OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2010

Estimated average burden hours per response...18.9

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3615

Madison Mosaic Equity Trust

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

W. Richard Mason

Madison/Mosaic Legal and Compliance Department

8777 N. Gainey Center Drive, Suite 220

Scottsdale, AZ 85258

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: December 31

Date of reporting period: June 30, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspoection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

Semi-Annual Report (unaudited)

June 30, 2009

Madison Mosaic Equity Trust

- Investors Fund

- Balanced Fund

- Mid-Cap Fund

- Disciplined Equity Fund

- Small/Mid-Cap Fund

Madison Mosaic Funds

(Madison Mosaic Logo)

www.mosaicfunds.com

Contents

|

Portfolio Manager Review |

|

|

Performance Review |

1 |

|

Market in Review |

1 |

|

Outlook |

1 |

|

Interview with lead equity manager Jay Sekelsky |

2 |

|

Investors Fund |

2 |

|

Balanced Fund |

4 |

|

Disciplined Equity Fund |

6 |

|

Mid-Cap Fund |

7 |

|

Small/Mid-Cap Fund |

9 |

|

Portfolio of Investments |

|

|

Investors Fund |

10 |

|

Balanced Fund |

11 |

|

Disciplined Equity Fund |

13 |

|

Mid-Cap Fund |

15 |

|

Small/Mid-Cap Fund |

16 |

|

Statements of Assets and Liabilities |

18 |

|

Statements of Operations |

19 |

|

Statements of Changes in Net Assets |

20 |

|

Financial Highlights |

22 |

|

Notes to Financial Statements |

25 |

|

Fund Expenses |

30 |

Madison Mosaic Equity Trust June 30, 2009

Portfolio Manager Review

Performance Review

The six-month period ended June 30, 2009 showed gains for all the funds in Equity Trust in a period of exceptional volatility. Our primary benchmark indices were down sharply through early March and then rebounded robustly, with the large-cap S&P 500 ending the sixth-month period up 3.16% and the Russell Midcap¨ Index a positive 9.96%. Mosaic Investors was up 9.46% for the six-month period, while Mosaic Midcap rose 5.22%. Mosaic Balanced gained 7.64%, while the all-sector Disciplined Equity Fund beat its S&P 500 benchmark with an 8.74% return. Our newest fund, Small/Mid-Cap Fund, which was launched at the beginning of the period, got off to a very strong start with a return of 10.80%, well ahead of its benchmark, the Russell 2500¨ Index, which saw a 6.52% return.

Market in Review

The wild ride for stock investors during the first half of 2009 can be traced by the path of the S&P 500, which is often used as a proxy for the overall market. The Index began the year with the same downward momentum that characterized 2008, when the market dropped a record-setting -37.0%. The Index fell an additional 25% by March

9, before turning upward, at one point hitting a 40% rally. By June 30, the Index had made up its early losses, finishing with a deceivingly average-looking year-to-date 3.16%.

The market was buffeted by unprecedented financial woes, the subsequent massive governmental stimulus and wide swings of investor psychology. In the fall of 2008 the collapse of Lehman Brothers and the subsequent massive interventions from the Federal government raised hopes that the worst was behind. But as we entered the first months of 2009 a new wave of uncertainty gripped the market. The new administration’s announcements of dramatic and sizable support initiatives were

not enough to overcome the continuing negative economic and corporate news. The economy, as measured by GDP, was dropping at an annualized 6% rate, and employment fell at a record-setting pace. The crisis in the housing market showed no sign of abating and the domestic automobile business was in freefall. It was no wonder consumer sentiment hit a new low while investor sentiment could be summed up in one word: fearful.

From the market lows in early March, the S&P rallied strongly through most of the remaining period, ending the six months in positive territory for the first half of 2009. This rebound was not so much driven by good news as it was by diminishing worry. In other words, investors who were once worried about the collapse of the global financial system and another great depression were beginning to believe that the economic problems were deep, but not fathomless. By the later part

of the period, some of the important economic indicators showed signs of bottoming and other problem areas showed decreasing losses. These signs, however modest, were eagerly noted by investors looking for hints of recovery and as we entered the second half of the period, the market sentiment shifted from fear to hope.

Outlook

After watching the market drop and then rebound during the past six months the question remains: Is this the beginning of a new bull market or a rally within a bear market? The answer may lie in an old market adage which describes rallies following a bear market: "First comes price, then comes optimism and then comes earnings." The price piece of this equation can be seen in the S&P 500’s 37% rally from the March low through period end. Optimism improved markedly since

Madison Mosaic Equity Trust 1

Portfolio Manager Review (continued)

the bleak days of early March, when there was real fear of a total collapse of the global financial system. However, positive earnings news remained sparse, leading us to the conclusion that it is too early to confidently categorize the latest rally. For the market to truly transition into a new bull market phase we need evidence of a return to positive revenue and earnings growth and at period end we simply were not there yet. We do expect overall corporate earnings to improve in

2010, but the rate and the breadth are subject to many variables. As a result, we continue to concentrate our portfolios in shares of high-quality companies with superior competitive advantages, strong balance sheets and positive free cash flow generation. These companies can be a source of stability if volatility increases while still providing upside if, in fact, a new bull market is upon us.

Interview with lead equity manager Jay Sekelsky (photo of Jay Sekelsky)

Can you summarize the performance of the funds in Equity Trust for the first six months of 2009?

We’ve just completed one of those rare six-month periods in which you could see the power of both a rampant bear and a raging bull. Historically, our risk-conscious style has shown relative strength in down markets while typically lagging in steep up markets. Over this six-month period the funds did not exactly follow this formula. Our large-cap portfolios (Investors, Disciplined Equity and the equity portion of Balanced) outperformed their benchmarks in the down market, and outperformed on the up side as well, which was particularly gratifying. Mid-Cap, which did beat the broader market as measured by the S&P 500, could not keep up with its benchmark Russell Midcap¨ Index, which was led by lower-quality and more speculative stocks. Our newest fund, Mosaic Small/Mid-Cap, was well ahead of its benchmark. After the dismal returns of 2008, any positive returns would have been welcome, but it was particularly gratifying to see such overall strong performance during a period in which our style has often lagged.

MADISON MOSAIC INVESTORS

How did the fund perform for the first six months of 2009?

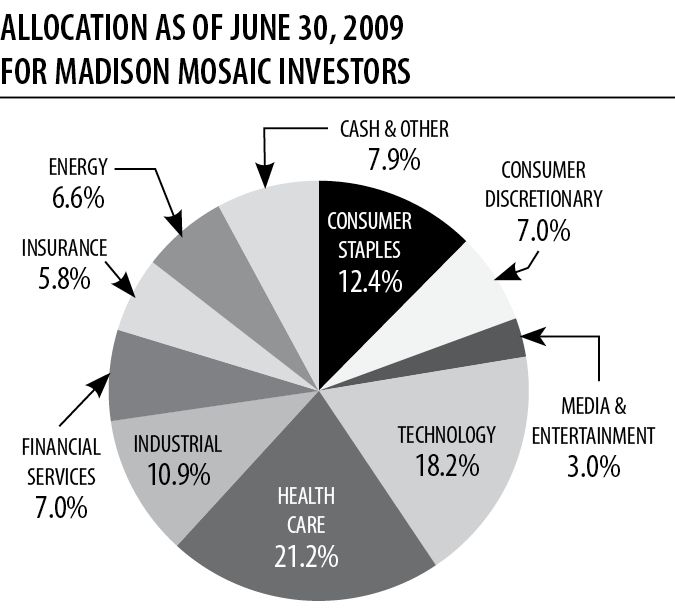

Mosaic Investors was up 9.46% for the period ended June 30, 2009. This return was well ahead of the return of the S&P 500, which rose 3.16%. This return also outdistanced the fund’s peer group, represented by the Lipper Large-Cap Core Index, which rose 5.35%. This discrepancy was largely due to stock selection, and to a lesser extent, sector positioning. The fund had especially good results from the Financial Sector which led the market in the second half of the period advancing 35.1%. We were overweight in financials going into this rally, and took some profits as we headed into the latter part of the period.

Have you made any significant changes to the portfolio since December 31, 2008?

Volatility can be unnerving to investors, but it is actually a boon for stock pickers. Emotional selling can drive down the price of all companies, regardless of their individual merits. As a result we’ve been more active over the first half of 2009 than we’ve been historically. We’ve tried to take advantage of these opportunities and this naturally produces some trading. For instance, we added to our high-quality financial holdings in the first quarter as the market took down share prices indiscriminately and reaped some of those profits in the second quarter. The Consumer Staples and Health Care Sectors lagged over the second

2 Semi-annual Report • June 30, 2009

Portfolio Manager Review (continued)

quarter, and we found opportunities in these areas, trimming names like Wells Fargo and adding companies including PepsiCo and Baxter. Baxter produces health care products and devices. As a result, the portfolio looked a little more defensive at the end of the period than it would have looked halfway through it.

In terms of percentages, at the beginning of the period we held 19.1% of the portfolio in financial stocks, compared to our benchmark’s 13.3%, and by the end of the period had trimmed these to 12.8%, underweight the index’s closing allocation of 13.6%. In terms of specific holdings, we sold all of our shares in Aflac and American Express. In the Consumer Discretionary Sector the fund benefited from a timely swap, selling flooring specialist Mohawk for Walt Disney

Company, which reported better than expected second quarter earnings.

An example of an opportunistic buy was the addition of dental supply company Dentsply. We’ve admired the company for some time and have held it in the past. The market weakness brought it back within our valuation target, and we expect the company to be well positioned as it supplies an aging domestic population as well as an increasingly affluent global market.

What holdings were the strongest contributors to fund performance?

Contributions to the portfolio were broad based with outperformance primarily due to individual stock selection. The strongest returns within the portfolio were in the Information Technology sector, which was the leading S&P sector as well. Within our Tech Sector holdings, Google showed the best first half 2009 performance, with its

share price rising 37%. The fund also had solid contributions from Check Point, Cisco Systems and EMC Corp. An area of particular relative strength was Health Care which was led by our holdings in mid-cap health-care stocks.

While Industrials were negative as a total S&P Sector, we had a contribution to performance from this sector that was positive, led by Expeditors International (which was sold after hitting our price target) and ABB Ltd. Expeditors is a leading facilitator for international shipping and ABB Ltd. provides hardware for the electrical utility industry. While the Energy Sector slumped -3.2% for the sector, our holdings produced positive returns for the period, led by Schlumberger,

the world’s leading oilfield services provider.

Although consumer spending was rattled by the economic crisis and unemployment, we did get a boost from individual holdings in the sector, including Staples, Best Buy and Comcast.

What holdings were the largest constraints on performance?

We can’t really point to any one sector as a problem area. We actually had positive relative contributions from all but one of the sectors in which we had significant exposure. Even the sectors we didn’t own helped as Telecommunication Services and Utilities had losses for the period, helping the portfolio’s performance relative to the market. Unfortunately, we did have individual companies with negative returns for the period, including Jacobs Engineering, Health Care stock Zimmer Holdings, Target Corporation and specialty insurer Markel.

What is your outlook for the remainder of 2009 and beyond?

We’re optimistic but cautious looking forward. When we add up the positives and negatives, the recipe is there for improving revenue growth, although it must be said that you have to take some of these corporate statistics with a grain of salt, since the comparisons will be to some of the worst quarterly performance on record. As the economy improves we should get margin improvement, but what we really are waiting to see is revenue growth. Margins should look better since productivity continues to improve

Madison Mosaic Equity Trust 3

Portfolio Manager Review (continued)

while wage inflation is controlled by the high unemployment rate. Companies have done a great job in trimming excess expenses and getting lean. Better revenue growth would signal that the economy is recovering, which when combined with solid margins could be a big plus for the market. On top of this, we still see a large amount of money on the sidelines, waiting for evidence of better fundamentals. We’re not calling for a huge return for the markets in 2009, but any progress

will be welcome after the deep losses of 2008.

TOP TEN STOCK HOLDINGS AS OF JUNE 30, 2009

FOR MADISON MOSAIC INVESTORS

|

% of net assets |

|

|

Cisco Systems Inc. |

4.28% |

|

Microsoft Corp. |

3.73% |

|

Google Inc. - CL A |

3.35% |

|

Berkshire Hathaway Inc. - CL B |

3.33% |

|

Diageo PLC - ADR |

3.24% |

|

Baxter International |

3.15% |

|

Waste Management Inc. |

3.03% |

|

Comcast Corp. - Special CL A |

3.00% |

|

Wells Fargo & Co. |

2.99% |

|

3M Company |

2.98% |

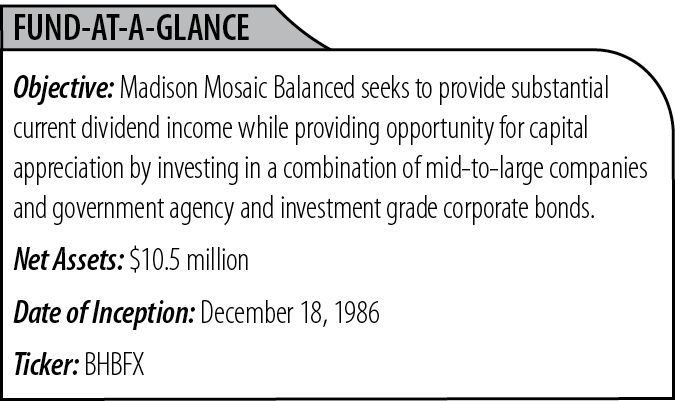

MADISON MOSAIC BALANCED

How did Mosaic Balanced perform for the six-month period?

Mosaic Balanced returned 7.64% for the six months, with strong results from the stock holdings overriding modest returns from the bond allocation. As with our Investors Fund, we had broad contributions from all sectors and a wide variety of stocks, while our portfolio of actively managed intermediate bonds was positive for the period. Over the course of the six months the Fund outperformed the Lipper Mixed Asset Allocation Growth Index, which showed a return of 6.57%.

Have you made any significant changes to the portfolio since December 31, 2008?

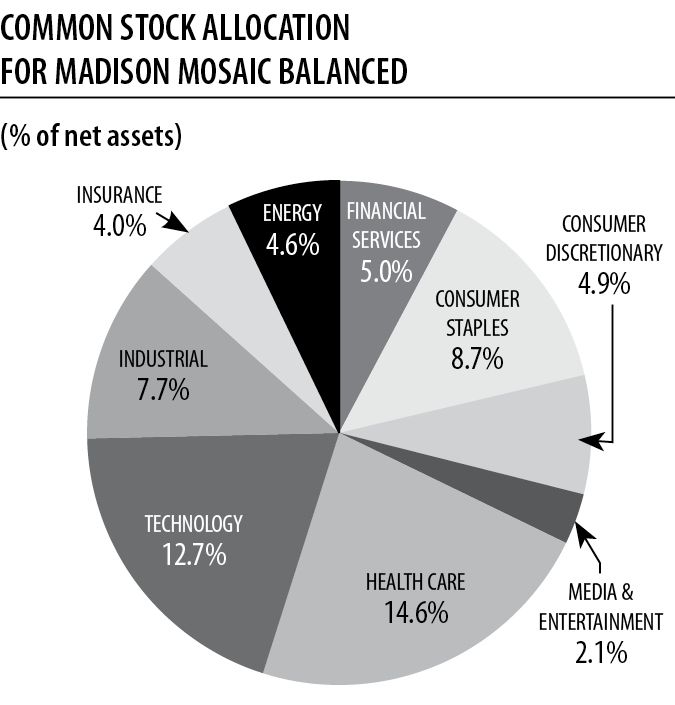

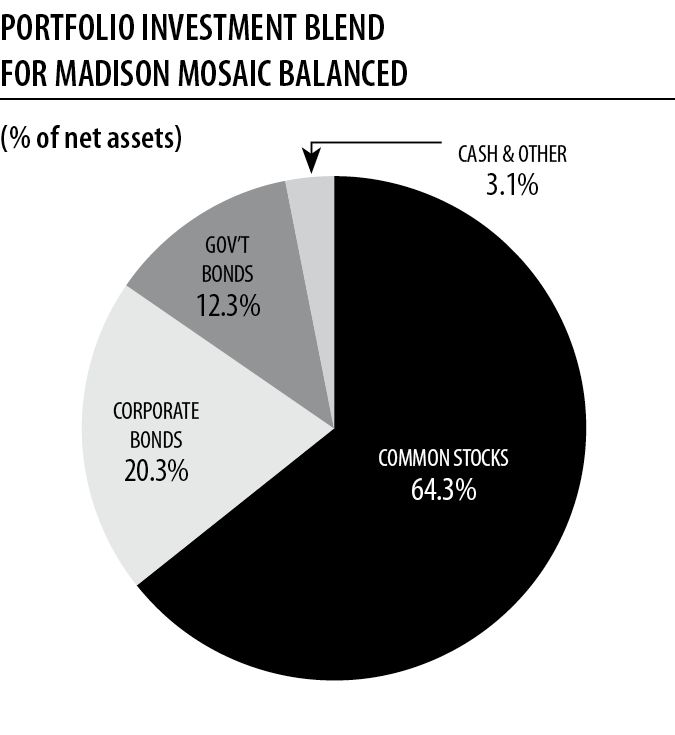

The stock holdings of Balanced mirror the holdings of Mosaic Investors as discussed above. These holdings continue to focus on solid, well-established domestic companies that have proven their earning ability through difficult times. One of the factors in our management of Balanced is the mix of stocks and bonds, with 70% being the highest allowable percentage of stocks. We began the period holding 60% stocks and finished the period with 64.3% in stocks, which reflects the relative appreciation of equities over bonds. On the bond side, we maintained our preference for high-quality corporate bonds over government issuances. We have also decreased the duration of the bonds slightly, from 3.44 years at the beginning of the period to 3.38 years at the end.

How did the stock holdings in Balanced contribute to overall performance?

The stock holdings in Balanced were solidly positive for the period as the stock market moved from deep losses to a steep recovery within the six-month period. The holdings mirror the stocks held in Mosaic Investors, discussed at some length above.

4 Semi-annual Report • June 30, 2009

Portfolio Manager Review (continued)

How did the bond holdings in Balanced contribute to overall performance?

Our bond holdings were positive for the period, benefiting from our position in the intermediate range of the yield curve. Our emphasis on corporate bonds was rewarded as their valuation, when compared to Treasuries, improved as the period progressed.

TOP FIVE STOCK AND FIXED INCOME HOLDINGS AS OF JUNE 30, 2009 FOR MADISON MOSAIC BALANCED

|

% of net assets |

|

|

Top Five Stock Holdings |

|

|

Cisco Systems Inc. |

3.07% |

|

Microsoft Corp. |

2.51% |

|

Google Inc. - CL A |

2.42% |

|

Berkshire Hathaway Inc. - CL B |

2.34% |

|

Diageo PLC - ADR |

2.26% |

|

% of net assets |

|

|

Top Five Fixed Income Holdings |

|

|

Fannie Mae, 6.625%, 11/15/10 |

2.05% |

|

Federal Home Loan Bank, 4.375%, 9/17/10 |

1.99% |

|

International Lease Finance, 4.875%, 9/1/10 |

1.70% |

|

AT&T Broadband, 8.375%, 3/15/13 |

1.63% |

|

UnitedHealth Group, 5%, 8/15/14 |

1.62% |

Madison Mosaic Equity Trust 5

Portfolio Manager Review (continued)

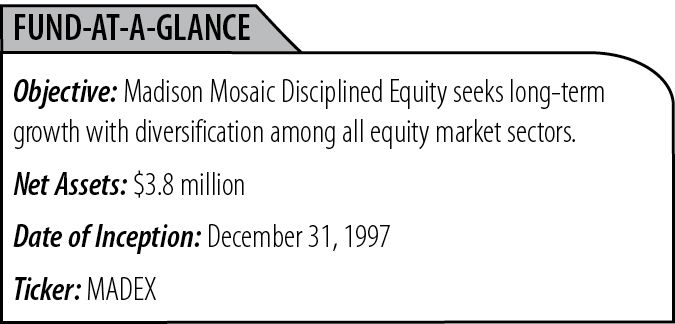

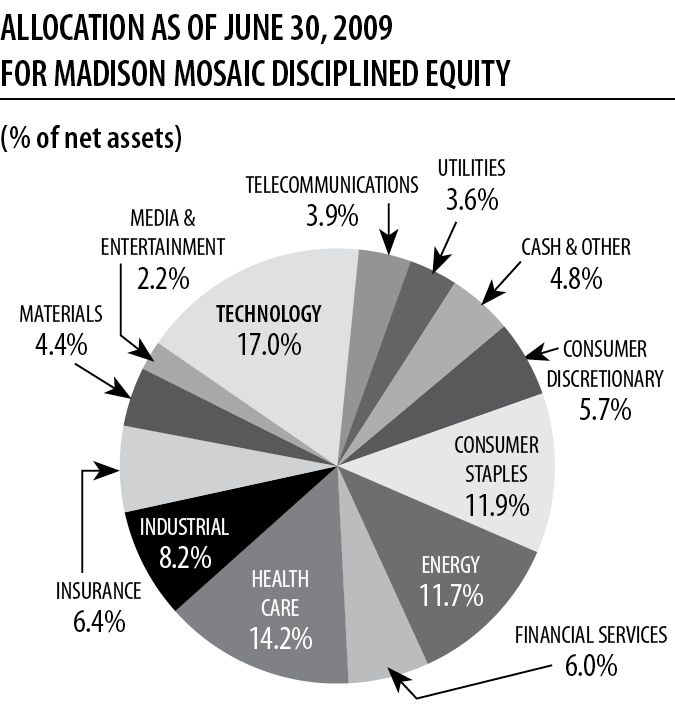

MADISON MOSAIC DISCIPLINED EQUITY

How would you characterize the performance of Disciplined Equity for the period?

We handily beat our S&P 500 benchmark’s return of 3.16% with an 8.74% return. We believe this was an excellent result, particularly during a period in which we saw a sharp market recovery led by smaller, more speculative companies. The fund also was ahead of its peer group, represented by the Lipper Large-Cap Core Index, which rose 5.35%.

Have you made any significant changes to the portfolio since December 31, 2008?

As with our other portfolios, we looked at the broad market decline as an opportunity to add great companies at reasonable valuations. In Consumer Discretionary we sold flooring company Mohawk while adding Walt Disney Company, which fits our definition of a company with great brand identity and exceptional barriers to entry. In Energy we sold Unit Corp. and added Apache Corp. In the Financial Sector we sold Aflac and American Express and in Technology, Adobe and Apple.

What holdings had the largest impact on this period’s performance?

Following our sector-neutral strategy, which tends to keep our allocations in line with the S&P 500, any performance discrepancy is typically a stock-picking issue. This was certainly true in the first six months of 2009, when our holdings outperformed their relative sectors in seven out of the ten S&P Sectors. And even in those

three sectors, our underperformance was only a fraction of a percent. Our best relative returns were in Energy and Industrials. Our weakest sector return on a relative basis was in Financials.

Among our strongest stocks were Tech Sector holdings Adobe (which was sold during the period), Check Point Software and Cisco Systems. Two of our energy holdings were major contributors: ConocoPhillips and Transocean Inc. We sold Transocean during the period. Among our weakest were PepsiCo and joint-replacement producer Zimmer Holdings.

TOP TEN STOCK HOLDINGS AS OF JUNE 30, 2009

FOR MADISON MOSAIC DISCIPLINED EQUITY

|

% of net assets |

|

|

Cisco Systems Inc. |

4.19% |

|

Microsoft Corp. |

4.04% |

|

Hewlett-Packard Co. |

2.73% |

|

Procter & Gamble |

2.67% |

|

Exxon Mobil Corp. |

2.63% |

|

Johnson & Johnson |

2.54% |

|

ConocoPhillips Inc. |

2.51% |

|

Schlumberger Limited |

2.28% |

|

Novartis AG - ADR |

2.26% |

|

Comcast Corp. Special - CL A |

2.24% |

6 Semi-annual Report • June 30, 2009

Portfolio Manager Review (continued)

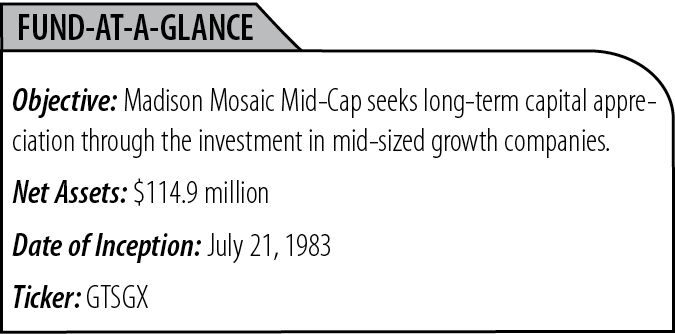

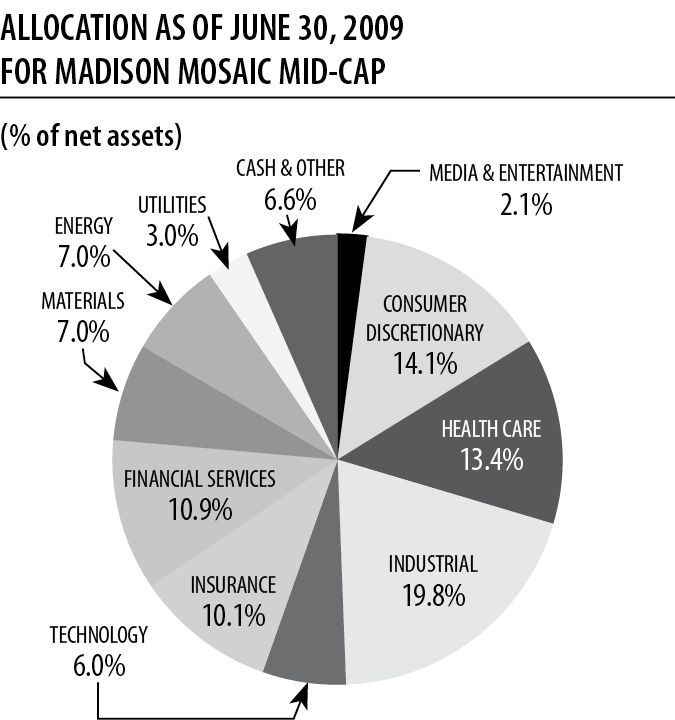

MADISON MOSAIC MID-CAP

An interview with Rich Eisinger, co-manager of Madison Mosaic Mid-Cap. (Photo of Rich Eisinger)

How would you characterize the performance of Mosaic Mid-Cap so far in 2009?

While any positive performance is a welcome relief from 2008, the first half of 2009 was not a market in which we outperformed. However, when I look back over the quarter, I don’t believe this is cause for concern. To the extent a rally is concentrated in more speculative issues, we are not likely to fully participate. By speculative, I mean companies with leveraged balance sheets generated better returns than those with solid balance sheets. Companies with lower S&P quality rankings outperformanced those with the highest rankings. Some of the same factors that helped us last year, such as a lack of exposure to credit in our financial holdings, hurt us during the stock market rally that took hold over the second half of the period. We remain confident that in the long run we own solid companies with talented management teams who will produce value in the long run. Our total return for the first six months was 5.22%, which was higher than the broader market’s, as indicated by the S&P 500’s 3.16% return.

Did you make any significant changes to the portfolio since December 31, 2008?

While we didn’t make any dramatic sector reallocations over the period, we did have some gradual shifts. As always, these are driven not by macro economic allocation strategies, but through the individual fundamentals of the companies we sell or add. We saw our consumer exposure drop, which fits our overall sense that the American

consumer has been hit hard by the economic crisis and growing unemployment. On top of this, the consumer deleveraging process is still in its early stages, leaving us skeptical about a fast rebound. We also added to our energy holdings.

Before I give some examples of buys and sells, let me reemphasize that we work very hard to own companies which are positioned well for long-term success. We like to own these companies for multiple years, longer if fundamentals and valuation allow. All of the companies whose holdings were in the top ten from the beginning of the period remained a part of our portfolio as of June 30.

As I mentioned above, we did rotate some assets from the Consumer sectors to Energy. Among our new holdings are EOG Resources, a major oil and natural gas producer, and Apache Corporation. Apache is an impressive company with deep oil and gas reserves concentrated in stable parts of the world. Apache has increased production in ten of the past eleven years and our entry share price was approximately half of the stock valuation from just a year previous.

We also bought Kirby, the leader in the domestic barge business. The company has a seasoned and proven management team. The recent supply/demand imbalance in the barge business drove the stock price down. We believe that patient investors will be rewarded in the event the expected economic recovery emerges. We also sold Clorox, which did very well for us on a relative basis, but we are concerned that budget-minded consumers will shift purchases to private-label brands. Another sale

was Donaldson, a high-quality industrial company concerned with filters, which we owned for a short period during which the stock went on a run and we felt valuation got ahead of itself.

Madison Mosaic Equity Trust 7

Portfolio Manager Review (continued)

What holdings were the strongest contributors to fund performance?

Most of our positive performance during the period came from three sectors: Consumer Discretionary, Energy and Industrials. These were also among the higher-producing index sectors. We also had positive returns from our technology holdings, even as these stocks did not keep pace with the overall sector. Our best relative performance was

in the Industrial Sector, where we benefited from an emphasis on non-smokestack industrial companies, such as Iron Mountain, the document and data-storage firm.

Our top returning holdings were led by CarMax, whose stock had an amazing 86% total return for the six months. We also saw strong returns from Bed, Bath & Beyond and a number of our industrial holdings, including Copart and Donaldson.

What holdings were the largest constraints on performance?

The most important factor in this period’s relative performance was what we didn’t own. A quick look at the performance of companies based on their S&P quality ratings explains a good deal of the story. Over the first six months of 2009, the performance of companies rated A+, A and A- were: 4.46%, -1.98% and 3.30%, while

the often highly leveraged companies in the C&D categories returned 58.64%.

We were underweight the Technology Sector which led the mid-cap index with a 23.8% return. In addition, we tend not to own the more cyclical companies that led the sector. Some of the factors which helped us last year were a drag in the first half of 2009. For instance, in the financial sector we had significant insurance exposure, rather than credit-sensitive institutions. It was the credit-sensitive companies which bounced back the strongest. We had negative contributions from

Markel and Odyssey Re and also from industrial holding Waste Management, and Covanta from the Utility Sector.

TOP TEN STOCK HOLDINGS AS OF JUNE 30, 2009

FOR MADISON MOSAIC MID-CAP

|

% of net assets |

|

|

Markel Corp. |

3.77% |

|

Laboratory Corp. of America Holdings |

3.70% |

|

Brookfield Asset Management Inc. |

3.52% |

|

Odyssey Re Holdings Corp. |

3.35% |

|

Zebra Technologies Corp. - CL A |

3.30% |

|

Covanta Holding Corp. |

3.04% |

|

Jacobs Engineering Group Inc. |

2.97% |

|

Brown & Brown, Inc. |

2.94% |

|

Zimmer Holdings Inc. |

2.88% |

|

Copart, Inc. |

2.81% |

8 Semi-annual Report • June 30, 2009

Portfolio Manager Review (concluded)

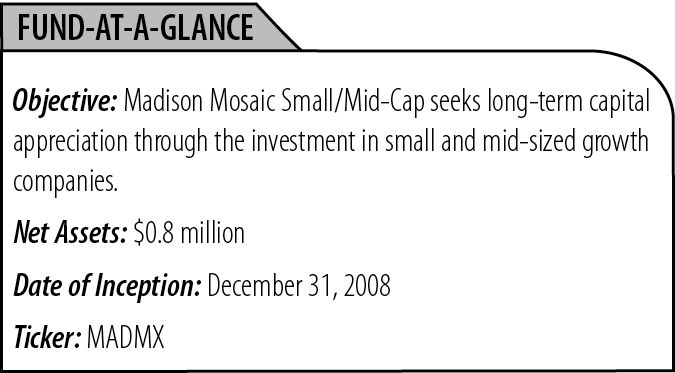

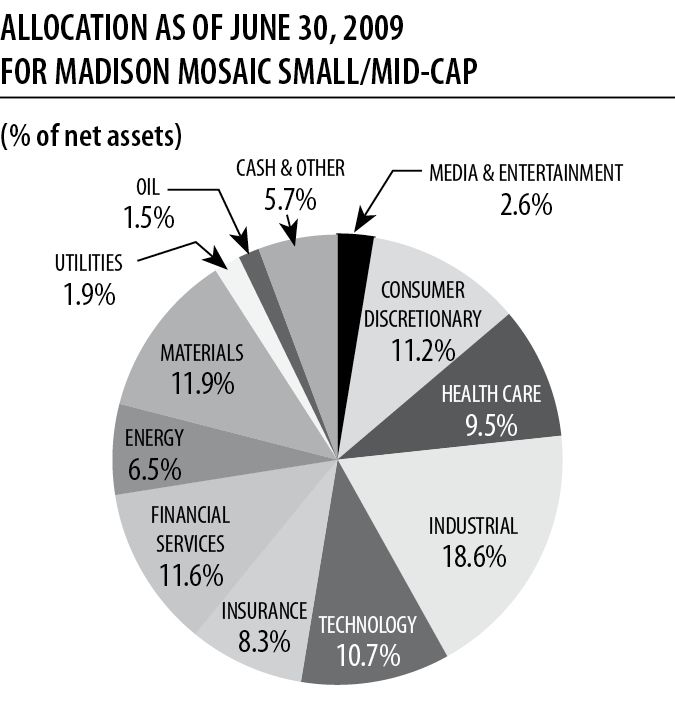

MADISON MOSAIC SMALL/MID-CAP

Mosaic Small/Mid-Cap Fund (MADMX) was launched on 12/31/08 with a mandate to find high-quality companies among a universe of stocks with market capitalizations in the general range of $200 million and $12 billion. The fund’s benchmark is the Russell 2500¨ Index. While it is too early to make any broad characterizations

regarding the fund’s performance, its first six months were quite strong, with a return of 10.80%, well ahead of its Russell benchmark, which saw a 6.52% return. There is currently no Small/Mid Lipper peer group, but the fund did compare favorably with the Lipper Mid-Cap Core Index, which returned 10.18% and the Lipper Small-Cap Core Index, which was up 8.23%.

TOP TEN STOCK HOLDINGS AS OF JUNE 30, 2009

FOR MADISON MOSAIC SMALL/MID-CAP

|

Laboratory Corp. of America Holdings |

2.30% |

|

iShares COMEX Gold Trust |

2.24% |

|

Valspar Corp. |

2.22% |

|

Sears Holdings Corp. |

2.10% |

|

Bed Bath & Beyond Inc. |

2.03% |

|

Iron Mountain |

2.00% |

|

IDEXX Labs, Inc. |

1.97% |

|

Kirby Corp. |

1.95% |

|

Ritchie Brothers Auctioneers |

1.95% |

|

Morningstar, Inc. |

1.93% |

Madison Mosaic Equity Trust 9

Madison Mosaic Equity Trust June 30, 2009

Investors Fund - Portfolio of Investments (unaudited)

|

NUMBER |

VALUE |

||||||

|

COMMON STOCKS: |

|||||||

|

CONSUMER DISCRETIONARY: 7.0% |

|||||||

|

Staples Inc. |

25,369 |

$ |

511,693 |

||||

|

Target Corp. |

20,610 |

813,477 |

|||||

|

Walt Disney Co. |

38,750 |

904,037 |

|||||

|

CONSUMER STAPLES: 12.4% |

|||||||

|

Coca-Cola Co. |

12,713 |

610,097 |

|||||

|

Costco Wholesale Corp. |

12,055 |

550,913 |

|||||

|

Diageo PLC - ADR |

18,030 |

1,032,217 |

|||||

|

PepsiCo, Inc. |

17,112 |

940,476 |

|||||

|

Walgreen Co. |

27,232 |

800,621 |

|||||

|

ENERGY: 6.6% |

|||||||

|

Apache Corp. |

7,745 |

558,802 |

|||||

|

Devon Energy Corp. |

11,840 |

645,280 |

|||||

|

Schlumberger Ltd. |

16,645 |

900,661 |

|||||

|

FINANCIAL SERVICES: 7.0% |

|||||||

|

Franklin Resources |

8,220 |

591,922 |

|||||

|

State Street Corp. |

14,400 |

679,680 |

|||||

|

Wells Fargo & Co. |

39,288 |

953,127 |

|||||

|

HEALTH CARE: 21.2% |

|||||||

|

Baxter International |

18,950 |

1,003,592 |

|||||

|

Covance Inc.* |

19,145 |

941,934 |

|||||

|

Dentsply International Inc. |

21,507 |

656,394 |

|||||

|

Johnson & Johnson |

15,639 |

888,295 |

|||||

|

Medtronic Inc. |

24,594 |

858,085 |

|||||

|

Novartis AG - ADR |

20,618 |

841,008 |

|||||

|

Quest Diagnostics Inc. |

11,745 |

662,770 |

|||||

|

Zimmer Holdings Inc.* |

21,041 |

896,347 |

|||||

|

INDUSTRIAL: 10.9% |

|||||||

|

3M Company |

15,796 |

949,340 |

|||||

|

ABB Ltd - ADR |

47,235 |

745,368 |

|||||

|

Jacobs Engineering Group Inc.* |

19,395 |

816,335 |

|||||

|

Waste Management Inc. |

34,210 |

963,354 |

|||||

|

INSURANCE: 5.8% |

|||||||

|

Berkshire Hathaway Inc.- Class B* |

366 |

$ |

1,059,837 |

||||

|

Markel Corp.* |

2,811 |

791,859 |

|||||

|

MEDIA & ENTERTAINMENT: 3.0% |

|||||||

|

Comcast Corp.- Special Class A* |

67,715 |

954,781 |

|||||

|

TECHNOLOGY: 18.2% |

|||||||

|

Check Point Software Technologies Ltd |

19,565 |

459,191 |

|||||

|

Cisco Systems Inc.* |

72,999 |

1,360,701 |

|||||

|

EMC Corp. |

65,700 |

860,670 |

|||||

|

Google Inc.- Class A* |

2,528 |

1,065,779 |

|||||

|

Hewlett-Packard Co. |

21,855 |

844,696 |

|||||

|

Microsoft Corp. |

50,004 |

1,188,595 |

|||||

|

TOTAL COMMON STOCKS |

$ |

29,301,934 |

|||||

|

REPURCHASE AGREEMENT: |

|||||||

|

With U.S. Bank National Association issued 6/30/09 at 0.01%, due 7/1/09, collateralized by $2,595,960 in Fannie Mae MBS #729590 |

2,544,987 |

||||||

|

TOTAL INVESTMENTS: 100.1% of net assets (Cost $35,644,879) |

$ |

31,846,921 |

|||||

|

LIABILITIES LESS CASH AND RECEIVABLES: (0.1%) of net assets |

(22,780) |

|

|||||

|

NET ASSETS: 100% |

$ |

31,824,141 |

|||||

*Non-income producing

The Notes to Financial Statements are an integral part of these statements.

10 Semi-annual Report • June 30, 2009

Madison Mosaic Equity Trust June 30, 2009

Balanced Fund - Portfolio of Investments (unaudited)

|

NUMBER |

VALUE |

||||||

|

COMMON STOCKS: |

|||||||

|

CONSUMER DISCRETIONARY: 4.9% |

|||||||

|

Staples Inc. |

6,055 |

$ |

122,129 |

||||

|

Target Corp. |

4,545 |

179,391 |

|||||

|

Walt Disney Co. |

9,150 |

213,469 |

|||||

|

CONSUMER STAPLES: 8.7% |

|||||||

|

Coca-Cola Co. |

2,885 |

138,451 |

|||||

|

Costco Wholesale Corp. |

2,865 |

130,931 |

|||||

|

Diageo PLC - ADR |

4,160 |

238,160 |

|||||

|

Pepsico, Inc. |

3,897 |

214,179 |

|||||

|

Walgreen Co. |

6,650 |

195,510 |

|||||

|

ENERGY: 4.6% |

|||||||

|

Apache Corp. |

1,840 |

132,756 |

|||||

|

Devon Energy Corp. |

2,630 |

143,335 |

|||||

|

Schlumberger Ltd. |

3,815 |

206,430 |

|||||

|

FINANCIAL SERVICES: 5.0% |

|||||||

|

Franklin Resources |

1,930 |

138,979 |

|||||

|

State Street Corp. |

3,395 |

160,244 |

|||||

|

Wells Fargo & Co. |

9,340 |

226,588 |

|||||

|

HEALTH CARE: 14.6% |

|||||||

|

Baxter International |

4,305 |

227,993 |

|||||

|

Covance Inc.* |

4,290 |

211,068 |

|||||

|

Dentsply International Inc. |

4,797 |

146,404 |

|||||

|

Johnson & Johnson |

3,595 |

204,196 |

|||||

|

Medtronic Inc. |

5,610 |

195,733 |

|||||

|

Novartis AG - ADR |

4,865 |

198,443 |

|||||

|

Quest Diagnostics Inc. |

2,790 |

157,440 |

|||||

|

Zimmer Holdings Inc.* |

4,601 |

196,003 |

|||||

|

INDUSTRIAL: 7.7% |

|||||||

|

3M Company |

3,760 |

225,976 |

|||||

|

ABB Ltd - ADR |

11,270 |

177,841 |

|||||

|

Jacobs Engineering Group Inc.* |

4,515 |

190,036 |

|||||

|

Waste Management Inc. |

7,650 |

215,424 |

|||||

|

INSURANCE: 4.0% |

|||||||

|

Berkshire Hathaway Inc.- Class B* |

85 |

246,137 |

|||||

|

Markel Corp.* |

627 |

176,626 |

|||||

|

NUMBER |

VALUE |

||||||

|

MEDIA & ENTERTAINMENT: 2.1% |

|||||||

|

Comcast Corp.- Special Class A* |

15,597 |

$ |

219,918 |

||||

|

TECHNOLOGY: 12.7% |

|||||||

|

Check Point Software Technologies Ltd |

4,305 |

101,038 |

|||||

|

Cisco Systems, Inc.* |

17,315 |

322,752 |

|||||

|

EMC Corp. |

15,420 |

202,002 |

|||||

|

Google Inc.- Class A* |

603 |

254,219 |

|||||

|

Hewlett-Packard Co. |

5,035 |

194,603 |

|||||

|

Microsoft Corp. |

11,100 |

263,847 |

|||||

|

TOTAL COMMON STOCKS |

$ |

6,768,251 |

|||||

|

PRINCIPAL AMOUNT |

VALUE |

||||||

|

DEBT INSTRUMENTS: |

|||||||

|

CORPORATE OBLIGATIONS: 20.3% |

|||||||

|

BANKS: 1.2% |

|||||||

|

Wachovia Corp., 5.25%, 8/1/14 |

$ |

125,000 |

$ |

122,456 |

|||

|

COMPUTERS & PERIPHERAL: 1.0% |

|||||||

|

Hewlett-Packard Co., 4.5%, 3/1/13 |

100,000 |

104,053 |

|||||

|

CONSUMER GOODS: 2.5% |

|||||||

|

Costco Wholesale Corp., 5.3%, 3/15/12 |

100,000 |

107,540 |

|||||

|

Wal-Mart Stores, Inc., 4.75%, 8/15/10 |

150,000 |

154,836 |

|||||

|

CONSUMER STAPLES: 2.0% |

|||||||

|

Kraft Foods, Inc., 5.625%, 11/1/11 |

100,000 |

106,305 |

|||||

|

Sysco Corp. 5.25%, 2/12/18 |

100,000 |

101,786 |

|||||

|

ENERGY: 1.5% |

|||||||

|

Valero Energy Corp., 6.875%, 4/15/12 |

150,000 |

159,613 |

|||||

|

FINANCIALS: 3.1% |

|||||||

|

American Express Co., 4.875%, 7/15/13 |

150,000 |

146,647 |

|||||

|

International Lease Finance, 4.875%, 9/1/10 |

200,000 |

179,323 |

|||||

Madison Mosaic Equity Trust 11

Balanced Fund • Portfolio of Investments • June 30, 2009 (concluded)

|

PRINCIPAL AMOUNT |

VALUE |

||||

|

HEALTH CARE: 2.9% |

|||||

|

Abbot Laboratories, 5.6%, 11/30/17 |

125,000 |

$ |

134,117 |

||

|

UnitedHealth Group, 5%, 8/15/14 |

175,000 |

170,418 |

|||

|

INDUSTRIAL: 1.0% |

|||||

|

United Parcel, 5.5%, 1/15/18 |

100,000 |

106,686 |

|||

|

TECHNOLOGY: 2.0% |

|||||

|

Cisco Systems, Inc., 5.25%, 2/22/11 |

100,000 |

105,485 |

|||

|

Oracle Corp., 4.95%, 4/15/13 |

100,000 |

104,806 |

|||

|

TELECOMMUNICATIONS: 3.1% |

|||||

|

AT & T Broadband, 8.375%, 3/15/13 |

150,000 |

171,139 |

|||

|

Verizon New England, 6.5%, 9/15/11 |

150,000 |

159,745 |

|||

|

US TREASURY & AGENCY OBLIGATIONS: 12.3% |

|||||

|

Fannie Mae, 6.625%, 11/15/10 |

200,000 |

215,947 |

|||

|

Fannie Mae, 4.875%, 5/18/12 |

150,000 |

163,145 |

|||

|

Federal Home Loan Bank, 4.375% 9/17/10 |

200,000 |

208,963 |

|||

|

Federal Home Loan Bank, 5.5% 8/13/14 |

150,000 |

167,650 |

|||

|

Freddie Mac, 4.875%, 11/15/13 |

150,000 |

163,826 |

|||

|

US Treasury Note, 5.125%, 6/30/11 |

150,000 |

161,848 |

|||

|

US Treasury Note, 3.875%, 5/15/18 |

60,000 |

61,842 |

|||

|

US Treasury Note, 3.75%, 11/15/18 |

150,000 |

152,637 |

|||

|

TOTAL DEBT INSTRUMENTS |

$ |

3,430,813 |

|||

|

PRINCIPAL AMOUNT |

VALUE |

||||

|

REPURCHASE AGREEMENT: |

|||||

|

With U.S. Bank National Association issued 6/30/09 at 0.01%, due 7/1/09, collateralized by $264,412 in Fannie Mae MBS #729590 due 7/1/18. Proceeds at maturity are $259,221 (Cost $259,221) |

$ |

259,221 |

|||

|

TOTAL INVESTMENTS: 99.4% of net assets (Cost $10,780,929) |

$ |

10,458,285 |

|||

|

CASH AND RECEIVABLES LESS LIABILITIES: 0.6% of net assets |

64,493 |

||||

|

NET ASSETS: 100% |

$ |

10,522,778 |

*Non-income producing

The Notes to Financial Statements are an integral part of these statements.

12 Semi-annual Report • June 30, 2009

Madison Mosaic Equity Trust June 30, 2009

Disciplined Equity Fund • Portfolio of Investments (unaudited)

|

NUMBER |

VALUE |

||||||

|

COMMON STOCKS: |

|||||||

|

CONSUMER DISCRETIONARY: 5.7% |

|||||||

|

Nike Inc.- Class B |

945 |

$ |

48,932 |

||||

|

Staples Inc. |

2,300 |

46,391 |

|||||

|

Target Corp. |

1,495 |

59,008 |

|||||

|

Walt Disney Co. |

2,605 |

60,775 |

|||||

|

CONSUMER STAPLES: 11.9% |

|||||||

|

Clorox Co. |

750 |

41,872 |

|||||

|

Coca-Cola Co. |

1,125 |

53,989 |

|||||

|

Costco Wholesale Corp. |

1,225 |

55,983 |

|||||

|

Diageo Ltd - ADR |

1,265 |

72,421 |

|||||

|

Pepsico, Inc. |

1,395 |

76,669 |

|||||

|

Procter & Gamble |

1,965 |

100,412 |

|||||

|

Walgreen Co. |

1,655 |

48,657 |

|||||

|

ENERGY: 11.7% |

|||||||

|

Apache Corp. |

565 |

40,765 |

|||||

|

ConocoPhillips Inc. |

2,245 |

94,425 |

|||||

|

Devon Energy Corp. |

1,230 |

67,035 |

|||||

|

Exxon Mobil Corp. |

1,418 |

99,132 |

|||||

|

Schlumberger Ltd. |

1,590 |

86,035 |

|||||

|

XTO Energy Inc. |

1,450 |

55,303 |

|||||

|

FINANCIAL SERVICES: 6.0% |

|||||||

|

Brookfield Asset Management Inc. |

2,060 |

35,164 |

|||||

|

Franklin Resources |

765 |

55,088 |

|||||

|

State Street Corp. |

1,250 |

59,000 |

|||||

|

Wells Fargo & Co. |

3,095 |

75,085 |

|||||

|

HEALTH CARE: 14.2% |

|||||||

|

Baxter International |

1,355 |

71,761 |

|||||

|

Becton, Dickinson & Co. |

390 |

27,811 |

|||||

|

Covance Inc.* |

1,200 |

59,040 |

|||||

|

Dentsply International Inc. |

1,295 |

39,523 |

|||||

|

Johnson & Johnson |

1,685 |

95,708 |

|||||

|

Medtronic, Inc. |

1,100 |

38,379 |

|||||

|

Novartis AG - ADR |

2,085 |

85,047 |

|||||

|

Quest Diagnostics Inc. |

805 |

45,426 |

|||||

|

Zimmer Holdings Inc.* |

1,657 |

70,588 |

|||||

|

NUMBER |

VALUE |

||||||

|

INDUSTRIAL: 8.2% |

|||||||

|

3M Company |

1,320 |

$ |

79,332 |

||||

|

ABB Ltd - ADR |

3,695 |

58,307 |

|||||

|

Jacobs Engineering Group Inc.* |

1,300 |

54,717 |

|||||

|

United Technologies |

1,165 |

60,533 |

|||||

|

Waste Management Inc. |

2,030 |

57,165 |

|||||

|

INSURANCE: 6.4% |

|||||||

|

Aflac Inc. |

1,505 |

46,790 |

|||||

|

Berkshire Hathaway Inc.- Class B* |

23 |

66,602 |

|||||

|

Markel Corp.* |

239 |

67,326 |

|||||

|

OdysseyRe Holdings Corp. |

1,555 |

62,169 |

|||||

|

MATERIALS: 4.4% |

|||||||

|

ITT Corp. |

1,025 |

45,612 |

|||||

|

Praxair Inc. |

570 |

40,510 |

|||||

|

Sigma-Aldrich |

780 |

38,657 |

|||||

|

Valspar Corp. |

1,785 |

40,216 |

|||||

|

MEDIA & ENTERTAINMENT: 2.2% |

|||||||

|

Comcast Corp.- Special Class A* |

5,987 |

84,417 |

|||||

|

TECHNOLOGY: 17.0% |

|||||||

|

Check Point Software Technologies Ltd |

2,290 |

53,746 |

|||||

|

Cisco Systems, Inc.* |

8,475 |

157,974 |

|||||

|

EMC Corp. |

6,035 |

79,059 |

|||||

|

Fiserv Inc.* |

875 |

39,987 |

|||||

|

Google Inc.- Class A* |

127 |

53,542 |

|||||

|

Hewlett-Packard Co. |

2,665 |

103,002 |

|||||

|

Microsoft Corp. |

6,400 |

152,128 |

|||||

|

TELECOMMUNICATIONS: 3.9% |

|||||||

|

AT & T |

1,985 |

49,308 |

|||||

|

China Mobile Ltd.-ADR |

675 |

33,804 |

|||||

|

Vodafone Group-ADR |

3,280 |

63,927 |

|||||

|

UTILITIES: 3.6% |

|||||||

|

Entergy Corp. |

920 |

71,318 |

|||||

|

FPL Group Inc. |

1,125 |

63,968 |

|||||

|

TOTAL COMMON STOCKS |

$ |

3,589,540 |

|||||

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Equity Trust 13

Disciplined Equity Fund • Portfolio of Investments • June 30, 2009 (concluded)

|

NUMBER |

VALUE |

||

|

REPURCHASE AGREEMENT: |

|||

|

With U.S. Bank National Association issued 6/30/09 at 0.01%, due 7/1/09, collateralized by $201,872 in Fannie Mae MBS #729590 due 7/1/18. Proceeds at maturity are $197,908 (Cost $197,908) |

$ |

197,908 |

|

|

TOTAL INVESTMENTS: 100.5% of net assets (Cost $4,048,432) |

$ |

3,787,448 |

|

|

LIABILITIES LESS CASH AND RECEIVABLES: (0.5%) of net assets |

(20,167) |

||

|

NET ASSETS: 100% |

$ |

3,767,281 |

*Non-income producing

The Notes to Financial Statements are an integral part of these statements.

14 Semi-annual Report • June 30, 2009

Madison Mosaic Equity Trust June 30, 2009

Mid-Cap Fund • Portfolio of Investments (unaudited)

|

NUMBER |

VALUE |

||||||

|

COMMON STOCKS: |

|||||||

|

CONSUMER |

|||||||

|

Bed Bath & Beyond Inc.* |

65,935 |

$ 2,027,501 |

|||||

|

Brown-Forman Corp.- Class B |

75,053 |

3,225,778 |

|||||

|

CarMax Inc.* |

166,614 |

2,449,226 |

|||||

|

Mohawk Industries Inc.* |

43,215 |

1,541,911 |

|||||

|

Starbucks Corp.* |

153,060 |

2,126,003 |

|||||

|

Tiffany & Company |

78,478 |

1,990,202 |

|||||

|

YUM! Brands Inc. |

85,525 |

2,851,404 |

|||||

|

ENERGY: 7.0% |

|||||||

|

Apache Corp. |

29,545 |

2,131,672 |

|||||

|

EOG Resources Inc. |

35,880 |

2,436,970 |

|||||

|

Noble Corp. |

70,485 |

2,132,171 |

|||||

|

Unit Corp.* |

50,795 |

1,400,418 |

|||||

|

FINANCIAL SERVICES: 10.9% |

|||||||

|

Brookfield Asset Management Inc. |

236,651 |

4,039,633 |

|||||

|

Glacier Bancorp, Inc. |

163,610 |

2,416,520 |

|||||

|

Leucadia National Corp. |

140,010 |

2,952,811 |

|||||

|

SEI Investments Co. |

175,049 |

3,157,884 |

|||||

|

HEALTH CARE: 13.4% |

|||||||

|

Covance Inc.* |

63,675 |

3,132,810 |

|||||

|

Dentsply International Inc. |

77,824 |

2,375,188 |

|||||

|

Laboratory Corp of America Holdings* |

62,649 |

4,246,976 |

|||||

|

Techne Corp. |

37,079 |

2,366,011 |

|||||

|

Zimmer Holdings Inc.* |

77,685 |

3,309,381 |

|||||

|

INDUSTRIAL: 19.8% |

|||||||

|

Copart, Inc.* |

93,200 |

3,231,244 |

|||||

|

Dun & Bradstreet Corp. |

32,065 |

2,603,998 |

|||||

|

Expeditors Int’l of Washington Inc. |

77,140 |

2,571,848 |

|||||

|

Iron Mountain* |

102,237 |

2,939,314 |

|||||

|

Jacobs Engineering Group Inc.* |

81,140 |

3,415,183 |

|||||

|

Kaydon Corp. |

68,340 |

2,225,150 |

|||||

|

Kirby Corp.* |

95,631 |

3,040,109 |

|||||

|

Waste Management, Inc. |

96,450 |

2,716,032 |

|||||

|

NUMBER |

VALUE |

||||||

|

INSURANCE: 10.1% |

|||||||

|

Brown & Brown, Inc. |

169,662 |

$3,381,364 |

|||||

|

Markel Corp.* |

15,376 |

4,331,419 |

|||||

|

Odyssey Re Holdings Corp. |

96,280 |

3,849,274 |

|||||

|

MATERIALS: 7.0% |

|||||||

|

Ecolab Inc. |

72,485 |

2,826,190 |

|||||

|

IDEX Corp. |

86,944 |

2,136,214 |

|||||

|

Martin Marietta Materials |

39,081 |

3,082,709 |

|||||

|

MEDIA & ENTERTAINMENT: 2.1% |

|||||||

|

Liberty Global Inc.- Series C* |

149,120 |

2,357,587 |

|||||

|

TECHNOLOGY: 6.0% |

|||||||

|

Fiserv Inc.* |

66,901 |

3,057,376 |

|||||

|

Zebra Technologies Corp.- Class A* |

160,400 |

3,795,064 |

|||||

|

UTILITIES: 3.0% |

|||||||

|

Covanta Holding Corp.* |

206,250 |

3,498,000 |

|||||

|

TOTAL COMMON STOCKS |

$ |

107,368,545 |

|||||

|

REPURCHASE AGREEMENT: |

|||||||

|

With U.S. Bank National Association issued 6/30/09 at 0.01%, due 7/1/09, collateralized by $7,246,995 in Fannie Mae MBS #729590 due 7/1/18. Proceeds at maturity are $7,104,696 (Cost $7,104,694) |

7,104,694 |

||||||

|

TOTAL INVESTMENTS: 99.6% of net assets (Cost $119,764,322) |

$ |

114,473,239 |

|||||

|

CASH AND RECEIVABLES LESS LIABILITIES: 0.4% of net assets |

437,919 |

||||||

|

NET ASSETS: 100% |

$ |

114,911,158 |

|||||

*Non-income producing

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Equity Trust 15

Madison Mosaic Equity Trust June 30, 2009

Small/Mid-Cap Fund • Portfolio of Investments (unaudited)

|

NUMBER |

VALUE |

||||||

|

COMMON STOCKS: |

|||||||

|

CONSUMER DISCRETIONARY: 11.2% |

|||||||

|

Bed Bath & Beyond Inc.* |

565 |

$ |

17,374 |

||||

|

Brown-Forman Corp.- Class B |

270 |

11,605 |

|||||

|

CarMax Inc.* |

770 |

11,319 |

|||||

|

Jack-in-the-Box Inc.* |

655 |

14,705 |

|||||

|

Mohawk Industries Inc.* |

260 |

9,277 |

|||||

|

Sears Holdings Corp.* |

270 |

17,960 |

|||||

|

YUM! Brands Inc. |

405 |

13,503 |

|||||

|

ENERGY: 6.5% |

|||||||

|

Cimarex Energy Co. |

370 |

10,486 |

|||||

|

ENSCO International Inc. |

440 |

15,343 |

|||||

|

EQT Corp. |

325 |

11,345 |

|||||

|

Rowan Companies, Inc. |

415 |

8,018 |

|||||

|

Unit Corp.* |

390 |

10,752 |

|||||

|

FINANCIAL SERVICES: 10.8% |

|||||||

|

Brookfield Asset Management Inc. |

805 |

13,741 |

|||||

|

Fidelity National Finance |

805 |

10,892 |

|||||

|

Glacier Bancorp, Inc. |

710 |

10,487 |

|||||

|

Jeffries Group Inc. |

575 |

12,265 |

|||||

|

Leucadia National Corp. |

655 |

13,814 |

|||||

|

Morningstar, Inc.* |

400 |

16,492 |

|||||

|

SEI Investments Co. |

845 |

15,244 |

|||||

|

HEALTH CARE: 9.5% |

|||||||

|

Covance Inc.* |

305 |

15,006 |

|||||

|

Dentsply International Inc. |

530 |

16,176 |

|||||

|

IDEXX Labs, Inc.* |

365 |

16,863 |

|||||

|

Laboratory Corp. of America Holdings* |

290 |

19,659 |

|||||

|

Techne Corp. |

210 |

13,400 |

|||||

|

INDUSTRIAL: 18.5% |

|||||||

|

Aecom Technology Corp.* |

495 |

15,840 |

|||||

|

American Ecology Corp. |

650 |

11,648 |

|||||

|

Copart, Inc.* |

460 |

15,948 |

|||||

|

Expeditors Int’l of Washington Inc. |

425 |

14,169 |

|||||

|

Fastenal Co. |

365 |

12,107 |

|||||

|

Iron Mountain* |

595 |

17,106 |

|||||

|

Kaydon Corp. |

385 |

12,536 |

|||||

|

Kirby Corp.* |

525 |

16,690 |

|||||

|

NUMBER |

VALUE |

||||||

|

INDUSTRIAL (continued) |

|||||||

|

Knight Transport Inc. |

730 |

$ |

12,082 |

||||

|

Middleby Corp. |

320 |

14,054 |

|||||

|

Ritchie Brothers Auctioneers |

710 |

16,650 |

|||||

|

INSURANCE: 8.3% |

|||||||

|

Aflac Inc. |

395 |

12,280 |

|||||

|

Brown & Brown, Inc. |

655 |

13,054 |

|||||

|

Markel Corp.* |

36 |

10,141 |

|||||

|

OdysseyRe Holdings Corp. |

365 |

14,593 |

|||||

|

RLI Corp. |

290 |

12,992 |

|||||

|

White Mountains Insurance Group |

35 |

7,981 |

|||||

|

MATERIALS: 11.9% |

|||||||

|

Ball Corp. |

315 |

14,225 |

|||||

|

Bemis Company |

480 |

12,096 |

|||||

|

IDEX Corp. |

615 |

15,111 |

|||||

|

iShares COMEX Gold Trust* |

210 |

19,160 |

|||||

|

Martin Marietta Materials |

111 |

8,756 |

|||||

|

Sigma-Aldrich |

270 |

13,381 |

|||||

|

Valspar Corp. |

845 |

19,038 |

|||||

|

MEDIA & ENTERTAINMENT: 2.6% |

|||||||

|

Discovery Communications Inc.* |

665 |

14,996 |

|||||

|

Liberty Global Inc.- Series C* |

485 |

7,668 |

|||||

|

OIL: 1.5% |

|||||||

|

Contango Oil & Gas* |

305 |

12,959 |

|||||

|

TECHNOLOGY: 10.7% |

|||||||

|

Concur Technologies, Inc.* |

480 |

14,918 |

|||||

|

FactSet Research Systems Inc. |

305 |

15,210 |

|||||

|

FARO Technologies Inc.* |

595 |

9,240 |

|||||

|

FLIR Systems, Inc.* |

460 |

10,378 |

|||||

|

Maxim Integrated Products, Inc. |

810 |

12,709 |

|||||

|

Teradata Corp.* |

670 |

15,698 |

|||||

|

Zebra Technologies Corp.- Class A* |

555 |

13,131 |

|||||

|

UTILITIES: 1.9% |

|||||||

|

Covanta Holding Corp.* |

970 |

16,451 |

|||||

|

TOTAL COMMON STOCKS |

$ |

800,722 |

|||||

The Notes to Financial Statements are an integral part of these statements.

16 Semi-annual Report • June 30, 2009

|

NUMBER |

VALUE |

|||

|

REPURCHASE AGREEMENT: |

||||

|

With U.S. Bank National Association issued 6/30/09 at 0.01%, due 7/1/09, collateralized by $50,381 in Fannie Mae MBS #729590 due 7/1/18. Proceeds at maturity are $49,392 (Cost $49,392) |

$ |

49,392 |

||

|

TOTAL INVESTMENTS: 99.2% of net assets (Cost $761,870) |

$ |

850,114 |

||

|

CASH AND RECEIVABLES LESS LIABILITIES: 0.8% of net assets |

6,764 |

|||

|

NET ASSETS: 100% |

$ |

856,878 |

||

*Non-income producing

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Equity Trust 17

Madison Mosaic Equity Trust June 30, 2009

Statements of Assets and Liabilities (unaudited)

|

Investors Fund |

Balanced Fund |

Disciplined Equity Fund |

Mid-Cap Fund |

Small/ Fund |

|

|

ASSETS |

|||||

|

Investments, at value (Notes 1 and 2) |

|||||

|

Investment securities |

$29,301,934 |

$10,199,064 |

$3,589,540 |

$107,368,545 |

$800,722 |

|

Repurchase agreements |

2,544,987 |

259,221 |

197,908 |

7,104,694 |

49,392 |

|

Total investments* |

31,846,921 |

10,458,285 |

3,787,448 |

114,473,239 |

850,114 |

|

Receivables |

|||||

|

Investment securities sold |

196,588 |

67,953 |

-- |

-- |

6,581 |

|

Dividends and interest |

20,422 |

51,134 |

5,368 |

57,824 |

375 |

|

Capital shares sold |

26,856 |

275 |

3,483 |

409,614 |

1,099 |

|

Total assets |

32,090,787 |

10,577,647 |

3,796,299 |

114,940,677 |

858,169 |

|

LIABILITIES |

|||||

|

Payables |

|||||

|

Investment securities purchased |

242,345 |

47,608 |

25,552 |

-- |

-- |

|

Dividends |

-- |

2,599 |

-- |

-- |

-- |

|

Capital shares redeemed |

3,000 |

1,074 |

1,341 |

14,798 |

-- |

|

Service agreement fees |

10,676 |

-- |

-- |

-- |

666 |

|

Auditor fees |

6,750 |

2,713 |

1,750 |

10,846 |

625 |

|

Independent trustee fees |

3,875 |

875 |

375 |

3,875 |

-- |

|

Total liabilities |

266,646 |

54,869 |

29,018 |

29,519 |

1,291 |

|

NET ASSETS |

$31,824,141 |

$10,522,778 |

$3,767,281 |

$114,911,158 |

$856,878 |

|

Net assets consists of: |

|||||

|

Paid in capital |

43,049,758 |

11,878,216 |

4,692,283 |

144,719,405 |

762,880 |

|

Undistributed net investment income (loss) |

96,448 |

-- |

15,372 |

(143,425) |

(1,122) |

|

Accumulated net realized gains (losses) |

(7,524,107) |

(1,032,794) |

(679,390) |

(24,373,739) |

6,876 |

|

Net unrealized appreciation (depreciation) |

(3,797,958) |

(322,644) |

(260,984) |

(5,291,083) |

88,244 |

|

Net assets |

$31,824,141 |

$10,522,778 |

$3,767,281 |

$114,911,158 |

$856,878 |

|

CAPITAL SHARES OUTSTANDING |

|||||

|

An unlimited number of capital shares, |

2,570,903 |

741,023 |

393,312 |

14,247,680 |

77,343 |

|

NET ASSET VALUE PER SHARE |

$12.38 |

$14.20 |

$9.58 |

$8.07 |

$11.08 |

|

*INVESTMENT SECURITIES, AT COST |

$35,644,879 |

$10,780,929 |

$4,048,432 |

$119,764,322 |

$761,870 |

The Notes to Financial Statements are an integral part of these statements.

18 Semi-annual Report • June 30, 2009

Madison Mosaic Equity Trust

Statements of Operations (unaudited)

For the six-months ended June 30, 2009

|

Investors Fund |

Balanced Fund |

Disciplined Equity Fund |

Mid-Cap Fund |

Small/ Fund |

|

|

INVESTMENT INCOME (Note 1) |

|||||

|

Interest income |

$66 |

$82,876 |

$-- |

$327 |

$-- |

|

Dividend income |

216,980 |

50,913 |

30,923 |

464,088 |

3,310 |

|

Total investment income |

217,046 |

133,789 |

30,923 |

464,415 |

3,310 |

|

EXPENSES (Notes 3 and 5) |

|||||

|

Investment advisory fees |

101,310 |

36,542 |

11,781 |

359,295 |

2,659 |

|

Other expenses: |

|||||

|

Service agreement fees |

20,564 |

19,977 |

2,998 |

229,949 |

1,148 |

|

Auditor fees |

6,750 |

2,713 |

1,750 |

10,846 |

625 |

|

Independent trustee fees |

7,750 |

1,750 |

750 |

7,750 |

-- |

|

Line of credit interest and fees |

8 |

-- |

-- |

-- |

-- |

|

Other expenses waived |

-- |

-- |

(1,728) |

-- |

-- |

|

Total other expenses |

35,072 |

24,440 |

3,770 |

248,545 |

1,773 |

|

Total expenses |

136,382 |

60,982 |

15,551 |

607,840 |

4,432 |

|

NET INVESTMENT INCOME (LOSS) |

80,664 |

72,807 |

15,372 |

(143,425) |

(1,122) |

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS |

|||||

|

Net realized gain (loss) on investments |

(3,703,083) |

(656,939) |

(339,821) |

(7,218,397) |

6,876 |

|

Change in net unrealized appreciation of investments |

6,178,596 |

1,317,997 |

630,284 |

14,735,991 |

88,244 |

|

NET GAIN ON INVESTMENTS |

2,475,513 |

661,058 |

290,463 |

7,517,594 |

95,120 |

|

TOTAL INCREASE IN NET ASSETS |

$2,556,177 |

$733,865 |

$305,835 |

$7,374,169 |

$93,998 |

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Equity Trust 19

Madison Mosaic Equity Trust

Statements of Changes in Net Assets

For the period indicated

|

Investors Fund |

Balanced Fund |

|||

|

(unaudited) |

Year Ended Dec. 31, |

(unaudited) |

Year Ended Dec. 31, |

|

|

2009 |

2008 |

2009 |

2008 |

|

|

INCREASE (DECREASE) IN NET ASSETS |

||||

|

Net investment income |

$80,664 |

$197,784 |

$72,807 |

$183,567 |

|

Net realized loss on investments |

(3,703,083) |

(3,690,284) |

(656,939) |

(374,909) |

|

Net unrealized appreciation (depreciation) on investments |

6,178,596 |

(12,030,041) |

1,317,997 |

(2,446,122) |

|

Total increase (decrease) in net assets |

2,556,177 |

(15,522,541) |

733,865 |

(2,637,464) |

|

DISTRIBUTIONS TO SHAREHOLDERS |

||||

|

From net investment income |

-- |

(182,000) |

(72,807) |

(183,567) |

|

From net capital gains |

-- |

(1,977,544) |

-- |

(442,077) |

|

Total distributions |

-- |

(2,159,544) |

(72,807) |

(625,644) |

|

CAPITAL SHARE TRANSACTIONS (Note 7) |

1,237,580 |

(10,278,608) |

(277,202) |

(397,601) |

|

TOTAL INCREASE (DECREASE) IN NET ASSETS |

3,793,757 |

(27,960,693) |

383,856 |

(3,660,709) |

|

NET ASSETS |

||||

|

Beginning of period |

$28,030,384 |

$55,991,077 |

$10,138,922 |

$13,799,631 |

|

End of period |

$31,824,141 |

$28,030,384 |

$10,522,778 |

$10,138,922 |

The Notes to Financial Statements are an integral part of these statements.

20 Semi-annual Report • June 30, 2009

Statements of Changes in Net Assets (concluded)

|

Disciplined Equity Fund |

Mid-Cap Fund |

Small/ |

|||

|

(unaudited) |

Year Ended Dec. 31, |

(unaudited) |

Year Ended Dec. 31, |

(unaudited) |

|

|

2009 |

2008 |

2009 |

2008 |

2009 |

|

|

INCREASE (DECREASE) IN NET ASSETS |

|||||

|

Net investment income (loss) |

$15,372 |

$31,772 |

$(143,425) |

$(396,723) |

$(1,122) |

|

Net realized gain (loss) on investments |

(339,821) |

(339,569) |

(7,218,397) |

(17,155,342) |

6,876 |

|

Net unrealized appreciation (depreciation) on investments |

630,284 |

(1,252,633) |

14,735,991 |

(37,108,476) |

88,244 |

|

Total increase (decrease) in net assets resulting from operations |

305,835 |

(1,560,430) |

7,374,169 |

(54,660,541) |

93,998 |

|

DISTRIBUTIONS TO SHAREHOLDERS |

|||||

|

From net investment income |

-- |

(31,772) |

-- |

- |

-- |

|

From net capital gains |

-- |

(55,612) |

-- |

(5,114,645) |

-- |

|

Total distributions |

-- |

(87,384) |

-- |

(5,114,645) |

-- |

|

CAPITAL SHARE TRANSACTIONS (Note 7) |

389,762 |

220,282 |

18,573,085 |

2,361,460 |

762,880 |

|

TOTAL INCREASE (DECREASE) IN NET ASSETS |

695,597 |

(1,427,532) |

25,947,254 |

(57,413,726) |

856,878 |

|

NET ASSETS |

|||||

|

Beginning of period |

$3,071,684 |

$4,499,216 |

$88,963,904 |

$146,377,630 |

$ -- |

|

End of period |

$3,767,281 |

$3,071,684 |

$114,911,158 |

$88,963,904 |

$856,878 |

* Inception of Fund was December 31, 2008 with effective date of January 1, 2009.

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Equity Trust 21

Madison Mosaic Equity Trust

Financial Highlights

Selected data for a share outstanding for the periods indicated.

INVESTORS FUND

|

(unaudited) |

Year Ended December 31, |

||||

|

2009 |

2008 |

2007 |

2006 |

2005 |

|

|

Net asset value, beginning of period |

$11.31 |

$18.44 |

$20.57 |

$18.81 |

$20.82 |

|

Investment operations: |

|||||

|

Net investment income |

0.03 |

0.08 |

0.20 |

0.09 |

0.06 |

|

Net realized and unrealized gain (loss) on investments |

1.04 |

(6.28) |

(0.21) |

3.02 |

(0.62) |

|

Total from investment operations |

1.07 |

(6.20) |

(0.01) |

3.11 |

(0.56) |

|

Less distributions: |

|||||

|

From net investment income |

-- |

(0.08) |

(0.20) |

(0.09) |

(0.06) |

|

From net capital gains |

-- |

(0.85) |

(1.92) |

(1.26) |

(1.39) |

|

Total distributions |

-- |

(0.93) |

(2.12) |

(1.35) |

(1.45) |

|

Net asset value, end of period |

$12.38 |

$11.31 |

$18.44 |

$20.57 |

$18.81 |

|

Total return (%) |

9.46 |

(33.40) |

(0.18) |

16.55 |

(2.81) |

|

Ratios and supplemental data |

|||||

|

Net assets, end of period (in thousands) |

$31,824 |

$28,030 |

$55,991 |

$176,861 |

$130,339 |

|

Ratio of expenses to average net assets (%) |

1.001 |

1.05 |

0.94 |

0.95 |

0.94 |

|

Ratio of net investment income to average net assets (%) |

0.591 |

0.47 |

0.78 |

0.55 |

0.29 |

|

Portfolio turnover (%) |

39 |

47 |

51 |

52 |

41 |

BALANCED FUND

|

(unaudited) |

Year Ended December 31, |

||||

|

2009 |

2008 |

2007 |

2006 |

2005 |

|

|

Net asset value, beginning of period |

$13.29 |

$17.62 |

$18.39 |

$17.40 |

$19.51 |

|

Investment operations: |

|||||

|

Net investment income |

0.10 |

0.25 |

0.28 |

0.23 |

0.18 |

|

Net realized and unrealized gain (loss) on investments |

0.91 |

(3.72) |

0.13 |

1.84 |

(0.60) |

|

Total from investment operations |

1.01 |

(3.47) |

0.41 |

2.07 |

(0.42) |

|

Less distributions: |

|||||

|

From net investment income |

(0.10) |

(0.25) |

(0.28) |

(0.23) |

(0.18) |

|

From net capital gains |

-- |

(0.61) |

(0.90) |

(0.85) |

(1.51) |

|

Total distributions |

(0.10) |

(0.86) |

(1.18) |

(1.08) |

(1.69) |

|

Net asset value, end of period |

$14.20 |

$13.29 |

$17.62 |

$18.39 |

$17.40 |

|

Total return (%) |

7.64 |

(19.92) |

2.24 |

11.96 |

(2.16) |

|

Ratios and supplemental data |

|||||

|

Net assets, end of period (in thousands) |

$10,523 |

$10,139 |

$13,800 |

$16,267 |

$17,514 |

|

Ratio of expenses to average net assets (%) |

1.241 |

1.24 |

1.22 |

1.22 |

1.21 |

|

Ratio of net investment income to average net assets (%) |

1.481 |

1.49 |

1.47 |

1.24 |

0.88 |

|

Portfolio turnover (%) |

27 |

50 |

42 |

35 |

34 |

1Annualized.

The Notes to Financial Statements are an integral part of these statements.

22 Semi-annual Report • June 30, 2009

Financial Highlights (continued)

Selected data for a share outstanding for the periods indicated.

DISCIPLINED EQUITY FUND

|

(unaudited) |

Year Ended December 31, |

||||

|

2009 |

2008 |

2007 |

2006 |

2005 |

|

|

Net asset value, beginning of period |

$8.81 |

$13.78 |

$14.07 |

$12.61 |

$13.38 |

|

Investment operations: |

|||||

|

Net investment income |

0.04 |

0.09 |

0.06 |

0.07 |

0.03 |

|

Net realized and unrealized gain (loss) on investments |

0.73 |

(4.80) |

1.21 |

2.05 |

(0.35) |

|

Total from investment operations |

0.77 |

(4.71) |

1.27 |

2.12 |

(0.32) |

|

Less distributions: |

|||||

|

From net investment income |

-- |

(0.09) |

(0.06) |

(0.07) |

(0.03) |

|

From net capital gains |

-- |

(0.17) |

(1.50) |

(0.59) |

(0.42) |

|

Total distributions |

-- |

(0.26 |

(1.56) |

(0.66) |

(0.45) |

|

Net asset value, end of period |

$9.58 |

$8.81 |

$13.78 |

$14.07 |

$12.61 |

|

Total return (%) |

8.74 |

(34.20) |

9.05 |

16.83 |

(2.34) |

|

Ratios and supplemental data |

|||||

|

Net assets, end of period (in thousands) |

$3,767 |

$3,072 |

$4,499 |

$4,081 |

$3,608 |

|

Ratio of expenses to average net assets before fee waiver (%) |

1.091 |

1.14 |

1.26 |

1.27 |

1.25 |

|

Ratio of expenses to average net assets after fee waiver (%) |

0.981 |

1.06 |

N/A |

N/A |

N/A |

|

Ratio of net investment income to average net assets |

0.861 |

0.72 |

0.41 |

0.54 |

0.24 |

|

Ratio of net investment income to average net assets |

0.971 |

0.80 |

N/A |

N/A |

N/A |

|

Portfolio turnover (%) |

41 |

63 |

70 |

54 |

122 |

MID-CAP FUND

|

(unaudited) |

Year Ended December 31, |

|||||

|

2009 |

2008 |

2007 |

2006 |

2005 |

||

|

Net asset value, beginning of period |

$7.67 |

$12.87 |

$13.04 |

$11.99 |

$12.52 |

|

|

Investment operations: |

||||||

|

Net investment loss |

(0.01) |

(0.03) |

(0.02) |

(0.02) |

(0.05) |

|

|

Net realized and unrealized gain (loss) on investments |

0.41 |

(4.71) |

1.15 |

1.98 |

0.12 |

|

|

Total from investment operations |

0.40 |

(4.74) |

1.13 |

1.96 |

0.07 |

|

|

Less distributions from capital gains |

-- |

(0.46) |

(1.30) |

(0.91) |

(0.60) |

|

|

Net asset value, end of period |

8.07 |

$7.67 |

$12.87 |

$13.04 |

$11.99 |

|

|

Total return (%) |

5.22 |

(36.61) |

8.62 |

16.32 |

0.55 |

|

|

Ratios and supplemental data |

||||||

|

Net assets, end of period (in thousands) |

$114,911 |

$88,964 |

$146,378 |

$147,122 |

$146,266 |

|

|

Ratio of expenses to average net assets (%) |

1.251

|

1.26 |

1.25 |

1.25 |

1.25 |

|

|

Ratio of net investment income to average net assets (%) |

(0.30)1

|

(0.33) |

(0.18) |

(0.18) |

(0.37) |

|

|

Portfolio turnover (%) |

24 |

76 |

43 |

47 |

46 |

|

1Annualized.

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Equity Trust 23

Financial Highlights (concluded)

Selected data for a share outstanding for the periods indicated.

SMALL/MID-CAP FUND

|

(unaudited) |

||

|

2009 |

||

|

Net asset value, beginning of period |

$10.00* |

|

|

Investment operations: |

||

|

Net investment loss |

(0.02) |

|

|

Net realized and unrealized gain on investments |

1.10 |

|

|

Total from investment operations |

1.08 |

|

|

Less distributions from capital gains |

-- |

|

|

Net asset value, end of period |

11.08 |

|

|

Total return (%) |

10.80 |

|

|

Ratios and supplemental data |

||

|

Net assets, end of period (in thousands) |

$857 |

|

|

Ratio of expenses to average net assets (%) |

1.221

|

|

|

Ratio of net investment income to average net assets (%) |

(0.311

|

|

|

Portfolio turnover (%) |

24 |

|

1Annualized.

* Inception of Fund was December 31, 2008 with effective date of January 1, 2009.

The Notes to Financial Statements are an integral part of these statements.

24 Semi-annual Report • June 30, 2009

Madison Mosaic Equity Trust

Notes to Financial Statements