UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the quarterly period ended

For the transition period from __________ to __________

Commission File Number:

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(IRS identification No.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

|

||

|

( |

||

|

(Registrant's Telephone Number, including Area Code) |

||

Securities registered pursuant to Section 12(g) of the Act:

|

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

|

|

|

|

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒

Indicate by check mark whether the Registrant is ☐ a large accelerated filer, ☐ an accelerated file, ☒ a

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

☐ Yes

Number of shares of issuer's common stock outstanding at April 21, 2024:

TABLE OF CONTENTS

2

PART I - FINANCIAL INFORMATION

Item 1 - Financial Statements

Thunder Mountain Gold, Inc.

Condensed Consolidated Balance Sheets (Unaudited)

March 31, 2024 and December 31, 2023

| March 31, 2024 | December 31, 2023 | |||||

| ASSETS | ||||||

| Current assets: | ||||||

| Cash and cash equivalents | $ | $ | ||||

| Investment in BeMetals, at fair value (Note 4) | ||||||

| Prepaid expenses and other assets | ||||||

| Total current assets | ||||||

| Property and equipment: | ||||||

| Land | ||||||

| Total property and equipment | ||||||

| Right to use asset (Note 9) | ||||||

| Total assets | $ | $ | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||

| Current liabilities: | ||||||

| Accounts payable and other accrued liabilities | $ | $ | ||||

| Accrued legal fees (Note 6) | ||||||

| Operating lease liability - (Note 9) | ||||||

| Deferred compensation (Note 6) | ||||||

| Total current liabilities | ||||||

| Operating lease liability - long-term (Note 9) | ||||||

| Accrued reclamation costs | ||||||

| Total liabilities | ||||||

| Commitments and Contingencies (Notes 2 and 3) | ||||||

| Stockholders' equity: | ||||||

| Preferred stock; $ |

||||||

| Common stock; $ |

||||||

| Additional paid-in capital | ||||||

| Less: |

( |

) | ( |

) | ||

| Accumulated deficit | ( |

) | ( |

) | ||

| Total Thunder Mountain Gold, Inc stockholders' equity | ( |

) | ( |

) | ||

| Noncontrolling interest in Owyhee Gold Trust (Note 3) | ||||||

| Total stockholders' equity | ( |

) | ( |

) | ||

| Total liabilities and stockholders' equity | $ | $ |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Thunder Mountain Gold, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

| Three Months Ended | ||||||

| March 31, | ||||||

| 2024 | 2023 | |||||

| Operating expenses: | ||||||

| Exploration |

$ |

$ |

||||

| Legal and accounting | ||||||

| Management and administrative | ||||||

| Depreciation | ||||||

| Total operating expenses | ||||||

| Net operating income (loss) | ( |

) | ( |

) | ||

| Other income (expense): | ||||||

| Loss on sale of investment | ( |

) | ||||

| Unrealized gain on investment | ( |

) | ||||

| Other | ||||||

| Total other (expense) | ( |

) | ( |

) | ||

| Net (loss) | ( |

) | ( |

) | ||

| Net income - noncontrolling interest in Owyhee Gold Trust | ||||||

| Net (loss) - Thunder Mountain Gold, Inc. | $ | ( |

) | $ | ( |

) |

| Net income (loss) per common share-basic and diluted | $ | $ | ( |

) | ||

| Weighted average common shares outstanding-basic and diluted | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Thunder Mountain Gold, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

| Three Months Ended | ||||||

| March 31, | ||||||

| 2024 | 2023 | |||||

| Cash flows from operating activities: | ||||||

| Net (loss) | $ | ( |

) | $ | ( |

) |

| Adjustments to reconcile net (loss) to net cash used by operating activities: | ||||||

| Noncash lease expense | ( |

) | ||||

| Depreciation | ||||||

| Unrealized loss on investment | ||||||

| Loss on sale of investment | ||||||

| Change in: | ||||||

| Prepaid expenses and other assets | ( |

) | ( |

) | ||

| Accounts payable and other accrued liabilities | ( |

) | ||||

| Accrued legal expenses | ( |

) | ||||

| Advance from BeMetals | ( |

) | ||||

| Net cash used by operating activities | ( |

) | ( |

) | ||

| Cash flows from investing activities: | ||||||

| Proceeds from sale of investments, net | ||||||

| Deposit on Land Purchase | ( |

) | ||||

| Net cash provided by (used in) investing activities | ( |

) | ||||

| Net increase (decrease) in cash and cash equivalents | ( |

) | ||||

| Cash and cash equivalents, beginning of period | ||||||

| Cash and cash equivalents, end of period | $ | $ | ||||

| Noncash financing and investing activities: | ||||||

| Operating lease liability arising from obtaining right to use asset (Note 9) | $ | |||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Thunder Mountain Gold, Inc.

Condensed Consolidated Statements of Changes in Stockholders' Equity (Unaudited)

For the three months ended March 31, 2024 and 2023

| Common Stock Shares |

Common Stock Amount |

Additional Paid-In Capital |

Treasury Stock |

Accumulated Deficit |

Non- Controlling Interest in OGT |

Total | |||||||||||||||

| Balances at January 1, 2023 | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | |||||||||||

| Net (loss) | - | - | - | - | ( |

) | - | ( |

) | ||||||||||||

| Balances at March 31, 2023 | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | |||||||||||

| Balances at January 1, 2024 | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | ( |

) | |||||||||

| Net income (loss) | - | - | - | - | ( |

) | - | ( |

) | ||||||||||||

| Balances at March 31, 2024 | $ | $ | $ | ( |

) | $ | ( |

) | $ | $ | ( |

) |

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

1. Summary of Significant Accounting Policies and Business Operations

Business Operations

Thunder Mountain Gold, Inc. ("Thunder Mountain", "THMG", or "the Company") was originally incorporated under the laws of the State of Idaho on November 9, 1935, under the name of Montgomery Mines, Inc. In April 1978, the Montgomery Mines Corporation was obtained by a group of the Thunder Mountain property holders and changed its name to Thunder Mountain Gold, Inc., with the primary goal to further develop their holdings in the Thunder Mountain Mining District, located in Valley County, Idaho. Thunder Mountain Gold, Inc. takes its name from the Thunder Mountain Mining District, where its principal lode mining claims were located. For several years, the Company's activities were restricted to maintaining its property position and exploration activities. During 2005, the Company sold its holdings in the Thunder Mountain Mining District. During 2007, the Company acquired the South Mountain Mines property in southwest Idaho and initiated exploration activities on that property, which continue today.

On January 18, 2024, the Company sold the remaining

Basis of Presentation and Going Concern

The consolidated financial statements accompanying this report show an accumulated deficit of $

The Company's ability to secure capital for exploration and working capital needs is crucial, given the absence of recurring revenue streams. Long-term strategies involve financing through stock or debt sales and eventual profitability from mining operations. Capital raising efforts are hindered by current capital market conditions and the broader economic climate in the United States. Company management is actively seeking additional funds through various means, including public offerings, private placements, mergers, option agreements, and external debt, to ensure the Company's viability.

The consolidated financial statements do not include any adjustments that might be necessary should the Company be unable to continue as a going concern. If the going concern basis was not appropriate for these financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

Principles of Consolidation

The consolidated financial statements include the accounts of the Company; its wholly owned subsidiaries, Thunder Mountain Resources, Inc. ("TMRI") and South Mountain Mines, Inc. ("SMMI"); and a company in which the Company owns

Accounting Estimates

The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The more significant areas requiring the use of management estimates and assumptions include the carrying value of properties and mineral interests, environmental remediation liabilities, deferred tax assets, and stock-based compensation. Management's estimates and assumptions are based on historical experience and other assumptions believed to be reasonable under the circumstances. Actual results could differ from those estimates.

7

Income Taxes

The Company recognizes deferred income tax liabilities or assets at the end of each period using the tax rate expected to be in effect when the taxes are actually paid or recovered. A valuation allowance is recognized on deferred tax assets when it is more likely than not that some or all of the deferred tax assets will not be realized.

Cash and Cash Equivalents

For the purposes of the balance sheet and statement of cash flows, the Company considers all highly liquid investments with a maturity of three months or less when purchased to be a cash equivalent.

Fair Value Measurements

When required to measure assets or liabilities at fair value, the Company uses a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used. The Company determines the level within the fair value hierarchy in which the fair value measurements in their entirety fall. The categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Level 1 uses quoted prices in active markets for identical assets or liabilities, Level 2 uses significant other observable inputs, and Level 3 uses significant unobservable inputs. The amount of the total gains or losses for the period are included in earnings that are attributable to the change in unrealized gains or losses relating to those assets and liabilities still held at the reporting date. The Company has no financial liabilities that are adjusted to fair value on a recurring basis.

Financial Instruments

The Company's financial instruments include cash and cash equivalents, and the investment in BeMetal's equity securities, the carrying value of which approximates fair value based on the nature of those instruments.

Investments

The Company determines the appropriate classification of investments at the time of acquisition and re-evaluates such determinations at each reporting date. Equity securities that have a readily determined fair value are carried at fair value determined using Level 1 fair value measurement inputs with the change in fair value recognized as unrealized gain (loss) in the consolidated statement of operations each reporting period. Gains and losses on the sale of securities are recognized on a specific identification basis.

Mineral Interests

The Company capitalizes costs for acquiring mineral interests, and expenses costs to maintain mineral rights and leases as incurred. Exploration costs are expensed in the period in which they are incurred. Should a property reach the production stage, these capitalized costs would be amortized using the units-of-production method based on periodic estimates of ore reserves. Mineral interests are periodically assessed for impairment of value and any subsequent losses are charged to operations at the time of impairment.

If a mineral interest is abandoned or sold, its capitalized costs are charged to operations. Consideration received by the Company pursuant to joint ventures or purchase option agreements is applied against the carrying value of the related mineral interest. When and if payments received exceed the carrying value, the excess amount is recognized as a gain in the consolidated statement of operations in the period the consideration is received.

Leases

Arrangements meeting the definition of a lease are classified as operating or financing leases and are recorded on the consolidated balance sheet as both a right-of-use asset and lease liability, calculated by discounting fixed lease payments over the lease term at the rate implicit in the lease or the Company's incremental borrowing rate. Lease liabilities are increased by interest and reduced by payments each period, and the right-of-use asset is amortized over the lease term. For operating leases, interest on the lease liability and the amortization of the right-of-use asset result in straight-line rent expense over the lease term. For finance leases, interest on the lease liability and the amortization of the right-of-use asset results in front-loaded expense over the lease term. Variable lease expenses are recorded when incurred.

8

Investments in Joint Ventures

For companies and joint ventures where the Company holds more than 50% of the voting interests, but less than 100%, and has significant influence, the company or joint venture is consolidated, and other investor interests are presented as noncontrolling. See Note 3 regarding the Company's investment in Owyhee Gold Trust. Joint ventures in which the Company has the ability to exercise significant influence, but does not control, are accounted for under the equity method of accounting.

Reclamation and Remediation

The Company's operations have been, and are subject to, standards for mine reclamation that have been established by various governmental agencies. The Company would record the fair value of an asset retirement obligation as a liability in the period in which the Company incurred a legal obligation for the retirement of tangible long-lived assets. A corresponding asset would also be recorded and depreciated over the life of the asset.

For non-operating properties, the Company accrues costs associated with environmental remediation obligations when it is probable that such costs will be incurred, and they are reasonably estimable. Such costs are based on management's estimate of amounts expected to be incurred when the remediation work is performed. The Company had accrued $

Share-Based Compensation

Share-based payments to employees and directors, including grants of employee stock options, are measured at fair value and expensed in the consolidated statements of operations over the vesting period.

Recent Accounting Pronouncements

Accounting Standards Updates

In December 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2023-09 Income Taxes (Topic 740): Improvements to Income Tax Disclosures. This update requires companies to report, on an annual basis, specific categories in the rate reconciliation and additional information on reconciling items greater than 5% of the taxable income or loss. The update also requires disclosure of income taxes paid to Federal, state and foreign jurisdictions along with other municipal and local jurisdictions representing 5% or more of total income taxes paid. This update is effective for annual periods beginning after December 15, 2024, with early adoption permitted. The Company is currently evaluating the impact of adopting this standard on its consolidated financial statements.

In June 2022, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2022-03 Fair Value Measurement (Topic 820): Fair Value Measurement of Equity Securities Subject to Contractual Resale Restrictions. This update is to clarify that a contractual restriction on the sale of an equity security is not considered part of the unit of account of the equity security and, therefore, is not considered in measuring fair value. This update is effective for the fiscal year beginning after December 15, 2023, with early adoption permitted. The adoption of this standard did not impact the Company's consolidated financial statements.

Net Income (Loss) Per Share

The Company is required to have dual presentation of basic earnings per share ("EPS") and diluted EPS. The Company calculates basic earnings (loss) per share by dividing net income or loss available to common stockholders by the weighted average number of common shares outstanding. Diluted earnings per share reflect potentially dilutive common stock equivalents, including options and warrants that could share in our earnings through the conversion to common shares, except where their inclusion would be anti-dilutive. For the quarters ended March 31, 2024 and 2023, outstanding common stock options were excluded from the calculation of diluted earnings per share as their effect would have been anti-dilutive due to the net loss for the period.

9

2. Mineral Interest Commitments

The Company holds two leases pertaining to land parcels adjacent to its South Mountain patented and unpatented mining claims. The details of these leases are as follows:

Acree Lease:

Commencing on June 20, 2008, the Company entered into a lease agreement with Ronald Acree for a period of

Lowry Lease:

On October 24, 2008, the Company executed a lease agreement with William and Nita Lowry for a duration of

The leases have no work requirements. It is the current intention of the Company to engage in negotiations for new leases with the current landowners upon the expiration of the existing lease agreements. The negotiations may involve modifications to terms, rates, or other conditions as mutually agreed upon by the parties involved.

The Company has

The claim fees are paid on these unpatented claims annually as follows:

| Target Area | 2024 | ||

| Trout Creek -State of Nevada | $ | ||

| Trout Creek -Lander County, Nevada | |||

| South Mountain-State of Idaho | |||

| Total | $ |

3. South Mountain Project

SMMI Joint Venture - OGT, LLC

The Company's wholly owned subsidiary SMMI is the sole manager of the South Mountain Project in its entirety through a separate Mining Lease with Option to Purchase ("Lease Option") with the Company's majority-owned subsidiary OGT. SMMI has an option to purchase the South Mountain mineral interest for a capped $

COMPLAINT

On April 12, 2023, the Company was served with a Complaint filed in the fourth judicial district court of the State of Idaho by legal representatives of a former mining contractor who had provided services for the South Mountain Mine project in the Fall of 2020. The case was subsequently dismissed with prejudice, and a judgment to that effect was entered on November 21, 2023. The contractor had a 42-day window from the date of judgment to appeal, which expired on January 2, 2024. No appeal was filed within this timeframe, leading to the dismissal of the claim.

10

4. Investment in BeMetals Corp.

On January 18, 2024, the Company sold the remaining

5. Property and Equipment

On December 13, 2023, the Company completed the strategic acquisition of

The Company's property and equipment are as follows:

| March 31, | December 31, | |||||

| 2024 | 2023 | |||||

| Vehicles | $ | $ | ||||

| Construction Equipment | ||||||

| Mining Equipment | ||||||

| Accumulated Depreciation | ( |

) | ( |

) | ||

| Land | ||||||

| Total Property and Equipment | $ | $ |

6. Related Party Transactions

Deferred Compensation

Three officers of the Company initiated deferred compensation arrangements for services provided starting April 1, 2015. On July 31, 2018, the Company ceased expensing and deferring compensation for these officers to support the marketing efforts of the SMMI project.

To preserve liquidity, the Company reinstated deferred salary arrangements for Eric Jones, the Chief Executive Officer, and Larry Thackery, the Chief Financial Officer effective August 1, 2023, as of March 31, 2024 the Company has deferred salaries for Eric Jones CEO and Larry Thackery CFO of $

As of March 31, 2024 and December 31, 2023, the balances of the total deferred compensation for the officers, accumulated prior to the BeMetals agreement, are as follows, Eric Jones, President and Chief Executive Officer: $

Accrued Legal Fees

From 2015 to 2018 the Company engaged Baird Hanson LLP ("Baird"), a company owned by one of the Company's former directors, to provide legal services. The Company's director Joseph Baird retired from the Board of Directors of Thunder Mountain Gold, Inc., and from all other positions or offices with the Company effective April 11, 2022. At March 31, 2024, and December 31, 2023, the balance due to Baird for prior years' legal services was $

11

7. Stockholders' Equity

The Company's common stock has a par value of $

8. Stock Options

The Company has a Stock Incentive Plan (the "SIP"), authorize the granting of stock options up to 10 percent of the total number of issued and outstanding shares of common stock, that provides for the grant of stock options, incentive stock options, stock appreciation rights, restricted stock awards, and incentive awards to eligible individuals including directors, executive officers and advisors that have furnished bona fide services to the Company not related to the sale of securities in a capital-raising transaction. On October 16, 2023 the Company's shareholders, at their Annual Meeting, ratified and reapproved the Stock Option Plan.

For the periods ended March 31, 2024 and 2023,

The following is a summary of the Company's options issued and outstanding under the SIP:

| Shares |

Weighted Average Exercise Price |

|||||

| Outstanding and exercisable at December 31, 2023 | $ | |||||

| Expired | ( |

) | ||||

| Outstanding and exercisable at March 31, 2024 | $ |

The average remaining contractual term of the options outstanding and exercisable at March 31, 2024, was

9. Leases

The Company renewed its office operating lease on February 1, 2023, for 24 months. The Company entered into a two-year operating lease for its corporate office space for a total lease payment of $

For the three months ended March 31, 2024, the Company expended cash of $

12

The table below displays the future operating lease payments and lease liability as of March 31, 2024, related to the Company's operating lease.

| Future Lease Payments | Total Amount | ||

| 2024 (remaining nine months) | $ | ||

| 2025 | |||

| Total | |||

| Less: Imputed Interest | ( |

) | |

| Total lease Liability | $ |

The Company's ROU asset decreased through amortization of $

13

Forward-Looking Statements

Certain statements contained in this Form 10-Q, including in Management's Discussion and Analysis of Financial Condition and Results of Operations and Quantitative and Qualitative Disclosures About Market Risk, are intended to be covered by the safe harbor provided for under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Our forward-looking statements include our current expectations and projections about future results, performance, results of litigation, prospects and opportunities, including reserves and other mineralization. We have tried to identify these forward-looking statements by using words such as "may," "will," "expect," "anticipate," "believe," "intend," "feel," "plan," "estimate," "project," "forecast" and similar expressions. These forward-looking statements are based on information currently available to us and are expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to a number of risks, uncertainties and other factors that could cause our actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements.

These risks, uncertainties and other factors include, but are not limited to, those set forth under Part I, Item 1A. - Risk Factors in our 2023 Form 10-K and in Part II, Item 1.A. - Risk Factors in this Form 10-Q. Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements. All subsequent written and oral forward-looking statements attributable to Thunder Mountain Gold, Inc. or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Except as required by federal securities laws, we do not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Item 2. Management's Discussion and Analysis or Plan of Operation

The following Management's Discussion and Analysis of Financial Condition and Results of Operation ("MD&A") is intended to help the reader understand our financial condition. MD&A is provided as a supplement to, and should be read in conjunction with, our financial statements and the accompanying integral notes ("Notes") thereto. The following statements may be forward-looking in nature and actual results may differ materially.

Plan of Operation:

The Company, including its subsidiaries, owns mining rights, mining claims, and properties in the mining areas of Nevada and Idaho, which includes its South Mountain Property in Idaho, and its Trout Creek Property in Nevada.

The Company owns 100% of the outstanding stock of Thunder Mountain Resources, Inc., a Nevada Corporation. Thunder Mountain Resources, Inc. owns 100% of the outstanding stock of South Mountain Mines, Inc. (SMMI), an Idaho Corporation., Thunder Mountain Resources, Inc. completed the direct purchase of 100% ownership of South Mountain Mines, Inc. on September 27, 2007, which consisted of 17 patented mining claims (approximately 327 acres) located in Owyhee County in southwestern Idaho. After the purchase, Thunder Mountain Resources staked 21 unpatented lode mining claims and obtained mineral leases on 545 acres of adjoining private ranch land.

The current land package at South Mountain consists of 18 patented mining claims encompassing approximately 346 acres, 36 acres of private land, 21 unpatented mining lode claims covering approximately 290 acres, and approximately 489 acres of leased private land. In addition, the project owns 360 acres of private land (mill site) not contiguous with the mining claims. All holdings are in the South Mountain Mining District, Owyhee County, Idaho.

The Company's plan of operation for the next twelve months, subject to business conditions, will be to continue to advance the South Mountain Project, including continued baseline environmental and engineering work necessary to complete a Preliminary Economic Analysis or Initial Analysis. Additional funds will be required to perform planned operations and environmental and engineering work. If the company is unable to raise additional funds, it will be unable to advance the project in 2024. The Company is uncertain whether it can obtain the necessary funding to continue the planned operations.

The South Mountain Project

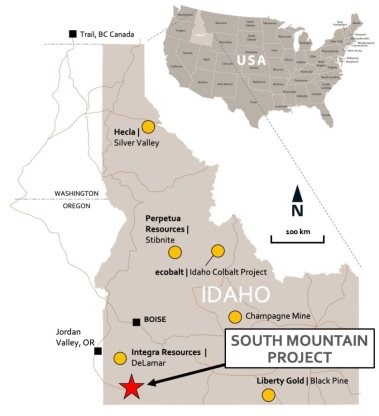

The South Mountain Mine is a polymetallic development project focused on high-grade zinc, silver, gold, and copper. It is located approximately 70 miles southwest of Boise, Idaho (see Figure 2). The Project was intermittently mined from the late 1800s to the late 1960s and its existing underground workings remain intact and well maintained. Historic production at the Project has largely come from high-grade massive sulphide zones that remain open at depth and along strike. According to historical smelter records, approximately 53,642 tons of mineralized material has been mined to date. These records also indicate average grades; 14.5% Zn, 11.63 opt Ag, 0.063 opt Au, 2.4% Pb, and 1.4% Cu were mined.

14

Thunder Mountain Gold Inc. purchased the Project in 2007, after selling its main asset in central Idaho and donating thousands of acres at that site to conservation. The Company continues to advance South Mountain, investing in excess of $20M during this period. The Project is largely on, and surrounded by private land, and as such, the permitting and environmental aspects of the Project are expected to be straightforward. Permits are currently in place for underground and surface exploration and development activities.

Figure 2. Location of South Mountain Project

PROJECT HIGHLIGHTS - SOUTH MOUNTAIN PROJECT

On December 21, 2023, the Company filed and reported a new and updated independent NI 43-101 Mineral Resource Estimate ("43-101 43-101 MRE") incorporating results from surface diamond drilling program conducting in 2021 at the South Mountain Project ("South Mountain" or "South Mountain Project" or the "Property") in southwestern Idaho, U.S.A. The updated 43-101 MRE includes an increased resource for the Project while maintaining the high-grade mineralization. The updated Independent 43-101 MRE, which has an effective date of October 16, 2023, was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI-43-101") by Hard Rock Consulting, LLC, based in the U.S.A.

This report is endorsed by the following Qualified Persons, as defined by NI 43-101: Ms. J.J. Brown, P.G., Mr. Jeffrey Choquette, P.E., and Mr. Richard Schwering, all of Hard Rock Consulting (HRC).

15

HIGHLIGHTS OF UPDATED MINERAL RESOURCE

-

Measured & Indicated ("M&I"): 223,000 tons grading 9.02% Zinc ("Zn"), 4.27 ounces per ton ("opt") Silver ("Ag"), 0.059 opt Gold ("Au"), 0.64% Copper ("Cu"), and 0.94% Lead ("Pb").

-

This represents a 7.7% increase to the M&I tonnage from the previous 2021 43-101 MRE, with a 18.82% Zn equivalent grade ("ZnEq"), or a 20.55opt Ag equivalent grade ("AgEq")

-

Inferred: 959,000 tons grading 7.56% Zn (14% increase in Zn lbs), 5.67 opt Ag (14.10% increase in Ag ounces), 0.037 opt Au (3.3% increase in Au ounces), 0.80% Cu (14.5% increase in Cu lbs), and 1.06% Pb (25.4% increase in Pb lbs).

-

This represents a 15.1% increase in the Inferred tonnage from the previous 2021 43-101 MRE with an 17.2% ZnEq or a 19.30 opt AgEq.

-

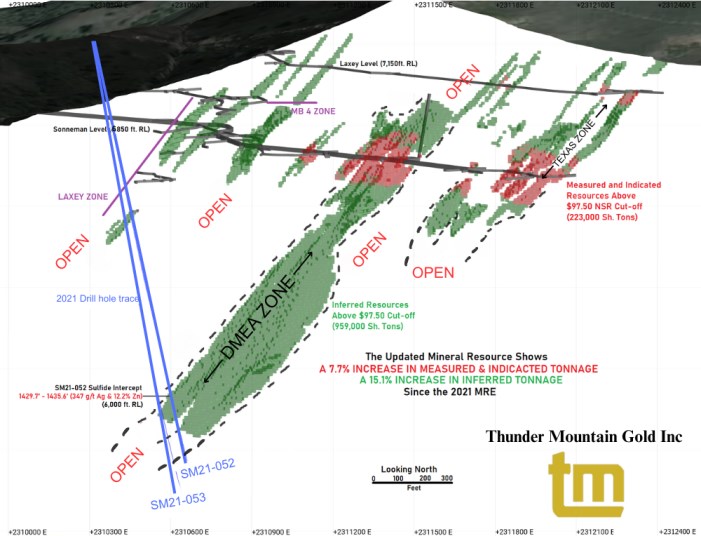

The DMEA Zone in the model was extended an additional 250 feet down dip and remains open.

This latest round of drilling completed during the late fall of 2021 proves the continuation of the down plunge extension of the DMEA zone at depth. This zone remains open in both directions. All the of the drill results have now been in incorporated into the updated 43-101 MRE for the South Mountain deposit. The increase in Measured and Indicated tons are the result of updated metal prices and mining costs. Surface drilling completed in 2021 accounts for approximately 8% of the increase in Inferred tons, while the remaining 7% increase is due to updated metal prices and mining costs.

Table 1 below provides the Mineral Resource Statement for the Project in U.S. units with details of the modelling methodology and cut-off grades applied to the mineral resource. Figure 1 illustrates the principal areas where the South Mountain deposit has been expanded from the historical 43-101 MRE that was completed in 2021. The historical Technical Report for the Mineral Resource Estimate for the South Mountain Project Owyhee County, Idaho USA Report Date: June 15, 2021 - is filed on SEDAR.

16

Table 1. South Mountain Mineral Resource Statement (U.S. Units)

| Metallurgical Domain | Massive Sulfide Type | |||

| Classification | Measured | Indicated | Measured + Indicated | Inferred |

| Short Tons | 54,000 | 122,000 | 176,000 | 868,000 |

| NSR ($/sh. Ton) | 343.35 | 370.05 | 361.92 | 307.62 |

| Zinc (%) | 11.51 | 11.15 | 11.26 | 8.25 |

| Zinc (lb.) | 12,300,000 | 27,300,000 | 39,600,000 | 143,200,000 |

| Silver (t. oz/ sh. Ton) | 3.62 | 4.74 | 4.39 | 5.96 |

| Silver (t. oz) | 194,000 | 580,000 | 774,000 | 5,177,000 |

| Gold (t. oz/ sh. Ton) | 0.070 | 0.074 | 0.073 | 0.040 |

| Gold (t. oz) | 3,800 | 9,100 | 12,900 | 34,700 |

| Copper (%) | 0.45 | 0.55 | 0.52 | 0.74 |

| Copper (lb.) | 500,000 | 1,300,000 | 1,800,000 | 12,800,000 |

| Lead (%) | 0.79 | 1.32 | 1.16 | 1.16 |

| Lead (lb.) | 850,000 | 3,240,000 | 4,080,000 | 20,200,000 |

| ZnEq (%) | 19.54 | 20.93 | 20.51 | 17.69 |

| ZnEq (lb.) | 20,900,000 | 51,200,000 | 72,200,000 | 307,200,000 |

| Metallurgical Domain | Skarn Type | |||

| Classification | Measured | Indicated | Measured + Indicated | Inferred |

| Short Tons | 15,000 | 32,000 | 47,000 | 91,000 |

| NSR ($/sh. Ton) | 196.71 | 149.31 | 164.73 | 166.76 |

| Zinc (%) | 0.99 | 0.44 | 0.62 | 1.02 |

| Zinc (lb.) | 300,000 | 300,000 | 600,000 | 1,900,000 |

| Silver (t. oz/ sh. Ton) | 4.61 | 3.44 | 3.82 | 2.86 |

| Silver (oz/ sh. Ton) | 70,000 | 109,000 | 179,000 | 261,000 |

| Gold (t. oz/ sh. Ton) | 0.017 | 0.005 | 0.009 | 0.005 |

| Gold (oz/ sh. Ton) | 300 | 100 | 400 | 400 |

| Copper (%) | 1.12 | 1.12 | 1.12 | 1.41 |

| Copper (lb.) | 300,000 | 700,000 | 1,000,000 | 2,600,000 |

| Lead (%) | 0.27 | 0.07 | 0.13 | 0.04 |

| Lead (lb.) | 80,000 | 40,000 | 120,000 | 70,000 |

| ZnEq (%) | 14.83 | 11.38 | 12.50 | 12.65 |

| ZnEq (lb.) | 4,500,000 | 7,200,000 | 11,700,000 | 23,100,000 |

| Metallurgical Domain | Total | |||

| Classification | Measured | Indicated | Measured + Indicated | Inferred |

| Short Tons | 69,000 | 154,000 | 223,000 | 959,000 |

| NSR ($/sh. Ton) | 310.88 | 324.73 | 320.46 | 294.21 |

| Zinc (%) | 9.18 | 8.95 | 9.02 | 7.56 |

| Zinc (lb.) | 12,600,000 | 27,600,000 | 40,200,000 | 145,000,000 |

| Silver (t. oz/ sh. Ton) | 3.84 | 4.47 | 4.27 | 5.67 |

| Silver (oz/ sh. Ton) | 264,000 | 688,000 | 953,000 | 5,438,000 |

| Gold (t. oz/ sh. Ton) | 0.058 | 0.060 | 0.059 | 0.037 |

| Gold (oz/ sh. Ton) | 4,000 | 9,300 | 13,300 | 35,200 |

| Copper (%) | 0.60 | 0.66 | 0.64 | 0.80 |

| Copper (lb.) | 800,000 | 2,000,000 | 2,900,000 | 15,400,000 |

| Lead (%) | 0.67 | 1.06 | 0.94 | 1.06 |

| Lead (lb.) | 930,000 | 3,280,000 | 4,210,000 | 20,270,000 |

| ZnEq (%) | 18.50 | 18.97 | 18.82 | 17.21 |

| ZnEq (lb.) | 25,500,000 | 58,400,000 | 83,900,000 | 330,300,000 |

1. The effective date of the mineral resource estimate is October 16, 2023Fe. The QP for the estimate Mr. Richard A. Schwering, SME-RM, P.G., of Hard Rock Consulting, LLC. is independent of South Mountain Mining, LLC.

2. Mineral resources are not mineral reserves and do not have demonstrated economic viability such as diluting materials and allowances for losses that may occur when material is mined or extracted; or modifying factors including but not restricted to mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors.

3. Inferred mineral resources are part of a mineral resource for which the grade or quality are estimated on the basis of limited geological evidence and sampling. Inferred mineral resources do not have demonstrated economic viability and may not be converted to mineral reserves. It is reasonably expected, though not guaranteed, that the majority of Inferred mineral resources could be upgraded to Indicated mineral resources with continued exploration.

4. The mineral resource is reported at an underground mining cut-off of $97.50 U.S. Net Smelter Return ("NSR") within coherent wireframe models. The NSR calculation and cut-off is based on the following assumptions: an Au price of $1,800/oz, a Ag price of $23.50/oz, a Pb price of $1.00/lb., a Zn price of $1.35/lb. and a Cu price of $4.00/lb.; Massive Sulfide type metallurgical recoveries and payables of 52.25% for Au, 71.25% for Ag, 71.40% for Zn, 66.50% for Pb, and 49.00% for Cu and a total smelter cost of $33.29; Skarn type metallurgical recoveries and payables of 71.25% for Au, 80.75% for Ag, 51.00% for Zn, 47.50% for Pb, and 87.70% for Cu and a smelter cost of $7.24; assumed mining cost of $65/ton, process costs of $25/ton, general and administrative costs of $7.50/ton. Based on the stated prices and recoveries the NSR formula is calculated as follows; NSR = (Ag grade * Ag price * Ag Recovery and Payable) + (Au grade * Au price * Au Recovery and Payable) + (Pb grade * 20 * Pb Price * Pb Recovery and Payable) + (Cu grade * 20 * Cu Price * Cu Recovery and Payable) + (Zn grade * 20 * Zn Price * Zn Recovery and Payable) for each metallurgical domain. The zinc equivalent grades were calculated as Zn Grade + (((Pb Price * Pb Recovery and Payable) / (Zn Price*Zn Recovery and Payable)) * Pb Grade) + (((Cu Price * Cu Recovery and Payable) / (Zn Price * Zn Recovery and Payable)) * Cu Grade) + (((Ag Price * Ag Recovery and Payable) / (Zn Price * 20 * Zn Recovery and Payable)) * Ag Grade) + (((Au Price * Au Recovery and Payable) / (Zn Price * 20 * Zn Recovery and Payable)) * Au Grade) for each metallurgical domain.

5. Rounding may result in apparent differences when summing tons, grade and contained metal content. Tonnage and grade are in U.S. Customary units.

17

Figure 1: 3D Perspective view inclined 200 looking north-north-east, indicating the areas of the expanded mineral resource, with zones that are open.

Qualified Person Statement for the Mineral Resource Estimate

Mr. Richard A. Schwering, P.G., SME-RM, a Resource Geologist with Hard Rock Consulting, LLC, is responsible for the South Mountain Project Mineral Resource Estimate with an effective date of October 16, 2023. Mr. Schwering is a Qualified Person as defined by NI43-101 and is independent of Thunder Mountain Gold Inc., and South Mountain Mines, Inc. Mr. Schwering estimated the mineral resources based on drill hole and channel sample data constrained by geologic boundaries using an Ordinary Krig algorithm. The Geologic Model and Mineral Resource Estimate were completed using Leapfrog Geo® Software version 2023.1.1. Hard Rock Consulting also completed the previous resource estimate.

Additional Project Highlights

On December 13, 2023, the Company completed a land purchase of an additional 56 acres of strategic land at the Company`s South Mountain Project. The land is a combination of both patented and private land, with full mineral rights, and was previously leased by the Company in prior years. The parcel is contiguous with the South Mountain patented claims and is important to the future development of the Texas Zone. This land acquisition covers a gap in the main mine area and eliminates any outside ownership within the main mine area.

18

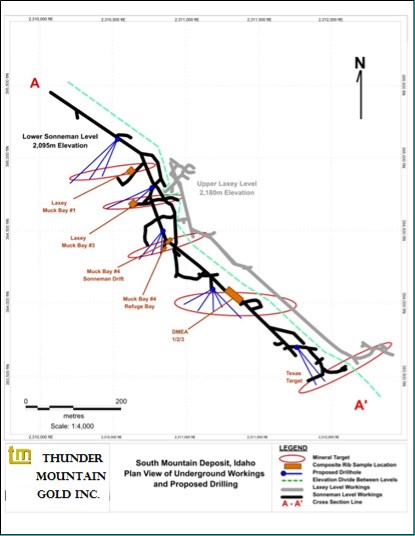

On September 5, 2022, Crone Geophysics based in Toronto, Canada initiated a time domain pulse electromagnetic (PEM) survey over a portion of the South Mountain Mines. The objective of the survey is to delineate massive sulfide mineralization within a marble unit bounded by Paleozoic schists. Historic mining on the area was conducted on massive sulfide mineralization associated hosted by the Laxey Marble within the survey area. Bowes (1985) describes the sulfide bodies as pipe-like dipping to the southwest at 40-50° and raking 50°. The survey was completed on November 7, 2022. In addition to the PEM survey, property scale topography, geology and ground magnetics will be included to provide supporting data for the interpretation. The digital products include raw data, intermediate processed products, and final products in several data formats.

In May of 2021, the Company and its project team completed an updated Mineral Resource Estimate ("MRE"), incorporating results from Phase 1 and 2 underground diamond drilling programs at the South Mountain Project. The updated MRE includes a substantially increased resource for the Project while maintaining the high-grade nature of the mineralization.

The updated Independent MRE, which has an effective date of April 20, 2021, was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI-43-101") by Hard Rock Consulting, LLC, based in the U.S.A. A technical report for this MRE was filed with SEDAR, and on the Company's website, within 45 days from the date of this news release.

Later in 2021, the Company embarked on a phase 3 program at South Mountain with the objective to significantly expand the scale of the current Mineral Resource Estimate ("MRE") at South Mountain (See Summary of the MRE below), testing and establishing the down depth extent of mineralization on the DMEA zone. The DMEA Zone is the largest known body of mineralization on the Property, containing the majority of tonnage in the current MRE, and the mineralized zone remains open at depth.

Based on the last two phases of underground drilling, the surface core drilling, and all the historical exploration data available, the Company is focused on extending the down-plunge extensions of the mineral resource with this new phase of surface drilling at the Property. Additional funds will be required to continue planned exploration programs on the South Mountain Project. The Company is currently in discussions to finance the planned exploration programs at the South Mountain Project.

South Mountain Project - BeMetals Option Agreement

In 2019, Thunder Mountain Gold Inc. and BeMetals Corp. formed a project team early in 2019 that is focused on advancing the South Mountain Project.

The project team commenced drilling at South Mountain in July of 2019 and drilled twenty-one holes totaling 7,517 feet (2,290 meters) from five underground drilling stations within the Sonneman level. The drilling program was designed to test potential down plunge extensions, and overall continuity to the mineralized zones and confirm the grade distribution of the current polymetallic mineral resource. All of the drill core recovered from the drilling was logged on site and assayed by ALS Chemex. Selected intervals and results are summarized in the Company`s Form 10K for the year ended December 31, 2022.

On December 30, 2022, Thunder Mountain Gold, Inc. by and through its subsidiaries Thunder Mountain Resources, Inc., a Nevada Corporation, and South Mountain Mines, Inc., an Idaho Corporation ("SMMI") (collectively the "Company", "THMG", or "We", "Our" or "Us") agreed to terminate the Option Agreement, (the "BeMetals Option Agreement") with BeMetals Corporation, a British Columbia corporation, and BeMetals USA Corporation, a Delaware corporation ("BeMetals BMET").

19

Figure 3: Plan View of Sonneman & Laxey Levels,

showing locations of previously reported rib sampling

Note to United States investors concerning estimates of measured, indicated and inferred resources.

Information concerning our mining properties has been prepared in accordance with the requirements of subpart 1300 of Regulation S-K, which first became applicable to us for the fiscal year ended December 31, 2021. These requirements differ significantly from the previously applicable disclosure requirements of SEC Industry Guide 7. Among other differences, subpart 1300 of Regulation S-K requires us to disclose our mineral resources, in addition to our mineral reserves, as of the end of our most recently completed fiscal year both in the aggregate and for each of our individually material mining properties. You are cautioned that mineral resources do not have demonstrated economic value. Mineral resources are subject to further exploration and development, are subject to additional risks, and no assurance can be given that they will eventually convert to future reserves. Inferred Resources, in particular, have a great amount of uncertainty as to their existence and their economic and legal feasibility. Investors are cautioned not to assume that any part or all of the Inferred Resource exists or is economically or legally mineable. See Item 1A, Risk Factors.

Disclosure of the NI-43-101 has been prepared in accordance with the requirements of Canadian securities laws, including Canadian National Instrument 43-101 ("NI 43-101"). The Highlights of South Mountain NI-43-101 section refers to "mineral resources," "measured mineral resources," "indicated mineral resources," and "inferred mineral resources."

Qualified Person - The technical information in this Form 10K has been reviewed and approved by Larry D. Kornze, (Retired), Director of Thunder Mountain Gold Inc., and a "Qualified Person" as defined by National Instrument 43-101 standards.

20

Trout Creek Project, Lander County, Nevada

The Trout Creek project is a highly prospective gold exploration target located along the western flank of the Shoshone Mountain Range in the Reese River Valley in Lander County, Nevada. The Project is located approximately 155 air miles northeast of Reno, Nevada, or approximately 20 miles south of Battle Mountain, Nevada, in Sections 10, 11, 14, 16, 21, 22, 27; T.29N.; R.44E. Mount Diablo Baseline & Meridian, Lander County, Nevada. Latitude: 40 23' 36" North, Longitude: 117 00' 58" West. The property is generally accessible year-round by traveling south from Battle Mountain Nevada on state highway 305, which is paved.

The Trout Creek target is anchored by a regional gravity anomaly on a well-defined northwest-southeast trending break in the alluvial fill thickness and underlying bedrock. Previous geophysical work in the 1980s revealed an airborne magnetic anomaly associated with the same structure, and this was further verified and outlined in 2008 by Company personnel, with consultation from Jim Wright - Wright Geophysics using a ground magnetometer. The target is covered by alluvial fan deposits of generally unknown thickness, shed from the adjacent Shoshone Range, a fault block mountain range composed of Paleozoic sediments of both upper and lower plate rocks of the Roberts Mountains thrust.

Wright Geophysics also conducted a ground gravity survey and CSMAT over the pediment target area and this provided insight into the gravel-bedrock contact as well as defining the favorable structural setting within the buried bedrock. An untested drill target was identified under the gravel pediment along these structures, and the geophysics showed that the bedrock was within 500 feet of the surface, which is reasonable depth for exploration drilling and potential mining if a significant mineralization is encountered.

The Company plans to option the Trout Creek Property in 2024, while focusing all of their efforts on advancing their South Mountain Project.

There are currently no environmental permits required for the planned exploration work on the property. In the future, a notice of intent may be required by the Bureau of Land Management.

Competition

We are an exploration stage company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Employees

The Company employs three full-time officers. It is anticipated that the employees will continue their work with the Company.

Results of Operations:

The decrease in Q1 - 2024's net loss is primarily attributed to a smaller combined realized and unrealized loss on the Company's investment in BeMetals stock during 2024 as compared to 2023. During the three months ended March 31, 2024, the Company recognized a net decrease of other expenses by $103,972 or 71% for the quarter, primarily due to a decrease in the unrealized loss on the BeMetals investment.

The Company recognized no income in management services income for the three-month period ended on March 31, 2024. Total operating loss for the three months ended March 31, 2024, of $162,834 decreased from the comparative period in 2023 by $50,298 or 24%. Exploration expenses for the three months ended March 31, 2024, increased by $1,644 or 9% when compared to same period in 2023. The increase in exploration expense is due to mine maintenance and the updating of the 43-101.

21

During the three-month period ended March 31, 2024, legal and accounting costs decreased in comparison to 2023 by $17,097 or 26%. This reduction is primarily attributed to the termination of the BeMetals Option Agreement and the Company's focus on financing operations. Legal fees and accounting expenses associated with the maintenance of the contract carried over into the first quarter of 2023.

Additionally, management and administrative expenses decreased by $34,514 or 27%, largely due to a decrease in management salaries totaling $27,647, reflecting the Company's efforts to preserve liquidity.

Liquidity and Capital Resources:

The consolidated financial statements accompanying this report show an accumulated deficit of $7,374,168 at March 31, 2024, which raises substantial doubt about the Company's ability to continue as a going concern.

As of March 31, 2024, the Company may not have sufficient liquidity to sustain normal operations for the next 12 months. While it is pursuing additional financing including possible strategic alternatives there can be no assurance that additional financing sources or strategic alternatives will be available.

Long-term strategies involve financing through stock or debt sales and eventual profitability from mining operations. Capital raising efforts are challenging given the current capital market conditions and the broader economic climate in the United States. Company management is actively seeking additional funds through various means, including public offerings, private placements, mergers, option agreements, and external debt, to ensure the Company's viability.

On January 18, 2024, the Company sold the remaining 6,636,000 shares held in BeMetals Corp. for a total consideration of $384,981 (equivalent to CAD $518,223). The transaction was executed through Canaccord Genuity at a unit price of $0.0594 (CAD $0.0801) per share. This sale was conducted in accordance with the terms outlined in the BeMetals Option Agreement. As a result of the sale, the Company incurred a loss of $42,855.

While the Company does not currently have cash sufficient to support exploration work at South Mountain, we believe that the survivability of Thunder Mountain Gold can be aided by the following:

- On March 31, 2024, the Company had cash and cash equivalents of $355,438.

- Management and the Board have not undertaken plans or commitments that exceed the cash available to the Company beyond fiscal year 2024. We do not include in this consideration any additional investment funds mentioned below.

Our plans for the long-term viability include financing our future operations through sales of our common stock and/or debt and the eventual profitable exploitation of our mining properties. There can be no assurance that such activities will be successful.

At March 31, 2024, we have current assets of $410,988. Our future liquidity and capital requirements will depend on many factors, including timing, cost and progress of our exploration efforts, our evaluation of, and decisions with respect to, our strategic alternatives, and costs associated with the regulatory approvals. If we do not have enough cash to complete our exploration programs, we will make every effort to raise additional funds from public offerings, sale of liquid stock or loans or to adjust our business plans accordingly.

- On April 15, 2024, we had $348,290 cash in our bank accounts.

- We do not include in this consideration any option payments mentioned below.

- Management is committed to managing expenses of all types to not exceed the on-hand cash resources of the Company at any point in time, now or in the future.

22

- The Company will also consider other sources of funding, including potential mergers or lease option to purchase, the sale of all or part of the Company`s assets, and/or additional farm-out of its other exploration property.

During the three months ended March 31, 2024, the Company discloses a net cash outflow from operating activities amounting to $200,171, compared to an operating cash outflow of $208,493 in 2023. In the quarter ended March 31, 2024, there was a net cash inflow from investment activities totaling $384,981, stemming from the sale of BeMetals common stock. Conversely, during the same period ended March 31, 2023, the Company committed to acquire an additional 56 acres, necessitating a $10,000 deposit, which was recorded as an investment outlay.

No cash outflows were reported for financing activities for the periods ended March 31, 2024, and 2023. The Company realized a net cash increase of $184,810 for the fiscal year ended March 31, 2024, in contrast to a net cash decrease of $218,493 for the corresponding period in 2023.

Our future liquidity and capital requirements will depend on many factors, including timing, cost and progress of our exploration efforts, our evaluation of, and decisions with respect to, our strategic alternatives, and costs associated with the regulatory approvals.

Going Concern:

The audit opinion and notes that accompany our consolidated financial statements for the year ended December 31, 2023 disclose a 'going concern' qualification to our ability to continue in business. These consolidated financial statements have been prepared on the basis that the Company is a going concern, which contemplates the realization of our assets and the settlement of our liabilities in the normal course of our operations. Disruptions in the credit and financial markets over the past several years have had a material adverse impact on a number of financial institutions and investors and have limited access to capital and credit for many companies. In addition, commodity prices and mining equities have seen significant volatility which increases the risk to precious metal investors. Market disruptions and alternative investment options, among other things, make it more difficult for us to obtain, or increase our cost of obtaining, capital and financing for our operations. Our access to additional capital may not be available on terms acceptable to us or at all. If we are unable to obtain financing through equity investments, we will seek multiple solutions including, but not limited to, asset sales, corporate transactions, credit facilities or debenture issuances in order to continue as a going concern.

As of the date of this report on Form 10-Q, we do not have sufficient cash to meet our normal operating commitments for the next 12 months without additional financing. Therefore, we expect to be required to engage in financial transactions to increase our cash balance or decrease our cash obligations in the near term. However, we are an exploration company with exploration programs that require significant cash expenditures. A significant drilling program, such as that we have executed in prior years, can result in depletion of cash and would be prohibitive unless we can secure sufficient cash to support normal operations for the following 12 months.

The condensed consolidated financial statements do not include any adjustments that might be necessary should we be unable to continue as a going concern. We believe that the going concern condition cannot be removed with confidence until the Company has entered into a business climate where funding of its activities is more assured. If the going concern basis were not appropriate for these financial statements, adjustments would be necessary in the carrying value of assets and liabilities, the reported expenses and the balance sheet classifications used.

We plan, as funding allows, to follow up on our positive drill results on our South Mountain Project. Subject to available capital, we may continue prudent exploration programs on our material exploration properties and/or fund some exploratory activities on early-stage properties.

We will require additional funding and/or reductions in exploration and administrative expenditures in future periods. Given current economic conditions, we cannot provide assurance that necessary financing transactions will be available on terms acceptable to us, or at all. Without additional financing, we would have to curtail our exploration and other expenditures while we seek alternative funding arrangements to provide sufficient capital to meet our ongoing, non-discretionary expenditures, and maintain our primary mineral properties. If we cannot obtain sufficient additional financing, we may be unable to make required property payments on a timely basis and be forced to return some or all of our leased or optioned properties to the underlying owners.

23

Contractual Obligations

The Company holds two leases pertaining to land parcels adjacent to its South Mountain patented and unpatented mining claims. The details of these leases are as follows:

Acree Lease:

Commencing on June 20, 2008, the Company entered into a lease agreement with Ronald Acree for a period of 6 years, covering 113 acres at a rate of $20 per acre. The lease includes an option to extend for an additional 10 years at a revised rate of $30 per acre. The total annual lease payment for the 113 acres amounts to $3,390. The Acree Lease is scheduled to expire on June 20, 2024.

Lowry Lease:

On October 24, 2008, the Company executed a lease agreement with William and Nita Lowry for a duration of 6 years, encompassing 376 acres at a rate of $20 per acre. Similar to the Acree Lease, the Lowry Lease incorporates an option to extend for an additional 10 years at a revised rate of $30 per acre. Following the passing of the original lessors, the lease was inherited by Michael Lowry, their son. The lease will expire on October 24, 2024.

The leases have no work requirements. It is the current intention of the Company to engage in negotiations for new leases with the current landowners upon the expiration of the existing lease agreements. The negotiations may involve modifications to terms, rates, or other conditions as mutually agreed upon by the parties involved.

OGT, LLC

SMMI is the sole manager of the South Mountain Project in its entirety through a separate Mining Lease with Option to Purchase ("Lease Option") with the Company's majority-owned subsidiary OGT. SMMI has an option to purchase the South Mountain mineral interest for a capped $5 million less net returns royalties paid through the date of exercise. The Lease Option expires in November 2026. Under the Lease Option, SMMI pays an advance of $5,000 net returns royalty to OGT annually on November 4 which is distributed to OGT's minority member.

The leases and net royalties' payment are summarized in the following table.

|

Contractual obligations |

Payments due by period |

||||

|

Total* |

Less than 1 year |

2-3 years |

4-5 years |

More than 5 years |

|

|

Acree Lease (yearly, June)(1) |

$3,390 |

$3,390 |

- |

- |

$ - |

|

Lowry Lease (yearly, October)(1)(2) |

$11,280 |

$11,280 |

- |

- |

$ - |

|

OGT LLC(3) |

$10,000 |

$5,000 |

$5,000 |

- |

$ - |

|

Total |

$24,670 |

$19,670 |

$5,000 |

- |

$ - |

(1) Amounts shown are for the lease periods years 15 through 16, a total of 2 years that remains after 2021, the lease was extended an additional 10 years at $30/acre after 2014.

(2) The Lowry lease has an early buy-out provision for 50% of the remaining amounts owed in the event the Company desires to drop the lease prior to the end of the first seven-year period.

(3) OGT LLC, managed by the Company's wholly owned subsidiary SMMI, receives a $5,000 per year payment for up to 10 years, or until a $5 million capped NPI Royalty is paid.

Critical Accounting Policies

We have identified our critical accounting policies, the application of which may materially affect the financial statements, either because of the significance of the financials statement item to which they relate, or because they require management's judgment in making estimates and assumptions in measuring, at a specific point in time, events which will be settled in the future. The critical accounting policies, judgments and estimates which management believes have the most significant effect on the financial statements are set forth below:

24

a) Estimates. Our management routinely makes judgments and estimates about the effect of matters that are inherently uncertain. As the number of variables and assumptions affecting the future resolution of the uncertainties increase, these judgments become even more subjective and complex. Although we believe that our estimates and assumptions are reasonable, actual results may differ significantly from these estimates. Changes in estimates and assumptions based upon actual results may have a material impact on our results of operation and/or financial condition.

b) Stock-based Compensation. The Company records stock-based compensation in accordance with ASC 718, "Compensation - Stock Compensation" using the fair value method. All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable.

c) Income Taxes. We have current income tax assets recorded in our financial statements that are based on our estimates relating to federal and state income tax benefits. Our judgments regarding federal and state income tax rates, items that may or may not be deductible for income tax purposes and income tax regulations themselves are critical to the Company's financial statement income tax items.

d) Investments. In a joint venture where the Company holds more than 50% of the voting interest and has significant influence, the joint venture is consolidated with the presentation of noncontrolling interest. In determining whether significant influences exist, the Company considers its participation in policy-making decisions and its representation on the venture's management committee.

e) Valuation. The critical accounting policies governing the valuation process outline the methodologies, assumptions, and criteria used to determine the fair value of land and mining rights. These policies ensure consistency, accuracy, and compliance with accounting standards such as ASC 360 for land and ASC 930 for mining rights.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Not required for smaller reporting companies.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

At the end of the period covered by this report, an evaluation was carried out under the supervision of, and with the participation of, the Company's Management, including the Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Company's disclosure controls and procedures (as defined in Rule 13a - 15(e) and Rule 15d - 15(e) of the Securities and Exchange Act of 1934, as amended). Based on that evaluation, the Chief Executive Officer and Chief Financial Officer have concluded that as of the end of the period covered by this report, the Company's disclosure controls and procedures were adequately designed and effective in ensuring that information required to be disclosed by the Company in its reports that it files or submits to the SEC under the Exchange Act, is recorded, processed, summarized and reported within the time period specified in applicable rules and forms.

Changes in Internal Controls Over Financial Reporting

During the quarter covered by this report, there have been no changes in the Company's internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting.

25

PART II - OTHER INFORMATION

Item 1. Legal Proceedings.

We are not aware of any material pending litigation or of any proceedings known to be contemplated by governmental authorities which are, or would be, likely to have a material adverse effect upon us or our operations, taken as a whole. No director, officer or affiliate of Thunder Mountain and no owner of record or beneficial owner of more than 5% of our securities or any associate of any such director, officer or security holder is a party adverse to Thunder Mountain or has a material interest adverse to Thunder Mountain in reference to any currently pending litigation.

Item 1A. Risk Factors.

Item 1A. - Risk Factors of our 2023 Form 10-K sets forth information relating to important risks and uncertainties that could materially adversely affect our business, financial condition or operating results.

Mineral resources are subject to further exploration and development, are subject to additional risks, and no assurance can be given that they will eventually convert to future reserves. Inferred Resources have a great amount of uncertainty as to their existence and their economic and legal feasibility. Mineral interests are periodically assessed for impairment of value and any subsequent losses are charged to operations at the time of impairment. Thunder Mountain Gold evaluated these impairment considerations and determined that no such impairments occurred as of March 31, 2024.

Risks Related to Our Company

Our ability to operate as a going concern is in doubt.

The audit opinion and notes that accompany our consolidated financial statements for the year ended December 31, 2023, disclose a 'going concern' qualification to our ability to continue in business. The accompanying consolidated financial statements have been prepared under the assumption that we will continue as a going concern. We have incurred losses since our inception. We do not have sufficient cash to fund normal operations and meet all of our obligations for the next 12 months. We will need to raise funds in the form of equity or debt financings to fund normal operations for the next 12 months.

Full disclosure of the going concern qualification appears in the notes to the financial statements (See Note 1 - Basis of Presentation and Going Concern.)

We have a limited operating history on which to base an evaluation of our business and prospects.

Our operating history has been restricted to the acquisition and exploration of our mineral properties, and this does not provide a meaningful basis for an evaluation of our prospects if we ever determine that we have a mineral reserve and commence the construction and operation of a mine. Other than through conventional and typical exploration methods and procedures, we have no additional way to evaluate the likelihood of whether our mineral properties contain any mineral reserves or, if they do that they will be operated successfully. As a result, we are subject to all of the risks associated with developing and establishing new mining operations and business enterprises including:

| · | completion of feasibility studies to verify reserves and commercial viability, including the ability to find sufficient metal resources to support a commercial mining operation; |

| · | the timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of infrastructure, mining, and processing facilities; |

| · | the availability and costs of drill equipment, exploration personnel, skilled labor, and mining and processing equipment, if required; |

| · | compliance with environmental and other governmental approval and permit requirements; |

| · | the availability of funds to finance exploration, development, and construction activities, as warranted; |

| · | potential opposition from non-governmental organizations, environmental groups, local groups, or local inhabitants which may delay or prevent development activities; |

| · | potential increases in exploration, construction, and operating costs due to changes in the cost of fuel, labor, power, materials, and supplies; and |

| · | potential shortages of mineral processing, construction, and other facilities-related supplies. |

26

The costs, timing, and complexities of exploration, development, and construction activities may be increased by the location of our properties and demand by other mineral exploration and mining companies. It is common in exploration programs to experience unexpected problems and delays during drill programs and, if warranted, development, construction, and mine start-up. Accordingly, our activities may not result in profitable mining operations and we may not succeed in establishing mining operations or profitably producing metals at any of our properties. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

We have a history of losses and expect to continue to incur losses in the future.

We have incurred losses since inception and expect to continue to incur losses in the future. We had an accumulated deficit of approximately $7,374,168 as of March 31, 2024. We expect to continue to incur losses unless and until such time as one of our properties enters into commercial production and generates sufficient revenues to fund continuing operations. We recognize that if we are unable to generate significant revenues from mining operations and dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses, and difficulties frequently encountered by companies at the start-up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition.

Minimal staffing may be reasonably likely to materially affect the Company's internal control over financial reporting

With a very limited staff, it is difficult to maintain appropriate segregation of duties in the initiating and recording of transactions, thereby creating a segregation of duties weakness. Due to the significance of the segregation of duties to the preparation of reliable financial statements, this weakness may result in more than a remote likelihood that a material misstatement or lack of disclosure within the annual or interim financial statements may not be prevented or detected.

Risks Associated with Mining and Exploration

All of our properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral reserve on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from these properties, and if we do not do so, and are unable to joint venture or sell the properties, we will lose all of the funds that we expend on exploration. If we do not discover any mineral reserve in a commercially exploitable quantity, our business could fail.

We have not established that any of our mineral properties contain any mineral reserves according to recognized reserve guidelines, nor can there be any assurance that we will be able to do so. A mineral reserve is defined by the SEC in its Regulation S-K subpart 1300 as that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a "reserve" that meets the requirements of the SEC's Regulation S-K subpart 1300 is remote. Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that they can be developed into producing mines to extract those minerals. Both mineral exploration and development involve a high degree of risk, and few properties that are explored are ultimately developed into producing mines. The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade, and other attributes of the mineral deposit, the proximity of the mineral deposit to infrastructure such as a smelter, roads, a point for shipping, government regulation, and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us, our venture partners, and our suppliers, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting, and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Given the political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation. The potential physical impacts of climate change on our operations are highly uncertain and would be particular to the geographic circumstances in areas in which we operate. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels, and changing temperatures. These impacts may adversely impact the cost, production, and financial performance of our operations.

27

If we establish the existence of a mineral reserve on any of our properties in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the reserve, and our business could fail.