Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

McDermott International, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

|

|

McDermott International, Inc. | |

| David Dickson |

757 N. Eldridge Pkwy. | |

| President and Chief Executive Officer |

Houston, Texas 77079 | |

March 27, 2015

Dear Stockholder:

You are cordially invited to attend this year’s Annual Meeting of Stockholders of McDermott International, Inc., which will be held on Friday, May 8, 2015, at The Westin Houston Hotel, 945 Gessner Road, Houston, Texas 77024, commencing at 10:00 a.m., local time. The notice of Annual Meeting and proxy statement following this letter describe the matters to be acted on at the meeting.

McDermott is utilizing the Securities and Exchange Commission’s Notice and Access proxy rule, which allows companies to furnish proxy materials via the Internet as an alternative to the traditional approach of mailing a printed set to each stockholder. In accordance with these rules, we have sent a Notice of Internet Availability of Proxy Materials to all stockholders who have not previously elected to receive a printed set of proxy materials. The Notice contains instructions on how to access our 2015 Proxy Statement and Annual Report to Stockholders, as well as how to vote either online, by telephone or in person at the 2015 Annual Meeting.

It is very important that your shares are represented and voted at the Annual Meeting. Please vote your shares by Internet or telephone, or, if you received a printed set of materials by mail, by returning the accompanying proxy card, as soon as possible to ensure that your shares are voted at the meeting. Further instructions on how to vote your shares can be found in our Proxy Statement.

Thank you for your support of our company.

Sincerely yours,

DAVID DICKSON

YOUR VOTE IS IMPORTANT.

Whether or not you plan to attend the meeting, please take a few minutes now to vote your shares.

Table of Contents

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on May 8, 2015.

The proxy statement and annual report are available on the Internet at www.proxyvote.com.

The following information applicable to the Annual Meeting may be found in the proxy statement and accompanying proxy card:

| • | The date, time and location of the meeting; |

| • | A list of the matters intended to be acted on and our recommendations regarding those matters; |

| • | Any control/identification numbers that you need to access your proxy card; and |

| • | Information about attending the meeting and voting in person. |

Table of Contents

McDERMOTT INTERNATIONAL, INC.

757 N. Eldridge Pkwy.

Houston, Texas 77079

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS

| Time and Location |

10:00 a.m., local time, on Friday, May 8, 2015 |

| The Westin Houston Hotel |

| 945 Gessner Road |

| Houston, Texas 77024 |

| Items of Business |

1. | To elect eight members to our Board of Directors, each for a term of one year. |

| 2. | To conduct an advisory vote to approve named executive officer compensation. |

| 3. | To ratify our Audit Committee’s appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2015. |

| 4. | To transact such other business that properly comes before the meeting or any adjournment thereof. |

| Record Date |

You are entitled to vote if you were a stockholder of record at the close of business on March 12, 2015. |

| Notice and Access |

Instead of mailing a printed copy of our proxy materials, including our Annual Report, to each stockholder of record, we are providing access to these materials via the Internet. This reduces the amount of paper necessary to produce these materials, as well as the costs associated with mailing these materials to all stockholders. Accordingly, on March 27, 2015, we began mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record as of March 12, 2015, and posted our proxy materials on the Web site referenced in the Notice (www.proxyvote.com). As more fully described in the Notice, all stockholders may choose to access our proxy materials on the Web site referred to in the Notice and/or may request a printed set of our proxy materials. In addition, the Notice and Web site provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. |

| Proxy Voting |

Your vote is important. Please vote your proxy promptly so your shares can be represented, even if you plan to attend the Annual Meeting. You can vote by Internet, by telephone, or by requesting a printed copy of the proxy materials and using the proxy card enclosed with the printed materials. |

| Meeting Admission |

Attendance at the meeting is limited to stockholders and beneficial owners as of the record date or duly appointed proxies. No guests will be admitted, except for guests invited by McDermott. Registration will begin at 9:00 a.m., and the meeting will begin promptly at 10:00 a.m. If your shares are held in “street name” through a broker, bank, trustee or other nominee, you are a beneficial owner, and beneficial owners will need to show proof of beneficial ownership, such as a copy of a brokerage account statement, reflecting stock ownership as of the record date in order to be admitted to the meeting. If you are a proxy holder for a stockholder, you will need to bring a validly executed proxy naming you as the proxy holder, together with proof of record ownership of the stockholder naming you as proxy holder. Please note that you may be asked to present valid photo identification, such as a valid driver’s license or passport, when you check in for registration. No cameras, recording equipment or other electronic devices will be allowed to be brought into the meeting room by stockholders or beneficial owners. |

By Order of the Board of Directors,

LIANE K. HINRICHS

Secretary

March 27, 2015

Table of Contents

PROXY STATEMENT FOR

2015 ANNUAL MEETING OF STOCKHOLDERS

| Page | ||||

| i | ||||

| Questions and Answers about the Annual Meeting of Stockholders and Voting |

1 | |||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 19 | ||||

| 26 | ||||

| 26 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 39 | ||||

| 42 | ||||

| 45 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

| 51 | ||||

| 52 | ||||

| 54 | ||||

| 55 | ||||

| 57 | ||||

| 58 | ||||

| 64 | ||||

| 66 | ||||

| 67 | ||||

| 69 | ||||

| 70 | ||||

| 71 | ||||

| 71 | ||||

| 72 | ||||

Table of Contents

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully. As used in this proxy statement, unless the context otherwise indicates or requires, references to “McDermott,” “we,” “us,” and “our” mean McDermott International, Inc. and its consolidated subsidiaries.

Annual Meeting of Stockholders

| • Time and Date: |

10:00 a.m., local time, May 8, 2015 | |

| • Place: |

The Westin Houston Hotel 945 Gessner Road Houston, Texas 77024 | |

| • Record Date: |

March 12, 2015 | |

| • Voting: |

Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. |

Items of Business for the Annual Meeting

| Item of Business | Board Vote Recommendation |

Page Reference | ||

| 1. Election of directors |

FOR Each Director Nominee |

6 | ||

| 2. Advisory vote to approve named executive officer compensation |

FOR | 64 | ||

| 3. Ratification of Deloitte & Touche LLP as auditor for 2015 |

FOR | 67 | ||

Your vote is important. Please vote your proxy promptly so your shares can be represented, even if you plan to attend the Annual Meeting. Stockholders of record can vote by Internet, by telephone, or by requesting a printed copy of the proxy materials and using the proxy card enclosed with the printed materials.

Item 1 — Election of Directors

The Board of Directors has nominated eight candidates, each for a one-year term. Our Board of Directors recommends that stockholders vote “For” each of the nominees named below.

| Name | Age | Director Since |

Independent | Committee Memberships | ||||||||||||||||

| Audit | Compensation | Finance | Governance | |||||||||||||||||

| John F. Bookout, III |

61 | 2006 | X | X | X | |||||||||||||||

| Roger A. Brown |

70 | 2005 | X | X | X | |||||||||||||||

| David Dickson |

47 | 2013 | ||||||||||||||||||

| Stephen G. Hanks |

64 | 2009 | X | X | Chairman | |||||||||||||||

| Gary P. Luquette |

59 | 2013 | X | X | ||||||||||||||||

| William H. Schumann, III |

64 | 2012 | X | Chairman | X | |||||||||||||||

| Mary L. Shafer-Malicki |

54 | 2011 | X | Chairman | X | |||||||||||||||

| David A. Trice |

67 | 2009 | X | X | Chairman | |||||||||||||||

i

Table of Contents

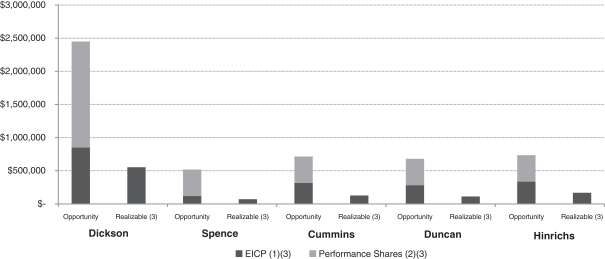

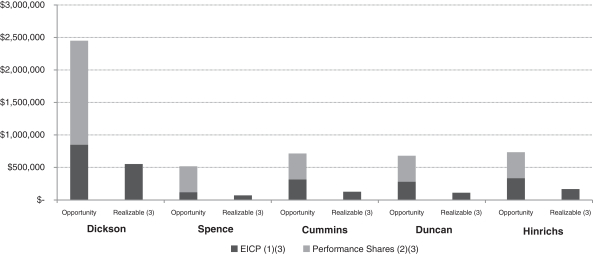

2014 Compensation Program and Realizable Value of Performance-Based Awards

As in prior years, the Compensation Committee continued to believe that a significant portion of a 2014 Named Executive Officer’s (“NEO’s”) compensation should be performance-based, designed for the purpose of aligning the interests of our NEOs with those of stockholders by rewarding performance that meets or exceeds established goals, with the ultimate objective of increasing stockholder value. Following an operating loss in 2013, a challenging outlook for 2014 and the anticipated need for significant strategic and operational actions to commence the turnaround of our business, the Compensation Committee implemented several changes to McDermott’s compensation programs for 2014. Those changes took into consideration our need for the 2014 compensation arrangements to attract, develop, retain and motivate the NEOs and other executive officers during our turnaround efforts, including challenges associated with stabilizing our company, delivering improved financial and operational performance and repositioning McDermott for long-term growth.

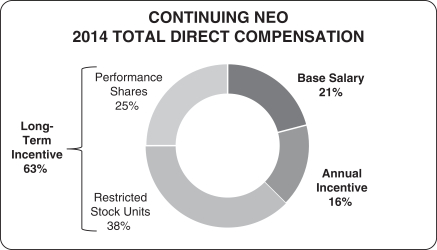

Reflecting the Compensation Committee’s philosophy and these considerations, compensation arrangements in 2014 provided for the continuing use of three elements of target total direct compensation:

| • | annual base salary; |

| • | annual incentive, with performance metrics under our Executive Incentive Compensation Plan, or EICP, designed to align with near-term operational priorities, composed entirely of performance-based compensation; and |

| • | long-term incentive, or LTI, with emphasis on restricted stock units to provide stability and support the retention of key employees during the organizational and leadership transition. |

McDermott’s financial performance resulted in revenues for the year ended December 31, 2014 of $2.3 billion, operating income of $8.6 million and year end backlog of $3.6 billion. Notwithstanding the significant improvement in performance over the financial results achieved for the year ended December 31, 2013, this performance, in accordance with our Compensation Committee’s philosophy and program, and based on the value of our common stock at year end, resulted in:

| • | Financial performance under the EICP that (as per the EICP) would have resulted in bonus pool funding of 1.015x. This amount was, following the recommendation of executive management (with consideration of our non-attainment of the threshold level for the order intake component of the financial performance goals), reduced by over 50% by the Compensation Committee, through the exercise of its discretion, to funding of 0.5x. |

| • | NEO performance shares granted in 2011, 2012, 2013 and 2014 having no realizable value as of December 31, 2014. |

ii

Table of Contents

The following table summarizes the 2014 performance-based compensation opportunities, as compared to the realizable values of such opportunities as of December 31, 2014, for each of our NEOs:

2014 Performance-Based Compensation Opportunity vs.

Realizable Value as of December 31, 2014

| (1) | Opportunity values for EICP are presented using the NEOs’ target EICP award levels. |

| (2) | Opportunity values for performance shares are presented using the grant date fair value of the respective awards. |

| (3) | The 2014 realizable values shown above are measured as of December 31, 2014. The realizable value of EICP awards shown above is based on each NEO’s actual earned EICP award. The realizable value of performance share awards shown above is based on the estimated payout as a percent of target based upon an extrapolation of 2014 operating income of $8.6 million over the three-year performance period, or 0% of the performance shares granted in 2014, multiplied by the closing price of our common stock as reported on the NYSE as of December 31, 2014 ($2.91). This value does not take into account our forecast or expectations for actual performance over the three-year performance period. The number of the performance shares granted in 2014 that ultimately vest, if any, will be determined by reference to performance goals over a three-year period and may be more or less than indicated in the table. The vesting of any of these performance shares would impact the future realizable value of these performance share awards. |

Compensation and Corporate Governance Policies and Procedures

The Board has implemented several policies and structures that we believe are “best practices” in corporate governance, including:

| • | Separating the Chairman of the Board and Chief Executive Officer roles; |

| • | Holding Board meeting executive sessions with independent directors only present; |

| • | Maintaining minimum stock ownership guidelines applicable to directors and executive officers; |

| • | Approving a policy prohibiting all directors, officers and employees from engaging in “short sales” or trading in puts, calls or other options on McDermott’s common stock, and from engaging in hedging transactions and from holding McDermott shares in a margin account or pledging McDermott shares as collateral for a loan; |

| • | Eliminating excise tax gross-ups; and |

| • | The Compensation Committee of the Board of Directors engaging Pay Governance LLC, an independent executive compensation consultant. |

iii

Table of Contents

Item 2 — Advisory Vote to Approve Named Executive Officer Compensation

Our stockholders have the opportunity to cast a non-binding advisory vote on the compensation of our named executive officers. Last year, over 86% of the votes cast on this proposal were in favor of our executive compensation program. We recommend that you review our Compensation Discussion and Analysis beginning on page 26, which explains in greater detail the philosophy of the Compensation Committee and its actions and decisions during 2014 regarding our compensation programs.

Our Board of Directors recommends that stockholders vote “For” the advisory vote to approve named executive officer compensation.

Item 3 — Ratification of Appointment of Deloitte & Touche LLP as Auditors

Our Board of Directors has ratified our Audit Committee’s appointment of Deloitte & Touche LLP as McDermott’s independent registered public accounting firm for the year ending December 31, 2015, and as a matter of good governance, we are seeking stockholder ratification of this appointment.

Our Board of Directors recommends that stockholders vote “For” the ratification of Deloitte & Touche LLP as McDermott’s independent registered public accounting firm for the year ending December 31, 2015.

Communicating with the Board of Directors

Stockholders or other interested persons may send written communications to the independent members of our Board, addressed to Board of Directors (independent members), c/o McDermott International, Inc., Corporate Secretary’s Office, 757 N. Eldridge Pkwy., Houston, Texas 77079.

iv

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE

ANNUAL MEETING OF STOCKHOLDERS AND VOTING

What is the purpose of these proxy materials?

As more fully described in the Notice, the Board of Directors of McDermott International, Inc. (“McDermott”) has made these materials available to you in connection with our 2015 Annual Meeting of Stockholders, which will take place on May 8, 2015 at 10:00 a.m., local time (the “Annual Meeting” or “Meeting”). We mailed the Notice to our stockholders beginning on March 27, 2015, and our proxy materials were posted on the Web site referenced in the Notice on that same date.

McDermott, on behalf of its Board of Directors, is soliciting your proxy to vote your shares at the 2015 Annual Meeting of Stockholders. We solicit proxies to give all stockholders of record an opportunity to vote on matters that will be presented at the Annual Meeting. In this proxy statement you will find information on these matters, which is provided to assist you in voting your shares.

Who will pay for the cost of this proxy solicitation?

We will bear all expenses incurred in connection with this proxy solicitation, which we expect to conduct primarily by mail. We have engaged The Proxy Advisory Group, LLC to assist in the solicitation for a fee that will not exceed $12,500, plus out-of-pocket expenses. In addition, our officers and regular employees may solicit your proxy by telephone, by facsimile transmission or in person, for which they will not be separately compensated. If your shares are held through a broker or other nominee (i.e., in “street name”) and you have requested printed versions of these materials, we have requested that your broker or nominee forward this proxy statement to you and obtain your voting instructions, for which we will reimburse them for reasonable out-of-pocket expenses. If your shares are held through the McDermott Thrift Plan and you have requested printed versions of these materials, the trustee of that plan has sent you this proxy statement and you can instruct the trustee on how to vote your plan shares.

Who is entitled to vote at, and who may attend, the Annual Meeting?

Our Board of Directors selected March 12, 2015 as the record date (the “Record Date”) for determining stockholders entitled to vote at the Annual Meeting. This means that if you owned McDermott common stock on the Record Date, you may vote your shares on the matters to be considered by our stockholders at the Annual Meeting.

There were 238,476,018 shares of our common stock outstanding on the Record Date. Each outstanding share of common stock entitles its holder to one vote on each matter to be acted on at the meeting.

Attendance at the meeting is limited to stockholders and beneficial owners as of the Record Date or duly appointed proxies. No guests will be admitted, except for guests invited by McDermott. Registration will begin at 9:00 a.m., and the meeting will begin promptly at 10:00 a.m. If your shares are held in “street name” through a broker, bank, trustee or other nominee, you are a beneficial owner, and beneficial owners will need to show proof of beneficial ownership, such as a copy of a brokerage account statement, reflecting stock ownership as of the Record Date in order to be admitted to the meeting. If you are a proxy holder for a stockholder, you will need to bring a validly executed proxy naming you as the proxy holder, together with proof of record ownership of the stockholder naming you as proxy holder. Please note that you may be asked to present valid photo identification, such as a valid driver’s license or passport, when you check in for registration. No cameras, recording equipment or other electronic devices will be allowed to be brought into the meeting room by stockholders or beneficial owners.

1

Table of Contents

What is the difference between holding shares as a stockholder of record and as a beneficial owner through a brokerage account or other arrangement with a holder of record?

If your shares are registered in your name with McDermott’s transfer agent and registrar, Computershare Trust Company, N.A., you are the “stockholder of record” of those shares. The Notice and the proxy materials have been provided or made available directly to you by McDermott.

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” but not the holder of record of those shares, and the Notice and the proxy materials have been forwarded to you by your broker, bank or other holder of record. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote your shares by using the voting instruction card or by following their instructions for voting by telephone or on the Internet.

How do I cast my vote?

Most stockholders can vote by proxy in three ways:

| • | by Internet at www.proxyvote.com; |

| • | by telephone; or |

| • | by mail. |

If you are a stockholder of record, you can vote your shares in person at the Annual Meeting or vote now by giving us your proxy via Internet, telephone or mail. You may give us your proxy by following the instructions included in the Notice or, if you received a printed version of these proxy materials, in the enclosed proxy card. If you want to vote by mail but have not received a printed version of these proxy materials, you may request a full packet of proxy materials by following the instructions in the Notice. If you vote using either the telephone or the Internet, you will save us mailing expense.

By giving us your proxy, you will be directing us how to vote your shares at the meeting. Even if you plan on attending the meeting, we urge you to vote now by giving us your proxy. This will ensure that your vote is represented at the meeting. If you do attend the meeting, you can change your vote at that time, if you then desire to do so.

If you are the beneficial owner of shares, but not the holder of record, you should refer to the instructions provided by your broker or nominee for further information. The broker or nominee that holds your shares has the authority to vote them, absent your approval, only as to matters for which they have discretionary authority under the applicable New York Stock Exchange (“NYSE”) rules. Neither the election of directors nor the advisory vote to approve named executive officer compensation are considered routine matters. That means that brokers may not vote your shares with respect to those matters if you have not given your broker specific instructions as to how to vote. Please be sure to give specific voting instructions to your broker.

If you received a printed version of these proxy materials, you should have received a voting instruction form from your broker or nominee that holds your shares. For shares of which you are the beneficial owner but not the holder of record, follow the instructions contained in the Notice or voting instruction form to vote by Internet, telephone or mail. If you want to vote by mail but have not received a printed version of these proxy materials, you may request a full packet of proxy materials as instructed by the Notice. If you want to vote your shares in person at the Annual Meeting, you must obtain a valid proxy from your broker or nominee. You should contact your broker or nominee or refer to the instructions provided by your broker or nominee for further information. Additionally, the availability of telephone or Internet voting depends on the voting process used by the broker or nominee that holds your shares.

2

Table of Contents

Why did I receive more than one Notice or proxy statement and proxy card or voting instruction form?

You may receive more than one Notice, proxy statement, proxy card or voting instruction form if your shares are held through more than one account (e.g., through different brokers or nominees). Each proxy card or voting instruction form only covers those shares of common stock held in the applicable account. If you hold shares in more than one account, you will have to provide voting instructions as to each of your accounts in order to vote all your shares.

What can I do if I change my mind after I vote?

If you are a stockholder of record, you may change your vote by written notice to our Corporate Secretary, by granting a new proxy before the Annual Meeting or by voting in person at the Annual Meeting. Unless you attend the meeting and vote your shares in person, you should change your vote before the meeting using the same method (by Internet, telephone or mail) that you first used to vote your shares. That way, the inspectors of election for the meeting will be able to verify your latest vote.

If you are the beneficial owner, but not the holder of record, of shares, you should follow the instructions in the information provided by your broker or nominee to change your vote before the meeting. If you want to change your vote as to shares of which you are the beneficial owner by voting in person at the Annual Meeting, you must obtain a valid proxy from the broker or nominee that holds those shares for you.

What is a broker non-vote?

If you are a beneficial owner whose shares are held of record by a broker or other holder of record, you must instruct the broker or other holder of record how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any proposal on which the broker does not have discretionary authority to vote. This is called a “broker non-vote.” In these cases, the broker or other holder of record can include your shares as being present at the Annual Meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required under the rules of the NYSE.

For this Annual Meeting, if you are a beneficial owner whose shares are held by a broker or other holder of record, your broker or other holder of record has discretionary voting authority under NYSE rules to vote your shares on the ratification of Deloitte & Touche LLP (“Deloitte”), even if it has not received voting instructions from you. However, such holder does not have discretionary authority to vote on the election of directors or the advisory vote to approve named executive officer compensation without instructions from you, in which case a broker non-vote will result and your shares will not be voted on those matters.

What is the quorum for the Annual Meeting?

The Annual Meeting will be held only if a quorum exists. The presence at the meeting, in person or by proxy, of holders of a majority of our outstanding shares of common stock as of the Record Date will constitute a quorum. If you attend the meeting or vote your shares by Internet, telephone or mail, your shares will be counted toward a quorum, even if you abstain from voting on a particular matter. Broker non-votes will be treated as present for the purpose of determining a quorum.

3

Table of Contents

Which items will be voted on at the Annual Meeting?

At the Annual Meeting, we are asking you to vote on the following:

| • | the election of John F. Bookout, III, Roger A. Brown, David Dickson, Stephen G. Hanks, Gary P. Luquette, William H. Schumann, III, Mary L. Shafer-Malicki and David A. Trice to our Board of Directors, each for a term of one year; |

| • | the advisory vote to approve named executive officer compensation; and |

| • | the ratification of our Audit Committee’s appointment of Deloitte as our independent registered public accounting firm for the year ending December 31, 2015. |

We are not aware of any other matters that may be presented or acted on at the Annual Meeting. If you vote by signing and returning the enclosed proxy card or using the telephone or Internet voting procedures, the individuals named as proxies on the card may vote your shares, in their discretion, on any other matter requiring a stockholder vote that comes before the meeting.

What are the Board’s voting recommendations?

For the reasons set forth in more detail later in this proxy statement, our Board recommends a vote:

| • | FOR the election of each director nominee; |

| • | FOR the advisory vote to approve named executive officer compensation; and |

| • | FOR the ratification of our Audit Committee’s appointment of Deloitte as our independent registered public accounting firm for the year ending December 31, 2015. |

What are the voting requirements to elect the Directors and to approve each of the proposals discussed in this proxy statement?

Each proposal requires the affirmative vote of a majority of our outstanding shares present in person or represented by proxy at the meeting and entitled to vote and actually voting on the matter. Because votes withheld in the election of any director, abstentions and broker non-votes are not actual votes with respect to a proposal, they will have no effect on the outcome of the vote on any proposal.

Our Corporate Governance Guidelines provide that, in an uncontested election of directors, the Board expects any incumbent director nominee who does not receive “FOR” votes by a majority of shares present in person or by proxy and entitled to vote and either voting “FOR” or registering a decision to withhold a vote with respect to the election of such director to promptly tender his or her resignation to the Governance Committee, subject to acceptance by our Board. Any shares subject to broker non-votes shall not be considered in making any determination pursuant to the immediately preceding sentence. The Governance Committee will then make a recommendation to the Board with respect to the director nominee’s resignation and the Board will consider the recommendation and take appropriate action within 120 days from the date of the certification of the election results.

What happens if I do not specify a choice for a proposal when returning a proxy or do not cast my vote?

You should specify your choice for each proposal on your proxy card or voting instruction form. Shares represented by proxies will be voted in accordance with the instructions given by the stockholders.

If you are a stockholder of record and your proxy card is signed and returned without voting instructions, it will be voted according to the recommendations of our Board. If you do not return your proxy card or cast your vote, no votes will be cast on your behalf on any of the items of business at the Annual Meeting.

4

Table of Contents

If you are the beneficial owner, but not the holder of record, of shares and fail to provide voting instructions, your broker or other holder of record is permitted to vote your shares on the ratification of Deloitte as our independent registered public accounting firm. However, absent instructions from you, your broker or other holder of record may not vote on the election of directors or the advisory vote to approve named executive officer compensation, and no votes will be cast on your behalf for those matters.

Is my vote confidential?

All voted proxies and ballots will be handled in a manner intended to protect your voting privacy as a stockholder. Your vote will not be disclosed except:

| • | to meet any legal requirements; |

| • | in limited circumstances such as a proxy contest in opposition to our Board of Directors; |

| • | to permit independent inspectors of election to tabulate and certify your vote; or |

| • | to respond to your written comments on your proxy card. |

5

Table of Contents

(ITEM 1)

Election Process. Our Articles of Incorporation provide that, at each annual meeting of stockholders, all directors shall be elected annually for a term expiring at the next succeeding annual meeting of stockholders or until their respective successors are duly elected and qualified. Accordingly, our Board has nominated the following persons for reelection as directors at this year’s Annual Meeting, for a term of one year: John F. Bookout, III, Roger A. Brown, David Dickson, Stephen G. Hanks, Gary P. Luquette, William H. Schumann, III, Mary L. Shafer-Malicki and David A. Trice.

Our By-Laws provide that (1) a person shall not be nominated for election or reelection to our Board of Directors if such person shall have attained the age of 72 prior to the date of election or reelection, and (2) any director who attains the age of 72 during his or her term shall be deemed to have resigned and retired at the first Annual Meeting following his or her attainment of the age of 72. Accordingly, a director nominee may stand for election if he or she has not attained the age of 72 prior to the date of election or reelection.

Director Qualifications. Our Governance Committee has determined that a candidate for election to our Board of Directors must meet specific minimum qualifications. Each candidate should:

| • | have a record of integrity and ethics in his/her personal and professional life; |

| • | have a record of professional accomplishment in his/her field; |

| • | be prepared to represent the best interests of our stockholders; |

| • | not have a material personal, financial or professional interest in any competitor of ours; and |

| • | be prepared to participate fully in Board activities, including active membership on at least one Board committee and attendance at, and active participation in, meetings of the Board and the committee(s) of which he or she is a member, and not have other personal or professional commitments that would, in the Governance Committee’s sole judgment, interfere with or limit his or her ability to do so. |

In addition, the Governance Committee also considers it desirable that candidates contribute positively to the collaborative culture among Board members and possess professional and personal experiences and expertise relevant to our business and industry.

While McDermott does not have a specific policy addressing board diversity, the Board recognizes the benefits of a diversified board and believes that any search for potential director candidates should consider diversity as to gender, ethnic background and personal and professional experiences. The Governance Committee solicits ideas for possible candidates from a number of sources — including independent director candidate search firms, members of the Board and our senior level executives.

Director Nominations. Any stockholder may nominate one or more persons for election as one of our directors at the annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in our By-Laws. See “Stockholders’ Proposals” in this proxy statement and our By-Laws, which may be found on our Web site at www.mcdermott.com at “About Us — Leadership & Corporate Governance — Corporate Governance.”

The Governance Committee will consider candidates identified through the processes described above and will evaluate the candidates, including incumbents, based on the same criteria. The Governance Committee also takes into account the contributions of incumbent directors as Board

6

Table of Contents

members and the benefits to us arising from their experience on the Board. Although the Governance Committee will consider candidates identified by stockholders, the Governance Committee has sole discretion whether to recommend those candidates to the Board.

2015 Nominees. In nominating individuals to become members of the Board of Directors, the Governance Committee considers the experience, qualifications and skills of each potential member. Each nominee brings a strong and unique background and set of skills to the Board, giving the Board, as a whole, competence and experience in a wide variety of areas. The Governance Committee and the Board of Directors considered the following information, including the specific experience, qualifications, attributes or skills, in concluding each individual was an appropriate nominee to serve as a member of our Board for the term commencing at this year’s Annual Meeting (ages are as of May 8, 2015).

Unless otherwise directed, the persons named as proxies on the enclosed proxy card intend to vote “FOR” the election of each of the nominees. If any nominee should become unavailable for election, the shares will be voted for such substitute nominee as may be proposed by our Board of Directors. However, we are not aware of any circumstances that would prevent any of the nominees from serving.

Our Board recommends that stockholders vote “FOR” each of the nominees named below.

7

Table of Contents

|

| ||

| John F. Bookout, III

|

Director Since 2006

| |

| Finance Committee Member Governance Committee Member

Mr. Bookout, 61, has served as a Managing Director of Kohlberg Kravis Roberts & Co., a private equity firm, since March 2008. Previously, he served as Senior Advisor to First Reserve Corporation, a private equity firm specializing in the energy industry, from 2006 to March 2008. Until 2006, he was a director of McKinsey & Company, a global management consulting firm, which he joined in 1978. Mr. Bookout previously served as a director of Tesoro Corporation from 2006-2010. The Board of Directors is nominating Mr. Bookout in consideration of his:

• global experience with the petroleum refining and marketing industry and oil and gas exploration and development industry;

• expertise in private equity and finance; and

• experience as a board member of public companies. | ||

| Roger A. Brown

|

Director Since 2005

| |

| Compensation Committee Member Governance Committee Member

From 2005 until his retirement in 2007, Mr. Brown, 70, was Vice President, Strategic Initiatives of Smith International, Inc., a supplier of goods and services to the oil and gas exploration and production industry, the petrochemical industry and other industrial markets. Mr. Brown was President of Smith Technologies (a business unit of Smith International, Inc.) from 1998 until 2005. Mr. Brown has served as a director of Ultra Petroleum Corp. since 2007, and previously served as a director of Boart Longyear Limited from 2010-2014. The Board of Directors is nominating Mr. Brown in consideration of his:

• executive leadership experience in the oil and gas exploration and production industry;

• knowledge of corporate governance issues; and

• experience as a board member of public companies. | ||

| David Dickson

|

Director Since 2013

| |

| President and Chief Executive Officer

Mr. Dickson, 47, has served as a member of our Board of Directors and as President and Chief Executive Officer since December 2013, prior to which he served as our Executive Vice President and Chief Operating Officer from October 2013. Mr. Dickson has over 24 years of offshore oilfield engineering and construction business experience, including 11 years of experience with Technip S.A. and its subsidiaries. From September 2008 to October 2013, he served as President of Technip U.S.A. Inc., with oversight responsibilities for all of Technip’s North American operations. In addition to being the President of Technip U.S.A. Inc., Mr. Dickson also had responsibility for certain operations in Latin America, including Mexico, Venezuela, Colombia and the Caribbean. Mr. Dickson also supported the Technip organization by managing key customer accounts with international oil companies based in the United States. The Board of Directors is nominating Mr. Dickson in consideration of his:

• position as our President and Chief Executive Officer;

• executive leadership experience in and significant knowledge of the offshore oilfield engineering and construction business; and

• broad knowledge of the expectations of our core customers.

| ||

|

| ||

8

Table of Contents

|

| ||

| Stephen G. Hanks

|

Director Since 2009

| |

| Governance Committee Chairman Audit Committee Member

Mr. Hanks, 64, served in various roles over a 30-year career with Washington Group International, Inc. (and its predecessor, Morrison Knudsen Corporation), an integrated construction and management services company, and from 2000 through 2007 served as President, Chief Executive Officer and a member of its board of directors. Mr. Hanks has also served as a director of Lincoln Electric Holdings, Inc. since 2006 and as a director of The Babcock & Wilcox Company since 2010. The Board of Directors is nominating Mr. Hanks in consideration of his:

• experience in executive leadership, including his position as the Chief Executive Officer of Washington Group;

• background and knowledge in the areas of accounting, auditing and financial reporting, having previously served as a Chief Financial Officer;

• experience in the engineering and construction industry; and

• experience as a board member of public companies. | ||

| Gary P. Luquette

|

Director Since 2013

| |

| Non-Executive Chairman of the Board Compensation Committee Member

Mr. Luquette, 59, has served as President and Chief Executive Officer of Frank’s International N.V., a global provider of engineered tubular services to the oil and gas industry, since January 2015, and has served as a member of its Board of Directors since November 2013, Previously, he served as President, Chevron North America Exploration and Production, a unit of Chevron Corporation, from 2006 until September 2013, and held other key exploration and production positions with Chevron in Europe, California, Indonesia and Louisiana. The Board of Directors is nominating Mr. Luquette in consideration of his:

• executive leadership experience in the oil and gas exploration and production industry, with significant international experience, including in Europe and Asia Pacific;

• experience in the upstream energy and supporting infrastructure businesses;

• knowledge of and experience with our core customers; and

• experience as a board member of public companies. | ||

| William H. Schumann, III

|

Director Since 2012

| |

| Audit Committee Chairman Finance Committee Member

From February 2007 until August 2012, Mr. Schumann, 64, served as Executive Vice President of FMC Technologies, Inc. (“FMC”), a global provider of technology solutions for the energy industry. Mr. Schumann previously served in the following capacities at FMC Technologies and its predecessor, FMC Corporation: Chief Financial Officer from 1999 until his retirement from that position in December 2011; Vice President, Corporate Development from 1998 to 1999; Vice President and General Manager, Agricultural Products Group from 1995 to 1998; Regional Director, North America Operations, Agricultural Products Group from 1993 to 1995; Executive Director of Corporate Development from 1991 to 1993, and other various management positions from the time he joined FMC in 1981. Mr. Schumann currently serves as Chairman of the Board of Avnet, Inc., a board on which he has served on since February 2010. He also previously served on the board of directors of Great Lakes Advisors, Inc. from 1991 to June 2011, UAP Holding Corp. from 2005 to 2008, AMCOL International Corporation from September 2012 to May 2014 and URS Corporation from March 2014 to October 2014. The Board of Directors is nominating Mr. Schumann in consideration of his:

• executive leadership experience in the energy industry;

• background and knowledge in the areas of accounting, auditing and financial reporting, having served as a Chief Financial Officer of a public company; and

• experience as a board member of public companies, including as a chairman of a public company.

| ||

|

| ||

9

Table of Contents

|

| ||

| Mary L. Shafer-Malicki

|

Director Since 2011

| |

| Compensation Committee Chairman Governance Committee Member

From July 2007 until her retirement in March 2009, Ms. Shafer-Malicki, 54, was Senior Vice President and Chief Executive Officer of BP Angola, a subsidiary of BP p.l.c., an oil and natural gas exploration, production, refining and marketing company. Previously, Ms. Shafer-Malicki served as Chief Operating Officer of BP Angola from January 2006 to June 2007 and in various other international engineering and managerial positions with BP p.l.c. Ms. Shafer-Malicki has also served as a director of Ausenco Limited since January 2011 and John Wood Group PLC since June 2012. The Board of Directors is nominating Ms. Shafer-Malicki in consideration of her:

• experience in the upstream energy and supporting infrastructure businesses;

• knowledge of and experience with our core customers;

• executive experience and business leadership skills, including operations, strategy, commercial, safety and supply chain management;

• significant international experience, having executive or management experience in Europe, Asia Pacific and Africa; and

• experience as a board member of public companies. | ||

| David A. Trice

|

Director Since 2009

| |

| Finance Committee Chairman Audit Committee Member

From February 2000 until his retirement in May 2009, Mr. Trice, 67, was Chief Executive Officer of Newfield Exploration Company, an oil and natural gas exploration and production company, and served as Chairman of its board from September 2004 to May 2010. Mr. Trice has served as a director of New Jersey Resources Corporation since 2004 and QEP Resources, Inc. since 2011. Mr. Trice previously served as a director of Grant PrideCo, Inc. from 2003 to 2008 and Hornbeck Offshore Services, Inc. from 2002 to 2011. The Board of Directors is nominating Mr. Trice in consideration of his:

• executive experience as a Chief Executive Officer of a public company;

• experience in the oil and gas exploration and production business;

• background and knowledge in the areas of accounting, auditing and financial reporting, having served as a Chief Financial Officer; and

• experience as a board member of public companies, including as a chairman of a public company.

| ||

|

| ||

10

Table of Contents

We maintain a corporate governance section on our Web site which contains copies of our principal governance documents. The corporate governance section may be found at www.mcdermott.com under “About Us — Leadership & Corporate Governance — Corporate Governance” and “About Us — Leadership & Corporate Governance — Board Committees.” The corporate governance section contains the following documents:

By-Laws

Corporate Governance Guidelines

Code of Ethics for CEO and Senior Financial Officers

Board of Directors Conflicts of Interest Policies and Procedures

Audit Committee Charter

Compensation Committee Charter

Finance Committee Charter

Governance Committee Charter

In addition, our Code of Business Conduct may be found on our Web site at www.mcdermott.com at “About Us — Leadership & Corporate Governance.”

The New York Stock Exchange listing standards require our Board of Directors to be comprised of at least a majority of independent directors. For a director to be considered independent, our Board must determine that the director does not have any direct or indirect material relationship with us. To assist it in determining director independence, and as permitted by NYSE rules then in effect, the Board previously established categorical standards which conform to, or are more exacting than, the independence requirements in the NYSE listing standards. These standards are contained in our Corporate Governance Guidelines, which can be found on our Web site at www.mcdermott.com under “About Us — Leadership & Corporate Governance — Corporate Governance.”

Based on these independence standards, our Board of Directors has affirmatively determined that the following directors are independent and meet our categorical independence standards:

| John F. Bookout, III |

William H. Schumann, III | |

| Roger A. Brown |

Mary L. Shafer-Malicki | |

| Stephen G. Hanks |

David A. Trice | |

| Gary P. Luquette |

In determining the independence of the directors, our Board considered ordinary course transactions between us and other entities with which the directors are associated, none of which were determined to constitute a material relationship with us. Messrs. Brown, Schumann and Trice have no relationship with McDermott, except as a director and stockholder. Messrs. Bookout and Hanks and Ms. Shafer-Malicki are directors of entities with which we transact business in the ordinary course. Mr. Bookout is Managing Director for a private equity firm which has invested in entities with which we transact business in the ordinary course. Mr. Luquette is an executive and director of an entity with which we transact business in the ordinary course; however, the aggregate annual amount of such transactions for 2014 was substantially lower than the thresholds contained in the independence requirements in the NYSE listing standards. Our Board also considered contributions by us to charitable organizations with which the directors were associated. No director is related to any executive or significant stockholder of McDermott, nor is any director, with the exception of Mr. Dickson, a current or former employee of McDermott.

11

Table of Contents

Our independent directors meet in executive session without management on a regular basis. Currently, Mr. Luquette, our Chairman of the Board of Directors, serves as the presiding director for those executive sessions.

Stockholders or other interested persons may send written communications to the independent members of our Board, addressed to Board of Directors (independent members), c/o McDermott International, Inc., Corporate Secretary’s Office, 757 N. Eldridge Pkwy., Houston, Texas 77079. Information regarding this process is posted on our Web site at www.mcdermott.com under “About Us — Leadership & Corporate Governance — Independent Director Access Information.”

Board of Directors and Its Committees

Our Board met 16 times during 2014. All directors attended 75% or more of the meetings of the Board and of the committees on which they served during 2014. In addition, as reflected in our Corporate Governance Guidelines, we have adopted a policy that each member of our Board must make reasonable efforts to attend our Annual Meeting. All directors then serving on the Board attended our 2014 Annual Meeting.

Board Leadership Structure. Mr. Luquette has served as Chairman of the Board since Mr. D. Bradley McWilliams, our former Chairman of the Board, retired as a member of our Board of Directors on May 6, 2014. Our Board believes that it is appropriate for McDermott to have a Chairman of the Board separate from the Chief Executive Officer, as this structure allows Mr. Dickson, McDermott’s President and Chief Executive Officer, to maintain his focus on our strategic direction and the management of our day-to-day operations and performance, while Mr. Luquette is able to set the Board’s agendas and lead the Board meetings.

Board Committees. Our Board currently has, and appoints the members of, standing Audit, Compensation, Finance and Governance Committees. Each of those committees is comprised entirely of independent nonemployee directors and has a written charter approved by the Board. The current charter for each standing Board committee is posted on our Web site at www.mcdermott.com under “About Us — Leadership & Corporate Governance — Board Committees.” Attendance at committee meetings is open to every director, regardless of whether he or she is a member of the committee. Occasionally, our Board may convene joint meetings of certain committees and the Board. Each portion of the joint meeting is counted separately for purposes of the number of meetings of the Board and its committees disclosed in this proxy statement. The following table shows the current membership, the principal functions and the number of meetings held in 2014 for each committee:

12

Table of Contents

|

| ||

| Committee | Principal Functions and Additional Information | |

| AUDIT

Committee Members: Mr. Schumann (Chair) Mr. Hanks Mr. Trice

4 Meetings Held in 2014 |

• Monitors our financial reporting process and internal control system. • Oversees the integrity of our financial statements. • Monitors our compliance with legal and regulatory financial requirements, including our compliance with the applicable reporting requirements established by the Securities and Exchange Commission (the “SEC”). • Evaluates the independence, qualifications, performance and compensation of our independent registered public accounting firm. • Oversees the performance of our internal audit function. • Oversees certain aspects of our Compliance and Ethics Program relating to financial matters, books and records and accounting and as required by applicable statutes, rules and regulations. • Provides an open avenue of communication among our independent registered public accounting firm, financial and senior management, the internal audit department and the Board.

Our Board has determined that Messrs. Trice, Hanks and Schumann each qualify as an “audit committee financial expert” within the definition established by the SEC. For more information on the backgrounds of those directors, see their biographical information under “Election of Directors” above.

| |

| COMPENSATION

Committee Members: Ms. Shafer-Malicki (Chair) Mr. Brown Mr. Luquette

7 Meetings Held in 2014 |

• Evaluates our officer and director compensation plans, policies and programs and our employee benefit plans. • Approves and/or recommends to the Board for approval such officer and director compensation plans, policies and programs. • Oversees our disclosures relating to compensation plans, policies and programs, including overseeing the preparation of the Compensation Discussion and Analysis included in this proxy statement. • Acts in its sole discretion to retain or terminate any compensation consultant to be used to assist the Compensation Committee in the discharge of its responsibilities. For additional information on the role of compensation consultants, please see “Compensation Discussion and Analysis — Role of Compensation Committee, Compensation Consultant and Management” below. • For 2014, the Compensation Committee authorized our Chief Executive Officer, in consultation with his direct reports, to establish individual goals under our Executive Incentive Compensation Plan (“EICP”) for our other executive officers who participate in the EICP. All payments under the EICP are subject to Compensation Committee approval. • Under the 2009 LTIP and 2014 LTIP, the Compensation Committee may delegate some of its duties to our Chief Executive Officer or other senior officers. The Compensation Committee has delegated certain authority to our Chief Executive Officer and Senior Vice President, Human Resources, for the approval of awards under the 2014 LTIP to new-hire, non-officer employees. • Under the McDermott International, Inc. Director and Executive Deferred Compensation Plan, which we refer to as the “DCP,” the Compensation Committee may delegate any of its powers or responsibilities to one or more members of the Committee or any other person or entity.

| |

13

Table of Contents

| FINANCE

Committee Members: Mr. Trice (Chair) Mr. Bookout Mr. Schumann

6 Meetings Held in 2014 |

• Reviews and oversees financial policies and strategies, including financings, capital structure, mergers and acquisitions and the investment performance of pension plans. • Recommends any change in dividend policies or stock repurchase programs. • Oversees capital expenditures and capital allocation strategies. • Oversees tax structure and monitors any developments relating to changes in tax legislation. • Generally has responsibility over such matters up to $50 million, and for activities involving amounts over $50 million, reviews each such activity and makes a recommendation to the Board. • Additionally, a subcommittee of the Finance Committee consisting of Messrs. Trice, Schumann and Hanks (who was a member of the Finance Committee at the time), constituted a Pricing Committee in connection with McDermott’s refinancing activities in early 2014. The Pricing Committee held 2 meetings in 2014, in addition to the 6 Finance Committee meetings held in 2014.

| |

| GOVERNANCE

Committee Members: Mr. Hanks (Chair) Mr. Bookout Mr. Brown Ms. Shafer-Malicki

5 Meetings Held in 2014 |

• Identifies individuals qualified to become Board members and recommends to the Board each year the director nominees for the next annual meeting of stockholders. • Recommends to the Board the directors to serve on each Board committee. • Develops, reviews and recommends to the Board any changes to our Corporate Governance Guidelines the Governance Committee deems appropriate. • Leads the Board in its annual review of the Board’s performance and, in conjunction with the Compensation Committee, oversees the annual evaluation of our Chief Executive Officer. • Reviews and assesses the succession plan for the Chief Executive Officer and other members of executive management and reviews such plan with the Board periodically, and at least on an annual basis. • Recommends to the Board the compensation of nonemployee directors. • Serves as the primary committee overseeing our Compliance and Ethics Program, excluding certain oversight responsibilities assigned to the Audit Committee. • Oversees our director and officer insurance program.

| |

|

| ||

14

Table of Contents

The Board’s Role in Risk Oversight

As part of its oversight function, the Board is actively involved in overseeing risk management through our Enterprise Risk Management (“ERM”) program, which includes periodic reporting through a regional and corporate ERM structure. In connection with the ERM program, the Board exercises its oversight responsibility with respect to key external, strategic, operational and financial risks and discusses the effectiveness of current efforts to mitigate certain focus risks as identified by senior management and the Board through anonymous risk surveys.

Although the Board is ultimately responsible for risk oversight, the Board is assisted in discharging its risk oversight responsibility by the Audit, Compensation, Finance and Governance Committees. Each committee oversees management of risks, including, but not limited to, the areas of risk summarized below, and periodically reports to the Board on those areas of risk:

|

| ||

| Committee | Risk Oversight | |

| Audit |

• Oversees management of risks related to our financial statements and the financial reporting process | |

| Compensation |

• Oversees management of risks related to our compensation policies and practices applicable to executives as well as employees generally, employee benefit plans and the administration of equity plans | |

| Finance |

• Oversees management of risks with respect to our policies and processes regarding capital structure, capital expenditures, financing and mergers and acquisitions | |

| Governance |

• Oversees management of risks related to succession planning for the Chief Executive Officer and other members of executive management, our Compliance and Ethics Program (excluding responsibilities assigned to the Audit Committee) and director and officer insurance coverage

| |

|

| ||

At their respective November 2014 meetings, each committee undertook an assessment of those areas of risk oversight that were delegated to it and provided a report to the Board. Also, at its November 2014 meeting, the Board received an ERM report and performed an assessment and review of the risks described in that report that were not delegated to the committees.

Compensation Policies and Practices and Risk

The Compensation Committee has concluded that risks arising from McDermott’s compensation policies and practices for McDermott employees are not reasonably likely to have a materially adverse effect on McDermott. In reaching this conclusion, the Compensation Committee considered the policies and practices in the following paragraph.

The Compensation Committee regularly reviews the design of our significant compensation programs with the assistance of its compensation consultant. We believe our compensation programs assist us in attracting, developing, motivating and retaining our executive officers while allowing for appropriate levels of business risk through some of the following features:

| • | Reasonable Compensation Programs — Using the elements of total direct compensation, the Compensation Committee seeks to provide compensation opportunities for employees targeted at or near the median compensation of comparable positions in our market. As a result, we believe the total direct compensation of executive officer employees provides a reasonable and appropriate mix of cash and equity, annual and longer-term incentives and performance metrics. |

15

Table of Contents

| • | Emphasis on Long-Term Incentive Compensation Over Annual Incentive Compensation — Long-term incentive compensation typically makes up a larger percentage of an executive officer’s total direct compensation than annual incentive compensation. Incentive compensation helps drive performance and align the interests of our employees with those of stockholders. In addition, tying a significant portion of an employee’s total direct compensation to long-term incentives (which typically vest over a period of three or more years) helps to promote longer-term perspectives regarding our company’s performance. |

| • | Clawback Policy — The Compensation Committee has adopted a policy that allows McDermott to recover, under certain circumstances, compensation paid to executive officers. |

| • | Long-Term Incentive Compensation Subject to Forfeiture — The Compensation Committee may terminate any outstanding stock award if the recipient, while employed by McDermott or performing services on behalf of McDermott under any consulting agreement: (1) is convicted of a misdemeanor involving fraud, dishonesty or moral turpitude or a felony; or (2) engages in conduct that adversely affects or, in the sole judgment of the Compensation Committee, may reasonably be expected to adversely affect, the business reputation or economic interests of our company. |

| • | Annual Incentive Compensation Subject to Linear and Capped Payouts — The Compensation Committee establishes financial performance goals which are generally used to plot a linear payout formula for annual incentive compensation, eliminating payout “cliffs” between the established performance goals. The maximum payout for the annual incentive compensation is capped at 200% of target. |

| • | Use of Multiple Performance Metrics — Utilizing diversified performance measures helps prevent compensation opportunities from being overly weighted toward the performance result of a single measure. In 2014, McDermott utilized operating income as the performance metric for our long-term incentive plan, and operating income, free cash flow, order intake and order intake operating margin as the performance metrics for our annual incentive plan. These metrics are further diversified from metrics used in prior years, which we believe further reduces risks related to incentive compensation. |

| • | Stock Ownership Guidelines — Our executive officers and directors are subject to stock ownership guidelines, which also help promote longer-term perspectives and align the interests of our executive officers and directors with those of our stockholders. All directors and executive officers currently meet or exceed their ownership requirement or are within the five-year period allowed to achieve compliance. |

Compensation Committee Interlocks and Insider Participation

All members of our Compensation Committee are independent in accordance with NYSE listing standards. No member of the Compensation Committee (1) was, during the year ended December 31, 2014, or had previously been, an officer or employee of McDermott or any of its subsidiaries, or (2) had any material interest in a transaction of McDermott or a business relationship with, or any indebtedness to, McDermott. No interlocking relationship existed during the year ended December 31, 2014 between any member of the Board of Directors or the Compensation Committee and an executive officer of McDermott.

16

Table of Contents

Under our 2014 nonemployee director compensation program, cash compensation for nonemployee directors consisted of retainers (paid monthly and prorated for partial terms) and meeting fees as follows:

| • | annual Board member retainer: $75,000; |

| • | additional retainer for the chair of each of the Audit Committee and Compensation Committee: $20,000; |

| • | additional retainer for the chair of each of the Finance Committee and Governance Committee: $10,000; |

| • | additional retainer for the Lead Director: $20,000; |

| • | additional retainer for the non-executive Chairman of the Board: $150,000; and |

| • | meeting fees of $2,500 for each meeting of the Board or a Committee (of which the nonemployee director is a member) attended, in person or by telephone, in excess of the twelfth Board or Committee meeting per annual director term of service. |

From 2011 to 2013, our nonemployee director compensation program was generally consistent with the above, with two exceptions. First, in 2014 we reinstated the additional retainer for the non-executive Chairman of the Board in connection with our return to a non-executive Chairman of the Board. Second, in 2014 we increased the number of meetings required to be attended per annual term of service before a director received additional meeting fees from 8 to 12 meetings of the Board or a Committee (of which the nonemployee director is a member) attended. All directors who continued to serve as a member of the Board of Directors after our 2014 Annual Meeting of Stockholders waived any additional meeting fees they would have been owed under our previous nonemployee director compensation program when the Governance Committee adopted the 2014 nonemployee director compensation program. On average, each of these directors waived over $7,000 in meeting fees during 2014.

The table below summarizes the compensation earned by or paid to our nonemployee directors during the year ended December 31, 2014. Mr. D. Bradley McWilliams served as our Chairman of the Board prior to his retirement in May 2014.

|

| ||||||

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | Total | |||

| John F. Bookout, III |

$75,000 | $119,997 | $194,997 | |||

| Roger A. Brown |

$78,333 | $119,997 | $198,330 | |||

| Stephen G. Hanks |

$81,932 | $119,997 | $201,929 | |||

| Gary P. Luquette(2) |

$172,727 | $119,997 | $292,724 | |||

| D. Bradley McWilliams(2) |

$91,894 | — | $91,894 | |||

| William H. Schumann, III |

$88,864 | $119,997 | $208,861 | |||

| Mary L. Shafer-Malicki |

$95,000 | $119,997 | $214,997 | |||

| David A. Trice |

$88,598 | $119,997 | $208,595 | |||

|

| ||||||

| (1) | Under our 2014 director compensation program, equity compensation for nonemployee directors generally consisted of a discretionary annual stock grant. On May 12, 2014, each of the nonemployee directors then serving as a director received a grant of 17,045 shares of restricted stock valued at $119,997, which is the aggregate grant date fair value computed in |

17

Table of Contents

| accordance with Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) Topic 718, using the closing market price of McDermott common stock on the date of grant ($7.04). Under the terms of each award, the restricted stock vested immediately on the grant date and immediately became unrestricted shares of McDermott common stock. |

| As of December 31, 2014, nonemployee directors had aggregate outstanding stock option awards as follows: Mr. Bookout – stock options to purchase 6,105 shares; and Mr. Brown – stock options to purchase 38,085 shares. All of such stock options were fully vested. |

| (2) | Mr. Luquette has served as non-executive Chairman of the Board since May 2014. Mr. McWilliams served as non-executive Chairman of the Board until his retirement in May 2014. |

18

Table of Contents

The profiles below and on the following pages provide summary information regarding the experience and 2014 compensation of our Chief Executive Officer, Chief Financial Officer and our three other most highly compensated executive officers, who were employed by McDermott as of December 31, 2014, whom we refer to as our “Continuing Named Executives” or “Continuing NEOs”. The Continuing Named Executive profiles provide biographical information, including age and tenure with McDermott as of May 8, 2015, and summarize the compensation disclosures that are provided in the Compensation Discussion and Analysis (“CD&A”) and executive compensation tables. These profiles are supplemental, and are being provided in addition to, and not in substitution for, the detailed compensation tables required by the SEC that follow the CD&A. Please consult the more detailed compensation tables and the accompanying footnotes following the CD&A for an explanation of how the compensation information is calculated. See the following pages for profiles of:

| • | David Dickson, our President and Chief Executive Officer; |

| • | Stuart A. Spence, our Executive Vice President and Chief Financial Officer; |

| • | Scott V. Cummins, our Senior Vice President, Commercial; |

| • | Tony Duncan, our Senior Vice President, Project Support; and |

| • | Liane K. Hinrichs, our Senior Vice President, General Counsel and Corporate Secretary. |

We have included below biographical information, including age as of May 8, 2015, for Messrs. Stephen L. Allen, our Senior Vice President, Human Resources, Hugh J. Cuthbertson, our Vice President, Asia, Thomas W. Mackie, our Vice President, Middle East, and Scott Munro, our Vice President, Americas, Europe & Africa, who are also executive officers but are not NEOs under applicable SEC rules.

The Continuing Named Executives and Mr. Perry L. Elders, our former Senior Vice President and Chief Financial Officer, who resigned in August 2014, are collectively referred to as our “Named Executives” or “NEOs.” Information relating to Mr. Elders is provided in the CD&A and the compensation-related tables included in this proxy statement.

Stephen L. Allen, 62, has served as our Senior Vice President, Human Resources since March 2014 and, previously, as our Senior Director, Human Resources from January 2014 to March 2014. Previously, he served as the Senior Vice President, Human Resources for Technip USA Inc., a subsidiary of Technip, S.A. (“Technip”), in Houston, Texas, from August 2005 until January 2014. Mr. Allen has over 25 years of human resources experience in the oil and gas, utility and engineering and construction industries. His human resources experience includes leadership roles in compensation, benefits, talent acquisition, talent management and real estate management. Prior to joining Technip in 2005, Mr. Allen held the position of General Manager, Human Resources for Duke Energy in Cincinnati, Ohio.

Hugh Cuthbertson, 57, has served as our Vice President, Asia, since January 2015. Previously, he served as our Vice President & General Manager Asia Pacific from April 2014 to January 2015; Senior Director, Operations, McDermott Australia Pty. Ltd. (“MAP”) from July 2013 to March 2014; Senior Director Business Development, MAP, from March 2012 to July 2013, and Managing Director, MAP, from May 2009 to March 2012. Mr. Cuthbertson joined McDermott in 1978, and has held positions of increasing responsibility in business development, project management and regional responsibility.

Thomas W. Mackie, 64, has served as our Vice President, Middle East, since January 2015. Mr. Mackie has held positions of increasing responsibility in project management, design, construction,

19

Table of Contents

installation, hook-up and commissioning and operations since joining McDermott in 2005, including serving as our Vice President & General Manager Middle East from April 2014 to January 2015; Director of Projects, McDermott Middle East, Inc. (“MME”) from April 2013 to April 2014; Senior Project Director, MME, from August 2012 to April 2013; General Manager, Hook-up and Brownfield, MME, from 2011 to August 2012; Project Director, MME, from 2009 to 2011; and General Manager Engineering, MME, from 2005 to 2009.

Scott Munro, 40, has served as our Vice President, Americas, Europe & Africa, since January 2015. Previously, he served as our Vice President & General Manager North Sea and Africa from April 2014 to January 2015; and Vice President Projects & Operations Subsea, from the time he joined McDermott in January 2014 to March 2014. Prior to joining McDermott, Mr. Munro was Vice President, Commercial, for Technip U.S.A. Inc., a subsidiary of Technip, from 2010 to 2013; and Vice President Offshore Unit, Technip France, an operating unit of Technip, from 2013 to 2014. Mr. Munro has management experience in the oil and gas industry having worked in the United Kingdom, United States, Canada, Brazil and France in a variety of operational and project management roles in organizations such as Coflexip Stena Offshore Group S.A., Acergy, S.A., Chevron Corporation and Technip.

20

Table of Contents

DAVID DICKSON

PRESIDENT AND CHIEF EXECUTIVE OFFICER

21

Table of Contents

STUART A. SPENCE

EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

22

Table of Contents

SCOTT V. CUMMINS

SENIOR VICE PRESIDENT, COMMERCIAL

23

Table of Contents

TONY DUNCAN

SENIOR VICE PRESIDENT, PROJECT SUPPORT

24

Table of Contents

LIANE K. HINRICHS

SENIOR VICE PRESIDENT,

GENERAL COUNSEL AND CORPORATE SECRETARY

25

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

The following Compensation Discussion and Analysis, or CD&A, provides information relevant to understanding the 2014 compensation of our executive officers and former executive officers identified in the Summary Compensation Table, whom we refer to as our NEOs. “Continuing NEOs”, as used in the CD&A, includes only the Named Executive Officers who remained employed with McDermott through the date of this Proxy Statement. The following discussion also contains statements regarding future individual and company performance targets and goals. These targets and goals are disclosed in the limited context of our compensation programs and should not be understood to be statements of management’s expectations or estimates of results or other guidance. We caution investors not to apply these statements in other contexts.

McDermott’s compensation programs are designed to attract, develop, retain and motivate qualified employees to create, expand and execute sound business opportunities for our company. The Compensation Committee is committed to targeting reasonable and competitive total direct compensation for our NEOs, with a significant portion of that compensation being performance-based.