UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14c of the

Securities Exchange Act of 1934

| Check the appropriate box: | |

| ☒ | Preliminary Information Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☐ | Definitive Information Statement |

FC Global Realty Incorporated

(Name of Registrant as Specified In Its Charter)

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

FC GLOBAL REATY INCORPORATED

15150 North Hayden Road, Suite 235

Scottsdale, Arizona 85260

Notice of Action Taken Pursuant to Written Consent of Stockholders

Dear Stockholder:

The accompanying Information Statement is furnished to holders of shares of Common Stock of FC Global Realty Incorporated (“our company”,” “our,” “we” or “us”) pursuant to Section 14 of the Securities Exchange Act of 1934, as amended, and Regulation 14C and Schedule 14C thereunder, in connection with an approval by written consent of the holders of our voting shares.

The purpose of this Notice and Information Statement is to notify our stockholders that, on May 15, 2019, we received written consents from stockholders to approve an amendment to our amended and restated articles of incorporation to, among other things (i) change the name of our company to “Gadsden Properties, Inc.”; (ii) increase the number of authorized shares of our Common Stock from 500,000,000 shares to 5,000,000,000 shares; and (iii) add certain provisions restricting ownership and transfer of shares to comply with requirements under the Internal Revenue Code for real estate investment trusts (the “Charter Amendment”).

Our board of directors approved the Charter Amendment and recommended that our stockholders approve it as well. In connection with the adoption of the Charter Amendment, our board of directors elected to seek the written consent of the holders of our outstanding voting shares in order to reduce associated costs and implement the Charter Amendment in a timely manner.

This Notice and the accompanying Information Statement are being furnished to you to inform you that the Charter Amendment has been approved by stockholders. The board of directors is not soliciting your proxy in connection with the Charter Amendment and proxies are not requested from stockholders.

The Charter Amendment will become effective upon filing with the Nevada Secretary of State’s Office, which will occur promptly following the 20th day after this Information Statement is first mailed to our stockholders. You are urged to read the Information Statement in its entirety for a description of the Charter Amendment.

| BY ORDER OF THE BOARD OF DIRECTORS, | |

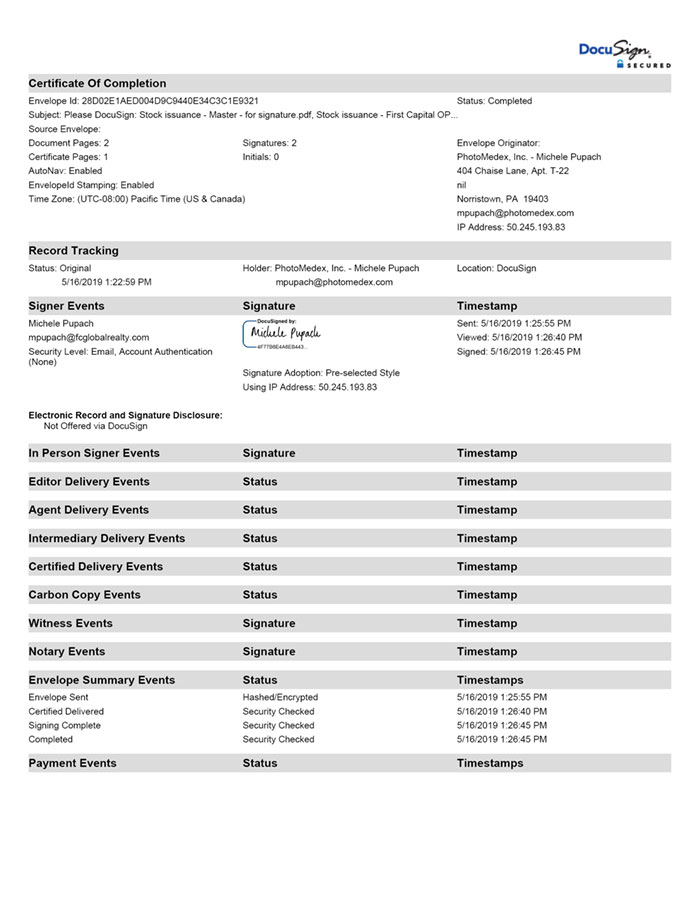

| /s/ Michele Pupach | |

| Michele Pupach | |

| Secretary |

[ ], 2019

THE ACCOMPANYING INFORMATION STATEMENT IS BEING MAILED

TO STOCKHOLDERS ON OR ABOUT [ ], 2019

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

FC GLOBAL REATY INCORPORATED

15150 North Hayden Road, Suite 235

Scottsdale, Arizona 85260

INFORMATION STATEMENT

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS

IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is first being mailed on or about [ ], 2019 to the holders of record of the outstanding Common Stock, $0.01 par value per share (the “Common Stock”), of FC Global Realty Incorporated, a Nevada corporation (“we,” “us,” “our” or “our company”), as of the close of business on May 15, 2019 (the “Record Date”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This Information Statement relates to a written consent in lieu of a meeting, dated May 15, 2019 (the “Written Consent”), of stockholders owning as of the Record Date (i) at least a majority of the outstanding shares of our Common Stock; (ii) all of the outstanding shares of our 7% Series A Cumulative Convertible Perpetual Preferred Stock, $0.01 par value per share (the “Series A Preferred Stock”), Series B Non-Voting Convertible Preferred Stock, $0.01 par value per share (the “Series B Preferred Stock”), and 10% Series C Cumulative Convertible Preferred Stock, $0.01 par value per share (the “Series C Preferred Stock”); and (iii) at least a majority of the shares of our outstanding Common Stock, Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock, voting together as a single class.

The Written Consent authorized and approved an amendment to our current amended and restated articles of incorporation (the “Current Charter”) to, among other things (i) change the name of our company to “Gadsden Properties, Inc.”; (ii) increase the number of authorized shares of our Common Stock from 500,000,000 shares to 5,000,000,000 shares; and (iii) add certain provisions restricting the ownership and transfer of shares to comply with requirements under the Internal Revenue Code for real estate investment trusts (the “Charter Amendment”). A copy of the Charter Amendment is attached to this Information Statement as Appendix A.

The Written Consent is sufficient under the Nevada Revised Statutes, the Current Charter and our amended and restated bylaws to approve the Charter Amendment. Accordingly, the Charter Amendment will not be submitted to the other stockholders of our company for a vote, and this Information Statement is being furnished to such other stockholders to provide them with certain information concerning the Written Consent in accordance with the requirements of the Exchange Act, and the regulations promulgated under the Exchange Act, including Regulation 14C.

We will, when permissible following the expiration of the 20-day period mandated by Rule 14c of the Exchange Act and the provisions of the Nevada Revised Statutes, file the Charter Amendment with the Nevada Secretary of State’s Office. The Charter Amendment will become effective upon such filing.

AUTHORIZATION BY THE BOARD OF DIRECTORS

AND THE MAJORITY STOCKHOLDERS

On May 15, 2019, our board of directors unanimously adopted resolutions approving the Charter Amendment and recommended that our stockholders approve it. In connection with the adoption of these resolutions, our board of directors elected to seek the written consent of stockholders in order to reduce associated costs and implement the Charter Amendment in a timely manner. On May 15, 2019, our stockholders Gadsden Growth Properties, Inc. (“Gadsden”) and FHDC Group, LLC (“FHDC” and together with Gadsden, the “Majority Stockholders”) executed and delivered the Written Consent to us.

Pursuant to our amended and restated bylaws, any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

Pursuant to the Nevada Revised Statutes, the Current Charter and our amended and restated bylaws, approval of the Charter Amendment at a meeting would require the affirmative vote of at least: (i) a majority of the total number of shares of our outstanding Common Stock; (ii) a majority of the total number of shares of our outstanding Series A Preferred Stock, voting as a separate class; (iii) a majority of the total number of shares of our outstanding Series B Preferred Stock, voting as a separate class; (iv) two-thirds of the total number of shares of our outstanding Series C Preferred Stock, voting as a separate class; and (v) a majority of the total number of shares of our outstanding Common Stock, Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock, voting together as a single class.

Holders of shares of Common Stock are entitled to one (1) vote per share. As of the Record Date, there were 389,104,820 shares of Common Stock issued and outstanding, of which Gadsden held 229,101,205 shares, or approximately 58.88%, and FHDC held 132,667,366 shares, or approximately 34.10%. Holders of shares of Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock were entitled to vote with respect to the Charter Amendment on an as-converted to Common Stock basis. As of the Record Date, we had issued and outstanding 889,075 shares of Series A Preferred Stock, all of which were held by Gadsden, 6,264,993 shares of Series B Preferred Stock, all of which were held by Gadsden, and 2,498,682 shares of Series C Preferred Stock, of which FHDC held 2,000,000 shares and Gadsden held 498,682.

Accordingly, we have obtained all necessary corporate approvals in connection with the Charter Amendment. We are not seeking written consent from any other stockholder, and other stockholders will not be given an opportunity to vote with respect to the actions described in this Information Statement. All necessary corporate approvals have been obtained. This Information Statement is furnished solely for the purposes of advising stockholders of the action taken by Written Consent and giving stockholders notice of such actions taken as required by the Exchange Act.

As the action taken by the Majority Stockholders was by written consent, there will be no security holders’ meeting and representatives of the principal accountants for the current year and for the most recently completed fiscal year will not have the opportunity to make a statement if they desire to do so and will not be available to respond to appropriate questions from our stockholders.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding beneficial ownership of our voting stock as of the Record Date by (i) each of our officers and directors; (ii) all of our officers and directors as a group; and (iii) each person who is known by us to beneficially own more than 5% of our voting stock. Unless otherwise specified, the address of each of the persons set forth below is in care of our company, 15150 North Hayden Road, Suite 235, Scottsdale, AZ 85260.

| Name and Address of Beneficial Owner | Amount of Beneficial Ownership(1) |

Percent of Common Stock(2) |

Percent of Series A Preferred Stock(3) | Percent of Series C Preferred Stock(4) | Percent of Total Voting Stock(5) | ||

|

Common Stock |

Series A Preferred Stock | Series C Preferred Stock | |||||

| John Hartman, CEO and Director | 0 | 0 | 0 | * | * | * | * |

| George Bell, COO | 0 | 0 | 0 | * | * | * | * |

| Scott Crist, CFO | 0 | 0 | 0 | * | * | * | * |

| Brian Ringel, Corporate Controller | 0 | 0 | 0 | * | * | * | * |

| Douglas A. Funke, Director | 0 | 0 | 0 | * | * | * | * |

| Dennis M. McGrath, Director (6) | 1,370,752 | 0 | 0 | * | * | * | * |

| B.J. Parrish, Director | 0 | 0 | 0 | * | * | * | * |

| Kristen E. Pigman, Director (7) | 13,841,684 | 0 | 0 | 3.56% | * | * | * |

| Dolev Rafaeli, Director (8) | 4,390,409 | 0 | 0 | 1.13% | * | * | * |

| James Walesa, Director | 0 | 0 | 0 | * | * | * | * |

| All directors and officers as a group (10 persons named above) | 19,602,845 | 0 | 0 | 5.04% | * | * | 1.34% |

| Gadsden Growth Properties, Inc. (9) | 229,101,205 | 889,075 | 498,682 | 58.88% | 100.00% | 19.96% | 54.77% |

| FHDC Group, LLC (10) | 132,667,366 | 0 | 2,000,000 | 34.10% | 80.04% | 43.36% | |

* Less than 1%

| (1) | Beneficial Ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”) and generally includes voting or investment power with respect to securities. Except as set forth below, each of the beneficial owners listed above has direct ownership of and sole voting power and investment power with respect to the shares of its stock. For each beneficial owner above, any options exercisable within 60 days have been included in the denominator. |

-2-

| (2) | Based on 389,104,820 shares of Common Stock outstanding as of the Record Date. |

| (3) | Based on 889,075 shares of Series A Preferred Stock outstanding as of the Record Date. Each share of Series A Preferred Stock is, upon the occurrence of certain events, convertible into an estimated 501 shares of Common Stock, with the exact number of shares to be equal to $25 divided by the VWAP per share of Common Stock during the twenty (20) consecutive trading days prior to the applicable conversion date. VWAP is defined, generally, as the volume weighted average price for Common Stock on the applicable trading market, subject to a minimum of $0.0499. Holders of Series A Preferred Stock vote with the holders of Common Stock on all matters on an as-converted to Common Stock basis. |

| (4) | Based on 2,498,682 shares of Series C Preferred Stock outstanding as of the Record Date. Each share of Series C Preferred Stock is, upon the occurrence of certain events, convertible into an estimated 250 shares of Common Stock, with the exact number of shares to be equal to $10 divided by 80% of the VWAP per share of Common Stock during the twenty (20) consecutive trading days prior to the applicable conversion date. VWAP is defined, generally, as the volume weighted average price for Common Stock on the applicable trading market, subject to a minimum of $0.05. Holders of Series C Preferred Stock vote with the holders of Common Stock on all matters on an as-converted to Common Stock basis. |

| (5) | Percentage of Total Voting Stock represents total ownership with respect to all shares of Common Stock, Series A Preferred Stock and Series C Preferred Stock, as a single class and on an as-converted to Common Stock basis. |

| (6) | Includes 1,331,862 shares of Common Stock and vested options to purchase 38,890 shares of Common Stock. |

| (7) | Represents shares held by Opportunity Fund I-SS, LLC. Kristen Pigman is the Director of OP Fund I Manager, LLC, which is the member and manager of Opportunity Fund I-SS, LLC, and has voting and dispositive power over the securities held by it. Mr. Pigman disclaims beneficial ownership of such securities except to the extent of his pecuniary in such securities, if any. |

| (8) | Includes 4,352,909 shares of Common Stock and vested options to purchase 37,500 shares of Common Stock. |

| (9) | We have been informed that the investment committee of the board of directors of Gadsden Growth Properties, Inc. has voting and investment control over the securities held by it, subject to the continuing oversight of its board of directors. We have been informed that the members of the investment committee are John Hartman (Chair), Kristen E. Pigman and James Walesa. The address of Gadsden Growth Properties, Inc. is 15150 N. Hayden Road, Suite 220, Scottsdale, Arizona 85260. |

| (10) | Jae Rye is the Managing Member of FHDC Group, LLC and has voting and dispositive power over the securities held by it. Mr. Rue disclaims beneficial ownership of such securities except to the extent of his pecuniary in such securities, if any. The address of FHDC Group, LLC is 2051 Junction Avenue, Suite 230, San Jose, California 95131. |

We do not currently have any arrangements which if consummated may result in a change of control of our company.

CHANGES IN CONTROL

On March 13, 2019, we entered into a Stock Purchase Agreement with Gadsden pursuant to which Gadsden agreed to transfer and assign to us all of its general partnership interests and Class A limited partnership interests in Gadsden Growth Properties, L.P., a Delaware limited partnership, the operating partnership of Gadsden that held all of its assets and liabilities, in exchange for shares of Common Stock, Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock. The parties amended the Stock Purchase Agreement on April 5, 2019 and May 2, 2019 (as amended, the “Purchase Agreement”).

On April 5, 2019, closing of the Purchase Agreement was completed. Pursuant to the Purchase Agreement, we issued to Gadsden 430,306,645 shares of Common Stock, 889,075 shares of Series A Preferred Stock, 11,696,944 shares of Series B Preferred Stock and 2,498,682 shares of Series C Preferred Stock. An additional 278,178,750 shares of Common Stock (the “Holdback Shares”) were to be issued to Gadsden upon filing of an amendment to our amended and restated articles of incorporation to increase our authorized Common Stock (the “Charter Amendment Date”). The Holdback Shares are subject to forfeiture based on the reconciliation and adjustment of the net asset value of Gadsden’s assets and its proposed real estate investments that have not closed as of the closing date of the Purchase Agreement (the “Scheduled Investments”) as described below.

-3-

On May 2, 2019, the parties amended the Purchase Agreement to (i) decrease the number of shares of Common Stock and Holdback Shares issued to Gadsden, and increase the number of shares of Series B Preferred Stock issued, as the result of an error in the original calculation of the shares to be issued; (ii) provide for the issuance of the Holdback Shares on the closing date, rather than the Charter Amendment Date; and (iii) provide for the issuance of certain of the shares of the Series B Preferred Stock and Series C Preferred Stock to FHDC in exchange for the equivalent number of shares of Gadsden held by it.

Specifically, such amendment provided that we issue the following securities as consideration under the Purchase Agreement: (i) to Gadsden, 229,101,205 shares of Common Stock, of which 110,477,220 shares are designed as Holdback Shares and will be held by Gadsden in a segregated account (the “Gadsden Specified Account”), which shall be subject to release in accordance with the terms of the Purchase Agreement, and 118,623,985 shares will not be subject to the Gadsden Specified Account; (ii) to Gadsden, 889,075 shares of Series A Preferred Stock; (iii) to Gadsden, 6,264,993 shares of Series B Preferred Stock; (iv) to Gadsden, 498,682 shares of Series C Preferred Stock; (v) to FHDC, 5,432,000 shares of Series B Preferred Stock, subject to entry into the Exchange Agreement (as defined below); and to FHDC, 2,000,000 shares of Series C Preferred Stock (together with the 5,432,000 shares of Series B Preferred Stock referred to above, the “FHDC Shares”), subject to entry into the Exchange Agreement.

On May 2, 2019, we entered into a Cancellation and Exchange Agreement (the “Exchange Agreement”) with Gadsden and FHDC, pursuant to which FHDC agreed to cancel (i) 5,432,000 shares of its Series B Non-Voting Convertible Preferred Stock and (ii) 2,000,000 shares of its 10% Series C Cumulative Convertible Preferred Stock of Gadsden held by it in exchange for the FHDC Shares.

In order to effect the forgoing, on May 2, 2019, we cancelled 201,205,440 shares of Common Stock issued to Gadsden and Gadsden placed a number of its remaining shares equal to the Holdback Shares into the Gadsden Specified Account. In addition, in accordance with the terms of the Exchange Agreement, we cancelled 5,432,000 shares of Series B Preferred Stock and 2,000,000 shares of Series C Preferred Stock issued to Gadsden and issued such shares to FHDC. On May 6, 2019, we also issued an additional 49 shares of Series B Preferred Stock to Gadsden.

On May 12, 2019, FHDC converted its 5,432,000 shares of Series B Preferred Stock into 132,667,366 shares of Common Stock.

The number of shares issued under the Purchase Agreement is based upon an estimated net asset value of Gadsden of $211,573,000 (the “Contract NAV”). The Contract NAV includes Gadsden’s assets and all of its Scheduled Investments. The Purchase Agreement provides for a reconciliation and adjustment of the final net asset value of Gadsden as described below.

If the Contract NAV is more than Gadsden’s final net asset value, then the difference (the “Shortfall”) will be settled by the transfer of shares of Common Stock, at a value equal to 3.771023733 shares of Common Stock for each $1.00 of Shortfall if the final net asst value is $80 million or more (and 2.860407207 for each $1.00 of Shortfall to the extent that the final net asst value is less $80 million). The Shortfall will first be paid by transfer of Holdback Shares by Gadsden to our company and such transferred shares will be cancelled. If the amount of the Shortfall is more than the value of the Holdback Shares, then we will issue more shares of Common Stock to our stockholders of record as of the closing date.

Gadsden’s final net asset value will be determined as the fair value of the each of its assets on the closing date and the Scheduled Investments acquired on or prior to May 20, 2019. Such fair value will be determined in accordance with the following:

| ● | in accordance with United States generally accepted accounting principles, and shall be derived from our annual report on Form 10-K for either of the fiscal years ended December 31, 2019 or December 31, 2020 with Gadsden having the option to choose which such fiscal year to utilize; |

| ● | as of the date of an appraisal from a licensed appraiser with knowledge of the applicable market that need not be a national firm; or |

-4-

| ● | if an asset is sold or otherwise disposed of by Gadsden in consideration for cash, the gross cash proceeds from the sale minus any indebtedness or other liabilities relating to the asset being sold or otherwise disposed of that were not assumed by the purchaser and that remain indebtedness or other liabilities of our company following the sale or other disposition. |

THE CHARTER AMENDMENT

Overview

On May 15, 2019, our board of directors and the Majority Stockholders approved an amendment to the Current Charter to, among other things (i) change the name of our company to “Gadsden Properties, Inc.”; (ii) increase the number of authorized shares of our Common Stock from 500,000,000 shares to 5,000,000,000 shares; and (iii) add certain provisions restricting the ownership and transfer of shares to comply with requirements under the Internal Revenue Code of 1986, as amended (the “Code”), for a real estate investment trust (“REIT”).

The Charter Amendment also amends to the purpose of our company to state that we may, but are not obligated to, engage in business as a REIT.

The Charter Amendment will become effective upon filing with the Nevada Secretary of State’s Office, which will occur promptly following the 20th day after this Information Statement is first mailed to our stockholders.

Reasons for the Amendments to our Current Charter

Name Change

The principal reason for our name change to “Gadsden Properties, Inc.” is to reflect the recent change to our business following closing of the Purchase Agreement. As described under “Changes in Control” above, we recently acquired Gadsden Growth Properties, L.P., the operating partnership of Gadsden that held all of its assets and liabilities, in a transaction that resulted in a change in control of our company. We believe that the name “Gadsden Properties, Inc.” more accurately reflects our business following this transaction.

Increase in Authorized Stock

The primary purpose of the amendment to increase our authorize Common Stock is to facilitate the issuance of shares of Common Stock upon the conversion of our recently issued Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock pursuant to the Purchase Agreement described under “Changes in Control” above.

Our Current Charter authorizes our company to issue 500,000,000 shares of Common Stock and 50,000,000 shares of Preferred Stock, of which 1,600,000 have been designated as Series A Preferred Stock, 11,696,993 have been designated as Series B Preferred Stock and 11,000,000 have been designated as Series C Preferred Stock. As of the Record Date, there were 389,104,820 shares of Common Stock, 889,075 shares of Series A Preferred Stock (convertible under certain circumstances, and subject to filing of the Charter Amendment, into up to approximately 445,426,575 shares of Common Stock), 6,264,993 shares of Series B Preferred Stock (convertible under certain circumstances, and subject to filing of the Charter Amendment, into up to approximately 153,011,804 shares of Common Stock) and 2,498,682 shares of Series C Preferred Stock (convertible under certain circumstances, and subject to filing of the Charter Amendment, into up to approximately 624,670,500 shares of Common Stock) issued and outstanding. We have also reserved 446,429 shares of Common Stock for issuance under outstanding warrants, 77,390 shares of Common Stock for issuance under outstanding options, and 4,600,000 under our shares of Common Stock for issuance under our 2018 Equity Incentive Plan.

We have also reserved, subject to filing of the Charter Amendment, 801,600,000 shares of Common Stock for conversion of the authorized Series A Preferred Stock, 285,679,170 shares of Common Stock for conversion of the authorized Series B Preferred Stock and 2,750,000,000 shares of Common Stock for conversion of the authorized Series C Preferred Stock.

The Charter Amendment will increase the number of authorized shares of Common Stock to 5,000,000,000 shares.

Although the primary purpose of the increase in the authorized Common Stock is to facilitate the issuance of shares of Common Stock upon the conversion of the Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock, this amendment will also provide us with increased flexibility in meeting future corporate needs and requirements by providing additional authorized shares of Common Stock, which will be available for issuance from time to time as determined by the board for any proper corporate purpose, including additional equity financings, without the expense and delay associated with a special stockholders’ meeting, except where required by applicable rules, regulations and laws.

-5-

Restrictions on Ownership and Transfer of Shares

Although we are not currently a REIT, we intend to qualify as a REIT for U.S. Federal income tax purposes commencing with our taxable year ending December 31, 2020. In order to qualify as a REIT under the Code, our stock must be beneficially owned by 100 or more persons during at least 335 days of a taxable year of 12 months (other than the first year for which an election to be a REIT has been made) or during a proportionate part of a shorter taxable year; and at any time during the last half of a taxable year (other than the first year for which an election to be a REIT has been made), not more than 50% of the value of the outstanding shares of stock (after taking into account options to acquire shares of stock) may be owned, directly, indirectly or through attribution, by five or fewer individuals (for this purpose, the term “individual” under the Code includes a supplemental unemployment compensation benefit plan, a private foundation or a portion of a trust permanently set aside or used exclusively for charitable purposes, but generally does not include a qualified pension plan or profit sharing trust).

The Charter Amendment contains restrictions on ownership and transfer of our stock that are intended, among other purposes, to assist us in complying with these requirements to qualify and thereafter continue to qualify as a REIT. These restrictions will be effective commencing on the date on which a registration statement on Form S-11 is declared effective by the SEC and until our board of directors determines that it is no longer in the best interests of our company to attempt to, or continue to, qualify as a REIT, or that compliance with the restrictions and limitations on ownership and transfers is no longer required in order for us to qualify as a REIT.

These limitations include that, subject to the exceptions in the discretion of the board of directors, no person or entity may actually or beneficially own, or be deemed to own by virtue of the applicable constructive ownership provisions of the Code, more than the Applicable Amount (as defined below), or other applicable amount given any ownership in excess of such amount that has been approved by the board of directors, of the outstanding shares of Common Stock, Preferred Stock or more than the Applicable Amount of the aggregate of the outstanding shares of all classes and series of stock. These restrictions are referred to as an “ownership limit” and collectively as the “ownership limits.” A person or entity that would have acquired actual, beneficial or constructive ownership of stock but for the application of the ownership limits or any of the other restrictions on ownership and transfer of stock discussed below is referred to as a “prohibited owner.” Under the provisions of the Charter Amendment, the term “Applicable Amount” is defined to be not more than 9.8% (in value or in number of shares, whichever is more restrictive) of the aggregate of the outstanding shares of capital stock, or such other percentage determined by the board of directors.

The constructive ownership rules under the Code are complex and may cause stock owned actually or constructively by a group of related individuals and/or entities to be owned constructively by one individual or entity. As a result, the acquisition of less than the Applicable Amount of Common Stock (or the acquisition of an interest in an entity that owns, actually or constructively, Common Stock) by an individual or entity could, nevertheless, cause that individual or entity, or another individual or entity, to own constructively in excess of the Applicable Amount of outstanding Common Stock and thereby violate the applicable ownership limit.

Our board of directors may increase or decrease the ownership limits, except that a decreased ownership limit will not be effective for any person whose actual, beneficial or constructive ownership of stock exceeds the decreased ownership limit at the time of the decrease until the person’s actual, beneficial or constructive ownership of stock equals or falls below the decreased ownership limit, although any further acquisition of stock will violate the decreased ownership limit. The board may not increase or decrease any ownership limit if the new ownership limit would cause our company to fail to qualify as a REIT.

These provisions further prohibit:

| ● | any person from actually, beneficially or constructively owning shares of stock that could result in our company being “closely held” under Section 856(h) of the Code (without regard to whether the ownership interest is held during the last half of a taxable year) or otherwise cause our company to fail to qualify as a REIT (including, but not limited to, actual, beneficial or constructive ownership of shares of stock that could result in (i) our company owning (actually or constructively) an interest in a tenant that is described in Section 856(d)(2)(B) of the Code, or (ii) any manager of a “qualified lodging facility” within the meaning of Section 856(d)(9)(D) of the Code or a “qualified health care facility” within the meaning of Section 856(e)(6)(D)(i) of the Code, leased by our company to one of its taxable REIT subsidiaries failing to qualify as an “eligible independent contractor” within the meaning of Section 856(d)(9)(A) of the Code, in each case if the income derived from such tenant or such taxable REIT subsidiary, taking into account our other income that would not qualify under the gross income requirements of Section 856(c) of the Code, would cause our company to fail to satisfy any the gross income requirements imposed on REITs); and |

-6-

| ● | any person from transferring shares of stock if such transfer would result in shares of our stock being beneficially owned by fewer than 100 persons (determined under the principles of Section 856(a)(5) of the Code). |

Any person who acquires or attempts or intends to acquire actual, beneficial or constructive ownership of shares of stock that will or may violate the ownership limits or any of the other restrictions on ownership and transfer of stock described above must give written notice immediately to us or, in the case of a proposed or attempted transaction, provide us at least fifteen (15) days prior written notice, and provide us with such other information as we may request in order to determine the effect of such transfer on our status as a REIT.

Pursuant to the Charter Amendment, if any purported transfer of stock or any other event would otherwise result in any person violating the ownership limits or such other limit established by the board, or could result in GPI being “closely held” within the meaning of Section 856(h) of the Code (without regard to whether the ownership interest is held during the last half of a taxable year) or otherwise failing to qualify as a REIT, then the number of shares causing the violation (rounded up to the nearest whole share) will be automatically transferred to, and held by, a trust for the exclusive benefit of one or more charitable organizations selected by our company. The prohibited owner will have no rights in shares of our stock held by the trustee. The automatic transfer will be effective as of the close of business on the business day prior to the date of the violative transfer or other event that results in the transfer to the trust. Any dividend or other distribution paid to the prohibited owner, prior to our discovery that the shares had been automatically transferred to a trust as described above, must be repaid to the trustee upon demand. In addition, the board is authorized to take such actions as it deems necessary or advisable in preserving our qualification as a REIT.

Shares of stock transferred to the trustee are deemed offered for sale to our company, or its designee, at a price per share equal to the lesser of (i) the price per share in the transaction that resulted in the transfer of shares to the trust (or, if the event that resulted in the transfer to the trust did not involve a purchase of such shares at market price, the market price of such shares on the day of the event that resulted in the transfer of such shares to the trust) and (ii) the market price on the date our company, or its designee, accepts such offer. We will be required to reduce the amount payable to the prohibited owner by the amount of dividends and other distributions paid to the prohibited owner and owed by the prohibited owner to the trustee. We will pay the amount of such reduction to the trustee for the benefit of the charitable beneficiary. We will have the right to accept such offer until the trustee has sold the shares of stock held in the trust. Upon a sale to us, the interest of the charitable beneficiary in the shares sold terminates and the trustee must distribute the net proceeds of the sale to the prohibited owner and any dividends or other distributions held by the trustee with respect to such stock will be paid to the charitable beneficiary.

If we do not buy the shares, the trustee must, within twenty (20) days of receiving notice from us of the transfer of shares to the trust, sell the shares to a person or persons, designated by the trustee, who could own the shares without violating the ownership limits or other restrictions on ownership and transfer of our stock. Upon such sale, the trustee must distribute to the prohibited owner an amount equal to the lesser of (i) the price paid by the prohibited owner for the shares (or, in the event of a gift, devise or other such transaction, the last sales price reported on the applicable stock market or exchange on the day of the transfer or other event that resulted in the transfer of such shares to the trust) and (ii) the market price on the date that the trustee, or its designee, accepts such offer. The trustee will reduce the amount payable to the prohibited owner by the amount of dividends and other distributions paid to the prohibited owner and owed by the prohibited owner to the trustee. Any net sales proceeds in excess of the amount payable to the prohibited owner will be immediately paid to the charitable beneficiary, together with any dividends or other distributions thereon. In addition, if, prior to discovery by our company that shares of stock have been transferred to the trustee, such shares of stock are sold by a prohibited owner, then such shares shall be deemed to have been sold on behalf of the trust and, to the extent that the prohibited owner received an amount for or in respect of such shares that exceeds the amount that such prohibited owner was entitled to receive, such excess amount shall be paid to the trustee upon demand.

The trustee will be designated by us and will be unaffiliated with any prohibited owner. Prior to the sale of any shares by the trust, the trustee will receive, in trust for the charitable beneficiary, all dividends and other distributions paid by us with respect to such shares, and may exercise all voting rights with respect to such shares for the exclusive benefit of the charitable beneficiary.

Every owner of 5% or more (or such lower percentage as required by the Code or the U.S. Treasury Department regulations promulgated thereunder) of the outstanding shares of our stock, within thirty (30) days after the end of each taxable year, must give written notice to us stating the name and address of such owner, the number of shares of each class and series of its stock that the owner beneficially owns and a description of the manner in which the shares are held. Each such owner also must provide us with any additional information that we request in order to determine the effect, if any, of the person’s actual or beneficial ownership on our status as a REIT and to ensure compliance with the ownership limits. In addition, any person that is an actual, beneficial or constructive owner of shares of our stock and any person (including the stockholder of record) who is holding shares of its stock for an actual, beneficial or constructive owner must, on request, disclose to us such information as we may request in good faith in order to determine our status as a REIT and comply with requirements of any taxing authority or governmental authority or determine such compliance.

-7-

Our board of directors may exercise the discretion noted above during the period that we are not qualified as a REIT so that we are able to qualify as a REIT commencing on the taxable year that our board of directors so determines that we should elect to be taxed as a REIT.

Possible Effects of the Amendments to our Current Charter

Release No. 34-15230 of the staff of the SEC requires disclosure and discussion of the effects of any stockholder proposal that may be used as an anti-takeover device.

The proposed increase in the authorized number of shares of our Common Stock could have an anti-takeover effect, in that additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that could make a change in control or takeover of us more difficult. For example, additional shares could be issued by us so as to dilute the stock ownership or voting rights of persons seeking to obtain control of us, even if the persons seeking to obtain control offers an above-market premium that is favored by a majority of the independent stockholders. Similarly, the issuance of additional shares to certain persons allied with our management could have the effect of making it more difficult to remove our current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. We have no plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover consequences. This proposal is not being presented with the intent that it be utilized as a type of anti-takeover device.

Our stockholders should recognize that, as a result of this proposal, they will own a fewer percentage of shares with respect to our total authorized shares than they presently own and will be diluted as a result of any issuance of shares by us in the future.

Other than in connection with the issuance of shares of Common Stock upon the conversion of Preferred Stock described above, there are currently no specific plans, arrangements, commitments or understandings for the issuance of the additional shares of stock which are proposed to be authorized (except with respect to potential issuances of shares upon exercise of currently outstanding options and warrants).

These restrictions on ownership and transfer contained in the Charter Amendment could also inhibit a transaction or a change of control of our company that might involve a premium price for our capital stock that stockholders otherwise believe to be in their best interest.

Interest of Certain Persons

All of our directors and officers were also directors and officers of Gadsden as of the Record Date and many of them beneficially own shares of Gadsden. However, none of these individuals was a director or officer of our company, or had any interest in the transactions contemplated by the Purchase Agreement, prior to closing thereof (except for Dennis M. McGrath and Dolev Rafaeli, who were not directors or officers of Gadsden prior to closing).

No Dissenters’ Rights

Under Nevada law, holders of our Common Stock are not entitled to dissenter’s rights of appraisal with respect to the approval of the Charter Amendment.

STOCKHOLDERS ENTITLED TO INFORMATION STATEMENT

This Information Statement is being mailed to you on or about [ ], 2019. We will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending this Information Statement to the beneficial owners of our Common Stock.

-8-

On May 15, 2019, our board of directors established May 15, 2019 as the Record Date for the determination of stockholders entitled to receive this Information Statement.

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS

We may deliver only one Information Statement to multiple stockholders sharing an address, unless we have received contrary instructions from one or more of the stockholders. We will promptly deliver a separate copy of this Information Statement to a stockholder at a shared address to which a single copy was delivered, upon written or oral request to us at the following address and telephone number:

FC Global Realty Incorporated

15150 North Hayden Road, Suite 235

Scottsdale, AZ 85260

Attn: Corporate Secretary

Phone: 480-530-3495

In addition, a stockholder can direct a notification to us at the phone number and mailing address listed above that the stockholder wishes to receive a separate information statement in the future. Stockholders sharing an address that receive multiple copies can request delivery of a single copy of the information statements by contacting us at the phone number and mailing address listed above.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC under the Exchange Act. You may read and copy this information at, or obtain copies of this information by mail from, the SEC’s Public Reference Room, 450 Fifth Street, N.W., Washington, D.C. 20549, at prescribed rates. Please call the SEC at (800) SEC-0330 for further information about the public reference room. Our filings with the SEC are also available to the public from commercial document retrieval services and at the web site maintained by the SEC at http://www.sec.gov.

| BY ORDER OF THE BOARD OF DIRECTORS, | |

| /s/ Michele Pupach | |

| Michele Pupach | |

| Secretary |

[ ], 2019

-9-

ANNEX A

Certificate of Amendment

EXHIBIT A

1. The name of the corporation is Gadsden Properties, Inc. (hereinafter, the “Corporation”).

3(a). The total number of shares of capital stock which the Corporation shall have authority to issue is five billion fifty million (5,050,000,000) shares, of which (i) fifty million (50,000,000) shares are designated as preferred stock, with a par value of $0.01 per share (“Preferred Stock”) and (ii) five billion (5,000,000,000) shares are designated as common stock, with a par value of $0.01 per share (“Common Stock”).

4. The purpose of the Corporation shall be to engage in any lawful act or activity for which corporations may be organized under the laws of the State of Nevada, including, without limitation or obligation, engaging in business as a real estate investment trust (“REIT”) under Sections 856 through 860 the Internal Revenue Code of 1986, as amended, or any successor statute (the “Code”).

10. Restrictions on Transfer and Ownership of Shares.

Section 10.1 Definitions. For the purpose of this Article 10, the following terms shall have the following meanings:

“Applicable Amount” shall mean not more than 9.8% (in value or in number of shares, whichever is more restrictive) of the aggregate of the outstanding shares of Capital Stock, or such other percentage determined by the Board of Directors in accordance with Section 10.2.8.

“Beneficial Ownership” shall mean ownership of Capital Stock by a Person, whether the interest in the shares of Capital Stock is held directly or indirectly (including by a nominee), and shall include interests that would be treated as owned through the application of Section 544 of the Code, as modified by Sections 856(h)(1)(B) and 856(h)(3) of the Code. The terms “Beneficial Owner,” “Beneficially Owns” and “Beneficially Owned” shall have the correlative meanings.

“Business Day” shall mean any day, other than a Saturday or Sunday, that is neither a legal holiday nor a day on which banking institutions in New York City are authorized or required by law, regulation or executive order to close.

“Capital Stock” shall mean all classes or series of stock of the Corporation, including, without limitation, Common Stock and Preferred Stock.

“Charitable Beneficiary” shall mean one or more beneficiaries of the Trust as determined pursuant to Section 10.3.6, provided that each such organization must be described in Section 501(c)(3) of the Code and contributions to each such organization must be eligible for deduction under each of Sections 170(b)(1)(A), 2055 and 2522 of the Code.

“Common Stock Ownership Limit” shall mean not more than 9.8% (in value or in number of shares, whichever is more restrictive) of the aggregate of the outstanding shares of Common Stock, or such other percentage determined by the Board of Directors in accordance with Section 10.2.8.

“Constructive Ownership” shall mean ownership of Capital Stock by a Person, whether the interest in the shares of Capital Stock is held directly or indirectly (including by a nominee), and shall include interests that would be treated as owned through the application of Section 318(a) of the Code, as modified by Section 856(d)(5) of the Code. The terms “Constructive Owner,” “Constructively Owns” and “Constructively Owned” shall have the correlative meanings.

“Effective Date” shall mean the date as of which the Corporation’s registration statement on Form S-11 is declared effective by the U.S. Securities and Exchange Commission.

“Excepted Holder” shall mean a Person for whom an Excepted Holder Limit is created by this Article 10 or by the Board of Directors pursuant to Section 10.2.7.

“Excepted Holder Limit” shall mean, provided that the affected Excepted Holder agrees to comply with any requirements established by the Board of Directors pursuant to Section 10.2.7 and subject to adjustment pursuant to Section 10.2.7(d), the percentage limit established by the Board of Directors pursuant to Section 10.2.7.

“Market Price” shall mean, with respect to any class or series of outstanding shares of Capital Stock, the Closing Price for such Capital Stock on such date. The “Closing Price” on any date shall mean the average of the highest and lowest price at which the stock traded during the day on the applicable stock market or exchange, or, if not so quoted, the average of the highest bid and lowest asked prices in the over-the-counter market, as reported by the principal automated quotation system that may then be in use or, if such Capital Stock is not quoted by any such system, the average of the closing bid and asked prices as furnished by a professional market maker making a market in such Capital Stock selected by the Board of Directors of the Corporation or, in the event that no trading price is available for such Capital Stock, the fair market value of the Capital Stock, as determined in good faith by the Board of Directors of the Corporation.

“Person” shall mean an individual, corporation, partnership, estate, trust (including a trust qualified under Sections 401(a) or 501(c)(17) of the Code), a portion of a trust permanently set aside for or to be used exclusively for the purposes described in Section 642(c) of the Code, association, private foundation within the meaning of Section 509(a) of the Code, joint stock company or other entity and also includes a group as that term is used for purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and a group to which an Excepted Holder Limit applies.

“Preferred Stock Ownership Limit” shall mean not more than 9.8% (in value or in number of shares, whichever is more restrictive) of the aggregate of the outstanding shares of any class or series of Preferred Stock, or such other percentage determined by the Board of Directors in accordance with Section 10.2.8.

“Prohibited Owner” shall mean, with respect to any purported Transfer, any Person that, but for the provisions of Section 10.2.1(b), would Beneficially Own or Constructively Own shares of Capital Stock in violation of Section 10.2.1 and, if appropriate in the context, shall also mean any Person who would have been the record owner of the shares that the Prohibited Owner would have so owned.

“Restriction Termination Date” shall mean the first day after the Effective Date on which the Board of Directors determines that it is no longer in the best interests of the Corporation to attempt to, or continue to, qualify as a REIT or that compliance with the restrictions and limitations on Beneficial Ownership, Constructive Ownership and Transfers of shares of Capital Stock set forth herein is no longer required in order for the Corporation to qualify as a REIT.

“Transfer” shall mean any issuance, sale, transfer, gift, assignment, devise or other disposition, as well as any other event that causes any Person to acquire or change its Beneficial Ownership or Constructive Ownership, or any agreement to take any such actions or cause any such events, of Capital Stock or the right to vote (other than solely pursuant to a revocable proxy) or receive dividends on Capital Stock, including (a) the granting or exercise of any option (or any disposition of any option), (b) any disposition of any securities or rights convertible into or exchangeable for Capital Stock or any interest in Capital Stock or any exercise of any such conversion or exchange right and (c) Transfers of interests in other entities that result in changes in Beneficial Ownership or Constructive Ownership of Capital Stock; in each case, whether voluntary or involuntary, whether owned of record, Constructively Owned or Beneficially Owned and whether by operation of law or otherwise. The terms “Transferring” and “Transferred” shall have the correlative meanings.

2

“Trust” shall mean any trust created by the Board of Directors for purposes provided for in Section 10.3.1.

“Trustee” shall mean the Person that is not a Prohibited Owner, and is not acting as an agent of the Prohibited Owner, that is appointed by the Corporation to serve as trustee of the Trust.

Section 10.2 Capital Stock.

10.2.1 Ownership Limitations. During the period commencing on the Effective Date and prior to the Restriction Termination Date, but subject to Section 10.2.7:

(a) Basic Restrictions.

(i) (1) No Person, other than a Person exempted pursuant to Section 10.2.7 or an Excepted Holder, shall Beneficially Own or Constructively Own shares of Capital Stock in excess of the Applicable Amount, (2) no Person, other than a person exempted pursuant to Section 10.2.7 or an Excepted Holder, shall Beneficially Own or Constructively Own shares of Common Stock in excess of the Common Stock Ownership Limit, (3) no Person, other than a Person exempted pursuant to Section 10.2.7 or an Excepted Holder, shall Beneficially Own or Constructively Own shares of Preferred Stock in excess of the Preferred Stock Ownership Limit and (4) no Excepted Holder shall Beneficially Own or Constructively Own shares of Capital Stock in excess of the Excepted Holder Limit for such Excepted Holder.

(ii) No Person shall Beneficially Own or Constructively Own shares of Capital Stock to the extent that such Beneficial Ownership or Constructive Ownership of Capital Stock would result in the Corporation being “closely held” within the meaning of Section 856(h) of the Code (without regard to whether the ownership interest is held during the last half of a taxable year), or otherwise cause the Corporation to fail to qualify as a REIT (including, but not limited to, actual, beneficial or constructive ownership of shares of the Corporation’s stock that could result in (i) the Corporation owning (actually or constructively) an interest in a tenant that is described in Section 856(d)(2)(B) of the Code, or (ii) any manager of either (A) a “qualified lodging facility,” within the meaning of Section 856(d)(9)(D) of the Code, or (B) a “qualified health care facility,” within the meaning of Section 856(e)(6)(D)(i), as applicable, leased by the Corporation to one of the Corporation’s taxable REIT subsidiaries failing to qualify as an “eligible independent contractor” within the meaning of Section 856(d)(9)(A) of the Code, in each case if the income we derive from such tenant or such taxable REIT subsidiary, taking into account the Corporation’s other income that would not qualify under the gross income requirements of Section 856(c) of the Code, would cause the Corporation to fail to satisfy any the gross income requirements imposed on REITs).

(iii) No Transfer of shares of Capital Stock shall be made that, if effective, would result in the Capital Stock being beneficially owned by fewer than 100 Persons (determined under the principles of Section 856(a)(5) of the Code).

3

(b) Transfer in Trust.

(i) If any purported Transfer of shares of Capital Stock occurs which, if effective, would result in (1) any Person Beneficially Owning or Constructively Owning shares of Capital Stock in violation of Section 10.2.1(a)(i) or (ii), or (2) the Capital Stock being beneficially owned by fewer than 100 Persons (determined under the principles of Section 856(a)(5) of the Code) as described in Section 10.2.1(a)(iii);

(ii) the Transfer of that number of shares of Capital Stock (rounded up to the nearest whole share) that would effectuate an outcome described in paragraph (i) above shall be void ab initio, and the intended transferee shall acquire no rights in such shares of Capital Stock; and

(iii) such shares of Capital Stock shall be automatically transferred to a Trust for the benefit of a Charitable Beneficiary, as described in Section 10.3, effective as of the close of business on the Business Day prior to the date of such purported Transfer, and such Person shall acquire no rights in such shares;

To the extent that, upon a transfer of shares of Capital Stock pursuant to this Section 10.2.1(b), a violation of any provision of this Article 10 would nonetheless be continuing (for example where the ownership of shares of Capital Stock by a single Trust would violate the 100 stockholder requirement applicable to REITs), then shares of Capital Stock shall be transferred to that number of Trusts, each having a distinct Trustee and a Charitable Beneficiary or Beneficiaries that are distinct from those of each other Trust, such that there is no violation of any provision of this Article 10.

10.2.2 Remedies for Breach. If the Board of Directors or any duly authorized committee thereof shall at any time determine that a Transfer or other event has taken place that results in a violation of Section 10.2.1 or that a Person intends to acquire or has attempted to acquire Beneficial Ownership or Constructive Ownership of any shares of Capital Stock in violation of Section 10.2.1 (whether or not such violation is intended), the Board of Directors or such committee thereof may take such action as it deems advisable to refuse to give effect to or to prevent such Transfer or other event, including, without limitation, causing the Corporation to redeem shares, refusing to give effect to such Transfer on the books of the Corporation or instituting proceedings to enjoin such Transfer or other event; provided, however, that any Transfer or attempted Transfer or other event in violation of Section 10.2.1 shall automatically result in the transfer to the Trust described above, and, where applicable, such Transfer (or other event) shall be void ab initio as provided above irrespective of any action (or non-action) by the Board of Directors or such committee thereof.

10.2.3 Notice of Restricted Transfer. Any Person who acquires or attempts or intends to acquire Beneficial Ownership or Constructive Ownership of shares of Capital Stock that will or may violate Section 10.2.1(a) or any Person who would have owned shares of Capital Stock that resulted in a transfer to the Trust pursuant to the provisions of Section 10.2.1(b) shall immediately give written notice to the Corporation of such event or, in the case of such a proposed or attempted transaction, give at least fifteen (15) days prior written notice, and shall provide to the Corporation such other information as the Corporation may request in order to determine the effect, if any, of such Transfer on the Corporation’s qualification and taxation as a REIT.

10.2.4 Owners Required to Provide Information. From the Effective Date and prior to the Restriction Termination Date:

(a) every owner of 5% or more (or such lower percentage as required by the Code or the U.S. Treasury Department regulations promulgated thereunder) of the outstanding shares of Capital Stock, within thirty (30) days after the end of each taxable year, shall give written notice to the Corporation stating the name and address of such owner, the number of shares of each class and series of Capital Stock Beneficially Owned and a description of the manner in which such shares are held. Each such owner shall provide promptly to the Corporation in writing such additional information as the Corporation may request in order to determine the effect, if any, of such Beneficial Ownership on the Corporation’s qualification as a REIT and to ensure compliance with the Common Stock Ownership Limit, the Preferred Stock Ownership Limit and the Applicable Amount; and

4

(b) each Person who is a Beneficial Owner or Constructive Owner of Capital Stock and each Person (including the stockholder of record) who is holding Capital Stock for a Beneficial Owner or Constructive Owner shall provide to the Corporation in writing such information as the Corporation may request, in good faith, in order to determine the Corporation’s qualification and taxation as a REIT and to comply with the requirements of any taxing authority or governmental authority or to determine such compliance.

10.2.5 Remedies Not Limited. Nothing contained in this Section 10.2 shall limit the authority of the Board of Directors to take such other actions as it deems necessary or advisable to protect the Corporation and the interests of its stockholders in preserving the Corporation’s qualification as a REIT.

10.2.6 Ambiguity. In the case of an ambiguity in the application of any of the provisions of this Section 10.2, Section 10.3, or any definition contained in Section 10.1, the Board of Directors shall have the power to determine the application of the provisions of this Section 10.2 or Section 10.3 or any such definition with respect to any situation based on the facts known to it. In the event Section 10.2 or Section 10.3 requires an action by the Board of Directors and this Article 10 fails to provide specific guidance with respect to such action, the Board of Directors shall have the power to determine the action to be taken so long as such action is not contrary to the provisions of Section 10.1, Section 10.2 or Section 10.3. Absent a decision to the contrary by the Board of Directors (which the Board may make in its sole and absolute discretion), if a Person would have (but for the remedies set forth in Section 10.2.2) acquired Beneficial Ownership or Constructive Ownership of Capital Stock in violation of Section 10.2.1, such remedies (as applicable) shall apply first to the shares of Capital Stock which, but for such remedies, would have been Beneficially Owned or Constructively Owned (but not actually owned) by such Person, pro rata among the Persons who actually own such shares of Capital Stock based upon the relative number of the shares of Capital Stock held by each such Person.

10.2.7 Exceptions.

(a) Subject to Section 10.2.1(a), the Board of Directors, in its sole discretion, may exempt (prospectively or retroactively) a Person from the Applicable Amount, the Preferred Stock Ownership Limit and/or the Common Stock Ownership Limit, as the case may be, and may establish or increase an Excepted Holder Limit for such Person if:

(i) the Board of Directors obtains such representations and undertakings from such Person as are reasonably necessary to ascertain that no individual’s (as defined in Section 542(a)(2) of the Code) Beneficial Ownership or Constructive Ownership of such shares of Capital Stock will violate Section 10.2.1(a); and

(ii) such Person agrees that any violation or attempted violation of such representations or undertakings (or other action which is contrary to the restrictions contained in Sections 10.2.1 through 10.2.6) will result in such shares of Capital Stock being automatically transferred to a Trust in accordance with Section 10.2.1(b) and Section 10.3.

5

(b) Prior to granting any exception pursuant to Section 10.2.7(a), the Board of Directors may require a ruling from the Internal Revenue Service, or an opinion of counsel, in either case in form and substance satisfactory to the Board of Directors in its sole discretion, as it may deem necessary or advisable in order to determine or ensure the Corporation’s qualification as a REIT. Notwithstanding the receipt of any ruling or opinion, the Board of Directors may impose such conditions or restrictions as it deems appropriate in connection with granting such exception.

(c) Subject to Section 10.2.1(a), an underwriter which participates in a public offering or a private placement of Capital Stock (or securities convertible into or exchangeable for Capital Stock) may Beneficially Own or Constructively Own shares of Capital Stock (or securities convertible into or exchangeable for Capital Stock) in excess of the Applicable Amount, the Preferred Stock Ownership Limit, the Common Stock Ownership Limit, or all such limits, but only to the extent necessary to facilitate such public offering or private placement.

(d) The Board of Directors may only reduce the Excepted Holder Limit for an Excepted Holder: (1) with the written consent of such Excepted Holder at any time, or (2) pursuant to the terms and conditions of the agreements and undertakings entered into with such Excepted Holder in connection with the establishment of the Excepted Holder Limit for that Excepted Holder. No Excepted Holder Limit shall be reduced to a percentage that is less than the Applicable Amount, the Preferred Stock Ownership Limit and/or the Common Stock Ownership Limit, as the case may be.

10.2.8 Increase or Decrease in Aggregate Stock Ownership, Preferred Stock Ownership Limit and Common Stock Ownership Limit.

(a) Subject to Section 10.2.1(a), the Board of Directors may from time to time increase or decrease the Common Stock Ownership Limit, the Preferred Stock Ownership Limit and the Applicable Amount; provided, however, that any decreased Common Stock Ownership Limit, the Preferred Stock Ownership Limit and/or Applicable Amount will not be effective for any Person whose percentage ownership in Common Stock, Preferred Stock of any class or series or Capital Stock is in excess of such decreased Common Stock Ownership Limit, Preferred Stock Ownership Limit and/or Applicable Amount until such time as such Person’s percentage of Common Stock, Preferred Stock of any class or series or Capital Stock equals or falls below the decreased Common Stock Ownership Limit, Preferred Stock Ownership Limit and/or Applicable Amount, but any further acquisition of Common Stock, Preferred Stock of any class or series or Capital Stock in excess of such percentage ownership of Common Stock, Preferred Stock or Capital Stock will be in violation of the Common Stock Ownership Limit, Preferred Stock Ownership Limit and/or Applicable Amount.

(b) Prior to increasing or decreasing the Common Stock Ownership Limit, the Preferred Stock Ownership Limit or the Applicable Amount pursuant to Section 10.2.8(a), the Board of Directors may require such opinions of counsel, affidavits, undertakings or agreements, in any case in form and substance satisfactory to the Board of Directors in its sole discretion, as it may deem necessary or advisable in order to determine or ensure the Corporation’s qualification as a REIT.

6

10.2.9 Legend. Each certificate for shares of Capital Stock, if certificated, or any written statement of information in lieu of a certificate delivered to a holder of uncertificated shares of Capital Stock shall bear substantially the following legend (or such other legend determined by the Board of Directors):

The shares of Capital Stock (“Shares”) represented by this certificate (“Certificate”) are subject to significant ownership and transfer restrictions set forth in the Amended and Restated Articles of Incorporation of the Corporation, as amended (the “Charter”), for the purpose, among others, of the Corporation’s maintenance of its qualification as a REIT under the Internal Revenue Code. Any attempted Transfer of Shares that, if effective, would result in violation of any of the restrictions set forth in the Charter shall be void ab initio, and the intended transferee shall acquire no rights in such Shares and such Shares shall be automatically transferred to one or more Trusts for the benefit of one or more Charitable Beneficiaries and may be redeemed by the Corporation, as set forth in the Charter. Any Person who acquires or attempts or intends to acquire Beneficial Ownership or Constructive Ownership (as defined by the Charter) of Shares in excess or in violation of the limitations set forth in the Charter must immediately notify the Corporation or, in the case of such a proposed or attempted transaction, give at least fifteen (15) days prior written notice. All capitalized terms in this legend have the meanings defined in the Charter, a copy of which will be furnished upon request to the Secretary of the Corporation and without charge, unless publicly available. By taking possession of this Certificate, you are deemed to have read and have knowledge of such restrictions set forth in the Charter, all of which are incorporated by reference into this Certificate.

Instead of the foregoing legend, the certificate or written statement of information delivered in lieu of a certificate, if any, may state that the Corporation will furnish a full statement about certain restrictions on transferability to a stockholder on request and without charge, provided that the Corporation is not required to furnish such statement to a stockholder if the restrictions on transferability, and the then current Common Stock Ownership Limit, the Preferred Stock Ownership Limit and the Applicable Amount is publicly available.

Section 10.3 Transfer of Capital Stock in Trust.

10.3.1 Ownership in Trust. Upon any purported Transfer or other event described in Section 10.2.1(b) that would result in a transfer of shares of Capital Stock to a Trust, such shares of Capital Stock shall be deemed to have been transferred to the Trustee as trustee of a Trust for the exclusive benefit of one or more Charitable Beneficiaries. Such transfer to the Trustee shall be effective as of the close of business on the Business Day prior to the purported Transfer or other event that results in the transfer to the Trust pursuant to Section 10.2.1(b). The Trustee shall be appointed by the Corporation and shall be a Person unaffiliated with the Corporation and any Prohibited Owner. Each Charitable Beneficiary shall be designated by the Corporation as provided in Section 10.3.6.

10.3.2 Status of Shares Held by the Trustee. Shares of Capital Stock held by the Trustee shall be issued and outstanding shares of Capital Stock. The Prohibited Owner shall have no rights in the shares held by the Trustee. The Prohibited Owner shall not benefit economically from ownership of any shares held in trust by the Trustee, shall have no rights to dividends or other distributions and shall not possess any rights to vote or other rights attributable to the shares held in the Trust.

7

10.3.3 Dividend and Voting Rights. The Trustee shall have all voting rights and rights to dividends or other distributions with respect to shares of Capital Stock held in the Trust, which rights shall be exercised for the exclusive benefit of the Charitable Beneficiary. Any dividend or other distribution paid prior to the discovery by the Corporation that the shares of Capital Stock have been transferred to the Trustee shall be paid by the recipient of such dividend or distribution to the Trustee upon demand and any dividend or other distribution authorized but unpaid shall be paid when due to the Trustee. Any dividend or other distribution so paid to the Trustee shall be held in trust for the Charitable Beneficiary. The Prohibited Owner shall have no voting rights with respect to shares held in the Trust and, subject to Nevada law, effective as of the date that the shares of Capital Stock have been transferred to the Trust, the Trustee shall have the authority (at the Trustee’s sole discretion) (i) to rescind as void any vote cast by a Prohibited Owner prior to the discovery by the Corporation that the shares of Capital Stock have been transferred to the Trustee and (ii) to recast such vote in accordance with the desires of the Trustee acting for the benefit of the Charitable Beneficiary; provided, however, that if the Corporation has already taken irreversible corporate action, then the Trustee shall not have the authority to rescind and recast such vote. Notwithstanding the provisions of this Article 10, until the Corporation has received notification that shares of Capital Stock have been transferred into a Trust, the Corporation shall be entitled to rely on its share transfer and other stockholder records for purposes of preparing lists of stockholders entitled to vote at meetings, determining the validity and authority of proxies and otherwise conducting votes of stockholders.

10.3.4 Sale of Shares by Trustee. Within twenty (20) days of receiving notice from the Corporation that shares of Capital Stock have been transferred to the Trust, the Trustee of the Trust shall sell the shares held in the Trust to a person, designated by the Trustee, whose ownership of the shares will not violate the ownership limitations set forth in Section 10.2.1(a). Upon such sale, the interest of the Charitable Beneficiary in the shares sold shall terminate and the Trustee shall distribute the net proceeds of the sale to the Prohibited Owner and to the Charitable Beneficiary as provided in this Section 10.3.4. The Prohibited Owner shall receive the lesser of (1) the price per share in the transaction that resulted in the transfer of shares to the trust (or, in the event of a gift, devise or other such transaction, the last sales price reported on the applicable stock market or exchange on the day of the transfer or other event that resulted in the transfer of such shares to the trust) and (2) the Market Price on the date that the Trustee, or its designee, accepts such offer. The Trustee shall reduce the amount payable to the Prohibited Owner by the amount of dividends and other distributions which have been paid to the Prohibited Owner and are owed by the Prohibited Owner to the Trustee pursuant to Section 10.3.3. Any net sales proceeds in excess of the amount payable to the Prohibited Owner shall be immediately paid to the Charitable Beneficiary, together with any other amounts held by the Trustee for the Charitable Beneficiary. If, prior to the discovery by the Corporation that shares of Capital Stock have been transferred to the Trustee, such shares are sold by a Prohibited Owner, then (i) such shares shall be deemed to have been sold on behalf of the Trust and (ii) to the extent that the Prohibited Owner received an amount for such shares that exceeds the amount that such Prohibited Owner was entitled to receive pursuant to this Section 10.3.4, such excess shall be paid to the Trustee upon demand.

10.3.5 Purchase Right in Stock Transferred to the Trustee. Shares of Capital Stock transferred to the Trustee shall be deemed to have been offered for sale to the Corporation, or its designee, at a price per share equal to the lesser of (i) the price per share in the transaction that resulted in such Transfer to the Trust (or, if the event that resulted in the Transfer to the Trust did not involve a purchase of such shares at Market Price, the Market Price of such shares on the day of the event that resulted in the Transfer of such shares to the Trust) and (ii) the Market Price on the date the Corporation, or its designee, accepts such offer. The Corporation shall reduce the amount payable to the Trustee by the amount of dividends and other distributions which has been paid to the Prohibited Owner and is owed by the Prohibited Owner to the Trustee pursuant to Section 10.3.3 and may pay the amount of such reduction to the Trustee for the benefit of the Charitable Beneficiary. The Corporation shall have the right to accept such offer until the Trustee has sold the shares held in the Trust pursuant to Section 10.3.4. Upon such a sale to the Corporation, the interest of the Charitable Beneficiary in the shares sold shall terminate and the Trustee shall distribute the net proceeds of the sale to the Prohibited Owner and any dividends or other distributions held by the Trustee with respect to such shares shall be paid to the Charitable Beneficiary.

8

10.3.6 Designation of Charitable Beneficiaries. By written notice to the Trustee, the Corporation shall designate one or more nonprofit organizations to be the Charitable Beneficiary of the interest in the Trust such that the shares of Capital Stock held in the Trust would not violate the restrictions set forth in Section 10.2.1(a) in the hands of such Charitable Beneficiary. Neither the failure of the Corporation to make such designation nor the failure of the Corporation to appoint the Trustee before the automatic transfer provided in Section 10.2.1(b) shall make such transfer ineffective, provided that the Corporation thereafter makes such designation and appointment.

Section 10.4 Enforcement. The Corporation is authorized specifically to seek equitable relief, including injunctive relief, to enforce the provisions of this Article 10.

Section 10.5 Non-Waiver. No delay or failure on the part of the Corporation or the Board of Directors in exercising any right hereunder shall operate as a waiver of any right of the Corporation or the Board of Directors, as the case may be, except to the extent specifically waived in writing.

Section 10.6 Severability. If any provision of this Article 10 or any application of any such provision is determined to be invalid by any federal or state court having jurisdiction over the issues, the validity of the remaining provisions shall not be affected and other applications of such provisions shall be affected only to the extent necessary to comply with the determination of such court.

9