UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14c of the

Securities Exchange Act of 1934

(Amendment No. 1)

| Check the appropriate box: | |

| ☒ | Preliminary Information Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☐ | Definitive Information Statement |

FC Global Realty Incorporated

(Name of Registrant as Specified In Its Charter)

| Payment of Filing Fee (Check the appropriate box): | ||

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies:

| |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

FC GLOBAL REATY INCORPORATED

15150 North Hayden Road, Suite 235

Scottsdale, Arizona 85260

Notice of Action Taken Pursuant to Written Consent of Stockholders

Dear Stockholder:

The accompanying Information Statement is furnished to holders of shares of Common Stock of FC Global Realty Incorporated (“our company”,” “our,” “we” or “us”) pursuant to Section 14 of the Securities Exchange Act of 1934, as amended, and Regulation 14C and Schedule 14C thereunder, in connection with an approval by written consent of the holders of our voting shares.

The purpose of this Notice and Information Statement is to notify our stockholders that, on May 15, 2019, we received written consents from stockholders to approve an amendment to our amended and restated articles of incorporation to, among other things (i) change the name of our company to “Gadsden Properties, Inc.”; (ii) increase the number of authorized shares of our Common Stock from 500,000,000 shares to 5,000,000,000 shares; and (iii) add certain provisions restricting ownership and transfer of shares to comply with requirements under the Internal Revenue Code for real estate investment trusts (the “Charter Amendment”).

Our board of directors approved the Charter Amendment and recommended that our stockholders approve it as well. In connection with the adoption of the Charter Amendment, our board of directors elected to seek the written consent of the holders of our outstanding voting shares in order to reduce associated costs and implement the Charter Amendment in a timely manner.

This Notice and the accompanying Information Statement are being furnished to you to inform you that the Charter Amendment has been approved by stockholders. The board of directors is not soliciting your proxy in connection with the Charter Amendment and proxies are not requested from stockholders.

The Charter Amendment will become effective upon filing with the Nevada Secretary of State’s Office, which will occur promptly following the 20th day after this Information Statement is first mailed to our stockholders. You are urged to read the Information Statement in its entirety for a description of the Charter Amendment.

| BY ORDER OF THE BOARD OF DIRECTORS, | |

| /s/ Michele Pupach | |

| Michele Pupach | |

| Secretary |

[ ], 2019

THE ACCOMPANYING INFORMATION STATEMENT IS BEING MAILED

TO STOCKHOLDERS ON OR ABOUT [ ], 2019

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

FC GLOBAL REATY INCORPORATED

15150 North Hayden Road, Suite 235

Scottsdale, Arizona 85260

INFORMATION STATEMENT

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS

IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is first being mailed on or about [ ], 2019 to the holders of record of the outstanding Common Stock, $0.01 par value per share (the “Common Stock”), of FC Global Realty Incorporated, a Nevada corporation (“we,” “us,” “our” or “our company”), as of the close of business on May 15, 2019 (the “Record Date”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). This Information Statement relates to a written consent in lieu of a meeting, dated May 15, 2019 (the “Written Consent”), of stockholders owning as of the Record Date (i) at least a majority of the outstanding shares of our Common Stock; (ii) all of the outstanding shares of our 7% Series A Cumulative Convertible Perpetual Preferred Stock, $0.01 par value per share (the “Series A Preferred Stock”), Series B Non-Voting Convertible Preferred Stock, $0.01 par value per share (the “Series B Preferred Stock”), and 10% Series C Cumulative Convertible Preferred Stock, $0.01 par value per share (the “Series C Preferred Stock”); and (iii) at least a majority of the shares of our outstanding Common Stock, Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock, voting together as a single class.

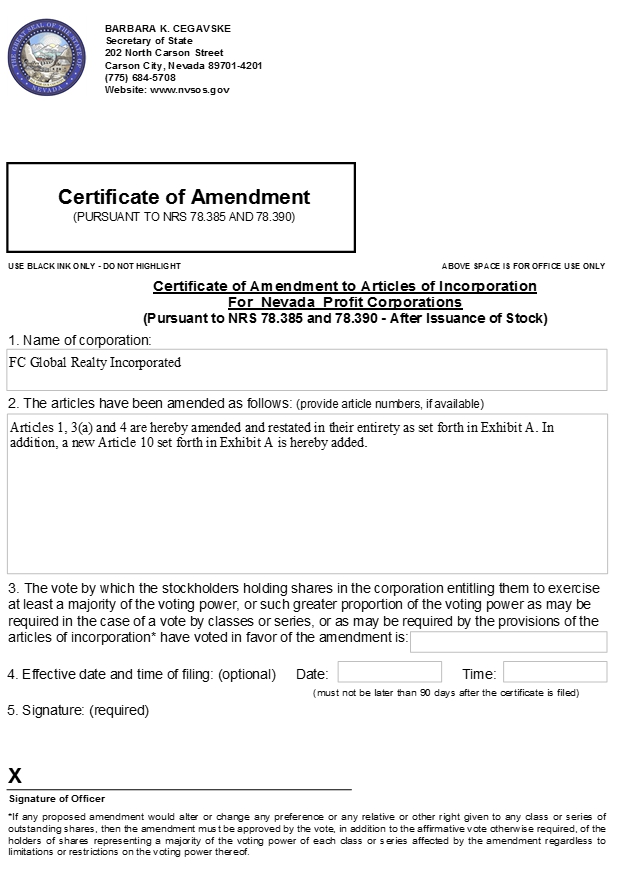

The Written Consent authorized and approved an amendment to our current amended and restated articles of incorporation (the “Current Charter”) to, among other things (i) change the name of our company to “Gadsden Properties, Inc.”; (ii) increase the number of authorized shares of our Common Stock from 500,000,000 shares to 5,000,000,000 shares; and (iii) add certain provisions restricting the ownership and transfer of shares to comply with requirements under the Internal Revenue Code for real estate investment trusts (the “Charter Amendment”). A copy of the Charter Amendment is attached to this Information Statement as Appendix A.

The Written Consent is sufficient under the Nevada Revised Statutes, the Current Charter and our amended and restated bylaws to approve the Charter Amendment. Accordingly, the Charter Amendment will not be submitted to the other stockholders of our company for a vote, and this Information Statement is being furnished to such other stockholders to provide them with certain information concerning the Written Consent in accordance with the requirements of the Exchange Act, and the regulations promulgated under the Exchange Act, including Regulation 14C.

We will, when permissible following the expiration of the 20-day period mandated by Rule 14c of the Exchange Act and the provisions of the Nevada Revised Statutes, file the Charter Amendment with the Nevada Secretary of State’s Office. The Charter Amendment will become effective upon such filing.

AUTHORIZATION BY THE BOARD OF DIRECTORS

AND THE MAJORITY STOCKHOLDERS

On May 15, 2019, our board of directors unanimously adopted resolutions approving the Charter Amendment and recommended that our stockholders approve it. In connection with the adoption of these resolutions, our board of directors elected to seek the written consent of stockholders in order to reduce associated costs and implement the Charter Amendment in a timely manner. On May 15, 2019, our stockholders Gadsden Growth Properties, Inc. (“Gadsden”) and FHDC Group, LLC (“FHDC” and together with Gadsden, the “Majority Stockholders”) executed and delivered the Written Consent to us.

Pursuant to our amended and restated bylaws, any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

-1-

Pursuant to the Nevada Revised Statutes, the Current Charter and our amended and restated bylaws, approval of the Charter Amendment at a meeting would require the affirmative vote of at least: (i) a majority of the total number of shares of our outstanding Common Stock; (ii) a majority of the total number of shares of our outstanding Series A Preferred Stock, voting as a separate class; (iii) a majority of the total number of shares of our outstanding Series B Preferred Stock, voting as a separate class; (iv) two-thirds of the total number of shares of our outstanding Series C Preferred Stock, voting as a separate class; and (v) a majority of the total number of shares of our outstanding Common Stock, Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock, voting together as a single class.

Holders of shares of Common Stock are entitled to one (1) vote per share. As of the Record Date, there were 389,104,820 shares of Common Stock issued and outstanding, of which Gadsden held 229,101,205 shares, or approximately 58.88%, and FHDC held 132,667,366 shares, or approximately 34.10%. Holders of shares of Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock were entitled to vote with respect to the Charter Amendment on an as-converted to Common Stock basis. As of the Record Date, we had issued and outstanding 889,075 shares of Series A Preferred Stock, all of which were held by Gadsden, 6,264,993 shares of Series B Preferred Stock, all of which were held by Gadsden, and 2,498,682 shares of Series C Preferred Stock, of which FHDC held 2,000,000 shares and Gadsden held 498,682.

Accordingly, we have obtained all necessary corporate approvals in connection with the Charter Amendment. We are not seeking written consent from any other stockholder, and other stockholders will not be given an opportunity to vote with respect to the actions described in this Information Statement. All necessary corporate approvals have been obtained. This Information Statement is furnished solely for the purposes of advising stockholders of the action taken by Written Consent and giving stockholders notice of such actions taken as required by the Exchange Act.

As the action taken by the Majority Stockholders was by written consent, there will be no security holders’ meeting and representatives of the principal accountants for the current year and for the most recently completed fiscal year will not have the opportunity to make a statement if they desire to do so and will not be available to respond to appropriate questions from our stockholders.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding beneficial ownership of our voting stock as of the Record Date by (i) each of our officers and directors; (ii) all of our officers and directors as a group; and (iii) each person who is known by us to beneficially own more than 5% of our voting stock. Unless otherwise specified, the address of each of the persons set forth below is in care of our company, 15150 North Hayden Road, Suite 235, Scottsdale, AZ 85260.

| Amount of Beneficial Ownership(1) | Percent | Percent of | Percent of | Percent of | ||||||||||||||||||||||||

| Name and Address of Beneficial Owner | Common Stock | Series A Preferred Stock | Series C Preferred Stock |

of Common Stock(2) |

Series A Preferred Stock(3) | Series C Preferred Stock(4) | Total Voting Stock(5) | |||||||||||||||||||||

| John Hartman, CEO and Director | 0 | 0 | 0 | * | * | * | * | |||||||||||||||||||||

| George Bell, COO | 0 | 0 | 0 | * | * | * | * | |||||||||||||||||||||

| Scott Crist, CFO | 0 | 0 | 0 | * | * | * | * | |||||||||||||||||||||

| Brian Ringel, Corporate Controller | 0 | 0 | 0 | * | * | * | * | |||||||||||||||||||||

| Douglas A. Funke, Director | 0 | 0 | 0 | * | * | * | * | |||||||||||||||||||||

| Dennis M. McGrath, Director (6) | 1,370,752 | 0 | 0 | * | * | * | * | |||||||||||||||||||||

| B.J. Parrish, Director | 0 | 0 | 0 | * | * | * | * | |||||||||||||||||||||

| Kristen E. Pigman, Director (7) | 13,841,684 | 0 | 0 | 3.56 | % | * | * | * | ||||||||||||||||||||

| Dolev Rafaeli, Director (8) | 4,390,409 | 0 | 0 | 1.13 | % | * | * | * | ||||||||||||||||||||

| James Walesa, Director | 0 | 0 | 0 | * | * | * | * | |||||||||||||||||||||

| All directors and officers as a group (10 persons named above) | 19,602,845 | 0 | 0 | 5.04 | % | * | * | 1.34 | % | |||||||||||||||||||

| Gadsden Growth Properties, Inc. (9) | 229,101,205 | 889,075 | 498,682 | 58.88 | % | 100.00 | % | 19.96 | % | 54.77 | % | |||||||||||||||||

| FHDC Group, LLC (10) | 132,667,366 | 0 | 2,000,000 | 34.10 | % | 80.04 | % | 43.36 | % | |||||||||||||||||||

| * | Less than 1% |

| (1) | Beneficial Ownership is determined in accordance with the rules of the Securities and Exchange Commission (the “SEC”) and generally includes voting or investment power with respect to securities. Except as set forth below, each of the beneficial owners listed above has direct ownership of and sole voting power and investment power with respect to the shares of its stock. For each beneficial owner above, any options exercisable within 60 days have been included in the denominator. |

-2-

| (2) | Based on 389,104,820 shares of Common Stock outstanding as of the Record Date. |

| (3) | Based on 889,075 shares of Series A Preferred Stock outstanding as of the Record Date. Each share of Series A Preferred Stock is, upon the occurrence of certain events, convertible into an estimated 501 shares of Common Stock, with the exact number of shares to be equal to $25 divided by the VWAP per share of Common Stock during the twenty (20) consecutive trading days prior to the applicable conversion date. VWAP is defined, generally, as the volume weighted average price for Common Stock on the applicable trading market, subject to a minimum of $0.0499. Holders of Series A Preferred Stock vote with the holders of Common Stock on all matters on an as-converted to Common Stock basis. |

| (4) | Based on 2,498,682 shares of Series C Preferred Stock outstanding as of the Record Date. Each share of Series C Preferred Stock is, upon the occurrence of certain events, convertible into an estimated 250 shares of Common Stock, with the exact number of shares to be equal to $10 divided by 80% of the VWAP per share of Common Stock during the twenty (20) consecutive trading days prior to the applicable conversion date. VWAP is defined, generally, as the volume weighted average price for Common Stock on the applicable trading market, subject to a minimum of $0.05. Holders of Series C Preferred Stock vote with the holders of Common Stock on all matters on an as-converted to Common Stock basis. |

| (5) | Percentage of Total Voting Stock represents total ownership with respect to all shares of Common Stock, Series A Preferred Stock and Series C Preferred Stock, as a single class and on an as-converted to Common Stock basis. |

| (6) | Includes 1,331,862 shares of Common Stock and vested options to purchase 38,890 shares of Common Stock. |

| (7) | Represents shares held by Opportunity Fund I-SS, LLC. Kristen Pigman is the Director of OP Fund I Manager, LLC, which is the member and manager of Opportunity Fund I-SS, LLC, and has voting and dispositive power over the securities held by it. Mr. Pigman disclaims beneficial ownership of such securities except to the extent of his pecuniary in such securities, if any. |

| (8) | Includes 4,352,909 shares of Common Stock and vested options to purchase 37,500 shares of Common Stock. |

| (9) | We have been informed that the investment committee of the board of directors of Gadsden Growth Properties, Inc. has voting and investment control over the securities held by it, subject to the continuing oversight of its board of directors. We have been informed that the members of the investment committee are John Hartman (Chair), Kristen E. Pigman and James Walesa. The address of Gadsden Growth Properties, Inc. is 15150 N. Hayden Road, Suite 220, Scottsdale, Arizona 85260. |

| (10) | Jae Rye is the Managing Member of FHDC Group, LLC and has voting and dispositive power over the securities held by it. Mr. Rue disclaims beneficial ownership of such securities except to the extent of his pecuniary in such securities, if any. The address of FHDC Group, LLC is 2051 Junction Avenue, Suite 230, San Jose, California 95131. |

We do not currently have any arrangements which if consummated may result in a change of control of our company.

CHANGES IN CONTROL

On March 13, 2019, we entered into a Stock Purchase Agreement with Gadsden pursuant to which Gadsden agreed to transfer and assign to us all of its general partnership interests and Class A limited partnership interests in Gadsden Growth Properties, L.P., a Delaware limited partnership, the operating partnership of Gadsden that held all of its assets and liabilities, in exchange for shares of Common Stock, Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock. The parties amended the Stock Purchase Agreement on April 5, 2019 and May 2, 2019 (as amended, the “Purchase Agreement”).

On April 5, 2019, closing of the Purchase Agreement was completed. Pursuant to the Purchase Agreement, we issued to Gadsden 430,306,645 shares of Common Stock, 889,075 shares of Series A Preferred Stock, 11,696,944 shares of Series B Preferred Stock and 2,498,682 shares of Series C Preferred Stock. An additional 278,178,750 shares of Common Stock (the “Holdback Shares”) were to be issued to Gadsden upon filing of an amendment to our amended and restated articles of incorporation to increase our authorized Common Stock (the “Charter Amendment Date”). The Holdback Shares are subject to forfeiture based on the reconciliation and adjustment of the net asset value of Gadsden’s assets and its proposed real estate investments that have not closed as of the closing date of the Purchase Agreement (the “Scheduled Investments”) as described below.

-3-

On May 2, 2019, the parties amended the Purchase Agreement to (i) decrease the number of shares of Common Stock and Holdback Shares issued to Gadsden, and increase the number of shares of Series B Preferred Stock issued, as the result of an error in the original calculation of the shares to be issued; (ii) provide for the issuance of the Holdback Shares on the closing date, rather than the Charter Amendment Date; and (iii) provide for the issuance of certain of the shares of the Series B Preferred Stock and Series C Preferred Stock to FHDC in exchange for the equivalent number of shares of Gadsden held by it.

Specifically, such amendment provided that we issue the following securities as consideration under the Purchase Agreement: (i) to Gadsden, 229,101,205 shares of Common Stock, of which 110,477,220 shares are designed as Holdback Shares and will be held by Gadsden in a segregated account (the “Gadsden Specified Account”), which shall be subject to release in accordance with the terms of the Purchase Agreement, and 118,623,985 shares will not be subject to the Gadsden Specified Account; (ii) to Gadsden, 889,075 shares of Series A Preferred Stock; (iii) to Gadsden, 6,264,993 shares of Series B Preferred Stock; (iv) to Gadsden, 498,682 shares of Series C Preferred Stock; (v) to FHDC, 5,432,000 shares of Series B Preferred Stock, subject to entry into the Exchange Agreement (as defined below); and to FHDC, 2,000,000 shares of Series C Preferred Stock (together with the 5,432,000 shares of Series B Preferred Stock referred to above, the “FHDC Shares”), subject to entry into the Exchange Agreement.

On May 2, 2019, we entered into a Cancellation and Exchange Agreement (the “Exchange Agreement”) with Gadsden and FHDC, pursuant to which FHDC agreed to cancel (i) 5,432,000 shares of its Series B Non-Voting Convertible Preferred Stock and (ii) 2,000,000 shares of its 10% Series C Cumulative Convertible Preferred Stock of Gadsden held by it in exchange for the FHDC Shares.

In order to effect the forgoing, on May 2, 2019, we cancelled 201,205,440 shares of Common Stock issued to Gadsden and Gadsden placed a number of its remaining shares equal to the Holdback Shares into the Gadsden Specified Account. In addition, in accordance with the terms of the Exchange Agreement, we cancelled 5,432,000 shares of Series B Preferred Stock and 2,000,000 shares of Series C Preferred Stock issued to Gadsden and issued such shares to FHDC. On May 6, 2019, we also issued an additional 49 shares of Series B Preferred Stock to Gadsden.

On May 12, 2019, FHDC converted its 5,432,000 shares of Series B Preferred Stock into 132,667,366 shares of Common Stock.

The number of shares issued under the Purchase Agreement is based upon an estimated net asset value of Gadsden of $211,573,000 (the “Contract NAV”). The Contract NAV includes Gadsden’s assets and all of its Scheduled Investments. The Purchase Agreement provides for a reconciliation and adjustment of the final net asset value of Gadsden as described below.

If the Contract NAV is more than Gadsden’s final net asset value, then the difference (the “Shortfall”) will be settled by the transfer of shares of Common Stock, at a value equal to 3.771023733 shares of Common Stock for each $1.00 of Shortfall if the final net asst value is $80 million or more (and 2.860407207 for each $1.00 of Shortfall to the extent that the final net asst value is less $80 million). The Shortfall will first be paid by transfer of Holdback Shares by Gadsden to our company and such transferred shares will be cancelled. If the amount of the Shortfall is more than the value of the Holdback Shares, then we will issue more shares of Common Stock to our stockholders of record as of the closing date.

Gadsden’s final net asset value will be determined as the fair value of the each of its assets on the closing date and the Scheduled Investments acquired on or prior to May 20, 2019. Such fair value will be determined in accordance with the following:

| ● | in accordance with United States generally accepted accounting principles, and shall be derived from our annual report on Form 10-K for either of the fiscal years ended December 31, 2019 or December 31, 2020 with Gadsden having the option to choose which such fiscal year to utilize; |

| ● | as of the date of an appraisal from a licensed appraiser with knowledge of the applicable market that need not be a national firm; or |

| ● | if an asset is sold or otherwise disposed of by Gadsden in consideration for cash, the gross cash proceeds from the sale minus any indebtedness or other liabilities relating to the asset being sold or otherwise disposed of that were not assumed by the purchaser and that remain indebtedness or other liabilities of our company following the sale or other disposition. |

-4-

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following management’s discussion and analysis should be read in conjunction with our financial statements and the notes thereto attached as Appendix B to this Information Statement.

Our Company

Our company, founded in 1980, has transitioned from its former business as a skin health company to a company focused on real estate development and asset management, concentrating primarily on investments in, and the management and development of, income producing real estate assets.

Until the sale of our consumer products division, we were a global skin health company providing integrated disease management and aesthetic solutions to dermatologists, professional aestheticians and consumers. Starting in 2014, we began to sell off certain business units and product lines and on January 23, 2017, we sold the last then remaining major product line. Following this transaction, we had only minimal operations and assets remaining of immaterial value to our company. In 2018, we sold certain of those assets, remaining inventory and assets of this business line, and now no longer operate within the skin health business.

Our focus is now to build our company into a leading real estate, asset management and development company concentrating primarily on investments in high yield income producing assets and other opportunistic commercial properties via direct property ownership and asset management. Our objective is to generate long-term net asset value growth while adhering to institutional best practices and a deep research process for all investments.

For income producing properties, we intend to acquire assets that provide recurring income with the potential for income growth over the long-term. We believe there can be an attractive risk/reward profile to such properties based on the location and the underlying creditworthiness of the tenants. We intend to use such income generation to fund additional acquisitions and development opportunities and for general corporate purposes. In addition, we intend to invest in land assets that can be developed into income generating properties or properties for sale. We believe that our size and scale provide an opportunity to take advantage of smaller-tier assets that most traditional investors do not focus on due to size limitations, thus creating unique investment opportunities. In particular, we intend to target assets in secondary and tertiary markets that require minimal capital expenditures but generate initial unlevered cash flow yields that are higher than those in primary markets.

A second component of our investment strategy will revolve around sourcing asset management opportunities for which we would operate as an asset manager of real estate properties. We are not structured as a Real Estate Investment Trust, or REIT, thus we have the ability to retain earnings and to operate in real estate asset management, development and peripheral real estate activities, items that may be limited by REIT requirements. We will look to utilize our existing infrastructure to provide economies of scale to owners of real estate assets as we grow our portfolio over time.

Existing Portfolio

As of March 31, 2019, our real estate portfolio consisted of the following properties.

In 2017, we acquired (i) three vacant land sites intended for development as gas stations in northern California, (ii) a majority membership interest in a limited liability company that owns a vacant land site located in Northern California, and (iii) an interest in a limited liability company which owns property located in Los Lunas, New Mexico being developed as a single family residential development. As discussed below, we have entered into contracts to sell two of these vacant land sites.

In 2018, our subsidiary, RETPROP I, LLC, completed the acquisition of a 7,738 square foot medical office building in Dayton, Ohio. The building’s former owner, and current tenant, a medical practice, has entered into a lease with us to continue its occupancy through April 2022, with the option to renew that lease for two additional five-year terms.

On January 14, 2019, we acquired, from Gadsden, a preferred interest in Gadsden Roseville, LLC, which is the sole owner of a parcel located on Roseville Road in Sacramento, California, for a cash payment of $350,000. The Roseville parcel is an approximately 9.6 acres parcel that is titled for the development of approximately 65 small lot single family detached homes.

-5-

Recent Developments

On May 2, 2019, we entered into a definitive sales contract with an independent third party for a land parcel located at 1039 Atwater Blvd, Atwater, CA 95301 (the “1039 Atwater Property”). The 1039 Atwater Property is comprised of 0.89 acres zoned Central Commercial, permitting a wide variety of commercial uses. The contracted sales price is $430,000 cash, net of delinquent property taxes, customary sales commissions and closing costs. The 1039 Atwater property is in escrow and scheduled to close on July 10, 2019. The carrying value of the 1039 Atwater Property was $430,000 as of March 31, 2019, and is included in Investment Properties, net, in the accompanying condensed consolidated balance sheet.

On April 29, 2019, we entered into a definitive sales contract with an independent third party for a land parcel located at 715 Atwater Blvd, Atwater, CA 95301 (the “715 Atwater Property”). The 715 Atwater Property is comprised of 0.45 acres zoned RT permitting both commercial and residential uses. The contracted sales price is $225,000 cash, net of delinquent property taxes, customary sales commissions and closing costs. The 715 Atwater property is in escrow and scheduled to close on July 15, 2019. The carrying value of the 715 Atwater Property was $230,000 as of March 31, 2019, and is included in Investment Properties, net, in the accompanying condensed consolidated balance sheet.

Please also see “Changes in Control” above for a description of the Purchase Agreement with Gadsden.

Results of Operations

Comparison of Three Months Ended March 31, 2019 and 2018

The following table sets forth key components of our results of operations during the three months ended March 31, 2019 and 2018.

(all dollar amounts in thousands)

| Three Months Ended March 31, | ||||||||

| 2019 | 2018 | |||||||

| Rental income | $ | 15 | $ | — | ||||

| Depreciation expense | (1 | ) | — | |||||

| Operating expenses: | ||||||||

| General and administrative | 592 | 1,210 | ||||||

| Operating loss | (578 | ) | (1,210 | ) | ||||

| Revaluation of option to purchase redeemable convertible preferred stock | — | (273 | ) | |||||

| Interest and other financing expense, net | (71 | ) | (34 | ) | ||||

| Equity in earnings of equity method investments | 11 | — | ||||||

| Loss from continuing operations | (638 | ) | (1,517 | ) | ||||

| Loss from discontinued operations | — | (133 | ) | |||||

| Net loss including portion attributable to non-controlling interest | (638 | ) | (1,650 | ) | ||||

| Loss attributable to non-controlling interest | 2 | 1 | ||||||

| Net loss | (636 | ) | (1,649 | ) | ||||

| Dividend on redeemable convertible preferred stock | — | (79 | ) | |||||

| Accretion of redeemable convertible preferred stock to redemption value | — | (1,968 | ) | |||||

| Net loss attributable to common stockholders and participating securities | $ | (636 | ) | $ | (3,696 | ) | ||

Rental income. For the three months ended March 31, 2019, rental income was $15 thousand compared to $0 in the three months ended March 31, 2018. The increase was due to the acquisition of a rental income producing property in April 2018.

General and administrative expenses. For the three months ended March 31, 2019, general and administrative expenses were approximately $0.59 million and are mainly comprised of payroll and related expenses, professional service, rent and other operating expenses. For the three months ended March 31, 2018, general and administrative expenses were approximately $1.2 million.

Revaluation of option to purchase redeemable convertible preferred stock. For the three months ended March 31, 2018, the revaluation of the option to purchase redeemable convertible preferred stock decreased by approximately $0.27 million due to the decrease in the conversion rate of the underlying redeemable convertible preferred stock, which caused the fair value of the instrument to decrease.

-6-

Interest and other financing expense, net. Net interest and other financing expense related to our notes payable and currency conversion differences for the three months ended March 31, 2019 was approximately $71 thousand. Net interest and other financing expense related to our notes payable and currency conversion differences for the three months ended March 31, 2018 was approximately $34 thousand.

Loss from discontinued operations. For the three months ended March 31, 2018, we recognized a loss of approximately $0.13 million related to the discontinued operations as a result of the sale of residual inventory to third parties, offset in part by historical tax assessments and adjustments.

Net loss. The factors discussed above resulted in net loss, including discontinued operations, of approximately $0.64 million for the three months ended March 31, 2019, as compared to net loss of approximately $3.70 million for the three months ended March 31, 2018.

Comparison of Years Ended December 31, 2018 and 2017

The following table sets forth key components of our results of operations during the years ended December 31, 2018 and 2017.

(All dollar amounts in thousands)

Year Ended December 31, | ||||||||

| 2018 | 2017 | |||||||

| Rental income, net | $ | 41 | $ | — | ||||

| Depreciation expense | (5 | ) | — | |||||

| Operating expenses: | ||||||||

| General and administrative | 3,900 | 10,817 | ||||||

| Impairment of investment properties | 326 | — | ||||||

| Impairment of investment in other company | 1,455 | 1,439 | ||||||

| Operating loss | (5,645 | ) | (12,256 | ) | ||||

| Revaluation of option to purchase redeemable convertible preferred stock | 3,288 | (3,018 | ) | |||||

| Extinguishment of option to purchase redeemable convertible preferred stock | 440 | — | ||||||

| Revaluation of asset contribution related financial instruments, net | — | (1,392 | ) | |||||

| Interest and other financing income (expense), net | 3 | (267 | ) | |||||

| Income tax provision | — | — | ||||||

| Loss from continuing operations | (1,914 | ) | (16,933 | ) | ||||

| Loss from discontinued operations | (172 | ) | (2,459 | ) | ||||

| Net loss including portion attributable to non-controlling interest | (2,086 | ) | (19,392 | ) | ||||

| Loss attributable to non-controlling interest | 42 | 8 | ||||||

| Net loss | (2,044 | ) | (19,384 | ) | ||||

| Dividend on redeemable convertible preferred stock | (177 | ) | — | |||||

| Deemed dividend related to the Remediation Agreement | (446 | ) | — | |||||

| Accretion of redeemable convertible preferred stock to redemption value | (2,001 | ) | — | |||||

| Net loss attributable to common stockholders | $ | (4,668 | ) | $ | (19,384 | ) | ||

Rental income. For the year ended December 31, 2018, rental income was $41 thousand compared to $0 in the year ended December 31, 2017. The increase was due to the acquisition of a rental income producing property in April 2018.

General and administrative expenses. Our general and administrative expenses are mainly comprised of payroll and related expenses, professional service, rent and other operating expenses. For the year ended December 31, 2018, general and administrative expenses were approximately $3.9 million, as compared to approximately $10.8 million for the year ended December 31, 2017. The decrease was due to the sale of the last remaining global skin health product lines in January 2017.

Impairment of investment properties. We periodically evaluate our long-lived assets, including investment properties, for indicators of impairment in accordance with ASC 360, “Property, Plant, and Equipment”, whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The judgments regarding the existence of indicators of impairment are based on the operating performance, market conditions, as well as our ability to hold and our intent with regard to each property. During the year ended December 31, 2018, based on management’s most recent analyses, impairment losses have been identified related to our investment properties amounting to $326 thousand.

-7-

Impairment of investment in other company. We evaluate investments in other company for impairment whenever events or changes in circumstances indicate that the carrying amount of an investment may not be recoverable in accordance with ASC 320 “Investments - Debt and Equity Securities.” The judgments regarding declines in value are based on operating performance, market conditions and our ability and intent to hold as well as our ability to influence significant decisions of the venture. During the year ended December 31, 2017, based on management’s then most recent analyses, prepared based on the property management’s ability to execute full development of the property, an impairment loss had been identified related to our investment in other company amounting to $1.4 million. In early 2019, we evaluated the other company’s draft 2018 financial statements, had discussions with the property manager (and majority shareholder) regarding the property’s development status and lack of potential funding for the continued development of the project. Based on these discussions and our inability to influence any decisions made on the project’s development, we had an updated analysis completed, by a third-party appraiser, to the current fair value of the investment. As a result, an impairment loss was identified related to our investment in other company of approximately $1.5 million.

Revaluation of option to purchase redeemable convertible preferred stock. For the year ended December 31, 2018, the revaluation of the option to purchase redeemable convertible preferred stock decreased by approximately $3.3 million due to the decrease in the share closing price of the underlying redeemable convertible preferred stock, which caused the fair value of the instrument to decrease. For the year ended December 31, 2017, the revaluation of the option to purchase redeemable convertible preferred stock increased to approximately $3.0 million due to excess of the initial value of the option liability over the proceeds received, net with the changes in the fair value of the Option at December 31, 2017.

Extinguishment of option to purchase redeemable convertible preferred stock. For the year ended December 31, 2018, we recorded an extinguishment of the option to purchase redeemable convertible preferred stock of $0.44 million due to the cancellation of the redeemable convertible preferred stock as of September 24, 2018.

Revaluation of asset contribution related financial instruments, net. For the year ended December 31, 2017, we recorded a revaluation of asset contribution was approximately $1.39 million due to the re-measurement of the asset contribution that resulted in a loss due to the reduced fair value of the asset contribution related to the financial instruments.

Interest and other financing income (expense), net. Net interest and other financing income of $3 thousand for the year ended December 31, 2018 related to notes payable which was offset by currency conversion income in Israel. For the year ended December 31, 2017 net interest and other financing expense was approximately $0.27 million.

Loss from discontinued operations. For the year ended December 31, 2018, we recognized a loss of approximately $0.17 million related to the discontinued operations as a result of the sale of residual inventory to third parties, offset by historical tax assessments and adjustments. We recognized a net loss from discontinued operations of approximately $2.46 million, including the loss on the sale of the discontinued operations, in the year ended December 31, 2017, which represents the difference between the adjusted net purchase price and the carrying value of the disposal group.

Net loss. The factors discussed above resulted in net loss, including discontinued operations, of approximately $2.04 million during the year ended December 31, 2018, as compared to net loss of approximately $19.38 million of which approximately $2.46 million was attributable to discontinued operations during the year ended December 31, 2017, with us primarily becoming a real estate asset management and development company.

Liquidity and Capital Resources

The accompanying condensed consolidated financial statements have been prepared assuming our company will continue as a going concern, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business.

As of March 31, 2019, we had an accumulated deficit of approximately $140.3 million and stockholders’ deficit of approximately $0.6 million. To date, and subsequent to the recent sale of our last significant business unit, we have dedicated most of our financial resources to general and administrative expenses.

We have historically financed our activities with cash from operations, the private placement of equity and debt securities, borrowings under lines of credit and, in recent periods, with sale of certain assets and business units.

-8-

We will be required to obtain additional liquidity resources in order to support our operations. At this time, there is no guarantee that we will be able to obtain an adequate level of financial resources required for the short and long-term support of our operations or that we will be able to obtain additional financing as needed, or meet the conditions of such financing, or that the costs of such financing may not be prohibitive.

The Gadsden transaction, completed on April 5, 2019, provided no additional working capital or cash for us.

Summary of Cash Flows

The following table provides detailed information about our net cash flow for the periods indicated:

Cash Flow

(In thousands)

| Three Months Ended March 31, | Year Ended December 31, | |||||||||||||||

| 2019 | 2018 | 2018 | 2017 | |||||||||||||

| Net cash used in operating activities | $ | (568 | ) | $ | (808 | ) | $ | (2,937 | ) | $ | (9,298 | ) | ||||

| Net cash provided by (used in) investing activities | (350 | ) | — | (326 | ) | 6,797 | ||||||||||

| Net cash provided by (used in) financing activities | (1 | ) | 2,023 | 4,148 | 906 | |||||||||||

| Effect of exchange rate changes on cash | (4 | ) | 21 | 7 | 208 | |||||||||||

| Net increase (decrease) in cash and cash equivalents | (923 | ) | 1,236 | 892 | (1,387 | ) | ||||||||||

| Cash and cash equivalents at beginning of period | 1,840 | 948 | 948 | 2,335 | ||||||||||||

| Cash and cash equivalent at end of period | $ | 917 | $ | 2,184 | $ | 1,840 | $ | 948 | ||||||||

Net cash used in operating activities was approximately $0.57 million for the three months ended March 31, 2019, compared to approximately $0.81 million net cash used in operating activities for the three months ended March 31, 2018. The primary reason for the change was the wind-down of the former business operations ahead of the acquisition of income-producing real estate properties, in the 2018 period.

Net cash used in operating activities was approximately $2.9 million for the year ended December 31, 2018 compared to approximately $9.3 million for the year ended December 31, 2017. The primary reason for the change is the continual wind-down of the former business operations ahead of the acquisition of income-producing real estate properties.

Net cash used in investing activities was $0.35 million for the three months ended March 31, 2019, compared to $0 for the three months ended March 31, 2018. Our net cash used in investing activities in the three months ended March 31, 2019 was for the purchase of Roseville.

Net cash used in investing activities was approximately $0.3 million for the year ended December 31, 2018 compared to net cash provided by investing activities of approximately $6.8 million for the year ended December 31, 2017. The primary reason for the change was the cash received from the sale of the consumer division to ICTV for the year ended December 31, 2017.

Net cash used in financing activities was approximately $1 thousand for the three months ended March 31, 2019, compared to $2.02 million net cash provided by financing activities for the three months ended March 31, 2018.

Net cash provided by financing activities was approximately $4.1 million for the year ended December 31, 2018 compared to approximately $0.9 million for the year ended December 31, 2017. The increase was due to the additional funding received from Opportunity Fund I-SS, LLC (defined below) during 2018.

Private Placement

On December 22, 2017, we entered into a Securities Purchase Agreement with Opportunity Fund I SS, LLC (“OFI”) under which OFI could invest up to $15 million in us in a series of closings, in exchange for which OFI would receive shares of Series B Preferred Stock at a purchase price of $1.00 per share.

On December 22, 2017, we completed the first closing, pursuant to which OFI provided $1.5 million to us in exchange for 1,500,000 shares of Series B Preferred Stock. On January 24, 2018, we completed a second closing, pursuant to which OFI provided $2.2 million to us in exchange for 2,225,000 shares of Series B Preferred Stock. On August 24, 2018, we completed a third closing, pursuant to which OFI provided $0.1 million to us in exchange for 100,000 shares of Series B Preferred Stock. OFI could, but was not obligated to, make additional investments in one or more subsequent closings until an aggregate amount of $15 million was invested or the Securities Purchase Agreement was terminated in accordance with its terms. Through December 31, 2018, we had raised approximately $5,725,000 from OFI under the Securities Purchase Agreement.

-9-

Payout Notes and Stock Grant Agreement

On October 12, 2017, all amounts due to Dr. Dolev Rafaeli and Dennis M. McGrath under their employment agreements, as well as amounts due to Dr. Yoav Ben-Dror for his services as a board member and officer of our foreign subsidiaries, were converted to Convertible Secured Notes in the principal amounts of $3,133,934, $977,666 and $1,515,000, respectively. The Convertible Secured Notes were due on October 12, 2018, carried a ten percent (10%) interest rate, payable monthly in arrears commencing on December 1, 2017, and were secured by a security interest in all of our assets pursuant to a Security Agreement that we entered into with the holders on October 12, 2017, and were convertible into shares of our Common Stock.

On December 22, 2017, we entered into a Stock Grant Agreement with Dr. Dolev Rafaeli, Dennis M. McGrath and Dr. Yoav Ben-Dror (the “Note Holders”) to (i) cause the early conversion of the Convertible Secured Notes into an aggregate of 5,628,291 shares of Common Stock, (ii) effectuate the release of all security interests associated with the Convertible Secured Notes, (iii) provide for the issuance of an aggregate of 1,857,336 additional shares of Common Stock, (iv) provide for certain cash payments in amounts equal to the interest payments that would have been made to the holders absent the conversion of the Convertible Secured Notes, (v) obtain the agreement of the Note Holders to provide certain support services to us, and (vi) obtain the conditional resignation of certain of the Note Holders from our Board of Directors. Accordingly, the Convertible Secured Notes were paid in full.

Pursuant to the Stock Grant Agreement, we ultimately made twelve (12) monthly payments on the first of each month commencing on January 1, 2018 in the amounts of $21,328.16, $6,653.56 and $10,310.42 to Messrs. Rafaeli, McGrath, and Ben-Dror, respectively. These cash payments are consideration for certain consulting services provided by the Note Holders specified in the Stock Grant Agreement. We were required to issue the 1,857,336 additional shares promptly, but in any event within ten (10) days after it obtained stockholder approval of such issuance, which was not obtained.

Remediation Agreement

On September 24, 2018, we entered into a Remediation Agreement with OFI and the Note Holders. Pursuant to the Remediation Agreement, the Stock Grant Agreement was terminated, the shares issued to the Note Holders were cancelled, and we issued to the Note Holders an aggregate of 7,485,627 shares of newly-designated Series C Preferred Stock. In addition, the resignations of Dr. Rafaeli and Mr. McGrath from our Board of Directors, which were previously effective upon certain events set forth in the Stock Grant Agreement, will now become effective upon the last to occur of (i) receipt of all of the shares of Common Stock underlying the shares of Series C Preferred Stock and (ii) the date that the shares of Common Stock underlying the shares of Series C Preferred Stock are registered for re-sale in accordance with the Registration Rights Agreement described below.

In addition, the Securities Purchase Agreement with OFI (subject to the survival of certain provisions identified in the Remediation Agreement), a Supplemental Agreement between us and OFI and a Cancellation and Exchange Agreement between us and OFI, each dated April 20, 2018, were terminated, the Series B Preferred Stock issued to OFI was cancelled and we issued to OFI 6,217,490 shares of newly-designated Series D Preferred Stock. In addition, OFI agreed to purchase $0.10 million of shares of Series D Preferred Stock for a purchase price of $0.65 per share on the last day of each month, until it has purchased an aggregate of $0.50 million of shares of Series D Preferred Stock; provided that, upon closing of any material business combination involving us that is approved by OFI, OFI agreed to purchase an additional $1.5 million of shares of Series D Preferred Stock at a price of $0.65 per share. Notwithstanding the foregoing, from and after the date that stockholder approval of the conversion of shares issued under the Remediation Agreement has been obtained, instead of purchasing shares of Series D Preferred Stock, OFI agreed to purchase shares of Common Stock at a price of $0.65 per share.

On September 28, 2018, a first closing under the Remediation Agreement was completed, pursuant to which OFI provided $0.10 million to us in exchange for 153,846 shares of Series D Preferred Stock.

On October 31, 2018, a second closing under the Remediation Agreement was completed, pursuant to which OFI provided $0.10 million to us in exchange for 153,846 shares of Series D Preferred Stock.

On November 29, 2018, our stockholders approved the Remediation Agreement and all shares of Series D Preferred Stock issued to OFI were converted into 6,619,483 shares of Common Stock and all shares of Series C Preferred Stock issued to the Note Holders were converted into 7,485,627 shares of Common Stock.

-10-

On November 29, 2018, a third closing under the Remediation Agreement was completed, pursuant to which OFI provided $0.10 million to us in exchange for 153,846 shares of Common Stock.

On December 31, 2018, OFI agreed, notwithstanding the investment schedule set forth in the Remediation Agreement, to provide the remaining funds to us, and the parties completed a final closing under the Remediation Agreement, pursuant to which OFI provided $1.6 million to us in exchange for 2,461,538 shares of Common Stock.

On December 31, 2018, OFI also provided an additional $0.2 million to us in exchange for 1,333,333 shares of Common Stock, or a purchase price of $0.15 per share, pursuant to a Letter Agreement, dated December 29, 2018, with OFI.

The Remediation Agreement also terminated two Voting Agreements, dated December 22, 2017, among OFI, the Note Holders and certain other security holders, the Registration Rights Agreement, dated December 22, 2017, between us and OFI, and the Registration Rights Agreement, dated December 22, 2017, between us and the Note Holders.

On September 24, 2018, in connection with the Remediation Agreement, we entered into a Registration Rights Agreement with OFI and the Note Holders, pursuant to which we agreed to register all shares of Common Stock that may be issued upon conversion of the Series C Preferred Stock and Series D Preferred Stock, as well as all other shares of capital stock held by OFI (the “Registrable Securities”), under the Securities Act of 1933, as amended. We agreed to file a registration statement covering the resale of such Registrable Securities within 30 days of the date of the Registration Rights Agreement and cause such registration statement to be declared effective as soon as possible but, in any event, no later than 120 days following the filing date if such registration statement is filed on Form S-3 or 150 days if such registration statement is filed on Form S-1. If such registration statement is not filed or declared effective by the SEC on or prior to such dates, or if after such registration statement is declared effective, without regard for the reason thereunder or efforts therefor, such registration statement ceases for any reason to be effective for more than an aggregate of 30 trading days during any 12-month period, which need not be consecutive, then in addition to any other rights the holders of Registrable Securities may have under the Registration Rights Agreement or under applicable law, we shall pay to each holder an amount in cash, as partial liquidated damages and not as a penalty, equal to 1.0% of the product obtained by multiplying (x) $1.00 by (y) the number of shares of Registrable Securities held by the holder (the “Investment Amount”); provided that, in no event will we be liable for liquidated damages in excess of 1.0% of the Investment Amount in any single month and that the maximum aggregate liquidated damages payable to the holders under the Registration Rights Agreement shall be ten percent (10%) of the Investment Amount. Notwithstanding the foregoing, the filing and effective date deadlines above shall be tolled (i.e., extended), during such time as we are actively pursuing a business combination involving us that is approved by each of OFI and the Note Holders. As result of the Purchase Agreement with Gadsden (and prior potential merger), the filing and effective date deadlines above are currently under extension.

Note Payable

On May 17, 2017, we assumed an installment note, dated April 7, 2015, made by First Capital Real Estate Operating Partnership, L.P. in favor of George Zambelli in the original principal amount of $470 thousand and a Long Form Deed of Trust and Assignment of Rents, dated April 7, 2015, between First Capital Real Estate Investments, LLC, as trustor, Fidelity National Title Company, as trustee, and George Zambelli, as beneficiary, which secures the note. The note carries a per annum interest rate of 8% which is payable on a monthly basis from the initial closing date. As of March 31, 2019, the note amounted to $454 thousand ($449 out of which is classified as non-current note payable) and has a maturity date of April 10, 2020.

During 2017, we entered into a note with a previous vendor for payment of its outstanding liabilities. The note carries a per annum interest rate of 10%. Due to its reduced cash flow, we ceased payment under the note in July 2018 and the unpaid balance was $663 as of December 31, 2017.

Off-Balance Sheet Arrangements

At March 31, 2019, we had no off-balance sheet arrangements.

Impact of Inflation

We have not operated in a highly inflationary period, and do not believe that inflation has had a material effect on revenues or expenses.

-11-

Critical Accounting Policies

Our consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles. The preparation of financial statements requires management to make estimates and judgments that affect the reported amounts of assets and liabilities, revenues and expenses and disclosures at the date of the financial statements. On an on-going basis, we evaluate our estimates, including, but not limited to, those related to acquisition of investment properties, impairment of investment properties, impairment of investment in other company and option to purchase redeemable convertible preferred stock. We use authoritative pronouncements, historical experience and other assumptions as the basis for making estimates. Actual results could differ from those estimates. Management believes that the following critical accounting policies affect our more significant judgments and estimates in the preparation of our consolidated financial statements. These critical accounting policies and the significant estimates made in accordance with these policies have been discussed with our audit committee.

Investment in Affiliated Companies. Investments in companies in which we have significant influence (ownership interest of between 20% and 50%) but less than controlling interests, are accounted for by the equity method. Income on intercompany sales, not yet realized outside of our company, was eliminated. We also review these investments for impairment whenever events indicate the carrying amount may not be recoverable. In accordance with ASC Topic 323-10-40-1, a change in our proportionate share of an investee’s equity, resulting from issuance of shares by the investee to third parties, is accounted for as if we had sold a proportionate share of our investment. Any gain or loss resulting from an investee’s share issuance is recognized in earnings. When we obtain control of an affiliated company that was accounted for by the equity method, the investment is then re-measured at its fair value as of the date of which control was obtained and any remeasurement gain or loss is recognized in earnings. Management evaluates investments in affiliated companies, for evidence of other-than-temporary declines in value. Such evaluation is dependent on the specific facts and circumstances and includes analysis of relevant financial information (e.g. budgets, business plans, financial statements, etc.). During the three months ended March 31, 2019, no impairment was identified.

Investment in Other Company. Commencing January 1, 2018, the investment in the other company, which has no readily determinable fair value, is stated at cost less impairment and plus or minus subsequent adjustments for observable price changes, since we do not have the ability to exercise significant influence over operating and financial policies of those investees. Changes in the basis of these equity investments will be reported in the current earnings. This election only applies to equity instruments that do not qualify for the NAV practical expedient. This investment is subject to single-step model under which a qualitative assessment is performed in each reporting period to identify impairment. When a qualitative assessment indicates an impairment exists, we measure the fair value of the investment and recognize in current earnings an impairment loss equal to the difference between such fair value and the carrying amount of the investment. During the year ended December 31, 2017, based on management’s then most recent analyses, prepared based on the property management’s ability to execute full development of the property, an impairment loss had been identified related to our investment in other company amounting to $1.4 million. Management continued to this method of analysis through 2018. In early 2019, management evaluated the other company’s draft 2018 financial statements, had discussions with the property manager (and majority shareholder) regarding the property’s development status and lack of potential funding for the continued development of the project. Based on these discussions and our inability to influence any decisions made on the project’s development, management had an updated analysis completed, by using a third-party appraiser, to the current fair value of the investment. As a result, an impairment loss was identified related our investment in other company of approximately $1.5 million.

Impairment of Long-Lived Assets. Long-lived assets, such as property and equipment are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset (or group of assets) may not be recoverable. Impairment test is applied at the lowest level where there are identifiable independent cash flows, which may involve a group of assets. Recoverability of assets to be held and used (or group of assets) is measured by a comparison of the carrying amount of an asset to the undiscounted cash flows expected to be generated by the asset. If an asset is determined to be impaired, an impairment charge is recognized in the amount by which the carrying amount of the asset exceeds the fair value of the asset. Assets to be disposed of are separately presented in the balance sheet and reported at the lower of the carrying amount or fair value less costs to sell and are no longer depreciated. The assets and liabilities of a disposed group classified as discontinued operations are presented separately in the appropriate asset and liability sections of the balance sheet.

Revenue Recognition. On April 26, 2018, our subsidiary, RETPROP I, LLC, completed the acquisition of a 7,738 square-foot medical office building in Dayton, Ohio for a $326 thousand purchase price, paid in cash consideration. The building’s former owner, and current tenant, a medical practice, has entered into a lease with us to continue its occupancy through April 2022, with the option to renew that lease for two additional five-year terms. Currently, we account for the arrangement as an operating lease under ASC 840, “Leases” by recording rental revenues from operating leases, as a lessor, on a straight-line basis under which contractual rent increases are recognized evenly over the lease term. Certain properties have leases that provide for tenant occupancy during periods where no rent is due or where minimum rent payments change during the term of the lease. Accordingly, receivables from tenants that we expect to collect over the remaining lease term are recorded on the balance sheet as straight-line rent receivables.

-12-

Option to Purchase Series B Preferred Stock. We had classified the option to purchase additional shares of our Series B Preferred Stock as a liability in accordance with ASC 480, “Distinguishing Liabilities from Equity” as the underlying shares were subject to redemption feature. We measured the option at fair value by using the Black Scholes Pricing Model in each reporting period until they are exercised or expired, with changes in the fair values being recognized in our statement of comprehensive loss.

Recent Accounting Pronouncements

Commencing January 1, 2019, we adopted ASU No. 2016-02 (Topic 842) “Leases.” Topic 842 supersedes the lease requirements in ASC Topic 842, “Leases”, which lessees are required to recognize assets and liabilities on the balance sheet for most leases and provide enhanced disclosures. ASU No. 2016-02 is effective for interim and annual reporting periods beginning after December 15, 2018. In July 2018, the FASB issued amendments in ASU 2018-11, which provide a transition election to not restate comparative periods for the effects of applying the new standard. This transition election permits entities to change the date of initial application to the beginning of the earliest comparative period presented, or retrospectively at the beginning of the period of adoption through a cumulative-effect adjustment. The guidance had no material impact on our consolidated financial statements.

Commencing January 1, 2018, we adopted ASU 2016-18, Statement of Cash Flows (Topic 230): “Restricted Cash,” which requires companies to include amounts generally described as restricted cash and restricted cash equivalents in cash and cash equivalents when reconciling beginning-of-period and end-of-period total amounts shown on the statement of cash flows. The amendments in this update are effective for public business entities for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. This guidance had no material impact on our consolidated financial statements.

In May 2017, the FASB issued ASU 2017-09, “Compensation-Stock Compensation.” The amendment provides guidance about which changes to terms or conditions of a share-based payment award require an entity to apply modification accounting. The guidance became effective for the fiscal year beginning on January 1, 2018, including interim periods within that year. This guidance had no material impact on our consolidated financial statements.

THE CHARTER AMENDMENT

Overview

On May 15, 2019, our board of directors and the Majority Stockholders approved an amendment to the Current Charter to, among other things (i) change the name of our company to “Gadsden Properties, Inc.”; (ii) increase the number of authorized shares of our Common Stock from 500,000,000 shares to 5,000,000,000 shares; and (iii) add certain provisions restricting the ownership and transfer of shares to comply with requirements under the Internal Revenue Code of 1986, as amended (the “Code”), for a real estate investment trust (“REIT”).

The Charter Amendment also amends to the purpose of our company to state that we may, but are not obligated to, engage in business as a REIT.

The Charter Amendment will become effective upon filing with the Nevada Secretary of State’s Office, which will occur promptly following the 20th day after this Information Statement is first mailed to our stockholders.

Reasons for the Amendments to our Current Charter

Name Change

The principal reason for our name change to “Gadsden Properties, Inc.” is to reflect the recent change to our business following closing of the Purchase Agreement. As described under “Changes in Control” above, we recently acquired Gadsden Growth Properties, L.P., the operating partnership of Gadsden that held all of its assets and liabilities, in a transaction that resulted in a change in control of our company. We believe that the name “Gadsden Properties, Inc.” more accurately reflects our business following this transaction.

-13-

Increase in Authorized Stock

The primary purpose of the amendment to increase our authorize Common Stock is to facilitate the issuance of shares of Common Stock upon the conversion of our recently issued Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock pursuant to the Purchase Agreement described under “Changes in Control” above, as well as to provide additional authorized Common Stock for future issuances.

Our Current Charter authorizes our company to issue 500,000,000 shares of Common Stock and 50,000,000 shares of Preferred Stock, of which 1,600,000 have been designated as Series A Preferred Stock, 11,696,993 have been designated as Series B Preferred Stock and 11,000,000 have been designated as Series C Preferred Stock.

As of the Record Date, there were 389,104,820 shares of Common Stock, 889,075 shares of Series A Preferred Stock, 6,264,993 shares of Series B Preferred Stock and 2,498,682 shares of Series C Preferred Stock issued and outstanding. The shares of Preferred Stock are convertible, under certain circumstances and subject to filing of the Charter Amendment, into shares of Common Stock. We have also reserved 446,429 shares of Common Stock for issuance under outstanding warrants, 77,390 shares of Common Stock for issuance under outstanding options and 4,600,000 shares of Common Stock for issuance under our 2018 Equity Incentive Plan. The following table summarizes the number of shares of Common Stock issuable upon conversion of our outstanding and authorized convertible securities as of the Record Date:

| Security | Common Equivalents Outstanding | Common Equivalents Authorized | ||||||

| Common Stock | 389,104,820 | 500,000,000 | ||||||

| Series A Preferred Stock | 445,426,575 | 801,600,000 | ||||||

| Series B Preferred Stock | 153,011,804 | 285,679,170 | ||||||

| Series C Preferred Stock | 624,670,500 | 2,750,000,000 | ||||||

| Stock Options | 77,390 | 77,390 | ||||||

| Warrants | 446,429 | 446,429 | ||||||

| 2018 Equity Incentive Plan | - | 4,600,000 | ||||||

| TOTALS | 1,612,737,518 | 4,342,402,989 | ||||||

As reflected above, we could be required to issue up to 1,612,737,518 shares of Common Stock upon the conversion of outstanding convertible securities (provided that the shares of Preferred Stock may not be converted until the Charter Amendment is filed) and up to 4,342,402,989 shares of Common Stock if we issue additional authorized securities and those securities are also converted. Since we are currently only authorized to issue 500,000,000 shares of Common Stock, the Charter Amendment will increase the number of authorized shares of Common Stock to 5,000,000,000 shares.

Although the primary purpose of the increase in the authorized Common Stock is to facilitate the issuance of shares of Common Stock upon the conversion of the Series A Preferred Stock, Series B Preferred Stock and Series C Preferred Stock, this amendment will also provide us with increased flexibility in meeting future corporate needs and requirements by providing additional authorized shares of Common Stock, which will be available for issuance from time to time as determined by the board for any proper corporate purpose, including additional equity financings, without the expense and delay associated with a special stockholders’ meeting, except where required by applicable rules, regulations and laws.

Restrictions on Ownership and Transfer of Shares

Although we are not currently a REIT, we intend to qualify as a REIT for U.S. Federal income tax purposes commencing with our taxable year ending December 31, 2020. In order to qualify as a REIT under the Code, our stock must be beneficially owned by 100 or more persons during at least 335 days of a taxable year of 12 months (other than the first year for which an election to be a REIT has been made) or during a proportionate part of a shorter taxable year; and at any time during the last half of a taxable year (other than the first year for which an election to be a REIT has been made), not more than 50% of the value of the outstanding shares of stock (after taking into account options to acquire shares of stock) may be owned, directly, indirectly or through attribution, by five or fewer individuals (for this purpose, the term “individual” under the Code includes a supplemental unemployment compensation benefit plan, a private foundation or a portion of a trust permanently set aside or used exclusively for charitable purposes, but generally does not include a qualified pension plan or profit sharing trust).

The Charter Amendment contains restrictions on ownership and transfer of our stock that are intended, among other purposes, to assist us in complying with these requirements to qualify and thereafter continue to qualify as a REIT. These restrictions will be effective commencing on the date on which a registration statement on Form S-11 is declared effective by the SEC and until our board of directors determines that it is no longer in the best interests of our company to attempt to, or continue to, qualify as a REIT, or that compliance with the restrictions and limitations on ownership and transfers is no longer required in order for us to qualify as a REIT.

-14-

These limitations include that, subject to the exceptions in the discretion of the board of directors, no person or entity may actually or beneficially own, or be deemed to own by virtue of the applicable constructive ownership provisions of the Code, more than the Applicable Amount (as defined below), or other applicable amount given any ownership in excess of such amount that has been approved by the board of directors, of the outstanding shares of Common Stock, Preferred Stock or more than the Applicable Amount of the aggregate of the outstanding shares of all classes and series of stock. These restrictions are referred to as an “ownership limit” and collectively as the “ownership limits.” A person or entity that would have acquired actual, beneficial or constructive ownership of stock but for the application of the ownership limits or any of the other restrictions on ownership and transfer of stock discussed below is referred to as a “prohibited owner.” Under the provisions of the Charter Amendment, the term “Applicable Amount” is defined to be not more than 9.8% (in value or in number of shares, whichever is more restrictive) of the aggregate of the outstanding shares of capital stock, or such other percentage determined by the board of directors.

The constructive ownership rules under the Code are complex and may cause stock owned actually or constructively by a group of related individuals and/or entities to be owned constructively by one individual or entity. As a result, the acquisition of less than the Applicable Amount of Common Stock (or the acquisition of an interest in an entity that owns, actually or constructively, Common Stock) by an individual or entity could, nevertheless, cause that individual or entity, or another individual or entity, to own constructively in excess of the Applicable Amount of outstanding Common Stock and thereby violate the applicable ownership limit.

Our board of directors may increase or decrease the ownership limits, except that a decreased ownership limit will not be effective for any person whose actual, beneficial or constructive ownership of stock exceeds the decreased ownership limit at the time of the decrease until the person’s actual, beneficial or constructive ownership of stock equals or falls below the decreased ownership limit, although any further acquisition of stock will violate the decreased ownership limit. The board may not increase or decrease any ownership limit if the new ownership limit would cause our company to fail to qualify as a REIT.

These provisions further prohibit:

| ● | any person from actually, beneficially or constructively owning shares of stock that could result in our company being “closely held” under Section 856(h) of the Code (without regard to whether the ownership interest is held during the last half of a taxable year) or otherwise cause our company to fail to qualify as a REIT (including, but not limited to, actual, beneficial or constructive ownership of shares of stock that could result in (i) our company owning (actually or constructively) an interest in a tenant that is described in Section 856(d)(2)(B) of the Code, or (ii) any manager of a “qualified lodging facility” within the meaning of Section 856(d)(9)(D) of the Code or a “qualified health care facility” within the meaning of Section 856(e)(6)(D)(i) of the Code, leased by our company to one of its taxable REIT subsidiaries failing to qualify as an “eligible independent contractor” within the meaning of Section 856(d)(9)(A) of the Code, in each case if the income derived from such tenant or such taxable REIT subsidiary, taking into account our other income that would not qualify under the gross income requirements of Section 856(c) of the Code, would cause our company to fail to satisfy any the gross income requirements imposed on REITs); and |

| ● | any person from transferring shares of stock if such transfer would result in shares of our stock being beneficially owned by fewer than 100 persons (determined under the principles of Section 856(a)(5) of the Code). |

Any person who acquires or attempts or intends to acquire actual, beneficial or constructive ownership of shares of stock that will or may violate the ownership limits or any of the other restrictions on ownership and transfer of stock described above must give written notice immediately to us or, in the case of a proposed or attempted transaction, provide us at least fifteen (15) days prior written notice, and provide us with such other information as we may request in order to determine the effect of such transfer on our status as a REIT.

-15-

Pursuant to the Charter Amendment, if any purported transfer of stock or any other event would otherwise result in any person violating the ownership limits or such other limit established by the board, or could result in GPI being “closely held” within the meaning of Section 856(h) of the Code (without regard to whether the ownership interest is held during the last half of a taxable year) or otherwise failing to qualify as a REIT, then the number of shares causing the violation (rounded up to the nearest whole share) will be automatically transferred to, and held by, a trust for the exclusive benefit of one or more charitable organizations selected by our company. The prohibited owner will have no rights in shares of our stock held by the trustee. The automatic transfer will be effective as of the close of business on the business day prior to the date of the violative transfer or other event that results in the transfer to the trust. Any dividend or other distribution paid to the prohibited owner, prior to our discovery that the shares had been automatically transferred to a trust as described above, must be repaid to the trustee upon demand. In addition, the board is authorized to take such actions as it deems necessary or advisable in preserving our qualification as a REIT.

Shares of stock transferred to the trustee are deemed offered for sale to our company, or its designee, at a price per share equal to the lesser of (i) the price per share in the transaction that resulted in the transfer of shares to the trust (or, if the event that resulted in the transfer to the trust did not involve a purchase of such shares at market price, the market price of such shares on the day of the event that resulted in the transfer of such shares to the trust) and (ii) the market price on the date our company, or its designee, accepts such offer. We will be required to reduce the amount payable to the prohibited owner by the amount of dividends and other distributions paid to the prohibited owner and owed by the prohibited owner to the trustee. We will pay the amount of such reduction to the trustee for the benefit of the charitable beneficiary. We will have the right to accept such offer until the trustee has sold the shares of stock held in the trust. Upon a sale to us, the interest of the charitable beneficiary in the shares sold terminates and the trustee must distribute the net proceeds of the sale to the prohibited owner and any dividends or other distributions held by the trustee with respect to such stock will be paid to the charitable beneficiary.