Summary Prospectus

Touchstone International Value Fund July 30, 2013

Class A Ticker: FSIEX Class C Ticker: FTECX

Class Y Ticker: FIEIX Institutional Ticker: FIVIX

Before you invest, you may want to review the Fund's prospectus, which contains information about the Fund and its risks. The Fund's prospectus and Statement of Additional Information, both dated July 30, 2013, as amended from time to time, are incorporated by reference into this summary prospectus. For free paper or electronic copies of the Fund's prospectus and other information about the Fund, go to www.TouchstoneInvestments.com/home/formslit/, call 1.800.543.0407, or ask any financial advisor, bank, or broker-dealer who offers shares of the Fund.

The Fund's Investment Goal

The Fund seeks long-term capital growth.

The Fund's Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts for Class A shares if you and your family invest, or agree to invest in the future, at least $50,000 or more in the Touchstone Funds. More information about these and other discounts is available from your financial professional and in the section entitled "Choosing a Class of Shares" in the Fund's prospectus on page 60 and in the Fund's Statement of Additional Information on page 75.

|

Shareholder Fees (fees paid directly from your investment) |

Class A |

Class C |

Class Y |

Institutional |

|||||||||||||||

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

5.75 |

% |

None |

None |

None |

||||||||||||||

|

Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or the amount redeemed, whichever is less) |

None |

1.00 |

% |

None |

None |

||||||||||||||

|

Wire Redemption Fee |

Up to $15 |

Up to $15 |

Up to $15 |

Up to $15 |

|||||||||||||||

|

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

|||||||||||||||||||

|

Management Fees |

1.00 |

% |

1.00 |

% |

1.00 |

% |

1.00 |

% |

|||||||||||

|

Distribution (12b-1) Fees |

0.25 |

% |

1.00 |

% |

None |

None |

|||||||||||||

|

Other Expenses |

0.97 |

% |

7.33 |

% |

0.51 |

% |

0.36 |

% |

|||||||||||

|

Total Annual Fund Operating Expenses |

0.97 |

% |

7.33 |

% |

0.51 |

% |

0.36 |

% |

|||||||||||

|

Acquired Fund Fees and Expenses |

0.00 |

% |

0.00 |

% |

0.00 |

% |

0.00 |

% |

|||||||||||

|

Total Annual Fund Operating Expenses |

2.22 |

% |

9.33 |

% |

1.51 |

% |

1.36 |

% |

|||||||||||

|

Fee Waiver and/or Expense Reimbursement1 |

(0.83 |

%) |

(7.19 |

%) |

(0.37 |

%) |

(0.37 |

%) |

|||||||||||

|

Total Annual Fund Operating Expenses After Fee Waiver or Expense Reimbursement1 |

1.39 |

% |

2.14 |

% |

1.14 |

% |

0.99 |

% |

|||||||||||

1Touchstone Advisors, Inc, and the Trust have entered into an expense limitation agreement whereby Touchstone Advisors has contractually agreed to waive a portion of its fees or reimburse certain Fund expenses in order to limit annual fund operating expenses to 1.36%, 2.11%, 1.11%, and 0.96%, for Class A, C, Y, and Institutional Class shares, respectively. This expense limitation will remain in effect until at least November 29, 2013, but can be terminated by a vote of the Board of Trustees of the Fund if they deem the termination beneficial to the Fund's shareholders. Following the expiration date of the contractual waiver fee above, Touchstone Advisors has contractually agreed to waive a portion of its fees or reimburse certain Fund expenses in order to limit annual fund operating expenses to 1.39%, 2.14%, 1.14%, and 0.99%, for Classes A, C, Y, and Institutional shares, respectively. This expense limitation will remain in effect until at least July 29, 2014, but can be terminated by a vote of the Board of Trustees of the Fund if they deem the termination to be beneficial to the Fund's shareholders. Touchstone Advisors is entitled to recoup, subject to approval by the Board of Trustees of the Fund, such amounts reduced or reimbursed for a period of up to three years from the year in which Touchstone Advisors reduced its compensation and/or assumed expenses for the Fund. No recoupment will occur unless the Fund's expenses are below the expense limitation. See the discussion entitled "Expense Limitation Agreement" under the section entitled "The Investment Advisor" in the Fund's Statement of Additional Information for more information.

1

Touchstone International Value Fund

Example. This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then, except as indicated, redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same (reflecting the contractual fee waiver). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

Assuming Redemption at End of Period |

Assuming No Redemption |

||||||||||||||||||||||

|

Class A |

Class C |

Class Y |

Institutional |

Class C |

|||||||||||||||||||

| 1 Year |

$ |

708 |

$ |

317 |

$ |

116 |

$ |

101 |

$ |

217 |

|||||||||||||

| 3 Years |

$ |

1,154 |

$ |

2,054 |

$ |

441 |

$ |

394 |

$ |

2,054 |

|||||||||||||

| 5 Years |

$ |

1,625 |

$ |

3,736 |

$ |

789 |

$ |

709 |

$ |

3,736 |

|||||||||||||

| 10 Years |

$ |

2,921 |

$ |

7,342 |

$ |

1,770 |

$ |

1,603 |

$ |

7,342 |

|||||||||||||

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the portfolio turnover rate of the Fund was 133% of the average value of its portfolio.

The Fund's Principal Investment Strategies

Under normal circumstances, the Fund primarily invests its assets in equity securities of foreign issuers. Equity securities include common and preferred stocks. Non-U.S. issuer or foreign companies (or issuers) are companies that: (i) are organized under the laws of; (ii) maintain their principal place of business in; (iii) have the principal trading market for their securities in; (iv) derive at least 50% of revenues or profits from operation in; or (v) have at least 50% of their assets in, foreign countries. The Fund allocates its assets to securities of issuers located in both developed and emerging markets. The companies whose securities are represented in the Fund's portfolio are located in at least three countries other than the U.S. The Fund may invest in companies of any market capitalization.

The Fund's sub-advisor, Barrow, Hanley, Mewhinney & Strauss, LLC ("Barrow Hanley" or "Sub-Advisor"), uses traditional methods of stock selection — research and analysis — to identify securities it believes are undervalued. Barrow Hanley seeks to invest in companies that have (1) price-to-earnings and price-to-book ratios below the market, (2) enterprise-value/free-cash-flow ratios at or below the market, and (3) dividend yields above the market. For purposes of the preceding sentence, the companies comprising the MSCI EAFE Index constitute the market. Barrow Hanley's investment management approach may be described as traditional value with a focus on income from dividends because it generally focuses on companies which are out of favor with other investors due to internal or external challenges judged to be short-term in nature. Barrow Hanley's process seeks to identify the reasons for a temporary undervaluation of a company's shares and believes that value to the Fund can be added through individual stock selection.

Barrow Hanley utilizes risk management tools in an effort to keep the Fund from becoming over-exposed to particular market segments. Barrow Hanley is a "bottom-up" value manager meaning it analyzes the fundamentals of companies one at a time rather than focusing on broader market themes.

Barrow Hanley generally considers selling a security when, in Barrow Hanley's opinion, the security reaches fair value estimate, when earnings forecasts do not appear to justify the current price, when there has been or there is an expectation of an adverse change in the company's fundamentals, or when other investment opportunities appear more attractive.

The Fund may engage in frequent and active trading as part of its principal investment strategy.

The Principal Risks

The Fund's share price will fluctuate. You could lose money on your investment in the Fund, and the Fund could also return less than other investments. The Fund is subject to the principal risks listed below.

Emerging Markets Risk: Emerging markets may be more likely to experience political turmoil or rapid changes in market or economic conditions than more developed countries. In addition, the financial stability of issuers (including governments) in emerging market countries may be more precarious than in other countries. As a result, there will tend to be an increased risk of price volatility associated with the Fund's investments in emerging market countries, which may be magnified by currency fluctuations relative to the U.S. dollar.

Equity Securities Risk: The Fund is subject to the risk that stock prices will fall over short or extended periods of time. Individual companies may report poor results or be negatively affected by industry or economic trends and developments. The prices of securities issued by these companies may suffer a decline in response to such developments which could result in a decline in the value of the Fund's shares.

2

Touchstone International Value Fund

• Large-Cap Risk: Large-cap risk is the risk that stocks of larger companies may underperform relative to those of small- and mid-sized companies. Large-cap companies may be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes, and also may not be able to attain the high growth rate of successful smaller companies, especially during extended periods of economic expansion.

• Mid-Cap Risk: The Fund is subject to the risk that medium capitalization stocks may underperform other types of stocks or the equity markets as a whole. Stocks of mid-sized companies may be subject to more abrupt or erratic market movements than stocks of larger, more established companies. Mid-sized companies may have limited product lines, or financial resources, and may be dependent upon a particular niche of the market.

• Small-Cap Risk: The Fund is subject to the risk that small capitalization stocks may underperform other types of stocks or the equity markets as a whole. Stocks of smaller companies may be subject to more abrupt or erratic market movements than stocks of larger, more established companies. Small companies may have limited product lines or financial resources, or may be dependent upon a small or inexperienced management group. In addition, small-cap stocks typically are traded in lower volume, and their issuers typically are subject to greater degrees of changes in their earnings and prospects.

Foreign Securities Risk: Investing in foreign securities poses additional risks since political and economic events unique in a country or region will affect those markets and their issuers. These events will not necessarily affect the U.S. economy or similar issuers located in the United States. In addition, investments in foreign securities are generally denominated in foreign currency. As a result, changes in the value of those currencies compared to the U.S. dollar may affect (positively or negatively) the value of the Fund's investments. There are also risks associated with foreign accounting standards, government regulation, market information, and clearance and settlement procedures. Foreign markets may be less liquid and more volatile than U.S. markets and offer less protection to investors.

Management Risk: The Advisor engages one or more sub-advisors to make investment decisions on its behalf for a portion or all of the Fund. There is a risk that the advisor may be unable to identify and retain sub-advisors who achieve superior investment returns relative to other similar sub-advisors. The value of your investment may decrease if the Sub-Advisor's judgment about the attractiveness, value or market trends affecting a particular security, issuer, industry or sector or about market movements is incorrect.

Portfolio Turnover Risk: Frequent and active trading may result in greater expenses to the Fund, which may lower the Fund's performance.

Value Investing Risk: A value-oriented investment approach is subject to the risk that a security believed to be undervalued does not appreciate in value as anticipated or experiences a decline in value.

As with any mutual fund, there is no guarantee that the Fund will achieve its investment goal. You can find more information about the Fund's investments and risks under the "Investment Strategies and Risks" section of the Fund's Prospectus.

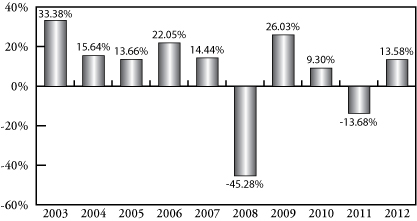

The Fund's Performance

The bar chart and the performance table below illustrate the risks and volatility of an investment in the Fund by showing changes in the Fund's performance from calendar year to calendar year and by showing how the Fund's average annual total returns for 1 year, 5 years, and 10 years compare with the MSCI EAFE Index, Net. The bar chart does not reflect any sales charges, which would reduce your return. Past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. Updated performance is available at no cost by visiting www.TouchstoneInvestments.com or by calling 1.800.543.0407

Touchstone International Value Fund — Class A shares Total Return as of December 31

|

Best Quarter: 2nd Quarter 2009 |

+24.58% |

||||||

|

Worst Quarter: 3rd Quarter 2008 |

-21.83 |

% |

|||||

The year-to-date return for the Fund's Class A shares as of June 30, 2013 is 0.00%.

3

Touchstone International Value Fund

Before the Fund commenced operations, all of the assets and liabilities of the Fifth Third International Equity Fund (the "Predecessor Fund") were transferred to the Fund in a tax-free reorganization (the "Reorganization"). The Reorganization occurred on September 10, 2012. As a result of the Reorganization, the Fund assumed the performance and accounting history of the Predecessor Fund prior to the date of the Reorganization. Financial and performance information prior to September 10, 2012 included in the Fund's prospectus is that of the Predecessor Fund. For more information on the prior history of the Fund, please see the section entitled "The Trust" in the Fund's Statement of Additional Information.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Your after-tax returns may differ from those shown and depend on your tax situation. The after-tax returns do not apply to shares held in an IRA, 401(k), or other tax-deferred account. After-tax returns are only shown for Class A shares and after-tax returns for other Classes will vary.

Class A shares began operations on August 18, 1994. Class C shares began operations on April 25, 1996. Class Y shares began operations on October 9, 1998. Institutional Class shares began operations on September 10, 2012. The Institutional Class shares performance was calculated using the historical performance of the Class A shares for the periods prior to September 10, 2012. Institutional Class shares would have had substantially similar annual returns because the shares are invested in the same portfolio. Annual returns would differ only to the extent that the Classes have different expenses.

Average Annual Total Returns

For the periods ended December 31, 2012

|

1 Year |

5 Years |

10 Years |

|||||||||||||

|

International Value Fund Class A Shares |

|||||||||||||||

|

Return Before Taxes |

7.07 |

% |

-6.97 |

% |

5.48 |

% |

|||||||||

|

Return After Taxes on Distributions |

7.01 |

% |

-8.24 |

% |

4.30 |

% |

|||||||||

|

Return After Taxes on Distributions and Sale of Fund Shares |

5.61 |

% |

-6.27 |

% |

4.37 |

% |

|||||||||

|

International Value Fund Class C Shares |

|||||||||||||||

|

Return Before Taxes |

11.90 |

% |

-6.55 |

% |

5.30 |

% |

|||||||||

|

International Value Fund Class Y Shares |

|||||||||||||||

|

Return Before Taxes |

13.93 |

% |

-5.60 |

% |

6.36 |

% |

|||||||||

|

International Value Fund Institutional Class Shares |

|||||||||||||||

|

Return Before Taxes |

13.93 |

% |

-5.81 |

% |

6.14 |

% |

|||||||||

|

MSCI EAFE Index, Net (reflects no deduction for fees or expenses) |

17.32 |

% |

-3.69 |

% |

8.21 |

% |

|||||||||

Investment Advisor

Touchstone Advisors, Inc.

| Investment Sub-Advisor |

Portfolio Manager(s) |

Investment Experience |

Primary Title with Investment Sub-Advisor |

||||||||||||

|

Barrow, Hanley, Mewhinney & Strauss, LLC |

David A. Hodges, CFA |

Managing the Fund since September 2012 |

Managing Director and Portfolio Manager |

||||||||||||

|

|

Randolph S. Wrighton, Jr., CFA |

Managing the Fund since September 2012 |

Director and Assistant Portfolio Manager |

||||||||||||

Buying and Selling Fund Shares

Minimum Investment Requirements

|

Class A, Class C, and Class Y |

|||||||||||

|

Initial Investment |

Additional Investment |

||||||||||

|

Regular Account |

$ |

2,500 |

$ |

50 |

|||||||

|

Retirement Account or Custodial Account under the Uniform Gifts/Transfers to Minors Act |

$ |

1,000 |

$ |

50 |

|||||||

|

Investments through the Automatic Investment Plan |

$ |

100 |

$ |

50 |

|||||||

4

Touchstone International Value Fund

|

Institutional Class |

|||||||||||

|

Initial Investment |

Additional Investment |

||||||||||

|

Regular Account |

$ |

500,000 |

$ |

50 |

|||||||

You may buy and sell shares in the Fund on a day when the New York Stock Exchange is open for trading. Class A shares and Class C shares may be purchased and sold directly from Touchstone Securities, Inc. ("Touchstone Securities") or through your financial advisor. Class Y shares are available only through financial institutions and financial intermediaries who have appropriate selling agreements in place with Touchstone Securities. Institutional Class shares are available through Touchstone Securities or your financial institution. For more information about buying and selling shares see the section "Investing with Touchstone" of the Fund's prospectus or call 1.800.543.0407.

Tax Information

The Fund intends to make distributions that may be taxed as ordinary income or capital gains except when shares are held through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Shares that are held in a tax-deferred account may be taxed as ordinary income or capital gains once they are withdrawn from the tax-deferred account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's web site for more information.

5

Touchstone International Value Fund

This page was intentionally left blank.

6

Touchstone International Value Fund

This page was intentionally left blank.

7

Touchstone International Value Fund

This page was intentionally left blank.

TSF-54-TST-FSIEX-1307

8