ANNUAL REPORT

December 31, 2010

Madison Mosaic Equity Trust

Investors Fund

Mid-Cap Fund

Small/Mid-Cap Fund

Disciplined Equity Fund

Balanced Fund

(Mosaic logo)

CONTENTS

|

Special Message from Your Portfolio Managers: On Risk Management

|

1

|

|

Management’s Discussion of Fund Performance

|

2

|

|

Economic Review

|

2

|

|

Outlook

|

3

|

|

Interview with Jay Sekelsky

|

3

|

|

Investors Fund

|

3

|

|

Mid-Cap Fund

|

6

|

|

Small/Mid-Cap Fund

|

8

|

|

Disciplined Equity Fund

|

9

|

|

Balanced Fund

|

10

|

|

Notes to Management’s Discussion of Fund Performance

|

12

|

|

Portfolio of Investments

|

|

|

Investors Fund

|

13

|

|

Mid-Cap Fund

|

14

|

|

Small/Mid-Cap Fund

|

15

|

|

Disciplined Equity Fund

|

16

|

|

Balanced Fund

|

17

|

|

Statements of Assets and Liabilities

|

19

|

|

Statements of Operations

|

20

|

|

Statements of Changes in Net Assets

|

21

|

|

Financial Highlights

|

23

|

|

Notes to Financial Statements

|

26

|

|

Report of Independent Registered Public Accounting Firm

|

32

|

|

Other Information

|

33

|

|

Trustees and Officers

|

37

|

Madison Mosaic Equity Trust

Special Message from Your Portfolio Managers: On Risk Management

Given that one can put a similar amount of check marks in the positive and negative columns regarding the top-down investment landscape, it’s worth reviewing how we invest when faced with uncertainty. For us, it’s important to have an informed view of the macroeconomic world. However, we also recognize that forecasts are almost always wrong. Rather than become attached to any one view, we accept this uncertainty, perhaps hearing some truth in a quotation attributed to Mark Twain that reads, "It’s not what we don’t know that hurts us; it’s what we know for sure that just ain’t so." For us, the critical element is not having precise forecasts of the economy and financial markets or sectors, but in having a strong risk management strategy should unpleasant surprises occur.

One thing that cannot be inferred from just looking at returns is how much risk was taken to achieve them. We feel that we take lower than average risk, and we believe it’s important that our fellow investors understand how we approach risk and uncertainty.

There are many different definitions of risk. Beginning in the 1960’s the academic world has defined risk, according to the capital market pricing model, or "CAPM," as the relative volatility of stock price movements. In other words, the more a stock price moves around in relation to other stocks, the riskier it is purported to be. However, to practitioners, this definition is unsatisfactory. As Warren Buffett asked in his 1993 letter to Berkshire Hathaway shareholders, does an investment become riskier if the market offers it to you at a lower price? If we feel we have made a reasonably good estimate for the value of the business, we see a lower stock price as an opportunity rather than a risk.

In contrast with the academic definition of risk we subscribe to a more practical one that will likely feel more pertinent to you. By our definition, investment risk is the likelihood that the underlying value of an investment becomes impaired, thus leading to the unpleasant condition of having to eventually "sell low" after having "bought high."

Our thinking on the dynamics of risk includes the progression noted in the steps below. In our daily work and market observations, this feels like a very recognizable dynamic that affords us opportunities to buy great businesses at very reasonable or sometimes even cheap prices.

A course of events can take many pathways, and people can’t know ahead of time which path will be followed.

Because the future will hold surprises securities will react to the new information by adjusting in price. Investment markets are usually fairly efficient at quickly pricing in new information, but not always to an appropriate degree.

Price adjustments in financial markets often overshoot to the upside and to the downside due to psychological idiosyncrasies that prohibit people from being perfectly rational decision makers.

Since we believe stock market prices and the underlying values of businesses sometimes diverge, we aim to take advantage of these occasional discrepancies by looking to buy a stock for less than its fair value. We expect these discrepancies will be corrected or closed over time.

By thinking about markets and risk in this way, we end up inverting the academic definition of risk. We’re delighted when overreactions in stock prices create buying opportunities. We believe we’re reducing risk if we buy good values offered to us by the market at low or reasonable prices. According to our thinking, the most important risks we take involve our judgments and assessments of the underlying values of the stocks we analyze. The cheaper a stock price in relation to its value, the better the protection we have against both macroeconomic uncertainty and imperfections inherent in our own estimates and analyses.

The final piece to our risk management strategy is to invest in high-quality businesses with what we believe are astute, ethical, and proven management teams. High quality, to us, most often means that our targeted businesses have what we deem are sustainable competitive advantages that enable them to achieve market share gains and exercise pricing power. It also means that management teams have demonstrated the ability to allocate capital well, toward the end of building more profitable businesses over time. These characteristics have lead to our owning stocks with earning profiles that are relatively steady over economic cycles. This steadiness allows us to feel more comfortable in our

Madison Mosaic Equity Trust | Special Message From Your Portfolio Managers | concluded

estimates of the values of the businesses since the earnings (our valuation inputs) don’t swing wildly.

We believe protection of investor capital in periods of stress and participation in the subsequent upside opportunities, can lead to outperformance over the course of a full business cycle. However, there’s a flipside to this approach, too. That is, when risk is hidden and animal spirits abound, our approach might trail that of those who invest in more speculative stocks. At these times, risks may lie silent for long periods, and no one appears any worse off for venturing up the risk curve. Nonetheless the risks persist, and often are exposed at the most inopportune times.

We’re confident the market will have overreactions that will offer us opportunities to choose from high-quality stocks at low prices in 2011 and beyond. In the meantime, we expect our portfolios of high-quality stocks will benefit from increasing demand commensurate with economic recovery.

Regarding stocks as an asset class, we also feel strongly about the proposition offered by stock ownership today. Leading businesses with competitive advantages offer pricing power as a hedge against future inflation, and earnings that continue to grow from productivity gains. Shareholders, as owners of these businesses, share in the prosperity afforded by innovation and advances in productivity, and benefit from the collective ingenuity of our business, science, and working professionals. We think the case for owning stocks remains strong over the next decade.

As always, we appreciate that you’ve entrusted us with your money, we take our fiduciary responsibility seriously, and we remain invested in the Mosaic Funds with you. We look forward to the prospect of growing our investments together through 2011 and beyond.

Respectfully,

The Madison Mosaic Funds Equity Management Team

Management’s Discussion of Fund Performance

ECONOMIC REVIEW

With returns of all the major U.S. stock indices up strongly, 2010 will be remembered as a good year for stock investors. The S&P 500 finished with a total return of 15.1% and mid-cap and small-cap indices outpaced the broader indices, with returns well above 20%. But these returns were mostly a late-year phenomenon and it is easy to forget how rocky returns were for much of the period. After a rally in March and April, investors began to get nervous. The spreading sovereign debt crisis in Europe helped generate widespread fears of a double-dip recession. Throughout much of the summer the S&P 500, widely regarded as the best proxy for the U.S. stock market in general, was showing negative returns for the year.

Just as economic indicators were suggesting that we were more likely to see a muted recovery than a double-dip recession the markets received a significant catalyst from the Federal Reserve, in both words and action. In an Op-Ed piece in the Washington Post published on November 4, Chairman Ben Bernanke explained the Fed’s rationale for introducing a second round of quantitative easing, dubbed QE2, where the Fed committed to purchase another $600 billion of longer-term Treasury securities by mid-2011. Bernanke essentially linked the Fed’s considerable monetary easing to an anticipated (or at least hoped for) rise in stock prices, which would in turn boost consumer confidence and ultimately spending. It seemed to work in the latter part of 2010, with the S&P 500 advancing 10.8% during the fourth quarter of 2010.

Madison Mosaic’s Equity Trust Funds all produced solid positive returns for the year, ranging from the 8.02% return of Madison Mosaic Balanced to the 21.15% return of Mosaic Mosaic Mid-Cap. However, after showing good relative performance during the market’s mid-year retreat, in the end we could not match the sharp rallies which drove the overall positive returns for the period. This result is consistent with Madison Mosaic’s historic performance and investment discipline, which favors high-quality companies with consistent and predictable earnings. For the year, smaller, lower-quality companies were in favor while more defensive sectors such as Health Care and Consumer Staples were laggards compared with the more traditionally

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance | continued

cyclical sectors of Materials, Consumer Discretionary, and Industrials.

OUTLOOK

Looking forward, we are encouraged by recent economic data. It would appear that moderate economic growth is in the cards for at least the first half of 2011. Generally, this would be considered a good backdrop for investors. Nonetheless, significant and cautionary macroeconomic issues persist. Housing market data continues to disappoint. European sovereign debt issues remain while domestically, state and local governments struggle to meet their financial obligations. As with past economic recoveries, the economic data will likely be volatile and capital markets will respond similarly. Ironically, one of our current concerns is the level of investor complacency that has rather suddenly returned to the stock market. Current sentiment is strongly bullish, while volatility has declined to near three-year lows; from our perspective, this is cause for some short-term caution.

In light of these lingering macro issues, the question we are constantly asking ourselves is, "where are we being appropriately compensated for the still very real risks that are out there?" In our opinion, the one clear answer to this question is quality. In this economic environment, we’d prefer to own companies with strong free cash flows, high earnings predictability and low volatility. Ideally, we would also be able to purchase these same "best of breed" companies at a discount to the market. As we conclude a volatile 2010 we are encouraged that we do not have to pay up for these "world class" companies; in fact they sport some of the lowest relative valuations in the stock market. From our perspective, this is a terrific opportunity, one we look to capitalize on going forward.

INTERVIEW WITH JAY SEKELSKY

Can you summarize the performance of the funds in Equity Trust in 2010?

Can you summarize the performance of the funds in Equity Trust in 2010?

After the deep losses of 2008 and early 2009, investors must have been heartened to see the strong rally that began in March of 2009 continue into 2010. However, as long-time shareholders know, a rapidly rising rally that rewards more cyclical and speculative companies is not the best environment for our investment discipline. As a result, we were not displeased when the market rally paused at several points during the year. We showed good resilience in general when the market took these breathers and when investors seemed to show renewed interest in stock fundamentals. But by the fourth quarter we were back into a steep market rally that seemed to be quite indifferent to company-specific metrics. So in the end 2010 became for us a story of good absolute returns, but trailing relative results. That said, when you look at our funds over the past three years, which is really a full market cycle including the crash of 2008, we feel very good about how well shareholders in Equity Trust funds have weathered what was the worst storm to have hit the market in our lifetimes.

MADISON MOSAIC INVESTORS FUND (MINVX)

|

FUND-AT-A-GLANCE

|

|

Objective: Madison Mosaic Investors seeks long-term capital appreciation through investments in large growth companies.

|

|

Net Assets: $42.9 million

|

|

Date of Inception: November 1, 1978

|

|

Ticker: MINVX

|

INVESTMENT STRATEGY HIGHLIGHTS

Madison Mosaic Investors Fund invests primarily in the common stocks of large-sized U.S. corporations. The fund typically owns 25-40 securities which are selected using our long-held investment discipline of seeking the highest-quality, proven companies and purchasing them when valuations appear advantageous. We follow a rigorous three-step process when evaluating companies. We consider the business model, the management team and the valuation of each potential investment. We strive to purchase securities trading at a discount to their intrinsic value as determined by discounted cash flows. We corroborate this valuation work with additional valuation

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Investors Fund | continued

methodologies. The fund typically sells a stock when the fundamental expectations for the purchase no longer apply, the price exceeds its perceived value or other stocks appear more attractively priced relative to its prospects.

PERFORMANCE DISCUSSION WITH LEAD EQUITY MANAGER

JAY SEKELSKY

How did the fund perform in 2010?

The Investors Fund ended the year with a gain of 10.44%, trailing our S&P 500 benchmark’s 15.06%. We faced a number of headwinds over this one-year period. While we always favor fundamentally sound, well-managed companies, the market can go through periods where there is less discrimination among stocks and even a preference for highly leveraged, more speculative enterprises. Such was the case for much of the trailing period. While we tend to own companies at the upper end of Standard & Poor’s quality rankings, in 2010 companies rated A+ and A by S&P trailed every other S&P quality category and returned half of the lowest category, C&D. Our stock selection discipline which includes a strong valuation screen, looks at companies one at a time. This process led us to above-benchmark weightings in Health Care, Consumer Staples and Information Technology, sectors which all trailed the benchmark in 2010. While it is harder to make generalizations of the sources of return of the fund’s peer group, it was a period where managers hewing closer to the standard large-cap benchmarks would have outperformed our results, while it was also possible to be rewarded for owning a higher percentage of more speculative or smaller companies. We found many of the best investment opportunities among very large domestic companies during a period when the top 20 largest companies in the S&P 500 underperformed as a group. Four of our top ten holdings were among these large companies (Microsoft, Google, IBM and Johnson & Johnson) and all underperformed the market.

Have you made any significant changes to the portfolio since December 31, 2009?

As bottom-up stock pickers we’re less thematic and more opportunistic. Because we seek companies with significant competitive advantages which we expect to be long term, and because we aren’t shifting the portfolio to reflect macro trends, we tend to make changes more gradually than some other managers. In 2010 we had turnover of 41%, close to our historic norm. This level of turnover implies that while we didn’t make drastic changes, there were shifts of note. For instance, Technology became the largest weight in our portfolio. It started the year at about 17% and by year-end we were up to about 23%. Again, not because we decided that the Technology Sector was the most promising as a general theme, but because we found the most attractive companies and valuations there. Meanwhile, Health Care was a fairly high weighting at the start of the year, at about 20%. It ended the period closer to 16.8% of the portfolio. We had found some compelling valuations in this sector as the market reacted to the impact of health care reform. We felt that those concerns did not apply globally to the sector, which produced some good buying opportunities. Many of those stocks rebounded over the course of the year and we sold into that rally. We started with a low weight in the consumer discretionary area and it continued to go down as the year unfolded, since it was difficult to find valuations there that met our criteria.

We added two strong-conviction names to our top-ten holdings over the period and both were additive to performance in 2010. We consider Chevron the best positioned of the integrated oil producers, with strong production coming online and good prospects for additional production. The company also benefited from the rise in oil prices over the course of the period. The second addition to our largest holdings is U.S. Bancorp, a well managed, profitable bank which avoided the excesses of the credit crisis which crippled many other large banking operations. U.S Bancorp has a diversified and attractive business mix that provides a less cyclical earnings stream and requires less capital intensity than many competitors. Their positive brand, business model, business investments, and underwriting discipline should allow them to gain market share and succeed despite a difficult economic environment.

What factors were the strongest contributors to fund performance?

Although 2010 was a strong year for stocks, there was wide disparity in results by sector, with the strongest S&P 500 sector, Consumer Discretionary, outperforming the worst, Health Care, by some 25%. As a result, sector allocation proved to be an important factor in relative returns. We had strong returns from our three consumer discretionary

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Investors Fund | continued

holdings, Target, Walt Disney and Yum! Brands. Despite having a slightly lower-than-index weighting in financial stocks, our holdings produced returns greater than their S&P sector.

On an individual stock basis, the greatest contribution to our positive returns came from Technology holding Qualcomm, Consumer Discretionary’s Yum!Brands, and Financial Sector’s Berkshire Hathaway. We also were rewarded for owning Energy Sector stocks Schlumberger and Chevron, and retailers Costco and Target.

What factors were the largest constraints on performance?

Four S&P 500 sectors outperformed the overall index, and we were underweighted in three of them: Materials, Consumer Discretionary, and Industrials. The fourth best performing sector was Energy, and although we had a slight overweighting, our emphasis on drilling and natural gas companies produced returns below the sector average. At the same time, we had a significant overweighting to Health Care, a sector which as a whole was barely positive for the year. Even though our stock selection was relatively strong, it was not enough to overcome the market’s general disdain for the entire sector over health care reform concerns. In an up market, holding cash is always a performance dampener when compared to a cash-free index, and this was the case in 2010.

On an individual security level the laggards were Health Care holding Quest Diagnostics which we sold in the later part of the period, Technology’s EMC Corporation, which we also sold during the period, Health Care holding Covance, tech giant Microsoft and Energy Sector holding Noble Corporation.

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS

|

|

Consumer Discretionary

|

4.6%

|

|

Consumer Staples

|

14.8%

|

|

Energy

|

12.8%

|

|

Financials

|

15.8%

|

|

Health Care

|

16.8%

|

|

Industrials

|

7.9%

|

|

Information Technology

|

23.0%

|

|

Cash & Other

|

4.3%

|

TOP TEN STOCK HOLDINGS AS OF DECEMBER 31, 2010

|

|

% of net assets

|

|

Microsoft Corp.

|

4.04%

|

|

Cisco Systems Inc.

|

3.73%

|

|

Google Inc., Class A

|

3.64%

|

|

International Business Machines Corp.

|

3.57%

|

|

Johnson & Johnson

|

3.47%

|

|

PepsiCo Inc./NC

|

3.38%

|

|

Chevron Corp.

|

3.36%

|

|

US Bancorp

|

3.26%

|

|

Bank of New York Mellon Corp./The

|

3.14%

|

|

3M Co.

|

3.10%

|

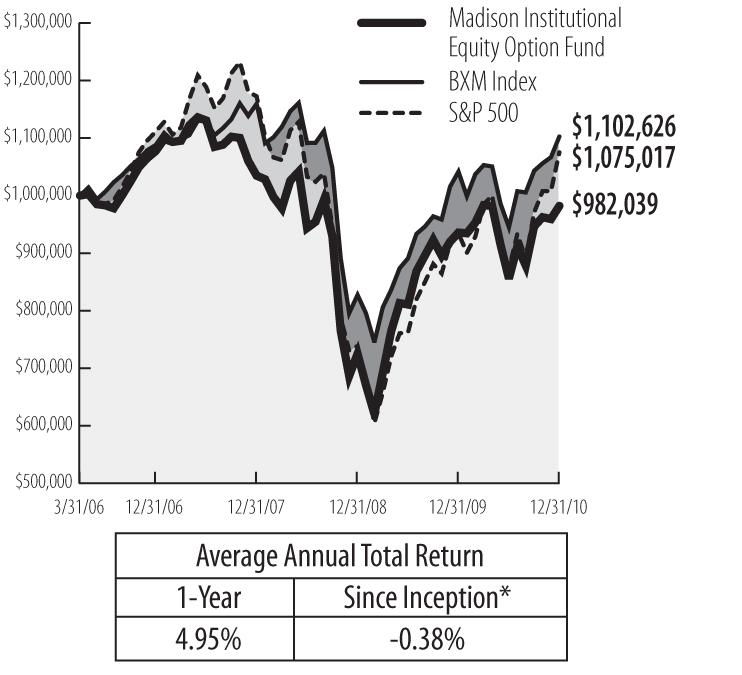

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT1.2

See accompanying Notes to Management’s Discussion of Fund Performance.

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Mid-Cap Fund | continued

MADISON MOSAIC MID-CAP FUND (GTSGX)

|

FUND-AT-A-GLANCE

|

|

Objective: Madison Mosaic Mid-Cap seeks long-term capital appreciation through the investment in mid-sized growth companies.

|

|

Net Assets: $159.4 million

|

|

Date of Inception: July 21, 1983

|

|

Ticker: GTSGX

|

INVESTMENT STRATEGY HIGHLIGHTS

Madison Mosaic Mid-Cap Fund invests primarily in the common stocks of mid-sized U.S. corporations. The fund typically owns 25-40 securities which are selected using our long-held investment discipline of seeking the highest-quality, proven companies and purchasing them when valuations appear advantageous. We follow a rigorous three-step process when evaluating companies. We consider the business model, the management team and the valuation of each potential investment. We strive to purchase securities trading at a discount to their intrinsic value as determined by discounted cash flows. We corroborate this valuation work with additional valuation methodologies. The fund typically sells a stock when the fundamental expectations for the purchase no longer apply, the price exceeds its perceived value or other stocks appear more attractively priced relative to its prospects.

PERFORMANCE DISCUSSION WITH RICH EISINGER, CO-MANAGER OF MADISON MOSAIC MID-CAP

How would you characterize the performance of Madison Mosaic Mid-Cap in 2010?

How would you characterize the performance of Madison Mosaic Mid-Cap in 2010?

Given the amount of risk incurred, we were content with our strong absolute returns in 2010. While we are never pleased to trail our benchmark, given the market environment and our style of investment, a 21.15% was a strong absolute number and a reasonable relative one. Our benchmark, the Russell Midcap¨ Index, returned 25.48% while the broader market, as measured by the S&P 500, was up 15.06%. Overall, this was a period in which smaller market-cap stocks in the Mid-Cap Index beat larger market stocks, the stocks of cyclical companies beat more predictable companies and lower-quality stocks outperformed higher-quality companies. Our discipline and holdings put us on the wrong side of each of these trends as we favor more predictable, high-quality businesses. However, when we did enter periods where we saw more investor concerns, as during the mid-year downturn, our stocks did decidedly better. In the end, we look back at 2010 as a year during which our investment style was out of favor. However, we believe we are in the late innings of a lower quality, speculative rally. As in previous recoveries, the market should eventually favor the higher-quality, solid businesses we prefer for the long run.

Did you make any significant changes to the portfolio since December 31, 2009?

While the market ended the year well ahead of its starting point, it wasn’t a smooth ride. When we reported at mid-year the fund and Russell Midcap¨ Index were negative for the first six months of the year. A volatile market often produces opportunities.

Our sector exposure showed some significant shifts over the year as we decreased our Consumer Discretionary exposure from 17.7% to 14.1%, saw our stake in financial firms grow from 17.3% to 24.3%, and our Technology Sector increased from 2.2% to 12.2%. As always, these shifts were not the result of top-down sector calls, but a result of company-by-company analysis as we seek the strongest possible holdings at reasonable valuations. That said, bottom-up stock selection often reveals macro trends, and it was no coincidence that we pared our Consumer Discretionary exposure; the sector that led the market in 2010. Meanwhile, the Technology Sector had below-market performance for the year and we were able to find some compelling valuations in this area of the economy.

We also had significant continuity across the year as seven of our 10 top holdings, which represented over one-third of our assets at year end, were stocks we held a year ago. The three new holdings in our top 10 are FLIR Systems, a company which specializes in thermal visioning technology and a firm we have held in the past, Brown & Brown, a leading insurance broker, and Arch Capital Group, a worldwide insurance and reinsurance company.

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Mid-Cap Fund | continued

What factors were the strongest contributors to fund performance?

In terms of absolute return, our strongest performing stocks tended to line up with the leading sectors of Consumer Discretionary and Industrials. Relative to our Index, we had excellent returns in the Financial, Consumer Staples, and Technology Sectors. Our top performing individual securities included Brookfield Asset Management, whose stock was up over 53% for the year, and two stocks which we sold during the period, Expeditors International of Washington which reached our price target, and technology firm Teradata. Two of our stronger relative contributors came from the Consumer Discretionary Sector, Interactive Data Corporation which supplies financial data to investment firms, and international cable provider Liberty Global.

What factors were the largest constraints on performance?

As a manager whose discipline leads us to reliable, steady companies, a year where cyclical sectors and stocks were favored is almost always a challenging one. We were particularly week in our Energy Sector holdings, as our holdings suffered from the indirect effects of the Gulf oil spill and from lower natural gas pricing. Our preference for steadier companies among our industrial holdings was a detriment and as always during a stock rally, our cash position was a constraint.

In terms of individual holdings, off-shore driller Noble Corporation was negatively impacted by the Gulf oil spill and its consequences, and its stock had a negative return in a period in which the Energy Sector as a whole was positive. Another similar result was seen from Southwestern Energy Company whose fortunes were tied to the sliding prices of natural gas. A slow recovery in the dental markets hurt Health Care holding Dentsply, while long-time holding Markel had below-market returns on weak insurance pricing and low investment yields in its investment portfolio.

What do you see for Mid-Cap looking ahead to 2011?

The mid-cap asset class has had tremendous relative performance over the last decade, a trend which suggests moderating future returns. As the period progressed we found better values toward the higher end of the mid-cap market-cap spectrum. This suggests that at some point the smaller cap stocks should take a pause. We believe there is good value towards the higher end of the spectrum in our universe.

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS

|

|

Consumer Discretionary

|

14.1%

|

|

Consumer Staples

|

3.9%

|

|

Energy

|

7.2%

|

|

Financials

|

24.3%

|

|

Health Care

|

15.3%

|

|

Industrials

|

15.7%

|

|

Information Technology

|

12.2%

|

|

Materials

|

2.5%

|

|

Cash & Other

|

4.8%

|

TOP TEN STOCK HOLDINGS AS OF DECEMBER 31, 2010

|

|

% of net assets

|

|

Brookfield Asset Management Inc.

|

5.09%

|

|

Copart Inc.

|

3.99%

|

|

Techne Corp.

|

3.90%

|

|

Markel Corp.

|

3.86%

|

|

Laboratory Corp. of America Holdings

|

3.40%

|

|

DENTSPLY International Inc.

|

3.34%

|

|

Bed Bath & Beyond Inc.

|

3.08%

|

|

FLIR Systems Inc.

|

3.00%

|

|

Brown & Brown Inc.

|

2.99%

|

|

Arch Capital Group Ltd.

|

2.94%

|

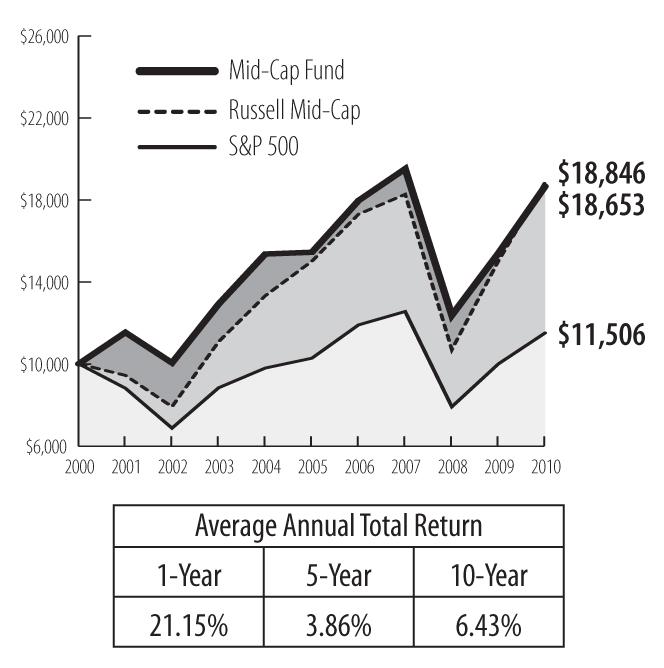

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT1.2

See accompanying Notes to Management’s Discussion of Fund Performance.

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Small/Mid-Cap Fund | continued

MADISON MOSAIC SMALL/MID-CAP FUND (MADMX)

|

FUND-AT-A-GLANCE

|

|

Objective: Madison Mosaic Small/Mid-Cap seeks long-term capital appreciation through the investment in small and mid-sized growth companies.

|

|

Net Assets: $1.8 million

|

|

Date of Inception: December 31, 2008

|

|

Ticker: MADMX

|

INVESTMENT STRATEGY HIGHLIGHTS

Madison Mosaic Small/Mid-Cap Fund invests primarily in the common stocks of small-to-mid-sized U.S. corporations. The fund typically owns 40-80 securities which are selected using our long-held investment discipline of seeking the highest-quality, proven companies and purchasing them when valuations appear advantageous. We follow a rigorous three-step process when evaluating companies. We consider the business model, the management team and the valuation of each potential investment. We strive to purchase securities trading at a discount to their intrinsic value as determined by discounted cash flows. We corroborate this valuation work with additional valuation methodologies. The fund typically sells a stock when the fundamental expectations for the purchase no longer apply, the price exceeds its perceived value or other stocks appear more attractively priced relative to its prospects.

Madison Mosaic Small/Mid-Cap Fund returned 18.42% for the year, a solid absolute number, although it trailed the fund’s benchmark, the Russell 2500¨ Index, which was up 26.71% for the year. As was true of Madison Mosaic Mid-Cap, the fund had a hard time overcoming the fundamental trends of the market rally that began in 2009 and continued, with a couple notable pauses, in 2010. This rally was led by highly leveraged, cyclical and lower-quality companies, while our discipline is designed to emphasize just the opposite.

The fund kept up with the hot Consumer Discretionary Sector, thanks to strong returns form AutoZone, Yum!Brands, Lamar Advertising, and Lumber Liquidators. Our overall picks were able to overcome disappointing returns from Sears Holdings and ITT Educational Services. While we added value with our financial holdings, we lagged in the more cyclical sectors of Energy, Industrials and Materials, where we tend to lean towards the steadier companies rather than the volatile ones which led the market. Brookfield Asset Management led our Financial Sector returns, while three Industrial Sector holdings, Fastenal, Wabtec and Expeditors International had great years.

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS

|

|

Consumer Discretionary

|

13.0%

|

|

Consumer Staples

|

3.1%

|

|

Energy

|

8.0%

|

|

Financials

|

19.8%

|

|

Health Care

|

12.0%

|

|

Industrials

|

12.3%

|

|

Information Technology

|

11.2%

|

|

Materials

|

3.1%

|

|

Telecommunication Services

|

1.9%

|

|

Cash & Other

|

15.6%

|

TOP TEN STOCK HOLDINGS AS OF DECEMBER 31, 2010

|

|

% of net assets

|

|

Brookfield Asset Management Inc.

|

2.68%

|

|

Copart Inc.

|

2.57%

|

|

DENTSPLY International Inc.

|

2.47%

|

|

Laboratory Corp. of America Holdings

|

2.25%

|

|

iShares Gold Trust

|

2.12%

|

|

FLIR Systems Inc.

|

2.11%

|

|

Techne Corp.

|

2.07%

|

|

Markel Corp.

|

2.02%

|

|

Arch Capital Group Ltd.

|

1.97%

|

|

Broadridge Financial Solutions Inc.

|

1.97%

|

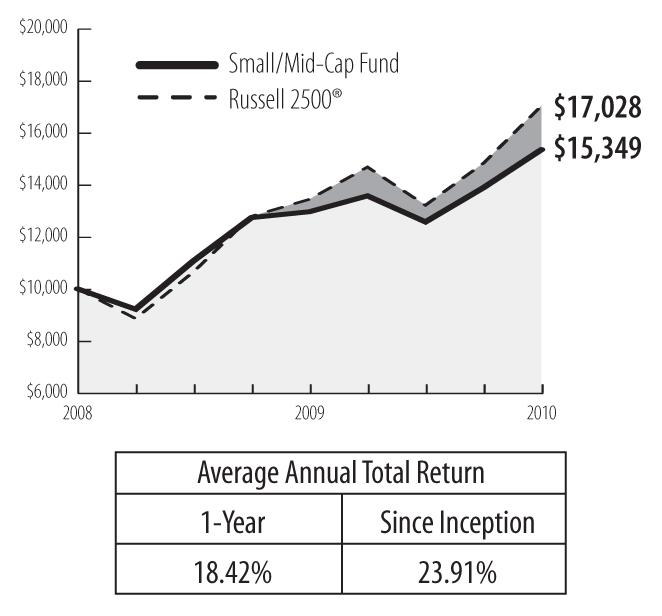

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT1.2

See accompanying Notes to Management’s Discussion of Fund Performance.

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Disciplined Equity Fund | continued

MADISON MOSAIC DISCIPLINED EQUITY (MADEX)

|

FUND-AT-A-GLANCE

|

|

Objective: Madison Mosaic Disciplined Equity seeks long-term growth with diversification among all equity market sectors.

|

|

Net Assets: $99.0 million

|

|

Date of Inception: December 31, 1997

|

|

Ticker: MADEX

|

INVESTMENT STRATEGY HIGHLIGHTS

Madison Mosaic Disciplined Equity Fund invests primarily in the common stocks of large-sized U.S. corporations. The fund seeks to maintain an overall sector weighting in line with the broader market, with quarterly rebalancing. The fund typically owns 50-70 securities which are selected using our long-held investment discipline of seeking the highest-quality, proven companies and purchasing them when valuations appear advantageous. We follow a rigorous three-step process when evaluating companies. We consider the business model, the management team and the valuation of each potential investment. We strive to purchase securities trading at a discount to their intrinsic value as determined by discounted cash flows. We corroborate this valuation work with additional valuation methodologies. The fund typically sells a stock when the fundamental expectations for the purchase no longer apply, the price exceeds its perceived value or other stocks appear more attractively priced relative to its prospects.

PERFORMANCE DISCUSSION WITH JAY SEKELSKY

How would you characterize the performance of the Disciplined Equity Fund for the period?

Against the fund’s benchmark S&P 500’s return of 15.06%, Disciplined Equity showed a modest return of 9.58%. While we continue to believe that our discipline will lead to excellent performance over time, it was not rewarded this year, when lower-quality, smaller and more speculative stocks led the market.

Have you made any significant changes to the portfolio since December 31, 2009?

As in the past, our equity positions are concentrated in large-cap companies which retain a leadership position in their industries and have shown the ability to produce predictable earnings over time.

Although the management team’s objective is to maintain relative sector neutrality against the S&P 500, we are dedicated to actively managing a select group of stocks within each of these sectors. At the beginning of the period the fund had 57 holdings and at the end of the period it held 55. Our goal is to own the highest quality companies we can in each sector of the market, a judgment made on an array of business metrics that boil down to a combination of attractive valuation and the ability to produce consistent, predictable earnings going forward. In many cases, this means selling a stock and replacing it with another we feel has greater potential. This is what we did, for example, in the Consumer Discretionary Sector as we sold AutoZone as it reached what we considered full valuation and ITT Educational Services when our projections for the company’s growth no longer seemed valid. We added advertising agency Omnicom Group as an industry leader poised to benefit from an improving economy and increased ad spending and retailer Staples, which we consider a high-quality company which was available at an attractive valuation.

What factors had the largest impact on this period’s performance?

All S&P 500 sectors were positive for the year, but there was quite a bit of disparity in return, with Consumer Discretionary leading Health Care by some 25%. This phenomenon was also true within sectors and performance varied widely depending on your holdings. We had excellent returns from our Financial Sector holdings as quality remained on investors’ minds as we still felt echoes of the 2008 credit crisis. While we maintained market-like exposure to the cyclical sectors, our high-quality bias was not additive during this period. In fact, most of our underperformance was in the cyclical sectors, notably Industrials and Energy where the more volatile cyclicals had the performance edge over our steadier choices. We also had individual security disappoints in our energy stocks, as driller Noble Corporation underperformed due to the Gulf oil spill and its consequences and Southwestern Energy Company underperformed due to the weakness of natural gas pricing. As is always the case in an up market, our cash position was a detriment when compared to the cash-free benchmark.

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Disciplined Equity Fund | continued

In terms of individual stocks, among the fund’s best relative performers were technology holding Qualcomm, ConocoPhillips, and Berkshire Hathaway.

|

SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS

|

|

Consumer Discretionary

|

10.2%

|

|

Consumer Staples

|

10.4%

|

|

Energy

|

11.3%

|

|

Financials

|

15.5%

|

|

Health Care

|

11.2%

|

|

Industrials

|

10.2%

|

|

Information Technology

|

18.4%

|

|

Materials

|

2.9%

|

|

Telecommunication Services

|

2.2%

|

|

Utilities

|

3.1%

|

|

Cash & Other

|

4.6%

|

TOP TEN STOCK HOLDINGS AS OF DECEMBER 31, 2010

|

|

% of net assets

|

|

Microsoft Corp.

|

3.36%

|

|

Chevron Corp.

|

2.91%

|

|

Google Inc., Class A

|

2.88%

|

|

International Business Machines Corp.

|

2.75%

|

|

3M Co.

|

2.61%

|

|

Cisco Systems Inc.

|

2.36%

|

|

US Bancorp

|

2.28%

|

|

PepsiCo Inc./NC

|

2.19%

|

|

AT&T Inc.

|

2.16%

|

|

Schlumberger Ltd.

|

2.10%

|

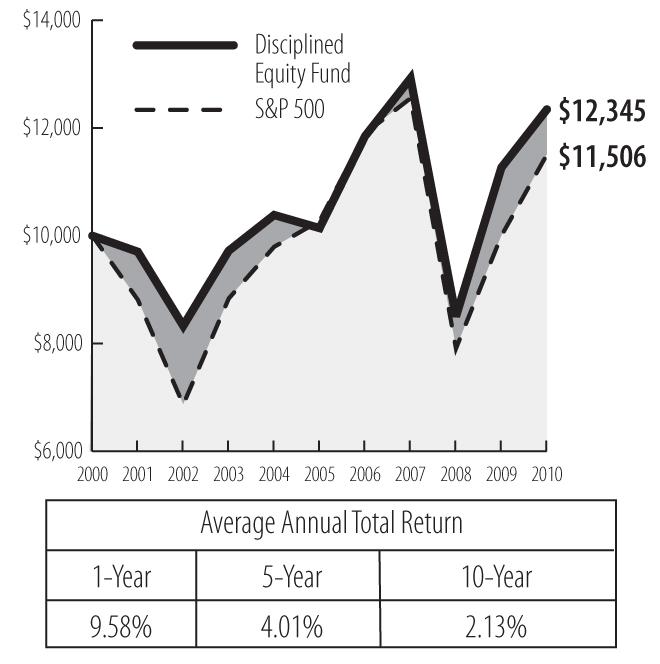

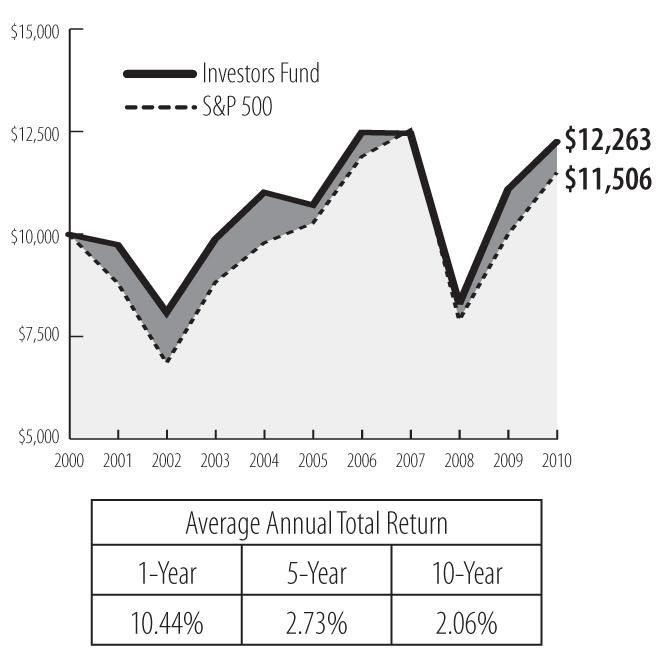

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT1.2

See accompanying Notes to Management’s Discussion of Fund Performance.

MADISON MOSAIC BALANCED (BHBFX)

|

FUND-AT-A-GLANCE

|

|

Objective: Madison Mosaic Balanced seeks to provide substantial current dividend income while providing opportunity for capital appreciation by investing in a combination of mid-to-large companies and government agency and investment grade corporate bonds.

|

|

Net Assets: $12.3 million

|

|

Date of Inception: December 18, 1986

|

|

Ticker: BHBFX

|

INVESTMENT STRATEGY HIGHLIGHTS

Madison Mosaic Balanced Fund invests primarily in the common stocks of large-sized U.S. corporations along with an actively managed portfolio of investment-grade intermediate-term bonds. The bond exposure is targeted to be at least 30% of the fund’s total assets. The fund typically owns 25-40 securities on the stock side which are selected using our long-held investment discipline of seeking the highest-quality, proven companies and purchasing them when valuations appear advantageous. Bonds are managed to seek the best risk-adjusted return through active management of sectors (corporate, Treasury and Agency), duration, and yield-curve positioning.

PERFORMANCE DISCUSSION WITH JAY SEKELSKY

AND PAUL LEFURGEY.

How did the Balanced Fund perform for the year?

The Balanced Fund rose 8.02% for the year, a return which reflects the fund’s risk management. The S&P 500 rose 15.06% during the period while the Barclays Capital Intermediate Government Credit Index was up 5.89%. This one-year period was one in which riskier assets in both stocks and bonds led the market, and the peer group has shown historical performance which indicates a higher risk

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Balanced Fund | continued

profile than Mosaic’s. Madison Mosaic Balanced is managed with the belief that shareholders in the fund are primarily interested in participating in up markets while receiving protection in down markets. As a result we avoided the more speculative edges of both the stock and bond markets in a year in which smaller, lower-quality stocks outperformed, as did riskier bond assets. Mosaic Balanced held the stocks of larger, established companies and a bond portfolio heavily favoring high-quality issuance and duration that was shorter, and thus more conservative, than the widely used benchmark, Barclays Capital Government/Credit Bond Index.

Have you made any significant changes to the portfolio since December 31, 2009?

The stock holdings of Balanced mirror the holdings of Mosaic Investors, as discussed above. These holdings continue to focus on solid, well-established domestic companies that have proven their earning ability through difficult times. One of the factors in our management of Balanced is the mix of stocks and bonds, with 70% being the highest allowable percentage of stocks. We began the period holding a 64.4% allocation to stocks and ended the period with a similar 65.4% exposure, a sign that we consider the potential returns of stocks to show greater prospects than those of bonds over the upcoming months.

On the bond side, we kept our relatively high exposure to corporate bonds, 16.9% at the end of period compared to 17.8% at the beginning. We continue to favor the higher yield of high-quality corporate bonds over similar maturity government issuance. However, in both corporate and government issuance we are favoring shorter durations, a stance which would be beneficial if intermediate-term interest rates were to rise, a scenario we consider likely over the next annual period.

How did the stock holdings in Balanced contribute to overall performance?

The stock holdings in Balanced were solidly positive for the year, but the fund’s holdings could not keep up with the benchmark S&P 500. The holdings mirror the stocks held in Mosaic Investors, discussed at some length above.

How did the bond holdings in Balanced contribute to overall performance?

Bond management produced widely divergent results in 2010, with exceptional returns for the riskiest corporate bonds. Our bonds produced positive returns for the portfolio, but did not match the broader market. We benefited from avoiding higher-risk securities when uncertainty and fear took center stage mid-year, but as the risk trade resumed, our bond holdings could not keep pace with the rapid upswing of lower quality bonds or portfolios with significant exposure to these bonds.

COMMON STOCK ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF DECEMBER 31, 2010

|

|

Consumer Discretionary

|

3.1%

|

|

Consumer Staples

|

10.3%

|

|

Energy

|

8.8%

|

|

Financials

|

10.7%

|

|

Health Care

|

11.5%

|

|

Industrials

|

5.3%

|

|

Information Technology

|

15.7%

|

PORTFOLIO INVESTMENT BLEND AS A PERCENTAGE OF NET ASSETS AS OF DECEMBER 31, 2010

|

|

Common Stocks

|

65.4%

|

|

Corporate Bonds

|

16.9%

|

|

Government Bonds

|

15.2%

|

|

Cash & Other

|

2.5%

|

TOP FIVE STOCK AND FIXED INCOME HOLDINGS

AS OF DECEMBER 31, 2010

|

|

% of net assets

|

|

Top Five Stock Holdings

(65.4% of net assets in stocks)

|

|

Microsoft Corp.

|

2.88%

|

|

Cisco Systems Inc.

|

2.47%

|

|

Google Inc., Class A

|

2.47%

|

|

International Business Machines Corp.

|

2.45%

|

|

PepsiCo Inc./NC

|

2.40%

|

| |

|

|

% of net assets

|

|

Top Five Fixed Income Holdings

(32.1% of net assets in fixed income)

|

|

U.S. Treasury Note, 1%, 7/31/11

|

3.28%

|

|

U.S. Treasury Note, 3.125%, 10/31/16

|

2.55%

|

|

U.S.Treasury Note, 3.75%, 11/15/18

|

1.61%

|

|

Federal Home Loan Bank, 5.5%, 8/13/14

|

1.40%

|

|

Freddie Mac, 4.875%, 11/15/13

|

1.36%

|

Madison Mosaic Equity Trust | Management’s Discussion of Fund Performance • Balanced Fund | concluded

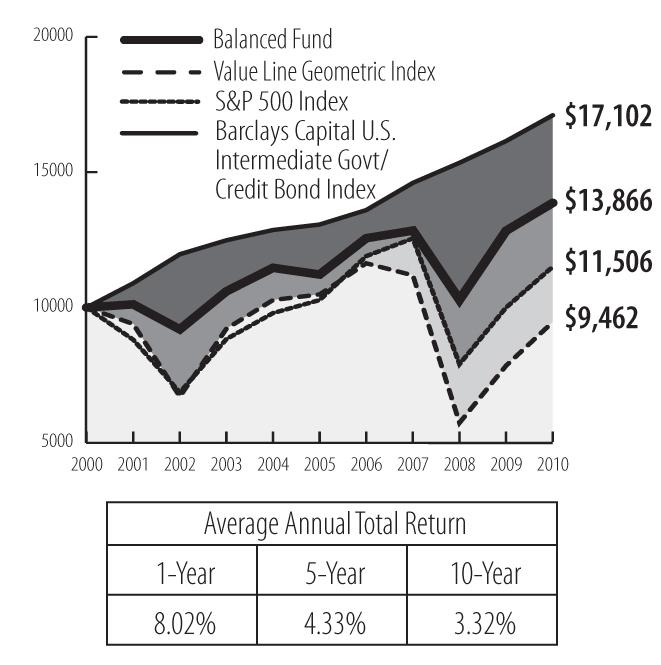

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT1.2

The primary benchmark is changing from the Value Line Geometric Index to the Barclays Capital Intermediate Government Credit Index and S&P 500 Index. See accompanying Notes to Management’s Discussion of Fund Performance.

NOTES TO MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

|

|

1This chart compares a $10,000 investment made in the fund to a $10,000 investment made in the index.

|

|

|

2Past performance is not predictive of future performance. The above graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares and assumes all dividends have been reinvested.

|

BENCHMARK DESCRIPTIONS

The Barclays Capital U.S. Intermediate Government/Credit Bond Index measures the performance of United States dollar-denominated United States Treasuries, government-related and investment-grade United States corporate securities that have a remaining maturity of greater than or equal to one year and less than 10 years.

The Russell Midcap Index measures the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap Index is a subset of the Russell 1000¨ Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The S&P 500 Index is a widely recognized, unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. Neither index reflects any investment management fees or transaction expenses, nor the effects of taxes, fees or other charges.

The Russell 2500¨ Index measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as "smid" cap. The Russell 2500¨ Index is a subset of the Russell 3000¨ Index. It includes approximately 2500 of the smallest securities based on a combination of their market cap and current index membership. The Index does not reflect any investment management fees or transaction expenses, nor the effect of taxes, fees or other charges.

The S&P 500 Index is a widely recognized, unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. Neither index reflects any investment management fees or transaction expenses, nor the effects of taxes, fees or other charges.

The Value Line Geometric Index is an equally weighted and geometrically averaged index based on the price changes of the 1,650 stocks in the Index. The Index does not reflect any investment management fees or transaction expenses, nor the effect of taxes, fees or other charges.

Madison Mosaic Equity Trust | December 31, 2010

Investors Fund • Portfolio of Investments

| |

|

|

|

COMMON STOCK - 95.7%

|

|

|

|

Consumer Discretionary - 4.6%

|

|

|

|

Target Corp.

|

21,080

|

$ 1,267,540

|

|

Walt Disney Co./The

|

19,005

|

|

| |

|

1,980,418

|

|

Consumer Staples - 14.8%

|

|

|

|

Coca-Cola Co./The

|

12,713

|

836,134

|

|

Costco Wholesale Corp.

|

13,355

|

964,365

|

|

Diageo PLC-Sponsored ADR

|

13,677

|

1,016,611

|

|

Kraft Foods Inc., Class A

|

31,255

|

984,845

|

|

PepsiCo Inc./NC

|

22,192

|

1,449,803

|

|

Walgreen Co.

|

27,835

|

|

| |

|

6,336,210

|

|

Energy - 12.8%

|

|

|

|

Apache Corp.

|

8,565

|

1,021,204

|

|

Chevron Corp.

|

15,800

|

1,441,750

|

|

Noble Corp.*

|

21,530

|

770,128

|

|

Schlumberger Ltd.

|

15,451

|

1,290,159

|

|

Southwestern Energy Co.*

|

25,823

|

|

| |

|

5,489,796

|

|

Financials - 15.8%

|

|

|

|

Bank of New York Mellon Corp./The

|

44,593

|

1,346,708

|

|

Berkshire Hathaway Inc., Class B*

|

8,860

|

709,775

|

|

Franklin Resources Inc.

|

10,932

|

1,215,748

|

|

Markel Corp.*

|

2,911

|

1,100,736

|

|

US Bancorp

|

51,790

|

1,396,776

|

|

Wells Fargo & Co.

|

33,033

|

|

| |

|

6,793,436

|

|

Health Care - 16.8%

|

|

|

|

Johnson & Johnson

|

24,089

|

1,489,906

|

|

Laboratory Corp. of America Holdings*

|

12,719

|

1,118,254

|

|

Merck & Co. Inc.

|

34,980

|

1,260,679

|

|

Novartis AG-ADR

|

20,533

|

1,210,420

|

|

St. Jude Medical Inc.*

|

25,975

|

1,110,431

|

|

UnitedHealth Group Inc.

|

28,499

|

|

| |

|

7,218,789

|

| |

|

|

|

Industrials - 7.9%

|

|

|

|

3M Co.

|

15,401

|

$ 1,329,106

|

|

Jacobs Engineering Group Inc.*

|

17,515

|

803,063

|

|

Waste Management Inc.

|

33,495

|

|

| |

|

3,367,130

|

|

Information Technology - 23.0%

|

|

|

|

Cisco Systems Inc.*

|

79,079

|

1,599,768

|

|

Google Inc., Class A*

|

2,630

|

1,562,141

|

|

Intel Corp.

|

59,905

|

1,259,802

|

|

International Business Machines Corp.

|

10,438

|

1,531,881

|

|

Microsoft Corp.

|

62,089

|

1,733,525

|

|

QUALCOMM Inc.

|

21,510

|

1,064,530

|

|

Visa Inc., Class A

|

15,700

|

|

| |

|

9,856,613

|

|

Total Common Stock

(Cost $35,774,822)

|

|

|

|

Repurchase Agreement - 4.3%

|

|

|

|

With U.S. Bank National Association issued 12/31/10 at 0.01%, due 1/3/11, collateralized by $1,890,491 in Freddie Mac MBS Pool #E01424 due 8/1/18. Proceeds at maturity are $1,853,423 (Cost $1,853,422)

|

|

|

TOTAL INVESTMENTS - 100.0% (Cost $37,628,244)

|

42,895,814

|

|

NET OTHER ASSETS AND LIABILITIES -

|

|

|

TOTAL ASSETS - 100.0%

|

|

|

*

|

Non-income producing

|

|

ADR

|

American Depository Receipt

|

See accompanying Notes to Financial Statements.

Madison Mosaic Equity Trust | December 31, 2010

Mid-Cap Fund • Portfolio of Investments

| |

|

|

|

COMMON STOCK - 95.2%

|

|

|

|

Consumer Discretionary - 14.1%

|

|

|

|

Bed Bath & Beyond Inc.*

|

99,815

|

$ 4,905,908

|

|

CarMax Inc.*

|

91,284

|

2,910,134

|

|

Liberty Global Inc., Class C*

|

92,169

|

3,123,607

|

|

Omnicom Group Inc.

|

100,790

|

4,616,182

|

|

TJX Cos. Inc.

|

91,855

|

4,077,443

|

|

Yum! Brands Inc.

|

57,030

|

|

| |

|

22,430,596

|

|

Consumer Staples - 3.9%

|

|

|

|

Brown-Forman Corp., Class B

|

43,869

|

3,054,160

|

|

McCormick & Co.

|

68,140

|

|

| |

|

6,224,714

|

|

Energy - 7.2%

|

|

|

|

EOG Resources Inc.

|

36,845

|

3,368,001

|

|

Noble Corp.*

|

128,770

|

4,606,103

|

|

Southwestern Energy Co.*

|

93,720

|

|

| |

|

11,482,044

|

|

Financials - 24.3%

|

|

|

|

Arch Capital Group Ltd.*

|

53,175

|

4,682,059

|

|

Brookfield Asset Management Inc.

|

243,751

|

8,114,471

|

|

Brown & Brown Inc.

|

199,400

|

4,773,636

|

|

Leucadia National Corp.

|

157,805

|

4,604,750

|

|

Markel Corp.*

|

16,260

|

6,148,394

|

|

SEI Investments Co.

|

164,779

|

3,920,092

|

|

T Rowe Price Group Inc.

|

49,682

|

3,206,476

|

|

WR Berkley Corp.

|

122,201

|

|

| |

|

38,795,741

|

|

Health Care - 15.3%

|

|

|

|

Covance Inc.*

|

78,587

|

4,040,158

|

|

CR Bard Inc.

|

37,355

|

3,428,068

|

|

DENTSPLY International Inc.

|

155,984

|

5,329,973

|

|

Laboratory Corp. of America Holdings*

|

61,642

|

5,419,565

|

|

Techne Corp.

|

94,711

|

|

| |

|

24,437,435

|

| |

|

|

|

Industrials - 15.7%

|

|

|

|

Copart Inc.*

|

170,323

|

$ 6,361,565

|

|

IDEX Corp.

|

104,764

|

4,098,368

|

|

Jacobs Engineering Group Inc.*

|

77,435

|

3,550,395

|

|

Ritchie Bros Auctioneers Inc.

|

130,408

|

3,005,904

|

|

Wabtec Corp./DE

|

63,214

|

3,343,388

|

|

Waste Management Inc.

|

123,975

|

|

| |

|

24,930,578

|

|

Information Technology - 12.2%

|

|

|

|

Amphenol Corp., Class A

|

61,151

|

3,227,551

|

|

Broadridge Financial Solutions Inc.

|

187,324

|

4,108,015

|

|

Factset Research Systems Inc.

|

34,216

|

3,208,092

|

|

FLIR Systems Inc.*

|

161,000

|

4,789,750

|

|

Western Union Co./The

|

220,090

|

|

| |

|

19,420,479

|

|

Materials - 2.5%

|

|

|

|

Ecolab Inc.

|

78,000

|

|

|

Total Common Stock

(Cost $122,291,780)

|

|

151,654,346

|

|

Repurchase Agreement - 3.5%

|

|

|

|

With U.S. Bank National Association issued 12/31/10 at 0.01%, due 1/3/11, collateralized by $5,745,041 in Freddie Mac MBS Pool #E01424 due 8/1/18. Proceeds at maturity are $5,632,395 (Cost $5,632,390)

|

|

|

TOTAL INVESTMENTS - 98.7% (Cost $127,924,170)

|

157,286,736

|

|

NET OTHER ASSETS AND LIABILITIES - 1.3%

|

|

|

TOTAL ASSETS - 100.0%

|

|

*Non-income producing

See accompanying Notes to Financial Statements.

Madison Mosaic Equity Trust | December 31, 2010

Small/Mid-Cap Fund • Portfolio of Investments

| |

|

|

|

COMMON STOCK - 84.4%

|

|

|

|

Consumer Discretionary - 13.0%

|

|

|

|

Bed Bath & Beyond Inc.*

|

690

|

$ 33,913

|

|

CarMax Inc.*

|

954

|

30,414

|

|

Lamar Advertising Co., Class A*

|

760

|

30,278

|

|

Lumber Liquidators Holdings Inc.*

|

845

|

21,049

|

|

Omnicom Group Inc.

|

710

|

32,518

|

|

Sears Holdings Corp.*

|

302

|

22,273

|

|

TJX Cos. Inc.

|

755

|

33,514

|

|

Yum! Brands Inc.

|

535

|

|

| |

|

230,201

|

|

Consumer Staples - 3.1%

|

|

|

|

Brown-Forman Corp., Class B

|

354

|

24,645

|

|

McCormick & Co.

|

630

|

|

| |

|

53,959

|

|

Energy - 8.0%

|

|

|

|

Contango Oil & Gas Co.*

|

455

|

26,358

|

|

Ensco PLC ADR

|

635

|

33,896

|

|

EOG Resources Inc.

|

320

|

29,251

|

|

Noble Corp.*

|

775

|

27,722

|

|

Southwestern Energy Co.*

|

630

|

|

| |

|

140,808

|

|

Financials - 19.8%

|

|

|

|

Arch Capital Group Ltd.*

|

395

|

34,780

|

|

Brookfield Asset Management Inc.

|

1,420

|

47,271

|

|

Brookfield Properties Corp.

|

1,832

|

32,115

|

|

Brown & Brown Inc.

|

1,285

|

30,763

|

|

IntercontinentalExchange Inc.*

|

251

|

29,907

|

|

Leucadia National Corp.

|

1,155

|

33,703

|

|

Markel Corp.*

|

94

|

35,544

|

|

RLI Corp.

|

475

|

24,971

|

|

SEI Investments Co.

|

1,130

|

26,883

|

|

T Rowe Price Group Inc.

|

407

|

26,268

|

|

WR Berkley Corp.

|

959

|

|

| |

|

348,462

|

|

Health Care - 12.0%

|

|

|

|

Covance Inc.*

|

589

|

30,280

|

|

CR Bard Inc.

|

325

|

29,825

|

|

DENTSPLY International Inc.

|

1,275

|

43,567

|

|

IDEXX Laboratories Inc.*

|

455

|

31,495

|

|

Laboratory Corp. of America Holdings*

|

452

|

39,740

|

|

Techne Corp.

|

555

|

|

| |

|

211,354

|

| |

|

|

|

Industrials - 12.3%

|

|

|

|

Copart Inc.*

|

1,213

|

$ 45,305

|

|

IDEX Corp.

|

880

|

34,426

|

|

Jacobs Engineering Group Inc.*

|

595

|

27,281

|

|

Knight Transportation Inc.

|

1,350

|

25,650

|

|

Ritchie Bros Auctioneers Inc.

|

1,285

|

29,619

|

|

Wabtec Corp./DE

|

510

|

26,974

|

|

Waste Management Inc.

|

775

|

|

| |

|

217,829

|

|

Information Technology - 11.2%

|

|

|

|

Adobe Systems Inc.*

|

750

|

23,085

|

|

Amphenol Corp., Class A

|

528

|

27,868

|

|

Blackboard Inc.*

|

390

|

16,107

|

|

Broadridge Financial Solutions Inc.

|

1,583

|

34,715

|

|

Factset Research Systems Inc.

|

280

|

26,253

|

|

FLIR Systems Inc.*

|

1,248

|

37,128

|

|

Western Union Co./The

|

1,720

|

|

| |

|

197,096

|

|

Materials - 3.1%

|

|

|

|

Ecolab Inc.

|

600

|

30,252

|

|

Valspar Corp.

|

740

|

|

| |

|

55,767

|

|

Telecommunication Services - 1.9%

|

|

|

|

Crown Castle International Corp.*

|

750

|

|

|

Total Common Stock (Cost $1,217,550)

|

1,488,350

|

|

INVESTMENT COMPANIES - 2.1%

|

|

|

|

iShares Gold Trust*

|

2,690

|

|

|

Total Investment Companies (Cost $25,638)

|

37,391

|

|

Repurchase Agreement - 13.5%

|

|

|

|

With U.S. Bank National Association issued 12/31/10 at 0.01%, due 1/3/11, collateralized by $242,229 in Freddie Mac MBS Pool #E01424 due 8/1/18. Proceeds at maturity are $237,480 (Cost $237,479)

|

|

| |

|

|

|

TOTAL INVESTMENTS - 100.0% (Cost $1,480,667)

|

1,763,220

|

|

NET OTHER ASSETS AND LIABILITIES - 0.0%

|

|

|

TOTAL ASSETS - 100.0%

|

|

*Non-income producing

See accompanying Notes to Financial Statements.

Madison Mosaic Equity Trust | December 31, 2010

Disciplined Equity Fund • Portfolio of Investments

| |

|

|

|

COMMON STOCK - 95.4%

|

|

|

|

Consumer Discretionary - 10.2%

|

|

|

|

NIKE Inc. , Class B

|

19,670

|

$ 1,680,211

|

|

Omnicom Group Inc.

|

41,557

|

1,903,311

|

|

Staples Inc.

|

42,325

|

963,740

|

|

Target Corp.

|

30,135

|

1,812,018

|

|

TJX Cos. Inc.

|

38,285

|

1,699,471

|

|

Walt Disney Co./The

|

30,375

|

1,139,366

|

|

Yum! Brands Inc.

|

18,810

|

|

| |

|

10,120,748

|

|

Consumer Staples - 10.4%

|

|

|

|

Coca-Cola Co./The

|

22,585

|

1,485,415

|

|

Costco Wholesale Corp.

|

24,255

|

1,751,454

|

|

Diageo PLC-Sponsored ADR

|

24,830

|

1,845,614

|

|

Kraft Foods Inc., Class A

|

35,975

|

1,133,572

|

|

PepsiCo Inc./NC

|

33,185

|

2,167,976

|

|

Walgreen Co.

|

47,120

|

|

| |

|

10,219,826

|

|

Energy - 11.3%

|

|

|

|

Apache Corp.

|

17,275

|

2,059,698

|

|

Chevron Corp.

|

31,605

|

2,883,956

|

|

ConocoPhillips

|

23,530

|

1,602,393

|

|

Noble Corp.*

|

36,690

|

1,312,401

|

|

Schlumberger Ltd.

|

24,870

|

2,076,645

|

|

Southwestern Energy Co.*

|

32,927

|

|

| |

|

11,167,551

|

|

Financials - 15.5%

|

|

|

|

American Express Co.

|

48,380

|

2,076,470

|

|

Bank of New York Mellon Corp./The

|

62,355

|

1,883,121

|

|

Berkshire Hathaway Inc., Class B*

|

10,160

|

813,918

|

|

Brookfield Asset Management Inc.

|

40,350

|

1,343,252

|

|

Franklin Resources Inc.

|

16,959

|

1,886,010

|

|

Markel Corp.*

|

4,762

|

1,800,655

|

|

Morgan Stanley

|

51,070

|

1,389,615

|

|

US Bancorp

|

83,525

|

2,252,669

|

|

Wells Fargo & Co.

|

61,410

|

|

| |

|

15,348,805

|

|

Health Care - 11.2%

|

|

|

|

Allergan Inc.

|

14,575

|

1,000,865

|

|

Johnson & Johnson

|

33,015

|

2,041,978

|

|

Laboratory Corp. of America Holdings*

|

18,342

|

1,612,629

|

|

Merck & Co. Inc.

|

54,175

|

1,952,467

|

|

Novartis AG ADR

|

31,420

|

1,852,209

|

|

St. Jude Medical Inc.*

|

32,445

|

1,387,024

|

|

UnitedHealth Group Inc.

|

34,430

|

|

| |

|

11,090,439

|

| |

|

|

|

Industrials - 10.2%

|

|

|

|

3M Co.

|

29,885

|

$ 2,579,075

|

|

Aecom Technology Corp.*

|

58,295

|

1,630,511

|

|

Copart Inc.*

|

28,625

|

1,069,144

|

|

Illinois Tool Works Inc.

|

31,035

|

1,657,269

|

|

Jacobs Engineering Group Inc.*

|

25,385

|

1,163,902

|

|

Waste Management Inc.

|

55,025

|

|

| |

|

10,128,673

|

|

Information Technology - 18.4%

|

|

|

|

Cisco Systems Inc.*

|

115,355

|

2,333,632

|

|

FLIR Systems Inc.*

|

46,975

|

1,397,506

|

|

Google Inc., Class A*

|

4,795

|

2,848,086

|

|

Intel Corp.

|

71,805

|

1,510,059

|

|

International Business Machines Corp.

|

18,518

|

2,717,702

|

|

Microsoft Corp.

|

119,100

|

3,325,272

|

|

QUALCOMM Inc.

|

36,955

|

1,828,903

|

|

Visa Inc., Class A

|

18,485

|

1,300,974

|

|

Western Union Co./The

|

52,800

|

|

| |

|

18,242,630

|

|

Materials - 2.9%

|

|

|

|

Ecolab Inc.

|

34,990

|

1,764,196

|

|

Praxair Inc.

|

11,850

|

|

| |

|

2,895,515

|

|

Telecommunication Services - 2.2%

|

|

|

|

AT&T Inc.

|

72,735

|

|

|

Utilities - 3.1%

|

|

|

|

Entergy Corp.

|

18,185

|

1,288,044

|

|

NextEra Energy Inc.

|

34,420

|

1,789,496

|

| |

|

|

|

Total Common Stock (Cost $84,667,238)

|

94,428,682

|

|

Repurchase Agreement - 6.4%

|

|

|

|

With U.S. Bank National Association issued 12/31/10 at 0.01%, due 1/3/11, collateralized by $6,476,551 in Freddie Mac MBS Pool #E01424 due 8/1/18. Proceeds at maturity are $6,349,561 (Cost $6,349,555)

|

|

|

TOTAL INVESTMENTS - 101.8% (Cost $91,016,793)

|

100,778,237

|

|

NET OTHER ASSETS AND LIABILITIES - (1.8%)

|

|

|

TOTAL ASSETS - 100.0%

|

|

|

*

|

Non-income producing

|

|

ADR

|

American Depository Receipt

|

See accompanying Notes to Financial Statements.

Madison Mosaic Equity Trust | December 31, 2010

Balanced Fund • Portfolio of Investments

| |

|

|

|

COMMON STOCK - 65.4%

|

|

|

|

Consumer Discretionary - 3.1%

|

|

|

|

Target Corp.

|

3,940

|

$ 236,912

|

|

Walt Disney Co./The

|

3,820

|

|

| |

|

380,200

|

|

Consumer Staples - 10.3%

|

|

|

|

Coca-Cola Co./The

|

2,485

|

163,438

|

|

Costco Wholesale Corp.

|

2,670

|

192,801

|

|

Diageo PLC-Sponsored ADR

|

2,735

|

203,293

|

|

Kraft Foods Inc., Class A

|

6,240

|

196,622

|

|

PepsiCo Inc./NC

|

4,502

|

294,116

|

|

Walgreen Co.

|

5,500

|

|

| |

|

1,264,550

|

|

Energy - 8.8%

|

|

|

|

Apache Corp.

|

1,690

|

201,498

|

|

Chevron Corp.

|

3,210

|

292,913

|

|

Noble Corp.*

|

4,075

|

145,763

|

|

Schlumberger Ltd.

|

2,930

|

244,655

|

|

Southwestern Energy Co.*

|

5,302

|

|

| |

|

1,083,283

|

|

Financials - 10.7%

|

|

|

|

Bank of New York Mellon Corp./The

|

8,357

|

252,382

|

|

Berkshire Hathaway Inc., Class B*

|

1,710

|

136,988

|

|

Franklin Resources Inc.

|

2,148

|

238,879

|

|

Markel Corp.*

|

577

|

218,181

|

|

US Bancorp

|

10,055

|

271,183

|

|

Wells Fargo & Co.

|

6,155

|

|

| |

|

1,308,356

|

|

Health Care - 11.5%

|

|

|

|

Johnson & Johnson

|

4,580

|

283,273

|

|

Laboratory Corp. of America Holdings*

|

2,465

|

216,723

|

|

Merck & Co. Inc.

|

6,705

|

241,648

|

|

Novartis AG-ADR

|

3,960

|

233,442

|

|

St. Jude Medical Inc.*

|

5,080

|

217,170

|

|

UnitedHealth Group Inc.

|

5,810

|

|

| |

|

1,402,055

|

|

Industrials - 5.3%

|

|

|

|

3M Co.

|

3,075

|

265,373

|

|

Jacobs Engineering Group Inc.*

|

3,365

|

154,285

|

|

Waste Management Inc.

|

6,325

|

|

| |

|

652,861

|

|

Information Technology - 15.7%

|

|

|

|

Cisco Systems Inc.*

|

14,969

|

302,822

|

|

Google Inc., Class A*

|

509

|

302,331

|

|

Intel Corp.

|

11,665

|

245,315

|

|

International Business Machines Corp.

|

2,047

|

300,418

|

|

Microsoft Corp.

|

12,650

|

353,188

|

| |

|

|

|

QUALCOMM Inc.

|

4,295

|

$ 212,560

|

|

Visa Inc., Class A

|

3,010

|

|

| |

|

1,928,478

|

|

Total Common Stock (Cost $6,771,676)

|

8,019,783

|

| |

|

|

|

CORPORATE NOTES AND BONDS - 16.9%

|

|

|

Consumer Discretionary - 0.5%

|

|

|

|

Comcast Cable Communications Holdings Inc., 8.375%, 3/15/13

|

$ 55,000

|

|

|

Consumer Staples - 1.9%

|

|

|

|

Costco Wholesale Corp., 5.3%, 3/15/12

|

100,000

|

105,235

|

|

Kraft Foods Inc., 5.625%, 11/1/11

|

13,000

|

13,508

|

|

Sysco Corp., 5.25%, 2/12/18

|

100,000

|

|

| |

|

229,104

|

|

Energy - 3.6%

|

|

|

|

BP Capital Markets PLC, 3.875%, 3/10/15

|

52,000

|

53,689

|

|

Devon Energy Corp., 6.3%, 1/15/19

|

100,000

|