SXCL 12.31.2014 10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________

FORM 10-K

|

| |

(Mark One) |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014 or

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 0-15071

_____________________

Steel Excel Inc.

(Exact name of Registrant as specified in its charter)

|

| |

DELAWARE (State or other jurisdiction of incorporation or organization) | 94-2748530 (I.R.S. Employer Identification No.) |

| |

1133 WESTCHESTER AVENUE, SUITE N222 WHITE PLAINS, NEW YORK (Address of principal executive offices) | 10604 (Zip Code) |

|

Registrant's telephone number, including area code (914) 461-1300 |

_____________________

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share

Preferred Stock Purchase Rights

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No ý

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No ý

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one).

|

| | | |

Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o | Smaller reporting company o |

| | (Do not check if a smaller reporting company) |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the Registrant's common stock held by non-affiliates of the Registrant as of June 30, 2014, the last business day of the Registrant's most recently completed second fiscal quarter, was approximately $116.9 million.

As of February 28, 2015, there were 11,566,746 shares of Steel Excel’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Items 10, 11, 12, 13 and 14 of Part III will be incorporated by reference to certain portions of a definitive proxy statement, which is expected to be filed by the Registrant within 120 days after the close of its fiscal year.

TABLE OF CONTENTS

|

| | | | |

| | |

| | | Business | |

| Item 1A. | | Risk Factors | |

| Item 1B. | | Unresolved Staff Comments | |

| Item 2. | | Properties | |

| Item 3. | | Legal Proceedings | |

| Item 4. | | Mine Safety Disclosures | |

| | | | |

| | |

| Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| Item 6. | | Selected Financial Data | |

| Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | |

| Item 8. | | Financial Statements and Supplementary Data | |

| Item 9. | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosures | |

| Item 9A. | | Controls and Procedures | |

| Item 9B. | | Other Information | |

| | | | |

Part III. | | | |

| Item 10. | | Directors, Executives Officers and Corporate Governance | |

| Item 11. | | Executive Compensation | |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13. | | Certain Relationships and Related Transactions, and Director Independence | |

| Item 14. | | Principal Accounting Fees and Services | |

| | | | |

Part IV. | | | |

| Item 15. | | Exhibits and Financial Statement Schedules | |

| | | | |

| | | Signatures | |

Certain statements contained in this annual report on Form 10-K that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended ( the “Exchange Act”). Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements of the Company to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, the Company’s actual results could differ materially from those set forth in the forward-looking statements. See “Risk Factors” in Item I Part 1A of this annual report on Form 10-K for a description of certain factors that might cause such differences.

PART I

Item 1. Business

General

Steel Excel Inc. and it subsidiaries (“Steel Excel”, the “Company”, “we”, “us”, “our”) currently operate in two reporting segments - Energy and Sports. Through its wholly-owned subsidiary Steel Energy Services Ltd. ("Steel Energy Services"), the Company’s Energy business provides drilling and production services to the oil and gas industry. Through its wholly-owned subsidiary Steel Sports Inc., the Company’s Sports business provides event-based sports services and other health-related services. The Company also makes significant non-controlling investments in entities in industries related to its reporting segments as well as entities in other unrelated industries. The Company continues to identify business acquisition opportunities in both the Energy and Sports industries as well as in other unrelated industries. Steel Partners Holdings L.P. (“Steel Partners”), an affiliate, beneficially owned approximately 58.0% of the Company’s outstanding common stock as of December 31, 2014.

Through September 2010, the Company provided enterprise-class external storage products and software to original equipment manufacturers, at which time the Company wound down its remaining business operations. At such time the Company focused on capital redeployment and identification of new business opportunities in which it could utilize existing working capital and maximize the use of net operating losses.

The Company began its Energy business in December 2011 with the acquisition of the business and assets of Rogue Pressure Services, LLC (“Rogue”). The Company expanded the business with the acquisition of the business and assets of Eagle Well Services, Inc., in February 2012 and the acquisition of Sun Well Service, Inc. ("Sun Well") in May 2012, both of which operate as Sun Well Service as a combined business. In December 2013, the Company further expanded its Energy business with the acquisition of the business and assets of Black Hawk Energy Services, Inc. (“Black Hawk”).

The Company began its Sports business in June 2011 with the acquisition of the assets of Baseball Heaven LLC (“Baseball Heaven”), a provider of baseball facility services, and the acquisition in August 2011 of a 75% membership in The Show, LLC (“The Show”), a provider of baseball uniforms to Little League and softball players and coaches. The Company expanded the business with the acquisition of a 50% interest in two Crossfit® facilities in California in November 2012, and in 2014 the Company increased its ownership interest in one of the Crossfit® facilities to approximately 86%. In January 2013, the Company acquired a 20% membership interest in Ruckus Sports LLC (“Ruckus”), an obstacle course and mass-participation events company that was controlled by the Company through its majority representation on the Ruckus board. The Company increased its membership interest in Ruckus to 45% during 2013. Also in January 2013, the Company acquired a 40% membership interest in Again Faster LLC, a fitness equipment company that is accounted for as an equity-method investment. In June 2013, the Company further expanded its Sports business with the acquisition of 80% of UK Elite Soccer, Inc. (“UK Elite”), a provider of youth soccer programs and camps.

In July 2012 and November 2013 the Company shut down The Show and Ruckus, respectively, after they did not meet operational and financial expectations. The Show and Ruckus are each reported as discontinued operations in the Company’s consolidated financial statements.

The Company's effected a 1-for-500 reverse stock split (the "Reverse Split") in June 2014, immediately followed by a 500-for-1 forward stock split (the "Forward Split", and together with the Reverse Split, the "Reverse/Forward Split"), of its common stock. As a result of the Reverse Split, stockholders holding fewer than 500 shares received a cash payment for all of their outstanding shares based on a per share price equal to the closing price of the Company’s common stock on June 18, 2014, the effective date of the Reverse/Forward Split. Stockholders holding 500 or more shares as of the effective date of the Reverse/Forward Split did not receive any payments for fractional shares resulting from the Reverse Split, and therefore the total number of shares held by such holders did not change as a result of the Reverse/Forward Split.

In December 2010, we changed our fiscal year-end date from March 31 to December 31. Accordingly, we had a nine-month transition period from April 1, 2010, to December 31, 2010.

The Company was incorporated in California in 1981 under the name “Adaptec, Inc.”, and reincorporated in Delaware in March 1998. The Company subsequently changed its name to “ADPT Corporation” in June 2010 and to “Steel Excel Inc.” in October 2011. Our website is http://www.steelexcel.com. All reports we file electronically with the Securities and Exchange Commission, including annual reports on Forms 10-K, quarterly reports on Forms 10-Q, current reports on Forms 8-K, and proxy statements along with any amendments to those reports are available, free of charge, on or through our website as soon as reasonably practicable after we file such reports with the Securities and Exchange Commission.

Segment Information

See Note 20 to the Company’s consolidated financial statements for information regarding segments.

Services

Energy business. The Energy business provides various services to exploration and production companies in the oil and gas business. The services provided include well completion and recompletion, well maintenance and workover, snubbing, flow testing, down hole pumping, plug and abatement, and rental of auxiliary equipment. Prior to the acquisition of the Black Hawk business in December 2013, the Energy business primarily provided its services to customers’ extraction and production operations in North Dakota and Montana in the Bakken basin, and to a lesser extent serviced customers in Colorado and Wyoming in the Niobrara basin. The acquisition of the Black Hawk business increased the Energy business’ heavy concentration in the Bakken basin, and expanded the business into Texas in the Permian basin and New Mexico in the San Juan basin.

Well completion services involve prepping the well for production, including running frac strings, setting production tubing, installing down hole equipment, drilling out vertical and horizontal plugs, cleaning out the wellbore, and starting production flow. Well recompletion services involve assisting in the re-stimulation of an existing well or plug-back to shut off the flow in the well from points before the plug. Well maintenance and workover services include pulling rods or tubing, installing submersible pumping equipment, repairing casing, and swabbing. Snubbing services involve installing or removing tubes to enable the customer to continue to work on a well and perform many tasks without having to stop production. Flow testing services involve separating the elements - oil, water, gas, and solids - so that the customer can maximize the quality and quantity of their product. Down hole pumping services involve pumping the necessary fluids into the wellbore. Plug and abatement services involve sealing the well and cleaning the site to reduce the potential for any pollution.

Sports business. The Sports business provides baseball facility services, soccer camps and leagues, and strength and conditioning services. The baseball facility services, which include tournaments, field rentals, camps, and player and umpire instruction, are provided at our facility that is equipped with four full-sized outdoor fields, three smaller youth-sized outdoor fields, and an indoor facility. Soccer camps and leagues are run at facilities owned by municipalities or schools and are run either in conjunction with local youth soccer leagues or as a stand-alone offering. Strength and conditioning services are provided at the two Crossfit® facilities.

Customers

Our Energy business client base consists of exploration and production companies in the oil and gas industry. For the year ended December 31, 2014, revenues from Oasis Petroleum and Continental Resources represented 20.7% and 20.3%, respectively, of the Company’s consolidated revenues; for the year ended December 31, 2013, revenues from Continental Resources and XTO Energy represented 17.0% and 10.5%, respectively, of the Company’s consolidated revenues; and for the year ended December 31, 2012, revenues from Continental Resources and Zenergy, Inc., represented 11.1% and 11.0%, respectively, of the Company’s consolidated revenues. For the years ended December 31, 2014, 2013, and 2012, revenues from the Energy business’ five largest customers represented 61.2%, 51.3%, and 48.3%, respectively, of the Company's consolidated revenues. For the years ended December 31, 2014, 2013, and 2012, the Energy business’ five largest customers represented 67.1%, 56.1%, and 49.7%, respectively, of the segment's revenues and the fifteen largest customers represented 89.0%, 88.2%, and 89.1%, respectively, of the segment’s revenues. The loss of a significant customer could have a material adverse effect on the Energy business and Steel Excel.

Our Sports business client base consists of numerous municipalities, youth sports leagues and organizations, and individuals, none of which provide a significant percentage of the Company’s consolidated revenues. The loss of a customer would not have a material adverse effect on the Sports business or Steel Excel.

Sales and Marketing

We rely primarily on our local operations to sell and market our services. Because they have conducted business together over several years, the members of our local operations have established strong working relationships with certain of our clients. These strong client relationships provide a better understanding of region-specific issues and enable us to better address customer needs.

Competition

Energy business. The Energy business operates in a highly competitive industry that is influenced by price, capacity, reputation, and experience. When oil and natural gas prices and drilling activities are at high levels, service companies are ordering new equipment to expand their capacity as they are seeing increased demand for their services and attractive returns on investment. When oil and natural gas prices are declining, service companies may be willing to provide their services at reduced prices to be able to cover their equipment and other fixed costs. To be successful, we must provide quality services that meet the specific needs of oil and gas exploration and production companies at competitive prices. In addition, we need to maintain a safe work environment and a well-trained work force to remain competitive.

Our Energy services are affected by seasonal factors, such as inclement weather, fewer daylight hours, and holidays during the winter months. Heavy snow, ice, wind, or rain can make it difficult to operate and to move equipment between work sites, which can reduce our ability to provide services and generate revenues. These seasonal factors affect our competitors as well. Demand for services in the industry as a whole fluctuates with the supply and demand for oil and natural gas. In general, the need for our services increases when demand exceeds supply. The oil and gas exploration and production companies attempt to take advantage of a higher-priced environment when demand exceeds supply, which leads to an increased need for our services. Conversely, as supply equals or exceeds demand, the oil and gas exploration and production companies will cut back on their production resulting in a decline in their well servicing needs or seek pricing concessions from us and other service providers when the price of oil declines.

Sports business. The market for the Sports business’ baseball facility services and soccer camps and leagues is very fragmented, and its competitors are primarily small local or regional operations. The market for its strength and conditioning services is fragmented, and its competitors vary from large national providers of such services to local providers of comparable or other niche services.

The baseball facility services and soccer camps and leagues are affected by seasonal factors, with business volume declining from late autumn through early spring as a result of colder temperatures and fewer daylight hours. In addition, inclement weather during peak seasons can have an adverse effect on the business since fields may not be available to reschedule any canceled events. In 2013, we completed the construction of an indoor baseball facility to enable us to provide year-round baseball services to partially mitigate the revenue declines experienced in non-peak months and during periods of inclement weather.

Government and Environmental Regulation

Our businesses are subject to multiple federal, state, and local laws and regulations pertaining to worker safety, the handling of hazardous materials, transportation standards, and the environment.

Among the various environmental laws we are subject to, the Clean Water Act established the basic structure for regulating discharges of pollutants into the waters of the United States and quality standards for surface waters. Our businesses could be required to obtain permits for the discharge of wastewater or stormwater. In addition, the Oil Pollution Act of 1990 imposed a multitude of requirements on responsible parties related to the prevention of oil spills and liability for damages resulting from such spills in the waters of the United States. These and comparable state laws provide for administrative, civil, and criminal penalties for unauthorized discharges and impose stringent requirements for spill prevention and response planning, as well as considerable potential liability for the costs of removal and damages in connection with unauthorized discharges.

The Comprehensive Environmental Response, Compensation and Liability Act, as amended, and comparable state laws (“CERCLA” or “Superfund”) impose liability without regard to fault or the legality of the original conduct on certain defined parties, including current and prior owners or operators of a site where a release of hazardous substances occurred and entities that disposed or arranged for the disposition of the hazardous substances found at the site. Under CERCLA, these parties may be subject to joint and several liability for the costs of cleaning up the hazardous substances that were released into the environment and for damages to natural resources. Further, claims may be filed for personal injury and property damages allegedly caused by the release of hazardous substances and other pollutants. We may encounter materials that are considered

hazardous substances in the course of our operations. As a result, we may incur CERCLA liability for cleanup costs and be subject to related third-party claims. We also may be subject to the requirements of the Resource Conservation and Recovery Act, as amended, and comparable state statutes (“RCRA”) related to solid wastes. Under CERCLA or RCRA, we could be required to clean up contaminated property (including contaminated groundwater) or to perform remedial activities to prevent future contamination.

Our businesses are also subject to the Clean Air Act, as amended, and comparable state laws and regulations that restrict the emission of air pollutants and impose various monitoring and reporting requirements. These laws and regulations may require us to obtain approvals or permits for construction, modification, or operation of certain projects or facilities and may require use of emission controls. Various scientific studies suggest that emissions of greenhouse gases, including, among others, carbon dioxide and methane, contribute to global warming. While it is not possible to predict how legislation or new regulations that may be adopted to address greenhouse gas emissions would impact our business, any new restrictions on emissions that are imposed could result in increased compliance costs for, or additional operating restrictions on, our customers and, which could have an adverse effect on our business.

We are also subject to the Occupational Safety and Health Act, as amended, (“OSHA”) and comparable state laws that regulate the protection of employee health and safety. OSHA’s hazard communication standard requires that information about hazardous materials used or produced in our operations be maintained and provided to employees and state and local government authorities. We believe we are in substantial compliance with OSHA and comparable state law requirements, including general industry standards, record keeping requirements, and monitoring of occupational exposure to regulated substances.

We cannot predict the level of enforcement or the interpretation of existing laws and regulations by enforcement agencies in the future, or the substance of future court rulings or permitting requirements. In addition, we cannot predict what additional laws and regulations may be put in place in the future, or the effect of those laws and regulations on our business and financial condition. We believe we are in substantial compliance with applicable environmental laws and regulations. While we do not believe that the cost of compliance is material to our business or financial condition, it is possible that substantial costs for compliance or penalties for non-compliance may be incurred in the future.

Employees

As of December 31, 2014, we had 1,000 employees, of which 923 were full-time employees and 77 were part-time employees. All of our employees are located in the United States. We also hire additional full-time and part-time employees during peak seasonal periods. None of our employees are covered by collective bargaining agreements. We consider our employee relations to be satisfactory.

Item 1A. Risk Factors

Our business faces significant risks, including those described is this Item 1A. If any of the events or circumstances described below as possible risk factors actually occur, our business, financial condition, or results of operations could be adversely affected and could result in a decline in the trading price of our common stock. Additional risks that we are not aware of or that we currently think are immaterial may also ultimately have an adverse effect on our results of operations and financial condition.

Our Energy business is susceptible to the impact of fluctuations in energy prices. High oil and natural gas prices result in an increase in drilling activity, increasing the demand for oilfield services. Oilfield service companies invest in new equipment in such an environment to expand their capacity to take advantage of this increased activity, which could result in an increasingly competitive environment. Declining oil and natural gas prices can result in our customers reducing their drilling and work over activities, which can result in a reduced demand for our services and requests for price concessions. Oilfield service companies may be willing to provide their services at reduced prices in such an environment to be able to cover their equipment and other fixed costs. The increased competition, reduced demand, or competitive pricing pressure could lead to declines in our prices and utilization, which would have an adverse effect on our results of operations.

We are heavily dependent on the oil and gas industry in North America. Our Energy business is dependent on our customers’ willingness to continue to explore for and produce oil and natural gas in North America, primarily in the Bakken and Permian basins. Factors affecting our customers’ willingness to continue to undertake exploration and production activities include the following:

| |

• | the prices for oil and natural gas and our customers’ perceptions of such prices in the future; |

| |

• | the supply and demand for oil and natural gas; |

| |

• | the cost for our customers to conduct the necessary exploration and production activities; |

| |

• | the discovery of new oil and gas reserves; |

| |

• | the availability of pipelines and other means of transportation; |

| |

• | increased regulation of the means of transporting oil out of the Bakken basin by rail or road; |

| |

• | the availability and cost of capital; |

| |

• | production levels and geopolitical factors in other oil and gas producing countries; |

| |

• | the price and availability of alternative sources of energy; and |

The adverse effects of any of these factors could result in a reduction in our customers’ exploration efforts, which could have a significant adverse effect on our results of operations.

We are exposed to potential unrecoverable losses that could have an adverse effect on our results of operations and financial condition. Our Energy business is subject to many hazards inherent in the industry, including blowouts, cratering, explosions, fires, loss of well control, loss of or damage to the wellbore or underground reservoir, damaged or lost drilling equipment, and damage or loss from inclement weather or natural disasters. Any of these hazards could result in personal injury or death, damage to or destruction of equipment and facilities, suspension of operations, environmental and natural resources damage, and damage to the property of others. We may be unable to obtain desired contractual indemnities for such hazards, and our insurance may not provide adequate coverage in certain instances. The occurrence of an event not fully indemnified or insured, or the failure or inability of a customer or insurer to meet its financial obligations, and resulting claims and litigation could result in substantial losses and have a significant adverse effect on our results of operations and financial condition.

Increased regulation of hydraulic fracturing could have an adverse impact on our customers. Many of our customers utilize hydraulic fracturing services, which is the process of creating or expanding cracks, or fractures, in formations underground where water, sand, and other additives are pumped under high pressure into the formation. Although we are not a provider of hydraulic fracturing services, many of our services complement the hydraulic fracturing process. Legislation that has been introduced in Congress to provide for broader federal regulation of hydraulic fracturing operations and the reporting and public disclosure of chemicals used in the fracturing process could be enacted. Additionally, the United States Environmental Protection Agency has asserted federal regulatory authority over certain hydraulic fracturing activities involving diesel fuel under the Safe Drinking Water Act and is completing the process of drafting guidance documents related to this asserted regulatory authority. Our customers’ operations could be adversely affected if additional regulation or permitting requirements were to be required for hydraulic fracturing activities, which could have an adverse effect on our results of operations.

Severe weather conditions could have an adverse effect on our customers and our ability to provide our services. Our Energy business is heavily concentrated in North Dakota and Montana, where severe weather conditions could result in a curtailment of our customers’ service requirements, damage to our facilities and equipment resulting in increased repair costs and a suspension of our operations, our inability to deliver services, and an overall decline in productivity, all of which could result in an adverse effect on our results of operations. In addition, inclement weather could result in the cancellation of events and tournaments in our Sports business during peak seasons, which would have an adverse effect on our results of operations.

We may not be able to attract and retain qualified workers, which could have a significant adverse effect on our Energy business. Our Energy business operations require personnel with specialized skills and experience who can perform physically demanding work, and there is intense competition for these workers in the Bakken basin where our Energy business is concentrated. As a result workers may choose to pursue employment in fields that offer a more desirable work environment or better pay. Our inability to attract and retain such qualified workers could have an adverse effect on our productivity, the quality of our service offerings, and our ability to expand our operations, all of which could have an adverse effect on our results of operations.

We may sustain losses in our investment portfolio, which could have an adverse effect on our results of operations, financial condition, and liquidity. A substantial portion of our assets consists of investments in marketable securities that we classify as available-for-sale securities, which are adjusted to fair value each period. An adverse change in global economic conditions may result in a decline in the value of our marketable securities. We have not recognized declines in the value of marketable securities held since we have deemed such unrealized losses to be temporary. However, any such declines in value will be recognized as losses upon the sale of such securities or if such declines are deemed to be other than temporary. Any adverse changes in the financial markets and resulting declines in value of our marketable securities could have an adverse effect on our results of operations, financial condition, and liquidity.

Certain of our investments may subject us to greater risk and be less liquid than other investments in our portfolio. Our investments include significant interests in equity-method investees, investments in limited partnerships, and participation in corporate term loans. We have also entered into short sale transactions on certain financial instruments and have sold call and put options. We may continue to engage in similar investing activities in the future. Such investments may be subject to greater price fluctuations, may be more difficult to sell, and may be sold at prices that do not reflect their intrinsic value.

We may be unable to identify and acquire new businesses, which could have an adverse effect on our long term growth. Acquisitions are a key element of our business strategy. We may not be able to identify and acquire acquisition candidates on acceptable terms. Our inability to identify and acquire new businesses on acceptable terms could have an adverse effect on our long-term growth.

We may be unable to integrate new businesses, which could have an adverse effect on our results of operations, financial condition, and long-term growth. We may not be able to properly integrate acquired businesses, which could result in such businesses not performing as expected when the acquisition was consummated and possibly being dilutive to our overall operating results. Our inability to properly integrate acquired businesses could result from, among other things, the following:

| |

• | our failure to retain and attract key employees; |

| |

• | our failure to retain and attract new customers; |

| |

• | our failure to develop effective sales and marketing capabilities; and |

| |

• | our failure to properly operate new lines of business. |

Our inability to integrate new businesses could have an adverse effect on our results of operations, financial condition, and our long-term growth.

We may issue shares of our common stock in the future, which could result in dilution to existing stockholders and have an adverse effect on the price of our common stock. As part of our strategy to grow through acquisitions we may issue additional shares of common stock as consideration for such acquisitions and also may issue common stock to employees and contractors as compensation. Any such issuances of common stock will result in our existing stockholders’ equity interest being diluted. Such issuances of common stock will also increase the number of outstanding shares of common stock that will be available for sale in the open market, and those individuals receiving shares of our common stock may be more likely to sell, which could have an adverse effect on the price of our common stock.

Restrictions on the transfer of our common stock could inhibit certain transactions that may be beneficial to shareholders. In order to preserve our tax benefit carryforwards, our Certificate of Incorporation generally prohibits the transfer of our common stock and other corporate securities if such a transfer would result in (i) a party having an ownership interest of 4.9% or greater in the Company or (ii) an increased ownership interest of a party that already has an ownership interest of 4.9% or greater in the Company. This restriction, which is in effect until May 2015, could inhibit or prevent certain transactions that would otherwise be beneficial to stockholders.

We may be deemed an investment company, which could impose on us burdensome compliance requirements and restrict our activities. The Investment Company Act of 1940, as amended (the “Investment Company Act”), requires companies to register as an investment company if they are engaged primarily in the business of investing, reinvesting, owning, holding, or trading securities. Generally, companies may be deemed investment companies under the Investment Company Act if they are viewed as engaging in the business of investing in securities or they own investment securities having a value exceeding 40% of certain assets. Depending on our future activities and operations, we may become subject to the Investment Company Act. Although the Investment Company Act provides certain exemptions, we may not qualify for any of these exemptions. If we are deemed to be an investment company we may be subject to certain restrictions that may make it difficult for us to complete business combinations, including restrictions on the nature of and custodial requirements for holding our investments and restrictions on our issuance of securities, which we may use as consideration in a business combination. In addition, if we are deemed to be an investing company we may have imposed upon us additional burdensome requirements, including the following:

| |

• | having to register as an investment company; |

| |

• | adopting a specific form of corporate structure; and |

| |

• | having to comply with certain reporting, record keeping, voting, proxy, and disclosure requirements. |

Such additional requirements would require us to incur additional costs and have an adverse effect on our results of operations and our ability to effectively carry out our business plan.

Our cash balances could be adversely affected by the instability of financial institutions. We maintain our cash, cash equivalents, and marketable securities with certain financial institutions at which our balances exceed the limits that are insured by the Federal Deposit Insurance Corporation. There could be an impact on our cash balances if financial institutions at which we maintain our cash and investments experience financial difficulties, which would have an adverse effect on our results of operations and financial condition.

We may not be able to fully utilize our tax benefits, which could result in increased cash payments for taxes in future periods. Net operating losses (“NOLs”) may be carried forward to offset federal and state taxable income in future years and reduce the amount of cash paid for income taxes otherwise payable on such taxable income, subject to certain limits and adjustments. If fully utilized our NOLs and other carry-forwards could provide us with significant tax savings in future periods. Our ability to utilize these tax benefits in future years will depend upon our ability to generate sufficient taxable income and to comply with the rules relating to the preservation and use of NOLs. The potential benefit of the NOLs and other carry-forwards may be limited or permanently lost as a result of the following:

| |

• | our inability to generate sufficient taxable income in future years to use such benefits before they expire; |

| |

• | a change in control of the Company that would trigger limitations on the amount taxable income in future years that may be offset by NOLs and other carry-forwards that existed prior to the change in control; and |

| |

• | examinations and audits by the Internal Revenue Service and other taxing authorities could reduce the amount of NOLs and other credit carry-forwards that are available for future years. |

We maintain a full valuation allowance against our NOLs and other carry-forwards due to uncertainty regarding our ability to generate sufficient taxable income in future periods. Our inability to utilize the NOLs and other carry-forwards could result in increased cash payments for taxes in future periods.

We may be liable for additional income taxes upon examination or audit by the taxing authorities. We are subject to income and other taxes in the United States and certain foreign jurisdictions in which we formerly operated. Our tax provision reflects judgments and estimates, including settlements, that are subject to audit and redetermination by the various taxing authorities. Although we believe our estimates are reasonable, the ultimate outcome of these tax matters may differ materially from the amounts recorded in our consolidated financial statements, which could have an adverse effect on our results of operations and financial position.

The Energy business carries inherent risks that could result in significant litigation. From time to time we are subject to litigation or claims that arise in the normal course of business. While the results of such litigation matters and claims cannot be predicted with certainty, we believe that the final outcome of such matters will not have a material adverse impact on our financial position or results of operations. However, because of the nature and inherent uncertainties of litigation, should the outcome of these actions be unfavorable, our business, financial condition, and results of operations could be materially and adversely affected.

Internal controls weaknesses that are currently immaterial may become material in future periods. We have identified certain deficiencies in internal controls over financial reporting as immaterial and therefore not requiring disclosure in our public filings with the Securities and Exchange Commission. Changes in circumstances could result in such deficiencies becoming material, which could result in material misstatements in our financial statements and required public disclosure if the appropriate remediation action is not undertaken.

A significant disruption in, or breach in security of, our information technology systems could adversely affect our business. We rely on information technology systems, some of which are managed by third parties, to process, transmit and store electronic information, and to manage or support a variety of critical business processes and activities. We also collect and store sensitive data, including confidential business information and personal data. These systems may be susceptible to damage, disruptions, or shutdowns due to attacks by computer hackers, computer viruses, employee error or malfeasance, power outages, hardware failures, telecommunication or utility failures, catastrophes, or other unforeseen events. In addition, security breaches of our systems could result in the misappropriation or unauthorized disclosure of confidential information or personal data belonging to us or to our employees, partners, customers, or suppliers. Any such events could disrupt our operations, inhibit our ability to produce financial information, damage customer relationships and our reputation, and result in legal claims or proceedings, liability, or penalties under privacy laws, each of which could adversely affect our business and our financial statements.

We may incur impairments charges related to our long-lived assets. We periodically evaluate the carrying value of our long-lived assets, including our property and equipment, identified intangible assets, and goodwill for impairment. In performing these assessments we rely on cash flow projections based on our current operating plans, estimates, and judgments.

We could incur impairment charges if our actual results are materially different from such cash flow projections, which could have a material adverse effect on our financial position and results of operations. In 2014, the Company incurred a goodwill impairment charge of $36.7 million

We could incur significant costs in the future to maintain regulatory compliance. Our Energy and Sports businesses are currently subject to federal, state, and local laws and regulations pertaining to worker safety, the handling of hazardous materials, transportation standards, and the environment, and may be subject to additional regulations in the future, including any regarding the emission of greenhouse gases. We may be required to obtain and maintain permits, approvals, and certificates from various authorities and incur other capital and operational costs in order to comply with such laws and regulations. Failure to comply with such laws and regulations could result in the assessment of penalties, imposition of cleanup and site restoration costs and liens, revocation of permits, or orders to limit or cease certain operations. In addition, certain such laws impose joint and several liability that could cause us to become liable for the conduct of others or for consequences of our own actions that were in compliance with all applicable laws at the time of those actions. While the cost of such compliance has not been significant in the past, new laws, regulations, and enforcement policies could become more stringent and significantly increase our compliance costs or limit our future business opportunities, which could have a material adverse effect on our results of operations and financial condition.

We may not be able to implement commercially competitive services and products, which could have an adverse effect on our results of operations. The market for our Energy business is characterized by continual technological developments to provide better and more reliable performance and services. Our inability to implement commercially competitive services and access commercially competitive products in a timely manner in response to changes in technology or our existing technologies and work processes becoming obsolete could have an adverse effect on our results of operations.

Our businesses do not have long-term contracts with their customers, which could result in customer turnover and other adverse effects to our business. Neither our Energy business nor our Sports business has long-term contracts with its customers. Both businesses rely on the quality of the service provided and established long-term relationships to retain customers. Absent such long-term contracts, customers can cease using our services for any reason with minimal notice. This can lead to us losing customers or making price concessions in order to retain customers, which could have an adverse effect on our business and results of operations.

Loss of a significant customer could have a material adverse effect on our results of operations and financial condition. The customer base of our Energy business is concentrated. For the year ended December 31, 2014, revenues from Oasis Petroleum and Continental Resources represented 20.7% and 20.3%, respectively, of our consolidated revenues, and the fifteen largest customers in the Energy business represented approximately 81.1% of our consolidated revenues. The loss of a significant customer could have a material adverse effect on our results of operations and financial condition.

The beneficial ownership of our common stock by Steel Partners provides it with control, and the common management shared with other Steel Partners’ entities may result in the interests of Steel Partners differing from the interests of other shareholders. At December 31, 2014, SPH Group Holdings LLC, an indirect wholly-owned subsidiary of Steel Partners, beneficially owned approximately 58.0% of our outstanding common stock. Warren G. Lichtenstein, the chairman of our board and chief executive of our Sports business, serves as executive chairman of the general partner of Steel Partners; Jack Howard, a director and our principal executive officer, serves as President and a director of the general partner of Steel Partners. In their capacities as directors and senior executive officers of the general partner of Steel Partners, Messrs. Lichtenstein and Howard generally have the ability to determine the outcome of any action requiring a stockholder vote, including the election of our Board of Directors, the approval of amendments to our certificate of incorporation, as amended, and the approval of any proposed merger. The interests of Messrs. Lichtenstein and Howard, as well as those of Steel Partners and its affiliates in such matters may differ from the interests of our other stockholders in some respects. In addition, employees and affiliates of Steel Partners hold positions with us, including John Quicke, a member of our Board of Directors and chief executive of our Energy business, James F. McCabe, Jr., our chief financial officer, and Leonard McGill, our general counsel.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

The Energy business owns four buildings in Williston, ND, including one that serves as its headquarters and operations hub in the Bakken basin along with separate buildings with office and shop space. To support its other operations,

the Energy business owns shop space in Texas and leases shop space in Colorado under an arrangement that expires in 2015. The Energy business also leases shop space and office space under month-to-month arrangements on an as needed basis, and owns and leases housing for temporary living arrangements for certain of its employees.

The Sports business has a lease for office space in Hermosa Beach, CA, that expires in June 2015, which serves as its headquarters. The Sports business has a lease for approximately 27.9 acres of land in Yaphank, NY, for its baseball services operation that expires in December 2016. Under this lease the Company has two extension options and a right of first refusal to purchase the parcel. The Sports business also has a lease for 2,300 square feet for its Crossfit® facility in Hermosa Beach, CA, that expires in July 2015 and a lease for 9,940 square feet for its Crossfit® facility in Torrance, CA, that expires in March 2023. In addition, the Sports business has leases in various states for small administrative offices to support its youth soccer operation.

The Company believes that its facilities are adequate to meet its needs.

Item 3. Legal Proceedings

From time to time we are subject to litigation or claims that arise in the normal course of business. While the results of such litigation matters and claims cannot be predicted with certainty, we believe that the final outcome of such matters will not have a material adverse impact on our financial position or results of operations. However, because of the nature and inherent uncertainties of litigation, should the outcome of these actions be unfavorable, our business, financial condition, and results of operations could be materially and adversely affected.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is currently traded in the over the counter market and is quoted on the OTCQB marketplace under the symbol “SXCL.” The following table sets forth the high and low closing prices for each period indicated.

|

| | | | | | | | | | | | | | | |

| 2014 | | 2013 |

| High | | Low | | High | | Low |

| | | | | | | |

Quarter Ended March 31, | $ | 33.00 |

| | $ | 29.00 |

| | $ | 27.30 |

| | $ | 24.76 |

|

Quarter Ended June 30, | $ | 50.00 |

| | $ | 30.00 |

| | $ | 29.00 |

| | $ | 26.07 |

|

Quarter Ended September 30, | $ | 35.35 |

| | $ | 32.00 |

| | $ | 29.65 |

| | $ | 28.75 |

|

Quarter Ended December 31, | $ | 32.50 |

| | $ | 23.50 |

| | $ | 29.90 |

| | $ | 27.00 |

|

As of February 28, 2014, there were approximately 18 registered holders of record of our common stock, which does not include holders that have shares of common stock held for them by a broker or other nominee. No dividends have been paid on the Company’s common stock.

We have applied for listing on the Nasdaq Stock Market (the “Nasdaq”). There can be no assurance that our application will be accepted. SPH Group Holdings LLC, a wholly owned subsidiary of Steel Partners Holdings L.P. (collectively, “Steel Partners”) beneficially owns more than 50% of our common stock. As a result, we would be considered a “controlled company” under the corporate governance rules of the Nasdaq. “Controlled companies” under those rules are companies of which more than 50% of the voting power is held by an individual, a group, or another company. Steel Partners and its affiliates have filed a Statement of Beneficial Ownership on Schedule 13D with the Securities and Exchange Commission relating to its holdings. On this basis, we propose to avail ourselves of the “controlled company” exception under the Nasdaq rules and not be subject to the Nasdaq listing requirements that would otherwise require us to have: (a) a Board of Directors consisting of a majority of independent directors; (b) compensation of our executive officers determined by a majority of our independent directors or a compensation committee consisting solely of independent directors; and (c) director nominees selected, or recommended for the Board of Director’s selection, either by a majority of our independent directors or a nominating committee consisting solely of independent directors. The Board of Directors has established a Compensation Committee and a Nominating and Governance Committee, each of which has two independent members, and an Audit Committee, which consists solely of independent directors. Warren G. Lichtenstein, Jack L. Howard, and John J. Quicke, each of whom is associated with Steel Partners, serve as three of the six members of our Board of Directors. The other members are John Mutch, Gary W. Ullman, and Robert J. Valentine, who are independent directors.

If the collective ownership of Steel Partners were to decrease to 50% or less of our outstanding common stock, our Nominating and Governance Committee and Compensation Committee would be required to have a majority of independent directors within ninety days and be fully independent within one year, and our Board of Directors would need to consist of a majority of independent directors within one year.

The following table sets forth information as of December 31, 2014, with respect to the Company's equity compensation plans under which securities of the Company are authorized for issuance.

|

| | | | | | | | | | |

Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted-average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| | (a) | | (b) | | (c) |

| | | | | | |

Equity compensation plans approved by security holders | | 70,750 |

| | $ | 23.75 |

| | 1,945,436 |

|

Equity compensation plans not approved by security holders | | — |

| | — |

| | — |

|

On December 16, 2013, and June 24, 2014, the Company's Board of Directors authorized stock repurchase programs to acquire up to 200,000 shares and 500,000 shares, respectively, of the Company's common stock. Any such repurchases will be made from time to time on the open market at prevailing market prices or in negotiated transactions off the market in compliance with applicable laws and regulations. The repurchase programs are expected to continue indefinitely, unless terminated by the Board of Directors. No repurchases were made under the repurchase programs during the three months ended December 31, 2014. The maximum number of shares that may yet be repurchased under the programs was 382,845 at December 31, 2014.

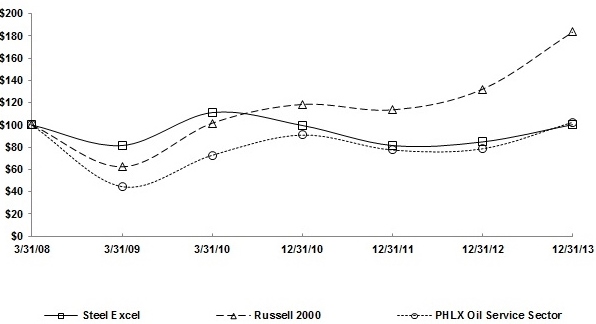

The following stock performance graph compares the cumulative total stockholder return on our common stock to the Russell 2000 Index and the PHLX Oil Service Sector. The graph assumes that $100 was invested in each of the investments on March 31, 2008, with any dividends reinvested. This stock performance graph shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934 (the “Exchange Act”) except to the extent that we specifically incorporate it by reference into such filing.

Item 6. Selected Financial Data

The following Selected Financial Data has been derived from our consolidated financial statements. Through September 2010, the Company provided enterprise-class external storage products and software to original equipment manufacturers (the "Predecessor Business"), at which time the Company wound down its remaining business operations. The Predecessor Business is reported as a discontinued operation in all periods presented in the Selected Financial Data. The Company began its Sports and Energy businesses in June 2011 and December 2011, respectively.

In December 2010, we changed our fiscal year-end date from March 31 to December 31. Accordingly, the Selected Financial Data includes a nine-month transition period from April 1, 2010, to December 31, 2010.

The Selected Financial Data should be read in conjunction with our financial statements and notes thereto and with “Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this Annual Report on Form 10-K.

|

| | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, | | Nine-Month Period Ended December 31, 2010(D) |

| 2014 (A) | | 2013 (B) | | 2012 (C) | | 2011 | |

| (in thousands, except per share data) |

Statements of Operations Data: | | | | | | | | | |

Net revenues | $ | 210,148 |

| | $ | 120,028 |

| | $ | 100,104 |

| | $ | 2,502 |

| | $ | — |

|

Income (loss) from continuing operations before income taxes | $ | (19,522 | ) | | $ | 7,911 |

| | $ | 6,467 |

| | $ | (158 | ) | | $ | (9,784 | ) |

Net income (loss) from continuing operations | $ | (24,269 | ) | | $ | 16,391 |

| | $ | 22,179 |

| | $ | 68 |

| | $ | (17,386 | ) |

Net income (loss) from continuing operations attributable to Steel Excel Inc. per share of common stock - basic and diluted | $ | (2.06 | ) | | $ | 1.31 |

| | 1.83 |

| | $ | 0.01 |

| | $ | (1.50 | ) |

| | | | | | | | | |

Balance Sheet Data: | | | | | | | | | |

Total assets | $ | 479,354 |

| | $ | 538,694 |

| | $ | 466,495 |

| | $ | 368,677 |

| | $ | 367,552 |

|

Long-term obligations | $ | 79,874 |

| | $ | 93,484 |

| | $ | 14,397 |

| | $ | — |

| | $ | — |

|

| |

(A) | Includes a goodwill impairment charge of $36.7 million. |

| |

(B) | Includes a benefit from income taxes of $9.3 million. |

| |

(C) | Includes a benefit from income taxes of $15.7 million. |

| |

(D) | No revenues are reported for the nine-month period ended December, 31, 2010, since the Energy and Sports businesses had not yet commenced and the Predecessor Business is reported as a discontinued operation in all periods. Period includes a restructuring charge of $3.9 million. |

No cash dividends have been paid or declared on the Company’s common stock.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Steel Excel Inc. (“Steel Excel” or the “Company”) currently operates in two reporting segments - Energy and Sports. The Energy segment focuses on providing drilling and production services to the oil and gas industry. The Sports segment provides event-based sports services and other health-related services. The Company also makes significant non-controlling investments in entities in industries related to its reporting segments as well as entities in other unrelated industries. The Company continues to identify business acquisition opportunities in both the Energy and Sports industries as well as in other unrelated industries.

The Company began its Energy business in December 2011 with the acquisition of the business and assets of Rogue Pressure Services Ltd. (“Rogue”). The Company expanded the business with the acquisition of the business and assets of Eagle Well Services, Inc. ("Eagle Well"), in February 2012 and the acquisition of Sun Well Service, Inc. ("Sun Well") in May 2012, both of which operate under Sun Well as a combined business. In December 2013, the Company further expanded its Energy business with the acquisition by its wholly-owned subsidiary Black Hawk Energy Services, Ltd. ("Black Hawk Ltd.") of the business and assets of Black Hawk Energy Services, Inc. (“Black Hawk Inc.”), for $59.6 million.

The Company began its Sports business in June 2011 with the acquisition of the assets of Baseball Heaven LLC (“Baseball Heaven”), a provider of baseball facility services, and the acquisition in August 2011 of a 75% membership in The Show, LLC (“The Show”), a provider of baseball uniforms to Little League and softball players and coaches. The Company expanded the business with the acquisition of a 50% interest in two Crossfit® facilities in California in November 2012, and in 2014 the Company increased its ownership interest in one of the Crossfit® facilities to approximately 86%. In January 2013, the Company acquired a 20% membership interest in Ruckus Sports LLC ("Ruckus"), an obstacle course and mass-participation events company that was controlled by the Company through its representation on the Ruckus board. The Company increased its membership interest in Ruckus to 45% during 2013. Also in January 2013, the Company acquired a 40% membership interest in Again Faster LLC, a fitness equipment company that is accounted for as an equity-method investment. In June 2013, the Company further expanded its Sports business with the acquisition of 80% of UK Elite Soccer, Inc. (“UK Elite”), a provider of youth soccer programs and camps. In 2014, UK Elite acquired the business and assets of three independent providers of soccer clinics and camps.

In July 2012 and November 2013 the Company shut down The Show and Ruckus, respectively, after they did not meet operational and financial expectations. The Show and Ruckus are reported as discontinued operations in the Company’s consolidated financial statements.

In July 2013, Steel Energy Services Ltd. ("Steel Energy Services"), a wholly-owned subsidiary of the Company, entered into a credit agreement, as amended (the “Amended Credit Agreement”), that provides for a borrowing capacity of $105.0 million consisting of a $95.0 million secured term loan and up to $10.0 million in revolving loans. A pre-existing credit agreement at Sun Well (the “Sun Well Credit Agreement”) that had been fully repaid was terminated upon the initial closing of the Amended Credit Agreement.

In June 2014, following stockholder approval and authorization from its board of directors, the Company effected a 1-for-500 reverse stock split (the "Reverse Split"), immediately followed by a 500-for-1 forward stock split (the "Forward Split", and together with the Reverse Split, the "Reverse/Forward Split"), of its common stock effective as of the close of business on June 18, 2014. In connection with the Reverse Split, the Company paid $10.1 million in July 2014 for 295,659 shares of common stock and the return of 1,388 non-vested restricted stock awards previously awarded to employees.

The following discussion and analysis should be read in conjunction with the Company’s consolidated financial statements and notes thereto.

Results of Operations

Revenues increased significantly in 2014 primarily as a result of a full year of operations from the businesses acquired during 2013, particularly the business acquired by Black Hawk Ltd. and UK Elite. The Company incurred an operating loss in 2014 as a result of a goodwill impairment charge. Operating income before goodwill impairments increased significantly in 2014 primarily from a full year of operations of the business acquired by Black Hawk Ltd. in 2013. This increase in operating income before goodwill impairments was partially offset by additional costs incurred for Corporate activities and the full year of operations of UK Elite that included expected seasonal losses not incurred in the prior year.

Recent developments in the oil services industry will have a significant adverse effect on the results of operations of the Company's Energy segment in 2015. The decline in energy prices, particularly the significant decline in oil prices, has

resulted in our customers, the oil and gas exploration and production companies (the "E&P Companies"), cutting back on their planned capital expenditure budgets for 2015, which will result in significantly reduced drilling activity. In addition, the E&P Companies are seeking price concessions from their service providers to offset their drop in revenue. Such actions on the part of the E&P Customers had little impact on the Energy segment's operations in 2014, but have had an adverse effect on its operations beginning in the early part of 2015. The Energy segment has experienced a decline in rig utilization in all of its operations and prices for its services have declined. The Company has taken certain actions and instituted cost-reduction measures in an effort to mitigate these adverse effects. The Energy segment's results of operations going forward will be dependent on the price of oil in the future, the resulting drilling rig count in the basins in which it operates, and the Company's ability to return to the pricing and service levels of the past as oil prices increase. Although the impact on the Energy segment's results of operations in 2015 is very uncertain, the drilling rig count in North America has declined 35% in the early part of 2015 from its high mark in 2014, which has directly impacted the segment's rig utilization, and the pricing for the segment's services has declined in the low-to-mid double-digit teens levels in the early part of 2015. As a result, the Company expects the Energy segment to experience a significant decline in operating income in 2015 as compared to the 2014 results. As a result of the adverse effects the decline in energy prices had on the oil services industry and the projected results of operations of the Company's Energy segment, the Company recognized a goodwill impairment charge of $36.7 million in the fourth quarter of 2014. At December 31, 2014, the remaining goodwill associated with the energy business was $28.7 million, which is at risk of impairment if the fair values of the Company's reporting units in the Energy segment decline further in value.

Year ended December 31, 2014, compared with 2013

Net revenues for the year ended December 31, 2014, increased by $90.1 million as compared to 2013. Net revenues from the Company's Energy segment increased by $82.0 million primarily as a result of an increase of $75.5 million from Black Hawk Ltd., which business was acquired in December 2013, and an increase in revenues of $6.5 million in the Energy segment's other operations due primarily to an increase in rig utilization for its snubbing services and an increase in revenues from its flow back services related to new equipment purchased in 2014. Net revenues in the Company's Sports segment increased by $8.1 million primarily as a result of an increase in revenues of $6.8 million from UK Elite, which was acquired in June 2013, and an increase in revenues of $1.1 million from Baseball Heaven.

Gross profit for the year ended December 31, 2014, increased by $24.5 million as compared to 2013, and as a percentage of revenue declined slightly to 28.2% from 28.9%. Gross profit in the Energy segment increased by $21.1 million, and as a percentage of revenue declined slightly to 26.5% in 2014 from 27.0% in 2013. Gross profit in the Energy segment increased as a result of an increase of $22.4 million from Black Hawk Ltd., partially offset by a decrease in gross profit of $1.2 million in the Energy segment's other operations. Gross profit in the Sports segment in 2014 increased by $3.4 million primarily as a result of an increase in gross profit of $2.7 million from UK Elite and an increase in gross profit of $0.6 million from Baseball Heaven.

SG&A expenses in 2014 increased by $13.0 million as compared to 2013. SG&A expenses in the Energy segment increased by $3.1 million as a result of an increase of $3.0 million in costs incurred at Black Hawk Ltd. in 2014. SG&A expenses in the Sports segment increased by $3.8 million primarily as a result of costs incurred at UK Elite, including costs associated with operating the businesses acquired in the current period. SG&A expenses in corporate and other business activities increased by $6.1 million primarily as a result of increased costs incurred for services provided by affiliates of the Company and an increase in stock-based compensation expense in the 2014 period.

The Company incurred an operating loss of $23.4 million in 2014 as compared to operating income of $2.6 million in 2013 primarily as a result of the goodwill impairment of $36.7 million relating to the Energy segment. Operating income before goodwill impairments was $13.3 million in 2014 as compared to $2.6 million in 2013 . Operating income before goodwill impairments in the Energy segment increased by $17.5 million primarily as a result of an increase of $16.8 million from Black Hawk Ltd. The operating loss in the Sports segment increased by $0.8 million primarily due to the expected seasonal losses incurred in the first half of the current year at UK Elite with no corresponding losses in the prior year. The operating loss from Corporate and other business activities increased by $6.1 million from increased costs incurred for services provided by affiliates of the Company and an increase in stock-based compensation expense in 2014 .

Amortization of intangibles in 2014 increased by $0.9 million as compared to 2013 as a result of amortization expense on the intangible assets recognized in connection with the businesses acquired by Black Hawk Ltd. and UK Elite, partially offset by a declining rate of amortization for the intangible assets recognized in connection with prior period acquisitions.

The Company recognized an impairment charge of $36.7 million in the fourth quarter of 2014 related to the goodwill associated with its Energy segment. The impairment resulted from the adverse effects the decline in energy prices had on the oil services industry and the projected results of operations of the Energy segment.

Interest expense of $3.2 million in 2014 increased by $1.5 million as compared to 2013 primarily as a result of the borrowings under the Amended Credit Agreement being outstanding for the full year in 2014.

Other income of $7.1 million in 2014 primarily represented investment income of $6.6 million and realized gains on the sale of marketable securities of $3.8 million, partially offset by a loss of $1.8 million recognized on financial instrument obligations, a loss of $0.6 million recognized upon initially accounting for an investment under the equity method of accounting at fair value, and a foreign exchange loss of $1.1 million.

The Company recognized a benefit for income taxes of $1.3 million for the year ended December 31, 2014. The provision recognized for Federal and state income taxes of $0.1 million and $0.3 million, respectively, was offset by a benefit recognized for foreign taxes of $1.7 million primarily resulting from a refund received upon the completion of tax authority audits pertaining prior periods.

The results of operations for the year ended December 31, 2014, included income from discontinued operations of $0.5 million primarily related to an adjustment to the outstanding obligations of Ruckus.

Year ended December 31, 2013, compared with 2012

Net revenues for the year ended December 31, 2013, increased by $19.9 million as compared to 2012. Net revenues from the Company's Energy segment increased by $12.4 million as a result of the acquisition of Sun Well in May 2012 being included for the entire 2013 period and the acquisition of Black Hawk Ltd. in December 2013 being included in the 2013 period. Such increases were partially offset by a decrease in revenues at operations in the Energy segment operated in both periods as a result of increased competition in the marketplace and a slight decline in rig utilization resulting from unfavorable weather conditions. Net revenues from the Company's Sports segment increased by $7.5 million primarily as a result of the acquisition of UK Elite in June 2013 and the acquisition of the Crossfit® entities in November 2012 being included for the entire 2013 period.

Gross profit for the year ended December 31, 2013, increased by $0.6 million as compared to 2012, and as a percentage of revenue declined to 28.9% from 34.0%. Gross profit in the Energy segment decreased by $2.4 million and as a percentage of revenue declined to 27.0% in 2013 from 32.9% in 2012. The decline in 2013 was due primarily to increased competition in the marketplace, a slight decline in rig utilization as a result of unfavorable weather conditions, increased rig staffing costs, fewer rigs operating around the clock that resulted in higher costs for generating comparable revenues, a decline in higher-margin services in 2013 resulting from a change in the overall mix of services provided, increased workers compensation insurance costs, and settlement of a customer claim. Such decline in the Energy segment was partially offset by the gross profit generated by Black Hawk Ltd. in 2013 subsequent to the acquisition. Gross profit in the Sports segment increased by $3.0 million primarily as a result of the acquisition of UK Elite in June 2013 and the acquisition of the Crossfit® entities in November 2012 being included for the entire 2013 period.

Selling, general and administrative ("SG&A") expenses in 2013 increased by $3.0 million as compared to 2012 primarily as a result of the acquisitions in the Sports segment and Sun Well being included for the entire 2013 period, partially offset by the reversal of the contingent consideration liability of $0.5 million associated with the acquisition of Rogue.

Amortization of intangibles in 2013 increased by $1.1 million as compared to 2012 as a result of intangible assets recognized in connection with the acquisitions of Sun Well in May 2012 and UK Elite in June 2013.

Interest expense of $1.7 million in 2013 increased by $1.3 million as compared to 2012 primarily associated with the borrowings under the Amended Credit Agreement.

Other income of $7.1 million in 2013 primarily represented investment income of $4.8 million and realized gains on the sale of marketable securities of $2.6 million, partially offset by a loss on extinguishment of debt of $0.5 million from the write off of unamortized deferred financing costs upon terminating the Sun Well Credit Agreement.

The Company recognized a benefit from income taxes of $9.3 million for the year ended December 31, 2013, primarily as a result of a reversal of $7.2 million of reserves for foreign taxes upon the expiration of the statute of limitations. In addition, in 2013 the Company reversed a portion of its valuation allowance for deferred tax assets as a result of deferred tax liabilities recognized in connection with unrealized gains on marketable securities included as a component of other comprehensive income. The Company recognized a benefit from income taxes of $15.7 million for the year ended December

31, 2012, primarily from a reversal of a portion of its valuation allowance for deferred tax assets as a result of deferred tax liabilities recognized on the identifiable intangible assets acquired in connection with the acquisition of Sun Well.

The results of operations for the year ended December 31, 2013, included a loss from discontinued operations of $5.5 million related to Ruckus, of which approximately $3.6 million related to the impairment of goodwill. The results of operations for the year ended December 31, 2012, included a loss from discontinued operations of $1.9 million related to The Show.

Liquidity and Capital Resources

The Amended Credit Agreement entered into in July 2013 and amended in December 2013 provides for a borrowing capacity of $105.0 million consisting of a $95.0 million secured term loan (the “Term Loan”) and up to $10.0 million in revolving loans (the “Revolving Loans”) subject to a borrowing base of 85% of the eligible accounts receivable. Steel Energy Services borrowed $70.0 million under the Term Loan in July 2013, the proceeds of which were combined with $10.0 million in intercompany loans from Sun Well and Rogue and used to pay the Company a dividend of $80.0 million. Steel Energy Services borrowed an additional $25.0 million under the Term Loan in December 2013, the proceeds of which were combined with cash provided by the Company and Steel Energy Services and used to fund the acquisition of the business and assets of Black Hawk Inc. At December 31, 2014, the Company had $10.0 million of borrowing capacity under the Revolving Loans, all of which was available as no Revolving Loans were outstanding. As of December 31, 2014, the Company had $79.3 million outstanding under the Term Loan.

Borrowings under the Amended Credit Agreement are collateralized by substantially all the assets of Steel Energy Services and its wholly-owned subsidiaries Sun Well, Rogue, and Black Hawk Ltd., and a pledge of all of the issued and outstanding shares of capital stock of Sun Well, Rogue, and Black Hawk Ltd. Borrowings under the Amended Credit Agreement are fully guaranteed by Sun Well, Rogue, and Black Hawk Ltd.

The Amended Credit Agreement runs through July 2018, with the Term Loan amortizing in quarterly installments of $3.3 million and a balloon payment due on the maturity date. Borrowings under the Amended Credit Agreement bear interest at annual rates of either (i) the Base Rate plus an applicable margin of 1.50% to 2.25% or (ii) LIBOR plus an applicable margin of 2.50% to 3.25%. The “Base Rate” is the greatest of (i) the prime lending rate, (ii) the Federal Funds Rate plus 0.5%, and (iii) the one-month LIBOR plus 1.0%. The applicable margin for both Base Rate and LIBOR is determined based on the leverage ratio calculated in accordance with the Amended Credit Agreement. LIBOR-based borrowings are available for interest periods of one, three, or six months. In addition, the Company is required to pay commitment fees of between 0.375% and 0.50% per annum on the daily unused amount of the Revolving Loans.

The Amended Credit Agreement contains certain financial covenants, including (i) a leverage ratio not to exceed 3.00:1 for quarterly periods through June 15, 2015, 2.75:1 for quarterly periods through June 30, 2017, and 2.5:1 thereafter and (ii) a fixed charge coverage ratio of 1.15:1 for quarterly periods through December 31, 2016, and 1.25:1 thereafter. The Company was in compliance with all financial covenants as of December 31, 2014.