December 31, 2012

Madison Mosaic

Equity Trust

Investors Fund

Mid-Cap Fund

Disciplined Equity Fund

Dividend Income Fund

NorthRoad International Fund

Madison Mosaic® Funds

www.mosaicfunds.com

CONTENTS

| Management’s Discussion of Fund Performance | 1 | |

| 2012 in Review | 1 | |

| Outlook | 1 | |

| Interview with Jay Sekelsky | 1 | |

| Investors Fund | 2 | |

| Mid-Cap Fund | 4 | |

| Disciplined Equity Fund | 6 | |

| Dividend Income Fund | 7 | |

| NorthRoad International Fund | 8 | |

| Notes to Management’s Discussion of Fund Performance | 10 | |

| Portfolio of Investments | ||

| Investors Fund | 11 | |

| Mid-Cap Fund | 12 | |

| Disciplined Equity Fund | 13 | |

| Dividend Income Fund | 14 | |

| NorthRoad International Fund | 15 | |

| Statement of Assets and Liabilities | 16 | |

| Statement of Operations | 17 | |

| Statements of Changes in Net Assets | 18 | |

| Financial Highlights | 20 | |

| Notes to Financial Statements | 24 | |

| Report of Independent Registered Public Accounting Firm | 31 | |

| Other Information | 32 | |

| Trustees and Officers | 36 | |

Madison Mosaic Equity Trust | December 31, 2012

Management’s Discussion of Fund Performance

2012 IN REVIEW

The old adage that markets climb “a wall of worry” was demonstrated by domestic and international stock markets in 2012. Despite signs of sluggish economic growth in the U.S., a recession in Europe, and slowing growth in the emerging markets, investors generally were rewarded for holding stocks. The domestic stock market, as measured by the S&P 500, was up 16.0%, while the broad international market, as measured by the MSCI EAFE Index Net advanced 17.3%. The Russell Emerging Markets Index advanced 19.2%, and even investors in Europe found enough good news in the midst of a still uncertain sovereign debt crisis to push stock valuations up. The Morningstar Europe Stock Category showed mutual funds specializing in this region up 20.9% for the year. We believe the largest reason for these positive returns was the continued, unprecedented stimulus from the Federal Reserve and central banks around the world.

Despite the impressive returns in the broad indices, stocks were not uniformly positive for the year, with a wide disparity of returns among U.S. Sectors. The Utilities Sector trailed with a loss of -2.9%, while the Financial Sector led the market with a 26.3% return, followed by the Consumer Discretionary Sector, with a 21.9% return. In general, more economically sensitive and lower-quality stocks rallied, while the more defensive sectors such as Utilities and Consumer Staples lagged the broader market. Lower demand and increased energy production, particularly in domestic natural gas, dampened commodity returns, with the S&P Energy Sector up just 2.3% for the year. In general, small and mid-cap stocks advanced in the same range as large stocks, while value stocks had a slight advantage over similarly sized stocks classified as growth.

While year-end investment returns were heartening to investors, the journey was uneven. Headlines seemed to provide an endless stream of uncertainties from around the world. The most potent of these influences was the sovereign debt crisis in Europe. Worries over the possible default of debt by the most economically troubled countries in southern Europe took the steam out of the year’s first quarter rally, as the S&P 500 dipped -9.6% between April 2 and June 1. Over the summer months, perceived progress on resolving Greece’s debt crisis fueled a rally. The S&P rose 15.4% between June 1 and September 14, as confidence rose for a positive resolution, supported by European Central bank President Mario Draghi’s July statement that he would do “whatever it takes” to hold the Eurozone together. As the year progressed, the nation’s attention turned away from Europe to the presidential election. Late in the period investors began to focus on the so-called fiscal cliff. The January 2013 deadline for automatic shifts to higher taxes and lower spending was partially fended off with a late-December, last-minute compromise which came too late to make up for December stock market losses which resulted from the nervousness regarding the pending cliff.

OUTLOOK

While optimism prevailed in 2012, our perspective suggests that the market may be overlooking the wide variety of risks that remain unresolved. These include worldwide credit issues, the upcoming battle over the domestic debt ceiling, and the possibility that the Federal Reserve’s long-standing policy of low rates may shift to higher rates. A sure sign that the “risk on” trade prevailed in 2012 was the rally in the stocks of speculative and highly leveraged companies, matched in the bond market by the preference for long-term and low-quality issuance. This risk awareness should not suggest that we recommend shifting sensible asset allocation strategies. Instead, we believe investors should consider rebalancing portfolios and examining the underlying risks of their holdings. In stocks, we remain convinced that fundamentals continue to count, and investors will be best served by owning solid companies with the ability to produce strong results in all kinds of environments.

INTERVIEW WITH LEAD EQUITY MANAGER JAY SEKELSKY

Can you summarize the performance of the funds in Equity Trust in 2012?

In a year in which broad domestic and international indices returns were up in the teens, we produced solid real

1

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance | continued

returns, even as the funds in Equity Trust slightly trailed our benchmarks. This is not unusual or unexpected, since across funds we seek high-quality, dependable companies which may lag when the market is rising sharply. The strength of the market was surprising in light of how economic growth moderated throughout the year as revenue growth slowed for S&P 500 companies relative to their expectations. Madison Mosaic Equity Trust’s Class Y annual returns ranged from Mid-Cap’s 15.69% to Dividend Income’s 10.86% return. Mosaic Investors returned 14.05%, NorthRoad International was up 13.76%, and Disciplined Equity advanced 12.25% over the year. The S&P 500, a large-stock index, was up 16.00%, the Russell Midcap® Index rose 17.28%, while international markets were also strong, as shown by the MSCI EAFE Index Net, which had a simple price appreciation of 17.32%.

The best way to appreciate the relative performance gap is to look at the quality gap. As measured by Bank of America’s Quality Indices, the highest rated stocks were the weakest performers, with A+ rated stocks returning 10.4% and A rated stocks also at 10.4%, while B- stocks were up 18.9% and the lowest rated C&D stocks rose 25.3%. This indicates a speculative market in which highly leveraged companies outpace steady, consistent companies with strong balance sheets.

MADISON MOSAIC INVESTORS FUND (MINVX)

| FUND-AT-A-GLANCE | ||

| Objective: Madison Mosaic Investors seeks long-term capital appreciation through investments in large growth companies. | ||

| Net Assets: $35.2 million | ||

| Date of Inception: November 1, 1978 | ||

| Ticker: MINVX |

Madison Mosaic Investors Fund invests primarily in the common stocks of large-sized U.S. corporations. The fund typically owns 25-40 securities which are selected using our long-held investment discipline of seeking the highest-quality, proven companies and purchasing them when valuations appear advantageous. We follow a rigorous three-step process when evaluating companies. We consider the business model, the management team and the valuation of each potential investment. We strive to purchase securities trading at a discount to their intrinsic value as determined by discounted cash flows. We corroborate this valuation work with additional valuation methodologies. The fund typically sells a stock when the fundamental expectations for the purchase no longer apply, the price exceeds its perceived value or other stocks appear more attractively priced relative to its prospects.

How did the fund perform in 2012?

The Investors Fund Class Y ended the year with a gain of 14.05%, trailing its S&P 500 benchmark’s 16.00% return and its Morningstar peer group, Large Growth, which showed an average return of 15.34%. The Large Growth category was the strongest of the three Morningstar large-cap categories with Large-Cap Value up 14.57% and Large-Cap Blend up 14.96%. Since we apply a rigorous valuation screen along with seeking growing companies, we believe fund performance was more aligned with the “Blend” and “Value” categories.

All in all we feel buoyed by the portfolio’s positive results in a market rally that we believe was in large part boosted by the Federal Reserve’s quantitative easing, a condition under which we feel risks are not fully contemplated by other market participants. One of the challenges for our management in 2012 was the way in which stocks tended to move on the macro factors, often global in nature, rather than on the underlying fundamentals we typically emphasize.

Have you made any significant changes to the portfolio since December 31, 2011?

Early in 2012 we increased our weight in consumer discretionary stocks, specifically those that were U.S.-centric, a sector which performed well during the year. Late in the year we trimmed or sold some of these well-performing stocks. As evidence accumulated that the global economy was slowing we found some opportunities to add to some consumer and information technology stocks that were more global in nature, where we thought that the valuations were compressed more than they deserved. The valuation tradeoff looked positive in selling some

2

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Investors Fund | continued

U.S.-centric names for much cheaper names with broader global exposure.

We believe it may be illustrative to highlight a couple of the larger holdings in the portfolio. One is 3M, a global industrial company that has been around since the early 1900s but is still often voted one of the most innovative companies in the world. It has a centralized research group that we believe is an unmatched asset in fostering new product development and product leadership. Over the past decade 3M has grown its organic sales at one and a half times the pace of global industrial production while maintaining very strong profitability. Sales are recurrent in nature and are often consumed in local markets. In fact, over a third of sales are now in developing markets growing faster than the developed world. 3M has also been in those markets for a long time. For instance, 3M’s been in Latin America since 1946. We’ve found the management actions are consistent with strengthening and upholding the company’s competitive advantages.

Another representative stock is Berkshire Hathaway, a collection of businesses that Warren Buffet has accumulated over the years. One of the beauties of Berkshire is how profits generated from these businesses do not have to go back into the same company or industry. Profits can be redeployed where the best returns on capital appear available. During periods of stress or distress Berkshire has been an opportunistic investor that’s been able to deploy cash to achieve great returns. In the past, the company has actually been strengthened during periods of economic distress. The results are impressive. Berkshire’s book value has outperformed the S&P 500’s total return for every five-year rolling period since 1965 and has never lost value over a five-year period. Finally, we also believe that there’s good value in Berkshire Hathaway at today’s price. In fact, Warren Buffet bought back stock in the fourth quarter.

What factors were the strongest contributors to fund performance?

Economically sensitive sectors like Consumer Discretionary and Financials were strong performers in 2012 as the U.S. housing market continued its slow improvement. In fact, we over-weighted the portfolio in Consumer Discretionary and Financials in early 2012, and those moves were rewarded. Overall, we had the strongest contribution to the fund’s positive returns from Financials, Consumer Discretionary and Technology Sectors. The only S&P 500 sector with negative returns was Utilities, where the fund had no exposure, a relative boost for it. The best performing individual securities in the portfolio were Visa, Target, Franklin Resources and Diageo.

What factors were the largest constraints on performance?

While Health Care was a strong sector in 2012, the companies the fund held trailed their sector average. The fund was underweight the large pharmaceutical and biotechnology companies that led the sector. Energy was a weak sector overall in 2012 as demand for oil and gas was not strong enough to offset new supply. The fund’s exposure to producers caused it to underperform the overall sector as worldwide demand remained soft. As always, any cash holdings in a sharply rising market are a relative drag. In terms of individual securities we saw the worst performance from technology holding FLIR, which we sold in the third quarter, and energy holding Canadian Natural Resources, also sold in the third quarter.

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/12 | |||

| Consumer Discretionary | 14.1 | % | |

| Consumer Staples | 11.0 | % | |

| Energy | 6.2 | % | |

| Financials | 19.3 | % | |

| Health Care | 9.8 | % | |

| Industrials | 14.2 | % | |

| Information Technology | 19.3 | % | |

| U.S. Government and Agency Obligations | 1.6 | % | |

| Cash & Other | 4.5 | % | |

| TOP TEN STOCK HOLDINGS AS OF 12/31/12 | |||

| % of net assets | |||

| Johnson & Johnson | 4.72 | % | |

| Berkshire Hathaway Inc., Class B | 4.17 | % | |

| 3M Co. | 4.12 | % | |

| Oracle Corp. | 3.75 | % | |

| PepsiCo Inc. | 3.48 | % | |

| NIKE Inc., Class B | 3.44 | % | |

| Markel Corp. | 3.37 | % | |

| Becton Dickinson & Co. | 3.32 | % | |

| Omnicom Group Inc. | 3.32 | % | |

| CH Robinson Worldwide Inc. | 3.31 | % | |

3

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Investors Fund | continued

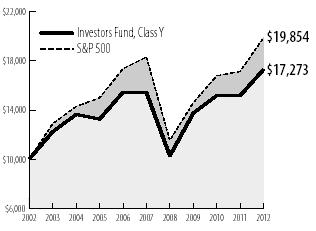

| Average Annual Total Return | |||||||||

| 1-Year | 5-Year | 10-Year | |||||||

| Investors Fund, Class Y | 14.05 | % | 2.32 | % | 5.62 | % | |||

| S&P 500 Index | 16.00 | % | 1.66 | % | 7.10 | % | |||

See accompanying Notes to Management’s Discussion of Fund Performance.

| FUND-AT-A-GLANCE | ||

| Objective: Madison Mosaic Mid-Cap seeks long-term capital appreciation through the investment in mid-sized growth companies. | ||

| Net Assets: $173.3 million | ||

| Date of Inception: July 21, 1983 | ||

| Ticker: GTSGX |

Madison Mosaic Mid-Cap Fund invests primarily in the common stocks of mid-sized U.S. corporations. The fund typically owns 25-40 securities which are selected using our long-held investment discipline of seeking the highest-quality, proven companies and purchasing them when valuations appear advantageous. We follow a rigorous three-step process when evaluating companies. We consider the business model, the management team and the valuation of each potential investment. We strive to purchase securities trading at a discount to their intrinsic value as determined by discounted cash flows. We corroborate this valuation work with additional valuation methodologies. The fund typically sells a stock when the fundamental expectations for the purchase no longer apply, the price exceeds its perceived value or other stocks appear more attractively priced relative to its prospects.

How would you characterize the performance of Madison Mosaic Mid-Cap in 2012?

For the full year the fund trailed the benchmark slightly while beating its Morningstar peer group. Overall, we were content with performance for the year, considering the market environment which favored riskier stocks over fundamentally strong ones. Madison Mosaic Mid-Cap Class Y was up 15.69% for the year, while the Russell Mid-Cap® Index advanced 17.28% and our Morningstar Mid-Cap Growth peer group averaged 14.07%. Looking back over the year, the fund performed as we would like, protecting capital during periods of market contraction, while largely participating in the strong up market which characterized most of the year.

Did you make any significant changes to the portfolio since December 31, 2011?

The fund’s turnover was 28% for the year, suggesting an average holding period of close to four years. We did find some new opportunities over the course of the one-year period. Expeditors International is a stock we purchased early in the fall and is a good example of the sort of company we like to hold when valuations are attractive. We had an opportunity to purchase the company at 15 times forward earnings, excluding the cash on the balance sheet. Expeditors is a global logistics company. We think of the company as a travel agent for freight movement across the globe. In addition to shipping goods it provides other services such as distribution management, cargo insurance, and customs clearance. The business model is asset light since there’s very little need for capital expenditures. The company has what we believe a solid balance sheet, with over six dollars a share in net cash, and a highly capable management team. Recent valuation has been compressed due to concerns over global growth and weak air and ocean volumes. We believe these are temporary issues and conditions will improve once the global macro-economy and global trade improve. Since we’ve bought the stock

4

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Mid-Cap Fund | continued

its price has moved up somewhat, but we still think it is attractive at year-end levels.

Another addition of the portfolio early in the fourth quarter was Crown Holding. It is a manufacturer of aluminum cans which are used for beverages, food products and other consumer products. The industry in which it participates has just a few players. We believe Crown has a stable, defensive end market. Management is shareholder friendly and it has a track record of wise allocation of capital. Crown has invested to build capacity in developing markets, particularly China and Brazil. These markets generate much higher returns on invested capital than developed markets, and future growth should be stronger. We believe these investments will pay off going forward. We were able to purchase the stock at what we calculated to be about eight and a half times future normalized free cash flow, which was an attractive multiple in our view. As a result, we’re optimistic on this stock going forward.

What factors were the strongest contributors to fund performance?

The fund had its best relative strength in its energy holdings, where it had strong results from Enso PLC, EOG Resources and Noble Corporation. It also did well with its Materials Sector stocks, with Valspar Corporation leading the way. Other top performers included Discovery Communications and Brookfield Asset Management.

What factors were the largest constraints on performance?

Our biggest disappointment was technology holding FLIR Systems, which suffered from declining defense spending. We sold FLIR in the third quarter. The fund also had what we feel is a temporary setback in long-time financial holding Markel. The insurer made a late-year acquisition which was not favored by the market, even though we believe it will add value over time.

What do you see for Mid-Cap looking ahead to 2013?

I feel stocks offer very good long-term opportunity at this juncture. I’d encourage people to take a long-term view. Look beyond the current financial headlines and concerns. The fund is invested in companies we believe have business models that possess durable competitive advantages, and this should allow them to compound earnings through economic cycles in a wide range of business environments. Owning these kinds of companies, in my view, is the key to wealth creation over time.

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/12 | |||

| Consumer Discretionary | 21.0 | % | |

| Consumer Staples | 3.1 | % | |

| Energy | 7.4 | % | |

| Financials | 23.6 | % | |

| Health Care | 8.3 | % | |

| Industrials | 19.5 | % | |

| Information Technology | 4.0 | % | |

| Materials | 6.7 | % | |

| U.S. Government and Agency Obligations | 3.8 | % | |

| Cash & Other | 2.6 | % | |

| TOP TEN STOCK HOLDINGS AS OF 12/31/12 | |||

| % of net assets | |||

| Markel Corp. | 4.92 | % | |

| Brookfield Asset Management Inc. | 4.02 | % | |

| Copart Inc. | 3.88 | % | |

| CH Robinson Worldwide Inc. | 3.55 | % | |

| WR Berkley Corp. | 3.47 | % | |

| Laboratory Corp. of America Holdings | 3.22 | % | |

| TJX Cos. Inc. | 3.16 | % | |

| CarMax Inc. | 3.03 | % | |

| Omnicom Group Inc. | 3.01 | % | |

| Wabtec Corp. | 2.87 | % | |

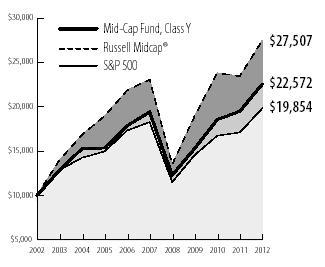

| Average Annual Total Return | ||||||||||||

| 1-Year | 5-Year | 10-Year | Since 2/29/12 Inception |

|||||||||

| Mid-Cap Fund, Class Y | 15.69 | % | 3.06 | % | 8.48 | % | – | |||||

| Mid-Cap Fund, Class R6 | – | – | – | 7.34 | % | |||||||

| Russell Midcap® Index | 17.28 | % | 3.57 | % | 10.65 | % | 6.17 | % | ||||

| S&P 500 Index | 16.00 | % | 1.66 | % | 7.10 | % | 6.43 | % | ||||

See accompanying Notes to Management’s Discussion of Fund Performance.

5

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Disciplined Equity Fund | continued

MADISON MOSAIC DISCIPLINED EQUITY (MADEX)

| FUND-AT-A-GLANCE | ||

| Objective: Madison Mosaic Disciplined Equity seeks long-term growth with diversification among all equity market sectors. | ||

| Net Assets: $148.5 million | ||

| Date of Inception: December 31, 1997 | ||

| Ticker: MADEX |

Madison Mosaic Disciplined Equity Fund invests primarily in the common stocks of large-sized U.S. corporations. The fund seeks to maintain an overall sector weighting in line with the broader market, with monthly rebalancing. The fund typically owns 50-70 securities which are selected using our long-held investment discipline of seeking the highest-quality, proven companies and purchasing them when valuations appear advantageous. We follow a rigorous three-step process when evaluating companies. We consider the business model, the management team and the valuation of each potential investment. We strive to purchase securities trading at a discount to their intrinsic value as determined by discounted cash flows. We corroborate this valuation work with additional valuation methodologies. The fund typically sells a stock when the fundamental expectations for the purchase no longer apply, the price exceeds its perceived value or other stocks appear more attractively priced relative to its prospects.

How would you characterize the performance of the Disciplined Equity Fund for the period?

Against the fund’s benchmark S&P 500’s return of 16.00%, Disciplined Equity’s Class Y shares showed a gain of 12.25%. The fund also trailed its Morningstar Large Blend peer group which had a return of 14.96%. With the portfolio currently allocated across S&P 500 sectors, the relative results against the S&P 500 were largely a function of our stock selection. In a market environment which favored riskier, highly leveraged companies, our emphasis on high-quality holdings was a detriment to returns across the year.

Have you made any significant changes to the portfolio since December 31, 2011?

As in the past, the fund’s equity positions are concentrated in large-cap companies which retain a leadership position in their industries and have shown the ability to produce predictable earnings over time. The fund’s turnover ratio was 29%, representing an average holding period of greater than three years. This is an indication that we are finding solid companies that have retained their attractive valuation over the years. By our measures, large, high-quality companies remain the best valued area of the market.

Although our team’s objective is to maintain relative sector neutrality against the broader market, we are dedicated to actively managing a select group of stocks within each of these sectors. At the beginning of the period, the fund had 51 holdings and at the end of the period it held 52. Our goal is to own the highest quality companies we can in each sector of the market, a judgment made on an array of business metrics that boil down to a combination of attractive valuation and the ability to produce consistent, predictable earnings going forward. In many cases, this means selling a stock and replacing it with another we feel has greater potential.

This is what we did, for example, in the Consumer Discretionary Sector as we sold Staples on disappointing business projections and added McDonald’s. In Technology over the course of the year we sold Cisco, Western Union and FLIR Systems and added Oracle and Micros Systems,

What factors had the largest impact on this period’s performance?

The year saw quite a bit of disparity in S&P 500 sector returns, with Utilities losing -2.9%, while Financials rose 26.3%. The fund’s results were similarly diverse, with above S&P 500 Index returns in Materials, Financials and Consumer Discretionary Sectors, negative returns in its Energy Sector holdings and below-market returns in Health Care.

In terms of individual holdings, the strongest contributors were Discovery Communications, a stock which was up more than 55% for the period, and NextEra Energy, which had above-index results for the year, well ahead of its S&P 500 Utility Sector, which was negative for the period. The

6

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Disciplined Equity Fund | continued

most disappointing results came from technology holding FLIR Systems, which we sold in the third quarter, and from the second-weakest S&P sector, Energy, where we saw losses in Canadian Natural Resources and Chevron. We sold Canadian Natural Resources in the third quarter.

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/12 | |||

| Consumer Discretionary | 11.6 | % | |

| Consumer Staples | 10.1 | % | |

| Energy | 11.0 | % | |

| Financials | 15.2 | % | |

| Health Care | 12.4 | % | |

| Industrials | 10.0 | % | |

| Information Technology | 19.8 | % | |

| Materials | 4.0 | % | |

| Telecommunication Services | 2.3 | % | |

| Utilities | 2.5 | % | |

| Cash & Other | 1.1 | % | |

| TOP TEN STOCK HOLDINGS AS OF 12/31/12 | |||

| % of net assets | |||

| Microsoft Corp. | 3.54 | % | |

| Johnson & Johnson | 3.39 | % | |

| Berkshire Hathaway Inc., Class B | 3.38 | % | |

| 3M Co. | 2.74 | % | |

| PepsiCo Inc. | 2.73 | % | |

| QUALCOMM Inc. | 2.68 | % | |

| Markel Corp. | 2.61 | % | |

| Accenture PLC, Class A | 2.60 | % | |

| NextEra Energy Inc. | 2.53 | % | |

| Apple Inc. | 2.49 | % | |

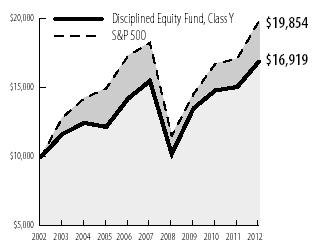

| Average Annual Total Return | ||||||||||||

| 1-Year | 5-Year | 10-Year | Since 2/29/12 Inception |

|||||||||

| Disciplined Equity Fund, Class Y | 12.25 | % | 1.75 | % | 5.40 | % | – | |||||

| Disciplined Equity Fund, Class R6 | – | – | – | 5.64 | % | |||||||

| S&P 500 Index | 16.00 | % | 1.66 | % | 7.10 | % | 6.43 | % | ||||

See accompanying Notes to Management’s Discussion of Fund Performance.

| FUND-AT-A-GLANCE | ||

| Objective: Beginning March 1, 2012, Madison Mosaic Dividend Income seeks to provide substantial current dividend income while providing opportunity for capital appreciation by investing in dividend paying stocks. | ||

| Net Assets: $13.3 million | ||

| Date of Inception: December 18, 1986 | ||

| Ticker: BHBFX |

Dividend Income Fund invests in a diversified portfolio of dividend-paying stocks, with the goal of producing current income while providing an opportunity for capital appreciation. It invests primarily in the common stocks of large-sized U.S. corporations. The fund typically owns 40-60 securities which are chosen for having a current yield exceeding the S&P 500’s average yield, strong fundamentals including an attractive balance sheet and reasonable valuations at the time of purchase. A key attraction for management is a company with a history of increasing dividend payments and a business model which supports the possibility of continuing these increases in the future.

How did the Dividend Income Fund perform for the year?

The Dividend Income Fund was in transition during the first quarter of 2012 from its former strategy as a Balanced Fund to its current allocation. This change was effective March 1, 2012. The Dividend Income Fund Classs Y shares

7

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Dividend Income Fund | continued

rose 10.86% for the year, compared to the S&P 500’s return of 16.00% and its Morningstar category of Large Value which rose 14.57%. This one-year period was one which saw strong returns from a broad range of domestic and international market indices. We were pleased to be able to produce double-digit returns in this transition year, as we shifted the holdings from a mix of stocks and bonds to a pure stock portfolio.

The fund’s return compared to its peer group and benchmark, both representing stock portfolios, was hampered by a combination of weak stock selection and the inclusion of bonds in the early part of the year as the portfolio transitioned from a balanced strategy to a dividend income strategy. The primary source of underperformance was the overall weakness of established, dividend-paying stocks in a market which preferred more leveraged and speculative companies, compounded by disappointing results in a number of our holdings.

The main shift was the strategy reorientation as reflected in the name change from Balanced to Dividend Income. Once we established our full portfolio of dividend-paying stocks in March, the portfolio was generally stable. Over the course of the year we did add some new names, including Automated Data Processing, Microchip Technology and Exxon Mobile. Sales including First Energy, Lockheed Martin, Norfolk Southern and Paychex.

| COMMON STOCK ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/12 | |||

| Consumer Discretionary | 9.7 | % | |

| Consumer Staples | 13.6 | % | |

| Energy | 11.6 | % | |

| Financials | 18.6 | % | |

| Health Care | 17.8 | % | |

| Industrials | 12.9 | % | |

| Information Technology | 9.5 | % | |

| Materials | 1.5 | % | |

| Telecommunication Services | 2.4 | % | |

| Cash & Other | 2.4 | % | |

| TOP TEN STOCK HOLDINGS AS OF 12/31/12 | |||

| % of net assets | |||

| Pfizer Inc. | 4.84 | % | |

| Chevron Corp. | 4.65 | % | |

| Johnson & Johnson | 4.60 | % | |

| Travelers Cos. Inc. | 3.95 | % | |

| ConocoPhillips | 3.80 | % | |

| Merck & Co. Inc. | 3.73 | % | |

| 3M Co. | 3.22 | % | |

| PepsiCo Inc. | 3.20 | % | |

| Microsoft Corp. | 3.00 | % | |

| United Technologies Corp. | 2.72 | % | |

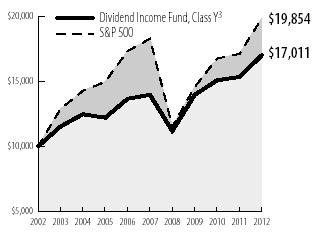

| Average Annual Total Return | |||||||||

| 1-Year | 5-Year | 10-Year | |||||||

| Dividend Income Fund, Class Y | 10.86 | % | 4.02 | % | 5.46 | % | |||

| S&P 500 Index | 16.00 | % | 1.66 | % | 7.10 | % | |||

See accompanying Notes to Management’s Discussion of Fund Performance.

NORTHROAD INTERNATIONAL FUND (NRIEX)

| FUND-AT-A-GLANCE | ||

| Objective: NorthRoad International seeks capital appreciation through investments in common stocks based outside the United States. | ||

| Net Assets: $28.9 million | ||

| Date of Inception: December 31, 2008* | ||

| Ticker: NRIEX |

NorthRoad International is an international stock fund that invests in high-quality companies with sustainable, high returns on capital that trade at attractive valuations.

8

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • NorthRoad Int'l Fund | continued

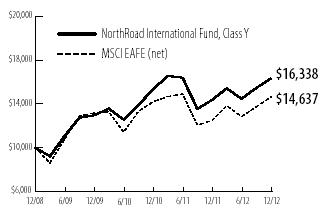

NorthRoad International Class Y returned 13.76% for 2012, while the MSCI EAFE Index Net was up 17.32% and the fund’s Morningstar Foreign Large Blend peer group averaged 18.29%. As with the Equity Trust’s domestic funds, the fund was fighting a low-quality over high-quality trend in the international markets. For instance, even with its fragile sovereign debt issues unresolved, the Greek stock market was up nearly 40% in U.S. dollars for the year. The fund also suffered from underexposure to banks, particularly European banks, the strongest area in the market’s highest performing sector. On average the portfolio’s holdings in the more defensive areas of the market, Consumer Staples and Health Care, delivered positive returns for the period, but did not keep pace with the overall market. Uncertainty regarding the macroeconomic environment will likely remain in place in 2013. Responding to an uncertain outlook, investors continued to be wary of equities through 2012, while central banks maintained easy money policies, driving U.S. Treasury and German government 10-year bond yields below 2%. In contrast to these historic low bond yields, the securities held in NorthRoad International Equity are high-quality, profitable, global businesses and generated an average annual yield of approximately 3.9% as of December 31, 2012. While recognizing the current macroeconomic risks, we believe value opportunities exist in global equity markets. Our disciplined, bottom-up focus and long-term horizon provide the framework to make sensible investments in an uncertain world that we believe will result in strong risk-adjusted performance over time. We believe the portfolio is attractively valued at about 11.6 times forward earnings with high and sustainable levels of profitability.

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/12 | |||

| Consumer Discretionary | 6.9 | % | |

| Consumer Staples | 18.8 | % | |

| Energy | 10.9 | % | |

| Financials | 11.7 | % | |

| Health Care | 15.5 | % | |

| Industrials | 7.9 | % | |

| Information Technology | 9.6 | % | |

| Materials | 13.3 | % | |

| Telecommunication Services | 5.3 | % | |

| Cash & Other | 0.1 | % | |

| TOP TEN STOCK HOLDINGS AS OF 12/31/12 | |||

| % of net assets | |||

| Novartis AG, ADR | 4.42 | % | |

| Unilever PLC, ADR | 3.47 | % | |

| SAP AG, ADR | 3.44 | % | |

| Roche Holding AG, ADR | 3.38 | % | |

| Nestle S.A., ADR | 3.34 | % | |

| Akzo Nobel NV, ADR | 3.20 | % | |

| Sanofi, ADR | 3.10 | % | |

| Syngenta AG, ADR | 3.09 | % | |

| ENI SpA, ADR | 3.05 | % | |

| HSBC Holdings PLC, ADR | 3.01 | % | |

| Average Annual Total Return | ||||||||||||

| 1-Year | 3-Year | Since Inception 12/31/08 |

Since 2/29/12 Inception |

|||||||||

| NorthRoad International Fund, Class Y | 13.76 | % | 8.02 | % | 13.07 | % | – | |||||

| NorthRoad International Fund, Class R6 | – | – | – | 6.70 | % | |||||||

| MSCI EAFE Index (Net) | 17.32 | % | 3.56 | % | 9.99 | % | 5.33 | % | ||||

See accompanying Notes to Management’s Discussion of Fund Performance.

9

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance | concluded

NOTES TO MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

| 1 | This chart compares a $10,000 investment made in the fund to a $10,000 investment made in the fund’s comparative index. |

| 2 | Past performance is not predictive of future performance. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares and assumes all dividends have been reinvested. The comparative Indices noted do not reflect any investment management fees or transaction expenses, nor the effects of taxes, fees or other changes. For current performance information, visit www.mosaicfunds.com. |

| 3 | Prior to March 1, 2012, the Dividend Income Fund was known as the Balanced Fund and had different investment objectives and strategies. Its fixed income holdings were liquidated prior to March 1, and the fund began implementing its new investment objectives and strategies thereafter. |

BENCHMARK DESCRIPTIONS

The S&P 500 Index is an unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. The index does not reflect any investment management fees or transaction expenses, nor the effects of taxes, fees or other charges.

The Russell Midcap® Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The S&P 500 Index is an unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. Neither index reflects any investment management fees or transaction expenses, nor the effects of taxes, fees or other charges.

The MSCI EAFE Index (net) (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the US & Canada. The Index does not reflect any investment management fees or transaction expenses, nor the effect of taxes, fees or other charges.

10

Madison Mosaic Equity Trust | December 31, 2012

Investors Fund • Portfolio of Investments

| Shares | Value (Note 1) | ||||||||

COMMON STOCK - 93.9% |

|||||||||

Consumer Discretionary - 14.1% |

|||||||||

CarMax Inc.* |

22,975 | $ | 862,481 | ||||||

McDonald’s Corp. |

8,175 | 721,117 | |||||||

NIKE Inc., Class B |

23,436 | 1,209,298 | |||||||

Omnicom Group Inc. |

23,390 | 1,168,564 | |||||||

Target Corp. |

16,690 | 987,547 | |||||||

| 4,949,007 | |||||||||

Consumer Staples - 11.0% |

|||||||||

Coca-Cola Co. |

18,132 | 657,285 | |||||||

Diageo PLC, ADR |

4,109 | 479,027 | |||||||

Mondelez International Inc., Class A |

27,481 | 699,941 | |||||||

Nestle S.A., ADR |

12,670 | 825,704 | |||||||

PepsiCo Inc. |

17,880 | 1,223,529 | |||||||

| 3,885,486 | |||||||||

Energy - 6.2% |

|||||||||

Apache Corp. |

8,343 | 654,926 | |||||||

Occidental Petroleum Corp. |

8,240 | 631,266 | |||||||

Schlumberger Ltd. |

12,754 | 883,725 | |||||||

| 2,169,917 | |||||||||

Financials - 19.3% |

|||||||||

Berkshire Hathaway Inc., Class B* |

16,371 | 1,468,479 | |||||||

Brookfield Asset Management Inc. |

21,320 | 781,378 | |||||||

Franklin Resources Inc. |

5,305 | 666,839 | |||||||

M&T Bank Corp. |

8,903 | 876,678 | |||||||

Markel Corp.* |

2,732 | 1,184,103 | |||||||

Northern Trust Corp. |

17,257 | 865,611 | |||||||

US Bancorp |

29,404 | 939,164 | |||||||

| 6,782,252 | |||||||||

Health Care - 9.8% |

|||||||||

Becton Dickinson & Co. |

14,922 | 1,166,751 | |||||||

Johnson & Johnson |

23,708 | 1,661,931 | |||||||

Laboratory Corp. of America Holdings* |

7,300 | 632,326 | |||||||

| 3,461,008 | |||||||||

Industrials - 14.2% |

|||||||||

3M Co. |

15,619 | 1,450,224 | |||||||

CH Robinson Worldwide Inc. |

18,425 | 1,164,829 | |||||||

Copart Inc.* |

33,955 | 1,001,672 | |||||||

Jacobs Engineering Group Inc.* |

17,215 | 732,843 | |||||||

United Parcel Service Inc., Class B |

8,791 | 648,160 | |||||||

| 4,997,728 | |||||||||

| Shares | Value (Note 1) | ||||||||

Information Technology - 19.3% |

|||||||||

Accenture PLC, Class A |

16,550 | $ | 1,100,576 | ||||||

Google Inc., Class A* |

1,486 | 1,054,124 | |||||||

MICROS Systems Inc.* |

19,265 | 817,607 | |||||||

Microsoft Corp. |

39,898 | 1,066,473 | |||||||

Oracle Corp. |

39,620 | 1,320,138 | |||||||

QUALCOMM Inc. |

14,909 | 924,656 | |||||||

Visa Inc., Class A |

3,351 | 507,945 | |||||||

| 6,791,519 | |||||||||

Total Common Stocks |

|||||||||

(Cost $28,128,720) |

33,036,917 | ||||||||

INVESTMENT COMPANY - 3.2% |

|||||||||

Invesco Short Term Investments Treasury |

1,113,112 | 1,113,112 | |||||||

Total Investment Company |

|||||||||

(Cost $1,113,112) |

1,113,112 | ||||||||

| Par Value | |||||||||

U.S. GOVERNMENT AND AGENCY OBLIGATIONS - 1.6% |

|||||||||

U.S. Treasury Bills - 1.6% |

|||||||||

0.06%, 4/25/13 |

$575,000 | 574,874 | |||||||

Total U.S. Government and Agency Obligations (Cost $574,874) |

574,874 | ||||||||

TOTAL INVESTMENTS - 98.7% (Cost $29,816,706) |

34,724,903 | ||||||||

NET OTHER ASSETS AND LIABILITIES - 1.3% |

450,632 | ||||||||

TOTAL ASSETS - 100.0% |

$ | 35,175,535 | |||||||

| * | Non-income producing | |

| ADR | American Depository Receipt | |

| PLC | Public Limited Company |

See accompanying Notes to Financial Statements.

11

Madison Mosaic Equity Trust | December 31, 2012

Mid-Cap Fund • Portfolio of Investments

| Shares | Value (Note 1) | ||||||||

COMMON STOCK - 93.6% |

|||||||||

Consumer Discretionary - 21.0% |

|||||||||

Advance Auto Parts Inc. |

44,525 | $ | 3,221,384 | ||||||

Bed Bath & Beyond Inc.* |

87,569 | 4,895,983 | |||||||

CarMax Inc.* |

139,881 | 5,251,133 | |||||||

Discovery Communications Inc., Class C* |

61,386 | 3,591,081 | |||||||

Liberty Global Inc., Class C* |

74,534 | 4,378,872 | |||||||

Omnicom Group Inc. |

104,321 | 5,211,877 | |||||||

Tiffany & Co. |

75,378 | 4,322,175 | |||||||

TJX Cos. Inc. |

128,958 | 5,474,267 | |||||||

| 36,346,772 | |||||||||

Consumer Staples - 3.1% |

|||||||||

Brown-Forman Corp., Class B |

25,710 | 1,626,158 | |||||||

McCormick & Co. Inc. |

60,182 | 3,823,362 | |||||||

| 5,449,520 | |||||||||

Energy - 7.4% |

|||||||||

Ensco PLC, ADR |

58,494 | 3,467,524 | |||||||

EOG Resources Inc. |

21,890 | 2,644,093 | |||||||

Noble Corp. |

82,010 | 2,855,588 | |||||||

World Fuel Services Corp. |

91,875 | 3,782,494 | |||||||

| 12,749,699 | |||||||||

Financials - 23.6% |

|||||||||

Arch Capital Group Ltd.* |

102,720 | 4,521,734 | |||||||

Brookfield Asset Management Inc. |

190,232 | 6,972,003 | |||||||

Brown & Brown Inc. |

141,181 | 3,594,468 | |||||||

Glacier Bancorp Inc. |

184,786 | 2,718,202 | |||||||

Leucadia National Corp. |

167,963 | 3,995,840 | |||||||

M&T Bank Corp. |

46,435 | 4,572,454 | |||||||

Markel Corp.* |

19,654 | 8,518,437 | |||||||

WR Berkley Corp. |

159,493 | 6,019,266 | |||||||

| 40,912,404 | |||||||||

Health Care - 8.3% |

|||||||||

DENTSPLY International Inc. |

101,664 | 4,026,911 | |||||||

Laboratory Corp. of America Holdings* |

64,325 | 5,571,831 | |||||||

Techne Corp. |

70,478 | 4,816,467 | |||||||

| 14,415,209 | |||||||||

Industrials - 19.5% |

|||||||||

CH Robinson Worldwide Inc. |

97,360 | 6,155,099 | |||||||

Copart Inc.* |

227,652 | 6,715,734 | |||||||

Expeditors International of Washington Inc. |

116,470 | 4,606,388 | |||||||

IDEX Corp. |

78,661 | 3,660,096 | |||||||

Jacobs Engineering Group Inc.* |

86,677 | 3,689,840 | |||||||

Ritchie Bros Auctioneers Inc. |

191,122 | 3,992,539 | |||||||

Wabtec Corp. |

56,840 | 4,975,774 | |||||||

| 33,795,470 | |||||||||

| Shares | Value (Note 1) | ||||||||

Information Technology - 4.0% |

|||||||||

Amphenol Corp., Class A |

48,555 | $3,141,508 | |||||||

MICROS Systems Inc.* |

90,020 | 3,820,449 | |||||||

| 6,961,957 | |||||||||

Materials - 6.7% |

|||||||||

Crown Holdings Inc.* |

116,012 | 4,270,402 | |||||||

Ecolab Inc. |

55,400 | 3,983,260 | |||||||

Valspar Corp. |

53,535 | 3,340,584 | |||||||

| 11,594,246 | |||||||||

Total Common Stocks |

|||||||||

(Cost $123,162,101) |

162,225,277 | ||||||||

INVESTMENT COMPANY - 0.7% |

|||||||||

Invesco Short Term Investments Treasury |

1,235,470 | 1,235,470 | |||||||

Total Investment Company |

|||||||||

(Cost $1,235,470) |

1,235,470 | ||||||||

| Par Value | |||||||||

U.S. GOVERNMENT AND AGENCY OBLIGATIONS - 3.8% |

|||||||||

U.S. Treasury Bill - 3.8% |

|||||||||

0.06%, 4/25/13 |

$6,625,000 | 6,623,552 | |||||||

Total U.S. Government and Agency Obligations (Cost $6,623,552) |

6,623,552 | ||||||||

TOTAL INVESTMENTS - 98.1% (Cost $131,021,123) |

170,084,299 | ||||||||

NET OTHER ASSETS AND LIABILITIES - 1.9% |

3,199,079 | ||||||||

TOTAL ASSETS - 100.0% |

$ | 173,283,378 | |||||||

| * | Non-income producing | |

| ADR | American Depository Receipt | |

| PLC | Public Limited Company |

See accompanying Notes to Financial Statements.

12

Madison Mosaic Equity Trust | December 31, 2012

Disciplined Equity Fund • Portfolio of Investments

| Shares | Value (Note 1) | ||||||||

COMMON STOCK - 98.9% |

|||||||||

Consumer Discretionary - 11.6% |

|||||||||

CarMax Inc.* |

44,865 | $ | 1,684,232 | ||||||

Discovery Communications Inc., Class C* |

33,000 | 1,930,500 | |||||||

McDonald’s Corp. |

22,265 | 1,963,996 | |||||||

NIKE Inc., Class B |

50,690 | 2,615,604 | |||||||

Omnicom Group Inc. |

56,222 | 2,808,851 | |||||||

Target Corp. |

47,000 | 2,780,990 | |||||||

TJX Cos. Inc. |

37,770 | 1,603,337 | |||||||

Walt Disney Co. |

38,265 | 1,905,214 | |||||||

| 17,292,724 | |||||||||

Consumer Staples - 10.1% |

|||||||||

Coca-Cola Co. |

50,460 | 1,829,175 | |||||||

Costco Wholesale Corp. |

19,705 | 1,946,263 | |||||||

Diageo PLC, ADR |

15,780 | 1,839,632 | |||||||

Mondelez International Inc., Class A |

100,000 | 2,547,000 | |||||||

Nestle S.A., ADR |

43,065 | 2,806,546 | |||||||

PepsiCo Inc. |

59,295 | 4,057,557 | |||||||

| 15,026,173 | |||||||||

Energy - 11.0% |

|||||||||

Apache Corp. |

39,929 | 3,134,427 | |||||||

Chevron Corp. |

26,809 | 2,899,125 | |||||||

ConocoPhillips |

60,000 | 3,479,400 | |||||||

Occidental Petroleum Corp. |

44,000 | 3,370,840 | |||||||

Schlumberger Ltd. |

50,376 | 3,490,553 | |||||||

| 16,374,345 | |||||||||

Financials - 15.2% |

|||||||||

Berkshire Hathaway Inc., Class B* |

55,980 | 5,021,406 | |||||||

Brookfield Asset Management Inc. |

62,550 | 2,292,458 | |||||||

Franklin Resources Inc. |

22,601 | 2,840,946 | |||||||

M&T Bank Corp. |

29,795 | 2,933,914 | |||||||

Markel Corp.* |

8,950 | 3,879,109 | |||||||

Northern Trust Corp. |

59,965 | 3,007,844 | |||||||

US Bancorp |

79,510 | 2,539,549 | |||||||

| 22,515,226 | |||||||||

Health Care - 12.4% |

|||||||||

Becton Dickinson & Co. |

44,300 | 3,463,817 | |||||||

Johnson & Johnson |

71,855 | 5,037,036 | |||||||

Laboratory Corp. of America Holdings* |

30,176 | 2,613,845 | |||||||

Novartis AG, ADR |

44,030 | 2,787,099 | |||||||

Stryker Corp. |

35,416 | 1,941,505 | |||||||

UnitedHealth Group Inc. |

48,210 | 2,614,910 | |||||||

| 18,458,212 | |||||||||

Shares |

Value (Note 1) |

||||||||

Industrials - 10.0% |

|||||||||

3M Co. |

43,798 | $ | 4,066,644 | ||||||

CH Robinson Worldwide Inc. |

31,950 | 2,019,879 | |||||||

Copart Inc.* |

68,160 | 2,010,720 | |||||||

Emerson Electric Co. |

40,625 | 2,151,500 | |||||||

Jacobs Engineering Group Inc.* |

47,500 | 2,022,075 | |||||||

United Parcel Service Inc., Class B |

35,665 | 2,629,580 | |||||||

| 14,900,398 | |||||||||

Information Technology - 19.8% |

|||||||||

Accenture PLC, Class A |

58,000 | 3,857,000 | |||||||

Apple Inc. |

6,941 | 3,699,761 | |||||||

Automatic Data Processing Inc. |

26,225 | 1,495,087 | |||||||

Google Inc., Class A* |

5,000 | 3,546,850 | |||||||

MICROS Systems Inc.* |

52,880 | 2,244,227 | |||||||

Microsoft Corp. |

196,625 | 5,255,786 | |||||||

Oracle Corp. |

99,400 | 3,312,008 | |||||||

QUALCOMM Inc. |

64,175 | 3,980,134 | |||||||

Visa Inc., Class A |

13,079 | 1,982,515 | |||||||

| 29,373,368 | |||||||||

Materials - 4.0% |

|||||||||

Ecolab Inc. |

22,000 | 1,581,800 | |||||||

International Flavors & Fragrances Inc. |

37,500 | 2,495,250 | |||||||

Praxair Inc. |

16,680 | 1,825,626 | |||||||

| 5,902,676 | |||||||||

Telecommunication Services - 2.3% |

|||||||||

AT&T Inc. |

99,170 | 3,343,021 | |||||||

Utilities - 2.5% |

|||||||||

NextEra Energy Inc. |

54,245 | 3,753,212 | |||||||

Total Common Stocks |

|||||||||

(Cost $129,989,176) |

146,939,355 | ||||||||

INVESTMENT COMPANY - 2.5% |

|||||||||

Invesco Short Term Investments Treasury |

3,727,120 | 3,727,120 | |||||||

Total Investment Company |

|||||||||

(Cost $3,727,120) |

3,727,120 | ||||||||

TOTAL INVESTMENTS - 101.4% |

|||||||||

| (Cost $133,716,296) | 150,666,475 | ||||||||

NET OTHER ASSETS AND LIABILITIES - (1.4%) |

(2,139,479 | ) | |||||||

TOTAL ASSETS - 100.0% |

$ | 148,526,996 | |||||||

| * | Non-income producing | |

| ADR | American Depository Receipt | |

| PLC | Public Limited Company |

See accompanying Notes to Financial Statements.

13

Madison Mosaic Equity Trust | December 31, 2012

Dividend Income Fund • Portfolio of Investments

| Shares | Value (Note 1) | ||||||||

| COMMON STOCK - 97.6% | |||||||||

| Consumer Discretionary - 9.7% | |||||||||

| McDonald’s Corp. | 3,350 | $ | 295,504 | ||||||

| Omnicom Group Inc. | 4,100 | 204,836 | |||||||

| Target Corp. | 4,445 | 263,011 | |||||||

| Time Warner Inc. | 7,300 | 349,159 | |||||||

| Viacom Inc., Class B* | 3,200 | 168,768 | |||||||

| 1,281,278 | |||||||||

| Consumer Staples - 13.6% | |||||||||

| Coca-Cola Co. | 5,600 | 203,000 | |||||||

| Diageo PLC, ADR | 1,869 | 217,888 | |||||||

| Nestle S.A., ADR | 3,400 | 221,578 | |||||||

| PepsiCo Inc. | 6,200 | 424,266 | |||||||

| Philip Morris International Inc. | 1,750 | 146,370 | |||||||

| Procter & Gamble Co. | 4,200 | 285,138 | |||||||

| Sysco Corp. | 4,700 | 148,802 | |||||||

| Wal-Mart Stores Inc. | 2,300 | 156,929 | |||||||

| 1,803,971 | |||||||||

| Energy - 11.6% | |||||||||

| Chevron Corp. | 5,700 | 616,398 | |||||||

| ConocoPhillips | 8,700 | 504,513 | |||||||

| Exxon Mobil Corp. | 2,300 | 199,065 | |||||||

| Occidental Petroleum Corp. | 2,800 | 214,508 | |||||||

| 1,534,484 | |||||||||

| Financials - 18.6% | |||||||||

| Axis Capital Holdings Ltd. | 6,300 | 218,232 | |||||||

| Bank of New York Mellon Corp. | 6,207 | 159,520 | |||||||

| BlackRock Inc. | 1,560 | 322,468 | |||||||

| M&T Bank Corp. | 2,000 | 196,940 | |||||||

| Northern Trust Corp. | 3,347 | 167,886 | |||||||

| PartnerRe Ltd. | 3,100 | 249,519 | |||||||

| Travelers Cos. Inc. | 7,300 | 524,286 | |||||||

| US Bancorp | 8,600 | 274,684 | |||||||

| Wells Fargo & Co. | 10,400 | 355,472 | |||||||

| 2,469,007 | |||||||||

| Health Care - 17.8% | |||||||||

| Becton Dickinson & Co. | 2,000 | 156,380 | |||||||

| Johnson & Johnson | 8,700 | 609,870 | |||||||

| Medtronic Inc. | 5,700 | 233,814 | |||||||

| Merck & Co. Inc. | 12,100 | 495,374 | |||||||

| Novartis AG, ADR | 3,635 | 230,096 | |||||||

| Pfizer Inc. | 25,600 | 642,048 | |||||||

| 2,367,582 | |||||||||

| Shares | Value (Note 1) | ||||||||

| Industrials - 12.9% | |||||||||

| 3M Co. | 4,594 | $ | 426,553 | ||||||

| Boeing Co. | 3,700 | 278,832 | |||||||

| Emerson Electric Co. | 4,100 | 217,136 | |||||||

| United Parcel Service Inc., Class B | 3,700 | 272,801 | |||||||

| United Technologies Corp. | 4,400 | 360,844 | |||||||

| Waste Management Inc. | 4,500 | 151,830 | |||||||

| 1,707,996 | |||||||||

| Information Technology - 9.5% | |||||||||

| Accenture PLC, Class A | 2,500 | 166,250 | |||||||

| Automatic Data Processing Inc. | 3,800 | 216,638 | |||||||

| Intel Corp. | 6,700 | 138,221 | |||||||

| Linear Technology Corp. | 5,200 | 178,360 | |||||||

| Microchip Technology Inc. | 4,900 | 159,691 | |||||||

| Microsoft Corp. | 14,900 | 398,277 | |||||||

| 1,257,437 | |||||||||

| Materials - 1.5% | |||||||||

| Air Products & Chemicals Inc. | 2,400 | 201,647 | |||||||

| Telecommunication Services - 2.4% | |||||||||

| AT&T Inc. | 9,400 | 316,873 | |||||||

Total Common Stocks |

|||||||||

(Cost $11,613,948) |

12,940,275 | ||||||||

| INVESTMENT COMPANY - 2.5% | |||||||||

| Invesco Short Term Investments Treasury | 329,855 | 329,855 | |||||||

Total Investment Company |

|||||||||

(Cost $329,855) |

329,855 | ||||||||

| TOTAL INVESTMENTS - 100.1% (Cost $11,943,803) | 13,270,130 | ||||||||

| NET OTHER ASSETS AND LIABILITIES - (0.1%) | (7,025 | ) | |||||||

| TOTAL ASSETS - 100.0% | $ | 13,263,105 | |||||||

| * | Non-income producing | |

| ADR | American Depository Receipt | |

| PLC | Public Limited Company |

See accompanying Notes to Financial Statements.

14

Madison Mosaic Equity Trust | December 31, 2012

NorthRoad International Fund • Portfolio of Investments

| Shares | Value (Note 1) | ||||||||

| COMMON STOCK - 99.9% | |||||||||

| Consumer Discretionary - 6.9% | |||||||||

| Compass Group PLC, ADR | 49,900 | $ | 597,802 | ||||||

| Reed Elsevier PLC, ADR | 16,060 | 675,162 | |||||||

| WPP PLC, ADR | 10,030 | 731,187 | |||||||

| 2,004,151 | |||||||||

| Consumer Staples - 18.8% | |||||||||

| Carrefour S.A., ADR | 74,096 | 381,594 | |||||||

| Diageo PLC, ADR | 7,459 | 869,570 | |||||||

| Imperial Tobacco Group PLC, ADR | 8,161 | 632,396 | |||||||

| Kao Corp., ADR | 28,408 | 737,756 | |||||||

| Nestle S.A., ADR | 14,787 | 963,669 | |||||||

| Tesco PLC, ADR | 51,561 | 854,881 | |||||||

| Unilever PLC, ADR | 25,862 | 1,001,377 | |||||||

| 5,441,243 | |||||||||

| Energy - 10.9% | |||||||||

| ENI SpA, ADR | 17,905 | 879,852 | |||||||

| Petroleo Brasileiro S.A., ADR | 31,474 | 612,799 | |||||||

| Royal Dutch Shell PLC, ADR | 12,424 | 856,635 | |||||||

| Total S.A., ADR | 15,046 | 782,542 | |||||||

| 3,131,828 | |||||||||

| Financials - 11.7% | |||||||||

| Allianz SE, ADR | 48,574 | 671,293 | |||||||

| AXA S.A., ADR | 28,587 | 520,855 | |||||||

| Credit Suisse Group AGon, ADR | 24,560 | 603,194 | |||||||

| HSBC Holdings PLC, ADR | 16,373 | 868,915 | |||||||

| Mitsubishi UFJ Financial Group Inc., ADR | 133,251 | 722,220 | |||||||

| 3,386,477 | |||||||||

| Health Care - 15.5% | |||||||||

| GlaxoSmithKline PLC, ADR | 19,156 | 832,711 | |||||||

| Novartis AG, ADR | 20,142 | 1,274,989 | |||||||

| Roche Holding AG, ADR | 19,335 | 976,418 | |||||||

| Sanofi, ADR | 18,895 | 895,245 | |||||||

| Teva Pharmaceutical Industries Ltd., ADR | 12,969 | 484,262 | |||||||

| 4,463,625 | |||||||||

| Industrials - 7.9% | |||||||||

| ABB Ltd.-Spon, ADR | 36,125 | 751,039 | |||||||

| Schneider Electric S.A., ADR | 58,215 | 861,000 | |||||||

| Secom Co. Ltd., ADR | 52,890 | 663,240 | |||||||

| 2,275,279 | |||||||||

| Shares | Value (Note 1) | ||||||||

| Information Technology - 9.6% | |||||||||

| Canon Inc., ADR | 17,570 | $ | 688,920 | ||||||

| Infosys Ltd.-Sp, ADR | 11,827 | 500,282 | |||||||

| SAP AG, ADR | 12,370 | 994,301 | |||||||

| Telefonaktiebolaget LM Ericsson, ADR | 57,591 | 581,669 | |||||||

| 2,765,172 | |||||||||

| Materials - 13.3% | |||||||||

| Akzo Nobel NV, ADR | 41,091 | 924,548 | |||||||

| BHP Billiton Ltd.-Spon, ADR | 8,525 | 668,701 | |||||||

| CRH PLC, ADR | 31,916 | 649,171 | |||||||

| Givaudan S.A., ADR | 34,021 | 717,843 | |||||||

| Syngenta AG, ADR | 11,048 | 892,678 | |||||||

| 3,852,941 | |||||||||

| Telecommunication Services - 5.3% | |||||||||

| France Telecom S.A., ADR | 41,221 | 455,492 | |||||||

| NTT DoCoMo Inc., ADR | 36,150 | 520,922 | |||||||

| Vodafone Group PLC-Sp, ADR | 21,700 | 546,623 | |||||||

| 1,523,037 | |||||||||

Total Common Stocks |

|||||||||

(Cost $26,980,268) |

28,843,753 | ||||||||

| INVESTMENT COMPANY - 1.5% | |||||||||

| Invesco Short Term Investments Treasury | 431,804 | 431,804 | |||||||

Total Investment Company |

|||||||||

(Cost $431,804) |

431,804 | ||||||||

| TOTAL INVESTMENTS - 101.4% (Cost $27,412,072) | 29,275,557 | ||||||||

| NET OTHER ASSETS AND LIABILITIES - (1.4%) | (408,524 | ) | |||||||

| TOTAL ASSETS - 100% | $ | 28,867,033 | |||||||

| * | Non-income producing | |

| ADR | American Depository Receipt | |

| PLC | Public Limited Company |

See accompanying Notes to Financial Statements.

15

Madison Mosaic Equity Trust | December 31, 2012

Statements of Assets and Liabilities | For the period ended December 31, 2012

| Disciplined | Dividend | Northroad | ||||||||||||||||||||||

| Investors | Mid-Cap | Equity | Income | International | ||||||||||||||||||||

ASSETS |

Fund | Fund | Fund | Fund1 | Fund | |||||||||||||||||||

Investments, at value (Note 1) |

||||||||||||||||||||||||

Investment securities |

$ | 33,036,916 | $ | 162,225,277 | $ | 146,939,355 | $ | 12,940,275 | $ | 28,843,753 | ||||||||||||||

Short-term investments |

1,687,987 | 7,859,022 | 3,727,120 | 329,855 | 431,804 | |||||||||||||||||||

Total investments* |

34,724,903 | 170,084,299 | 150,666,475 | 13,270,130 | 29,275,557 | |||||||||||||||||||

Receivables |

||||||||||||||||||||||||

Investment securities sold |

482,403 | 4,319,884 | – | – | – | |||||||||||||||||||

Dividends and interest |

23,029 | 57,168 | 95,052 | 16,467 | 32,157 | |||||||||||||||||||

Capital shares sold |

4,882 | 762,942 | 154,337 | 307 | 3,000 | |||||||||||||||||||

Total assets |

35,235,217 | 175,224,293 | 150,915,864 | 13,286,904 | 29,310,714 | |||||||||||||||||||

LIABILITIES |

||||||||||||||||||||||||

Payables |

||||||||||||||||||||||||

Investment securities purchased |

– | 769,710 | – | – | – | |||||||||||||||||||

Dividends |

18,778 | – | 1,574,174 | 3,126 | 408,047 | |||||||||||||||||||

Capital shares redeemed |

6,142 | 982,467 | 676,358 | 5,130 | 934 | |||||||||||||||||||

Management fees |

22,509 | 112,853 | 99,033 | 8,521 | 19,793 | |||||||||||||||||||

Service fees |

16,754 | 75,885 | 58,730 | 8,726 | 14,907 | |||||||||||||||||||

Waived fees |

(4,501 | ) | – | (19,427 | ) | (1,704 | ) | – | ||||||||||||||||

Net Management and Service fees |

34,762 | 188,738 | 138,336 | 15,543 | 34,700 | |||||||||||||||||||

Total liabilities |

59,682 | 1,940,915 | 2,388,868 | 23,799 | 443,681 | |||||||||||||||||||

NET ASSETS |

$ | 35,175,535 | $ | 173,283,378 | $ | 148,526,996 | $ | 13,263,105 | $ | 28,867,033 | ||||||||||||||

Net assets consists of: |

||||||||||||||||||||||||

Paid in capital |

31,578,047 | $ | 130,850,532 | $ | 130,074,912 | 11,961,290 | $ | 27,069,772 | ||||||||||||||||

Accumulated net realized gains (losses) |

(1,310,709 | ) | 3,369,670 | 1,501,905 | (24,512 | ) | (66,224 | ) | ||||||||||||||||

Net unrealized appreciation on investments |

4,908,197 | 39,063,176 | 16,950,179 | 1,326,327 | 1,863,485 | |||||||||||||||||||

Net assets |

$ | 35,175,535 | $ | 173,283,378 | $ | 148,526,996 | $ | 13,263,105 | $ | 28,867,033 | ||||||||||||||

CLASS Y SHARES |

||||||||||||||||||||||||

Net Assets |

$ | 35,175,535 | $ | 168,427,745 | $ | 145,519,620 | $ | 13,263,105 | $ | 28,856,363 | ||||||||||||||

Shares of beneficial interest outstanding |

1,894,975 | 12,967,144 | 10,874,913 | 741,005 | 2,776,395 | |||||||||||||||||||

Net Asset Value and redemption price per share |

$ | 18.56 | $ | 12.99 | $ | 13.38 | $ | 17.90 | $ | 10.39 | ||||||||||||||

CLASS R6 SHARES2 |

||||||||||||||||||||||||

Net Assets |

$ | 4,855,633 | $ | 3,007,376 | $ | 10,670 | ||||||||||||||||||

Shares of beneficial interest outstanding |

372,784 | 224,836 | 1,027 | |||||||||||||||||||||

Net Asset Value and redemption price per share |

$ | 13.03 | $ | 13.38 | $ | 10.39 | ||||||||||||||||||

*INVESTMENT SECURITIES, AT COST |

$ | 29,816,706 | $ | 131,021,123 | $ | 133,716,296 | $ | 11,943,803 | $ | 27,412,072 | ||||||||||||||

| 1 | Prior to March 1, 2012, the fund was known as the Balanced Fund. | |

| 2 | The Investors and Dividend Income Funds do not offer Class R6 shares. |

See accompanying Notes to Financial Statements.

16

Madison Mosaic Equity Trust | December 31, 2012

Statements of Operations | For the period ended December 31, 2012

| Disciplined | Dividend | NorthRoad | ||||||||||||||||||||||||

| Investors | Mid-Cap | Equity | Income | International | ||||||||||||||||||||||

| Fund | Fund | Fund1 | Fund | Fund | ||||||||||||||||||||||

INVESTMENT INCOME (Note 1) |

||||||||||||||||||||||||||

Interest income |

$ | 215 | $ | 1,390 | $ | 863 | $ | 18,594 | $ | 151 | ||||||||||||||||

Dividend income |

620,934 | 2,118,139 | 3,275,761 | 361,831 | 736,721 | |||||||||||||||||||||

Total investment income |

621,149 | 2,119,529 | 3,276,624 | 380,425 | 736,872 | |||||||||||||||||||||

EXPENSES (Notes 2 and 3) |

||||||||||||||||||||||||||

Investment advisory fees |

270,608 | 1,326,185 | 1,164,725 | 93,769 | 190,018 | |||||||||||||||||||||

Service agreement fees |

106,553 | 787,027 | 444,751 | 52,444 | 83,107 | |||||||||||||||||||||

Total expenses |

377,161 | 2,113,212 | 1,609,476 | 146,213 | 273,125 | |||||||||||||||||||||

Waived fees |

(27,216 | ) | – | (130,332 | ) | (10,069 | ) | – | ||||||||||||||||||

Net expenses |

349,945 | 2,113,212 | 1,479,144 | 136,144 | 273,125 | |||||||||||||||||||||

NET INVESTMENT INCOME |

271,204 | 6,317 | 1,797,480 | 244,281 | 463,747 | |||||||||||||||||||||

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS |

||||||||||||||||||||||||||

Net realized gain (loss) on investments |

2,058,621 | 10,532,602 | 7,145,805 | 235,265 | (65,728 | ) | ||||||||||||||||||||

Change in net unrealized appreciation of investments |

2,486,753 | 14,509,191 | 9,954,955 | 781,331 | 2,035,365 | |||||||||||||||||||||

NET GAIN ON INVESTMENTS |

4,545,374 | 25,041,793 | 17,100,760 | 1,016,596 | 1,969,637 | |||||||||||||||||||||

TOTAL INCREASE IN NET ASSETS |

||||||||||||||||||||||||||

RESULTING FROM OPERATIONS |

$ | 4,816,578 | $ | 25,048,110 | $ | 18,898,240 | $ | 1,260,877 | $ | 2,433,384 | ||||||||||||||||

| 1 | Prior to March 1, 2012, the fund was known as the Balanced Fund. |

See accompanying Notes to Financial Statements.

17

Madison Mosaic Equity Trust | December 31, 2012

Statements of Changes in Net Assets | For the period indicated

| Investors Fund | Mid-Cap Fund | |||||||||||||||||||

| Year Ended December 31, | Year Ended December 31, | |||||||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||||||

INCREASE (DECREASE) IN NET ASSETS |

||||||||||||||||||||

RESULTING FROM OPERATIONS |

||||||||||||||||||||

Net investment income (loss) |

$ | 271,204 | $ | 330,669 | $ | 6,317 | $ | (312,288) | ||||||||||||

Net realized gain on investments |

2,058,621 | 2,427,210 | 10,532,602 | 13,451,723 | ||||||||||||||||

Net unrealized appreciation (depreciation) on investments |

2,486,753 | (2,846,126 | ) | 14,509,191 | (4,808,581 | ) | ||||||||||||||

Net increase (decrease) in net assets resulting from operations |

4,816,578 | (88,247 | ) | 25,048,110 | 8,330,854 | |||||||||||||||

DISTRIBUTIONS TO SHAREHOLDERS |

||||||||||||||||||||

From net investment income |

||||||||||||||||||||

Class Y |

(271,204 | ) | (330,669 | ) | – | – | ||||||||||||||

Class R62 |

– | – | (6,317 | ) | – | |||||||||||||||

From net capital gains |

||||||||||||||||||||

Class Y |

– | – | (6,194,230 | ) | (6,784,343 | ) | ||||||||||||||

Class R62 |

– | – | (173,726 | ) | – | |||||||||||||||

Total distributions |

(271,204 | ) | (330,669 | ) | (6,374,273 | ) | (6,784,343 | ) | ||||||||||||

CAPITAL SHARE TRANSACTIONS (Note 6) |

||||||||||||||||||||

Class Y |

(5,708,658 | ) | (6,123,944 | ) | (10,692,239 | ) | (632,136 | ) | ||||||||||||

Class R62 |

– | – | 4,974,012 | – | ||||||||||||||||

Total capital share transactions |

(5,708,658 | ) | (6,123,944 | ) | (5,718,227 | ) | (632,136 | ) | ||||||||||||

TOTAL INCREASE (DECREASE) IN NET ASSETS |

(1,163,284 | ) | (6,542,860 | ) | 12,955,610 | 914,375 | ||||||||||||||

NET ASSETS |

||||||||||||||||||||

Beginning of period |

$ | 36,338,819 | $ | 42,881,679 | $ | 160,327,768 | $ | 159,413,393 | ||||||||||||

End of period |

$ | 35,175,535 | $ | 36,338,819 | $ | 173,283,378 | $ | 160,327,768 | ||||||||||||

| Disciplined Equity Fund | Dividend Income Fund1 | ||||||||||||||||||||

| Year Ended December 31, | Year Ended December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2012 | 2011 | ||||||||||||||||||

INCREASE (DECREASE) IN NET ASSETS |

|||||||||||||||||||||

RESULTING FROM OPERATIONS |

|||||||||||||||||||||

Net investment income |

$ | 1,797,480 | $ | 1,581,978 | $ | 244,281 | $ | 128,629 | |||||||||||||

Net realized gain on investments |

7,145,805 | 2,888,003 | 235,265 | 949,897 | |||||||||||||||||

Net unrealized appreciation (depreciation) on investments |

9,954,955 | (2,766,220 | ) | 781,331 | (868,837 | ) | |||||||||||||||

Net increase in net assets resulting from operations |

18,898,240 | 1,703,761 | 1,260,877 | 209,689 | |||||||||||||||||

DISTRIBUTIONS TO SHAREHOLDERS |

|||||||||||||||||||||

From net investment income |

|||||||||||||||||||||

Class Y |

(1,755,531 | ) | (1,581,978 | ) | (244,281 | ) | (128,629 | ) | |||||||||||||

Class R62 |

(41,949 | ) | – | – | – | ||||||||||||||||

From net capital gains |

|||||||||||||||||||||

Class Y |

(7,483,283 | ) | (1,169,811 | ) | (555,330 | ) | (276,130 | ) | |||||||||||||

Class R62 |

(145,634 | ) | – | – | – | ||||||||||||||||

Total distributions |

(9,426,397 | ) | (2,751,789 | ) | (799,611 | ) | (404,759 | ) | |||||||||||||

CAPITAL SHARE TRANSACTIONS (Note 6) |

|||||||||||||||||||||

Class Y |

(28,419,945 | ) | 66,296,492 | 1,612,849 | (872,159 | ) | |||||||||||||||

Class R62 |

3,245,294 | – | – | – | |||||||||||||||||

Total capital share transactions |

(25,174,651 | ) | 66,296,492 | 1,612,849 | (872,159 | ) | |||||||||||||||

TOTAL INCREASE (DECREASE) IN NET ASSETS |

(15,702,808 | ) | 65,248,464 | 2,074,115 | (1,067,229 | ) | |||||||||||||||

NET ASSETS |

|||||||||||||||||||||

Beginning of period |

$ | 164,229,804 | $ | 98,981,340 | $ | 11,188,990 | $ | 12,256,219 | |||||||||||||

End of period |

$ | 148,526,996 | $ | 164,229,804 | $ | 13,263,105 | $ | 11,188,990 | |||||||||||||

| 1 | Prior to March 1, 2012, the fund was known as the Balanced Fund. | |

| 2 | The Investors and Dividend Income Funds do not offer Class R6 shares. |

See accompanying Notes to Financial Statements.

18

Madison Mosaic Equity Trust | December 31, 2012

Statements of Changes in Net Assets | For the period indicated (concluded)

| NorthRoad International Fund | ||||||||||

| Year Ended December 31, | ||||||||||

| 2012 | 2011 | |||||||||

INCREASE (DECREASE) IN NET ASSETS |

||||||||||

RESULTING FROM OPERATIONS |

||||||||||

Net investment income |

$ | 463,747 | $ | 6,986 | ||||||

Net realized gain (loss) on investments |

(65,728 | ) | 361,522 | |||||||

Net unrealized appreciation (depreciation) on investments |

2,035,365 | (454,433 | ) | |||||||

Net increase (decrease) in net assets resulting from operations |

2,433,384 | (85,925 | ) | |||||||

DISTRIBUTIONS TO SHAREHOLDERS |

||||||||||

From net investment income |

||||||||||

Class Y |

(463,551 | ) | (6,986 | ) | ||||||

Class R6 |

(196 | ) | – | |||||||

From net capital gains |

||||||||||

Class Y |

– | (380,990 | ) | |||||||

Class R6 |

– | – | ||||||||

Total distributions |

(463,747 | ) | (387,976 | ) | ||||||

CAPITAL SHARE TRANSACTIONS (Note 6) |

||||||||||

Class Y |

25,266,346 | 331,449 | ||||||||

Class R6 |

10,196 | – | ||||||||

Total capital share transactions |

$ | 25,276,542 | 331,449 | |||||||

TOTAL INCREASE (DECREASE) IN NET ASSETS |

27,246,179 | (142,452 | ) | |||||||

NET ASSETS |

||||||||||

Beginning of period |

$ | 1,620,854 | $ | 1,763,306 | ||||||

End of period |

$ | 28,867,033 | $ | 1,620,854 | ||||||

See accompanying Notes to Financial Statements.

19

Madison Mosaic Equity Trust | December 31, 2012

Financial Highlights | Selected data for a share outstanding for the periods indicated.

| Year Ended December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| CLASS Y | ||||||||||||||||||||

| Net asset value, beginning of period | $ | 16.40 | $ | 16.55 | $ | 15.07 | $ | 11.31 | $ | 18.44 | ||||||||||

| Investment operations: | ||||||||||||||||||||

Net investment income1 |

0.13 | 0.15 | 0.09 | 0.05 | 0.08 | |||||||||||||||

Net realized and unrealized gain (loss) on investments |

2.17 | (0.15 | ) | 1.48 | 3.76 | (6.28 | ) | |||||||||||||

| Total from investment operations | 2.30 | – | 1.57 | 3.81 | (6.20 | ) | ||||||||||||||

Less distributions: |

||||||||||||||||||||

From net investment income |

(0.14 | ) | (0.15 | ) | (0.09 | ) | (0.05 | ) | (0.08 | ) | ||||||||||

From net capital gains |

– | – | – | – | (0.85 | ) | ||||||||||||||

| Total distributions | (0.14 | ) | (0.15 | ) | (0.09 | ) | (0.05 | ) | (0.93 | ) | ||||||||||

| Net asset value, end of period | $ | 18.56 | $ | 16.40 | $ | 16.55 | $ | 15.07 | $ | 11.31 | ||||||||||

| Total return (%) | 14.05 | 0.00 | 10.44 | 33.73 | (33.40 | ) | ||||||||||||||

| Ratios and supplemental data | ||||||||||||||||||||

| Net assets, end of period (in thousands) | $ | 35,176 | $ | 36,339 | $ | 42,882 | $ | 39,684 | $ | 28,030 | ||||||||||

Ratio of expenses to average net assets before fee waiver (%) |

1.05 | 0.99 | 0.99 | 1.00 | 1.05 | |||||||||||||||

Ratio of expenses to average net assets after fee waiver (%) |

0.97 | N/A | N/A | N/A | N/A | |||||||||||||||

Ratio of net investment income to average net assets before fee waiver (%) |

0.68 | 0.82 | 0.60 | 0.40 | 0.47 | |||||||||||||||

Ratio of net investment income to average net assets after fee waiver (%) |

0.75 | N/A | N/A | N/A | N/A | |||||||||||||||

Portfolio turnover2 (%) |

47 | 36 | 41 | 74 | 47 | |||||||||||||||

| MID-CAP FUND | ||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| CLASS Y | ||||||||||||||||||||

| Net asset value, beginning of period | ||||||||||||||||||||

| Investment operations: | $ | 11.65 | $ | 11.57 | $ | 9.55 | $ | 7.67 | $ | 12.87 | ||||||||||

| Net investment income1 | ||||||||||||||||||||

| Net realized and unrealized gain (loss) on investments | – | (0.02 | ) | (0.03 | ) | (0.03 | ) | (0.03 | ) | |||||||||||

| Total from investment operations | 1.82 | 0.61 | 2.05 | 1.91 | (4.71 | ) | ||||||||||||||

| Less distributions from capital gains | 1.82 | 0.59 | 2.02 | 1.88 | (4.74 | ) | ||||||||||||||

| Net asset value, end of period | (0.48 | ) | (0.51 | ) | – | – | (0.46 | ) | ||||||||||||

| Total return (%) | $ | 12.99 | $ | 11.65 | $ | 11.57 | $ | 9.55 | $ | 7.67 | ||||||||||

| Ratios and supplemental data | 15.69 | 5.10 | 21.15 | 24.51 | (36.61 | ) | ||||||||||||||

| Net assets, end of period (in thousands) | ||||||||||||||||||||

| Ratio of expenses to average net assets (%) | $ | 168,428 | $ | 160,328 | $ | 159,413 | $ | 140,548 | $ | 88,964 | ||||||||||

| Ratio of net investment income to average net assets (%) | 1.20 | 1.25 | 1.25 | 1.26 | 1.26 | |||||||||||||||

| Portfolio turnover2 (%) | 0.00 | (0.20 | ) | (0.26 | ) | (0.36 | ) | (0.33 | ) | |||||||||||

| 28 | 32 | 57 | 63 | 76 | ||||||||||||||||

| 1 | Based on average daily shares outstanding during the year. | |

| 2 | Portfolio Turnover is calculated at the fund level and represents the entire period. |

See accompanying Notes to Financial Statements.

20

Madison Mosaic Equity Trust | December 31, 2012

Financial Highlights | Selected data for a share outstanding for the periods indicated.

| Year Ended | ||||||||||||||||||||

| December 31, | ||||||||||||||||||||

| 2012 | ||||||||||||||||||||

| CLASS R61 | ||||||||||||||||||||

| Net asset value, beginning of period | $ | 11.65 | ||||||||||||||||||

| Investment operations: | ||||||||||||||||||||

Net investment income2 |

0.13 | |||||||||||||||||||

Net realized and unrealized gain (loss) on investments |

1.75 | |||||||||||||||||||

| Total from investment operations | 1.88 | |||||||||||||||||||

Less distributions: |

||||||||||||||||||||

From net investment income |

(0.02 | ) | ||||||||||||||||||

From net capital gains |

(0.48 | ) | ||||||||||||||||||

| Total distributions | (0.50 | ) | ||||||||||||||||||

| Net asset value, end of period | $ | 13.03 | ||||||||||||||||||

| Total return (%) | 7.34 | |||||||||||||||||||

| Ratios and supplemental data | ||||||||||||||||||||

| Net assets, end of period (in thousands) | $ | 4,856 | ||||||||||||||||||

Ratio of expenses to average net assets (%) |

0.76 | 3 | ||||||||||||||||||

Ratio of net investment income to average net assets (%) |

1.19 | 3 | ||||||||||||||||||

Portfolio turnover4 (%) |

28 | |||||||||||||||||||

| DISCIPLINED EQUITY FUND | ||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2012 | 2011 | 2010 | 2009 | 2008 | ||||||||||||||||

| CLASS Y | ||||||||||||||||||||

| Net asset value, beginning of period | $ | 12.68 | $ | 12.68 | $ | 11.66 | $ | 8.81 | $ | 13.78 | ||||||||||

| Investment operations: | ||||||||||||||||||||

Net investment income2 |

0.16 | 0.12 | 0.07 | 0.01 | 0.09 | |||||||||||||||

Net realized and unrealized gain (loss) on investments |

1.39 | 0.09 | 1.05 | 2.85 | (4.80 | ) | ||||||||||||||

| Total from investment operations | 1.55 | 0.21 | 1.12 | 2.86 | (4.71 | ) | ||||||||||||||

Less distributions: |

||||||||||||||||||||

From net investment income |

(0.16 | ) | (0.12 | ) | (0.07 | ) | (0.01 | ) | (0.09 | ) | ||||||||||

From net capital gains |

(0.69 | ) | (0.09 | ) | (0.03 | ) | – | (0.17 | ) | |||||||||||

| Total distributions | (0.85 | ) | (0.21 | ) | (0.10 | ) | (0.01 | ) | (0.26 | ) | ||||||||||

| Net asset value, end of period | $ | 13.38 | $ | 12.68 | $ | 12.68 | $ | 11.66 | $ | 8.81 | ||||||||||

| Total return (%) | 12.25 | 1.68 | 9.58 | 32.50 | (34.20 | ) | ||||||||||||||

| Ratios and supplemental data | ||||||||||||||||||||

| Net assets, end of period (in thousands) | $ | 145,520 | $ | 164,230 | $ | 98,981 | $ | 41,450 | $ | 3,072 | ||||||||||

Ratio of expenses to average net assets before fee waiver (%) |

1.04 | 0.98 | 1.09 | 1.06 | 1.14 | |||||||||||||||

Ratio of expenses to average net assets after fee waiver (%) |

0.95 | 0.96 | 0.99 | 0.96 | 1.06 | |||||||||||||||