Subject to Completion Preliminary Term Sheet dated January 25, 2017 | Filed Pursuant to Rule 424(b)(2) Registration Statement No. 333-213265 (To Prospectus dated November 4, 2016, Prospectus Supplement dated November 4, 2016 and Product Supplement STOCK-OL-1 dated January 24, 2017) |

Units $10 principal amount per unit CUSIP No.  | Pricing Date* Settlement Date* Maturity Date* | February , 2017 February , 2017 February , 2018 | |||

*Subject to change based on the actual date the notes are priced for initial sale to the public (the “pricing date”) | |||||

BofA Finance LLC Notes Linked to a Basket of Stocks Fully and Unconditionally Guaranteed by Bank of America Corporation ■ Maturity of approximately one year and one week ■ A conditional payment of [$1.50 to $1.90] per unit if the Basket is flat or increases above the Starting Value ■ The Basket will be comprised of the common stocks of Amazon.com, Inc., Steel Dynamics, Inc., General Dynamics Corporation, JPMorgan Chase & Co. and Frontier Communications Corporation (each, a “Basket Stock”). Each Basket Stock will be given an equal weight ■ 1-to-1 downside exposure to decreases in the Basket, with 100% of your investment at risk ■ All payments occur at maturity and are subject to the credit risk of BofA Finance LLC, as issuer of the notes, and the credit risk of Bank of America Corporation, as guarantor of the notes ■ No periodic interest payments ■ In addition to the underwriting discount set forth below, the notes include a hedging-related charge of $0.075 per unit. See “Structuring the Notes” ■ Limited secondary market liquidity, with no exchange listing | |||||

Per Unit | Total | |

Public offering price(1) | $10.000 | $ |

Underwriting discount(1) | $0.175 | $ |

Proceeds, before expenses, to BofA Finance | $9.825 | $ |

(1) | For any purchase of 500,000 units or more in a single transaction by an individual investor or in combined transactions with the investor’s household in this offering, the public offering price and the underwriting discount will be $9.950 per unit and $0.125 per unit, respectively. See “Supplement to the Plan of Distribution; Conflicts of Interest” below. |

Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

Terms of the Notes | Redemption Amount Determination | |

Issuer: |

BofA Finance LLC (“BofA Finance”) |  |

Guarantor: |

Bank of America Corporation (“BAC”) | |

Principal Amount: |

$10.00 per unit | |

Term: |

Approximately one year and one week | |

Market Measure: |

An equally weighted basket of stocks comprised of Amazon.com, Inc. (NASDAQ symbol: “AMZN”), Steel Dynamics, Inc. (NASDAQ symbol: “STLD”), General Dynamics Corporation (NYSE symbol: “GD”), JPMorgan Chase & Co. (NYSE symbol: “JPM”) and Frontier Communications Corporation (NASDAQ symbol: “FTR”) (each, a “Basket Stock”). | |

Starting Value: |

The Starting Value will be set to 100.00 on the pricing date. | |

Ending Value: |

The value of the Basket on the calculation day. | |

Calculation Day: |

February , 2018. The calculation day is subject to postponement in the event of Market Disruption Events, as described beginning on page PS-19 of product supplement STOCK-OL-1. | |

Conditional Payment: |

[$1.50 to $1.90] per unit, representing a return of [15.00% to 19.00%] of the principal amount. The actual Conditional Payment will be determined on the pricing date. | |

Threshold Value: |

100% of the Starting Value. | |

Price Multiplier: |

1 for each Basket Stock, subject to adjustment for certain corporate events relating to the Basket Stocks described beginning on page PS-20 of product supplement STOCK-OL-1. | |

Fees and Charges: |

The underwriting discount of $0.175 per unit listed on the cover page and the hedging related charge of $0.075 per unit described in “Structuring the Notes” on page TS-17. | |

Calculation Agent: |

Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”), an affiliate of BofA Finance. | |

TS-2 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

■ | Product supplement STOCK-OL-1 dated January 24, 2017: http://www.sec.gov/Archives/edgar/data/70858/000119312517016284/d523982d424b5.htm |

■ | Series A MTN prospectus supplement dated November 4, 2016 and prospectus dated November 4, 2016: http://www.sec.gov/Archives/edgar/data/70858/000119312516760144/d266649d424b3.htm |

You may wish to consider an investment in the notes if: | The notes may not be an appropriate investment for you if: |

■ You anticipate that the Ending Value will be equal to or greater than the Starting Value. ■ You accept that the return on the notes will be limited to the return represented by the Conditional Payment. ■ You accept that your investment will result in a loss, which could be significant, if the Ending Value is below the Starting Value. ■ You are willing to forgo the interest payments that are paid on conventional interest bearing debt securities. ■ You are willing to forgo dividends or other benefits of owning shares of the Basket Stocks. ■ You are willing to accept a limited or no market for sales prior to maturity, and understand that the market prices for the notes, if any, will be affected by various factors, including our and BAC’s actual and perceived creditworthiness, BAC’s internal funding rate and fees and charges on the notes. ■ You are willing to assume our credit risk, as issuer of the notes, and BAC’s credit risk, as guarantor of the notes, for all payments under the notes, including the Redemption Amount. | ■ You believe that the value of the Basket will decrease from the Starting Value to the Ending Value. ■ You seek an uncapped return on your investment. ■ You seek principal repayment or preservation of capital. ■ You seek interest payments or other current income on your investment. ■ You want to receive dividends or other distributions paid on the Basket Stocks. You seek an investment for which there will be a liquid secondary market. ■ You are unwilling or are unable to take market risk on the notes, to take our credit risk as issuer of the notes or to take BAC’s credit risk, as guarantor of the notes. |

TS-3 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

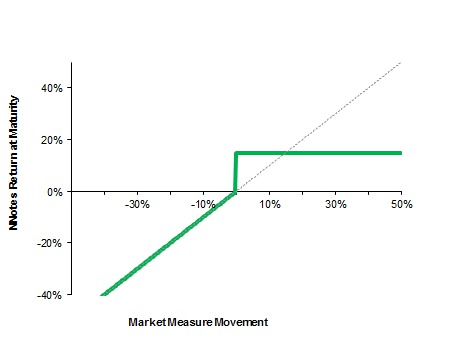

| This graph reflects the returns on the notes based on a Conditional Payment of $1.70 per unit (the midpoint of the Conditional Payment range of [$1.50 to $1.90]). The green line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct investment in the Basket Stocks, excluding dividends. This graph has been prepared for purposes of illustration only. |

| Ending Value | Percentage Change from the Starting Value to the Ending Value | Redemption Amount per Unit |

Total Rate of

Return on the Notes |

| 50.00 | -50.00% | $5.00 | -50.00% |

| 60.00 | -40.00% | $6.00 | -40.00% |

| 70.00 | -30.00% | $7.00 | -30.00% |

| 80.00 | -20.00% | $8.00 | -20.00% |

| 90.00 | -10.00% | $9.00 | -10.00% |

| 95.00 | -5.00% | $9.50 | -5.00% |

| 98.00 | -2.00% | $9.80 | -2.00% |

| 100.00(1) | 0.00% | $11.70(2) | 17.00% |

| 102.00 | 2.00% | $11.70 | 17.00% |

| 105.00 | 5.00% | $11.70 | 17.00% |

| 110.00 | 10.00% | $11.70 | 17.00% |

| 120.00 | 20.00% | $11.70 | 17.00% |

| 130.00 | 30.00% | $11.70 | 17.00% |

| 140.00 | 40.00% | $11.70 | 17.00% |

| 150.00 | 50.00% | $11.70 | 17.00% |

(1) | The Starting Value and the Threshold Value will be set to 100.00 on the pricing date. |

(2) | The Redemption Amount per unit cannot exceed the sum of the principal amount and the hypothetical Conditional Payment. |

TS-4 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

Example 1 | ||

The Ending Value is 80.00, or 80.00% of the Starting Value: | ||

Starting Value: 100.00 | ||

Ending Value: 80.00 | ||

|

= $8.00 Redemption Amount per unit | |

Example 2 | ||

The Ending Value is 105.00, or 105.00% of the Starting Value: | ||

Starting Value: 100.00 | ||

Ending Value: 105.00 | ||

$10 + $1.70 | = $11.70 Redemption Amount per unit | |

Example 3 | ||

The Ending Value is 130.00, or 130.00% of the Starting Value: | ||

Starting Value: 100.00 | ||

Ending Value: 130.00 | ||

$10 + $1.70 |

= $11.70 Redemption Amount per unit | |

TS-5 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

■ | Depending on the performance of the Basket as measured shortly before the maturity date, your investment may result in a loss; there is no guaranteed return of principal. |

■ | Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of comparable maturity. |

■ | Your investment return is limited to the return represented by the Conditional Payment and may be less than a comparable investment in the Basket Stocks. |

■ | Payments on the notes are subject to our credit risk, and the credit risk of BAC, and actual or perceived changes in our or BAC’s creditworthiness are expected to affect the value of the notes. If we and BAC become insolvent or are unable to pay our respective obligations, you may lose your entire investment. |

■ | We are a finance subsidiary and, as such, will have limited assets and operations. |

■ | BAC’s obligations under its guarantee of the notes will be structurally subordinated to liabilities of its subsidiaries |

■ | The notes issued by us will not have the benefit of any cross-default or cross-acceleration with other indebtedness of BofA Finance or BAC: events of bankruptcy or insolvency or resolution proceedings relating to BAC and covenant breach by BAC will not constitute an event of default with respect to the notes. |

■ | The initial estimated value of the notes considers certain assumptions and variables and relies in part on certain forecasts about future events, which may prove to be incorrect. The initial estimated value of the notes is an estimate only, determined as of a particular point in time by reference to our and our affiliates’ pricing models. These pricing models consider certain assumptions and variables, including our credit spreads and those of BAC, BAC’s internal funding rate on the pricing date, mid-market terms on hedging transactions, expectations on interest rates and volatility, price-sensitivity analysis, and the expected term of the notes. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. |

■ | The public offering price you pay for the notes will exceed the initial estimated value. If you attempt to sell the notes prior to maturity, their market value may be lower than the price you paid for them and lower than the initial estimated value. This is due to, among other things, changes in the value of the Basket, BAC’s internal funding rate, and the inclusion in the public offering price of the underwriting discount and the hedging related charge, all as further described in “Structuring the Notes” on page TS-17. These factors, together with various credit, market and economic factors over the term of the notes, are expected to reduce the price at which you may be able to sell the notes in any secondary market and will affect the value of the notes in complex and unpredictable ways. |

■ | The initial estimated value does not represent a minimum or maximum price at which we, BAC, MLPF&S or any of our other affiliates would be willing to purchase your notes in any secondary market (if any exists) at any time. The value of your notes at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Basket, our and BAC’s creditworthiness and changes in market conditions. |

■ | A trading market is not expected to develop for the notes. None of us, BAC or MLPF&S is obligated to make a market for, or to repurchase, the notes. There is no assurance that any party will be willing to purchase your notes at any price in any secondary market. |

■ | BAC and its affiliates’ hedging and trading activities (including trades in shares of the Basket Stocks) and any hedging and trading activities BAC or its affiliates engage in that are not for your account or on your behalf, may affect the market value and return of the notes and may create conflicts of interest with you. |

■ | The Underlying Companies will have no obligations relating to the notes, and neither we nor MLPF&S will perform any due diligence procedures with respect to any Underlying Company in connection with this offering. |

■ | Changes in the price of one of the Basket Stocks may be offset by changes in the prices of the other Basket Stocks. |

■ | You will have no rights of a holder of the Basket Stocks, and you will not be entitled to receive shares of the Basket Stocks or dividends or other distributions by the Underlying Companies. |

■ | While BAC and our affiliates may from time to time own securities of the Underlying Companies, we, BAC and our other affiliates do not control any Underlying Company, and have not verified any disclosures made by any Underlying Company. |

■ | The payment on the notes will not be adjusted for all corporate events that could affect a Basket Stock. See “Description of the Notes—Anti-Dilution Adjustments” beginning on page PS-20 of product supplement STOCK-OL-1. |

TS-6 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

■ | There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours. We have the right to appoint and remove the calculation agent. |

■ | The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a holder of the notes. See “Summary Tax Consequences” below and “U.S. Federal Income Tax Summary” beginning on page PS-30 of product supplement STOCK-OL-1. |

TS-7 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

Basket Stock | Bloomberg Symbol | Initial Component Weight | Closing Market Price(1)(2) | Hypothetical Component Ratio(1)(3) | Initial Basket Value Contribution | |||||

Amazon.com, Inc. | AMZN | 20.00% | 807.48 | 0.02476842 | 20.00 | |||||

Steel Dynamics, Inc. | STLD | 20.00% | 37.27 | 0.53662463 | 20.00 | |||||

General Dynamics Corporation | GD | 20.00% | 175.99 | 0.11364282 | 20.00 | |||||

JPMorgan Chase & Co. | JPM | 20.00% | 83.94 | 0.23826543 | 20.00 | |||||

Frontier Communications Corporation | FTR | 20.00% | 3.54 | 5.64971751 | 20.00 | |||||

Starting Value | 100.00 |

(1) | The actual Closing Market Price of each Basket Stock and the resulting actual Component Ratios will be determined on the pricing date and will be set forth in the final term sheet that will be made available in connection with sales of the notes. |

(2) | These were the Closing Market Prices of the Basket Stocks on January 18, 2017. |

(3) | Each hypothetical Component Ratio equals the Initial Component Weight of the relevant Basket Stock (as a percentage) multiplied by 100, and then divided by the Closing Market Price of that Basket Stock on January 18, 2017 and rounded to eight decimal places. |

TS-8 |

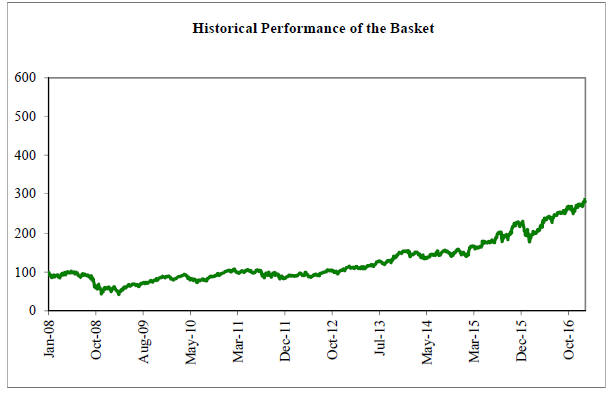

Notes Linked to a Basket of Stocks, due February , 2018 |  |

TS-9 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

TS-10 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

High ($) | Low ($) | |

2008 | ||

First Quarter | 96.25 | 62.43 |

Second Quarter | 84.51 | 71.99 |

Third Quarter | 88.09 | 63.35 |

Fourth Quarter | 69.58 | 35.03 |

2009 | ||

First Quarter | 75.58 | 48.44 |

Second Quarter | 87.56 | 73.50 |

Third Quarter | 93.85 | 75.63 |

Fourth Quarter | 142.25 | 88.67 |

2010 | ||

First Quarter | 136.55 | 116.00 |

Second Quarter | 150.09 | 108.61 |

Third Quarter | 160.73 | 109.14 |

Fourth Quarter | 184.76 | 153.03 |

2011 | ||

First Quarter | 191.25 | 160.97 |

Second Quarter | 206.07 | 178.34 |

Third Quarter | 241.69 | 177.79 |

Fourth Quarter | 246.71 | 173.10 |

2012 | ||

First Quarter | 205.44 | 175.93 |

Second Quarter | 231.90 | 185.50 |

Third Quarter | 261.68 | 215.36 |

Fourth Quarter | 261.50 | 220.64 |

2013 | ||

First Quarter | 283.99 | 253.39 |

Second Quarter | 281.76 | 248.23 |

Third Quarter | 318.12 | 280.93 |

Fourth Quarter | 404.39 | 298.23 |

2014 | ||

First Quarter | 407.05 | 336.52 |

Second Quarter | 342.99 | 288.32 |

Third Quarter | 360.84 | 307.06 |

Fourth Quarter | 338.64 | 287.06 |

2015 | ||

First Quarter | 387.83 | 286.95 |

Second Quarter | 445.99 | 370.26 |

Third Quarter | 548.39 | 429.70 |

Fourth Quarter | 693.97 | 520.72 |

2016 | ||

First Quarter | 636.99 | 482.07 |

Second Quarter | 728.24 | 586.14 |

Third Quarter | 837.31 | 725.68 |

Fourth Quarter | 844.36 | 719.07 |

2017 | ||

First Quarter (through January 18, 2017) | 817.14 | 753.67 |

TS-11 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

High ($) | Low ($) | |

2008 | ||

First Quarter | 35.27 | 23.02 |

Second Quarter | 40.67 | 33.90 |

Third Quarter | 38.09 | 16.06 |

Fourth Quarter | 15.92 | 5.23 |

2009 | ||

First Quarter | 13.79 | 6.90 |

Second Quarter | 16.26 | 8.98 |

Third Quarter | 17.88 | 12.94 |

Fourth Quarter | 18.39 | 13.39 |

2010 | ||

First Quarter | 20.19 | 14.75 |

Second Quarter | 18.66 | 13.19 |

Third Quarter | 15.14 | 13.03 |

Fourth Quarter | 18.43 | 14.05 |

2011 | ||

First Quarter | 20.46 | 17.67 |

Second Quarter | 19.60 | 15.07 |

Third Quarter | 16.55 | 9.92 |

Fourth Quarter | 13.69 | 9.35 |

2012 | ||

First Quarter | 16.48 | 14.03 |

Second Quarter | 14.86 | 10.41 |

Third Quarter | 13.45 | 11.23 |

Fourth Quarter | 14.15 | 11.24 |

2013 | ||

First Quarter | 16.09 | 14.25 |

Second Quarter | 16.04 | 14.19 |

Third Quarter | 17.40 | 15.09 |

Fourth Quarter | 19.70 | 16.38 |

2014 | ||

First Quarter | 19.22 | 15.83 |

Second Quarter | 18.90 | 17.18 |

Third Quarter | 24.95 | 17.86 |

Fourth Quarter | 23.47 | 19.16 |

2015 | ||

First Quarter | 20.40 | 16.93 |

Second Quarter | 22.49 | 19.78 |

Third Quarter | 21.67 | 16.69 |

Fourth Quarter | 19.37 | 16.56 |

2016 | ||

First Quarter | 22.83 | 15.86 |

Second Quarter | 26.68 | 22.37 |

Third Quarter | 27.98 | 23.24 |

Fourth Quarter | 39.03 | 23.72 |

2017 | ||

First Quarter (through January 18, 2017) | 37.99 | 35.61 |

TS-12 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

High ($) | Low ($) | |

2008 | ||

First Quarter | 88.93 | 78.85 |

Second Quarter | 94.60 | 82.90 |

Third Quarter | 94.25 | 71.40 |

Fourth Quarter | 72.00 | 48.54 |

2009 | ||

First Quarter | 61.23 | 36.31 |

Second Quarter | 60.46 | 42.19 |

Third Quarter | 64.61 | 51.54 |

Fourth Quarter | 70.66 | 62.55 |

2010 | ||

First Quarter | 78.48 | 66.35 |

Second Quarter | 78.67 | 58.56 |

Third Quarter | 64.32 | 55.87 |

Fourth Quarter | 71.10 | 61.75 |

2011 | ||

First Quarter | 78.11 | 69.97 |

Second Quarter | 77.42 | 69.37 |

Third Quarter | 75.81 | 55.87 |

Fourth Quarter | 66.92 | 55.67 |

2012 | ||

First Quarter | 73.91 | 67.40 |

Second Quarter | 74.09 | 61.96 |

Third Quarter | 67.20 | 61.99 |

Fourth Quarter | 70.40 | 62.13 |

2013 | ||

First Quarter | 71.86 | 64.57 |

Second Quarter | 79.12 | 65.99 |

Third Quarter | 89.65 | 78.07 |

Fourth Quarter | 95.55 | 84.28 |

2014 | ||

First Quarter | 112.66 | 94.46 |

Second Quarter | 120.89 | 104.99 |

Third Quarter | 129.45 | 114.39 |

Fourth Quarter | 145.36 | 117.85 |

2015 | ||

First Quarter | 142.24 | 132.19 |

Second Quarter | 145.99 | 131.27 |

Third Quarter | 153.28 | 135.11 |

Fourth Quarter | 150.78 | 136.71 |

2016 | ||

First Quarter | 138.24 | 124.18 |

Second Quarter | 145.71 | 130.84 |

Third Quarter | 156.01 | 138.41 |

Fourth Quarter | 178.67 | 149.60 |

2017 | ||

First Quarter (through January 18, 2017) | 177.89 | 175.45 |

TS-13 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

High ($) | Low ($) | |

2008 | ||

First Quarter | 48.25 | 36.48 |

Second Quarter | 49.25 | 34.31 |

Third Quarter | 48.24 | 31.02 |

Fourth Quarter | 49.85 | 22.72 |

2009 | ||

First Quarter | 31.35 | 15.90 |

Second Quarter | 38.94 | 27.25 |

Third Quarter | 46.47 | 32.27 |

Fourth Quarter | 47.16 | 40.27 |

2010 | ||

First Quarter | 45.02 | 37.70 |

Second Quarter | 47.81 | 36.61 |

Third Quarter | 41.64 | 35.63 |

Fourth Quarter | 42.67 | 36.96 |

2011 | ||

First Quarter | 48.00 | 43.40 |

Second Quarter | 47.64 | 39.49 |

Third Quarter | 42.29 | 29.27 |

Fourth Quarter | 37.02 | 28.38 |

2012 | ||

First Quarter | 46.27 | 34.91 |

Second Quarter | 46.13 | 31.00 |

Third Quarter | 41.57 | 33.90 |

Fourth Quarter | 44.53 | 39.29 |

2013 | ||

First Quarter | 51.00 | 44.57 |

Second Quarter | 55.62 | 46.64 |

Third Quarter | 56.67 | 50.32 |

Fourth Quarter | 58.48 | 50.75 |

2014 | ||

First Quarter | 61.07 | 54.31 |

Second Quarter | 60.67 | 53.31 |

Third Quarter | 61.63 | 55.56 |

Fourth Quarter | 63.15 | 55.08 |

2015 | ||

First Quarter | 62.49 | 54.38 |

Second Quarter | 69.75 | 59.95 |

Third Quarter | 70.08 | 59.84 |

Fourth Quarter | 68.46 | 59.99 |

2016 | ||

First Quarter | 63.73 | 53.07 |

Second Quarter | 65.81 | 57.32 |

Third Quarter | 67.50 | 59.55 |

Fourth Quarter | 87.13 | 66.51 |

2017 | ||

First Quarter (through January 18, 2017) | 87.23 | 83.55 |

TS-14 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

High ($) | Low ($) | |

2008 | ||

First Quarter | 12.84 | 9.75 |

Second Quarter | 11.96 | 10.01 |

Third Quarter | 12.94 | 11.14 |

Fourth Quarter | 11.80 | 6.35 |

2009 | ||

First Quarter | 8.87 | 5.32 |

Second Quarter | 8.16 | 6.62 |

Third Quarter | 7.60 | 6.43 |

Fourth Quarter | 8.57 | 7.12 |

2010 | ||

First Quarter | 8.02 | 7.23 |

Second Quarter | 8.38 | 7.07 |

Third Quarter | 8.30 | 6.96 |

Fourth Quarter | 9.78 | 8.16 |

2011 | ||

First Quarter | 9.84 | 7.68 |

Second Quarter | 8.97 | 7.71 |

Third Quarter | 8.23 | 6.09 |

Fourth Quarter | 6.40 | 4.79 |

2012 | ||

First Quarter | 5.37 | 3.81 |

Second Quarter | 4.44 | 3.06 |

Third Quarter | 5.15 | 3.59 |

Fourth Quarter | 4.98 | 4.09 |

2013 | ||

First Quarter | 4.68 | 3.71 |

Second Quarter | 4.43 | 3.80 |

Third Quarter | 4.76 | 3.91 |

Fourth Quarter | 5.02 | 4.16 |

2014 | ||

First Quarter | 5.74 | 4.40 |

Second Quarter | 6.10 | 5.41 |

Third Quarter | 7.24 | 5.62 |

Fourth Quarter | 7.15 | 5.62 |

2015 | ||

First Quarter | 8.46 | 6.36 |

Second Quarter | 7.50 | 4.86 |

Third Quarter | 5.64 | 4.19 |

Fourth Quarter | 5.47 | 4.44 |

2016 | ||

First Quarter | 5.85 | 3.81 |

Second Quarter | 5.75 | 4.57 |

Third Quarter | 5.22 | 4.07 |

Fourth Quarter | 4.36 | 3.10 |

2017 | ||

First Quarter (through January 18, 2017) | 3.82 | 3.39 |

TS-15 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

● | the investor’s spouse (including a domestic partner), siblings, parents, grandparents, spouse’s parents, children and grandchildren, but excluding accounts held by aunts, uncles, cousins, nieces, nephews or any other family relationship not directly above or below the individual investor; |

● | a family investment vehicle, including foundations, limited partnerships and personal holding companies, but only if the beneficial owners of the vehicle consist solely of the investor or members of the investor’s household as described above; and |

● | a trust where the grantors and/or beneficiaries of the trust consist solely of the investor or members of the investor’s household as described above; provided that, purchases of the notes by a trust generally cannot be aggregated together with any purchases made by a trustee’s personal account. |

TS-16 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

TS-17 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

■ | There is no statutory, judicial, or administrative authority directly addressing the characterization of the notes. |

■ | You agree with us (in the absence of an administrative determination, or judicial ruling to the contrary) to characterize and treat the notes for all tax purposes as a single financial contract with respect to the Basket. |

■ | Under this characterization and tax treatment of the notes, a U.S. Holder (as defined beginning on page 50 of the prospectus) generally will recognize capital gain or loss upon maturity or upon a sale, exchange, or redemption of the notes prior to maturity. This capital gain or loss generally will be long-term capital gain or loss if you held the notes for more than one year. |

■ | No assurance can be given that the IRS or any court will agree with this characterization and tax treatment. |

■ | The IRS has issued guidance that states that the U.S. Treasury Department and the IRS intend to amend the effective dates of the U.S. Treasury regulations to provide that withholding on “dividend equivalent” payments (as discussed in the product supplement), if any, will not apply to specified ELIs that are not delta-one instruments and that are issued before January 1, 2018. |

TS-18 |

Notes Linked to a Basket of Stocks, due February , 2018 |  |

TS-19 |