UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________

FORM 10-Q

_____________________________________________________________

| Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||||

For the quarterly period ended April 30, 2022

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||||

For the transition period from to

Commission File Number 1-8597

_____________________________________________________________

(Exact name of registrant as specified in its charter)

_____________________________________________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (925 ) 460-3600

_____________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | ||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ☐ No ☒

On May 27, 2022, 49,336,487 shares of Common Stock, $0.10 par value, were outstanding.

INDEX

| Page No. | ||||||||

| PART I. | ||||||||

| Item 1. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II. | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

2

PART I. FINANCIAL INFORMATION

Item 1. Unaudited Financial Statements

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Consolidated Statements of Income and Comprehensive Income

Periods Ended April 30,

(In millions, except for earnings per share)

(Unaudited)

| Three Months | Six Months | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Net sales | $ | $ | $ | $ | |||||||||||||||||||

| Cost of sales | |||||||||||||||||||||||

| Gross profit | |||||||||||||||||||||||

| Selling, general and administrative expense | |||||||||||||||||||||||

| Research and development expense | |||||||||||||||||||||||

| Amortization of intangibles | |||||||||||||||||||||||

| Operating income | |||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||

| Other (income) expense, net | ( | ( | ( | ||||||||||||||||||||

| Income before income taxes | |||||||||||||||||||||||

| Provision for income taxes (Note 6) | ( | ||||||||||||||||||||||

| Net income | $ | $ | $ | $ | |||||||||||||||||||

| Earnings per share (Note 7): | |||||||||||||||||||||||

| Basic | $ | $ | $ | $ | |||||||||||||||||||

| Diluted | $ | $ | $ | $ | |||||||||||||||||||

| Number of shares used to compute earnings per share: | |||||||||||||||||||||||

| Basic | |||||||||||||||||||||||

| Diluted | |||||||||||||||||||||||

| Other comprehensive income, net of tax: | |||||||||||||||||||||||

| Cash flow hedges | $ | $ | $ | $ | |||||||||||||||||||

| Foreign currency translation adjustment | ( | ( | |||||||||||||||||||||

| Comprehensive income | $ | $ | $ | $ | |||||||||||||||||||

The accompanying notes are an integral part of these Consolidated Condensed Financial Statements.

3

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Consolidated Condensed Balance Sheets

(In millions, unaudited)

| April 30, 2022 | October 31, 2021 | ||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

Trade accounts receivable, net of allowance for credit losses of $ | |||||||||||

| Inventories (Note 3) | |||||||||||

| Prepaid expense and other current assets | |||||||||||

| Assets held-for-sale | |||||||||||

| Total current assets | |||||||||||

| Property, plant and equipment, at cost | |||||||||||

| Less: accumulated depreciation and amortization | |||||||||||

| Operating lease right-of-use assets | |||||||||||

| Goodwill (Note 4) | |||||||||||

| Other intangibles, net (Note 4) | |||||||||||

| Deferred tax assets | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Short-term debt (Note 5) | $ | $ | |||||||||

| Accounts payable | |||||||||||

| Employee compensation and benefits | |||||||||||

| Operating lease liabilities | |||||||||||

| Other current liabilities | |||||||||||

| Liabilities held-for-sale | |||||||||||

| Total current liabilities | |||||||||||

| Long-term debt (Note 5) | |||||||||||

| Deferred tax liabilities | |||||||||||

| Long-term tax payable | |||||||||||

| Operating lease liabilities | |||||||||||

| Accrued pension liability and other | |||||||||||

| Total liabilities | $ | $ | |||||||||

| Contingencies (Note 12) | |||||||||||

| Stockholders’ equity: | |||||||||||

Preferred stock, $ | |||||||||||

Common stock, $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

| Retained earnings | |||||||||||

Treasury stock at cost: | ( | ( | |||||||||

| Total Cooper stockholders’ equity | |||||||||||

| Noncontrolling interests | |||||||||||

| Stockholders’ equity (Note 9) | |||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

The accompanying notes are an integral part of these Consolidated Condensed Financial Statements.

4

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Consolidated Condensed Statements of Stockholders' Equity

(In millions, unaudited)

| Common Shares | Treasury Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings | Treasury Stock | Noncontrolling Interests | Total Stockholders' Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at November 1, 2020 | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for stock plans, net | — | — | — | ( | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for employee stock purchase plan | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Dividends on common stock ($ | — | — | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation expense | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury stock repurchase | ( | — | — | — | — | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||

| — | — | — | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at January 31, 2021 | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for stock plans, net | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for employee stock purchase plan | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation expense | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury stock repurchase | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at April 30, 2021 | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

5

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Consolidated Condensed Statements of Stockholders' Equity

(In millions, unaudited)

| Common Shares | Treasury Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings | Treasury Stock | Noncontrolling Interests | Total Stockholders' Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at November 1, 2021 | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax | — | — | — | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for stock plans, net | — | — | — | ( | — | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for employee stock purchase plan | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Dividends on common stock ($ | — | — | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation expense | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury stock repurchase | ( | — | — | — | — | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at January 31, 2022 | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income, net of tax | — | — | — | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for stock plans, net | 0.1 | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock for employee stock purchase plan | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Share-based compensation expense | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Treasury stock repurchase | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at April 30, 2022 | $ | $ | $ | $ | ( | $ | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these Consolidated Condensed Financial Statements.

6

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Consolidated Condensed Statements of Cash Flows

Six Months Ended April 30,

(In millions, unaudited)

| 2022 | 2021 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income | $ | $ | |||||||||

| Depreciation and amortization | |||||||||||

| Settlement of contingent consideration (Note 2) | ( | ||||||||||

| Increase in operating capital | ( | ( | |||||||||

| Deferred income taxes | ( | ||||||||||

| Other non-cash items | ( | ||||||||||

| Net cash provided by operating activities | |||||||||||

| Cash flows from investing activities: | |||||||||||

| Purchases of property, plant and equipment | ( | ( | |||||||||

| Acquisitions of businesses and assets, net of cash acquired, and other | $ | ( | ( | ||||||||

| Proceeds from sale of interest in a subsidiary (Note 2) | |||||||||||

| Net cash used in investing activities | $ | ( | ( | ||||||||

| Cash flows from financing activities: | |||||||||||

| Proceeds from long-term debt | |||||||||||

| Repayments of long-term debt | ( | ( | |||||||||

| Net proceeds from short-term debt | |||||||||||

| Net payments related to share-based compensation awards | ( | ( | |||||||||

| Dividends on common stock | ( | ( | |||||||||

| Repurchase of common stock | ( | ( | |||||||||

| Issuance of common stock for employee stock purchase plan | |||||||||||

| Debt issuance costs | ( | ||||||||||

| Settlement of contingent consideration (Note 2) | ( | ||||||||||

| Net cash provided by (used in) financing activities | ( | ||||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | ( | ||||||||||

| Net increase in cash, cash equivalents and restricted cash | ( | ||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | |||||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | $ | |||||||||

| Reconciliation of cash flow information: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash included in other current assets | |||||||||||

| Total cash, cash equivalents and restricted cash | $ | $ | |||||||||

The accompanying notes are an integral part of these Consolidated Condensed Financial Statements.

7

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

Note 1. General

The accompanying Consolidated Condensed Financial Statements of the Cooper Companies, Inc. and its subsidiaries (the Company) have been prepared in accordance with generally accepted accounting principles in the United States ("GAAP") for interim financial information and with the requirements of Regulation S-X, Rule 10-01 for financial statements required to be filed as a part of this Quarterly Report on Form 10-Q. Unless the context requires otherwise, terms "the Company", "we", "us", and "our" are used to refer collectively to the Cooper Companies, Inc. and its subsidiaries.

The accompanying Consolidated Condensed Financial Statements and related notes are unaudited and should be read in conjunction with the audited Consolidated Financial Statements of the Cooper Companies, Inc. and its subsidiaries (the Company) and related notes as contained in the Company’s Annual Report on Form 10-K for the fiscal year ended October 31, 2021. The Consolidated Condensed Financial Statements include all adjustments (consisting only of normal recurring adjustments) and accruals necessary in the judgment of management for a fair presentation of the results for the interim periods presented. Readers should not assume that the results reported here either indicate or guarantee future performance.

Accounting Policies

There have been no material changes to our significant accounting policies described in our Annual Report on Form 10-K for the fiscal year ended October 31, 2021.

Estimates

The World Health Organization categorized the Coronavirus disease 2019 (COVID-19) as a pandemic. The COVID-19 pandemic has caused a severe global health crisis, along with economic and societal disruptions and uncertainties, which have negatively impacted business and healthcare activity globally. As a result of healthcare systems responding to the demands of managing the pandemic, governments around the world imposing measures designed to reduce the transmission of the COVID-19 virus, and individuals responding to the concerns of contracting the COVID-19 virus, many optical practitioners & retailers, hospitals, medical offices and fertility clinics closed their facilities, restricted access, or delayed or canceled patient visits, exams and elective medical procedures, and many customers that have reopened are experiencing reduced patient visits. These factors have had, and in the future may continue to have, an adverse effect on our sales, operating results and cash flows.

The preparation of Consolidated Condensed Financial Statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of net sales and expenses during the reporting period. Actual results could differ from those estimates particularly as it relates to estimates reliant on forecasts and other assumptions reasonably available to the Company and the uncertain future impacts of the COVID-19 pandemic and related economic disruptions. The extent to which the COVID-19 pandemic and related economic disruptions impact our business and financial results will depend on future developments including, but not limited to, the continued spread, duration and severity of the COVID-19 pandemic; the occurrence, spread, duration and severity of any subsequent wave or waves of outbreaks, including the emergence and spread of variants of the COVID-19 virus; the actions taken by the U.S. and foreign governments to contain the COVID-19 pandemic, address its impact or respond to the reduction in global and local economic activity; the occurrence, duration and severity of a global, regional or national recession, depression or other sustained adverse market event; the impact of the developments described above on our customers and suppliers; and how quickly and to what extent normal economic and operating conditions can resume. The accounting matters assessed included, but were not limited to:

•allowance for doubtful accounts and credit losses

•the carrying value of inventory

•the carrying value of goodwill and other long-lived assets

There was not a material impact to the above estimates in the Company’s Consolidated Condensed Financial Statements for the three and six months ended April 30, 2022. The Company continually monitors and evaluates the estimates used as additional information becomes available. Adjustments will be made to these provisions periodically to reflect new facts and circumstances that may indicate that historical experience may not be indicative of current and/or future results. The Company’s future assessment of the magnitude and duration of COVID-19, as well as other factors, could result in material

8

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

Exit costs

During the second quarter of fiscal 2022, the Company initiated a plan to exit its contact lens care business, a non-core business unit of the CooperVision segment. We expect the exit activity to be completed by the end of fiscal 2022. Exit charges recognized in the three months ended April 30, 2022, were $20.7 million, of which $17.4 million is recognized in cost of sales and $3.3 million is recognized in selling, general, and administrative expense in the Consolidated Statements of Income. Exit costs primarily related to inventory write-down, asset impairments and employee-related costs. Total exit costs are expected to be in a range of $30.0 million to $40.0 million.

Accounting Pronouncements Recently Adopted

In December 2019, the Financial Accounting Standards Board (FASB) issued ASU 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. This guidance removes certain exceptions to the general principles in Topic 740 and enhances and simplifies various aspects of the income tax accounting guidance, including requirements such as tax basis step-up in goodwill obtained in a transaction that is not a business combination, ownership changes in investments, and interim-period accounting for enacted changes in tax law. This standard is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2020. Early adoption is permitted. The Company adopted this guidance on November 1, 2021, and it did not have an impact on the Consolidated Condensed Financial Statements.

In August 2020, the FASB issued ASU 2020-06, Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40). This update amends the guidance on convertible instruments and the derivatives scope exception for contracts in an entity's own equity and improves and amends the related EPS guidance for both Subtopics. This standard is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2021. Early adoption is permitted but no earlier than fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. The Company early adopted this guidance on November 1, 2021, and it did not have an impact on the Consolidated Condensed Financial Statements.

In October 2021, the FASB issued ASU 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers. This update requires that an acquirer recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with Topic 606, Revenue from Contracts with Customers. This standard is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2022, and should be applied prospectively to business combinations occurring on or after the effective date of the standard. Early adoption is permitted, including adoption in an interim period. The Company early adopted this guidance on November 1, 2021, and has applied the guidance to the business combinations entered into during fiscal 2022. Refer to Note 2. Acquisitions and Joint Venture for further information.

Accounting Pronouncements Issued Not Yet Adopted

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting and subsequent amendment to the initial guidance: ASU 2021-01, Reference Rate Reform (Topic 848): Scope (collectively, “Topic 848”). Topic 848 provides optional expedients and exceptions for applying GAAP to contracts, hedging relationships, and other transactions affected by reference rate reform if certain criteria are met. The amendments apply only to contracts, hedging relationships, and other transactions that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform. The guidance generally can be applied from March 12, 2020 through December 31, 2022. The Company is currently assessing the impacts of the practical expedients provided in Topic 848 and which, if any, the Company will adopt.

In November 2021, the FASB issued ASU 2021-10, Government Assistance (Topic 832): Disclosures by Business Entities about Government Assistance. This update requires annual disclosures about transactions with a government that are accounted for by applying a grant or contribution accounting model by analogy. This standard is effective for fiscal years beginning after December 15, 2021, and should be applied either prospectively or retrospectively. Early adoption is permitted. The Company is currently evaluating the impact of ASU 2021-10 on the Consolidated Condensed Financial Statements.

9

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

Note 2. Acquisitions and Joint Venture

The following is a summary of the allocation of the total purchase consideration for business and asset acquisitions that the Company completed during the six months ended April 30, 2022, and fiscal 2021:

| (In millions) | April 30, 2022 | October 31, 2021 | |||||||||

| Technology | $ | $ | |||||||||

| In-Process Research & Development (IPR&D) | |||||||||||

| Customer relationships | |||||||||||

| Trademarks | |||||||||||

| Other | |||||||||||

| Total identifiable intangible assets | $ | $ | |||||||||

| Goodwill | |||||||||||

| Net tangible liabilities | ( | ( | |||||||||

| Fair value of contingent consideration | ( | ( | |||||||||

| Total closing purchase price | $ | $ | |||||||||

All acquisitions were funded by cash generated from operations or facility borrowings.

For business acquisitions, the Company recorded tangible and intangible assets acquired and liabilities assumed at their fair values as of the applicable date of acquisition. For asset acquisitions, the Company recorded tangible and intangible assets acquired and liabilities assumed at their estimated and relative fair values as of the applicable date of acquisition.

The Company believes these acquisitions strengthen CooperSurgical's and CooperVision's businesses through the addition of new distributors or complementary products and services.

Fiscal Year 2022

On April 6, 2022, CooperSurgical completed the acquisition of a private cryopreservation services company that specializes in cryogenic services. The purchase price allocation is preliminary, and the Company is in the process of finalizing information primarily related to the valuation of intangible assets and property, plant and equipment and the corresponding impact on goodwill.

Refer to "Fiscal Year 2021" below for details on formation of a joint venture with Essilor International and related activities that occurred in fiscal year 2022 following the acquisition of SightGlass Vision, Inc. (SGV) in fiscal year 2021.

On February 7, 2022, CooperSurgical entered into a binding letter of intent to acquire Cook Medical's Reproductive Health business, a manufacturer of minimally invasive medical devices focused on the fertility, obstetrics and gynecology markets. The aggregate consideration is $875.0 million in cash, with $675.0 million payable at the closing and the remaining $200.0 million payable in $50.0

Generate Life Sciences®

On December 17, 2021, CooperSurgical completed the acquisition of 100 % of the equity interests in Generate Life Sciences (Generate), a privately held leading provider of donor egg and sperm for fertility treatments, fertility cryopreservation services and newborn stem cell storage (cord blood & cord tissue), and paid an aggregate purchase consideration of approximately $1.663 billion, reflecting working capital, and other adjustments. The cash consideration was funded through a combination of $1.5 billion in proceeds from the issuance of a senior unsecured term loan and available cash on hand.

The Company has accounted for the acquisition of Generate as a business combination, in accordance with ASC Topic 805, Business Combinations. The following table summarizes the preliminary fair values of assets acquired and liabilities assumed as of the acquisition date:

10

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

(In millions) | |||||

| Current assets: | |||||

Cash and cash equivalents | $ | ||||

Trade accounts receivable, net | |||||

Inventories | |||||

Prepaid expense and other current assets | |||||

| Total current assets | |||||

Property, plant and equipment | |||||

Operating lease right-of-use assets | |||||

| Goodwill | |||||

Customer relationships | |||||

Trademarks | |||||

| Deferred tax assets | |||||

Other assets | |||||

Total assets acquired | $ | ||||

| Current liabilities: | |||||

Accounts payable | $ | ||||

Employee compensation and benefits | |||||

Operating lease liabilities | |||||

| Deferred revenue | |||||

Other current liabilities | |||||

| Total current liabilities | |||||

Deferred tax liabilities | |||||

Operating lease liabilities | |||||

Deferred revenue | |||||

Other liabilities | |||||

Total liabilities assumed | $ | ||||

Total purchase price | $ | ||||

The purchase accounting is incomplete and subject to change during the measurement period, which may result in material changes to the purchase price allocation. The Company is in the process of finalizing information primarily related to the valuation of intangible assets and property, plant and equipment, the measurement of deferred revenue, the associated deferred tax adjustments and the corresponding impact on goodwill. The Company recorded a measurement period adjustment of $62.2 million to goodwill in the second quarter of fiscal 2022 ended April 30, 2022.

Deferred revenue was recognized in accordance with ASC Topic 606, Revenue from Contracts with Customers, as a result of the adoption of ASU 2021-08. See Note 1. General for additional information.

The Company currently estimates that customer relationships will be amortized over 13 years and trademarks will be amortized over 14 years. Goodwill is primarily attributable to assembled workforce and expected synergies to be achieved. The goodwill recognized is not deductible for tax purposes.

The transaction costs associated with the acquisition consisted primarily of legal, regulatory and financial advisory fees, which were expensed as incurred as selling, general and administrative expense.

Generate's revenue and net income for the period from the acquisition date to April 30, 2022, were $104.8 million and $4.2 million, respectively. The following unaudited pro forma information summarizes the combined results of operations of the Company and Generate as if the acquisition had been completed at the beginning of the Company’s fiscal 2021:

11

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

| Three months ended April 30, | Six months ended April 30, | |||||||||||||||||||||||||

(In millions) | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||

Revenue | $ | $ | $ | $ | ||||||||||||||||||||||

Net income | $ | $ | $ | $ | ||||||||||||||||||||||

The unaudited pro forma information for the first six months of fiscal 2022 and 2021 was calculated after applying the Company's accounting policies and the impact of acquisition date fair value adjustments. The adjustments primarily include increased amortization for the fair value of acquired intangible assets, increased depreciation for the fair value of acquired property, plant, and equipment, increased revenue as a result of the ASU 2021-08 deferred revenue adjustments, decreased interest expense as a result of the reversal of Generate's historical interest expense partially offset by additional interest expense on the debt obtained to finance the transaction.

The pro forma information does not reflect the effect of costs or synergies that would have been expected to result from the integration of the acquisition. The pro forma information does not purport to be indicative of the results of operations that actually would have resulted had the acquisition occurred at the beginning of fiscal 2021, or of future results of the consolidated entities.

Fiscal Year 2021

On May 3, 2021, CooperSurgical completed the acquisition of a privately-held medical device company that develops single-use illuminating medical devices. The purchase price allocation is preliminary, and the Company is in the process of finalizing information primarily related to the valuation of intangible assets and inventory, the associated deferred tax adjustments and the corresponding impact on goodwill.

On April 26, 2021, CooperVision completed the acquisition of a privately-held UK contact lens manufacturer focusing on specialty contact lenses. This acquisition expands CooperVision’s specialty eye care portfolio and accelerates its development of myopia management solutions in the UK.

On March 1, 2021, CooperSurgical completed the acquisition of a privately-held medical device company that designed and developed an innovative obstetric product for use in urgent obstetrics to reduce risks associated with childbirth.

On February 1, 2021, CooperSurgical acquired all of the remaining equity interests of a privately-held medical device company that developed the Mara® Water Vapor Ablation System, which is used for endometrial ablation. The Company accounted for this acquisition as an asset acquisition, whereby the Company allocated the total cost of the acquisition to the net assets acquired on the basis of their estimated relative fair values on the acquisition date with no goodwill recognized. The primary asset acquired in this asset acquisition is Technology.

On January 19, 2021, CooperVision acquired all of the remaining equity interests of SGV, a privately-held medical device company that developed spectacle lenses for myopia management. The transaction included potential payments of future consideration that were contingent upon the achievement of the regulatory approval milestone (the regulatory approval payment) and the acquired business reaching certain revenue thresholds over a specified period (the revenue payments). The undiscounted range of the contingent consideration was zero to $139.1 million payable to the other former equity interest owners.

The fair value of the regulatory approval payment was determined using an option pricing framework based on the expected payment under the contractual terms and the estimates of the probability of achieving the regulatory approval. The fair value of the revenue payments was determined using a Monte Carlo simulation based on the revenue projections and the expected payment for each simulation.

In March 2022, the entities amended the terms of the contingent consideration, which resulted in CooperVision paying $42.9 million to the former equity interest owners in exchange for the elimination of the revenue payments. As a result, during the three and six months ended April 30, 2022, CooperVision recognized a net gain of $15.7 million and $12.2 million, respectively. As of April 30, 2022, the remaining contingent liability related to regulatory approval payment was $31.8 million.

Further, in March 2022, CooperVision and Essilor International SAS (Essilor) executed the Contribution Agreement and Stock Purchase Agreement (the “Agreements”) whereby Essilor paid CooperVision $52.6 million in exchange for 50 % interest in SGV and their proportionate share of the revenue payments. As part of the Agreements, each party contributed their interest in SGV and $10 90.0 million which resulted in a $57.4 million gain in Other (income) expense on deconsolidation of SGV.

12

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

The fair value of the joint venture was determined using the income valuation approach. Under the income approach, we used a discounted cash flow model (“DCF”) in which cash flows anticipated over several periods, plus a terminal value at the end of that time horizon, are discounted to their present value using an appropriate expected rate of return. The discount rate used for cash flows reflects capital market conditions and the specific risks associated with the business. This valuation approaches is considered a Level 3 fair value measurement. Fair value determination requires complex assumptions and judgment by management in projecting future operating results, selecting guideline companies for comparisons, determining appropriate market value multiples, selecting the discount rate to measure the risks inherent in the future cash flows. Any material changes in key assumptions, including failure to meet business plans, deterioration in the financial market, an increase in interest rate or an increase in the cost of equity financing by market participants within the industry or other unanticipated events and circumstances, may affect such estimates.

On December 31, 2020, CooperSurgical completed the acquisition of a privately-held in vitro fertilization (IVF) cryo-storage software solutions company.

The pro forma results of operations of these acquisitions have not been presented because the effect of the business combinations described above was not material to the consolidated results of operations.

Contingent Consideration

Certain of the Company’s business combinations involve potential payments of future consideration that are contingent upon the achievement of regulatory milestones and/or the acquired business reaching certain revenue thresholds. A liability is recorded for the estimated fair value of the contingent consideration on the acquisition date. The fair value of the contingent consideration is remeasured at each reporting period, and the change in fair value is recognized in selling, general and administrative expense in the Consolidated Statements of Income and Comprehensive Income.

The following table provides a reconciliation of the beginning and ending balances of contingent consideration:

| Periods Ended April 30, | Three Months | Six Months | |||||||||||||||||||||

| (In millions) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Beginning balance | $ | $ | $ | $ | |||||||||||||||||||

| Purchase price contingent consideration | |||||||||||||||||||||||

| Payments | ( | ( | |||||||||||||||||||||

| Change in fair value | ( | ( | |||||||||||||||||||||

| Ending balance | $ | $ | $ | $ | |||||||||||||||||||

Note 3. Inventories

| (In millions) | April 30, 2022 | October 31, 2021 | |||||||||

| Raw materials | $ | $ | |||||||||

| Work-in-process | |||||||||||

| Finished goods | |||||||||||

| Total inventories | $ | $ | |||||||||

Inventories are stated at the lower of cost and net realizable value. Cost is computed using standard cost that approximates actual cost, on a first-in, first-out basis.

Note 4. Intangible Assets

Goodwill

| (In millions) | CooperVision | CooperSurgical | Total | ||||||||||||||

| Balance at October 31, 2021 | $ | $ | $ | ||||||||||||||

| Current period additions | |||||||||||||||||

| Foreign currency translation adjustment | ( | ( | ( | ||||||||||||||

| Balance at April 30, 2022 | $ | $ | $ | ||||||||||||||

13

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

The Company evaluates goodwill for impairment annually during the third quarter of the fiscal year and when an event occurs or circumstances change such that it is reasonably possible that impairment may exist. The Company accounts for goodwill, evaluates and tests goodwill balances for impairment in accordance with related accounting standards.

The Company performed an annual impairment assessment in the third quarter of fiscal 2021, and its analysis indicated that there was no impairment of goodwill in its reporting units.

Other Intangible Assets

| April 30, 2022 | October 31, 2021 | ||||||||||||||||||||||||||||

| (In millions) | Gross Carrying Amount | Accumulated Amortization | Gross Carrying Amount | Accumulated Amortization | Weighted Average Amortization Period (in years) | ||||||||||||||||||||||||

| Intangible assets with definite lives: | |||||||||||||||||||||||||||||

| Composite intangible asset | $ | $ | $ | $ | |||||||||||||||||||||||||

| Customer relationships | |||||||||||||||||||||||||||||

| Technology | |||||||||||||||||||||||||||||

| Trademarks | |||||||||||||||||||||||||||||

| License and distribution rights and other | |||||||||||||||||||||||||||||

| $ | $ | ||||||||||||||||||||||||||||

| Less: accumulated amortization and translation | |||||||||||||||||||||||||||||

| Intangible assets with definite lives, net | |||||||||||||||||||||||||||||

Intangible assets with indefinite lives, net (1) | |||||||||||||||||||||||||||||

| Total other intangibles, net | $ | $ | |||||||||||||||||||||||||||

(1) Intangible assets with indefinite lives include technology and trademarks.

Balances include foreign currency translation adjustments.

Intangible assets with definite lives are amortized over the estimated useful life of the assets. As of April 30, 2022, the estimate of future amortization expenses for intangible assets with definite lives is as follows:

| Fiscal Years: | (In millions) | ||||

| Remainder of 2022 | $ | ||||

| 2023 | |||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| Thereafter | |||||

| Total remaining amortization for intangible assets with definite lives | $ | ||||

The Company assesses definite-lived intangible assets whenever events or changes in circumstances indicate that the carrying amount of a definite-lived intangible asset (asset group) may not be recoverable. When events or changes in circumstances indicate that the carrying amount of a definite-lived intangible asset may not be recoverable, in accordance with related accounting standards, the Company evaluates whether the definite-lived intangible asset is impaired by comparing its carrying value to its undiscounted future cash flows.

The Company assesses indefinite-lived intangible assets annually in the third quarter of the fiscal year, or whenever events or circumstances indicate that the carrying amount of an indefinite-lived intangible asset (asset group) may not be recoverable. The Company evaluates whether the indefinite-lived intangible asset is impaired by comparing its carrying value to its fair value.

The Company performed an annual impairment assessment in the third quarter of fiscal 2021 and did no t recognize any intangible asset impairment charges.

14

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

Note 5. Debt

| (In millions) | April 30, 2022 | October 31, 2021 | |||||||||

| Overdraft and other credit facilities | $ | $ | |||||||||

| Term loan | |||||||||||

| Less: unamortized debt issuance cost | ( | ||||||||||

| Short-term debt | $ | $ | |||||||||

| Revolving credit | |||||||||||

| Term loans | |||||||||||

| Other | |||||||||||

| Less: unamortized debt issuance cost | ( | ( | |||||||||

| Long-term debt | |||||||||||

| Total debt | $ | $ | |||||||||

Term Loan Agreement on December 17, 2021

On December 17, 2021, the Company entered into a Term Loan Agreement (the 2021 Credit Agreement) by and among the Company, the lenders from time to time party thereto, and PNC Bank, National Association, as administrative agent. The 2021 Credit Agreement provides for a term loan facility (the 2021 Term Loan Facility) in an aggregate principal amount of $1.5 billion, which, unless terminated earlier, matures on December 17, 2026. In addition, the Company has the ability from time to time to request an increase to the commitments under the 2021 Term Loan Facility or to establish a new term loan facility under the 2021 Credit Agreement in an aggregate principal amount not to exceed $1.125 billion, upon prior written notice to the administrative agent and subject to the discretionary participation of the lenders funding such term loans and certain limitations set forth in the 2021 Credit Agreement.

Amounts outstanding under the 2021 Term Loan Facility will bear interest, at the Company’s option, at either (i) the alternate base rate, which is a rate per annum equal to the greatest of (a) the administrative agent’s prime rate, (b) one-half of one percent in excess of the federal funds effective rate and (c) one percent in excess of the adjusted London interbank offered (“LIBO”) rate for a one-month interest period on such day, or (ii) the adjusted LIBO rate, plus, in each case, an applicable rate of, initially, zero basis points, in respect of base rate loans, and 75 basis points, in respect of adjusted LIBO rate loans. Following a specified period after the closing date, the applicable rates will be determined quarterly by reference to a grid based upon the Company’s ratio of consolidated net indebtedness to consolidated EBITDA, each as defined in the 2021 Credit Agreement.

The 2021 Term Loan Facility is not subject to amortization and is not subject to mandatory prepayments prior to maturity. The Company may prepay loan balances from time to time, in whole or in part, without premium or penalty (other than any related breakage costs).

On December 17, 2021, the Company borrowed $1.5 billion under the 2021 Term Loan Facility and used the proceeds to fund the acquisition of Generate. Refer to Note. 2 Acquisitions and Joint Venture for more details.

The interest rate on the 2021 Term Loan Facility was 1.71 % at April 30, 2022.

The 2021 Credit Agreement contains customary restrictive covenants, as well as financial covenants that require the Company to maintain a certain Total Leverage Ratio and Interest Coverage Ratio, each as defined in the 2021 Credit Agreement, consistent with the 2020 Credit Agreement discussed below.

Term Loan Agreement on November 2, 2021

On November 2, 2021, the Company entered into a 364 -day, $840.0 million, term loan agreement by and among the Company, the lenders party thereto and The Bank of Nova Scotia, as administrative agent (the 2021 364 -Day Term Loan Agreement), which matures on November 1, 2022. The Company used part of the funds to partially repay outstanding borrowings under the 2020 Revolving Credit Facility and for general corporate purposes.

15

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

Amounts outstanding under the 2021 364 -Day Term Loan Agreement will bear interest, at the Company’s option, at either the alternate base rate, or the adjusted LIBO rate (each as defined in the 2021 364 -Day Term Loan Agreement), plus, in the case of adjusted LIBO rate loans, an applicable rate of 60 basis points.

The 2021 364 -Day Term Loan Agreement contains customary restrictive covenants, as well as financial covenants that require the Company to maintain a certain total leverage ratio and interest coverage ratio, each as defined in the 2021 364 -Day Term Loan Agreement, consistent with the 2020 Credit Agreement. discussed below.

Revolving Credit and Term Loan Agreement on April 1, 2020

On April 1, 2020, the Company entered into a Revolving Credit and Term Loan Agreement (the 2020 Credit Agreement), among the Company, CooperVision International Holding Company, LP, CooperSurgical Netherlands B.V., CooperVision Holding Kft. the lenders from time to time party thereto, and KeyBank National Association, as administrative agent. The 2020 Credit Agreement provides for (a) a multicurrency revolving credit facility (the 2020 Revolving Credit Facility) in an aggregate principal amount of $1.29 billion and (b) a term loan facility (the 2020 Term Loan Facility) in an aggregate principal amount of $850.0 million, each of which, unless terminated earlier, mature on April 1, 2025. In addition, the Company has the ability from time to time to request an increase to the size of the revolving credit facility or establish one or more new term loans under the term loan facility in an aggregate amount up to $1.605 billion, subject to the discretionary participation of the lenders.

Amounts outstanding under the 2020 Credit Agreement will bear interest, at the Company’s option, at either the base rate, or the adjusted LIBO rate or adjusted foreign currency rate, plus, in each case, an applicable rate of between 0.00 % and 0.50 % in respect of base rate loans, and between 0.75 % and 1.50 % in respect of adjusted LIBO rate or adjusted foreign currency rate loans, in each case in accordance with a pricing grid tied to the Total Leverage Ratio, as defined in the 2020 Credit Agreement. During the term of the 2020 Revolving Credit Facility, the Borrowers may borrow, repay and re-borrow amounts available under the Revolving Credit Facility, subject to voluntary reduction of the revolving commitment.

The Company pays an annual commitment fee that ranges from 0.10 % to 0.20 % of the unused portion of the 2020 Revolving Credit Facility based upon the Company’s Total Leverage Ratio, as defined in the 2020 Credit Agreement. In addition to the annual commitment fee, the Company is also required to pay certain letter of credit and related fronting fees and other administrative fees pursuant to the terms of the 2020 Credit Agreement.

On April 1, 2020, the Company borrowed $850.0 million under the 2020 Term Loan Facility and $445.0 million under the 2020 Revolving Credit Facility and used the proceeds to repay the outstanding amounts under the previous credit agreement and an outstanding term loan, and for general corporate purposes.

On October 30, 2020, the Company entered into Amendment No. 1 to the 2020 Credit Agreement (the First Amendment to the 2020 Credit Agreement). The First Amendment to the 2020 Credit Agreement modifies the 2020 Credit Agreement by, among other things, adding CooperVision International Limited as a revolving borrower and releasing certain borrowers in the 2020 Credit Agreement.

On December 17, 2021, the Company entered into Amendment No.2 to the 2020 Credit Agreement (the Second Amendment to the 2020 Credit Agreement). The Second Amendment to the 2020 Credit Agreement modified the 2020 Credit Agreement by, among other things, adding CooperSurgical Holdings Limited as a revolving borrower, releasing CooperVision Holding Kft as a borrower, and updating the benchmark replacement language in the 2020 Credit Agreement.

The interest rate on the 2020 Term Loan Facility was 1.71 % at April 30, 2022.

The 2020 Credit Agreement contains customary restrictive covenants, as well as financial covenants that require the Company to maintain a certain Total Leverage Ratio and Interest Coverage Ratio, each as defined in the 2020 Credit Agreement:

•Interest Coverage Ratio, as defined, to be at least 3.00 to 1.00 at all times.

•Total Leverage Ratio, as defined, to be no higher than 3.75 to 1.00.

At April 30, 2022, the Company was in compliance with the Interest Coverage Ratio at 39.28 to 1.00 and the Total Leverage Ratio at 2.59 to 1.00. The Company, after considering the potential impacts of the COVID-19 pandemic, expects to remain in compliance with its financial maintenance covenant and meet its debt service obligations for at least the twelve months following the date of issuance of these financial statements.

Refer to our Annual Report on Form 10-K for the fiscal year ended October 31, 2021, for more details.

16

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

The following is a summary of the maximum commitments and the net amounts available to us under credit facilities discussed above as of April 30, 2022:

| (In millions) | Facility Limit | Outstanding Borrowings | Outstanding Letters of Credit | Total Amount Available | Maturity Date | |||||||||||||||||||||||||||

| 2021 Term Loan Facility | $ | $ | n/a | December 17, 2026 | ||||||||||||||||||||||||||||

2021 | n/a | — | November 1, 2022 | |||||||||||||||||||||||||||||

| 2020 Revolving Credit Facility | $ | $ | April 1, 2025 | |||||||||||||||||||||||||||||

| 2020 Term Loan Facility | n/a | — | April 1, 2025 | |||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||||||||||||||||||

Note 6. Income Taxes

The Company's effective tax rates for the three months ended April 30, 2022, and April 30, 2021, were 22.7 % and 13.8 %, respectively. The increase was primarily due to changes in the geographical composition of pre-tax earnings and excess tax benefits from share-based compensation.

The Company's effective tax rates for the six months ended April 30, 2022, and April 30, 2021, were 22.3 % and (704.2 )%, respectively. The increase was primarily due to an intra-group transfer of intellectual property during the six months ended April 30, 2021, as discussed below.

In November 2020, the Company completed an intra-group transfer of certain intellectual property and related assets of CooperVision to a UK subsidiary as part of a group restructuring to establish headquarters operations in the UK. Determining fair value involved significant judgment related to future revenue growth, operating margins and discount rates. The transfer resulted in a step-up of the UK tax-deductible basis in the intellectual property and goodwill, creating a temporary difference between the book basis and the tax basis of these assets. As a result, the Company recognized a deferred tax asset of $1,987.9 million, with a corresponding income tax benefit, during the three months ended January 31, 2021.

Note 7. Earnings Per Share

| Periods Ended April 30, | Three Months | Six Months | |||||||||||||||||||||

| (In millions, except per share amounts) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Net income | $ | $ | $ | $ | |||||||||||||||||||

| Basic: | |||||||||||||||||||||||

| Weighted average common shares | |||||||||||||||||||||||

| Basic earnings per share | $ | $ | $ | $ | |||||||||||||||||||

| Diluted: | |||||||||||||||||||||||

| Weighted average common shares | |||||||||||||||||||||||

| Effect of dilutive stock plans | |||||||||||||||||||||||

| Diluted weighted average common shares | |||||||||||||||||||||||

| Diluted earnings per share | $ | $ | $ | $ | |||||||||||||||||||

The following table sets forth stock options to purchase our common stock that were not included in the diluted earnings per share calculation because their effect would have been antidilutive for the periods presented:

| Periods Ended April 30, | Three Months | Six Months | |||||||||||||||||||||

| (In thousands, except exercise prices) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Stock option shares excluded | |||||||||||||||||||||||

| Range of exercise prices | $ | $ | $ | $ | |||||||||||||||||||

| Restricted stock units excluded | |||||||||||||||||||||||

17

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

Note 8. Share-Based Compensation Plans

The Company has several share-based compensation plans that are described in the Company’s Annual Report on Form 10‑K for the fiscal year ended October 31, 2021. The compensation expense and related income tax benefit recognized in our Consolidated Statements of Income and Comprehensive Income for share-based awards were as follows:

| Periods Ended April 30, | Three Months | Six Months | |||||||||||||||||||||

| (In millions) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Selling, general and administrative expense | $ | $ | $ | $ | |||||||||||||||||||

| Cost of sales | |||||||||||||||||||||||

| Research and development expense | |||||||||||||||||||||||

| Total share-based compensation expense | $ | $ | $ | $ | |||||||||||||||||||

| Related income tax benefit | $ | $ | $ | $ | |||||||||||||||||||

Note 9. Stockholders’ Equity

Analysis of Changes in Accumulated Other Comprehensive (Loss) Income:

| (In millions) | Foreign Currency Translation Adjustment | Minimum Pension Liability | Derivative Instruments | Total | |||||||||||||||||||

| Balance at October 31, 2020 | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Gross change in value | |||||||||||||||||||||||

| Tax effect | ( | ( | ( | ( | |||||||||||||||||||

| Balance at October 31, 2021 | $ | ( | $ | ( | $ | $ | ( | ||||||||||||||||

| Gross change in value | ( | ( | |||||||||||||||||||||

| Tax effect | ( | ( | |||||||||||||||||||||

| Balance at April 30, 2022 | $ | ( | $ | ( | $ | $ | ( | ||||||||||||||||

Share Repurchases

In December 2011, the Company's Board of Directors authorized the 2012 Share Repurchase Program and through subsequent amendments, the most recent in March 2017, the total repurchase authorization was increased from $500.0 million to $1.0 billion of the Company's common stock. This program has no expiration date and may be discontinued at any time. Purchases under the 2012 Share Repurchase Program are subject to a review of the circumstances in place at the time and may be made from time to time as permitted by securities laws and other legal requirements.

During the three months ended April 30, 2022, there were no share repurchases under the program. During the six months ended April 30, 2022, the Company repurchased 191.2 thousand shares of its common stock for $78.5 million, at an average purchase price of $410.41 per share. At April 30, 2022, $256.4 million remained authorized for repurchase under the 2012 Share Repurchase Program.

During the three months ended April 30, 2021, there were no shares repurchases under the program. During the six months ended April 30, 2021, the Company repurchased 69.6 thousand shares of its common stock for $24.8 million, at an average purchase price of $356.61 per share.

Dividends

The Company paid a semiannual dividend of approximately $1.5 million or 3 cents per share, on February 9, 2022, to stockholders of record on January 21, 2022. The Company paid a semiannual dividend of approximately $1.5 million or 3 cents per share, on February 9, 2021, to stockholders of record on January 22, 2021.

Note 10. Fair Value Measurements

18

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

valuation techniques used to measure fair value. An asset’s or liability’s level is based on the lowest level of input that is significant to the fair value measurement. Assets and liabilities carried at fair value are valued and disclosed in one of the following three levels of the valuation hierarchy:

Level 1: Quoted market prices in active markets for identical assets or liabilities.

Level 2: Observable market-based inputs or unobservable inputs that are corroborated by market data.

Level 3: Unobservable inputs reflecting the reporting entity’s own assumptions.

At April 30, 2022, and October 31, 2021, the carrying value of cash and cash equivalents, accounts receivable, prepaid expense and other current assets, lines of credit, accounts payable and other current liabilities approximate fair value due to the short-term nature of such instruments and the ability to obtain financing on similar terms.

The carrying value of the Company's revolving credit facility and term loans approximates fair value based on current market rates (Level 2). On April 6, 2020, the Company entered into six interest rate swap contracts which are used to hedge its exposure to changes in cash flows associated with its variable rate debt and are designated as derivatives in a cash flow hedge. The payment streams are based on a total notional amount of $1.5 billion at the inception of the contracts. The interest rate swap contracts had maturities of seven years or less. As of April 30, 2022, three of the six interest rate swap contracts have matured and the outstanding contracts have a total notional amount of $1.0 billion.

The gain or loss on the derivatives is recorded as a component of accumulated other comprehensive income and subsequently reclassified into interest expense in the same period during which the hedged transaction affects earnings.

The fair value of the interest rate swap contracts is measured on a recurring basis by netting the discounted future fixed cash payments and the discounted expected variable cash receipts. The variable cash receipts are based on the expectation of future interest rates (forward curves) derived from observable market interest rate curves. The interest rate swap contracts were categorized as Level 2 in the fair value hierarchy, as the inputs to the derivative pricing model are generally observable and do not contain a high level of subjectivity. Refer to Note 14. Financial Derivatives and Hedging for further information.

The Company did not have any cross currency swaps or foreign currency forward contracts as of April 30, 2022, and October 31, 2021.

The fair value of the Company's contingent consideration for which a liability is recorded and the initial measurement of the joint venture interest, are a Level 3 measurement, and the change in fair value is recognized in selling, general and administrative expense in the Consolidated Statements of Income and Comprehensive Income. Refer to Note 2. Acquisitions and Joint Venture for further information.

Nonrecurring fair value measurements

Note 11. Employee Benefits

19

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

The Company's results of operations for the three and six months ended April 30, 2022, and 2021, reflect the following components of net periodic defined benefit costs:

| Periods Ended April 30, | Three Months | Six Months | |||||||||||||||||||||

| (In millions) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Service cost | $ | $ | $ | $ | |||||||||||||||||||

| Interest cost | |||||||||||||||||||||||

| Expected return on plan assets | ( | ( | ( | ( | |||||||||||||||||||

| Recognized net actuarial gain | |||||||||||||||||||||||

| Net periodic defined benefit plan cost | $ | $ | $ | $ | |||||||||||||||||||

The Company has not determined how much it expects to contribute to the Plan and did no t contribute to the Plan in the first half of fiscal 2022. The Company did no t contribute to the Plan in the first half of fiscal 2021. The expected rate of return on Plan assets for determining net periodic benefit plan cost is 8 %.

Note 12. Contingencies

Note 13. Business Segment Information

The Company discloses information about its operating segments, which were established based on the way that management organizes segments within the Company for making operating decisions and assessing financial performance. The Company's two operating segments are described below.

•CooperVision. Competes in the worldwide contact lens market by developing, manufacturing and marketing a broad range of products for contact lens wearers, featuring advanced materials and optics. CooperVision designs its products to solve vision challenges such as astigmatism, presbyopia, myopia, ocular dryness and eye fatigues, with a broad collection of spherical, toric and multifocal contact lenses.

•CooperSurgical. Competes in the general health care market with a focus on advancing the health of women, babies and families through a diversified portfolio of products and services focusing on women's health and fertility.

The Company has 50 % ownership in the new joint venture and accounts for this investment under the equity method of accounting. This joint venture is not considered material to the overall results of the Company and is grouped under CooperVision segment.

The Company uses operating income, as presented in our financial reports, as the primary measure of segment profitability. The Company does not allocate costs from corporate functions to segment operating income. Items below operating income are not considered when measuring the profitability of a segment. The Company uses the same accounting policies to generate segment results as the Company does for consolidated results.

Total identifiable assets are those used in continuing operations except cash and cash equivalents, which the Company includes as corporate assets.

20

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

Segment information:

| Periods Ended April 30, | Three Months | Six Months | |||||||||||||||||||||

| (In millions) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

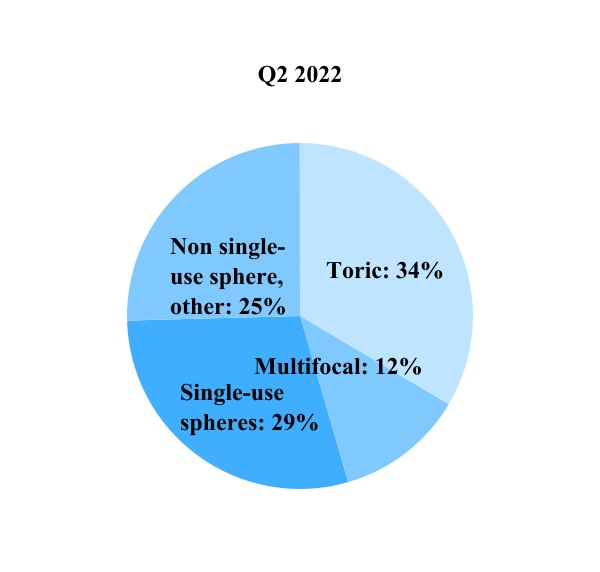

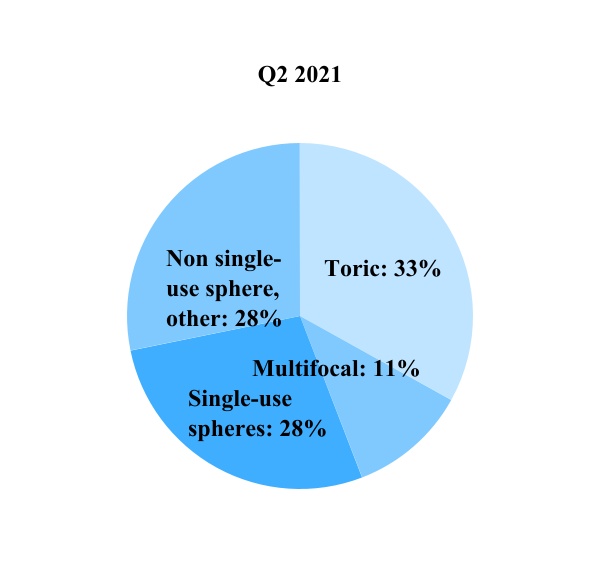

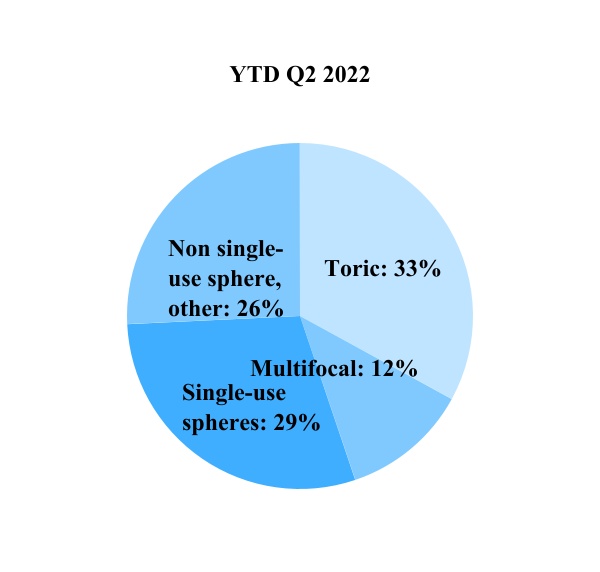

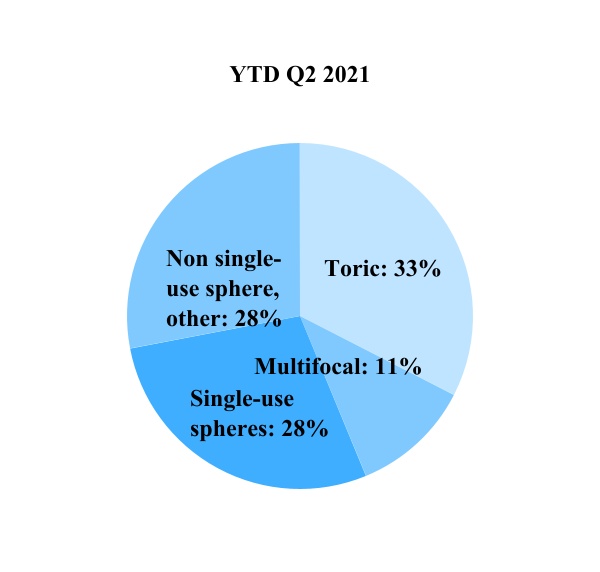

| CooperVision net sales by category: | |||||||||||||||||||||||

| Toric lens | $ | $ | $ | $ | |||||||||||||||||||

| Multifocal lens | |||||||||||||||||||||||

| Single-use sphere lens | |||||||||||||||||||||||

| Non single-use sphere, other | |||||||||||||||||||||||

| Total CooperVision net sales | $ | $ | $ | $ | |||||||||||||||||||

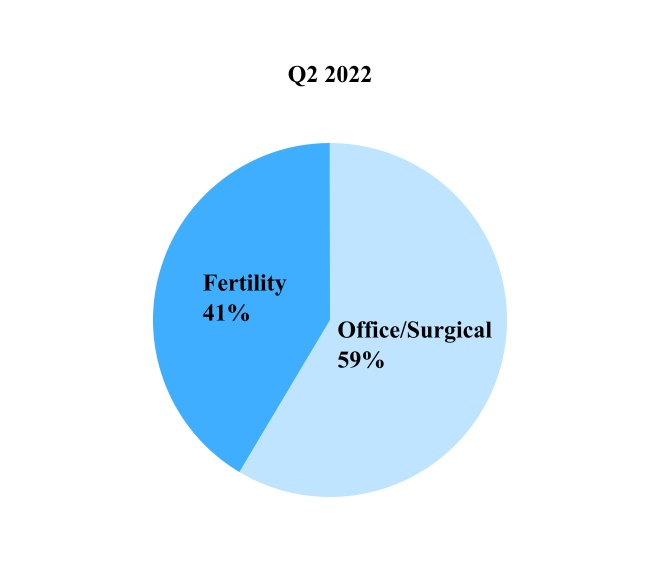

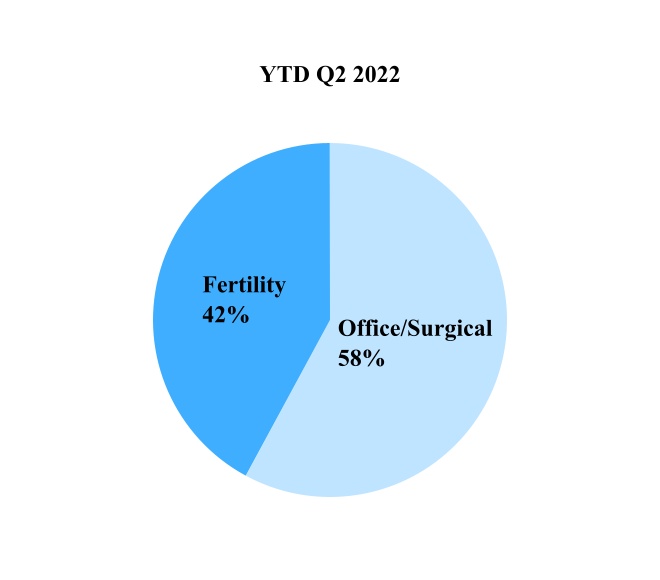

| CooperSurgical net sales by category: | |||||||||||||||||||||||

| Office and surgical products | $ | $ | $ | $ | |||||||||||||||||||

| Fertility | |||||||||||||||||||||||

| CooperSurgical net sales | |||||||||||||||||||||||

| Total net sales | $ | $ | $ | $ | |||||||||||||||||||

| Operating income (loss): | |||||||||||||||||||||||

| CooperVision | $ | $ | $ | $ | |||||||||||||||||||

| CooperSurgical | |||||||||||||||||||||||

| Corporate | ( | ( | ( | ( | |||||||||||||||||||

| Total operating income | |||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||

| Other (income) expense, net | ( | ( | ( | ||||||||||||||||||||

| Income before income taxes | $ | $ | $ | $ | |||||||||||||||||||

| (In millions) | April 30, 2022 | October 31, 2021 | |||||||||

| Total identifiable assets: | |||||||||||

| CooperVision | $ | $ | |||||||||

| CooperSurgical | |||||||||||

| Corporate | |||||||||||

| Total | $ | $ | |||||||||

Geographic information:

| Periods Ended April 30, | Three Months | Six Months | |||||||||||||||||||||

| (In millions) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Net sales to unaffiliated customers by country of domicile: | |||||||||||||||||||||||

| United States | $ | $ | $ | $ | |||||||||||||||||||

| Europe | |||||||||||||||||||||||

| Rest of world | |||||||||||||||||||||||

| Total | $ | $ | $ | $ | |||||||||||||||||||

| (In millions) | April 30, 2022 | October 31, 2021 | |||||||||

| Net property, plant and equipment by country of domicile: | |||||||||||

| United States | $ | $ | |||||||||

| Europe | |||||||||||

| Rest of world | |||||||||||

| Total | $ | $ | |||||||||

21

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

Note 14. Financial Derivatives and Hedging

As part of the Company’s overall risk management practices the Company enters into financial derivatives, interest rate swaps designated as cash flow hedges, to hedge the Company's exposure to changes in cash flows associated with its variable rate debt.

The Company records all derivatives on its Consolidated Condensed Balance Sheets at fair value. The accounting for changes in the fair value of derivatives depends on the intended use of the derivative, whether the Company has elected to designate a derivative in a hedging relationship and apply hedge accounting, and whether the hedging relationship has satisfied the criteria necessary to apply hedge accounting. All of the Company's derivatives have satisfied the criteria necessary to apply hedge accounting.

The gain or loss on derivative instruments designated and qualifying for cash flow hedge accounting is deferred in other comprehensive income. The changes in fair value for all trades that are not designated for hedge accounting are recognized in current period earnings. Deferred gains or losses from designated cash flow hedges are reclassified into earnings in the period that the hedged interest expense affects earnings. The effectiveness of cash flow hedges is assessed at inception and quarterly thereafter. The Company does not offset fair value amounts recognized for derivative instruments in its Consolidated Condensed Balance Sheets for presentation purposes.

Credit risk related to derivative transactions reflects the risk that a party to the transaction could fail to meet its obligation under the derivative contracts. Therefore, the Company’s exposure to the counterparty’s credit risk is generally limited to the amounts, if any, by which the counterparty’s obligations to the Company exceed the Company’s obligations to the counterparty. The Company’s policy is to enter into contracts only with financial institutions which meet certain minimum credit ratings to help mitigate counterparty credit risk.

As of April 30, 2022, and October 31, 2021, the Company had the following outstanding derivatives designated as hedging instruments:

| (In millions, except for number of instruments) | Number of Instruments | Notional Value | |||||||||

| Interest Rate Swap Contracts | $ | ||||||||||

These contracts have remaining maturities of five years or less.

The pre-tax impact of gain on derivatives recognized in other comprehensive income was $86.8 million ($65.7 million, net of tax) as of April 30, 2022. The pre-tax impact of loss on derivatives recognized in other comprehensive income was $8.9 million ($6.7 million, net of tax) as of April 30, 2021.

The following table summarizes the fair values of derivative instruments as of the periods indicated and the line items in the accompanying Consolidated Condensed Balance Sheets where the instruments are recorded:

| Derivative Assets | ||||||||||||||||||||

| (In millions) | April 30, 2022 | October 31, 2021 | ||||||||||||||||||

| Derivatives designated as cash flow hedges | Balance sheet location | |||||||||||||||||||

| Interest rate swap contracts | Other non-current assets | $ | $ | |||||||||||||||||

The following table summarizes the amounts recognized with respect to our derivative instruments within the accompanying Consolidated Statements of Income and Comprehensive Income:

| Periods Ended April 30, | Three Months | Six Months | |||||||||||||||||||||||||||

| (In millions) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||||

| Derivatives designated as cash flow hedges | Location of Loss Recognized on Derivatives | ||||||||||||||||||||||||||||

| Interest rate swap contracts | Interest expense | $ | $ | $ | $ | ||||||||||||||||||||||||

The Company expects that $(14.6 ) million recorded as a component of accumulated other comprehensive income will be realized in the Consolidated Statements of Income and Comprehensive Income over the next twelve months and the amount will vary depending on prevailing interest rates.

22

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

The following table details the changes in accumulated other comprehensive income:

| (In millions) | Amount | |||||||

| Beginning balance gain as of October 31, 2021 | $ | |||||||

Amount recognized in other comprehensive income on interest rate swap contracts, gross ($ | ||||||||

Amount reclassified from other comprehensive income into earnings, gross ($ | ||||||||

| Ending balance gain as of April 30, 2022 | $ | |||||||

23

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Item 2. Management’s Discussion and Analysis of Financial Condition

and Results of Operations

Note numbers refer to “Notes to Consolidated Condensed Financial Statements” in Item 1. Unaudited Financial Statements.

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These include statements relating to plans, prospects, goals, strategies, future actions, events or performance and other statements which are other than statements of historical fact, including all statements regarding the expected impact of the ongoing Coronavirus disease 2019 (COVID-19) pandemic on our business; and statements regarding acquisitions including the acquired companies' financial position, market position, product development and business strategy, expected cost synergies, expected timing and benefits of the transaction, difficulties in integrating entities or operations, as well as estimates of our and the acquired entities' future expenses, sales and earnings per share are forward-looking. In addition, all statements regarding anticipated growth in our net sales, anticipated effects of any product recalls, anticipated market conditions, planned product launches and expected results of operations and integration of any acquisition are forward-looking. To identify these statements, look for words like “believes,” “outlook,” “probable,” “expects,” “may,” “will,” “should,” “could,” “seeks,” “intends,” “plans,” “estimates” or “anticipates” and similar words or phrases. Forward-looking statements necessarily depend on assumptions, data or methods that may be incorrect or imprecise and are subject to risks and uncertainties. Among the factors that could cause our actual results and future actions to differ materially from those described in forward-looking statements are:

•The effects of the ongoing COVID-19 pandemic and related economic disruptions and new governmental regulations on our business, results of operations, cash flow and financial condition, including but not limited to the potential impact on our sales, operations and supply chain.

•Adverse changes in the global or regional general business, political and economic conditions, including the impact of continuing uncertainty and instability of certain countries, that could adversely affect our global markets, and the potential adverse economic impact and related uncertainty caused by these items, including but not limited to, the ongoing COVID-19 pandemic, inflation and escalating global trade barriers.

•The impact of Russia's invasion of Ukraine and the global response to this invasion on the global economy, European economy, financial markets, energy markets, currency rates and our ability to supply product to, or through, affected countries.

•Changes in tax laws or their interpretation, changes in statutory tax rates, and adverse outcomes in tax disputes including but not limited to, the United States (U.S.), the United Kingdom (UK) and other countries may affect our taxation of earnings recognized in foreign jurisdictions, result in unexpected tax liabilities, and/or negatively impact our effective tax rate.

•Foreign currency exchange rate and interest rate fluctuations including the risk of fluctuations in the value of foreign currencies or interest rates that would decrease our net sales and earnings.

•Our existing and future variable rate indebtedness and associated interest expense is impacted by rate increases, which could adversely affect our financial health or limit our ability to borrow additional funds.

•Acquisition-related adverse effects including the failure to successfully achieve the anticipated net sales, margins and earnings benefits of acquisitions, integration delays or costs and the requirement to record significant adjustments to the preliminary fair value of assets acquired and liabilities assumed within the measurement period, required regulatory approvals for an acquisition not being obtained or being delayed or subject to conditions that are not anticipated, adverse impacts of changes to accounting controls and reporting procedures, contingent liabilities or indemnification obligations, increased leverage and lack of access to available financing (including financing for the acquisition or refinancing of debt owed by us on a timely basis and on reasonable terms).

•Compliance costs and potential liability in connection with U.S. and foreign laws and health care regulations pertaining to privacy and security of personal information, such as HIPAA and the California Consumer Privacy

24

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Item 2. Management’s Discussion and Analysis of Financial Condition

and Results of Operations

Act (CCPA) in the U.S. and the General Data Protection Regulation requirements in Europe, including but not limited to those resulting from data security breaches.

•A major disruption in the operations of our manufacturing, accounting and financial reporting, research and development, distribution facilities or raw material supply chain due to the ongoing COVID-19 pandemic, integration of acquisitions, man-made or natural disasters, cybersecurity incidents or other causes.

•A major disruption in the operations of our manufacturing, accounting and financial reporting, research and development or distribution facilities due to technological problems, including any related to our information systems maintenance, enhancements or new system deployments, integrations or upgrades.

•Market consolidation of large customers globally through mergers or acquisitions resulting in a larger proportion or concentration of our business being derived from fewer customers.