Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Amendment No. 1)

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

NEXTGEN HEALTHCARE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of this filing: | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

PRELIMINARY PROXY MATERIALS — SUBJECT TO COMPLETION

NEXTGEN HEALTHCARE, INC.

3535 Piedmont Rd., NE, Building 6, Suite 700

Atlanta, Georgia 30305

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD OCTOBER 13, 2021

To the Shareholders of NextGen Healthcare, Inc.:

The annual meeting of shareholders of NextGen Healthcare, Inc. (the “Company”) is scheduled be held at our [•] on October 13, 2021, at 10:00 a.m. Eastern Time, for the following purposes:

| 1. | Proposal 1: To approve the reincorporation of the Company in the State of Delaware pursuant to a merger with and into a wholly-owned subsidiary of the Company (the “Reincorporation”); |

| 2. | Proposal 2A: To approve provisions in the Certificate of Incorporation (the “Delaware Certificate”) of NextGen Healthcare, Inc., a Delaware corporation (“NextGen Delaware”) and Bylaws of NextGen Delaware (the “Delaware Bylaws”) limiting the Company’s stockholders’ right to call special meetings of stockholders; |

| 3. | Proposal 2B: To approve a provision in the Delaware Certificate providing that vacancies occurring on the Board of Directors and newly created directorships may be filled solely by a majority of the remaining directors; |

| 4. | Proposal 2C: To approve a provision disallowing cumulative voting; |

| 5. | Proposal 2D: To approve a provision in the Delaware Certificate providing that the total number of directors constituting the Board of Directors may be fixed solely by resolution of the Board of Directors; |

| 6. | Proposal 2E: To approve a provision of the Delaware Certificate providing that, unless NextGen Delaware consents in writing to the selection of an alternate forum, certain intracorporate claims may be brought exclusively in the Delaware Court of Chancery (or, if such court lacks subject matter jurisdiction, the other state or federal courts in the State of Delaware); |

| 7. | Proposal 2F: To approve a provision of the Delaware Certificate requiring any complaint asserting a cause of action under the Securities Act to be brought exclusively in the federal district courts of the United States; |

| 8. | Proposal 2G: To approve a provision in the Delaware Bylaws providing proxy access for director nominees by stockholders; |

| 9. | Proposal 3: To conduct an advisory vote to approve the compensation for our named executive officers (i.e., “Say-on-Pay”); |

| 10. | Proposal 4: To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2022; |

| 11. | Proposal 5: To approve the amendment and restatement of our 2015 Equity Incentive Plan; |

| 12. | Proposal 6A: If Proposals 1 and 2C are approved and the Reincorporation is effected, to select nine persons to serve as directors of NextGen Delaware until the 2022 annual meeting of shareholders, which persons will be appointed by the director(s) of NextGen Delaware to fill any vacant seats or unfilled newly created directorships. Cumulative voting will not be available with respect to this Proposal 6A; |

| 13. | Proposal 6B: If either Proposal 1 or 2C is not approved, to elect nine persons to serve as directors of our company until the 2022 annual meeting of shareholders. If timely and properly invoked in accordance with California law and the Company’s bylaws, cumulative voting will apply to this Proposal 6B; |

For the avoidance of doubt, if Proposal 6A is voted on, Proposal 6B will not be voted on, and vice versa. For both Proposals 6A and 6B, our nominees for election to our Board of Directors (“Board”) are Craig A. Barbarosh, George H. Bristol, Julie D. Klapstein, Jeffrey H. Margolis, Dr. Geraldine McGinty, Morris Panner, Dr. Pamela Puryear, [ ] and [ ]; and

| 14. | To transact such other business as may properly come before the annual meeting or any adjournments or postponements thereof. |

Approval of Proposal 1 is conditioned upon approval of Proposal 2C. For the avoidance of doubt, if Proposals 1 and 2C are approved by shareholders at the annual meeting:

| • | The Company, as the current sole stockholder of NextGen Delaware, will have executed a consent of the sole stockholder of NextGen Delaware in lieu of a meeting of stockholders of NextGen Delaware with respect to Proposals 2A – 2B and 2D – 2G and Proposals 3-5 (which consent will approve only those remaining proposals that would have otherwise received the requisite approval of the NextGen California shareholders at this annual meeting); |

| • | The certificate of merger with respect to the Reincorporation will be filed and the Reincorporation will be effected after the voting on Proposals 1, 2A-2G, 3, 4 and 5 and prior to voting on Proposal 6A; |

| • | The total number of directors constituting the board of directors of NextGen Delaware will be increased to nine (9) directors; a |

| • | The nine (9) nominees who receive a plurality of the votes cast by the shareholders of NextGen California in Proposal 6A will be appointed by the director(s) of NextGen Delaware to fill any vacant seats or unfilled newly created directorships, and cumulative voting will not be available with respect to Proposal 6A; and |

| • | Proposal 6B will not be voted on. |

All shareholders are cordially invited to attend the annual meeting in person. Only shareholders of record at the close of business on September 2, 2021, are entitled to notice of and to vote at the annual meeting and at any adjournments or postponements of the annual meeting.

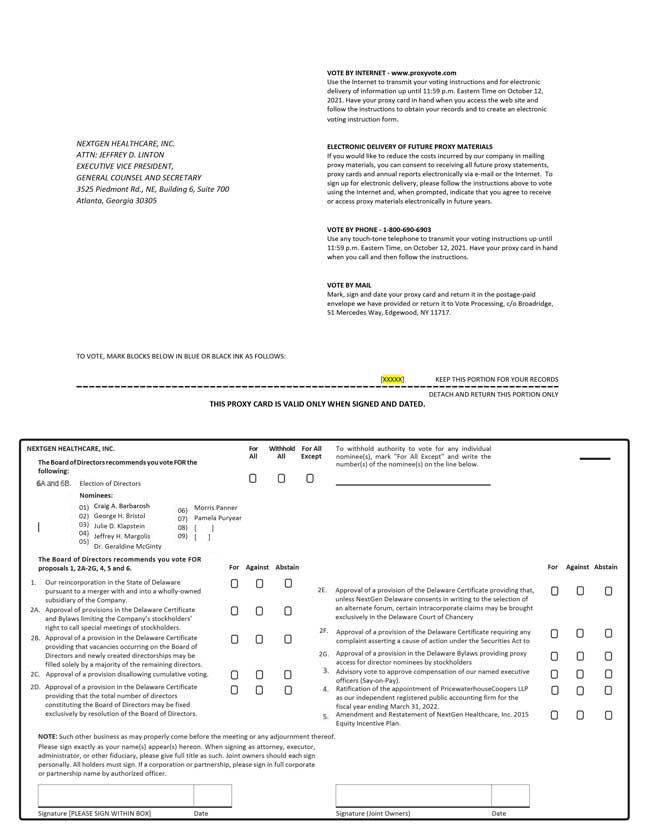

Whether or not you plan to attend the annual meeting, please complete and sign the enclosed WHITE proxy card and return it in the enclosed addressed envelope. Your promptness in returning the proxy card will assist in the expeditious and orderly processing of the proxy and will assure that you are represented at the annual meeting even if you cannot attend the meeting in person. You may also vote by telephone or internet by following the instructions on the proxy card. If you return your proxy card or vote by telephone or internet, you may nevertheless attend the annual meeting and vote your shares in person. Shareholders whose shares are held in the name of a broker or other nominee and who desire to vote in person at the meeting should bring with them a legal proxy.

Messrs. Sheldon Razin and Lance E. Rosenzweig have notified the Company of their intention to propose director nominees for election at the annual meeting in opposition to the nominees recommended by the Board. As a result, you may receive solicitation materials, including a blue proxy card, from Messrs. Razin and Rosenzweig seeking your proxy to vote for their nominees. We do not endorse the election of any of Messrs. Razin’s and Rosenzweig’s nominees to become a director. THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF ALL OF THE BOARD’S NOMINEES USING THE ENCLOSED WHITE PROXY CARD AND URGES YOU NOT TO SIGN OR RETURN OR VOTE ANY BLUE PROXY CARD SENT TO YOU BY OR ON BEHALF OF MESSRS. RAZIN AND ROSENZWEIG. If you have previously submitted a blue proxy card sent to you by Messrs. Razin and Rosenzweig, you can revoke that proxy and vote for our Board’s nominees and on the other matters to be voted on at the meeting by using the enclosed WHITE proxy card.

Table of Contents

We are not responsible for the accuracy of any information provided by or relating to Messrs. Razin and Rosenzweig and their nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Messrs. Razin and Rosenzweig or any other statements that Messrs. Razin and Rosenzweig may otherwise make. Messrs. Razin and Rosenzweig choose which shareholders of the Company receive its proxy solicitation materials.

OUR BOARD RECOMMENDS A VOTE “FOR” PROPOSAL 1, “FOR” PROPOSALS 2A-2G, “FOR” PROPOSAL 3, “FOR” PROPOSAL 4, “FOR” PROPOSAL 5 AND IN THE CASE OF PROPOSALS 6A OR 6B (AS APPLICABLE), FOR” THE ELECTION OF ALL OF OUR DIRECTOR NOMINEES NAMED ON THE ENCLOSED WHITE PROXY CARD.

| By Order of the Board of Directors, |

| NEXTGEN HEALTHCARE, INC. |

| /s/ Jeffrey D. Linton |

| Jeffrey D. Linton |

| Executive Vice President, General Counsel and Secretary |

| Atlanta, Georgia |

| [ ], 2021 |

Table of Contents

3535 Piedmont Rd., NE, Building 6, Suite 700

Atlanta, Georgia 30305

Table of Contents

PRELIMINARY PROXY MATERIALS — SUBJECT TO COMPLETION

NEXTGEN HEALTHCARE, INC

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD OCTOBER 13, 2021

PROXY STATEMENT

The accompanying proxy is solicited by the Board of Directors (“Board”) of NextGen Healthcare, Inc. (“NextGen Healthcare,” the “Company,” “us,” “we” or “our”) for use at our annual meeting of shareholders to be held [•] on October 13, 2021 at 10:00 a.m. Eastern Time, and at any and all adjournments and postponements thereof. All shares represented by each properly submitted and unrevoked proxy received in advance of the annual meeting will be voted in the manner specified therein.

Any shareholder has the power to revoke the shareholder’s proxy at any time before it is voted. A proxy may be revoked by delivering a written notice of revocation to our Secretary prior to or at the annual meeting, by voting again on the internet or by telephone (only your latest internet or telephone proxy submitted prior to 11:59 P.M. Eastern Time on October 12, 2021 will be counted), by submitting to our Secretary, prior to or at the annual meeting, a later dated proxy card executed by the person executing the prior proxy, or by attendance at the annual meeting and voting in person by the person submitting the prior proxy or voting by ballot at the annual meeting.

Any shareholder who holds shares in street name and desires to vote in person at the annual meeting should inform the shareholder’s broker of that desire and request a legal proxy from the broker. The shareholder will need to bring the legal proxy to the annual meeting along with valid picture identification such as a driver’s license or passport, in addition to documentation indicating share ownership. If the shareholder does not receive the legal proxy in time, then the shareholder should bring to the annual meeting the shareholder’s most recent brokerage account statement showing that the shareholder owned NextGen Healthcare, Inc. common stock as of the record date. Upon submission of proper identification and ownership documentation, we should be able to verify ownership of common stock and admit the shareholder to the annual meeting; however, the shareholder will not be able to vote at the annual meeting without a legal proxy. Shareholders are advised that if they own shares in street name and request a legal proxy, any previously executed proxy will be revoked, and the shareholder’s vote will not be counted unless the shareholder appears at the annual meeting and votes in person or legally appoints another proxy to vote on its behalf.

We will bear all expenses in connection with the Company’s solicitation of proxies. We will reimburse brokers, fiduciaries and custodians for their costs in forwarding the Company’s proxy materials to beneficial owners of common stock. Our directors, officers and employees may solicit proxies by mail, telephone and personal contact on behalf of the Company. They will not receive any additional compensation for these activities.

Messrs. Sheldon Razin and Lance E. Rosenzweig have notified the Company of their intention to propose director nominees for election at the annual meeting in opposition to the nominees recommended by the Board. As a result, you may receive solicitation materials, including a blue proxy card, from Messrs. Razin and Rosenzweig seeking your proxy to vote for their nominees. We do not endorse the election of any of Messrs. Razin’s and Rosenzweig’s nominees to become a director. THE BOARD RECOMMENDS A VOTE FOR THE ELECTION OF ALL OF THE BOARD’S NOMINEES USING THE ENCLOSED WHITE PROXY CARD AND URGES YOU NOT TO SIGN OR RETURN OR VOTE ANY BLUE PROXY CARD SENT TO YOU BY OR ON BEHALF OF MESSRS. RAZIN AND ROSENZWEIG. If you have previously submitted a blue proxy card sent to you by Messrs. Razin and Rosenzweig, you can revoke that proxy and vote for our Board’s nominees and on the other matters to be voted on at the meeting by using the enclosed WHITE proxy card.

We are not responsible for the accuracy of any information provided by or relating to Messrs. Razin and Rosenzweig and their nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Messrs. Razin and Rosenzweig or any other statements that Messrs. Razin and Rosenzweig may otherwise make. Messrs. Razin and Rosenzweig choose which shareholders receive its proxy solicitation materials.

This proxy statement, the accompanying proxy card and our 2021 annual report are being made available to our shareholders on or about September [•], 2021.

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on October 13, 2021.

This proxy statement, the notice of our 2021 annual meeting of shareholders and the Company’s 2021 annual report to shareholders are available on our website at http://investor.nextgen.com/financial-information.

PARTICIPANTS IN THE PROXY SOLICITATION

Under applicable regulations of the Securities and Exchange Commission (the “SEC”), in addition to the Company, each person who is a member of the Board and each person who is an executive officer of the Company listed below under “Additional Information Regarding Participants in the Solicitation” in Appendix A is deemed to be a “participant” in the proxy solicitation. Information relating to the participants in our solicitation is contained in Appendix A attached hereto. Proxies may also be solicited by certain of our regular employees, without additional compensation.

1

Table of Contents

OUTSTANDING SHARES AND VOTING RIGHTS

Only holders of record of the [ ] shares of our common stock outstanding at the close of business on the record date, September 2, 2021, are entitled to notice of and to vote at the annual meeting or any adjournments or postponements thereof. A majority of the outstanding shares, represented in person or by proxy, will constitute a quorum for the transaction of business. All properly submitted and unrevoked proxies will be counted in determining the presence of a quorum, including those providing for abstention or withholding of authority and those submitted by brokers voting without beneficial owner instruction and exercising a non-vote on certain matters.

Each shareholder will be entitled to one vote, in person or by proxy, for each share of common stock held on the record date. However, under our Bylaws and California law, if any shareholder gives notice at the annual meeting, prior to the voting, of an intention to cumulate the shareholder’s votes in the election of directors, then all shareholders entitled to vote at the annual meeting may cumulate their votes in the election of directors if Proposals 1 and 2C are not approved, the Reincorporation is not effected and Proposal 6B is voted on. Cumulative voting means that a shareholder has the right to give any one candidate who has been properly placed in nomination a number of votes equal to the number of directors to be elected multiplied by the number of shares the shareholder is entitled to vote, or to distribute such votes on the same principle among as many properly nominated candidates (up to the number of persons to be elected) as the shareholder may wish. If cumulative voting applies at the annual meeting and Proposal 6B is voted on, the cumulative number of votes a shareholder may cast in director elections will be equal to the number of shares held by such shareholder on the record date multiplied by nine (the number of directors to be elected at the annual meeting).

Approval of Proposal 1 is conditioned upon approval of Proposal 2C. Proposal 1, a vote to approve the reincorporation of the Company in the State of Delaware pursuant to a merger with and into a wholly-owned subsidiary of the Company (the “Reincorporation”) and Proposal 2C (elimination of cumulative voting) each requires the affirmative vote of the holders of a majority of the outstanding shares of the Company’s common stock entitled to vote. Consequently, abstentions and broker non-votes will have the effect of votes against each of these proposals. For the avoidance of doubt, if Proposals 1 and 2C are approved by shareholders at the annual meeting:

| • | The Company, as the current sole stockholder of NextGen Delaware, will have executed a consent of the sole stockholder of NextGen Delaware in lieu of a meeting of stockholders of NextGen Delaware with respect to Proposals 2A – 2B and 2D – 2G and Proposals 3-5 (which consent will approve only those remaining proposals that would have otherwise received the requisite approval of the NextGen California shareholders at this annual meeting); |

| • | The certificate of merger with respect to the Reincorporation will be filed and the Reincorporation will be effected after voting on Proposals 1, 2A-2G, 3, 4 and 5 and prior to voting on Proposal 6A; |

| • | The total number of directors constituting the board of directors of NextGen Delaware will be increased to nine (9) directors; |

| • | The nine (9) nominees who receive a plurality of the votes cast by the shareholders of NextGen California in Proposal 6A will be appointed by the director(s) of NextGen Delaware to fill any vacant seats or unfilled newly created directorships, and cumulative voting will not be available with respect to Proposal 6A; and |

| • | Proposal 6B will not be voted on. |

Under applicable state law, shareholder approval of the Reincorporation is sufficient to implement the proposed governance-related provisions in the Certificate of Incorporation of NextGen Delaware (the “Delaware Certificate”) and the Bylaws of NextGen Delaware (the “Delaware Bylaws”). If the shareholders do not approve both Proposals 1 and 2C at the annual meeting, Proposals 2A-2B and 2D-2G will not be presented for a vote at the annual meeting. We intend to present Proposals 3-5 for shareholder approval regardless of whether Proposals 1 and 2C are approved by the shareholders at the meeting. Either Proposal 6A or 6B will be presented, depending upon whether Proposals 1 and 2C are approved.

Approval of Proposal No. 3, an advisory vote to approve the compensation of our named executive officers (i.e., “Say-on-Pay”), will occur if the vote constitutes both: (i) the affirmative vote of a majority of the shares represented and voting and (ii) the affirmative vote of at least a majority of the required quorum. For purposes of this proposal, abstentions and broker non-votes will not affect the outcome under clause (i), which recognizes only actual votes cast. Abstentions and broker non-votes may affect the outcome under clause (ii) because abstentions and broker non-votes are counted for purposes of determining the quorum and have the effect of a vote against the proposal.

Approval of Proposal No. 4, the ratification of the appointment of our independent registered public accounting firm, is not required. However, this proposal will be considered approved if the vote constitutes both: (i) the affirmative vote of a majority of the shares represented and voting and (ii) the affirmative vote of at least a majority of the required quorum. For purposes of this proposal, abstentions and broker non-votes will not affect the outcome under clause (i), which recognizes only actual votes cast. Abstentions and broker non-votes may affect the outcome under clause (ii) because abstentions and broker non-votes are counted for purposes of determining the quorum and have the effect of a vote against the proposal.

Approval of Proposal No. 5, the amendment of the amendment and restatement of our 2015 Equity Incentive Plan (the “Amended 2015 Equity Incentive Plan”), will occur if the vote constitutes both: (i) the affirmative vote of a majority of the shares represented and voting and (ii) the affirmative vote of at least a majority of the required quorum. For purposes of this proposal, abstentions and broker non-votes will not affect the outcome under clause (i), which recognizes only actual votes cast. Abstentions and broker non-votes may affect the outcome under clause (ii) because abstentions and broker non-votes are counted for purposes of determining the quorum and have the effect of a vote against the proposal.

Regardless of whether Proposal 6A or 6B is voted on, the nine director nominees who receive the highest number of affirmative votes (a plurality) will be elected or appointed as directors; abstentions and broker non-votes will have no effect on Proposal 6A or 6B. See “Additional Information on the Mechanics of Cumulative Voting” below for more information on the operation of cumulative voting.

2

Table of Contents

Additional Information on the Mechanics of Cumulative Voting

In the event that Proposal 6B is voted on and cumulative voting applies, all shareholders will have the right to cumulate their votes in the election of directors. Cumulative voting means that each shareholder may cumulate such shareholder’s voting power for the election by distributing a number of votes, determined by multiplying the number of shares held by the shareholder as of the record date by nine (the number of directors to be elected at the annual meeting). Such shareholder may distribute all of the votes to one individual director nominee, or distribute such votes among any two or more director nominees, as the shareholder chooses. If you do not specifically instruct otherwise, the proxy being solicited by our Board will confer upon the proxy holders the authority, in the event that cumulative voting applies, to cumulate votes at the instruction and discretion of our Board or any committee thereof so as to provide for the election of the maximum number of our director nominees (for whom authority is not otherwise specifically withheld) including, but not limited to, the prioritization of such nominees to whom such votes may be allocated. Using its authority, the Board may vote your shares for fewer than nine nominees.

If you elect to grant us your proxy and do not specifically instruct otherwise, you are authorizing the proxy holders to vote your shares in accordance with the discretion and at the instruction of the Board, including to cumulate your votes in favor of certain nominees (rather than allocating votes equally among the nominees) and to determine the specific allocation of votes to individual nominees. You may withhold your authority to vote for one or more nominees, in which case the Board will retain discretion to allocate your votes among our other nominees unless you specifically instruct otherwise. Under no circumstances may the proxy holders cast your votes for any nominee from whom you have withheld authority to vote.

For example, a proxy marked “FOR ALL EXCEPT” may only be voted for those of our director nominees for whom you have not otherwise specifically withheld authority to vote, a proxy marked “WITHHOLD ALL” may not be voted for any of our director nominees, and a proxy marked “FOR ALL” may be voted for all of our director nominees. In exercising its discretion with respect to cumulating votes, our Board may instruct, in its sole judgment, the proxy holders to cumulate and cast the votes represented by your proxy for any of our director nominees for whom you have not otherwise withheld authority. For example, if you grant a proxy with respect to shares representing 900 cumulative votes, and mark “FOR ALL EXCEPT” one of our director nominees, the Board may instruct the proxy holders to cast the 900 votes for any or all of our eight other director nominees; of those eight other director nominees, moreover, the Board may allocate the 900 votes among them as it determines, such that each of those other director nominees may receive unequal portions of the 900 votes or none at all.

In the event that Proposal 6B is voted on and cumulative voting applies, unless you specifically instruct otherwise, the Board will instruct the proxy holders to cast the votes as to which voting authority has been granted so as to provide for the election of the maximum number of our director nominees, and will provide instructions as to the order of priority of the Board candidates in the event that fewer than all of our Board candidates are elected. The Board has not yet made any determination as to the order of priority of candidates to which it would allocate votes in the event cumulative voting applies, and expects to make this determination, if necessary, at the annual meeting. Accordingly, if you grant a proxy to us and have not specifically instructed otherwise, your shares will be voted for our director nominees at the discretion of the Board with respect to all of your shares (except that the Board will not be able to vote your shares for a candidate from whom you have withheld authority to vote). If you wish to exercise your own discretion as to allocation of votes among nominees, and you are a record holder of shares, you will be able to do so by attending the meeting and voting in person, by appointing another person as your proxy to vote on your behalf at the meeting, or by providing us with specific instructions as to how to allocate your votes.

A holder of record who wishes to invoke cumulative voting must submit a proxy card by mail, check the box indicating the exercise of cumulative voting and hand mark the number of votes such holder wishes to allocate to each particular nominee next to the name of such nominee on the enclosed proxy card. A holder of record who wishes to provide vote allocation instructions, in the event that cumulative voting applies, must submit a proxy card by mail and should hand mark the number of votes such holder wishes to allocate to any particular nominee next to the name of such nominee on the enclosed proxy card. If you provide vote allocation instructions for less than all of the votes that you are entitled to cast, the proxy holders will retain discretionary authority to cast your remaining votes pursuant to the instructions of the Board, except for any nominee for whom you have withheld authority by marking the “FOR ALL EXCEPT” box. If you wish to grant the proxy holders discretionary authority to allocate votes among all our nominees you may check the “FOR ALL” box, but you are not required to do so. The proxy holders will retain discretionary authority to allocate votes among all our nominees except where you provide a specific instruction by hand marking the number of votes to be allocated or by marking the “FOR ALL EXCEPT” box.

Any shareholder who holds shares in street name and desires to specifically allocate votes among nominees, in the event cumulative voting applies, may do so by either informing the shareholder’s broker, banker or other custodian of the shareholder’s desire to attend the annual meeting, and requesting a legal proxy to attend the meeting, or by providing the broker, banker or other custodian with instructions as to how to allocate votes among nominees, which can then be delivered to the Company. Because each broker, banker or custodian has its own procedures and requirements, a shareholder holding shares in street name who wishes to allocate votes to specific nominees should contact its broker, banker or other custodian for specific instructions on how to obtain a legal proxy or provide vote allocation instructions.

3

Table of Contents

Please note you will not be able to submit vote allocation instructions for director elections if you grant a proxy by telephone or the internet.

4

Table of Contents

CAUTION CONCERNING FORWARD LOOKING

STATEMENTS

Statements made in this proxy statement that are not historical in nature, or that state our or our management’s intentions, hopes, beliefs, expectations or predictions of the future, may constitute “forward-looking statements” within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended. Forward-looking statements can often be identified by the use of forward-looking language, such as “could,” “should,” “will,” “will be,” “will lead,” “will assist,” “intended,” “continue,” “believe,” “may,” “expect,” “hope,” “anticipate,” “goal,” “forecast,” “plan,” or “estimate” or variations thereof or similar expressions. Forward-looking statements are not guarantees of future performance. These forward-looking statements may include, without limitation, the impact of the COVID-19 pandemic, discussions of our product development plans, business strategies, future operations, financial condition and prospects, the results of this proxy contest, developments in and the impacts of government regulation and legislation and market factors influencing our results.

Forward-looking statements involve risks, uncertainties and assumptions. It is important to note that any such performance and actual results, financial condition or business, could differ materially from those expressed in such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the risk factors discussed under “Risk Factors” in our Annual Report on Form 10-K for fiscal year ended March 31, 2021, as well as factors discussed elsewhere in this and other reports and documents we file with the SEC. Other unforeseen factors not identified herein could also have such an effect. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results, financial condition or business over time unless required by law. Interested persons are urged to review the risks described under “Risk Factors” and in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for fiscal year ended March 31, 2021, as well as in our other public disclosures and filings with the SEC.

5

Table of Contents

REINCORPORATION OF THE COMPANY FROM CALIFORNIA TO DELAWARE

(Proposal No. 1)

Our Board of Directors has approved a change in our state of incorporation from California to Delaware (the “Reincorporation”), subject to the approval of our shareholders.

If approved, the Reincorporation will be effected through the merger of the Company into a newly formed wholly-owned subsidiary of the Company incorporated in the State of Delaware (“NextGen Delaware”). For purposes of the discussion below, the Company as it currently exists is a corporation organized under the laws of the State of California and is sometimes referred to as “NextGen California.”

Summary

The principal effects of the Reincorporation will be that, at the effective time of the Reincorporation (the “Effective Time”):

| • | The internal affairs of the Company will cease to be governed by California laws with respect to corporations, and instead will be governed by Delaware laws with respect to corporations. |

| • | Depending on the results of the proposals under Proposal 2, the Company’s existing Articles of Incorporation (the “California Articles”) and bylaws (the “California Bylaws”) will be replaced by a new Certificate of Incorporation (the “Delaware Certificate”) and bylaws (the “Delaware Bylaws”), as more fully described below. |

| • | Each share of common stock, par value $0.01 per share, of NextGen California outstanding immediately prior to the Effective Time will automatically be converted into one share of common stock, par value $0.01 per share, of NextGen Delaware. |

| • | All of our employee benefit and incentive compensation plans in effect immediately prior to the Effective Time will be assumed and continued by NextGen Delaware, including, but not limited to, equity incentive plans and the amended and restated NextGen Healthcare, Inc. 2015 Equity Incentive Plan (the “Amended 2015 Plan”), if approved by stockholders pursuant to Proposal 5, and each equity award to purchase or acquire shares of NextGen California’s common stock in effect immediately prior to the Effective Time will become an equity award to purchase or acquire an equivalent number of shares of NextGen Delaware’s common stock on the same terms and subject to the same conditions. Following the Effective Time, the Amended 2015 Plan, if approved by our stockholders, will be used by NextGen Delaware to make awards to directors, officers and employees of NextGen Delaware and its subsidiaries as permitted in the Amended 2015 Plan. |

| • | Other than the change in corporate domicile, the Reincorporation will not result in any change in the business, physical location, management, assets, liabilities, net worth or number of authorized shares of the Company, nor will it result in any change in location of our current employees, including management. |

| • | In connection with the Reincorporation, the Company is proposing to eliminate cumulative voting (see Proposal 2C). |

| • | Under California law and the California Articles, directors are elected by a plurality of the votes cast unless a shareholder provides notice at the meeting and prior to the voting of his or her intention to cumulate votes for the election of directors, in which case all shareholders are also entitled to cumulate their votes at such election. Under cumulative voting, each share entitles the holder to a number of votes equal to the number of directors to be elected in the election, and shareholders are allowed to cumulate those votes among the candidates. As a result, cumulative voting allows a nominee that does not have the support of the holders of a majority of the outstanding shares to be elected. Assuming Proposals 1 and 2C are approved by the shareholders at the annual meeting, the certificate of merger with respect to the Reincorporation will be filed and the Reincorporation will be effected prior to Proposal 6A being voted upon, the Delaware Certificate will not provide for cumulative voting and cumulative voting will not be available with respect to Proposal 6A and Proposal 6B will not be voted on. |

| • | Under the default provisions of Delaware law, directors are elected by a plurality of the votes. However, consistent with Delaware law, the Delaware Bylaws provide that directors in uncontested director elections are elected by a majority of votes cast, and directors in contested director elections are elected by a plurality of the votes cast. Since this is a contested election, directors will be elected by a plurality of the votes. |

6

Table of Contents

| • | In order to take full advantage of one of the primary benefits of the Reincorporation, if Proposal 2E is approved, the Delaware Certificate will generally provide that, unless NextGen Delaware consents in writing to the selection of an alternate forum, the Delaware Court of Chancery (or, if such court does not have subject matter jurisdiction thereof, the other state or federal courts in the State of Delaware) will be the sole and exclusive forum for any derivative action or proceeding brought on behalf of NextGen Delaware; any action asserting a claim of breach of a fiduciary duty owed to NextGen Delaware or its stockholders by any director, officer, other employee or stockholder of NextGen Delaware; any action asserting a claim arising pursuant to any provision of the General Corporation Law of the State of Delaware (the “DGCL”) or as to which the DGCL confers jurisdiction upon the Delaware Court of Chancery; any action asserting a claim arising pursuant to any provision of the Delaware Certificate or Delaware Bylaws; or any action asserting a claim governed by the internal affairs doctrine. |

| • | In addition, if Proposal 2F is approved, the Delaware Certificate will generally provide that, unless NextGen Delaware consents in writing to the selection of an alternate forum, the federal district courts of the United States will, to the fullest extent permitted by applicable law, be the sole and exclusive forum for any complaint asserting a cause of action arising under the Securities Act of 1933 (the “Securities Act”). |

| • | Other key substantive rights of shareholders, including the annual election of directors and the right to call a special meeting, will remain, subject to certain variations depending on the outcome of Proposal 2. See the comparison contained in the chart below under the heading “The Charters and Bylaws of NextGen California and NextGen Delaware Compared and Contrasted and Significant Differences Between the Corporation Laws of California and Delaware” beginning on page [ • ]. |

Shareholders are urged to read this proposal carefully, including all of the related exhibits referenced below and attached to this Proxy Statement, before voting on the Reincorporation. The following discussion summarizes the reasons, mechanics and effect of the Reincorporation. This summary is subject to and qualified in its entirety by the Agreement and Plan of Merger (the “Reincorporation Agreement”) between NextGen California and NextGen Delaware attached as Annex A, the Delaware Certificate, in the form attached as Annex B and the Delaware Bylaws in the form attached as Annex C. Copies of the California Articles and California Bylaws are filed at the SEC as exhibits to our periodic reports and also are available for inspection at our principal executive offices. Copies of the California Articles and California Bylaws will be sent to shareholders free of charge upon written request to the Company (Attn: Corporate Secretary) or at investor.nextgen.com

Reasons for the Reincorporation

Because the corporate law of the state of incorporation governs the internal affairs of a corporation, choice of a state domicile is an extremely important decision for a public company. Management and boards of directors of corporations look to state corporate law—and judicial interpretations of state law—to guide their decision-making on many key issues, including determining appropriate governance policies and procedures, ensuring that boards satisfy their fiduciary obligations to their respective corporations and shareholders, and evaluating key strategic alternatives for the corporation, including mergers, acquisitions, and divestitures. Our Board of Directors believes that it is essential for us to be able to draw upon well-established principles of corporate governance in making legal and business decisions. The prominence and predictability of Delaware corporate law provide a reliable foundation on which our governance decisions can be based, and we believe that our shareholders will benefit from the responsiveness of Delaware corporate law to their needs. In addition, our Board of Directors believes that any direct benefit that the DGCL provides to a corporation indirectly benefits the shareholders, who are our owners. The principal factors the Board of Directors considered in electing to pursue the Reincorporation are access to specialized courts, a highly developed and predictable body of corporate law in Delaware, and an enhanced ability to attract and retain qualified directors and officers.

Access to Specialized Courts. Delaware has a specialized court of equity called the Court of Chancery that hears corporate law cases. The Delaware Court of Chancery operates under rules that are intended to ensure disputes involving Delaware corporations, including claims brought directly by stockholders against the corporation or its directors and officers and claims brought derivatively by stockholders in the name of the corporation against its directors and officers, are resolved in a timely and effective way, keeping in mind the timelines and constraints of business decision-making and market dynamics. The appellate process on decisions emanating from the Court of Chancery is similarly streamlined, with appeals heard directly by the Delaware Supreme Court, and the justices of the Delaware Supreme Court tend to have substantial experience with corporate cases because of the relatively higher volume of these cases in the Delaware courts. As the leading state of incorporation for both private and public companies, Delaware has developed a vast body of corporate law that helps to promote greater consistency and predictability in judicial rulings. In contrast, California does not have a similar specialized court established to hear only corporate law cases. Rather, disputes involving questions of California corporate law are either heard by the California Superior Court, the general trial court in California that hears all manner of cases, or, if federal jurisdiction exists, a federal district court. These courts hear many different types of cases, and the cases may be heard before judges or juries with limited corporate law experience. As a result, corporate law cases brought in California may not proceed as expeditiously as cases brought in Delaware and the outcomes in such courts may be less consistent and predictable.

7

Table of Contents

Highly Developed and Predictable Corporate Law. Our Board of Directors believes Delaware has one of the most modern statutory corporation codes, which is revised regularly in response to changing legal and business needs of corporations. The Delaware legislature is particularly responsive to developments in modern corporate law and Delaware has proven sensitive to changing needs of corporations and their shareholders. As a result of these factors, it is anticipated that the DGCL will provide greater efficiency, predictability and flexibility in the Company’s legal affairs than is presently available under California law. Moreover, Delaware case law provides a well-developed body of law defining the nature of the duties and decision making processes expected of boards of directors in managing or overseeing the direction of the business and affairs of the corporation and in evaluating potential or proposed extraordinary corporate transactions. In addition, the Delaware Secretary of State is particularly flexible and responsive in its administration of the filings required for mergers, acquisitions and other corporate transactions. Delaware has become a preferred domicile for most major American corporations and the DGCL and administrative practices have become comparatively well-known and widely understood.

Enhanced Ability to Attract and Retain Directors and Officers. The Board of Directors believes that the Reincorporation will enhance our ability to attract and retain a diverse group of qualified directors and officers, as well as encourage directors and officers to continue to make decisions in good faith and in the best interests of the Company and its stockholders generally. We are in a competitive industry and compete for talented individuals to serve on our management team and on our Board of Directors. The vast majority of public companies are incorporated in Delaware. Not only is Delaware law more familiar to directors and officers, it also offers greater certainty and stability from the perspective of those who serve as corporate officers and directors. The parameters of director and officer liability are more extensively addressed in Delaware court decisions and are therefore better defined and better understood than under California law. The Board of Directors believes that the Reincorporation will provide appropriate protection for shareholders from possible abuses by directors and officers, while enhancing our ability to recruit and retain qualified directors and officers. In this regard, it should be noted that, under Delaware law, directors’ personal liability for monetary damages to the corporation or its stockholders cannot be limited or eliminated for any breach of their duty of loyalty to the corporation or its stockholders, acts or omissions not in good faith or that involve intentional misconduct, unlawful dividend payments or unlawful stock purchases or redemptions, or any transaction from which the director derives an improper personal benefit. In addition, under Delaware law, a corporation cannot limit or eliminate the liability of officers to the corporation or its stockholders for monetary damages for breach of their fiduciary duty. We believe that the better understood and comparatively stable corporate environment afforded by Delaware law will enable us to compete more effectively with other public companies in the recruitment of talented and experienced directors and officers.

Changes to the Business of the Company as a Result of the Reincorporation

Other than the change in corporate domicile, the Reincorporation will not result in any change in the business, physical location, management, assets, liabilities, net worth or number of authorized or issued and outstanding shares of common stock of the Company, nor will it result in any change in location of our current employees, including management. Upon consummation of the Reincorporation, our daily business operations will continue as they are presently conducted at our principal executive offices located at 3535 Piedmont Rd NE, Building 6, Suite 700, Atlanta, Georgia 30305, and our telephone number will remain (404) 467-1500. The consolidated financial condition and results of operations of NextGen Delaware immediately after consummation of the Reincorporation will be the same as those of NextGen California immediately prior to the consummation of the Reincorporation. In addition, upon the effectiveness of the Reincorporation, the Board of Directors of NextGen Delaware will consist of those persons elected to the Board of Directors of NextGen California and will continue to serve for the term of their respective elections to our Board of Directors, and the individuals serving as executive officers of NextGen California immediately prior to the Reincorporation will continue to serve as executive officers of NextGen Delaware, without a change in title or responsibilities. Upon effectiveness of the Reincorporation, NextGen Delaware will be the successor in interest to NextGen California, and the shareholders will become stockholders of NextGen Delaware.

The Reincorporation Agreement provides that the Board of Directors may abandon the Reincorporation at any time prior to the Effective Time if the Board of Directors determines that the Reincorporation is inadvisable for any reason. For example, the DGCL may be changed to reduce the benefits that the Company hopes to achieve through the Reincorporation, or the costs of operating as a Delaware corporation may be increased, although the Company does not know of any such changes under consideration. The Reincorporation Agreement may be amended at any time prior to the Effective Time, either before or after the shareholders have voted to adopt the proposal, subject to applicable law. The Company will re-solicit shareholder approval of the Reincorporation if the terms of the Reincorporation Agreement are changed in any material respect that requires shareholder approval.

8

Table of Contents

Mechanics of the Reincorporation

The Reincorporation will be effected by the merger of NextGen California with and into NextGen Delaware, a wholly-owned subsidiary of the Company that has been recently incorporated under the DGCL for purposes of the Reincorporation. The Company as it currently exists as a California corporation will cease to exist as a result of the merger, and NextGen Delaware will be the surviving corporation and will continue to operate our business as it existed prior to the Reincorporation. The existing holders of our common stock will own all of the outstanding shares of NextGen Delaware common stock, and no change in ownership will result from the Reincorporation. Assuming approval by our shareholders, we currently intend to cause the Reincorporation to become effective after the votes on Proposals 1, 2A-2G, 3, 4 and 5 and prior to the vote on Proposal 6A, and Proposal 6B will not be voted on.

At the Effective Time, we will be governed by the Delaware Certificate, the Delaware Bylaws and the DGCL. Although the Delaware Certificate and the Delaware Bylaws contain many provisions that are similar to the provisions of the California Articles and the California Bylaws, they do include certain provisions that are different from the provisions contained in the California Articles and the California Bylaws or under the California General Corporation Law as described in more detail below.

If Proposal 1 and Proposal 2C are approved and the Reincorporation is effected, then upon the Effective Time, each outstanding share of common stock of NextGen California will automatically be converted into one share of common stock of NextGen Delaware. All of our employee benefit and incentive compensation plans and arrangement immediately prior to the Reincorporation will be continued by NextGen Delaware, including, but not limited to, equity incentive plans and the Amended 2015 Plan, if approved by stockholders pursuant to Proposal 5, and each outstanding equity award to purchase or acquire shares of NextGen California’s common stock will be converted into an equity award to purchase or acquire an equivalent number of shares of NextGen Delaware’s common stock on the same terms and subject to the same conditions. Following the Effective Time, the Amended 2015 Plan, if approved by our stockholders, will be used by NextGen Delaware to make awards to directors, officers and employees of NextGen Delaware and its subsidiaries as permitted in the Amended 2015 Plan. The registration statements of NextGen California on file with the SEC immediately prior to the Reincorporation will be assumed by NextGen Delaware, and the shares of NextGen Delaware will continue to be listed on Nasdaq.

CERTIFICATES CURRENTLY REPRESENTING SHARES OF COMMON STOCK OF NEXTGEN CALIFORNIA WILL AUTOMATICALLY BE DEEMED TO REPRESENT SHARES OF COMMON STOCK OF NEXTGEN DELAWARE UPON COMPLETION OF THE MERGER, AND OUR SHAREHOLDERS WILL NOT BE REQUIRED TO EXCHANGE THEIR STOCK CERTIFICATES AS A RESULT OF THE REINCORPORATION.

The Board of Directors did not intend to present the shareholders of the Company with the Reincorporation Proposal (Proposal 1) until Messrs. Razin and Rosenzweig informed the Company that intended to run a contested election of directors for control of the Board. The Reincorporation is not being pursued to entrench the current Board but to prevent the cumulation of votes and to obtain the benefits of a Delaware corporation stated above.

Possible Negative Considerations

Notwithstanding the belief of the Board of Directors as to the benefits to our shareholders of the Reincorporation, it should be noted that Delaware law has been criticized by some commentators and institutional shareholders on the grounds that it does not afford minority shareholders the same substantive rights and protections as are available in a number of other states, including California. In addition, because the Delaware Certificate will not provide for cumulative voting if Proposal 2C is approved, the Reincorporation may make it more difficult for minority shareholders to elect directors and influence our policies.

It should also be noted that the interests of the Board of Directors and management in voting on the Reincorporation proposal may not be the same as those of shareholders as some substantive provisions of California and Delaware law apply only to directors and officers. See “Interests of Our Directors and Executive Officers in the Reincorporation” below. For a comparison of shareholders’ rights and the material substantive provisions that apply to the Board of Directors and management under Delaware and California law, see “The Charters and Bylaws of NextGen California and NextGen Delaware Compared and Contrasted and Significant Differences Between the Corporation Laws of California and Delaware” below. In addition, franchise taxes payable by us in Delaware are estimated to be approximately $250,000 per year and such taxes are not currently required in California.

The Board of Directors has considered the potential disadvantages of the Reincorporation and has concluded that the potential benefits outweigh the possible disadvantages.

9

Table of Contents

Interests of Our Directors and Executive Officers in the Reincorporation

In considering the recommendations of the Board of Directors, shareholders should be aware that certain of our directors and executive officers have interests in the transaction that are different from, or in addition to, the interests of the shareholders generally. For instance, the Reincorporation may be of benefit to our directors and officers by reducing their potential personal liability and increasing the scope of permitted indemnification, by strengthening directors’ ability to resist a takeover bid, and in other respects. The Board of Directors was aware of these interests and considered them, among other matters, in reaching its decision to approve the Reincorporation and to recommend that our shareholders vote in favor of this proposal.

U.S. Federal Income Tax Considerations of the Reincorporation

The following discussion is a summary of U.S. federal income tax considerations of the Reincorporation generally applicable to holders of our common stock. The summary is based on and subject to the Internal Revenue Code of 1986, as amended (the “Code”), regulations promulgated under the Code by the U.S. Treasury Department (including proposed and temporary regulations), rulings, current administrative interpretations and official pronouncements of the Internal Revenue Service (the “IRS”), and judicial decisions, all as currently in effect and all of which are subject to change, possibly with retroactive effect, and to differing interpretations. No assurance can be given that the IRS would not assert, or that a court would not sustain, a position contrary to any of the tax consequences described herein.

This summary is for general information only and does not address all aspects of U.S. federal income taxation that may be important to a particular holder in light of its investment or tax circumstances, including any tax consequences arising under the Medicare contribution tax on net investment income, or to holders subject to special tax rules, such as partnerships or other entities or arrangements classified as partnerships for U.S. federal income tax purposes, subchapter S corporations, or other pass-through entities (and investments therein); banks, thrifts, mutual funds and other financial institutions; tax-exempt entities or governmental organizations; insurance companies; regulated investment companies and real estate investment trusts; trusts and estates; dealers or brokers in stocks, securities or currencies; traders in securities who elect to apply a mark-to-market method of accounting; persons holding our common stock as part of an integrated transaction, including a “straddle,” “hedge,” “constructive sale,” “conversion transaction,” or other risk reduction transaction; U.S. Holders whose functional currency is not the U.S. dollar; persons subject to the alternative minimum tax; individual retirement and other deferred accounts; U.S. expatriates and former citizens or long-term residents of the United States; “passive foreign investment companies” or “controlled foreign corporations,” and corporations that accumulate earnings to avoid U.S. federal income tax; U.S. Holders who own or are deemed to own 10% or more of our voting stock; persons who purchase or sell their shares as part of a wash sale for tax purposes; and persons who received their shares through the exercise of employee stock options or otherwise as compensation or through a tax-qualified retirement plan. This summary does not include any description of the tax laws of any state or local governments, or of any foreign government, that may be applicable to a particular holder.

This summary is directed solely to holders that hold our common stock as capital assets within the meaning of Section 1221 of the Code, which generally means as property held for investment. In addition, the following summary only addresses “U.S. persons” for U.S. federal income tax purposes, generally defined as beneficial owners of our common stock who are:

| • | individuals who are citizens or residents of the United States; |

| • | corporations (including an entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States or of any state of the United States or of the District of Columbia; |

| • | estates the income of which is subject to U.S. federal income taxation regardless of its source; |

| • | trusts if (i) a court within the United States is able to exercise primary supervision over the administration of any such trust and one or more U.S. persons have the authority to control all substantial decisions of such trust; or (ii) trusts that have valid elections in effect under applicable U.S. Treasury regulations to be treated as U.S. persons for U.S. federal income tax purposes. |

If a partnership, including for this purpose any entity or arrangement that is treated as a partnership for U.S. federal income tax purposes, holds our common stock, the U.S. federal income tax treatment of a partner in the partnership generally will depend on the status of the partner and the activities of the partnership. A holder that is a partnership for U.S. federal income tax purposes and the partners in such partnership should consult their own tax advisors regarding the U.S. federal income tax consequences of the Reincorporation.

THIS SUMMARY IS FOR INFORMATION PURPOSES ONLY AND IS NOT TAX ADVICE. THIS SUMMARY IS NOT A COMPREHENSIVE DESCRIPTION OF ALL OF THE U.S. FEDERAL INCOME TAX CONSEQUENCES THAT MAY BE RELEVANT TO HOLDERS. WE URGE YOU TO CONSULT YOUR TAX ADVISORS REGARDING YOUR PARTICULAR CIRCUMSTANCES AND THE U.S. FEDERAL INCOME TAX CONSEQUENCES TO YOU OF THE REINCORPORATION, AS WELL AS ANY TAX CONSEQUENCES

10

Table of Contents

ARISING UNDER THE U.S. FEDERAL TAX LAWS OTHER THAN THOSE PERTAINING TO INCOME TAX, INCLUDING ESTATE OR GIFT TAX LAWS, OR UNDER ANY STATE, LOCAL OR NON-U.S. TAX LAWS OR UNDER ANY APPLICABLE INCOME TAX TREATY.

We have not requested a ruling from the IRS or an opinion of counsel regarding the U.S. federal income tax consequences of the Reincorporation. However, we believe that:

| • | the Reincorporation will constitute a tax-free reorganization under Section 368(a) of the Code; |

| • | no gain or loss will be recognized by holders of NextGen California common stock on receipt of NextGen Delaware common stock, or upon surrender of NextGen California common stock, pursuant to the Reincorporation; |

| • | the aggregate tax basis of the NextGen Delaware common stock received by each holder will equal the aggregate tax basis of the NextGen California common stock surrendered by such holder in exchange therefor; and |

| • | the holding period of the NextGen Delaware common stock received by each holder will include the period during which such holder held the NextGen California common stock surrendered in exchange therefor. |

Accounting Consequences

We believe that there will be no material accounting consequences to the Company resulting from the Reincorporation.

Regulatory Approval

To our knowledge, the only required regulatory or governmental approval or filings necessary in connection with the consummation of the Reincorporation would be the filing of certificate of merger with the Secretary of State of California and the filing of a certificate of merger with the Secretary of State of the State of Delaware.

Vote Required

To approve this proposal a majority of the outstanding shares of common stock of the Company entitled to vote must vote “FOR” this proposal. In addition, approval of this proposal is conditioned on the approval of Proposal 2C (elimination of cumulative voting). Abstentions and broker non-votes will have the effect of votes “AGAINST” this proposal. If you submit a WHITE proxy card to vote your shares but do not indicate how your shares are to be voted on this proposal, your shares will be voted “FOR” this proposal.

Recommendation of the Board of Directors:

THE COMPANY’S BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE FOR THE APPROVAL OF THE REINCORPORATION.

11

Table of Contents

GOVERNANCE PROVISIONS OF THE COMPANY’S CERTIFICATE OF INCORPORATION AND BYLAWS RELATING TO THE REINCORPORATION

(Proposals No. 2A-2G)

Summary

If approved by the requisite vote of the Company’s shareholders, the Company will change the state of its incorporation from California to Delaware through a merger with and into NextGen Delaware, which is currently a wholly-owned subsidiary of the Company. Upon completion of the Reincorporation, the Company will be governed by the DGCL and the certificate of incorporation of NextGen Delaware (the “Delaware Certificate”) and bylaws of NextGen Delaware (the “Delaware Bylaws”). The Delaware Certificate and Delaware Bylaws will govern the Company following the completion of the Reincorporation differs in some material respects from the Company’s existing articles of incorporation and bylaws. At the meeting, you will be asked to consider and vote on each of the governance-related provisions in the Company’s organizational documents to be in effect after the Reincorporation described below.

The following is a summary of selected governance-related provisions of the organizational documents of the Company to be in effect after the Reincorporation. While the Company believes that this description covers the material governance-related provisions of the organizational documents of the Company to be in effect after the Reincorporation, which differ materially from the Company’s existing organizational documents, it may not contain all of the information that is important to you and is qualified in its entirety by reference to the form of Delaware Certificate or Delaware Bylaws are attached to this proxy statement as Exhibits B and C, respectively. We urge you to read each of these documents carefully. See also the section of this proxy statement entitled “The Charters and Bylaws of NextGen California and NextGen Delaware Compared and Contrasted and Significant Differences Between the Corporation Laws of California and Delaware” beginning on page [ • ] for a comparison of rights of equity holders and matters of corporate governance before and after the Reincorporation.

Proposal 2A: A proposal to approve provisions in the Delaware Certificate and Bylaws limiting the Company’s stockholders’ right to call special meetings of stockholders.

Proposal 2B: A proposal to approve a provision in the Delaware Certificate providing that vacancies occurring on the Board of Directors and newly created directorships may be filled solely by a majority of the remaining directors.

Proposal 2C: A proposal to approve a provision disallowing cumulative voting.

Proposal 2D: A proposal to approve a provision in the Delaware Certificate providing that the total number of directors constituting the Board of Directors may be fixed exclusively by resolution of the Board of Directors.

Proposal 2E: A proposal to approve a provision of the Delaware Certificate providing that, unless NextGen Delaware consents in writing to the selection of an alternate forum, certain intracorporate claims may be brought exclusively in the Delaware Court of Chancery (or, if such court lacks subject matter jurisdiction, the other state or federal courts in the State of Delaware).

Proposal 2F: A proposal to approve a provision of the Delaware Certificate requiring any complaint asserting a cause of action under the Securities Act to be brought exclusively in the federal district courts of the United States.

Proposal 2G: A proposal to approve a provision in the Delaware Bylaws providing proxy access for director nominees by stockholders.

Proposal 2A: A proposal to approve provisions in the Delaware Certificate and Bylaws limiting the Company’s stockholders’ right to call special meetings of stockholders.

Under California law and the California Bylaws, a special meeting of shareholders may be called at any time by one or more shareholders holding shares in the aggregate entitled to cast at least 10% of the votes in that meeting. The Delaware Bylaws provide that NextGen Delaware shall be required to call a special meeting of stockholders at the written request of one or more shareholders holding shares in the aggregate representing at least 25% in voting power of the outstanding shares entitled to vote generally in the election of directors, subject to compliance with certain procedures and limitations.

12

Table of Contents

In order for a special meeting of stockholders to be called at the direction of stockholders, a stockholder must deliver a written demand to the Secretary of the Company in advance of the special meeting setting forth, among other things, certain information regarding the stockholder submitting the request and specifying the items of business proposed to be transacted at the special meeting.

A written demand from a stockholder to call a special meeting will not be accepted if it relates to an item of business that is identical or substantially similar to an item of business (a “Similar Item”): (i) for which a record date for notice of a stockholder meeting was previously fixed between 61 days after such previous record date and one year after such previous record date, (ii) for a Similar Item submitted for stockholder approval at any stockholder meeting to be held on or before 90 days after the Secretary receives such demand or (iii) if a Similar Item has been presented at the most recent annual meeting or at any special meeting held within one year prior to receipt by the Secretary of such demand to call a special meeting.

Proposal 2B: A proposal to approve a provision in the Delaware Certificate providing that vacancies occurring on the Board of Directors and newly created directorships may be filled solely by a majority of the remaining directors.

Under California law and the California Bylaws, except in a situation of a vacancy created by removal, vacancies may be filled by a majority of the remaining directors, though less than a quorum, or by a sole remaining director. If the Board of Directors does not fill such vacancy, the Company’s shareholders may elect one or more directors at any time to fill any such vacancies, and any such election to fill a vacancy by written consent requires the consent of the holders of a majority of the outstanding shares entitled to vote.

The Delaware Certificate and Delaware Bylaws provide that vacancies occurring on the Board of Directors from the death, resignation or removal of a director or other cause, and newly created directorships resulting from an increase in the total number of directors, may be filled solely by a majority of the remaining members of the Board of Directors, although such majority is less than a quorum, or by a sole remaining director.

Proposal 2C: A proposal to approve a provision disallowing cumulative voting.

The California Bylaws provide for cumulative voting for the election of directors at meetings of shareholders. Every shareholder voting for the election of the Company’s board of directors may (i) cumulate such shareholder’s votes and give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of shares that such shareholders holds or (ii) distribute such shareholder’s votes on the same principle among as many candidates as the shareholder may select, provided that votes cannot be cast for more than the number of candidates standing for election. However, no shareholder shall be entitled to cumulate votes for a candidate unless the candidate’s name has been placed in nomination prior to the voting and the shareholder, or any other shareholder, has given notice at the meeting prior to the voting of the intention to cumulate votes.

Under Delaware law, unless the certificate of incorporation expressly so provides, stockholders are not entitled to cumulate votes in an election of directors. The Delaware Certificate does not provide for cumulative voting in connection with the election of directors. Under Delaware law, unless otherwise specified in the certificate of incorporation or bylaws, directors are elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. The Delaware Bylaws provide that, in any uncontested election, each director shall be elected by a majority of the votes cast for or against such director’s election and that, in any contested director election, the directors shall be elected by a plurality of the votes.

Proposal 2D: A proposal to approve a provision in the Delaware Certificate providing that the total number of directors constituting the Board of Directors may be fixed exclusively by resolution of the Board of Directors.

The California Bylaws provide that the number of directors of the Company shall not be less than five nor more than nine until changed by an amendment of the articles or by a bylaw duly adopted by approval of the outstanding shares. The exact number of members of the Board of Directors shall be nine until an amendment has been duly adopted by either the board or the shareholders. California law provides that a bylaw specifying or changing a fixed number of directors or the maximum or minimum number of directors or changing from a variable to a fixed board (or vice versa) may only be adopted by the affirmative vote of a majority of the outstanding shares entitled to vote.

The Delaware Certificate will provide that the total number of directors constituting the NextGen Delaware Board of Directors may be fixed from time to time exclusively by resolution of the NextGen Delaware Board of Directors.

13

Table of Contents

Proposal 2E: A proposal to approve a provision of the Delaware Certificate providing that, unless NextGen Delaware consents in writing to the selection of an alternate forum, certain intracorporate claims may be brought exclusively in the Delaware Court of Chancery (or, if such court lacks subject matter jurisdiction, the other state or federal courts in the State of Delaware).

The California Certificate and California Bylaws do not currently have a forum selection provision.

The Delaware Certificate provides that, unless NextGen Delaware consents in writing to the selection of an alternative forum, the Delaware Court of Chancery (or, if such court does not have subject matter jurisdiction thereof, the other state or federal courts in the State of Delaware) will, to the fullest extent permitted by applicable law, be the sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of NextGen Delaware, (ii) any action asserting a claim of breach of fiduciary duty owed by any director, officer, other employee or stockholder of NextGen Delaware to NextGen Delaware or its stockholders, (iii) any action asserting a claim arising pursuant to any provision of the DGCL or the Delaware Certificate or Delaware Bylaws or as to which the DGCL confers jurisdiction upon the Court of Chancery, or (iv) any action asserting a claim governed by the internal affairs doctrine.

Proposal 2F: A proposal to approve a provision of the Delaware Certificate requiring any complaint asserting a cause of action under the Securities Act of 1933 (the “Securities Act”) to be brought exclusively in the federal district courts of the United States.

The California Certificate and California Bylaws do not currently have a forum selection provision.

The Delaware Certificate provides that, unless NextGen Delaware consents in writing to the selection of an alternative forum, the federal district courts of the United States will, to the fullest extent permitted by applicable law, be the sole and exclusive forum for any complaint asserting a cause of action arising under the Securities Act.

Proposal 2G: A proposal to approve a provision in the Delaware Bylaws providing proxy access for director nominees by stockholders.

The California Bylaws do not currently have a proxy access provision.

The Delaware Bylaws provide that a long-term stockholder, or group of stockholders no larger than 20 stockholders, holding at least 3% of NextGen Delaware’s stock will be able to include their own director nominees (up to the greater of two directors and 20% of the Board of Directors) in NextGen Delaware’s proxy materials along with the candidates nominated by the Board.

Purpose

The Company’s Board of Directors has approved the Delaware Certificate and Delaware Bylaws, which include the provisions described above. These provisions, including, for example, the additional procedures governing, and limitations on, stockholders’ rights to call special meetings, may have the effect of delaying or deterring unsolicited takeover transactions. The Board of Directors determined that it was appropriate to include these provisions in the Delaware Certificate and Delaware Bylaws, notwithstanding the fact that such provisions are absent from the Company’s current governing documents in order to enhance stockholder value by helping the Company deter hostile or coercive overtures that are not supported by the Board of Directors.

Vote Required

Under applicable state law, shareholder approval of the Reincorporation is sufficient to implement the proposed governance-related provisions in the Delaware Certificate and Delaware Bylaws. Under rules promulgated by the Securities and Exchange Commission, however, we are required to present each of the proposed governance-related provisions as a separate proposal for shareholder approval. Accordingly, we have determined that we will not implement a proposed governance-related provision unless such provision is approved by the affirmative vote of a majority of the shares represented and voting at the meeting (which shares voting affirmatively also constitute at least a majority of the required quorum). In addition, we will not implement Proposal 1 (the Reincorporation) unless we receive shareholder approval of Proposal 2C (elimination of cumulative voting). For the avoidance of doubt, in the event that certain governance provisions receive sufficient votes but others do not, then such provisions receiving approval would still be implemented, but for the provisions that do not receive approval, the Company would implement governance provisions most similar to the Company’s existing corresponding governance provisions, subject to complying with Delaware law.

Recommendation of the Board of Directors:

THE COMPANY’S BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” PROPOSALS 2A-2G.

14

Table of Contents

THE CHARTER AND BYLAWS OF NEXTGEN CALIFORNIA AND NEXTGEN DELAWARE COMPARED AND CONTRASTED AND SIGNIFICANT DIFFERENCES BETWEEN THE CORPORATION LAWS OF CALIFORNIA AND DELAWARE

The following is a comparison of the provisions in the charters and bylaws of NextGen California and NextGen Delaware, as well as certain provisions of California law and Delaware law. The comparison summarizes the important differences, but is not intended to list all differences, and is qualified in its entirety by reference to such documents and to the respective General Corporation Laws of the States of California and Delaware. Shareholders are encouraged to read the Delaware Certificate, the Delaware Bylaws, the California Articles and the California Bylaws in their entirety. The Delaware Bylaws and Delaware Certificate are attached to this proxy statement, and the California Bylaws and California Articles are filed publicly as exhibits to our periodic reports.

| Provisions |

NextGen California |

NextGen Delaware | ||

| Authorized Shares | 100 million shares of common stock, par value $0.01 per share. | 100 million shares of common stock, par value $0.01 per share; 10 million shares of “blank check” preferred stock, par value $0.01 per share, none of which are designated.