Exhibit 99.1

|

For additional information, contact: | |||

| T. Heath Fountain | Terry L. Hester | |||

| President and Chief Executive Officer | Chief Financial Officer | |||

| (229) 426-6000, ext. 6012 | (229) 426-6000, ext. 6002 |

COLONY BANKCORP SIGNS DEFINITIVE AGREEMENT

TO ACQUIRE LAGRANGE, GEORGIA-BASED LBC BANCSHARES, INC.

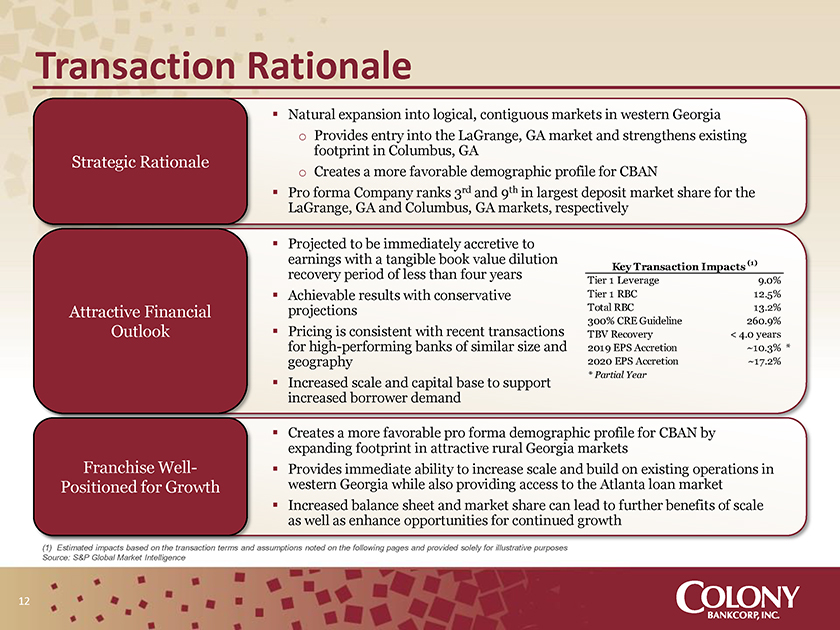

FITZGERALD, GA. (December 18, 2018) – Colony Bankcorp, Inc. (Nasdaq: CBAN) (“Colony” or “the Company”), the holding company for Colony Bank, a Georgia state-chartered bank, today announced the signing of an Agreement and Plan of Merger with LBC Bancshares, Inc. (“LBC”), parent company of Calumet Bank, a Georgia state-chartered bank, under which Colony has agreed to acquire 100% of the common stock of LBC in a combined stock-and-cash transaction valued at approximately $34.1 million.

LBC, headquartered in LaGrange, Georgia, is the parent company for Calumet Bank, which has two branches – one each in LaGrange and Columbus – as well as a loan production office in Atlanta. As of September 30, 2018, LBC had approximately $228 million in assets, $130 million in loans, $204 million in deposits and $19 million in tangible common equity. Upon completion of the transaction, Colony is expected to have approximately $1.4 billion in assets, $930 million in loans, and $1.2 billion in deposits. The transaction is expected to be immediately accretive to Colony’s fully diluted earnings per share, excluding transaction costs.

Under the terms of the Agreement and Plan of Merger, each LBC shareholder will have the option to receive either $23.50 in cash or 1.3239 shares of Colony’s common stock in exchange for each share of LBC common stock, subject to customary proration and allocation procedures, such that 55% of LBC shares will receive the stock consideration and 45% will receive the cash consideration, and at least 50% of the merger consideration will be paid in Company stock. The aggregate consideration is valued at approximately $34.1 million, based on 1,447,554 LBC common shares outstanding, 101,842 LBC in-the money options, 32,806 LBC in-the-money warrants and Colony’s stock price of $16.10 per share as of December 17, 2018.

The Agreement and Plan of Merger has been approved by the Boards of Directors of Colony and LBC. The closing of the transaction, which is expected to occur in the first half of 2019, is subject to customary conditions, including regulatory approval and approval by the shareholders of LBC.

Commenting on the announcement, Heath Fountain, President and Chief Executive Officer, said, “We are pleased to announce the acquisition of LBC and Calumet Bank. This acquisition will allow Colony to accelerate its growth by increasing our footprint to include the attractive Western Georgia markets of LaGrange and Columbus and additionally providing us access to the Atlanta market via Calumet’s loan production office there. Considering Calumet’s market strength and reputation, as well as the lack of overlap between our markets, we believe significant opportunities exist for continued growth in LaGrange, Columbus and Atlanta as we increase our combined company’s operational scale and bring additional resources to our new markets.”

“Outside of the appealing financial and growth rationale for this transaction, we also are pleased to note other positive intangibles, like a strong cultural and operational fit between our organizations, as well as likeminded core philosophies on community banking,” Fountain continued. “These factors should result in a smooth integration, which should be seamless for Calumet’s customers. We look forward to earning their confidence and continued loyalty as we work to deliver custom solutions that help them achieve their financial goals.” Fountain added that Leonard “Lenny” H. Bateman, Jr., LBC Bancshares President and Chief Executive Officer, will join Colony when the acquisition is completed, with an initial focus on ensuring a smooth transition in customer relationships and overseeing regional growth strategies. Fountain expects that role to be expanded within the Company’s corporate structure in the future.

-MORE-

CBAN to Acquire LBC Bancshares

Page 2

December 18, 2018

Bateman commented, “As our company considered its growth path and strategic alternatives, our Board was quickly impressed by Colony and its team. Colony will provide greater capital resources and operational scale that will allow us to grow as part of a larger community bank that shares our views about, and commitment to, the customers and communities we serve. By joining forces with Colony, we help create a stronger regional bank with more than $1.4 billion in total assets and the tools and resources to enhance long-term value for our shareholders.”

Hovde Group, LLC served as financial advisor and Alston & Bird LLP provided legal counsel to Colony. Banks Street Partners, LLC served as financial advisor to LBC and James-Bates-Brannan-Grover served as its legal advisor.

About Colony Bankcorp

Colony Bankcorp, Inc. is the bank holding company for Colony Bank. Founded in 1975 and headquartered in Fitzgerald, Georgia, Colony operates 27 full-service branches throughout Central, Southern and Coastal Georgia, as well as a full-service website. Colony’s common stock is traded on the NASDAQ Global Market under the symbol CBAN.

About LBC Bancshares

LBC Bancshares is the parent company of Calumet Bank. Holding $204 million in deposits, Calumet Bank is well capitalized with strong asset quality positioned for continued growth. Since 2008, Calumet has served the community as a locally owned and managed bank dedicated to the highest levels of service. With state-of-the-art technology, Calumet Bank provides customers with robust banking systems in a distinct culture of stewardship and trust. The main office is located in LaGrange, Georgia, in Calumet Center, with the additional branch in Columbus, Georgia, on Airport Thruway. The bank also has a loan production office located in Atlanta Tech Park, a technology incubator located at 107 Technology Parkway in Peachtree Corners, Georgia.

Forward-Looking Statements

This news release contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. In general, forward-looking statements usually use words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “estimate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, including statements related to the expected timing of the closing of the Merger, the expected returns and other benefits of the Merger, to shareholders, expected improvement in operating efficiency resulting from the Merger, estimated expense reductions resulting from the transactions and the timing of achievement of such reductions, the impact on and timing of the recovery of the impact on tangible book value, and the effect of the Merger on the Company’s capital ratios. Forward-looking statements represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Forward-looking statements are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial condition to differ materially from those expressed in or implied by such statements.

Factors that could cause or contribute to such differences include, but are not limited to the risk that the cost savings and any revenue synergies from the Merger may not be realized or take longer than anticipated to be realized, disruption from the Merger with customers, suppliers, employee or other business partners relationships, the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, the risk of successful integration of LBC’s business into the Company, the failure to obtain the necessary approvals by the shareholders of LBC, the amount of the costs, fees, expenses and charges related to the Merger, the ability by the Company to obtain required governmental approvals of the Merger, reputational risk and the reaction of each of the companies’

-MORE-

CBAN to Acquire LBC Bancshares

Page 3

December 18, 2018

customers, suppliers, employees or other business partners to the Merger, the failure of the closing conditions in the Merger Agreement to be satisfied, or any unexpected delay in closing of the Merger, the risk that the integration of LBC’s operations into the operations of the Company will be materially delayed or will be more costly or difficult than expected, the possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events, the dilution caused by the Company’s issuance of additional shares of its common stock in the merger transaction, and general competitive, economic, political and market conditions. Additional factors which could affect the forward-looking statements can be found in the cautionary language included under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in the Company’s Annual Reports on Form 10-K for the year ended December 31, 2017, and other documents subsequently filed by the Company with the SEC. Consequently, no forward-looking statement can be guaranteed. Neither the Company nor LBC undertakes any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. For any forward-looking statements made in this new release or any related documents, the Company and LBC claim protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Additional Information About the Merger and Where to Find It

In connection with the proposed Merger, the Company will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that will include a proxy statement of LBC and a prospectus of the Company, as well as other relevant documents concerning the proposed transaction. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, LBC AND THE PROPOSED MERGER. The proxy statement/prospectus will be sent to the shareholders of LBC seeking the required shareholder approval. Investors and security holders will be able to obtain free copies of the registration statement on Form S-4 and the related proxy statement/prospectus, when filed, as well as other documents filed with the SEC by the Company through the web site maintained by the SEC at www.sec.gov. Documents filed with the SEC by the Company will also be available free of charge by directing a written request to Colony Bankcorp, Inc., 115 South Grant Street, Fitzgerald, Georgia 31750 Attn: Terry L. Hester. The Company’s telephone number is (229) 426-6000.

Participants in the Transaction

The Company, LBC and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of LBC in connection with the proposed transaction. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus regarding the proposed transaction when it becomes available. Additional information about the Company and its directors and officers may be found in the definitive proxy statement of the Company relating to its 2018 Annual Meeting of Shareholders filed with the SEC on April 20, 2018. The definitive proxy statement can be obtained free of charge from the sources described above.

-END-