QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant /x/ | ||

| Filed by a Party other than the Registrant / / | ||

Check the appropriate box: |

||

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| /x/ | Definitive Proxy Statement | |

| / / | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to §240.14a-12 |

|

Sun Microsystems, Inc. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| /x/ | No fee required. | |||

| / / | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

| / / | Fee paid previously with preliminary materials. | |||

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

| |

|

|

|---|---|---|

| Sun Microsystems, Inc. 901 San Antonio Road, Palo Alto, CA 94303-4900 650-960-1300 |

||

SUN MICROSYSTEMS, INC. |

||

October 2, 2001 |

||

Dear Stockholder: |

||

|

Our 2001 Annual Meeting of Stockholders will be held on November 7, 2001 in the Auditorium of our Santa Clara campus, 4030 George Sellon Circle, Santa Clara, California. Details regarding admission to the meeting and the business to be conducted are more fully described in the accompanying Notice of 2001 Annual Meeting of Stockholders and in the Proxy Statement. |

|

Your vote is important. Whether or not you plan to attend the meeting, I urge you to vote your shares as soon as possible. Instructions in the proxy card will tell you how to vote over the Internet, by telephone or by returning your proxy card. The proxy statement explains more about proxy voting. Please read it carefully. |

||

Similar to our past annual meetings, in addition to considering matters described in the proxy statement, we will review major business developments since our last stockholders' meeting. |

||

Thank you for your continued support of our company. |

| |

|

|

|

|---|---|---|---|

| Sincerely, | |||

|

|||

Scott G. McNealy Chairman of the Board of Directors and Chief Executive Officer |

SUN MICROSYSTEMS, INC.

NOTICE OF 2001 ANNUAL MEETING OF STOCKHOLDERS

| |

|

|

||

|---|---|---|---|---|

| Date: | Wednesday, November 7, 2001 | |||

Time: |

10:00 a.m. (registration will begin at 9:00 a.m.) |

|||

Place: |

Auditorium Sun Microsystems, Inc. Santa Clara campus 4030 George Sellon Circle Santa Clara, California |

|||

At the meeting you will vote to: |

||||

• Elect eight (8) directors; |

||||

• Approve an increase in the number of shares reserved for issuance under our 1990 Long-Term Equity Incentive Plan; |

||||

• Approve our Section 162(m) Executive Officer Performance-Based Bonus Plan; |

||||

• Consider a stockholder proposal; and |

||||

• Consider any other matters that may properly be brought before the meeting. |

||||

| |

|

|

|---|---|---|

| By order of the Board of Directors, | ||

Michael H. Morris Senior Vice President, General Counsel and Secretary |

||

Palo Alto, California October 2, 2001 |

Please vote by telephone or by using the Internet as instructed in the proxy card, or complete, sign and date the proxy card as promptly as possible and return it in the enclosed envelope.

PROXY STATEMENT

Information concerning solicitation and voting

Your vote is very important. For this reason, our Board of Directors is requesting that you permit your common stock to be represented at the annual meeting by the proxies named on the enclosed proxy card. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the meeting. Please read it carefully.

Voting materials, which include the proxy statement, proxy card, the 2001 annual report to stockholders and the annual report on Form 10-K for fiscal year 2001, were mailed to stockholders beginning October 2, 2001. Sun's principal executive offices are located at 901 San Antonio Road, Palo Alto, California 94303. Sun's main telephone number is (650) 960-1300.

General information about the meeting

Who may vote

You may vote your Sun common stock if our records show that you owned your shares on September 12, 2001. At the close of business on that date, 3,239,365,851 shares of Sun common stock were outstanding and eligible to vote. You may cast one vote for each share of common stock held by you on all matters presented, except for the election of the directors (read "Vote required" at the end of "Proposal 1, Election of Directors" below for further explanation).

Voting your proxy

Whether you hold shares in your name or through a broker, bank or other nominee, you may vote without attending the meeting. You may vote by granting a proxy or, for shares held through a broker, bank or other nominee, by submitting voting instructions to that nominee. Instructions for voting by telephone, by using the Internet or by mail are on your proxy card. For shares held through a broker, bank or other nominee, follow the instructions on the voting instruction card included with your voting materials. If you provide specific voting instructions, your shares will be voted as you have instructed. If you hold shares in your name and sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by our Board of Directors. See "Vote required" following each proposal for further information.

Votes needed to hold the meeting

The

annual meeting will be held if a majority of Sun's outstanding shares entitled to vote is represented at the meeting. This is called a quorum. Your shares will be counted for purposes of

determining if there is a quorum, even if you wish to abstain from voting on some or all matters introduced at the meeting, if you:

–are present and vote in person at the meeting; or

–have properly submitted a proxy card or voted by telephone or by using the Internet.

Matters to be voted on at the meeting

- •

- Election

of the Board of Directors;

- •

- Approval

of an increase in the shares reserved for issuance under our 1990 Long-Term Equity Incentive Plan;

- •

- Approval

of our Section 162(m) Executive Officer Performance-Based Bonus Plan; and

- •

- A stockholder proposal entitled "US Business Principles for Human Rights of Workers in China."

There are four proposals that will be presented for your consideration at the meeting:

1

Cost of this proxy solicitation

We will pay the costs of the solicitation. We have hired Skinner & Co., Inc. to help us solicit proxies from brokers, bank nominees and other institutions for a fee of $7,500, plus reasonable out-of-pocket expenses estimated to be not more than $14,500. We may also reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding the voting materials to their customers who are beneficial owners and obtaining their voting instructions. In addition to soliciting proxies by mail, our board members, officers and employees may solicit proxies on our behalf, without additional compensation, personally or by telephone. We are soliciting proxies electronically through the Internet from stockholders who are our employees or who previously requested to receive proxy materials electronically through the Internet.

Attending the meeting

You may vote shares held directly in your name in person at the meeting. If you choose to attend the meeting, please bring the enclosed proxy card or proof of identification for entrance to the meeting. If you want to vote shares that you hold in street name at the meeting, you must request a legal proxy from your broker, bank or other nominee that holds your shares.

Changing your vote

You may revoke your proxy and change your vote at any time before the final vote at the meeting. You may do this by signing a new proxy card with a later date, voting on a later date by telephone or by using the Internet (only your latest telephone or Internet proxy is counted), or by attending the meeting and voting in person. However, your attendance at the meeting will not automatically revoke your proxy; you must specifically revoke your proxy. See "General information about the meeting—Voting your proxy" above for further instructions.

Our voting recommendations

Our

Board of Directors recommends that you vote:

• "FOR" each of management's nominees to the Board of Directors;

• "FOR" amendment of our 1990 Long-Term Equity Incentive Plan;

• "FOR" approval of the Section 162(m) Executive Officer Performance-Based Bonus Plan; and

• "AGAINST" adoption of the stockholder proposal entitled "US Business Principles for Human Rights of Workers in China."

Voting results

The preliminary voting results will be announced at the meeting. The final voting results will be published in our quarterly report on Form 10-Q for the second quarter of fiscal 2002.

Delivery of voting materials

To reduce the expenses of delivering duplicate voting materials to our stockholders who may have more than one Sun stock account, we are taking advantage of new householding rules that permit us to deliver only one set of voting materials, meaning the proxy statement, proxy card, the 2001 annual report to stockholders and the annual report on Form 10-K for fiscal 2001, to stockholders who share an address unless otherwise requested.

How to obtain a separate set of voting materials

If you share an address with another stockholder and have received only one set of voting materials, you may write or call us to request a separate copy of these materials at no cost to you. For future annual meetings, you may request separate voting materials, or request that we send only one set of voting materials to you if you are receiving multiple copies, by calling us at: (650) 960-1300 or by writing us at: Sun Microsystems, Inc., 901 San Antonio Road, Palo Alto, CA 94303, Attn: Investor Relations.

2

PROPOSAL 1

ELECTION OF DIRECTORS

Our entire Board of Directors, consisting of eight members, will be elected at the annual meeting to hold office until the next annual meeting and the election of their successors.

Although we know of no reason why any of the nominees would not be able to serve, if any nominee is unavailable for election, the proxies will vote your common stock to approve the election of any substitute nominee proposed by the Board of Directors. The Board may also choose to reduce the number of directors to be elected, as permitted by our Bylaws.

Nominees

All nominees are currently directors. Each nominee has agreed to be named in this proxy statement and to serve if elected. Unless set forth below, each nominee has been engaged in his or her principal occupation for at least the past five years. The age indicated and other information in each nominee's biography is as of September 12, 2001.

Information about the nominees

Scott G. McNealy (Age 46)

Chairman of the Board of Directors and Chief Executive Officer, Sun Microsystems, Inc.

Mr. McNealy is a Founder of Sun and has served as Chairman of the Board of Directors and Chief Executive Officer since April 1999. He was Chairman of the Board of Directors, President and Chief Executive Officer from December 1984 until April 1999, President and Chief Operating Officer from February 1984 until December 1984 and Vice President of Operations from February 1982 until February 1984. Mr. McNealy has served as a director of Sun since our incorporation in February 1982. He is also a director of General Electric Company.

James L. Barksdale (Age 58)

Managing Partner, The Barksdale Group

Mr. Barksdale has been Managing Partner of The Barksdale Group, a venture capital firm, since April 1999. He served as President and Chief Executive Officer of Netscape Communications Corporation, an Internet company, from January 1995 until March 1999, when Netscape was acquired by America Online, Inc. Mr. Barksdale is also a director of AOL Time Warner Inc. and FedEx Corporation. He has been a director of Sun since 1999.

L. John Doerr (Age 50)

General Partner, Kleiner Perkins Caufield & Byers

Mr. Doerr has served as General Partner of Kleiner Perkins Caufield & Byers, a venture capital firm, since August 1980. Mr. Doerr is also a Director of Amazon.com, Inc, Drugstore.com, Inc., Handspring, Inc., Healtheon/Web MD Corporation, HomeStore.com, Inc., Intuit, Inc. and Martha Stewart Living Omnimedia. He has been a director of Sun since 1982.

Judith L. Estrin (Age 46)

Chief Executive Officer, Packet Design, LLC

Ms. Estrin has served as Chief Executive Officer, Packet Design, LLC, an IP services and technology company, since May 2000. From April 1998 to May 2000, she served as Senior Vice President and Chief Technology Officer of Cisco Systems, Inc., an end-to-end network solutions company. She served as President and Chief Executive Officer of Precept Software, Inc., a multimedia networking software company, from March 1995 to April 1998. Ms. Estrin is also a director of FedEx Corporation and The Walt Disney Company. She has been a director of Sun since 1995.

3

Robert J. Fisher (Age 47)

Director, The Gap, Inc.

Mr. Fisher has served as a director of The Gap, Inc., a clothing retailer, since November 1990. From April 1997 to November 1999, he served as President, Gap Division, The Gap, Inc. From November 1995 to April 1997, he served as Executive Vice President and Chief Operating Officer of The Gap, Inc. He has been a director of Sun since 1995.

Robert L. Long (Age 64)

Independent Management Consultant

Mr. Long retired as Senior Vice President, Eastman Kodak Company and has been an independent management consultant since January 1992. Mr. Long has been a director of Sun since 1988.

M. Kenneth Oshman (Age 61)

Chairman of the Board of Directors, Chief Executive Officer, Echelon Corporation

Mr. Oshman has served as Chairman of the Board of Directors, President and Chief Executive Officer of Echelon Corporation, a provider of control network technologies, since November 1988. Mr. Oshman is also a director of Knight-Ridder, Inc. He has been a director of Sun since 1988.

Naomi O. Seligman (Age 63)

Senior Partner, Ostriker von Simson, Inc.

Ms. Seligman has served as Senior Partner of Ostriker von Simson, Inc. (OvonS), an IT strategy exchange since October 1975. Ms. Seligman is also a director of Dun & Bradstreet, John Wiley & Sons, Inc., Martha Stewart Living Omnimedia and Transora. She has been a director of Sun since 1999.

About the Board and its committees

During fiscal 2001, our Board held six meetings. Each director attended at least 75% of our Board meetings and committee meetings for committees on which such director served during fiscal 2001. The Board has an Audit Committee, a Leadership Development and Compensation Committee and a Nominating Committee. The following table presents information about each committee. All members of these committees, with the exception of the Nominating Committee, are non-employee directors.

| |

|

|

||

|---|---|---|---|---|

| Audit Committee(1) | Robert L. Long (Chairman), James L. Barksdale, Judith L. Estrin, Naomi O. Seligman |

|||

| Met six times in fiscal 2001. The committee: | ||||

• |

selects and replaces independent auditors as appropriate |

|||

| • | evaluates performance of independent auditors | |||

| • | evaluates Sun's accounting policies | |||

| • | evaluates procedures relating to internal auditing functions and control | |||

Leadership Development and Compensation Committee |

L. John Doerr (Chairman), Robert J. Fisher, M. Kenneth Oshman Met five times in fiscal 2001. The committee: |

|||

| • | reviews and approves the executive compensation policies | |||

| • | administers the employee stock option and stock purchase plans | |||

| • | reviews executive and leadership development policies, plans and practices | |||

4

Nominating Committee(2) |

M. Kenneth Oshman (Chairman), L. John Doerr, Scott G. McNealy Did not meet in fiscal 2001. The committee: |

|||

• |

reviews and makes recommendations regarding candidates for service on the Board |

|||

| • | considers nominees recommended by stockholders | |||

- (1)

- The

Audit Committee has adopted a charter attached as Appendix A to this proxy statement. The Audit Committee charter more fully describes the functions of the Audit

Committee. Sun's securities are listed on The Nasdaq National Market and are governed by its listing standards. All the members of the Audit Committee meet the independence standards of

Rule 4200(a)(15) of the National Association of Securities Dealers' listing standards.

- (2)

- If you want to recommend a nominee at the 2002 annual meeting, you must deliver a written notice to the Secretary of Sun no earlier than July 4, 2002 and no later than August 3, 2002. Your notice must state: your name, age and business address; the occupation of the nominee; the number of Sun shares you and the nominee each own; and all other information required for nominees pursuant to Regulation 14A of the Securities Exchange Act of 1934.

Director compensation

During fiscal 2001, non-employee directors were paid $1,000 for each Board meeting attended, $1,000 for each committee meeting attended and an additional $1,000 per meeting attended where such non-employee director presided as Chairman.

Stock option plan for non-employee directors

Non-employee directors participate in our 1988 Directors' Stock Option Plan. Under the plan, each non-employee director who is a partner, officer or director of an entity having an equity investment in Sun is automatically granted a nonstatutory stock option to purchase 10,000 shares of common stock on the date he or she becomes a director. Each non-employee director who is not, on the date appointed to the Board, affiliated with an entity having an equity investment in Sun, is automatically granted a nonstatutory stock option to purchase 20,000 shares of common stock upon becoming a director. Thereafter, each director is automatically granted a nonstatutory stock option to purchase 10,000 shares of common stock on the date of each annual meeting of stockholders, if the director is re-elected and has served on the Board for at least six months. The number of options subject to an automatic grant under the plan is not adjusted for forward stock splits, stock dividends, a combination or reclassification or similar transaction that increases the number of shares of Sun common stock outstanding without receipt by Sun of consideration. Options have an exercise price equal to the closing price of Sun common stock on the annual meeting date as reported on The Nasdaq National Market. Options under the plan terminate after five years, vest at a rate of 25% per year and can only be exercised while the optionee is a director, or within six months after service terminates due to death or disability, or within ninety days after the optionee ceases to serve as a director for any other reason.

During fiscal 2001, each non-employee director was granted an option to purchase 20,000 shares (after giving effect to the two-for-one stock split in December 2000) of common stock, at an exercise price of $50.16 (after giving effect to the two-for-one stock split in December 2000) per share. During fiscal 2001, Messrs. Doerr, Fisher, Long, Oshman and Ms. Estrin exercised options to purchase an aggregate of 1,856,000 shares of common stock, at exercise prices ranging from $1.42 to $3.62 (after giving effect to the two-for-one stock splits in December 1996, April 1999, December 1999 and December 2000) per share for an aggregate net realized gain of $96,238,324, based on the closing price of Sun's common stock on the dates of exercise as reported on The Nasdaq National Market. Ms. Estrin also exercised options to

5

purchase an aggregate of 120,000 shares of common stock, at exercise prices ranging from $3.97 to $7.87 (after giving effect to the two-for-one stock splits in April 1999, December 1999 and December 2000) per share, for an aggregate net realized gain of $6,995,308, based on the closing price of Sun's common stock on the dates of exercise as reported on The Nasdaq National Market.

Compensation committee interlocks and insider participation

In June 1996, Sun entered into a Limited Partnership Agreement ("Agreement") with KPCB Java Associates L.P., a California limited partnership, as general partner ("KPCB Java"), and certain other limited partners (the "Partnership"). Pursuant to the Agreement, Sun agreed to make capital contributions of $16,000,000 to the Partnership and, in addition, pay an annual management fee of $320,000 to KPCB VIII Associates, L.P., a California limited partnership and a general partner of KPCB Java ("KPCB VIII"). Mr. Doerr, who is a General Partner of KPCB VIII, is a Sun director and chairman of our Leadership Development and Compensation Committee.

Vote required

Directors must be elected by a plurality of the votes cast at the meeting. This means that the eight individuals receiving the highest number of votes will be elected. You may give each nominee one vote for each share you hold; or you may cumulate your votes by giving one candidate a number of votes equal to the number of directors to be elected (eight), multiplied by the number of shares you hold; or you may distribute your votes among as many candidates as you wish. However, you may not cast votes for more than eight nominees. If you wish to cumulate your votes at the meeting, you must notify the Secretary of Sun of your intentions prior to the meeting.

6

Security ownership of management

The following table shows the number of shares of common stock beneficially owned as of September 12, 2001 by:

- •

- each

nominee for director;

- •

- the

executive officers named in the Summary Compensation Table; and

- •

- all directors and executive officers as a group.

| Name |

Number of shares owned(1) |

Right to acquire(2) |

Percent of outstanding shares |

||||

|---|---|---|---|---|---|---|---|

| Scott G. McNealy(3) | 55,675,951 | 16,920,000 | 2 | % | |||

| Edward J. Zander(4) | 247,732 | 5,382,000 | * | ||||

| James L. Barksdale | 0 | 65,000 | * | ||||

| Crawford W. Beveridge(5) | 81,014 | 0 | * | ||||

| L. John Doerr | 2,878,496 | 425,000 | * | ||||

| Judith L. Estrin | 84,000 | 145,000 | * | ||||

| Robert J. Fisher | 897,600 | 425,000 | * | ||||

| Masood A. Jabbar | 973,288 | 1,437,696 | * | ||||

| Michael E. Lehman | 101,190 | 900,000 | * | ||||

| Robert L. Long(6) | 237,412 | 360,000 | * | ||||

| M. Kenneth Oshman | 2,163,200 | 425,000 | * | ||||

| Naomi O. Seligman | 0 | 10,000 | * | ||||

| All current directors and executive officers as a group (27 persons)(3)(4)(5)(6) | 66,466,430 | 43,998,096 | 3 | % |

- *

- Less

than 1%

- (1)

- Excludes

shares that may be acquired through option exercises.

- (2)

- Shares

that may be acquired through stock option exercises on or before November 11, 2001.

- (3)

- Includes

187,600 shares held in Mr. McNealy's grantor retained annuity trust.

- (4)

- Includes

13,120 shares held by Mr. Zander's minor children and 40,000 shares held in Mr. Zander's grantor retained annuity trust.

- (5)

- Includes

30,000 shares held by Mr. Beveridge's minor children and wife.

- (6)

- Includes 153,961 shares held in Mr. Long's grantor retained annuity trust and family limited partnership.

Security ownership of certain beneficial owners

As of September 12, 2001, based on our review of filings made with the SEC and correspondence with one shareholder confirming its holdings, we are not aware of any stockholders owning 5% or more of our common stock.

7

The following table shows compensation information for Sun's Chief Executive Officer and the next four most highly compensated executive officers for the last three fiscal years:

| |

Annual compensation |

|

Long-term compensation |

||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

|

|

|

Awards |

Payouts |

|||||||||||||||||

| Name and principal position |

Fiscal year |

Salary ($)(1) |

Bonus ($)(1) |

Other annual compensation ($) |

Restricted stock awards ($)(2) |

Securities underlying options (#) |

LTIP payouts ($)(3) |

All other compensation ($)(4) |

|||||||||||||||

| Scott G. McNealy Chairman of the Board of Directors and Chief Executive Officer |

2001 2000 1999 |

$ |

100,000 103,846 116,154 |

$ |

4,767,500 3,623,653 |

(8) |

1,500,000 1,000,000 400,000 |

$ | 2,227,316 | $ |

6,800 6,923 4,431 |

(8) |

|||||||||||

| Edward J. Zander President and Chief Operating Officer |

2001 2000 1999 |

788,462 778,846 750,000 |

2,145,375 1,631,278 |

500,000 400,000 2,000,000 |

614,415 |

6,800 6,800 6,400 |

(8) |

||||||||||||||||

| Crawford W. Beveridge Executive Vice President and Chief Human Resources Officer |

2001 2000 1999 |

410,000 138,769 |

(5) |

250,000 510,623 |

(6) (6) |

$ |

66,782 |

(7) |

$ |

1,999,967 |

750,000 700,000 |

12,425 |

|||||||||||

| Masood A. Jabbar Executive Vice President, Global Sales Operations |

2001 2000 1999 |

451,923 434,615 400,000 |

540,561 376,740 |

150,000 260,000 340,000 |

7,650 7,181 6,185 |

||||||||||||||||||

| Michael E. Lehman Executive Vice President, Corporate Resources and Chief Financial Officer |

2001 2000 1999 |

600,000 623,077 600,000 |

1,144,200 869,400 |

1,100,000 400,000 |

573,442 |

6,800 6,800 6,400 |

|||||||||||||||||

- (1)

- Mr. McNealy elected to defer 20% of his fiscal year 1999 salary and 100% of his fiscal year 1999 bonus until he retires, and Mr. Jabbar elected to defer 30% of his fiscal year 2000 salary, 40% of his fiscal year 2000 bonus, 30% of his fiscal year 1999 salary and 30% of his fiscal year 1999 bonus until retirement, as permitted under our Non-Qualified Deferred Compensation Plan. For a description of our Non-Qualified Deferred Compensation Plan, see "Report of the Leadership Development and Compensation Committee of the Board on Executive Compensation–Long-term incentives–Deferred compensation plan."

- (2)

- All awards of restricted stock are valued by multiplying the number of shares granted by the closing price on the date of grant, minus any consideration paid by the named executive. As of June 30, 2001, 250,000 shares of Sun's restricted common stock were outstanding, having an aggregate value of $3,020,153. As of June 30, 2001, Mr. Zander held 200,000 shares of restricted common stock having an aggregate value of $1,020,186. The repurchase option expired as to 100,000 of Mr. Zander's shares on July 12, 2000 and will expire as to the remaining 100,000 on January 12, 2003. As of June 30, 2001, Mr. Beveridge held 50,000 shares of restricted common stock having an aggregate value of $1,999,967, which shares are subject to Sun's repurchase option. The repurchase option will expire as to 25,000 of such shares on September 1, 2002 and will expire as to the remaining 25,000 on March 1, 2005. Sun's "repurchase option," refers to Sun's option to repurchase shares of the restricted stock at the original purchase price paid by the executive officer upon termination of the officer's employment before the applicable vesting dates. Executive officers receive the same dividends on all shares of restricted stock as received by all other stockholders of Sun; however, Sun has never paid and does not currently anticipate paying any cash dividends in the foreseeable future.

- (3)

- Reflects amounts paid on October 6, 2000 to such executive officers who were granted Book Value Units ("BVUs") under the 1990 Long-Term Equity Incentive Plan. These BVUs were granted in December 1990, became fully vested on July 1, 1998 and were payable in cash only. The BVUs accrued value each year based on Sun's reported fiscal year end earnings per share amounts and continued to accrue value until exercised. Executive officers were permitted, at their option, to exercise all or a portion of their BVUs at any time until August 31, 2000 after which all unexercised BVUs were automatically paid to such executive officers. Accordingly, no executive officer holds any BVUs and the BVU program has expired.

- (4)

- Amounts stated reflect contributions made by Sun to such executive officer's 401(k) Plan account.

- (5)

- Mr. Beveridge commenced employment with Sun on March 1, 2000.

- (6)

- Amounts reflect a $500,000 sign-on bonus paid to Mr. Beveridge in two installments of $250,000 in each of fiscal 2000 and fiscal 2001.

- (7)

- Includes $64,499 in relocation expenses and $2,283 paid in connection with a Sun sales conference.

- (8)

- Reflects correction to amount previously reported.

8

Option grants in last fiscal year

The following table shows the stock option grants made to the executive officers named in the Summary Compensation Table during fiscal 2001:

Option Grants in Last Fiscal Year

| |

|

|

|

|

Potential realizable value at assumed annual rates of stock price appreciation for option term(4) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Number of securities underlying options granted (#)(1) |

% of total options granted to employees in fiscal year |

|

|

|||||||||||

| Name |

Exercise or base price ($/Sh)(2)(3) |

Expiration date |

|||||||||||||

| 5%($) |

10%($) |

||||||||||||||

| Scott G. McNealy | 1,500,000 | 1.32 | % | $ | 18.5800 | 4/18/11 | $ | 17,527,293 | $ | 44,417,602 | |||||

| Edward J. Zander | 500,000 | 0.44 | % | 18.5800 | 4/18/11 | 5,842,431 | 14,805,867 | ||||||||

| Crawford W. Beveridge | 750,000 | 0.66 | % | 18.5800 | 4/18/11 | 8,763,647 | 22,208,801 | ||||||||

| Masood A. Jabbar | 150,000 | 0.13 | % | 18.5800 | 4/18/11 | 1,752,729 | 4,441,760 | ||||||||

| Michael E. Lehman | – | – | – | – | – | – | |||||||||

- (1)

- Stock options have a ten year term. Mr. McNealy's stock options vest at a rate of 20% on the third anniversary, 40% on the fourth anniversary and 40% on the fifth anniversary of the option grant date; Mr. Zander's stock options vest at a rate of 10% on the third anniversary, 40% on the fourth anniversary and 50% on the fifth anniversary of the option grant date; Mr. Jabbar's stock options vest at a rate of 50% on the first anniversary and 50% on the second anniversary of the option grant date; and Mr. Beveridge's stock options vest at a rate of 20% per year commencing on the first anniversary of the option grant date. See also "Employment contracts and change-in-control arrangements."

- (2)

- The exercise price and tax withholding obligations may be paid in cash and, subject to certain conditions or restrictions, by delivery of already owned shares, pursuant to a subscription agreement or pursuant to a cashless exercise procedure under which the optionee provides irrevocable instructions to a brokerage firm to sell the purchased shares and to remit to Sun, out of the sale proceeds, an amount equal to the exercise price plus all applicable withholding taxes.

- (3)

- Options were granted at an exercise price equal to the last reported sale price of Sun common stock, as reported on The Nasdaq National Market on the date of grant.

- (4)

- Potential realizable value assumes that the common stock appreciates at the annual rate shown (compounded annually) from the date of grant until the options expire. These numbers are calculated based on the SEC's requirements and do not represent an estimate by Sun of future stock price growth.

The following table shows stock option exercises and the value of unexercised stock options held by the executive officers named in the Summary Compensation Table during fiscal year 2001.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| Name |

Shares acquired on exercise(#) |

Value realized($)(1) |

Number of securities underlying unexercised options at fiscal year-end(#) exercisable/unexercisable |

Value of unexercised in-the-money options at fiscal year-end($)(1) exercisable/unexercisable |

||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Scott G. McNealy | – | – | 17,369,088/4,780,000 | $ | 233,286,670/$25,461,736 | |||||

| Edward J. Zander | 1,050,000 | $ | 43,497,740 | 5,062,000/3,988,000 | 63,897,864/19,590,958 | |||||

| Crawford W. Beveridge | – | – | —/1,450,000 | —/— | ||||||

| Masood A. Jabbar | 912,000 | 12,679,080 | 1,437,696/906,000 | 17,923,850/3,693,033 | ||||||

| Michael E. Lehman | 680,000 | 36,027,312 | 788,000/1,960,000 | 6,892,078/8,545,437 | ||||||

- (1)

- Market value of underlying securities at exercise date or fiscal year end, as the case may be, minus the exercise price.

9

Employment contracts and change-in-control arrangements

We have no employment contracts with any of our executive officers. In October 1990, we approved a form of Senior Management Change of Control Agreement. Each of the executive officers named in the Summary Compensation Table has signed a "change-of-control" agreement. Subject to certain provisions in the agreement, each officer is eligible to receive the following if such officer's employment is terminated within one year following a change-of-control of Sun: (i) an amount equal to two and one-half times such officer's annual compensation (or, in the case of Mr. McNealy, three times his annual compensation); (ii) continuation of health benefits and group term life insurance for 24 months; and (iii) the acceleration of vesting for all stock options held. The officer's wages, salary and incentive compensation for the immediately preceding calendar year is counted as annual compensation. A "change-of-control" includes (i) a merger or acquisition of Sun resulting in a 50% or greater change in the total voting power of Sun immediately following such transaction, or (ii) certain changes in the majority composition of the Board of Directors during a 36 month period, not initiated by the Board of Directors.

Sun also entered into individual change-of-control agreements with each of its corporate executive officers, in addition to the executive officers named in the Summary Compensation Table. The individual change-of-control agreements contain substantially the same terms as the change-of-control agreements described above.

Vice President change of control severance plan

The Executive Change of Control Severance Plan was adopted in June 1990, amended in November 1996 and renamed the Vice President Change of Control Severance Plan. It covers our vice presidents who are not eligible to enter into the Senior Management Change of Control Agreement. If such vice president is terminated within one year after the date of any "change-of-control," except under certain conditions, he or she will receive: (i) two times annual compensation; (ii) continuation of health benefits and group term life insurance for 24 months; and (iii) the acceleration of vesting for all stock options held. For purposes of this plan, a "change-of-control" is defined similarly to the description in "Employment contracts and change-in-control arrangements."

Deferred compensation arrangements

Under our Non-Qualified Deferred Compensation Plan, in the event of a participant's death while an employee, such participant's beneficiaries are entitled to receive the employee's account balance plus a supplemental survivor benefit equal to two times the amount of compensation the participant deferred under the plan, not to exceed $3,000,000. See "Report of the Leadership Development and Compensation Committee of the Board on Executive Compensation–Long-term incentives–Deferred compensation plan" for a description of the Non-Qualified Deferred Compensation Plan.

Certain transactions with management

In November 1999, Patricia C. Sueltz, Executive Vice President, Software Systems Group, received a loan from Sun in the amount of $850,000, payable in full on or before December 1, 2004, at an interest rate of 6.02%. This loan was made for the purchase of her residence in connection with her job-related relocation. As of June 30, 2001, the entire $850,000 amount remained outstanding.

Section 16(a) beneficial ownership reporting compliance

Our directors and executive officers file reports with the SEC indicating the number of shares of any class of our equity securities they owned when they became a director or executive officer and, after that, any changes in their ownership of our equity securities. These reports are required by Section 16(a) of the Securities Exchange Act of 1934, as amended. Based on our review of the reports, we believe that during fiscal 2001 all of our officers, directors and 10% stockholders complied with the foregoing filing requirements.

10

REPORT OF THE LEADERSHIP DEVELOPMENT AND COMPENSATION

COMMITTEE OF THE BOARD ON EXECUTIVE COMPENSATION

The following Report of the Leadership Development and Compensation Committee of the Board on Executive Compensation shall not be deemed to be "soliciting material" or to be "filed" with the SEC nor shall this information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, each as amended, except to the extent that Sun specifically incorporates it by reference into a filing.

Compensation philosophy

Our philosophy in setting compensation policies for executive officers is to maximize stockholder value over time. The Leadership Development and Compensation Committee sets our compensation policies applicable to the executive officers, including the chief executive officer, and evaluates the performance of such officers. The Committee strongly believes that executive compensation should be directly linked to continuous improvements in corporate performance and increases in stockholder value and has adopted the following guidelines for compensation decisions:

- •

- Provide a competitive total compensation package that enables Sun to attract and retain key executive talent;

- •

- Align all pay programs with Sun's annual and long-term business strategies and objectives; and

- •

- Provide variable compensation opportunities that are directly linked to the performance of Sun and that link executive reward to stockholder return.

The Committee also believes that it is in the best interests of our stockholders for our executive officers (as well as for the members of the Board of Directors and certain other individuals) to own Sun stock. During fiscal 2000, the Committee established stock ownership guidelines, applicable to these covered individuals, reflecting the Committee's expectations as to the number of shares of Sun's common stock such individuals should hold depending on their positions.

Components of executive compensation

The Committee focuses primarily on the following three components in forming the total compensation package for its executive officers:

- •

- Base salary;

- •

- Annual incentive bonus; and

- •

- Long-term incentives.

Base salary

The Committee intends to compensate our executive officers, including the chief executive officer, competitively within the industry. In order to evaluate Sun's competitive position in the industry, the Committee reviews and analyzes the compensation packages, including base salary levels, offered by other high technology companies, including companies in the S&P Computers (Hardware) Index. In addition, the Committee, together with the Board of Directors, will also subjectively evaluate the level of performance of each executive officer, including Mr. McNealy, in order to determine current and future appropriate base pay levels. In prior years, for the chief executive officer, the Committee targeted the lower-end of the base salary range determined by its aforementioned competitive analysis, giving more significant emphasis to annual bonus and longer-term incentives for Mr. McNealy's total compensation package. For fiscal years 2001 and 2000, Mr. McNealy's base salary was $100,000 and $103,846, respectively, such that his annual bonus, if awarded, would comprise the vast majority of his total potential annual compensation. This focus has allowed the Committee to directly compensate Mr. McNealy for corporate performance, while ultimately paying Mr. McNealy competitively by industry standards. See "Annual incentive bonus" below. With respect to our other corporate executive officers, the Committee has

11

targeted the higher end of the industry competitive base salary range, linking a lesser (yet still significant) portion of these executives' total compensation to an annual bonus. See "Annual incentive bonus" below. The Committee also emphasizes longer-term compensation incentives for these executives as it believes that these longer-term incentives help motivate the executives to better achieve Sun's corporate performance goals, thereby more directly contributing to stockholder value.

Annual incentive bonus

During fiscal 2001, our executive officers were eligible for a target annual incentive bonus, calculated by the Committee as a percentage of the officers' base salary, under the terms of our Section 162(m) Executive Officer Performance-Based Bonus Plan (the "Bonus Plan") See "Discussion of compensation in excess of $1 million per year" below and "Proposal 3 Approval of Section 162(m) Executive Officer Performance-Based Bonus Plan" for a description of the Bonus Plan. All corporate executive officers, other than Mr. McNealy, were eligible for target bonuses ranging from 45% to 155% of their base salary, depending on their positions. Mr. McNealy was eligible for a target bonus of 2500% of his base salary. During fiscal 2001, no bonuses were awarded under the Bonus Plan to Mr. McNealy or to the executive officers. Due to economic challenges experienced during the last fiscal year, our earnings per share ("EPS") and revenue were significantly below plan. In addition, certain corporate performance goals based on business, operations and management objectives and certain customer quality and satisfaction goals set by the Committee at the beginning of fiscal 2001 were not met. Furthermore, none of our divisions or functions performed well enough, in combination with Sun's results, to earn a bonus payout. These goals were measured objectively in accordance with a scoring system assigned to each goal by the Committee. The EPS and revenue targets, as well as the corporate performance goals and the customer quality and satisfaction goals are all based on confidential information and are competitively sensitive to Sun as they are derived from Sun's internal projections and business plan.

Elements of Sun's financial performance for fiscal 2001 that directly affected the determination not to pay bonuses to Mr. McNealy, the executive officers nor to any Sun employee included revenue growth of 16% compared with revenue growth of 33% in fiscal 2000, and proforma EPS of $.42 for fiscal 2001 compared with fiscal 2000 proforma EPS of $.55 (excluding realized gains or losses on Sun's equity portfolio, acquisition-related items, and any unusual one time items and the related tax effects of these items.)

Long-term incentives

Options and restricted stock. The Committee provides our executive officers with long-term incentive awards through grants of stock options and, in some cases, restricted stock. The Committee is responsible for determining who should receive the grants, when the grants should be made, the exercise price per share and the number of shares to be granted. The Committee considers grants of long-term incentive awards to executive officers during each fiscal year. Long-term incentive awards are granted based on individual or corporate performance as determined by the Committee.

The Committee believes that stock options provide our executive officers with the opportunity to purchase and maintain an equity interest in Sun and to share in the appreciation of the value of the stock. The Committee believes that stock options directly motivate an executive to maximize long-term stockholder value. The options also utilize vesting periods in order to encourage key employees to continue to be employed by Sun. All options to executive officers to date have been granted at the fair market value of Sun's common stock on the date of the grant. The Committee considers the grant of each option subjectively, considering factors such as the individual performance of executive officers and competitive compensation packages in the industry. Mr. McNealy's option grants are also determined by the Committee. Mr. McNealy also has authority to grant stock options from time to time to certain individuals, subject to certain guidelines prescribed by the Committee.

The Committee also makes restricted stock awards which can be similarly beneficial to executives as the value of the award increases with an increasing stock price. The use of restricted stock has been primarily limited within the last several fiscal years to specific cases in which a newly hired senior executive receives a

12

grant in order to replace vested benefits and/or an equity position at a prior employer, to award an executive officer for extraordinary performance or to aid in retention. For fiscal year 2001, there were no restricted stock awards made to executives named in the Summary Compensation Table. For information regarding the valuation and vesting of restricted stock awards, see "Summary Compensation Table—footnote 2."

Deferred compensation plan. In June 1995, the Committee approved another component of our executive compensation program, the Non-Qualified Deferred Compensation Plan (the "Deferred Plan"). The Committee last amended the Deferred Plan on June 30, 2001. The Deferred Plan is a voluntary, non-tax qualified, deferred compensation plan available to Board of Director members, executive officers and other members of our management, to enable them to save for retirement by deferring a portion of their current compensation. Under the Deferred Plan, compensation may be deferred until termination or other specified dates they may choose. Deferred amounts may be credited with earnings based on investment choices made available by the Committee for this purpose. Participants' dependents are also eligible to receive a pre-retirement death benefit. The purpose of this Deferred Plan is to encourage participants to remain in the service of Sun as benefits of the Deferred Plan increase over time.

Discussion of compensation in excess of $1 million per year

The Committee has considered the implications of Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), enacted under the Revenue Reconciliation Act of 1993. This section precludes a public corporation from taking a tax deduction for individual compensation in excess of $1 million for its chief executive officer or any of its four other highest-paid officers. This section also provides for certain exemptions to this limitation, specifically compensation that is performance based within the meaning of Section 162(m).

In order to qualify compensation derived by executive officers from stock options as performance-based compensation, amendments to the 1990 Long-Term Equity Incentive Plan were submitted to and approved by our stockholders at our 1994 annual meeting.

Additionally, with respect to bonuses granted by this Committee to such executive officers, the Committee approved the Section 162(m) Executive Officer Performance-Based Bonus Plan to qualify bonus payments to executives under Section 162(m). Stockholders approved the plan at our 1995 annual meeting. Periodically, the plan must be re-qualified by submitting it to our shareholders for approval. You are being asked to approve the plan at this meeting. See "Proposal 3 Approval of Section 162(m) Executive Officer Performance-Based Bonus Plan" for a description of the plan you are being asked to approve. The Committee, however, reserves the right to award compensation to our executives in the future that may not qualify under Section 162(m) as deductible compensation. The Committee will, however, continue to consider all elements of the cost to Sun of providing such compensation, including the potential impact of Section 162(m).

Conclusion

The Committee believes that its executive compensation philosophy serves the best interests of Sun and our stockholders.

L.

John Doerr, Chairman

Robert J. Fisher

M. Kenneth Oshman

13

The following Report of the Audit Committee shall not be deemed to be "soliciting material" or to be "filed" with the SEC nor shall this information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, each as amended, except to the extent that Sun specifically incorporates it by reference into a filing.

The Audit Committee, currently comprised of James L. Barksdale, Judith L. Estrin, Robert L. Long and Naomi O. Seligman, evaluates audit performance, manages relations with Sun's independent accountants and evaluates policies and procedures relating to internal accounting functions and controls. The Board of Directors has adopted a written charter for the Audit Committee which details the responsibilities of the Audit Committee. This charter is attached as Appendix A to this proxy statement. This report relates to the activities undertaken by the Audit Committee in fulfilling such role.

The Audit Committee members are not professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management and the independent auditor, nor can the Audit Committee certify that the independent auditor is "independent" under applicable rules. The Audit Committee serves a board-level oversight role in which it provides advice, counsel and direction to management and the auditors on the basis of the information it receives, discussions with management and the auditors and the experience of the Audit Committee's members in business, financial and accounting matters.

The Audit Committee oversees our financial reporting process on behalf of the Board of Directors. Our management has the primary responsibility for the financial statements and reporting process, including our systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed with management the audited financial statements included in the Annual Report on Form 10-K for the fiscal year ended June 30, 2001. This review included a discussion of the quality and the acceptability of our financial reporting and controls, including the clarity of disclosures in the financial statements.

The Audit Committee also reviewed with our independent accountants, who are responsible for expressing an opinion on the conformity of our audited financial statements with generally accepted accounting principles, their judgments as to the quality and the acceptability of our financial reporting and such other matters as are required to be discussed with the Committee under generally accepted auditing standards including Statement on Auditing Standards No. 61. The Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Statement No. 1. The Audit Committee discussed with the independent accountants their independence from management and Sun, including the matters in their written disclosures required by the Independence Standards Board including Statement No. 1.

The Audit Committee further discussed with our internal auditors and independent accountants the overall scope and plans for their respective audits. The Audit Committee meets periodically with the internal auditors and independent accountants, with and without management present, to discuss the results of their examinations, their evaluations of our internal controls, and the overall quality of our financial reporting. The Audit Committee held six meetings during fiscal year 2001.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended June 30, 2001 for filing with the SEC.

Submitted by the Audit Committee of the Board of Directors.

Robert

L. Long, Chairman

James L. Barksdale

Judith L. Estrin

Naomi O. Seligman

14

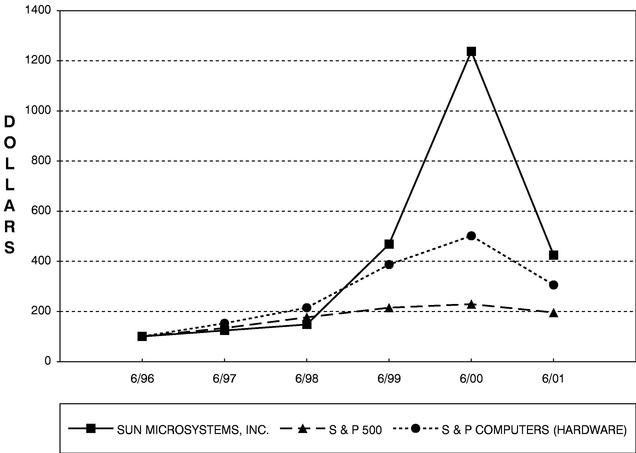

The information contained in the performance graph shall not be deemed "soliciting material" or to be "filed" with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that Sun specifically incorporates it by reference into such filing. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

Presented below is a line graph that compares the cumulative return of the following to our five years ending on June 30, 2001:

- •

- Sun

Common Stock;

- •

- S&P

500 Index; and

- •

- S&P

Computers (Hardware) Index

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG SUN MICROSYSTEMS, INC., THE S & P 500 INDEX

AND THE S & P COMPUTERS (HARDWARE) INDEX

*$100 INVESTED ON 6/30/96 IN STOCK OR INDEX–

INCLUDING REINVESTMENT OF DIVIDENDS.

FISCAL YEAR ENDING JUNE 30.

15

PROPOSAL 2

AMENDMENT TO 1990 LONG-TERM EQUITY INCENTIVE PLAN

We are asking you to approve an amendment to our 1990 Long-Term Equity Incentive Plan ("1990 Incentive Plan"). The purpose of the amendment is to increase the number of shares of Sun common stock we may issue under the 1990 Incentive Plan by 50,275,000 shares from 1,117,200,000 to 1,167,475,000.

As of September 12, 2001 under the 1990 Incentive Plan, 241,172,664 shares of Sun common stock were available for issuance and we had granted options to purchase 1,063,781,976 shares with a market value of $10,946,316,533 of which 402,613,822 shares of Sun common stock had been issued upon the exercise of options. The average exercise price per share of options that were outstanding as of September 12, 2001 was $23.62.

We may also issue and sell restricted shares of our common stock under the 1990 Incentive Plan. As of September 12, 2001, 8,487,440 shares of Sun restricted stock with a market value of $87,335,758 had been issued and sold at an average purchase price of $.01 per share. Of these, 864,961 shares remain subject to Sun's repurchase option.

A brief summary of the 1990 Incentive Plan follows.

Purpose

The purpose of the 1990 Incentive Plan is to:

- •

- provide an additional incentive to eligible employees, officers and consultants whose present and potential contributions are important to the continued success of Sun;

- •

- afford these employees, officers and consultants an opportunity to acquire a proprietary interest in Sun; and

- •

- enable Sun to hire and retain the best available employees.

Eligibility

Officers, consultants and other employees of Sun and its subsidiaries are eligible to receive awards under the 1990 Incentive Plan. As of September 12, 2001, there were over 40,000 employees and 6,000 consultants eligible to receive awards under the 1990 Incentive Plan.

Administration

The 1990 Incentive Plan is administered by our Board of Directors or a committee appointed by the Board (the "Committee"). The Committee has the authority to construe and interpret the 1990 Incentive Plan, to prescribe, amend and rescind rules and regulations relating to the 1990 Incentive Plan, and to make all other determinations necessary or advisable for the administration of the 1990 Incentive Plan. Members of the Board receive no additional compensation for their administration of the 1990 Incentive Plan.

Stock options

The 1990 Incentive Plan permits the granting of options, both incentive stock options (ISOs) and non-statutory stock options (NSOs), to purchase Sun common stock.

In general, the option exercise price for each share covered by an option must equal or exceed the fair market value of a share of common stock on the date the option is granted. However, an NSO granted by the Board to an employee in lieu of reasonable salary or compensation may be granted at an exercise price less than the fair market value of Sun common stock (but not less than 85% of such fair market value) on the date of grant.

In August 1995, the Board established a special reserve under which it could grant a limited number of NSOs under the 1990 Incentive Plan at exercise prices below fair market value. The number of shares in

16

the special reserve is restricted to an amount equal to 3% of the total number of shares reserved for issuance under the 1990 Incentive Plan at any one time (including all increases to the number of shares reserved for issuance approved by the stockholders). In addition, grants to individuals subject to Section 16(b) of the Securities Exchange Act of 1934, as amended, may not be at less than 50% of the fair market value of Sun common stock on the date of grant.

The Committee is responsible for establishing the terms and conditions applicable to option grants. In the case of ISOs, the term of the option may not exceed 10 years from the date of grant. Options may be exercisable in installments (i.e., vest over a period of time), and their exercisability may be accelerated by the Committee in its discretion.

The exercise price of options granted under the 1990 Incentive Plan may be paid for by the following methods:

- •

- cash;

- •

- check;

- •

- promissory note;

- •

- Sun common stock with a fair market value on the exercise date equal to the aggregate exercise price of the options; or

- •

- delivery of an irrevocable subscription agreement.

Additionally, Sun will accept as payment the delivery of a properly executed exercise notice together with irrevocable instructions to a broker to promptly deliver to Sun the amount of sale or loan proceeds required to pay the exercise price. Finally, the Board may authorize Sun to accept payment by any combination of the methods stated above.

Under the 1990 Incentive Plan, if an optionee's employment or consultancy terminates for any reason, including retirement, the optionee may generally exercise the option (to the extent it was exercisable on the date of termination or as otherwise set forth in the terms of the option) within the time period determined by the Board, subject to the stated term of the option. In the case of ISOs, the time period may not be more than 90 days. If the Board has determined that an employee was discharged for just cause, all vested and unvested options that were previously granted to the employee under the 1990 Incentive Plan, automatically expire. However, in the event of the death of an employee optionee, his or her vested option will generally be exercisable for a period of six months, provided the death occurs during the employment term or within one month following termination from employment.

The granting of stock options under the 1990 Incentive Plan by the Board is subjective and is dependent upon, among other things, an employee's individual performance. See "Proposal 2 Amendment to 1990 Long-Term Equity Incentive Plan–Participation in the 1990 Incentive Plan." Therefore, the number of future option grants to officers and employees under the 1990 Incentive Plan cannot be determined with specificity at this time. The 1990 Incentive Plan does, however, limit the number of shares subject to an option that may be granted to any employee in any one fiscal year. The annual limit is 4,800,000 shares per employee, except with respect to newly-hired employees, who may receive a one-time grant of up to 6,400,000 shares upon acceptance of employment with Sun.

Stock appreciation rights

The Board may grant non-transferable stock appreciation rights ("SARs") in conjunction with related options. SARs entitle the holder to receive, upon exercise, an amount of cash, Sun common stock (as determined by the Board) or both, equal in value to the excess of the fair market value of the shares covered by the SAR on the date of exercise over the aggregate exercise price of the related option for such shares. The exercise of an SAR results in cancellation of the related option or, conversely, the exercise of the related option will result in cancellation of the SAR. An SAR may only be exercised when the fair

17

market value of Sun common stock exceeds the exercise price of the option underlying the SAR. No SARs had been granted under the 1990 Incentive Plan as of September 12, 2001.

Stock purchase rights

The Board may grant participants stock purchase rights (i.e., restricted stock) to purchase Sun common stock for limited periods of up to 60 days under such terms, conditions and restrictions as the Board may apply. Stock purchase rights may be granted alone, in addition to, or in tandem with, other awards under the 1990 Incentive Plan and/or cash awards made outside of the 1990 Incentive Plan. In the case of participants who are subject to Section 16(b) of the Securities Exchange Act of 1934, as amended, the stock purchase rights may not be granted at a price higher than $0.00067 per share, the par value of Sun's common stock.

Sun has the right to repurchase the stock acquired by the purchaser pursuant to a stock repurchase right in the event of the voluntary or involuntary termination of employment of the purchaser. Sun's right to repurchase the stock lapses over time, and stock that is no longer subject to Sun's right of repurchase is vested. There are limits on how quickly the stock acquired pursuant to stock purchase rights may vest. Generally, restricted stock may not vest earlier than 21/2 years from the date of grant as to 50% of the shares subject to the grant, and as to the remaining unvested shares subject to the grant, not earlier than 5 years after the date of grant. The Board may exercise its repurchase rights at its discretion with regard to stock purchase rights granted from the special reserve described above under "Stock options." In addition, the vesting restrictions on such stock purchase rights are determined at the Board's discretion.

The granting of stock purchase rights under the 1990 Incentive Plan is subjective and is tied to an employee's individual performance. These rights are most commonly granted to new key employees and, less frequently, to officers to reward extraordinary performance or to aid in retention. See "Report of the Leadership Development and Compensation Committee of the Board on Executive Compensation." Because the Committee has discretion to select the participants, the actual number of employees who will receive stock purchase rights during any particular fiscal year cannot be determined in advance.

Long-term performance awards

Long-term performance awards may also be granted. Long-term performance awards are bonus awards that are payable in cash or Sun common stock, and they are based on criteria that the Board believes to be appropriate. These criteria include certain performance factors relating to Sun and its subsidiaries, as well as performance goals for the individual to be considered for the award, and may vary from participant to participant, group to group, and period to period.

No long-term performance awards were granted under the 1990 Incentive Plan during fiscal 2001.

Adjustments for stock dividends, mergers and other events

Appropriate adjustments to awards may be made to reflect stock dividends, stock splits and similar events. In the event of a merger, liquidation or similar event, the Committee may provide for the assumption, substitution, adjustment or acceleration of such awards at its discretion.

Amendment and termination

The 1990 Incentive Plan may be amended, altered or discontinued at any time. However, any such amendment, alteration or discontinuation may not adversely affect any outstanding stock options, SARs, stock purchase rights, or long-term performance awards unless the recipient of such award consents to such a modification.

Subject to the specific terms of the 1990 Incentive Plan described above, the Committee may accelerate any award or option or waive any conditions or restrictions pertaining to such award or option at any time. In addition, to the extent necessary to comply with Rule 16b-3 under the Securities Exchange Act of 1934,

18

as amended, or Section 422 of the Code (or any other applicable law or regulation), Sun will obtain stockholder approval of any 1990 Incentive Plan amendment in such a manner and to such a degree as is required by applicable law.

Summary of Certain Income Tax Information

The following is only a brief summary of the effect of federal income taxation on the recipient of an award and Sun under the 1990 Incentive Plan. This summary is not exhaustive and does not discuss the income tax laws of any municipality, state or country outside of the United States in which a recipient of an award may reside.

Stock options

If an option granted under the 1990 Incentive Plan is an ISO, the optionee will recognize no income upon grant of the ISO and will incur no tax liability upon exercise unless the optionee is subject to the alternative minimum tax. Sun will not be permitted a deduction for federal income tax purposes due to an exercise of an ISO regardless of the applicability of the alternative minimum tax, unless the exercise constitutes a disqualifying disposition of the ISO. Upon the sale or exchange of the shares at least two years after grant of the ISO and one year after exercise by the optionee, any gain (or loss) will be treated as long-term capital gain (or loss). If these holding periods are not satisfied (i.e., a disqualifying disposition occurs), the optionee will recognize ordinary income equal to the difference between the exercise price and the lower of the fair market value of the stock at the date of the option exercise or the sale price of the stock. Sun will be entitled to a deduction in the same amount as the ordinary income recognized by the optionee. Any gain (or loss) recognized on a disqualifying disposition of the shares in excess of the amount treated as ordinary income will be characterized as capital gain (or loss).

All options that do not qualify as ISOs are taxed as NSOs. An optionee will not recognize income at the time he or she is granted an NSO. However, upon the exercise of an NSO, the optionee will recognize ordinary income measured by the excess of the fair market value of the shares over the option price. In certain circumstances, where the shares are subject to a substantial risk of forfeiture when acquired, the date of taxation may be deferred unless the optionee files an election with the Internal Revenue Service under Section 83(b) of the Code. The income recognized by an optionee who is also an employee of Sun will be subject to tax withholding by Sun. Upon the sale of such shares by the optionee, any difference between the sale price and the exercise price, to the extent not recognized as ordinary income as provided above, will be treated as capital gain (or loss). Sun will be entitled to a tax deduction in the same amount as the ordinary income recognized by the optionee with respect to shares acquired upon exercise of an NSO.

Stock appreciation rights

A recipient will not recognize any taxable income in connection with the grant of an SAR in connection with a stock option. On exercise of an SAR, the recipient will generally recognize ordinary income in the year of exercise in an amount equal to the difference between the exercise price (if any) of the SAR and the fair market value of the SAR (computed with reference to the Sun common stock) at the time of exercise. If the recipient is an employee, such amount will be subject to withholding by Sun. Sun will be entitled to a tax deduction in the amount and at the time an employee recipient recognizes ordinary income with respect to an SAR.

If the recipient receives shares of Sun common stock upon exercise of an SAR, the tax consequences on the purchase and sale of such shares will be the same as those discussed above for NSOs.

Stock purchase rights

Stock purchase rights will generally be subject to the tax consequences discussed above for NSOs.

19

Long-term performance award

A recipient generally will not recognize any taxable income in connection with the grant of a long-term performance award that is in the form of Sun common stock. At the time the stock performance award vests (unless a Section 83(b) election is timely filed at the time of grant), the recipient will generally recognize ordinary income in an amount equal to the fair market value of the award (computed with reference to Sun common stock) at the time of vesting. If the recipient is an employee, any amount included in income will be subject to withholding by Sun. As a general rule, Sun will be entitled to a tax deduction in the amount and at the time the employee recipient recognizes ordinary income with respect to the long-term performance award included as ordinary income by the recipient. In the event a long-term performance award constitutes cash, the award must be included in the gross income of the recipient in the year of receipt and Sun is entitled to a deduction if the recipient is an employee.

Capital gains

Capital gains are grouped and netted by holding periods. Net capital gains on capital assets held for 12 months or less are taxed at the individual's federal ordinary income tax rate. Net capital gains on capital assets held for more than 12 months are taxed at a maximum federal rate of 20%. Capital losses associated with the disposition of a capital asset are allowed in full against capital gains and up to $3,000 against other income.

Deductibility of executive compensation

Special rules limit the deductibility of compensation paid to Sun's Chief Executive Officer and next four most highly compensated executive officers. Under Section 162(m) of the Code, the annual compensation paid to each of these executives may not be deductible to the extent that their compensation exceeds $1 million. However, Sun is able to preserve the deductibility of compensation over $1 million if the requirements for deductability under Section 162(m) are satisfied. The 1990 Incentive Plan has been designed to permit certain stock options granted under the 1990 Incentive Plan to satisfy the conditions of Section 162(m).

Participation in the 1990 Incentive Plan

The grant of options, SARs, stock purchase rights and long-term performance awards under the 1990 Incentive Plan to employees, including the officers named in the Summary Compensation Table, is subject to the discretion of the Committee. As of the date of this proxy statement, there has been no determination by the Board with respect to future awards under the 1990 Incentive Plan. Accordingly, future awards are not determinable at this time. Non-employee directors are not eligible to participate in the 1990 Incentive Plan. No SARs or long-term performance awards were granted during fiscal year 2001. As of September 12, 2001, the fair market value of Sun's common stock was $10.29 per share, which was the closing price reported by The Nasdaq National Market. Please refer to the table below for more detail regarding participation in the 1990 Incentive Plan.

Option grant table

The following table summarizes option grants made during fiscal year 2001 to:

- •

- the executive officers named in the Summary Compensation Table;

- •

- all current executive officers as a group;

- •

- all current directors who are not executive officers as a group; and

- •

- all other employees as a group.

20

AMENDED PLAN BENEFITS

1990 LONG-TERM EQUITY INCENTIVE PLAN

| Name and position of individual |

Securities underlying options granted (#) |

Weighted average exercise price per share ($/sh) |

|||

|---|---|---|---|---|---|

| Scott G. McNealy Chairman of the Board of Directors and Chief Executive Officer |

1,500,000 | $ | 18.58 | ||

| Edward J. Zander President and Chief Operating Officer |

500,000 | 18.58 | |||

| Crawford W. Beveridge Executive Vice President and Chief Human Resources Officer |

750,000 | 18.58 | |||

| Masood A. Jabbar Executive Vice President, Global Sales Operations |

150,000 | 18.58 | |||

| Michael E. Lehman Executive Vice President, Corporate Resources and Chief Financial Officer |

– | – | |||

| All current executive officers as a group | 2,900,000 | 18.58 | |||

| All current directors who are not executive officers as a group | – | – | |||

| All other employees (including all current officers who are not executive officers) as a group | 105,830,402 | 28.73 | |||

Vote required

The affirmative vote of a majority of the total votes cast on this proposal at the annual meeting is necessary to approve the amendment to the 1990 Incentive Plan. If you hold your shares in your own name and abstain from voting, your abstention will have no effect on the vote. Similarly, if you hold your shares through a broker, bank or other institution and you do not instruct them on how to vote on this proposal, they may not vote your shares, and your shares will have no effect on the vote. If the amendment to the 1990 Incentive Plan is not approved, the current 1990 Incentive Plan will remain in effect, and the total number of shares reserved for issuance under the plan will not be increased.

Board recommendation

The Board of Directors recommends that you vote "FOR" the amendment to the 1990 Long-Term Equity Incentive Plan.

21

PROPOSAL 3

APPROVAL OF SECTION 162(m) EXECUTIVE OFFICER

PERFORMANCE-BASED BONUS PLAN

This section provides a summary of the terms and conditions of the Section 162(m) Executive Officer Performance-Based Bonus Plan (the "Performance Plan") and the proposal to re-approve the amended and restated Performance Plan.

The Performance Plan was first adopted by our Board of Directors in August 1995 and by our stockholders in November 1995. Because the Performance Plan is designed to qualify as providing "performance-based" compensation under Section 162(m) of the Code, periodically we must ask you to renew your approval of the Performance Plan. Additionally, we have made certain changes to the Performance Plan. These changes also require your approval. Your affirmative vote to re-approve the Performance Plan also means that you are voting in favor of the changes made to the plan. We are asking you to renew the approval of the Performance Plan so that we may deduct for federal income tax purposes any compensation over $1 million that we may pay to certain of our most highly paid executives in a single year pursuant to the Performance Plan as well as the changes made to the Performance Plan.

General