|

|

1 |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number

(Exact name of registrant as specified in its charter)

|

REPUBLIC OF |

|

|

|

(State or Other Jurisdiction of |

|

(I.R.S. Employer |

|

|

|

|

|

|

|

|

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code:

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

Name of each Exchange on which registered |

|

|

|

|

OTC Pink Marketplace (1) |

Securities registered pursuant to Section 12(g) of the Act: None

|

(1) |

On February 6, 2020, the New York Stock Exchange filed a Form 25 with the Securities and Exchange Commission to delist the common stock, $1.00 par value (the “Common Stock”), of McDermott International, Inc. (the “Registrant”) from the New York Stock Exchange. The delisting was effective 10 days after the Form 25 was filed. The deregistration of the Common Stock under Section 12(b) of the Act will become effective 90 days after the filing date of the Form 25, at which point the Common Stock will be deemed registered under Section 12(g) of the Act. The Registrant’s Common Stock began trading on the OTC Pink Marketplace on January 22, 2020 under the symbol “MDRIQ.” ________________________ |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☑ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

|

|

|

|

Emerging growth company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the registrant’s common stock held by nonaffiliates of the registrant on the last business day of the registrant’s most recently completed second fiscal quarter (based on the closing sales price on the New York Stock Exchange on June 28, 2019) was approximately $

The number of shares of the registrant’s common stock outstanding at February 26, 2020 was

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

McDERMOTT INTERNATIONAL, INC.

INDEX—FORM 10-K

|

|

|

|

|

PAGE |

|

|

|

|

|

|

|

Item 1. |

|

|

1 |

|

|

Item 1A. |

|

|

16 |

|

|

Item 1B. |

|

|

38 |

|

|

Item 2. |

|

|

39 |

|

|

Item 3. |

|

|

41 |

|

|

Item 4. |

|

|

41 |

|

|

|

|

|

|

|

|

Item 5. |

|

|

42 |

|

|

Item 6. |

|

|

44 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

46 |

|

Item 7A. |

|

|

84 |

|

|

Item 8. |

|

|

85 |

|

|

|

|

|

88 |

|

|

|

|

|

89 |

|

|

|

|

|

90 |

|

|

|

|

|

91 |

|

|

|

|

|

92 |

|

|

|

|

|

93 |

|

|

|

|

|

94 |

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

160 |

|

Item 9A. |

|

|

160 |

|

|

Item 9B. |

|

|

161 |

|

|

|

|

|

|

|

|

Item 10. |

|

|

163 |

|

|

Item 11. |

|

|

163 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

163 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

163 |

|

Item 14. |

|

|

163 |

|

|

|

|

|

|

|

|

Item 15. |

|

|

164 |

|

|

Item 16. |

|

|

170 |

|

|

|

171 |

|||

ITEM 1. BUSINESS

Statements we make in this Annual Report on Form 10-K which express a belief, expectation or intention, as well as those that are not historical fact, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to various risks, uncertainties and assumptions, including those to which we refer under the headings “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” in Items 1 and 1A of Part I of this Annual Report on Form 10-K.

PART I

|

Item 1. |

BUSINESS |

The Company

McDermott International, Inc. (“McDermott”), a corporation incorporated under the laws of the Republic of Panama in 1959, is a fully integrated provider of engineering, procurement, construction and installation (“EPCI”) and technology solutions to the energy industry. We design and build end-to-end infrastructure and technology solutions to transport and transform oil and gas into a variety of products. Our proprietary technologies, integrated expertise and comprehensive solutions are utilized for offshore, subsea, power, liquefied natural gas (“LNG”) and downstream energy projects around the world. Our customers include national, major integrated and other oil and gas companies as well as producers of petrochemicals and electric power, and we operate in most major energy producing regions throughout the world.

In this report, unless the context otherwise indicates, “McDermott,” “we,” “our” or “us” mean McDermott and its consolidated subsidiaries, and references to any of the Notes to the accompanying Consolidated Financial Statements refer to the Notes to the Consolidated Financial Statements included in Item 8 of Part II.

On May 10, 2018 (the “Combination Date”), we completed our combination with Chicago Bridge & Iron Company N.V. (“CB&I”) through a series of transactions (the “Combination”) (see Note 3, Business Combination, to the accompanying Consolidated Financial Statements for further discussion). Since we completed the Combination, we have incurred losses on several projects (the “Focus Projects”) that were undertaken by CB&I and its subsidiaries, in amounts that have substantially exceeded the amounts estimated by CB&I prior to the Combination and by us subsequent to the Combination. Two of those projects, the Cameron LNG export facility project in Hackberry, Louisiana and the Freeport LNG export facility project in Freeport, Texas, remain ongoing. These projects have used substantial amounts of cash in each of the periods following completion of the Combination. The usage of cash on these projects, coupled with the substantial amounts of letters of credit and procurement funding needed to secure and commence work on new contracts reflected in our near-record level of backlog, which was $18.6 billion as of December 31, 2019, has strained our liquidity and capital resources. As a result of these and other factors, we determined in September 2019 that there was a significant level of uncertainty as to whether we would be in compliance with several financial covenants in the second half of 2019, such as the leverage ratio and fixed charge coverage ratio covenants under the Credit Agreement and the Letter of Credit Agreement (each as defined and described in Note 13, Debt). In the absence of appropriate amendments or waivers, our failure to remain in compliance with these financial covenants would have triggered an event of default under the Credit Agreement and the Letter of Credit Agreement and a potential cross default under the Senior Notes Indenture (as defined and described in Note 13, Debt).

As a result of the uncertainty described above and our ongoing liquidity requirements, as of December 31, 2019, we had taken the actions described below.

|

|

• |

We retained legal and financial advisors to help us evaluate strategic and capital structure alternatives. |

|

|

• |

We appointed a Chief Transformation Officer to report to McDermott’s CEO and the Board of Directors of McDermott. |

|

|

• |

We announced the commencement of a process to explore strategic alternatives for our Technology segment. |

|

|

• |

On October 21, 2019, we entered into a superpriority senior secured credit facility (the “Superpriority Credit Agreement”) which provided for borrowings and letters of credit in an aggregate principal amount of $1.7 billion, consisting of (1) a $1.3 billion term loan facility (the “New Term Facility”) and (2) a $400 million letter of credit facility (the “New LC Facility”). Upon the closing of the Superpriority Credit Agreement, we were provided access to $650 million of capital (“Tranche A”), comprised of $550 million under the New Term Facility, before reduction for related fees and expenses, and $100 million under the New LC Facility. |

|

|

1 |

|

ITEM 1. BUSINESS

|

|

• |

On October 21, 2019, we entered into the Credit Agreement Amendment and the LC Agreement Amendment (each as defined and described in Note 13, Debt), which, among other things, amended our leverage ratio, fixed charge coverage ratio and minimum liquidity covenant under the Credit Agreement (each as defined and described in Note 13, Debt) for each fiscal quarter through December 31, 2021 and also modified certain affirmative covenants, negative covenants and events of default to, among other things, make changes to allow for the incurrence of indebtedness and pledge of assets under the Superpriority Credit Agreement. |

|

|

• |

We entered into consent and waiver agreements with holders of our 12% Redeemable Preferred Stock on October 21, 2019 and December 1, 2019, respectively, to: (1) permit us to enter into the Superpriority Credit Agreement, the Credit Agreement Amendment and the LC Agreement Amendment; and (2) allow for the incurrence of additional indebtedness under the Superpriority Credit Agreement. |

|

|

• |

Our applicable subsidiaries elected not to make the payment, when due, of approximately $69 million in interest due on their 10.625% senior notes due 2024 (the “Senior Notes”) on November 1, 2019. As a result of the non-payment, a 30-day grace period following non-payment of the interest commenced. |

|

|

• |

On December 1, 2019, we entered into Credit Agreement Amendment No. 2 and the LC Agreement Amendment No. 2 (each as defined and described in Note 13, Debt), which amended, among other things, the events of default under the Credit Agreement to provide that, for so long as the Forbearance Agreement (as defined below) was in effect and the Senior Notes (as defined below) were not accelerated, the failure to make the payment of $69 million of interest (the “Interest Payment”) on the Senior Notes would not constitute an event of default. |

|

|

• |

On December 1, 2019, we entered into a forbearance agreement with holders of over 35% of the Senior Notes (the “Forbearance Agreement”). Under the terms of the Forbearance Agreement, holders of over 35% of the Senior Notes agreed to forbear from exercising any rights related to the interest payment due on November 1, 2019, subject to certain conditions. The forbearance period extended through January 15, 2020 and was subject to further extension by a majority of the holders who were party to the Forbearance Agreement. |

|

|

• |

On December 1, 2019, we entered into Amendment No. 1 to the Superpriority Credit Agreement (the “Superpriority Amendment”), which amended the Superpriority Credit Agreement to, among other things: (1) waive certain conditions precedent to the Tranche B funding to facilitate such funding; (2) provide for the acknowledgement and consent by the lenders under the Superpriority Credit Agreement of our compliance with required business plan milestones; and (3) modify the cross-default provisions contained in the Superpriority Credit Agreement related to the failure to pay interest on the Senior Notes. |

|

|

• |

On December 4, 2019, we were provided access to $350 million of capital (“Tranche B”) under the Superpriority Credit Agreement, comprised of $250 million under the New Term Facility, before reduction for related fees and expenses, and $100 million under the New LC Facility. Prior to the funding of Tranche B, we issued approximately 11 million shares of our common stock, 0.09 million of Series B Warrants (that entitle each holder to purchase one share of our common stock at a purchase price of $0.01 per share) and 0.56 million shares of a newly designated series of preferred stock, Series A Preferred Stock, to certain of the lenders under the terms of the Superpriority Credit Agreement, in accordance with the terms of the Superpriority Credit Agreement. |

Ultimately, subsequent to December 31, 2019, we concluded, even after taking the actions described above, we would not have sufficient liquidity to satisfy our debt service obligations and meet other financial obligations as they came due. We concluded that a reduction in our long-term debt and cash interest obligations was required to improve our financial position and flexibility.

|

|

2 |

|

ITEM 1. BUSINESS

Recent Developments

Restructuring Support Agreement and Chapter 11 Proceedings

On January 21, 2020 (the “Petition Date”), McDermott and certain of its subsidiaries (collectively, the “Debtors”): (1) entered into a Restructuring Support Agreement (together with all exhibits and schedules thereto, the “RSA”) with certain of their lenders, letter of credit issuers and holders of the Senior Notes issued by certain of the Debtors and guaranteed by McDermott and certain of the other Debtors (such lenders, letter of credit issuers and holders of the Senior Notes are referred to below as the “Consenting Parties”); and (2) filed voluntary petitions (the “Bankruptcy Petitions”) for reorganization under Chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”) to pursue a Joint Prepackaged Chapter 11 Plan of Reorganization of the Debtors (as proposed pursuant to the RSA, the “Plan of Reorganization”). At the time of filing the Chapter 11 cases (the “Chapter 11 Cases”), the Debtors had the support of more than two-thirds of all of their funded debt creditors for the RSA. The Chapter 11 Cases are being jointly administered under the caption In re McDermott International, Inc., Case No. 20-30336. The Debtors continue to operate their businesses as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court.

In connection with the RSA and the Chapter 11 Cases, certain Consenting Parties or their affiliates have provided the Debtors with superpriority debtor-in-possession financing pursuant to a new credit agreement (the “DIP Credit Agreement”). The DIP Credit Agreement provides for, among other things, term loans and letters of credit in an aggregate principal amount of up to $2.81 billion, including (1) up to $2,067 million under a term loan facility consisting of (a) a $550 million tranche that was made available at closing, (b) a $650 million tranche that was made available upon entry of the Final DIP Order (as defined in the RSA), (c) a $823 million tranche consisting of the principal amount of term loans outstanding under Tranche A and Tranche B of the New Term Loan Facility under our Superpriority Credit Agreement and accrued interest and fees related to term loans outstanding under Tranche A and Tranche B of the New Term Loan Facility under our Superpriority Credit Agreement and the New LC Facility under our Superpriority Credit Agreement, in each case that was rolled up from the Superpriority Credit Agreement and deemed issued under the DIP Credit Agreement upon entry of the Final DIP Order and (d) a $44 million tranche consisting of the make-whole amount owed to the lenders under our Superpriority Credit Agreement that was rolled up from the Superpriority Credit Agreement and deemed issued under the DIP Credit Agreement upon entry of the Final DIP Order (the “DIP Term Facility”) and (2) up to $743 million under a letter of credit facility consisting of (a) $300 million made available at closing, (b) $243 million that was made available upon entry of the Final DIP Order and (c) $200 million amount of term loans outstanding under Tranche A and Tranche B of the New LC Facility under our Superpriority Credit Agreement that was rolled up from the Superpriority Credit Agreement and deemed issued under the DIP Credit Agreement upon entry of the Final DIP Order (the “DIP LC Facility” and, together with the DIP Term Facility, the “DIP Facilities”). The Final DIP Order was entered by the Bankruptcy Court on February 24, 2020. We intend to use proceeds of the DIP Facilities to, among other things: (1) pay certain fees, interest, payments and expenses related to the Chapter 11 Cases; (2) pay adequate protection payments; (3) fund our working capital needs and expenditures during the Chapter 11 proceedings; (4) fund the Carve-Out (as defined below), which accounts for certain administrative, court and legal fees payable in connection with the Chapter 11 Cases; and (5) pay fees and expenses related to the transactions contemplated by the DIP Facilities.

In addition to the DIP Facilities, the RSA contemplates that, on the Effective Date, the Debtors will (1) conduct a non-backstopped equity rights offering (the “Rights Offering”) and (2) enter into new exit credit facilities (the “Exit Facilities”), as described in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” Accordingly, consummation of the Plan of Reorganization will require that the Debtors meet all of the conditions to completion of the Exit Facilities.

The Plan of Reorganization, which remains subject to the approval of the Bankruptcy Court, provides that, among other things, on the effective date of the Plan of Reorganization (the “Effective Date”):

|

|

• |

holders of claims arising under the DIP Credit Agreement shall be paid in full, in cash, on the Effective Date, funded from the proceeds of the Lummus Technology sale or, to the extent not paid in full from the proceeds of the Lummus Technology sale: |

|

|

• |

holders of claims arising under the DIP Term Loans (as defined in the Plan of Reorganization) other than the Make Whole Amount (as defined in the Plan of Reorganization) shall receive cash on hand and proceeds from the Exit Facilities; |

|

|

• |

holders of claims arising under the DIP Term Loans constituting the Make Whole Amount shall receive their respective pro rata shares of the term loans arising under the Make Whole Tranche (as defined in the Plan of Reorganization); and |

|

|

3 |

|

ITEM 1. BUSINESS

|

|

• |

holders of claims arising under drawn DIP Letters of Credit (as defined in the Plan of Reorganization) that have not been reimbursed in full in cash as of the Effective Date shall receive payment in full in cash. |

|

|

• |

holders of DIP Cash Secured Letters of Credit (as defined in the Plan of Reorganization) shall receive participation in the Cash Secured Exit Facility (as defined in the RSA) in amounts equal to their respective DIP Cash Secured Letter of Credit Claims (as defined in the Plan of Reorganization; provided that any such cash collateral in the DIP Cash Secured LC Account (as defined in the DIP Credit Facility Term Sheet) shall collateralize the Cash Secured LC Exit Facility); |

|

|

• |

holders of claims arising under the DIP Letters of Credit (other than the DIP Cash Secured Letters of Credit) shall receive participation in the Super Senior Exit Facility in amounts equal to their respective DIP Letter of Credit Facility commitments; |

|

|

• |

holders of claims arising under the (1) 2021 LC Facility (as defined in the Plan of Reorganization), (2) the 2023 LC Facility (as defined in the Plan of Reorganization), (3) the Revolving Credit Facility (as defined in the Plan of Reorganization) and (4) the Lloyds’ LC Facility (as defined in the Plan of Reorganization) shall receive participation rights in the Roll-Off LC Exit Facility (as defined in the Plan of Reorganization) or receive their respective pro rata shares of the Secured Creditor Funded Debt Distribution (as defined in the Plan of Reorganization), depending upon the nature of such claims; |

|

|

• |

holders of claims arising under the Term Loan Facility and Credit Agreement Hedging Claims (as defined in the Plan of Reorganization) other than hedging obligations rolled into the DIP Facilities and the Exit Facilities, will receive pro rata shares of the Secured Creditor Funded Debt Distribution; |

|

|

• |

holders of claims arising under the Senior Notes will receive their pro rata shares of (a) 6% of the new common equity interests in the reorganized McDermott (the “New Common Stock”), plus additional shares of New Common Stock as a result of the Prepetition Funded Secured Claims Excess Cash Adjustment (as defined in the Plan of Reorganization), subject to dilution on account of the New Warrants and a new Management Incentive Plan (each as defined in the RSA); and (b) the New Warrants; |

|

|

• |

holders of general unsecured claims shall either (1) have their claims reinstated or (2) be paid in full in cash; |

|

|

• |

each existing equity interest in any of the Debtors other than McDermott shall be reinstated or cancelled, released and extinguished without any distribution at the Debtors’ election and with the consent of the Required Consenting Lenders (as defined in the Plan of Reorganization); and |

|

|

• |

each existing equity interest in McDermott will be cancelled, released and extinguished without any distribution. |

The deadline to vote on the Plan of Reorganization was February 19, 2020, and the results of that voting continued to reflect the support of more than two-thirds of all the Debtors’ funded debt creditors. The Bankruptcy Court has set March 12, 2020 as the date for the hearing on confirmation of the Plan of Reorganization.

The RSA contains certain covenants on the part of the Debtors and the Consenting Parties, including that the Consenting Parties, among other things, (1) vote in favor of the Plan of Reorganization in the Chapter 11 Cases and (2) otherwise support and take all actions that are necessary and appropriate to facilitate the confirmation of the Plan of Reorganization and consummation of the Debtors’ restructuring in accordance with the RSA. The RSA further provides that the Consenting Parties shall have the right, but not the obligation, to terminate the RSA upon the occurrence of certain events, including the failure of the Debtors to achieve certain milestones.

The RSA also contemplates that, on or prior to the Effective Date, we will complete the Lummus Technology sale. In order to pursue the satisfaction of that requirement, we have entered into a Share and Asset Purchase Agreement (the “SAPA”) with a “stalking horse” bidder. The Lummus Technology sale will be subject to the approval of the Bankruptcy Court. Under the terms of the SAPA, the stalking horse bidder has agreed, absent any higher or otherwise better bid, to acquire the Lummus Technology business from us for a purchase price of $2.725 billion, subject to certain adjustments. If we receive any bids that are higher or otherwise better than the terms reflected in the SAPA, we expect to conduct an auction for the Lummus Technology business on March 9, 2020. If we consummate an alternative sale of the Lummus Technology business to any person other than the stalking horse bidder, we would be required to pay to the stalking horse bidder a break-up fee equal to 3% of the purchase price and reimburse certain expenses associated with the negotiation, drafting and execution of the SAPA. On February 24, 2020, the Bankruptcy Court approved the selection of the stalking horse bidder and the contractual protections provided to that bidder described above, as well as the bidding procedures for the ultimate sale process.

|

|

4 |

|

ITEM 1. BUSINESS

The foregoing descriptions of the RSA, the Plan of Reorganization, the DIP Facilities and the SAPA are not complete and are qualified in their entirety by reference to the full text of each of those documents, copies of which are filed as exhibits to this report.

Debtor-in-Possession Financing

As described above, in connection with the RSA and the Chapter 11 Cases, certain Consenting Parties or their affiliates provided us with superpriority debtor-in-possession financing pursuant to the DIP Credit Agreement. All loans outstanding under the DIP Term Facility bear interest at an adjusted LIBOR rate plus 9.00% per annum. All undrawn letters of credit under the DIP LC Facility (other than cash secured letters of credit) bear interest at a rate of 9.00% per annum. During the continuance of an event of default, the outstanding amounts under the DIP Facilities would bear interest at an additional 2.00% per annum above the interest rate otherwise applicable.

The lenders under the DIP Facility, Crédit Agricole Corporate and Investment Bank (“CACIB”), as collateral agent and revolving administrative agent under the DIP Facilities, and Barclays Bank PLC (“Barclays”), as term loan administrative agent under the DIP Term Facility, subject to the Carve-Out (as defined below) and the terms of the Interim DIP Order (as defined in the RSA), at all times: (1) are entitled to joint and several super-priority administrative expense claim status in the Chapter 11 Cases; (2) have a first priority lien on substantially all assets of the Debtors; (3) have a junior lien on any assets of the Debtors subject to a valid, perfected and non-avoidable lien as of the Petition Date, other than such liens securing the obligations under the Credit Agreement, the Superpriority Credit Agreement, the Lloyds’ LC Facility and the 2021 LC Facility; and (4) have a first priority pledge of 100% of the stock and other equity interests in each of McDermott’s direct and indirect subsidiaries. The Debtors’ obligations to the DIP Lenders and the liens and superpriority claims are subject in each case to a carve out (the “Carve-Out”) that accounts for certain administrative, court and legal fees payable in connection with the Chapter 11 Cases.

The DIP Facilities are subject to certain affirmative and negative covenants, including, among other covenants we believe to be customary in debtor-in-possession financings, reporting by the Debtors in the form of a budget and rolling 13-week cash flow forecasts, together with a reasonably detailed written explanation of all material variances from the budget.

Debtor-in-Possession Financial Covenants Covenants—The DIP Facilities include the following financial covenants:

|

|

• |

as of any Variance Testing Date (as defined in the DIP Facilities), we shall not allow (i) our aggregate cumulative actual total receipts for such variance testing period to be less than the projected amount therefor set forth in the most recently delivered Approved Budget (as defined in the DIP Facilities) by more than 15%, (ii) our aggregate cumulative actual total disbursements (A) for the variance testing period to exceed the projected amount therefor set forth in the most recently delivered Approved Budget by more than 15% and (B) for each week within such variance testing period, to exceed the projected amount therefor set forth in the most recently delivered Approved Budget by more than (x) 20%, with respect to each of the first week and on a cumulative basis for the two-week period ending with the second week of such variance testing and (y) 15% on a cumulative basis with respect to the three-week period ending with the third week and the four week period ending with the fourth week, in each case of such variance testing period, and (iii) our aggregate cumulative actual vendor disbursements and JV infusions with respect to the Specified Projects (as defined in the DIP Facilities) to exceed the projected amount therefore set forth in the most recently delivered Approved Budget by more than 15% for such variance testing period and for each week within such variance testing period by more than (x) 20% with respect to each of the first week and on a cumulative basis for the two-week period ending with the second week of such variance testing and (y) 15% on a cumulative basis with respect to the three-week period ending with the third week and the four week period ending with the fourth week, in each case of such variance testing period |

|

|

• |

beginning with the fiscal quarter ended June 30, 2020, our adjusted EBITDA (as defined in the DIP Facilities) for the most recently ended four fiscal quarter period for which consolidated financial statements have been delivered pursuant to the DIP Facilities shall not be less than the minimum amount set forth below as set forth opposite such ended fiscal quarter: |

|

Test Period End Date |

|

Adjusted EBITDA (In millions) |

|

|

|

June 30, 2020 |

|

|

230 |

|

|

September 30, 2020 |

|

|

410 |

|

|

December 31, 2020 |

|

|

640 |

|

|

|

5 |

|

ITEM 1. BUSINESS

|

|

• |

beginning with the fiscal quarter ended December 31, 2019, the Project Charges (as defined in the DIP Facilities) for the most recently ended fiscal quarter for which consolidated financial statements have been delivered pursuant to the DIP Facilities shall not be more than the maximum amount set for the below as set forth opposite such ended fiscal quarter: |

|

Test Period End Date |

|

Maximum Project Charges (In millions) |

|

|

|

December 31, 2019 |

|

|

260 |

|

|

March 31, 2019 |

|

|

50 |

|

|

June 30, 2020 |

|

|

50 |

|

|

September 30, 2020 |

|

|

40 |

|

|

December 31, 2020 |

|

|

30 |

|

As of December 31, 2019, we were in compliance with our maximum project charges covenant under the DIP Facilities.

The DIP Facilities contain certain events of default we believe to be customary in debtor-in-possession financings, including: (1) conversion of the Chapter 11 Cases to a Chapter 7 case; (2) appointment of a trustee, examiner or receiver in the Chapter 11 Cases; and (3) the final order not being entered by the Bankruptcy Court within 30 days of the interim order relating to the DIP Facilities.

The DIP Facilities will mature on the earliest of (1) nine months after the Petition Date, which date shall be extended automatically by an additional 90 days if certain conditions are satisfied, (2) the Effective Date and (3) the date of acceleration of the obligations under the DIP Facilities following an event of default.

On January 23, 2020, we received $550 million, before reduction for related fees and expenses of $87 million, under the DIP Term Facility, and $300 million of letter of credit capacity under the DIP LC Facility. On February 26, 2020, we received $650 million (related fees and expenses were immaterial), under the DIP Term Facility, and $243 million of letter of credit capacity under the DIP LC Facility.

Going Concern and Financial Reporting in Reorganization

Our commencement of the Chapter 11 Cases and weak industry conditions have negatively impacted our results of operations and cash flows and may continue to do so in the future. These factors raise substantial doubt about our ability to continue as a going concern. The accompanying consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles which contemplate the continuation of the Company as a going concern. See Note 2, Basis of Presentation and Significant Accounting Policies, to the accompanying Consolidated Financial Statements and Item 1A. Risk Factors for additional information regarding our debt instruments and bankruptcy proceedings under Chapter 11.

Delisting of our Common Stock from the New York Stock Exchange

Our common stock was previously listed on the New York Stock Exchange (the “NYSE”) under the symbol “MDR.” As a result of our failure to satisfy the continued listing requirements of the NYSE, on January 22, 2020, our common stock ceased to trade on the NYSE. Since January 23, 2020, our common stock has been quoted on the OTC Pink marketplace maintained by the OTC Markets Group, Inc. (“OTC Pink”) under the symbol “MDRIQ.” On February 6, 2020, the NYSE filed a Form 25 with the SEC to delist our common stock from the NYSE. The delisting was effective 10 days after the Form 25 was filed. The deregistration of the Common Stock under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), will become effective 90 days after the filing date of the Form 25.

Review of Business Portfolio and Strategic Transactions

We performed a review of our business portfolio, which included businesses acquired in the Combination. Our review sought to determine if any portions of our business were non-core for purposes of our vertically integrated offering model. This review initially identified our pipe fabrication and industrial storage tank businesses as non-core. We completed the sale of Alloy Piping Products LLC (“APP”), a portion of the pipe fabrication business, during the second quarter of 2019. We are continuing to pursue the sale of the remaining portion of the pipe fabrication business. In the third quarter of 2019, we terminated the sales process for our industrial storage tank business, as we concluded that the net cash proceeds from the sale, if completed, would likely be significantly below initial expectations.

|

|

6 |

|

ITEM 1. BUSINESS

Business Segments

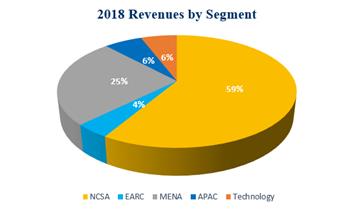

Following completion of the Combination, during the second quarter of 2018, we reorganized our operations into five business segments. This reorganization is intended to better serve our global clients, leverage our workforce, help streamline operations and provide enhanced growth opportunities. Our five business segments, which represent our reportable segments are: North, Central and South America (“NCSA”); Europe, Africa, Russia and Caspian (“EARC”); the Middle East and North Africa (“MENA”); Asia Pacific (“APAC”); and Technology. We also report certain corporate and other non-operating activities under the heading of “Corporate and Other,” which primarily reflects costs that are not allocated to our segments. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Note 24, Segment Reporting, to the accompanying Consolidated Financial Statements for further discussion of our business segments.

Through our five business segments, we deliver a broad services offering that addresses four key end markets, as follows:

Offshore and subsea—We offer a comprehensive range of technology and EPCI services for the upstream oil & gas sector, including any combination of front-end design, engineering, procurement, fabrication, construction, installation, hook-up, start-up and commissioning services across all phases of the project life cycle. We have a particular focus on installation of offshore oil & gas production systems, including jackets, topsides and floating production, storage and offloading (FPSO) vessels and pipelines, as well as installation of subsea production systems.

LNG—We offer a full range of technology and engineering, procurement, fabrication and construction services for the LNG industry, with a focus on natural gas liquefaction plants and LNG regasification terminals. We provide a full range of services, including conceptual design, detailed engineering, material procurement, pipe and storage tank fabrication, construction, project management, compliance support, commissioning and startup, and operator training.

Downstream—We design, build, and offer technology licenses and services for state-of-the-art petrochemical and refinery process units and plants. Our comprehensive services include market-leading proprietary technologies, process design, front-end engineering and design, detailed engineering, material procurement, pipe and storage tank fabrication, construction, permitting assistance, operator training, commissioning and startup. We offer solutions for clean fuels production, including low sulfur gasoline and diesel, as well as a wide range of refinery process units and related ancillary facilities.

Power—We design and build new combined-cycle and simple-cycle gas-fired power generation projects and provide related engineering, procurement, construction and commissioning services. Additionally, we are a joint venture partner of NET Power, LLC, a company that is developing a new natural gas power generation technology that produces low-cost electricity while reducing air emissions. In January 2020, as part of our strategic realignment, we announced plans to wind down our power portfolio.

Contracts

Our contracts are awarded on a competitively bid and negotiated basis. We execute our contracts through a variety of methods, principally fixed-price, but also including cost reimbursable, cost-plus, day-rate and unit-rate basis or some combination of those methods. Factors that customers may consider include price, facility or equipment availability, technical capabilities of equipment and personnel, efficiency, safety record and reputation.

Fixed-price contracts are for a fixed amount to cover costs and any profit element for a defined scope of work. Fixed-price contracts can involve more risk to us because they require us to predetermine both the quantities of work to be performed and the costs associated with executing the work. See “Risk Factors—We are subject to risks associated with contractual pricing in our industry, including the risk that, if our actual costs exceed the costs we estimate on our fixed-price contracts, our profitability will decline and we may suffer losses” in Item 1A.

We have contracts that extend beyond one year. Most of our long-term contracts have provisions for progress payments. We attempt to cover anticipated increases in labor, material and service costs of our long-term contracts either through an estimate of such charges, which is reflected in the original price, or through risk-sharing mechanisms, such as escalation or price adjustments for items such as labor and commodity prices.

We generally recognize our contract revenues and related costs on a percentage-of-completion basis. Accordingly, for each contract, we regularly review contract price and cost estimates as the work progresses and reflect adjustments in profit proportionate to the percentage of completion of the related project in the period when we revise those estimates. To the extent these adjustments result in a reduction or elimination of previously reported profits with respect to a project, we recognize a charge against current earnings, which could be material.

|

|

7 |

|

ITEM 1. BUSINESS

Our arrangements with customers frequently require us to provide letters of credit, bid and performance bonds or guarantees to secure bids or performance under contracts. While these letters of credit, bonds and guarantees may involve significant dollar amounts, historically there have been no material payments to our customers under these arrangements.

Some of our contracts contain provisions that require us to pay liquidated damages if we are responsible for the failure to meet specified contractual milestone dates and the applicable customer asserts a claim under those provisions. Those contracts define the conditions under which our customers may make claims against us for liquidated damages. In many cases in which we have historically had potential exposure for liquidated damages, such damages ultimately were not asserted by our customers. See Note 23, Commitments and Contingencies, to the accompanying Consolidated Financial Statements.

Change orders, which are a normal and recurring part of our business, can increase (sometimes substantially) the future scope and cost of a job. Therefore, change order awards (although frequently beneficial in the long term) can have the short-term effect of reducing the job percentage of completion and thus the revenues and profits recognized to date. We regularly review contract price and cost estimates as the work progresses and reflect adjustments in profit, proportionate to the job percentage of completion in the period when those estimates are revised. Revenue from unapproved change orders is recognized to the extent of amounts management expects to recover or costs incurred. Unapproved change orders that are disputed by the customer are treated as claims.

In the event of a contract deferral or cancellation, we generally would be entitled to recover costs incurred, settlement expenses and profit on work completed prior to deferral or termination. Significant or numerous cancellations could adversely affect our business, financial condition, results of operations and cash flows.

Some of our contracts, regardless of type, may operate under joint venture, consortium or other collaborative arrangements. Typically, we enter into these arrangements with reputable companies with whom we have worked previously. These arrangements are generally made to strengthen our market position or technical skills, or where the size, scale or location of the project warrants the use of such arrangements.

Remaining Performance Obligations (“RPOs”)

RPOs represent the amount of revenues we expect to recognize in the future from our contract commitments on projects. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Outlook—Remaining Performance Obligations” for discussion and quantification of our RPO’s. See also “Risk Factors—Our RPOs are subject to unexpected adjustments and cancellations” in Item 1A.

Competition

We operate in a competitive environment. Technology performance, price, timeliness of completion, quality, safety record, track record and reputation are principal competitive factors within our industry. There are numerous regional, national and global competitors that offer similar services to those offered by each of our operating groups, including Axens SA; Bechtel Group Inc.; China Offshore Oil Engineering Co. Ltd.; Fluor Corporation; Honeywell/UOP; Hyundai Heavy Industrial Co. Ltd.; KBR Inc.; Kiewit Corporation; Larsen and Toubro Ltd.; Lyondell Basell Industries N.V.; Petrofac International Ltd.; Saipem S.P.A.; Samsung Heavy Industries Co., Ltd.; Subsea 7 S.A.; Techidas Reunidas, S.A; TechnipFMC plc; Wood plc; WorleyParsons Limited and W.R. Grace & Co.

Significant Customers

See Note 24, Segment Reporting, to the accompanying Consolidated Financial Statements for information on customers that accounted for significant percentages of our consolidated revenues.

Raw Materials and Suppliers

The principal raw materials we use are metal plate, structural steel, pipe, fittings, catalysts, proprietary equipment and selected engineered equipment such as pressure vessels, exchangers, pumps, valves, compressors, motors and electrical and instrumentation components. Most of these materials are available from numerous suppliers worldwide, with some furnished under negotiated supply agreements. We anticipate being able to obtain these materials for the foreseeable future; however, the price, availability and scheduled deliveries offered by our suppliers may vary significantly from year to year due to various factors, including supplier consolidations, supplier raw material shortages, costs, surcharges, supplier capacity, customer demand, market conditions and any duties and tariffs imposed on the materials.

|

|

8 |

|

ITEM 1. BUSINESS

We use subcontractors where it assists us in meeting customer requirements with regard to resources, schedule, cost or technical expertise. These subcontractors may range from small local entities to companies with global capabilities, some of which may be utilized on a repetitive or preferred basis.

Employees

At December 31, 2019, we employed approximately 42,600 persons worldwide, comprised of approximately 14,400 salaried employees and approximately 28,200 hourly and craft employees. Our number of employees, particularly hourly and craft, varies in relation to the location, number and size of projects we have in process at any given time. To preserve our project management and technological expertise as core competencies, we continuously recruit and develop qualified personnel, and maintain ongoing training programs for all our key personnel.

The percentage of our employees represented by unions at December 31, 2019 was approximately 5% to 10%. We have agreements, which we customarily renew periodically, with various unions representing groups of employees at project sites and fabrication facilities in the U.S. and Canada and various other countries. We consider our relationships with our employees and the applicable labor unions to be satisfactory.

Patents and Licenses

We have numerous active patents and patent applications throughout the world, the majority of which are associated with technologies licensed by our Technology operating group. We continue to invest in research and development to ensure that our portfolio of patents remains competitive and we also acquire rights to technologies when we consider it advantageous for us to do so. However, no individual patent is so essential that its loss would materially affect our business.

Hazard Risks and Loss Control Systems

Our operations present risks of injury to or death of people, loss of or damage to property and damage to the environment. We conduct difficult and frequently precise operations in very challenging and dynamic locations. We have created loss control systems to assist us in the identification and treatment of the hazard risks presented by our operations, and we endeavor to make sure these systems are effective.

As loss control measures will not always be successful, we seek to establish various means of funding losses and liability related to incidents or occurrences. We primarily seek to do this through contractual protections, including waivers of consequential damages, indemnities, caps on liability, liquidated damage provisions and access to the insurance of other parties. We also procure insurance for certain potential losses or liabilities, operate our own “captive” insurance company or establish funded or unfunded reserves. In cases where we place insurance, we are subject to the credit worthiness of the relevant insurer(s), the available limits of the coverage, our retention under the relevant policy, exclusions in the policy and gaps in coverage. There can be no assurance that our insurance arrangements will adequately address all risks. See “Item 1A, Risk Factors—Risk Factors Relating to Our Business Operations—Our operations are subject to operating risks and limits on insurance coverage and contractual indemnity protections, which could expose us to potentially significant liabilities and costs.”

Our wholly owned “captive” insurance subsidiaries provide coverage for our retentions under employer’s liability, general and products liability, automotive liability and workers’ compensation insurance and, from time to time, builder’s risk and marine hull insurance within certain limits. We may also have business reasons in the future to arrange for our insurance subsidiary to insure other risks which we cannot or do not wish to transfer to outside insurance companies. Premiums charged and reserves related to these insurance programs are based on the facts and circumstances specific to historic losses, loss factors and the performance of the outside insurance market for the type of risk at issue. The actual outcome of insured claims could differ significantly from estimated amounts. We maintain actuarially determined accruals in our consolidated balance sheets to cover losses in our captive insurance programs. These accruals are based on certain assumptions developed utilizing historical data to project future losses. Loss estimates in the calculation of these accruals are adjusted as required based upon reported claims, actual claim payments and settlements and claim reserves. Claims as a result of our operations, if greater in frequency or severity than actuarially predicted, could adversely impact the ability of our captive insurance subsidiaries to respond to all claims presented.

|

|

9 |

|

ITEM 1. BUSINESS

Governmental Regulations and Environmental Matters

General

Many aspects of our operations and properties are affected by political developments and are subject to both domestic and foreign governmental regulations, including those relating to:

|

|

• |

constructing and equipping offshore production platforms and various onshore and offshore facilities; |

|

|

• |

workplace health and safety, including marine vessel safety; |

|

|

• |

the operation of foreign-flagged vessels in the coastal trade; |

|

|

• |

the Foreign Corrupt Practices Act and similar anti-corruption laws; |

|

|

• |

data privacy; |

|

|

• |

currency conversions and repatriation; |

|

|

• |

taxation of unremitted earnings and earnings of expatriate personnel; and |

|

|

• |

protecting the environment. |

In addition, we depend on the demand for certain of our services from the oil and gas industry and, therefore, are affected by changing taxes, price controls and other laws and regulations relating to the oil and gas industry generally. The adoption of laws and regulations curtailing offshore exploration and development drilling for oil and gas for environmental, economic and other policy reasons would adversely affect our operations by limiting demand for our services.

We are required by various governmental and quasi-governmental agencies to obtain certain permits, licenses and certificates with respect to our operations.

The exploration and development of oil and gas properties on the continental shelf of the United States is regulated primarily under the U.S. Outer Continental Shelf Lands Act and related regulations. These laws require the construction, operation and removal of offshore production facilities located on the outer continental shelf of the United States to meet stringent engineering and construction specifications. Similar regulations govern the plugging and abandoning of wells located on the outer continental shelf of the United States and the removal of all production facilities. Violations of regulations issued pursuant to the U.S. Outer Continental Shelf Lands Act and related laws can result in substantial civil and criminal penalties, as well as injunctions curtailing operations.

We cannot determine the extent to which new legislation, new regulations or changes in existing laws or regulations may affect our future operations.

Environmental

Our operations and properties are subject to a wide variety of increasingly complex and stringent foreign, federal, state and local environmental laws and regulations, including those governing discharges into the air and water, the handling and disposal of solid and hazardous wastes, the remediation of soil and groundwater contaminated by hazardous substances and the health and safety of employees. Sanctions for noncompliance may include revocation of permits, corrective action orders, administrative or civil penalties and criminal prosecution. Some environmental laws provide for strict, joint and several liability for remediation of spills and other releases of hazardous substances, as well as damage to natural resources. In addition, companies may be subject to claims alleging personal injury or property damage as a result of alleged exposure to hazardous substances. Such laws and regulations may also expose us to liability for the conduct of or conditions caused by others or for our acts that were in compliance with all applicable laws at the time such acts were performed.

These laws and regulations include the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended (“CERCLA”), the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act and similar laws that provide for responses to, and liability for, releases of hazardous substances into the environment. These laws and regulations also include similar foreign, state or local counterparts to these federal laws, which regulate air emissions, water discharges and hazardous substances and waste management and disposal, and require public disclosure related to the use of various hazardous substances. Our operations are also governed by laws and regulations relating to workplace safety and worker health, including, in the United States, the Occupational Safety and Health Act and regulations promulgated thereunder.

|

|

10 |

|

ITEM 1. BUSINESS

In addition, offshore construction and drilling in some areas have been opposed by environmental groups and, in some areas, have been restricted. To the extent laws are enacted or other governmental actions are taken that prohibit or restrict offshore construction and drilling or impose environmental protection requirements that result in increased costs to the oil and gas industry in general and the offshore construction industry in particular, our business and prospects could be adversely affected.

We have been identified as a potentially responsible party at various cleanup sites under the CERCLA. CERCLA and other environmental laws can impose liability for the entire cost of cleanup on any of the potentially responsible parties, regardless of fault or the lawfulness of the original conduct.

In connection with the historical operation of our facilities, including those associated with acquired operations, substances which currently are or might be considered hazardous were used or disposed of at some sites that will or may require us to make expenditures for remediation. In addition, we have agreed to indemnify parties from whom we have purchased or to whom we have sold facilities for certain environmental liabilities arising from acts occurring before the dates those facilities were transferred. Generally, however, where there are multiple responsible parties, a final allocation of costs is made based on the amount and type of wastes disposed of by each party and the number of financially viable parties, although this may not be the case with respect to any particular site. We have not been determined to be a major contributor of waste to any of these sites. On the basis of our relative contribution of waste to each site, we expect our share of the ultimate liability for the various sites will not have a material adverse effect on our consolidated financial condition, results of operations or cash flows in any given year.

We believe we are in compliance, in all material respects, with applicable environmental laws and regulations and maintain insurance coverage to mitigate our exposure to environmental liabilities. We do not anticipate we will incur material capital expenditures for environmental control facilities or for the investigation or remediation of environmental conditions during 2020 or 2021. As of December 31, 2019, we had no environmental reserve recorded. See Note 23, Commitments and Contingencies, to the accompanying Consolidated Financial Statements for additional information.

Cautionary Statement Concerning Forward-Looking Statements

We are including the following discussion to inform our existing and potential security holders generally of some of the risks and uncertainties that can affect our company and to take advantage of the “safe harbor” protection for forward-looking statements that applicable federal securities law affords.

From time to time, our management or persons acting on our behalf make “forward-looking statements,” within the meaning of the Private Securities Litigation Reform Act of 1995, to inform existing and potential security holders about our company. These statements may include projections and estimates concerning the scope, execution, timing and success of specific projects and our future remaining performance obligations (“RPOs”), revenues, income and capital spending. Forward-looking statements are generally accompanied by words such as “achieve,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “strategy” or other words that convey the uncertainty of future events or outcomes. Sometimes we will specifically describe a statement as being a forward-looking statement and refer to this cautionary statement.

In addition, various statements in this report, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. Those forward-looking statements appear in Item 1, Business, and Item 3, Legal Proceedings, in Part I of this report and in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and in the Notes to our Consolidated Financial Statements and elsewhere in this report.

These forward-looking statements include, but are not limited to, statements that relate to, or statements that are subject to risks, contingencies or uncertainties that relate to:

|

|

• |

expectations relating to the duration, effects and ultimate outcome of the Chapter 11 cases; |

|

|

• |

the adequacy of our sources of liquidity and capital resources, including after entering into the DIP Credit Agreement and after completing the Exit Facilities; |

|

|

• |

future levels of revenues, operating margins, operating income (loss), cash flows, net income (loss) or earnings (loss) per share; |

|

|

• |

the outcome of project awards and scope, execution and timing of specific projects, including timing to complete and cost to complete these projects; |

|

|

11 |

|

ITEM 1. BUSINESS

|

|

• |

future project activities, including the commencement and subsequent timing of, and the success of, operational activities on specific projects, and the ability of projects to generate sufficient revenues to cover our fixed costs; |

|

|

• |

estimates of revenues over time and contract profits or losses; |

|

|

• |

expectations regarding the acquisition or divestiture of assets, including the completion of the Lummus Technology sale and the sale of the remaining portion of our pipe fabrication business and the timing of, and use of proceeds from, those transactions; |

|

|

• |

anticipated levels of demand for our products and services; |

|

|

• |

global demand for oil and gas and fundamentals of the oil and gas industry; |

|

|

• |

expectations regarding offshore development of oil and gas; |

|

|

• |

market outlook for the EPCI market; |

|

|

• |

expectations regarding cash flows from operating activities; |

|

|

• |

expectations regarding RPOs; |

|

|

• |

future levels of capital, environmental or maintenance expenditures; |

|

|

• |

the success or timing of completion of ongoing or anticipated capital or maintenance projects; |

|

|

• |

the adequacy of our sources of liquidity and capital resources; |

|

|

• |

the ability to alleviate substantial doubt regarding our ability to continue as a going concern; |

|

|

• |

the impact of the NYSE delisting of our common stock on the liquidity and market price of our common stock; |

|

|

• |

interest expense; |

|

|

• |

the effectiveness of our derivative contracts in mitigating foreign currency and interest rate risks; |

|

|

• |

results of our capital investment program; |

|

|

• |

the impact of U.S. and non-U.S. tax law changes; |

|

|

• |

the potential effects of judicial or other proceedings on our business, financial condition, results of operations and cash flows; and |

|

|

• |

the anticipated effects of actions of third parties such as competitors, or federal, foreign, state or local regulatory authorities, or plaintiffs in litigation. |

These forward-looking statements speak only as of the date of this report; we disclaim any obligation to update these statements unless required by securities law, and we caution you not to rely on them unduly. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks, contingencies and uncertainties relate to, among other matters, the following:

|

|

• |

risks and uncertainties relating to the Chapter 11 Cases, including, but not limited to: |

|

|

• |

our ability to obtain the Bankruptcy Court’s approval with respect to motions or other requests made to the Bankruptcy Court in the Chapter 11 Cases, including maintaining strategic control as debtor-in-possession; |

|

|

• |

our ability to retain the exclusive right to propose a Plan of Reorganization and our ability to achieve confirmation of such plan; |

|

|

• |

the effects of the Chapter 11 Cases on us and our various constituents, including our stockholders; |

|

|

• |

Bankruptcy Court rulings in the Chapter 11 Cases as well as the outcome of all other pending litigation and the outcome of the Chapter 11 Cases in general; |

|

|

• |

third-party motions in the Chapter 11 Cases, which may interfere with our ability to consummate the Plan of Reorganization; |

|

|

12 |

|

ITEM 1. BUSINESS

|

|

• |

uncertainties and risks associated with the completion of the Lummus Technology sale, which is a condition to consummation of the Plan of Reorganization; |

|

|

• |

our ability to maintain relationships with suppliers, customers, employees and other third parties as a result of the Chapter 11 Cases; |

|

|

• |

the length of time we will operate under the Chapter 11 Cases; |

|

|

• |

attendant risks associated with restrictions on our ability to pursue some of our business strategies; |

|

|

• |

the potential adverse effects of the Chapter 11 Cases on our liquidity and results of operations; |

|

|

• |

the potential adverse effects of the Chapter 11 Cases on our access to capital resources, including our continuing access to bilateral letter of credit facilities; |

|

|

• |

the cancellation of our common stock in the Chapter 11 Cases; |

|

|

• |

the impact of the NYSE delisting of our common stock on the liquidity and market price of our common stock; |

|

|

• |

the potential material adverse effect of claims that are not discharged in the Chapter 11 Cases; |

|

|

• |

uncertainties regarding our ability to retain key personnel; |

|

|

• |

uncertainties regarding the reactions of our customers, subcontractors, prospective customers, suppliers and service providers to the Chapter 11 Cases; and |

|

|

• |

uncertainties and continuing risks associated with our ability to achieve our stated goals and continue as a going concern; |

|

|

• |

general economic and business conditions and industry trends; |

|

|

• |

general developments in the industries in which we are involved; |

|

|

• |

the volatility of oil and gas prices; |

|

|

• |

decisions about capital investment to be made by oil and gas companies and other participants in the energy and natural resource industries, demand from which is the largest component of our revenues; |

|

|

• |

other factors affecting future levels of demand, including investments across the natural gas value chain, including LNG and petrochemicals, investments in power and petrochemical facilities and investments in various types of facilities that require storage structures and pre-fabricated pipe; |

|

|

• |

the highly competitive nature of the businesses in which we are engaged; |

|

|

• |

uncertainties as to timing and funding of new contract awards; |

|

|

• |

our ability to appropriately bid, estimate and effectively perform projects on time, in accordance with the schedules established by the applicable contracts with customers; |

|

|

• |

changes in project design or schedule; |

|

|

• |

changes in scope or timing of work to be completed under contracts; |

|

|

• |

cost overruns on fixed-price or similar contracts or failure to receive timely or proper payments on cost-reimbursable contracts, whether as a result of improper estimates, performance, disputes or otherwise; |

|

|

• |

changes in the costs or availability of, or delivery schedule for, equipment, components, materials, labor or subcontractors; |

|

|

• |

risks associated with labor productivity; |

|

|

• |

cancellations of contracts, change orders and other modifications and related adjustments to RPOs and the resulting impact from using RPOs as an indicator of future revenues or earnings; |

|

|

• |

the collectability of amounts reflected in change orders and claims relating to work previously performed on contracts; |

|

|

• |

our ability to settle or negotiate unapproved change orders and claims and estimates regarding liquidated damages; |

|

|

• |

the capital investment required to construct new-build vessels and maintain and/or upgrade our existing fleet of vessels; |

|

|

• |

the ability of our suppliers and subcontractors to deliver raw materials in sufficient quantities and/or perform in a timely manner; |

|

|

13 |

|

ITEM 1. BUSINESS

|

|

• |

volatility and uncertainty of the credit markets; |

|

|

• |

our ability to comply with covenants in our credit agreements and other debt instruments and the availability, terms and deployment of capital; |

|

|

• |

the unfunded liabilities of our pension and other post-retirement plans, which may negatively impact our liquidity and, depending upon future operations, may impact our ability to fund our pension obligations; |

|

|

• |

the continued availability of qualified personnel; |

|

|

• |

the operating risks normally incident to our lines of business, which could lead to increased costs and affect the quality, costs or availability of, or delivery schedule for, equipment, components, materials, labor or subcontractors and give rise to contractually imposed liquidated damages; |

|

|

• |

natural or man-caused disruptive events that could damage our facilities, equipment or our work-in-progress and cause us to incur losses and/or liabilities; |

|

|

• |

equipment failure; |

|

|

• |

changes in, or our failure or inability to comply with, government regulations; |

|

|

• |

adverse outcomes from legal and regulatory proceedings; |

|

|

• |

impact of potential regional, national and/or global requirements to significantly limit or reduce greenhouse gas and other emissions in the future; |

|

|

• |

changes in, and liabilities relating to, existing or future environmental regulatory matters; |

|

|

• |

changes in U.S. and non-U.S. tax laws or regulations; |

|

|

• |

the continued competitiveness and availability of, and continued demand and legal protection for, our intellectual property assets or rights, including the ability of our patents or licensed technologies to perform as expected and to remain competitive, current, in demand, profitable and enforceable; |

|

|

• |

our ability to keep pace with rapid technological changes or innovations; |

|

|

• |

the risk that we may not be successful in updating and replacing current information technology and the risks associated with information technology systems interruptions and cybersecurity threats; |

|

|

• |

the risks associated with failures to protect data privacy in accordance with applicable legal requirements and contractual provisions binding upon us; |

|

|

• |

difficulties we may encounter in obtaining regulatory or other necessary approvals of any strategic transactions; |

|

|

• |

the risks associated with negotiating divestitures of assets with third parties; |

|

|

• |

the risks associated with integrating acquired businesses; |

|

|

• |

the risks associated with forming and operating joint ventures, including exposure to joint and several liability for failures in performance by our co-venturers; |

|

|

• |

social, political and economic situations in countries where we do business; |

|

|

• |

the risks associated with our international operations, including risks relating to local content or similar requirements; |

|

|

• |

the consequences of significant changes in foreign currency and interest rate risks and our ability to manage or obtain adequate hedge arrangements for those or similar risks; |

|

|

• |

interference from adverse weather or sea conditions; |

|

|

• |

the possibilities of war, other armed conflicts or terrorist attacks; |

|

|

• |

the effects of asserted and unasserted claims and the extent of available insurance coverages; |

|

|

• |

our ability to obtain surety bonds, letters of credit and new financing arrangements; |

|

|

• |

our ability to maintain builder’s risk, liability, property and other insurance in amounts and on terms we consider adequate and at rates that we consider economical; |

|

|

14 |

|

ITEM 1. BUSINESS

|

|

• |

the aggregated risks retained in our captive insurance subsidiaries; and |

|

|

• |

the impact of the loss of insurance rights as part of the Chapter 11 Bankruptcy settlement concluded in 2006 involving several of our former subsidiaries. |

We believe the items we have outlined above are important factors that could cause estimates in our consolidated financial statements to differ materially from actual results and those expressed in a forward-looking statement made in this report or elsewhere by us or on our behalf. We have discussed many of these factors in more detail elsewhere in this report, including those mentioned under the caption “Risk Factors.” These factors are not necessarily all the factors that could affect us. Unpredictable or unanticipated factors we have not discussed in this report could also have material adverse effects on actual results of matters that are the subject of our forward-looking statements. We do not intend to update our description of important factors each time a potential important factor arises, except as required by applicable securities laws and regulations. We advise our security holders that they should (1) be aware that factors not referred to above could affect the accuracy of our forward-looking statements and (2) use caution and common sense when considering our forward-looking statements.

Available Information

Our website address is www.mcdermott.com. We make available through the Investors section of this website under “Financial Information,” free of charge, our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, statements of beneficial ownership of securities on Forms 3, 4 and 5 and amendments to those reports as soon as reasonably practicable after we electronically file those materials with, or furnish those materials to, the Securities and Exchange Commission (the “SEC”). In addition, the SEC maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. We have also posted on our website our: Corporate Governance Guidelines; Code of Ethics for our Chief Executive Officer and Senior Financial Officers; Board of Directors Conflicts of Interest Policies and Procedures; Officers, Board Members and Contact Information; Amended and Restated Articles of Incorporation; Amended and Restated By-laws; and charters for the Audit, Compensation and Governance Committees of our Board.

Use of our Website to Distribute Material Company Information

In accordance with guidance provided by the SEC regarding use by a company of its website as a means to disclose material information to investors and to comply with its disclosure obligations under SEC Regulation FD, we hereby notify investors, the media and other interested parties that we intend to continue to use our website at www.mcdermott.com to publish important information about McDermott, including information that may be deemed material to investors. We routinely post on our website important information, including press releases, investor presentations and financial information, which may be accessed by clicking on the Investors section of our website. We also use our website to expedite public access to time-critical information regarding our company in advance of or in lieu of distributing a press release or a filing with the SEC disclosing the same information. We therefore encourage investors, the media, and other interested parties to review the information posted on our website as described above, in addition to information announced through our SEC filings, press releases and public conference calls and webcasts.

|

|

15 |

|

ITEM 1A. RISK FACTORS

|

Item 1A. |

RISK FACTORS |