UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ¨ | Definitive Proxy Statement | |||

| x | Definitive Additional Materials | |||

| ¨ | Soliciting Material under §240.14a-12 | |||

| QUALITY SYSTEMS, INC. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| x | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of this filing: | |||

| (1) | Amount Previously Paid:

| |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

|

| ||||

| (3) | Filing Party:

| |||

|

| ||||

| (4) | Date Filed:

| |||

|

| ||||

Presentation to

ISS July 23, 2012 |

2

Safe Harbor Provisions

SAFE HARBOR PROVISIONS FOR FORWARD-LOOKING STATEMENTS: Statements made in

this document, the proxy statements to be filed with the SEC, communications to shareholders,

press releases and oral statements made by our representatives that are not historical in

nature, or that state our or management's intentions, hopes, beliefs, expectations or predictions of

the future, may constitute "forward-looking statements" within the meaning of

Section 21E of the Securities and Exchange Act of 1934, as amended. Forward-looking

statements can often be identified by the use of forward-looking words, such as

"could," "should," "will," "will be," "will lead," "will assist," "intended,"

"continue," "believe," "may," " expect," "hope,"

"anticipate," "goal," "forecast," "plan," or "estimate" or

variations thereof or similar expressions. Forward-looking statements are not guarantees of future

performance.

Forward-looking statements involve risks, uncertainties and assumptions. It is important to note

that any such performance and actual results, financial condition or business, could differ

materially from those expressed in such forward-looking statements. Factors that could

cause or contribute to such differences include, but are not limited to, the risk factors

discussed under "Risk Factors" in our Annual Report on Form 10-K for fiscal year

ended March 31, 2012, as well as factors discussed elsewhere in this and other reports and documents

we file with the SEC. Other unforeseen factors not identified herein could also have such an effect.

We undertake no obligation to update or revise forward-looking statements to reflect

changed assumptions, the occurrence of unanticipated events or changes in future operating

results, financial condition or business over time unless required by law. Interested persons

are urged to review the risks described under "Risk Factors" and in "Management's

Discussion and Analysis of Financial Condition and Results of Operations" in our Annual

Report on Form 10-K for fiscal year ended March 31, 2012, as well as in our other public disclosures

and filings with the SEC.

|

3

>

QSI Company Overview

>

Strategy to Continue Creating Shareholder Value

>

Well-Positioned in a High Growth Market

>

Proven Track Record of Creating Value

>

Highly Qualified Board and Management Team

>

Strong Corporate Governance

>

Hussein Takeover Attempt a Threat to Shareholder Value

Agenda |

4

Company Overview

>

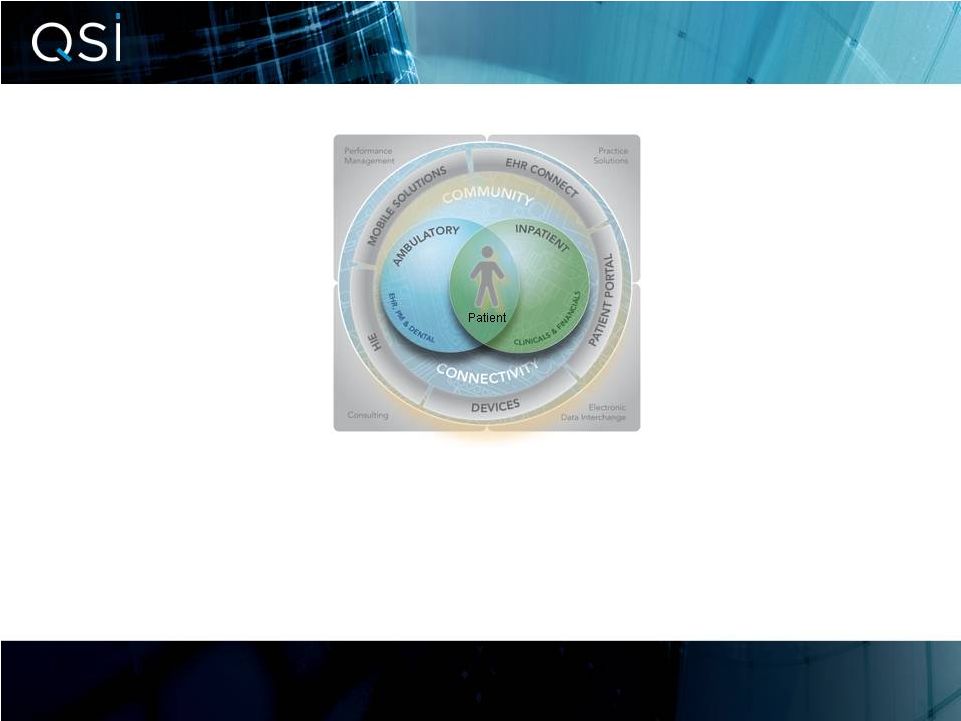

Quality Systems, Inc. (QSI) develops and markets computer-based

practice management, electronic health records (EHR) and revenue

cycle management (RCM) applications, as well as connectivity products

and services, for medical and dental group practices and hospitals.

>

QSII

has

been

publicly

traded

since

1982,

and

has

delivered

some

of

the

strongest

returns to investors over the last 12 years of any publicly traded company (over

2600%)

>

QSI employs more than 2,000 people, from its corporate headquarters in Irvine,

California

as

well

as

locations

throughout

the

United

States

and

its

QSI

Healthcare

business unit in Bangalore, India. |

5

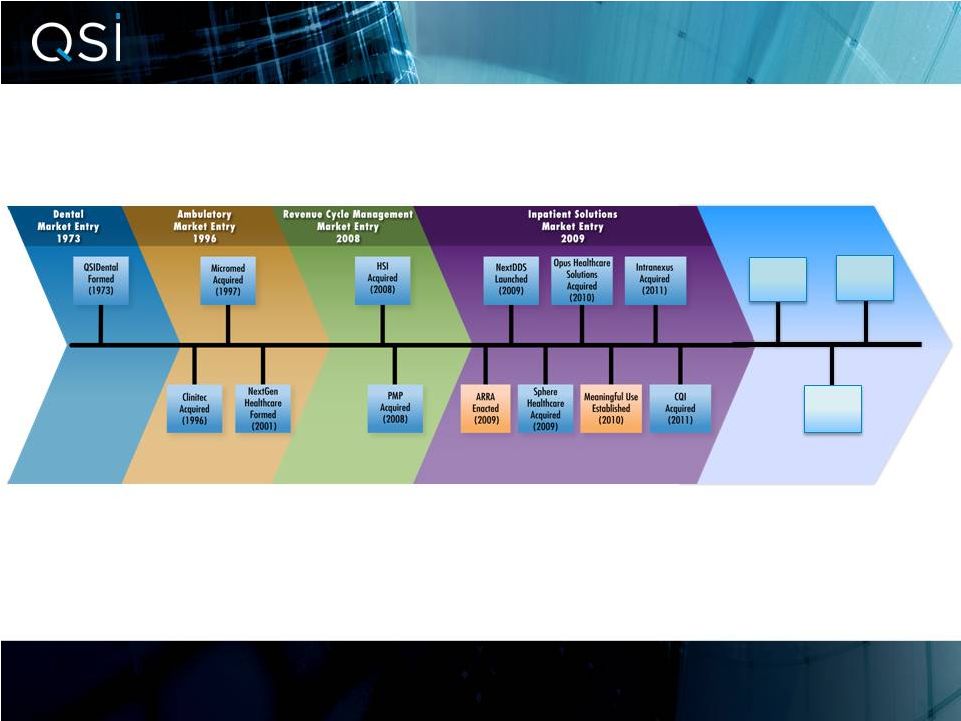

Company History

A track-record of being willing and able to reinvest and reinvent to better

compete Recent Additions

2011-2012

ViaTrack

Acquired

(2011)

Matrix

Acquired

(2012)

Poseidon

Acquired

(2012) |

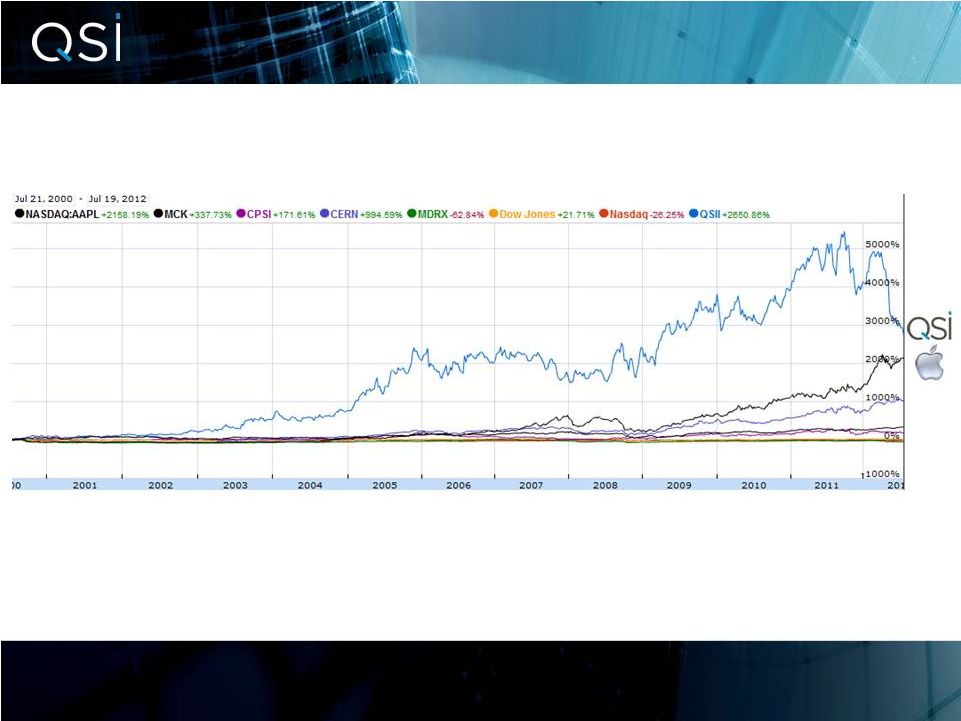

6

Shareholder Reward

Continued execution on reinvestment and reinvention has yielded tremendous returns

to shareholders

of

over

2600%

since

July

of

2000 |

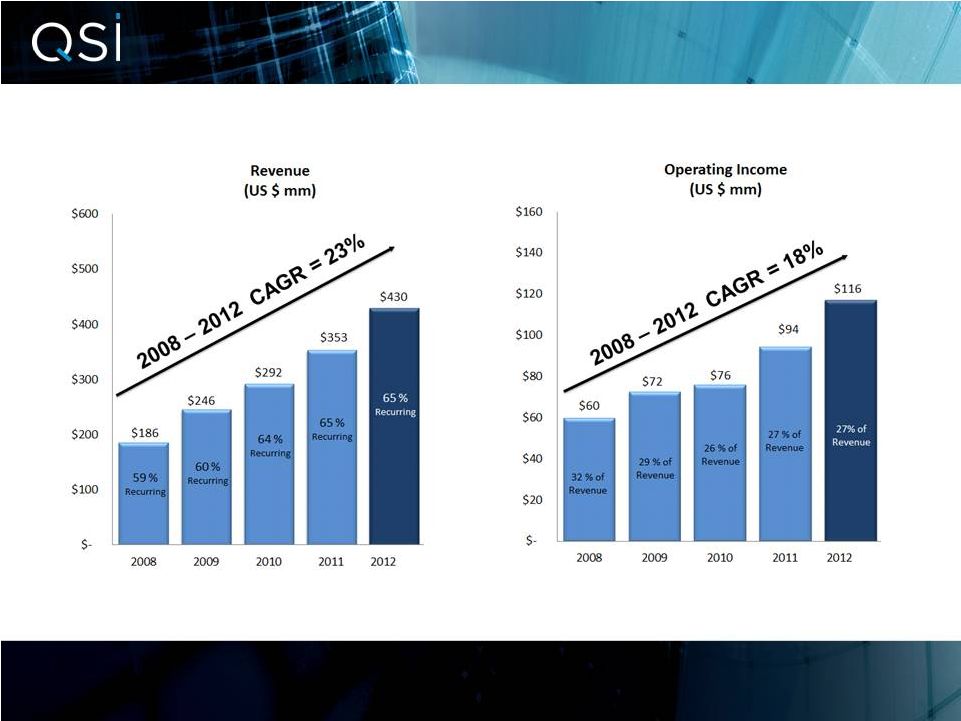

7

Growth Performance

Performance over last 5 Years

QSI has been one of the fastest growers of both top and bottom line results in the

entire HCIT sector |

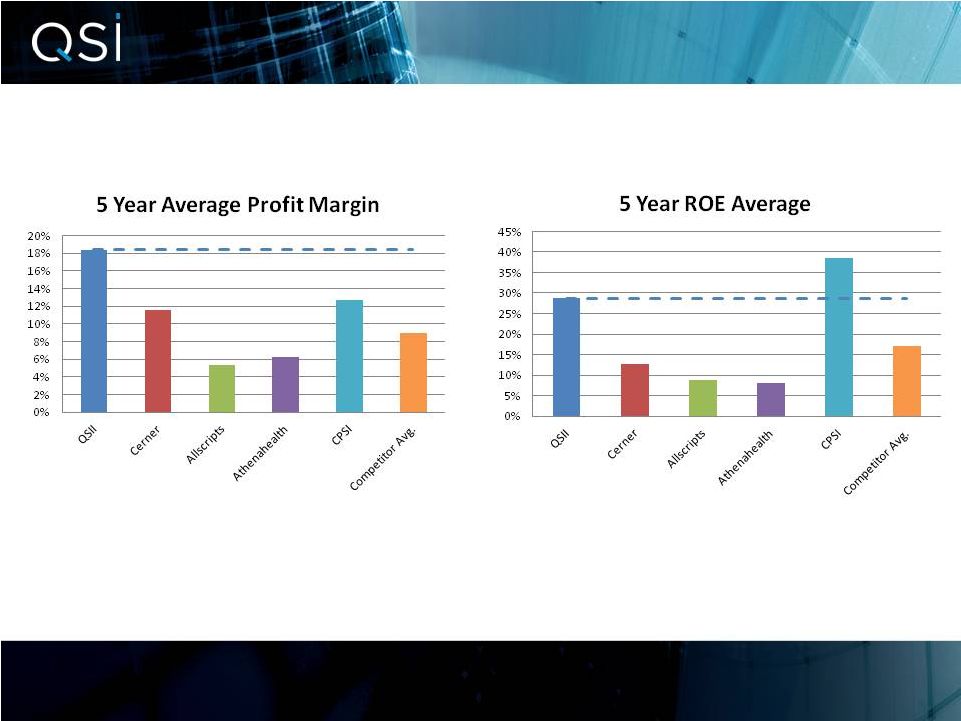

8

Highly Profitable and Efficient

QSI is among the most profitable and financially efficient companies in the HCIT

sector |

9

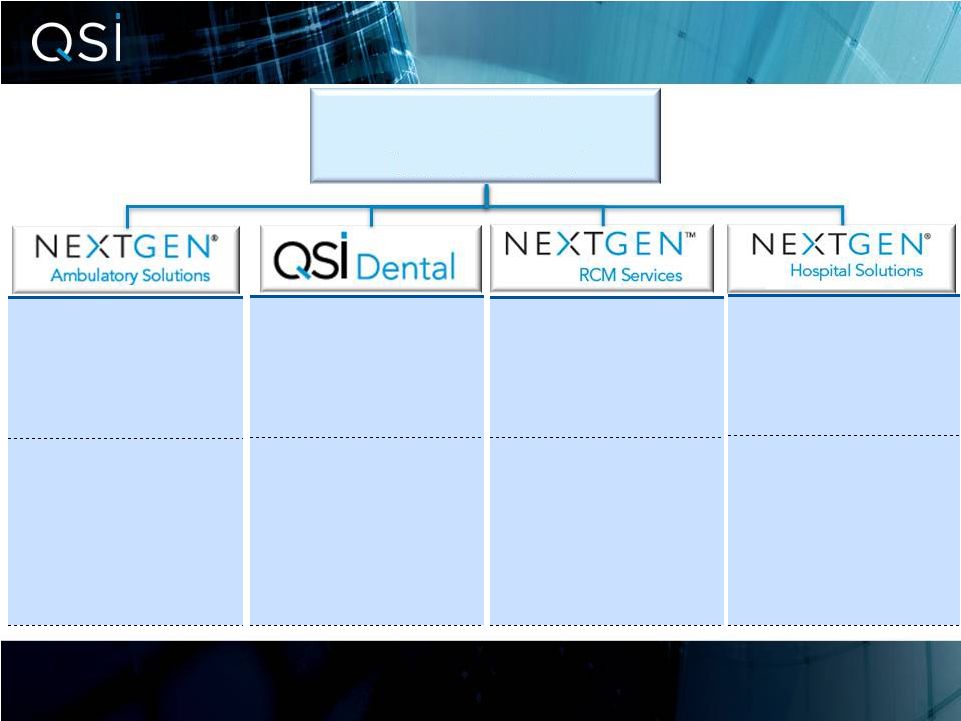

Quality Systems Today

March 31, 2012

Revenue: $429.8mm

Diluted EPS: $1.28

FY 2012

Revenue:

$325.5mm (75.7%

of total)

75,000 +

Physicians

Markets

Served:

Physicians

•

Practice

Management

•

Electronic Health

Records

•

EDI

FY 2012

Revenue:

$19.3mm (4.6% of

total)

5,000 +

Dentists

Markets

Served:

Dentists

•

Practice

Management

•

Electronic

Dental Record

•

EDI

FY 2012

Revenue:

$50.3mm (11.7%

of total)

6,500 +

Physicians

Markets

Served:

Physicians

•

Revenue Cycle

Management

•

Other Services

FY 2012

Revenue:

$34.5mm (8.0% of

total)

200 +

Hospitals

Markets

Served:

Small Hospitals

•

Financials

•

Clinical

•

Surgery

Scheduling |

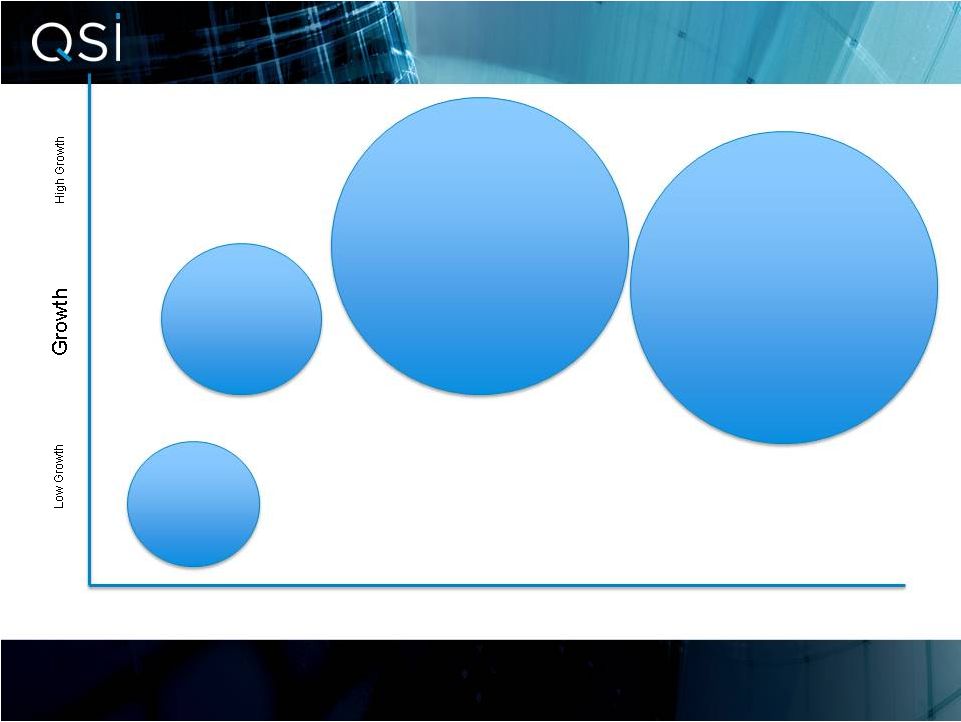

Market Opportunity

& Positioning Penetration Opportunity

High Opportunity (Low Penetration)

Low Opportunity (High Penetration)

Revenue Cycle

Management Services

$4-5 Billion

20-25% Penetrated

Ambulatory Software

$4-5 Billion

40-50% Penetrated

<100 Bed

Hospital

Software

$1-2 Billion

50-60%

Penetrated

Dental

Software

<$ 1 Billion

80%

Penetrated

10 |

11

>

Our strategic plan includes the following initiatives, many already

underway:

>

Continued Growth of our Core Businesses

>

This

is

only

the

second

year

of

government

incentive

payments

to

physicians

and

hospitals

with

half

of

the market to go.

>

Focusing on Opportunities to Sell Complementary Products

>

There is significant opportunity in CROSS-SELLING new solutions to the

existing customer base and BUNDLING MULTIPLE SOLUTIONS together for new

customers >

Continued Development and Acquisition of Innovative Solutions

>

The company is already taking steps to stay in the forefront of developing

technology in the industry through smart acquisitions and ongoing product

enhancements >

Five new products were introduced at HIMSS in February 2012

>

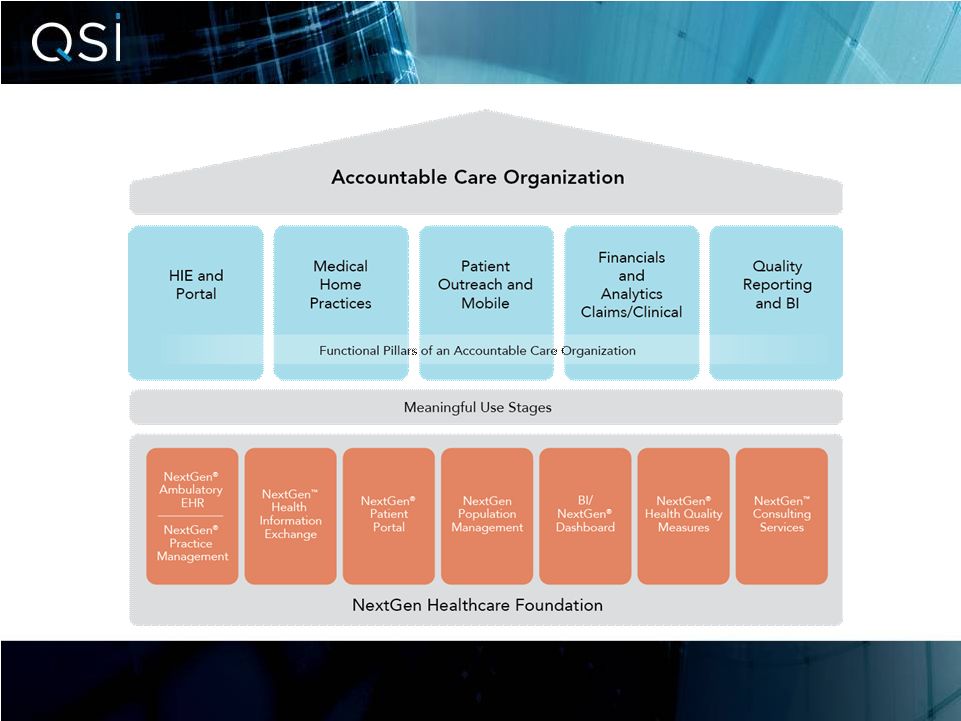

Enabling New Healthcare Delivery Models

>

QSI is a leader in enabling new healthcare delivery models such as Accountable

Care Organizations, Patient-Centered Medical Home and Fee for

Performance QSI’s Strategy to Create Value |

12

>

Our strategic plan includes the following initiatives, many already

underway (cont.):

>

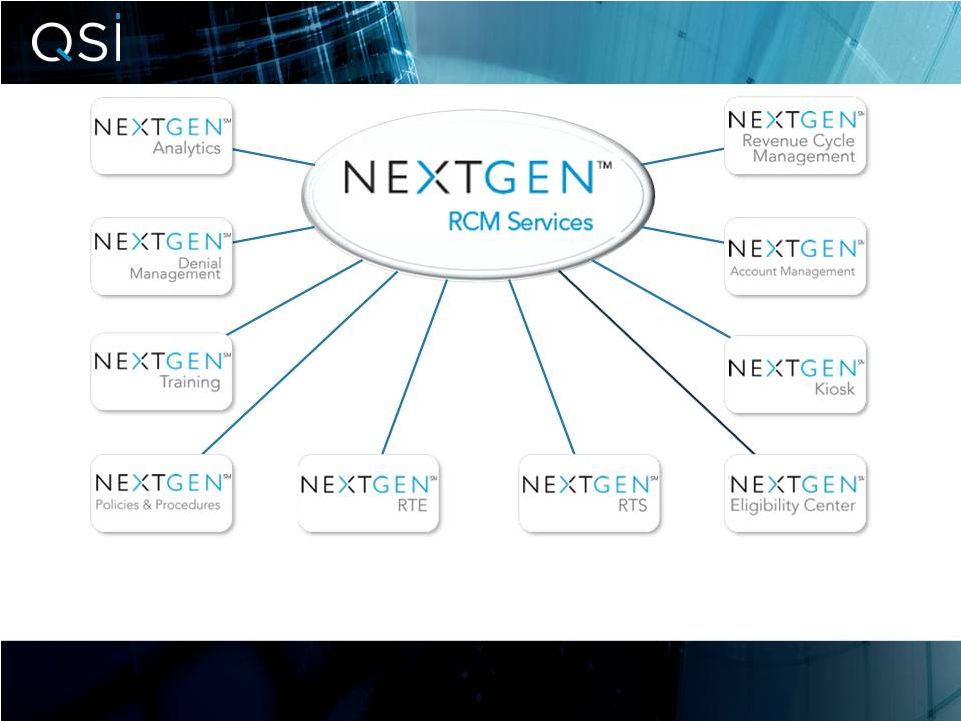

NextGen RCM has been set-up to grow the company’s RCM business and is

already seeing strong results. With plans to expand into dental and

hospital markets. >

QSI is focused on “bolt-on”

acquisitions to fill a strategic gap or kick-start entry into newer business

lines

>

A growing technology innovation center in Bangalore, India currently employs more

than 150 technologists and engineers

>

QSI recently announced a partnership with Dell and Puerto Rico Hospital

QSI’s Strategy to Create Value

>

Expand Revenue Cycle Management Capabilities

>

Continued Growth through Acquisitions

>

Expand Offshore Capabilities to Capture Cost Efficiencies

>

Extend International Distribution Channels |

13

Continued Growth of Core Business

Source: SK&A, 2011

Source: Blackstone, Wall Street equity research, SK&A

12

Est.

>EHR opportunity is

significant and QSI is perfectly positioned as the enterprise EHR

needs grow

>

Estimates show total market EHR adoption is only approximately 40-50%

today >

The market is in only the second year of government incentive payments

>

The

NextGen

product

line

is

4

th

in

Medicare

attestations,

a

testament

to

product

strength

>

As

the

governmental

standards

for

EHR

technologies

continues

to

strengthen,

QSI

will

further

strengthen its leadership position

PRACTICE SIZE

TOTAL # OF PRACTICES

EHR PENETRATION (July '11)

1-3 Physicians

~186,000

~30%

4-9 Physicians

~28,000

~50%

10-25 Physicians

~6,900

~70%

26+ Physicians

~1,750

~85%

Total

~226,650

~35% |

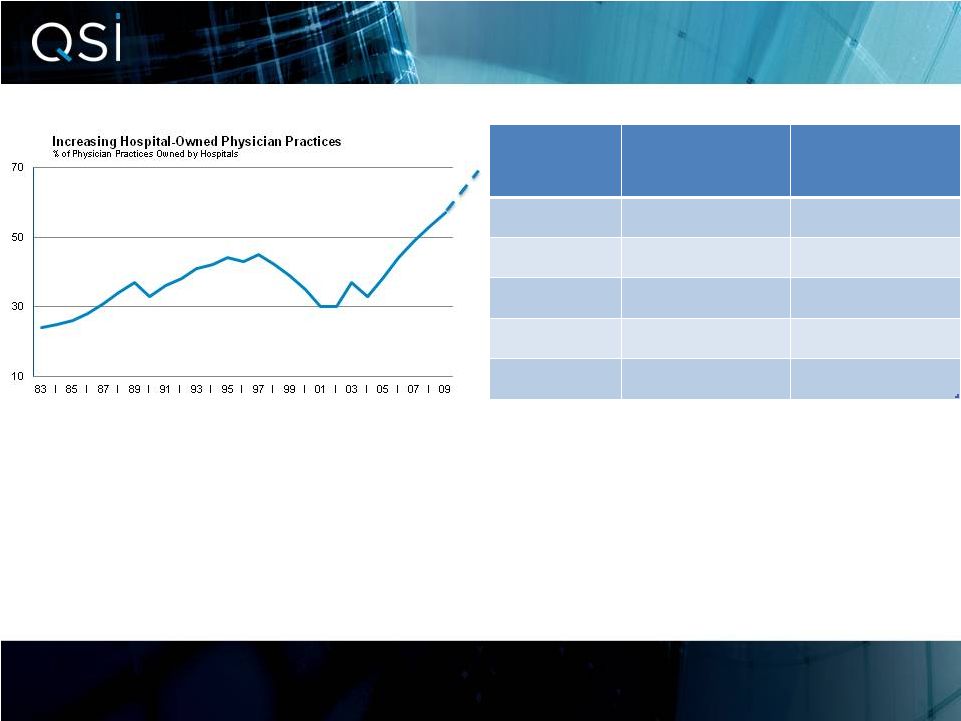

14

Additional Cross-Selling

>

QSI has a holistic approach to the market that will enhance cross-sell

growth >

Market movements of convergence in Hospital and Ambulatory markets increases

cross-sell of our Hospital technology into existing Ambulatory base as

well as Ambulatory technology into the Hospital base

>

Increased billing complexity from ICD-9 to ICD-10 (from 14,000 codes

to 87,000 codes) will increase the cross-sell of RCM services into both

the Ambulatory and Hospital client base >

Continued improvements in Dental cloud technology will drive cross-sell for

Dental into the Ambulatory base of CHC, FQHC and Indian Health clients

|

15

Accountable Care

>

HIMSS Analytics survey results of hospital executives:

>11% currently

participating in an ACO >

72% planning future participation |

16

Accountable Care |

17

13

Expanding Revenue Cycle

>

QSI had the vision to know that clients will increasingly need to focus on their Core

Competencies

>

As the pay for quality model moves forward, and ICD-10 complicates back

office, our RCM Services will

see

substantial

growth

while

generating

significant

ROI

for

our

clients |

18

With 9 acquisitions in 4 years, the commitment and

capabilities are there for QSI to continue adding shareholder

value through strategically sound and financially value-added

acquisitions. These acquisitions comprise:

>

Healthcare Strategic Initiatives, April 2008

>

Practice Management Partners, October 2008

>

Sphere Health Systems, August 2009

>

Opus Healthcare, February 2010

>

IntraNexus, April 2011

>

CQI Solutions, August 2011

>

ViaTrack Systems, December 2011

>

Matrix Management Solutions, April 2012

>

Poseidon Group, May 2012

13

Continued Growth Via Acquisition |

19

13

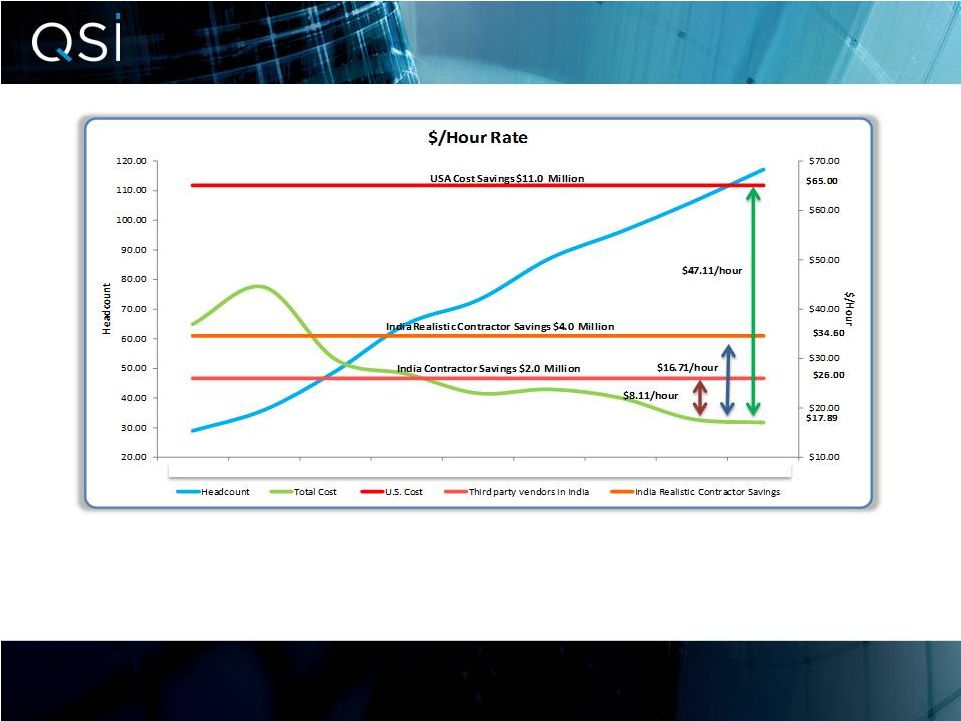

Expand Offshore Capabilities

>

QSI

has

made

the

investment

in

an

offshore

captive

that

enables

significant

labor

arbitrage.

>

This will ensure QSI can continue making the right investment in products that

will drive growth AND deliver bottom line results to Shareholders

|

20

13

Extend International Distribution

>

QSI has significant growth beyond the US market

>

An initial expansion plan has already begun, with an international distribution

agreement with Dell and Puerto Rico Hospital Supply, Inc.

|

21

QSI’s track record of strategic growth, profitability and

innovation in the industry has been well documented:

>

Forbes ranked QSI as one of the 25 Fastest Growing Technology

Companies for the fourth consecutive year (May 2012)

>

Forbes ranked QSI as one of the 100 Best Small Companies for

the eleventh consecutive year –

#14 in 2011 (November 2011)

>

QSI received the International Business Award for Company of the

Year in the field of Computer Services (October 2011)

13

Recognized Industry Leader |

22

Highly Qualified Board Nominees

>

Our Board nominees have the right experience, the right strategic plan

and a strong track record of growth and profitability to benefit

all shareholders

>

Nominees drawn from financial services, healthcare, and information

technology fields --

providing the relevant knowledge and diversity of

experience

the

Board

needs

>

The Board is fully engaged and continues to provide active leadership

and critical understanding of the company, its history and how the

industry's competitive landscape has evolved

>

Our new independent director nominee, Mark Davis, brings significant

information

technology

business

and

accounting

experience

to

the

QSI

Board

>

Mr. Davis has more than 20 years’

experience advising and financing technology

companies, including software, cloud infrastructure and information technology

firms, as well as experience as a certified public accountant

|

23

The Right Board

Director &

Years of

Years on

Current Occupation

Expertise

Relevant Experience

the QSI Board

Sheldon Razin

Healthcare IT

38

38

Founder and Chairman, Quality Systems, Inc.

Steven Plochocki

Healthcare

36

8

President & CEO, Quality Systems, Inc.

Russell Pflueger

Healthcare

25

6

Founder, Chairman & CEO,

Quiescence Medical, Inc.

George Bristol

Financial Services

26

4

Janas Associates

Craig Barbarosh

Banking & Corporate Law

20

3

Partner, Katten Muchin Rosenman LLP

Maureen Spivack

Financial Services -

20

2

Managing Director, Locust Walk Securities

Healthcare

Lance Rosenzweig

International Outsourcing

14

-

CEO, 24/7 Card

Mark Davis

Financial

Services

-

20

-

Managing Director, B. Riley & Co, LLC

IT

Managing

Director

–

Corporate

Finance, |

24

Collaborative Management Team Aids

Cross-Selling

>

We operate four distinct business divisions led by experienced

managers that provide focused leadership to:

>

Develop and execute on business strategy

>

Guide development of new technology

>

Provide management accountability in each of business lines

>

Develop a deep and broad bench of management talent

>

Ensure the infrastructure and client service remain strong

>

Working together, these proven leaders guide the successful

development

and

implementation

of

complementary

service

offerings

and integration of new solutions with existing offerings

This strengthens our ability to cross-sell within our existing customer base

and win multi-solution deals with new customers

|

25

Name/Title

Years of Industry Experience

Steven Plochocki

36

President & CEO, Quality Systems, Inc.

Paul Holt

13

Executive Vice President & CFO, Quality Systems, Inc.

James Sullivan

11

Executive Vice President, General Counsel & Secretary, Quality Systems,

Inc. Scott Decker

13

President, NextGen Healthcare Information Systems

Donn Neufeld

32

Executive Vice President, EDI and Dental

Monte Sandler

16

Executive Vice President, NextGen RCM Services

Steve Puckett

20

Executive Vice President, NextGen Hospital Solutions

Experienced Management Team |

26

Strong Corporate Governance

An annually elected Board, with a majority of independent directors

Cumulative voting rights

Shareholders may call meetings and act by written consent

No “poison pill”

Annual “say-on-pay”

advisory vote to approve executive

compensation

>

QSI is committed to upholding strong standards of corporate

governance, including:

>

99% shareholder approval of our executive compensation program

at

our

2011

annual

shareholders’

meeting |

27

Strong Corporate Governance

>

Our

corporate governance provisions, including the definition of

“independent

director,”

meet

all

NASDAQ

requirements

>

Seven

of

our

eight

Board

nominees

are

independent

NASDAQ criteria

>

In

2011,

ISS

rated

QSI

“green

-

low

concern”

for

board

structure,

shareholder rights and audit

>

In

2011,

Glass

Lewis

gave

QSI

an

“A”

grade

in

its

pay-for-

performance assessment

under

the |

28

Hussein: Takeover Attempt Threatens QSI

Shareholder Value

Hussein’s Goal

>

Cumulative voting ensures he can elect himself and perhaps one other nominee,

which matches his proportionate interest

>

In his prior proxy solicitation campaigns, he has failed to obtain meaningful

support from other shareholders, while imposing significant expense on the

Company >

We believe that the 2 seats he obtained in 2008 and 2005 principally reflect his

ability to cumulate votes

>

Mr. Hussein seeks to replace a majority of our Board, and, if successful, we

believe that he intends to assume leadership of the Board

>

This is Mr. Hussein’s fourth attempt in the past eight years to unilaterally

nominate directors to the Board and his third proxy contest

>

In the boardroom and in his SEC filings, Mr. Hussein is, in our opinion, more

interested

in

making

what

we

believe

to

be

vague

and

unjustified

complaints

about procedural issues than in offering strategic insight.

|

29

Hussein: A Threat to QSI Shareholder Value

Hussein Offers No Distinct Plan

>

QSI has a deliberate, disciplined process for considering potential acquisitions,

which focuses on transactions that are accretive, fit a strategic gap for

QSI’s business and are minimally dilutive to shareholders

>

QSI is open to larger acquisitions, if they present the right strategic fit for

the company >

Hussein fails to appreciate how divisions incubate products before broader

integration >

Divisional

leadership

provides

accountability

and

focus

to

drive

product

development

>

A divisional architecture provides the added benefits of a broader team of

executive management

>

We

believe

that

most

of

his

“proposals”

are

Company

initiatives

already

being

executed

under

the

guidance

of

our

current

Board

and

director

nominees

>

To

the

extent

that

his

“proposals”

differ,

we

believe

that

Mr.

Hussein

is

misguided

>

Acquisition strategy

>

Consolidation of business divisions |

30

Hussein: A Threat to QSI Shareholder Value

Hussein’s History of Poor Governance and Bad Behavior

>

Was

sued

by

his

client,

in

his

former

job

as

a

broker,

for,

among

other

things,

excessive

trading

in a

discretionary

account,

a

case

which

his

employer

settled

for

$2.5

million

>

Was previously terminated by his employer, Dean Witter, for allegedly lying on an

employee questionnaire because he failed to disclose a personal account that

he held with his employer >

Was previously censured by the American Stock Exchange, in his former job as a

broker, after the exchange

determined

that

he

had

“…willfully

engaged

in

a

course

of

fraudulent

conduct

in

violation

of

Section 10(b) of the Securities Exchange Act of 1934, and Rule 10(b)-5

thereunder…” >

Refuses to comply with the Company’s insider trading policy, including

restrictions that prohibit holding Company stock in margin accounts

>

Refuses

to

preform

customary

Board

duties

such

as

signing

routine

corporate

documents,

including

board

resolutions, director evaluations and SEC filings

>

Holds

all

shares

of

Company

stock

in

margin

accounts,

despite

having

certified

to

the

Company

that

he

does not hold any shares in margin accounts

>

Routinely leaves Board meetings before their scheduled completion, missing

important strategy discussions

>

Was pursued by the IRS for failure to pay $700,000 in personal income taxes, a

proceeding which Mr. Hussein settled

>

While

Chairman

of

SIMO,

an

Egyptian

paper

company,

was

suspended

from

the

board

of

directors

in

connection with the deterioration in SIMO’s financial condition

>

Previously,

as

Lead

Director

of

QSI,

managed

to

have

himself

appointed

to

all

of

the

Company’s

Board

committees,

including

the

Audit

Committee

while

owning

19.2%

of

the

Company’s

shares |

APPENDIX:

INDEPENDENT DIRECTOR BIOGRAPHIES |

Sheldon Razin

Chairman and Founder

Sheldon

Razin

age

74,

is

a

director.

He

is

the

founder

of

our

company

and

has

served

as our Chairman of the Board since our incorporation in 1974. Throughout his tenure

as our Chairman, Mr. Razin has received several awards recognizing his

service and contributions as a director. Most recently, Mr. Razin was

honored in 2011 as a Director of the Year in Orange County’s 16th

Annual Forum for Corporate Directors Awards. Mr. Razin’s

past

honors

include,

winner

in

the

Software

Category

of

TechAmerica’s

52

nd

Annual

Innovator

Awards

in

2010,

the

Chairman

of

the

Year

in

the

2009

American

Business

Awards,

the

2009

Ernst

&

Young

Entrepreneur

of

the

Year

in

the

Healthcare

Category for Orange County, and the Excellence in Entrepreneurship Award from the

Orange

County

Business

Journal

in

2009.

Mr.

Razin

also

served

as

our

Chief

Executive

Officer from 1974 until April 2000. Since our incorporation until April 2000, he

also served as our President, except for the period from August 1990 to

August 1991. Additionally, Mr. Razin served as our Treasurer from our

incorporation until October 1982. Prior to founding our company, he held

various technical and managerial positions with Rockwell International

Corporation and was a founder of our predecessor, Quality Systems, a sole

proprietorship engaged in the development of software for commercial and space

applications and in management consulting work. Mr. Razin holds a B.S.

degree in Mathematics from the Massachusetts Institute of Technology. Mr.

Razin, as our founder, brings valuable knowledge to our Board regarding our

history, operations, technology and marketplace.

,

32 |

33

Russell Pflueger

Founder, Chairman & CEO, Quiescence Medical Inc.

Russell

Pflueger

age

48,

is

a

director.

Mr.

Pflueger

is

an

investor

and

serial

entrepreneur

with

over

25

years

in

healthcare

and

over

30

issued

patents.

His

background includes R&D and sales positions at organizations including the

National Institutes of Health, Pfizer, Baxter Healthcare, and Beech Street.

He also helped form, manage, and sell a major medical practice and surgery

centers. He was a semi-finalist for the Ernst & Young Orange County

Entrepreneur of the Year award in 1999. In 2002, Russell sold Pain Concepts,

Inc., a minimally invasive spinal device company he founded to Stryker, Inc.

(SYK:NYSE) for a publicly reported $42.5 million. He is the founder of

Quiescence Medical, Inc., a medical device development company working on novel

approaches to the treatment of sleep apnea, and has served as its Chairman

and Chief Executive Officer since its inception in 2002. Mr. Pflueger is an

active investor in many public and private companies and also various real

estate interests. He played collegiate basketball and golf, holds a Chemical

Engineering degree from Texas A&M University, and a Master of Business

Administration degree with top honors from the University of California at

Irvine. Mr. Pflueger has been a director of our company since 2006. Mr.

Pflueger brings to our Board experience in the healthcare industry as an

entrepreneur and corporate and government employee, as well as his diverse

work-related experiences in research and development, sales and

executive management. , |

George

Bristol Managing Director–Corporate Finance, Janas Associates

George

H.

Bristol

age

63,

is

a

director.

Mr.

Bristol

is

a

Managing

Director

of

Janas

Associates, a corporate financial advisor. From August 2006 until March 2010 he

served as Managing Director —

Corporate Finance of Crowell Weedon & Co. Prior to August

2006, he was a member and Chief Financial Officer of Vantis Capital Management,

LLC, a registered investment advisor which managed the Vantis hedge funds

totaling over $1.4 billion from November 2002. Prior to Vantis, he was an

investment banker with several firms including Ernst & Young, Paine

Webber, Prudential Securities and Dean Witter. He is

a

graduate

of

the

University

of

Michigan

and

Harvard

Business

School.

Mr.

Bristol

has

been a director of our company since 2008. Mr. Bristol’s experience at Janas,

Vantis and his various corporate finance positions provides our Board with

insight from someone with direct responsibility for strategic and

transactional financial matters. ,

34 |

35

Craig Barbarosh

Partner, Katten Muchin Rosenman LLP

Craig

Barbarosh

age

44,

is

a

director.

Mr.

Barbarosh

is

a

partner

at

the

international

law

,

firm of Katten Muchin Rosenman LLP and was previously a partner of the international law

firm of Pillsbury Winthrop Shaw Pittman LLP. Mr. Barbarosh is a nationally recognized

restructuring expert. He has served in several leadership positions while a partner at Pillsbury

including serving on the firm’s Board of Directors, as the Chair of the firm’s

Board’s Strategy Committee, as a co-leader of the firm’s national Insolvency

& Restructuring practice section and as the Managing Partner of the firm’s Orange

County office. At Katten, Mr. Barbarosh is a member of the firm’s Board and management

team. Mr. Barbarosh received a Juris Doctorate

from

the

University

of

the

Pacific,

McGeorge

School

of

Law

in

1992,

with

distinction, and a Bachelor of Arts in Business Economics from the University of California at

Santa Barbara in 1989. Mr. Barbarosh received certificates from Harvard Business School for

completing executive education courses on Private Equity and Venture Capital (2007) and

Financial

Analysis

for

Business

Evaluation

(2010).

Mr.

Barbarosh

is

also

a

frequent

speaker

and

author

on

restructuring

and

governance

topics.

Mr.

Barbarosh

has

been

a

director

of

our

company since September 2009. Mr. Barbarosh, as a practicing attorney specializing in the

area of financial and operational restructuring and related mergers and acquisitions, provides

our Board with experienced guidance on similar transactions facing our company. Mr.

Barbarosh is also a director of Sabra Health Care REIT, Inc. (NASDAQ: SBRA), where he is

the Chair of the Audit Committee and a member of the Compensation Committee.

|

Maureen

Spivack Managing Director, Locust Walk Securities

Maureen

Spivack

age

55,

is

a

director.

Ms.

Spivack

has

over

20

years

of

investment

banking experience in executing strategic and financial transactions for health

care companies. Ms. Spivack is a Managing Director at the Healthcare

Advisory Firm, Locust Walk Securities. She joined Locust Walk after 3.5

years as a Managing Director in the health

care

group

of

Morgan

Keegan

&

Co.

Prior

to

joining

Morgan

Keegan

in

2008,

Ms.

Spivack served as a Managing Director in the Global Healthcare Group of UBS

Investment Bank from 2006 until June 2008. From 1998 to 2006, Ms. Spivack was a

Managing Director and head of Strategic Advisory Services for Health Care at

Merrill Lynch & Co. Prior to joining Merrill Lynch Health Care Group,

Ms. Spivack was a Partner at Ernst & Young, where she managed the

National Healthcare Corporate Finance practice for 10 years. Ms. Spivack has

an MBA from The Wharton School and an MSN from the University of

Pennsylvania. Ms. Spivack’s 20 years of experience executing strategic

and financial transactions for publicly traded, privately held and not-for-profit

healthcare companies, including hospitals and physician groups, provides

significant insights and experience to our Board in these areas.

,

36 |

Lance

Rosenzweig CEO, 24/7 Card

Lance

Rosenzweig

age

49,

is

a

director.

Mr.

Rosenzweig

is

founder

and

chief

executive

officer of 24/7 Card, a provider of pre-paid debit and remit cards. Prior to

founding 24/7 Card in 2010, Mr. Rosenzweig founded and served as chairman of

the board of PeopleSupport,

Inc.,

a

business

process

outsourcing

company

with

operations

in

the

Philippines

and

Costa

Rica,

since

its

inception

in

1998.

He

also

served

as

PeopleSupport’s chief executive officer from March 2002 until the

company’s sale in 2008. From 1993 to 1997, Mr. Rosenzweig was a

founder, chairman of the board and president of Newcastle Group, a privately

held plastics manufacturing company. He was also a founder of Unisite, a

privately held wireless cell site management company. Prior to 1993, Mr.

Rosenzweig was a divisional vice president at GE Capital; a vice president in

the investment banking group of Dean Witter (now Morgan Stanley); a vice president

in the investment banking group of Capel Court Pacific, an Australian

investment banking firm; and a corporate planning manager of Jefferson

Smurfit Group, a multinational packaging company. Mr. Rosenzweig has a

Master’s degree in business administration from Northwestern

University’s Kellogg School of Management and a Bachelor of Science

degree in industrial engineering, with Tau Beta Pi honors, from Northwestern

University. ,

37 |

38

Mark Davis

Managing Director, B. Riley & Co. LLC

Mark

Davis

51,

is

a

Managing

Director

at

B.

Riley

&

Co,

LLC,

an

investment

firm

specializing in research, sales and trading and corporate finance. From October

2010 to February 2012, Mr. Davis was Head of Technology Investment Banking

at Cantor Fitzgerald. From March 2009 to February 2010, Mr. Davis was a

Managing Director at Macquarie

Capital,

an

Australian

Merchant

and

Investment

Banking

firm.

From

2004

to

2009, Mr. Davis was a Managing Director at Citigroup, a diversified financial

institution, focused on providing strategic and financial advice to a broad

range of information technology companies and was head of its Data

Infrastructure sector. Earlier in his career, Mr. Davis also held Director

and Vice President positions at Citigroup, and served as a certified

public

accountant

for

Price

Waterhouse

where

he

was

an

Audit

Senior.

Mr.

Davis

earned a Master’s of Business Administration from the Wharton School of the

University of Pennsylvania, where he graduated with distinction and

graduated Summa Cum Laude from the University of Maryland with a Bachelor of

Science in Accounting. Mr. Davis’s more

than

20

years’

experience

advising

and

financing

technology

-

related

companies

including software, cloud infrastructure and information technology firms provides

the Board with

insights

into

the

rapid

changes

in

technology

including

software

as

a

service,

implications of the cloud and other areas important to the Company’s strategy.

In addition, his background in Public Accounting provides the Board with

insights into financial reporting and internal controls.

, |

APPENDIX:

MANAGEMENT BIOGRAPHIES |

40

Steven Plochocki

President & CEO

Steven

T.

Plochocki

age

60,

serves

as

the

President

and

Chief

Executive

Officer

of

the

Company, after the promotion of Patrick Cline to president on November 24, 2009.

Mr. Plochocki

was

appointed

president

and

chief

executive

officer

on

August

11,

2008.

He

has

been

a

director

of

the

company

since

2004.

From

February

2007

to

May

2008,

he

served

as chairman and chief executive officer of Omniflight Helicopter, Inc., a

Dallas-based air medical services company. He previously served as chief

executive officer and director of Trinity Hospice, a national hospice

provider from October 2004 through October 2006. Prior

to

joining

Trinity

Hospice,

he

was

chief

executive

officer

of

InSight,

a

national

provider

of diagnostic imaging services from November 1999 to August 2004. Prior to that, he

was chief executive officer of Centratex Support Services, Inc., a support

services company for the healthcare industry and had previously held other

senior level positions with healthcare industry

firms.

He

holds

B.A.

in

Journalism

and

Public

Relations

from

Wayne

State

University and a Master's degree in Business Management from Central Michigan

University.

, |

41

Paul Holt

Executive Vice President & CFO

Paul

A.

Holt

age

46,

was

appointed

our

Chief

Financial

Officer

in

November

2000.

Mr.

Holt

served as our Controller from January 2000 to May 2000 and was appointed interim

Chief Financial

Officer

in

May

2000.

Prior

to

joining

us,

Mr.

Holt

was

the

Controller

of

Sierra

Alloys

Co., Inc., a titanium metal manufacturing company, from August 1999 to December

1999. From May 1997 to July 1999, he was Controller of Refrigeration

Supplies Distributor, a wholesale

distributor

and

manufacturer

of

refrigeration

supplies

and

heating

controls.

From

March 1995 to April 1997 he was Assistant Controller of Refrigeration Supplies

Distributor. Mr.

Holt

was

a

Certified

Public

Accountant

at

McGladrey

&

Pullen

and

holds

an

M.B.A.

from

the University of Southern California and a B.A. in Economics from the University

of California, Irvine.

, |

42

James Sullivan

Executive Vice President, General Counsel and Secretary

James

J.

Sullivan

age

54,

was

appointed

our

Executive

Vice

President,

General

Counsel

and Secretary in November 2010. Prior to his appointment, Mr. Sullivan was Senior Vice

President, General Counsel and Secretary of The TriZetto Group, Inc., a healthcare

technology company. Prior to joining The TriZetto Group in July 2001, Mr. Sullivan ran a

legal and consulting practice focused on general corporate and securities matters for

emerging growth companies from June 2000 to July 2001. From March 1997 to June 2000,

Mr. Sullivan was Senior Vice President, General Counsel and Secretary of Long Beach

Financial

Corporation.

Earlier

in

his

career,

Mr.

Sullivan

was

a

corporate

and

securities

associate with Gibson, Dunn & Crutcher in its Newport Beach, California office. Mr. Sullivan

brings more than 25 years of experience as a practicing corporate and securities law

attorney, and is also a certified public accountant (inactive status). Mr. Sullivan holds a J.D.

from

Loyola

Law

School

in

Los

Angeles,

California,

and

a

B.S.

in

Business

Administration

from the University of Southern California, Los Angeles, California.

, |

43

Scott Decker

President, NextGen Healthcare Information Systems

Scott

D.

Decker

was

promoted

to

president

of

the

company's

NextGen

Healthcare

Information Systems Division on November 24, 2009. Mr. Decker joined NextGen in 2007

as a senior vice president, initially developing the company's Health Information Exchange

(HIE) and hospital sector targeted business approach and strategy. In 2008, he assumed

additional responsibility for corporate marketing and has been extremely involved in the

re-building

of

NextGen's

marketing,

branding

and

product

management

strategy.

Previously, Mr. Decker founded and served as chairman of the board of directors and

chief executive officer of Healthvision, Inc., a pioneer in the HIE market, where he built

and deployed one of the first Software-as-a-Service (SaaS)-based infrastructures for

the healthcare industry. Prior to joining Healthvision, Mr. Decker was vice president of

development for VHA Inc.'s health information technologies business unit and focused on

the development of one of the nation's first Intranets: VHAseCURE.net. Mr. Decker began

his

career

at

IBM

Corporation,

where

he

held

a

variety

of

sales,

marketing

and

business

development

positions

within

the

global

health

industry

business

unit. |

44

Monte Sandler

Executive Vice President, NextGen RCM Services

Monte

Sandler

serves

as

executive

vice

president

of

NextGen

RCM

Services,

responsible for overseeing the company's RCM business unit and managing its

operations. Previously, Sandler served as vice president of account management with

NextGen RCM Services. His responsibilities included managing large client

accounts, encompassing sales, implementation, operational oversight,

financial review and client relations. Prior to joining NextGen Healthcare,

Sandler was partner and co-founder at Healthcare Strategic Initiatives

(HSI) for 12 years, where he was instrumental in all phases of the company's

growth since its inception in 1996. HSI is a revenue cycle entity acquired

by the company in 2008. Prior to HSI, Sandler was an auditor with KPMG Peat

Marwick in St. Louis. He holds his Certified Public Accountant (CPA) license in

Missouri and is a graduate of the Kelley Business School at Indiana

University in Bloomington, Ind. Sandler is a member of the Healthcare

Financial Management Association (HFMA) and also serves on the Board of

Directors of the St. Louis Jewish Community Center (JCC). He is based in St.

Louis. |

45

Steve Puckett

Executive Vice President, NextGen Hospital Solutions

Steve

Puckett

is

Executive

Vice

President

of

NextGen

Hospital

Solutions.

He

oversees

day-to-day operations and manages the company's line of inpatient products.

Formerly, Puckett served as founder, CEO, and President of MicroMed, one of

two companies merged to create NextGen Healthcare and establish NextGen

Practice Management as its

financial

product

offering.

He

began

his

career

at

Accenture

and

later

worked

in

the

inpatient sector at Gerber Alley, which became part of McKesson's product line.

Puckett is a graduate from the Georgia Institute of Technology

|

46

Donn E. Neufeld

Executive Vice President, EDI and Dental

Donn

E.

Neufeld

was

appointed

Executive

Vice

President,

EDI

and

Dental,

in

April,

2010.

Mr. Neufeld has served as our Vice President Software and Operations since January

1996. He served as our Vice President of Operations from June 1986 until

January 1996. From April 1981 until June 1986, Mr. Neufeld held the position

of Manager of Customer Support. He joined our company in 1980.

|

47

INFORMATION REGARDING PARTICIPANTS

Information concerning the company and our directors, director nominees, and

certain executives who are or ADDITIONAL INFORMATION

On July 13, 2012, the company filed its definitive proxy statement in connection

with its 2012 annual meeting of shareholders,

and

on

July

16,

2012,

began

the

process

of

mailing

such

proxy

statement

to

its

shareholders,

together with a WHITE proxy card. Shareholders are strongly advised to read the

definitive proxy statement and the accompanying proxy card, as they will

contain important information. Shareholders may obtain the definitive proxy

statement, any amendments or supplements to such proxy statement, and other documents

filed by the company with the SEC for free at the Internet website maintained by

the SEC at www.sec.gov. Copies of the definitive proxy statement and any

amendments and supplements to such proxy statement may be requested by

contacting our proxy solicitor, MacKenzie Partners, Inc. at (800) 322-2885 toll-free or by

email at proxy@mackenziepartners.com.

may be participants in the solicitation of proxies in connection with the company's

upcoming 2012 annual meeting of shareholders is available in the definitive

proxy statement filed by the company with the SEC on July 13, 2012. |

ISS

Presentation July 23, 2012 |