UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03651

Touchstone Strategic Trust – December Funds

(Exact name of registrant as specified in charter)

303 Broadway,

Suite 1100

Cincinnati, Ohio 45202-4203

(Address of principal executive offices) (Zip code)

E. Blake Moore, Jr.

303 Broadway,

Suite 1100

Cincinnati, Ohio 45202-4203

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

| Touchstone Strategic Trust |

| Touchstone Anti-Benchmark® US Core Equity Fund |

| Touchstone Dynamic Global Allocation Fund |

| Touchstone Sands Capital International Growth Fund |

President

Touchstone Strategic Trust

| Average Annual Total Returns** | ||

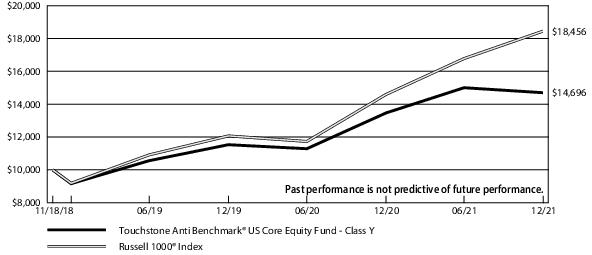

| Touchstone Anti-Benchmark® US Core Equity Fund | 1 Year | Since Inception* |

| Class A | 3.44% | 10.99% |

| Class C | 7.05% | 12.00% |

| Class Y | 9.14% | 13.14% |

| Institutional Class | 9.17% | 13.20% |

| Russell 1000® Index | 26.45% | 21.72% |

| * | The chart above represents performance of Class Y shares only, which will vary from the performance of Class A shares, Class C shares and Institutional Class shares based on the differences in sales loads and fees paid by shareholders in the different classes. The inception date of Class A shares, Class C shares, Class Y shares and Institutional Class shares was October 2, 2020, October 2, 2020, November 19, 2018, and November 19, 2018, respectively. Class A shares' and Class C shares' performance was calculated using the historical performance of Class Y shares for the periods prior to October 2, 2020. The returns have been restated for sales loads and fees applicable to Class A and Class C. The returns of the index listed above are based on the inception date of the Fund. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares and Institutional Class shares are not subject to sales charges. |

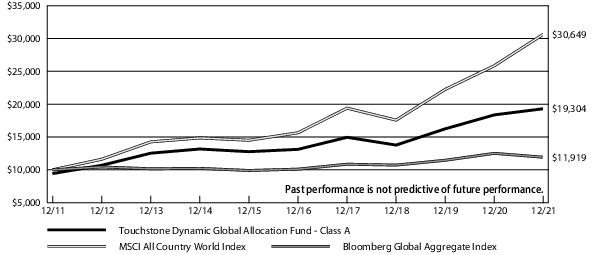

| Average Annual Total Returns** | |||

| Touchstone Dynamic Global Allocation Fund | 1 Year | 5 Years | 10 Years |

| Class A | -0.17% | 6.75% | 6.80% |

| Class C | 3.35% | 7.23% | 6.79% |

| Class Y | 5.39% | 8.29% | 7.70% |

| MSCI All Country World Index | 18.54% | 14.40% | 11.85% |

| Bloomberg Global Aggregate Index | -4.71% | 3.36% | 1.77% |

| * | The chart above represents performance of Class A shares only, which will vary from the performance of Class C shares and Class Y shares based on the differences in sales loads and fees paid by shareholders in the different classes. |

| ** | The average annual total returns shown above are adjusted for maximum sales loads and fees, if applicable. The maximum offering price per share of Class A shares is equal to the net asset value (“NAV”) per share plus a sales load equal to 5.26% of the NAV (or 5.00% of the offering price). Class C shares are subject to a contingent deferred sales charge (“CDSC”) of 1.00%. The CDSC will be assessed on an amount equal to the lesser of (1) the NAV at the time of purchase of the shares being redeemed or (2) the NAV of such shares being redeemed, if redeemed within a one-year period from the date of purchase. Class Y shares are not subject to sales charges. |

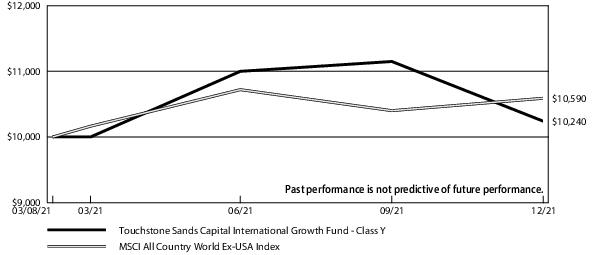

| Cumulative Total Returns** | |

| Touchstone Sands Capital International Growth Fund | Since Inception* |

| Class Y | 2.40% |

| Institutional Class | 2.50% |

| Class R6 | 2.50% |

| MSCI All Country World Ex-USA Index | 5.90% |

| * | The chart above represents performance of Class Y shares only, which will vary from the performance of Institutional Class shares and Class R6 shares based on the differences in fees paid by shareholders in the different classes. The inception date of the Fund was March 8, 2021. The returns of the index listed above are based on the inception date of the Fund. |

| ** | Not annualized. |

| Portfolio Abbreviations: |

| PLC – Public Limited Company |

| REIT – Real Estate Investment Trust |

| Valuation Inputs at Reporting Date: | ||||

| Description | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | $29,468,419 | $— | $— | $29,468,419 |

| Short-Term Investment Funds | 499,594 | — | — | 499,594 |

| Total | $29,968,013 | $— | $— | $29,968,013 |

| Portfolio Abbreviations: |

| ADR – American Depositary Receipt |

| PLC – Public Limited Company |

| 144a - This is a restricted security that was sold in a transaction qualifying for the exemption under Rule 144a of the Securities Act of 1933. This security may be sold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2021, these securities were valued at $9,434,591 or 15.0% of net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Trustees. |

| Valuation inputs at Reporting Date: | ||||

| Description | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | ||||

| Japan | $986,212 | $9,081,561 | $— | $10,067,773 |

| Netherlands | 3,585,018 | 3,045,003 | — | 6,630,021 |

| Taiwan | 6,057,172 | — | — | 6,057,172 |

| United States | 4,704,215 | — | — | 4,704,215 |

| Switzerland | 859,348 | 3,555,558 | — | 4,414,906 |

| China | — | 4,324,068 | — | 4,324,068 |

| Canada | 3,429,701 | — | — | 3,429,701 |

| Germany | 912,144 | 2,150,698 | — | 3,062,842 |

| India | 1,606,448 | 1,405,157 | — | 3,011,605 |

| France | — | 2,475,720 | — | 2,475,720 |

| United Kingdom | — | 1,959,046 | — | 1,959,046 |

| Denmark | — | 1,940,682 | — | 1,940,682 |

| Argentina | 1,926,864 | — | — | 1,926,864 |

| Sweden | — | 1,909,863 | — | 1,909,863 |

| Australia | — | 1,401,613 | — | 1,401,613 |

| Hong Kong | — | 1,112,232 | — | 1,112,232 |

| Russia | 1,025,778 | — | — | 1,025,778 |

| Brazil | 517,294 | — | — | 517,294 |

| Short-Term Investment Fund | 3,267,626 | — | — | 3,267,626 |

| Total | $28,877,820 | $34,361,201 | $— | $63,239,021 |

| Touchstone Anti- Benchmark® US Core Equity Fund | Touchstone Dynamic Global Allocation Fund | Touchstone Sands Capital International Growth Fund | |

| Assets | |||

| Affiliated securities, at cost | $— | $59,372,150 | $— |

| Non-affiliated securities, at cost | 24,213,561 | 24,595,920 | 65,380,870 |

| Affiliated securities, at market value | $— | $66,046,410 | $— |

| Non-affiliated securities, at market value* | 29,968,013 | 25,130,316 | 63,239,021 |

| Foreign currency † | — | — | 13,433 |

| Dividends and interest receivable | 16,270 | 9,014 | 13,018 |

| Receivable for capital shares sold | — | 4,590 | 512,586 |

| Receivable for investments sold | — | 764,692 | — |

| Receivable for securities lending income | 81 | 1,262 | — |

| Tax reclaim receivable | — | — | 2,608 |

| Other assets | 11,195 | 18,101 | 33,850 |

| Total Assets | 29,995,559 | 91,974,385 | 63,814,516 |

| Liabilities | |||

| Bank overdrafts | — | — | 8,062 |

| Payable for return of collateral for securities on loan | 242,685 | 6,776,220 | — |

| Payable for capital shares redeemed | 17,545 | 108,434 | 98,906 |

| Payable for investments purchased | 615,139 | — | 805,394 |

| Payable to Investment Advisor | 306 | 5,861 | 7,074 |

| Payable to other affiliates | 6,014 | 10,701 | 8,330 |

| Payable to Trustees | 18,786 | 18,786 | 18,786 |

| Payable for professional services | 26,471 | 25,932 | 36,145 |

| Payable for reports to shareholders | 4,608 | 5,190 | 3,019 |

| Payable for transfer agent services | 13,607 | 56,916 | 8,328 |

| Other accrued expenses and liabilities | 5,237 | 4,554 | 5,855 |

| Total Liabilities | 950,398 | 7,012,594 | 999,899 |

| Net Assets | $29,045,161 | $84,961,791 | $62,814,617 |

| Net assets consist of: | |||

| Paid-in capital | 20,127,192 | 76,191,160 | 65,884,181 |

| Distributable earnings (deficit) | 8,917,969 | 8,770,631 | (3,069,564) |

| Net Assets | $29,045,161 | $84,961,791 | $62,814,617 |

| *Includes market value of securities on loan of: | $225,418 | $6,637,159 | $— |

| †Cost of foreign currency: | $— | $— | $13,426 |

| Touchstone Anti- Benchmark® US Core Equity Fund | Touchstone Dynamic Global Allocation Fund | Touchstone Sands Capital International Growth Fund | |

| Pricing of Class A Shares | |||

| Net assets applicable to Class A shares* | $6,481,839 | $77,866,484 | $— |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | 438,656 | 5,917,979 | — |

| Net asset value price per share | $14.78 | $13.16 | $— |

| Maximum sales charge - Class A shares | 5.00% | 5.00% | — |

| Maximum offering price per share (100%/(100%-maximum sales charge) of net asset value adjusted to the nearest cent) - Class A shares | $15.56 | $13.85 | $— |

| Pricing of Class C Shares | |||

| Net assets applicable to Class C shares | $1,481,982 | $2,034,742 | $— |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | 111,894 | 158,113 | — |

| Net asset value and offering price per share** | $13.24 | $12.87 | $— |

| Pricing of Class Y Shares | |||

| Net assets applicable to Class Y shares | $15,923,771 | $5,060,565 | $1,274,274 |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | 1,065,407 | 380,474 | 124,454 |

| Net asset value, offering price and redemption price per share | $14.95 | $13.30 | $10.24 |

| Pricing of Institutional Class Shares | |||

| Net assets applicable to Institutional Class shares | $5,157,569 | $— | $35,915,458 |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | 339,907 | — | 3,503,980 |

| Net asset value, offering price and redemption price per share | $15.17 | $— | $10.25 |

| Pricing of Class R6 Shares | |||

| Net assets applicable to Class R6 shares | $— | $— | $25,624,885 |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | — | — | 2,500,250 |

| Net asset value, offering price and redemption price per share | $— | $— | $10.25 |

| * | There is no sales load on subscriptions of $1 million or more. Redemptions that were part of a $1 million or more subscription may be subject to a contingent deferred sales load if redeemed within a one-year period from the date of purchase. |

| ** | Redemption price per share varies by length of time shares are held due to the terms of the contingent deferred sales charge. |

| Touchstone Anti- Benchmark® US Core Equity Fund | Touchstone Dynamic Global Allocation Fund | Touchstone Sands Capital International Growth Fund(A) | |

| Investment Income | |||

| Dividends from affiliated securities | $— | $1,057,632 | $— |

| Dividends from non-affiliated securities* | 757,500 | 471,145 | 112,035 |

| Income from securities loaned | 414 | 20,919 | — |

| Total Investment Income | 757,914 | 1,549,696 | 112,035 |

| Expenses | |||

| Investment advisory fees | 176,449 | 221,461 | 287,571 |

| Administration fees | 66,008 | 116,034 | 46,110 |

| Compliance fees and expenses | 3,038 | 3,038 | 2,552 |

| Custody fees | 16,627 | 3,907 | 11,851 |

| Professional fees | 35,384 | 28,403 | 50,953 |

| Transfer Agent fees, Class A | 10,726 | 74,520 | — |

| Transfer Agent fees, Class C | 2,091 | 3,228 | — |

| Transfer Agent fees, Class Y | 16,480 | 5,266 | 525 |

| Transfer Agent fees, Institutional Class | 221 | — | 7,838 |

| Transfer Agent fees, Class R6 | — | — | 21 |

| Registration Fees, Class A | 9,101 | 16,789 | — |

| Registration Fees, Class C | 8,373 | 14,079 | — |

| Registration Fees, Class Y | 9,749 | 9,818 | 3,432 |

| Registration Fees, Institutional Class | 5,755 | — | 6,770 |

| Registration Fees, Class R6 | — | — | 2,454 |

| Reports to Shareholders, Class A | 3,338 | 11,301 | — |

| Reports to Shareholders, Class C | 2,532 | 3,643 | — |

| Reports to Shareholders, Class Y | 3,445 | 3,531 | 2,574 |

| Reports to Shareholders, Institutional Class | 2,138 | — | 2,825 |

| Reports to Shareholders, Class R6 | — | — | 2,534 |

| Distribution expenses, Class A | 16,273 | 202,547 | — |

| Distribution and shareholder servicing expenses, Class C | 17,291 | 25,120 | — |

| Trustee fees | 23,821 | 23,821 | 23,821 |

| Other expenses | 23,478 | 46,914 | 17,715 |

| Total Expenses | 452,318 | 813,420 | 469,546 |

| Fees waived and/or reimbursed by the Advisor and/or Affiliates(B) | (170,980) | (373,151) | (165,985) |

| Net Expenses | 281,338 | 440,269 | 303,561 |

| Net Investment Income (Loss) | 476,576 | 1,109,427 | (191,526) |

| Realized and Unrealized Gains (Losses) on Investments | |||

| Net realized gains(losses) on investments in non-affiliated securities | 4,739,599 | 181,405 | (876,236) |

| Net realized gains on investments in affiliated securities | — | 1,794,980 | — |

| Net realized gains (losses) on foreign currency transactions | (44) | — | 10,633 |

| Capital gain distributions received from affiliated funds | — | 3,276,695 | — |

| Net change in unrealized appreciation(depreciation) on investments in non-affiliated securities | (1,116,577) | (921,412) | (2,141,849) |

| Net change in unrealized appreciation (depreciation) on investments in affiliated securities | — | (955,482) | — |

| Net change in unrealized appreciation (depreciation) on foreign currency transactions | — | — | (539) |

| Net Realized and Unrealized Gains (Losses) on Investments | 3,622,978 | 3,376,186 | (3,007,991) |

| Change in Net Assets Resulting from Operations | $4,099,554 | $4,485,613 | $(3,199,517) |

| *Net of foreign tax withholding of: | $— | $— | $14,549 |

| (A) | Represents the period from commencement of operations (March 8, 2021) through December 31, 2021. |

| (B) | See Note 4 in Notes to Financial Statements. |

| Touchstone Anti- Benchmark® US Core Equity Fund | Touchstone Dynamic Global Allocation Fund | Touchstone Sands Capital International Growth Fund | ||||

| For the Year Ended December 31, 2021 | For the Three Months Ended December 31, 2020(A) | For the Year Ended September 30, 2020 | For the Year Ended December 31, 2021 | For the Year Ended December 31, 2020 | For the Period Ended December 31, 2021(B) | |

| From Operations | ||||||

| Net investment income (loss) | $476,576 | $106,753 | $565,367 | $1,109,427 | $1,008,492 | $(191,526) |

| Net realized gains (losses) on investments and foreign currency transactions | 4,739,555 | 5,181,759 | 1,127,307 | 5,253,080 | 1,030,762 | (865,603) |

| Net change in unrealized appreciation (depreciation) on investments and foreign currency transactions | (1,116,577) | (644,549) | 2,259,173 | (1,876,894) | 8,115,933 | (2,142,388) |

| Change in Net Assets from Operations | 4,099,554 | 4,643,963 | 3,951,847 | 4,485,613 | 10,155,187 | (3,199,517) |

| Distributions to Shareholders: | ||||||

| Distributed earnings, Class A | (214,429) | (65,466) | — | (4,319,434) | (2,320,966) | — |

| Distributed earnings, Class C | (44,902) | — | — | (98,167) | (69,303) | — |

| Distributed earnings, Class Y | (579,062) | (224,585) | (4,992) | (289,245) | (139,672) | — |

| Distributed earnings, Institutional Class | (510,927) | (3,121) | (1,274,135) | — | — | — |

| Return of capital, Class Y | — | — | (98) | — | — | — |

| Return of capital, Institutional Class | — | — | (28,806) | — | — | — |

| Total Distributions | (1,349,320) | (293,172) | (1,308,031) | (4,706,846) | (2,529,941) | — |

| Change in Net Assets from Share Transactions(C) | (22,329,169) | 13,528,761 | 1,401,151 | (4,191,020) | (4,562,939) | 66,014,134 |

| Total Increase (Decrease) in Net Assets | (19,578,935) | 17,879,552 | 4,044,967 | (4,412,253) | 3,062,307 | 62,814,617 |

| Net Assets | ||||||

| Beginning of period | 48,624,096 | 30,744,544 | 26,699,577 | 89,374,044 | 86,311,737 | — |

| End of period | $29,045,161 | $48,624,096 | $30,744,544 | $84,961,791 | $89,374,044 | $62,814,617 |

| (A) | The Fund changed its year end from September 30 to December 31. |

| (B) | Represents the period from commencement of operations (March 8, 2021) through December 31, 2021. |

| (C) | For details on share transactions by class, see Statements of Changes in Net Assets - Capital Stock Activity on page 22 - 23. |

| Touchstone Anti- Benchmark® US Core Equity Fund | ||||||

| For the Year Ended December 31, 2021 | For the Three Months Ended December 31, 2020(A) | For the Year Ended September 30, 2020 | ||||

| Shares | Dollars | Shares | Dollars | Shares | Dollars | |

| Class A | ||||||

| Proceeds from Shares issued | 41,894 | $619,883 | 7,778 | $109,618 | — | $— |

| Proceeds from Shares issued in connection with reorganization | — | — | 452,453 | 5,867,004 | — | — |

| Reinvestment of distributions | 10,386 | 152,526 | 3,187 | 44,558 | — | — |

| Cost of Shares redeemed | (53,991) | (809,581) | (23,051) | (310,179) | — | — |

| Change from Class A Share Transactions | (1,711) | (37,172) | 440,367 | 5,711,001 | — | — |

| Class C | ||||||

| Proceeds from Shares issued | 338 | 4,524 | 216 | 2,621 | — | — |

| Proceeds from Shares issued in connection with reorganization | — | — | 171,625 | 1,985,084 | — | — |

| Reinvestment of distributions | 3,317 | 43,502 | — | — | — | — |

| Cost of Shares redeemed | (47,554) | (631,369) | (16,048) | (196,557) | — | — |

| Change from Class C Share Transactions | (43,899) | (583,343) | 155,793 | 1,791,148 | — | — |

| Class Y | ||||||

| Proceeds from Shares issued | 32,704 | 490,829 | 5,349 | 72,146 | 8,687 | 96,718 |

| Proceeds from Shares issued in connection with reorganization | — | — | 1,297,709 | 17,043,427 | — | — |

| Net shares reduction due to reverse stock split | — | — | (1,492) | — | — | — |

| Reinvestment of distributions | 34,967 | 519,941 | 13,739 | 194,269 | 440 | 5,090 |

| Cost of Shares redeemed | (228,587) | (3,451,230) | (102,684) | (1,408,744) | (330) | (3,598) |

| Change from Class Y Share Transactions | (160,916) | (2,440,460) | 1,212,621 | 15,901,098 | 8,797 | 98,210 |

| Institutional Class | ||||||

| Proceeds from Shares issued | — | — | 235 | 3,121 | — | — |

| Proceeds from Shares issued in connection with reorganization | — | — | 9,204 | 122,393 | — | — |

| Net shares reduction due to reverse stock split | — | — | (315,728) | — | — | — |

| Reinvestment of distributions | 33,650 | 510,927 | — | — | 113,294 | 1,302,941 |

| Cost of Shares redeemed | (1,276,961) | (19,779,121) | (740,193) | (10,000,000) | — | — |

| Change from Institutional Class Share Transactions | (1,243,311) | (19,268,194) | (1,046,482) | (9,874,486) | 113,294 | 1,302,941 |

| Class R6 | ||||||

| Proceeds from Shares issued | — | — | — | — | — | — |

| Cost of Shares redeemed | — | — | — | — | — | — |

| Change from Class R6 Share Transactions | — | — | — | — | — | — |

| Change from Share Transactions | (1,449,837) | $(22,329,169) | 762,299 | $13,528,761 | 122,091 | $1,401,151 |

| (A) | The Fund changed its year end from September 30 to December 31. |

| (B) | Represents the period from commencement of operations (March 8, 2021) through December 31, 2021. |

| Touchstone Dynamic Global Allocation Fund | Touchstone Sands Capital International Growth Fund | ||||

| For the Year Ended December 31, 2021 | For the Year Ended December 31, 2020 | For the Period Ended December 31, 2021(B) | |||

| Shares | Dollars | Shares | Dollars | Shares | Dollars |

| 163,860 | $2,239,998 | 400,834 | $4,843,914 | — | $— |

| — | — | — | — | — | — |

| 289,884 | 3,862,634 | 160,456 | 2,050,596 | — | — |

| (702,314) | (9,645,407) | (777,518) | (9,250,675) | — | — |

| (248,570) | (3,542,775) | (216,228) | (2,356,165) | — | — |

| 25,752 | 345,614 | 64,738 | 682,216 | — | — |

| — | — | — | — | — | — |

| 7,477 | 97,049 | 5,481 | 69,832 | — | — |

| (107,897) | (1,446,387) | (282,171) | (3,264,988) | — | — |

| (74,668) | (1,003,724) | (211,952) | (2,512,940) | — | — |

| 63,672 | 886,019 | 73,255 | 890,900 | 171,130 | 1,927,465 |

| — | — | — | — | — | — |

| — | — | — | — | — | — |

| 20,088 | 270,809 | 10,235 | 131,691 | — | — |

| (57,404) | (801,349) | (62,593) | (716,425) | (46,676) | (532,912) |

| 26,356 | 355,479 | 20,897 | 306,166 | 124,454 | 1,394,553 |

| — | — | — | — | 3,614,814 | 40,776,835 |

| — | — | — | — | — | — |

| — | — | — | — | — | — |

| — | — | — | — | — | — |

| — | — | — | — | (110,834) | (1,159,754) |

| — | — | — | — | 3,503,980 | 39,617,081 |

| — | — | — | — | 2,500,250 | 25,002,504 |

| — | — | — | — | — | (4) |

| — | — | — | — | 2,500,250 | 25,002,500 |

| (296,882) | $(4,191,020) | (407,283) | $(4,562,939) | 6,128,684 | $66,014,134 |

| Touchstone Anti-Benchmark® US Core Equity Fund—Class A | ||

| Selected Data for a Share Outstanding Throughout Each Period | ||

| Year Ended December 31, 2021 | Period Ended December 31,(A) 2020 | |

| Net asset value at beginning of period | $14.04 | $12.97 |

| Income (loss) from investment operations: | ||

| Net investment income | 0.11(B) | 0.02 |

| Net realized and unrealized gains on investments | 1.13 | 1.20 |

| Total from investment operations | 1.24 | 1.22 |

| Distributions from: | ||

| Net investment income | (0.28) | (0.15) |

| Realized capital gains | (0.22) | — |

| Total distributions | (0.50) | — |

| Net asset value at end of period | $14.78 | $14.04 |

| Total return(C) | 8.89% | 9.41%(D) |

| Ratios and supplemental data: | ||

| Net assets at end of period (000's) | $6,482 | $6,184 |

| Ratio to average net assets: | ||

| Net expenses | 0.79% | 0.79%(E) |

| Gross expenses | 1.29% | 1.31%(E) |

| Net investment income | 0.71% | 0.70%(E) |

| Portfolio turnover rate | 59% | 54%(D)(F) |

| Touchstone Anti-Benchmark® US Core Equity Fund—Class C | ||

| Selected Data for a Share Outstanding Throughout Each Period | ||

| Year Ended December 31, 2021 | Period Ended December 31, 2020(A) | |

| Net asset value at beginning of period | $12.64 | $11.57 |

| Income (loss) from investment operations: | ||

| Net investment income | (—)(B)(G) | —(G) |

| Net realized and unrealized gains on investments | 1.00 | 1.07 |

| Total from investment operations | 1.00 | 1.07 |

| Distributions from: | ||

| Net investment income | (0.18) | — |

| Realized capital gains | (0.22) | — |

| Total distributions | (0.40) | — |

| Net asset value at end of period | $13.24 | $12.64 |

| Total return(C) | 8.05% | 9.25%(D) |

| Ratios and supplemental data: | ||

| Net assets at end of period (000's) | $1,482 | $1,969 |

| Ratio to average net assets: | ||

| Net expenses | 1.54% | 1.54%(E) |

| Gross expenses | 2.44% | 2.22%(E) |

| Net investment loss | (0.04%) | (0.05%)(E) |

| Portfolio turnover rate | 59% | 54%(D)(F) |

| (A) | Represents the period from commencement of operations (October 2, 2020) through December 31, 2020. |

| (B) | The net investment income per share was based on average shares outstanding for the period. |

| (C) | Total return shown exclude the effect of applicable sales loads. If these charges were included, the returns would be lower. |

| (D) | Not annualized. |

| (E) | Annualized. |

| (F) | Portfolio turnover excludes the purchases and sales of securities of the Touchstone Dynamic Equity Fund merger on October 2, 2020. If these transactions were included, portfolio turnover would have been higher. |

| (G) | Less than $0.005 per share. |

| Touchstone Anti-Benchmark® US Core Equity Fund—Class Y | ||||

| Selected Data for a Share Outstanding Throughout Each Period | ||||

| Year Ended December 31, 2021 | Three Months Ended December 31, 2020(A)(B) | Year Ended September 30, 2020(A) | Period Ended September 30, 2019(A)(C) | |

| Net asset value at beginning of period | $14.20 | $13.05 | $11.88 | $11.22 |

| Income (loss) from investment operations: | ||||

| Net investment income | 0.15(D) | 0.04 | 0.29 | 0.10 |

| Net realized and unrealized gains on investments | 1.14 | 1.30 | 1.44 | 0.63 |

| Total from investment operations | 1.29 | 1.34 | 1.73 | 0.73 |

| Distributions from: | ||||

| Net investment income | (0.32) | (0.19) | (0.38) | (0.07) |

| Realized capital gains | (0.22) | — | (0.17) | — |

| Return of capital | — | — | (0.01) | — |

| Total distributions | (0.54) | (0.19) | (0.56) | (0.07) |

| Net asset value at end of period | $14.95 | $14.20 | $13.05 | $11.88 |

| Total return | 9.14% | 10.23%(E) | 14.63% | 6.57%(E) |

| Ratios and supplemental data: | ||||

| Net assets at end of period (000's) | $15,924 | $17,411 | $159 | $52 |

| Ratio to average net assets: | ||||

| Net expenses | 0.54% | 0.54%(F) | 0.54% | 0.54%(F) |

| Gross expenses | 0.85% | 1.04%(F) | 9.63% | 110.89%(F) |

| Net investment income | 0.96% | 0.92%(F) | 1.91% | 2.10%(F) |

| Portfolio turnover rate | 59% | 54%(E)(G) | 73% | 137%(E)(H) |

| (A) | During the Three Months Ended December 31, 2020, the Fund effected the following reverse stock split effective the close of business October 2, 2020: 0.8911 for 1 for Class Y shares. All historical per share information has been retroactively adjusted to reflect this reverse stock split. |

| (B) | The Fund changed its fiscal year end from September 30 to December 31. |

| (C) | Represents the period from commencement of operations (November 19, 2018) through September 30, 2019. |

| (D) | The net investment income per share was based on average shares outstanding for the period. |

| (E) | Not annualized. |

| (F) | Annualized. |

| (G) | Portfolio turnover excludes the purchases and sales of securities of the Touchstone Dynamic Equity Fund merger on October 2, 2020. If these transactions were included, portfolio turnover would have been higher. |

| (H) | Portfolio turnover excludes securities received from processing a subscription-in-kind. |

| Touchstone Anti-Benchmark® US Core Equity Fund—Institutional Class | ||||

| Selected Data for a Share Outstanding Throughout Each Period | ||||

| Year Ended December 31, 2021 | Three Months Ended December 31, 2020(A)(B) | Year Ended September 30, 2020(A) | Period Ended September 30, 2019(A)(C) | |

| Net asset value at beginning of period | $14.57 | $13.22 | $12.03 | $11.36 |

| Income (loss) from investment operations: | ||||

| Net investment income | 0.17(D) | 0.04 | 0.25 | 0.22 |

| Net realized and unrealized gains on investments | 1.16 | 1.31 | 1.53 | 0.52 |

| Total from investment operations | 1.33 | 1.35 | 1.78 | 0.74 |

| Distributions from: | ||||

| Net investment income | (0.51) | (—)(E) | (0.41) | (0.07) |

| Realized capital gains | (0.22) | — | (0.17) | — |

| Return of capital | — | — | (0.01) | — |

| Total distributions | (0.73) | — | (0.59) | (0.07) |

| Net asset value at end of period | $15.17 | $14.57 | $13.22 | $12.03 |

| Total return | 9.17% | 10.22%(F) | 14.77% | 6.59%(F) |

| Ratios and supplemental data: | ||||

| Net assets at end of period (000's) | $5,158 | $23,061 | $30,585 | $26,648 |

| Ratio to average net assets: | ||||

| Net expenses | 0.44% | 0.44%(G) | 0.44% | 0.44%(G) |

| Gross expenses | 0.72% | 0.82%(G) | 0.77% | 0.85%(G) |

| Net investment income | 1.06% | 1.02%(G) | 2.01% | 2.21%(G) |

| Portfolio turnover rate | 59% | 54%(F)(H) | 73% | 137%(F)(I) |

| (A) | During the Three Months Ended December 31, 2020, the Fund effected the following reverse stock split effective the close of business October 2, 2020: 0.8799 for 1 for Institutional Class shares. All historical per share information has been retroactively adjusted to reflect this reverse stock split. |

| (B) | The Fund changed its fiscal year end from September 30 to December 31. |

| (C) | Represents the period from commencement of operations (November 19, 2018) through September 30, 2019. |

| (D) | The net investment income per share was based on average shares outstanding for the period. |

| (E) | Less than $0.005 per share. |

| (F) | Not annualized. |

| (G) | Annualized. |

| (H) | Portfolio turnover excludes the purchases and sales of securities of the Touchstone Dynamic Equity Fund merger on October 2, 2020. If these transactions were included, portfolio turnover would have been higher. |

| (I) | Portfolio turnover excludes securities received from processing a subscription-in-kind. |

| Touchstone Dynamic Global Allocation Fund—Class A | |||||

| Selected Data for a Share Outstanding Throughout Each Period | |||||

| Year Ended December 31, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value at beginning of period | $13.24 | $12.06 | $10.63 | $12.56 | $11.56 |

| Income (loss) from investment operations: | |||||

| Net investment income | 0.17 | 0.16 | 0.21 | 0.20 | 0.21 |

| Net realized and unrealized gains (losses) on investments | 0.50 | 1.41 | 1.68 | (1.16) | 1.39 |

| Total from investment operations | 0.67 | 1.57 | 1.89 | (0.96) | 1.60 |

| Distributions from: | |||||

| Net investment income | (0.33) | (0.19) | (0.26) | (0.26) | (0.26) |

| Realized capital gains | (0.42) | (0.20) | (0.20) | (0.71) | (0.34) |

| Total distributions | (0.75) | (0.39) | (0.46) | (0.97) | (0.60) |

| Net asset value at end of period | $13.16 | $13.24 | $12.06 | $10.63 | $12.56 |

| Total return(A) | 5.11% | 13.09% | 17.95% | (7.91%) | 13.96% |

| Ratios and supplemental data: | |||||

| Net assets at end of period (000's) | $77,866 | $81,624 | $77,001 | $54,871 | $67,562 |

| Ratio to average net assets: | |||||

| Net expenses(B) | 0.49% | 0.49% | 0.49% | 0.49% | 0.49% |

| Gross expenses(B) | 0.88% | 0.91% | 0.94% | 0.92% | 0.91% |

| Net investment income | 1.26% | 1.26% | 1.77% | 1.57% | 1.72% |

| Portfolio turnover rate | 20% | 33% | 38% | 40% | 32% |

| Touchstone Dynamic Global Allocation Fund—Class C | |||||

| Selected Data for a Share Outstanding Throughout Each Period | |||||

| Year Ended December 31, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value at beginning of period | $12.95 | $11.80 | $10.38 | $12.28 | $11.31 |

| Income (loss) from investment operations: | |||||

| Net investment income | 0.08 | 0.25 | 0.25 | 0.11 | 0.12 |

| Net realized and unrealized gains (losses) on investments | 0.48 | 1.20 | 1.51 | (1.13) | 1.35 |

| Total from investment operations | 0.56 | 1.45 | 1.76 | (1.02) | 1.47 |

| Distributions from: | |||||

| Net investment income | (0.22) | (0.10) | (0.14) | (0.17) | (0.16) |

| Realized capital gains | (0.42) | (0.20) | (0.20) | (0.71) | (0.34) |

| Total distributions | (0.64) | (0.30) | (0.34) | (0.88) | (0.50) |

| Net asset value at end of period | $12.87 | $12.95 | $11.80 | $10.38 | $12.28 |

| Total return(A) | 4.34% | 12.28% | 17.01% | (8.55%) | 13.10% |

| Ratios and supplemental data: | |||||

| Net assets at end of period (000's) | $2,035 | $3,015 | $5,250 | $24,897 | $33,039 |

| Ratio to average net assets: | |||||

| Net expenses(B) | 1.24% | 1.24% | 1.24% | 1.24% | 1.24% |

| Gross expenses(B) | 2.33% | 2.03% | 1.90% | 1.68% | 1.66% |

| Net investment income | 0.51% | 0.51% | 1.02% | 0.82% | 0.97% |

| Portfolio turnover rate | 20% | 33% | 38% | 40% | 32% |

| (A) | Total returns shown exclude the effect of applicable sales loads and fees. If these charges were included, the returns would be lower. |

| (B) | Ratio does not include expenses of the underlying funds. |

| Touchstone Dynamic Global Allocation Fund—Class Y | |||||

| Selected Data for a Share Outstanding Throughout Each Period | |||||

| Year Ended December 31, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value at beginning of period | $13.37 | $12.19 | $10.73 | $12.67 | $11.66 |

| Income (loss) from investment operations: | |||||

| Net investment income | 0.21 | 0.17 | 0.31 | 0.27 | 0.24 |

| Net realized and unrealized gains (losses) on investments | 0.51 | 1.42 | 1.64 | (1.21) | 1.40 |

| Total from investment operations | 0.72 | 1.59 | 1.95 | (0.94) | 1.64 |

| Distributions from: | |||||

| Net investment income | (0.37) | (0.21) | (0.29) | (0.29) | (0.29) |

| Realized capital gains | (0.42) | (0.20) | (0.20) | (0.71) | (0.34) |

| Total distributions | (0.79) | (0.41) | (0.49) | (1.00) | (0.63) |

| Net asset value at end of period | $13.30 | $13.37 | $12.19 | $10.73 | $12.67 |

| Total return | 5.39% | 13.23% | 18.35% | (7.69%) | 14.21% |

| Ratios and supplemental data: | |||||

| Net assets at end of period (000's) | $5,061 | $4,735 | $4,060 | $5,525 | $12,758 |

| Ratio to average net assets: | |||||

| Net expenses(A) | 0.24% | 0.24% | 0.24% | 0.24% | 0.24% |

| Gross expenses(A) | 0.87% | 0.88% | 0.97% | 0.85% | 0.78% |

| Net investment income | 1.51% | 1.51% | 2.02% | 1.82% | 1.97% |

| Portfolio turnover rate | 20% | 33% | 38% | 40% | 32% |

| Touchstone Sands Capital International Growth Fund—Class Y | |

| Selected Data for a Share Outstanding Throughout The Period | |

| Period Ended December 31, 2021(B) | |

| Net asset value at beginning of period | $10.00 |

| Income (loss) from investment operations: | |

| Net investment loss | (0.03) |

| Net realized and unrealized gains on investments | 0.27 |

| Total from investment operations | 0.24 |

| Net asset value at end of period | $10.24 |

| Total return | 2.40%(C) |

| Ratios and supplemental data: | |

| Net assets at end of period (000's) | $1,274 |

| Ratio to average net assets: | |

| Net expenses | 0.98%(D) |

| Gross expenses | 2.57%(D) |

| Net investment loss | (0.67%)(D) |

| Portfolio turnover rate | 18%(C) |

| (A) | Ratio does not include expenses of the underlying funds. |

| (B) | Represents the period from commencement of operations (March 8, 2021) through December 31, 2021. |

| (C) | Not annualized. |

| (D) | Annualized. |

| Touchstone Sands Capital International Growth Fund—Institutional Class | |

| Selected Data for a Share Outstanding Throughout The Period | |

| Period Ended December 31, 2021(A) | |

| Net asset value at beginning of period | $10.00 |

| Income (loss) from investment operations: | |

| Net investment loss | (0.02) |

| Net realized and unrealized gains on investments | 0.27 |

| Total from investment operations | 0.25 |

| Net asset value at end of period | $10.25 |

| Total return | 2.50%(B) |

| Ratios and supplemental data: | |

| Net assets at end of period (000's) | $35,915 |

| Ratio to average net assets: | |

| Net expenses | 0.88%(C) |

| Gross expenses | 1.36%(C) |

| Net investment loss | (0.57%)(C) |

| Portfolio turnover rate | 18%(B) |

| Touchstone Sands Capital International Growth Fund—Class R6 | |

| Selected Data for a Share Outstanding Throughout The Period | |

| Period Ended December 31, 2021(A) | |

| Net asset value at beginning of period | $10.00 |

| Income (loss) from investment operations: | |

| Net investment loss | (0.04) |

| Net realized and unrealized gains on investments | 0.29 |

| Total from investment operations | 0.25 |

| Net asset value at end of period | $10.25 |

| Total return | 2.50%(B) |

| Ratios and supplemental data: | |

| Net assets at end of period (000's) | $25,625 |

| Ratio to average net assets: | |

| Net expenses | 0.82%(C) |

| Gross expenses | 1.25%(C) |

| Net investment loss | (0.51%)(C) |

| Portfolio turnover rate | 18%(B) |

| (A) | Represents the period from commencement of operations (March 8, 2021) through December 31, 2021. |

| (B) | Not annualized. |

| (C) | Annualized. |

| Touchstone Anti-Benchmark® US Core Equity Fund ("Anti-Benchmark® US Core Equity Fund”) |

| Touchstone Dynamic Global Allocation Fund ("Dynamic Global Allocation Fund”) |

| Touchstone Sands Capital International Growth Fund ("Sands Capital International Growth Fund”) |

| Equity Fund Allocation | Fixed Income Fund Allocation | |

| Dynamic Global Allocation Fund | 45-75% | 25-55% |

| Fund | Investment Goal |

| Touchstone Anti-Benchmark® International Core Equity Fund | Seeks capital appreciation. |

| Touchstone Credit Opportunities Fund | Seeks absolute total return, primarily from income and capital appreciation. |

| Touchstone Growth Opportunities Fund | Seeks long-term growth of capital. |

| Touchstone International Growth Fund | Seeks to achieve long-term capital appreciation. |

| Touchstone Impact Bond Fund | Seeks high current income. Capital appreciation is secondary goal. |

| Touchstone Mid Cap Fund | Seeks long-term capital growth. |

| Touchstone Sands Capital Emerging Markets Growth Fund | Seeks long-term capital appreciation. |

| Touchstone Sands Capital Select Growth Fund | Seeks long-term capital appreciation. |

| Touchstone Small Cap Value Fund | Seeks long-term capital growth. |

| Touchstone Ultra Short Duration Fixed Income Fund | Seeks maximum total return consistent with the preservation of capital. |

| Touchstone Value Fund | Seeks to provide investors with long-term capital growth. |

| Dreyfus Government Cash Management | Seeks as high a level of current income as is consistent with the preservation of capital and the maintenance of liquidity. |

| iShares Core MSCI Emerging Markets ETF | Seeks to track the investment results of an index composed of large-, mid- and small-capitalization emerging market equities. |

| iShares International Treasury Bond ETF | Seeks to track the investment results of an index composed of non-U.S. developed market government bonds. |

| iShares MSCI EAFE Value ETF | Seeks to track the investment results of an index composed of developed market equities, excluding the U.S. and Canada, that exhibit value characteristics. |

| Vanguard Emerging Markets Government Bond ETF | Seeks to track the performance of a benchmark index that measures the investment return of U.S. dollar-denominated bonds issued by governments and government related issuers in emerging market countries. |

| Vanguard Total International Bond ETF | Seeks to track the performance of a benchmark index that measures the investment return of investment-grade bonds issued outside of the United States. |

| (1) | market value of investment securities, assets and liabilities at the current rate of exchange on the valuation date; and |

| (2) | purchases and sales of investment securities, income, and expenses at the relevant rates of exchange prevailing on the respective dates of such transactions. |

| Fund | Security Type | Market Value of Securities Loaned* | Market Value of Collateral Received** | Net Amount*** |

| Anti-Benchmark® US Core Equity Fund | Common Stocks | $225,418 | $242,685 | $17,267 |

| Dynamic Global Allocation Fund | Exchange-Traded Funds | 6,637,159 | 6,776,220 | 139,061 |

| * | The remaining contractual maturity is overnight for all securities. |

| ** | Gross amount of recognized liabilities for securities lending included in the Statements of Assets and Liabilities. |

| *** | Net amount represents the net amount payable due to (receive from) the borrower in the event of default. |

| Anti- Benchmark® US Core Equity Fund | Dynamic Global Allocation Fund | Sands Capital International Growth Fund | |

| Purchases of investment securities | $28,492,194 | $17,685,193 | $70,197,214 |

| Proceeds from sales and maturities | $50,993,384 | $22,060,905 | $7,197,621 |

| Anti-Benchmark® US Core Equity Fund | 0.35% on the first $1 billion 0.30% on such assets over $1 billion |

| Dynamic Global Allocation Fund | 0.25% on the first $1 billion 0.225% on the next $1 billion 0.20% on the next $1 billion 0.175% on such assets over $3 billion |

| Sands Capital International Growth Fund | 0.80% on all assets |

| TOBAM S.A.S. | Wilshire Advisors LLC | Sands Capital Management, LLC |

| Anti-Benchmark® US Core Equity Fund | Dynamic Global Allocation Fund | Sands Capital International Growth Fund |

| Class A | Class C | Class Y | Institutional Class | Class R6 | Termination Date | |

| Anti-Benchmark® US Core Equity Fund | 0.79% | 1.54% | 0.54% | 0.44% | — | April 29, 2022 |

| Dynamic Global Allocation Fund | 0.49% | 1.24% | 0.24% | — | — | April 29, 2022 |

| Sands Capital International Growth Fund | — | — | 0.98% | 0.88% | 0.82% | April 29, 2022 |

| Fund | Investment Advisory Fees Waived | Administration Fees Waived | Other Operating Expenses Reimbursed/ Waived | Total |

| Anti-Benchmark® US Core Equity Fund | $— | $55,221 | $115,759 | $170,980 |

| Dynamic Global Allocation Fund | 12,757 | 6,620 | 353,774 | 373,151 |

| Sands Capital International Growth Fund | 4,482 | 46,110 | 115,393 | 165,985 |

| Fund | Expires on or before September 30, 2022 | Expires on or before December 31, 2022 | Expires on or before September 30, 2023 | Expires on or before December 31, 2023 | Expires on or before December 31, 2024 | Total |

| Anti-Benchmark® US Core Equity Fund | $87,698 | $— | $102,369 | $49,914 | $139,222 | $379,203 |

| Dynamic Global Allocation Fund | — | 273,307 | — | 189,693 | 145,484 | 608,484 |

| Sands Capital International Growth Fund | — | — | — | — | 165,985 | 165,985 |

| Fund | Amount |

| Anti-Benchmark® US Core Equity Fund | $ 63 |

| Dynamic Global Allocation Fund | 9,824 |

| Fund | Class A | Class C |

| Anti-Benchmark® US Core Equity Fund | $ 4 | $ — |

| Dynamic Global Allocation Fund | 9 | 1,153 |

| Underlying Fund* | Market Value 12/31/20 | Purchases at cost | Proceeds from sales | Net Realized Gain (Loss)** | Net Change in Unrealized Appreciation (Depreciation) | Market Value 12/31/21 | Dividend Income | Shares |

| Touchstone Anti-Benchmark International Core Equity Fund | $9,082,029 | $2,052,313 | $(899,208) | $62,623 | $(1,541,949) | $8,755,808 | $369,202 | 888,013 |

| Touchstone Credit Opportunities Fund | 2,718,304 | 2,047,595 | (1,304,375) | (51,012) | 64,561 | 3,475,073 | 71,701 | 336,732 |

| Underlying Fund* | Market Value 12/31/20 | Purchases at cost | Proceeds from sales | Net Realized Gain (Loss)** | Net Change in Unrealized Appreciation (Depreciation) | Market Value 12/31/21 | Dividend Income | Shares | ||||||

| Touchstone Growth Opportunities Fund | $7,255,842 | $1,731,108 | $(1,495,348) | $223,967 | $236,095 | $7,951,664 | $— | 175,533 | ||||||

| Touchstone High Yield Fund | 2,684,179 | 123,194 | (2,810,898) | 297,612 | (294,087) | — | 71,662 | — | ||||||

| Touchstone Impact Bond Fund | 12,318,055 | 1,931,730 | (1,848,128) | (19,631) | (336,745) | 12,045,281 | 250,436 | 1,147,170 | ||||||

| Touchstone International Growth Fund | 4,495,125 | 861,496 | (997,531) | 109,445 | (316,820) | 4,151,715 | 77 | 286,325 | ||||||

| Touchstone Mid Cap Fund | 1,787,292 | 59,219 | (338,798) | 72,658 | 141,026 | 1,721,397 | 6,680 | 34,580 | ||||||

| Touchstone Sands Capital Emerging Markets Growth Fund | 2,806,340 | 2,198,940 | (2,018,369) | (33,011) | (315,799) | 2,638,101 | 46,146 | 136,406 | ||||||

| Touchstone Sands Capital Select Growth Fund | 5,681,280 | 392,585 | (2,131,582) | 606,158 | (705,179) | 3,843,262 | — | 200,588 | ||||||

| Touchstone Small Cap Value Fund | 1,781,595 | 3,949 | (568,798) | 80,375 | 427,263 | 1,724,384 | 7,868 | 49,438 | ||||||

| Touchstone Ultra Short Duration Fixed Income Fund | 3,501,404 | 2,924,802 | (316,649) | (3,184) | (34,121) | 6,072,252 | 58,063 | 662,187 | ||||||

| Touchstone Value Fund | 14,261,275 | 1,504,302 | (4,267,357) | 448,980 | 1,720,273 | 13,667,473 | 175,797 | 1,226,883 | ||||||

| Total: | $68,372,720 | $15,831,233 | $(18,997,041) | $1,794,980 | $(955,482) | $66,046,410 | $1,057,632 |

| * | All affiliated fund investments are invested in the Institutional Class shares, unless otherwise indicated. |

| ** | Excludes capital gain distributions. |

| Anti-Benchmark® US Core Equity Fund | Dynamic Global Allocation Fund | Sands Capital International Growth Fund | ||||

| Year Ended December 31, 2021 | Three Months Ended December 31, 2020 | Year Ended September 30, 2020 | Year Ended December 31, 2021 | Year Ended December 31, 2020 | Period Ended December 31, 2021(A) | |

| From ordinary income | $1,349,320 | $290,036 | $905,831 | $2,665,675 | $2,182,735 | $— |

| From long-term capital gains | — | — | 373,296 | 2,041,171 | 347,206 | — |

| From return of capital | — | — | 28,904 | — | — | — |

| Total distributions | $1,349,320 | $290,036 | $1,308,031 | $4,706,846 | $2,529,941 | $— |

| (A) | Represents the period from commencement of operations (March 8, 2021) through December 31, 2021. |

| Anti-Benchmark® US Core Equity Fund | Dynamic Global Allocation Fund | Sands Capital International Growth Fund | |

| Tax cost of portfolio investments | $25,458,307 | $84,073,683 | $65,615,464 |

| Gross unrealized appreciation on investments | 6,570,551 | 7,518,555 | 4,165,893 |

| Gross unrealized depreciation on investments | (2,060,845) | (415,512) | (6,542,336) |

| Net unrealized appreciation (depreciation) on investments | 4,509,706 | 7,103,043 | (2,376,443) |

| Gross unrealized appreciation on foreign currency transactions | — | — | 331 |

| Gross unrealized depreciation on foreign currency transactions | — | — | (1,227) |

| Net unrealized appreciation (depreciation) on foreign currency transactions | — | — | (896) |

| Capital loss carryforwards | (1,067,749) | — | (641,706) |

| Late year ordinary losses deferrals | — | — | (50,519) |

| Undistributed ordinary income | 1,185,991 | — | — |

| Undistributed capital gains | 4,312,476 | 1,667,588 | — |

| Other temporary differences | (22,455) | — | — |

| Accumulated earnings (deficit) | $8,917,969 | $8,770,631 | $(3,069,564) |

| Fund | No Expiration Short Term | No Expiration Long Term | Total |

| Anti-Benchmark® US Core Equity Fund | $ — | $ 1,067,749 | $ 1,067,749 |

| Sands Capital International Growth Fund | 641,706 | — | 641,706 |

| Fund | Utilized |

| Anti-Benchmark® US Core Equity Fund | $ 212,652 |

| Fund | Paid-In Capital | Distributable Earnings |

| Anti-Benchmark® US Core Equity Fund | $ 15,888 | $ (15,888) |

| Sands Capital International Growth Fund | (129,953) | 129,953 |

| Funds comprising the Touchstone Strategic Trust | Statement of Operations | Statements of changes in net assets | Financial Highlights |

| Touchstone Anti-Benchmark® US Core Equity Fund | For the year ended December 31, 2021 | For the year ended December 31, 2021, for the period from October 1, 2020 to December 31, 2020, and for the year ended September 30, 2020 | For the year ended December 31, 2021, for the period from October 1, 2020 to December 31, 2020, for the year ended September 30, 2020, and for the period from November 19, 2018 (commencement of operations) through September 30, 2019 |

| Touchstone Dynamic Global Allocation Fund | For the year ended December 31, 2021 | For each of the two years in the period ended December 31, 2021 | For each of the five years in the period ended December 31, 2021 |

| Touchstone Sands Capital International Growth Fund | For the period from March 8, 2021 through December 31, 2021 | For the period from March 8, 2021 (commencement of operations) through December 31, 2021 | |

| Anti-Benchmark® US Core Equity Fund | 49.62 % |

| Dynamic Global Allocation Fund | 58.66 % |

| Anti-Benchmark® US Core Equity Fund | 49.22 % |

| Dynamic Global Allocation Fund | 22.49 % |

| Anti-Benchmark® US Core Equity Fund | $ 4,312,476 |

| Dynamic Global Allocation Fund | $ 3,708,759 |

| Net Expense Ratio Annualized December 31, 2021 | Beginning Account Value July 1, 2021 | Ending Account Value December 31, 2021 | Expenses Paid During the Six Months Ended December 31, 2021* | ||

| Anti-Benchmark® US Core Equity Fund | |||||

| Class A | Actual | 0.79% | $1,000.00 | $978.10 | $3.94 |

| Class A | Hypothetical | 0.79% | $1,000.00 | $1,021.22 | $4.02 |

| Class C | Actual | 1.54% | $1,000.00 | $974.90 | $7.67 |

| Class C | Hypothetical | 1.54% | $1,000.00 | $1,017.44 | $7.83 |

| Class Y | Actual | 0.54% | $1,000.00 | $979.40 | $2.69 |

| Class Y | Hypothetical | 0.54% | $1,000.00 | $1,022.48 | $2.75 |

| Institutional Class | Actual | 0.44% | $1,000.00 | $979.60 | $2.20 |

| Institutional Class | Hypothetical | 0.44% | $1,000.00 | $1,022.99 | $2.24 |

| Dynamic Global Allocation Fund | |||||

| Class A | Actual | 0.49% | $1,000.00 | $993.30 | $2.46 |

| Class A | Hypothetical | 0.49% | $1,000.00 | $1,022.74 | $2.50 |

| Class C | Actual | 1.24% | $1,000.00 | $989.20 | $6.22 |

| Class C | Hypothetical | 1.24% | $1,000.00 | $1,018.95 | $6.31 |

| Class Y | Actual | 0.24% | $1,000.00 | $994.60 | $1.21 |

| Class Y | Hypothetical | 0.24% | $1,000.00 | $1,024.00 | $1.22 |

| Sands Capital International Growth Fund | |||||

| Class Y | Actual | 0.98% | $1,000.00 | $930.90 | $4.77 |

| Class Y | Hypothetical | 0.98% | $1,000.00 | $1,020.27 | $4.99 |

| Institutional Class | Actual | 0.88% | $1,000.00 | $931.80 | $4.28 |

| Institutional Class | Hypothetical | 0.88% | $1,000.00 | $1,020.77 | $4.48 |

| Class R6 | Actual | 0.82% | $1,000.00 | $931.80 | $3.99 |

| Class R6 | Hypothetical | 0.82% | $1,000.00 | $1,021.07 | $4.18 |

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

| Interested Trustees1: | |||||

| Name Address Year of Birth | Position Held with Trust | Term of Office And Length of Time Served2 | Principal Occupation(s) During Past 5 Years | Number of Funds Overseen in the Touchstone Fund Complex3 | Other Directorships Held During Past 5 Years4 |

| Jill T. McGruder Touchstone Advisors, Inc. 303 Broadway Suite 1100 Cincinnati, Ohio 45202 Year of Birth: 1955 | Trustee | Until retirement at age 75 or until she resigns or is removed Trustee since 1999 | President of Touchstone Funds from 1999 to 2020; Director and CEO of IFS Financial Services, Inc. (a holding company) since 1999; and Senior Vice President and Chief Marketing Officer of Western & Southern Financial Group, Inc. (a financial services company) since 2016. | 36 | Director, Integrity Life Insurance Co. and National Integrity Life Insurance Co. since 2005; Director, Touchstone Securities (the Distributor) since 1999; Director, Touchstone Advisors (the Advisor) since 1999; Director, W&S Brokerage Services, Inc. since 1999; Director, W&S Financial Group Distributors, Inc. since 1999; Director, Insurance Profillment Solutions LLC since 2014; Director, Columbus Life Insurance Co. since 2016; Director, The Lafayette Life Insurance Co. since 2016; Director, Gerber Life Insurance Company since 2019; Director, Western & Southern Agency, Inc. since 2018; and Director, LL Global, Inc. (not-for-profit trade organization with operating divisions LIMRA and LOMA) since 2016. |

| E. Blake Moore, Jr. Touchstone Advisors, Inc. 303 Broadway Suite 1100 Cincinnati, Ohio 45202 Year of Birth: 1958 | President and Trustee | Until retirement at age 75 or until he resigns or is removed Trustee since 2021 | President, Touchstone Funds since 2021; Chief Executive Officer of Touchstone Advisors, Inc. and Touchstone Securities, Inc. since 2020; President, Foresters Investment Management Company, Inc. from 2018 to 2020; President, North American Asset Management at Foresters Financial from 2018 to 2020; Managing Director, Head of Americas at UBS Asset Management from 2015 to 2017; and Executive Vice President, Head of Distribution at Mackenzie Investments from 2011 to 2014. | 36 | Trustee, College of Wooster since 2008; and Director, UBS Funds from 2015 to 2017. |

| Independent Trustees: | |||||

| Karen Carnahan c/o Touchstone Advisors, Inc. 303 Broadway Suite 1100 Cincinnati, Ohio 45202 Year of Birth: 1954 | Trustee | Until retirement at age 75 or until she resigns or is removed Trustee since 2019 | Retired; formerly Chief Operating Officer of Shred-it (a business services company) from 2014 to 2015; formerly President & Chief Operating Officer of the document management division of Cintas Corporation (a business services company) from 2008 to 2014. | 36 | Director, Cintas Corporation since 2019; Director, Boys & Girls Club of West Chester/Liberty since 2016; and Board of Advisors, Best Upon Request since 2020. |

| William C. Gale c/o Touchstone Advisors, Inc. 303 Broadway Suite 1100 Cincinnati, Ohio 45202 Year of Birth: 1952 | Trustee | Until retirement at age 75 or until he resigns or is removed Trustee since 2013 | Retired; formerly Senior Vice President and Chief Financial Officer of Cintas Corporation (a business services company) from 1995 to 2015. | 36 | None. |

| Independent Trustees (Continued): | |||||

| Name Address Year of Birth | Position Held with Trust | Term of Office And Length of Time Served2 | Principal Occupation(s) During Past 5 Years | Number of Funds Overseen in the Touchstone Fund Complex3 | Other Directorships Held During Past 5 Years4 |

| Susan J. Hickenlooper, CFA(5) c/o Touchstone Advisors, Inc. 303 Broadway Suite 1100 Cincinnati, Ohio 45202 Year of Birth: 1946 | Trustee | Until retirement at age 75 or until she resigns or is removed Trustee since 2009 | Retired from investment management. | 36 | Trustee, Episcopal Diocese of Southern Ohio from 2014 to 2018. |

| Susan M. King c/o Touchstone Advisors, Inc. 303 Broadway Suite 1100 Cincinnati, Ohio 45202 Year of Birth: 1963 | Trustee | Until retirement at age 75 or until she resigns or is removed Trustee since 2021 | Formerly, Partner of ID Funds LLC (2020 to 2021); formerly, Senior Vice President, Head of Product and Marketing Strategy of Foresters Financial (2018 to 2020); formerly, Managing Director, Head of Sales Strategy and Marketing, Americas of UBS Asset Management (2015 to 2017); formerly, Director, Allianz Funds, Allianz Funds Multi-Strategy Trust and AllianzGI Institutional Multi-Series Trust (2014 to 2015); and formerly, Director, Alliance Capital Cash Management Offshore Funds (2003 to 2005). | 36 | Trustee, Claremont McKenna College since 2017; Trustee, Israel Cancer Research Fund since 2019; and Board Member of WHAM! (Women's Health Access Matters) since 2021. |

| Kevin A. Robie c/o Touchstone Advisors, Inc. 303 Broadway Suite 1100 Cincinnati, Ohio 45202 Year of Birth: 1956 | Trustee | Until retirement at age 75 or until he resigns or is removed Trustee since 2013 | Retired; formerly Vice President of Portfolio Management at Soin LLC (private multinational holding company and family office) from 2004 to 2020. | 36 | Director, SaverSystems, Inc. since 2015; Director, Buckeye EcoCare, Inc. from 2013 to 2018; Director, Turner Property Services Group, Inc. since 2017; Trustee, Dayton Region New Market Fund, LLC (private fund) since 2010; and Trustee, Entrepreneurs Center, Inc. (business incubator) since 2006. |

| William H. Zimmer III c/o Touchstone Advisors, Inc. 303 Broadway Suite 1100 Cincinnati, Ohio 45202 Year of Birth: 1953 | Trustee | Until retirement at age 75 or until he resigns or is removed Trustee since 2019 | Independent Treasury Consultant since 2014. | 36 | Director, Deaconess Associations, Inc. (healthcare) since 2001; Trustee, Huntington Funds (mutual funds) from 2006 to 2015; and Director, National Association of Corporate Treasurers from 2011 to 2015. |

| Principal Officers: | |||

| Name Address Year of Birth | Position(s) Held with Trust(1) | Term of Office And Length of Time Served | Principal Occupation(s) During Past 5 Years |

| E. Blake Moore, Jr. Touchstone Advisors, Inc. 303 Broadway Suite 1100 Cincinnati, Ohio 45202 Year of Birth: 1958 | President and Trustee | Until resignation, removal or disqualification President since January 2021 | See biography above. |

| Timothy D. Paulin Touchstone Advisors, Inc. 303 Broadway Suite 1100 Cincinnati, Ohio 45202 Year of Birth: 1963 | Vice President | Until resignation, removal or disqualification Vice President since 2010 | Senior Vice President of Investment Research and Product Management of Touchstone Advisors, Inc. |

| Timothy S. Stearns Touchstone Advisors, Inc. 303 Broadway Suite 1100 Cincinnati, Ohio 45202 Year of Birth: 1963 | Chief Compliance Officer | Until resignation, removal or disqualification Chief Compliance Officer since 2013 | Chief Compliance Officer of Touchstone Advisors, Inc. |

| Terrie A. Wiedenheft Touchstone Advisors, Inc. 303 Broadway Suite 1100 Cincinnati, Ohio 45202 Year of Birth: 1962 | Controller and Treasurer | Until resignation, removal or disqualification Controller and Treasurer since 2006 | Senior Vice President, Chief Financial Officer and Chief Operations Officer, of IFS Financial Services, Inc. (a holding company) and Senior Vice President and Chief Administration Officer within the Office of the Chief Marketing Officer of Western & Southern Financial Group (2021 to Present). |

| Meredyth A. Whitford-Schultz Western & Southern Financial Group 400 Broadway Cincinnati, Ohio 45202 Year of Birth: 1981 | Secretary | Until resignation, removal or disqualification Secretary since 2018 | Senior Counsel - Securities/Mutual Funds of Western & Southern Financial Group (2015 to present); Associate at Morgan Lewis & Bockius LLP (law firm) (2014 to 2015); Associate at Bingham McCutchen LLP (law firm) (2008 to 2014). |

303 Broadway

Cincinnati, Ohio 45202-4203

800.638.8194

www.touchstoneinvestments.com

303 Broadway

Cincinnati, Ohio 45202-4203

4400 Computer Drive

Westborough, Massachusetts 01581

(b) Not applicable.

Item 2. Code of Ethics.

| (a) | The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. |

| (c) | There have been no amendments, during the period covered by this report, to a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, and that relates to any element of the code of ethics description. |

| (d) | The registrant has not granted any waivers, including an implicit waiver, from a provision of the code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party, that relates to one or more of the items set forth in paragraph (b) of this item’s instructions. |

| (e) | Not applicable. |

| (f) | A copy of the code of ethics is attached hereto as Exhibit 13(a)(1). |

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees has determined that the registrant has at least one audit committee financial expert serving on its audit committee. Ms. Karen Carnahan is the registrant’s audit committee financial expert and is an independent trustee within the meaning of the Investment Company Act of 1940, as amended (the “1940 Act”).

Item 4. Principal Accountant Fees and Services.

Audit Fees

| (a) | Audit fees for Touchstone Strategic Trust (December Funds) totaled $57,500 and $55,100 for the fiscal years ended December 31, 2021 and December 31, 2020, respectively, including fees associated with the annual audits and filings of Form N-1A and Form N-CEN. |

Audit-Related Fees

| (b) | The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant's financial statements and are not reported under paragraph (a) of this Item are $0 and $8,000 for the fiscal years ended December 31, 2021 and December 31, 2020, respectively. The fees for 2020 are associated with filings of Form N-1A and Form N-14. |

Tax Fees

| (c) | The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning were $20,060 and $11,760 for the fiscal years ended December 31, 2021 and December 31, 2020, respectively. The fees relate to the preparation of federal income and excise tax returns and review of capital gains distribution calculations. |

All Other Fees

| (d) | The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item are $1,266 and $1,639 for the fiscal years ended December 31, 2021 and December 31, 2020, respectively. The fees relate to the PFIC analyzer and Global Withholding Tax Reporter subscriptions. |

| (e)(1) | Disclose the audit committee's pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

The Audit Committee’s pre-approval policies describe the types of audit, audit-related, tax and other services that have the general pre-approval of the Audit Committee. The pre-approval policies provide that annual audit service fees, tax services not specifically granted pre-approval, services exceeding pre-approved cost levels and other services that have not received general pre-approval will be subject to specific pre-approval by the Audit Committee. The pre-approval policies further provide that the Committee may grant general pre-approval to other audit services (statutory audits and services associated with SEC registration statements, periodic reports and other documents filed with the SEC or other documents issued in connection with securities offerings), audit-related services (accounting consultations related to accounting, financial reporting or disclosure matters not classified as “audit services,” assistance with understanding and implementing new accounting and financial reporting guidance from rulemaking authorities, agreed-upon or expanded audit procedures related to accounting and/or billing records required to respond to or comply with financial, accounting or regulatory reporting matters and assistance with internal control reporting requirements under Form N-CSR), tax services that have historically been provided by the auditor that the Committee believes would not impair the independence of the auditor and are consistent with the SEC’s rules on auditor independence and permissible non-audit services classified as “all other services” that are routine and recurring services.

| (e)(2) | All of the services described in paragraphs (b) through (d) of Item 4 were approved by the Audit Committee. |

| (f) | The percentage of hours expended on the principal accountant's engagement to audit the registrant's financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant's full-time, permanent employees was less than fifty percent. |

| (g) | The aggregate non-audit fees for Touchstone Strategic Trust and certain entities*, totaled approximately $528,481 and $766,767 for the fiscal years ended December 31, 2021 and December 31, 2020, respectively. |

* These include the advisors (excluding non-affiliated sub-advisors) and any entity controlling, controlled by or under common control with the advisors that provides ongoing services to the registrant (Funds).

| (h) | The registrant's audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant's independence. |

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to shareholders filed under Item 1(a) of this form. |

| (b) | Not applicable. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which the shareholders may recommend nominees to the registrant’s board of trustees, where those changes were implemented after the registrant last provided disclosure in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K (17 CFR 229.407) (as required by Item 22(b)(15) of Schedule 14A (17 CFR 240.14a-101)), or this Item.

Item 11. Controls and Procedures.

| (a) | The registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)). |

| (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d))) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13. Exhibits.

| (a)(1) | Code of ethics, and any amendment thereto, that is the subject of disclosure required by Item 2 is attached hereto. |

| (a)(2) | Certifications pursuant to Rule 30a-2(a) under the 1940 Act and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto. |

| (a)(2)(1) | Not applicable. |

| (a)(2)(2) | Not applicable. |

| (b) | Certifications pursuant to Rule 30a-2(b) under the 1940 Act and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | Touchstone Strategic Trust |

| By (Signature and Title)* | /s/ E. Blake Moore, Jr. | |

| E. Blake Moore, Jr., President | ||

| (principal executive officer) | ||

| Date | March 1, 2022 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ E. Blake Moore, Jr. | |

| E. Blake Moore, Jr., President | ||

| (principal executive officer) | ||

| Date | March 1, 2022 |

| By (Signature and Title)* | /s/ Terrie A. Wiedenheft | |

| Terrie A. Wiedenheft, Controller and Treasurer | ||

| (principal financial officer) | ||

| Date | March 1, 2022 |

* Print the name and title of each signing officer under his or her signature.