meeting, should the stockholder return his proxy card or otherwise vote his shares? |

| A: | Yes. Completing, signing, dating and returning the proxy card by mail or submitting a proxy by calling the toll-free number shown on the proxy card or submitting a proxy by visiting the website shown on the proxy card ensures that the stockholder’s shares will be represented and voted at the special meeting, even if the stockholder is unable to or does not attend. |

| Q: | If an ACCO stockholder’s shares are held in “street name” by his broker, will the broker vote the shares for the stockholder? |

| A: | If an ACCO stockholder’s shares are held in “street name,” which means such shares are held of record by a broker, bank or nominee, he will receive instructions from his broker, bank or other nominee that he must follow in order to have his shares of ACCO common stock voted. If an ACCO stockholder has not received such voting instructions or requires further information regarding such voting instructions, the ACCO stockholder should contact his bank, broker or other nominee. Brokers, banks or other nominees who hold shares of ACCO common stock for a beneficial owner of those shares typically have the authority to vote in their discretion on “routine” proposals when they have not received instructions from beneficial owners. However, brokers, banks and other nominees are not allowed to exercise their voting discretion with respect to the approval of matters that are “non-routine,” such as approval of the Share Issuance proposal or the incentive plan amendments proposal, without specific instructions from the beneficial owner. All proposals for the ACCO special meeting are non-routine and non-discretionary. Broker non-votes are shares held by a broker, bank or other nominee that are represented at the meeting but with respect to which the broker, bank or other nominee is not instructed by the beneficial owner of such shares to vote on the particular proposal, and the broker, bank or other nominee does not have discretionary voting power on such proposal. If an ACCO stockholder’s broker, bank or other nominee holds the ACCO stockholder’s shares of ACCO common stock in “street name,” the ACCO stockholder’s bank, broker or other nominee will vote the ACCO stockholder’s shares only if the ACCO stockholder provides instructions on how to vote by filling out the voter instruction form sent to him by his bank, broker or other nominee with this proxy statement/prospectus-information statement. |

WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING, YOU ARE ENCOURAGED TO GRANT YOUR PROXY AS DESCRIBED IN THIS PROXY STATEMENT/PROSPECTUS-INFORMATION STATEMENT.

| Q: | Can ACCO stockholders change their vote? |

| A: | Yes. Holders of record of ACCO common stock who have properly completed and submitted their proxy card or proxy by telephone or internet can change their vote before the proxy is voted at the ACCO special meeting in any of the following ways: |

| • | sending a written notice that is received prior to the special meeting stating that the stockholder revokes his proxy to the corporate secretary of ACCO at 300 Tower Parkway, Lincolnshire, IL 60069; |

| • | properly completing, signing and dating a new proxy card bearing a later date and properly submitting it so that it is received prior to the special meeting; |

| • | visiting the website shown on the proxy card and submitting a new proxy in the same manner that the stockholder would submit his proxy via the internet or by calling the toll-free number shown on the proxy card to submit a new proxy by telephone; or |

| • | attending the special meeting in person and voting their shares. |

8

Table of Contents

Simply attending the special meeting will not revoke a proxy.

An ACCO stockholder whose shares are held in “street name” by his broker and who has directed that person to vote his shares should instruct that person to change his vote.

| Q: | What will happen if ACCO stockholders abstain from voting, fail to vote or do not direct how to vote on their proxy? |

| A: | The failure of an ACCO stockholder to vote or to instruct his broker to vote if his shares are held in “street name” may have a negative effect on the ability of ACCO to obtain the number of votes necessary for approval of the proposals. For purposes of the stockholder vote, an abstention, which occurs when a stockholder attends a meeting, either in person or by proxy, but abstains from voting, will have the same effect as voting against the proposal to approve the Share Issuance, voting against the proposal to approve the incentive plan amendments and voting against the meeting adjournment proposal. The failure of an ACCO stockholder to vote or to instruct his broker, bank or nominee to vote if his shares are held in “street name” will not (assuming a quorum is present) affect the proposals to approve the Share Issuance or the incentive plan amendments (provided that the total votes cast on this proposal represent over 50% of the outstanding shares of ACCO common stock entitled to vote on the proposal) or the meeting adjournment proposal. All properly signed proxies that are received prior to the special meeting and that are not revoked will be voted at the special meeting according to the instructions indicated on the proxies. If a proxy is returned without an indication as to how shares of ACCO common stock represented are to be voted with regard to a particular proposal, the shares of ACCO common stock represented by the proxy will be voted in accordance with the recommendation of the ACCO Board of Directors and therefore, “FOR” the proposal to approve the Share Issuance, “FOR” the proposal to approve the incentive plan amendments and “FOR” the proposal to adjourn the special meeting, if necessary or appropriate, to permit further solicitation of proxies. |

9

Table of Contents

QUESTIONS AND ANSWERS FOR MWV STOCKHOLDERS

The following are some of the questions that MWV stockholders may have regarding the Transactions, and brief answers to those questions. For more detailed information about the matters discussed in these questions and answers, see “The Transactions” beginning on page 48. These questions and answers, as well as the following summary, are not meant to be a substitute for the information contained in the remainder of this proxy statement/prospectus-information statement, and this information is qualified in its entirety by the more detailed descriptions and explanations contained elsewhere in this proxy statement/prospectus-information statement. Stockholders are urged to read this proxy statement/prospectus-information statement in its entirety. You should pay special attention to the “Risk Factors” beginning on page 31 and “Cautionary Statement Regarding Forward-Looking Statements” beginning on page 42.

| Q: | What will MWV stockholders be entitled to receive pursuant to the Distribution and the Merger? |

| A: | As a result of the Distribution and the Merger, it is currently estimated, based on the assumptions described under the heading “The Transactions—Calculation of Merger Consideration,” that MWV stockholders will be entitled to receive approximately 56,651,967 shares of ACCO common stock as a result of the proposed transactions, or approximately 0.33 shares of ACCO for every share of MWV common stock they own on the record date of the Distribution. However, this amount will be finally determined at the effective time of the Merger based on the number of shares of ACCO common stock outstanding immediately prior to the effective time of the Merger and the number of shares of MWV common stock outstanding immediately prior to the Distribution that are entitled to shares of Spinco common stock in the Distribution. Therefore, the actual number of shares of ACCO common stock that MWV stockholders are entitled to receive will change if the number of shares of ACCO common stock outstanding or shares of MWV common stock outstanding at those times changes because of any increase or decrease in share amounts for any reason. See “The Transaction Agreements—The Merger Agreement—Merger Consideration.” Under no circumstances will any shares of Spinco common stock be physically distributed to MWV stockholders. |

Based on the closing price of ACCO common stock on March 16, 2012 of $12.72, as reported by the NYSE, and the assumptions described under the heading “The Transactions—Calculation of Merger Consideration,” the approximate value MWV stockholders will receive in the Merger will equal $720,613,022 in the aggregate and $4.18 per share of MWV common stock they own on the record date for the Distribution. However, any change in the market value of ACCO common stock or the number of outstanding shares of ACCO common stock at the effective time of the Merger or the number of shares of MWV common stock outstanding and entitled to receive Spinco common stock in the Distribution will cause the estimated per share value MWV stockholders will receive in the Merger to change. Also, those MWV stockholders who would otherwise receive a fractional share of ACCO common stock in the Merger may receive a different per share value with respect to fractional shares when those fractional shares are liquidated by the distribution agent. See “The Transaction Agreements—The Merger Agreement—Merger Consideration.”

| Q: | Has MWV set a record date for the Distribution? |

| A: | No. MWV will publicly announce the record date for the Distribution when the record date has been determined. This announcement will be made prior to the completion of the Separation, the Distribution and the Merger. |

| Q: | What will happen to the shares of MWV common stock owned by MWV stockholders? |

| A: | Holders of MWV common stock will retain all of their shares of MWV common stock. |

| Q: | How will shares of ACCO common stock be distributed to MWV stockholders? |

| A: | Holders of MWV common stock on the record date for the Distribution will receive shares of ACCO common stock in book-entry form. Record stockholders will receive additional information from ACCO’s transfer agent shortly after the Distribution date. Beneficial holders will receive information from their brokerage firms or other nominees. |

10

Table of Contents

| Q: | Will MWV stockholders who sell their shares of MWV common stock shortly before the completion of the Distribution and the Merger still be entitled to receive shares of ACCO common stock with respect to the shares of MWV common stock that were sold? |

| A: | It is currently expected that beginning two business days before the record date to be established for the Distribution, and continuing through the closing date of the Merger (or the previous business day, if the Merger closes before the opening of trading in MWV common stock and ACCO common stock on the NYSE on the closing date), there will be two markets in MWV common stock on the NYSE: a “regular way” market and an “ex-distribution” market. |

If a MWV stockholder sells shares of MWV common stock in the “regular way” market under the ticker symbol “MWV” during this time period, that MWV stockholder will be selling both his shares of MWV common stock and the right (represented by a “due-bill”) to receive shares of Spinco common stock that will be converted into shares of ACCO common stock, and cash in lieu of fractional shares (if any), at the closing of the Merger. MWV stockholders should consult their brokers before selling their shares of MWV common stock in the “regular way” market during this time period to be sure they understand the effect of the NYSE “due-bill” procedures. The “due-bill” process is not managed, operated or controlled by MWV or ACCO.

If a MWV stockholder sells shares of MWV common stock in the “ex-distribution” market during this time period, that MWV stockholder will be selling only his shares of MWV common stock, and will retain the right to receive shares of Spinco common stock that will be converted into shares of ACCO common stock, and cash in lieu of fractional shares (if any), at the closing of the Merger. It is currently expected that “ex-distribution” trades of MWV common stock will settle within three business days after the closing date of the Merger and that if the Merger is not completed all trades in this “ex-distribution” market will be cancelled.

After the closing date of the Merger, shares of MWV common stock will no longer trade in this “ex-distribution” market, and shares of MWV common stock that are sold in the “regular way” market will no longer reflect the right to receive shares of Spinco common stock that will be converted into shares of ACCO common stock, and cash in lieu of fractional shares (if any), at the closing of the Merger.

| Q: | How may MWV stockholders sell the shares of ACCO common stock which they are entitled to receive in the Merger prior to receiving those shares of ACCO common stock? |

| A: | It is currently expected that beginning two business days before the record date to be established for the Distribution, and continuing through the closing date of the Merger (or the previous business day, if the Merger closes before the opening of trading in MWV common stock and ACCO common stock on the NYSE on the closing date), there will be two markets in ACCO common stock on the NYSE: a “regular way” market and a “when issued” market. |

The “regular way” market will be the regular trading market for issued shares of ACCO common stock under the ticker symbol “ABD.”