|

Management’s Discussion of Fund Performance

|

|

|

2011 in Review

|

2

|

|

Outlook

|

2

|

|

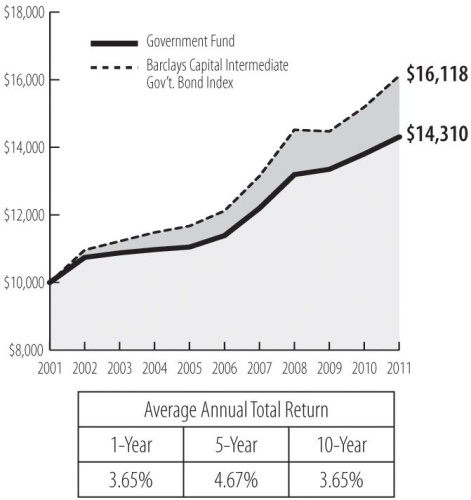

Government Fund

|

3

|

|

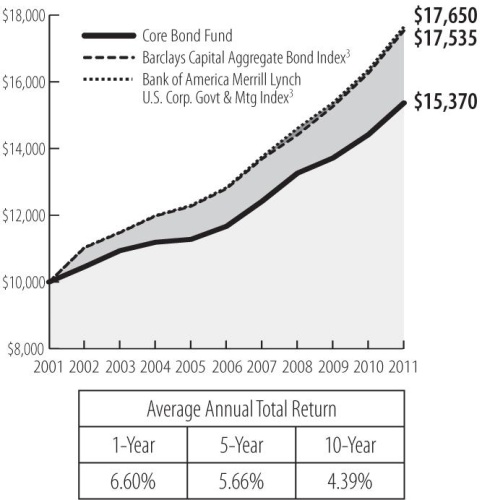

Core Bond Fund

|

4

|

|

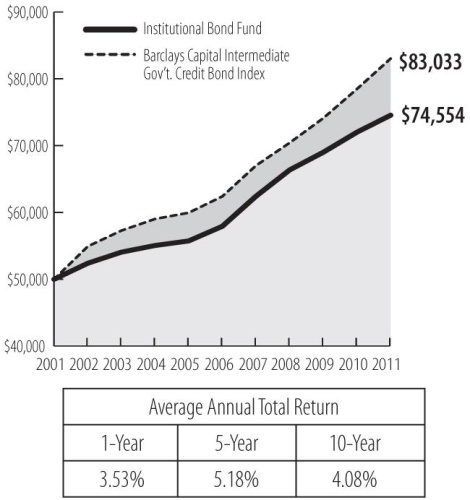

Institutional Bond Fund

|

5

|

|

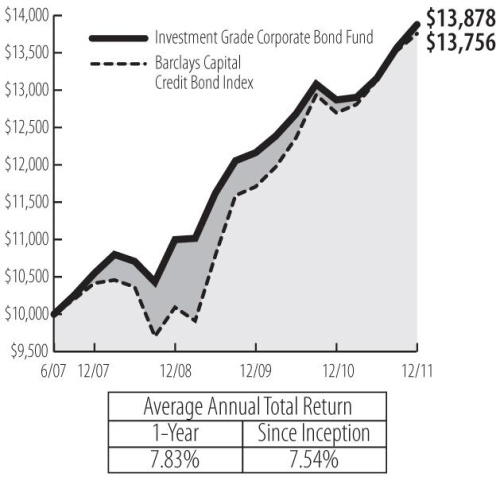

Investment Grade Corporate Bond Fund

|

6

|

|

Notes to Management’s Discussion of Fund Performance

|

7

|

|

Portfolio of Investments

|

|

|

Government Fund

|

8

|

|

Core Bond Fund

|

9

|

|

Institutional Bond Fund

|

11

|

|

Investment Grade Corporate Bond Fund

|

13

|

|

Statements of Assets and Liabilities

|

15

|

|

Statements of Operations

|

16

|

|

Statements of Changes in Net Assets

|

17

|

|

Financial Highlights

|

18

|

|

Notes to Financial Statements

|

20

|

|

Report of Independent Registered Public Accounting Firm

|

26

|

|

Other Information

|

27

|

|

Trustees and Officers

|

31

|

|

FUND-AT-A-GLANCE

|

|

Objective: Madison Mosaic Government Fund provides investors with monthly dividends by investing in bonds and other securities issued or guaranteed by the U.S. Government.

|

|

Net Assets: $5.3 million

|

|

Date of Inception: July 21, 1983

|

|

Ticker: MADTX

|

|

TOP TEN STOCK HOLDINGS AS OF DECEMBER 31, 2011

|

|

|

% of net assets

|

|

|

U.S. Treasury Note, 3.125%, 10/31/16

|

12.49%

|

|

Freddie Mac, 2.5%, 5/27/16

|

6.96%

|

|

Fannie Mae, 2.375%, 4/11/16

|

4.96%

|

|

Federal Home Loan Bank, 1.375%, 5/28/14

|

4.79%

|

|

U.S. Treasury Note, 2.625%, 4/30/16

|

4.06%

|

|

Fannie Mae, 2.375%, 7/28/15

|

3.96%

|

|

Fannie Mae, 1.625%, 10/26/15

|

3.85%

|

|

U.S. Treasury Note, 0.625%, 12/31/12

|

3.77%

|

|

U.S.Treasury Note, 3.75%, 11/15/18

|

3.28%

|

|

Freddie Mac, 4.5%, 7/15/13

|

3.00%

|

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS

AS OF 12/31/11

|

|

|

Mortgage Backed Securities

|

10.8%

|

|

U.S. Agency Notes

|

48.3%

|

|

U.S. Treasury Notes

|

37.3%

|

|

Cash and Other

|

3.6%

|

|

FUND-AT-A-GLANCE

|

|

Objective: Madison Mosaic Core Bond Fund provides relatively higher income by investing in a mix of higher, medium and lower-rated corporate bonds.

|

|

Net Assets: $8.8 million

|

|

Date of Inception: July 21, 1983

|

|

Ticker: MADBX

|

|

TOP TEN STOCK HOLDINGS AS OF DECEMBER 31, 2011

|

|

|

% of net assets

|

|

|

U.S. Treasury Note, 3.125%, 5/15/19

|

13.31%

|

|

U.S. Treasury Bond, 5.375%, 2/15/31

|

5.64%

|

|

Ginnie Mae 698089, 4%, 4/15/39

|

3.42%

|

|

Freddie Mac, 5%, 2/16/17

|

3.34%

|

|

Kimberly-Clark Corp., 6.125%, 8/1/17

|

2.08%

|

|

Fannie Mae 889260, 5%, 4/1/38

|

2.05%

|

|

ConocoPhillips, 4.6%, 1/15/15

|

1.88%

|

|

Merck & Co. Inc., 4%, 6/30/15

|

1.87%

|

|

U.S. Treasury Note, 2.625%, 11/15/20

|

1.83%

|

|

Bank of New York Mellon Corp./The, 4.3%, 5/15/14

|

1.82%

|

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS

AS OF 12/31/11

|

|

|

Consumer Discretionary

|

2.9%

|

|

Consumer Staples

|

8.5%

|

|

Energy

|

5.4%

|

|

Financials

|

15.3%

|

|

Health Care

|

5.7%

|

|

Industrials

|

2.6%

|

|

Information Technology

|

8.0%

|

|

Materials

|

1.2%

|

|

Utilities

|

0.9%

|

|

Mortgage Backed Securities

|

21.1%

|

|

U.S. Government and Agency Obligations

|

24.6%

|

|

Cash and Other

|

3.8%

|

|

FUND-AT-A-GLANCE

|

|

Objective: The Madison Mosaic Institutional Bond Fund seeks total investment return through a combination of intermediate corporate and government bonds.

|

|

Net Assets: $104.8 million

|

|

Date of Inception: May 1, 2000

|

|

Ticker: MIIBX

|

|

TOP TEN HOLDINGS AS OF DECEMBER 31, 2011

|

|

|

% of net assets

|

|

|

U.S. Treasury Note, 1%, 3/31/12

|

7.17%

|

|

U.S. Treasury Note, 4.25%, 8/15/14

|

5.25%

|

|

U.S. Treasury Note, 2%, 11/30/13

|

4.93%

|

|

U.S. Treasury Note, 1.375%, 1/15/13

|

4.83%

|

|

U.S. Treasury Note, 3.125%, 5/15/19

|

3.74%

|

|

U.S. Treasury Note, 4.875%, 2/15/12

|

3.45%

|

|

Fannie Mae, 4.625%, 10/15/14

|

3.45%

|

|

U.S. Treasury Note, 2.625%, 11/15/20

|

2.31%

|

|

Freddie Mac, 4.5%, 7/15/13

|

2.28%

|

|

Abbott Laboratories, 5.6%, 11/30/17

|

2.28%

|

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS

AS OF 12/31/11

|

|

|

Consumer Discretionary

|

2.1%

|

|

Consumer Staples

|

10.0%

|

|

Energy

|

2.1%

|

|

Financials

|

15.8%

|

|

Health Care

|

4.4%

|

|

Industrials

|

1.7%

|

|

Information Technology

|

10.9%

|

|

Materials

|

1.5%

|

|

U.S. Government & Agency Obligations

|

47.0%

|

|

Cash & Other

|

4.5%

|

|

FUND-AT-A-GLANCE

|

|

Objective: The Madison Mosaic Investment Grade Corporate Bond Fund provides investors with monthly income by investing in investment grade corporate securities.

|

|

Net Assets: $17.6 million

|

|

Date of Inception: July 1, 2007

|

|

Ticker: COINX

|

|

TOP TEN HOLDINGS AS OF DECEMBER 31, 2011

|

|

|

% of net assets

|

|

|

Comcast Corp., 6.45%, 3/15/37

|

2.91%

|

|

Oracle Corp., 5.75%, 4/15/18

|

2.91%

|

|

Walgreen Co., 5.25%, 1/15/19

|

2.85%

|

|

Abbott Laboratories, 5.875%, 5/15/16

|

2.84%

|

|

General Electric Capital Corp., 6.75%, 3/15/32

|

2.84%

|

|

Cisco Systems Inc., 5.5%, 2/22/16

|

2.82%

|

|

Devon Energy Corp., 5.6%, 7/15/41

|

2.75%

|

|

Target Corp., 5.375%, 5/1/17

|

2.68%

|

|

Wells Fargo & Co., 5.625%, 12/11/17

|

2.67%

|

|

Berkshire Hathaway Finance Corp., 5.4%, 5/15/18

|

2.66%

|

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS

AS OF 12/31/11

|

|

|

Consumer Discretionary

|

10.0%

|

|

Consumer Staples

|

18.1%

|

|

Energy

|

10.8%

|

|

Financials

|

27.6%

|

|

Health Care

|

5.6%

|

|

Industrials

|

2.7%

|

|

Information Technology

|

15.1%

|

|

Materials

|

4.9%

|

|

Utilities

|

2.4%

|

|

Cash & Other

|

2.8%

|

|

|

1This chart compares a $10,000 investment made in the fund to a $10,000 investment made in the index.

|

|

|

2Past performance is not predictive of future performance. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares and assumes all dividends have been reinvested. The comparative Indices noted do not reflect any investment management fees or transaction expenses, nor the effects of taxes, fees or other changes.

|

|

|

3The primary benchmark is changing from the Barclays Capital Aggregate Bond Index to the Bank of America Merrill Lynch U.S. Corporate Government and Mortgage Index.

|

|

Par Value

|

Value (Note 1)

|

|

|

MORTGAGE BACKED SECURITIES - 10.8%

|

||

|

Fannie Mae - 4.6%

|

||

|

5.5%, 2/1/18 Pool # 555345

|

$ 16,647

|

$ 18,087

|

|

5%, 6/1/18 Pool # 555545

|

34,275

|

37,025

|

|

6.5%, 5/1/32 Pool # 636758

|

8,104

|

9,205

|

|

6.5%, 6/1/32 Pool # 254346

|

9,517

|

10,810

|

|

6%, 8/1/32 Pool # 254405

|

15,943

|

17,775

|

|

4.5%, 12/1/35 Pool # 745147

|

108,964

|

116,214

|

|

5.5%, 1/1/38 Pool # 953589

|

32,667

|

35,603

|

|

244,719

|

||

|

Freddie Mac - 4.0%

|

||

|

5.5%, 8/1/17 Pool # E90778

|

12,676

|

13,749

|

|

4.5%, 11/1/23 Pool # G13342

|

32,020

|

33,986

|

|

6.5%, 6/1/32 Pool # C01364

|

9,268

|

10,551

|

|

4%, 10/1/40 Pool # A94362

|

146,398

|

153,813

|

|

212,099

|

||

|

Ginnie Mae - 2.2%

|

||

|

7%, 9/20/27 Pool # E2483

|

6,218

|

7,226

|

|

6%, 2/15/38 Pool # 676516

|

27,578

|

31,260

|

|

4%, 4/15/39 Pool # 698089

|

75,013

|

80,613

|

|

119,099

|

||

|

Total Mortgage Backed Securities

(Cost $539,711)

|

575,917

|

|

|

U.S. GOVERNMENT AND AGENCY OBLIGATIONS - 85.6%

|

||

|

Fannie Mae - 26.1%

|

||

|

4.875%, 5/18/12

|

100,000

|

101,853

|

|

3.625%, 2/12/13

|

150,000

|

155,600

|

|

4.75%, 2/21/13

|

150,000

|

157,591

|

|

4.375%, 7/17/13

|

150,000

|

159,247

|

|

4.625%, 10/15/13

|

125,000

|

134,483

|

|

2.375%, 7/28/15

|

200,000

|

211,195

|

|

1.625%, 10/26/15

|

200,000

|

205,151

|

|

2.375%, 4/11/16

|

250,000

|

264,408

|

|

1,389,528

|

||

|

Par Value

|

Value (Note 1)

|

|

|

Federal Home Loan Bank - 9.7%

|

||

|

4%, 9/6/13

|

$150,000

|

$ 159,113

|

|

3.125%, 12/13/13

|

100,000

|

104,840

|

|

1.375%, 5/28/14

|

250,000

|

255,078

|

|

519,031

|

||

|

Freddie Mac - 12.5%

|

||

|

4.5%, 7/15/13

|

150,000

|

159,597

|

|

2.875%, 2/9/15

|

125,000

|

133,406

|

|

2.5%, 5/27/16

|

350,000

|

371,064

|

|

664,067

|

||

|

U.S. Treasury Note - 37.3%

|

||

|

4%, 11/15/12

|

150,000

|

155,022

|

|

0.625%, 12/31/12

|

200,000

|

200,969

|

|

0.625%, 1/31/13

|

150,000

|

150,756

|

|

4.25%, 8/15/14

|

100,000

|

110,172

|

|

2.625%, 4/30/16

|

200,000

|

216,422

|

|

3.125%, 10/31/16

|

600,000

|

665,391

|

|

4.5%, 5/15/17

|

90,000

|

106,755

|

|

3.75%, 11/15/18

|

150,000

|

174,527

|

|

1.375%, 11/30/18

|

100,000

|

100,359

|

|

2.625%, 11/15/20

|

100,000

|

107,672

|

|

1,988,045

|

||

|

Total U.S. Government and Agency Obligations (Cost $4,413,701)

|

4,560,671

|

|

|

Repurchase Agreement - 3.1%

|

||

|

With U.S. Bank National Association issued 12/30/11 at 0.01%, due 1/3/12, collateralized by $105,907 in Fannie Mae Pool #695167 due 5/1/33 and $60,991 in Fannie Mae Pool #729590 due 7/1/18. Proceeds at maturity are $163,633 (Cost $163,633)

|

163,633

|

|

|

TOTAL INVESTMENTS - 99.5% (Cost $5,117,045)

|

5,300,221

|

|

|

NET OTHER ASSETS AND LIABILITIES - 0.5%

|

28,143

|

|

|

TOTAL ASSETS - 100.0%

|

$ 5,328,364

|

|

|

Par Value

|

Value (Note 1)

|

|

|

CORPORATE NOTES AND BONDS - 50.5%

|

||

|

Consumer Discretionary - 2.9%

|

||

|

Comcast Cable Communications Holdings Inc., 8.375%, 3/15/13

|

$ 27,000

|

$ 29,371

|

|

Comcast Corp., 5.3%, 1/15/14

|

100,000

|

107,808

|

|

McDonald’s Corp., 5.35%, 3/1/18

|

100,000

|

119,650

|

|

256,829

|

||

|

Consumer Staples - 8.5%

|

||

|

Bottling Group LLC., 5.125%, 1/15/19

|

100,000

|

116,841

|

|

Costco Wholesale Corp., 5.5%, 3/15/17

|

100,000

|

119,577

|

|

Kellogg Co., 4.45%, 5/30/16

|

100,000

|

111,116

|

|

Kimberly-Clark Corp., 6.125%, 8/1/17

|

150,000

|

183,701

|

|

Sysco Corp., 5.25%, 2/12/18

|

100,000

|

117,347

|

|

Walgreen Co., 4.875%, 8/1/13

|

100,000

|

106,730

|

|

755,312

|

||

|

Energy - 5.4%

|

||

|

BP Capital Markets PLC, 3.875%, 3/10/15

|

52,000

|

55,568

|

|

ConocoPhillips, 4.6%, 1/15/15

|

150,000

|

166,018

|

|

Devon Energy Corp., 6.3%, 1/15/19

|

125,000

|

153,119

|

|

Valero Energy Corp., 6.875%, 4/15/12

|

100,000

|

101,632

|

|

476,337

|

||

|

Financials - 15.3%

|

||

|

Allstate Corp./The, 6.2%, 5/16/14

|

100,000

|

111,588

|

|

American Express Credit Corp., 5.875%, 5/2/13

|

150,000

|

157,724

|

|

Bank of New York Mellon Corp./The, 4.3%, 5/15/14

|

150,000

|

161,033

|

|

Berkshire Hathaway Finance Corp., 4.85%, 1/15/15

|

100,000

|

110,853

|

|

General Electric Capital Corp., 4.8%, 5/1/13

|

100,000

|

104,722

|

|

Goldman Sachs Group Inc./The, 5.75%, 10/1/16

|

100,000

|

103,793

|

|

JPMorgan Chase & Co., 3.7%, 1/20/15

|

150,000

|

155,633

|

|

Markel Corp., 6.8%, 2/15/13

|

75,000

|

77,822

|

|

National Rural Utilities Cooperative Finance Corp., 4.75%, 3/1/14

|

100,000

|

107,948

|

|

US Bancorp, 4.2%, 5/15/14

|

100,000

|

107,123

|

|

Wells Fargo & Co., 4.375%, 1/31/13

|

150,000

|

155,066

|

|

1,353,305

|

||

|

Health Care - 5.7%

|

||

|

Abbott Laboratories, 5.6%, 11/30/17

|

100,000

|

119,569

|

|

Eli Lilly & Co., 4.2%, 3/6/14

|

100,000

|

107,203

|

|

Merck & Co. Inc., 4%, 6/30/15

|

150,000

|

165,320

|

|

Pfizer Inc., 5.35%, 3/15/15

|

100,000

|

113,203

|

|

505,295

|

||

|

Par Value

|

Value (Note 1)

|

|

|

Industrials - 2.6%

|

||

|

Danaher Corp., 3.9%, 6/23/21

|

100,000

|

$ 110,615

|

|

United Parcel Service Inc., 5.5%, 1/15/18

|

100,000

|

119,992

|

|

230,607

|

||

|

Information Technology - 8.0%

|

||

|

Cisco Systems Inc., 5.5%, 2/22/16

|

100,000

|

116,482

|

|

Google Inc., 3.625%, 5/19/21

|

100,000

|

109,541

|

|

Hewlett-Packard Co., 5.5%, 3/1/18

|

100,000

|

111,293

|

|

Oracle Corp., 4.95%, 4/15/13

|

100,000

|

105,638

|

|

Texas Instruments Inc., 2.375%, 5/16/16

|

150,000

|

156,413

|

|

Western Union Co./The, 5.93%, 10/1/16

|

100,000

|

112,794

|

|

712,161

|

||

|

Materials - 1.2%

|

||

|

EI du Pont de Nemours & Co., 4.75%, 11/15/12

|

100,000

|

103,432

|

|

Utilities - 0.9%

|

||

|

Dominion Resources Inc./VA, 5.7%, 9/17/12

|

75,000

|

77,528

|

|

Total Corporate Notes and Bonds

(Cost $4,225,723)

|

4,470,806

|

|

|

MORTGAGE BACKED SECURITIES - 21.1%

|

||

|

Fannie Mae - 12.6%

|

||

|

5%, 2/1/19 Pool # 725341

|

27,261

|

29,449

|

|

6%, 3/1/21 Pool # 745406

|

40,551

|

43,914

|

|

5.5%, 3/1/21 Pool # 837199

|

51,429

|

55,877

|

|

6.5%, 5/1/32 Pool # 636758

|

10,806

|

12,274

|

|

4.5%, 12/1/35 Pool # 745147

|

108,964

|

116,214

|

|

5%, 2/1/36 Pool # 745275

|

108,840

|

117,687

|

|

5%, 3/1/36 Pool # 745355

|

144,606

|

156,360

|

|

5.5%, 5/1/36 Pool # 745516

|

47,118

|

51,456

|

|

6%, 12/1/36 Pool # 256514

|

57,323

|

63,245

|

|

6%, 12/1/36 Pool # 902070

|

50,300

|

55,497

|

|

6%, 12/1/36 Pool # 903002

|

52,350

|

57,759

|

|

5.5%, 1/1/37 Pool # 905805

|

94,156

|

102,737

|

|

5.5%, 1/1/38 Pool # 953589

|

32,667

|

35,603

|

|

6%, 1/1/38 Pool # 965649

|

35,127

|

38,724

|

|

5%, 4/1/38 Pool # 889260

|

167,536

|

181,128

|

|

1,117,924

|

||

|

Freddie Mac - 5.1%

|

||

|

5%, 2/1/21 Pool # G11911

|

53,983

|

58,196

|

|

4.5%, 4/1/23 Pool # J07302

|

117,002

|

124,184

|

|

4.5%, 11/1/23 Pool # G13342

|

64,040

|

67,972

|

|

6%, 8/1/36 Pool # A51727

|

46,599

|

51,348

|

|

6.5%, 11/1/36 Pool # C02660

|

54,205

|

61,033

|

|

5%, 9/1/38 Pool # G04815

|

80,868

|

86,999

|

|

449,732

|

||

|

Par Value

|

Value (Note 1)

|

|

|

MORTGAGE BACKED SECURITIES (continued)

|

||

|

Ginnie Mae - 3.4%

|

||

|

4%, 4/15/39 Pool # 698089

|

$281,299

|

$ 302,300

|

|

Total Mortgage Backed Securities

(Cost $1,743,429)

|

1,869,956

|

|

|

U.S. GOVERNMENT AND AGENCY OBLIGATIONS - 24.6%

|

||

|

Freddie Mac - 3.3%

|

||

|

5%, 2/16/17

|

250,000

|

295,426

|

|

U.S. Treasury Bond - 5.6%

|

||

|

5.375%, 2/15/31

|

350,000

|

498,914

|

|

U.S. Treasury Note - 15.7%

|

||

|

3.125%, 10/31/16

|

35,000

|

38,815

|

|

3.125%, 5/15/19

|

1,050,000

|

1,177,476

|

|

2.625%, 11/15/20

|

150,000

|

161,508

|

|

1,377,799

|

||

|

Total U.S. Government and Agency Obligations (Cost $2,003,921)

|

2,172,139

|

|

|

Value (Note 1)

|

||

|

Repurchase Agreement - 2.8%

|

||

|

With U.S. Bank National Association issued 12/30/11 at 0.01%, due 1/3/12, collateralized by $159,916 in Fannie Mae Pool #695167 due 5/1/33 and $92,096 in Fannie Mae Pool #729590 due 7/1/18. Proceeds at maturity are $247,082 (Cost $247,082)

|

$ 247,082

|

|

|

TOTAL INVESTMENTS - 99.0% (Cost $8,220,155)

|

8,759,983

|

|

|

NET OTHER ASSETS AND LIABILITIES - 1.0%

|

85,565

|

|

|

TOTAL ASSETS - 100.0%

|

$ 8,845,548

|

|

|

Par Value

|

Value (Note 1)

|

|

|

CORPORATE NOTES AND

BONDS - 48.5%

|

||

|

Consumer Discretionary - 2.1%

|

||

|

McDonald’s Corp., 5.35%, 3/1/18

|

$1,000,000

|

$ 1,196,500

|

|

Target Corp., 5.875%, 3/1/12

|

1,000,000

|

1,008,434

|

|

2,204,934

|

||

|

Consumer Staples -10.0%

|

||

|

Coca-Cola Co./The, 4.875%, 3/15/19

|

1,000,000

|

1,172,913

|

|

Costco Wholesale Corp., 5.3%, 3/15/12

|

1,000,000

|

1,009,314

|

|

PepsiCo Inc./NC, 4.65%, 2/15/13

|

1,500,000

|

1,569,810

|

|

Procter & Gamble Co./The, 4.7%, 2/15/19

|

1,500,000

|

1,772,955

|

|

Sysco Corp., 5.25%, 2/12/18

|

1,000,000

|

1,173,466

|

|

Walgreen Co., 4.875%, 8/1/13

|

125,000

|

133,413

|

|

Walgreen Co., 5.25%, 1/15/19

|

1,500,000

|

1,785,941

|

|

Wal-Mart Stores Inc., 4.55%, 5/1/13

|

125,000

|

131,975

|

|

Wal-Mart Stores Inc., 4.5%, 7/1/15

|

1,500,000

|

1,681,190

|

|

10,430,977

|

||

|

Energy - 2.1%

|

||

|

BP Capital Markets PLC, 3.875%, 3/10/15

|

518,000

|

553,540

|

|

ConocoPhillips, 4.6%, 1/15/15

|

1,500,000

|

1,660,178

|

|

2,213,718

|

||

|

Financials - 15.8%

|

||

|

Allstate Corp./The, 6.2%, 5/16/14

|

2,000,000

|

2,231,766

|

|

American Express Co., 4.875%, 7/15/13

|

1,500,000

|

1,569,177

|

|

Bank of New York Mellon Corp./The, 4.3%, 5/15/14

|

1,500,000

|

1,610,334

|

|

Berkshire Hathaway Finance Corp., 4.85%, 1/15/15

|

1,450,000

|

1,607,363

|

|

General Electric Capital Corp., 4.25%, 6/15/12

|

170,000

|

172,078

|

|

General Electric Capital Corp., 4.8%, 5/1/13

|

830,000

|

869,193

|

|

Goldman Sachs Group Inc./The, 6.6%, 1/15/12

|

1,000,000

|

1,001,562

|

|

JPMorgan Chase & Co., 3.7%, 1/20/15

|

2,000,000

|

2,075,100

|

|

National Rural Utilities Cooperative Finance Corp., 4.75%, 3/1/14

|

1,450,000

|

1,565,246

|

|

US Bancorp, 4.2%, 5/15/14

|

1,500,000

|

1,606,845

|

|

Wells Fargo & Co., 5.625%, 12/11/17

|

2,000,000

|

2,281,970

|

|

16,590,634

|

||

|

Health Care - 4.4%

|

||

|

Abbott Laboratories, 5.6%, 11/30/17

|

2,000,000

|

2,391,374

|

|

Eli Lilly & Co., 4.2%, 3/6/14

|

450,000

|

482,414

|

|

Pfizer Inc., 5.35%, 3/15/15

|

1,500,000

|

1,698,043

|

|

4,571,831

|

||

|

Par Value

|

Value (Note 1)

|

|

|

Industrials - 1.7%

|

||

|

United Parcel Service Inc., 5.5%, 1/15/18

|

1,500,000

|

$ 1,799,870

|

|

Information Technology - 10.9%

|

||

|

Cisco Systems Inc., 5.5%, 2/22/16

|

1,500,000

|

1,747,238

|

|

Google Inc., 3.625%, 5/19/21

|

1,500,000

|

1,643,113

|

|

Hewlett-Packard Co., 5.25%, 3/1/12

|

1,000,000

|

1,006,599

|

|

Intel Corp., 1.95%, 10/1/16

|

2,000,000

|

2,058,362

|

|

International Business Machines Corp., 4.75%, 11/29/12

|

1,000,000

|

1,034,291

|

|

Microsoft Corp., 3%, 10/1/20

|

750,000

|

799,432

|

|

Oracle Corp., 4.95%, 4/15/13

|

1,000,000

|

1,056,380

|

|

Texas Instruments Inc., 2.375%, 5/16/16

|

2,000,000

|

2,085,504

|

|

11,430,919

|

||

|

Materials - 1.5%

|

||

|

EI du Pont de Nemours & Co., 3.25%, 1/15/15

|

1,500,000

|

1,600,821

|

|

Total Corporate Notes and Bonds

(Cost $49,402,247)

|

50,843,704

|

|

|

U.S. GOVERNMENT AND AGENCY OBLIGATIONS - 47.0%

|

||

|

Fannie Mae - 5.1%

|

||

|

4.625%, 10/15/14

|

3,250,000

|

3,613,597

|

|

1.375%, 11/15/16

|

1,750,000

|

1,767,532

|

|

5,381,129

|

||

|

Federal Home Loan Bank - 2.0%

|

||

|

3.625%, 5/29/13

|

2,000,000

|

2,092,640

|

|

Freddie Mac - 6.2%

|

||

|

5.125%, 7/15/12

|

2,250,000

|

2,311,004

|

|

4.5%, 7/15/13

|

2,250,000

|

2,393,951

|

|

2.5%, 5/27/16

|

1,750,000

|

1,855,318

|

|

6,560,273

|

||

|

U.S. Treasury Note - 33.7%

|

||

|

4.875%, 2/15/12

|

3,600,000

|

3,619,527

|

|

1%, 3/31/12

|

7,500,000

|

7,518,457

|

|

4%, 11/15/12

|

2,000,000

|

2,066,954

|

|

1.375%, 1/15/13

|

5,000,000

|

5,062,890

|

|

2%, 11/30/13

|

5,000,000

|

5,165,820

|

|

4.25%, 8/15/14

|

5,000,000

|

5,508,595

|

|

3.125%, 5/15/19

|

3,500,000

|

3,924,921

|

|

2.625%, 11/15/20

|

2,250,000

|

2,422,618

|

|

35,289,782

|

||

|

Total U.S. Government and Agency Obligations (Cost $48,264,827)

|

49,323,824

|

|

|

Value (Note 1)

|

||

|

Repurchase Agreement - 7.2%

|

||

|

With U.S. Bank National Association issued 12/30/11 at 0.01%, due 1/3/12, collateralized by $4,851,618 in Fannie Mae Pool #695167 due 5/1/33 and $2,794,037 in Fannie Mae Pool #729590 due 7/1/18. Proceeds at maturity are $7,496,081 (Cost $7,496,079)

|

$ 7,496,079

|

|

|

TOTAL INVESTMENTS - 102.7% (Cost $105,163,153)

|

107,663,607

|

|

|

NET OTHER ASSETS AND LIABILITIES - (2.7%)

|

(2,814,971)

|

|

|

TOTAL ASSETS - 100.0%

|

$104,848,636

|

|

|

Par Value

|

Value (Note 1)

|

|

|

CORPORATE NOTES AND BONDS - 97.2%

|

||

|

Consumer Discretionary - 10.0%

|

||

|

Comcast Corp., 6.45%, 3/15/37

|

$420,000

|

$ 510,871

|

|

DIRECTV Holdings LLC. / DIRECTV Financing Co. Inc., 5%, 3/1/21

|

400,000

|

428,878

|

|

McDonald’s Corp., 5.8%, 10/15/17

|

20,000

|

24,394

|

|

Target Corp., 5.875%, 7/15/16

|

20,000

|

23,709

|

|

Target Corp., 5.375%, 5/1/17

|

400,000

|

470,668

|

|

Time Warner Inc., 6.25%, 3/29/41

|

250,000

|

300,840

|

|

1,759,360

|

||

|

Consumer Staples - 18.1%

|

||

|

Coca-Cola Refreshments USA Inc., 7.375%, 3/3/14

|

10,000

|

11,364

|

|

Costco Wholesale Corp., 5.3%, 3/15/12

|

20,000

|

20,186

|

|

CVS Caremark Corp., 5.75%, 6/1/17

|

400,000

|

467,289

|

|

General Mills Inc., 5.65%, 2/15/19

|

380,000

|

451,615

|

|

Kellogg Co., 1.875%, 11/17/16

|

400,000

|

402,078

|

|

Kimberly-Clark Corp., 6.125%, 8/1/17

|

10,000

|

12,247

|

|

Kraft Foods Inc., 6.5%, 8/11/17

|

20,000

|

23,820

|

|

Kraft Foods Inc., 5.375%, 2/10/20

|

400,000

|

462,312

|

|

PepsiCo Inc., 5.5%, 1/15/40

|

275,000

|

343,116

|

|

Sysco Corp., 5.25%, 2/12/18

|

25,000

|

29,337

|

|

Walgreen Co., 5.25%, 1/15/19

|

420,000

|

500,064

|

|

Wal-Mart Stores Inc., 3.25%, 10/25/20

|

420,000

|

449,977

|

|

3,173,405

|

||

|

Energy - 10.8%

|

||

|

BP Capital Markets PLC, 3.875%, 3/10/15

|

13,000

|

13,892

|

|

ConocoPhillips, 4.6%, 1/15/15

|

420,000

|

464,850

|

|

Devon Energy Corp., 5.625%, 1/15/14

|

15,000

|

16,364

|

|

Devon Energy Corp., 5.6%, 7/15/41

|

400,000

|

482,807

|

|

Marathon Oil Corp., 6%, 10/1/17

|

400,000

|

465,981

|

|

Valero Energy Corp., 6.875%, 4/15/12

|

10,000

|

10,163

|

|

Valero Energy Corp., 6.625%, 6/15/37

|

410,000

|

441,012

|

|

1,895,069

|

||

|

Financials - 27.6%

|

||

|

Allstate Corp./The, 5%, 8/15/14

|

400,000

|

431,924

|

|

American Express Co., 4.875%, 7/15/13

|

25,000

|

26,153

|

|

American Express Co., 6.15%, 8/28/17

|

400,000

|

458,016

|

|

Bank of New York Mellon Corp./The, 4.3%, 5/15/14

|

425,000

|

456,261

|

|

Berkshire Hathaway Finance Corp., 4.85%, 1/15/15

|

20,000

|

22,171

|

|

Berkshire Hathaway Finance Corp., 5.4%, 5/15/18

|

400,000

|

467,127

|

|

General Electric Capital Corp., 6.75%, 3/15/32

|

425,000

|

499,107

|

|

Goldman Sachs Group Inc./The, 5.125%, 1/15/15

|

20,000

|

20,456

|

|

Par Value

|

Value (Note 1)

|

|

|

Goldman Sachs Group Inc./The, 3.625%, 2/7/16

|

$250,000

|

$ 241,782

|

|

JPMorgan Chase & Co., 4.75%, 3/1/15

|

20,000

|

21,287

|

|

JPMorgan Chase & Co., 4.25%, 10/15/20

|

400,000

|

403,542

|

|

National Rural Utilities Cooperative Finance Corp., 4.75%, 3/1/14

|

425,000

|

458,779

|

|

Simon Property Group LP, 4.125%, 12/1/21

|

400,000

|

419,119

|

|

US Bancorp, 4.2%, 5/15/14

|

25,000

|

26,781

|

|

US Bancorp, 2.2%, 11/15/16

|

400,000

|

404,300

|

|

Wells Fargo & Co., 5.625%, 12/11/17

|

410,000

|

467,804

|

|

Wells Fargo & Co., 4.6%, 4/1/21

|

15,000

|

16,481

|

|

4,841,090

|

||

|

Health Care - 5.6%

|

||

|

Abbott Laboratories, 5.875%, 5/15/16

|

425,000

|

499,060

|

|

Merck & Co. Inc., 3.875%, 1/15/21

|

400,000

|

451,176

|

|

Pfizer Inc., 5.35%, 3/15/15

|

25,000

|

28,301

|

|

978,537

|

||

|

Industrials - 2.7%

|

||

|

Caterpillar Inc., 5.2%, 5/27/41

|

20,000

|

24,053

|

|

CSX Corp., 6.15%, 5/1/37

|

20,000

|

24,135

|

|

Norfolk Southern Corp., 3.25%, 12/1/21

|

400,000

|

406,712

|

|

United Parcel Service Inc., 5.5%, 1/15/18

|

20,000

|

23,998

|

|

478,898

|

||

|

Information Technology - 15.1%

|

||

|

Cisco Systems Inc., 5.5%, 2/22/16

|

425,000

|

495,051

|

|

Hewlett-Packard Co., 4.75%, 6/2/14

|

400,000

|

422,664

|

|

Hewlett-Packard Co., 3.75%, 12/1/20

|

25,000

|

24,723

|

|

Intel Corp., 1.95%, 10/1/16

|

300,000

|

308,754

|

|

Intel Corp., 3.3%, 10/1/21

|

20,000

|

21,113

|

|

International Business Machines Corp., 4.75%, 11/29/12

|

20,000

|

20,686

|

|

International Business Machines Corp., 1.95%, 7/22/16

|

400,000

|

412,113

|

|

Intuit Inc., 5.4%, 3/15/12

|

10,000

|

10,085

|

|

Oracle Corp., 5.75%, 4/15/18

|

420,000

|

510,352

|

|

Texas Instruments Inc., 1.375%, 5/15/14

|

400,000

|

405,214

|

|

Western Union Co./The, 5.93%, 10/1/16

|

20,000

|

22,559

|

|

2,653,314

|

||

|

Materials - 4.9%

|

||

|

Dow Chemical Co./The, 4.125%, 11/15/21

|

400,000

|

411,100

|

|

EI du Pont de Nemours & Co., 4.75%, 11/15/12

|

25,000

|

25,858

|

|

EI du Pont de Nemours & Co., 3.25%, 1/15/15

|

400,000

|

426,886

|

|

863,844

|

||

|

Par Value

|

Value (Note 1)

|

|

|

CORPORATE NOTES AND BONDS (continued)

|

||

|

Utilities - 2.4%

|

||

|

Dominion Resources Inc., 5.7%, 9/17/12

|

$410,000

|

$ 423,821

|

|

Total Corporate Notes and Bonds

(Cost $16,852,657)

|

17,067,338

|

|

|

Repurchase Agreement - 1.7%

|

||

|

With U.S. Bank National Association issued 12/30/11 at 0.01%, due 1/3/12, collateralized by $189,600 in Fannie Mae Pool #695167 due 5/1/33 and $109,190 in Fannie Mae Pool #729590 due 7/1/18. Proceeds at maturity are $292,945 (Cost $292,944)

|

292,944

|

|

|

TOTAL INVESTMENTS - 98.9% (Cost $17,145,601)

|

17,360,282

|

|

|

NET OTHER ASSETS AND LIABILITIES - 1.1%

|

190,172

|

|

|

TOTAL ASSETS - 100.0%

|

$17,550,454

|

|

|

LLC Limited Liability Company

|

|

PLC Public Limited Company

|

|

Government

Fund

|

Core Bond

Fund

|

Institutional Bond Fund

|

Investment Grade Corporate Bond Fund

|

|

|

ASSETS

|

||||

|

Investments, at value (Notes 1 and 2)

|

||||

|

Investment securities

|

$ 5,136,588

|

$ 8,512,901

|

$100,167,528

|

$17,067,338

|

|

Repurchase agreements

|

163,633

|

247,082

|

7,496,079

|

292,944

|

|

Total investments*

|

5,300,221

|

8,759,983

|

107,663,607

|

17,360,282

|

|

Receivables

|

||||

|

Interest

|

32,424

|

81,912

|

1,024,827

|

191,172

|

|

Capital shares sold

|

3,085

|

8,103

|

282,224

|

–

|

|

Total assets

|

5,335,730

|

8,849,998

|

108,970,658

|

17,551,454

|

|

LIABILITIES

|

||||

|

Payables

|

||||

|

Investment securities purchased

|

–

|

–

|

4,107,757

|

–

|

|

Capital shares redeemed

|

4,616

|

1,200

|

8,515

|

–

|

|

Auditor fees

|

2,500

|

3,000

|

5,500

|

1,000

|

|

Independent trustee fees

|

250

|

250

|

250

|

–

|

|

Total liabilities

|

7,366

|

4,450

|

4,122,022

|

1,000

|

|

NET ASSETS

|

$ 5,328,364

|

$ 8,845,548

|

$104,848,636

|

$17,550,454

|

|

Net assets consists of:

|

||||

|

Paid in capital

|

$5,142,845

|

$8,334,202

|

$102,401,058

|

$17,335,773

|

|

Accumulated net realized gain (loss)

|

2,343

|

(27,287)

|

(52,876)

|

–

|

|

Net unrealized appreciation on investments

|

183,176

|

538,633

|

2,500,454

|

214,681

|

|

Net Assets

|

$ 5,328,364

|

$ 8,845,548

|

$104,848,636

|

$17,550,454

|

|

CAPITAL SHARES OUTSTANDING

|

||||

|

An unlimited number of capital shares, without par value, are authorized. (Note 7)

|

492,656

|

1,241,445

|

9,402,350

|

1,557,347

|

|

NET ASSET VALUE PER SHARE

|

$10.82

|

$7.13

|

$11.15

|

$11.27

|

|

*INVESTMENT SECURITIES, AT COST

|

$ 5,117,045

|

$ 8,220,155

|

$105,163,153

|

$17,145,601

|

|

Government

Fund

|

Core Bond

Fund

|

Institutional Bond Fund

|

Investment Grade Corporate Bond Fund

|

|

|

INVESTMENT INCOME (Note 1)

|

||||

|

Interest income

|

$128,485

|

$307,331

|

$1,376,963

|

$ 91,935

|

|

EXPENSES (Notes 3 and 4)

|

||||

|

Investment advisory fees

|

20,631

|

33,743

|

209,246

|

13,570

|

|

Other expenses:

|

||||

|

Service agreement fees

|

9,941

|

20,307

|

125,022

|

8,178

|

|

Auditor fees

|

3,500

|

4,000

|

6,500

|

2,000

|

|

Independent trustee fees

|

1,000

|

1,000

|

1,000

|

–

|

|

Line of credit interest and fees

|

255

|

253

|

250

|

–

|

|

Total other expenses

|

14,696

|

25,560

|

132,772

|

10,178

|

|

Total expenses

|

35,327

|

59,303

|

342,018

|

23,748

|

|

NET INVESTMENT INCOME

|

93,158

|

248,028

|

1,034,945

|

68,187

|

|

REALIZED AND UNREALIZED GAIN ON INVESTMENTS

|

||||

|

Net realized gain (loss) on investments

|

47,196

|

12,197

|

(52,876)

|

20,796

|

|

Change in net unrealized appreciation of investments

|

44,311

|

261,165

|

1,255,427

|

147,554

|

|

NET GAIN ON INVESTMENTS

|

91,507

|

273,362

|

1,202,551

|

168,350

|

|

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$184,665

|

$521,390

|

$2,237,496

|

$236,537

|

|

Government Fund

|

Core Bond Fund

|

|||

|

Year Ended December 31,

|

Year Ended December 31,

|

|||

|

2011

|

2010

|

2011

|

2010

|

|

|

INCREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

||||

|

Net investment income

|

$ 93,158

|

$ 116,984

|

$ 248,028

|

$ 357,455

|

|

Net realized gain on investments

|

47,196

|

5,634

|

12,197

|

255,707

|

|

Net unrealized appreciation on investments

|

44,311

|

31,782

|

261,165

|

40,434

|

|

Net increase in net assets resulting from operations

|

184,665

|

154,400

|

521,390

|

653,596

|

|

DISTRIBUTION TO SHAREHOLDERS

|

||||

|

From net investment income

|

(93,158)

|

(116,984)

|

(248,028)

|

(357,455)

|

|

From net capital gains

|

(44,407)

|

(5,897)

|

–

|

–

|

|

Total distributions

|

(137,565)

|

(122,881)

|

(248,028)

|

(357,455)

|

|

CAPITAL SHARE TRANSACTIONS (Note 7)

|

233,715

|

716,384

|

(523,472)

|

(3,701,608)

|

|

NET INCREASE (DECREASE) IN NET ASSETS

|

280,815

|

747,903

|

(250,110)

|

(3,405,467)

|

|

NET ASSETS

|

||||

|

Beginning of period

|

$5,047,549

|

$4,299,646

|

$ 9,095,658

|

$12,501,125

|

|

End of period

|

$5,328,364

|

$5,047,549

|

$ 8,845,548

|

$ 9,095,658

|

|

Institutional Bond Fund

|

Investment Grade

Corporate Bond Fund

|

|||

|

Year Ended December 31,

|

Year Ended December 31,

|

|||

|

2011

|

2010

|

2011

|

2010

|

|

|

INCREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

||||

|

Net investment income

|

$ 1,034,945

|

$ 994,219

|

$ 68,187

|

$ 46,400

|

|

Net realized gain (loss) on investments

|

(52,876)

|

102,500

|

20,796

|

3,769

|

|

Net unrealized appreciation on investments

|

1,255,427

|

1,208,983

|

147,554

|

8,240

|

|

Net increase in net assets resulting from operations

|

2,237,496

|

2,305,702

|

236,537

|

58,409

|

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||

|

From net investment income

|

(1,034,945)

|

(994,219)

|

(68,187)

|

(46,400)

|

|

From net capital gains

|

(59,296)

|

(38,218)

|

(23,110)

|

-

|

|

Total distributions

|

(1,094,241)

|

(1,032,437)

|

(91,297)

|

(46,400)

|

|

CAPITAL SHARE TRANSACTIONS (Note 7)

|

51,317,599

|

24,732,606

|

16,336,110

|

70,435

|

|

NET INCREASE IN NET ASSETS

|

52,460,854

|

26,005,871

|

16,481,350

|

82,444

|

|

NET ASSETS

|

||||

|

Beginning of period

|

$ 52,387,782

|

$26,381,911

|

$ 1,069,104

|

$ 986,660

|

|

End of period

|

$104,848,636

|

$52,387,782

|

$17,550,454

|

$1,069,104

|

|

Year Ended December 31,

|

|||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

|

|

Net asset value, beginning of period

|

$10.72

|

$10.63

|

$10.81

|

$10.30

|

$9.94

|

|

Investment operations:

|

|||||

|

Net investment income

|

0.20

|

0.26

|

0.27

|

0.32

|

0.33

|

|

Net realized and unrealized gain (loss) on investments

|

0.19

|

0.10

|

(0.15)

|

0.51

|

0.36

|

|

Total from investment operations

|

0.39

|

0.36

|

0.12

|

0.83

|

0.69

|

|

Less distributions:

|

|||||

|

From net investment income

|

(0.20)

|

(0.26)

|

(0.27)

|

(0.32)

|

(0.33)

|

|

From net capital gains

|

(0.09)

|

(0.01)

|

(0.03)

|

–

|

–

|

|

Total distribution

|

(0.29)

|

(0.27)

|

(0.30)

|

(0.32)

|

(0.33)

|

|

Net asset value, end of period

|

$10.82

|

$10.72

|

$10.63

|

$10.81

|

$10.30

|

|

Total return (%)

|

3.65

|

3.40

|

1.19

|

8.17

|

7.10

|

|

Ratios and supplemental data

|

|||||

|

Net assets, end of period (in thousands)

|

$5,328

|

$5,048

|

$4,300

|

$5,071

|

$2,986

|

|

Ratio of expenses to average net assets (%)

|

0.69

|

0.68

|

0.69

|

0.78

|

1.15

|

|

Ratio of net investment income to average net assets (%)

|

1.81

|

2.39

|

2.55

|

3.00

|

3.30

|

|

Portfolio turnover (%)

|

45

|

20

|

38

|

67

|

18

|

|

Year Ended December 31,

|

|||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

|

|

Net asset value, beginning of period

|

$6.89

|

$6.76

|

$6.74

|

$6.58

|

$6.44

|

|

Investment operations:

|

|||||

|

Net investment income

|

0.21

|

0.21

|

0.21

|

0.27

|

0.26

|

|

Net realized and unrealized gain (loss) on investments

|

0.24

|

0.13

|

0.02

|

0.16

|

0.14

|

|

Total from investment operations

|

0.45

|

0.34

|

0.23

|

0.43

|

0.40

|

|

Less distributions from net investment income

|

(0.21)

|

(0.21)

|

(0.21)

|

(0.27)

|

(0.26)

|

|

Net asset value, end of period

|

$7.13

|

$6.89

|

$6.76

|

$6.74

|

$6.58

|

|

Total return (%)

|

6.60

|

5.11

|

3.43

|

6.80

|

6.41

|

|

Ratios and supplemental data

|

|||||

|

Net assets, end of period (in thousands)

|

$8,846

|

$9,096

|

$12,501

|

$5,188

|

$4,523

|

|

Ratio of expenses to average net assets (%)

|

0.70

|

0.70

|

0.70

|

0.80

|

1.12

|

|

Ratio of net investment income to average net assets (%)

|

2.94

|

3.04

|

3.13

|

4.18

|

4.05

|

|

Portfolio turnover (%)

|

21

|

32

|

16

|

36

|

41

|

|

INSTITUTIONAL BOND FUND

|

|||||

|

Year Ended December 31,

|

|||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

|

|

Net asset value, beginning of period

|

$10.94

|

$10.68

|

$10.47

|

$10.41

|

$10.08

|

|

Investment operations:

|

|||||

|

Net investment income

|

0.16

|

0.19

|

0.20

|

0.48

|

0.44

|

|

Net realized and unrealized gain (loss) on investments

|

0.22

|

0.27

|

0.21

|

0.16

|

0.33

|

|

Total from investment operations

|

0.38

|

0.46

|

0.41

|

0.64

|

0.77

|

|

Less distributions:

|

|||||

|

From net investment income

|

(0.16)

|

(0.19)

|

(0.20)

|

(0.48)

|

(0.44)

|

|

From net capital gains

|

(0.01)

|

(0.01)

|

–

|

(0.10)

|

–

|

|

Total distributions

|

(0.17)

|

(0.20)

|

(0.20)

|

(0.58)

|

(0.44)

|

|

Net asset value, end of period

|

$11.15

|

$10.94

|

$10.68

|

$10.47

|

$10.41

|

|

Total return (%)

|

3.53

|

4.35

|

3.99

|

6.30

|

7.77

|

|

Ratios and supplemental data

|

|||||

|

Net assets, end of period (in thousands)

|

$104,849

|

$52,388

|

$26,382

|

$2,155

|

$6,413

|

|

Ratio of expenses to average net assets (%)

|

0.49

|

0.49

|

0.49

|

0.56

|

0.47

|

|

Ratio of net investment income to average net assets (%)

|

1.48

|

1.76

|

2.21

|

3.70

|

4.21

|

|

Portfolio turnover (%)

|

9

|

21

|

11

|

73

|

42

|

|

INVESTMENT GRADE CORPORATE BOND FUND

|

|||||

|

Year Ended December 31,

|

|||||

|

2011

|

2010

|

2009

|

2008

|

2007*

|

|

|

Net asset value, beginning of period

|

$10.81

|

$10.68

|

$10.16

|

$10.26

|

$10.00

|

|

Investment operations:

|

|||||

|

Net investment income

|

0.22

|

0.48

|

0.53

|

0.52

|

0.27

|

|

Net realized and unrealized gain (loss) on investments

|

0.61

|

0.13

|

0.52

|

(0.09)

|

0.26

|

|

Total from investment operations

|

0.83

|

0.61

|

1.05

|

0.43

|

0.53

|

|

Less distributions:

|

|||||

|

From net investment income

|

(0.36)

|

(0.48)

|

(0.53)

|

(0.52)

|

(0.27)

|

|

From net capital gains

|

(0.01)

|

–

|

–

|

(0.01)

|

–

|

|

Total distributions

|

(0.37)

|

(0.48)

|

(0.53)

|

(0.53)

|

(0.27)

|

|

Net asset value, end of period

|

$11.27

|

$10.81

|

$10.68

|

$10.16

|

$10.26

|

|

Total return (%)

|

7.83

|

5.81

|

10.58

|

4.29

|

5.37

|

|

Ratios and supplemental data

|

|||||

|

Net assets, end of period (in thousands)

|

$17,550

|

$1,069

|

$987

|

$948

|

$637

|

|

Ratio of expenses to average net assets (%)

|

0.69

|

0.06

|

–

|

–

|

–

|

|

Ratio of net investment income to average net assets (%)

|

1.98

|

4.44

|

5.05

|

5.21

|

5.29

|

|

Portfolio turnover (%)

|

10

|

14

|

18

|

5

|

3

|

|

|

Level 1 –quoted prices in active markets for identical investments

|

|

|

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rate volatilities, prepayment speeds, credit risk, benchmark yields, transactions, bids, offers, new issues, spreads and other relationships observed in the markets among comparable securities, underlying equity of the issuer; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data, etc.)

|

|

|

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

|

|

Fund

|

Level 1

|

Level 2

|

Level 3

|

Value at 12/31/11

|

|

Government

|

||||

|

Mortgage Backed Securities

|

$ –

|

$ 575,917

|

$ –

|

$ 575,917

|

|

U.S. Government and Agency Obligations

|

–

|

4,560,671

|

–

|

4,560,671

|

|

Repurchase Agreement

|

–

|

163,633

|

–

|

163,633

|

|

Total

|

$ –

|

$ 5,300,221

|

$ –

|

$ 5,300,221

|

|

Core Bond

|

||||

|

Corporate Notes and Bonds

|

$ –

|

$ 4,470,806

|

$ –

|

$ 4,470,806

|

|

Mortgage Backed Securities

|

–

|

1,869,956

|

–

|

1,869,956

|

|

U.S. Government and Agency Obligations

|

–

|

2,172,139

|

–

|

2,172,139

|

|

Repurchase Agreement

|

–

|

247,082

|

–

|

247,082

|

|

Total

|

$ –

|

$ 8,759,983

|

$ –

|

$ 8,759,983

|

|

Institutional Bond

|

||||

|

Corporate Notes and Bonds

|

$ –

|

$ 50,843,704

|

$ –

|

$ 50,843,704

|

|

U.S. Government and Agency Obligations

|

–

|

49,323,824

|

–

|

49,323,824

|

|

Repurchase Agreement

|

–

|

7,496,079

|

–

|

7,496,079

|

|

Total

|

$ –

|

$107,663,607

|

$ –

|

$107,663,607

|

|

Investment Grade Corporate Bond Fund

|

||||

|

Corporate Notes and Bonds

|

$ –

|

$ 17,067,338

|

$ –

|

$ 17,067,338

|

|

Repurchase Agreement

|

–

|

292,944

|

–

|

292,944

|

|

Total

|

$ –

|

$ 17,360,282

|

$ –

|

$ 17,360,282

|

|

Please see the Portfolio of Investments for each Fund for a listing of all securities within each caption.

|

||||

|

2011

|

2010

|

|

|

Government Fund:

|

||

|

Distributions paid from:

|

||

|

Ordinary income

|

$106,536

|

$121,062

|

|

Long-term capital gains

|

31,029

|

1,819

|

|

Core Bond Fund:

|

||

|

Distributions paid from ordinary income

|

$248,028

|

$357,455

|

|

Institutional Bond Fund:

|

||

|

Distributions paid from:

|

||

|

Ordinary income

|

$1,073,254

|

$1,028,225

|

|

Long-term capital gains

|

20,987

|

11,212

|

|

Investment Grade Corporate Bond Fund:

|

||

|

Distributions paid from:

|

||

|

Ordinary income

|

$69,098

|

$46,400

|

|

Long-term capital gains

|

$22,199

|

–

|

|

Government Fund:

|

|

|

Accumulated net realized gains

|

$ 2,343

|

|

Net unrealized appreciation on investments

|

183,176

|

|

$185,519

|

|

|

Core Bond Fund:

|

|

|

Accumulated net realized losses

|

$ (27,287)

|

|

Net unrealized appreciation on investments

|

538,633

|

|

$511,346

|

|

|

Institutional Bond Fund:

|

|

|

Accumulated net realized losses

|

$ (52,876)

|

|

Net unrealized appreciation on investments

|

2,500,454

|

|

$2,447,578

|

|

|

Investment Grade Corporate Bond Fund:

|

|

|

Net unrealized appreciation on investments

|

$214,681

|

|

$214,681

|

|

Fund

|

Short-Term Losses

|

Long-Term Losses

|

Expire

|

|

Core Bond

|

$17,156

|

–

|

December 31, 2014

|

|

10,131

|

–

|

December 31, 2017

|

|

|

Institutional Bond

|

–

|

$52,876

|

Do not expire.

|

|

Purchases

|

Sales

|

|

|

Government Fund:

|

||

|

U.S. Gov’t securities

|

$2,336,940

|

$2,207,409

|

|

Other

|

–

|

–

|

|

Core Bond Fund:

|

||

|

U.S. Gov’t securities

|

$959,189

|

$1,773,766

|

|

Other

|

750,189

|

878,696

|

|

Purchases

|

Sales

|

|

|

Institutional Fund:

|

||

|

U.S. Gov’t securities

|

$27,133,080

|

$2,736,258

|

|

Other

|

26,949,917

|

3,170,350

|

|

Investment Grade

Corporate Bond Fund:

|

||

|

U.S. Gov’t securities

|

$ –

|

$ –

|

|

Other

|

16,258,533

|

346,236

|

|

Government

Fund

|

Core Bond

Fund

|

|

|

Aggregate Cost

|

$5,117,045

|

$8,221,350

|

|

Gross unrealized appreciation

|

183,176

|

539,828

|

|

Gross unrealized depreciation

|

–

|

(1,195)

|

|

Net unrealized appreciation

|

$ 183,176

|

$ 538,633

|

|

Institutional

Bond Fund

|

Investment Grade Corporate Bond Fund

|

|

|

Aggregate Cost

|

$105,163,153

|

$17,145,601

|

|

Gross unrealized appreciation

|

2,502,917

|

242,323

|

|

Gross unrealized depreciation

|

(2,463)

|

(27,642)

|

|

Net unrealized appreciation

|

$ 2,500,454

|

$ 214,681

|

|

Year Ended December 31,

|

||

|

Government Fund

|

2011

|

2010

|

|

In Dollars

|

||

|

Shares sold

|

$2,417,691

|

$1,700,722

|

|

Shares issued in reinvestment of dividends

|

133,374

|

118,897

|

|

Total shares issued

|

2,551,065

|

1,819,619

|

|

Shares redeemed

|

(2,317,350)

|

(1,103,235)

|

|

Net increase

|

$ 233,715

|

$ 716,384

|

|

In Shares

|

||

|

Shares sold

|

223,668

|

157,293

|

|

Shares issued in reinvestment of dividends

|

12,353

|

11,009

|

|

Total shares issued

|

236,021

|

168,302

|

|

Shares redeemed

|

(214,360)

|

(101,855)

|

|

Net increase

|

21,661

|

66,447

|

|

Year Ended December 31,

|

||

|

Core Bond Fund

|

2011

|

2010

|

|

In Dollars

|

||

|

Shares sold

|

$4,239,259

|

$4,604,402

|

|

Shares issued in reinvestment of dividends

|

234,467

|

335,564

|

|

Total shares issued

|

4,473,726

|

4,939,966

|

|

Shares redeemed

|

(4,997,198)

|

(8,641,574)

|

|

Net decrease

|

$ (523,472)

|

$(3,701,608)

|

|

In Shares

|

||

|

Shares sold

|

597,435

|

658,207

|

|

Shares issued in reinvestment of dividends

|

33,525

|

48,369

|

|

Total shares issued

|

630,960

|

706,576

|

|

Shares redeemed

|

(709,623)

|

(1,236,378)

|

|

Net decrease

|

(78,663)

|

(529,802)

|

|

Year Ended December 31,

|

||

|

Institutional Bond Fund

|

2011

|

2010

|

|

In Dollars

|

||

|

Shares sold

|

$57,572,393

|

$35,940,448

|

|

Shares issued in reinvestment of dividends

|

187,051

|

395,053

|

|

Total shares issued

|

57,759,444

|

36,335,501

|

|

Shares redeemed

|

(6,441,845)

|

(11,602,895)

|

|

Net increase

|

$51,317,599

|

$24,732,606

|

|

In Shares

|

||

|

Shares sold

|

5,176,600

|

3,345,384

|

|

Shares issued in reinvestment of dividends

|

16,928

|

36,448

|

|

Total shares issued

|

5,193,528

|

3,381,832

|

|

Shares redeemed

|

(580,883)

|

(1,061,304)

|

|

Net increase

|

4,612,645

|

2,320,528

|

|

Year Ended December 31,

|

||

|

Investment Grade

Corporate Bond Fund

|

2011

|

2010

|

|

In Dollars

|

||

|

Shares sold

|

$17,067,503

|

$24,035

|

|

Shares issued in reinvestment of dividends

|

33,583

|

46,400

|

|

Total shares issued

|

17,101,086

|

70,435

|

|

Shares redeemed

|

(764,976)

|

–

|

|

Net increase

|

$16,336,110

|

$70,435

|

|

In Shares

|

||

|

Shares sold

|

1,525,450

|

2,229

|

|

Shares issued in reinvestment of dividends

|

3,068

|

4,254

|

|

Total shares issued

|

1,528,518

|

6,483

|

|

Shares redeemed

|

(70,047)

|

–

|

|

Net increase

|

1,458,471

|

6,483

|

|

Based on Actual Total Return1

|

||||

|

Beginning

Account Value

|

Ending

Account Value

|

Annualized

Expense Ratio

|

Expenses Paid

During the Period2

|

|

|

Government Fund

|

$1,000.00

|

$1,022.15

|

0.69%

|

$3.50

|

|

Core Bond Fund

|

$1,000.00

|

$1,040.62

|

0.70%

|

$3.63

|

|

Institutional Bond Fund

|

$1,000.00

|

$1,019.74

|

0.49%

|

$2.49

|

|

Investment Grade Corporate Bond Fund

|

$1,000.00

|

$1,054.82

|

0.69%

|

$3.58

|

|

1For the six-months ended December 31, 2011.

2Expenses are equal to the respective Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365.

|

||||

|

Based on Hypothetical Total Return1

|

||||

|

Beginning

Account Value

|

Ending

Account Value

|

Annualized

Expense Ratio

|

Expenses Paid

During the Period2

|

|

|

Government Fund

|

$1,000.00

|

$1,025.47

|

0.69%

|

$3.50

|

|

Core Bond Fund

|

$1,000.00

|

$1,025.47

|

0.70%

|

$3.59

|

|

Institutional Bond Fund

|

$1,000.00

|

$1,025.47

|

0.49%

|

$2.50

|

|

Investment Grade Corporate Bond Fund

|

$1,000.00

|

$1,025.47

|

0.69%

|

$3.47

|

|

1For the six-months ended December 31, 2011.

2Expenses are equal to the respective Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365.

|

||||

|

Name and

Year of Birth

|

Position(s)

and Length of Time Served

|

Principal Occupation(s)

During Past Five Years

|

Other Directorships/Trusteeships

|

|

Katherine L. Frank1

1960

|

President,

1996 - Present, and Trustee, 2001 - Present

|

Madison Investment Holdings, Inc. ("MIH") (affiliated investment advisory firm of the Adviser), Executive Director and Chief Operating Officer, 2010 - Present; Managing Director and Vice President, 1986 - 2010; Madison Asset Management, LLC ("MAM") (affiliated investment advisory firm of the Adviser), Executive Director and Chief Operating Officer, 2010 - Present; Vice President, 2004 - 2010; Madison Investment Advisors, LLC ("Madison" or the "Adviser"), Executive Director and Chief Operating Officer, 2010 - Present; President, 1996 - 2010; Madison Mosaic Funds (13 funds, including the Funds), President, 1996 - Present; Madison Strategic Sector Premium Fund (closed end fund), President, 2005 - Present; Madison/Claymore Covered Call and Equity Strategy Fund (closed end fund), Vice President, 2005 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (17) (mutual funds), President, 2009 - Present

|

Madison Mosaic Funds (all but Equity Trust), 2001 - Present; Madison Strategic Sector Premium Fund, 2005 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (17), 2009 - Present

|

|

Frank E. Burgess1

1942

|

Trustee and

Vice President, 1996 - Present

|

MIH, Executive Director and President, 2010 - Present; Managing Director and President, 1973 -

2010; MAM, Executive Director and President, 2010 - Present; President, 2004 - 2010; Madison, Executive Director and President, 2010 - Present; Madison Mosaic Funds (13 funds, including the Funds), Vice President, 1996 - Present; Madison Strategic Sector Premium Fund, Vice President, 2005 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (17), Vice President, 2009 -

Present

|

Madison Mosaic Funds (13), 1996 - Present; Madison

Strategic Sector Premium Fund and Madison/Claymore Covered Call & Equity Strategy Fund, 2005 - Present; Capitol Bank of Madison, WI, 1995 - Present; American Riviera

Bank of Santa Barbara, CA, 2006 - Present

|

|

Name and

Year of Birth

|

Position(s)

and Length of Time Served

|

Principal Occupation(s)

During Past Five Years

|

Other Directorships/Trusteeships

|

|

Jay R. Sekelsky

1959

|

Vice President, 1996 - Present

|

MIH, Executive Director and Chief Investment Officer, 2010 - Present; Managing Director and Vice President, 1990 - 2010; MAM, Executive Director and Chief Investment Officer, 2010 - Present; Madison, Executive Director and Chief Investment Officer, 2010 - Present; Vice President, 1996 - 2010; Madison Mosaic Funds (13 funds, including the Funds), Vice President, 1996 - Present; Madison Strategic Sector Premium Fund and Madison/Claymore Covered Call and Equity Strategy Fund, Vice President, 2005 - Present;

MEMBERS Mutual Funds (13) and Ultra Series Fund (17), Vice President, 2009 - Present

|

N/A

|

|

Paul Lefurgey

1964

|

Vice President, 2009 - Present

|