ANNUAL REPORT

December 31, 2011

Madison Mosaic

Equity Trust

Investors Fund

Mid-Cap Fund

Disciplined Equity Fund

Balanced Fund

NorthRoad International Fund

Madison Mosaic(R) Funds

www.mosaicfunds.com

CONTENTS

|

Management’s Discussion of Fund Performance

|

1

|

|

2011 in Review

|

1

|

|

Outlook

|

1

|

|

Interview with Jay Sekelsky

|

2

|

|

Investors Fund

|

3

|

|

Mid-Cap Fund

|

5

|

|

Disciplined Equity Fund

|

7

|

|

Balanced Fund

|

9

|

|

NorthRoad International Fund

|

10

|

|

Notes to Management’s Discussion of Fund Performance

|

12

|

|

Portfolio of Investments

|

|

|

Investors Fund

|

13

|

|

Mid-Cap Fund

|

14

|

|

Disciplined Equity Fund

|

15

|

|

Balanced Fund

|

16

|

|

NorthRoad International Fund

|

18

|

|

Statements of Assets and Liabilities

|

19

|

|

Statements of Operations

|

20

|

|

Statements of Changes in Net Assets

|

21

|

|

Financial Highlights

|

23

|

|

Notes to Financial Statements

|

26

|

|

Report of Independent Registered Public Accounting Firm

|

32

|

|

Other Information

|

33

|

|

Trustees and Officers

|

37

|

Madison Mosaic Equity Trust

Management’s Discussion of Fund Performance

2011 IN REVIEW

A quick glance at the 2011 returns of the major domestic investment indices might suggest a benign and uneventful year for investors. The S&P 500, considered a benchmark for the U.S. domestic stock market, was virtually flat for the year, with dividend income responsible for almost all of the 2.1% positive total return. Yet a lot was going on under these start-to-finish indicators. The overseas indices provide a hint at some of the most important dislocations that were occurring behind these domestic stock returns. The MSCI EAFE Index, which is a widely used proxy for stock markets outside the U.S., slid -11.7% for the year, while emerging markets really took a beating, as shown by the MSCI Emerging Markets Index, which was down -18.4% for 2011. The volatility U.S. investors actually experienced is evident in the return of the S&P 500 from its 2011 high on April 29 to its low on October 3; a period in which the Index lost -18.6%. Bond investors experienced some of the same sort of drama as the yield on the 10-Year Treasury reached 3.7% on February 8 before dropping by more than half to its record-setting closing low of 1.7% on September 22.

In the U.S., 2011 began with considerable optimism as stock indices rose briskly in the first quarter. Stock prices had on their side the strength of corporate profits and balance sheets combined with reasonable market valuations as measured by price/earnings ratios. But these positives were tested over and over again this year by extraneous events. The first blow in 2011 came with the chain reaction of freedom movements in the Middle East. While the flowering of democratic impulse was heartening, change and uncertainty are never well received by stock markets, especially when coupled with concerns over the effect on oil prices. The tragic earthquake and tsunami in Japan soon followed, with the recognition this much damage to one of the world’s largest economies would likely have serious global impact. For much of the rest of the 2011, it was the almost daily ups and downs of the European debt crisis which sparked volatility and a continued inflow into the perceived safety of bonds, particularly U.S. Treasuries. The markets were not helped by the mid-year stalemate in Washington over the U.S. deficit, which seemed to drag on endlessly. This impasse eventually sparked Standard & Poor’s landmark downgrade of U.S. debt on August 6. But even the downgrade couldn’t stem the flight to safety, as demand continued to push Treasury yields lower through most of September.

By the beginning of the third quarter, it appeared that 2011 would be a great year for bonds and a distinctly bad one for stocks. While this held true for foreign markets, U.S. stocks staged a dramatic rally over the last few months of the year, bringing the major large-stock indices back into positive territory for 2011. This rally was fueled by the persistence of positive economic indicators, strong corporate fundamentals, and a sense that while the European situation was likely to remain troublesome, it might not actually be as calamitous for U.S. stocks as once feared.

OUTLOOK

Looking forward, we are impressed with the resiliency of the U.S. economy. Still, we expect below-average economic growth for 2012 as the debt deleveraging process continues. Many of the cautionary macroeconomic issues that existed at the start of 2011 still persist at year end: weak housing, strained government budgets, and stagnant wage growth. Europe remains a wild card, and the progression of the debt crisis appears likely to lead to continued periods of "risk on" and "risk off" for global financial markets throughout the coming year. All told, we believe volatility is here to stay until the heightened level of global uncertainty begins to subside.

In terms of stocks, although the year-end economic backdrop is far from optimal, we believe attractive valuations on high-quality U.S. and international stocks are a silver lining. Filtering out the daily market "noise," many high-quality multinationals appear to offer exceptional long-term return potential. When attractive valuations are paired with strong free cash flow generation and high earnings predictability, we believe high-quality companies offer the ideal characteristics

Annual Report | December 31, 2011 | 1

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance | continued

to navigate through our growth challenged economic environment.

INTERVIEW WITH LEAD EQUITY MANAGER JAY SEKELSKY

Can you summarize the performance of the funds in Equity Trust in 2011?

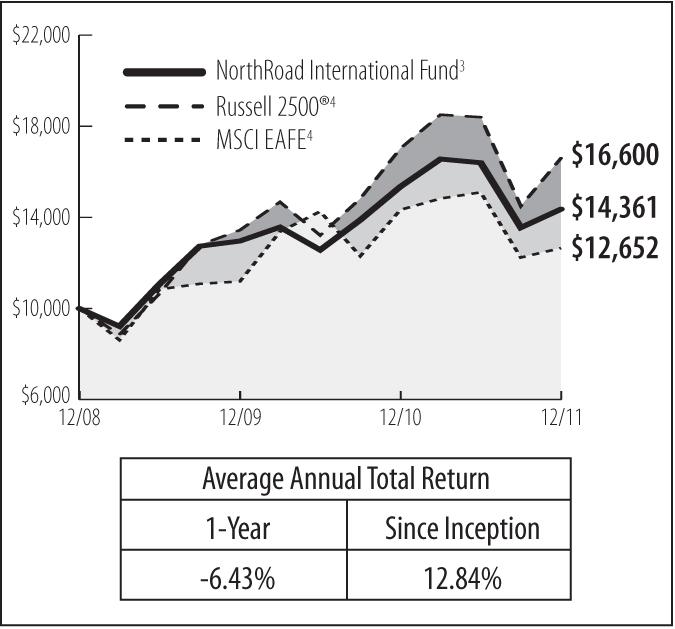

In a year in which large-cap indices were up modestly, while mid-cap, small-cap, and international indices showed losses, Madison Mosaic Equity Trust’s returns were also mixed. We had positive returns from three of our funds with Mid-Cap up 5.10%, Disciplined Equity up 1.68% and Balanced up 1.73%. Investors was flat, while NorthRoad International showed strong relative performance while slipping -6.43% (recognizing, of course, that the first half of the year the fund was managed as the Small/Mid-Cap Fund). The S&P 500, a large-cap index, was up 2.11%; the Russell Midcap(R) Index fell -1.55%, and international markets really struggled, as shown by the broad MSCI EAFE Index, which dropped -11.67%.

The Investors and Disciplined Equity Funds ended the year at or close to where they began 2011, which put them a bit behind the S&P 500’s modest return. Essentially, the funds lost some ground in the first two months of 2011 during the more speculative market. From mid-February forward, the funds closed a large portion of the gap. So although the funds had a rough start, overall we were pleased with the performance of these two funds.

The year 2011 was particularly rewarding for the Mid-Cap Fund. In a volatile year it protected capital in down markets, but it also outperformed in the up markets. In fact, the fund outperformed its Russell Midcap(R) Index benchmark every quarter for the whole year. Attribution also showed a positive stock selection across all of the fund’s invested sectors for the full year. So that’s quite gratifying to us as managers.

Our newest fund, NorthRoad International, was up against a very difficult market, as investors fled from foreign stocks in the face of a series of disruptions which included the Middle East rebellions, the natural disasters in Japan, and the man-made sovereign debt crisis in Europe. While we couldn’t avoid the drag which took the major international indices down double-digits, our careful stock selection and focus on company fundamentals kept the fund well ahead of its international benchmark and peer average for the six months it operated under the international strategy.

In terms of general trends, we were heartened to see that the market seemed to be refocusing on risk, which is always an element in our stock selection process. High-quality stocks which have solid business fundamentals outperformed more speculative companies for the year, a reversal of a trend which had been in place since the market bounced off its lows in the spring of 2009. This change in leadership fits in well with our overall stock selection process, and we expect this trend to continue in 2012.

2 | Annual Report | December 31, 2011

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance | continued

MADISON MOSAIC INVESTORS FUND (MINVX)

|

FUND-AT-A-GLANCE

|

|

Objective: Madison Mosaic Investors seeks long-term capital appreciation through investments in large growth companies.

|

|

Net Assets: $36.3 million

|

|

Date of Inception: November 1, 1978

|

|

Ticker: MINVX

|

INVESTMENT STRATEGY HIGHLIGHTS

Madison Mosaic Investors Fund invests primarily in the common stocks of large-sized U.S. corporations. The fund typically owns 25-40 securities which are selected using our long-held investment discipline of seeking the highest-quality, proven companies and purchasing them when valuations appear advantageous. We follow a rigorous three-step process when evaluating companies. We consider the business model, the management team and the valuation of each potential investment. We strive to purchase securities trading at a discount to their intrinsic value as determined by discounted cash flows. We corroborate this valuation work with additional valuation methodologies. The fund typically sells a stock when the fundamental expectations for the purchase no longer apply, the price exceeds its perceived value or other stocks appear more attractively priced relative to its prospects.

PERFORMANCE DISCUSSION WITH LEAD EQUITY MANAGER JAY SEKELSKY, CO-MANAGER OF MADISON MOSAIC INVESTORS FUND

How did the fund perform in 2011?

The Investors Fund ended the year where it started returning 0.00%, trailing its S&P 500 benchmark’s 2.11% return, while outperforming its Morningstar peer group, Large Growth, which showed an average return of -2.46%. It wasn’t just large-cap growth managers who had trouble keeping up with the market in 2011; both of the other Large-Cap Morningstar Categories had negative averages, with Value down -0.75% and Blend down -1.27%. One of the challenges was the way in which stocks tended to move on the macro factors, often global in nature, rather than on the underlying fundamentals. For large-cap companies, we observed significant correlation of returns among stocks in each sector, even while sectors showed quite disparate results. Looking back over the year, most of the fund’s underperformance occurred in the first quarter of the year, when low-quality and speculative companies had a period of favor. As the year progressed, the fund actually outperformed the market, other than a slight lag in the steep fourth quarter rally.

Have you made any significant changes to the portfolio since December 31, 2010?

As bottom-up stock pickers, we’re less thematic and more opportunistic. Because we seek companies with significant competitive advantages which we expect to be long term, and because we aren’t shifting the portfolio to reflect macro trends, we tend to make changes more gradually than some other managers. In 2011, the fund had turnover of 36%, which represents an average holding period of close to three years. This level of turnover implies that while we didn’t make drastic changes, there were shifts of note, even though we didn’t see major shifts in the fund’s sector concentration. That said, we saw our exposure to the more economically sensitive Consumer Discretionary Sector rise during the year, while we trimmed Consumer Staples. We also were able to find additional opportunities in financial stocks, while we retained the fund’s highest concentration in the Technology Sector.

In terms of individual securities, we sold all holdings in Costco Wholesale, Intel, IBM, Merck & Co., Noble Corp., Novartis, Southwest Energy Co., St. Jude Medical, Wells Fargo and Waste Management. New holdings include Becton Dickinson & Co., Brookfield Asset Management, Canadian Natural Resources Ltd., FLIR Systems Inc., Northern Trust Co., Occidental Petroleum, Staples, Stryker Corp., and United Parcel Service.

To give a better sense of how we make these changes, health care company Becton Dickinson can be illustrative. It’s a well-established, high-quality company which has been on our radar screens for some time. We purchased it late in the year as we were impressed with the company’s leadership position in providing injection devices and catheters, as well as its strong business in infection and cancer detection through its diagnostic testing areas. They’ve had a very consistent history of growth and high profitability, and they’ve been making consistent headway

Annual Report | December 31, 2011 | 3

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Investors Fund | continued

into emerging markets as well, so much so that it accounts for about 20 percent of their revenue these days. The emerging markets provide great opportunities and a source of potential growth for many years, as these countries expand access to high-end health care. The stock came under pressure during the third quarter when they had what we assessed as transitory issues. We took advantage of this pullback in the stock price to add this high-quality company to the fund’s portfolio at what we felt was a decidedly reasonable price.

What factors were the strongest contributors to fund performance?

Although 2011 was a relatively flat year for large-cap U.S. stocks, there was wide disparity in results by sector, with the strongest S&P 500 sector, Utilities, outperforming the worst, Financials, by approximately 33%. As a result, sector allocation proved to be an important factor in relative returns. The Health Care and Consumer Staples Sectors were both up double-digits for the year, and both of these areas were plusses for the fund’s results in 2011, with its Consumer Staples holdings outperforming the market. In general, the Financial Sector was a weak area for the year, but our emphasis on insurance companies and money managers was less of a drag than the results posted by the overall sector, which was hampered by the performance of banks with heavy credit exposure. The area that was most positive for the fund was the Technology Sector, where our high weighting in solid performers helped the portfolio.

On an individual stock basis, the greatest contribution to positive returns came from Technology holding Visa, whose stock was up more than 45% for the year, followed by Chevron, Kraft Foods, Google, IBM and Costco Warehouse, which we sold over the course of the year.

What factors were the largest constraints on performance?

Although the Utilities Sector is a small slice of the S&P 500, not having any holdings in the top-performing sector was a drag on performance, as was holding cash, particularly in the rapidly rising fourth quarter. Although the Energy Sector was up 2.8%, the fund’s holdings showed a small negative return for the period. This was also the case in Consumer Discretionary, where the fund showed a negative return against a sector that was up 4.4%. The primary culprit here was Staples, which suffered disappointing results in the wake of the slow economic recovery that was particularly hard on its core audience of small businesses. The fund’s health care holdings lagged their sector performance a bit over the course of the year. On an individual security level, the laggards were Bank of New York Mellon Corp., retailer Staples, and Brazilian energy concern Petrobas.

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS

|

|

Consumer Discretionary

|

8.2%

|

|

Consumer Staples

|

11.1%

|

|

Energy

|

11.4%

|

|

Financials

|

18.5%

|

|

Health Care

|

14.5%

|

|

Industrials

|

7.4%

|

|

Information Technology

|

22.0%

|

|

Cash & Other

|

6.9%

|

TOP TEN STOCK HOLDINGS AS OF DECEMBER 31, 2011

|

|

% of net assets

|

|

Google Inc., Class A

|

5.00%

|

|

Microsoft Corp.

|

4.94%

|

|

Cisco Systems Inc.

|

4.44%

|

|

Target Corp.

|

4.44%

|

|

Johnson & Johnson

|

4.12%

|

|

PepsiCo Inc./NC

|

4.08%

|

|

3M Co.

|

3.76%

|

|

Berkshire Hathaway Inc., Class B

|

3.44%

|

|

US Bancorp

|

3.28%

|

|

Becton Dickinson & Co.

|

3.04%

|

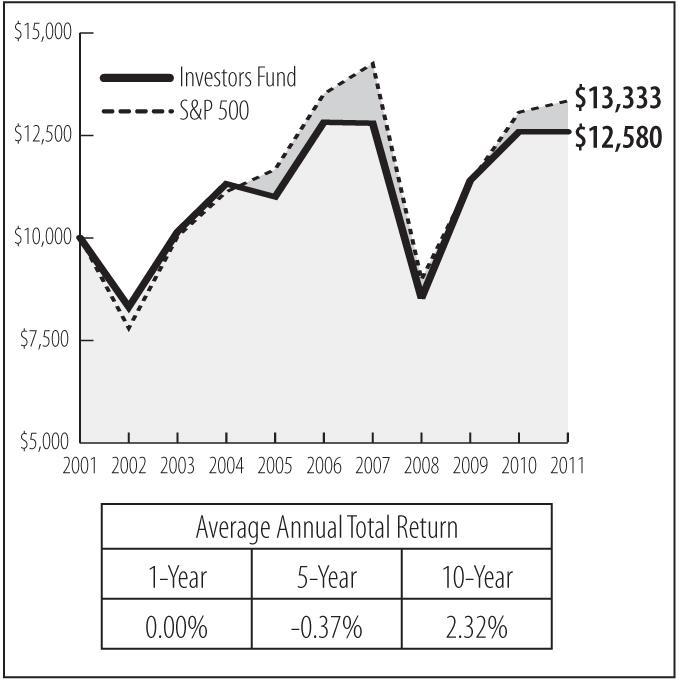

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT1.2

See accompanying Notes to Management’s Discussion of Fund Performance.

4 | Annual Report | December 31, 2011

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Mid-Cap Fund | continued

MADISON MOSAIC MID-CAP FUND (GTSGX)

|

FUND-AT-A-GLANCE

|

|

Objective: Madison Mosaic Mid-Cap seeks long-term capital appreciation through the investment in mid-sized growth companies.

|

|

Net Assets: $160.3 million

|

|

Date of Inception: July 21, 1983

|

|

Ticker: GTSGX

|

INVESTMENT STRATEGY HIGHLIGHTS

Madison Mosaic Mid-Cap Fund invests primarily in the common stocks of mid-sized U.S. corporations. The fund typically owns 25-40 securities which are selected using our long-held investment discipline of seeking the highest-quality, proven companies and purchasing them when valuations appear advantageous. We follow a rigorous three-step process when evaluating companies. We consider the business model, the management team and the valuation of each potential investment. We strive to purchase securities trading at a discount to their intrinsic value as determined by discounted cash flows. We corroborate this valuation work with additional valuation methodologies. The fund typically sells a stock when the fundamental expectations for the purchase no longer apply, the price exceeds its perceived value or other stocks appear more attractively priced relative to its prospects.

PERFORMANCE DISCUSSION WITH RICH EISINGER, CO-MANAGER OF MADISON MOSAIC MID-CAP FUND

How would you characterize the performance of Madison Mosaic Mid-Cap in 2011?

For some time we’ve been wary of the market’s indifference to risk, and 2011 was a year in which that trend appeared to reverse. In a highly volatile year, the fund protected capital in down markets, but also outperformed in the up markets, which hasn’t always been the case historically, especially when those rallies were more speculative. The fund ended the full year with a significant advantage over the benchmark Russell Midcap(R) Index, as the fund returned 5.10% while the Index lost -1.55%. The fund’s performance was even stronger in relation to its Morningstar peer group, Mid-Cap Growth, which lost -3.96%. Attribution also demonstrated that every sector in which the fund invested showed a positive stock selection for the full year. So those were gratifying results for us and the primary reason for its outperformance in 2011.

Did you make any significant changes to the portfolio since December 31, 2010?

Portfolio turnover was 32% for the year, which was consistent with its historic range. One addition over the course of the year was Valspar Corporation, a member of the Materials Sector. Valspar produces paint and coatings for a wide range of industrial applications. Our analysis showed that Valspar’s valuation wasn’t reflecting its attractive opportunities to expand its industrial coatings business into some new, large markets or the company’s ability to take market share in the consumer paint business. The fund saw an almost immediate positive impact from this addition, as the stock rallied strongly in the fourth quarter following its August and September purchases.

Late in the year, we added to the fund’s position in Richie Brothers Auctioneers. Ritchie Brothers is the world’s largest auctioneer selling used industrial equipment, such as industrial sized cranes, dump trucks and large earthmovers. It’s what we call a tollgate business. Ritchie Brothers is the third party that facilitates the sale of equipment between the seller and buyer, taking roughly a 10% commission. Their costs include inexpensive land where they hold these auctions and IT systems so they can conduct the auctions over the Internet, as they reach out to a global set of buyers and salespeople. We believe their growth potential is large since there are few obstacles to expanding worldwide, especially once demand returns with economic recovery. They currently have about 3% of the total global market, while possessing about a 20% share of the Canadian market, suggesting considerable potential to gain global market share. The stock has been depressed on global construction concerns which provided, in our view, a long-term opportunity to own a very high-quality business. We added to this position as it sold off in the fourth quarter.

Annual Report | December 31, 2011 | 5

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Mid-Cap Fund | continued

What factors were the strongest contributors to fund performance?

We achieved solid, consistent performance throughout the year within several areas in the portfolio. On a sector basis, the fund’s Consumer Discretionary, Consumer Staples, and Materials holdings posted double digit returns. Within the Financial Sector, which produced very strong relative returns for the fund, the insurance stocks that it owns, W.R. Berkley, Arch Capital, and Markel, were strongly additive to performance as a group. These stocks continue to grow book value nicely, and there are signs that insurance pricing, at the least, is stabilizing.

The Consumer Discretionary Sector was also very strong for the fund. Its most additive stock in this area was TJX, the off-price retailer with outlets under the T.J. Maxx and Marshalls names. It proved to be an ideal stock for this environment as its stores offer an attractive value proposition to consumers who are very frugal in this economy. Industrials were also a very strong sector for the fund. Copart, the seller of salvage vehicles, and Wabtec, a manufacturer of train components, two very high-confidence businesses for us, were quite strong on a relative basis and very additive to performance.

What factors were the largest constraints on performance?

One disappointment in the Consumer Discretionary sector was Staples, the seller of office products. We’ve had anemic white-collar employment growth and a lack of small and midsize business formation, and that really hampered results. Another stock that hurt performance, Brookfield Asset Management, was one of the fund’s larger holdings. It had strong years in 2009 and 2010, but was detractive from performance in 2011. Investors’ negative sentiment towards financials in general, and commercial real estate specifically, impacted the stock. Brookfield is also invested in several infrastructure-related businesses that have indirect ties to China. Towards the end of the year, concerns emerged that the Chinese economy was slowing, which furthered negative sentiment on the stock. However, Brookfield continues to generate strong cash flow and we have a great deal of confidence in management’s ability to allocate capital and create value for shareholders.

What do you see for Mid-Cap looking ahead to 2012?

We feel stocks offer very good long-term opportunity at this juncture. The U.S. banking system has improved relative to where it was a few years ago. Balance sheets have improved and a significant amount of bad debt has been written off. While there isn’t great demand for loans yet, that should eventually come as the economy picks up. The housing bubble created great risk and a lot of problems, but that bubble has popped. We feel that the bulk of the risk here is behind us and the likelihood of another financial debacle like we witnessed in 2008 is a very low probability.

It’s true that the consumer still faces headwinds with unemployment high and rising commodity costs. But the deleveraging process has begun, which is a good sign. It will still take some time, however, to completely work itself out. Housing represents a large part of the economy and we have confidence that over time, demand for housing will reach equilibrium with supply. When reached, this should positively impact unemployment and boost the domestic economy in general. Meanwhile, corporations are generally in good shape with strong balance sheets. Europe and the political situation in Washington certainly create a lot of uncertainty, but generally U.S. corporations have found a way to navigate through rough waters and continue to create shareholder value. We think that when investors look back at this period from the vantage point of several years in the future, it will be seen to have been an opportune time to invest in high-quality stocks.

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS

|

|

Consumer Discretionary

|

18.8%

|

|

Consumer Staples

|

4.0%

|

|

Energy

|

5.8%

|

|

Financials

|

24.9%

|

|

Health Care

|

9.0%

|

|

Industrials

|

14.2%

|

|

Information Technology

|

9.8%

|

|

Materials

|

7.3%

|

|

Cash & Other

|

6.2%

|

6 | Annual Report | December 31, 2011

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Mid-Cap Fund | continued

TOP TEN STOCK HOLDINGS AS OF DECEMBER 31, 2011

|

|

% of net assets

|

|

Markel Corp.

|

4.57%

|

|

Brookfield Asset Management Inc.

|

4.40%

|

|

TJX Cos. Inc.

|

4.17%

|

|

Ecolab Inc.

|

3.75%

|

|

Valspar Corp.

|

3.56%

|

|

WR Berkley Corp.

|

3.53%

|

|

Copart Inc.

|

3.36%

|

|

CarMax Inc.

|

3.24%

|

|

DENTSPLY International Inc.

|

3.18%

|

|

Laboratory Corp. of America Holdings

|

3.09%

|

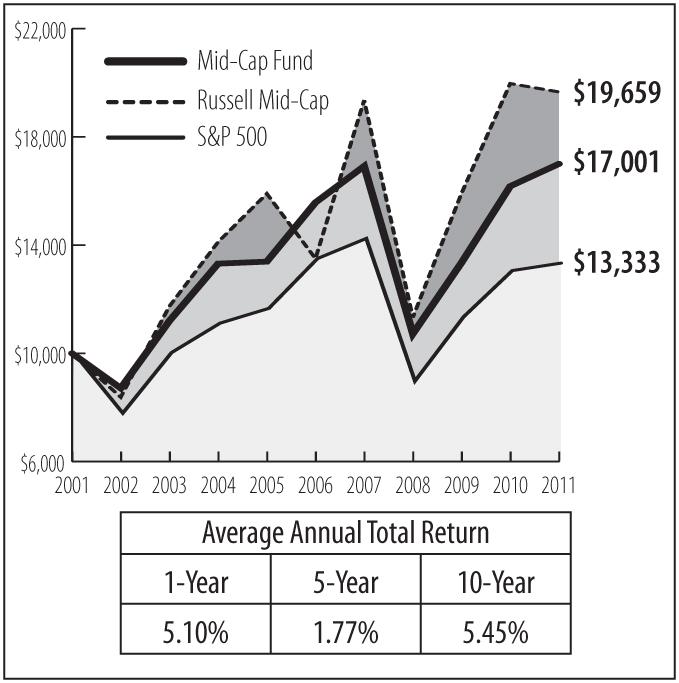

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT1.2

See accompanying Notes to Management’s Discussion of Fund Performance.

MADISON MOSAIC DISCIPLINED EQUITY (MADEX)

|

FUND-AT-A-GLANCE

|

|

Objective: Madison Mosaic Disciplined Equity seeks long-term growth with diversification among all equity market sectors.

|

|

Net Assets: $164.2 million

|

|

Date of Inception: December 31, 1997

|

|

Ticker: MADEX

|

INVESTMENT STRATEGY HIGHLIGHTS

Madison Mosaic Disciplined Equity Fund invests primarily in the common stocks of large-sized U.S. corporations. The fund seeks to maintain an overall sector weighting in line with the broader market, with monthly rebalancing. The fund typically owns 50-70 securities which are selected using our long-held investment discipline of seeking the highest-quality, proven companies and purchasing them when valuations appear advantageous. We follow a rigorous three-step process when evaluating companies. We consider the business model, the management team and the valuation of each potential investment. We strive to purchase securities trading at a discount to their intrinsic value as determined by discounted cash flows. We corroborate this valuation work with additional valuation methodologies. The fund typically sells a stock when the fundamental expectations for the purchase no longer apply, the price exceeds its perceived value or other stocks appear more attractively priced relative to its prospects.

PERFORMANCE DISCUSSION WITH JAY SEKELSKY, CO-MANAGER OF MADISON MOSAIC DISCIPLINED EQUITY FUND

How would you characterize the performance of the Disciplined Equity Fund for the period?

Against the fund’s benchmark S&P 500’s return of 2.11%, Disciplined Equity showed a gain of 1.68%. While trailing the Index a bit, the fund was ahead of its Morningstar Large Blend peer group which had a return of -1.27%. With our portfolio currently allocated across S&P 500 sectors, the relative results against the S&P 500 were largely a function of our stock selection. Given that the S&P 500 is an unmanaged index that has no expenses, we are please with our stock selection against the Index, with our emphasis on high-quality holdings playing out well for most of the year.

Have you made any significant changes to the portfolio since December 31, 2010?

As in the past, our equity positions are concentrated in large-cap companies which retain a leadership position in their industries and have shown the ability to produce

Annual Report | December 31, 2011 | 7

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Disciplined Equity Fund | continued

predictable earnings over time. In a volatile year, the fund’s turnover ratio was a bit higher than we would expect over time, at 57%, which suggests a holding period of slightly less than two years.

Although the management team’s objective is to maintain relative sector neutrality against the S&P 500, we are dedicated to actively managing a select group of stocks within each of these sectors. At the beginning of the period, the fund had 55 holdings and at the end of the period it held 51. Our goal is to own the highest quality companies we can in each sector of the market, a judgment made on an array of business metrics that boil down to a combination of attractive valuation and the ability to produce consistent, predictable earnings going forward. In many cases, this means selling a stock and replacing it with another we feel has greater potential.

This is what we did, for example, in the Consumer Staples Sector when we sold Walgreen Co. on disappointing business projections and added Nestle, a well-positioned international company which we felt was being unfairly punished by the European sovereign debt crisis. Our mid-year sale of Walgreen worked out well as the fund harvested positive returns for the year in a company which ended up dropping -13.3% for the period. While the turmoil in Europe kept pressure on Nestle’s stock price, we remain optimistic about the company’s prospects and potential with what we feel was an attractive year-end valuation.

What factors had the largest impact on this period’s performance?

The year saw quite a bit of disparity in S&P 500 sector returns, with Utilities and Consumer Staples up 14.8% and 10.5%, respectively, while Financials sank -18.4% and Materials dropped -11.6%. The fund’s results were similarly diverse, with strong double-digit returns from its utilities and consumer staples holdings, but negative returns from its financial, energy, and industrial holdings. That said, the fund’s financial stocks were much stronger than the overall market sector, as we emphasized insurance and money management companies over credit-sensitive banks. As a result, the fund had its best relative returns in this sector, followed by excellent relative and real results in technology.

In terms of individual stocks, among the fund’s best contributors were technology holding Qualcomm, discount retailer TJX Companies, alternative energy leader NextEra Energy Inc., and UnitedHealth Group Inc.

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS

|

|

Consumer Discretionary

|

9.9%

|

|

Consumer Staples

|

11.5%

|

|

Energy

|

11.4%

|

|

Financials

|

14.2%

|

|

Health Care

|

12.1%

|

|

Industrials

|

10.5%

|

|

Information Technology

|

18.3%

|

|

Materials

|

4.0%

|

|

Telecommunication Services

|

2.4%

|

|

Utilities

|

3.0%

|

|

Cash & Other

|

2.7%

|

TOP TEN STOCK HOLDINGS AS OF DECEMBER 31, 2011

|

|

% of net assets

|

|

Google Inc., Class A

|

3.90%

|

|

Johnson & Johnson

|

3.55%

|

|

Microsoft Corp.

|

3.22%

|

|

PepsiCo Inc./NC

|

3.01%

|

|

NextEra Energy Inc.

|

2.97%

|

|

Berkshire Hathaway Inc., Class B

|

2.64%

|

|

3M Co.

|

2.63%

|

|

Schlumberger Ltd.

|

2.48%

|

|

Cisco Systems Inc.

|

2.47%

|

|

AT&T Inc.

|

2.43%

|

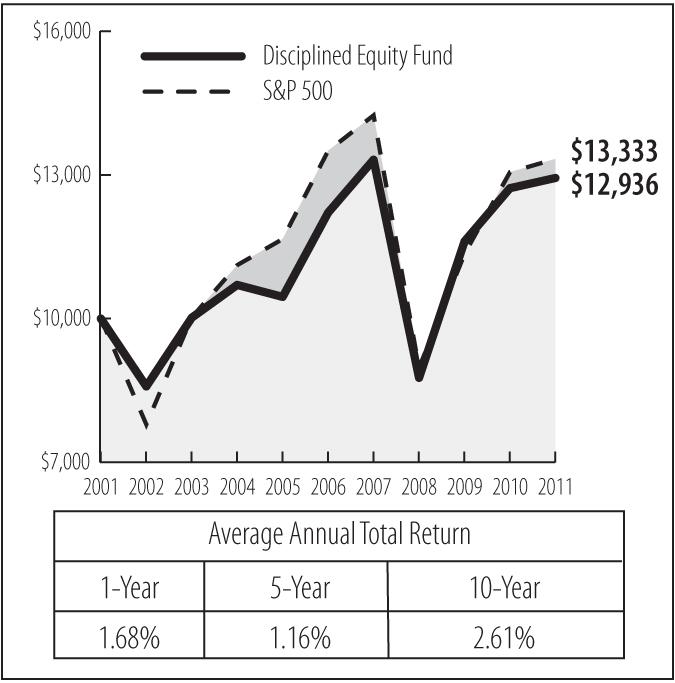

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT1.2

See accompanying Notes to Management’s Discussion of Fund Performance.

8 | Annual Report | December 31, 2011

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Balanced Fund | continued

MADISON MOSAIC BALANCED (BHBFX)

|

FUND-AT-A-GLANCE

|

|

Objective: For the period covered by this report, Madison Mosaic Balanced seeks to provide substantial current dividend income while providing opportunity for capital appreciation by investing in a combination of mid-to-large companies and government agency and investment grade corporate bonds.

|

|

Net Assets: $11.2 million

|

|

Date of Inception: December 18, 1986

|

|

Ticker: BHBFX

|

INVESTMENT STRATEGY HIGHLIGHTS

For the period covered by this report, Madison Mosaic Balanced Fund invested primarily in the common stocks of large-sized U.S. corporations along with an actively managed portfolio of investment-grade intermediate-term bonds. The bond exposure was targeted to be at least 30% of the fund’s total assets. The fund typically owned 25-40 securities on the stock side which were selected using our long-held investment discipline of seeking the highest-quality, proven companies and purchasing them when valuations appear advantageous. Bonds were managed to seek the best risk-adjusted return through active management of sectors (corporate, Treasury and Agency), duration, and yield-curve positioning.

PERFORMANCE DISCUSSION WITH JAY SEKELSKY AND PAUL LEFURGEY, CO-MANAGERS

How did the Balanced Fund perform for the year?

The Balanced Fund rose 1.73% for the year, a return just short of the S&P 500’s return of 2.11%. The fund outperformed its Morningstar category of Moderate Allocation which lost -0.11%. This one-year period was one which saw mixed results in the stock market, while just about every bond category had a strong year, although the returns on the shortest bonds continued to be constrained by extremely low interest rates. The fund’s bond holdings, which were conservatively postured with a short duration, had positive returns that trailed the overall bond market in a year in which long bonds soundly outperformed intermediate and short bonds. On the stock side, the portfolio mirrored the results of the Trust’s large-cap stock funds, Investors and Disciplined Equity, which modestly trailed the S&P 500 for the year for the reasons described above for those funds.

COMMON STOCK ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF DECEMBER 31, 2011

|

|

Consumer Discretionary

|

6.8%

|

|

Consumer Staples

|

10.8%

|

|

Energy

|

7.4%

|

|

Financials

|

13.7%

|

|

Health Care

|

11.7%

|

|

Industrials

|

6.4%

|

|

Information Technology

|

7.4%

|

|

Materials

|

1.1%

|

PORTFOLIO INVESTMENT BLEND AS A PERCENTAGE OF NET ASSETS AS OF DECEMBER 31, 2011

|

|

Common Stocks

|

65.3%

|

|

Corporate Bonds

|

18.1%

|

|

Government Bonds

|

14.4%

|

|

Cash & Other

|

2.2%

|

TOP FIVE STOCK AND FIXED INCOME HOLDINGS

AS OF DECEMBER 31, 2011

|

|

Top Five Stock Holdings

(65.3% of net assets in stocks)

|

% of net assets

|

|

Microsoft Corp.

|

3.26%

|

|

Chevron Corp.

|

3.14%

|

|

Target Corp.

|

3.04%

|

|

PepsiCo Inc./NC

|

2.98%

|

|

Pfizer Inc.

|

2.94%

|

|

Top Five Fixed Income Holdings

(32.5% of net assets in fixed income)

|

% of net assets

|

|

U.S. Treasury Note, 0.625%, 1/31/13

|

1.57%

|

|

U.S. Treasury Note, 0.625%, 12/31/12

|

1.57%

|

|

Federal Home Loan Bank, 5.5%, 8/13/14

|

1.51%

|

|

Freddie Mac, 4.875%, 11/15/13

|

1.45%

|

|

U.S.Treasury Note, 3.75%, 11/15/18

|

1.40%

|

Annual Report | December 31, 2011 | 9

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Balanced Fund | continued

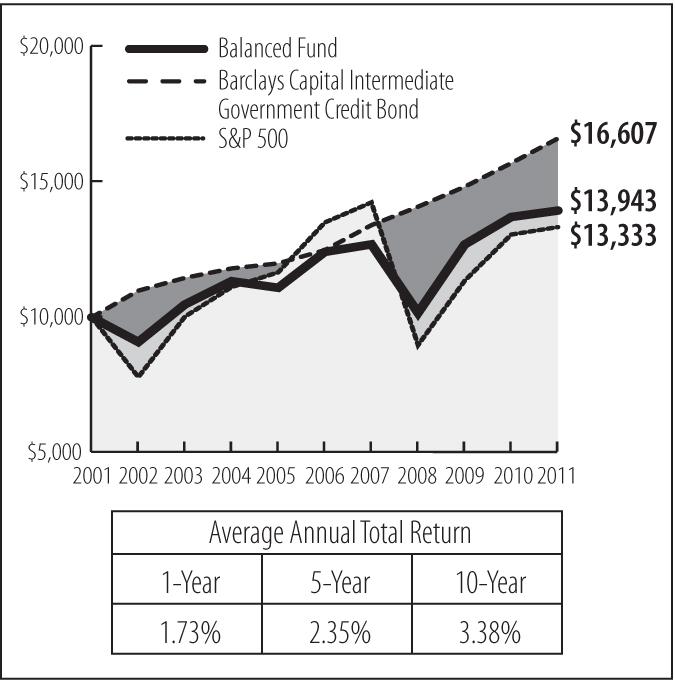

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT1.2

See accompanying Notes to Management’s Discussion of Fund Performance.

NORTHROAD INTERNATIONAL FUND (NRIEX)

|

FUND-AT-A-GLANCE

|

|

Objective: Beginning June 30, 2011, NorthRoad International seeks capital appreciation through investments in common stocks based outside the United States.

|

|

Net Assets: $1.6 million

|

|

Date of Inception: December 31, 2008*

|

|

Ticker: NRIEX

|

INVESTMENT STRATEGY HIGHLIGHTS

NorthRoad International returned -6.43% for 2011, a period which includes six months of operation under the fund’s previous small/mid-cap mandate. These domestic stock holdings were liquated on June 29, 2011 and the fund began implementing its new international strategy thereafter. The year 2011 was a tough year for international stocks, as the fund’s Morningstar peer group, Foreign Large Blend, dropped -13.97%, while the fund’s international benchmark, the MSCI EAFE Index, fell -11.67%.

In terms of the international management for the second half of the period, the environment was particularly difficult, with the EAFE Index dropping -16.16% for these six months. NorthRoad International showed considerably more resilience, with a second half return of -12.86%. The portfolio’s advantage during these months was largely due to management’s preference for high-quality, consistently profitable, well-established large companies who typically weather downturns better than the market as a whole, particularly economically sensitive cyclical or speculative enterprises.

While these results look discouraging, they actually reflect positive fourth quarter returns, a trend which brightens the prospects for 2012. Signs of improvement in the U.S. economy and hopes for improved coordination in the Eurozone, where the fund has its largest regional exposure, helped pare the sharp declines experienced in the third quarter. However, investors’ willingness to take on risk continued to be hampered by the European sovereign debt crisis. The sizeable amount of European sovereign debt that needs to be issued in 2012 and the potential impact of austerity programs on European economies continue to weigh heavily on sentiment. While the situation is most acute in the Eurozone, high levels of public indebtedness are a concern across the developed world. A slowdown in growth in key emerging markets also has dampened investor expectations. The outlook for the global economy is challenging and uncertain, however we continue to believe there are high quality businesses with strong balance sheets and healthy returns on capital trading at attractive

10 | Annual Report | December 31, 2011

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • NorthRoad Intl Fund | concluded

valuations. Just as environments of too much optimism in the markets make it difficult to find value, periods of pessimism create compelling opportunities for long-term, disciplined investors.

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS

|

|

Consumer Discretionary

|

4.5%

|

|

Consumer Staples

|

20.3%

|

|

Energy

|

12.3%

|

|

Financials

|

10.7%

|

|

Health Care

|

15.4%

|

|

Industrials

|

4.7%

|

|

Information Technology

|

9.0%

|

|

Materials

|

13.4%

|

|

Telecommunication Services

|

5.1%

|

|

Cash & Other

|

4.6%

|

TOP TEN STOCK HOLDINGS AS OF DECEMBER 31, 2011

|

|

% of net assets

|

|

Novartis AG, ADR

|

3.72%

|

|

Royal Dutch Shell PLC, ADR

|

3.52%

|

|

Diageo PLC, ADR

|

3.41%

|

|

GlaxoSmithKline PLC, ADR

|

3.39%

|

|

Unilever PLC, ADR

|

3.36%

|

|

Nestle S.A., ADR

|

3.30%

|

|

Givaudan S.A., ADR

|

3.29%

|

|

Total S.A., ADR

|

3.19%

|

|

Roche Holding AG, ADR

|

3.16%

|

|

Sanofi, ADR

|

3.15%

|

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT1.2

See accompanying Notes to Management’s Discussion of Fund Performance.

Annual Report | December 31, 2011 | 11

Madison Mosaic Equity Trust

NOTES TO MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

|

|

1This chart compares a $10,000 investment made in the fund to a $10,000 investment made in the index.

|

|

|

2Past performance is not predictive of future performance. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares and assumes all dividends have been reinvested.

|

|

|

3Prior to June 30, 2011, the NorthRoad International Fund was known as the Small/Mid-Cap Fund and had different investment objectives and strategies. Its portfolio holdings were liquidated on June 29, 2011, and the fund began inmplementing its new investment objectives and strategies thereafter.

|

|

|

4Due to the change in investment objectives and strategies effective June 30, 2011 (see footnote 3), the primary benckmark was changed from the Russell 2500(R) Index to the MSCI EAFE Index. The Russell 2500(R) will no longer be presented in future reports. The performance of the Fund under its respective investment objectives and strategies and its corresponding benchmark return was as follows:

|

| |

1/1/11-6/30/11

|

7/1/11-12/31/11

|

|

Small/Mid-Cap Fund

|

6.84%

|

–

|

|

Russell 2500(R)

|

8.06%

|

–

|

|

NorthRoad International Fund

|

–

|

-12.43%

|

|

MSCI EAFE

|

–

|

-16.21%

|

BENCHMARK DESCRIPTIONS

The Barclays Capital U.S. Intermediate Government/Credit Bond Index measures the performance of United States dollar-denominated United States Treasuries, government-related and investment-grade United States corporate securities that have a remaining maturity of greater than or equal to one year and less than 10 years. The Index does not reflect any investment management fees or transaction expenses, nor the effect of taxes, fees or other charges.

The Russell Midcap Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap Index is a subset of the Russell 1000(R) Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The S&P 500 Index is a widely recognized, unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. Neither index reflects any investment management fees or transaction expenses, nor the effects of taxes, fees or other charges.

The Russell 2500(R) Index measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as "smid" cap. The Russell 2500(R) Index is a subset of the Russell 3000(R) Index. It includes approximately 2500 of the smallest securities based on a combination of their market cap and current index membership. The Index does not reflect any investment management fees or transaction expenses, nor the effect of taxes, fees or other charges.

The S&P 500 Index is a widely recognized, unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. The index does not reflect any investment management fees or transaction expenses, nor the effects of taxes, fees or other charges.

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the US & Canada. The Index does not reflect any investment management fees or transaction expenses, nor the effect of taxes, fees or other charges.

12 | Annual Report | December 31, 2011

Madison Mosaic Equity Trust | December 31, 2011

Investors Fund • Portfolio of Investments

| |

|

|

|

COMMON STOCK - 93.1%

|

|

|

|

Consumer Discretionary - 8.2%

|

|

|

|

Staples Inc.

|

54,326

|

$ 754,588

|

|

Target Corp.

|

31,530

|

1,614,967

|

|

Walt Disney Co./The

|

16,506

|

|

| |

|

2,988,530

|

|

Consumer Staples - 11.1%

|

|

|

|

Coca-Cola Co./The

|

10,858

|

759,734

|

|

Diageo PLC, ADR

|

8,881

|

776,377

|

|

Kraft Foods Inc., Class A

|

26,755

|

999,567

|

|

PepsiCo Inc.

|

22,348

|

|

| |

|

4,018,468

|

|

Energy - 11.4%

|

|

|

|

Apache Corp.

|

7,070

|

640,401

|

|

Canadian Natural Resources Ltd.

|

22,978

|

858,688

|

|

Chevron Corp.

|

9,493

|

1,010,055

|

|

Occidental Petroleum Corp.

|

7,989

|

748,569

|

|

Schlumberger Ltd.

|

12,921

|

|

| |

|

4,140,346

|

|

Financials - 18.5%

|

|

|

|

Bank of New York Mellon Corp./The

|

37,003

|

736,730

|

|

Berkshire Hathaway Inc., Class B*

|

16,376

|

1,249,489

|

|

Brookfield Asset Management Inc.

|

30,269

|

831,792

|

|

Franklin Resources Inc.

|

9,518

|

914,299

|

|

Markel Corp.*

|

2,365

|

980,694

|

|

Northern Trust Corp.

|

20,857

|

827,189

|

|

US Bancorp

|

44,115

|

|

| |

|

6,733,504

|

|

Health Care - 14.5%

|

|

|

|

Becton Dickinson & Co.

|

14,775

|

1,103,988

|

|

Johnson & Johnson

|

22,831

|

1,497,257

|

|

Laboratory Corp. of America Holdings*

|

8,505

|

731,175

|

|

Stryker Corp.

|

19,033

|

946,130

|

|

UnitedHealth Group Inc.

|

19,731

|

|

| |

|

5,278,517

|

| |

|

|

|

Industrials - 7.4%

|

|

|

|

3M Co.

|

16,713

|

$ 1,365,953

|

|

Jacobs Engineering Group Inc.*

|

14,232

|

577,535

|

|

United Parcel Service Inc., Class B

|

10,240

|

|

| |

|

2,692,954

|

|

Information Technology - 22.0%

|

|

|

|

Cisco Systems Inc.

|

89,140

|

1,611,651

|

|

FLIR Systems Inc.

|

33,205

|

832,449

|

|

Google Inc., Class A*

|

2,813

|

1,816,917

|

|

Microsoft Corp.

|

69,092

|

1,793,628

|

|

QUALCOMM Inc.

|

18,508

|

1,012,388

|

|

Visa Inc., Class A

|

9,161

|

|

| |

|

|

|

Total Common Stock (Cost $31,428,024)

|

33,849,468

|

|

Repurchase Agreement - 6.9%

|

|

|

|

With U.S. Bank National Association issued 12/30/11 at 0.01%, due 1/3/12, collateralized by $1,617,889 in Fannie Mae Pool #695167 due 5/1/33 and $931,739 in Fannie Mae Pool #729590 due 7/1/18. Proceeds at maturity are $2,499,749 (Cost $2,499,748)

|

|

|

TOTAL INVESTMENTS - 100.0% (Cost $33,927,772)

|

36,349,216

|

|

NET OTHER ASSETS AND LIABILITIES - 0.0%

|

|

|

TOTAL ASSETS - 100.0%

|

|

|

*

|

Non-income producing

|

|

ADR

|

American Depository Receipt

|

|

PLC

|

Public Limited Company

|

See accompanying Notes to Financial Statements.

Annual Report | December 31, 2011 | 13

Madison Mosaic Equity Trust | December 31, 2011

Mid-Cap Fund • Portfolio of Investments

| |

|

|

|

COMMON STOCK - 93.8%

|

|

|

|

Consumer Discretionary - 18.8%

|

|

|

|

Bed Bath & Beyond Inc.*

|

62,955

|

$ 3,649,501

|

|

CarMax Inc.*

|

170,194

|

5,187,513

|

|

Discovery Communications Inc., Class C*

|

89,393

|

3,370,116

|

|

Liberty Global Inc., Class C*

|

87,969

|

3,476,535

|

|

Omnicom Group Inc.

|

94,590

|

4,216,822

|

|

Staples Inc.

|

252,247

|

3,503,711

|

|

TJX Cos. Inc.

|

103,519

|

|

| |

|

30,086,350

|

|

Consumer Staples - 4.0%

|

|

|

|

Brown-Forman Corp., Class B

|

39,569

|

3,185,700

|

|

McCormick & Co. Inc.

|

63,740

|

|

| |

|

6,399,471

|

|

Energy - 5.8%

|

|

|

|

Ensco PLC, ADR

|

54,205

|

2,543,299

|

|

EOG Resources Inc.

|

36,568

|

3,602,314

|

|

Noble Corp.*

|

104,780

|

|

| |

|

9,312,064

|

|

Financials - 24.9%

|

|

|

|

Arch Capital Group Ltd.*

|

115,510

|

4,300,437

|

|

Brookfield Asset Management Inc.

|

256,448

|

7,047,191

|

|

Brown & Brown Inc.

|

144,201

|

3,263,269

|

|

Glacier Bancorp Inc.

|

184,786

|

2,222,976

|

|

Leucadia National Corp.

|

157,998

|

3,592,875

|

|

M&T Bank Corp.

|

49,304

|

3,763,867

|

|

Markel Corp.*

|

17,671

|

7,327,633

|

|

T Rowe Price Group Inc.

|

49,682

|

2,829,390

|

|

WR Berkley Corp.

|

164,644

|

|

| |

|

40,009,745

|

|

Health Care - 9.0%

|

|

|

|

DENTSPLY International Inc.

|

145,784

|

5,100,982

|

|

Laboratory Corp. of America Holdings*

|

57,582

|

4,950,324

|

|

Techne Corp.

|

63,176

|

|

| |

|

14,363,700

|

| |

|

|

|

Industrials - 14.2%

|

|

|

|

Copart Inc.*

|

112,473

|

$ 5,386,332

|

|

IDEX Corp.

|

127,433

|

4,729,039

|

|

Jacobs Engineering Group Inc.*

|

118,125

|

4,793,512

|

|

Ritchie Bros Auctioneers Inc.

|

174,642

|

3,856,095

|

|

Wabtec Corp./DE

|

58,509

|

|

| |

|

22,857,683

|

|

Information Technology - 9.8%

|

|

|

|

Amphenol Corp., Class A

|

56,766

|

2,576,609

|

|

Broadridge Financial Solutions Inc.

|

204,689

|

4,615,737

|

|

FLIR Systems Inc.

|

166,073

|

4,163,450

|

|

Western Union Co./The

|

239,285

|

|

| |

|

15,725,140

|

|

Materials - 7.3%

|

|

|

|

Ecolab Inc.

|

103,935

|

6,008,482

|

|

Valspar Corp.

|

146,308

|

|

| |

|

|

|

Total Common Stock (Cost $125,910,273)

|

150,464,258

|

|

Repurchase Agreement - 4.9%

|

|

|

|

With U.S. Bank National Association issued 12/30/11 at 0.01%, due 1/3/12, collateralized by $5,029,011 in Fannie Mae Pool #695167 due 5/1/33 and $2,896,198 in Fannie Mae Pool #729590 due 7/1/18. Proceeds at maturity are $7,770,166 (Cost $7,770,164)

|

|

|

TOTAL INVESTMENTS - 98.7% (Cost $133,680,437)

|

158,234,422

|

|

NET OTHER ASSETS AND LIABILITIES - 1.3%

|

|

|

TOTAL ASSETS - 100.0%

|

|

|

*

|

Non-income producing

|

|

ADR

|

American Depository Receipt

|

|

PLC

|

Public Limited Company

|

See accompanying Notes to Financial Statements.

14 | Annual Report | December 31, 2011

Madison Mosaic Equity Trust | December 31, 2011

Disciplined Equity Fund • Portfolio of Investments

| |

|

|

|

COMMON STOCK - 97.3%

|

|

|

|

Consumer Discretionary - 9.9%

|

|

|

|

Discovery Communications Inc., Class C*

|

59,850

|

$ 2,256,345

|

|

Omnicom Group Inc.

|

68,402

|

3,049,361

|

|

Staples Inc.

|

179,245

|

2,489,713

|

|

Target Corp.

|

63,840

|

3,269,885

|

|

TJX Cos. Inc.

|

47,720

|

3,080,326

|

|

Walt Disney Co./The

|

58,180

|

|

| |

|

16,327,380

|

|

Consumer Staples - 11.5%

|

|

|

|

Coca-Cola Co./The

|

31,430

|

2,199,157

|

|

Costco Wholesale Corp.

|

23,705

|

1,975,101

|

|

Diageo PLC, ADR

|

40,245

|

3,518,218

|

|

Kraft Foods Inc., Class A

|

80,560

|

3,009,722

|

|

Nestle S.A., ADR

|

55,410

|

3,199,805

|

|

PepsiCo Inc.

|

74,500

|

|

| |

|

18,845,078

|

|

Energy - 11.4%

|

|

|

|

Apache Corp.

|

37,054

|

3,356,351

|

|

Canadian Natural Resources Ltd.

|

67,455

|

2,520,793

|

|

Chevron Corp.

|

23,349

|

2,484,334

|

|

ConocoPhillips

|

49,765

|

3,626,375

|

|

Occidental Petroleum Corp.

|

29,400

|

2,754,780

|

|

Schlumberger Ltd.

|

59,676

|

|

| |

|

18,819,101

|

|

Financials - 14.2%

|

|

|

|

Bank of New York Mellon Corp./The

|

110,000

|

2,190,100

|

|

Berkshire Hathaway Inc., Class B*

|

56,774

|

4,331,856

|

|

Brookfield Asset Management Inc.

|

105,985

|

2,912,468

|

|

Franklin Resources Inc.

|

26,941

|

2,587,952

|

|

M&T Bank Corp.

|

27,305

|

2,084,464

|

|

Markel Corp.*

|

7,646

|

3,170,567

|

|

Northern Trust Corp.

|

65,765

|

2,608,240

|

|

US Bancorp

|

126,610

|

|

| |

|

23,310,447

|

|

Health Care - 12.1%

|

|

|

|

Becton Dickinson & Co.

|

44,300

|

3,310,096

|

|

Johnson & Johnson

|

88,890

|

5,829,406

|

|

Laboratory Corp. of America Holdings*

|

30,176

|

2,594,231

|

|

Novartis AG, ADR

|

54,780

|

3,131,773

|

|

Stryker Corp.

|

62,750

|

3,119,303

|

|

UnitedHealth Group Inc.

|

38,910

|

|

| |

|

19,956,767

|

| |

|

|

|

Industrials - 10.5%

|

|

|

|

3M Co.

|

52,798

|

$ 4,315,181

|

|

Copart Inc.*

|

40,180

|

1,924,220

|

|

Emerson Electric Co.

|

49,925

|

2,326,006

|

|

Jacobs Engineering Group Inc.*

|

56,615

|

2,297,437

|

|

Rockwell Collins Inc.

|

44,600

|

2,469,502

|

|

United Parcel Service Inc., Class B

|

52,665

|

|

| |

|

17,186,897

|

|

Information Technology - 18.3%

|

|

|

|

Cisco Systems Inc.

|

224,815

|

4,064,655

|

|

FLIR Systems Inc.

|

110,325

|

2,765,848

|

|

Google Inc., Class A*

|

9,907

|

6,398,931

|

|

International Business Machines Corp.

|

12,993

|

2,389,153

|

|

Microsoft Corp.

|

203,525

|

5,283,509

|

|

QUALCOMM Inc.

|

62,775

|

3,433,793

|

|

Visa Inc., Class A

|

26,804

|

2,721,410

|

|

Western Union Co./The

|

160,425

|

|

| |

|

29,986,659

|

|

Materials - 4.0%

|

|

|

|

Ecolab Inc.

|

49,000

|

2,832,690

|

|

International Flavors & Fragrances Inc.

|

30,250

|

1,585,705

|

|

Praxair Inc.

|

19,680

|

|

| |

|

6,522,187

|

|

Telecommunication Services - 2.4%

|

|

|

|

AT&T Inc.

|

132,170

|

|

|

Utilities - 3.0%

|

|

|

|

NextEra Energy Inc.

|

80,245

|

|

|

Total Common Stock (Cost $152,841,429)

|

159,836,653

|

|

Repurchase Agreement - 2.7%

|

|

|

|

With U.S. Bank National Association issued 12/30/11 at 0.01%, due 1/3/12, collateralized by $2,816,979 in Fannie Mae Pool #695167 due 5/1/33 and $1,622,292 in Fannie Mae Pool #729590 due 7/1/18. Proceeds at maturity are $4,352,425 (Cost $4,352,424)

|

|

|

TOTAL INVESTMENTS - 100.0% (Cost $157,193,853)

|

164,189,077

|

|

NET OTHER ASSETS AND LIABILITIES - 0.0%

|

|

|

TOTAL ASSETS - 100.0%

|

|

|

*

|

Non-income producing

|

|

ADR

|

American Depository Receipt

|

|

PLC

|

Public Limited Company

|

See accompanying Notes to Financial Statements.

Annual Report | December 31, 2011 | 15

Madison Mosaic Equity Trust | December 31, 2011

Balanced Fund • Portfolio of Investments

| |

|

|

|

COMMON STOCK - 65.3%

|

|

|

|

Consumer Discretionary - 6.8%

|

|

|

|

Omnicom Group Inc.

|

2,700

|

$ 120,366

|

|

Staples Inc.

|

11,835

|

164,388

|

|

Target Corp.

|

6,645

|

340,357

|

|

Time Warner Inc.

|

3,700

|

|

| |

|

758,829

|

|

Consumer Staples - 10.8%

|

|

|

|

Coca-Cola Co./The

|

2,185

|

152,884

|

|

Diageo PLC, ADR

|

1,869

|

163,388

|

|

Kraft Foods Inc., Class A

|

5,640

|

210,710

|

|

Nestle S.A., ADR

|

1,500

|

86,622

|

|

PepsiCo Inc.

|

5,017

|

332,878

|

|

Procter & Gamble Co./The

|

2,600

|

173,446

|

|

Wal-Mart Stores Inc.

|

1,400

|

|

| |

|

1,203,592

|

|

Energy - 7.4%

|

|

|

|

Chevron Corp.

|

3,300

|

351,120

|

|

ConocoPhillips

|

4,400

|

320,628

|

|

Ensco PLC, ADR

|

3,400

|

|

| |

|

831,276

|

|

Financials - 13.7%

|

|

|

|

Axis Capital Holdings Ltd.

|

3,800

|

121,448

|

|

Bank of New York Mellon Corp./The

|

7,707

|

153,446

|

|

BlackRock Inc.

|

700

|

124,768

|

|

Franklin Resources Inc.

|

2,023

|

194,330

|

|

M&T Bank Corp.

|

1,300

|

99,242

|

|

Northern Trust Corp.

|

3,347

|

132,742

|

|

Travelers Cos. Inc./The

|

4,600

|

272,182

|

|

US Bancorp

|

10,055

|

271,988

|

|

Wells Fargo & Co.

|

5,900

|

|

| |

|

1,532,750

|

|

Health Care - 11.7%

|

|

|

|

Johnson & Johnson

|

4,870

|

319,375

|

|

Medtronic Inc.

|

4,400

|

168,300

|

|

Merck & Co. Inc.

|

7,700

|

290,290

|

|

Novartis AG, ADR

|

3,635

|

207,813

|

|

Pfizer Inc.

|

15,200

|

|

| |

|

1,314,706

|

|

Industrials - 6.4%

|

|

|

|

3M Co.

|

3,494

|

285,564

|

|

Emerson Electric Co.

|

1,600

|

74,544

|

|

Illinois Tool Works Inc.

|

2,500

|

116,775

|

|

United Parcel Service Inc., Class B

|

2,135

|

156,261

|

|

Waste Management Inc.

|

2,700

|

|

| |

|

721,461

|

| |

|

|

|

Information Technology - 7.4%

|

|

|

|

Cisco Systems Inc.

|

10,000

|

$ 180,800

|

|

Intel Corp.

|

4,650

|

112,762

|

|

International Business Machines Corp.

|

400

|

73,552

|

|

Linear Technology Corp.

|

3,100

|

93,093

|

|

Microsoft Corp.

|

14,055

|

|

| |

|

825,075

|

|

Materials - 1.1%

|

|

|

|

Air Products & Chemicals Inc.

|

1,400

|

|

|

Total Common Stock (Cost $6,955,300)

|

7,306,955

|

| |

|

|

|

CORPORATE NOTES AND BONDS - 18.1%

|

|

|

Consumer Discretionary - 0.5%

|

|

|

|

Comcast Cable Communications Holdings Inc., 8.375%, 3/15/13

|

$ 55,000

|

|

|

Consumer Staples - 2.0%

|

|

|

|

Costco Wholesale Corp., 5.3%, 3/15/12

|

100,000

|

100,931

|

|

Sysco Corp., 5.25%, 2/12/18

|

100,000

|

|

| |

|

218,278

|

|

Energy - 4.0%

|

|

|

|

BP Capital Markets PLC, 3.875%, 3/10/15

|

52,000

|

55,568

|

|

Devon Energy Corp., 6.3%, 1/15/19

|

100,000

|

122,495

|

|

Marathon Oil Corp., 6%, 10/1/17

|

100,000

|

116,495

|

|

Valero Energy Corp., 6.875%, 4/15/12

|

150,000

|

|

| |

|

447,007

|

|

Financials - 4.3%

|

|

|

|

Allstate Corp./The, 6.2%, 5/16/14

|

100,000

|

111,588

|

|

American Express Co., 4.875%, 7/15/13

|

150,000

|

156,918

|

|

Berkshire Hathaway Finance Corp., 4.85%, 1/15/15

|

100,000

|

110,853

|

|

General Electric Capital Corp., 4.8%, 5/1/13

|

100,000

|

|

| |

|

484,081

|

|

Health Care - 1.3%

|

|

|

|

Abbott Laboratories, 5.6%, 11/30/17

|

125,000

|

|

|

Industrials - 1.1%

|

|

|

|

United Parcel Service Inc., 5.5%, 1/15/18

|

100,000

|

|

|

Information Technology - 4.8%

|

|

|

|

Cisco Systems Inc., 5.5%, 2/22/16

|

100,000

|

116,482

|

|

Hewlett-Packard Co., 4.5%, 3/1/13

|

100,000

|

102,874

|

|

Oracle Corp., 4.95%, 4/15/13

|

100,000

|

105,638

|

|

Texas Instruments Inc., 2.375%, 5/16/16

|

100,000

|

104,275

|

|

Western Union Co./The, 5.93%, 10/1/16

|

100,000

|

|

| |

|

542,063

|

|

Total Corporate Notes and Bonds (Cost $1,900,463)

|

|

2,020,712

|

See accompanying Notes to Financial Statements.

16 | Annual Report | December 31, 2011

Madison Mosaic Equity Trust | Balanced Fund • Portfolio of Investments | December 31, 2011 | concluded

| |

|

|

|

U.S. GOVERNMENT AND AGENCY OBLIGATIONS - 14.4%

|

|

|

|

Fannie Mae - 2.3%

|

|

|

|

4.875%, 5/18/12

|

$ 150,000

|

$ 152,780

|

|

2.375%, 7/28/15

|

100,000

|

|

| |

|

258,378

|

|

Federal Home Loan Bank - 1.5%

|

|

|

|

5.5%, 8/13/14

|

150,000

|

|

|

Freddie Mac - 1.5%

|

|

|

|

4.875%, 11/15/13

|

150,000

|

|

|

U.S. Treasury Note - 9.1%

|

|

|

|

1%, 4/30/12

|

15,000

|

15,049

|

|

1.875%, 6/15/12

|

75,000

|

75,624

|

|

0.625%, 12/31/12

|

175,000

|

175,848

|

|

0.625%, 1/31/13

|

175,000

|

175,882

|

|

0.5%, 11/15/13

|

75,000

|

75,357

|

|

4.25%, 8/15/14

|

100,000

|

110,172

|

|

3.125%, 10/31/16

|

125,000

|

138,623

|

|

3.75%, 11/15/18

|

135,000

|

157,075

|

|

3.125%, 5/15/19

|

85,000

|

|

| |

|

1,018,949

|

|

Total U.S. Government and Agency

Obligations (Cost $1,535,961)

|

1,609,053

|

| |

|

|

|

Repurchase Agreement - 1.0%

|

|

|

|

With U.S. Bank National Association issued 12/30/11 at 0.01%, due 1/3/12, collateralized by $77,020 in Fannie Mae Pool #695167 due 5/1/33 and $44,356 in Fannie Mae Pool #729590 due 7/1/18. Proceeds at maturity are $119,002 (Cost $119,002)

|

|

|

TOTAL INVESTMENTS - 98.8% (Cost $10,510,726)

|

11,055,722

|

|

NET OTHER ASSETS AND LIABILITIES - 1.2%

|

|

|

TOTAL ASSETS - 100.0%

|

|

|

*

|

Non-income producing

|

|

ADR

|

American Depository Receipt

|

|

PLC

|

Public Limited Company

|

See accompanying Notes to Financial Statements.

Annual Report | December 31, 2011 | 17

Madison Mosaic Equity Trust | December 31, 2011

NorthRoad International Fund • Portfolio of Investments

| |

|

|

|

COMMON STOCK - 95.4%

|

|

|

|

Consumer Discretionary - 4.5%

|

|

|

|

Reed Elsevier PLC, ADR

|

973

|

$ 31,369

|

|

WPP PLC, ADR

|

785

|

|

| |

|

72,370

|

|

Consumer Staples - 20.3%

|

|

|

|

Carrefour S.A., ADR

|

5,370

|

24,036

|

|

Diageo PLC, ADR

|

633

|

55,337

|

|

Imperial Tobacco Group PLC, ADR

|

657

|

49,725

|

|

Kao Corp., ADR

|

1,784

|

48,762

|

|

Nestle S.A., ADR

|

927

|

53,532

|

|

Tesco PLC, ADR

|

2,277

|

42,830

|

|

Unilever PLC, ADR

|

1,625

|

|

| |

|

328,692

|

|

Energy - 12.3%

|

|

|

|

ENI SpA, ADR

|

1,223

|

50,473

|

|

Petroleo Brasileiro S.A., ADR

|

1,646

|

40,903

|

|

Royal Dutch Shell PLC, ADR

|

780

|

57,010

|

|

Total S.A., ADR

|

1,013

|

|

| |

|

200,161

|

|

Financials - 10.7%

|

|

|

|

Allianz SE, ADR

|

3,276

|

31,432

|

|

AXA S.A., ADR

|

2,102

|

27,410

|

|

Banco Santander S.A., ADR

|

3,634

|

27,328

|

|

HSBC Holdings PLC, ADR

|

1,130

|

43,053

|

|

Mitsubishi UFJ Financial Group Inc., ADR

|

10,728

|

|

| |

|

174,173

|

|

Health Care - 15.4%

|

|

|

|

GlaxoSmithKline PLC, ADR

|

1,203

|

54,893

|

|

Novartis AG, ADR

|

1,054

|

60,257

|

|

Roche Holding AG, ADR

|

1,205

|

51,288

|

|

Sanofi, ADR

|

1,399

|

51,119

|

|

Teva Pharmaceutical Industries Ltd., ADR

|

786

|

|

| |

|

249,280

|

|

Industrials - 4.7%

|

|

|

|

Schneider Electric S.A., ADR

|

3,657

|

38,624

|

|

Secom Co. Ltd., ADR

|

3,282

|

|

| |

|

76,482

|

| |

|

|

|

Information Technology - 9.0%

|

|

|

|

Canon Inc., ADR

|

1,104

|

$ 48,620

|

|

Nintendo Co. Ltd., ADR

|

1,598

|

27,520

|

|

SAP AG, ADR

|

755

|

39,977

|

|

Telefonaktiebolaget LM Ericsson, ADR

|

2,870

|

|

| |

|

145,190

|

|

Materials - 13.4%

|

|

|

|

Akzo Nobel NV, ADR

|

862

|

41,806

|

|

BHP Billiton Ltd.-Spon, ADR

|

523

|

36,939

|

|

CRH PLC, ADR

|

2,285

|

45,289

|

|

Givaudan S.A., ADR

|

2,788

|

53,369

|

|

Syngenta AG, ADR*

|

668

|

|

| |

|

216,775

|

|

Telecommunication Services - 5.1%

|

|

|

|

France Telecom S.A., ADR

|

2,671

|

41,828

|

|

NTT DoCoMo Inc., ADR

|

2,269

|

|

| |

|

83,464

|

|

Total Common Stock (Cost $1,718,467)

|

1,546,587

|

|

Repurchase Agreement - 4.3%

|

|

|

|

With U.S. Bank National Association issued 12/30/11 at 0.01%, due 1/3/12, collateralized by $44,807 in Fannie Mae Pool #695167 due 5/1/33 and $25,804 in Fannie Mae Pool #729590 due 7/1/18. Proceeds at maturity are $69,229 (Cost $69,229)

|

|

|

TOTAL INVESTMENTS - 99.7% (Cost $1,787,696)

|

1,615,816

|

|

NET OTHER ASSETS AND LIABILITIES - 0.3%

|

|

|

TOTAL ASSETS - 100.0%

|

|

|

*

|

Non-income producing

|

|

ADR

|

American Depository Receipt