UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES | |

| EXCHANGE ACT OF 1934 | ||

| For the fiscal year ended December 31, 2016 | ||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | |

| SECURITIES EXCHANGE ACT OF 1934 | ||

| For the transition period from _______ to _______ | ||

| Commission file number 000-20827 |

| CASS INFORMATION SYSTEMS, INC. |

| (Exact name of registrant as specified in its charter) |

| Missouri | 43-1265338 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 12444 Powerscourt Drive, Suite 550, St. Louis, Missouri 63131 | (314) 506-5500 | |

| (Address of principal executive offices) (Zip Code) | (Telephone Number, incl. area code) | |

| Securities registered pursuant to Section 12(b) of the Act: | ||

| Title of each Class | Name of each exchange on which registered | |

| Common Stock, par value $.50 | The Nasdaq Global Select Market | |

| Securities registered pursuant to Section 12(g) of the Act: | ||

| Title of each Class | ||

| None | ||

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Large accelerated filer: ☐ Accelerated filer: ☒ Non-accelerated filer: ☐ Smaller reporting company: ☐

The aggregate market value of the common stock held by non-affiliates of the Registrant was approximately $548,000,000 based on the closing price of the common stock of $51.70 on June 30, 2016, as reported by The Nasdaq Global Select Market. As of March 1, 2016, the Registrant had 11,197,226 shares outstanding of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required for Part III of this report is incorporated by reference to the Registrant’s Proxy Statement for the 2017 Annual Meeting of Shareholders.

CASS INFORMATION SYSTEMS,

INC.

FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

Forward-looking Statements - Factors That May Affect Future Results

This report may contain or incorporate by reference forward-looking statements made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Although we believe that, in making any such statements, our expectations are based on reasonable assumptions, forward-looking statements are not guarantees of future performance and involve risks, uncertainties, and other factors beyond our control, which may cause future performance to be materially different from expected performance summarized in the forward-looking statements. These risks, uncertainties and other factors are discussed in the section Part I, Item 1A, “Risk Factors.” We undertake no obligation to publicly update or revise any forward-looking statements to reflect changed assumptions, the occurrence of anticipated or unanticipated events, or changes to future results over time.

Description of Business

Cass Information Systems, Inc. (“Cass” or the “Company”) is a leading provider of payment and information processing services to large manufacturing, distribution and retail enterprises across the United States. The Company provides transportation invoice rating, payment processing, auditing, accounting and transportation information to many of the nation’s largest companies. It is also a processor and payer of energy invoices, including electricity, gas, waste, and other facility related expenses. Additionally, Cass competes in the telecommunications expense management market which includes bill processing, audit and payment services for telephone, data line, wireless and communication equipment expense. The Company, through its wholly owned bank subsidiary, Cass Commercial Bank (the “Bank”), also provides commercial banking services. The Bank’s primary focus is to support the Company’s payment operations and provide banking services to its target markets, which include privately-owned businesses and churches and church-related ministries. Services include commercial and commercial real estate loans, checking, savings and time deposit accounts and other cash management services.

Company Strategy and Core Competencies

Cass is an information services company with a primary focus on processing payables and payables-related transactions for large corporations located in the United States. Cass possesses four core competencies that encompass most of its processing services.

Data acquisition – This refers to the gathering of data elements from diverse, heterogeneous sources and the building of complete databases for our customers. Data is the raw material of the information economy. Cass gathers vital data from complex and diverse input documents, electronic media, proprietary databases and data feeds, including data acquired from vendor invoices as well as customer procurement and sales systems. Through its numerous methods of obtaining streams and pieces of raw data, Cass is able to assemble vital data into centralized data management systems and warehouses, thus producing an engine to create the power of information for managing critical corporate functions and processing systems.

Data management – Once data is assembled, Cass is able to utilize the power from derived information to produce significant savings and benefits for its clients. This information is integrated into customers’ unique financial and accounting systems, eliminating the need for internal accounting processing and providing internal and external support for these critical systems. Information is also used to produce management and exception reporting for operational control, feedback, planning assistance and performance measurement.

Business Intelligence – Receiving information in the right place at the right time and in the required format is paramount for business survival. Cass’ information delivery solutions provide reports, digital images, data files and retrieval capabilities through the Internet or directly into customer internal systems. Cass’ proprietary Internet management delivery system is the foundation for driving these critical functions. Transaction, operational, control, status and processing exception information are all delivered through this system creating an efficient, accessible and highly reliable asset for Cass customers.

Financial exchange – Since Cass is unique among its competition in that it owns a commercial bank, it is also able to manage the movement of funds from its customers to their suppliers. This is a distinguishing factor, which clearly requires the processing capability, operating systems and financial integrity of a banking organization. Cass provides immediate, accurate, controlled and protected funds management and transfer system capabilities for all of its customers. Old and costly check processing and delivery mechanisms are replaced with more efficient electronic cash management and funds transfer systems.

Cass’ core competencies allow it to perform the highest volumes of transaction processing in an integrated, efficient and systematic approach. Not only is Cass able to process the transaction, it is also able to collect the data defining the transaction and effect the financial payment governing its terms.

These core competencies, enhanced through shared business processes, drive Cass’ strategic business units. Building upon these foundations, Cass continues to explore new business opportunities that leverage these competencies and processes.

1

Marketing, Customers and Competition

The Company, through its Transportation Information Services business unit, is one of the largest firms in the transportation bill processing and payment industry in the United States based on the total dollars of transportation bills paid and items processed. Competition consists of a few primary competitors and numerous small transportation bill audit firms located throughout the United States. While offering transportation payment services, few of these audit firms compete on a national basis. These competitors compete mainly on price, functionality and service levels. The Company, through its Expense Management business unit, also competes with other companies, located throughout the United States, that pay energy and waste bills and provide management reporting. Available data indicates that the Company is one of the largest providers of energy information processing and payment services. Cass is unique among these competitors in that it is not exclusively affiliated with any one energy service provider (“ESP”). The ESPs market the Company’s services adding value with their unique auditing, consulting and technological capabilities. Many of Cass’ services are customized for the ESPs, providing a full-featured solution without any development costs to the ESP. Also the Company, through its Telecom Information Services business unit, is a leader in the growing telecom expense management market, and competes with other companies located throughout the United States in this market.

The Bank is organized as a Missouri trust company with banking powers and was founded in 1906. The Company is classified as a bank holding corporation due to its ownership of a federally-insured commercial bank and was originally organized in 1982 as Cass Commercial Corporation under the laws of Missouri. Approval by the Board of Governors of the Federal Reserve System was received in February 1983. The Company changed its name to Cass Information Systems, Inc. in January 2001. In December 2011, the Federal Reserve Bank (“FRB”) of St. Louis approved the election of Cass Information Systems, Inc. to become a financial holding company. As a financial holding company, Cass may engage in activities that are financial in nature or incidental to a financial activity. The Bank encounters competition from numerous banks and financial institutions located throughout the St. Louis, Missouri metropolitan area and other areas in which the Bank competes. The Bank’s principal competitors, however, are large bank holding companies that are able to offer a wide range of banking and related services through extensive branch networks. The Bank targets its services to privately held businesses located in the St. Louis, Missouri area and church and church-related institutions located in St. Louis, Missouri, Orange County, California, Colorado Springs, Colorado, and other selected cities located throughout the United States.

The Company holds several trademarks for the payment and rating services it provides. These include: FreightPay®, Transdata®, Ratemaker®, Best Rate®, Rate Exchange®, CassPort®, Expense$mart®, WasteVision™ and Direct2Carrier Payments™. The Company and its subsidiaries are not dependent on any one customer for a significant portion of their businesses. The Company and its subsidiaries have a varied client base with no individual client exceeding 10% of total revenue.

Employees

The Company and its subsidiaries had 790 full-time and 285 part-time employees as of March 3, 2017. Of these employees, the Bank had 52 full-time and no part-time employees.

Supervision and Regulation

The Company and its bank subsidiary are extensively regulated under federal and state law. These laws and regulations are intended to primarily protect depositors, not shareholders. The Bank is subject to regulation and supervision by the Missouri Division of Finance, the FRB and the Federal Deposit Insurance Corporation (the “FDIC”). The Company is a financial holding company within the meaning of the Bank Holding Company Act of 1956, as amended (the “BHC Act”), and as such, it is subject to regulation, supervision and examination by the FRB. Significant elements of the laws and regulations applicable to the Company and the Bank are described below. The description is qualified in its entirety by reference to the full text of the statutes, regulations and policies that are described. Also, such statutes, regulations and policies are continually under review by Congress and state legislatures and federal and state regulatory agencies. A change in statutes, regulations or regulatory policies applicable to the Company and its subsidiaries could have a material effect on the business, financial condition and results of operations of the Company.

Bank Holding Company Activities – In general, the BHC Act limits the business of bank holding companies to banking, managing or controlling banks and other related activities. In addition, bank holding companies that qualify and elect to be financial holding companies such as the Company, may engage in any activity, or acquire and retain the shares of a company engaged in any activity, that is either (i) financial in nature or incidental to such financial activity complementary to a financial activity and does not pose a substantial risk to the safety and soundness of depository institutions or the financial system generally. Such permitted activities include securities underwriting and dealing, insurance underwriting and making merchant banking investments.

To maintain financial holding company status, a financial holding company and all of its depository institution subsidiaries must be “well capitalized” and “well managed.” A depository institution subsidiary is considered to be “well capitalized” if it satisfies the requirements for this status discussed in the section “Prompt Corrective Action” below. A depository institution subsidiary is considered “well managed” if it received a composite rating and management rating of at least “satisfactory” in its most recent examination. A financial holding company’s status will also depend upon it maintaining its status as “well capitalized” and “well managed’ under applicable FRB regulations. If a financial holding company ceases to meet these capital and management requirements, the FRB may impose limitations or conditions on the conduct of its activities during the non-compliance period, and the company may not commence any of the broader financial activities permissible for financial holding companies or acquire a company engaged in such financial activities without prior approval of the FRB. If the company does not return to compliance within 180 days, the FRB may require divestiture of the holding company’s depository institutions.

2

In order for a financial holding company to commence any new activity permitted by the BHC Act or to acquire a company engaged in any new activity permitted by the BHC Act, each insured depository institution subsidiary of the financial holding company must have received a rating of at least “satisfactory” in its most recent examination under the Community Reinvestment Act. See “Community Reinvestment Act” below.

The FRB has the power to order any bank holding company or its subsidiaries to terminate any activity or to terminate its ownership or control of any subsidiary when the FRB has reasonable grounds to believe that continuation of such activity or such ownership or control constitutes a serious risk to the financial soundness, safety or stability of any bank subsidiary of the bank holding company.

The BHC Act, the Bank Merger Act, and other federal and state statutes regulate acquisitions of banks and banking companies. The BHC Act requires the prior approval of the FRB for the direct or indirect acquisition by the Company of more than 5% of the voting shares or substantially all of the assets of a bank or bank holding company. Under the Bank Merger Act, the prior approval of the FRB or other appropriate bank regulatory authority is required for the Bank to merge with another bank or purchase the assets or assume the deposits of another bank. In reviewing acquisition applications, the bank regulatory authorities will consider, among other things, the competitive effect and public benefits of the transactions, the capital position of the combined organization, the risks to the stability of the U.S. banking or financial system, the applicant’s performance record under the Community Reinvestment Act and fair housing laws.

The Dodd-Frank Act – The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), enacted in July 2010, significantly restructured the financial regulatory environment in the United States, affecting all bank holding companies and banks, including the Company and the Bank, some of which are described in more detail below. The scope and impact of many of the Dodd-Frank Act’s provisions will be determined over time as regulations are issued and become effective. As a result, the Company cannot predict the ultimate impact of the Dodd-Frank Act on the Company or the Bank at this time, including the extent to which it could increase costs or restrict the ability to pursue business opportunities, or otherwise adversely affect the Company’s business, financial condition and results of operations. However, at a minimum, the Company expects that the regulations enacted under the Dodd-Frank Act will increase operating and compliance costs.

Dividends – Both the Company and the Bank are subject to various regulations that restrict their ability to pay dividends and the amount of dividends that they may pay. Under the Federal Deposit Insurance Corporation Improvement Act of 1991 (“FDICIA”), a depository institution, such as the Bank, may not pay dividends if payment would cause it to become undercapitalized or if it is already undercapitalized. The payment of dividends by the Company and the Bank may also be affected or limited by other factors, such as the requirement to maintain adequate capital and, under certain circumstances, the ability of federal regulators to prohibit dividend payments as an unsound or unsafe practice.

Capital Requirements – As a bank holding company, the Company and the Bank are subject to capital requirements pursuant to the FRB’s capital guidelines which include (i) risk-based capital guidelines, which are designed to make capital requirements more sensitive to various risk profiles and account for off-balance sheet exposure; (ii) guidelines that consider market risk, which is the risk of loss due to change in value of assets and liabilities due to changes in interest rates; and (iii) guidelines that use a leverage ratio which places a constraint on the maximum degree of risk to which a financial holding company may leverage its equity capital base.

Effective July 2, 2013, the FRB approved final rules known as the “Basel III Capital Rules” that substantially revised the risk-based capital and leverage capital requirements applicable to bank holding companies and depository institutions, including the Company and the Bank. The Basel III Capital Rules implement aspects of the Basel III capital framework agreed upon by the Basel Committee and incorporate changes required by the Dodd-Frank Act. The Basel III Capital Rules came into effect for the Company and the Bank on January 1, 2015 (subject to a phase-in period).

The Basel III Capital Rules require FDIC insured depository institutions to meet and maintain several minimum capital standards: a common equity Tier 1 capital to risk-based assets ratio of 4.5%, a Tier 1 capital to risk-based assets ratio of 6.0%, a total capital to risk-based assets of 8.0%, and a 4.0% Tier 1 capital to total assets leverage ratio.

Common equity Tier 1 capital is generally defined as common stockholders’ equity and retained earnings. Tier 1 capital is generally defined as common equity Tier 1 and Additional Tier 1 capital. Additional Tier 1 capital generally includes certain noncumulative perpetual preferred stock and related surplus and minority interests in equity accounts of consolidated subsidiaries. Total capital includes Tier 1 capital (common equity Tier 1 capital plus Additional Tier 1 capital) and Tier 2 capital. Tier 2 capital is comprised of capital instruments and related surplus meeting specified requirements. Also included in Tier 2 capital is the allowance for loan losses limited to a maximum of 1.25% of risk-weighted assets and, for institutions like Cass, that have exercised an opt-out election regarding the treatment of Accumulated Other Comprehensive Income (“AOCI”), up to 45% of net unrealized gains on available-for-sale equity securities with readily determinable fair market values. The calculation of all types of regulatory capital is subject to deductions and adjustments specified in the regulations.

3

In determining the amount of risk-weighted assets for purposes of calculating risk-based capital ratios, all assets, including certain off-balance sheet assets are multiplied by a risk weight factor assigned by the regulations based on the risks believed inherent in the type of asset. Higher levels of capital are required for asset categories believed to present greater risk. For example, a risk weight of 0% is assigned to cash and U.S. government securities, a risk weight of 50% is generally assigned to prudently underwritten first lien one to four-family residential mortgages, a risk weight of 100% is assigned to commercial and consumer loans, a risk weight of 150% is assigned to certain past due loans, and a risk weight of between 0% to 600% is assigned to permissible equity interests, depending on certain specified factors.

In addition to establishing the minimum regulatory capital requirements, the Basel III Capital Rules limit capital distributions and certain discretionary bonus payments to management if the institution does not hold a “capital conservation buffer” consisting of 2.5% of common equity Tier 1 capital to risk-weighted assets above the amount necessary to meet its minimum risk-based capital requirements. The capital conservation buffer requirement is being phased in beginning January 1, 2016 at 0.625% of risk-weighted assets and increasing by that amount each subsequent January 1 until fully implemented at 2.5% on January 1, 2019.

The FRB has authority to establish individual minimum capital requirements in appropriate cases upon a determination that an institution’s capital level is or may become inadequate in light of the particular risks or circumstances. As of December 31, 2016, the Company and the Bank met all capital adequacy requirements under the Basel III Capital Rules.

Source of Strength Doctrine – FRB and other regulations require bank holding companies to act as a source of financial and managerial strength to their subsidiary banks. Under this requirement, the Company is expected to commit resources to support the Bank. Any capital loans by a bank holding company to any of its subsidiary banks are subordinate in right of payment to depositors and to certain other indebtedness of such subsidiary banks. In the event of a bank holding company’s bankruptcy, any commitment by the bank holding company to a federal bank regulatory agency to maintain the capital of a subsidiary bank will be assumed by the bankruptcy trustee and entitled to priority of payment.

Deposit Insurance – Substantially all of the deposits of the Bank are insured up to applicable limits by the Deposit Insurance Fund (“DIF”) of the FDIC, and the Bank is subject to deposit insurance assessments to maintain the DIF. Deposit insurance assessments are based on average consolidated total assets minus average tangible equity. Under the FDIC’s risk-based assessment system, insured institutions with less than $10 billion in assets, such as the Bank, are assigned to one of four risk categories based on supervisory evaluations, regulatory capital level, and certain other factors, with less risky institutions paying lower assessments. An institution’s assessment rate depends upon the category to which it is assigned and certain other factors.

In October 2010, the FDIC adopted a new DIF restoration plan to ensure that the DIF reserve ratio reaches 1.35% by September 30, 2020, as required by the Dodd-Frank Act. At least semi-annually, the FDIC will update its loss and income projections for the fund and, if needed, will increase or decrease assessment rates, following notice-and-comment rulemaking if required. FDIC insurance expense totaled approximately $309,700, $349,200 and $332,600 for the years ended December 31, 2016, 2015 and 2014, respectively.

The FDIC may terminate deposit insurance upon a finding that the institution has engaged in unsafe and unsound practices, is in an unsafe or unsound condition to continue operations, or has violated any applicable law, regulation, rule, order or condition imposed by the FDIC.

Prompt Corrective Action – The Basel III Capital Rules incorporate new requirements into the prompt correction action framework, described above. The Federal Deposit Insurance Act (“FDIA”) requires that federal banking agencies take “prompt corrective action” against depository institutions that do not meet minimum capital requirements and includes the following five capital tiers: “well-capitalized,” “adequately capitalized,” “undercapitalized,” “significantly undercapitalized” and “critically undercapitalized.” A depository institution’s capital tier will depend upon how its capital levels compare with various relevant capital measures and certain other factors, as established by regulation.

A depository institution is deemed to be (i) “well-capitalized” if the institution has a total risk-based capital ratio of 10% or greater, a Tier 1 risk-based capital ratio of 8% or greater, a leverage ratio of 5% or greater, a common equity Tier 1 ratio of 6.5% or greater and is not subject to any regulatory order agreement or written directive to meet and maintain a specific capital level for any capital measure; (ii) “adequately capitalized” if the institution has a total risk-based capital ratio of 8% or greater, a Tier 1 risk-based capital ratio of 6% or greater, a leverage ratio of 4% or greater, a common equity Tier 1 ratio of 4.5% or greater and does not meet the definition of “well capitalized”; (iii) “undercapitalized” if the institution has a total risk-based capital ratio that is less than 8%, a Tier 1 risk-based capital ratio of less than 6%, a leverage ratio of less than 4% or a common equity Tier 1 ratio of less than 4.5%; (iv) “significantly undercapitalized” if the institution has a total risk-based capital ratio of less than 6%, a Tier 1 risk-based capital ratio of less than 4%, a leverage ratio of less than 3% or a common equity Tier 1 ratio of less than 3%; and (v) “critically undercapitalized” if the institution has a ratio of tangible equity (as defined in the regulations) to total assets that is equal to or less than 2%. An institution may be deemed to be in a capital category that is lower than indicated by its capital ratios if it is determined to be in an unsafe or unsound condition or if it receives an unsatisfactory examination rating with respect to certain matters. A bank’s capital category is determined solely for the purpose of applying prompt corrective action regulations, and the capital category may not constitute an accurate representation of the bank’s overall financial condition or prospects for other purposes.

4

Subject to a narrow exception, a receiver or conservator is required to be appointed for an institution that is “critically undercapitalized” within specified time frames. The regulations also provide that a capital restoration plan must be filed with the FRB within 45 days of the date an institution is deemed to have received notice that it is “undercapitalized,” “significantly undercapitalized” or “critically undercapitalized.” Compliance with the plan must be guaranteed by any parent holding company up to the lesser of 5% of the institution’s total assets when it was deemed to be undercapitalized or the amount necessary to achieve compliance with applicable capital requirements. In addition, numerous mandatory supervisory actions become immediately applicable to an undercapitalized institution including, but not limited to, increased monitoring by regulators and restrictions on growth, capital distributions and expansion. The FRB could also take any one of a number of discretionary supervisory actions, including the issuance of a capital directive and the replacement of senior executive officers and directors. Significantly and critically undercapitalized institutions are subject to additional mandatory and discretionary measures.

As of December 31, 2016, the most recent notification from the regulatory agencies categorized the Company and the Bank as well-capitalized. For further information regarding the capital ratios and leverage ratio of the Company and the Bank, see Item 8, Note 2 of this report.

Safety and Soundness Regulations – In accordance with the FDIA, the federal banking agencies adopted guidelines establishing general standards relating to internal controls, information systems, internal audit systems, loan documentation, credit underwriting, interest rate risk exposure, asset growth, asset quality, earnings, compensation, fees and benefits. In general, the guidelines require that institutions maintain appropriate systems and practices to identify and manage the risks and exposures specified in the guidelines. The guidelines prohibit excessive compensation as an unsafe and unsound practice and describe compensation as excessive when the amounts paid are unreasonable or disproportionate to the services performed by an executive officer, employee, director or principal shareholder. In addition, regulations adopted by the federal banking agencies authorize the agencies to require that an institution that has been given notice that it is not satisfying any of such safety and soundness standards to submit a compliance plan. If the institution fails to submit an acceptable compliance plan or fails in any material respect to implement an accepted compliance plan, the agency must issue an order directing corrective actions and may issue an order directing other actions of the types to which an undercapitalized institution is subject under the “prompt corrective action” provisions of FDIA. If the institution fails to comply with such an order, the agency may seek to enforce such order in judicial proceedings and to impose civil money penalties.

Loans-to-One-Borrower – The Bank generally may not make loans or extend credit to a single or related group of borrowers in excess of 15% of unimpaired capital and surplus. An additional amount may be loaned, up to 10% of unimpaired capital and surplus, if the loan is secured by readily marketable collateral, which generally does not include real estate. As of December 31, 2016, the Bank was in compliance with the loans-to-one-borrower limitations.

Depositor Preference – The FDIA provides that, in the event of the “liquidation or other resolution” of an insured depository institution, the claims of depositors of the institution, including the claims of the FDIC as subrogee of insured depositors, and certain claims for administrative expenses of the FDIC as a receiver, will have priority over other general unsecured claims against the institution. If an insured depository institution fails, insured and uninsured depositors, along with the FDIC, will have priority in payment ahead of unsecured, non-deposit creditors, including depositors whose deposits are payable only outside of the United States and the parent bank holding company, with respect to any extensions of credit they have made to such insured depository institution.

Community Reinvestment Act – The Community Reinvestment Act of 1977 (“CRA”) requires depository institutions to assist in meeting the credit needs of their market areas consistent with safe and sound banking practice. Under the CRA, each depository institution is required to help meet the credit needs of its market areas by, among other things, providing credit to low- and moderate-income individuals and communities. Depository institutions are periodically examined for compliance with the CRA and are assigned ratings that must be publicly disclosed. In order for a financial holding company to commence any new activity permitted by the BHC Act, or to acquire any company engaged in any new activity permitted by the BHC Act, each insured depository institution subsidiary of the financial holding company must have received a rating of at least “satisfactory” in its most recent examination under the CRA. The Bank received a rating of “satisfactory” in its most recent CRA exam.

Financial Privacy – Banks and other financial institutions are subject to regulations that limit their ability to disclose non-public information about consumers to nonaffiliated third parties. These limitations require disclosure of privacy policies to consumers and affect how consumer information is transmitted through diversified financial companies and conveyed to outside vendors.

5

The Bank is also subject to regulatory guidelines establishing standards for safeguarding customer information and maintaining information security programs. The standards set forth in the guidelines are intended to ensure the security and confidentiality of customer records and information, protect against any anticipated threats or hazards to the security or integrity of such records and protect against unauthorized access to or use of such records or information that could result in substantial harm or inconvenience to any customer.

Transactions with Affiliates – Transactions between the Bank and its affiliates are subject to regulations that limit the types and amounts of covered transactions engaged in by the Bank and generally require those transactions to be on an arm’s-length basis. The term “affiliate” is defined to mean any company that controls or is under common control with the Bank and includes the Company and its non-bank subsidiaries. “Covered transactions” include a loan or extension of credit, as well as a purchase of securities issued by an affiliate, certain purchases of assets from the affiliate, certain derivative transactions that create a credit exposure to an affiliate, the acceptance of securities issued by the affiliate as collateral for a loan, and the issuance of a guarantee, acceptance or letter of credit on behalf of an affiliate. In general, these regulations require that any such transaction by the Bank (or its subsidiaries) with an affiliate must be secured by designated amounts of specified collateral and must be limited to certain thresholds on an individual and aggregate basis.

Federal law also limits the Bank’s authority to extend credit to its directors, executive officers and 10% shareholders, as well as to entities controlled by such persons. Among other things, extensions of credit to insiders are required to be made on terms that are substantially the same as, and follow credit underwriting procedures that are not less stringent than, those prevailing for comparable transactions with unaffiliated persons. Also, the terms of such extensions of credit may not involve more than the normal risk of repayment or present other unfavorable features and may not exceed certain limitations on the amount of credit extended to such persons, individually and in the aggregate, which limits are based, in part, on the amount of the Bank’s capital.

Federal Reserve System – FRB regulations require depository institutions to maintain cash reserves against their transaction accounts (primarily NOW and demand deposit accounts). A reserve of 3% is to be maintained against aggregate transaction accounts between $15.2 million and $110.2 million (subject to adjustment by the FRB) plus a reserve of 10% (subject to adjustment by the FRB between 8% and 14%) against that portion of total transaction accounts in excess of $110.2 million. The first $15.2 million of otherwise reservable balances (subject to adjustment by the FRB) is exempt from the reserve requirements. The Bank is in compliance with the foregoing requirements.

Other Regulations – The operations of the Company and the Bank are also subject to:

| ● |

Truth-In-Lending Act, governing disclosures

of credit terms to consumer borrowers; |

| ● |

Fair Credit Reporting Act, governing the

provision of consumer information to credit reporting agencies and the use

of consumer information; |

| ● |

Fair Debt Collection Act, governing the

manner in which consumer debts may be collected by collection

agencies; |

| ● |

Electronic Funds Transfer Act, governing

automatic deposits to and withdrawals from deposit accounts and customers’

rights and liabilities arising from the use of automated teller machines

and other electronic banking services. |

| ● |

Real Estate Settlement Procedures Act,

requiring that borrowers for mortgage loans for one- to four-family

residential real estate receive various disclosures, including good faith

estimates of settlement costs, lender servicing and escrow account

practices, and prohibiting certain practices that increase the cost of

settlement services; |

| ● |

Equal Credit Opportunity Act, prohibiting

discrimination on the basis of race, creed or other prohibited factors in

extending credit; |

| ● |

Check Clearing for the 21st Century Act

(also known as “Check 21”), which gives “substitute checks,” such as

digital check images and copies made from that image, the same legal

standing as the original paper check; and |

| ● |

The USA PATRIOT Act, which requires banks

and savings institutions to establish broadened anti-money laundering

compliance programs and due diligence policies and controls to ensure the

detection and reporting of money laundering. |

| ● |

The Bank Secrecy Act, which requires U.S. financial institutions to collaborate with the U.S. government in cases of suspected money laundering and fraud. |

6

Website Availability of SEC Reports

Cass files annual, quarterly and current reports with the Securities and Exchange Commission (the “SEC”). Cass will, as soon as reasonably practicable after they are electronically filed with or furnished to the SEC, make available free of charge on its website each of its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, all amendments to those reports, and its definitive proxy statements. The address of Cass’ website is: www.cassinfo.com. All reports filed with the SEC are available for reading and copying at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549-2736 or for more information call the Public Reference Room at 1-800-SEC-0330. The SEC also makes all filed reports, proxy statements and information statements available on its website at www.sec.gov.

The reference to the Company’s website address does not constitute incorporation by reference of the information contained on the website and should not be considered part of this report.

Financial Information about Segments

The services provided by the Company are classified in two reportable segments: Information Services and Banking Services. The revenues from external customers, net income and total assets by segment as of and for each of the years in the three-year period ended December 31, 2016, are set forth in Item 8, Note 16 of this report.

Statistical Disclosure by Bank Holding Companies

For the statistical disclosure by bank holding companies, refer to Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

This section highlights specific risks that could affect the Company’s business. Although this section attempts to highlight key factors, please be aware that other risks may prove to be important in the future. New risks may emerge at any time, and Cass cannot predict such risks or estimate the extent to which they may affect the Company’s financial performance. In addition to the factors discussed elsewhere or incorporated by reference in this report, the identified risks that could cause actual results to differ materially include the following:

General political, economic or industry conditions may be less favorable than expected.

Local, domestic, and international economic, political and industry-specific conditions and governmental monetary and fiscal policies affect the industries in which the Company competes, directly and indirectly. Conditions such as inflation, recession, unemployment, volatile interest rates, tight money supply, real estate values, international conflicts and other factors outside of Cass’ control may adversely affect the Company. Economic downturns could result in the delinquency of outstanding loans, which could have a material adverse impact on Cass’ earnings.

Unfavorable developments concerning customer credit quality could affect Cass’ financial results.

Although the Company regularly reviews credit exposure related to its customers and various industry sectors in which it has business relationships, default risk may arise from events or circumstances that are difficult to detect or foresee. Under such circumstances, the Company could experience an increase in the level of provision for credit losses, delinquencies, nonperforming assets, net charge-offs and allowance for credit losses.

The Company has lending concentrations, including, but not limited to, churches and church-related entities located in selected cities and privately-held businesses located in or near St. Louis, Missouri, that could suffer a significant decline which could adversely affect the Company.

Cass’ customer base consists, in part, of lending concentrations in several segments and geographical areas. If any of these segments or areas is significantly affected by weak economic conditions, the Company could experience increased credit losses, and its business could be adversely affected.

7

Fluctuations in interest rates could affect Cass’ net interest income and balance sheet.

The operations of financial institutions such as the Company are dependent to a large degree on net interest income, which is the difference between interest income from loans and investments and interest expense on deposits and borrowings. Prevailing economic conditions, the fiscal and monetary policies of the federal government and the policies of various regulatory agencies all affect market rates of interest, which in turn significantly affect financial institutions’ net interest income. Fluctuations in interest rates affect Cass’ financial statements, as they do for all financial institutions. Volatility in interest rates can also result in disintermediation, which is the flow of funds away from financial institutions into direct investments, such as federal government and corporate securities and other investment vehicles, which, because of the absence of federal insurance premiums and reserve requirements, generally pay higher rates of return than financial institutions. As discussed in greater detail in Item 7A, “Quantitative and Qualitative Disclosures about Market Risk,” a continuation of the current low level of interest rates would have a negative impact on the Company’s net interest income.

Operational difficulties or cyber-security problems could damage Cass’ reputation and business.

In the ordinary course of business, the Company depends on the reliable operation of its computer operations and network connections from its clients to its systems. Any failure, interruption, or breach in security of these systems would cause Cass to be unable to process transactions for its clients, resulting in decreased revenues. Additionally, any failure, interruption, breach in security or loss of data, whatever the cause, could reduce client satisfaction with the Company’s products and services and harm Cass’ financial results. These types of threats may derive from human error, fraud or malice on the part of external or internal parties, or may result from accidental technological failure. Further, to access the Company’s products and services, Cass’ customers may use computers and mobile devices that are beyond the Company’s security control systems. The Company’s technologies, systems, networks and software, and those of other financial institutions have been, and are likely to continue to be, the target of cybersecurity threats and attacks, which may range from uncoordinated individual attempts to sophisticated and targeted measures directed at Cass. The risk of a security breach or disruption, particularly through cyber-attack or cyber intrusion, has increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. A material security problem affecting Cass could damage its reputation, deter prospects from purchasing its products and services, deter customers from using its products and services or result in liability to Cass.

Although the Company makes significant efforts to maintain the security and integrity of Cass’ information systems and have implemented various measures to manage the risk of a security breach or disruption, there can be no assurance that Cass’ security efforts and measures will be effective or that attempted security breaches or disruptions would not be successful or damaging. Even the most well protected information, networks, systems and facilities remain potentially vulnerable because attempted security breaches, particularly cyber-attacks and intrusions, or disruptions will occur in the future, and because the techniques used in such attempts are constantly evolving and generally are not recognized until launched against a target, and in some cases are designed not to be detected and, in fact, may not be detected. Accordingly, the Company may be unable to anticipate these techniques or to implement adequate security barriers or other preventative measures, and thus it is virtually impossible to entirely mitigate this risk. While specific “cyber” insurance coverage is maintained, which would apply in the event of various breach scenarios, the amount of coverage may not be adequate in any particular case. Furthermore, because cyber threat scenarios are inherently difficult to predict and can take many forms, some breaches may not be covered under Cass’ cyber insurance coverage. A security breach or other significant disruption of Cass’ information systems or those related to customers, merchants and third party vendors, including as a result of cyber-attacks, could 1) disrupt the proper functioning of Cass’ networks and systems and therefore operations and/or those of certain customers; 2) result in the unauthorized access to, and destruction, loss, theft, misappropriation or release of confidential, sensitive or otherwise valuable information of the Company or its customers; 3) result in a violation of applicable privacy, data breach and other laws, subjecting the Company to additional regulatory scrutiny and expose Cass to civil litigation, governmental fines and possible financial liability; 4) require significant management attention and resources to remedy the damages that result; or 5) harm Cass’ reputation or cause a decrease in the number of customers that choose to do business with the Company. The occurrence of any of the foregoing could have a material adverse effect on Cass’ business, financial condition and results of operations.

Cass must respond to rapid technological changes and these changes may be more difficult or expensive than anticipated.

If competitors introduce new products and services embodying new technologies, or if new industry standards and practices emerge, the Company’s existing product and service offerings, technology and systems may become obsolete. Further, if Cass fails to adopt or develop new technologies or to adapt its products and services to emerging industry standards, Cass may lose current and future customers. Finally, Cass’ ability to adopt these technologies can also be inhibited by intellectual property rights of third parties. Any of these could have a material adverse effect on its business, financial condition and results of operations. The payment processing and financial services industries are changing rapidly and in order to remain competitive, Cass must continue to enhance and improve the functionality and features of its products, services and technologies. These changes may be more difficult or expensive than the Company anticipates.

Operations of the Company’s customer base are impacted by macro-economic factors such as a strong dollar and/or volatility in commodity prices. A reduction in its customers’ operations could have a material adverse effect on Cass’ results of operations.

The recent decline in the cost of oil worldwide has had a negative effect on both the number of freight transactions processed and the dollar amount of invoices processed. For example, lower oil prices have caused a significant drop in drilling supplies being transported to fracking operations by domestic railroads and trucks, as U.S. oil prices are no longer as competitive with the prices of imported oil. Lower oil prices have also resulted in lower gas and fuel prices, negatively affecting the dollar amounts of the invoices that Cass processes for its freight and shipping customers. A further decline in oil prices would continue to have an adverse effect on the Company’s revenues and could significantly impact its results of operations.

Methods of reducing risk exposures might not be effective.

Instruments, systems and strategies used to hedge or otherwise manage exposure to various types of credit, interest rate, market and liquidity, operational, regulatory/compliance, business risks and enterprise-wide risks could be less effective than anticipated. As a result, the Company may not be able to effectively mitigate its risk exposures in particular market environments or against particular types of risk.

8

Customer borrowing, repayment, investment, deposit, and payable processing practices may be different than anticipated.

The Company uses a variety of financial tools, models and other methods to anticipate customer behavior as part of its strategic and financial planning and to meet certain regulatory requirements. Individual, economic, political and industry-specific conditions and other factors outside of Cass’ control could alter predicted customer borrowing, repayment, investment, deposit, and payable processing practices. Such a change in these practices could adversely affect Cass’ ability to anticipate business needs, including cash flow and its impact on liquidity, and to meet regulatory requirements.

Cass’ stock price can become volatile and fluctuate widely in response to a variety of factors.

The Company’s stock price can fluctuate based on factors that can include actual or anticipated variations in Cass’ quarterly results; new technology or services by competitors; unanticipated losses or gains due to unexpected events, including losses or gains on securities held for investment purposes; significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving the Company or its competitors; changes in accounting policies or practices; failure to integrate acquisitions or realize anticipated benefits from acquisitions; or changes in government regulations.

General market fluctuations, industry factors and general economic and political conditions, such as economic slowdowns or recessions, governmental intervention, interest rate changes, credit loss trends, low trading volume or currency fluctuations also could cause Cass’ stock price to decrease regardless of the Company’s operating results.

Competitive product and pricing pressure within Cass’ markets may change.

The Company operates in a very competitive environment, which is characterized by competition from a number of other vendors and financial institutions in each market in which it operates. The Company competes with large payment processors and national and regional financial institutions and also smaller auditing companies and banks in terms of products and pricing. If the Company is unable to compete effectively in products and pricing in its markets, business could decline.

Management’s ability to maintain and expand customer relationships may differ from expectations.

The industries in which the Company operates are very competitive. The Company not only competes for business opportunities with new customers, but also competes to maintain and expand the relationships it has with its existing customers. The Company continues to experience pressures to maintain these relationships as its competitors attempt to capture its customers.

The introduction, withdrawal, success and timing of business initiatives and strategies, including, but not limited to, the expansion of payment and processing activities to new markets, the expansion of products and services to existing markets and opening of new bank branches, may be less successful or may be different than anticipated. Such a result could adversely affect Cass’ business.

The Company makes certain projections as a basis for developing plans and strategies for its payment processing and banking products. If the Company does not accurately determine demand for its products and services, it could result in the Company incurring significant expenses without the anticipated increases in revenue, which could result in an adverse effect on its earnings.

Management’s ability to retain key officers and employees may change.

Cass’ future operating results depend substantially upon the continued service of Cass’ executive officers and key personnel. Cass’ future operating results also depend in significant part upon Cass’ ability to attract and retain qualified management, financial, technical, marketing, sales, and support personnel. Competition for qualified personnel is intense, and the Company cannot ensure success in attracting or retaining qualified personnel. There may be only a limited number of persons with the requisite skills to serve in these positions, and it may be increasingly difficult for the Company to hire personnel over time. Cass’ business, financial condition and results of operations could be materially adversely affected by the loss of any of its key employees, by the failure of any key employee to perform in his or her current position, or by Cass’ inability to attract and retain skilled employees.

9

Recent legislative and regulatory initiatives to support the financial services industry have been coupled with numerous restrictions and requirements that could detrimentally affect the Company’s business.

The Dodd-Frank Act is significantly changing the current bank regulatory structure and affecting the lending, deposit, investment, trading and operating activities of financial institutions and their holding companies.

The Company and the Bank are supervised and regulated primarily by the FRB. In addition, the Company is subject to consolidated capital requirements, made more strict by the recent adoptions and implementation of the Basel III Capital Rules, and must serve as a source of strength to the Bank. It is possible such requirements may limit our capacity to pay dividends or repurchase shares.

The Dodd-Frank Act also broadens the base for FDIC insurance assessments. The FDIC insures deposits at FDIC-insured financial institutions, including the Bank. The FDIC charges insured financial institutions premiums to maintain the DIF at a specific level. The Bank’s FDIC insurance premiums increased substantially beginning in 2009, and the Bank expects to pay high premiums in the future. Economic conditions during the recent recession increased bank failures and decreased the DIF. The FDIC may increase the assessment rates or impose additional special assessments in the future to keep the DIF at the statutory target level. Any increase in our FDIC premiums could have an adverse effect on the Bank’s profits and financial condition.

The scope and impact of many of the Dodd-Frank Act provisions will be determined over time as regulations are issued and become effective. As a result, the Company cannot predict the ultimate impact of the Dodd-Frank Act at this time, including the extent to which it could increase costs or limit the ability to pursue business opportunities in an efficient manner, or otherwise adversely affect the business, financial condition and results of operations. However, it is expected that at a minimum, any new regulations issued will increase operating and compliance costs.

New capital rules generally require insured depository institutions and their holding companies to hold more capital. The impact of the new rules on our financial condition and operations is uncertain but could be materially adverse.

The Dodd-Frank Act requires the federal banking agencies to establish stricter risk-based capital requirements and leverage limits to apply to banks and bank and savings and loan holding companies. In July 2013, the federal banking agencies published the final Basel III Capital Rules that revised their risk-based and leverage capital requirements and their method for calculating risk-weighted assets. The Basel III Capital Rules will apply to banking organizations, including the Company and the Bank. As discussed in Item 1, “Business—Supervision and Regulation,” the Basel III Capital Rules became effective on January 1, 2015 with a phase-in period that generally extends through January 1, 2019. The final rules increase capital requirements and generally include two new capital measurements that will affect the Company—a risk-based common equity Tier 1 ratio and a capital conservation buffer. Common equity Tier 1 capital is a subset of Tier 1 capital and is limited to common equity (plus related surplus), retained earnings, accumulated other comprehensive income and certain other items. Other instruments that have historically qualified for Tier 1 treatment, including non-cumulative perpetual preferred stock, are consigned to a category known as Additional Tier 1 capital and must be phased out over a period of nine years beginning in 2014. The rules permit bank holding companies with less than $15 billion in assets (such as the Company) to continue to include trust preferred securities and non-cumulative perpetual preferred stock issued before May 19, 2010 in Tier 1 capital, but not common equity Tier 1 capital. Tier 2 capital consists of instruments that have historically been placed in Tier 2, as well as cumulative perpetual preferred stock.

The final rules adjust all three categories of capital by requiring new deductions from and adjustments to capital that will result in more stringent capital requirements. Beginning January 1, 2015, the minimum capital requirements are (i) a common equity Tier 1 capital ratio of 4.5%; (ii) a Tier 1 capital ratio (common equity Tier 1 capital plus Additional Tier 1 capital) of 6%; (iii) a total capital ratio of 8%; and (iv) a leverage ratio of 4%. Beginning in 2016, a capital conservation buffer is being phased in over three years, ultimately resulting in a requirement of 2.5% on top of the common equity Tier 1, Tier 1 and total capital requirements, resulting in a required common equity Tier 1 capital ratio of 7%, a Tier 1 capital ratio of 8.5%, and a total capital ratio of 10.5%. Failure to satisfy any of these three capital requirements will result in limits on paying dividends, engaging in share repurchases and paying discretionary bonuses. These limitations will establish a maximum percentage of eligible retained income that could be utilized for such actions.

In addition to the higher required capital ratios and the new deductions and adjustments, the final rules increase the risk weights for certain assets, meaning that the Company will have to hold more capital against these assets. For example, commercial real estate loans that do not meet certain new underwriting requirements now must be risk-weighted at 150%, rather than the previous 100%. There are also new risk weights for unsettled transactions and derivatives. There will also be a requirement to hold capital against short-term commitments that are not unconditionally cancelable (currently, there are no capital requirements for these off-balance sheet assets). All changes to the risk weights took effect in 2015. Implementation of changes to asset risk weightings for risk-based capital calculations, items included or deducted in calculating regulatory capital or additional capital conservation buffers, could result in management modifying its business strategy and could limit the ability to make distributions, including paying dividends or buying back shares.

10

Cass is subject to extensive regulatory oversight.

The Company is subject to extensive regulation and supervision that is designed primarily for the protection of the DIF and depositors, and not to the benefit of the shareholders. As a result, the Company is limited in the manner in which it conducts business, undertakes new investments and activities and obtains financing. This regulatory structure also gives the regulatory authorities extensive discretion in connection with their supervisory and enforcement activities and examination policies, including policies with respect to capital levels, the timing and amount of dividend payments, the classification of assets and the establishment of adequate loan loss reserves for regulatory purposes. Failure to comply with these and other regulatory requirements can lead to, among other remedies, administrative enforcement actions and other legal proceedings, including the imposition of civil money penalties.

Changes in regulation or oversight may have a material adverse impact on Cass’ operations.

The Company is subject to extensive regulation, supervision and examination by the Missouri Division of Finance, the FDIC, the FRB, the SEC and other regulatory bodies. Such regulation and supervision governs the activities in which the Company may engage. Regulatory authorities have extensive discretion in their supervisory and enforcement activities, including the imposition of restrictions on Cass’ operations, investigations and limitations related to Cass’ securities, the classification of Cass’ assets and determination of the level of Cass’ allowance for loan losses. Any change in such regulation and oversight, whether in the form of regulatory policy, regulations, legislation or supervisory action, may have a material adverse impact on Cass’ operations.

Legal and regulatory proceedings and related matters with respect to the financial services industry, including those directly involving the Company and its subsidiaries, could adversely affect Cass or the financial services industry in general.

The Company is subject to various legal and regulatory proceedings. It is inherently difficult to assess the outcome of these matters, and there can be no assurance that the Company will prevail in any proceeding or litigation. Any such matter could result in substantial cost and diversion of Cass’ efforts, which by itself could have a material adverse effect on Cass’ financial condition and operating results. Further, adverse determinations in such matters could result in actions by Cass’ regulators that could materially adversely affect Cass’ business, financial condition or results of operations. Please refer to Item 3, “Legal Proceedings.”

The Company’s accounting policies and methods are the basis of how Cass reports its financial condition and results of operations, and they require management to make estimates about matters that are inherently uncertain. In addition, changes in accounting policies and practices, as may be adopted by the regulatory agencies, the Financial Accounting Standards Board, or other authoritative bodies, could materially impact Cass’ financial statements.

The Company’s accounting policies and methods are fundamental to how Cass records and reports its financial condition and results of operations. Management must exercise judgment in selecting and applying many of these accounting policies and methods in order to ensure that they comply with generally accepted accounting principles and reflect management’s judgment as to the most appropriate manner in which to record and report Cass’ financial condition and results of operations. In some cases, management must select the accounting policy or method to apply from two or more alternatives, any of which might be reasonable under the circumstances yet might result in the Company reporting materially different amounts than would have been reported under a different alternative.

Cass has identified three accounting policies as being “critical” to the presentation of its financial condition and results of operations because they require management to make particularly subjective and/or complex judgments about matters that are inherently uncertain and because of the likelihood that materially different amounts would be reported under different conditions or using different assumptions. More information on Cass’ critical accounting policies is contained in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

From time to time, the regulatory agencies, the Financial Accounting Standards Board (“FASB”), and other authoritative bodies change the financial accounting and reporting standards that govern the preparation of the Company’s financial statements. These changes can be hard to predict and can materially impact how management records and reports the Company’s financial condition and results of operations.

11

Cass is subject to examinations and challenges by tax authorities, which, if not resolved in the Company’s favor, could adversely affect the Company’s financial condition and results of operations.

In the normal course of business, Cass and its affiliates are routinely subject to examinations and challenges from federal and state tax authorities regarding the amount of taxes due in connection with investments it has made and the businesses in which it is engaged. Recently, federal and state taxing authorities have become increasingly aggressive in challenging tax positions taken by financial institutions. These tax positions may relate to tax compliance, sales and use, franchise, gross receipts, payroll, property and income tax issues, including tax base, apportionment and tax credit planning. The challenges made by tax authorities may result in adjustments to the timing or amount of taxable income or deductions or the allocation of income among tax jurisdictions. If any such challenges are made and are not resolved in the Company’s favor, they could have an adverse effect on Cass’ financial condition and results of operations.

There could be terrorist activities or other hostilities, which may adversely affect the general economy, financial and capital markets, specific industries, and the Company.

The terrorist attacks in September 2001 in the United States and ensuing events, as well as the resulting decline in consumer confidence, had a material adverse effect on the economy. Any similar future events may disrupt Cass’ operations or those of its customers. In addition, these events had and may continue to have an adverse impact on the U.S. and world economy in general and consumer confidence and spending in particular, which could harm Cass’ operations. Any of these events could increase volatility in the U.S. and world financial markets, which could harm Cass’ stock price and may limit the capital resources available to its customers and the Company. This could have a significant impact on Cass’ operating results, revenues and costs and may result in increased volatility in the market price of Cass’ common stock.

There could be natural disasters, including, but not limited to, hurricanes, tornadoes, earthquakes, fires and floods, which may adversely affect the general economy, financial and capital markets, specific industries, and the Company.

The Company has significant operations and customer base in Missouri, California, Ohio, Massachusetts, South Carolina, Kansas, Florida, Colorado and other regions where natural disasters may occur. These regions are known for being vulnerable to natural disasters and other risks, such as tornadoes, hurricanes, earthquakes, fires and floods. These types of natural disasters at times have disrupted the local economy, Cass’ business and customers and have posed physical risks to Cass’ property. A significant natural disaster could materially affect Cass’ operating results.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

In September 2012, the Company entered into a 10-year lease for office space in St. Louis County, Missouri, to house the headquarters of the Company and the Bank. The Company’s headquarters occupy 13,991 square feet in an office center at 12444 Powerscourt Drive along with 3,563 square feet in the same center at 12412 Powerscourt Drive. The Bank’s headquarters occupy 10,564 square feet in the same center at 12412 Powerscourt Drive.

The Company owns approximately 61,500 square feet of office space at 13001 Hollenberg Drive in Bridgeton, Missouri where the Company’s transportation processing activities are performed.

The Company owns a production facility of approximately 45,500 square feet located at 2675 Corporate Exchange Drive, Columbus, Ohio. Additional facilities are located in Lowell, Massachusetts, Greenville, South Carolina, Wellington, Kansas, Jacksonville, Florida and Columbus, Ohio. The Company has an office in Breda, Netherlands to service its multinational customers.

In addition, the Bank owns a banking facility near downtown St. Louis, Missouri, has an operating branch in the Bridgeton, Missouri location, and has additional leased facilities in Fenton, Missouri, Santa Ana, California and Colorado Springs, Colorado.

Management believes that these facilities are suitable and adequate for the Company’s operations.

12

The Company and its subsidiaries are not involved in any pending proceedings other than ordinary routine litigation incidental to their businesses. Management believes none of these proceedings, if determined adversely, would have a material effect on the business or financial conditions of the Company or its subsidiaries.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

13

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

The Company’s common stock is quoted on The Nasdaq Global Select Market® under the symbol “CASS.” As of March 3, 2017, there were approximately 2,921 holders of record of the Company’s common stock. High and low sale prices, as reported by The Nasdaq Global Select Market for each quarter of 2016 and 2015, were as follows:

| 2016 | 2015 | |||||||||||

| High | Low | High | Low | |||||||||

| 1st Quarter | $ | 53.66 | $ | 47.65 | $ | 57.54 | $ | 43.00 | ||||

| 2nd Quarter | 52.76 | 45.05 | 58.25 | 48.97 | ||||||||

| 3rd Quarter | 58.64 | 49.55 | 59.09 | 43.78 | ||||||||

| 4th Quarter | 74.83 | 52.69 | 54.71 | 47.40 | ||||||||

The Company has continuously paid regularly scheduled cash dividends since 1934 and expects to continue to pay quarterly cash dividends in the future. Cash dividends paid per share by the Company during the two most recent fiscal years were as follows:

| 2016 | 2015 | |||||

| March | $ | .220 | $ | .210 | ||

| June | .220 | .210 | ||||

| September | .220 | .210 | ||||

| December | .230 | .220 | ||||

Subsidiary dividends can be a significant source of funds for payment of dividends by the Company to its shareholders. Both the Company and the Bank are subject to various regulations that restrict their ability to pay dividends and the amount of dividends that they may pay. Under the FDICIA, a depository institution, such as the Bank, may not pay dividends if payment would cause it to become undercapitalized or if it is already undercapitalized. The payment of dividends by the Company and the Bank may also be affected or limited by other factors, such as the requirement to maintain adequate capital and, under certain circumstances, the ability of federal regulators to prohibit dividend payments as an unsound or unsafe practice. For further information regarding capital ratios and leverage ratio requirements of the Company and the Bank and the effect on payment of dividends, see Item 8, Note 2 of this report.

The Company repurchased a total of 187,123 shares at an aggregate cost of $9,215,000 during the year ended December 31, 2016 and 216,412 shares at an aggregate cost of $10,591,000 during the year ended December 31, 2015. A portion of the repurchased shares may be used for the Company’s employee benefit plans, and the balance will be available for other general corporate purposes. The stock repurchase authorization does not have an expiration date and the pace of repurchase activity will depend on factors such as levels of cash generation from operations, cash requirements for investments, repayment of debt, current stock price, and other factors. The Company may repurchase shares from time to time on the open market or in private transactions, including structured transactions. The stock repurchase program may be modified or discontinued at any time.

14

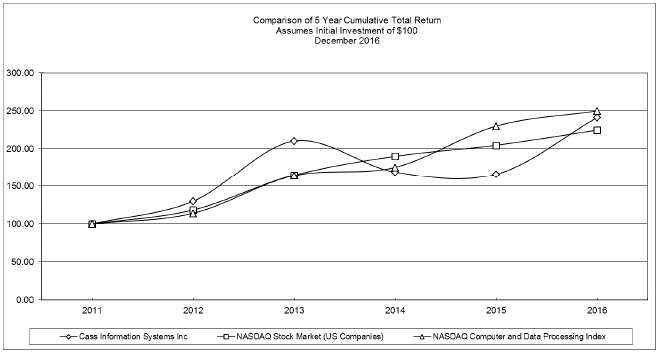

Performance Quoted on The Nasdaq Stock Market for the Last Five Fiscal Years

The following graph compares the cumulative total returns over the last five fiscal years of a hypothetical investment of $100 in shares of common stock of the Company with a hypothetical investment of $100 in The Nasdaq Stock Market (“Nasdaq”) and in the index of Nasdaq computer and data processing stocks. The graph assumes $100 was invested on December 31, 2011, with dividends reinvested. Returns are based on period end prices.

15

ITEM 6. SELECTED FINANCIAL DATA

The following table presents selected financial information for each of the five years ended December 31. The selected financial data should be read in conjunction with the Company’s consolidated financial statements and accompanying notes included in Item 8 of this report.

| (Dollars in thousands except per share data) | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

| Fee revenue and other income | $ | 86,136 | $ | 83,368 | $ | 79,907 | $ | 76,572 | $ | 71,138 | ||||||||||

| Interest income on loans | 29,063 | 28,669 | 29,726 | 32,110 | 35,525 | |||||||||||||||

| Interest income on debt and equity securities | 9,801 | 9,498 | 9,441 | 8,915 | 9,938 | |||||||||||||||

| Other interest income | 1,066 | 543 | 592 | 552 | 470 | |||||||||||||||

| Total interest income | 39,930 | 38,710 | 39,759 | 41,577 | 45,933 | |||||||||||||||

| Interest expense on deposits | 2,029 | 2,111 | 2,460 | 2,832 | 3,148 | |||||||||||||||

| Provision for loan losses | (1,500 | ) | (850 | ) | — | 500 | 2,400 | |||||||||||||

| Net interest income after provision | 39,401 | 37,449 | 37,299 | 38,245 | 40,385 | |||||||||||||||

| Operating expense | 93,473 | 89,783 | 85,414 | 84,086 | 80,333 | |||||||||||||||

| Income before income tax expense | 32,064 | 31,034 | 31,792 | 30,731 | 31,190 | |||||||||||||||

| Income tax expense | 7,716 | 7,978 | 7,759 | 7,234 | 7,887 | |||||||||||||||

| Net income | $ | 24,348 | $ | 23,056 | $ | 24,033 | $ | 23,497 | $ | 23,303 | ||||||||||

| Diluted earnings per share | $ | 2.15 | $ | 2.00 | $ | 2.06 | $ | 2.02 | $ | 2.02 | ||||||||||

| Dividends per share | .89 | .85 | .81 | .74 | .64 | |||||||||||||||

| Dividend payout ratio | 40.98 | % | 42.06 | % | 38.85 | % | 36.21 | % | 31.59 | % | ||||||||||

| Average total assets | $ | 1,504,474 | $ | 1,439,511 | $ | 1,424,967 | $ | 1,351,782 | $ | 1,344,492 | ||||||||||

| Average net loans | 667,158 | 659,109 | 651,984 | 647,827 | 671,900 | |||||||||||||||

| Average investment securities | 352,129 | 330,095 | 321,836 | 294,846 | 313,184 | |||||||||||||||

| Average total deposits | 614,975 | 579,752 | 571,039 | 550,110 | 541,046 | |||||||||||||||

| Average total shareholders’ equity | 207,060 | 197,853 | 200,149 | 175,441 | 167,867 | |||||||||||||||

| Return on average total assets | 1.62 | % | 1.60 | % | 1.69 | % | 1.74 | % | 1.73 | % | ||||||||||

| Return on average equity | 11.76 | 11.65 | 12.01 | 13.39 | 13.88 | |||||||||||||||

| Average equity to assets ratio | 13.76 | 13.74 | 14.05 | 12.98 | 12.49 | |||||||||||||||

| Equity to assets ratio at year-end | 13.82 | 14.25 | 13.36 | 14.36 | 13.80 | |||||||||||||||

| Tangible common equity to tangible assets | 13.04 | 13.42 | 12.52 | 13.39 | 12.47 | |||||||||||||||

| Tangible common equity to risk-weighted | ||||||||||||||||||||

| assets | 20.13 | 21.19 | 19.65 | 20.37 | 17.98 | |||||||||||||||

| Net interest margin | 3.32 | 3.38 | 3.43 | 3.63 | 4.00 | |||||||||||||||

| Allowance for loan losses to loans at year-end | 1.53 | 1.77 | 1.78 | 1.79 | 1.80 | |||||||||||||||

| Nonperforming assets to loans and foreclosed | ||||||||||||||||||||

| assets | .04 | .48 | * | .07 | .27 | 1.15 | * | |||||||||||||

| Net loan (recoveries) charge-offs to average | ||||||||||||||||||||

| loans outstanding | (.01 | ) | (.09 | ) | (.03 | ) | .18 | .44 | ||||||||||||

| * |

In February 2016, one nonaccrual loan with a balance of $2,727,000 was paid in full. The percentage, as adjusted, would have been .06%. In February 2013, a payment of $4,115,000 was received for one nonaccrual loan with a balance of $4,198,000. $83,000 was charged off. The percentage, as adjusted, would have been ..54%. |

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis provides information about the financial condition and results of operations of the Company for the years ended December 31, 2016, 2015 and 2014. This discussion and analysis should be read in conjunction with the Company’s consolidated financial statements and accompanying notes and other selected financial data presented elsewhere in this report.

Executive Overview