|

Summary

Data: Investors Fund

|

1

|

|

Investment

Objectives/Goals

|

1

|

|

Fees

and Expenses

|

1

|

|

Portfolio

Turnover

|

1

|

|

Principal

Investment Strategies

|

2

|

|

Principal

Risks

|

2

|

|

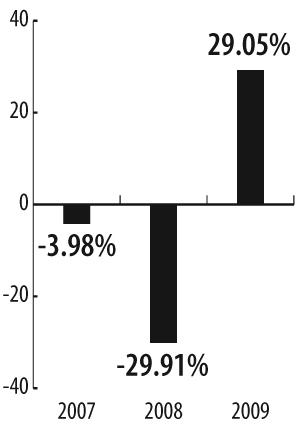

Risk/Return

Bar Chart and Performance Table

|

2

|

|

Management

|

3

|

|

Purchase

and Sale of Fund Shares

|

4

|

|

Tax

Information

|

4

|

|

Payments

to Broker-Dealers and Other Financial Intermediaries

|

4

|

|

Summary

Data: Mid-Cap Fund

|

5

|

|

Investment

Objectives/Goals

|

5

|

|

Fees

and Expenses

|

5

|

|

Portfolio

Turnover

|

5

|

|

Principal

Investment Strategies

|

6

|

|

Principal

Risks

|

6

|

|

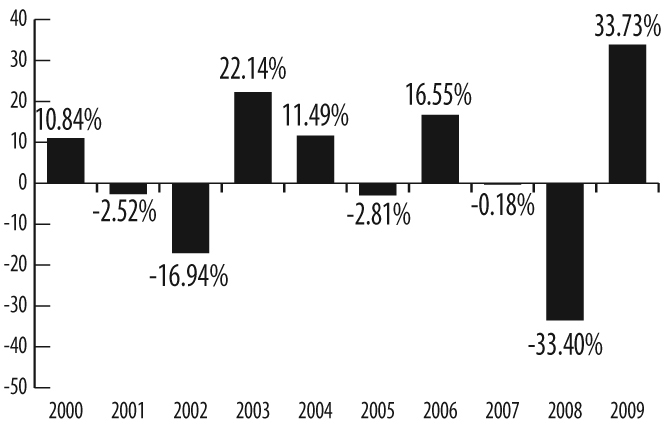

Risk/Return

Bar Chart and Performance Table

|

7

|

|

Management

|

8

|

|

Purchase

and Sale of Fund Shares

|

8

|

|

Tax

Information

|

8

|

|

Payments

to Broker-Dealers and Other Financial Intermediaries

|

8

|

|

Summary

Data: Small/Mid-Cap Fund

|

9

|

|

Investment

Objectives/Goals

|

9

|

|

Fees

and Expenses

|

9

|

|

Portfolio

Turnover

|

9

|

|

Principal

Investment Strategies

|

10

|

|

Principal

Risks

|

10

|

|

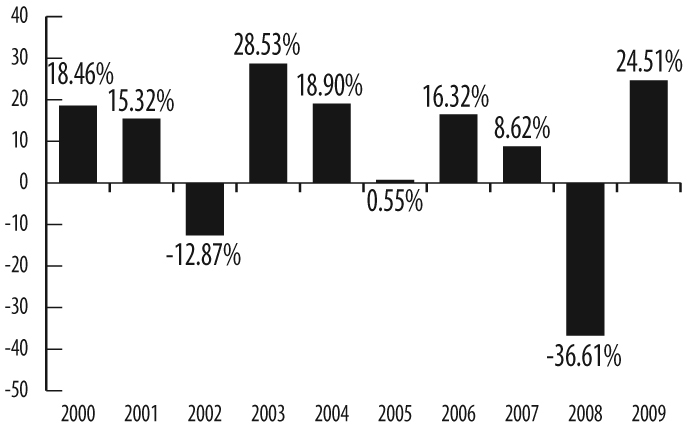

Risk/Return

Bar Chart and Performance Table

|

11

|

|

Management

|

12

|

|

Purchase

and Sale of Fund Shares

|

12

|

|

Tax

Information

|

12

|

|

Payments

to Broker-Dealers and Other Financial Intermediaries

|

12

|

|

Summary

Data: Disciplined Equity Fund

|

13

|

|

Investment

Objectives/Goals

|

13

|

|

Fees

and Expenses

|

13

|

|

Portfolio

Turnover

|

13

|

|

Principal

Investment Strategies

|

13

|

|

Principal

Risks

|

14

|

|

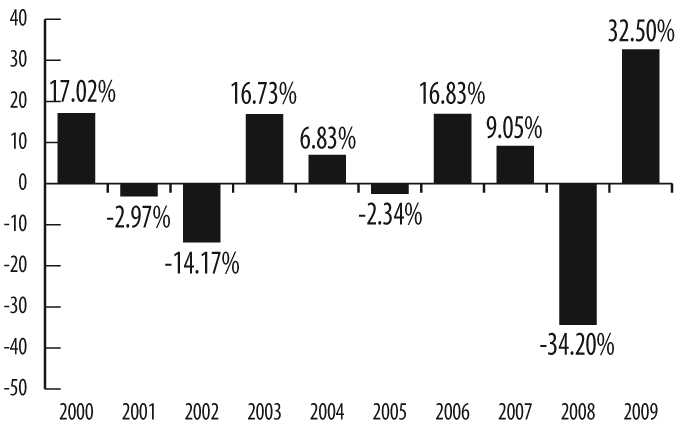

Risk/Return

Bar Chart and Performance Table

|

15

|

|

Management

|

16

|

|

Purchase

and Sale of Fund Shares

|

17

|

|

Tax

Information

|

17

|

|

Payments

to Broker-Dealers and Other Financial Intermediaries

|

17

|

|

Summary

Data: Balanced Fund

|

18

|

|

Investment

Objectives/Goals

|

18

|

|

Fees

and Expenses

|

18

|

|

Portfolio

Turnover

|

18

|

|

Principal

Investment Strategies

|

19

|

|

Principal

Risks

|

19

|

|

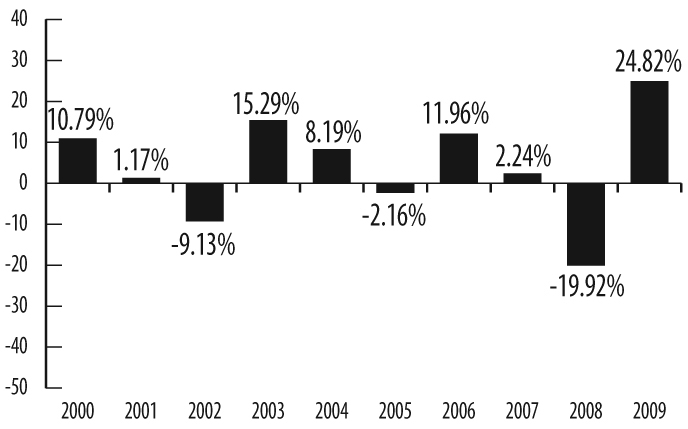

Risk/Return

Bar Chart and Performance Table

|

20

|

|

Management

|

21

|

|

Purchase

and Sale of Fund Shares

|

21

|

|

Tax

Information

|

21

|

|

Payments

to Broker-Dealers and Other Financial Intermediaries

|

21

|

|

Investment

Objectives

|

22

|

|

Implementation

of Investment Objectives

|

22

|

|

All

Funds

|

22

|

|

Fund-Specific

Strategies

|

23

|

|

Risks

|

25

|

|

All

Funds

|

25

|

|

Additional

Fund-Specific Risks

|

26

|

|

Portfolio

Holdings

|

26

|

|

Management

|

27

|

|

Investment

Adviser

|

27

|

|

Compensation

|

28

|

|

Marketing/Distribution

Arrangements

|

29

|

|

Pricing

of Fund Shares

|

29

|

|

Shareholder

Information

|

30

|

|

Purchase

and Redemption Procedures

|

30

|

|

Dividends

and Distributions

|

30

|

|

Frequent

Purchases and Redemptions of Fund Shares

|

30

|

|

Taxes

|

32

|

|

Federal

Taxes

|

32

|

|

State

and Local Taxes

|

32

|

|

Taxability

of Transactions

|

33

|

|

Certification

of Tax Identification Number

|

33

|

|

Financial

Highlights

|

33

|

|

Maximum

sales charge (load)

|

None

|

|

Redemption

fee

|

None

|

|

Exchange

fee

|

None

|

|

Management

fee

|

0.75%

|

|

Distribution

(12b-1) fees

|

None

|

|

Other

expenses1

|

0.24%

|

|

Total

annual fund operating expenses1

|

0.99%

|

|

1

Year

|

3

Years

|

5

Years

|

10

Years

|

|

$101

|

$315

|

$547

|

$1213

|

|

Investors

Fund

Average

Annual Total Returns

(for

the period ended December 31, 2009)

|

|||

|

One

Year

|

Five

Years

|

Ten

Years

|

|

|

Return

before taxes

|

33.73%

|

0.14%

|

2.10%

|

|

Return

after taxes on distributions

|

33.66%

|

-0.81%

|

1.11%

|

|

Return

after taxes on distributions and sale of fund shares

|

22.02%

|

0.11%

|

1.58%

|

|

S&P

500® Index (reflects no deduction for fees, expenses or

taxes)

|

26.46%

|

0.42%

|

-0.95%

|

|

Maximum

sales charge (load)

|

None

|

|

Redemption

fee

|

None

|

|

Exchange

fee

|

None

|

|

Management

fee

|

0.75%

|

|

Distribution

(12b-1) fees

|

None

|

|

Other

expenses

|

0.51%

|

|

Total

annual fund operating expenses

|

1.26%

|

|

1

Year

|

3

Years

|

5

Years

|

10

Years

|

|

$128

|

$400

|

$692

|

$1523

|

|

Mid-Cap

Fund

Average

Annual Total Returns

(for

the period ended December 31, 2009)

|

|||

|

One

Year

|

Five

Years

|

Ten

Years

|

|

|

Return

before taxes

|

24.51%

|

0.06%

|

6.19%

|

|

Return

after taxes on distributions

|

24.51%

|

-0.97%

|

4.63%

|

|

Return

after taxes on distributions and sale of fund shares

|

15.93%

|

-0.12%

|

4.71%

|

|

Russell

Midcap® Index (reflects no deduction for fees, expenses or

taxes)

|

40.48%

|

2.43%

|

4.98%

|

|

Maximum

sales charge (load)

|

None

|

|

Redemption

fee

|

None

|

|

Exchange

fee

|

None

|

|

Management

fee

|

0.75%

|

|

Distribution

(12b-1) fees

|

None

|

|

Other

expenses

|

0.50%

|

|

Total

annual fund operating expenses

|

1.25%

|

|

1

Year

|

3

Years

|

5

Years

|

10

Years

|

|

$127

|

$397

|

$686

|

$1511

|

|

One

Year

(1/1/09

Inception Date)

|

|

|

Return

before taxes

|

29.66%

|

|

Return

after taxes on distributions

|

26.15%

|

|

Return

after taxes on distributions and sale of fund shares

|

19.46%

|

|

Russell

2500® Index (reflects no deduction for fees, expenses or

taxes)

|

34.39%

|

|

Maximum

sales charge (load)

|

None

|

|

Redemption

fee

|

None

|

|

Exchange

fee

|

None

|

|

Management

fee

|

0.75%

|

|

Distribution

(12b-1) fees

|

None

|

|

Other

expenses

|

0.35%

|

|

Total

annual fund operating expenses

|

1.10%

|

|

1

Year

|

3

Years

|

5

Years

|

10

Years

|

|

$112

|

$350

|

$606

|

$1340

|

|

Disciplined

Equity Fund

Average

Annual Total Returns

(for

the period ended December 31, 2009)

|

|||

|

One

Year

|

Five

Years

|

Ten

Years

|

|

|

Return

before taxes

|

32.50%

|

1.64%

|

2.80%

|

|

Return

after taxes on distributions

|

32.48%

|

0.77%

|

2.22%

|

|

Return

after taxes on distributions and sale of fund shares

|

21.16%

|

1.19%

|

2.22%

|

|

S&P

500® Index (reflects no deduction for fees, expenses or

taxes)

|

26.46%

|

0.42%

|

-0.95%

|

|

Maximum

sales charge (load)

|

None

|

|

Redemption

fee

|

None

|

|

Exchange

fee

|

None

|

|

Management

fee

|

0.75%

|

|

Distribution

(12b-1) fees

|

None

|

|

Other

expenses

|

0.50%

|

|

Total

annual fund operating expenses

|

1.25%

|

|

1

Year

|

3

Years

|

5

Years

|

10

Years

|

|

$127

|

$397

|

$686

|

$1511

|

|

Balanced

Fund

Average

Annual Total Returns

(for

the period ended December 31, 2009)

|

|||

|

One

Year

|

Five

Years

|

Ten

Years

|

|

|

Return

before taxes

|

24.82%

|

2.28%

|

3.59%

|

|

Return

after taxes on distributions

|

24.53%

|

1.24%

|

2.44%

|

|

Return

after taxes on distributions and sale of fund shares

|

16.31%

|

1.71%

|

2.63%

|

|

S&P

500® Index (reflects no deduction for fees, expenses or

taxes)

|

26.46%

|

0.42%

|

-0.95%

|

|

|

Investors

Fund. Jay Sekelsky and Dave Halford co-manage the

Investors Fund. Mr. Sekelsky is a Managing Director of Madison

and serves as the senior equity manager for the firm and its large-cap

portfolios. He joined Madison in 1990, and has earned both the

Certified Public Accountant (“CPA”) and Certified Financial Advisor

(“CFA”) designations. Mr. Halford is a Vice President of

Madison, having joined the firm in 2000. Like Mr. Sekelsky, he

holds both the CPA and CFA

designations.

|

|

|

Mid-Cap

Fund. Rich Eisinger and Matt Hayner co-manage the

Mid-Cap Fund. Mr. Eisinger is a Managing Director of Madison

and is the lead equity manager for the firm’s mid-cap equity

strategies. He joined Madison in 1997 and holds both an MBA and

a law degree. Mr. Hayner is a Vice President of Madison, having

joined the firm in 2002. Mr. Hayner holds the CFA

designation.

|

|

|

Small/Mid-Cap

Fund. Rich Eisinger and Matt Hayner co-manage the

Small/Mid-Cap Fund. Their biographies are set forth

above.

|

|

|

Balanced

Fund. Jay Sekelsky and Paul Lefurgey co-manage the

Balanced Fund. Mr. Sekelsky’s biography is set forth

above. Mr. Lefurgey has served as a Managing Director since

joining the firm in 2005, and is currently the head of fixed income

investing at Madison. Prior to joining the firm, he was a Vice President

for MEMBERS Capital Advisors, Inc. Mr. Lefurgey holds the CFA

designation.

|

|

|

Disciplined Equity

Fund. Jay Sekelsky and Marian Quade co-manage the

Disciplined Equity Fund. Mr. Sekelsky’s biography is set forth

above. Ms. Quade is a Vice President of Madison, having joined

the firm in 2009. She has more than 30 years of investment

experience with 22 of those as a portfolio manager, and specializes in

personalized portfolio management for Madison’s high net worth

relationships. Prior to joining Madison, Ms. Quade served in a

similar capacity for Thompson Investment Management and, prior to that,

was Head of Equities for U.S.

Bank.

|

|

|

For all Funds: Madison

is not

responsible for (i) fees related to the Funds’ portfolio holdings (such as

brokerage commissions, interest on loans, etc.), (ii) acquired fund fees,

if any, and (iii) extraordinary or non-recurring fees (such as fees and

costs relating to any temporary line of credit the Funds maintain for

emergency or extraordinary purposes). Each Fund is also responsible for

payment of the advisory fee to Madison, as discussed above. Also, as noted

above, the total annual operating expenses for the Investors Fund and the

Disciplined Equity Fund are currently limited to 0.99%. Furthermore,

Madison is not responsible

for (i) fees and expenses of the Funds’ independent registered public

accountants, and (ii) fees of the Funds’ independent trustees

(collectively, the “Independent Expenses”). However, for certain Funds,

the Independent Expenses paid affects the amounts paid to Madison to

provide all remaining services and for paying all other fees and expenses

under its services agreement with the Funds as

follows:

|

|

|

For the Investors,

Small/Mid-Cap and Disciplined Equity Funds: The amount paid to

Madison is reduced by any Independent Expenses paid by the respective

Fund. As a result, increases (or decreases) in the cost of Independent

Expenses and changes in the Fund’s economies of scale will not affect the

amount the Fund pays for other fees and expenses as a percentage of

average daily net assets.

|

|

|

For the Mid-Cap and Balanced

Funds: Independent Expenses for the respective Fund are paid in

addition to the services fees paid to Madison. Increases (or decreases) in

the cost of Independent Expenses and changes in the Fund’s economies of

scale will increase (or

|

|

|

decrease)

the amount the Fund pays for other fees and expenses as a percentage of

average daily net assets.

|

|

Fund

|

Service

Fee

|

|

Investors

Fund

|

0.25%

|

|

Mid-Cap

Fund

|

0.51%1

|

|

Small/Mid-Cap

Fund

|

0.50%

|

|

Disciplined

Equity Fund

|

0.34%2

|

|

Balanced

Fund

|

0.50%

|

|

|

2

Madison waived expenses for the fiscal year ended December 31, 2009 so the

actual fees paid for other expenses as an annualized percentage of average

daily net assets for the Disciplined Equity Fund was

0.23%.

|

|

Year

Ended December 31,

|

|||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|

|

Net

asset value, beginning of year

|

$11.31

|

$18.44

|

$20.57

|

$18.81

|

$20.82

|

|

Investment

operations:

|

|||||

|

Net

investment income

|

0.05

|

0.08

|

0.20

|

0.09

|

0.06

|

|

Net

realized and unrealized gain (loss) on investments

|

3.76

|

(6.28)

|

(0.21)

|

3.02

|

(0.62)

|

|

Total

from investment operations

|

3.81

|

(6.20)

|

(0.01)

|

3.11

|

(0.56)

|

|

Less

distributions:

|

|||||

|

From

net investment income

|

(0.05)

|

(0.08)

|

(0.20)

|

(0.09)

|

(0.06)

|

|

From

net capital gains

|

--

|

(0.85)

|

(1.92)

|

(1.26)

|

(1.39)

|

|

Total

distributions

|

(0.05)

|

(0.93)

|

(2.12)

|

(1.35)

|

(1.45)

|

|

Net

asset value, end of year

|

$15.07

|

$11.31

|

$18.44

|

$20.57

|

$18.81

|

|

Total return

(%)

|

33.73

|

(33.40)

|

(0.18)

|

16.55

|

(2.81)

|

|

Ratios

and supplemental data

|

|||||

|

Net assets, end of year

(in thousands)

|

$39,684

|

$28,030

|

$55,991

|

$176,861

|

$130,339

|

|

Ratio

of expenses to average net assets (%)

|

1.00

|

1.05

|

0.94

|

0.95

|

0.94

|

|

Ratio

of net investment income to average net

assets (%)

|

0.40

|

0.47

|

0.78

|

0.55

|

0.29

|

|

Portfolio

turnover (%)

|

74

|

47

|

51

|

52

|

41

|

|

Year

Ended December 31,

|

|||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|

|

Net

asset value, beginning of year

|

$7.67

|

$12.87

|

$13.04

|

$11.99

|

$12.52

|

|

Investment

operations:

|

|||||

|

Net

investment loss

|

(0.03)

|

(0.03)

|

(0.02)

|

(0.02)

|

(0.05)

|

|

Net

realized and unrealized gain (loss) on investments

|

1.91

|

(4.71)

|

1.15

|

1.98

|

0.12

|

|

Total

from investment operations

|

1.88

|

(4.74)

|

1.13

|

1.96

|

0.07

|

|

Less

distributions from capital gains

|

--

|

(0.46)

|

(1.30)

|

(0.91)

|

(0.60)

|

|

Net

asset value, end of year

|

$9.55

|

$7.67

|

$12.87

|

$13.04

|

$11.99

|

|

Total

return (%)

|

24.51

|

(36.61)

|

8.62

|

16.32

|

0.55

|

|

Ratios

and supplemental data

|

|||||

|

Net assets, end of year

(in thousands)

|

$140,548

|

$88,964

|

$146,378

|

$147,122

|

$146,266

|

|

Ratio

of expenses to average net assets (%)

|

1.26

|

1.26

|

1.25

|

1.25

|

1.25

|

|

Ratio

of net investment income to average net

assets (%)

|

(0.36)

|

(0.33)

|

(0.18)

|

(0.18)

|

(0.37)

|

|

Portfolio

turnover (%)

|

63

|

76

|

43

|

47

|

46

|

|

Year

Ended December 31,

|

|

|

2009

|

|

|

Net

asset value, beginning of year

|

$10.00*

|

|

Investment

operations:

|

|

|

Net

investment loss

|

(0.03)

|

|

Net

realized and unrealized gain (loss) on investments

|

3.01

|

|

Total

from investment operations

|

2.98

|

|

From

net investment income

|

--

|

|

From

net capital gains

|

(1.06)

|

|

Total

distributions

|

(1.06)

|

|

Net

asset value, end of year

|

$11.92

|

|

Total

return (%)

|

29.66

|

|

Ratios

and supplemental data

|

|

|

Net assets, end of year

(in thousands)

|

$1,056

|

|

Ratio

of expenses to average net assets (%)

|

1.24

|

|

Ratio

of net investment income to average net

assets (%)

|

(0.31)

|

|

Portfolio

turnover (%)

|

74

|

|

Year

Ended December 31,

|

|||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|

|

Net

asset value, beginning of year

|

$8.81

|

$13.78

|

$14.07

|

$12.61

|

$13.38

|

|

Investment

operations:

|

|||||

|

Net

investment income

|

0.01

|

0.09

|

0.06

|

0.07

|

0.03

|

|

Net

realized and unrealized gain (loss) on investments

|

2.85

|

(4.80)

|

1.21

|

2.05

|

(0.35)

|

|

Total

from investment operations

|

2.86

|

(4.71)

|

1.27

|

2.12

|

(0.32)

|

|

Less

distributions:

|

|||||

|

From

net investment income

|

(0.01)

|

(0.09)

|

(0.06)

|

(0.07)

|

(0.03)

|

|

From

net capital gains

|

--

|

(0.17)

|

(1.50)

|

(0.59)

|

(0.42)

|

|

Total

distributions

|

(0.01)

|

(0.26)

|

(1.56)

|

(0.66)

|

(0.45)

|

|

Net

asset value, end of year

|

$11.66

|

$8.81

|

$13.78

|

$14.07

|

$12.61

|

|

Total return

(%)

|

32.50

|

(34.20)

|

9.05

|

16.83

|

(2.34)

|

|

Ratios

and supplemental data

|

|||||

|

Net assets, end of year

(in thousands)

|

$41,450

|

$3,072

|

$4,499

|

$4,081

|

$3,608

|

|

Ratio

of expenses to average net assets before fee waiver (%)

|

1.06

|

1.14

|

1.26

|

1.27

|

1.25

|

|

Ratio

of expenses to average net assets after fee waiver (%)

|

0.96

|

1.06

|

N/A

|

N/A

|

N/A

|

|

Ratio

of net investment income to average net assets before fee waiver

(%)

|

0.49

|

0.72

|

0.41

|

0.54

|

0.24

|

|

Ratio

of net investment income to average net assets after fee waiver

(%)

|

0.60

|

0.80

|

N/A

|

N/A

|

N/A

|

|

Portfolio

turnover (%)

|

62

|

63

|

70

|

54

|

122

|

|

Year

Ended December 31,

|

|||||

|

2009

|

2008

|

2007

|

2006

|

2005

|

|

|

Net

asset value, beginning of year

|

$13.29

|

$17.62

|

$18.39

|

$17.40

|

$19.51

|

|

Investment

operations:

|

|||||

|

Net

investment income

|

0.17

|

0.25

|

0.28

|

0.23

|

0.18

|

|

Net

realized and unrealized gain (loss) on investments

|

3.10

|

(3.72)

|

0.13

|

1.84

|

(0.60)

|

|

Total

from investment operations

|

3.27

|

(3.47)

|

0.41

|

2.07

|

(0.42)

|

|

Less

distributions:

|

|||||

|

From

net investment income

|

(0.17)

|

(0.25)

|

(0.28)

|

(0.23)

|

(0.18)

|

|

From

net capital gains

|

--

|

(0.61)

|

(0.90)

|

(0.85)

|

(1.51)

|

|

Total

distributions

|

(0.17)

|

(0.86)

|

(1.18)

|

(1.08)

|

(1.69)

|

|

Net

asset value, end of year

|

$16.39

|

$13.29

|

$17.62

|

$18.39

|

$17.40

|

|

Total return

(%)

|

24.82

|

(19.92)

|

2.24

|

11.96

|

(2.16)

|

|

Ratios

and supplemental data

|

|||||

|

Net assets, end of year

(in thousands)

|

$12,119

|

$10,139

|

$13,800

|

$16,267

|

$17,514

|

|

Ratio

of expenses to average net assets (%)

|

1.25

|

1.24

|

1.22

|

1.22

|

1.21

|

|

Ratio

of net investment income to average net

assets (%)

|

1.19

|

1.49

|

1.47

|

1.24

|

0.88

|

|

Portfolio

turnover (%)

|

57

|

50

|

42

|

35

|

34

|

|

Input:

|

|

|

Document

1 ID

|

|

|

Description

|

|

|

Document

2 ID

|

|

|

Description

|

|

|

Rendering

set

|

|

|

Legend:

|

|

|

Inserted

cell

|

|

|

Deleted

cell

|

|

|

Moved

cell

|

|

|

Split/Merged

cell

|

|

|

Padding

cell

|

|

|

Statistics:

|

|

|

Count

|

|

|

Insertions

|

|

|

Deletions

|

|

|

Moved

from

|

|

|

Moved

to

|

|

|

Style

change

|

|

|

Format

changed

|

|

|

Total

changes

|

|