SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

|

Preliminary Proxy Statement |

|

|

|

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

☒ |

|

Definitive Proxy Statement |

|

|

|

☐ |

|

Definitive Additional Materials |

|

|

|

☐ |

|

Soliciting Material Pursuant to §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ |

|

No fee required. |

|

|

|

☐ |

|

Fee paid previously with preliminary materials. |

|

|

|

☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD AUGUST 22, 2023

To the stockholders of NextGen Healthcare, Inc.:

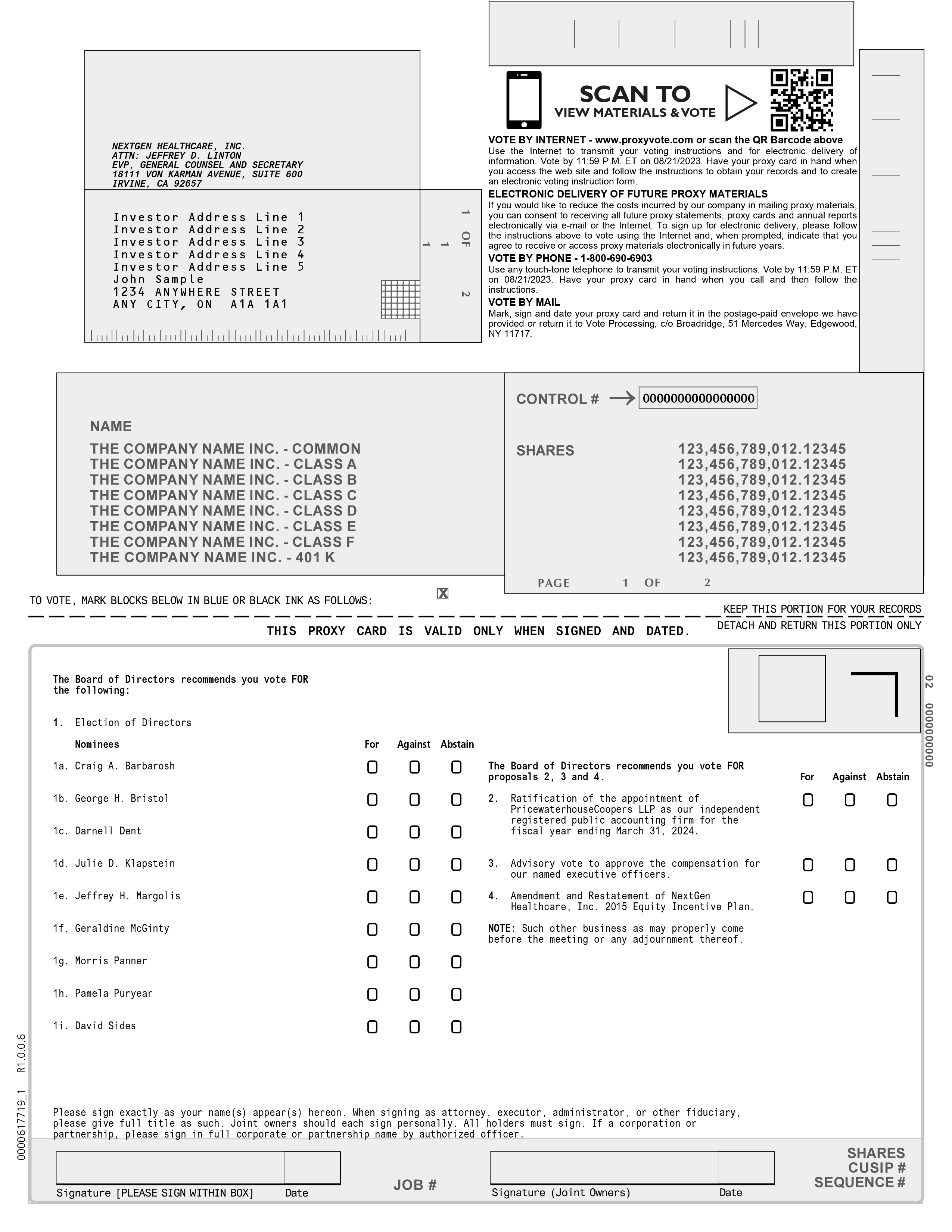

Notice is hereby given that the 2023 Annual Meeting of Stockholders (“Annual Meeting”) of NextGen Healthcare, Inc., a Delaware corporation (the “Company”), will be held at 18101 Von Karman Ave, Suite 200, Irvine, CA 92612 on August 22, 2023, at 10:00 a.m. Pacific Time, for the following purposes:

These items are described more fully in the accompanying proxy statement.

All stockholders are cordially invited to attend the Annual Meeting in person. Only stockholders of record at the close of business on July 13, 2023, are entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements of the Annual Meeting.

Whether or not you plan to attend the Annual Meeting, please complete and sign the enclosed proxy card and return it in the enclosed addressed envelope. Your promptness in returning the proxy card will assist in the expeditious and orderly processing of the proxy and will assure that you are represented at the Annual Meeting even if you cannot attend the meeting in person. You may also vote by telephone or internet by following the instructions on the proxy card. If you return your proxy card or vote by telephone or internet, you may nevertheless attend the Annual Meeting and vote your shares in person. Stockholders whose shares are held in the name of a broker or other nominee and who desire to vote in person at the meeting should bring with them a legal proxy.

OUR BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL OF OUR DIRECTOR NOMINEES NAMED ON THE ENCLOSED PROXY CARD, AND “FOR” PROPOSALS 2, 3, AND 4.

By Order of the Board of Directors, NEXTGEN HEALTHCARE, INC.

/s/ Jeffrey D. Linton |

Jeffrey D. Linton Executive Vice President, General Counsel and Secretary July 26, 2023 |

TABLE OF CONTENTS

NEXTGEN HEALTHCARE, INC.

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD AUGUST 22, 2023

PROXY STATEMENT

SOLICITATION OF PROXIES

The accompanying proxy is solicited by the Board of Directors (“Board”) of NextGen Healthcare, Inc. (“NextGen Healthcare,” the “Company,” “us,” “we” or “our”) for use at our annual meeting of stockholders to be held at 18101 Von Karman Ave, Suite 200, Irvine, CA 92612 on August 22, 2023, at 10:00 a.m. Pacific Time, and at any and all adjournments and postponements thereof. All shares represented by each properly submitted and unrevoked proxy received in advance of the annual meeting will be voted in the manner specified therein.

Any stockholder has the power to revoke the stockholder’s proxy at any time before it is voted. A proxy may be revoked by a stockholder of record by delivering a written notice of revocation to our Secretary prior to or at the annual meeting, by voting again on the internet or by telephone (only your latest internet or telephone proxy submitted prior to 11:59 P.M. Eastern Time on August 21, 2023 will be counted), by submitting to our Secretary, prior to or at the annual meeting, a later dated proxy card executed by the person executing the prior proxy, or by attendance at the annual meeting and voting in person by the person submitting the prior proxy or voting by ballot at the annual meeting. Stockholders who hold shares in street name through a broker may revoke their proxy and change their vote by following the instructions provided by their broker.

Any stockholder who holds shares in street name and desires to vote in person at the annual meeting should inform the stockholder’s broker of that desire and request a legal proxy from the broker. The stockholder will need to bring the legal proxy to the annual meeting along with valid picture identification such as a driver’s license or passport, in addition to documentation indicating share ownership. If the stockholder does not receive the legal proxy in time, then the stockholder should bring to the annual meeting the stockholder’s most recent brokerage account statement showing that the stockholder owned NextGen Healthcare, Inc. common stock as of the record date. Upon submission of proper identification and ownership documentation, we should be able to verify ownership of common stock and admit the stockholder to the annual meeting; however, the stockholder will not be able to vote at the annual meeting without a legal proxy. Stockholders are advised that if they own shares in street name and request a legal proxy, any previously executed proxy will be revoked, and the stockholder’s vote will not be counted unless the stockholder appears at the annual meeting and votes in person or legally appoints another proxy to vote on its behalf.

We will bear all expenses in connection with the Company’s solicitation of proxies. We will reimburse brokers, fiduciaries, and custodians for their costs in forwarding the Company’s proxy materials to beneficial owners of common stock. Our directors, officers and employees may solicit proxies by mail, telephone and personal contact on behalf of the Company. They will not receive any additional compensation for these activities.

This proxy statement, the accompanying proxy card and our 2023 annual report are being made available to our stockholders on or about July 26, 2023.

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on August 22, 2023.

This proxy statement, the notice of our 2023 annual meeting of stockholders and the Company’s 2023 annual report to stockholders are available on our website at https://investor.nextgen.com/.

1

Only holders of record of the 67,018,411 shares of our common stock outstanding at the close of business on the record date, July 13, 2023, are entitled to notice of, to attend, and to vote at the annual meeting or any adjournments or postponements thereof. A majority in voting power of the shares of capital stock of the Company issued and outstanding and entitled to vote, present in person or represented by proxy, shall constitute a quorum for the transaction of business. All properly submitted and unrevoked proxies will be counted in determining the presence of a quorum, including those providing for abstention and broker non-votes. Broker non-votes occur when a stockholder who beneficially owns shares that are held in street name, that is through a broker, does not provide the broker with instructions on how to vote those shares on matters that are considered non-routine. Brokers can vote without instruction from the beneficial owners only on routine matters, such as the ratification of the appointment of our independent auditors. The election of directors, the Say-on-Pay and approval of the Amended 2015 Plan are non-routine matters and brokers are not authorized to vote on these matters without instruction. When no instruction is given, it is considered a broker non-vote.

If a quorum is not present or represented at any meeting of the stockholders, the person presiding over the meeting shall have power to recess the meeting or adjourn the meeting from time to time in the manner provided under our Bylaws until a quorum is present or represented. At any recessed or adjourned meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the meeting as originally noticed.

A list of stockholders entitled to vote at the Annual Meeting will be available upon request for examination for ten (10) days prior to the Annual Meeting by contacting us via email to our Secretary, Jeffrey D. Linton, at secretary@nextgen.com. The stockholder list will also be available during the Annual Meeting.

Each stockholder will be entitled to one vote, in person or by proxy, for each share of common stock held on the record date.

Approval of Proposal No. 1, election to the Board of each nominee named in this Proxy Statement requires the affirmative vote of the holders of a majority of the votes cast. Thus, the number of shares voted “FOR” any nominee must exceed the number of shares voted “AGAINST” such nominee for such nominee to be elected to serve until the Company’s 2024 annual meeting and until his or her successor has been duly elected, or until his or her earlier resignation or removal. Abstentions and broker non-votes are not counted as a vote cast and thus will have no effect.

Any incumbent director nominee who fails to receive the requisite majority vote at an annual or special meeting held for the purpose of election of directors, where the election is uncontested, must tender his or her resignation to the Board, which resignation shall be contingent on the acceptance by the Board in accordance with the policies and procedures adopted by the Board for such purpose. The Nominating and Governance Committee shall make a recommendation to the Board as to whether to accept or reject the resignation of such incumbent director, or whether other action should be taken. The Board will act on the tendered resignation, and publicly disclose its decision and rationale, within ninety (90) days following certification of the stockholder vote. The Nominating and Governance Committee in making its recommendation and the Board in making its decision each may consider any factors and other information that they consider appropriate and relevant. If the Board accepts a director’s resignation, or if a nominee for director is not elected and the nominee is not an incumbent director, then the Board may fill the resulting vacancy pursuant to our Charter and Bylaws.

Approval of Proposal No. 2, the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2024 requires the affirmative vote of the holders of a majority of the votes cast (excluding abstentions and broker non-votes). Thus, the number of votes “FOR” must exceed the number of votes “AGAINST” for this proposal to pass. Brokers are authorized to vote on this proposal without instructions from the beneficial owners and thus broker non-votes are not expected. Abstentions will have no effect on this proposal.

2

Approval of Proposal No. 3, the approval, on an advisory basis, of the compensation of our named executive officers, as disclosed in this Proxy Statement (i.e., “Say-on-Pay”), requires the affirmative vote of the holders of a majority of the votes cast (excluding abstentions and broker non-votes). Thus, the number of votes “FOR” must exceed the number of votes “AGAINST” for this proposal to pass. Brokers are not authorized to vote on this proposal without instruction from the beneficial owners. Abstentions and broker non-votes will have no effect on this proposal.

Approval of Proposal No. 4, the approval of the Amended 2015 Plan requires the affirmative vote of the holders of a majority of the votes cast (excluding abstentions and broker non-votes). Thus, the number of votes “FOR” must exceed the number of votes “AGAINST” for this proposal to pass. Brokers are not authorized to vote on this proposal without instruction from the beneficial owners. Abstentions and broker non-votes will have no effect on this proposal. If this Proposal 4 is approved by our stockholders, the Amended 2015 Plan will become effective as of the date of the annual meeting.

The Board recommends that you vote your shares:

1. “FOR” each of the nine (9) nominees for election to the Board;

2. “FOR” the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2024;

3. “FOR” the approval, on an advisory basis, of the compensation of our named executive officers as disclosed in this Proxy Statement; and

4. “FOR” the proposal to approve an amendment of our 2015 Equity Incentive Plan, as amended and restated (the "Amended 2015 Plan").

Unless otherwise instructed, the proxy holders will vote the proxies they receive in accordance with the Board’s recommendations above.

The Board knows of no other matters that will be presented for consideration at the annual meeting. If any other matters are properly brought before the annual meeting, the proxy holders will vote the shares for which you grant your proxy on those matters in accordance with their best judgment.

Your vote is very important. Regardless of whether you plan to attend the annual meeting or not, we recommend that you vote as soon as possible. We encourage you to review this Proxy Statement and your proxy card or voting instructions for your voting options and cast your vote in advance of the annual meeting.

3

CAUTIONARY NOTE CONCERNING FORWARD LOOKING STATEMENTS

This proxy statement and accompanying materials contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. You can identify forward-looking statements by words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” “estimate,” “predict,” “potential,” “continue” or other similar expressions. Actual results may differ from those set forth in the forward-looking statements due to a variety of factors, including those contained in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2023, and the Company’s other filings with the U.S. Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statements.

4

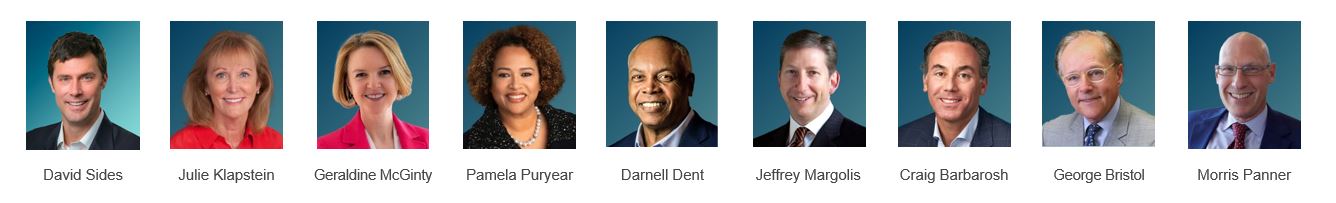

DIRECTORS

Listed below are the nine nominees for election as director. Each nominee currently serves on the Board. Four of the nine directors elected at the Company’s 2021 Annual Meeting of Stockholders were new to the Board and advanced diversity across race, gender, age, and tenure. The Board comprises a diverse group of leaders with decades of experience across healthcare providers, health insurance, life sciences and enterprise software. In addition, the Board has functional experience in commercialization, corporate strategy and M&A, corporate governance and compensation, finance and accounting, human capital, and public company boards. The Board has an average tenure of 6 years, providing a combination of fresh perspectives and institutional knowledge to inform opportunities that build on the Company’s transformation. The Board believes that the collective experiences, viewpoints, and perspectives of the Company’s nominees for directors result in a Board with the commitment and energy to advance the interests of the Company’s stockholders.

Board Diversity Matrix |

|

|||||||||||||||

|

|

Total Number of Directors |

|

|||||||||||||

|

|

Female |

|

|

Male |

|

|

Non-Binary |

|

|

Did Not |

|

||||

Part I: Gender Identity |

|

|||||||||||||||

Directors |

|

|

3 |

|

|

|

6 |

|

|

|

|

|

|

|

|

|

Part II: Demographic Background |

|

|||||||||||||||

African American or Black |

|

|

1 |

|

|

|

1 |

|

|

|

|

|

|

|

|

|

Alaskan Native or Native American |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asian |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hispanic or Latinx |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Native Hawaiian or Pacific Islander |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

White |

|

|

2 |

|

|

|

5 |

|

|

|

|

|

|

|

|

|

Two or More Races or Ethnicities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LGBTQ+ |

|

|

|

|

||||||||||||

Did Not Disclose Demographic Background |

|

|

|

|

||||||||||||

5

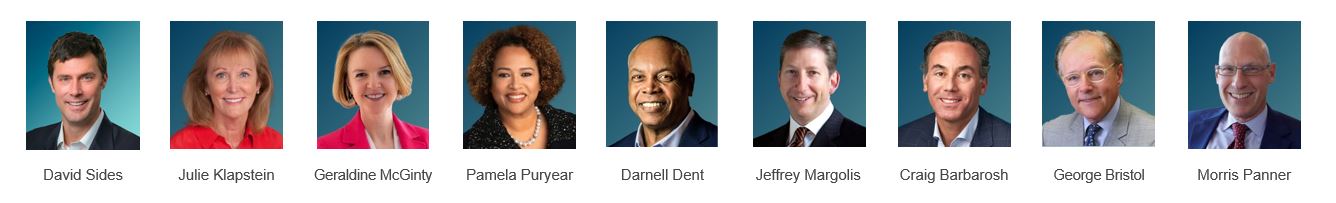

Board Skills and Qualifications

The Board and the Nominating and Governance Committee believe the skills, qualities, attributes, and experience of the nominees provide the Company with business acumen.

The biographies below describe the skills, qualities, attributes, and experience of the nominees that led the Board and the Nominating and Governance Committee to determine that it is appropriate to nominate these directors.

Director Biographies

Craig A. Barbarosh, age 55, is a director and previously served as our Vice Chair of the Board since November 2015. Currently, he is the Chairman of the Board of Lifecore Biomedical, Inc., where he is a member of the Compensation Committee, a director at Evolent Health, Inc., where he is Chair of the Strategy Committee and a member of the Compensation Committees, and Sabra Health Care REIT, Inc., where he is the Chair of the Audit Committee and a member of the Compensation Committee. Mr. Barbarosh previously served on the boards of Aratana Therapeutics, Inc., where he was the Chair of the Strategy Committee and a member of the Compensation Committee, Bazaarvoice, Inc., where he was a member of the Compensation Committee, and BioPharmX, Inc., where he was the Chair of the Nominating and Governance Committee and a member of the Audit and Compensation Committees. Mr. Barbarosh also previously served as the Independent Board Observer for Payless Holdings, Inc. and as an independent director of Ruby Tuesday, Inc. Mr. Barbarosh is a former practicing attorney and was previously a partner at the international law firm of Katten Muchin Rosenman LLP, a position he held from June 2012 through January 2023. Previously, Mr. Barbarosh was a partner of the international law firm of Pillsbury Winthrop Shaw Pittman LLP. He served in several leadership positions while a partner at Pillsbury including serving on the firm’s Managing Board, as the Chair of the firm’s Board’s Strategy Committee, as a co-leader of the firm’s national Insolvency & Restructuring practice section and as the Managing Partner of the firm’s Orange County office. At Katten, Mr. Barbarosh served as a member of the firm’s Executive and Operating Committee from June 2012 through June 2016 and served on the firm’s Board of Directors for seven years. Mr. Barbarosh received a Juris Doctorate from the University of the Pacific, McGeorge School of Law in 1992, with distinction, and a Bachelor of Arts in Business Economics from the University of California at Santa Barbara in 1989. Mr. Barbarosh received certificates for completing executive education courses from the Wharton School of the University of Pennsylvania in Corporate Valuation (2019) and Harvard Business School in Private Equity and Venture Capital (2007), Financial Analysis for Business Evaluation (2010) and Effective Corporate Boards (2015) and from Carnegie Mellon University in Cybersecurity Oversight (2019). Mr. Barbarosh is also a frequent speaker and author on governance and restructuring topics. Our Board has concluded that Mr. Barbarosh, as an experienced board director and attorney specializing in the area of financial and operational restructuring and related mergers and acquisitions, provides our Board with experienced guidance on governance and transactional matters involving our Company. Mr. Barbarosh has been a director since 2009.

George H. Bristol, age 74, is a director. Mr. Bristol is a Managing Director of Janas Associates, a corporate financial advisor, a position he has held since 2010. From August 2006 until March 2010, Mr. Bristol served as Managing Director-Corporate Finance of Crowell Weedon & Co. From November 2002 until August 2006, Mr.

6

Bristol was a member and Chief Financial Officer of Vantis Capital Management, LLC, a registered investment advisor which managed the Vantis hedge funds totaling over $1.4 billion. Prior to Vantis, Mr. Bristol was an investment banker with several firms including Ernst & Young, Paine Webber, Prudential Securities and Dean Witter. Mr. Bristol is a graduate of the University of Michigan and Harvard Business School. Our Board has concluded that Mr. Bristol’s experience analyzing, evaluating and understanding financial statements in his various corporate finance positions provides our Board with insight from someone with direct responsibility for strategic and transactional financial matters. Mr. Bristol has been a director since 2008.

Darnell Dent, age 71, is a director. Mr. Dent is an experienced managed healthcare executive with over nineteen years of board service as a director. Currently, he is the principal of Dent Advisory Services, LLC where he serves as a strategic advisor to Softheon, Inc., a leading provider of cloud-based health insurance exchange (“HIX” or “marketplace”) technology that facilitates private and public marketplace participation and administration since 2019. More recently, he served in a similar capacity for Virgin Pulse, part of Sir Richard Branson’s Virgin Group, a global well-being solution provider providing employees with integrated health, well-being, safety, benefits navigation, and care guidance. Mr. Dent was formerly the CEO of FirstCare Health Plans from 2012 to 2018, and a senior executive at University of Pittsburgh Medical Center Health Plan, Community Health Plan of Washington, Health Net, and Lincoln National Corporation. Mr. Dent is also a board member for several non-profit organizations, including the National Association of Corporate Directors and the Managed Healthcare Executive Editorial Advisory Board. Our Board has concluded that Mr. Dent should serve on our Board because of his executive expertise in the healthcare insurance industry and his experience having served on private company and non-profit organization boards. Mr. Dent earned his bachelor’s degree from Norfolk State University in Psychology and his MA from Pepperdine University in Public Administration. Mr. Dent has been a director since 2021.

Julie D. Klapstein, age 68 is a director. Ms. Klapstein was the founding Chief Executive Officer of Availity, LLC, one of the nation’s largest health information networks optimizing the automated delivery of critical business and clinical information among healthcare stakeholders. Ms. Klapstein served as Availity’s Chief Executive Officer and board member from 2001 to 2011. She was the interim Chief Executive Officer at Medical Reimbursements of America, Inc., a private company, from February 2017 to June 2017. Ms. Klapstein’s more than thirty-five years of experience in the healthcare information technology industry include executive roles at Phycom, Inc. (President and Chief Executive Officer from 1996 to 2001), Sunquest Information Systems (Executive Vice President), Shared Medical Systems’ Turnkey Systems Division (now Siemens Medical Systems), and GTE Health Systems. Ms. Klapstein is a director of Amedisys Inc., where she serves on the Governance, Quality and Compensation committees, and where she serves as Lead Director; Oak Street Health, where she serves on the Compliance committee and as chair of the Compensation committee; and MultiPlan Corporation, where she serves on the Audit and Compensation committees. She also currently serves on the board of directors of a private company, Revecore, which specializes in complex claims solutions and payment integrity for hospitals. Ms. Klapstein previously was a director for two public companies, Annie’s Homegrown/Annies, Inc. from January 2012 to September 2014, where she served on the Governance, Compensation, and Audit committees, and Standard Register Inc. from April 2011 to November 2014, where she served on the Governance, Compensation, and Audit committees. She also has been a director for multiple private companies. Ms. Klapstein earned her bachelor’s degree from Portland State University in Portland, Oregon. Our Board has concluded that Ms. Klapstein should serve on our Board based on her extensive knowledge of the healthcare industry including healthcare information technology, relevant executive and management experience, and public company board experience. Ms. Klapstein has been a director since 2017.

Jeffrey H. Margolis, age 60, is a director and has served as the Chair of our Board since November 2015. Mr. Margolis is the former Chair & CEO of Welltok, Inc., a data-driven, enterprise SaaS company that develops and delivers a consumer activation platform to the healthcare industry, serving in both roles from April 2013 through April 2020 and chair through November 2021. Mr. Margolis is Chair Emeritus of TriZetto Corporation, a recognized leader of in the provision of health information technology for payers and providers and the originator of the industry-vertical SaaS model, where he served as the founding CEO beginning in 1997, served as Chair and CEO until 2010 (publicly traded on NASDAQ from October 1999—August 2008), and continued as Chair until October 2011. Mr. Margolis also served as Senior Executive Advisor to the Oliver Wyman Health Innovation Center, an organization that identifies and disseminates ideas and best practices that aim to transform healthcare, during 2012 and 2013. From 1989 to 1997, Mr. Margolis served as Senior Vice President and Chief Information Officer of FHP International Corp. and its predecessors, a publicly traded company that focused on the delivery of managed group and individual health care insurance and hospital and ambulatory-based clinical services along with a broad array of

7

healthcare ancillary services. Earlier in his career, Mr. Margolis served in various positions with Andersen Consulting including his final position as Manager, Healthcare Consulting. Mr. Margolis currently serves on the board of directors of Alignment Healthcare, Inc., a publicly traded population health management company, TriNetX, Inc., a private, for-profit data and software-as-a-service entity that supports clinical trials, Hydrogen Health Management Feeder, LLC, Get-Grin, Inc., a tele-orthodontic IT Platform, and DNAnexus, a multi-omics data management entity and Brightside Healthcare, a telehealth platform delivering mental healthcare to individuals. He has previously served on a variety of other for-profit boards. He also has served on a number of not-for-profit boards of directors. He is a member of the board of governors at Cedars-Sinai in Los Angeles, California and is on the Advisory Boards of the University of California at Irvine’s Center for Healthcare Management & Policy and Center for Digital Transformation. Mr. Margolis also serves as a Senior Advisor to Blackstone (NYSE: BX), one of the world’s largest investment firms. A published author of several books on the topics of healthcare information technology and systems, Mr. Margolis earned a bachelor’s degree in business administration/management information systems with high honors from the University of Illinois in 1984 and holds CPA certificates (currently inactive) in Colorado and Illinois. Our Board has concluded that Mr. Margolis should serve on our Board based on his experience as a chief executive officer in the health care information technology sector and his experience as an executive officer and director of various companies. Mr. Margolis has been a director since 2014.

Geraldine McGinty, MD, MBA, FACR, age 59, is a director. A faculty member at Weill Cornell Medicine in New York City since March 2014, Dr. McGinty serves several roles including Senior Associate Dean of Clinical Affairs and Professor of Clinical Radiology and Population Health Sciences. She formerly served as Chief Strategy Officer and Chief Contracting Officer for the Weill Cornell Medicine Physician Organization, which includes more than 1,600 members. Her role as lead negotiator for managed care contracts at Weill Cornell Medicine incorporated both traditional fee for service agreements as well as value-based payment arrangements. Her broad experience includes: serving as an advisor to the CPT Editorial Panel, the JCAHO and the National Quality Forum, Chair of the American College of Radiology’s Commission on Economics and radiology member of the AMA’s Relative Value Update Committee. She was elected as the Chair of the ACR’s Board of Chancellors from May 2018 to August 2021, the first woman to hold this office. She has also served as Managing Partner of a 70-physician multispecialty medical group on Long Island. She was until September 2021 a Non-Executive Director of IDA Ireland, the national foreign direct investment agency and serves on the Medical Advisory Board of Agamon, a healthcare technology start-up. Dr. McGinty earned her MBA from Columbia University and her MB (MD equivalent) from the National University of Ireland, Galway. Our Board has concluded that Dr. McGinty should serve on our Board as Dr. McGinty is an internationally recognized expert in health care strategy, a practicing Radiologist, and an unwavering advocate for patient-centered care with strong advocacy for the intersection of technology and healthcare and, in 2019, was named as one of the 2019 Most Powerful Women in Health IT by Health Data magazine. Dr. McGinty has been a director since 2021.

Pamela S. Puryear, PhD, MBA, age 59, is a director. Dr. Puryear is a business executive with 35 years of global experience in healthcare, financial services, consulting, and retail. From 2009 to 2021, Dr. Puryear held several executive leadership roles, including Executive Vice President, Global Chief Human Resources Officer at Walgreens Boots Alliance; Senior Vice President, Chief Human Resources Officer at Zimmer Biomet; Senior Vice President, Chief Talent Officer at Pfizer Inc.; and Vice President, Organizational Development and Chief Talent Officer at Hospira Inc. In these global executive team roles, she has driven value creation through her expertise in human capital management, organizational transformation, innovation, and operational excellence. Earlier, Dr. Puryear led an independent organizational development consulting practice for 12 years working globally and across industry sectors, including healthcare, consumer products, financial services, professional services and insurance. Dr. Puryear spent her first 10 years post-MBA in financial services in the real estate investment advisor industry. Dr. Puryear is a recognized business and human capital thought leader who has received numerous honors, most recently, the 2021 “Elite 100”, recognizing black female executives changing the face of corporate America, and she was inducted into the Executive Leadership Council (ELC), the preeminent member organization for Black Executives in 2019. Dr. Puryear is a director at Standard Motor Products, where she serves on all committees, and a director at SpartanNash where she serves on the Compensation and Audit Committees. Dr. Puryear previously served as a director at Rockley Photonics, where she served as the Chair of the Compensation Committee and as a member of the Nominating and Governance Committee. Dr. Puryear holds a PhD degree in organizational psychology; an MBA degree from the Harvard Business School; and a BA degree in psychology with a concentration in organizational behavior from Yale University. Our Board has concluded that Dr. Puryear should serve on our Board as she is a seasoned global business executive with a demonstrated track record of success in

8

senior executive positions in the pharmaceutical, medical device and pharmacy sectors of the healthcare industry with deep understanding of human capital issues. Dr. Puryear has been a director since 2021.

Morris Panner, age 60, is a director. Mr. Panner is a long tenured executive with expertise in both healthcare software companies, including SaaS capabilities, and the law. Currently, Mr. Panner is the President of Intelerad Medical Systems, Inc., a medical imaging management solutions company. Prior to his current role, from 2011 until 2021, Mr. Panner was Chief Executive Officer of Ambra Health (formerly DICOM Grid), a cloud-based healthcare software company that manages diagnostic imaging and related healthcare data. Prior to joining Ambra Health as Chief Executive Officer in September 2011, Mr. Panner was the Chief Executive Officer of Townflier, Inc. and related affiliates that provide group communications services, from May 2010 to August 2011. Previously, from April 2000 to May 2010, he was Chief Executive Officer of OpenAir, Inc., a SaaS project management company, which he led from start-up to its successful acquisition by NetSuite Inc., a provider of an integrated web-based business software suite, in 2008. Following the acquisition, Panner led the OpenAir division of NetSuite, during which time he oversaw the acquisition and integration of OpenAir’s nearest competitor, QuickArrow, Inc., as well as the expansion of OpenAir internationally. Mr. Panner served as a board member and as Chair of the Board of the Software Division of the Software and Information Industry Association. Mr. Panner is a lawyer who served as an Assistant United States Attorney, the Resident Legal Advisor in Bogota, Columbia for the U.S. Department of Justice and as the Principal, Deputy Chief of the Narcotics and Dangerous Drug Section of the U.S. Department of Justice. He served on the board of directors of Unanet Technologies, Inc., a software development company specializing in services automation solutions for project-based companies. He currently serves on the External Advisory Board for the Imaging Data Commons of the National Cancer Institute (NCI) at the National Institutes of Health (NIH), and on the board of Drug Strategies, a non-profit research institution on issues of drug addiction and treatment. Mr. Panner was previously a director of the Washington Office on Latin America, a not-for-profit organization, from 2003 to 2009. Mr. Panner graduated from Yale College with a BA in History in 1984 and from the Harvard Law School with a JD in 1988. Our Board has concluded that Mr. Panner’s qualifications as a director include his executive experience at software companies, including at health care software companies, and his legal training. Mr. Panner has been a director since 2013.

David Sides, age 53, was appointed President and Chief Executive Officer in September 2021. Prior to joining the Company, Mr. Sides served as Chief Operating Officer at Teladoc Health, the global leader in virtual care, where he led the company’s worldwide commercial and operations teams. During his tenure at Teladoc, revenues doubled in 2020 and exceeded $2.1 billion in 2021. Previously, Mr. Sides served as CEO of Streamline Health, which offers revenue cycle management solutions for healthcare providers. Mr. Sides led the full-scale turnaround of Streamline Health, growing revenue, EBITDA and cash flow organically. Prior to that, Sides was recruited by TPG to serve as CEO of iMDsoft, an Israeli headquartered provider of clinical information systems and electronic medical records for critical, perioperative and acute care organizations. Under Mr. Sides’ leadership, iMDsoft delivered a more than 30% increase in revenue while investing in new systems and processes. Earlier in his career, Mr. Sides worked for Cerner Corporation, a leading supplier of health information technology services, devices and hardware, from 1995-2012. Among other roles, he served as Senior Vice President, World Wide Consulting, where he led Cerner’s professional services in 24 countries and owned global P&L and functional responsibilities from sales through implementation for the business. At Cerner, he created new methodologies for deployment, new service lines and development plans for 3,500 associates, growing the consulting business from $643 million in 2008 to $1.031 billion in 2012. Mr. Sides is a former director at EMIS Group (EMIS.L), a major provider of healthcare software, information technology and related services in the UK, and at Streamline Health. He is a Fellow in the American College of Healthcare Executives and is NACD Directorship Certified. Mr. Sides holds a B.A. in Biophysics from the University of California, Berkeley, and an MBA and MHA from the University of Missouri, Columbia. Our Board has concluded that Mr. Sides’ position as our President and Chief Executive Officer, as well as his prior executive experience with other companies, provides our Board with the perspective of a person with significant executive management and healthcare information technology industry experience who is involved in the Company’s day to day activities. Mr. Sides has been a director since 2021.

9

NON-DIRECTOR EXECUTIVE OFFICERS

James R. Arnold, Jr., age 67, was appointed our Executive Vice President and Chief Financial Officer in March of 2016, and on July 28, 2021, the Board appointed Mr. Arnold to serve as the interim principal executive officer. Prior to joining the Company, Mr. Arnold served as Chief Financial Officer and Executive Board member of Kofax Ltd., a publicly traded software company, from June 2010 to May 2015, where Mr. Arnold participated in and facilitated the strategic process that resulted in the sale of Kofax Ltd.’s enterprise software division. From 2004 to 2009, Mr. Arnold was Senior Vice President at Nuance Communications, Inc., a publicly traded software company, where he also served as Chief Financial Officer from 2004 to 2008. Previously, Mr. Arnold held numerous other senior-level finance positions at technology companies, to include roles as Vice President Corporate Controller at Cadence Design Systems, Inc., Chief Financial Officer at Informix Software, Inc., and Corporate Controller at Centura Software Corporation. Additionally, from 2003 to 2010 he served as director and chair of the audit committee at Selectica, Inc., where he also was co-chair of the board in 2010. Earlier in his career, Mr. Arnold provided consulting and auditing services to companies in diverse industries while at Price Waterhouse LLP. Mr. Arnold holds a Bachelor of Business Administration degree in Finance from Delta State University in Cleveland, Mississippi, and a Master’s degree in Business Administration from Loyola University in New Orleans, Louisiana.

Jeffrey D. Linton, age 60, became our Executive Vice President, General Counsel and Secretary in December of 2017. Prior to joining the Company, Mr. Linton served as General Counsel and Secretary of Applied Proteomics, Inc. from November 2016 to November 2017. Previously, Mr. Linton was Senior Vice President, General Counsel and Secretary of Sequenom, Inc. from September 2014 to October 2016. Before joining Sequenom, Mr. Linton was Senior Vice President and General Counsel at Beckman Coulter, Inc. from July 2011 to September 2014 and, prior to that, was Vice President, Deputy General Counsel from September 2008 to July 2011. Before joining Beckman Coulter, Mr. Linton was President of the research products and services division of Serologicals Corporation, a company that developed, manufactured and sold life science research products and technologies, diagnostic kits and drug discovery services. Before that role, he served as Vice President, Law, Corporate Business Development and Public Affairs at Serologicals from October 2000 to April 2003. He has held various other positions in law, government and public affairs and human resources. Mr. Linton earned a B.A., magna cum laude, from Butler University and a J.D., cum laude, from the University of Notre Dame Law School. He is a member of the Board of Directors of the Notre Dame Law Association.

Srinivas S. Velamoor, age 48, became our Chief Growth & Strategy Officer and Executive Vice President, in July 2022. Mr. Velamoor brings two decades of experience in driving growth and performance at leading global healthcare, financial services and technology organizations. Prior to joining the Company, Mr. Velamoor served as a partner and the health sector leader of McKinsey & Company’s North America digital analytics and ‘Leap’ business building practices. Over a decade at McKinsey, he orchestrated the growth and scale-up of the firm’s healthcare technology and digital health practices and led the creation, scaling and commercial acceleration of several new digital health businesses. Before joining McKinsey & Company, Velamoor was a principal at both PricewaterhouseCoopers and Diamond Management & Technology Consultants, where he advised industry leading firms in financial services and healthcare. Mr. Velamoor received an MBA in Finance from The Wharton School at The University of Pennsylvania, and a BSE in Biomedical Engineering, Electrical Engineering and Economics from Duke University.

Mitchell L. Waters, age 59, became our Executive Vice President of Commercial Growth in January 2022. Mr. Waters joined the Company in December 2016 as the Senior Vice President, Sales, and served in that role until 2022. Prior to joining the Company, Mr. Waters spent 28 years at McKesson Corporation in leadership roles within the technology, automation and pharmaceutical business units. While employed full-time at McKesson, Mr. Waters earned a Master of Business Administration from Auburn University. Mr. Waters earned his B.S. in Industrial Management from Georgia Institute of Technology, Atlanta, Georgia.

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Except as otherwise indicated in the related footnotes, the following table sets forth information with respect to the beneficial ownership of our common stock as of the record date of July 13, 2023, by:

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. To our knowledge, unless indicated by footnote, and subject to community property laws where applicable, the persons named in the table below have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. Shares of common stock underlying options, if any, that currently are exercisable or are scheduled to become exercisable for shares of common stock within 60 days after the date of the table are deemed to be outstanding in calculating the percentage ownership of each listed person or group but are not deemed to be outstanding as to any other person or group. Percentage of beneficial ownership is based on 67,018,411 shares of common stock outstanding as of July 13, 2023.

Unless otherwise indicated, the address for each beneficial owner listed in the table below is c/o NextGen Healthcare, Inc., a remote-first company, which accordingly, does not maintain a headquarters. Messrs. Barbarosh, Bristol, Dent, Margolis, Panner, Ms. Klapstein and Drs. McGinty and Puryear are current directors. Our NEOs for our fiscal year 2023 were Messrs. Sides, Arnold, Linton, Velamoor and Waters, as well as Mr. Metcalfe, our former Chief Technology Officer, each of whom is included in the table below.

Name of Beneficial Owner** |

|

Number of Shares of Common Stock Beneficially Owned |

|

|

Percent of Common Stock Beneficially Owned |

|

||

Director and Named Executive Officers |

|

|

|

|

|

|

||

Craig A. Barbarosh |

|

|

57,183 |

|

(1) |

* |

|

|

George H. Bristol |

|

|

72,803 |

|

|

* |

|

|

Darnell Dent |

|

|

20,942 |

|

|

* |

|

|

Julie D. Klapstein |

|

|

60,018 |

|

|

* |

|

|

Jeffrey H. Margolis |

|

|

136,829 |

|

|

* |

|

|

Geraldine McGinty |

|

|

22,791 |

|

|

* |

|

|

Morris Panner |

|

|

89,957 |

|

|

* |

|

|

Pamela Puryear |

|

|

20,942 |

|

|

* |

|

|

David Sides |

|

|

713,877 |

|

|

|

1.1 |

% |

James R. Arnold, Jr. |

|

|

960,829 |

|

(2) |

|

1.4 |

% |

David A. Metcalfe |

|

|

178,207 |

|

(3) |

* |

|

|

Srinivas Velamoor |

|

|

370,998 |

|

|

* |

|

|

Mitchell Waters |

|

|

82,027 |

|

(4) |

* |

|

|

Jeffrey D. Linton |

|

|

239,808 |

|

(5) |

* |

|

|

All directors, director nominees and executive officers as a group |

|

|

3,080,076 |

|

(6) |

|

4.6 |

% |

Stockholders Holding 5% or More |

|

|

|

|

|

|

||

Three Prong Investments, LLC |

|

|

9,889,827 |

|

(7) |

|

14.8 |

% |

Blackrock, Inc. |

|

|

9,663,011 |

|

(8) |

|

14.4 |

% |

The Vanguard Group |

|

|

6,389,869 |

|

(9) |

|

9.5 |

% |

* Represents less than 1.0%

11

12

CORPORATE GOVERNANCE

Corporate Governance Highlights

The following are highlights of our governance practices:

13

INFORMATION ABOUT OUR BOARD OF DIRECTORS, BOARD COMMITTEES AND RELATED MATTERS

Board of Directors

General

Our business, property and affairs are managed under the direction of our Board. Directors are kept informed of our business through discussions with our executive officers, by reviewing materials provided to them and by participating in meetings of our Board and its committees. For the fiscal year ended March 31, 2023, our Board consisted of nine directors who are elected to serve until the election and qualification of their respective successors.

Director Independence

As required under the Nasdaq Stock Market (“Nasdaq”) listing standards, a majority of the members of a listed Company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. The Board consults with our counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in Nasdaq listing standards, as in effect from time to time. Based on definitions of independence established by Nasdaq, SEC rules and regulations, guidelines established in our Bylaws, and the determinations of our Nominating and Governance Committee and our Board, Messrs. Barbarosh, Bristol, Dent, Margolis and Panner, Ms. Klapstein, and Drs. McGinty and Puryear, are independent. Mr. Sides is not independent because he serves on our management team as President and Chief Executive Officer.

The Nasdaq independence definition includes a series of objective tests, such as that the director or director nominee is not and has not been for the past three years an employee of the Company and has not engaged in various types of business dealings with the Company. In addition, as further required by the Nasdaq rules, our Board has made a subjective determination as to each independent director and director nominee that no relationships exist which, in the opinion of our Board, would interfere with the exercise of independent judgment of such director or director nominee in carrying out his or her responsibilities as a director. In making these determinations, our Board reviewed and discussed information provided by our directors, director nominees and management about each director’s and director nominee’s business and personal activities as they may relate to our management and us. The independent members of our Board meet periodically in executive session without management.

Attendance at Board and Stockholders’ Meetings

During the fiscal year ended March 31, 2023, our Board held ten (10) meetings. No director attended less than 75% of the aggregate of all Board meetings or meetings held by any committee of the Board on which they served during the fiscal year ended March 31, 2023.

Board Leadership Structure

The Board believes that its current leadership structure best serves the objectives of the Board’s oversight of management, the Board’s ability to carry out its roles and responsibilities on behalf of the Company’s stockholders, and the Company’s overall corporate governance. The Board currently believes that the separation of the Chair and the Chief Executive Officer roles allows the Company’s Chief Executive Officer to focus his time and energy on operating and managing the Company. The Board periodically reviews this leadership structure to determine whether it continues to best serve the Company and its stockholders. For the upcoming term, the Board determined that the historical justification for a Vice Chair role is no longer present and therefore intends to eliminate that position at the conclusion of the current term.

14

Executive Sessions of Independent Directors

The independent directors of the Company meet regularly in executive session, i.e., with no management directors or management present. These executive sessions may include such topics as the independent directors determine. During these executive sessions, the independent directors have access to members of management and other guests as the independent directors determine.

Annual Board and Committee Evaluations

In accordance with its Charter, the Nominating and Governance Committee is responsible for facilitating an annual evaluation of the Board. The Nominating and Governance Committee also oversees the annual performance evaluation of the committees of the Board.

Board Involvement in Risk Oversight

Our Board is actively engaged, as a whole, and also at the committee level, in overseeing management of our risks. Our Board provides oversight of our annual enterprise risk assessment program as well as regularly reviewing information regarding our personnel, technology, liquidity, and operations, as well as the risks associated with each. Our Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements. Our Audit Committee oversees management of financial risks, cybersecurity, and potential conflicts of interest. Our Nominating and Governance committee manages risks associated with the independence and qualifications of our directors. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, our entire Board is regularly informed through committee reports about such risks and matters which may evolve into risks.

Board Committees and Charters

The Board had three standing committees in fiscal year 2023:

The Board has adopted written charters for each of the three standing committees that satisfy the applicable standards of the SEC and the Nasdaq. The Board has determined that the chair and each of the committee and all committee members are independent under applicable Nasdaq and SEC rules for committee memberships.

Audit Committee

Our Board has an Audit Committee, established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), that consists of Mr. Bristol (Chair), Ms. Klapstein and Dr. Puryear.

Our Audit Committee is comprised entirely of independent directors under SEC and Nasdaq rules and operates under a written charter adopted by our Board. The duties of our Audit Committee include meeting with our independent public accountants to review the scope of the annual audit and to review our quarterly and annual financial statements before the statements are released to our stockholders. Our Audit Committee also evaluates the independent public accountants’ performance and determines whether the independent registered public accounting firm should be retained by us for the ensuing fiscal year. In addition, our Audit Committee reviews our internal accounting and financial controls and reporting systems practices and is responsible for reviewing, approving and ratifying all related party transactions. Our Audit Committee also exercises primary oversight, on behalf of the Board, over management’s execution of the Company’s cybersecurity and data privacy function.

15

During the fiscal year ended March 31, 2023, our Audit Committee held four (4) meetings. Our Audit Committee’s current charter is posted on our internet website at www.nextgen.com. Our Audit Committee and our Board have confirmed that our Audit Committee does and will continue to include at least three independent members. Our Audit Committee and our Board have confirmed that Mr. Bristol met applicable Nasdaq listing standards for designation as an “Audit Committee Financial Expert.”

Nominating and Governance Committee

Our Board has a Nominating and Governance Committee that consists of Messrs. Panner (Chair), Barbarosh, and Dent. Our Nominating and Governance Committee is responsible for identifying and recommending nominee candidates to our Board, and is required to be composed entirely of independent directors. Our Nominating and Governance Committee may receive suggestions from current Board members, our executive officers or other sources, which may be either unsolicited or in response to requests from our Nominating and Governance Committee for such candidates. Our Nominating and Governance Committee may also, from time to time, engage firms that specialize in identifying director candidates.

Our Nominating and Governance Committee will also consider on the same basis nominees recommended by stockholders for election as a director. Recommendations should be sent to our Secretary and should include the candidate’s name and qualifications and a statement from the candidate that he or she consents to being named in our proxy statement and will serve as a director if elected. In order for any candidate to be considered by our Nominating and Governance Committee and, if nominated, to be included in our proxy statement, such recommendation must be received by the Secretary within the time period set forth under “Proposals of Stockholders,” below.

Our Nominating and Governance Committee works with our Board to determine the appropriate characteristics, skills, and experiences for the Board as a whole and its individual members with the objective of having a Board with diverse backgrounds and experience. Characteristics expected of all directors include independence, integrity, high personal and professional ethics, sound business judgment, and the ability and willingness to commit sufficient time to our Board. In evaluating the suitability of individual candidates, our Nominating and Governance Committee takes into account many factors, including general understanding of marketing, finance, and other disciplines relevant to the success of a large publicly traded company in today’s business environment; understanding of our business; educational and professional background; personal accomplishment; and geographic, gender, age, and ethnic diversity. Our Nominating and Governance Committee evaluates each individual in the context of our Board as a whole, with the objective of recommending a group that can best perpetuate the success of our business and represent stockholder interests through the exercise of sound judgment using its diversity of experience. Our Nominating and Governance Committee evaluates each incumbent director to determine whether he or she should be nominated to stand for re-election, based on the types of criteria outlined above as well as the director’s contributions to our Board during their current term.

Once a person has been identified by our Nominating and Governance Committee as a potential candidate, our Nominating and Governance Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If our Nominating and Governance Committee determines that the candidate warrants further consideration, the Chair of the Committee or another member of our Nominating and Governance Committee may contact the person. Generally, if the person expresses a willingness to be considered and to serve on our Board, our Nominating and Governance Committee may request information from the candidate, review the person’s accomplishments and qualifications and may conduct one or more interviews with the candidate. Our Nominating and Governance Committee may consider all such information in light of information regarding any other candidates that our Nominating and Governance Committee might be evaluating for nomination to our Board. Nominating and Governance Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater firsthand knowledge of the candidate’s accomplishments.

Our Nominating and Governance Committee may also engage an outside firm to conduct background checks on candidates as part of the nominee evaluation process. Our Nominating and Governance Committee’s evaluation process does not vary based on the source of the recommendation, though in the case of a stockholder nominee, our Nominating and Governance Committee and/or our Board may take into consideration the number of shares held by

16

the recommending stockholder and the length of time that such shares have been held. Our Nominating and Governance Committee also has authority to develop and recommend to the Board a set of corporate governance principles, to evaluate the nature, structure and operations of the Board and its committees and to make recommendations to address issues raised by such evaluations. During the fiscal year ended March 31, 2023, our Nominating and Governance Committee held four (4) meetings. Our Nominating and Governance Committee’s current charter is posted on our internet website at www.nextgen.com.

Proxy Access

Our Bylaws provide for “proxy access” by permitting a stockholder or group of no larger than 20 stockholders holding 3% or greater ownership of NextGen Healthcare, Inc.’s common stock for three years the opportunity to include our proxy materials a number of nominees for election as directors up to the greater of 2 and 20% of the Board of Directors.

Majority Voting for Directors with Plurality Carve-out For Contested Elections; Director Resignation Policy

Our Bylaws provide that, in the case of an uncontested director election (i.e., where the number of nominees is the same as the number of directors to be elected), each director shall be elected by the vote of the majority of the votes cast with respect to such director’s election, and in the case of a contested election, directors shall be elected by the vote of a plurality of the votes cast. A majority of the votes cast means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against” such director’s election (with “abstentions” and “broker non-votes” not counted as a vote cast either “for” or “against” such director’s election).

Any incumbent director nominee who fails to receive the requisite majority vote at an annual or special meeting held for the purpose of election directors, where the election is uncontested, must tender his or her resignation to the Board, which resignation shall be contingent on the acceptance by the Board in accordance with the policies and procedures adopted by the Board for such purpose. The Nominating and Governance Committee shall make a recommendation to the Board as to whether to accept or reject the resignation of such incumbent director, or whether other action should be taken. The Board will act on the tendered resignation, and publicly disclose its decision and rationale, within 90 days following certification of the stockholder vote. The Nominating and Governance Committee in making its recommendation and the Board in making its decision each may consider any factors and other information that they consider appropriate and relevant. If the Board accepts a director’s resignation, or if a nominee for director is not elected and the nominee is not an incumbent director, then the Board may fill the resulting vacancy pursuant to our Charter and Bylaws.

Compensation Committee

Our Board has a Compensation Committee that consists of Mr. Barbarosh (Chair), Ms. Klapstein, and Dr. McGinty.

Our Compensation Committee is composed entirely of independent directors under Nasdaq rules, and is responsible for (i) ensuring that senior management will be accountable to our Board through the effective application of compensation policies, (ii) monitoring the effectiveness of our compensation plans applicable to senior management and our Board (including committees thereof) and (iii) approving the compensation plans applicable to senior management. Our Compensation Committee establishes and approves compensation policies applicable to our executive officers. During the fiscal year ended March 31, 2023, our Compensation Committee held four (4) meetings. Our Compensation Committee’s current charter is posted on our internet website at www.nextgen.com.

Our executive officers have played no role in determining the amount or form of director compensation. At the request of the Compensation Committee, our executives provide information from time to time to our Compensation Committee about certain accomplishments, recommendations, qualitative assessments or other metrics regarding the NEOs to assist our Compensation Committee in making compensation decisions for the NEOs. We also have conducted discussions with our NEOs concerning information regarding their performance and prospects.

17

The Compensation Committee has the authority, in its sole discretion, to retain or obtain the advice of an independent compensation consultant, legal counsel or other advisers to assist in carrying out the Compensation Committee’s duties and responsibilities. Prior to selecting a compensation adviser, the Compensation Committee shall assess whether work performed or advice rendered by such compensation adviser would raise any conflicts of interest. From time to time, the Compensation Committee has engaged independent compensation consultants to advise it on matters of Board and executive compensation. In each case, the Compensation Committee has utilized these compensation consultants to compile and present peer-group compensation data to the Compensation Committee, but did not delegate any authority to the consultants to determine or recommend the amount or form of executive compensation. The Compensation Committee also consults publicly available compensation data from time to time as part of its Board and executive compensation decisions. For fiscal year 2023, there were no conflicts of interest with respect to any compensation advisers.

Audit Committee Report

The following Audit Committee Report shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission or subject to Regulations 14A or 14C of the Exchange Act, or the liabilities of Section 18 of the Exchange Act. The Audit Committee Report shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent the Company specifically incorporates it by reference.

Our Audit Committee reports to our Board and provides oversight of our financial management, independent registered public accounting firm, and financial reporting system, including accounting policy. Management is responsible for our financial reporting process, including our system of internal control, and for the preparation of our consolidated financial statements. Our independent registered public accounting firm is responsible for auditing our financial statements and expressing an opinion on those statements and on management’s assessment of internal control over financial reporting and for reviewing our quarterly financial statements. The Audit Committee has reviewed and discussed our audited consolidated financial statements and the assessments of internal control contained in its annual report on Form 10-K for the fiscal year ended March 31, 2023, with management and our independent registered public accounting firm.

The Audit Committee selects and retains the independent registered public accounting firm, and once retained, the independent registered public accounting firm reports directly to the Audit Committee. The Audit Committee is responsible for approving both audit and non-audit services provided by the independent registered public accounting firm. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the Securities and Exchange Commission. The Audit Committee has received from our independent registered public accounting firm the written disclosures and letter required by the applicable requirements of the PCAOB regarding our independent registered public accounting firm’s communications with the Audit Committee concerning independence and has discussed with our independent registered public accounting firm its independence.

The Audit Committee discussed the overall approach, scope and plans for its audit with our independent registered public accounting firm. At the conclusion of the audit, the Audit Committee met with our independent registered public accounting firm, with and without management present, to discuss the results of its examination, its evaluation of our internal control and the overall quality of our financial reporting.

18

In reliance on the reviews and discussions referred to above, our Audit Committee recommended to our Board (and our Board approved) that the audited financial statements be included in our Annual Report on Form 10-K for the year ended March 31, 2023, and for filing with the SEC.

The Audit Committee has re-appointed PricewaterhouseCoopers LLP to serve as our independent registered public accounting firm for the fiscal year ending March 31, 2024.

AUDIT COMMITTEE

George H. Bristol, Chair

Julie Klapstein Pamela Puryear

Code of Ethics

We have adopted a Code of Business Conduct and Ethics, or code of ethics, that applies to our Chief Executive Officer (principal executive officer), Chief Financial Officer (our principal financial officer), Chief Accounting Officer (principal accounting officer), as well as all directors, officers and employees of the Company. Our code of ethics is posted on our internet website located at www.nextgen.com and may be found as follows: From our main web page, click on “NXGN Investors”, then click on “Corporate Governance.” We intend to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to, or waiver from, a provision of our code of ethics by posting such information on our website, at the address and location specified above.

Security Holder Communications with our Board

Stockholders and interested parties who wish to communicate with any member (or all members) of our Board, or our independent directors as a group, any Board committee or any Chair of any such committee, may do so by sending written communications electronically. Correspondence should be addressed to the intended recipient in care of our Secretary, Jeffrey D. Linton, at secretary@nextgen.com.

All communications received as set forth in the preceding paragraph will be reviewed by our Secretary for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, patently offensive material or matters deemed inappropriate for our Board will be forwarded promptly to the addressee. In the case of communications to our Board, any group or committee of directors, our Secretary will forwarded to each director who is a member of the group or committee to which the communication is addressed.

19

We strive to create a respectful, diverse, ethical, environmentally sustainable, safe, healthy, and inclusive workplace culture in order to bring out the best in our employees and for our community. We also seek to develop inspiring and caring leaders by supporting community service and volunteer opportunities for our employees. In addition, we are dedicated to providing the best training and professional development opportunities to our employees in order to promote engagement, retention, and performance. We are committed to creating a diverse and inclusive work environment of equal opportunity, where employees feel respected and valued for their contributions. We embrace varied viewpoints, culture, and expertise. We regularly engage with our Board of Directors on strategies, participation, and impact of these initiatives.

TALENT, CULTURE AND ENGAGEMENT

Recruitment, Development and Retention

Engagement

Diversity, Equity, Inclusion and Belonging

20

Health, Safety and Well-Being

Community

ENVIRONMENT AND CORPORATE SUSTAINABILITY

Although as a software and services company our business has low environmental impact by its nature, we embrace sustainable, environmentally friendly practices and assess opportunities to reduce our corporate footprint, promote energy efficiency and reduce waste.

Reducing our Carbon Footprint

21

Facilities; Sustainability

Risk Management

ENABLING ESG PERFORMANCE THROUGH OUR SOLUTIONS AND PARTNERSHIPS

22

Review, Approval or Ratification of Transactions with Related Persons

During fiscal year 2023, our Audit Committee was responsible for reviewing and approving transactions with related persons. Our Board and Audit Committee have adopted written related party transaction policies and procedures relating to approval or ratification of transactions with related persons. Under the policies and procedures, our Audit Committee is to review the material facts of all related party transactions that require our Audit Committee’s approval and either approve or disapprove of our entry into the related party transactions, subject to certain exceptions, by taking into account, among other factors the committee deems appropriate, whether the related party transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances and the extent of the related party’s interest in the transaction. No director may participate in any discussion or approval of a related party transaction for which he or she is a related party. If an interested transaction will be ongoing, the Committee may establish guidelines for our management to follow in its ongoing dealings with the related party and then at least annually must review and assess ongoing relationships with the related party.

Under the policies and procedures, a “related party transaction” is any transaction, arrangement or relationship or series of similar transactions, arrangements, or relationships (including any indebtedness or guarantee of indebtedness) in which the aggregate amount involved will or may be expected to exceed $30,000 in any calendar year, we are a participant, and any related party has or will have a direct or indirect interest. A “related party” is any person who is or was since the beginning of our last fiscal year an executive officer, director or Board-approved nominee for election as a director and inclusion in our proxy statement at our next annual stockholders’ meeting, any greater than 5% beneficial owner of our common stock known to us through filings with the SEC, any immediate family member of any of the foregoing, or any firm, corporation or other entity in which any of the foregoing persons is employed or is a partner or principal or holds a similar position or in which such person has a 5% or greater beneficial ownership interest. “Immediate family member” includes a person’s spouse, parents, stepparents, children, stepchildren, siblings, mothers- and fathers-in-law, sons- and daughters-in-law, and brothers- and sisters-in-law and anyone residing in such person’s home (other than a tenant or employee).

Our Audit Committee has reviewed and pre-approved certain types of related party transactions described below. In addition, our Board has delegated to the Chair of our Audit Committee the authority to pre-approve or ratify (as applicable) any related party transaction in which the aggregate amount involved is expected to be less than $15,000. Pre-approved interested transactions include:

23

Indemnification Agreements

We are party to indemnification agreements with each of our directors and executive officers. The indemnification agreements and our Articles of Incorporation and Bylaws require us to indemnify our directors and executive officers to the fullest extent permitted by Delaware law.

24

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information about our common stock that may be issued pursuant to awards under all of our equity compensation plans as of March 31, 2023.

Plan Category |

|

Number of Securities to be issued upon exercise of outstanding options, warrants and rights (a) |

|

|

Weighted-average exercise price of outstanding options, warrants and rights (b) |

|

|

Number of securities remaining available for future issuance under equity compensation (excluding securities reflected in column (a)) |

|

|

|||

Equity compensation plans approved by security holders |

|

|

2,155,473 |

|

(1) |

$ |

14.75 |

|

(2) |

|

4,760,467 |

|

(3) |

Equity compensation plans not approved by security holders(4) |

|

|

425,666 |

|

(5) |

|

— |

|

|

|

159,384 |

|

(6) |

Total |

|

|

2,581,139 |

|

|

$ |

14.75 |

|

|

|

4,919,851 |

|

|

25

EXECUTIVE AND DIRECTOR COMPENSATION AND RELATED INFORMATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes the Company’s executive compensation philosophy and program, the decisions the Compensation Committee made with respect to the Company’s fiscal year 2023 executive compensation program, and the factors that the Compensation Committee considered in making those decisions. The Company’s named executive officers (our “NEOs”) for fiscal year 2023 were:

David Sides – President and Chief Executive Officer

James R. Arnold, Jr. – Executive Vice President and Chief Financial Officer

Jeffrey D. Linton – Executive Vice President, General Counsel and Secretary

Srinivas S. Velamoor – Executive Vice President, Chief Growth Officer

Mitchell L. Waters – Executive Vice President, Commercial Growth

David A. Metcalfe – Former Executive Officer and Chief Technology Officer*

* Effective February 17, 2023, Mr. Metcalfe ceased serving as our Executive Vice President and Chief Technology Officer.

Executive Summary

NextGen Healthcare, Inc. is a leading provider of innovative, cloud-based healthcare technology solutions that empower ambulatory healthcare practices to manage the risk and complexity of delivering care in the rapidly evolving U.S. healthcare system. Our combination of technological breadth, depth and domain expertise makes us a preferred solution provider and trusted advisor for our clients. In addition to highly configurable core clinical, practice management and financial capabilities, our portfolio includes tightly integrated solutions that deliver on ambulatory healthcare imperatives including population health, care management, patient outreach, managed services, telemedicine and nationwide clinical information exchange. We compete for executive talent with a broad range of companies that are leaders in the software and healthcare information technology industries. Our compensation program is intended to:

Accomplishments During Fiscal Year 2023

NextGen Healthcare is committed to creating better healthcare outcomes for all and continues to reinvest in its business to achieve its vision and long-term growth agenda. Achievements in fiscal year 2023 include:

26

These achievements demonstrate how our plan for business success is well underway, even in the midst of a challenging macroeconomic environment.

Overview of Executive Compensation Program

Executive Compensation Program Best Practices

We are committed to maintaining good corporate governance standards with respect to our compensation program, procedures, and practices. As such, our Company’s and Compensation Committee’s practices include the following:

What We Do |

|

What We Don’t Do |

||