This amended and restated pricing supplement amends and restates in full the preliminary pricing supplement dated December 19, 2023 for CUSIP No. 09710PFK7.

This pricing supplement, which is not complete and may be changed, relates to an effective Registration Statement under the Securities Act of 1933. This pricing supplement and the accompanying product supplement, prospectus supplement and prospectus are not an offer to sell these notes in any country or jurisdiction where such an offer would not be permitted.

Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

| ● | Approximate 5 year term if not called prior to maturity. |

| ● | Payments on the Notes will depend on the individual performance of the common stock of Advanced Micro Devices, Inc., the common stock of Amazon.com, Inc. and the common stock of NVIDIA Corporation (each an “Underlying Stock”). |

| ● | Contingent coupons payable monthly if the Observation Value of the Least Performing Underlying Stock on the applicable Observation Date is greater than or equal to 80% of its Starting Value. The coupon per $1,000 in principal amount of Notes payable on the related Contingent Payment Date, if applicable, will equal (i) the product of $6.25 times the number of Contingent Payment Dates that have occurred up to the relevant Contingent Payment Date (inclusive of the relevant Contingent Payment Date) minus (ii) the sum of all Contingent Coupon Payments previously paid. |

| ● | Beginning in December 2024, automatically callable quarterly for an amount equal to the principal amount plus the relevant Contingent Coupon Payment if the Observation Value of the Least Performing Underlying Stock is greater than or equal to 100% of its Starting Value on the relevant Observation Date occurring quarterly. |

| ● | Assuming the Notes are not called prior to maturity, at maturity you will receive the principal amount. At maturity you will also receive the final Contingent Coupon Payment if the Observation Value of the Least Performing Underlying Stock on the final Observation Date is greater than or equal to 80% of its Starting Value. |

| ● | All payments on the Notes are subject to the credit risk of BofA Finance LLC (“BofA Finance”), as issuer of the Notes, and Bank of America Corporation (“BAC” or the “Guarantor”), as guarantor of the Notes. |

| ● | The Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation, due December 26, 2028 (the “Notes”) are expected to price on December 20, 2023 and expected to issue on December 26, 2023. |

| ● | The Notes will not be listed on any securities exchange. |

| ● | CUSIP No. 09710PFK7. |

The initial estimated value of the Notes as of the pricing date is expected to be between $929.30 and $979.30 per $1,000 in principal amount of Notes, which is less than the public offering price listed below. The actual value of your Notes at any time will reflect many factors and cannot be predicted with accuracy. See “Risk Factors” beginning on page PS-9 of this pricing supplement and “Structuring the Notes” on page PS-17 of this pricing supplement for additional information.

There are important differences between the Notes and a conventional debt security. Potential purchasers of the Notes should consider the information in “Risk Factors” beginning on page PS-9 of this pricing supplement, page PS-5 of the accompanying product supplement, page S-6 of the accompanying prospectus supplement, and page 7 of the accompanying prospectus.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Public offering price(1) | Underwriting discount(1)(2) | Proceeds, before expenses, to BofA Finance(2) | |

| Per Note | $1,000.00 | $3.50 | $996.50 |

| Total |

| (1) | Certain dealers who purchase the Notes for sale to certain fee-based advisory accounts may forgo some or all of their selling concessions, fees or commissions. The public offering price for investors purchasing the Notes in these fee-based advisory accounts may be as low as $996.50 per $1,000 in principal amount of Notes. |

| (2) |

The underwriting discount per $1,000 in principal amount of Notes may be as high as $3.50, resulting in proceeds, before expenses, to BofA Finance of as low as $996.50 per $1,000 in principal amount of Notes. |

The Notes and the related guarantee:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

|

| Selling Agent |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

Terms of the Notes

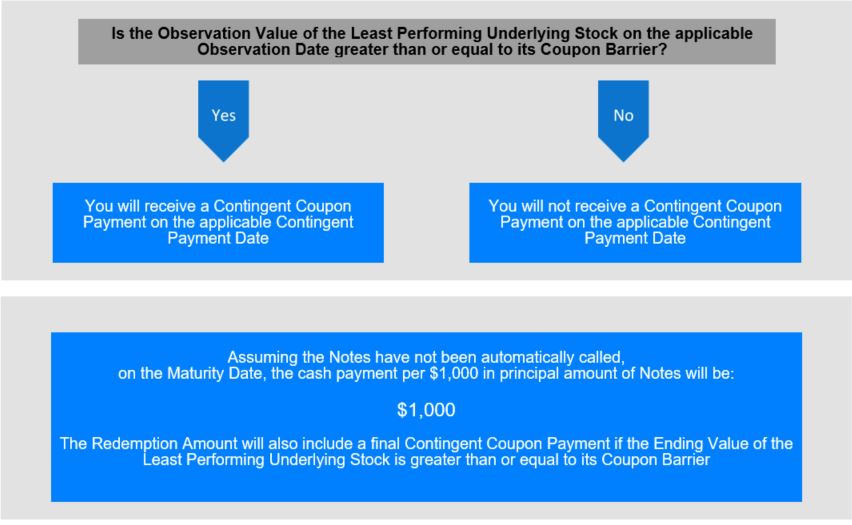

The Notes provide a monthly Contingent Coupon Payment on the applicable Contingent Payment Date if, on any monthly Observation Date, the Observation Value of the Least Performing Underlying Stock is greater than or equal to its Coupon Barrier. The coupon per $1,000 in principal amount of Notes payable on the related Contingent Payment Date, if applicable, will equal (i) the product of $6.25 times the number of Contingent Payment Dates that have occurred up to the relevant Contingent Payment Date (inclusive of the relevant Contingent Payment Date) minus (ii) the sum of all Contingent Coupon Payments previously paid.

Beginning in December 2024, if the Observation Value of the Least Performing Underlying Stock is greater than or equal to its Call Value on any of the Observation Dates occurring quarterly indicated by the second footnote appearing below the table beginning on page PS-4, the Notes will be automatically called, in whole but not in part, at 100% of the principal amount, together with the relevant Contingent Coupon Payment. No further amounts will be payable following an Automatic Call. If the Notes are not automatically called, at maturity you will receive the principal amount. At maturity you will also receive the final Contingent Coupon Payment if the Observation Value of the Least Performing Underlying Stock on the final Observation Date is greater than or equal to its Coupon Barrier. It is possible that the Notes will not pay any Contingent Coupon Payments and it is possible that you may not earn a return on your investment in the Notes. Any payments on the Notes will be calculated based on $1,000 in principal amount of Notes and will depend on the performance of the Underlying Stocks, subject to our and BAC’s credit risk.

| Issuer: | BofA Finance |

| Guarantor: | BAC |

| Denominations: | The Notes will be issued in minimum denominations of $1,000 and whole multiples of $1,000 in excess thereof. |

| Term: | Approximately 5 years, unless previously automatically called. |

| Underlying Stocks: | The common stock of Advanced Micro Devices, Inc. (Nasdaq Global Select Market symbol: “AMD”), the common stock of Amazon.com, Inc. (Nasdaq Global Select Market symbol: “AMZN”) and the common stock of NVIDIA Corporation (Nasdaq Global Select Market symbol: “NVDA”). |

| Pricing Date*: | December 20, 2023 |

| Issue Date*: | December 26, 2023 |

| Valuation Date*: | December 20, 2028, subject to postponement as described under “Description of the Notes—Certain Terms of the Notes—Events Relating to Observation Dates” in the accompanying product supplement. |

| Maturity Date*: | December 26, 2028 |

| Starting Value: | With respect to each Underlying Stock, its Closing Market Price on the pricing date. |

| Observation Value: | With respect to each Underlying Stock, its Closing Market Price on the applicable Observation Date multiplied by its Price Multiplier. |

| Ending Value: | With respect to each Underlying Stock, its Observation Value on the Valuation Date. |

| Call Value: | With respect to each Underlying Stock, 100% of its Starting Value. |

| Price Multiplier: | With respect to each Underlying Stock, 1, subject to adjustment for certain corporate events relating to that Underlying Stock as described in “Description of the Notes — Anti-Dilution Adjustments” beginning on page PS-23 of the accompanying product supplement. |

| Coupon Barrier: | With respect to each Underlying Stock, 80% of its Starting Value. |

|

Contingent Coupon Payment: |

If, on any monthly Observation Date, the Observation Value of the Least Performing Underlying Stock is greater than or equal to its Coupon Barrier, we will pay a Contingent Coupon Payment per $1,000 in principal amount of Notes on the applicable Contingent Payment Date (including the Maturity Date) equal to (i) the product of $6.25 times the number of Contingent Payment Dates that have occurred up to the relevant Contingent Payment Date (inclusive of the relevant Contingent Payment Date) minus (ii) the sum of all Contingent Coupon Payments previously paid. |

| Automatic Call: | Beginning in December 2024, all (but not less than all) of the Notes will be automatically called if the Observation Value of the Least Performing Underlying Stock is greater than or equal to its Call Value on any of the Observation |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-2 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

| Dates occurring quarterly indicated by the second footnote appearing below the table beginning on page PS-4. If the Notes are automatically called, the Early Redemption Amount will be paid on the applicable Contingent Payment Date. No further amounts will be payable following an Automatic Call. | |

|

Early Redemption Amount: |

For each $1,000 in principal amount of Notes, $1,000 plus the applicable Contingent Coupon Payment. |

| Redemption Amount: | If the Notes have not been automatically called prior to maturity, the Redemption Amount per $1,000 in principal amount of Notes will be: |

| $1,000 | |

| The Redemption Amount will also include the final Contingent Coupon Payment if the Ending Value of the Least Performing Underlying Stock is greater than or equal to its Coupon Barrier. |

| Observation Dates*: | As set forth beginning on page PS-4. |

|

Contingent Payment Dates*: |

As set forth beginning on page PS-4. |

| Calculation Agent: | BofA Securities, Inc. (“BofAS”), an affiliate of BofA Finance. |

| Selling Agent: | BofAS |

| CUSIP: | 09710PFK7 |

| Underlying Stock Return: |

With respect to each Underlying Stock on any Observation Date, (Observation Value – Starting Value) Starting Value

With respect to each Underlying Stock on the Valuation Date, (Ending Value – Starting Value) Starting Value |

| Least Performing Underlying Stock: | For any Observation Date or the Valuation Date, as applicable, the Underlying Stock with the lowest Underlying Stock Return. |

| Events of Default and Acceleration: | If an Event of Default, as defined in the senior indenture relating to the Notes and in the section entitled “Description of Debt Securities of BofA Finance LLC—Events of Default and Rights of Acceleration; Covenant Breaches” on page 54 of the accompanying prospectus, with respect to the Notes occurs and is continuing, the amount payable to a holder of the Notes upon any acceleration permitted under the senior indenture will be equal to the amount described under the caption “Redemption Amount” above, calculated as though the date of acceleration were the Maturity Date of the Notes and as though the Valuation Date were the third trading day prior to the date of acceleration. We will also determine whether the final Contingent Coupon Payment is payable based upon the prices of the Underlying Stocks on the deemed Valuation Date; any such final Contingent Coupon Payment will be prorated by the calculation agent to reflect the length of the final contingent payment period. In case of a default in the payment of the Notes, whether at their maturity or upon acceleration, the Notes will not bear a default interest rate. |

*Subject to change.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-3 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

Observation Dates and Contingent Payment Dates

| Observation Dates* | Contingent Payment Dates | |||

| January 22, 2024 | January 25, 2024 | |||

| February 20, 2024 | February 23, 2024 | |||

| March 20, 2024 | March 25, 2024 | |||

| April 22, 2024 | April 25, 2024 | |||

| May 20, 2024 | May 23, 2024 | |||

| June 20, 2024 | June 25, 2024 | |||

| July 22, 2024 | July 25, 2024 | |||

| August 20, 2024 | August 23, 2024 | |||

| September 20, 2024 | September 25, 2024 | |||

| October 21, 2024 | October 24, 2024 | |||

| November 20, 2024 | November 25, 2024 | |||

| December 20, 2024** | December 26, 2024 | |||

| January 21, 2025 | January 24, 2025 | |||

| February 20, 2025 | February 25, 2025 | |||

| March 20, 2025** | March 25, 2025 | |||

| April 21, 2025 | April 24, 2025 | |||

| May 20, 2025 | May 23, 2025 | |||

| June 20, 2025** | June 25, 2025 | |||

| July 21, 2025 | July 24, 2025 | |||

| August 20, 2025 | August 25, 2025 | |||

| September 22, 2025** | September 25, 2025 | |||

| October 20, 2025 | October 23, 2025 | |||

| November 20, 2025 | November 25, 2025 | |||

| December 22, 2025** | December 26, 2025 | |||

| January 20, 2026 | January 23, 2026 | |||

| February 20, 2026 | February 25, 2026 | |||

| March 20, 2026** | March 25, 2026 | |||

| April 20, 2026 | April 23, 2026 | |||

| May 20, 2026 | May 26, 2026 | |||

| June 22, 2026** | June 25, 2026 | |||

| July 20, 2026 | July 23, 2026 | |||

| August 20, 2026 | August 25, 2026 | |||

| September 21, 2026** | September 24, 2026 | |||

| October 20, 2026 | October 23, 2026 | |||

| November 20, 2026 | November 25, 2026 | |||

| December 21, 2026** | December 24, 2026 | |||

| January 20, 2027 | January 25, 2027 | |||

| February 22, 2027 | February 25, 2027 | |||

| March 22, 2027** | March 25, 2027 | |||

| April 20, 2027 | April 23, 2027 |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-4 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

| Observation Dates* | Contingent Payment Dates | |||

| May 20, 2027 | May 25, 2027 | |||

| June 21, 2027** | June 24, 2027 | |||

| July 20, 2027 | July 23, 2027 | |||

| August 20, 2027 | August 25, 2027 | |||

| September 20, 2027** | September 23, 2027 | |||

| October 20, 2027 | October 25, 2027 | |||

| November 22, 2027 | November 26, 2027 | |||

| December 20, 2027** | December 23, 2027 | |||

| January 20, 2028 | January 25, 2028 | |||

| February 22, 2028 | February 25, 2028 | |||

| March 20, 2028** | March 23, 2028 | |||

| April 20, 2028 | April 25, 2028 | |||

| May 22, 2028 | May 25, 2028 | |||

| June 20, 2028** | June 23, 2028 | |||

| July 20, 2028 | July 25, 2028 | |||

| August 21, 2028 | August 24, 2028 | |||

| September 20, 2028** | September 25, 2028 | |||

| October 20, 2028 | October 25, 2028 | |||

| November 20, 2028 | November 24, 2028 | |||

| December 20, 2028 (the “Valuation Date”) | December 26, 2028 (the “Maturity Date”) |

* The Observation Dates are subject to postponement as set forth in “Description of the Notes—Certain Terms of the Notes—Events Relating to Observation Dates” on page PS-21 of the accompanying product supplement.

** The Notes will be automatically called if, on such Observation Date, the Observation Value of the Least Performing Underlying Stock is greater than or equal to its Call Value. If the Notes are automatically called, the Early Redemption Amount will be paid on the applicable Contingent Payment Date. No further amounts will be payable following an Automatic Call.

Any payments on the Notes depend on the credit risk of BofA Finance, as Issuer, and BAC, as Guarantor, and on the performance of the Underlying Stocks. The economic terms of the Notes are based on BAC’s internal funding rate, which is the rate it would pay to borrow funds through the issuance of market-linked notes, and the economic terms of certain related hedging arrangements BAC’s affiliates enter into. BAC’s internal funding rate is typically lower than the rate it would pay when it issues conventional fixed or floating rate debt securities. This difference in funding rate, as well as the underwriting discount, if any, and the hedging related charges described below (see “Risk Factors” beginning on page PS-9), will reduce the economic terms of the Notes to you and the initial estimated value of the Notes. Due to these factors, the public offering price you pay to purchase the Notes will be greater than the initial estimated value of the Notes as of the pricing date.

The initial estimated value range of the Notes is set forth on the cover page of this pricing supplement. The final pricing supplement will set forth the initial estimated value of the Notes as of the pricing date. For more information about the initial estimated value and the structuring of the Notes, see “Risk Factors” beginning on page PS-9 and “Structuring the Notes” on page PS-17.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-5 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

Contingent Coupon Payment and Redemption Amount Determination

On each Contingent Payment Date, you may receive a

Contingent Coupon Payment per $1,000 in principal amount of Notes determined as follows:

All payments described above are subject to the credit risk of BofA Finance, as issuer, and BAC, as guarantor.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-6 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

Total Contingent Coupon Payment Examples

The examples below illustrate the hypothetical total Contingent Coupon Payments per $1,000 in principal amount of Notes over the term of the Notes, based on the Contingent Coupon Payment per $1,000 in principal amount of Notes equal to (i) the product of $6.25 times the number of Contingent Payment Dates that have occurred up to the relevant Contingent Payment Date (inclusive of the relevant Contingent Payment Date) minus (ii) the sum of all Contingent Coupon Payments previously paid, depending on how many Contingent Coupon Payments are payable prior to an Automatic Call or maturity. Depending on the performance of the Underlying Stocks, you may not receive any Contingent Coupon Payments during the term of the Notes.

Example 1 – The Observation Value of the Least Performing Underlying Stock on the first through eleventh Observation Dates is below its Coupon Barrier. No Contingent Coupon Payment will be paid on any of the applicable Contingent Payment Dates. The Observation Value of the Least Performing Underlying Stock on the twelfth Observation Date (which is also the first date on which the Notes may be automatically called) is above its Coupon Barrier but below its Call Value. Therefore, a Contingent Coupon Payment will be paid on the applicable Contingent Payment Date, but the Notes will not be automatically called on the Contingent Payment Date. The Contingent Coupon Payment per $1,000 in principal amount of Notes due on the related Contingent Payment Date will be calculated as follows:

(i) the product of $6.25 times the number of Contingent Payment Dates that have occurred up to the relevant Contingent Payment Date

(inclusive of the relevant Contingent Payment Date) minus (ii) the sum of all Contingent Coupon Payments previously paid.

= (i) $6.25 x 12 - (ii) $0.00 = $75.00 per $1,000 in principal amount of Notes.

The Observation Value of the Least Performing Underlying Stock on each of the thirteenth and fourteenth Observation Dates is above its Coupon Barrier, and therefore a Contingent Coupon Payment in the amount of $6.25 is paid on each related Contingent Payment Date. On the fifteenth Observation Date, the Observation Value of the Least Performing Underlying Stock is above its Observation Value and its Call Value. Therefore, the Notes will be automatically called on the fifteenth Contingent Payment Date, and the Contingent Coupon Payment per $1,000 in principal amount of Notes otherwise due on the related Contingent Payment Date will be calculated as follows:

(i) the product of $6.25 times the number of Contingent Payment Dates that have occurred up to the relevant Contingent Payment Date

(inclusive of the relevant Contingent Payment Date) minus (ii) the sum of all Contingent Coupon Payments previously paid.

= (i) $6.25 x 15 - (ii) $87.50 = $6.25 per $1,000 in principal amount of Notes. No further amounts will be payable following an Automatic Call.

Example 2 - The Observation Value of the Least Performing Underlying Stock on the first through eleventh Observation Dates is below its Coupon Barrier. No Contingent Coupon Payment will be paid on any of the applicable Contingent Payment Dates. The Observation Value of the Least Performing Underlying Stock on the twelfth Observation Date (which is also the first date on which the Notes may be automatically called) is below its Coupon Barrier and Call Value. Therefore, the Notes will not be automatically called and no Contingent Coupon Payment is paid on the applicable Contingent Payment Date. The Observation Value of the Least Performing Underlying Stock on each of the thirteenth and fourteenth Observation Dates is below its Coupon Barrier, and therefore no Contingent Coupon Payment will be paid on either of the applicable Contingent Payment Dates. On the fifteenth Observation Date, the Observation Value of the Least Performing Underlying Stock is above its Coupon Barrier and its Call Value. Therefore, the Notes will be automatically called, and the Contingent Coupon Payment per $1,000 in principal amount of Notes otherwise due on the related Contingent Payment Date will be calculated as follows:

(i) the product of $6.25 times the number of Contingent Payment Dates that have occurred up to the relevant Contingent Payment Date

(inclusive of the relevant Contingent Payment Date) minus (ii) the sum of all Contingent Coupon Payments previously paid.

= (i) $6.25 x 15 - (ii) $0.00 = $93.75 per $1,000 in principal amount of Notes. No further amounts will be payable following an Automatic Call.

Example 3 - The Observation Value of the Least Performing Underlying Stock on the first through eleventh Observation Dates is above its Coupon Barrier. A Contingent Coupon Payment in the amount of $6.25 will be paid on each of the applicable Contingent Payment Dates. The Observation Value of the Least Performing Underlying Stock on the twelfth Observation Date (which is also the first date on which the Notes may be automatically called) is above its Coupon Barrier but below its Call Value. Therefore, the Notes will not be automatically called but a Contingent Coupon Payment will be payable on the related Contingent Payment Date, calculated as follows:

(i) the product of $6.25 times the number of Contingent Payment Dates that have occurred up to the relevant Contingent Payment Date (inclusive of the relevant Contingent Payment Date) minus (ii) the sum of all Contingent Coupon Payments previously paid.

= (i) $6.25 x 12 - (ii) $6.25 x 11 = $6.25 per $1,000 in principal amount of Notes.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-7 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

Hypothetical Payout Profile and Examples of Payments at Maturity

Contingent Income Auto-Callable Yield Notes Table

The following table is for purposes of illustration only. It assumes the Notes have not been automatically called prior to maturity and is based on hypothetical values and shows hypothetical returns on the Notes. The table illustrates the calculation of the Redemption Amount and the return on the Notes based on a hypothetical Starting Value of 100 for the Least Performing Underlying Stock, a hypothetical Coupon Barrier of 80 for the Least Performing Underlying Stock, a Contingent Coupon Payment of $6.25 per $1,000 in principal amount of Notes and a range of hypothetical Ending Values of the Least Performing Underlying Stock. The actual amount you receive and the resulting return will depend on the actual Starting Values, Coupon Barriers, Observation Values and Ending Values of the Underlying Stocks, whether the Notes are automatically called prior to maturity, and whether you hold the Notes to maturity. The following examples do not take into account any tax consequences from investing in the Notes. The table below also assumes that a Contingent Coupon Payment was paid on each Contingent Payment Date prior to maturity.

For recent actual values of the Underlying Stocks, see “The Underlying Stocks” section below. The Ending Value of each Underlying Stock will not include any income generated by dividends or other distributions paid with respect to shares of that Underlying Stock. In addition, all payments on the Notes are subject to Issuer and Guarantor credit risk.

|

Ending Value of the Least Performing Underlying Stock

|

Underlying Stock Return of the Least Performing Underlying Stock

|

Redemption Amount per Note (including any final Contingent Coupon Payment)

|

Return on the Notes(1)

|

| 160.00 | 60.00% | $1,006.25(2) | 0.625% |

| 150.00 | 50.00% | $1,006.25 | 0.625% |

| 140.00 | 40.00% | $1,006.25 | 0.625% |

| 130.00 | 30.00% | $1,006.25 | 0.625% |

| 120.00 | 20.00% | $1,006.25 | 0.625% |

| 110.00 | 10.00% | $1,006.25 | 0.625% |

| 105.00 | 5.00% | $1,006.25 | 0.625% |

| 102.00 | 2.00% | $1,006.25 | 0.625% |

| 100.00(3) | 0.00% | $1,006.25 | 0.625% |

| 90.00 | -10.00% | $1,006.25 | 0.625% |

| 80.00(4) | -20.00% | $1,006.25 | 0.625% |

| 79.99 | -20.01% | $1,000.00 | 0.000% |

| 70.00 | -30.00% | $1,000.00 | 0.000% |

| 50.00 | -50.00% | $1,000.00 | 0.000% |

| 0.00 | -100.00% | $1,000.00 | 0.000% |

| (1) | The “Return on the Notes” is calculated based on the Redemption Amount and potential final Contingent Coupon Payment, not including any Contingent Coupon Payments paid prior to maturity, and assumes that the relevant Contingent Coupon Payment has been made on each prior Contingent Payment Date. |

| (2) | This amount represents the sum of the principal amount and a final monthly Contingent Coupon Payment of $6.25 per $1,000 in principal amount of Notes (assuming that each prior monthly Contingent Coupon Payment has been made on the related Contingent Payment Date). |

| (3) | The hypothetical Starting Value of 100 used in the table above has been chosen for illustrative purposes only and does not represent a likely Starting Value of any Underlying Stock. |

| (4) | This is the hypothetical Coupon Barrier of the Least Performing Underlying Stock. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-8 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

Risk Factors

Your investment in the Notes entails significant risks, many of which differ from those of a conventional debt security. Your decision to purchase the Notes should be made only after carefully considering the risks of an investment in the Notes, including those discussed below, with your advisors in light of your particular circumstances. The Notes are not an appropriate investment for you if you are not knowledgeable about significant elements of the Notes or financial matters in general. You should carefully review the more detailed explanation of risks relating to the Notes in the “Risk Factors” sections beginning on page PS-5 of the accompanying product supplement, page S-6 of the accompanying prospectus supplement and page 7 of the accompanying prospectus, each as identified on page PS-22 below.

Structure-related Risks

| ● | Your return on the Notes is limited to the return represented by the Contingent Coupon Payments, if any, over the term of the Notes. Your return on the Notes is limited to the Contingent Coupon Payments paid over the term of the Notes, regardless of the extent to which the Observation Value or Ending Value of any Underlying Stock exceeds its Coupon Barrier or Starting Value, as applicable. Similarly, the amount payable at maturity or upon an Automatic Call will never exceed the sum of the principal amount and the applicable Contingent Coupon Payment, regardless of the extent to which the Observation Value or Ending Value of any Underlying Stock exceeds its Starting Value. In contrast, a direct investment in the Underlying Stocks would allow you to receive the benefit of any appreciation in their prices. Any return on the Notes will not reflect the return you would realize if you actually owned shares of an Underlying Stock and received the dividends paid or distributions made on them. |

| ● | The Notes are subject to a potential Automatic Call, which would limit your ability to receive the Contingent Coupon Payments over the full term of the Notes. The Notes are subject to a potential Automatic Call. Beginning in December 2024, the Notes will be automatically called if, on any of the Observation Dates occurring quarterly indicated by the second footnote appearing below the table beginning on page PS-4, the Observation Value of the Least Performing Underlying Stock is greater than or equal to its Call Value. If the Notes are automatically called prior to the Maturity Date, you will be entitled to receive the principal amount and the Contingent Coupon Payment with respect to the applicable Observation Date and no further amounts will be payable following the Automatic Call. In this case, you will lose the opportunity to continue to receive Contingent Coupon Payments after the date of the Automatic Call. If the Notes are called prior to the Maturity Date, you may be unable to invest in other securities with a similar level of risk that could provide a return that is similar to the Notes. |

| ● | You may not receive any Contingent Coupon Payments. The Notes do not provide for any regular fixed coupon payments. Investors in the Notes will not necessarily receive any Contingent Coupon Payments on the Notes. If the Observation Value of any Underlying Stock is less than its Coupon Barrier on an Observation Date, you will not receive the Contingent Coupon Payment applicable to that Observation Date (unless on a later Observation Date a Contingent Coupon Payment is payable). If the Observation Value of any Underlying Stock is less than its Coupon Barrier on all the Observation Dates during the term of the Notes, you will not receive any Contingent Coupon Payments during the term of the Notes, and will not receive a positive return on the Notes. |

| ● | Your return on the Notes may be less than the yield on a conventional debt security of comparable maturity. Any return that you receive on the Notes may be less than the return you would earn if you purchased a conventional debt security with the same Maturity Date. As a result, your investment in the Notes may not reflect the full opportunity cost to you when you consider factors, such as inflation, that affect the time value of money. In addition, if interest rates increase during the term of the Notes, the Contingent Coupon Payment (if any) may be less than the yield on a conventional debt security of comparable maturity. |

| ● | The Contingent Coupon Payment, Early Redemption Amount or Redemption Amount, as applicable, will not reflect changes in the prices of the Underlying Stocks other than on the Observation Dates. The prices of the Underlying Stocks during the term of the Notes other than on the Observation Dates will not affect payments on the Notes. Notwithstanding the foregoing, investors should generally be aware of the performance of the Underlying Stocks while holding the Notes, as the performance of the Underlying Stocks may influence the market value of the Notes. The calculation agent will determine whether each Contingent Coupon Payment is payable and will calculate the Early Redemption Amount or the Redemption Amount, as applicable, by comparing only the Starting Value or Coupon Barrier, as applicable, to the Observation Value or the Ending Value for the Least Performing Underlying Stock. No other prices of the Underlying Stocks will be taken into account. |

| ● | Because the Notes are linked to the least performing (and not the average performance) of the Underlying Stocks, you may not receive any positive return on the Notes even if the Observation Value of one Underlying Stock is greater than or equal to its Coupon Barrier on all the Observation Dates. Your Notes are linked to the least performing of the Underlying Stocks, and a change in the price of one Underlying Stock may not correlate with changes in the price of the other Underlying Stocks. The Notes are not linked to a basket composed of the Underlying Stocks, where the depreciation in the price of one Underlying Stock could be offset to some extent by the appreciation in the price of the other Underlying Stocks. In the case of the Notes, the individual performance of each Underlying Stock would not be combined, and the depreciation in the price of one Underlying Stock would not be offset by any appreciation in the price of the other Underlying Stocks. Even if the Observation Value of an Underlying Stock is at or above its Coupon Barrier on an Observation Date, you will not receive the Contingent Coupon Payment with respect to that Observation Date if the Observation Value of another Underlying Stock is below its Coupon Barrier on that day. |

| ● | Any payments on the Notes are subject to our credit risk and the credit risk of the Guarantor, and any actual or perceived changes

in our or the Guarantor’s creditworthiness are expected to affect the value of the Notes. The Notes are our senior unsecured

debt securities. Any payment on the Notes will be fully and unconditionally guaranteed by the Guarantor. The Notes are not guaranteed

by any entity other than the Guarantor. As a result, your receipt of the Early Redemption Amount or the Redemption Amount at maturity,

as applicable, will be dependent upon our ability and the ability of the Guarantor to repay our respective obligations under the Notes

on the applicable Contingent Payment Date or the Maturity Date, regardless of the Ending Value of the Least Performing Underlying Stock

as compared to its Starting Value. No assurance can be given as to what our financial condition or the financial condition of the Guarantor

will be at any time after the pricing date of the Notes. If we and the Guarantor become unable to meet our respective financial obligations

as they become due, you may not receive the amount(s) payable under the terms of the Notes. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-9 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

| In addition, our credit ratings and the credit ratings of the Guarantor are assessments by ratings agencies of our respective abilities to pay our obligations. Consequently, our or the Guarantor’s perceived creditworthiness and actual or anticipated decreases in our or the Guarantor’s credit ratings or increases in the spread between the yield on our respective securities and the yield on U.S. Treasury securities (the “credit spread”) prior to the Maturity Date may adversely affect the market value of the Notes. However, because your return on the Notes depends upon factors in addition to our ability and the ability of the Guarantor to pay our respective obligations, such as the prices of the Underlying Stocks, an improvement in our or the Guarantor’s credit ratings will not reduce the other investment risks related to the Notes. |

| ● | We are a finance subsidiary and, as such, have no independent assets, operations, or revenues. We are a finance subsidiary of the Guarantor, have no operations other than those related to the issuance, administration and repayment of our debt securities that are guaranteed by the Guarantor, and are dependent upon the Guarantor and/or its other subsidiaries to meet our obligations under the Notes in the ordinary course. Therefore, our ability to make payments on the Notes may be limited. |

Valuation- and Market-related Risks

| ● | The public offering price you pay for the Notes will exceed their initial estimated value. The range of initial estimated values of the Notes that is provided on the cover page of this preliminary pricing supplement, and the initial estimated value as of the pricing date that will be provided in the final pricing supplement, are each estimates only, determined as of a particular point in time by reference to our and our affiliates’ pricing models. These pricing models consider certain assumptions and variables, including our credit spreads and those of the Guarantor, the Guarantor’s internal funding rate, mid-market terms on hedging transactions, expectations on interest rates, dividends and volatility, price-sensitivity analysis, and the expected term of the Notes. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. If you attempt to sell the Notes prior to maturity, their market value may be lower than the price you paid for them and lower than their initial estimated value. This is due to, among other things, changes in the prices of the Underlying Stocks, changes in the Guarantor’s internal funding rate, and the inclusion in the public offering price of the underwriting discount, if any, and the hedging related charges, all as further described in “Structuring the Notes” below. These factors, together with various credit, market and economic factors over the term of the Notes, are expected to reduce the price at which you may be able to sell the Notes in any secondary market and will affect the value of the Notes in complex and unpredictable ways. |

| ● | The initial estimated value does not represent a minimum or maximum price at which we, BAC, BofAS or any of our other affiliates would be willing to purchase your Notes in any secondary market (if any exists) at any time. The value of your Notes at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Underlying Stocks, our and BAC’s creditworthiness and changes in market conditions. |

| ● | We cannot assure you that a trading market for your Notes will ever develop or be maintained. We will not list the Notes on any securities exchange. We cannot predict how the Notes will trade in any secondary market or whether that market will be liquid or illiquid. |

Conflict-related Risks

| ● | Trading and hedging activities by us, the Guarantor and any of our other affiliates, including BofAS, may create conflicts of interest

with you and may affect your return on the Notes and their market value. We, the Guarantor or one or more of our other affiliates,

including BofAS, may buy or sell shares of the Underlying Stocks, or futures or options contracts or exchange traded instruments on the

Underlying Stocks, or other instruments whose value is derived from the Underlying Stocks. We, the Guarantor or one or more of our other

affiliates, including BofAS, may execute such purchases or sales for our own or their own accounts, for business reasons, or in connection

with hedging our obligations under the Notes. These transactions may present a conflict of interest between your interest in the Notes

and the interests we, the Guarantor and our other affiliates, including BofAS, may have in our or their proprietary accounts, in facilitating

transactions, including block trades, for our or their other customers, and in accounts under our or their management. These transactions

may adversely affect the prices of the Underlying Stocks in a manner that could be adverse to your investment in the Notes. On or before

the pricing date, any purchases or sales by us, the Guarantor or our other affiliates, including BofAS or others on our or their behalf

(including those for the purpose of hedging some or all of our anticipated exposure in connection with the Notes), may affect the prices

of the Underlying Stocks. Consequently, the prices of the Underlying Stocks may change subsequent to the pricing date, which may adversely

affect the market value of the Notes. We, the Guarantor or one or more of our other affiliates, including BofAS, also expect to engage in hedging activities that could affect the prices of the Underlying Stocks on the pricing date. In addition, these hedging activities, including the unwinding of a hedge, may decrease the market value of your Notes prior to maturity, and may affect the amounts to be paid on the Notes. We, the Guarantor or one or more of our other affiliates, including BofAS, may purchase or otherwise acquire a long or short position in the Notes and may hold or resell the Notes. For example, BofAS may enter into these transactions in connection with any market making activities in which it engages. We cannot assure you that these activities will not adversely affect the prices of the Underlying Stocks, the market value of your Notes prior to maturity or the amounts payable on the Notes. |

| ● | There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours. We have the right to appoint and remove the calculation agent. One of our affiliates will be the calculation agent for the Notes and, as such, will make a variety of determinations relating to the Notes, including the amounts that will be paid on the Notes. Under some circumstances, these duties could result in a conflict of interest between its status as our affiliate and its responsibilities as calculation agent. |

Underlying Stock-related Risks

| ● | The terms of the Notes will not be adjusted for all corporate events that could affect an issuer of an Underlying Stock. The Price Multiplier of an Underlying Stock, the determination of the payments on the Notes, and other terms of the Notes may be adjusted for the specified |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-10 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

| corporate events affecting the Underlying Stock, as described in the section entitled “Description of the Notes—Anti-Dilution Adjustments” beginning on page PS-23 of the accompanying product supplement. However, these adjustments do not cover all corporate events that could affect the market price of an Underlying Stock, such as offerings of common shares for cash or in connection with certain acquisition transactions. The occurrence of any event that does not require the calculation agent to adjust the applicable Price Multiplier or the amounts that may be paid on the Notes at maturity may adversely affect the price of an Underlying Stock, and, as a result, the market value of the Notes. |

Tax-related Risks

| ● | The U.S. federal income tax consequences of an investment in the Notes are uncertain. However, it would be reasonable to treat your Notes as variable rate debt instruments for U.S. federal income tax purposes. The U.S. federal income tax consequences of an investment in the Notes are not certain. Under the terms of the Notes, you will have agreed with us to treat the Notes as variable rate debt instruments, as described below under “U.S. Federal Income Tax Summary.” If you are a secondary purchaser of the Notes, the tax consequences to you may be different. No ruling will be requested from the Internal Revenue Service (the “IRS”) with respect to the Notes and no assurance can be given that the IRS will agree with the statements made in the section entitled “U.S. Federal Income Tax Summary.” You are urged to consult with your own tax advisor regarding all aspects of the U.S. federal income tax consequences of investing in the Notes. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-11 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

The Underlying Stocks

We have derived the following information on each Underlying Stock and each company issuing an Underlying Stock (each, an “Underlying Company” and, together, the “Underlying Companies”) from publicly available documents. Because each Underlying Stock is registered under the Securities Exchange Act of 1934, the Underlying Companies are required to file periodically certain financial and other information specified by the SEC. Information provided to or filed with the SEC by the Underlying Companies can be located through the SEC’s web site at sec.gov by reference to the applicable CIK number set forth below.

This document relates only to the offering of the Notes and does not relate to any offering of Underlying Stock or any other securities of the Underlying Companies. None of us, the Guarantor, BofAS or any of our other affiliates has made any due diligence inquiry with respect to the Underlying Companies in connection with the offering of the Notes. None of us, the Guarantor, BofAS or any of our other affiliates has independently verified the accuracy or completeness of the publicly available documents or any other publicly available information regarding the Underlying Companies and hence makes no representation regarding the same. Furthermore, there can be no assurance that all events occurring prior to the date of this document, including events that would affect the accuracy or completeness of these publicly available documents that could affect the trading price of the Underlying Stocks, have been or will be publicly disclosed. Subsequent disclosure of any events or the disclosure of or failure to disclose material future events concerning an Underlying Company could affect the price of the applicable Underlying Stock and therefore could affect your return on the Notes. The selection of the Underlying Stocks is not a recommendation to buy or sell the Underlying Stocks.

Advanced Micro Devices, Inc.

Advanced Micro Devices, Inc. (AMD) produces semiconductor products and devices. The company offers products such as microprocessors, embedded microprocessors, chipsets, graphics, video and multimedia products and supplies it to third-party foundries, as well as provides assembling, testing, and packaging services. AMD serves customers worldwide. This Underlying Stock trades on the Nasdaq Global Select Market under the symbol "AMD." The company's CIK number is 0000002488.

Historical Performance of AMD

The following graph sets forth the daily historical performance of AMD in the period from October 15, 2018 through December 13, 2023. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. The Closing Market Prices reflected in the graph below may have been adjusted to reflect certain corporate actions, such as stock splits and reverse stock splits. The horizontal line in the graph represents AMD’s hypothetical Coupon Barrier of $110.55 (rounded to two decimal places), which is 80% of AMD’s hypothetical Starting Value of $138.19, which was its Closing Market Price on December 13, 2023. The actual Starting Value and Coupon Barrier will be determined on the pricing date.

This historical data on AMD is not necessarily indicative of the future performance of AMD or what the value of the Notes may be. Any historical upward or downward trend in the Closing Market Price of AMD during any period set forth above is not an indication that the Closing Market Price of AMD is more or less likely to increase or decrease at any time over the term of the Notes.

Before investing in the Notes, you should consult publicly available sources for the Closing Market Prices and trading pattern of AMD.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-12 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

Amazon.com, Inc.

Amazon.com, Inc. is an online retailer that offers a wide range of products. The company’s products include books, music, computers, electronics and numerous other products. Amazon offers personalized shopping services, Web-based credit card payment, and direct shipping to customers. Amazon also operates a cloud platform offering services globally. This Underlying Stock trades on the Nasdaq Global Select Market under the symbol "AMZN." The company's CIK number is 0001018724.

Historical Performance of AMZN

The following graph sets forth the daily historical performance of AMZN in the period from January 2, 2018 through December 13, 2023. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. The Closing Market Prices reflected in the graph below may have been adjusted to reflect certain corporate actions, such as stock splits and reverse stock splits. The horizontal line in the graph represents AMZN’s hypothetical Coupon Barrier of $119.07 (rounded to two decimal places), which is 80% of AMZN’s hypothetical Starting Value of $148.84, which was its Closing Market Price on December 13, 2023. The actual Starting Value and Coupon Barrier will be determined on the pricing date.

This historical data on AMZN is not necessarily indicative of the future performance of AMZN or what the value of the Notes may be. Any historical upward or downward trend in the Closing Market Price of AMZN during any period set forth above is not an indication that the Closing Market Price of AMZN is more or less likely to increase or decrease at any time over the term of the Notes.

Before investing in the Notes, you should consult publicly available sources for the Closing Market Prices and trading pattern of AMZN.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-13 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

NVIDIA Corporation

NVIDIA Corporation designs, develops, and markets three dimensional (3D) graphics processors and related software. The company offers products that provides interactive 3D graphics to the mainstream personal computer market. This Underlying Stock trades on the Nasdaq Global Select Market under the symbol "NVDA." The company's CIK number is 0001045810.

Historical Performance of NVDA

The following graph sets forth the daily historical performance of NVDA in the period from January 2, 2018 through December 13, 2023. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. The Closing Market Prices reflected in the graph below may have been adjusted to reflect certain corporate actions, such as stock splits and reverse stock splits. The horizontal line in the graph represents NVDA’s hypothetical Coupon Barrier of $384.70 (rounded to two decimal places), which is 80% of NVDA’s hypothetical Starting Value of $480.88, which was its Closing Market Price on December 13, 2023. The actual Starting Value and Coupon Barrier will be determined on the pricing date.

This historical data on NVDA is not necessarily indicative of the future performance of NVDA or what the value of the Notes may be. Any historical upward or downward trend in the Closing Market Price of NVDA during any period set forth above is not an indication that the Closing Market Price of NVDA is more or less likely to increase or decrease at any time over the term of the Notes.

Before investing in the Notes, you should consult publicly available sources for the Closing Market Prices and trading pattern of NVDA.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-14 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

Supplement to the Plan of Distribution; Role of BofAS and Conflicts of Interest

BofAS, a broker-dealer affiliate of ours, is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and will participate as selling agent in the distribution of the Notes. Accordingly, the offering of the Notes will conform to the requirements of FINRA Rule 5121. BofAS may not make sales in this offering to any of its discretionary accounts without the prior written approval of the account holder.

We expect to deliver the Notes against payment therefor in New York, New York on a date that is greater than two business days following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, if the initial settlement of the Notes occurs more than two business days from the pricing date, purchasers who wish to trade the Notes more than two business days prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement.

Under our distribution agreement with BofAS, BofAS will purchase the Notes from us as principal at the public offering price indicated on the cover of this pricing supplement, less the indicated underwriting discount, if any. BofAS will sell the Notes to other broker-dealers that will participate in the offering and that are not affiliated with us, at an agreed discount to the principal amount. Each of those broker-dealers may sell the Notes to one or more additional broker-dealers. BofAS has informed us that these discounts may vary from dealer to dealer and that not all dealers will purchase or repurchase the Notes at the same discount. Certain dealers who purchase the Notes for sale to certain fee-based advisory accounts may forgo some or all of their selling concessions, fees or commissions. The public offering price for investors purchasing the Notes in these fee-based advisory accounts may be as low as $996.50 per $1,000 in principal amount of Notes.

BofAS and any of our other broker-dealer affiliates may use this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus for offers and sales in secondary market transactions and market-making transactions in the Notes. However, they are not obligated to engage in such secondary market transactions and/or market-making transactions. These broker-dealer affiliates may act as principal or agent in these transactions, and any such sales will be made at prices related to prevailing market conditions at the time of the sale.

At BofAS’s discretion, for a short, undetermined initial period after the issuance of the Notes, BofAS may offer to buy the Notes in the secondary market at a price that may exceed the initial estimated value of the Notes. Any price offered by BofAS for the Notes will be based on then-prevailing market conditions and other considerations, including the performance of the Underlying Stocks and the remaining term of the Notes. However, none of us, the Guarantor, BofAS or any of our other affiliates is obligated to purchase your Notes at any price or at any time, and we cannot assure you that any party will purchase your Notes at a price that equals or exceeds the initial estimated value of the Notes.

Any price that BofAS may pay to repurchase the Notes will depend upon then prevailing market conditions, the creditworthiness of us and the Guarantor, and transaction costs. At certain times, this price may be higher than or lower than the initial estimated value of the Notes.

European Economic Area and United Kingdom

None of this pricing supplement, the accompanying product supplement, the accompanying prospectus or the accompanying prospectus supplement is a prospectus for the purposes of the Prospectus Regulation (as defined below). This pricing supplement, the accompanying product supplement, the accompanying prospectus and the accompanying prospectus supplement have been prepared on the basis that any offer of Notes in any Member State of the European Economic Area (the “EEA”) or in the United Kingdom (each, a “Relevant State”) will only be made to a legal entity which is a qualified investor under the Prospectus Regulation (“Qualified Investors”). Accordingly any person making or intending to make an offer in that Relevant State of Notes which are the subject of the offering contemplated in this pricing supplement, the accompanying product supplement, the accompanying prospectus and the accompanying prospectus supplement may only do so with respect to Qualified Investors. Neither BofA Finance nor BAC has authorized, nor does it authorize, the making of any offer of Notes other than to Qualified Investors. The expression “Prospectus Regulation” means Regulation (EU) 2017/1129.

PROHIBITION OF SALES TO EEA AND UNITED KINGDOM RETAIL INVESTORS – The Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA or in the United Kingdom. For these purposes: (a) a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU, as amended (“MiFID II”); or (ii) a customer within the meaning of Directive (EU) 2016/97 (the Insurance Distribution Directive) where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in the Prospectus Regulation; and (b) the expression “offer” includes the communication in any form and by any means of sufficient information on the terms of the offer and the Notes to be offered so as to enable an investor to decide to purchase or subscribe for the Notes. Consequently no key information document required by Regulation (EU) No 1286/2014, as amended (the “PRIIPs Regulation”) for offering or selling the Notes or otherwise making them available to retail investors in the EEA or in the United Kingdom has been prepared and therefore offering or selling the Notes or otherwise making them available to any retail investor in the EEA or in the United Kingdom may be unlawful under the PRIIPs Regulation.

United Kingdom

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-15 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

The communication of this pricing supplement, the accompanying product supplement, the accompanying prospectus supplement, the accompanying prospectus and any other document or materials relating to the issue of the Notes offered hereby is not being made, and such documents and/or materials have not been approved, by an authorized person for the purposes of section 21 of the United Kingdom’s Financial Services and Markets Act 2000, as amended (the “FSMA”). Accordingly, such documents and/or materials are not being distributed to, and must not be passed on to, the general public in the United Kingdom. The communication of such documents and/or materials as a financial promotion is only being made to those persons in the United Kingdom who have professional experience in matters relating to investments and who fall within the definition of investment professionals (as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Financial Promotion Order”)), or who fall within Article 49(2)(a) to (d) of the Financial Promotion Order, or who are any other persons to whom it may otherwise lawfully be made under the Financial Promotion Order (all such persons together being referred to as “relevant persons”). In the United Kingdom, the Notes offered hereby are only available to, and any investment or investment activity to which this pricing supplement, the accompanying product supplement, the accompanying prospectus supplement and the accompanying prospectus relates will be engaged in only with, relevant persons. Any person in the United Kingdom that is not a relevant person should not act or rely on this pricing supplement, the accompanying product supplement, the accompanying prospectus supplement or the accompanying prospectus or any of their contents.

Any invitation or inducement to engage in investment activity (within the meaning of Section 21 of the FSMA) in connection with the issue or sale of the Notes may only be communicated or caused to be communicated in circumstances in which Section 21(1) of the FSMA does not apply to BofA Finance, as issuer, or BAC, as guarantor.

All applicable provisions of the FSMA must be complied with in respect to anything done by any person in relation to the Notes in, from or otherwise involving the United Kingdom.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-16 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

Structuring the Notes

The Notes are our debt securities, the return on which is linked to the performance of the Underlying Stocks. The related guarantee is BAC’s obligation. As is the case for all of our and BAC’s respective debt securities, including our market-linked notes, the economic terms of the Notes reflect our and BAC’s actual or perceived creditworthiness at the time of pricing. In addition, because market-linked notes result in increased operational, funding and liability management costs to us and BAC, BAC typically borrows the funds under these types of notes at a rate, which we refer to in this pricing supplement as BAC’s internal funding rate, that is more favorable to BAC than the rate that it might pay for a conventional fixed or floating rate debt security. This generally relatively lower internal funding rate, which is reflected in the economic terms of the Notes, along with the fees and charges associated with market-linked notes, typically results in the initial estimated value of the Notes on the pricing date being less than their public offering price.

In order to meet our payment obligations on the Notes, at the time we issue the Notes, we may choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives) with BofAS or one of our other affiliates. The terms of these hedging arrangements are determined based upon terms provided by BofAS and its affiliates, and take into account a number of factors, including our and BAC’s creditworthiness, interest rate movements, the volatility of the Underlying Stocks, the tenor of the Notes and the hedging arrangements. The economic terms of the Notes and their initial estimated value depend in part on the terms of these hedging arrangements.

BofAS has advised us that the hedging arrangements will include hedging related charges, reflecting the costs associated with, and our affiliates’ profit earned from, these hedging arrangements. Since hedging entails risk and may be influenced by unpredictable market forces, actual profits or losses from these hedging transactions may be more or less than any expected amounts.

For further information, see “Risk Factors” beginning on page PS-9 above and “Supplemental Use of Proceeds” on page PS-18 of the accompanying product supplement.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-17 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

U.S. Federal Income Tax Summary

The following summary of the material U.S. federal income and estate tax considerations of the acquisition, ownership, and disposition of the Notes supplements, and to the extent inconsistent supersedes, the discussion under “U.S. Federal Income Tax Considerations” in the accompanying prospectus and is not exhaustive of all possible tax considerations. This summary is based upon the Internal Revenue Code of 1986, as amended (the “Code”), regulations promulgated under the Code by the U.S. Treasury Department (“Treasury”) (including proposed and temporary regulations), rulings, current administrative interpretations and official pronouncements of the IRS, and judicial decisions, all as currently in effect and all of which are subject to differing interpretations or to change, possibly with retroactive effect. No assurance can be given that the IRS would not assert, or that a court would not sustain, a position contrary to any of the tax consequences described below. This summary does not include any description of the tax laws of any state or local governments, or of any foreign government, that may be applicable to a particular holder.

Although the Notes are issued by us, they will be treated as if they were issued by BAC for U.S. federal income tax purposes. Accordingly throughout this tax discussion, references to “we,” “our” or “us” are generally to BAC unless the context requires otherwise.

This summary is directed solely to U.S. Holders and Non-U.S. Holders that, except as otherwise specifically noted, will purchase the Notes upon original issuance and will hold the Notes as capital assets within the meaning of Section 1221 of the Code, which generally means property held for investment, and that are not excluded from the discussion under “U.S. Federal Income Tax Considerations” in the accompanying prospectus. This discussion does not address the tax consequences applicable to holders subject to Section 451(b) of the Code. This summary assumes that the issue price of the Notes, as determined for U.S. federal income tax purposes, equals the principal amount thereof.

You should consult your own tax advisor concerning the U.S. federal income tax consequences to you of acquiring, owning, and disposing of the Notes, as well as any tax consequences arising under the laws of any state, local, foreign, or other tax jurisdiction and the possible effects of changes in U.S. federal or other tax laws.

U.S. Holders

The tax treatment of your Notes is uncertain. The tax treatment of your Notes will depend upon whether the Notes are properly treated as variable rate debt instruments or contingent payment debt instruments. This in turn depends, in part, upon whether it is reasonably expected that the return on the Notes during the first half of the Notes’ term will be significantly greater or less than the return on the Notes during the second half of the Notes’ term. Based on our numerical analysis, we expect to take the position that it is not reasonably expected that the return on the Notes during the first half of the Notes’ term will be significantly greater or less than the return on the Notes during the second half of the Notes’ term. We accordingly expect to treat your Notes as variable rate debt instruments for U.S. federal income tax purposes.

Based on market conditions on the trade date, we may take the position that it is reasonably expected that the return on the Notes during the first half of the Notes term will be significantly greater or less than the return on the Notes during the second half of the Notes term. In this case, we would treat your Notes as contingent payment debt instruments, as discussed below under “Alternative Tax Treatments”. We will make a final determination as to the manner in which we intend to treat the Notes on the trade date based on market conditions in effect at such time. The final disclosure statement will set forth the manner in which we intend to treat the Notes for tax purposes. Except as otherwise Noted below under “Alternative Treatments,” the discussion below assumes that the Notes will be treated as variable rate debt instruments for U.S. federal income tax purposes. Under this characterization, interest on a Note generally will be included in the income of a U.S. Holder as ordinary income at the time it is accrued or is received in accordance with the U.S. Holder’s regular method of accounting for U.S. federal income tax purposes. Please see the discussion in the prospectus under the section entitled “U.S. Federal Income Tax Considerations—General—Consequences to U.S. Holders—Variable Rate Debt Securities” for a discussion of these rules.

Upon the sale, exchange, redemption, retirement, or other disposition of a Note, a U.S. Holder will recognize gain or loss equal to the difference between the amount realized upon the sale, exchange, redemption, retirement, or other disposition (less an amount equal to any accrued interest not previously included in income if the Note is disposed of between interest payment dates, which will be included in income as interest income for U.S. federal income tax purposes) and the U.S. Holder’s adjusted tax basis in the Note. A U.S. Holder’s adjusted tax basis in a Note generally will be the cost of the Note to such U.S. Holder. Any gain or loss realized on the sale, exchange, redemption, retirement, or other disposition of a Note generally will be capital gain or loss and will be long-term capital gain or loss if the Note has been held for more than one year. The ability of U.S. Holders to deduct capital losses is subject to limitations under the Code.

Alternative Tax Treatments. If it is determined that it is reasonably expected that the return on the Notes during the first half of the Notes’ term will be significantly greater or less than the return on the Notes during the second half of the Notes’ term, the Notes should be treated as a debt instrument subject to special rules governing contingent payment debt instruments for U.S. federal income tax purposes. If the Notes are so treated, a U.S. Holder would be required to accrue original issue discount every year at a “comparable yield” determined at the time of issuance. In addition, you would be required to construct a projected payment schedule for the Notes and you would make a “positive adjustment” to the extent of any excess of an actual payment over the corresponding projected payment under the Notes, and you would make a “negative adjustment” to the extent of the excess of any projected payment over the corresponding actual payment under the Notes. Any gain realized by a U.S. Holder at maturity or upon a sale, exchange, or redemption of the Notes generally would be treated as ordinary income, and any loss realized at maturity or upon a sale,

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-18 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

exchange, or redemption of the Notes generally would be treated as ordinary loss to the extent of the U.S. Holder’s prior accruals of original issue discount, and as capital loss thereafter.

It is also possible that the IRS could determine that the Notes should be subject to special rules for Notes that provide for alternative payment schedules if one of such schedules is significantly more likely than not to occur. If your Notes are subject to those rules, you would generally be required to include the stated interest on your Notes in income as it accrues even if you are otherwise subject to the cash basis method of accounting for tax purposes. The rules for Notes that provide alternative payment schedules if one of such schedules is significantly more likely than not to occur are discussed under “U.S. Federal Income Tax Considerations—General—Consequences to U.S. Holders—Debt Securities Subject to Contingencies” in the accompanying prospectus.

Non-U.S. Holders

Please see the discussion under “U.S. Federal Income Tax Considerations—General—Consequences to Non-U.S. Holders” in the accompanying prospectus for the material U.S. federal income tax consequences that will apply to Non-U.S. Holders of the Notes, except that the following disclosure supplements the discussion in the prospectus.

A “dividend equivalent” payment is treated as a dividend from sources within the United States and such payments generally would be subject to a 30% U.S. withholding tax if paid to a Non-U.S. Holder. Under Treasury regulations, payments (including deemed payments) with respect to equity-linked instruments (“ELIs”) that are “specified ELIs” may be treated as dividend equivalents if such specified ELIs reference an interest in an “underlying security,” which is generally any interest in an entity taxable as a corporation for U.S. federal income tax purposes if a payment with respect to such interest could give rise to a U.S. source dividend. However, IRS guidance provides that withholding on dividend equivalent payments will not apply to specified ELIs that are not delta-one instruments and that are issued before January 1, 2025. Based on our determination that the Notes are not delta-one instruments, Non-U.S. Holders should not be subject to withholding on dividend equivalent payments, if any, under the Notes. However, it is possible that the Notes could be treated as deemed reissued for U.S. federal income tax purposes upon the occurrence of certain events affecting the Underlying Stocks or the Notes, and following such occurrence the Notes could be treated as subject to withholding on dividend equivalent payments. Non-U.S. Holders that enter, or have entered, into other transactions in respect of the Underlying Stocks or the Notes should consult their tax advisors as to the application of the dividend equivalent withholding tax in the context of the Notes and their other transactions. If any payments are treated as dividend equivalents subject to withholding, we (or the applicable paying agent) would be entitled to withhold taxes without being required to pay any additional amounts with respect to amounts so withheld.

Backup Withholding and Information Reporting

Please see the discussion under “U.S. Federal Income Tax Considerations — General — Backup Withholding and Information Reporting” in the accompanying prospectus for a description of the applicability of the backup withholding and information reporting rules to payments made on the Notes.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-19 |

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Common Stock of Advanced Micro Devices, Inc., the Common Stock of Amazon.com, Inc. and the Common Stock of NVIDIA Corporation

Where You Can Find More Information

The terms and risks of the Notes are contained in this pricing supplement and in the following related product supplement, prospectus supplement and prospectus, which can be accessed at the following links:

| ● | Product Supplement STOCK-1 dated December 30, 2022: https://www.sec.gov/Archives/edgar/data/1682472/000119312522315468/d427660d424b2.htm |

| ● | Series A MTN prospectus supplement dated December 30, 2022 and prospectus dated December 30, 2022: https://www.sec.gov/Archives/edgar/data/1682472/000119312522315195/d409418d424b3.htm |

This pricing supplement and the accompanying product supplement, prospectus supplement and prospectus have been filed as part of a registration statement with the SEC, which may, without cost, be accessed on the SEC website at www.sec.gov or obtained from BofAS by calling 1-800-294-1322. Before you invest, you should read this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus for information about us, BAC and this offering. Any prior or contemporaneous oral statements and any other written materials you may have received are superseded by this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus. Certain terms used but not defined in this pricing supplement have the meanings set forth in the accompanying product supplement or prospectus supplement. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our,” or similar references are to BofA Finance, and not to BAC.