DocumentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

| | |

Colony Bankcorp, Inc. |

| (Name of Registrant as Specified in its Charter) |

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check all boxes that apply)

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

April 12, 2023

Dear Fellow Shareholder:

On behalf of the Board of Directors and management of Colony Bankcorp, Inc. (the "Company"), I cordially invite you to attend the 2023 Annual Meeting of Shareholders. The meeting will be held at 11:00 a.m., local time, on May 18, 2023, at the Company’s Corporate Headquarters, 115 South Grant Street, Fitzgerald, Georgia.

As we do at this meeting every year, in addition to considering the matters described in the Proxy Statement, we will present the management’s report on the Company’s 2022 financial and operating performance and will address your questions and comments.

A Proxy Statement describing the business to be conducted at the Annual Meeting and a proxy card enabling you to vote without attending the meeting is enclosed. Our Annual Report to Shareholders for the year ended December 31, 2022 is also provided. In accordance with the rules of the Securities and Exchange Commission, our Proxy Statement, proxy card and 2022 Annual Report to Shareholders are also available on the Internet at https://materials.proxyvote.com/19623P.

An important part of the Annual Meeting is the shareholder vote on corporate business items. I urge each of you to exercise your rights as a shareholder to vote and participate in this process. In this Annual Meeting, shareholders are being asked to consider and vote upon: (1) the election of ten directors of the Company; (2) the advisory (non-binding) resolution to approve our executive compensation as disclosed in the enclosed Proxy Statement; (3) the ratification of the appointment of Mauldin & Jenkins, LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2023; and (4) any other business that may properly come before the Annual Meeting or any other adjournment or postponement thereof.

It is important that your shares be represented and voted at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we urge you to read the enclosed Proxy Statement and vote and submit your proxy online, by telephone, or by mail. This will ensure that your shares are represented at the Annual Meeting and will save us the additional expense of soliciting proxies. If you vote your shares prior to the Annual Meeting, you will have the right to revoke your proxy and vote your shares by one of the methods described in the Proxy Statement.

Your Board of Directors and management are committed to the continued success of Colony Bankcorp, Inc. and the enhancement of your investment. As CEO, and acting CFO want to express my appreciation for your confidence and support.

Sincerely,

T. Heath Fountain

Chief Executive Officer and

Acting Chief Financial Officer

COLONY BANKCORP, INC.

Post Office Box 989

115 South Grant Street

Fitzgerald, Georgia 31750

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 18, 2023

To the shareholders of Colony Bankcorp, Inc.:

NOTICE IS HEREBY GIVEN that the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) of Colony Bankcorp, Inc. (the “Company”) will be held at Colony Bankcorp, Inc.’s Corporate Office at 115 South Grant Street, Fitzgerald, Georgia on Thursday, May 18, 2023 at 11:00 a.m., local time, for the following purposes:

1.To elect ten directors to serve until the 2024 Annual Meeting of Shareholders and until their successors have been duly elected and qualified;

2.To solicit an advisory (non-binding) vote approving the Company’s executive compensation;

3.To ratify the appointment of Mauldin & Jenkins, LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2023; and

4.To transact any other business that may properly come before the Annual Meeting or any other adjournment or postponement thereof. As of the date of this proxy statement, the Board of Directors is not aware of any other such business.

The close of business on March 24, 2023 has been fixed as the record date by the Board of Directors for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. Only shareholders of record at the close of business on the record date are entitled to notice of, and to vote at, the Annual Meeting.

Shareholders may receive more than one proxy because of shares registered in different names or addresses. Each such proxy should be marked, dated, signed and returned. Please check to be certain of the manner in which your shares are registered - whether individually, as joint tenants, or in a representative capacity - and sign the related proxy accordingly.

A complete list of shareholders entitled to vote at the Annual Meeting will be available for examination by any shareholder, for any purpose germane to the Annual Meeting, during normal business hours, for a period of at least 10 days prior to the Annual Meeting at the Company’s corporate office located at the address set forth above.

It is important that your shares be represented and voted at the meeting regardless of the numbers of shares you own. Whether or not you plan to attend the Annual Meeting, you are urged to promptly vote the enclosed proxy. You can vote your shares online or by telephone, or by completing and returning the proxy card or voting instruction card sent to you. Voting instructions are printed on your proxy card or voting instruction card and are included in the accompanying proxy statement. You may revoke your proxy at any time prior to its exercise by written notice to the Company prior to the meeting or by attending the meeting personally and voting. Returning your proxy does not deprive you of your right to attend the Annual Meeting and vote your shares in person.

More detailed information regarding the matters to be acted upon at the special meeting is contained in the proxy statement accompanying this notice.

By Order of the Board of Directors

T. Heath Fountain

Chief Executive Officer and

Acting Chief Financial Officer

Fitzgerald, Georgia

April 12, 2023

COLONY BANKCORP, INC.

Post Office Box 989

115 South Grant Street

Fitzgerald, Georgia 31750

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD

May 18, 2023

This proxy statement is being furnished to the shareholders of Colony Bankcorp, Inc. in connection with the solicitation of proxies by its Board of Directors (the “Board”) to be voted at the 2023 Annual Meeting of Shareholders and at any adjournments thereof (the “Annual Meeting”) for the purposes set forth in this proxy statement and the accompanying notice of the meeting. The Annual Meeting will be held on Thursday, May 18, 2023, at Colony Bankcorp, Inc.’s Corporate Office at 115 South Grant Street, Fitzgerald, Georgia 31750, at 11:00 a.m. local time.

The approximate date on which this proxy statement and the accompanying proxy card are first being sent or mailed to shareholders is April 12, 2023. You should read the entire proxy statement carefully before voting.

As used in this proxy statement, the terms “Colony Bankcorp,” “Company,” “Colony,” “we,” “our” and “us” all refer to Colony Bankcorp, Inc. and its wholly-owned banking subsidiary, Colony Bank, except where the context requires otherwise.

Notice Regarding The Internet Availability Of Proxy Materials

We have posted materials related to the 2023 Annual Meeting on the Internet. The following materials are available on the Internet at https://materials.proxyvote.com/19623P:

•This proxy statement for the 2023 Annual Meeting,

•Colony’s 2022 annual report to shareholders, and

•Colony’s Annual Report on Form 10-K for the year ended December 31, 2022, and filed with the Securities and Exchange Commission.

VOTING

General

The securities which can be voted at the Annual Meeting consist of the Company’s common stock, $1.00 par value per share (“Company common stock”), with each share entitling its owner to one vote on each matter submitted to the shareholders. The record date for determining the holders of Company common stock who are entitled to notice of and to vote at the Annual Meeting is March 24, 2023. On the record date, 17,593,879 shares of Company common stock were outstanding and eligible to be voted.

Quorum and Vote Required

The presence, in person or by proxy, of a majority of the outstanding shares of Company common stock is necessary to constitute a quorum at the Annual Meeting. In determining whether a quorum exists at the Annual Meeting for purposes of all matters to be voted on, all votes “for” or “against” as well as all broker non-votes and abstentions (including votes to withhold authority to vote) will be counted.

In voting for the proposal to elect ten directors (Proposal No. 1), you may vote in favor of all nominees or withhold your votes as to all or as to specific nominees. The vote required to approve each director nominee set forth in Proposal No. 1 is governed by the Company’s Amended and Restated Bylaws and is an affirmative vote of a majority of the votes cast at the Annual Meeting where a quorum is present, provided, however, in the event of a contested election for a director seat, such director shall be elected by a plurality of votes received rather than a majority of votes cast. Abstentions, votes withheld, and broker non-votes will not be counted and will have no effect. Shareholders are not entitled to cumulative voting in the election of our directors. Any other matter which may be submitted to shareholders at the Annual Meeting will be determined by a majority of the votes cast at the Annual Meeting, excluding abstentions, votes withheld, and broker non-votes, which will not be counted and will have no effect.

In voting on the proposal to approve the advisory (non-binding) vote on executive compensation (Proposal No. 2), you may vote for or against the proposal or abstain. The proposal will be deemed approved if a majority of the votes cast at the Annual Meeting are voted for Proposal No. 2, excluding abstentions, votes withheld, and broker non-votes, which will not be counted and will have no effect. The vote is advisory, and will not be binding upon the directors.

In voting on the proposal to approve the ratification of the Company’s independent registered public accounting firm (Proposal No. 3), you may vote for or against the proposal or abstain. The proposal will be deemed approved if a majority of the votes cast at the Annual Meeting are voted for Proposal No. 3, excluding abstentions and votes withheld, which will not be counted and will have no effect.

As of March 24, 2023 our directors and executive officers held 1,265,120 shares of Company common stock, or approximately 7.18% of all outstanding common stock, and we believe that all of those shares will be voted in favor of all proposals.

In the event there are not sufficient votes for a quorum or to approve or ratify any proposal at the time of the Annual Meeting, the Annual Meeting may be adjourned or postponed to permit the further solicitation of proxies.

The Board recommends that you vote your shares "FOR" the election of each of the ten director nominees named in this proxy statement, "FOR" the advisory vote on the compensation of Colony’s named executive officers, and "FOR" the ratification of Mauldin & Jenkins, LLC as our independent registered public accounting firm for 2023.

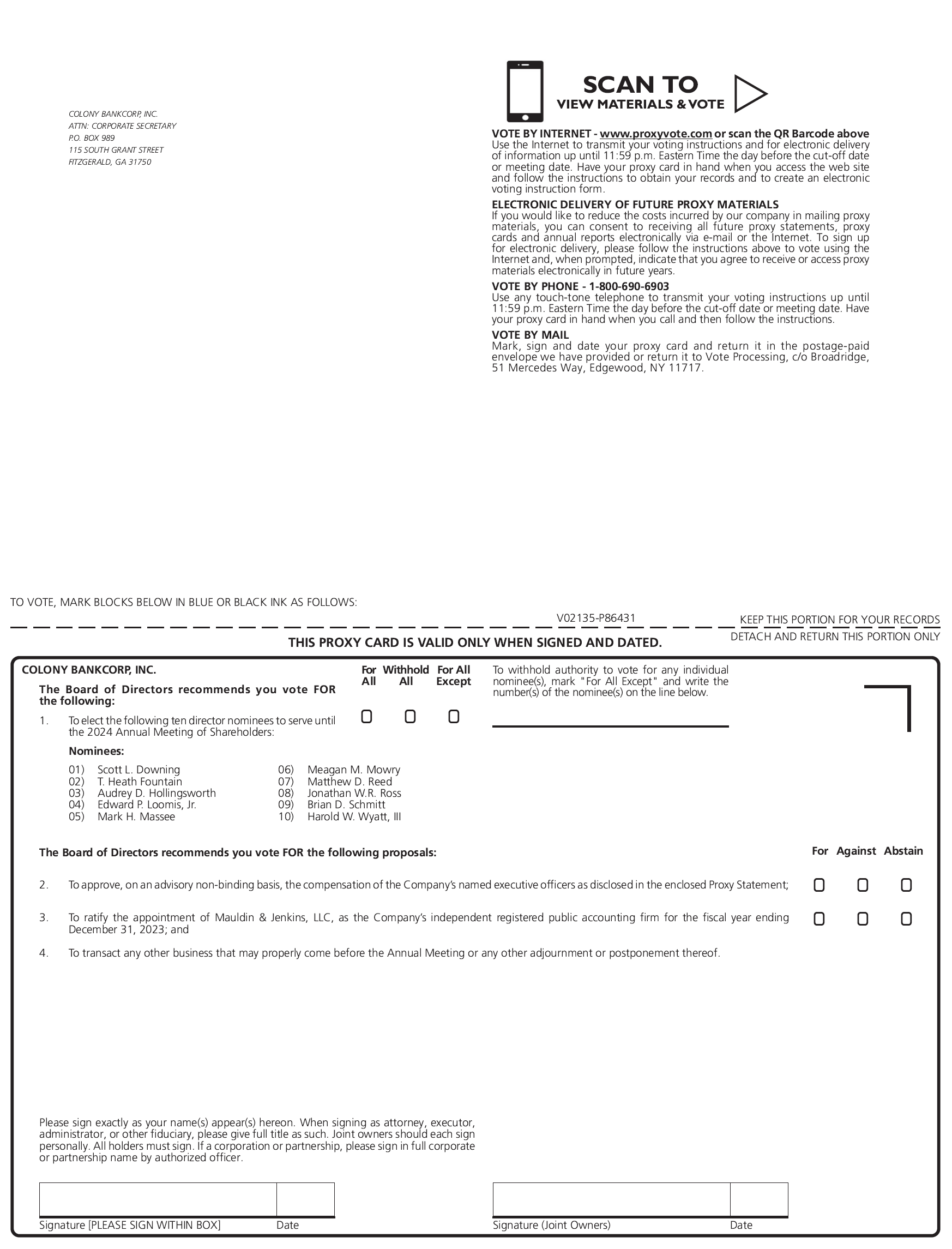

Proxies

If you hold your shares in your own name, you may vote by proxy or in person at the Annual Meeting. To vote your shares, you may select one of the following options:

•Vote by Telephone - You can vote your shares by telephone by calling 1-800-690-6903. Telephone voting is available 24 hours a day, seven days a week, until 11:59 P.M., Eastern Time, on May 17, 2023. Easy-to-follow voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded. Our telephone voting procedures are designed to authenticate the shareholder by using individual control numbers. If you vote by telephone, you do NOT need to return your proxy card.

•Vote by Internet - You can also choose to vote by visiting www.proxyvote.com. Internet voting is available 24 hours a day, seven days a week, until 11:59 P.M., Eastern Time, on May 17, 2023. You will be given the opportunity to confirm that your instructions have been properly recorded. If you vote on the Internet, you do NOT need to return your proxy card.

•Vote by Mail - If you choose to vote by mail, simply mark your proxy card, date and sign it and return it in the postage-paid envelope provided.

•Vote in Person - You can vote your shares at the Annual Meeting by attending the Annual Meeting and voting in person.

All properly executed proxy cards delivered pursuant to this solicitation and not revoked will be voted at the Annual Meeting in accordance with the directions given. In voting by proxy with regard to the election of directors, you may vote in favor of all nominees, withhold your votes as to all nominees or withhold your votes as to specific nominees. You should specify your choices on the proxy card. If no specific instructions are given with regard to the matters to be voted upon, the shares represented by a signed proxy card will be voted “FOR” the proposals listed on the proxy card. If any other matters properly come before the Annual Meeting, the persons named as proxies will vote upon such matters according to their judgment.

All proxy cards delivered pursuant to this solicitation are revocable at any time before the Annual Meeting by giving written notice to our Secretary, Edward L. Bagwell, at 115 South Grant Street, Fitzgerald, Georgia 31750, by delivering a later dated proxy card, by voting in person at the Annual Meeting, or by voting again by telephone or on the Internet prior to 11:59 P.M., Eastern Time, on May 17, 2023.

All expenses incurred in connection with the solicitation of proxies will be paid by the Company. Solicitation may take place by mail, telephone, telegram, or personal contact by our directors, officers, and employees of the Company without additional compensation. The Annual Report of the Company for the year 2022, which includes the Audited Consolidated Financial Statements and accompanying Notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations, accompanies this proxy statement.

Beneficial Holders: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, commonly referred to as “street name,” you should have received our proxy materials from that organization rather than from us. As a beneficial owner, you have the right to direct your broker, bank or other agent on how to vote the shares in your account. You should follow the instructions provided by your broker, bank or other agent regarding how to vote your shares. To vote in person at the Annual Meeting, you must obtain a “legal proxy” from your broker, bank or other agent and follow the instructions from your broker, bank or other agent.

If your shares are held by your broker, bank or other agent as your nominee, you are considered the “beneficial holder” of the shares held for you in what is known as “street name.” You are not the “record holder” of such shares. If this is the case, you will need to obtain a proxy card from the organization that holds your shares and follow the instructions included on that form regarding how to instruct your broker, bank or other agent to vote your shares. Brokers, banks or other agents that have not received voting instructions from their customers cannot vote on their customers’ behalf with respect to proposals that are not “routine” but may vote their customers’ shares with respect to proposals that are “routine.” Shares that brokers, banks and other agents are not authorized to vote are referred to as “broker non-votes.” The ratification of the Company’s independent registered public accounting firm is a routine proposal, while the election of directors, and the advisory vote on executive compensation are not “routine” proposals. Therefore, if you are a beneficial holder and if you submit a voting instruction form to your bank, broker or other nominee but do not specify how to vote your shares, your shares will be voted in the bank, broker or other nominee’s discretion with respect to the ratification of the Company’s independent registered public accounting firm but such shares will not be voted with respect to the election of directors, and the advisory vote on executive compensation.

If your shares are held by your broker, bank or other agent as your nominee, you must follow the instructions provided by your broker, bank or other agent as your nominee if you wish to change or revoke your vote.

Voting Results

The Company will publish the voting results in a Current Report on Form 8-K, which will be filed with the Securities and Exchange Commission (“SEC”) within four business days following the Annual Meeting.

Attending the Annual Meeting

If you attend the Annual Meeting and desire to vote your shares at the meeting, you must bring photo identification. If you hold your shares through a bank, broker or other agent, you must also bring proof of your ownership of your shares, such as the voting instruction form or an account statement from your broker, bank or other agent. Without proof of ownership, you may not be allowed to vote at the meeting. The use of cameras, sound recording equipment, communications devices or any similar equipment during the Annual Meeting is prohibited without express written consent of the Company.

Proxy Solicitation

The Board of Directors is asking for your proxy, and we will pay all of the costs of soliciting shareholder proxies. In addition to the solicitation of proxies via mail, our officers, directors and employees may solicit proxies personally or by other means of communication, without being paid additional compensation for such services. The Company will reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding the proxy materials to beneficial owners of common stock.

Additional Questions

Shareholders who have questions about the matters to be voted on at the Annual Meeting or how to submit a proxy, or who desire additional copies of the Proxy should contact Edward L. Bagwell at Colony Bankcorp, Inc., 115 South Grant Street, Fitzgerald, Georgia 31750 or by phone at (229) 426-6000 or by email to lbagwell@colonybank.com.

BUSINESS OF THE COMPANY

The Company is a Georgia business corporation that began operating as Colony Bank in 1975. The Company was organized for the purpose of operating as a bank-holding company in 1982 under the Federal Bank Holding Company Act of 1956, as amended, and the bank holding company laws of Georgia. From 1984 through 2008, the Company engaged in a series of mergers and acquisitions that resulted in the Company’s ownership of seven banking subsidiaries and one non-bank subsidiary. In 2008, the Company affected a merger (the “Merger”) of its subsidiary banks into one surviving bank, Colony Bank of Fitzgerald, which it renamed Colony Bank (the “Bank”).

The Company conducts a general full service commercial, consumer and mortgage borrowing business through 36 locations throughout Georgia and is now serving Alabama. The Bank also helps its customers achieve their goal of home ownership through Colony Bank Mortgage. In 2021, through a fully owned subsidiary of the Bank, CBAN Customer Synergy, LLC, the Company began offering insurance to its customers. Because the Company is a bank holding company, its principal operations are conducted through its wholly-owned subsidiary bank, Colony Bank. The Company has 100 percent ownership of the Bank and maintains systems of financial, operational and administrative controls that permit centralized evaluation of the operations of the Bank in selected functional areas including operations, accounting, marketing, investment management, purchasing, human resources, computer services, auditing, compliance and credit review.

Responsibility for management of the Bank remains with the Bank’s Board of Directors and officers. Services rendered by the Company are intended to assist bank management and to expand the scope of available banking services.

Colony Bankcorp, Inc.’s common stock is quoted on the NASDAQ Global Market under the symbol “CBAN.”

Employees

As of December 31, 2022 the Company and its subsidiaries employed 522 employees, 499 of which are full-time employees.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board of Directors consists of ten members, eight of whom are non-employee directors. The Company’s Amended and Restated Bylaws provide that the Board of Directors shall consist of not less than three nor more than 25 persons, with the exact number to be fixed and determined from time to time by resolution of the Board of Directors, or by resolution of the shareholders at any annual or special meeting of shareholders. Our Board of Directors also serves as the Board of Directors of the Bank.

The Board of Directors has voted that the Board consist of ten members for the Company’s 2023 fiscal year.

The Nominating Committee, consisting of independent directors Edward P. Loomis, Jr., Meagan M. Mowry, Matthew D. Reed and Harold Wyatt, III, recommended to the full Board a slate of directors for consideration in the shareholders proxy for the Annual Meeting. The Board of Directors, based on the Nominating Committee recommendations, has nominated the following persons for submission to the shareholders for election for a one-year term expiring at the 2024 annual meeting:

Scott L. Downing Meagan M. Mowry

T. Heath Fountain Matthew D. Reed

Audrey D. Hollingsworth Jonathan W.R. Ross

Edward P. Loomis, Jr. Brian D. Schmitt

Mark H. Massee Harold W. Wyatt, III

Each of the nominees is currently a director.

The Board of Directors unanimously recommends that you vote “FOR” each of the ten nominees named above to the Board of Directors.

Each of the nominees has consented to serve if elected. If any nominee should be unavailable to serve for any reason, the Board may designate a substitute nominee (in which event the persons named as proxies will vote the shares represented by all valid proxy cards for the election of such substitute nominee), allow the vacancy to remain open until a suitable candidate is located, or reduce the number of directors.

Set forth below is information as of March 24, 2023 about each of the director nominees, including his or her name, age, experience and qualifications, each of the positions and offices he or she holds with the Company, his or her term of office as a director, and all periods during which he or she has served as a director of the Company. Each director's beneficial ownership of Company common stock is set forth in the table under the section "Stock Ownership" in this proxy statement.

As currently comprised, the Board of Directors is a diverse group of individuals who are drawn from various market sectors and industry groups with a presence in the Bank's markets. Board members are individuals with knowledge and experience who serve and represent the Company's geographic footprint throughout the counties and communities served. Current board representation by outside directors demonstrates a background in banking, local government, construction and small business ownership, with the expertise of these individuals covering a broad array of skills including corporate management, human resource management, strategic planning, business acquisitions, and small business operations. In addition, generational attributes further broaden the diversity of the full board.

Directors and Nominees

Scott L. Downing. Mr. Downing, age 52, is the President of SDI Investments and President of Lowell Packing Company. He has served as President of SDI Investments since 2005 and as an officer of Lowell Packaging Company since 1997. Mr. Downing presently is involved with managing family investments. He is very active in community affairs and currently serves as Chairman of the Dorminy Medical Center Foundation. Mr. Downing has also served as Ben Hill County Commissioner and Chairman of the ACCG policy committee for Economic Development and Transportation. He previously served as a Director of the Colony Bank Fitzgerald charter until the Merger in 2008 and has served as a community board member of the Colony Bank Fitzgerald office since 2008. Mr. Downing graduated from Georgia Southern University with a BBA in Management. Mr. Downing has been a Director of the Company since January 2012.

The Board of Directors believes that Mr. Downing’s broad business background dealing with regulatory issues and bank board experience will provide invaluable expertise in oversight and setting policy for the Company and will make him an excellent candidate for Director of the Company.

T. Heath Fountain. Mr. Fountain, age 47, has served as Chief Executive Officer of the Company since July 2018 and Acting Chief Financial Officer since January 2023. In these roles, he is responsible for providing strategic

leadership by working with the Board of Directors and the senior management team to establish long-term goals, growth strategies, and processes and procedures for the Company and the Bank. Mr. Fountain’s primary objective is

to ensure the Bank’s affairs are carried out competently, ethically, in accordance with the law, and in the best interest of employees, customers, and shareholders. Mr. Fountain also served as President of the Company from July 2018 until September 2022. Mr. Fountain is an experienced executive officer and has numerous years of experience in the banking industry and brings significant public-company experience and market-area knowledge to the position. From 2015 to 2018, Mr. Fountain served as the President and Chief Executive Officer of Planters First Bank in Hawkinsville, Georgia. Prior to his tenure at Planters First Bank, he served as Executive Vice President and Chief Financial Officer of Albany-based Heritage Financial Group from 2007 until its acquisition by Renasant Bank in 2015. Mr. Fountain graduated from University of Georgia with a BBA in Accounting. Mr. Fountain has been a Director of the Company since July 2018.

The Board of Directors believes that Mr. Fountain’s background in executive leadership roles and his experience in the banking industry will make him an excellent candidate for Director of the Company.

Audrey D. Hollingsworth. Ms.. Hollingsworth, age 60, is Vice President of People Services for Goodwill Industries of the Southern Rivers, a position she has held since 2018. In her current position she is continuing her career in human resources management Before joining Goodwill Industries of the Southern Rivers, Ms. Hollingsworth was President of the Hollingsworth Group, a human resources and information technology consulting company. For 26 years prior to joining Hollingsworth Group, she served in positions of increasing responsibility at Synovus Financial Corporation, eventually ascending to the position of Group Executive and Chief People Officer. Ms. Hollingsworth serves on the Board of Directors for the Development Authority Foundation Board, the University of Georgia’s J.W. Fanning Institute for Leadership Development Advisory Board, the Mayor’s Advisory Committee for Public Safety and Law Enforcement, and the Greater Columbus Georgia Chamber of Commerce, of

which she is Past Chairman. In addition, she is an alumna, Past President, and Chairman of Leadership Georgia and is currently a member of the Society for Human Resources and Delta Sigma Theta Sorority, Inc. Ms. Hollingsworth is a recipient of the Girl Scouts of Historic Georgia’s Women of Achievement Award. She holds a Bachelor of Science in Business Education from the University of Georgia and a Master of Science in Management from Troy State University. Ms. Hollingsworth has been a Director of the Company since December 2022

The Board of Directors believes that Ms. Hollingsworth’s experience in Human Resource roles and her experience in the banking industry will make her an excellent candidate for Director of the Company.

Edward P. Loomis, Jr. Mr. Loomis, age 69, served as President and Chief Executive Officer of the Company from May 2012 until he retired from the position in July 2018. During his time with the Company he steered the the Company out of the recession, adding new efficiencies and expanding it into new markets. Mr. Loomis is an experienced executive officer beginning his career in 1975 at Trust Company Bank in Atlanta, Georgia, where he served as Vice President and Commercial Leander. Mr. Loomis served as President and Chief Executive Officer of Atlantic Southern Bank from 2009 to 2011 and First Macon Bank & Trust from 1987 to 1998, both based in Macon, Georgia. In addition, he served as interim President and Chief Executive Officer of Rivoli Bank and Trust in Macon from August to December 2005. Mr. Loomis graduated from University of Mississippi with a BBA in Banking and Finance. Mr. Loomis has been a Director of the Company since May 2012.

The Board of Directors believes that Mr. Loomis’ background in executive leadership roles and his experience in the banking industry will make him an excellent candidate for Director of the Company.

Mark H. Massee. Mr. Massee, age 69, is a self-employed building construction consultant. He is the retired President of Massee Builders, Inc. with which he was affiliated for 42 years. Mr. Massee is Owner/Manager of MHM Properties and is Owner/President of Dorminy-Massee House Inc., a bed and breakfast inn. Currently Mr. Massee works as a consultant on construction projects throughout the State. Mr. Massee is the former mayor of the City of Fitzgerald, Georgia. He has served as Director of Colony Bank since 1996. Mr. Massee graduated from Georgia Institute of Technology with a BS in Industrial Management. Mr. Massee has been a Director of the Company since February 2007 and served as Vice Chairman of the Board from June 2013 until June 2016. Mr. Massee has served as Chairman of the Board since June 2016.

The Board of Directors believes that Mr. Massee’s experience in commercial real estate and management will make him an excellent candidate for Director of the Company.

Meagan M. Mowry. Ms. Mowry, age 46, is the co-founder and co-owner of Simcoe Investments, founded in September, 2008, and its development and construction subsidiaries, Homes of Integrity Construction and Integrity Real Estate. Ms. Mowry has served as Manager and Marketing Director of Integrity Real Estate, LLC since January 2016 and as Vice President of Homes of Integrity from 2004 to 2016. Ms. Mowry entered the real estate industry in 2004 and has been a licensed real estate agent since 2014 through the Savannah Board of Realtors. Ms. Mowry currently serves as a board member for the Sales and Marketing Council of the Savannah Home Builders Association. Ms. Mowry has been a Director of the Company since March 2019.

The Board of Directors believes that Ms. Mowry’s knowledge of real estate lending and finance and her understanding of the real estate industry will make her an excellent candidate for Director of the Company.

Matthew D. Reed. Mr. Reed, age 35, is the owner and Chief Executive Officer of Georgia CEO, a network of local websites focused on the business communities across Georgia and South Carolina. Mr. Reed has been the owner of the company since 2010 and Chief Executive Officer of the company since 2012. Mr. Reed also serves on the Board of Governors for the Georgia Chamber of Commerce and sits on the UGA Small Business Development Center’s State Advisory Board. He has served as a community board member of the Colony Bank Albany office since December 2018. Mr. Reed graduated from Valdosta State University with a BBA in Management. Mr. Reed has been a Director of the Company since March 2019.

The Board of Directors believes that Mr. Reed’s record of business and civic achievement will be invaluable to our mission as a community bank. Also, the expertise and insight he provides to the Greater Georgia business community will add a unique perspective to our Board’s governance and will make him an excellent candidate for Director of the Company.

Jonathan W.R. Ross. Mr. Ross, age 59, is President of Ross Construction Company, a heavy highway commercial construction company that Mr. Ross has operated as President for the past 20 years. Mr. Ross previously served as a Director of the Colony Bank Worth charter until the Merger in 2008 and has served as a community board member of the Colony Bank Sylvester office since 2008. Mr. Ross has been a Director of the Company since May 2007.

The Board of Directors believes that Mr. Ross’ business and management experience will make him an excellent candidate for Director of the Company.

Brian D. Schmitt. Mr. Schmitt, age 61, has served as Executive Vice Chairman of the Board and a Director of the Company since August 2021. From July 2016 to August 2021, Mr. Schmitt served as President and Chief Executive Officer of SouthCrest Financial Group, Inc. and SouthCrest Bank until its merger with the Company in August 2021. In his past Mr. Schmitt has a history of start-up, growth, consolidation and sale of financial institutions. Prior to his time at SouthCrest, Mr. Schmitt has held many other executive leadership positions with other banks, including The PrivateBank, Premier Bank and Heritage Financial Group. Mr. Schmitt graduated from Troy University with a BA in Finance. He has been in banking since 1983.

The Board of Directors believes that Mr. Schmitt's experience in bank executive management will make him an excellent candidate for Director of the Company.

Harold W. Wyatt, III. Mr. Wyatt, age 54, has been involved in the commercial real estate industry since 1994 and is currently the principal owner of Wyatt Capital, LLC and Wyatt Realty Company, LLC. Both companies were founded in 2007 by Mr. Wyatt and are principally in the business of developing, acquiring, improving, and selling investment commercial real estate assets along with providing third party general brokerage services to clients. Mr. Wyatt has previously served on the Board of Directors for Darlington School in Rome, Georgia, Trinity School in Atlanta, Georgia, and Peachtree Golf Club in Atlanta, Georgia. Mr. Wyatt was elected to the SouthCrest board in 2010 and served as Chairman of the Board of Directors of SouthCrest Financial Group, Inc. beginning in 2018 until its merger with Colony in August 2021. Mr. Wyatt graduated from University of Georgia with a BBA in Finance. He has served as a Director of the Company since August 2021.

The Board of Directors believes that Mr. Wyatt's business and management experience will make him an excellent candidate for Director of the Company.

No director named herein has a family relationship, as defined in Item 401 of Regulation S-K, with any of the other directors or executive officers. No director named herein is being proposed for election pursuant to any agreement or understanding between such director and the Company. Each director serves until the Annual Meeting following his election or until such later time as his successor is elected and qualifies or there is a decrease in the number of directors.

Retiring Director

The following director is retiring from the Board of Directors after the Annual Meeting.

M. Frederick Dwozan, Jr. Mr. Dwozan, age 74 is the Owner, Chairman and President of Hospice Care Options, I.V. Care Options, D & B Homecare, and Prescription Shop. Mr. Dwozan has operated these entities ranging from 23 to 42 years. These entities employ over 180 employees and provide care to critically ill patients with home IV therapy, nutritional support, pain and disease management, hospice care, and medical equipment in 104 Georgia counties. He previously served as a Director of Colony Bank Dodge until the Merger in 2008 and has served as a community board member of the Colony Bank Eastman office since 2008. Mr. Dwozan graduated from University of Georgia with a BS in Pharmacy. Mr. Dwozan has been a Director of the Company since January 2012

and has served as Vice Chairman since June 2017. With his broad business and bank board experience, Mr. Dwozan

was an invaluable asset to the Company and the Bank during his tenure.

Executive Officers

T. Heath Fountain, Edward Lee Bagwell, III, Leonard Bateman, Jr., Roy Dallis Copeland, Jr., Kimberly C. Dockery, and Brian D. Schmitt are executive officers of the Company. The following are certain biographical information for our executive officers. For Mr. Fountain and Mr. Schmitt, who also serve as directors of the Company, please see “Directors and Nominees” for their biographical information.

Edward L. Bagwell, III. Mr. Bagwell, age 55, has served as Executive Vice President, Chief Risk Officer and General Counsel of the Company since May 2019, and Corporate Secretary of the Company since December 2019, and previously served as Executive Vice President and Chief Credit Officer of the Company from August 2017 until May 2019. In his current role with the Company, Mr. Bagwell is responsible for identifying, assessing, measuring, monitoring, mitigating and managing all types of risk arising from the internal and external business environment at a bank-wide level as well as supervising all legal matters involving the bank, reviews all legal matters involving the bank, and reviews all legal bills submitted to the Company for propriety and reasonableness of charges payment. Mr. Bagwell served as Senior Vice President and Chief Credit Officer from October 2016 to August 2017. Mr. Bagwell joined the Company in June 2003 as a commercial lender and in-house legal counsel

with Colony Bank Southeast. Beginning in 2008 he served as the Company’s in-house legal counsel and was in charge of the Bank’s special assets. Prior to that time, Mr. Bagwell was in private practice of law in Douglas, Georgia.

Leonard Bateman, Jr. Mr. Bateman, age 50, has served as Executive Vice President and Chief Credit Officer of the Company since May 2020, and previously served as Senior Credit Officer of the Company between May 2019 and May 2020. In his current role with the Company, Mr. Bateman is responsible for galvanizing and managing all aspects of the credit risk management function including design, execution and communication of policy, approval process, administration, and portfolio analysis. Mr. Bateman served as Director, President and CEO of Calumet Bank in LaGrange, Georgia from August 2012 to May 2019, when it was acquired by the Company. While at Calumet during the great recession, Calumet performed in the top quartile in multiple credit metrics. Mr. Bateman served as Chief Lending Officer at Calumet until he was appointed President and CEO, previously he served as Regional Credit Officer of Flag Bank. He has approximately 25 years of banking experience.

Roy Dallis Copeland, Jr. Mr. Copeland, age 54, has served as President of the Company and the Bank since September 2022, and previously served as Special Advisor of the Company and the Bank from July of 2021 to September 2022. Mr. Copeland also served as Executive Vice President and Chief Community Banking Officer at Synovus Financial Corporation from 2015 until 2019, where he was responsible for all banking services including corporate, commercial real estate, retail, private wealth, treasury management, credit card, marketing and special assets. During his tenure at Synovus, he was a member of the Executive Committee and reported directly to the Chairman and CEO from 2009 until his retirement in 2019. Mr. Copeland currently serves on the Board of the Development Authority of Columbus. He previously served on the executive committee for the University System of Georgia Foundation and has served as a member of various boards, including the Greater Columbus Chamber of Commerce and the Georgia Bankers Association.

Kimberly C. Dockery. Ms. Dockery, age 40, has served as Executive Vice President and Chief of Staff since September 2022, prior to that she served as Executive Vice President and Chief Administrative Officer of the Company from July 2018. In her current role with the Company, Ms. Dockery is responsible for the day to day oversight of Information Technology and Human Resources as well as for the Innovative and Strategic objectives of the company. Prior to her joining the Company, she served as Chief Administrative Officer at Planters First Bank from 2015 to 2018. Prior to joining Planters First Bank, Ms. Dockery served as Management Reporting and Banking Officer at Albany-based Heritage Financial Group from 2007 to 2015.

Executive officers do not hold office for a fixed term but may be removed by the Board of Directors with or without cause. There are no arrangements or understandings between any of the executive officer and any other person pursuant to which he or she was selected as an executive officer. No executive officer named herein has a family relationship, as defined in Item 401 of Regulation S-K, with any of the directors or other executive officers.

Governance of the Company

Overview

Our Board of Directors believes that the purpose of corporate governance is to ensure that shareholder value is maximized in a manner consistent with legal requirements and the highest standards of integrity. The Company, through its Board of Directors and management, has long sought to meet the highest standards of corporate governance. The Board has adopted and adheres to corporate governance guidelines which the Board and senior management believe promotes this purpose, are sound and represent best practices. We continually review these governance practices, Georgia law (the law of the state in which we are incorporated), the rules and listing standards of the NASDAQ Stock Market, and SEC regulations, as well as best practices suggested by recognized governance authorities.

Director Independence

The Board has evaluated the independence of its directors in accordance with the NASDAQ rules and

applicable rules and regulations of the SEC. Our corporate governance guidelines and principles and the NASDAQ

rules require that a majority of the Board be composed of directors who meet the requirements for independence

established by these standards. Currently, our Board of Directors has eleven members, all of whom meet the

NASDAQ standard for independence with the exception of Messrs. Fountain, and Schmitt. The rules of the NASDAQ Stock Market, as well as those of the SEC, also impose several other requirements with respect to the

independence of our directors Following the Annual Meeting, the Board of Directors will consist of ten members,

of which eight members will meet the NASDAQ standard for independence. The Board of Directors has determined

that Messrs. Fountain and Schmitt each do not qualify as an independent director because they are current or past

executive officers of the Company and/or the Bank. The Board has further determined that each director who serves

on the Audit Committee, Governance Committee, Compensation Committee and Nominating Committee satisfies

the independence requirements for such committees in accordance with the NASDAQ rules and applicable rules and

regulations of the SEC

Director Qualifications

We believe that our directors should have the highest professional and personal ethics and values,

consistent with our longstanding values and standards. They should have broad experience at the policy-making

level in business, government or civic organizations. They should be committed to enhancing shareholder value and

should have sufficient time to carry out their duties and to provide insight and practical wisdom based on their own

unique experience. Each director must represent the interests of all shareholders. When considering potential

director candidates, our Board of Directors also considers the candidate’s independence, character, judgment,

diversity, age, skills, financial literacy, and experience in the context of the Company’s needs and those of our Board

of Directors. Our Board of Directors’ priority in selecting board members is the identification of individuals who

will further the interests of our shareholders through their record of professional and personal experiences and

expertise relevant to our growth strategy.

Leadership Structure of the Board

The Company is committed to strong Board leadership. Our governance framework provides the Board

with flexibility to select the appropriate leadership structure for the Company. In making leadership structure

determinations, the Board considers many factors, including the specific needs of the business and what is in the

best interests of the Company’ shareholders. In accordance with the Company’s Amended and Restated Bylaws, the

Board of Directors elects our Chief Executive Officer and our Chairman; each of these positions may be held by the

same person or may be held by two persons. Currently, Mark H. Massee serves as Chairman of both the Company

and the Bank and T. Heath Fountain serves as Chief Executive Officer of both the Company and the Bank. In this

capacity as Chairman, Mr. Massee has frequent contact with Mr. Fountain and other members of management on a

broad range of matters and has additional corporate governance responsibilities for the Board. The Board of

Directors believes that separating the Chairman and Chief Executive Officer roles fosters clear accountability,

effective decision-making, and alignment with corporate strategy and provides an effective leadership model for the

Company. In light of the active involvement by all independent directors, the Board of Directors has not specified a

lead independent director at this time. The Board of Directors believes that its current structure is appropriate to

effectively manage the affairs of the Company and the best interests of the Company’s shareholders.

From time to time, the board leadership structure will be re-evaluated to ensure that it continues to be the

most effective approach in serving the Company’s goals. [In addition, to further strengthen the oversight of the full

board of directors, our independent directors hold executive sessions at which only independent directors are

present. The executive sessions are scheduled in connection with regularly scheduled board meetings, which occurs

at least four times a year.

Board’s Role in Risk Oversight

The Board of Directors is actively involved in oversight of risks that could affect the Company and the Bank. The Board of Directors has ultimate authority and responsibility for overseeing our risk management. The Board of Directors monitors, reviews and reacts to material enterprise risks identified by management. The Board receives specific reports from management on financial, credit, liquidity, interest rate, capital, operational, legal compliance and reputation risks and the degree of exposure to those risks. The Board helps ensure that management is properly focused on risk by, among other things, reviewing and discussing the performance of senior management and business line leaders. This oversight is conducted primarily through committees of the Board, as disclosed in the descriptions of each of the committees below. However, the full Board has retained responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company and the Bank.

Cybersecurity and Information Security Risk Oversight

Our Board recognizes the importance of maintaining the trust and confidence of our customers, clients, and employees, and devotes significant time and attention to oversight of cybersecurity and information security risk. In particular, our Board and Risk Management Committee receive regular reporting on cybersecurity and information security risk, as well as presentations throughout the year on cybersecurity and information security topics. Our Risk Management Committee also annually reviews and approves our Information Security Policy. Our Risk Management Committee reviews cybersecurity and information security as well as steps taken by management to understand and mitigate such risks. Our Board received quarterly updates on cybersecurity and information security

risk in 2022 and discussed cyber security and information security risks with both the Information Security Officer and Chief Risk Officer.

Board Diversity

The Company highly values diversity on its Board of Directors. We aim to ensure that the composition of

the Board reflects diversity of race, gender, age, geography, education, and work experience. We believe that a

diverse board translates to more effective strategic planning, critical decision making, and creative problem solving,

all resulting in a better return for our shareholders. We are actively working to increase the diversity of our Board,

including the number of women and ethnic minorities on the Board. The following matrix depicts the diversity of

the Board as of March 24, 2023.

Board Diversity Matrix

| | | | | | | | |

| Female | Male |

| Total Number of Directors | |

| Part I: Gender Identity |

| Directors | 2 | 9 |

| Part II: Demographic Background |

| White | 1 | 9 |

| African-American | 1 | 0 |

Environmental, Social and Governance Initiatives ("ESG")

Our Board of Directors is committed to overseeing our ESG initiatives. We consider ESG-related matters throughout the organization with a focus on transparency and continuous improvement. Our ESG initiatives are currently focused on supporting the communities we serve in the areas of affordable housing, community development and financial education; promoting diversity, equity and inclusion within the Company; and corporate governance best practices.

•Environmental

◦Increasing customer usage of electronic statements, online/mobile banking and electronic billpay.

◦Reducing energy consumption by converting to LED lights - Company goal is to have all offices converted by December 2024.

◦Utilizing digital processes such as e-signature and digital board packages as well as more remote work and virtual meeting to conserve fossil fuels.

◦The company uses vendors to dispose of our waste byproducts (shred, end of life IT equipment, etc.) that use safe and environmentally friendly processes.

◦Banking renewable industries such as farming and timber.

•Social

◦Developing youth leaders through Colony Leadership Academy - 55 students have graduated from the first two classes in 2021 and 2022. The Class of 2023 is underway with over 40 High School Juniors selected from High Schools within our footprint. This professional leadership curriculum is achieved through an eleven-month program of structured activity where participants are encouraged to recognize their own potential and develop their leadership skills. The goal of this program is to develop a committed group of young leaders who will be challenged to apply their new leadership skills through interactions with community leaders, decision makers, and peers from other schools. There are 4 sessions per class for these students to participate in that take them to different markets across the state where they are introduced to a range of industries. At each session they will tour different organizations and get hands-on experience in areas like Health and Recreation, Economic Development, Arts and Culture, Public Safety, Social Services, Education, Government Affairs, and more. During these visits, the Colony Leadership Academy presents each organization with a $1,000 donation to the non-profit of their choice. Colony Leadership Academy also utilizes professional leadership trainers through the University of Georgia’s J.W Fanning Institute for Leadership Development where they learn crucial skills and lessons about being an exceptional leader. Upon completion of the program, participants receive up to a $1,000 scholarship to the College/University of their choice.

◦Providing financial literacy education to over 5,000 high school students - Provided the Dave Ramsey Foundations coursework to 21 high schools throughout our footprint. Over 5,000 students now have access to financial literacy in their classrooms.

◦Through contribution to the local rural hospitals in our markets by contributing $500,000 in 2022 to the Georgia HEART hospital program.

◦Financial and volunteer support for charitable and community organizations - over 4,500 of our employees and directors hours are volunteered annually.

◦Support in organizing of Colony Museums, LLC, a 501(c)(3) Charity that will display one of the largest collections of African art and artifacts in private hands.

◦As of December 31, 2022, 69% of our employees were women and 19.5% of our employees were people of color. On an executive level, at December 31, 2022, 17% of our executive leadership team were women and none of our executive leadership team were people of color. We continue to work on improving representation of women and people of color in senior leadership roles.

•Governance

◦All members of the Board of Directors are elected to one year terms.

◦Insider ownership of 7.18% aligns leadership with shareholders.

◦Added two females to the board and one females to executive management since 2018.

◦Proactively looking for opportunities to add diversity to the board, management and staff.

Code of Conduct and Code of Ethics

Our Board of Directors has adopted a Code of Conduct that applies to all of our directors, officers and employees. The code provides fundamental ethical principles to which these individuals are expected to adhere to and operates as a tool to help our directors, officers and employees understand the high ethical standards required for employment by, or association with, our Company. In addition, our Board of Directors has also adopted a Code of Ethics that applies to our directors and senior financial officers to prescribe and enforce the policies and procedures employed by our financial operations. Our Code of Conduct and Code of Ethics are both available on our website at www.colony.bank under “About Us > Investor Relations > Corporate Information > Governance Documents.” We expect that any amendments to the codes, or any waivers of its requirements, will be disclosed on our website, as well as any other means required by NASDAQ Stock Market rules.

Committees of the Board of Directors

The Company has standing Audit Committee, Governance Committee, Compensation Committee and Nominating Committee of the Board of Directors. Each committee operates under a written charter adopted by the Board of Directors, which are reviewed annually. You may review each of these charters under the Company’s website at www.colony.bank under “About Us > Investor Relations > Corporate Information > Governance Documents.”

Meeting Attendance

Our Board of Directors conducts regular meetings and also conducts some of its business through the committees described below. The Board met 11 times during 2022, and each director attended at least 75 percent of the meetings of the full Board and of the committee or committees on which he or she serves. The Company does not have a formal policy regarding director attendance at the Company’s Annual Meeting, but all directors are encouraged to attend. All incumbent directors who were serving as directors in 2022 were in attendance at the 2022 Annual Meeting.

Audit Committee

The Audit Committee is appointed by the Chairman of the Board of Directors of the Company, subject to election by the full Board. The purpose of the Audit Committee is to assist the Board in fulfilling its oversight responsibilities for the Company’s accounting and financial reporting processes and audits of the financial statements of the Company by monitoring the integrity of the Company’s financial statements, the independence and qualifications of its external auditor, the Company’s system of internal controls, the performance of the Company’s internal audit process and external auditor and the Company’s compliance with laws, regulations and the Code of Ethics and the Code of Conduct. Mr. Massee is the Chairman of the Audit Committee. Mr. Loomis, Mr. Massee, Ms. Mowry, Mr. Ross, and Mr. Wyatt were members of the Audit Committee during the year 2022. None of these

members have participated in the preparation of the financial statements of the Company. As of December 31, 2022, the members of the Audit Committee met the independence requirements of the rules of NASDAQ. The Audit Committee met 8 times during the year 2022.

Compensation Committee

The Compensation Committee is appointed by the Chairman of the Board of Directors of the Company, subject to approval by the full Board. The purpose of the Compensation Committee is to ensure that the Chief Executive Officer, other executive officers and key management of the Company are compensated effectively in a manner consistent with the compensation strategy of the Company, internal equity considerations, competitive practice, and any requirements of appropriate regulatory bodies; to establish guidelines and oversee the administration of executive compensation plans and arrangements as well as certain employee benefit plans; and to recommend any changes to the Directors’ compensation packages. The Chief Executive Officer makes recommendations to the Compensation Committee on executive compensation except for his own compensation. The Compensation Committee does not delegate its authority to other persons or groups. Mr. Massee is the Chairman of the Compensation Committee. Mr. Downing, Mr. Dwozan, Ms. Hollingsworth, Mr. Massee, and Mr. Ross were members of the Compensation Committee during the year 2022. As of December 31, 2022, the members of the Compensation Committee met the independence requirements of the rules of NASDAQ. The Compensation Committee met 10 times during the year.

Governance Committee

The Governance Committee is appointed by the Chairman of the Board of Directors of the Company, subject to election by the full Board. The purpose of the Governance Committee is to take a leadership role in shaping the corporate governance of the Company, to develop and recommend to the Board a set of corporate governance guidelines and to address committee structure and operations. Mr. Loomis is the Chairman of the Governance Committee. Mr. Reed, Mr. Loomis, Ms. Mowry, and Mr. Wyatt were members of the Governance Committee during the year 2022. As of December 31, 2022, the members of the Governance Committee met the independence requirements of the rules of NASDAQ. The Governance Committee 4 times during 2022.

Nominating Committee

The Nominating Committee is appointed by the Chairman of the Board of Directors of the Company, subject to election by the full Board. The purpose of the Nominating Committee is to make recommendations to the Board on qualifications and selection criteria for Board members, to review the qualifications of potential candidates for the Board and to make recommendations to the Board on nominees to be elected at the Annual Meeting of Shareholders. Mr. Loomis is the Chairman of the Nominating Committee. Mr. Reed, Mr. Loomis, Ms. Mowry, and Mr. Wyatt were members of the Nominating Committee during the year 2022. Each of the members of the Committee was deemed independent as defined in the listing standards of NASDAQ. The Nominating Committee does not currently have a formal policy or process for identifying and evaluating nominees. However, in addition to meeting the qualification requirements set forth by the Georgia Department of Banking and Finance, a possible director-candidate must also meet the following criteria to be considered by the Nominating Committee: independence; exceptional personal and professional ethics and integrity; willingness to devote sufficient time to fulfilling duties as a Director; impact on the diversity of the Board’s overall experience in business, government, education, technology and other areas relevant to the Company’s business; impact on the diversity of the Board’s composition in terms of age, skills, ethnicity and other factors relevant to the Company’s business; and number of other public company boards on which the candidate may serve (generally, should not be more than three public company boards in addition to the Company). In considering candidates for the Board of Directors, the Nominating Committee considers the entirety of each candidate's credentials in the context of these standards. The Nominating Committee operates under the Nominating and Governance Committee Charter. The Charter is available on the Company’s website at www.colony.bank under “About Us > Investor Relations > Corporate Information > Governance Documents.” The Nominating Committee met two times during 2022.

The Nominating Committee will consider candidates for nomination as a director submitted by shareholders. Although the Committee does not have a separate policy that addresses the consideration of director candidates recommended by shareholders, the Board does not believe that such a separate policy is necessary as the Company’s bylaws permit shareholders to nominate candidates. The Committee evaluates individuals recommended by shareholders for nomination as directors according to the criteria discussed above under “Director Qualifications”

and in accordance with the Company’s bylaws and the procedures described under “Shareholder Proposals” of this proxy statement.

Risk Management Committee

The Risk Management Committee was formed in October 2018 and is appointed by the Chairman of the Board of Directors of the Company, subject to election by the full Board. The purpose of the Risk Management Committee is to look at risk and rewards in maximizing shareholder value. Risks noted in banking include interest rate risk, credit risk, compliance risk, liquidity risk, pricing risk, reputational risk, strategic risk, cyber risk, transaction risk, legal risk and regulatory risk. Mr. Dwozan is the Chairman of the Risk Management Committee. All directors are members of the Risk Management Committee. The Risk Management Committee met 4 times during 2022.

Independence of Audit Committee Members

The Company’s Audit Committee is comprised of Mark H. Massee, Jonathan W.R. Ross Meagan M. Mowry, Harold W. Wyatt, III and Edward P. Loomis. Each of these members meets the requirements for independence as defined by the applicable listing standards of NASDAQ and SEC regulations applicable to listed companies. In addition, the Board of Directors has determined that Mr. Massee meets the NASDAQ and SEC “audit committee financial expert” standards and thus elected him to serve as the Audit Committee’s “audit committee financial expert.” In addition the Board of Directors has determined the financial acumen of each member of the Audit Committee to be very strong and capable of satisfactorily discharging their duties and responsibilities to the Board of Directors and the shareholders.

Audit Committee Report

The Audit Committee has the responsibilities and powers set forth in its charter, which include the responsibility to assist the Board of Directors in its oversight of our accounting and financial reporting principles and policies and internal audit controls and procedures, the integrity of our financial statements, our compliance with legal and regulatory requirements, the independent auditor’s qualifications and independence, and the performance of the independent auditor and our internal audit function. The Audit Committee is also required to prepare this report to be included in our annual proxy statement pursuant to the proxy rules of the SEC.

Management is responsible for the preparation, presentation and integrity of our financial statements and for maintaining appropriate accounting and financial reporting principles and policies and internal controls and procedures to provide for compliance with accounting standards and applicable laws and regulations. The internal auditor is responsible for testing such internal controls and procedures. Our independent registered public accounting firm is responsible for planning and carrying out a proper audit of our annual financial statements, reviews of our quarterly financial statements prior to the filing of each quarterly report on Form 10-Q, and other procedures.

The Audit Committee reports as follows with respect to the audit of the Company’s 2022 audited consolidated financial statements.

•The Audit Committee has reviewed and discussed the Company’s 2022 audited consolidated financial statements with the Company’s management;

•The Audit Committee has discussed with the independent auditors, Mauldin & Jenkins, LLC, the matters required to be discussed by the SEC and the Public Company Accounting Oversight Board, including Auditing Standard 16, Communications with Audit Committees, which include, among other items, matters related to the conduct of the audit of the Company’s consolidated financial statements;

•The Audit Committee has received written disclosures and the letter from the independent auditors required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor’s communications with the Audit Committee concerning independence and discussed with the independent auditors the independent auditors’ independence from the Company and its management; and

•Based on review and discussions of the Company’s 2022 audited consolidated financial statements with management and discussions with the independent auditors, the Audit Committee recommended to the Board of Directors that the Company’s 2022 audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 for filing with the SEC.

This report is submitted on behalf of the members of the Audit Committee and shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall it be incorporated by any general statement incorporating by reference this proxy statement into any filing under the Securities Act or the Securities Exchange Act of 1934, as amended (“Exchange Act”), except to the extent that we specifically incorporate this information by reference and shall not otherwise be deemed filed under the Securities Act and Exchange Act.

AUDIT COMMITTEE:

Mark H. Massee (Chairman)

Edward P. Loomis

Jonathan W.R. Ross

Meagan M. Mowry

Harold W. Wyatt, III

STOCK OWNERSHIP

The following table provides information regarding the beneficial ownership of our common stock as of March 24, 2023:

•each shareholder known by us to beneficially own more than 5% of our outstanding common stock;

•each of our directors;

•each of our executive officers; and

•all of our directors and executive officers as a group.

We have determined beneficial ownership in accordance with the rules of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting of securities, or to dispose or direct the disposition of securities, or has the right to acquire such powers within 60 days. For purposes of calculating each person’s percentage ownership, common stock issuable pursuant to options that are currently exercisable or will become exercisable within 60 days are included as outstanding and beneficially owned for that person or group, but are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as disclosed in the footnotes to this table and subject to applicable community property laws, we believe that each person identified in the table has sole voting and investment power over all of the shares shown opposite such person’s name.

The percentage of beneficial ownership is based on 17,593,879 shares of our common stock outstanding as of March 24, 2023. Except as indicated below, the address for each shareholder listed in the table below is: Colony Bankcorp, Inc., 115 South Grant Street, Fitzgerald, Georgia 31750.

Security Ownership of Certain Beneficial Owners

As of March 24, 2023, the Company’s records and other information from outside sources indicated the following were beneficial owners of more than 5 percent of the outstanding shares of the Company’s common stock (excluding directors and officers of the Company):

| | | | | | | | | | | | | | |

| Name and Address | | Shares Beneficially Owned | | Percent of Ownership |

| Fourthstone, LLC | | 969,338 | | | 5.49 | % |

| 13476 Clayton Rd | | | | |

| St. Louis, MO, 63131 | | | | |

| | | | |

| The Vanguard Group | | 973,295 | | | 5.52 | % |

| 100 Vanguard Blvd. | | | | |

| Malvern, PA, 19355 | | | | |

| | | | |

| Blackrock, Inc. | | 1,042,224 | | | 5.90 | % |

| 55 East 52nd St | | | | |

| New York, NY 10055 | | | | |

| | | | |

| The Banc Funds Company LLC | | 1,105,072 | | | 6.20 | % |

| 20 N. Wacker Drive, Suite 300 | | | | |

| Chicago, IL 60606 | | | | |

Directors and Executive Officers

The following table sets forth information as of March 24, 2023 regarding the beneficial ownership of the Company’s common stock by each Company director (including nominees for director) and by the executive officers of the Company and its subsidiaries, and by all directors and executive officers as a group.

| | | | | | | | | | | | | | | | | |

| | Shares Beneficially | | | Percent of |

| Name | | Owned (1)(2) | | | Class |

| Scott L. Downing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | | 221,007 | | | | 1.26 | % |

| Director | | | | | |

| | | | | |

| M. Frederick Dwozan, Jr. . . . . . . . . . . . . . . . . . . . . . . . . | | 39,137 | | | | 0.22 | % |

| Director | | | | | |

| | | | | |

| T. Heath Fountain. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | | 70,395 | | (3) | | 0.40 | % |

| Director; Executive Officer | | | | | |

| | | | | |

| Audrey D. Hollingsworth | | — | | | | — | % |

| Director | | | | | |

| | | | | |

| Edward P. Loomis, Jr. . . . . . . . . . . . . . . . . . . . . . . . . . . | | 48,900 | | | | 0.28 | % |

| Director | | | | | |

| | | | | |

| Mark H. Massee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | | 64,364 | | | | 0.37 | % |

| Director | | | | | |

| | | | | |

| Meagan M. Mowry . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | | 22,965 | | | | 0.13 | % |

| Director | | | | | |

| | | | | |

| Matthew D. Reed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | | 13,543 | | | | 0.08 | % |

| Director | | | | | |

| | | | | |

| Jonathan W.R. Ross . . . . . . . . . . . . . . . . . . . . . . . . . . . | | 485,443 | | (4) | | 2.76 | % |

| Director | | | | | |

| | | | | |

| Brian D. Schmitt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | | 76,865 | | | | 0.44 | % |

| Director, Executive Officer | | | | | |

| | | | | |

| Harold W. Wyatt, III . . . . . . . . . . . . . . . . . . . . . . . . . . . . | | 132,898 | | (5) | | 0.75 | % |

| Director | | | | | |

| | | | | |

| Edward L Bagwell, III . . . . . . . . . . . . . . . . . . . . . . . . . . . | | 25,773 | | | | 0.15 | % |

| Executive Officer | | | | | |

| | | | | |

| Leonard Bateman, Jr. . . . . . . . . . . . . . . . . . . . . . . . . . . . | | 21,583 | | | | 0.12 | % |

| Executive Officer | | | | | |

| | | | | |

| Roy Dallis Copeland, Jr | | 16,830 | | | | 0.10 | % |

| Executive Officer | | | | | |

| | | | | |

| Kimberly C. Dockery . . . . . . . . . . . . . . . . . . . . . . . . . . . | | 25,417 | | | | 0.14 | % |

| Executive Officer | | | | | |

| | | | | |

| All directors and executive officers | | | | | |

| as a group (15 persons) . . . . . . . . . . . . . . . . . . . . . . . . | | 1,265,120 | | | | 7.18 | % |

(1)Includes shares owned by spouses and minor children of officers and directors, as well as shares owned by trusts or businesses in which officers and directors have a significant interest. The information contained herein shall not be construed as an admission that any such person is, for purposes of Section 13(d) or Section 13(g) of the Securities Exchange Act of 1934, as amended, the beneficial owner of any securities not held of record by that person or entity.

(2)Beneficial ownership is determined in accordance with rules of the SEC and includes voting or investment power to the securities. Except as disclosed in the footnotes to this table and subject to applicable community property laws, we believe that each beneficial owner identified in the table possesses sole voting and investment power over all our shares of common stock shown as beneficially owned by the beneficial owner.

(3)Includes 2,200 shares held in a UTMA accounts for his children.

(4)Includes 21,079 shares held in Ross Life Insurance Trust and 84 shares held by Family Trust.

(5)Represents the holdings of Wyatt Investment Group LP, of which the reporting person is a limited partner. The reporting person disclaims beneficial ownership of registrant common stock held by Wyatt Investment Group LP except to the extent of his pecuniary interest. Pursuant to Rule 16a-1(a)(4) under the Securities Exchange Act of 1934, the inclusion of these securities in this report shall not be deemed an admission of beneficial ownership of all of the reported securities by any reporting person for purposes of Section 16 or for any other purpose.

EXECUTIVE COMPENSATION

Summary Compensation Table

The table below summarizes the total compensation paid or earned by cash of the named executive officers for the fiscal years ended December 31, 2022 and 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary | | Bonus(1) | | Stock Award(2) | | All Other Compensation | | Total |

| T. Heath Fountain | | 2022 | | $485,000 | | $109,125 | | $45,630 | | $52,818 | (3) | $692,573 |

| Chief Executive Officer | | 2021 | | 420,000 | | 147,000 | | 215,160 | | 55,223 | | 837,383 |

| | | | | | | | | | | | |

Brian D. Schmitt | | 2022 | | 335,000 | | 50,250 | | 136,560 | | 49,799 | (5) | 571,609 |

| Executive Vice Chairman | | 2021 | | 128,610 | | 385,736 | (4) | — | | 19,595 | | 533,941 |

| | | | | | | | | | | | |

| Roy Dallis Copeland, Jr | | 2022 | | 256,667 | | 36,750 | | 119,490 | | 19,051 | (6) | 431,958 |

President(7) | | | | | | | | | | | | |

(1)Discretionary cash bonus paid in current year based on Company performance in prior year.

(2)Reflects the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 of restricted stock awards granted in the applicable year based on the stock price per share on the date of grant.

(3)Includes $5,000 car allowance, $569 attributable as the aggregate incremental cost company-owned car, $389 for Company-paid life insurance premiums, $3,368 for interest paid on deferred bonus, $4,500 for social club dues, $18,000 for director fees, $1,680 for dividends on restricted stock, $4,438 for Company-paid disability insurance and $14,874 for 401(k) match.

(4)Includes bonus payment of $195,736 based on what Mr. Schmitt would have received under the SouthCrest Bank executive incentive plan, as well as $190,000 in bonus under his Integration Bonus Agreement.

(5)Includes $15,250 for Company 401(k) match, $12,000 for car allowance, $1,584 for Company-paid life insurance premiums, $18,000 for director fees, and $2,965 for Company paid disability insurance.

(6)Includes $13,067 for 401(k) match, $552 for Company-paid life insurance premiums, $1,061 for Company-paid disability insurance premiums, $4,000 for car allowance and $371 for interest paid on deferred bonus.

(7)Mr. Copeland was appointed President of the Company and the Bank effective as of September 13, 2022.

Summary of Terms of Compensation Program