▪ | 87th consecutive quarter of profitability |

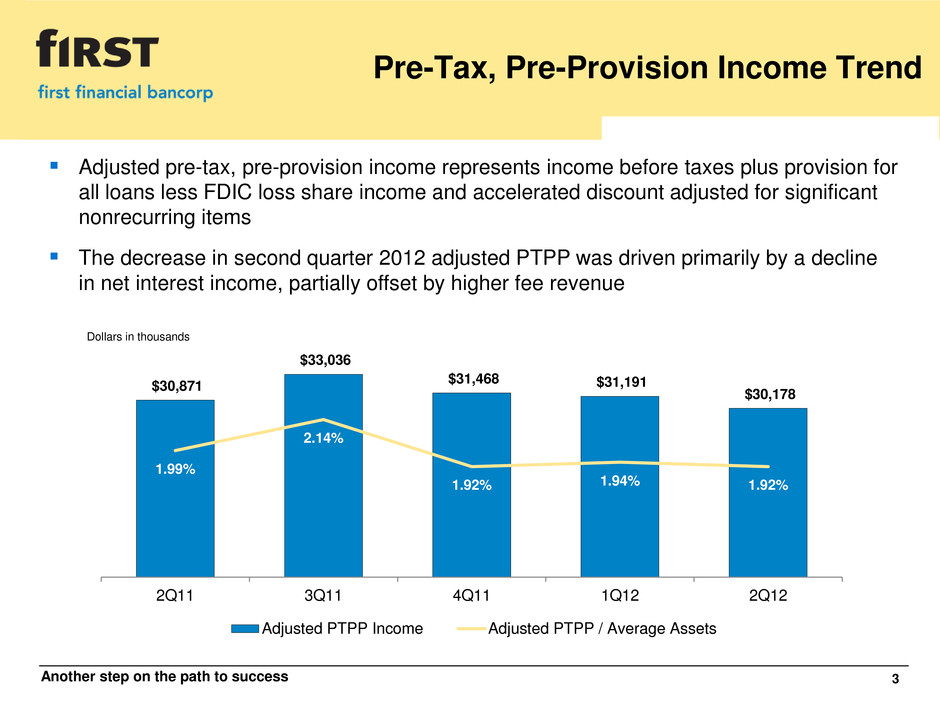

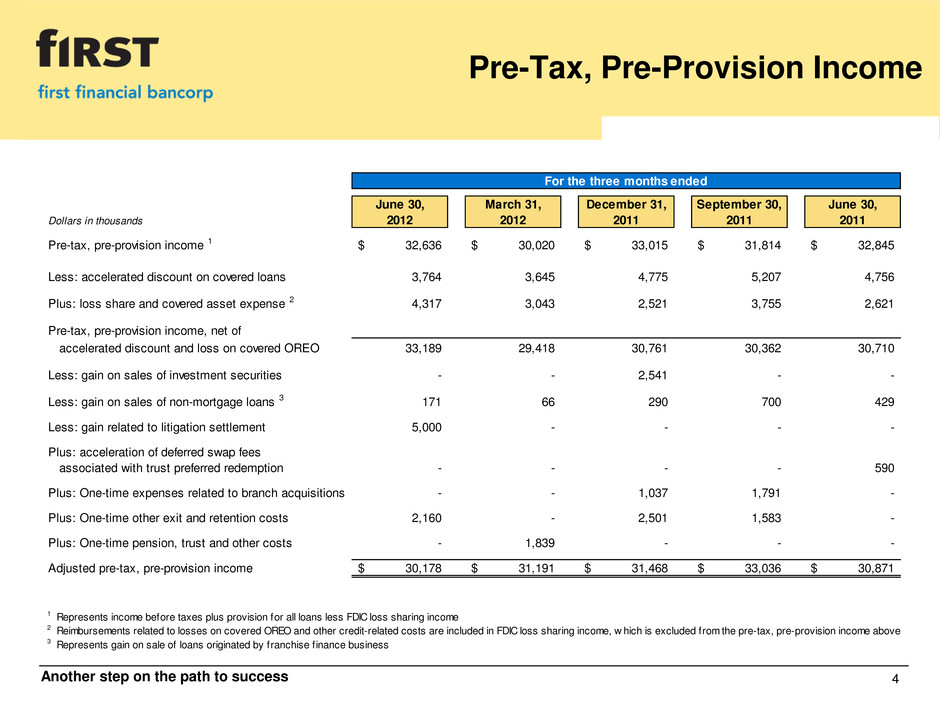

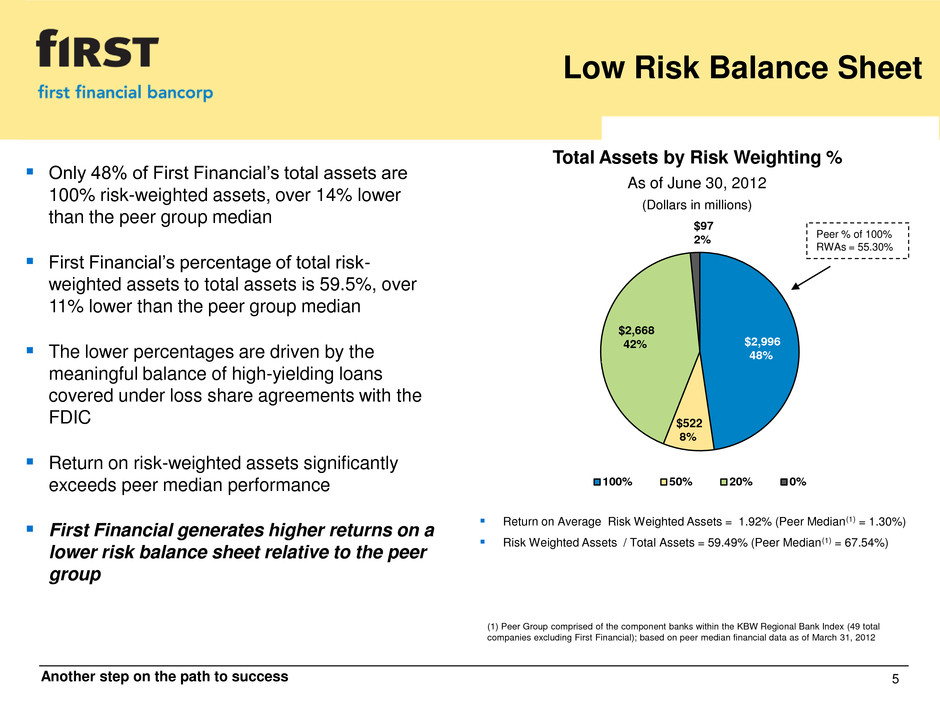

▪ | Quarterly adjusted pre-tax, pre-provision income remains solid, totaling $30.2 million, or 1.92% of average assets |

▪ | Continued strong quarterly performance |

• | Return on average assets of 1.13% |

• | Return on average risk-weighted assets of 1.92% |

• | Return on average shareholders' equity of 9.98% |

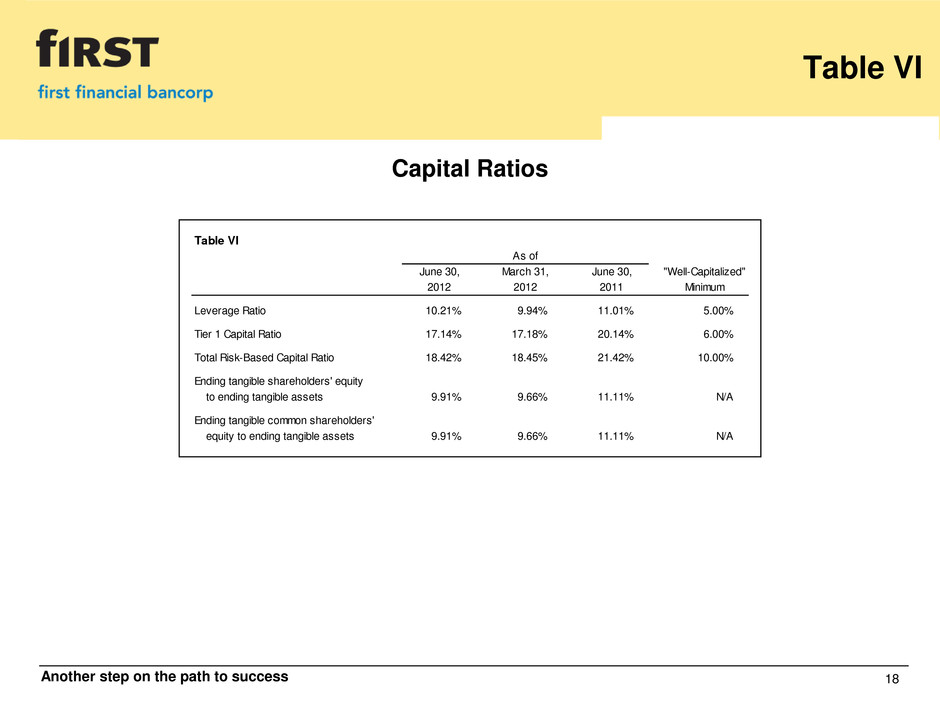

▪ | Capital ratios remain high |

• | Tangible common equity to tangible assets of 9.91% |

• | Tier 1 capital ratio of 17.14% |

• | Total risk-based capital ratio of 18.42% |

▪ | Quarterly net interest margin remains strong at 4.49%, benefiting from the continued decline in deposit funding costs resulting from strategic initiatives |

▪ | Total uncovered loan portfolio growth of 6.7% on an annualized basis |

• | Strong growth in commercial real estate loan balances |

• | Increasing contribution from specialty finance product lines |

▪ | Total classified assets declined $9.1 million, or 5.9%, compared to the linked quarter and $39.2 million, or 21.2%, compared to June 30, 2011 |

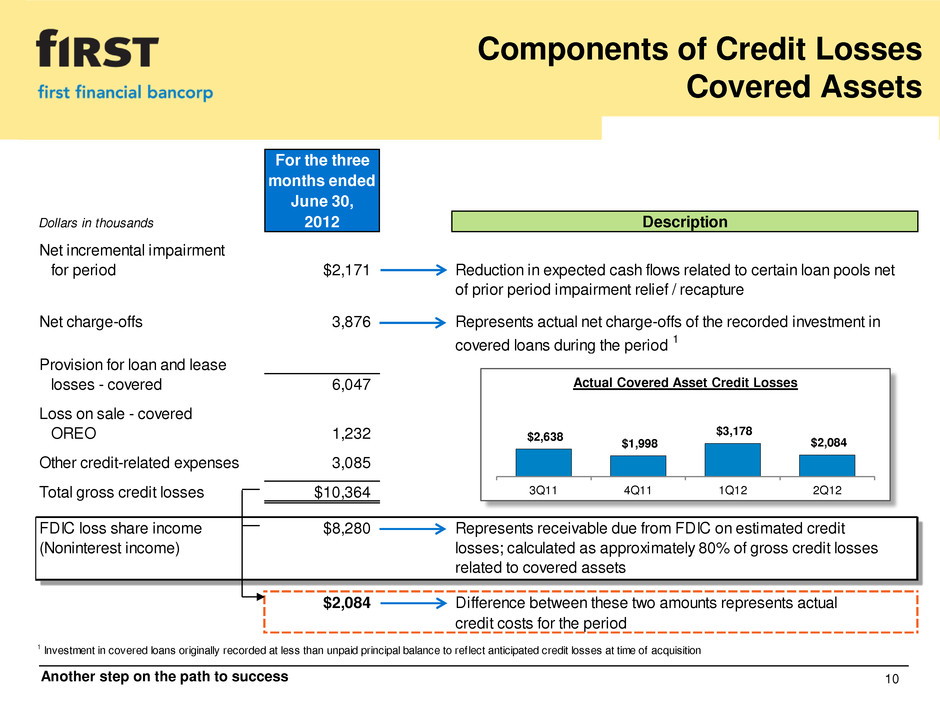

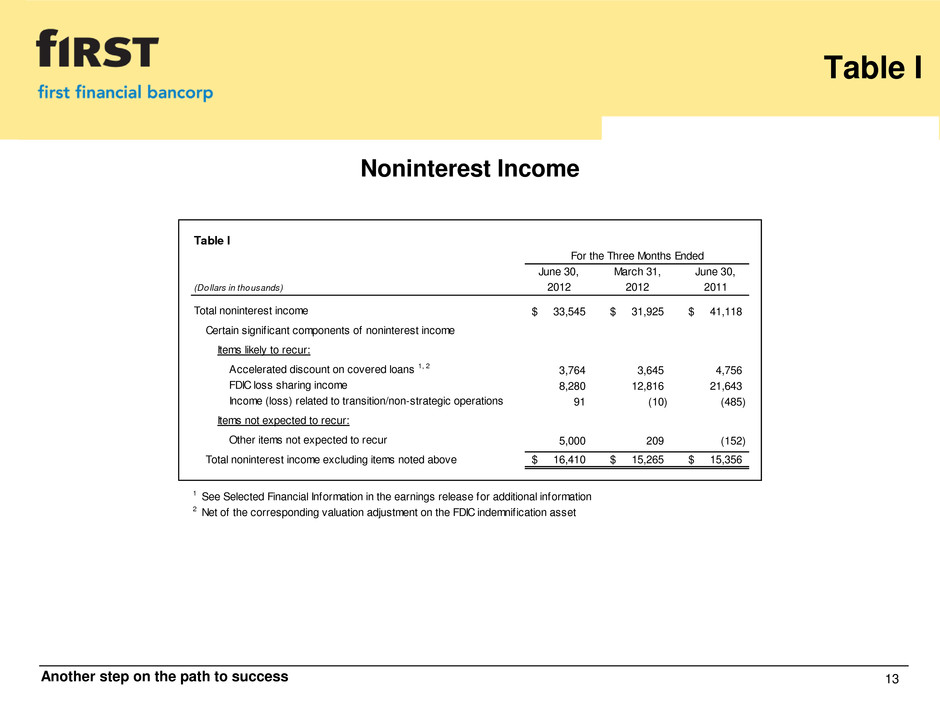

Table I | |||||||||||||

For the Three Months Ended | |||||||||||||

June 30, | March 31, | June 30, | |||||||||||

(Dollars in thousands) | 2012 | 2012 | 2011 | ||||||||||

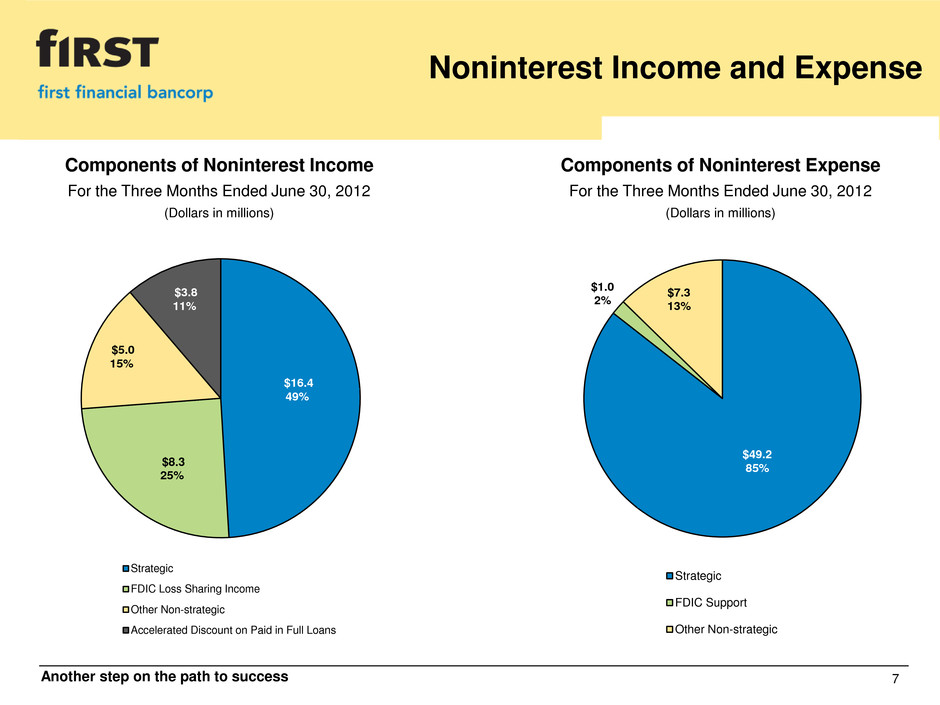

Total noninterest income | $ | 33,545 | $ | 31,925 | $ | 41,118 | |||||||

Certain significant components of noninterest income | |||||||||||||

Items likely to recur: | |||||||||||||

Accelerated discount on covered loans 1, 2 | 3,764 | 3,645 | 4,756 | ||||||||||

FDIC loss sharing income | 8,280 | 12,816 | 21,643 | ||||||||||

Income (loss) related to transition/non-strategic operations | 91 | (10 | ) | (485 | ) | ||||||||

Items not expected to recur: | |||||||||||||

Other items not expected to recur | 5,000 | 209 | (152 | ) | |||||||||

Total noninterest income excluding items noted above | $ | 16,410 | $ | 15,265 | $ | 15,356 | |||||||

1 See Selected Financial Information for additional information | |||||||||||||

2 Net of the corresponding valuation adjustment on the FDIC indemnification asset | |||||||||||||

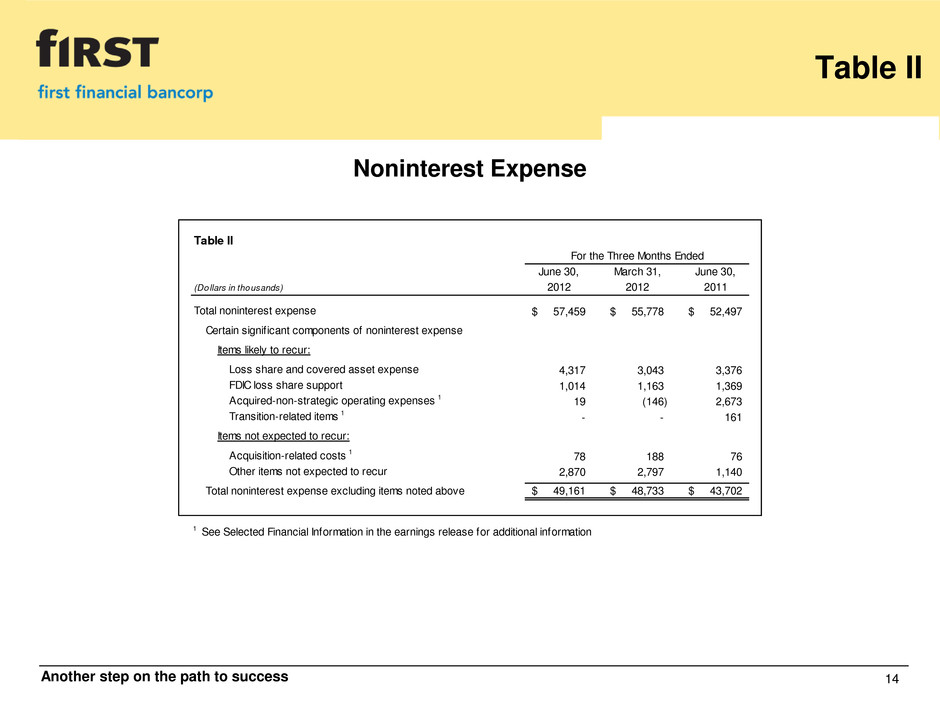

Table II | |||||||||||||

For the Three Months Ended | |||||||||||||

June 30, | March 31, | June 30, | |||||||||||

(Dollars in thousands) | 2012 | 2012 | 2011 | ||||||||||

Total noninterest expense | $ | 57,459 | $ | 55,778 | $ | 52,497 | |||||||

Certain significant components of noninterest expense | |||||||||||||

Items likely to recur: | |||||||||||||

Loss share and covered asset expense | 4,317 | 3,043 | 3,376 | ||||||||||

FDIC loss share support | 1,014 | 1,163 | 1,369 | ||||||||||

Acquired-non-strategic operating expenses 1 | 19 | (146 | ) | 2,673 | |||||||||

Transition-related items 1 | — | — | 161 | ||||||||||

Items not expected to recur: | |||||||||||||

Acquisition-related costs 1 | 78 | 188 | 76 | ||||||||||

Other items not expected to recur | 2,870 | 2,797 | 1,140 | ||||||||||

Total noninterest income excluding items noted above | $ | 49,161 | $ | 48,733 | $ | 43,702 | |||||||

1 See Selected Financial Information for additional information | |||||||||||||

Table III | |||||||||||||||||||||

As of or for the Three Months Ended | |||||||||||||||||||||

June 30, | March 31, | December 31, | September 30, | June 30, | |||||||||||||||||

(Dollars in thousands) | 2012 | 2012 | 2011 | 2011 | 2011 | ||||||||||||||||

Total nonaccrual loans | $ | 63,093 | $ | 55,945 | $ | 54,299 | $ | 59,150 | $ | 56,536 | |||||||||||

Troubled debt restructurings - accruing | 9,909 | 9,495 | 4,009 | 4,712 | 3,039 | ||||||||||||||||

Troubled debt restructurings - nonaccrual | 10,185 | 17,205 | 18,071 | 12,571 | 14,443 | ||||||||||||||||

Total troubled debt restructurings | 20,094 | 26,700 | 22,080 | 17,283 | 17,482 | ||||||||||||||||

Total nonperforming loans | 83,187 | 82,645 | 76,379 | 76,433 | 74,018 | ||||||||||||||||

Total nonperforming assets | 98,875 | 97,681 | 87,696 | 88,436 | 90,331 | ||||||||||||||||

Nonperforming assets as a % of: | |||||||||||||||||||||

Period-end loans plus OREO | 3.27 | % | 3.28 | % | 2.94 | % | 3.00 | % | 3.22 | % | |||||||||||

Total assets | 1.57 | % | 1.52 | % | 1.31 | % | 1.40 | % | 1.50 | % | |||||||||||

Nonperforming assets ex. accruing TDRs as a % of: | |||||||||||||||||||||

Period-end loans plus OREO | 2.94 | % | 2.96 | % | 2.81 | % | 2.84 | % | 3.11 | % | |||||||||||

Total assets | 1.42 | % | 1.37 | % | 1.25 | % | 1.32 | % | 1.44 | % | |||||||||||

Nonperforming loans as a % of total loans | 2.76 | % | 2.79 | % | 2.57 | % | 2.60 | % | 2.65 | % | |||||||||||

Provision for loan and lease losses - uncovered | $ | 8,364 | $ | 3,258 | $ | 5,164 | $ | 7,643 | $ | 5,756 | |||||||||||

Allowance for uncovered loan & lease losses | $ | 50,952 | $ | 49,437 | $ | 52,576 | $ | 54,537 | $ | 53,671 | |||||||||||

Allowance for loan & lease losses as a % of: | |||||||||||||||||||||

Period-end loans | 1.69 | % | 1.67 | % | 1.77 | % | 1.86 | % | 1.92 | % | |||||||||||

Nonaccrual loans | 80.8 | % | 88.4 | % | 96.8 | % | 92.2 | % | 94.9 | % | |||||||||||

Nonaccrual loans plus nonaccrual TDRs | 69.5 | % | 67.6 | % | 72.7 | % | 76.0 | % | 75.6 | % | |||||||||||

Nonperforming loans | 61.3 | % | 59.8 | % | 68.8 | % | 71.4 | % | 72.5 | % | |||||||||||

Total net charge-offs | $ | 6,849 | $ | 6,397 | $ | 7,125 | $ | 6,777 | $ | 5,730 | |||||||||||

Annualized net-charge-offs as a % of average | |||||||||||||||||||||

loans & leases | 0.93 | % | 0.87 | % | 0.95 | % | 0.96 | % | 0.83 | % | |||||||||||

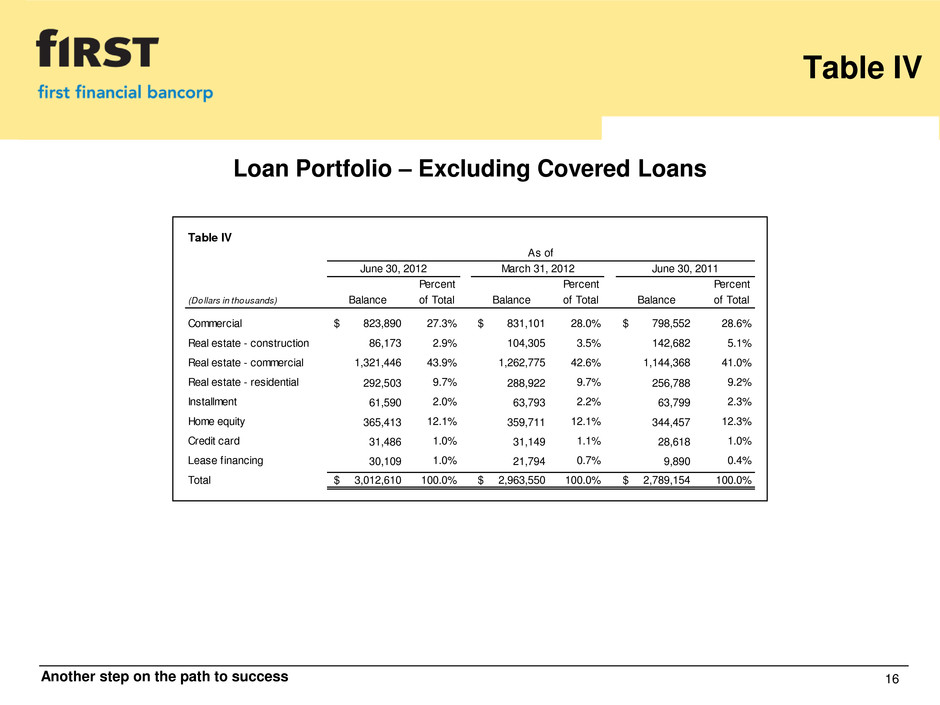

Table IV | ||||||||||||||||||||||

As of | ||||||||||||||||||||||

June 30, 2012 | March 31, 2012 | June 30, 2011 | ||||||||||||||||||||

Percent | Percent | Percent | ||||||||||||||||||||

(Dollars in thousands) | Balance | of Total | Balance | of Total | Balance | of Total | ||||||||||||||||

Commercial | $ | 823,890 | 27.3 | % | $ | 831,101 | 28.0 | % | $ | 798,552 | 28.6 | % | ||||||||||

Real estate - construction | 86,173 | 2.9 | % | 104,305 | 3.5 | % | 142,682 | 5.1 | % | |||||||||||||

Real estate - commercial | 1,321,446 | 43.9 | % | 1,262,775 | 42.6 | % | 1,144,368 | 41.0 | % | |||||||||||||

Real estate - residential | 292,503 | 9.7 | % | 288,922 | 9.7 | % | 256,788 | 9.2 | % | |||||||||||||

Installment | 61,590 | 2.0 | % | 63,793 | 2.2 | % | 63,799 | 2.3 | % | |||||||||||||

Home equity | 365,413 | 12.1 | % | 359,711 | 12.1 | % | 344,457 | 12.3 | % | |||||||||||||

Credit card | 31,486 | 1.0 | % | 31,149 | 1.1 | % | 28,618 | 1.0 | % | |||||||||||||

Lease financing | 30,109 | 1.0 | % | 21,794 | 0.7 | % | 9,890 | 0.4 | % | |||||||||||||

Total | $ | 3,012,610 | 100.0 | % | $ | 2,963,550 | 100.0 | % | $ | 2,789,154 | 100.0 | % | ||||||||||

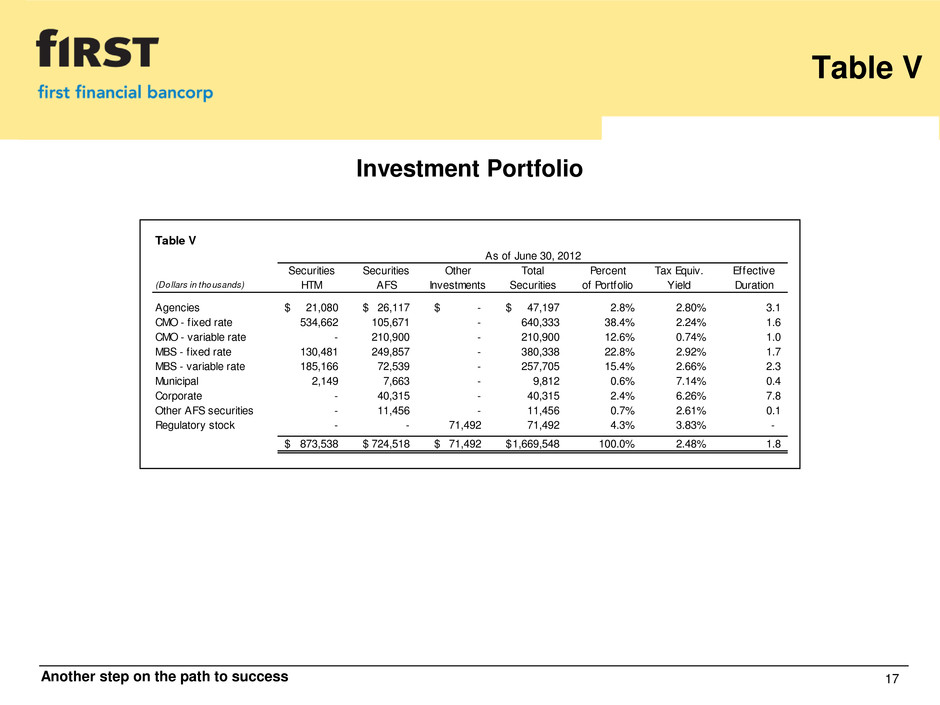

Table V | |||||||||||||||||||||||||||

As of June 30, 2012 | |||||||||||||||||||||||||||

Securities | Securities | Other | Total | Percent | Tax Equiv. | Effective | |||||||||||||||||||||

(Dollars in thousands) | HTM | AFS | Investments | Securities | of Portfolio | Yield | Duration | ||||||||||||||||||||

Agencies | $ | 21,080 | $ | 26,117 | — | $ | 47,197 | 2.8 | % | 2.80 | % | 3.1 | |||||||||||||||

CMO - fixed rate | 534,662 | 105,671 | — | 640,333 | 38.4 | % | 2.24 | % | 1.6 | ||||||||||||||||||

CMO - variable rate | — | 210,900 | — | 210,900 | 12.6 | % | 0.74 | % | 1.0 | ||||||||||||||||||

MBS - fixed rate | 130,481 | 249,857 | — | 380,338 | 22.8 | % | 2.92 | % | 1.7 | ||||||||||||||||||

MBS - variable rate | 185,166 | 72,539 | — | 257,705 | 15.4 | % | 2.66 | % | 2.3 | ||||||||||||||||||

Municipal | 2,149 | 7,663 | — | 9,812 | 0.6 | % | 7.14 | % | 0.4 | ||||||||||||||||||

Corporate | — | 40,315 | — | 40,315 | 2.4 | % | 6.26 | % | 7.8 | ||||||||||||||||||

Other AFS securities | — | 11,456 | — | 11,456 | 0.7 | % | 2.61 | % | 0.1 | ||||||||||||||||||

Regulatory stock | — | — | 71,492 | 71,492 | 4.3 | % | 3.83 | % | — | ||||||||||||||||||

$ | 873,538 | $ | 724,518 | $ | 71,492 | $ | 1,669,548 | 100.0 | % | 2.48 | % | 1.8 | |||||||||||||||

Table VI | |||||||||||||

As of | |||||||||||||

June 30, | March 31, | June 30, | "Well-Capitalized" | ||||||||||

2012 | 2012 | 2011 | Minimum | ||||||||||

Leverage Ratio | 10.21 | % | 9.94 | % | 11.01 | % | 5.00 | % | |||||

Tier 1 Capital Ratio | 17.14 | % | 17.18 | % | 20.14 | % | 6.00 | % | |||||

Total Risk-Based Capital Ratio | 18.42 | % | 18.45 | % | 21.42 | % | 10.00 | % | |||||

Ending tangible shareholders' equity | |||||||||||||

to ending tangible assets | 9.91 | % | 9.66 | % | 11.11 | % | N/A | ||||||

Ending tangible common shareholders' | |||||||||||||

equity to ending tangible assets | 9.91 | % | 9.66 | % | 11.11 | % | N/A | ||||||

▪ | management's ability to effectively execute its business plan; |

▪ | the risk that the strength of the United States economy in general and the strength of the local economies in which we conduct operations may continue to deteriorate resulting in, among other things, a further deterioration in credit quality or a reduced demand for credit, including the resultant effect on our loan portfolio, allowance for loan and lease losses and overall financial performance; |

▪ | U.S. fiscal debt and budget matters; |

▪ | the ability of financial institutions to access sources of liquidity at a reasonable cost; |

▪ | the impact of recent upheaval in the financial markets and the effectiveness of domestic and international governmental actions taken in response, and the effect of such governmental actions on us, our competitors and counterparties, financial markets generally and availability of credit specifically, and the U.S. and international economies, including potentially higher FDIC premiums arising from increased payments from FDIC insurance funds as a result of depository institution failures; |

▪ | the effect of and changes in policies and laws or regulatory agencies (notably the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act); |

▪ | the effect of the current low interest rate environment or changes in interest rates on our net interest margin and our loan originations and securities holdings; |

▪ | our ability to keep up with technological changes; |

▪ | failure or breach of our operational or security systems or infrastructure, or those of our third party vendors or other service providers; |

▪ | our ability to comply with the terms of loss sharing agreements with the FDIC; |

▪ | mergers and acquisitions, including costs or difficulties related to the integration of acquired companies and the wind-down of non-strategic operations that may be greater than expected, such as the risks and |

▪ | the risk that exploring merger and acquisition opportunities may detract from management's time and ability to successfully manage our Company; |

▪ | expected cost savings in connection with the consolidation of recent acquisitions may not be fully realized or realized within the expected time frames, and deposit attrition, customer loss and revenue loss following completed acquisitions may be greater than expected; |

▪ | our ability to increase market share and control expenses; |

▪ | the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies as well as the Financial Accounting Standards Board and the SEC; |

▪ | adverse changes in the securities, debt and/or derivatives markets; |

▪ | our success in recruiting and retaining the necessary personnel to support business growth and expansion and maintain sufficient expertise to support increasingly complex products and services; |

▪ | monetary and fiscal policies of the Board of Governors of the Federal Reserve System (Federal Reserve) and the U.S. government and other governmental initiatives affecting the financial services industry; |

▪ | our ability to manage loan delinquency and charge-off rates and changes in estimation of the adequacy of the allowance for loan and lease losses; and |

▪ | the costs and effects of litigation and of unexpected or adverse outcomes in such litigation. |

Contents | Page |

Consolidated Financial Highlights | 2 |

Consolidated Statements of Income | 3 |

Consolidated Quarterly Statements of Income | 4 - 5 |

Consolidated Statements of Condition | 6 |

Average Consolidated Statements of Condition | 7 |

Net Interest Margin Rate / Volume Analysis | 8 - 9 |

Credit Quality | 10 |

Capital Adequacy | 11 |

Supplemental Information on Covered Assets and Acquisition-Related Items | 12 - 15 |

FIRST FINANCIAL BANCORP. | |||||||||||||||||||||||||||

CONSOLIDATED FINANCIAL HIGHLIGHTS | |||||||||||||||||||||||||||

(Dollars in thousands, except per share data) | |||||||||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||||||||

Three Months Ended, | Six months ended, | ||||||||||||||||||||||||||

Jun. 30, | Mar. 31, | Dec. 31, | Sep. 30, | Jun. 30, | Jun. 30, | ||||||||||||||||||||||

2012 | 2012 | 2011 | 2011 | 2011 | 2012 | 2011 | |||||||||||||||||||||

RESULTS OF OPERATIONS | |||||||||||||||||||||||||||

Net income | $ | 17,802 | $ | 16,994 | $ | 17,941 | $ | 15,618 | $ | 15,973 | $ | 34,796 | $ | 33,180 | |||||||||||||

Net earnings per share - basic | $ | 0.31 | $ | 0.29 | $ | 0.31 | $ | 0.27 | $ | 0.28 | $ | 0.60 | $ | 0.58 | |||||||||||||

Net earnings per share - diluted | $ | 0.30 | $ | 0.29 | $ | 0.31 | $ | 0.27 | $ | 0.27 | $ | 0.59 | $ | 0.57 | |||||||||||||

Dividends declared per share | $ | 0.29 | $ | 0.31 | $ | 0.27 | $ | 0.27 | $ | 0.12 | $ | 0.60 | $ | 0.24 | |||||||||||||

KEY FINANCIAL RATIOS | |||||||||||||||||||||||||||

Return on average assets | 1.13 | % | 1.05 | % | 1.09 | % | 1.01 | % | 1.03 | % | 1.09 | % | 1.07 | % | |||||||||||||

Return on average shareholders' equity | 9.98 | % | 9.67 | % | 9.89 | % | 8.54 | % | 9.05 | % | 9.83 | % | 9.54 | % | |||||||||||||

Return on average tangible shareholders' equity | 11.68 | % | 11.37 | % | 11.59 | % | 9.56 | % | 9.84 | % | 11.52 | % | 10.38 | % | |||||||||||||

Net interest margin | 4.49 | % | 4.51 | % | 4.32 | % | 4.55 | % | 4.61 | % | 4.50 | % | 4.67 | % | |||||||||||||

Net interest margin (fully tax equivalent) (1) | 4.50 | % | 4.52 | % | 4.34 | % | 4.57 | % | 4.62 | % | 4.51 | % | 4.69 | % | |||||||||||||

Ending shareholders' equity as a percent of ending assets | 11.41 | % | 11.14 | % | 10.68 | % | 11.47 | % | 11.95 | % | 11.41 | % | 11.95 | % | |||||||||||||

Ending tangible shareholders' equity as a percent of: | |||||||||||||||||||||||||||

Ending tangible assets | 9.91 | % | 9.66 | % | 9.23 | % | 10.38 | % | 11.11 | % | 9.91 | % | 11.11 | % | |||||||||||||

Risk-weighted assets | 16.39 | % | 16.42 | % | 16.63 | % | 18.47 | % | 19.65 | % | 16.39 | % | 19.65 | % | |||||||||||||

Average shareholders' equity as a percent of average assets | 11.32 | % | 10.91 | % | 11.05 | % | 11.83 | % | 11.38 | % | 11.11 | % | 11.24 | % | |||||||||||||

Average tangible shareholders' equity as a percent of | |||||||||||||||||||||||||||

average tangible assets | 9.84 | % | 9.43 | % | 9.58 | % | 10.70 | % | 10.56 | % | 9.64 | % | 10.42 | % | |||||||||||||

Book value per share | $ | 12.25 | $ | 12.21 | $ | 12.22 | $ | 12.48 | $ | 12.39 | $ | 12.25 | $ | 12.39 | |||||||||||||

Tangible book value per share | $ | 10.47 | $ | 10.41 | $ | 10.41 | $ | 11.15 | $ | 11.42 | $ | 10.47 | $ | 11.42 | |||||||||||||

Tier 1 Ratio (2) | 17.14 | % | 17.18 | % | 17.47 | % | 18.81 | % | 20.14 | % | 17.14 | % | 20.14 | % | |||||||||||||

Total Capital Ratio (2) | 18.42 | % | 18.45 | % | 18.74 | % | 20.08 | % | 21.42 | % | 18.42 | % | 21.42 | % | |||||||||||||

Leverage Ratio (2) | 10.21 | % | 9.94 | % | 9.87 | % | 10.87 | % | 11.01 | % | 10.21 | % | 11.01 | % | |||||||||||||

AVERAGE BALANCE SHEET ITEMS | |||||||||||||||||||||||||||

Loans (3) | $ | 2,995,296 | $ | 2,979,508 | $ | 2,983,354 | $ | 2,800,466 | $ | 2,782,947 | $ | 2,987,402 | $ | 2,802,092 | |||||||||||||

Covered loans and FDIC indemnification asset | 1,100,014 | 1,179,670 | 1,287,776 | 1,380,128 | 1,481,353 | 1,139,842 | 1,554,592 | ||||||||||||||||||||

Investment securities | 1,713,503 | 1,664,643 | 1,257,574 | 1,199,473 | 1,093,870 | 1,689,073 | 1,069,715 | ||||||||||||||||||||

Interest-bearing deposits with other banks | 4,454 | 126,330 | 485,432 | 306,969 | 375,434 | 65,392 | 326,408 | ||||||||||||||||||||

Total earning assets | $ | 5,813,267 | $ | 5,950,151 | $ | 6,014,136 | $ | 5,687,036 | $ | 5,733,604 | $ | 5,881,709 | $ | 5,752,807 | |||||||||||||

Total assets | $ | 6,334,973 | $ | 6,478,931 | $ | 6,515,756 | $ | 6,136,815 | $ | 6,219,754 | $ | 6,406,952 | $6,242,952 | ||||||||||||||

Noninterest-bearing deposits | $ | 1,044,405 | $ | 931,347 | $ | 860,863 | $ | 735,621 | $ | 734,674 | $ | 987,876 | $ | 733,962 | |||||||||||||

Interest-bearing deposits | 4,210,079 | 4,545,151 | 4,630,412 | 4,366,827 | 4,402,103 | 4,377,615 | 4,416,732 | ||||||||||||||||||||

Total deposits | $ | 5,254,484 | $ | 5,476,498 | $ | 5,491,275 | $ | 5,102,448 | $ | 5,136,777 | $ | 5,365,491 | $ | 5,150,694 | |||||||||||||

Borrowings | $ | 234,995 | $ | 161,911 | $ | 174,939 | $ | 195,140 | $ | 218,196 | $ | 198,453 | $ | 224,109 | |||||||||||||

Shareholders' equity | $ | 717,111 | $ | 706,547 | $ | 719,964 | $ | 725,809 | $ | 707,750 | $ | 711,829 | $ | 701,441 | |||||||||||||

CREDIT QUALITY RATIOS (excluding covered assets) | |||||||||||||||||||||||||||

Allowance to ending loans | 1.69 | % | 1.67 | % | 1.77 | % | 1.86 | % | 1.92 | % | 1.69 | % | 1.92 | % | |||||||||||||

Allowance to nonaccrual loans | 80.76 | % | 88.37 | % | 96.83 | % | 92.20 | % | 94.93 | % | 80.76 | % | 94.93 | % | |||||||||||||

Allowance to nonperforming loans | 61.25 | % | 59.82 | % | 68.84 | % | 71.35 | % | 72.51 | % | 61.25 | % | 72.51 | % | |||||||||||||

Nonperforming loans to total loans | 2.76 | % | 2.79 | % | 2.57 | % | 2.60 | % | 2.65 | % | 2.76 | % | 2.65 | % | |||||||||||||

Nonperforming assets to ending loans, plus OREO | 3.27 | % | 3.28 | % | 2.94 | % | 3.00 | % | 3.22 | % | 3.27 | % | 3.22 | % | |||||||||||||

Nonperforming assets to total assets | 1.57 | % | 1.52 | % | 1.31 | % | 1.40 | % | 1.50 | % | 1.57 | % | 1.50 | % | |||||||||||||

Net charge-offs to average loans (annualized) | 0.93 | % | 0.87 | % | 0.95 | % | 0.96 | % | 0.83 | % | 0.90 | % | 0.72 | % | |||||||||||||

FIRST FINANCIAL BANCORP. | |||||||||||||||||||||

CONSOLIDATED STATEMENTS OF INCOME | |||||||||||||||||||||

(Dollars in thousands, except per share data) | |||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||

Three months ended, | Six months ended, | ||||||||||||||||||||

Jun. 30, | Jun. 30, | ||||||||||||||||||||

2012 | 2011 | % Change | 2012 | 2011 | % Change | ||||||||||||||||

Interest income | |||||||||||||||||||||

Loans, including fees | $ | 63,390 | $ | 71,929 | (11.9 | )% | $ | 129,826 | $ | 145,945 | (11.0 | )% | |||||||||

Investment securities | |||||||||||||||||||||

Taxable | 10,379 | 7,080 | 46.6 | % | 20,896 | 13,883 | 50.5 | % | |||||||||||||

Tax-exempt | 121 | 192 | (37.0 | )% | 255 | 390 | (34.6 | )% | |||||||||||||

Total investment securities interest | 10,500 | 7,272 | 44.4 | % | 21,151 | 14,273 | 48.2 | % | |||||||||||||

Other earning assets | (1,967 | ) | (1,384 | ) | 42.1 | % | (3,957 | ) | (2,338 | ) | 69.2 | % | |||||||||

Total interest income | 71,923 | 77,817 | (7.6 | )% | 147,020 | 157,880 | (6.9 | )% | |||||||||||||

Interest expense | |||||||||||||||||||||

Deposits | 6,381 | 10,767 | (40.7 | )% | 14,097 | 22,167 | (36.4 | )% | |||||||||||||

Short-term borrowings | 37 | 49 | (24.5 | )% | 49 | 94 | (47.9 | )% | |||||||||||||

Long-term borrowings | 675 | 937 | (28.0 | )% | 1,355 | 2,026 | (33.1 | )% | |||||||||||||

Subordinated debentures and capital securities | 0 | 197 | (100.0 | )% | 0 | 391 | (100.0 | )% | |||||||||||||

Total interest expense | 7,093 | 11,950 | (40.6 | )% | 15,501 | 24,678 | (37.2 | )% | |||||||||||||

Net interest income | 64,830 | 65,867 | (1.6 | )% | 131,519 | 133,202 | (1.3 | )% | |||||||||||||

Provision for loan and lease losses - uncovered | 8,364 | 5,756 | 45.3 | % | 11,622 | 6,403 | 81.5 | % | |||||||||||||

Provision for loan and lease losses - covered | 6,047 | 23,895 | (74.7 | )% | 18,998 | 49,911 | (61.9 | )% | |||||||||||||

Net interest income after provision for loan and lease losses | 50,419 | 36,216 | 39.2 | % | 100,899 | 76,888 | 31.2 | % | |||||||||||||

Noninterest income | |||||||||||||||||||||

Service charges on deposit accounts | 5,376 | 4,883 | 10.1 | % | 10,285 | 9,493 | 8.3 | % | |||||||||||||

Trust and wealth management fees | 3,377 | 3,507 | (3.7 | )% | 7,168 | 7,432 | (3.6 | )% | |||||||||||||

Bankcard income | 2,579 | 2,328 | 10.8 | % | 5,115 | 4,483 | 14.1 | % | |||||||||||||

Net gains from sales of loans | 1,132 | 854 | 32.6 | % | 2,072 | 1,843 | 12.4 | % | |||||||||||||

FDIC loss sharing income | 8,280 | 21,643 | (61.7 | )% | 21,096 | 45,078 | (53.2 | )% | |||||||||||||

Accelerated discount on covered loans | 3,764 | 4,756 | (20.9 | )% | 7,409 | 10,539 | (29.7 | )% | |||||||||||||

Other | 9,037 | 3,147 | 187.2 | % | 12,325 | 5,908 | 108.6 | % | |||||||||||||

Total noninterest income | 33,545 | 41,118 | (18.4 | )% | 65,470 | 84,776 | (22.8 | )% | |||||||||||||

Noninterest expenses | |||||||||||||||||||||

Salaries and employee benefits | 29,048 | 25,123 | 15.6 | % | 57,909 | 52,693 | 9.9 | % | |||||||||||||

Net occupancy | 5,025 | 4,493 | 11.8 | % | 10,407 | 11,353 | (8.3 | )% | |||||||||||||

Furniture and equipment | 2,323 | 2,581 | (10.0 | )% | 4,567 | 5,134 | (11.0 | )% | |||||||||||||

Data processing | 2,076 | 1,453 | 42.9 | % | 3,977 | 2,691 | 47.8 | % | |||||||||||||

Marketing | 1,238 | 1,402 | (11.7 | )% | 2,392 | 2,643 | (9.5 | )% | |||||||||||||

Communication | 913 | 753 | 21.2 | % | 1,807 | 1,567 | 15.3 | % | |||||||||||||

Professional services | 2,151 | 3,095 | (30.5 | )% | 4,298 | 5,322 | (19.2 | )% | |||||||||||||

State intangible tax | 970 | 1,236 | (21.5 | )% | 1,996 | 2,601 | (23.3 | )% | |||||||||||||

FDIC assessments | 1,270 | 1,152 | 10.2 | % | 2,433 | 3,273 | (25.7 | )% | |||||||||||||

Other | 12,445 | 11,209 | 11.0 | % | 23,451 | 23,010 | 1.9 | % | |||||||||||||

Total noninterest expenses | 57,459 | 52,497 | 9.5 | % | 113,237 | 110,287 | 2.7 | % | |||||||||||||

Income before income taxes | 26,505 | 24,837 | 6.7 | % | 53,132 | 51,377 | 3.4 | % | |||||||||||||

Income tax expense | 8,703 | 8,864 | (1.8 | )% | 18,336 | 18,197 | 0.8 | % | |||||||||||||

Net income | $ | 17,802 | $ | 15,973 | 11.5 | % | $ | 34,796 | $ | 33,180 | 4.9 | % | |||||||||

ADDITIONAL DATA | |||||||||||||||||||||

Net earnings per share - basic | $ | 0.31 | $ | 0.28 | $ | 0.60 | $ | 0.58 | |||||||||||||

Net earnings per share - diluted | $ | 0.30 | $ | 0.27 | $ | 0.59 | $ | 0.57 | |||||||||||||

Dividends declared per share | $ | 0.29 | $ | 0.12 | $ | 0.60 | $ | 0.24 | |||||||||||||

Return on average assets | 1.13 | % | 1.03 | % | 1.09 | % | 1.07 | % | |||||||||||||

Return on average shareholders' equity | 9.98 | % | 9.05 | % | 9.83 | % | 9.54 | % | |||||||||||||

Interest income | $ | 71,923 | $ | 77,817 | (7.6 | )% | $ | 147,020 | $ | 157,880 | (6.9 | )% | |||||||||

Tax equivalent adjustment | 216 | 240 | (10.0 | )% | 434 | 478 | (9.2 | )% | |||||||||||||

Interest income - tax equivalent | 72,139 | 78,057 | (7.6 | )% | 147,454 | 158,358 | (6.9 | )% | |||||||||||||

Interest expense | 7,093 | 11,950 | (40.6 | )% | 15,501 | 24,678 | (37.2 | )% | |||||||||||||

Net interest income - tax equivalent | $ | 65,046 | $ | 66,107 | (1.6 | )% | $ | 131,953 | $ | 133,680 | (1.3 | )% | |||||||||

Net interest margin | 4.49 | % | 4.61 | % | 4.50 | % | 4.67 | % | |||||||||||||

Net interest margin (fully tax equivalent) (1) | 4.50 | % | 4.62 | % | 4.51 | % | 4.69 | % | |||||||||||||

Full-time equivalent employees | 1,525 | 1,374 | |||||||||||||||||||

(1) The tax equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 35% tax rate. Management believes that it is a standard practice in the banking industry to present net interest income on a fully tax equivalent basis. Therefore, management believes, these measures provided useful information to investors by allowing them to make peer comparisons. Management also uses these measures to make peer comparisons. | |||||||||||||||||||||

FIRST FINANCIAL BANCORP. | |||||||||||||||

CONSOLIDATED QUARTERLY STATEMENTS OF INCOME | |||||||||||||||

(Dollars in thousands, except per share data) | |||||||||||||||

(Unaudited) | |||||||||||||||

2012 | |||||||||||||||

Second | First | % Change | |||||||||||||

Quarter | Quarter | YTD | Linked Qtr. | ||||||||||||

Interest income | |||||||||||||||

Loans, including fees | 63,390 | $ | 66,436 | $ | 129,826 | (4.6 | )% | ||||||||

Investment securities | |||||||||||||||

Taxable | 10,379 | 10,517 | 20,896 | (1.3 | )% | ||||||||||

Tax-exempt | 121 | 134 | 255 | (9.7 | )% | ||||||||||

Total investment securities interest | 10,500 | 10,651 | 21,151 | (1.4 | )% | ||||||||||

Other earning assets | (1,967 | ) | (1,990 | ) | (3,957 | ) | (1.2 | )% | |||||||

Total interest income | 71,923 | 75,097 | 147,020 | (4.2 | )% | ||||||||||

Interest expense | |||||||||||||||

Deposits | 6,381 | 7,716 | 14,097 | (17.3 | )% | ||||||||||

Short-term borrowings | 37 | 12 | 49 | 208.3 | % | ||||||||||

Long-term borrowings | 675 | 680 | 1,355 | (0.7 | )% | ||||||||||

Total interest expense | 7,093 | 8,408 | 15,501 | (15.6 | )% | ||||||||||

Net interest income | 64,830 | 66,689 | 131,519 | (2.8 | )% | ||||||||||

Provision for loan and lease losses - uncovered | 8,364 | 3,258 | 11,622 | 156.7 | % | ||||||||||

Provision for loan and lease losses - covered | 6,047 | 12,951 | 18,998 | (53.3 | )% | ||||||||||

Net interest income after provision for loan and lease losses | 50,419 | 50,480 | 100,899 | (0.1 | )% | ||||||||||

Noninterest income | |||||||||||||||

Service charges on deposit accounts | 5,376 | 4,909 | 10,285 | 9.5 | % | ||||||||||

Trust and wealth management fees | 3,377 | 3,791 | 7,168 | (10.9 | )% | ||||||||||

Bankcard income | 2,579 | 2,536 | 5,115 | 1.7 | % | ||||||||||

Net gains from sales of loans | 1,132 | 940 | 2,072 | 20.4 | % | ||||||||||

FDIC loss sharing income | 8,280 | 12,816 | 21,096 | (35.4 | )% | ||||||||||

Accelerated discount on covered loans | 3,764 | 3,645 | 7,409 | 3.3 | % | ||||||||||

Other | 9,037 | 3,288 | 12,325 | 174.8 | % | ||||||||||

Total noninterest income | 33,545 | 31,925 | 65,470 | 5.1 | % | ||||||||||

Noninterest expenses | |||||||||||||||

Salaries and employee benefits | 29,048 | 28,861 | 57,909 | 0.6 | % | ||||||||||

Net occupancy | 5,025 | 5,382 | 10,407 | (6.6 | )% | ||||||||||

Furniture and equipment | 2,323 | 2,244 | 4,567 | 3.5 | % | ||||||||||

Data processing | 2,076 | 1,901 | 3,977 | 9.2 | % | ||||||||||

Marketing | 1,238 | 1,154 | 2,392 | 7.3 | % | ||||||||||

Communication | 913 | 894 | 1,807 | 2.1 | % | ||||||||||

Professional services | 2,151 | 2,147 | 4,298 | 0.2 | % | ||||||||||

State intangible tax | 970 | 1,026 | 1,996 | (5.5 | )% | ||||||||||

FDIC assessments | 1,270 | 1,163 | 2,433 | 9.2 | % | ||||||||||

Other | 12,445 | 11,006 | 23,451 | 13.1 | % | ||||||||||

Total noninterest expenses | 57,459 | 55,778 | 113,237 | 3.0 | % | ||||||||||

Income before income taxes | 26,505 | 26,627 | 53,132 | (0.5 | )% | ||||||||||

Income tax expense | 8,703 | 9,633 | 18,336 | (9.7 | )% | ||||||||||

Net income | $ | 17,802 | $ | 16,994 | $ | 34,796 | 4.8 | % | |||||||

ADDITIONAL DATA | |||||||||||||||

Net earnings per share - basic | $ | 0.31 | $ | 0.29 | $ | 0.60 | |||||||||

Net earnings per share - diluted | $ | 0.30 | $ | 0.29 | $ | 0.59 | |||||||||

Dividends declared per share | $ | 0.29 | $ | 0.31 | $ | 0.60 | |||||||||

Return on average assets | 1.13 | % | 1.05 | % | 1.09 | % | |||||||||

Return on average shareholders' equity | 9.98 | % | 9.67 | % | 9.83 | % | |||||||||

Interest income | $ | 71,923 | $ | 75,097 | $ | 147,020 | (4.2 | )% | |||||||

Tax equivalent adjustment | 216 | 218 | 434 | (0.9 | )% | ||||||||||

Interest income - tax equivalent | 72,139 | 75,315 | 147,454 | (4.2 | )% | ||||||||||

Interest expense | 7,093 | 8,408 | 15,501 | (15.6 | )% | ||||||||||

Net interest income - tax equivalent | $ | 65,046 | $ | 66,907 | $ | 131,953 | (2.8 | )% | |||||||

Net interest margin | 4.49 | % | 4.51 | % | 4.50 | % | |||||||||

Net interest margin (fully tax equivalent) (1) | 4.50 | % | 4.52 | % | 4.51 | % | |||||||||

Full-time equivalent employees | 1,525 | 1,513 | |||||||||||||

(1) The tax equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 35% tax rate. Management believes that it is a standard practice in the banking industry to present net interest income on a fully tax equivalent basis. Therefore, management believes, these measures provided useful information to investors by allowing them to make peer comparisons. Management also uses these measures to make peer comparisons. | |||||||||||||||

FIRST FINANCIAL BANCORP. | ||||||||||||||||||||

CONSOLIDATED QUARTERLY STATEMENTS OF INCOME | ||||||||||||||||||||

(Dollars in thousands, except per share data) | ||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||

2011 | ||||||||||||||||||||

Fourth | Third | Second | First | Full | ||||||||||||||||

Quarter | Quarter | Quarter | Quarter | Year | ||||||||||||||||

Interest income | ||||||||||||||||||||

Loans, including fees | $ | 69,658 | $ | 70,086 | $ | 71,929 | $ | 74,016 | $ | 285,689 | ||||||||||

Investment securities | ||||||||||||||||||||

Taxable | 6,945 | 7,411 | 7,080 | 6,803 | 28,239 | |||||||||||||||

Tax-exempt | 201 | 176 | 192 | 198 | 767 | |||||||||||||||

Total investment securities interest | 7,146 | 7,587 | 7,272 | 7,001 | 29,006 | |||||||||||||||

Other earning assets | (1,819 | ) | (1,721 | ) | (1,384 | ) | (954 | ) | (5,878 | ) | ||||||||||

Total interest income | 74,985 | 75,952 | 77,817 | 80,063 | 308,817 | |||||||||||||||

Interest expense | ||||||||||||||||||||

Deposits | 8,791 | 9,823 | 10,767 | 11,400 | 40,781 | |||||||||||||||

Short-term borrowings | 25 | 44 | 49 | 45 | 163 | |||||||||||||||

Long-term borrowings | 693 | 867 | 937 | 1,089 | 3,586 | |||||||||||||||

Subordinated debentures and capital securities | 0 | 0 | 197 | 194 | 391 | |||||||||||||||

Total interest expense | 9,509 | 10,734 | 11,950 | 12,728 | 44,921 | |||||||||||||||

Net interest income | 65,476 | 65,218 | 65,867 | 67,335 | 263,896 | |||||||||||||||

Provision for loan and lease losses - uncovered | 5,164 | 7,643 | 5,756 | 647 | 19,210 | |||||||||||||||

Provision for loan and lease losses - covered | 6,910 | 7,260 | 23,895 | 26,016 | 64,081 | |||||||||||||||

Net interest income after provision for loan and lease losses | 53,402 | 50,315 | 36,216 | 40,672 | 180,605 | |||||||||||||||

Noninterest income | ||||||||||||||||||||

Service charges on deposit accounts | 4,920 | 4,793 | 4,883 | 4,610 | 19,206 | |||||||||||||||

Trust and wealth management fees | 3,531 | 3,377 | 3,507 | 3,925 | 14,340 | |||||||||||||||

Bankcard income | 2,490 | 2,318 | 2,328 | 2,155 | 9,291 | |||||||||||||||

Net gains from sales of loans | 1,172 | 1,243 | 854 | 989 | 4,258 | |||||||||||||||

FDIC loss sharing income | 7,433 | 8,377 | 21,643 | 23,435 | 60,888 | |||||||||||||||

Accelerated discount on covered loans | 4,775 | 5,207 | 4,756 | 5,783 | 20,521 | |||||||||||||||

Gain on sale of investment securities | 2,541 | 0 | 0 | 0 | 2,541 | |||||||||||||||

Other | 2,778 | 2,800 | 3,147 | 2,761 | 11,486 | |||||||||||||||

Total noninterest income | 29,640 | 28,115 | 41,118 | 43,658 | 142,531 | |||||||||||||||

Noninterest expenses | ||||||||||||||||||||

Salaries and employee benefits | 26,447 | 27,774 | 25,123 | 27,570 | 106,914 | |||||||||||||||

Net occupancy | 5,893 | 4,164 | 4,493 | 6,860 | 21,410 | |||||||||||||||

Furniture and equipment | 2,425 | 2,386 | 2,581 | 2,553 | 9,945 | |||||||||||||||

Data processing | 1,559 | 1,466 | 1,453 | 1,238 | 5,716 | |||||||||||||||

Marketing | 1,567 | 1,584 | 1,402 | 1,241 | 5,794 | |||||||||||||||

Communication | 864 | 772 | 753 | 814 | 3,203 | |||||||||||||||

Professional services | 2,252 | 2,062 | 3,095 | 2,227 | 9,636 | |||||||||||||||

State intangible tax | 436 | 546 | 1,236 | 1,365 | 3,583 | |||||||||||||||

FDIC assessments | 1,192 | 1,211 | 1,152 | 2,121 | 5,676 | |||||||||||||||

Other | 12,033 | 11,177 | 11,209 | 11,801 | 46,220 | |||||||||||||||

Total noninterest expenses | 54,668 | 53,142 | 52,497 | 57,790 | 218,097 | |||||||||||||||

Income before income taxes | 28,374 | 25,288 | 24,837 | 26,540 | 105,039 | |||||||||||||||

Income tax expense | 10,433 | 9,670 | 8,864 | 9,333 | 38,300 | |||||||||||||||

Net income | $ | 17,941 | $ | 15,618 | $ | 15,973 | $ | 17,207 | $ | 66,739 | ||||||||||

ADDITIONAL DATA | ||||||||||||||||||||

Net earnings per share - basic | $ | 0.31 | $ | 0.27 | $ | 0.28 | $ | 0.30 | $ | 1.16 | ||||||||||

Net earnings per share - diluted | $ | 0.31 | $ | 0.27 | $ | 0.27 | $ | 0.29 | $ | 1.14 | ||||||||||

Dividends declared per share | $ | 0.27 | $ | 0.27 | $ | 0.12 | $ | 0.12 | $ | 0.78 | ||||||||||

Return on average assets | 1.09 | % | 1.01 | % | 1.03 | % | 1.11 | % | 1.06 | % | ||||||||||

Return on average shareholders' equity | 9.89 | % | 8.54 | % | 9.05 | % | 10.04 | % | 9.37 | % | ||||||||||

Interest income | $ | 74,985 | $ | 75,952 | $ | 77,817 | $ | 80,063 | $ | 308,817 | ||||||||||

Tax equivalent adjustment | 265 | 236 | 240 | 238 | 979 | |||||||||||||||

Interest income - tax equivalent | 75,250 | 76,188 | 78,057 | 80,301 | 309,796 | |||||||||||||||

Interest expense | 9,509 | 10,734 | 11,950 | 12,728 | 44,921 | |||||||||||||||

Net interest income - tax equivalent | $ | 65,741 | $ | 65,454 | $ | 66,107 | $ | 67,573 | $ | 264,875 | ||||||||||

Net interest margin | 4.32 | % | 4.55 | % | 4.61 | % | 4.73 | % | 4.55 | % | ||||||||||

Net interest margin (fully tax equivalent) (1) | 4.34 | % | 4.57 | % | 4.62 | % | 4.75 | % | 4.57 | % | ||||||||||

Full-time equivalent employees | 1,508 | 1,377 | 1,374 | 1,483 | ||||||||||||||||

(1) The tax equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 35% tax rate. Management believes that it is a standard practice in the banking industry to present net interest income on a fully tax equivalent basis. Therefore, management believes, these measures provided useful information to investors by allowing them to make peer comparisons. Management also uses these measures to make peer comparisons. | ||||||||||||||||||||

FIRST FINANCIAL BANCORP. | |||||||||||||||||||||||||

CONSOLIDATED STATEMENTS OF CONDITION | |||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||||||

Jun. 30, | Mar. 31, | Dec. 31, | Sep. 30, | Jun. 30, | % Change | % Change | |||||||||||||||||||

2012 | 2012 | 2011 | 2011 | 2011 | Linked Qtr. | Comparable Qtr. | |||||||||||||||||||

ASSETS | |||||||||||||||||||||||||

Cash and due from banks | $ | 126,392 | $ | 125,949 | $ | 149,653 | $ | 108,253 | $ | 104,150 | 0.4 | % | 21.4 | % | |||||||||||

Interest-bearing deposits with other banks | 9,187 | 24,101 | 375,398 | 369,130 | 147,108 | (61.9 | )% | (93.8 | )% | ||||||||||||||||

Investment securities available-for-sale | 724,518 | 736,309 | 1,441,846 | 1,120,179 | 1,134,114 | (1.6 | )% | (36.1 | )% | ||||||||||||||||

Investment securities held-to-maturity | 873,538 | 917,758 | 2,664 | 2,724 | 3,001 | (4.8 | )% | 29,008.2 | % | ||||||||||||||||

Other investments | 71,492 | 71,492 | 71,492 | 71,492 | 71,492 | 0.0 | % | 0.0 | % | ||||||||||||||||

Loans held for sale | 20,971 | 21,052 | 24,834 | 14,259 | 8,824 | (0.4 | )% | 137.7 | % | ||||||||||||||||

Loans | |||||||||||||||||||||||||

Commercial | 823,890 | 831,101 | 856,981 | 822,552 | 798,552 | (0.9 | )% | 3.2 | % | ||||||||||||||||

Real estate - construction | 86,173 | 104,305 | 114,974 | 136,651 | 142,682 | (17.4 | )% | (39.6 | )% | ||||||||||||||||

Real estate - commercial | 1,321,446 | 1,262,775 | 1,233,067 | 1,202,035 | 1,144,368 | 4.6 | % | 15.5 | % | ||||||||||||||||

Real estate - residential | 292,503 | 288,922 | 287,980 | 300,165 | 256,788 | 1.2 | % | 13.9 | % | ||||||||||||||||

Installment | 61,590 | 63,793 | 67,543 | 70,034 | 63,799 | (3.5 | )% | (3.5 | )% | ||||||||||||||||

Home equity | 365,413 | 359,711 | 358,960 | 362,919 | 344,457 | 1.6 | % | 6.1 | % | ||||||||||||||||

Credit card | 31,486 | 31,149 | 31,631 | 30,435 | 28,618 | 1.1 | % | 10.0 | % | ||||||||||||||||

Lease financing | 30,109 | 21,794 | 17,311 | 12,870 | 9,890 | 38.2 | % | 204.4 | % | ||||||||||||||||

Total loans, excluding covered loans | 3,012,610 | 2,963,550 | 2,968,447 | 2,937,661 | 2,789,154 | 1.7 | % | 8.0 | % | ||||||||||||||||

Less | |||||||||||||||||||||||||

Allowance for loan and lease losses | 50,952 | 49,437 | 52,576 | 54,537 | 53,671 | 3.1 | % | (5.1 | )% | ||||||||||||||||

Net loans - uncovered | 2,961,658 | 2,914,113 | 2,915,871 | 2,883,124 | 2,735,483 | 1.6 | % | 8.3 | % | ||||||||||||||||

Covered loans | 903,862 | 986,619 | 1,053,244 | 1,151,066 | 1,242,730 | (8.4 | )% | (27.3 | )% | ||||||||||||||||

Less | |||||||||||||||||||||||||

Allowance for loan and lease losses | 48,327 | 46,156 | 42,835 | 48,112 | 51,044 | 4.7 | % | (5.3 | )% | ||||||||||||||||

Net loans - covered | 855,535 | 940,463 | 1,010,409 | 1,102,954 | 1,191,686 | (9.0 | )% | (28.2 | )% | ||||||||||||||||

Net loans | 3,817,193 | 3,854,576 | 3,926,280 | 3,986,078 | 3,927,169 | (1.0 | )% | (2.8 | )% | ||||||||||||||||

Premises and equipment | 142,744 | 141,664 | 138,096 | 120,325 | 114,797 | 0.8 | % | 24.3 | % | ||||||||||||||||

Goodwill | 95,050 | 95,050 | 95,050 | 68,922 | 51,820 | 0.0 | % | 83.4 | % | ||||||||||||||||

Other intangibles | 9,195 | 10,193 | 10,844 | 8,436 | 4,847 | (9.8 | )% | 89.7 | % | ||||||||||||||||

FDIC indemnification asset | 146,765 | 156,397 | 173,009 | 177,814 | 193,113 | (6.2 | )% | (24.0 | )% | ||||||||||||||||

Accrued interest and other assets | 245,632 | 262,027 | 262,345 | 290,117 | 281,172 | (6.3 | )% | (12.6 | )% | ||||||||||||||||

Total Assets | $ | 6,282,677 | $ | 6,416,568 | $ | 6,671,511 | $ | 6,337,729 | $ | 6,041,607 | (2.1 | )% | 4.0 | % | |||||||||||

LIABILITIES | |||||||||||||||||||||||||

Deposits | |||||||||||||||||||||||||

Interest-bearing demand | $ | 1,154,852 | $ | 1,289,490 | $ | 1,317,339 | $ | 1,288,721 | $ | 1,021,519 | (10.4 | )% | 13.1 | % | |||||||||||

Savings | 1,543,619 | 1,613,244 | 1,724,659 | 1,537,420 | 1,643,110 | (4.3 | )% | (6.1 | )% | ||||||||||||||||

Time | 1,331,758 | 1,491,132 | 1,654,662 | 1,658,031 | 1,581,603 | (10.7 | )% | (15.8 | )% | ||||||||||||||||

Total interest-bearing deposits | 4,030,229 | 4,393,866 | 4,696,660 | 4,484,172 | 4,246,232 | (8.3 | )% | (5.1 | )% | ||||||||||||||||

Noninterest-bearing | 1,071,520 | 1,007,049 | 946,180 | 814,928 | 728,178 | 6.4 | % | 47.2 | % | ||||||||||||||||

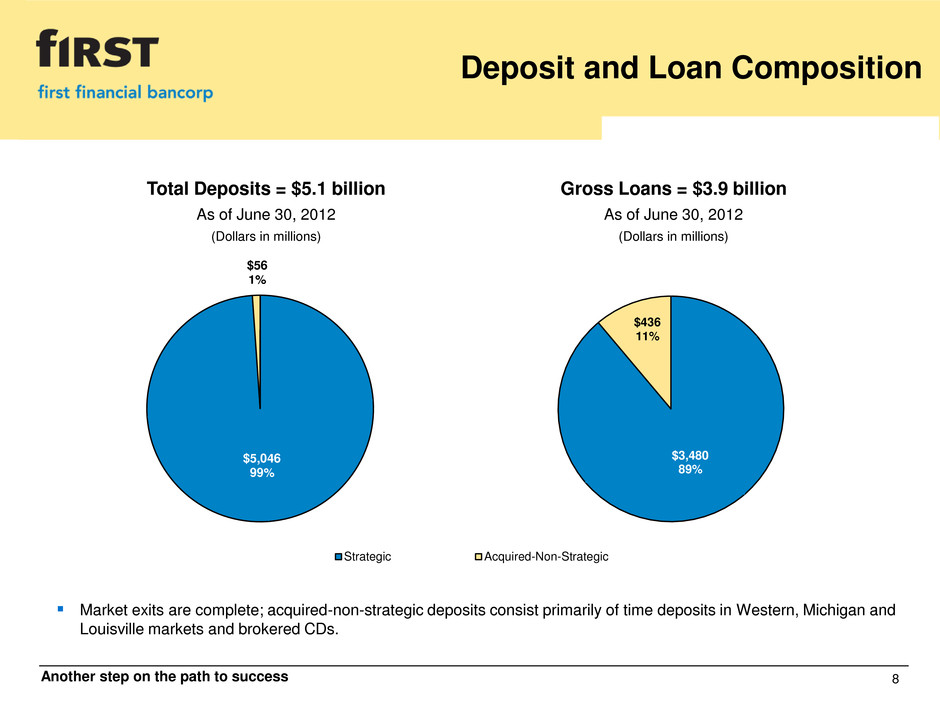

Total deposits | 5,101,749 | 5,400,915 | 5,642,840 | 5,299,100 | 4,974,410 | (5.5 | )% | 2.6 | % | ||||||||||||||||

Federal funds purchased and securities sold | |||||||||||||||||||||||||

under agreements to repurchase | 73,919 | 78,619 | 99,431 | 95,451 | 105,291 | (6.0 | )% | (29.8 | )% | ||||||||||||||||

FHLB short-term borrowings | 176,000 | 0 | 0 | 0 | 0 | N/M | N/M | ||||||||||||||||||

Total short-term borrowings | 249,919 | 78,619 | 99,431 | 95,451 | 105,291 | 217.9 | % | 137.4 | % | ||||||||||||||||

Long-term debt | 75,120 | 75,745 | 76,544 | 76,875 | 102,255 | (0.8 | )% | (26.5 | )% | ||||||||||||||||

Total borrowed funds | 325,039 | 154,364 | 175,975 | 172,326 | 207,546 | 110.6 | % | 56.6 | % | ||||||||||||||||

Accrued interest and other liabilities | 139,101 | 146,596 | 140,475 | 139,171 | 137,889 | (5.1 | )% | 0.9 | % | ||||||||||||||||

Total Liabilities | 5,565,889 | 5,701,875 | 5,959,290 | 5,610,597 | 5,319,845 | (2.4 | )% | 4.6 | % | ||||||||||||||||

SHAREHOLDERS' EQUITY | |||||||||||||||||||||||||

Common stock | 576,929 | 575,675 | 579,871 | 578,974 | 577,856 | 0.2 | % | (0.2 | )% | ||||||||||||||||

Retained earnings | 331,315 | 330,563 | 331,351 | 329,243 | 329,455 | 0.2 | % | 0.6 | % | ||||||||||||||||

Accumulated other comprehensive loss | (18,172 | ) | (18,687 | ) | (21,490 | ) | (3,388 | ) | (7,902 | ) | (2.8 | )% | 130.0 | % | |||||||||||

Treasury stock, at cost | (173,284 | ) | (172,858 | ) | (177,511 | ) | (177,697 | ) | (177,647 | ) | 0.2 | % | (2.5 | )% | |||||||||||

Total Shareholders' Equity | 716,788 | 714,693 | 712,221 | 727,132 | 721,762 | 0.3 | % | (0.7 | )% | ||||||||||||||||

Total Liabilities and Shareholders' Equity | $ | 6,282,677 | $ | 6,416,568 | $ | 6,671,511 | $ | 6,337,729 | $ | 6,041,607 | (2.1 | )% | 4.0 | % | |||||||||||

N/M = Not meaningful. | |||||||||||||||||||||||||

FIRST FINANCIAL BANCORP. | |||||||||||||||||||||||||||

AVERAGE CONSOLIDATED STATEMENTS OF CONDITION | |||||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||||||||

Quarterly Averages | Year-to-Date Averages | ||||||||||||||||||||||||||

Jun. 30, | Mar. 31, | Dec. 31, | Sep. 30, | Jun. 30, | Jun. 30, | ||||||||||||||||||||||

2012 | 2012 | 2011 | 2011 | 2011 | 2012 | 2011 | |||||||||||||||||||||

ASSETS | |||||||||||||||||||||||||||

Cash and due from banks | $ | 121,114 | $ | 123,634 | $ | 121,603 | $ | 110,336 | $ | 118,829 | $ | 122,374 | $ | 115,410 | |||||||||||||

Interest-bearing deposits with other banks | 4,454 | 126,330 | 485,432 | 306,969 | 375,434 | 65,392 | 326,408 | ||||||||||||||||||||

Investment securities | 1,713,503 | 1,664,643 | 1,257,574 | 1,199,473 | 1,093,870 | 1,689,073 | 1,069,715 | ||||||||||||||||||||

Loans held for sale | 19,554 | 19,722 | 21,067 | 9,497 | 8,530 | 19,638 | 12,304 | ||||||||||||||||||||

Loans | |||||||||||||||||||||||||||

Commercial | 827,722 | 850,092 | 851,006 | 794,447 | 797,158 | 838,907 | 800,035 | ||||||||||||||||||||

Real estate - construction | 99,087 | 112,945 | 135,825 | 141,791 | 139,255 | 106,016 | 148,776 | ||||||||||||||||||||

Real estate - commercial | 1,279,869 | 1,235,613 | 1,206,678 | 1,145,195 | 1,132,662 | 1,257,741 | 1,134,138 | ||||||||||||||||||||

Real estate - residential | 290,335 | 287,749 | 293,158 | 258,377 | 260,920 | 289,042 | 263,211 | ||||||||||||||||||||

Installment | 62,846 | 65,302 | 68,945 | 63,672 | 65,568 | 64,074 | 66,628 | ||||||||||||||||||||

Home equity | 361,166 | 358,360 | 360,389 | 346,486 | 341,876 | 359,763 | 341,085 | ||||||||||||||||||||

Credit card | 31,383 | 31,201 | 30,759 | 29,505 | 28,486 | 31,292 | 28,404 | ||||||||||||||||||||

Lease financing | 23,334 | 18,524 | 15,527 | 11,496 | 8,492 | 20,929 | 7,511 | ||||||||||||||||||||

Total loans, excluding covered loans | 2,975,742 | 2,959,786 | 2,962,287 | 2,790,969 | 2,774,417 | 2,967,764 | 2,789,788 | ||||||||||||||||||||

Less | |||||||||||||||||||||||||||

Allowance for loan and lease losses | 50,353 | 53,513 | 55,157 | 55,146 | 55,132 | 51,933 | 57,431 | ||||||||||||||||||||

Net loans - uncovered | 2,925,389 | 2,906,273 | 2,907,130 | 2,735,823 | 2,719,285 | 2,915,831 | 2,732,357 | ||||||||||||||||||||

Covered loans | 950,226 | 1,020,220 | 1,113,876 | 1,196,327 | 1,295,228 | 985,223 | 1,357,367 | ||||||||||||||||||||

Less | |||||||||||||||||||||||||||

Allowance for loan and lease losses | 47,964 | 47,152 | 51,330 | 51,955 | 39,070 | 47,558 | 31,278 | ||||||||||||||||||||

Net loans - covered | 902,262 | 973,068 | 1,062,546 | 1,144,372 | 1,256,158 | 937,665 | 1,326,089 | ||||||||||||||||||||

Net loans | 3,827,651 | 3,879,341 | 3,969,676 | 3,880,195 | 3,975,443 | 3,853,496 | 4,058,446 | ||||||||||||||||||||

Premises and equipment | 143,261 | 140,377 | 128,168 | 116,070 | 115,279 | 141,819 | 117,132 | ||||||||||||||||||||

Goodwill | 95,050 | 95,050 | 77,158 | 52,004 | 51,820 | 95,050 | 51,820 | ||||||||||||||||||||

Other intangibles | 9,770 | 10,506 | 9,094 | 4,697 | 5,031 | 10,138 | 5,225 | ||||||||||||||||||||

FDIC indemnification asset | 149,788 | 159,450 | 173,900 | 183,801 | 186,125 | 154,619 | 197,225 | ||||||||||||||||||||

Accrued interest and other assets | 250,828 | 259,878 | 272,084 | 273,773 | 289,393 | 255,353 | 289,267 | ||||||||||||||||||||

Total Assets | $ | 6,334,973 | $ | 6,478,931 | $ | 6,515,756 | $ | 6,136,815 | $ | 6,219,754 | $ | 6,406,952 | $ | 6,242,952 | |||||||||||||

LIABILITIES | |||||||||||||||||||||||||||

Deposits | |||||||||||||||||||||||||||

Interest-bearing demand | $ | 1,192,868 | $ | 1,285,196 | $ | 1,388,903 | $ | 1,153,178 | $ | 1,130,503 | $ | 1,239,032 | $ | 1,109,762 | |||||||||||||

Savings | 1,610,411 | 1,682,507 | 1,617,588 | 1,659,152 | 1,636,821 | 1,646,459 | 1,611,086 | ||||||||||||||||||||

Time | 1,406,800 | 1,577,448 | 1,623,921 | 1,554,497 | 1,634,779 | 1,492,124 | 1,695,884 | ||||||||||||||||||||

Total interest-bearing deposits | 4,210,079 | 4,545,151 | 4,630,412 | 4,366,827 | 4,402,103 | 4,377,615 | 4,416,732 | ||||||||||||||||||||

Noninterest-bearing | 1,044,405 | 931,347 | 860,863 | 735,621 | 734,674 | 987,876 | 733,962 | ||||||||||||||||||||

Total deposits | 5,254,484 | 5,476,498 | 5,491,275 | 5,102,448 | 5,136,777 | 5,365,491 | 5,150,694 | ||||||||||||||||||||

Federal funds purchased and securities sold | |||||||||||||||||||||||||||

under agreements to repurchase | 80,715 | 85,891 | 98,268 | 100,990 | 95,297 | 83,303 | 92,432 | ||||||||||||||||||||

FHLB short-term borrowings | 78,966 | 0 | 0 | 0 | 0 | 39,483 | 0 | ||||||||||||||||||||

Total short-term borrowings | 159,681 | 85,891 | 98,268 | 100,990 | 95,297 | 122,786 | 92,432 | ||||||||||||||||||||

Long-term debt | 75,314 | 76,020 | 76,671 | 94,150 | 102,506 | 75,667 | 111,171 | ||||||||||||||||||||

Other long-term debt | 0 | 0 | 0 | 0 | 20,393 | 0 | 20,506 | ||||||||||||||||||||

Total borrowed funds | 234,995 | 161,911 | 174,939 | 195,140 | 218,196 | 198,453 | 224,109 | ||||||||||||||||||||

Accrued interest and other liabilities | 128,383 | 133,975 | 129,578 | 113,418 | 157,031 | 131,179 | 166,708 | ||||||||||||||||||||

Total Liabilities | 5,617,862 | 5,772,384 | 5,795,792 | 5,411,006 | 5,512,004 | 5,695,123 | 5,541,511 | ||||||||||||||||||||

SHAREHOLDERS' EQUITY | |||||||||||||||||||||||||||

Common stock | 576,276 | 578,514 | 579,321 | 578,380 | 577,417 | 577,395 | 578,597 | ||||||||||||||||||||

Retained earnings | 332,280 | 324,370 | 323,624 | 331,107 | 318,466 | 328,325 | 313,680 | ||||||||||||||||||||

Accumulated other comprehensive loss | (18,242 | ) | (20,344 | ) | (5,396 | ) | (6,013 | ) | (10,488 | ) | (19,293 | ) | (11,862 | ) | |||||||||||||

Treasury stock, at cost | (173,203 | ) | (175,993 | ) | (177,585 | ) | (177,665 | ) | (177,645 | ) | (174,598 | ) | (178,974 | ) | |||||||||||||

Total Shareholders' Equity | 717,111 | 706,547 | 719,964 | 725,809 | 707,750 | 711,829 | 701,441 | ||||||||||||||||||||

Total Liabilities and Shareholders' Equity | $ | 6,334,973 | $ | 6,478,931 | $ | 6,515,756 | $ | 6,136,815 | $ | 6,219,754 | $ | 6,406,952 | $ | 6,242,952 | |||||||||||||

FIRST FINANCIAL BANCORP. | |||||||||||||||||||||||||||||||||||

NET INTEREST MARGIN RATE/VOLUME ANALYSIS (1) | |||||||||||||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||||||||||||||||

Quarterly Averages | Year-to-Date Averages | ||||||||||||||||||||||||||||||||||

Jun. 30, 2012 | Mar. 31, 2012 | Jun. 30, 2011 | Jun. 30, 2012 | Jun. 30, 2011 | |||||||||||||||||||||||||||||||

Balance | Yield | Balance | Yield | Balance | Yield | Balance | Yield | Balance | Yield | ||||||||||||||||||||||||||

Earning assets | |||||||||||||||||||||||||||||||||||

Investment securities | $ | 1,713,503 | 2.46 | % | $ | 1,664,643 | 2.57 | % | $ | 1,093,870 | 2.67 | % | $ | 1,689,073 | 2.53 | % | $ | 1,069,715 | 2.69 | % | |||||||||||||||

Interest-bearing deposits with other banks | 4,454 | 0.18 | % | 126,330 | 0.28 | % | 375,434 | 0.35 | % | 65,392 | 0.28 | % | 326,408 | 0.38 | % | ||||||||||||||||||||

Gross loans (2) | 4,095,310 | 6.02 | % | 4,159,178 | 6.21 | % | 4,264,300 | 6.60 | % | 4,127,244 | 6.15 | % | 4,356,684 | 6.62 | % | ||||||||||||||||||||

Total earning assets | 5,813,267 | 4.96 | % | 5,950,151 | 5.06 | % | 5,733,604 | 5.44 | % | 5,881,709 | 5.04 | % | 5,752,807 | 5.53 | % | ||||||||||||||||||||

Nonearning assets | |||||||||||||||||||||||||||||||||||

Allowance for loan and lease losses | (98,317 | ) | (100,665 | ) | (94,202 | ) | (99,491 | ) | (88,709 | ) | |||||||||||||||||||||||||

Cash and due from banks | 121,114 | 123,634 | 118,829 | 122,374 | 115,410 | ||||||||||||||||||||||||||||||

Accrued interest and other assets | 498,909 | 505,811 | 461,523 | 502,360 | 463,444 | ||||||||||||||||||||||||||||||

Total assets | $ | 6,334,973 | $ | 6,478,931 | $ | 6,219,754 | $ | 6,406,952 | $ | 6,242,952 | |||||||||||||||||||||||||

Interest-bearing liabilities | |||||||||||||||||||||||||||||||||||

Total interest-bearing deposits | $ | 4,210,079 | 0.61 | % | $ | 4,545,151 | 0.68 | % | $ | 4,402,103 | 0.98 | % | $ | 4,377,615 | 0.65 | % | $ | 4,416,732 | 1.01 | % | |||||||||||||||

Borrowed funds | |||||||||||||||||||||||||||||||||||

Short-term borrowings | 159,681 | 0.09 | % | 85,891 | 0.06 | % | 95,297 | 0.21 | % | 122,786 | 0.08 | % | 92,432 | 0.21 | % | ||||||||||||||||||||

Long-term debt | 75,314 | 3.59 | % | 76,020 | 3.59 | % | 102,506 | 3.67 | % | 75,667 | 3.61 | % | 111,171 | 3.68 | % | ||||||||||||||||||||

Other long-term debt | 0 | N/M | 0 | N/M | 20,393 | 3.87 | % | 0 | N/M | 20,506 | 3.85 | % | |||||||||||||||||||||||

Total borrowed funds | 234,995 | 1.22 | % | 161,911 | 1.71 | % | 218,196 | 2.17 | % | 198,453 | 1.43 | % | 224,109 | 2.26 | % | ||||||||||||||||||||

Total interest-bearing liabilities | 4,445,074 | 0.64 | % | 4,707,062 | 0.72 | % | 4,620,299 | 1.04 | % | 4,576,068 | 0.68 | % | 4,640,841 | 1.07 | % | ||||||||||||||||||||

Noninterest-bearing liabilities | |||||||||||||||||||||||||||||||||||

Noninterest-bearing demand deposits | 1,044,405 | 931,347 | 734,674 | 987,876 | 733,962 | ||||||||||||||||||||||||||||||

Other liabilities | 128,383 | 133,975 | 157,031 | 131,179 | 166,708 | ||||||||||||||||||||||||||||||

Shareholders' equity | 717,111 | 706,547 | 707,750 | 711,829 | 701,441 | ||||||||||||||||||||||||||||||

Total liabilities & shareholders' equity | $ | 6,334,973 | $ | 6,478,931 | $ | 6,219,754 | $ | 6,406,952 | $ | 6,242,952 | |||||||||||||||||||||||||

Net interest income (1) | $ | 64,830 | $ | 66,689 | $ | 65,867 | $ | 131,519 | $ | 133,202 | |||||||||||||||||||||||||

Net interest spread (1) | 4.32 | % | 4.34 | % | 4.40 | % | 4.36 | % | 4.46 | % | |||||||||||||||||||||||||

Net interest margin (1) | 4.49 | % | 4.51 | % | 4.61 | % | 4.50 | % | 4.67 | % | |||||||||||||||||||||||||

(1) Not tax equivalent. | |||||||||||||||||||||||||||||||||||

(2) Loans held for sale, nonaccrual loans, covered loans, and indemnification asset are included in gross loans. | |||||||||||||||||||||||||||||||||||

N/M = Not meaningful. | |||||||||||||||||||||||||||||||||||

FIRST FINANCIAL BANCORP. | ||||||||||||||||||||||||||||||||||||

NET INTEREST MARGIN RATE/VOLUME ANALYSIS (1) | ||||||||||||||||||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||||||||||||

Linked Qtr. Income Variance | Comparable Qtr. Income Variance | Year-to-Date Income Variance | ||||||||||||||||||||||||||||||||||

Rate | Volume | Total | Rate | Volume | Total | Rate | Volume | Total | ||||||||||||||||||||||||||||

Earning assets | ||||||||||||||||||||||||||||||||||||

Investment securities | $ | (450 | ) | $ | 299 | $ | (151 | ) | $ | (569 | ) | $ | 3,797 | $ | 3,228 | $ | (878 | ) | $ | 7,756 | $ | 6,878 | ||||||||||||||

Interest-bearing deposits with other banks | (32 | ) | (55 | ) | (87 | ) | (159 | ) | (167 | ) | (326 | ) | (156 | ) | (363 | ) | (519 | ) | ||||||||||||||||||

Gross loans (2) | (1,978 | ) | (958 | ) | (2,936 | ) | (6,262 | ) | (2,534 | ) | (8,796 | ) | (10,227 | ) | (6,992 | ) | (17,219 | ) | ||||||||||||||||||

Total earning assets | (2,460 | ) | (714 | ) | (3,174 | ) | (6,990 | ) | 1,096 | (5,894 | ) | (11,261 | ) | 401 | (10,860 | ) | ||||||||||||||||||||

Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||

Total interest-bearing deposits | $ | (827 | ) | $ | (508 | ) | $ | (1,335 | ) | $ | (4,095 | ) | $ | (291 | ) | $ | (4,386 | ) | $ | (7,944 | ) | $ | (126 | ) | $ | (8,070 | ) | |||||||||

Borrowed funds | ||||||||||||||||||||||||||||||||||||

Short-term borrowings | 8 | 17 | 25 | (27 | ) | 15 | (12 | ) | (57 | ) | 12 | (45 | ) | |||||||||||||||||||||||

Long-term debt | 1 | (6 | ) | (5 | ) | (18 | ) | (244 | ) | (262 | ) | (35 | ) | (636 | ) | (671 | ) | |||||||||||||||||||

Other long-term debt | 0 | 0 | 0 | (197 | ) | 0 | (197 | ) | (391 | ) | 0 | (391 | ) | |||||||||||||||||||||||

Total borrowed funds | 9 | 11 | 20 | (242 | ) | (229 | ) | (471 | ) | (483 | ) | (624 | ) | (1,107 | ) | |||||||||||||||||||||

Total interest-bearing liabilities | (818 | ) | (497 | ) | (1,315 | ) | (4,337 | ) | (520 | ) | (4,857 | ) | (8,427 | ) | (750 | ) | (9,177 | ) | ||||||||||||||||||

Net interest income (1) | $ | (1,642 | ) | $ | (217 | ) | $ | (1,859 | ) | $ | (2,653 | ) | $ | 1,616 | $ | (1,037 | ) | $ | (2,834 | ) | $ | 1,151 | $ | (1,683 | ) | |||||||||||

(1) Not tax equivalent. | ||||||||||||||||||||||||||||||||||||

(2) Loans held for sale, nonaccrual loans, covered loans, and indemnification asset are included in gross loans. | ||||||||||||||||||||||||||||||||||||

FIRST FINANCIAL BANCORP. | |||||||||||||||||||||||||||

CREDIT QUALITY | |||||||||||||||||||||||||||

(excluding covered assets) | |||||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||||||||

Six months ended, | |||||||||||||||||||||||||||

Jun. 30, | Mar 31, | Dec. 31, | Sep. 30, | Jun. 30, | Jun. 30, | Jun. 30, | |||||||||||||||||||||

2012 | 2012 | 2011 | 2011 | 2011 | 2012 | 2011 | |||||||||||||||||||||

ALLOWANCE FOR LOAN AND LEASE LOSS ACTIVITY | |||||||||||||||||||||||||||

Balance at beginning of period | $ | 49,437 | $ | 52,576 | $ | 54,537 | $ | 53,671 | $ | 53,645 | $ | 52,576 | $ | 57,235 | |||||||||||||

Provision for uncovered loan and lease losses | 8,364 | 3,258 | 5,164 | 7,643 | 5,756 | 11,622 | 6,403 | ||||||||||||||||||||

Gross charge-offs | |||||||||||||||||||||||||||

Commercial | 1,129 | 1,186 | 1,742 | 879 | 383 | 2,315 | 815 | ||||||||||||||||||||

Real estate - construction | 717 | 1,787 | 2,105 | 1,771 | 1,213 | 2,504 | 2,403 | ||||||||||||||||||||

Real estate - commercial | 3,811 | 2,244 | 2,505 | 2,997 | 2,791 | 6,055 | 4,880 | ||||||||||||||||||||

Real estate - residential | 191 | 604 | 473 | 564 | 406 | 795 | 514 | ||||||||||||||||||||

Installment | 116 | 60 | 115 | 162 | 177 | 176 | 249 | ||||||||||||||||||||

Home equity | 915 | 644 | 488 | 510 | 923 | 1,559 | 1,185 | ||||||||||||||||||||

Other | 259 | 297 | 363 | 291 | 339 | 556 | 787 | ||||||||||||||||||||

Total gross charge-offs | 7,138 | 6,822 | 7,791 | 7,174 | 6,232 | 13,960 | 10,833 | ||||||||||||||||||||

Recoveries | |||||||||||||||||||||||||||

Commercial | 48 | 72 | 348 | 92 | 222 | 120 | 322 | ||||||||||||||||||||

Real estate - construction | 0 | 0 | 5 | 0 | 27 | 0 | 27 | ||||||||||||||||||||

Real estate - commercial | 68 | 113 | 68 | 168 | 38 | 181 | 73 | ||||||||||||||||||||

Real estate - residential | 9 | 28 | 3 | 4 | 29 | 37 | 38 | ||||||||||||||||||||

Installment | 75 | 123 | 96 | 87 | 82 | 198 | 180 | ||||||||||||||||||||

Home equity | 28 | 24 | 71 | 9 | 12 | 52 | 37 | ||||||||||||||||||||

Other | 61 | 65 | 75 | 37 | 92 | 126 | 189 | ||||||||||||||||||||

Total recoveries | 289 | 425 | 666 | 397 | 502 | 714 | 866 | ||||||||||||||||||||

Total net charge-offs | 6,849 | 6,397 | 7,125 | 6,777 | 5,730 | 13,246 | 9,967 | ||||||||||||||||||||

Ending allowance for uncovered loan and lease losses | $ | 50,952 | $ | 49,437 | $ | 52,576 | $ | 54,537 | $ | 53,671 | $ | 50,952 | $ | 53,671 | |||||||||||||

NET CHARGE-OFFS TO AVERAGE LOANS AND LEASES (ANNUALIZED) | |||||||||||||||||||||||||||

Commercial | 0.53 | % | 0.53 | % | 0.65 | % | 0.39 | % | 0.08 | % | 0.53 | % | 0.12 | % | |||||||||||||

Real estate - construction | 2.91 | % | 6.36 | % | 6.13 | % | 4.96 | % | 3.42 | % | 4.75 | % | 3.22 | % | |||||||||||||

Real estate - commercial | 1.18 | % | 0.69 | % | 0.80 | % | 0.98 | % | 0.97 | % | 0.94 | % | 0.85 | % | |||||||||||||

Real estate - residential | 0.25 | % | 0.81 | % | 0.64 | % | 0.86 | % | 0.58 | % | 0.53 | % | 0.36 | % | |||||||||||||

Installment | 0.26 | % | (0.39 | )% | 0.11 | % | 0.47 | % | 0.58 | % | (0.07 | )% | 0.21 | % | |||||||||||||

Home equity | 0.99 | % | 0.70 | % | 0.46 | % | 0.57 | % | 1.07 | % | 0.84 | % | 0.68 | % | |||||||||||||

Other | 1.46 | % | 1.88 | % | 2.47 | % | 2.46 | % | 2.68 | % | 1.66 | % | 3.36 | % | |||||||||||||

Total net charge-offs | 0.93 | % | 0.87 | % | 0.95 | % | 0.96 | % | 0.83 | % | 0.90 | % | 0.72 | % | |||||||||||||

COMPONENTS OF NONPERFORMING LOANS, NONPERFORMING ASSETS, AND UNDERPERFORMING ASSETS | |||||||||||||||||||||||||||

Nonaccrual loans | |||||||||||||||||||||||||||

Commercial | $ | 12,065 | $ | 5,936 | $ | 7,809 | $ | 10,792 | $ | 9,811 | $ | 12,065 | $ | 9,811 | |||||||||||||

Real estate - construction | 7,243 | 7,005 | 10,005 | 13,844 | 13,237 | 7,243 | 13,237 | ||||||||||||||||||||

Real estate - commercial | 36,116 | 35,581 | 28,349 | 26,408 | 26,213 | 36,116 | 26,213 | ||||||||||||||||||||

Real estate - residential | 5,069 | 5,131 | 5,692 | 5,507 | 4,564 | 5,069 | 4,564 | ||||||||||||||||||||

Installment | 319 | 377 | 371 | 322 | 335 | 319 | 335 | ||||||||||||||||||||

Home equity | 2,281 | 1,915 | 2,073 | 2,277 | 2,376 | 2,281 | 2,376 | ||||||||||||||||||||

Nonaccrual loans | 63,093 | 55,945 | 54,299 | 59,150 | 56,536 | 63,093 | 56,536 | ||||||||||||||||||||

Troubled debt restructurings (TDRs) | |||||||||||||||||||||||||||

Accruing | 9,909 | 9,495 | 4,009 | 4,712 | 3,039 | 9,909 | 3,039 | ||||||||||||||||||||

Nonaccrual | 10,185 | 17,205 | 18,071 | 12,571 | 14,443 | 10,185 | 14,443 | ||||||||||||||||||||

Total TDRs | 20,094 | 26,700 | 22,080 | 17,283 | 17,482 | 20,094 | 17,482 | ||||||||||||||||||||

Total nonperforming loans | 83,187 | 82,645 | 76,379 | 76,433 | 74,018 | 83,187 | 74,018 | ||||||||||||||||||||

Other real estate owned (OREO) | 15,688 | 15,036 | 11,317 | 12,003 | 16,313 | 15,688 | 16,313 | ||||||||||||||||||||

Total nonperforming assets | 98,875 | 97,681 | 87,696 | 88,436 | 90,331 | 98,875 | 90,331 | ||||||||||||||||||||

Accruing loans past due 90 days or more | 143 | 203 | 191 | 235 | 149 | 143 | 149 | ||||||||||||||||||||

Total underperforming assets | $ | 99,018 | $ | 97,884 | $ | 87,887 | $ | 88,671 | $ | 90,480 | $ | 99,018 | $ | 90,480 | |||||||||||||

Total classified assets | $ | 145,621 | $ | 154,684 | $ | 162,372 | $ | 172,581 | $ | 184,786 | $ | 145,621 | $ | 184,786 | |||||||||||||

CREDIT QUALITY RATIOS (excluding covered assets) | |||||||||||||||||||||||||||

Allowance for loan and lease losses to | |||||||||||||||||||||||||||

Nonaccrual loans | 80.76 | % | 88.37 | % | 96.83 | % | 92.20 | % | 94.93 | % | 80.76 | % | 94.93 | % | |||||||||||||

Nonaccrual loans plus nonaccrual TDRs | 69.53 | % | 67.58 | % | 72.65 | % | 76.04 | % | 75.62 | % | 69.53 | % | 75.62 | % | |||||||||||||

Nonperforming loans | 61.25 | % | 59.82 | % | 68.84 | % | 71.35 | % | 72.51 | % | 61.25 | % | 72.51 | % | |||||||||||||

Total ending loans | 1.69 | % | 1.67 | % | 1.77 | % | 1.86 | % | 1.92 | % | 1.69 | % | 1.92 | % | |||||||||||||

Nonperforming loans to total loans | 2.76 | % | 2.79 | % | 2.57 | % | 2.60 | % | 2.65 | % | 2.76 | % | 2.65 | % | |||||||||||||

Nonperforming assets to | |||||||||||||||||||||||||||

Ending loans, plus OREO | 3.27 | % | 3.28 | % | 2.94 | % | 3.00 | % | 3.22 | % | 3.27 | % | 3.22 | % | |||||||||||||

Total assets | 1.57 | % | 1.52 | % | 1.31 | % | 1.40 | % | 1.50 | % | 1.57 | % | 1.50 | % | |||||||||||||

Nonperforming assets, excluding accruing TDRs to | |||||||||||||||||||||||||||

Ending loans, plus OREO | 2.94 | % | 2.96 | % | 2.81 | % | 2.84 | % | 3.11 | % | 2.94 | % | 3.11 | % | |||||||||||||

Total assets | 1.42 | % | 1.37 | % | 1.25 | % | 1.32 | % | 1.44 | % | 1.42 | % | 1.44 | % | |||||||||||||

FIRST FINANCIAL BANCORP. | |||||||||||||||||||||||||||

CAPITAL ADEQUACY | |||||||||||||||||||||||||||

(Dollars in thousands, except per share data) | |||||||||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||||||||

Six months ended, | |||||||||||||||||||||||||||

Jun. 30, | Mar. 31, | Dec. 31, | Sep. 30, | Jun. 30, | Jun. 30, | Jun. 30, | |||||||||||||||||||||

2012 | 2012 | 2011 | 2011 | 2011 | 2012 | 2011 | |||||||||||||||||||||

PER COMMON SHARE | |||||||||||||||||||||||||||

Market Price | |||||||||||||||||||||||||||

High | $ | 17.70 | $ | 18.28 | $ | 17.06 | $ | 17.12 | $ | 17.20 | $ | 18.28 | $ | 18.91 | |||||||||||||

Low | $ | 14.88 | $ | 16.11 | $ | 13.40 | $ | 13.34 | $ | 15.04 | $ | 14.88 | $ | 15.04 | |||||||||||||

Close | $ | 15.98 | $ | 17.30 | $ | 16.64 | $ | 13.80 | $ | 16.69 | $ | 15.98 | $ | 16.69 | |||||||||||||

Average shares outstanding - basic | 57,933,281 | 57,795,258 | 57,744,662 | 57,735,811 | 57,694,792 | 57,864,269 | 57,642,970 | ||||||||||||||||||||

Average shares outstanding - diluted | 58,958,279 | 58,881,043 | 58,672,575 | 58,654,099 | 58,734,662 | 58,921,689 | 58,722,448 | ||||||||||||||||||||

Ending shares outstanding | 58,513,393 | 58,539,458 | 58,267,054 | 58,256,136 | 58,259,440 | 58,513,393 | 58,259,440 | ||||||||||||||||||||

REGULATORY CAPITAL | Preliminary | ||||||||||||||||||||||||||

Tier 1 Capital | $ | 640,644 | $ | 637,612 | $ | 636,836 | $ | 661,838 | $ | 681,492 | $ | 640,644 | $ | 681,492 | |||||||||||||

Tier 1 Ratio | 17.14 | % | 17.18 | % | 17.47 | % | 18.81 | % | 20.14 | % | 17.14 | % | 20.14 | % | |||||||||||||

Total Capital | $ | 688,401 | $ | 684,838 | $ | 683,255 | $ | 706,570 | $ | 724,763 | $ | 688,401 | $ | 724,763 | |||||||||||||

Total Capital Ratio | 18.42 | % | 18.45 | % | 18.74 | % | 20.08 | % | 21.42 | % | 18.42 | % | 21.42 | % | |||||||||||||

Total Capital in excess of minimum | |||||||||||||||||||||||||||

requirement | $ | 389,367 | $ | 387,954 | $ | 391,623 | $ | 425,128 | $ | 454,034 | $ | 389,367 | $ | 454,034 | |||||||||||||

Total Risk-Weighted Assets | $ | 3,737,920 | $ | 3,711,053 | $ | 3,645,403 | $ | 3,518,026 | $ | 3,384,115 | $ | 3,737,920 | $ | 3,384,115 | |||||||||||||

Leverage Ratio | 10.21 | % | 9.94 | % | 9.87 | % | 10.87 | % | 11.01 | % | 10.21 | % | 11.01 | % | |||||||||||||

OTHER CAPITAL RATIOS | |||||||||||||||||||||||||||

Ending shareholders' equity to ending assets | 11.41 | % | 11.14 | % | 10.68 | % | 11.47 | % | 11.95 | % | 11.41 | % | 11.95 | % | |||||||||||||

Ending tangible shareholders' equity to ending tangible assets | 9.91 | % | 9.66 | % | 9.23 | % | 10.38 | % | 11.11 | % | 9.91 | % | 11.11 | % | |||||||||||||

Average shareholders' equity to average assets | 11.32 | % | 10.91 | % | 11.05 | % | 11.83 | % | 11.38 | % | 11.11 | % | 11.24 | % | |||||||||||||

Average tangible shareholders' equity to average tangible assets | 9.84 | % | 9.43 | % | 9.58 | % | 10.70 | % | 10.56 | % | 9.64 | % | 10.42 | % | |||||||||||||

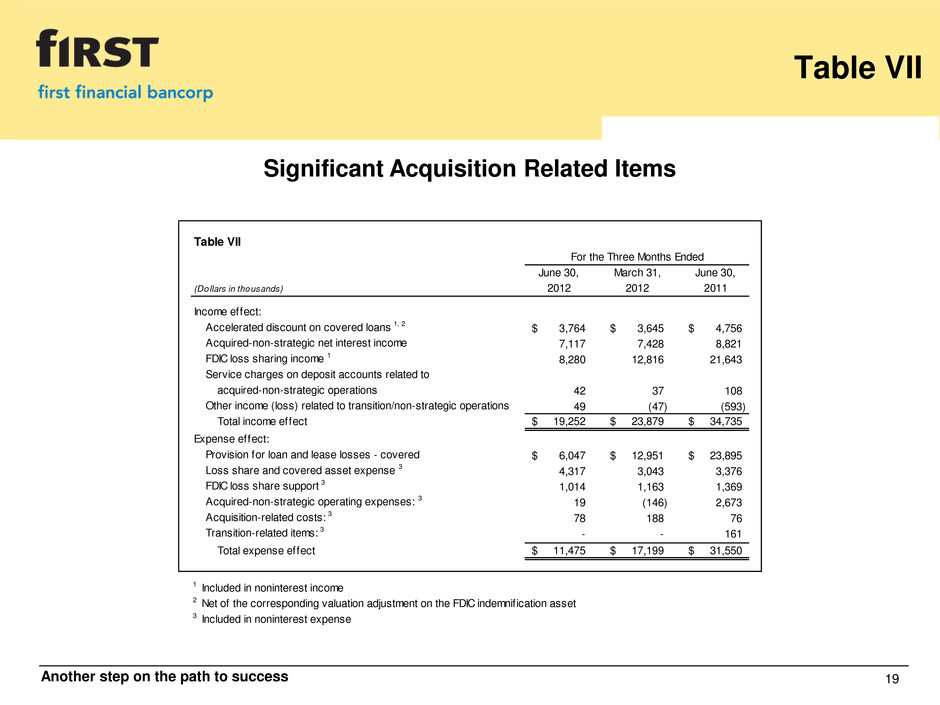

Table VII | |||||||||||||

For the Three Months Ended | |||||||||||||

June 30, | March 31, | June 30, | |||||||||||

(Dollars in thousands) | 2012 | 2012 | 2011 | ||||||||||

Income effect: | |||||||||||||

Accelerated discount on covered loans 1, 2 | $ | 3,764 | $ | 3,645 | $ | 4,756 | |||||||

Acquired-non-strategic net interest income | 7,117 | 7,428 | 8,821 | ||||||||||

FDIC loss sharing income 1 | 8,280 | 12,816 | 21,643 | ||||||||||

Service charges on deposit accounts related to | |||||||||||||

acquired-non-strategic operations | 42 | 37 | 108 | ||||||||||

Other income (loss) related to transition/non-strategic operations | 49 | (47 | ) | (593 | ) | ||||||||

Total income effect | $ | 19,252 | $ | 23,879 | $ | 34,735 | |||||||

Expense effect: | |||||||||||||

Provision for loan and lease losses - covered | $ | 6,047 | $ | 12,951 | $ | 23,895 | |||||||

Loss share and covered asset expense 3 | 4,317 | 3,043 | 3,376 | ||||||||||

FDIC loss share support 3 | 1,014 | 1,163 | 1,369 | ||||||||||

Acquired-non-strategic operating expenses: 3 | 19 | (146 | ) | 2,673 | |||||||||

Acquisition-related costs: 3 | 78 | 188 | 76 | ||||||||||

Transition-related items: 3 | — | — | 161 | ||||||||||

Total expense effect | $ | 11,475 | $ | 17,199 | $ | 31,550 | |||||||

1 Included in noninterest income | |||||||||||||

2 Net of the corresponding valuation adjustment on the FDIC indemnification asset | |||||||||||||

3 Included in noninterest expense | |||||||||||||

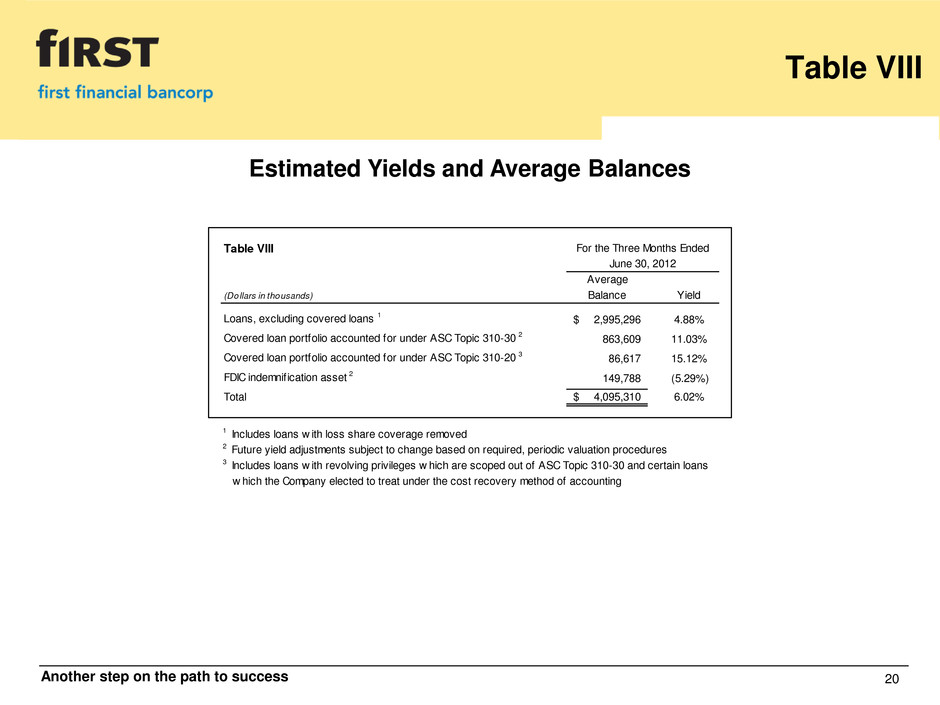

Table VIII | For the Three Months Ended | |||||||

June 30, 2012 | ||||||||

Average | ||||||||

(Dollars in thousands) | Balance | Yield | ||||||

Loans, excluding covered loans 1 | $ | 2,995,296 | 4.88% | |||||

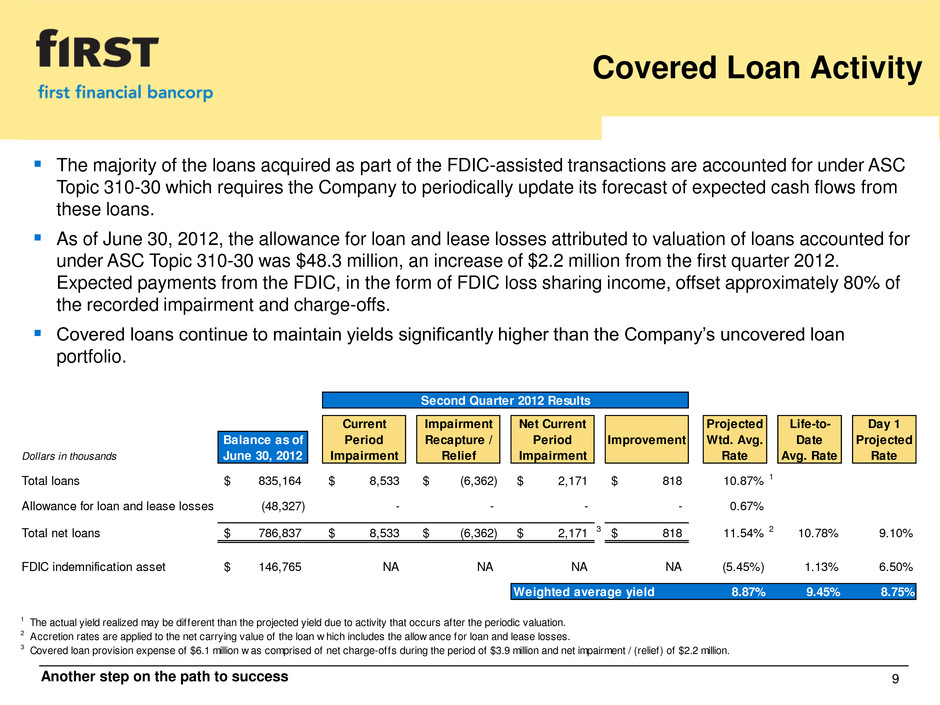

Covered loan portfolio accounted for under ASC Topic 310-30 2 | 863,609 | 11.03% | ||||||

Covered loan portfolio accounted for under ASC Topic 310-20 3 | 86,617 | 15.12% | ||||||

FDIC indemnification asset 2 | 149,788 | -5.29% | ||||||

Total | $ | 4,095,310 | 6.02% | |||||

1 Includes loans with loss share coverage removed | ||||||||

2 Future yield adjustments subject to change based on required, periodic valuation procedures | ||||||||

3 Includes loans with revolving privileges which are scoped out of ASC Topic 310-30 and certain loans | ||||||||

which the Company elected to treat under the cost recovery method of accounting. | ||||||||

Table IX | ||||||||||||||||||||||||||||

Covered Loan Activity - Second Quarter 2012 | ||||||||||||||||||||||||||||

Reduction in Recorded Investment Due to: | ||||||||||||||||||||||||||||

March 31, | Contractual | Net | Loans With | June 30, | ||||||||||||||||||||||||

(Dollars in thousands) | 2012 | Sales | Prepayments | Activity 1 | Charge-Offs 2 | Coverage Removed | 2012 | |||||||||||||||||||||

Commercial | $ | 164,933 | $ | — | $ | 14,360 | $ | 7,365 | $ | 1,199 | $ | — | $ | 142,009 | ||||||||||||||

Real estate - construction | 16,727 | — | 35 | 566 | 793 | — | 15,333 | |||||||||||||||||||||

Real estate - commercial | 609,141 | 1,285 | 35,579 | 13,159 | 1,399 | 1,046 | 556,673 | |||||||||||||||||||||

Real estate - residential | 115,428 | — | 2,667 | 939 | 102 | — | 111,720 | |||||||||||||||||||||

Installment | 12,079 | — | 333 | 99 | 6 | — | 11,641 | |||||||||||||||||||||

Home equity | 64,824 | — | 3,155 | (1,870 | ) | 377 | — | 63,162 | ||||||||||||||||||||

Other covered loans | 3,487 | — | — | 163 | — | — | 3,324 | |||||||||||||||||||||

Total covered loans | $ | 986,619 | $ | 1,285 | $ | 56,129 | $ | 20,421 | $ | 3,876 | $ | 1,046 | $ | 903,862 | ||||||||||||||

1 Includes partial paydowns, accretion of the valuation discount and advances on revolving loans | ||||||||||||||||||||||||||||

2 Indemnified at 80% from the FDIC | ||||||||||||||||||||||||||||

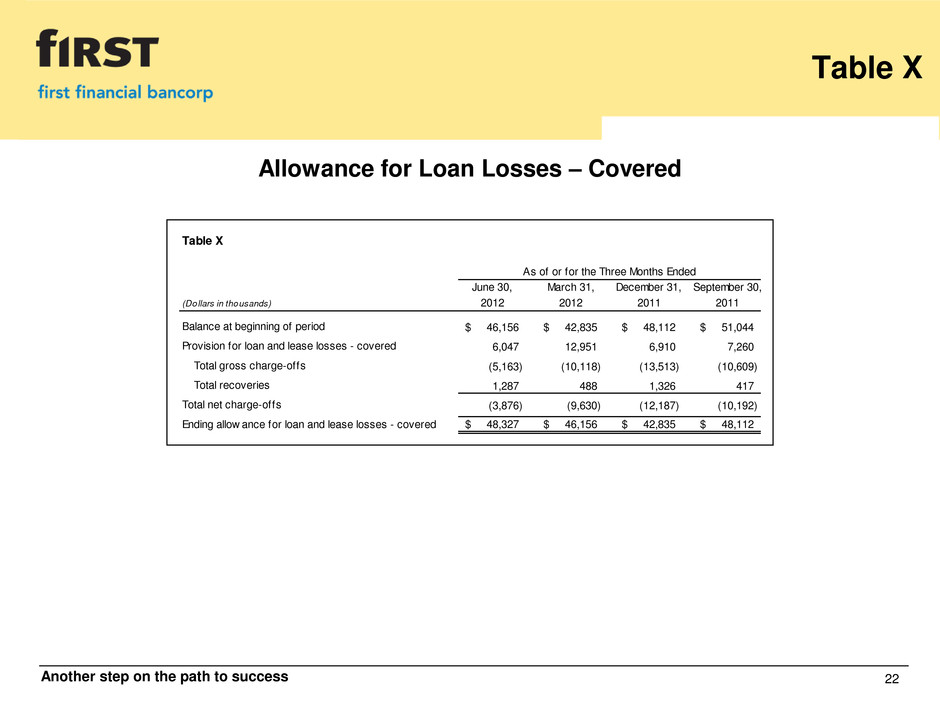

Table X | |||||||||||||||||

As of or for the Three Months Ended | |||||||||||||||||

June 30, | March 31, | December 31, | September 30, | ||||||||||||||

(Dollars in thousands) | 2012 | 2012 | 2011 | 2011 | |||||||||||||

Balance at beginning of period | $ | 46,156 | $ | 42,835 | $ | 48,112 | $ | 51,044 | |||||||||

Provision for loan and lease losses - covered | 6,047 | 12,951 | 6,910 | 7,260 | |||||||||||||

Total gross charge-offs | (5,163 | ) | (10,118 | ) | (13,513 | ) | (10,609 | ) | |||||||||

Total recoveries | 1,287 | 488 | 1,326 | 417 | |||||||||||||

Total net charge-offs | (3,876 | ) | (9,630 | ) | (12,187 | ) | (10,192 | ) | |||||||||

Ending allowance for loan and lease losses - covered | $ | 48,327 | $ | 46,156 | $ | 42,835 | $ | 48,112 | |||||||||