UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number:

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

|

(Address of principal executive offices) |

(Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

Accelerated filer ☐ |

|

Non-accelerated filer ☐ |

|

Smaller reporting company |

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

The aggregate market value of the voting stock held by non-affiliates of the Registrant as of September 30, 2021: $

The Registrant has no non-voting common equity.

The number of outstanding shares of the Registrant’s common stock as of May 13, 2022 was

* For purposes of this Annual Report on Form 10-K, in addition to those shareholders which fall within the definition of “affiliates” under Rule 405 of the Securities Act of 1933, as amended, holders of ten percent or more of the Registrant’s common stock are deemed to be affiliates for purposes of this Report.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement related to the 2022 Annual Shareholders' Meeting to be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended March 31, 2022 are incorporated herein by reference in Part III of this Annual Report on Form 10-K where indicated.

NEXTGEN HEALTHCARE, INC.

TABLE OF CONTENTS

2022 ANNUAL REPORT ON FORM 10-K

|

Item |

|

|

|

|

Page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

|

4 |

|

|

||

|

Item 1A. |

|

|

|

15 |

|

|

||

|

Item 1B. |

|

|

|

29 |

|

|

||

|

Item 2. |

|

|

|

29 |

|

|

||

|

Item 3. |

|

|

|

29 |

|

|

||

|

Item 4. |

|

|

|

29 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

|

30 |

|

|

||

|

Item 6. |

|

|

|

31 |

|

|

||

|

Item 7. |

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

32 |

|

|

|

|

Item 7A. |

|

|

|

46 |

|

|

||

|

Item 8. |

|

|

|

46 |

|

|

||

|

Item 9. |

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

46 |

|

|

|

|

Item 9A. |

|

|

|

47 |

|

|

||

|

Item 9B. |

|

|

|

47 |

|

|

||

|

Item 9C |

|

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

47 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

|

48 |

|

|

||

|

Item 11. |

|

|

|

48 |

|

|

||

|

Item 12. |

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

48 |

|

|

|

|

Item 13. |

|

|

Certain Relationships and Related Transactions, and Director Independence |

|

48 |

|

|

|

|

Item 14. |

|

|

|

48 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

|

49 |

|

|

||

|

Item 16. |

|

|

|

49 |

|

|

||

|

|

|

|

|

55 |

|

|

||

CAUTIONARY STATEMENT

This Annual Report on Form 10-K (this "Report") and certain information incorporated herein by reference contain forward-looking statements within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements included or incorporated by reference in this Report, other than statements that are purely historical, are forward-looking statements. Words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “should,” “would,” “could,” “may,” and similar expressions also identify forward-looking statements. These forward-looking statements include, without limitation, discussions of the impact of the COVID-19 pandemic and measures taken in response thereto, as well as our product development plans, business strategies, future operations, financial condition and prospects, developments in and the impacts of government regulation and legislation, and market factors influencing our results. Our expectations, beliefs, objectives, intentions and strategies regarding our future results are not guarantees of future performance and are subject to risks and uncertainties, both foreseen and unforeseen, that could cause actual results to differ materially from results contemplated in our forward-looking statements. These risks and uncertainties include, but are not limited to, our ability to continue to develop new products and increase systems sales in markets characterized by rapid technological evolution, consolidation, and competition from larger, better-capitalized competitors. Many other economic, competitive, governmental and technological factors could affect our ability to achieve our goals, and interested persons are urged to review the risk factors discussed in “Item 1A. Risk Factors” of this Report, as well as in our other public disclosures and filings with the Securities and Exchange Commission (“SEC”). Because of these risk factors, as well as other variables affecting our financial condition and results of operations, past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods. We assume no obligation to update any forward-looking statements. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of the filing of this Report. Each of the terms “NextGen Healthcare,” “NextGen,” “we,” “us,” “our,” or the “Company” as used throughout this Report refers collectively to NextGen Healthcare, Inc. and its wholly-owned subsidiaries, unless otherwise indicated.

3

PART I

ITEM 1. BUSINESS

Company Overview

NextGen Healthcare is a leading provider of innovative, cloud-based, healthcare technology solutions that empower healthcare practices to manage the risk and complexity of delivering care in the United States healthcare system. Our combination of technological breadth, depth, and domain expertise makes us a preferred solution provider and trusted advisor for our clients. In addition to highly configurable core clinical and financial capabilities, our portfolio includes tightly integrated solutions that deliver on ambulatory healthcare imperatives, including consumerism, digitization, risk allocation, regulatory influence, and integrated care and health equity.

We serve clients across all 50 states. Over 100,000 providers use NextGen Healthcare solutions to deliver care in nearly every medical specialty in a wide variety of practice models including accountable care organizations (“ACOs”), independent physician associations (“IPAs”), managed service organizations (“MSOs”), Veterans service organizations (“VSOs”), and dental service organizations (“DSOs”). Our clients range from some of the largest and most progressive multi-specialty groups in the country to sole practitioners with a wide variety of business models. With the addition of behavioral health to our medical and oral health capabilities, we continue to extend our share not only in federally qualified health centers (“FQHCs”) but also in the growing integrated care market.

Our company was incorporated in California in 1974. Previously named Quality Systems, Inc., we changed our corporate name to NextGen Healthcare, Inc. in September 2018, and in 2021, we changed our state of incorporation to Delaware. Our principal executive offices are located at 3525 Piedmont Rd., NE, Building 6, Suite 700, Atlanta, Georgia. Our principal website is www.nextgen.com. We operate on a fiscal year ending on March 31.

Our Vision, Mission and Strategy

NextGen Healthcare’s vision is better healthcare outcomes for all. We strive to achieve this vision by delivering innovative solutions and insights aimed at creating healthier communities. We focus on improving care delivered in ambulatory settings but do so recognizing that the entire healthcare ecosystem needs to work in concert to achieve the quadruple aim… “to improved patient experience, improved provider experience, improve the health of a population, and reduce per capita health care costs.”

Our long-term strategy is to position NextGen Healthcare as both the essential, integrated, delivery platform and the most trusted advisor for the ambulatory practices of the future. To that end, we primarily serve organizations that provide or orchestrate care in ambulatory settings and do so across diverse practice sizes, specialties, care modalities, and business models. These customers include conventional practices as well as new market entrants.

We plan to continue investing in our current capabilities as well as building and/or acquiring new capabilities. In October 2019, we acquired Topaz Information Systems, LLC for its behavioral health solutions. In December 2019, we acquired Medfusion, Inc. for its Patient Experience Platform capabilities (i.e., patient portal, self-scheduling, and patient pay) and OTTO Health, LLC for its virtual care solutions, notably telemedicine. The integration of these acquired technologies has made NextGen Healthcare’s solutions among the most comprehensive in the market. Further, we are also actively innovating our business models and exploring new high-growth market domains as we extend our position as the essential, integrated, delivery platform and trusted impact partner for the ambulatory practices of the future.

Market Opportunity, and Trends

The scale and scope of the healthcare industry continues to expand. Annual United States healthcare spend today represents nearly $4.1 trillion and ~20% of GDP. A significant portion of this spend is directed towards the treatment of chronic conditions and administering an increasingly complex system with diverse stakeholders. While there are several convergent market forces reshaping the healthcare industry landscape, we are focused on six trends we believe will materially impact the markets we participate in and our customer value proposition:

|

|

1. |

Regulatory Influence – Medicare and Medicaid continue to expand and represent approximately a third of covered lives. Further, the 21st Century Cures Act (“Cures Act”) certification requirements and impending changes by Centers for Medicare & Medicaid Services (“CMS”) to Medicare reimbursement and shared savings programs parameters (i.e., MIPS, MSSP and telehealth programs) represent continued and escalating regulatory requirements in the healthcare industry broadly and the shape of primary healthcare. Considering these regulatory and market-based changes, many ambulatory practices have come to place a very high value on partnering with vendors that stay ahead of these regulatory and industry changes |

4

|

|

2. |

Risk Reallocation – As healthcare shifts away from defined benefit models towards defined contribution, employers, payors, providers and consumers are increasingly evaluating models to share and reallocate risk. In 2020, nearly 40% of all healthcare payments representing over 75% of all covered lives flowed through an alternative payment model. While Medicare Advantage related payments led the charge with over 55% of payments tied to alternative models, a plurality of commercial payors are also leveraging value-based provider arrangements to incent care quality standards and reduce health disparities. For providers, effective participation in these models requires a full view of the patient population’s clinical and cost data and robust financial management solutions and services to navigate multiple contract types. |

|

|

3. |

Consumerism – Consumers are increasingly directing their own healthcare and are expecting greater levels of access, convenience, and experience personalization. Beyond tailoring healthcare interactions to their needs and preferences, they also expect much greater transparency about the costs for visits, medications, and procedures. Accompanied by a significant shift of care from inpatient to lower cost outpatient settings and virtual modes, healthcare is poised to becomes increasingly ‘retail-like’ and will place unique demands on practices and care providers who need comprehensive engagement platforms to attract, retain and engage patients through their complete health journey |

|

|

4. |

New Modalities and Coordinated Team Based Care – Untethered from physical clinics and desktops, care is now being delivered in “boundless” venues by multiple, coordinated care providers. |

|

|

5. |

Meaningful Interoperability & Digitization – Greater levels of data exchange, automation, Artificial Intelligence (AI) and speech enabled workflows. |

|

|

6. |

Integrated Care and Health Equity – Integrated, whole-person health continues to trend strongly as evidenced by FQHCs/CHCs receiving Health Resources and Services Administration (“HRSA”) funding to drive integrated medical, behavioral, and oral health. Public sector and private investment in understanding and addressing social determinants of health and improving community health are growing. |

NextGen Healthcare is well positioned to play a key role in guiding our clients through short-term and long-term changes that impact healthcare in the United States and is committed to helping them deliver better outcomes.

Our Value Proposition

NextGen Healthcare’s value proposition to our clients can be summarized by the four “I’s” as follows:

|

|

• |

Integration – Delivering a broad and highly integrated set of solutions and end-user experiences. NextGen Healthcare, a top KLAS-ranked platform solution provider, is driving greater levels of efficiency and experience for practices. Our clients value the full breadth of our solution offering and seamless integration into their clinical workflows. This integration is an important determinant of our success. |

|

|

• |

Interoperability – Building seamlessly connected data and human networks across ambulatory healthcare. NextGen Healthcare’s Interoperability solutions help create a frictionless environment where those that need important healthcare data can rapidly find and utilize it. For example, NextGen Healthcare powers over a third of all United States Health Information Exchanges (“HIE’s”), with over 170 million patient records passing over our network of almost 2.8 million directory addresses. |

|

|

• |

Insights – Providing intelligence at the point of care to enable better health and financial decision-making. We are helping our clients move from being data rich to insight rich. By providing intelligence, through innovative solutions that take data out of electronic health records (“EHR”), normalize, cleanse, and present it back as usable data pipelines, NextGen Healthcare can help optimize prescription guidance, care gap reviews, billing quality, practice variance, etc. and insert it directly into clinician’s workflows in order to facilitate sound clinical and financial decisions when serving patients. |

|

|

• |

Impact – Delivering and shaping outcomes in all aspects of our solutions and service. NextGen Healthcare is pivoting towards becoming a true performance partner for our clients and is evidenced by proactively helping manage performance and outcomes for our clients. |

NextGen Healthcare delivers value to our clients in several ways. Our solutions enable our clients to address current needs while preparing for the needs of the future including expanding access to health services, enhancing the coordination and management of care, and optimizing patient outcomes while also ensuring the sustainability of their practices. Specifically, we offer a range of solutions to allow clinicians to practice anywhere and in new and innovative collaboration models.

NextGen Healthcare provides integrated cloud-based solutions and services that align with our client’s strategic imperatives. Ultimately, this value is reflected in the overall insights and impact delivered to the client. The foundation for our integrated ambulatory care platform is a core of our industry-leading EHR and practice management (“PM”) systems that support clinical, financial and patient engagement activities.

We optimize the core with an automation and workflow layer that gives our clients control over how platform capabilities are implemented to drive their desired outcomes. The workflow layer includes mobile and voice-enabled capabilities proven to reduce physician burden. Recognizing that engaged patients are key to positive outcomes, our patient experience platform enables our clients to create personalized care experiences that enhance trust and drive patient loyalty. Further, we support the advances in integrated care that focuses on the whole person with solutions supporting behavioral and oral health. Our cloud-based population health and analytics engine allows our clients to improve results in both fee-for-service and fee-for-value environments.

5

In support of extensibility, we surround the core with open, web-based application programming interfaces (“APIs”) to drive the secure exchange of health and patient data with connected health solutions. Our commitment to interoperability, defragmenting care and our experience powering many of the nation’s HIE’s places us in a unique position to enable our clients to leverage this technology to lower the cost of care and improve the patient and provider experience by providing an integrated community patient record.

Finally, to ensure our clients get maximum value from our solutions, we have augmented our technology with key services aligned with their needs, helping to ensure they reach their organizational goals. We partner with our clients to optimize their information technology (“IT”) operations, enhance revenue cycle processes across fee-for-service and fee-for-value models, service line expansion and operations, as well as advise on long-term strategy.

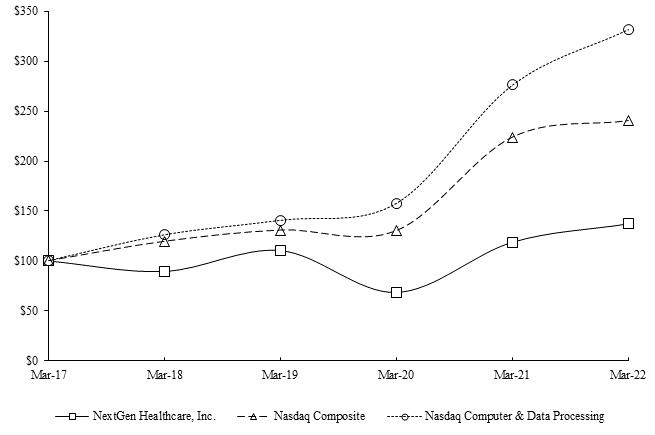

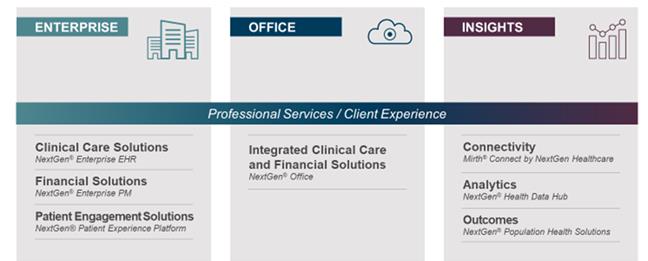

Positioning NextGen Healthcare for Growth. As NextGen Healthcare applies this value proposition framework across the ambulatory care market, we incorporate some or all our current solution offerings within three broad domains illustrated in Figure 1 below:

|

|

• |

Enterprise – The Enterprise domain is both the largest and incorporates our broadest portfolio of solutions (e.g., clinical, financial, and patient engagement solution portfolios) provided to ambulatory care practices that incorporate 10 or more healthcare providers. One of these solutions, our practice management offering, NextGen® Enterprise PM, was recognized as the #1 Practice Management Solution (11-75 Physicians) for four consecutive years – 2019, 2020, 2021 and 2022 Best in KLAS Report. |

|

|

• |

Office – The Office domain reflects almost all solutions (software solutions and adjacent services) provided to an ambulatory care practice that incorporates fewer than 10 healthcare providers. Our main offering in this group is a cloud-based, multi-tenant SaaS EHR and PM solution, called NextGen® Office, which was recognized as the #1 Small Practice Ambulatory EMR/PM (<10 Physicians) in the 2022 Best in KLAS Report. |

|

|

• |

Insights – The Insights domain incorporates solutions that address interoperability, data and analytics, and value-based care. Previously described as population health and connected health, the Insights solutions portfolio is offered to clients across both our Enterprise and Office domains as well as additional ambulatory healthcare stakeholders addressing connectivity or value-based care needs. NextGen is highlighting this domain as a reflection of its overall importance and high future growth potential. |

Figure 1: NextGen Healthcare Solutions Domains

Additional commentary on our collection of solutions within the three broad domains are described in further detail below.

6

ENTERPRISE

Clinical Care Solutions improve the quality and efficiency of care delivery as well as the patient and provider experience. They significantly ease the administrative burden and enable the delivery of high quality, personalized care. Providers can automate patient intake, streamline clinical workflows, and leverage vendor-agnostic interoperability to achieve quality measures and qualify for incentives. Examples of our clinical care solutions are:

NextGen® Enterprise EHR – Our electronic health records solution stores and maintains clinical patient information and offers a workflow module, prescription management, automatic document and letter generation, patient education, referral tracking, interfaces to billing and lab systems, physician alerts and reminders, and reporting and data analysis tools.

Financial Solutions provides key analytics that allow clients to drive healthy, predictable financial outcomes. More than just billing and collection services, financial management involves all functions that effectively capture revenue at the lowest cost, while providing an efficient experience for the patient. Financial management solutions help practices improve performance and correct operational inefficiencies, while enhancing the practice’s financial outcomes throughout the revenue cycle. An example of our financial management solutions is:

NextGen® Enterprise PM – Our practice management offering is a seamlessly integrated, scalable, multi-module solution that includes a master patient index, enterprise-wide appointment scheduling with referral tracking, and clinical support.

Patient Engagement Solutions boost loyalty and improve outcomes by engaging patients in their own care. Our patient engagement tools enable patients to better manage their own health through direct patient-provider messaging, online scheduling, automated reminders, easy payment options, and virtual visits. The ability of patients to handle their own scheduling and billing frees provider staff, restoring valuable time. An example of our patient engagement solutions is:

NextGen Virtual Visits™ – Delivers a tightly integrated, bi-directional telehealth experience that allows patients to have a virtual visit with their own personal doctor and their own provider’s care team. The solution allows for screen-sharing, document passing, in-visit chat, one-touch access to interpretive services, and a "no-login" experience for patients.

OFFICE

Integrated Clinical Care and Financial Solutions provide a comprehensive set of software and services specifically targeted to improve the clinical and financial performance of small and independent practices across a broad set of clinical specialties. An example of our solution in this space is:

NextGen® Office – A cloud-based EHR and PM solution for physicians and medical billing services designed to meet the specific needs of smaller practices.

INSIGHTS

Interoperability Solutions (formerly Connected Health Solutions) enable different information technology systems to communicate and exchange usable data thereby allowing caregivers to more effectively work together within and across care teams and organizational boundaries, and equipping patients to collaborate on their own care. Our integration and interoperability offerings enable providers to leverage their current technology for better outcomes and truly connected patient care. Example of our interoperability solutions are:

NextGen® Share – A broad and expanding suite of plug-and-play interoperability solutions which help NextGen® Enterprise EHR users safely and securely exchange clinical content with external providers and organizations. The platform includes support for secure direct messaging with more than 2.8 million providers and organizations, care quality integration to enable automated data exchange of over 250 million records to date.

Mirth® Connect – Enables patient data from disparate systems to be easily and securely shared, aggregated, and put to work, regardless of EHR, PM, or other healthcare IT platform or location. This offering optimizes interoperability capabilities with advanced administration tools that help drive affordable and effective health data exchange and supports client’s ability to control resources and elevate performance.

7

Data and Analytics Solutions help NextGen Healthcare’s customers to unlock the value of their information assets and deliver actionable insight and decision support at the point of care. We do this by aggregating and normalizing data assets across multiple sources of truth, enriching those data sets as needed with proprietary and 3rd party information assets and applying sophisticated analytics to develop a broad set of clinical, operational, financial, and experiential insights. An example of our data and analytics solutions is:

NextGen® Health Data Hub (“HDH”) – A fully redesigned data aggregation platform to meet the expanding market demand for robust data sharing, aggregation, and community access. HDH was built from the ground-up to provide comprehensive, continuous access to aggregated patient health data on a robust, reliable, platform that will enable system-wide connectivity, and support the growing enterprise data management needs for HIEs, hospitals and large ambulatory practices.

Value Based Care Solutions (formerly Population Health Solutions) provide our customers the ability to enhance care quality and optimize the total cost of delivering care to patient populations across risk strata. As the incidence of chronic conditions rises across patient populations, providers are increasingly seeking turnkey chronic condition management, remote patient monitoring and care program adherence solutions that can improve clinical outcomes. Our solutions also give practices the ability to share risk with payors under alternative payment models and sustainably navigate the transition from fee-for-service to fee-for-value. An example of our value based care solutions is:

NextGen® Population Health Solutions – Delivers robust capabilities for core population health insights using integrated clinical and claims data to support both broad and deep analysis for populations of interest (attribute visualization, risk stratification, gaps in care, etc.).

SERVICES

Applicable across all three domains, NextGen Healthcare provides additional value to clients in the form of services that help clients achieve their strategic objectives. Through these services, we enable clients to effectively address core operational and financial needs so they can focus on their primary mission of providing efficient and high-quality patient care. Our three categories of services include:

Managed Services include our scalable, cloud hosting services reduce the burden of information technology expertise from our clients and speed implementations, simplify upgrades, cut technology costs significantly and provide 24/7 monitoring and support by a broad team of technical experts. In addition, we offer Revenue Cycle Management (“RCM”) Services that includes billing and collections, electronic claims submission and denials management, electronic remittance and payment posting and accounts receivable follow-up. Our dedicated account management model helps make NextGen Healthcare a top-performing provider of RCMS as reported in the 2020 KLAS Ambulatory RCM Services Report.

Professional Services include training, project management, installation services, and application managed services. Our consulting services, which include physician, professional, and technical consulting, assisting clients to optimize their staffing and software solutions, enhance financial and clinical outcomes, achieve regulatory requirements in the drive to value-based care, and meet the evolving requirements of healthcare reform.

Client Service and Support in which our technical services staff provides support for the dependable and timely resolution of technical inquiries from clients. Such inquiries are made via telephone, email and the internet. We offer several levels of support, with the most comprehensive service covering 24 hours a day, seven days a week.

Competition

The markets for healthcare information systems and services are intensely competitive and highly fragmented. Our traditional full-suite competitors in the healthcare information systems and services market include: Allscripts Healthcare Solutions, Inc., athenahealth, Inc., Cerner Corporation, eClinicalWorks, Epic Systems Corporation, Greenway Health, LLC, and Modernizing Medicine, Inc. Emerging smaller competitors also bring competition in specific sectors of the market. Additionally, we face competition from technology vendors who offer verticalized data management and analytics solutions and services-only competitors like business process outsourcers, hosting providers and transcription companies.

The EHR, PM, interoperability, and connectivity markets are subject to rapid changes in technology. We expect that competition in these market segments could increase as new competitors enter the market. We believe our principal competitive advantages are our ambulatory-only focus, the essential nature of the EHR and PM clinical platforms to care delivery, our comprehensive and fully-integrated solution, and our deep domain expertise, which enables our subject matter experts to serve as trusted advisors to our clients.

8

Regulatory Environment

As a participant in the healthcare industry, our business, and that of our clients, is subject to a wide array of complex and rapidly changing federal and state laws, regulations, and industry initiatives, in the areas of information sharing, electronic health record and interoperability standards, e-prescribing, claims processing and transmission, security and privacy of patient data, and healthcare fraud. The impact of such laws and regulations on us is direct, to the extent we are subject to these laws and regulations, and is also indirect, in terms of government program requirements applicable to our clients for the use of our solutions or that impact payment models. The complexity and rapidly changing nature of these laws and regulations have created both challenges as well as significant opportunities for our business. New laws and regulations have targeted the adoption of EHRs, health data exchange and interoperability, value-based payment, care coordination, utilization of telehealth services, migration of inpatient to outpatient care, and expansion of behavioral health services. Many of these changes have spanned multiple Congresses and Presidential Administrations and taken years to fully implement (e.g., The Medicare Access and CHIP Reauthorization Act of 2015 (“MACRA”) and Cures Act):

|

|

• |

Cures Act – The Cures Act, which was passed in 2016 and laid the groundwork for a nationwide trusted health information exchange, includes provisions that directly call for, or describe roles for the use of, health information technology to help providers comply with new federal requirements under Medicare and state Medicaid programs. Sections of the law addressing interoperability also codified the concept of information blocking, requiring a new regulatory structure to respond to concerns that actors in the healthcare industry intentionally block the exchange of information between various stakeholders. In 2020, the Health and Human Services (“HHS”) Office of the National Coordinator for Health Information Technology (“ONC”) released a final regulation which, among other things, calls on developers of certified EHRs to adopt standardized APIs and to meet a list of other new certification requirements to retain approved federal government certification status. In 2022, we announced that our NextGen® Enterprise EHR achieved the ONC-Health IT 2015 Edition Cures Update Health IT certification. |

|

|

• |

MACRA – The Medicare Access and CHIP Reauthorization Act of 2015 (“MACRA”), which reformed how physicians are paid under Medicare and established Merit-based Incentive Payment Systems (“MIPS”), also includes provisions that directly call for or describe roles for the use of health information technology to help providers comply with new federal requirements under Medicare and state Medicaid programs. In 2023, healthcare providers will have to utilize EHR software that meets these requirements to successfully participate in the MACRA Quality Payment Program (“QPP”) and other federal programs that require the use of certified EHRs. |

|

|

• |

HITECH – Various U.S. federal, state and non-government agencies continue to generate requirements for the use of certified health information technology and interoperability standards. These requirements are expansions of the statutory ARRA Health Information Technology for Economic and Clinical Health Act (“HITECH”) program that began providing incentive payments in 2011 to eligible providers and hospitals for the "meaningful use of certified electronic health record technology ("CEHRT")." Although those incentive programs have expired, CEHRT continues to be a requirement of participation in federal healthcare programs to receive reimbursement for health items and services provided by our clients to Medicare and Medicaid beneficiaries. |

Through annual payment policy rules from the CMS and other targeted rulemakings from the United States Department of Health and Human Services (“HHS”), the federal government continues to implement and/or update different aspects of these laws every year, for example:

|

|

• |

2020 – The HHS Office of the National Coordinator for Health Information Technology (“ONC”) released a final regulation which implements the key interoperability provisions included in the Cures Act. The rule calls on developers of certified EHRs to adopt standardized application programming interfaces (“APIs”) and to meet a list of other new certification and maintenance of certification requirements in order to retain approved federal government certification status. |

|

|

• |

2022 – NextGen Healthcare announced that its NextGen® Enterprise EHR achieved the Office of the National Coordinator for Health Information Technology (ONC-Health IT) 2015 Edition Cures Update Health IT certification via an Authorized Certification Body (“ACB”). This made NextGen Healthcare the first EHR developer to certify a complete EHR solution to the 2015 Edition Cures Update criteria. In 2023, healthcare providers will have to utilize EHR software that meets these requirements to successfully participate in the MACRA law’s Quality Payment Program (“QPP”) and other federal programs that require the use of certified EHRs. |

In addition, reform of payment policies for Medicare and Medicaid continues to evolve. For example:

|

|

• |

PPACA – The Patient Protection and Affordable Care Act (“PPACA”) is a comprehensive healthcare reform legislation that became law in 2010 and introduced value-based principles into federal health insurance payments systems and sought to improve healthcare quality and expanded access to affordable health insurance. MACRA built upon the value-based policies introduced by the ACA. Notably, in the last several years, participation in Medicare's "alternative payment models" to replace traditional "fee for service" payments with quality and risk-sharing payment models has been conditioned on the adoption of CEHRT. |

Refer also to the discussion of regulatory risks within “Item 1A. Risk Factors” for governmental regulations and policies that may affect our business.

9

COVID-19

In January 2020, HHS officially declared that a public health emergency (“PHE”) existed as a result of the pandemic. Soon after, HHS issued a series of rules and orders to offer healthcare providers flexibility or waivers from certain regulatory requirements during the PHE that are still in effect today. For example, changes were made through waivers and other regulatory authority to increase access to telehealth services by, among other things, increasing reimbursement, permitting the enrollment of out of state providers and eliminating prior authorization requirements. It is uncertain how long these COVID-19 related regulatory changes will remain in effect and whether they will continue beyond the PHE period. These laws include the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act ("CARES Act”) and the $1.9 trillion American Rescue Plan Act, both of which included record federal investments in FQHCs and behavioral health service providers.

Additional regulations that directly and/or indirectly impact our business include:

Privacy and Security Laws. There are numerous United States federal and state laws and regulations as well as foreign legislation which govern the confidentiality of personal information, how that information may be used, and the circumstances under which such information may be released. These regulations govern both the disclosure and use of confidential personal and patient medical record information and require the users of such information to implement specified security and privacy measures.

|

|

• |

HIPAA – Health Insurance Portability and Accountability Act (“HIPAA”) and its implementing regulations contain substantial restrictions and requirements with respect to the use and disclosure of individual’s protected health information (“PHI”) and require the implementation of administrative, physical, and technical safeguards to ensure the confidentiality, integrity, and availability of individually identifiable health information in electronic form. The principal effects of HIPAA are, first, to require that our systems be capable of being operated by us and our clients in a manner that is compliant with the Transaction, Security and Privacy Standards mandated by HIPAA, and second, to comply with HIPAA when it directly applies to us. |

|

|

• |

Patient Information, Privacy and Security – Our business is subject to rules, particularly HIPAA and HITECH, and contractual obligations relating to the privacy and security of PHI that we and our subcontractors may have access to as part of the operation of our business. These rules and obligations have increased the cost of compliance and could subject us to additional enforcement actions and contractual liability, which could further increase our costs and adversely affect the way in which we do business. |

Fraud and Abuse Laws. The healthcare industry is subject to laws and regulations on fraud and abuse that, among other things, prohibit the direct or indirect payment or receipt of any remuneration for patient referrals, or for the purchase or order, or arranging for or recommending referrals or purchases, of any item or service paid for in whole or in part by these federal or state healthcare programs. Federal enforcement personnel have substantial funding, powers and remedies to pursue suspected or perceived fraud and abuse. Moreover, both federal and state laws forbid bribery and similar behavior.

|

|

• |

Anti-Kickback Laws prohibit giving anything of value to induce referrals of patients or healthcare products and services that are paid by federal healthcare programs. |

|

|

• |

False Claims Act prohibit knowingly or intentionally including false information on a claim for payment submitted to a government payer or being deliberately ignorant to the fact that the information is false. |

Healthcare fraud and abuse laws and regulations can vary significantly from jurisdiction to jurisdiction, and the state and federal interpretation of existing laws and regulations, and their enforcement, may change from time to time. We may also be subject to future legislation and regulations concerning the development and marketing of healthcare software systems or requirements related to product functionality.

Research and Development

The healthcare information systems and services industry is characterized by rapid technological change, requiring us to engage in continuing investments in our research and development to update, enhance and improve our systems. These efforts include developing new solutions as well as new features and enhancements to our existing solutions, which we believe will create additional opportunities to connect our systems to the healthcare community.

Sales and Marketing

We sell and market our products primarily through a direct sales force and to a significantly lesser extent, through a reseller channel. NextGen Healthcare also provides solutions to networks of practices such as MSOs, IPAs, ACOs, ambulatory care centers (“ACCs”), and community health centers (“CHCs”). Our direct sales force is comprised of sales executives and account executives, who seek to understand the client strategy and identify the opportunities in their practice and build both a multistage roadmap to reach the desired end state. For large clients, we use both inside and outside sales where efforts are a mix of on-site as well as web based. For smaller clients, efforts are all inside sales via web and phone, all of whom deliver presentations to potential clients by demonstrating our systems and capabilities either on prospective client’s premises or through video meeting and web-based presentations. Our sales and marketing employees identify prospective clients through a variety of means, including a healthcare data and analytics platform, search engine optimization and value exchange content on nextgen.com; digital advertising; direct mail and email campaigns; referrals from existing clients and industry consultants; contacts at professional society meetings and trade shows (online and in person); webinars; public relations and social media

10

campaigns; and telemarketing. Our sales cycle can vary significantly and typically ranges from six to 18 months from initial contact to contract execution. Smaller practices on NextGen Office tend to have significantly shorter sales cycles ranging in weeks. Moving forward, we expect more of our transactions to move to subscriptions. Clients have the option to purchase hosting and maintenance services, which are invoiced on a monthly, quarterly or annual basis. Subscriptions are delivered electronically after the agreement is signed. They generally include implementation and are typically billed monthly after implementation or based on volume or throughput. We continue to concentrate our direct sales and marketing efforts on the ambulatory market from large multi-specialty organizations to small-single specialty practices in high-opportunity specialty segments.

We have numerous clients and do not believe that the loss of any single client would adversely affect us. No client accounted for 10% or more of our net revenue during each of the years ended March 31, 2022, 2021 and 2020. In addition, software license sales to resellers represented less than 10% of total revenue for each of the years ended March 31, 2022, 2021 and 2020. Substantially all our clients are located in the United States.

Proprietary Rights

We rely on a combination of patents, copyrights, trademarks, service marks, trade secrets, and contractual restrictions to establish and protect proprietary rights in our products and services. To protect our proprietary rights, we enter into confidentiality agreements and invention assignment agreements with our employees with whom such controls are relevant. In addition, we include intellectual property protective provisions in our client and other third-party contracts and control access to software, documentation and other proprietary information. However, because the software industry is characterized by rapid technological change, we believe such factors as the technological and creative skills of our personnel, new product developments, frequent product enhancements, name recognition, and reliable product maintenance are more important to establishing and maintaining a technology leadership position than the various legal protections of our technology.

We rely on intellectual property obtained from third parties for certain components of our products and services. These components enhance our products and services and help meet evolving client needs. The failure to license any necessary technology, or to maintain our existing licenses, could result in reduced functionality of or reduced demand for our products.

Although we believe our products and services, and other proprietary rights, do not infringe upon the proprietary rights of third parties, third parties may assert intellectual property infringement claims against us in the future. Any such claims may result in costly, time-consuming litigation and may require us to enter into royalty or cross-license arrangements.

Privacy and Security

Our business operations involve hosting, storing, processing, and transmitting confidential information, including personally identifiable information, protected health information (“PHI”) and payment card information. We have implemented physical, technical, and administrative safeguards designed to help protect our systems in the event of a system interruption, security incident, or breach of information. Additionally, our comprehensive Information Security Management Program (“ISMP”) is designed to help safeguard the confidentiality, integrity and availability of our clients’ data through use of testing for assurances and outlining processes for appropriate response and reporting of security incidents.

Physical Safeguards

We utilize the industry’s most well-respected certifications starting with Health Information Trust Alliance (“HITRUST”) Common Security Framework (“CSF”), which provides a process to standardize requirements of Health Insurance Portability and Accountability Act (“HIPAA”) and coordinate it with other national and international data security frameworks and many state laws.

We maintain Payment Card Industry Data Security Standard (“PCI-DSS”) Level 1 Service Provider, which allows us to minimize our clients’ PCI scope. In addition, we are a DirectTrust Health Information Service Provider (“HISP”), helping to maintain compliance with Security Organization Control 2, or SOC 2 Type II, across the domains of privacy, security, confidentiality, and availability.

These certifications and pertinent audits help with our client’s third-party assurance programs to ensure we are meeting or exceeding HIPAA and other regulatory requirements.

Technical Safeguards

We operate both single-tenant environments and unified multi-tenant platforms that offer reliability, scalability, performance, security and privacy for our clients and the customers and patients they serve. To create geographical redundancy, our infrastructure resides in several geographically diverse regions across the United States.

Additionally, we have systems in place to monitor the security and confidentiality of PHI, and procedures designed to promptly initiated investigations and mitigation efforts upon notification or identification of a security incident.

11

Administrative Safeguards

We have a comprehensive training and awareness program which includes on-going awareness simulations, required training, supplemental training, and cross-functional incident response testing. All employees are required to complete each cybersecurity training, HIPAA training, and PCI DSS training annually. These training modules are reviewed annually to ensure compliance with the latest regulatory guidelines, laws, and industry best practices, and include information on how our employees’ can ensure they are meeting our security requirements while working in a remote environment.

All policies and procedures are made available to all employees through our organization’s intranet, and acknowledgement of these is required at time of hire. Our Privacy Policy, which outlines how we collect and utilize personal data, is made available on our public facing website.

We recognize that these safeguards may not always prevent future cybersecurity incidents or breaches, especially in the current landscape of increasing cybersecurity risks from, among other areas, the prevalence of remote work, the ability of cyber-criminals to monetize cybersecurity incidents (ransomware, dark web, etc.), growth in digital payments, and cloud computing technology. We also recognize that regulatory scrutiny of privacy, data collection, use and sharing of data is increasing on a global basis, and we are uncertain how current and future data privacy laws may impact our business practices and privacy policies.

Managing Cybersecurity Risks

We conduct regular risk assessments, which are one component of our internal control environment that brings together key stakeholders to identify and evaluate threats and critical risks (both internal and external) that may impact our overall mission and objectives of the organization. The risk assessment process assigns certain risks identified through process to key stakeholders to monitor, manage and implement appropriate measures.

To mitigate the increasing risk of cybersecurity incidents, we review and evaluate our cybersecurity insurance coverage on an annual basis. Our evaluation is based on industry standard, and specific needs of the organization which are identified through business and privacy impact assessments.

We use a third-party vendor to conduct, perform and validate a bona fide annual risk assessment required by the HIPAA Security Rule. The third‐party vendor conducts interviews with key stakeholders and performs penetration testing, evidence collection and on‐site analysis. Formal rating systems determine what, if any, remediation strategies are warranted, and are then incorporated into a remediation plan. The vendor provides a report that is reviewed and approved by the Chief Information Security Office (“CISO”) and reported to appropriate members of executive management and Board of Directors.

The information systems team conducts weekly meetings to review and identify risks through the change management process. Meetings are held to ensure that projects, risks, compliance, federal regulations, and personnel are in line with the organizational goals regarding security and compliance. Continuity and resiliency planning are based on National Institute of Standards and Technology (“NIST”) cybersecurity best practices and are tested no less than annually.

A comprehensive assurance program is maintained with oversight by our CISO, which is included with the organization procurement gating process. Administrative and technical assessments are conducted prior to contract signing with any third-party. Our control consciousness is influenced significantly by our Board of Directors and Audit Committee. While the management of our business is delegated to the management team, the Board of Directors oversees management’s execution of the organization’s business activities.

Human Capital

Workforce Statistics

As of March 31, 2022, NextGen Healthcare had approximately 2,655 full-time employees, approximately 758 of whom were based in Bangalore, India with the remainder located in the United States. None of our employees are covered by a collective bargaining agreement or are represented by a labor union.

Talent Recruitment

We recognize and value our employees as unique contributors through their entire journey at NextGen Healthcare. As such, we have a thoughtful and tailored approach to attracting, developing and retaining talent. We seek highly qualified applicants from a variety of sources with an increased focus on recruiting diverse talent. To ensure transparency and with a desire to mitigate bias, we conduct panel and round robin interviews for hiring and promotion. Discover NextGen, our adventure-based onboarding experience, provides a deep and broad picture of the organization with recognition that employees’ first few weeks on the job potentially cement their commitment to the company and culture.

12

Talent Retention and Development

We provide a career framework for our employees enabling their career development either within a single career track or through the ability to traverse multiple career ladders as they refine or optimize their development. Our Talent Community connects interested employees with internal functional subject matter experts to share job information including knowledge and skills required for advancement. We are committed to developing our employees through a culture of learning. We maintain an organizational development group focused on all aspects of employee development, including management and leadership through our LEAD framework and skill building. We also sponsor 24/7 on-demand training for employee certifications and relevant career-based skillsets and provide education reimbursement for continued education.

Diversity

We recognize our responsibility and strategic opportunity to champion varied viewpoints, culture and expertise. Our Diversity, Equity, Inclusion & Belonging (“DEIB”) strategy includes goals around recruiting, retaining and developing diverse employees and leaders in the Company. Our Employee Resource Groups (“ERGs”) focus their efforts on career, culture, market and community. These ERGs include: AAPI (Asian American Pacific Islander), ABLED (Awareness Benefiting Leadership & Employees About Disabilities), beiNG (Black Equity and Inclusion at NextGen), NextGen United, Generational and Allies, LatinX. LGBTQ+, Military/Veterans and Allies, Remote Engagement, Working Parents, and Women-In-Tech. Our ERGs communicate directly with senior leadership through Listening Sessions with our Chief Executive Officer and other C-level executives. Our BELONG (Bringing Employees to Leadership Opportunities at NextGen) sponsorship program pairs a senior member of our organization (the sponsor) with a more junior member (the protégé) with the goal of career clarity and potential advancement. We also provide and promote employee training on harassment prevention, cultivating a respectful workplace and elimination of unconscious bias. Beyond the fundamental conversation about DEIB, we regularly engage with outside experts on training and facilitated conversations about topics including cultural competency and humility and career progression through a non-dominant culture lens. To measure the impact of the above activities, we survey our employees annually through a specific DEIB survey. We regularly engage with our Board of Directors on strategies, participation, and impact of these initiatives.

Employee Compensation

In recognition of the competitive talent landscape, we align our Total Rewards with the hiring landscape. Our comprehensive approach to compensation includes performance-based merit and bonus rewards. Additionally, long term incentives, 401(k) plan and match, and the Employee Stock Purchase Plan round out our reward strategy. To ensure we support pay equity, we conduct compensation analyses semi-annually in alignment with pay equity training for managers.

Culture and Engagement

NextGen Healthcare understands the vital importance of engaged employees to create a high potential community. We closely track our engagement and culture scores through an annual VOTE (Voice of The Employee) survey and on a monthly basis through our Employee Experience Monitor. We provide our team members with safe and confidential channels to voice concerns and receive a response and ensure they have access to members of our executive leadership team. Employees receive training on ethics and our code of conduct, including how to make reports on our ethics hotline. Our regularly scheduled Town Halls with all employees have become a vital part of our culture of community building. Our Board of Directors receive regular updates on employee engagement and satisfaction issues.

We believe that supporting community and volunteer service among our employees builds a strong culture and caring leaders. Each year, we sponsor NextGen Days of Caring during which our employees can volunteer for external charitable organizations. Our NextGen Cares program also allows employees to donate vacation time to help colleagues who have experienced natural disaster or tragedy. We also encourage our employees to participate in volunteer activities by providing the benefit of paid time off to volunteer through our Volunteer Time Off program.

Our Bangalore development center in India, under the leadership of its Corporate Social Responsibility Committee, conducts community relations activities every quarter to advance and support women’s empowerment, improve health, support education and help fight poverty.

13

Health & Safety

Our health and welfare plans reflect our desire to support our employees in a holistic way. Our healthcare plans are the cornerstone of the program, supplemented with additional insurance, mental health services for all employees, an Employee Assistance Program, and time off plans including vacation, sick leave and parental leave. We also support our employees’ well-being through an integrated online platform that offers a variety of ‘campuses’ such as Family Care, Financial, New Hire, Wellness and Life Events. The campuses provide resources and access to certain programs/benefits relating to childcare, children of aging parents, gym membership, health coaching and more.

COVID-19/Transition to Remote Workforce

Our immediate and most pressing concern regarding the COVID-19 pandemic was and continues to be the safety and well-being of our employees and their families. Commencing in March 2020, we implemented immediate safety measures to protect our employees, including transitioning most of our employees to remote work and implementing policies and procedures to protect the health and safety of our employees who have continued on-site work. As the severity of the pandemic waned and in response to the overwhelming preference of our employees, we implemented remote work as our standard. Our Human Resources, Organizational Development and Information Security teams keep our employees engaged with resources to work remotely, remain productive and avoid burnout. Our business continuity health and safety team continue to share information and guidance on all pandemic updates through our internal health and safety communication channel.

Available Information

Our principal website is www.nextgen.com. We make our periodic and current reports, together with amendments to these reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, available on our website, free of charge, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. You may access such filings through our Investor Relations website at http://investor.nextgen.com. The SEC maintains an internet site at www.sec.gov that contains the reports, proxy statements and other information that we file electronically with the SEC. Our website and the information contained therein or connected thereto is not intended to be incorporated into this Report or any other report or information we file with the SEC. We also use the following social media channels as a means of disclosing information about the company, our platform, our planned financial and other announcements and attendance at upcoming investor and industry conferences:

|

|

• |

NextGen Healthcare Twitter Account (https://twitter.com/NextGen?s=20) |

|

|

• |

NextGen Healthcare Company Blog (https://www.nextgen.com/blog) |

|

|

• |

NextGen Healthcare Facebook Page (https://www.facebook.com/NextGenHealthcare) |

|

|

• |

NextGen Healthcare LinkedIn Page (https://www.linkedin.com/company/nextgenhealthcareinc/) |

|

|

• |

NextGen Healthcare Instagram Page (https://www.instagram.com/nextgenhealthcare/) |

|

|

• |

NextGen Healthcare YouTube Page (https://www.youtube.com/user/nghisinc) |

We encourage our investors and others to review the information we make public in these locations as such information could be deemed to be material information. Please note that this list may be updated from time to time.

14

ITEM 1A. RISK FACTORS

You should carefully consider the risks described below, as well as the other cautionary statements and risks described elsewhere, and the other information contained in this Report and in our other filings with the SEC, including subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. We operate in a rapidly changing environment that involves a number of risks. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business operations. If any of these known or unknown risks actually occur, our business, financial condition or results of operations could be materially and adversely affected, in which case the trading price of our common stock may decline, and you may lose all or part of your investment. The following information should be read in conjunction with Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes in Part II, Item 8, “Financial Statements and Supplementary Data” of this Form 10-K.

Risks Related to COVID-19

The COVID-19 pandemic has adversely affected, and could in the future, adversely affect our business and the business of our customers and suppliers. The COVID-19 pandemic and continuing efforts to control its spread or the resurgence thereof has had a significant, ongoing impact on our operations (including in India) and the operations of our healthcare clients. For example, declines in patient volumes at the onset of the pandemic negatively impacted our revenue in the fourth quarter of fiscal 2020, most notably for purchases of software and hardware. The impact of the disruption also impacted the first half of fiscal 2021, primarily in managed services and EDI, which are volume driven.

We may experience further negative financial impact due to a number of factors, including without limitation:

|

|

• |

Social, economic, and labor instability in India which continues to experience a severe COVID-19 resurgence and where we have operations; |

|

|

• |

A general decline in business activity including the impact of our clients’ office closures; |

|

|

• |

A disproportionate impact on the healthcare groups and other healthcare professionals with whom we contract; |

|

|

• |

Financial pressures on our clients, which may in turn result in their deferment of purchase decisions, or a delay in collections or non-payment; |

|

|

• |

Declines in new business bookings as our clients reduce or delay purchasing decisions; |

|

|

• |

Extensions of the length of sales and implementation cycles; |

|

|

• |

Disruptions to our supply chains and our third-party vendors, partners, and suppliers; and |

|

|

• |

The potential negative impact on the health or productivity of employees, especially if a significant number of them are impacted. |

The magnitude and duration of the disruption and resulting decline in business activity will largely depend on future developments which are highly uncertain and cannot be predicted, including but not limited to the duration and severity of the pandemic, resurgences or additional “waves” of outbreaks of the virus in various jurisdictions (including new strains or mutations of the virus), the impact of the pandemic on economic activity, the actions taken by health authorities and policy makers to contain its impacts on public health and the global economy, and the effectiveness of vaccines. Even after the COVID-19 pandemic has subsided, we may experience material adverse impacts to our business because of the global or U.S. economic impact and any recession that has occurred or may occur in the future. Additionally, concerns over the economic impact of the COVID-19 pandemic have caused extreme volatility in financial and capital markets which has and may continue to adversely impact our stock price and may adversely impact our ability to access capital markets. The COVID-19 pandemic may also have the effect of heightening many of the other risks described below.

Risks Related to Our Business

We face significant, evolving competition which, if we fail to properly address, could adversely affect our business, results of operations, financial condition, and price of our stock. The markets for healthcare information systems are intensely competitive and subject to evolving technology, solution standards and user needs. We face significant competition from various sources and several of our competitors have substantially greater name recognition and financial, technical, product development and marketing resources than we do. Some of our larger competitors, who have greater scale than we do, have, and may continue to become more active in our markets both through internal development and acquisitions. Moreover, we expect that competition will continue to increase because of government programs and consolidation in both the IT and healthcare industries. There can be no assurance that we will be able to compete successfully against current and future competitors or that the competitive pressures that we face will not materially and adversely impact our business, financial condition, and operating results. Transaction induced and other competitive pressures and factors, such as new product introductions by us or our competitors, may result in price or market share erosion that could adversely affect our business, results of operations and financial condition.

We may not be able to develop and market new products to respond to technological changes or evolving industry standards and our clients may not accept our products or services. There can be no assurance that we will be successful

15

in developing and marketing new products that respond to technological changes or evolving industry standards. If we are unable, for technological or other reasons, to develop and introduce new products in a timely manner in response to user needs, changing market conditions or client requirements, our business, results of operations and financial condition may be adversely affected. Also, there can be no assurance that our applications will achieve broad market acceptance or will successfully compete with other available software products. If we fail to distinguish our offerings from other options available to healthcare providers, the demand for and market share of our offerings may decrease. In response to increasing market demand, we are currently developing new generations of targeted software products. There can be no assurance that we will successfully develop these new software products or that these products will operate successfully, or that any such development, even if successful, will be completed concurrently with or prior to introduction of competing products. Any such failure or delay could adversely affect our competitive position or could make our current products obsolete.

Saturation or consolidation in the healthcare industry could result in the loss of existing clients, a reduction in our potential client base and downward pressure on the prices for our products and services. As the healthcare information systems market continues to evolve, saturation of this market with our products or our competitors' products could limit our revenues and opportunities for growth. There has also been increasing consolidation amongst healthcare industry participants in recent years, creating integrated healthcare delivery systems with greater market power. As provider networks and managed care organizations consolidate, the number of market participants decreases, the importance of establishing and maintaining relationships with key industry participants increases, and competition to provide products and services like ours will become more intense. Consolidation of management and billing services may lead integrated delivery systems to require newly acquired physician practices to replace their products with that already in use in the larger enterprise. Our inability to make initial sales of our systems to, or maintain relationships with, newly formed groups and/or healthcare providers that are replacing or substantially modifying their healthcare information systems, or, if we were forced to reduce our prices, could adversely affect our business, results of operations and financial condition.

Our relationships with strategic partners may fail to benefit us as expected. We face risk and/or the possibility of claims from activities related to strategic partners, which could be expensive and time-consuming, divert personnel and other resources from our business and result in adverse publicity that could harm our business. We rely on third parties to provide certain services for our business. These third parties could raise their prices and/or be acquired by our competitors, which could potentially create short and long-term disruptions to our business, negatively impacting our revenue, profit and/or stock price. We also have relationships with certain third parties where these third parties serve as sales channels through which we generate a portion of our revenue. Due to these third-party relationships, we could be subject to claims as a result of the activities, products, or services of these third-party service providers even though we were not directly involved in the circumstances leading to those claims. Even if these claims do not result in liability to us, defending and investigating these claims could be expensive and time-consuming, divert personnel and other resources from our business and result in adverse publicity that could harm our business. In addition, our strategic partners may compete with us in some or all of the markets in which we operate. If we lose any of these third-party relationships or fail to establish additional relationships, or if our relationships fail to benefit us as expected, this could materially and adversely impact our business, financial condition and operating results.

We are dependent on our license rights and other services from third parties, which may cause us to discontinue, delay or reduce product shipments. We depend upon licenses for some of the technology used in our products as well as other services from third parties. Our remote hosting and cloud services businesses also rely on a limited number of software and services suppliers for certain functions of these businesses. Most of these arrangements can be continued/renewed only by mutual consent and may be terminated for any number of reasons. We may not be able to continue using the products or services made available to us under these arrangements on commercially reasonable terms or at all. As a result, we may have to discontinue, delay or reduce product development or services provided until we can obtain equivalent technology or services. Most of our third-party licenses are non-exclusive. Our competitors may obtain the right to use any of the business elements covered by these arrangements and use these elements to compete directly with us. Our use of third-party technologies exposes us to increased risks, including, but not limited to, risks associated with the integration of new technology into our solutions, the diversion of our resources from development of our own proprietary technology and our inability to generate revenue from licensed technology sufficient to offset associated acquisition and maintenance costs. In addition, if our vendors choose to discontinue providing their technology or services in the future or are unsuccessful in their continued research and development efforts, we may not be able to modify or adapt our own products.

We have acquired companies, and may engage in future acquisitions, which may be expensive, time consuming, subject to inherent risks and from which we may not realize anticipated benefits. Historically, we have acquired numerous businesses, technologies, and products. We may acquire additional businesses, technologies and products if we determine that these additional businesses, technologies and products are likely to serve our strategic goals. Acquisitions have inherent risks, which may have a material adverse effect on our business, financial condition, operating results or prospects, including, but not limited to the following: (i) failure to achieve projected synergies and performance targets; (ii) potentially dilutive issuances of our securities, the incurrence of debt and contingent liabilities and amortization expenses related to intangible assets with indefinite useful lives; (iii) using cash as acquisition currency may adversely affect interest or investment income, which may in turn adversely affect our earnings and /or earnings per share; (iv) unanticipated expenses or difficulty in fully or effectively integrating or retaining the acquired technologies, software products, services, business practices, management teams or personnel, which would prevent us from realizing the intended benefits of the acquisition; (v) failure to maintain uniform standard controls, policies and procedures across acquired businesses; (vi) difficulty in predicting and

16