|

|

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-234425 (To Prospectus dated December 31, 2019, Prospectus Supplement dated December 31, 2019 and Product Supplement COMM SUN-1 dated December 6, 2022) |

|

224,450 Units

$10 principal amount per unit CUSIP No. 06054E192

|

Pricing Date

Settlement Date Maturity Date |

December 13, 2022

December 20, 2022 December 21, 2023 |

|||

|

|

|||||

|

|

|

|

|

||

|

BofA Finance LLC

Market-Linked One Look Notes with Enhanced Buffer Linked to the WTI Crude Oil Futures Contract

Fully and Unconditionally Guaranteed by Bank of America Corporation

■

Maturity of approximately one year

■

If the WTI Crude Oil Futures Contract is greater than or equal to 84.00% of the Starting Value, a return of 20.00%

■

1-to-1 downside exposure to decreases in the WTI Crude Oil Futures Contract beyond a 16.00% decline, with up to 84.00% of your principal at risk

■

All payments occur at maturity and are subject to the credit risk of BofA Finance LLC, as issuer of the notes, and the credit risk of Bank of America Corporation, as guarantor of the notes

■

No periodic interest payments

■

In addition to the underwriting discount set forth below, the notes include a hedging-related charge of $0.05 per unit. See “Structuring the Notes”

■

Limited secondary market liquidity, with no exchange listing

|

|||||

|

|

|||||

|

|

Per Unit

|

Total

|

|

Public offering price

|

$10.00

|

$2,244,500.00

|

|

Underwriting discount

|

$ 0.15

|

$ 33,667.50

|

|

Proceeds, before expenses, to BofA Finance

|

$ 9.85

|

$2,210,832.50

|

|

Are Not FDIC Insured

|

Are Not Bank Guaranteed

|

May Lose Value

|

|

Market-Linked One Look Notes with Enhanced Buffer

Linked to the WTI Crude Oil Futures Contract, due December 21, 2023 |

|

|

Terms of the Notes

|

Redemption Amount Determination

|

|

|

Issuer:

|

BofA Finance LLC (“BofA Finance”)

|

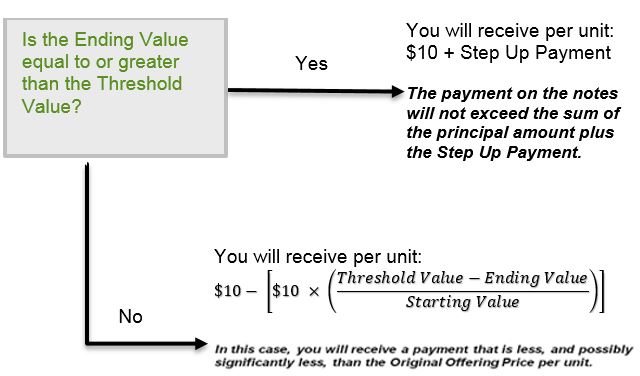

Notwithstanding anything to the contrary in the accompanying product supplement, the Redemption Amount will be determined as set forth in this term sheet. On the maturity date, you will receive a cash payment per unit determined as follows:

|

|

Guarantor:

|

Bank of America Corporation (“BAC”)

|

|

|

Principal Amount:

|

$10.00 per unit

|

|

|

Term:

|

Approximately one year

|

|

|

Market Measure:

|

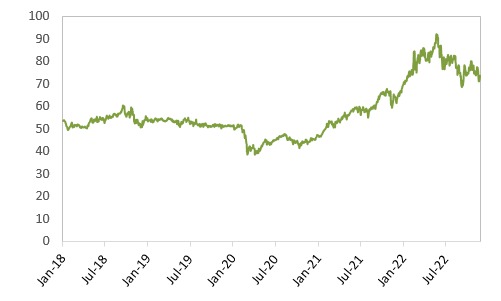

The WTI Crude Oil Futures Contract scheduled for delivery in January 2024, as measured on Bloomberg Page “CLF4”.

|

|

|

Starting Value:

|

73.67

|

|

|

Ending Value:

|

The closing value of the Market Measure on the scheduled calculation day. The calculation day is subject to postponement in the event of Market Disruption Events, as described beginning on page PS-27 of the accompanying product supplement.

|

|

|

Step Up Payment:

|

$2.00 per unit, which represents a return of 20.00% over the principal amount.

|

|

|

Threshold Value:

|

61.88, which is 84.00% of the Starting Value (rounded to two decimal places).

|

|

|

Calculation Day:

|

December 14, 2023

|

|

|

Fees and Charges:

|

The underwriting discount of $0.15 per unit listed on the cover page and the hedging related charge of $0.05 per unit described in “Structuring the Notes” on page TS-11.

|

|

|

Calculation Agent:

|

BofA Securities, Inc. (“BofAS”)

|

|

|

Market-Linked One Look Notes with Enhanced Buffer

|

TS-2

|

|

Market-Linked One Look Notes with Enhanced Buffer

Linked to the WTI Crude Oil Futures Contract, due December 21, 2023 |

|

|

■

|

Product supplement COMM SUN-1 dated December 6, 2022:

https://www.sec.gov/Archives/edgar/data/1682472/000148105722004545/form424b5.htm |

|

■

|

Series A MTN prospectus supplement dated December 31, 2019 and prospectus dated December 31, 2019:

https://www.sec.gov/Archives/edgar/data/70858/000119312519326462/d859470d424b3.htm |

|

You may wish to consider an investment in the notes if:

|

The notes may not be an appropriate investment for you if:

|

|

|

■

You anticipate that the Ending Value will not be less than the Threshold Value.

■

You accept that the return on the notes will be limited to the return represented by the Step Up Payment.

■

You are willing to risk a loss of principal and return if the WTI Crude Oil Futures Contract decreases from the Starting Value to an Ending Value that is below the Threshold Value.

■

You are willing to forgo the interest payments that are paid on conventional interest bearing debt securities.

■

You are willing to forgo the rights and benefits of owning the WTI Crude Oil Futures Contract or the related commodity.

■

You are willing to accept a limited or no market for sales prior to maturity, and understand that the market prices for the notes, if any, will be affected by various factors, including our and BAC’s actual and perceived creditworthiness, BAC’s internal funding rate and fees and charges on the notes.

■

You are willing to assume our credit risk, as issuer of the notes, and BAC’s credit risk, as guarantor of the notes, for all payments under the notes, including the Redemption Amount, as applicable.

|

■

You believe that the WTI Crude Oil Futures Contract will decrease from the Starting Value to an Ending Value that is below the Threshold Value or that it will increase by more than the return represented by the Step Up Payment.

■

You seek an uncapped return on your investment.

■

You seek 100% principal repayment or preservation of capital.

■

You seek interest payments or other current income on your investment.

■

You want to receive the rights and benefits of owning the WTI Crude Oil Futures Contract or the related commodity.

■

You seek an investment for which there will be a liquid secondary market.

■

You are unwilling or are unable to take market risk on the notes or to take our credit risk as issuer of the notes or to take BAC's credit risk, as guarantor of the notes.

|

|

Market-Linked One Look Notes with Enhanced Buffer

|

TS-3

|

|

Market-Linked One Look Notes with Enhanced Buffer

Linked to the WTI Crude Oil Futures Contract, due December 21, 2023 |

|

|

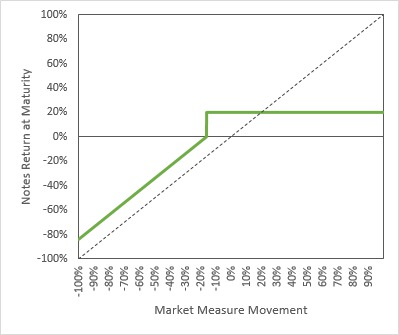

Market-Linked One Look Notes with Enhanced Buffer

|

This graph reflects the returns on the notes, based on the Threshold Value of 84.00% of the Starting Value and the Step Up Payment of $2.00 per unit. The green line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct investment in the WTI Crude Oil Futures Contract.

This graph has been prepared for purposes of illustration only.

|

|

Ending Value

|

Percentage Change from the Starting Value to the Ending Value

|

Redemption Amount per Unit

|

Total Rate of Return on the Notes

|

|

0.00

|

-100.00%

|

$1.60

|

-84.00%

|

|

50.00

|

-50.00%

|

$6.60

|

-34.00%

|

|

80.00

|

-20.00%

|

$9.60

|

-4.00%

|

|

84.00(1)

|

-16.00%

|

$12.00(2)

|

20.00%

|

|

94.00

|

-6.00%

|

$12.00

|

20.00%

|

|

97.00

|

-3.00%

|

$12.00

|

20.00%

|

|

100.00(3)

|

0.00%

|

$12.00

|

20.00%

|

|

102.00

|

2.00%

|

$12.00

|

20.00%

|

|

105.00

|

5.00%

|

$12.00

|

20.00%

|

|

110.00

|

10.00%

|

$12.00

|

20.00%

|

|

120.00

|

20.00%

|

$12.00

|

20.00%

|

|

127.00

|

27.00%

|

$12.00

|

20.00%

|

|

140.00

|

40.00%

|

$12.00

|

20.00%

|

|

150.00

|

50.00%

|

$12.00

|

20.00%

|

|

160.00

|

60.00%

|

$12.00

|

20.00%

|

|

165.00

|

65.00%

|

$12.00

|

20.00%

|

|

(1)

|

This is the hypothetical Threshold Value.

|

|

(2)

|

This amount represents the sum of the principal amount and the Step Up Payment of $2.00. Your investment return is limited to the return represented by the Step Up Payment.

|

|

(3)

|

The hypothetical Starting Value of 100 used in these examples has been chosen for illustrative purposes only. The actual Starting Value is 73.67, which was the closing value of the Market Measure on the pricing date.

|

|

Market-Linked One Look Notes with Enhanced Buffer

|

TS-4

|

|

Market-Linked One Look Notes with Enhanced Buffer

Linked to the WTI Crude Oil Futures Contract, due December 21, 2023 |

|

|

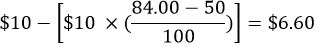

Example 1

|

|

|

The Ending Value is 50.00, or 50.00% of the Starting Value:

|

|

|

Starting Value: 100.00

|

|

|

Threshold Value: 84.00

|

|

|

Ending Value: 50.00

|

|

|

Redemption Amount per unit

|

|

Example 2

|

|

|

The Ending Value is 90.00, or 90.00% of the Starting Value:

|

|

|

Starting Value: 100.00

|

Threshold Value: 84.00

|

Ending Value: 90.00

|

|

$10.00 + $2.00 = $12.00

|

Redemption Amount per unit, the principal amount plus the Step Up Payment, since the Ending Value is equal to or greater than the Threshold Value

|

|

Example 3

|

|

|

The Ending Value is 140.00, or 140.00% of the Starting Value:

|

|

|

Starting Value: 100.00

Threshold Value: 84.00

|

|

|

Ending Value: 140.00

|

|

|

$10.00 + $2.00 = $12.00

|

Redemption Amount per unit, the principal amount plus the Step Up Payment, since the Ending Value is equal to or greater than the Threshold Value.

|

|

Market-Linked One Look Notes with Enhanced Buffer

|

TS-5

|

|

Market-Linked One Look Notes with Enhanced Buffer

Linked to the WTI Crude Oil Futures Contract, due December 21, 2023 |

|

|

■

|

Depending on the performance of the Market Measure as measured shortly before the maturity date, your investment may result in a loss; there is no guaranteed return of principal.

|

|

■

|

Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of comparable maturity.

|

|

■

|

Payments on the notes are subject to our credit risk, and the credit risk of BAC, and any actual or perceived changes in our or BAC’s creditworthiness are expected to affect the value of the notes. If we and BAC become insolvent or are unable to pay our respective obligations, you may lose your entire investment.

|

|

■

|

Your investment return is limited to the return represented by the Step Up Payment and may be less than a comparable investment directly in the Market Measure or the related commodity.

|

|

■

|

We are a finance subsidiary and, as such, have no independent assets, operations or revenues.

|

|

■

|

BAC’s obligations under its guarantee of the notes will be structurally subordinated to liabilities of its subsidiaries.

|

|

■

|

The notes issued by us will not have the benefit of any cross-default or cross-acceleration with other indebtedness of BofA Finance or BAC; events of bankruptcy or insolvency or resolution proceedings relating to BAC and covenant breach by BAC will not constitute an event of default with respect to the notes.

|

|

■

|

The initial estimated value of the notes considers certain assumptions and variables and relies in part on certain forecasts about future events, which may prove to be incorrect. The initial estimated value of the notes is an estimate only, determined as of the pricing date by reference to our and our affiliates’ pricing models. These pricing models consider certain assumptions and variables, including our credit spreads and those of BAC, BAC’s internal funding rate on the pricing date, mid-market terms on hedging transactions, expectations on interest rates and volatility, price-sensitivity analysis, and the expected term of the notes. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect.

|

|

■

|

The public offering price you are paying for the notes exceeds the initial estimated value. If you attempt to sell the notes prior to maturity, their market value may be lower than the price you paid for them and lower than the initial estimated value. This is due to, among other things, changes in the price of the Market Measure, changes in BAC’s internal funding rate, and the inclusion in the public offering price of the underwriting discount and the hedging related charge, all as further described in “Structuring the Notes” beginning on page TS-11. These factors, together with various credit, market and economic factors over the term of the notes, are expected to reduce the price at which you may be able to sell the notes in any secondary market and will affect the value of the notes in complex and unpredictable ways.

|

|

■

|

The initial estimated value does not represent a minimum or maximum price at which we, BAC, MLPF&S, BofAS or any of our other affiliates would be willing to purchase your notes in any secondary market (if any exists) at any time. The value of your notes at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Market Measure, our and BAC’s creditworthiness and changes in market conditions.

|

|

■

|

A trading market is not expected to develop for the notes. None of us, BAC, MLPF&S, BofAS is obligated to make a market for, or to repurchase, the notes. There is no assurance that any party will be willing to purchase your notes at any price in any secondary market.

|

|

■

|

BAC and its affilates’ business hedging and trading activities (including trades related to the WTI Crude Oil Futures Contract), and any hedging and trading activities BAC or its affiliates engage in for our clients’ accounts, may affect the market value and return of the notes and may create conflicts of interest with you.

|

|

■

|

There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours. We have the right to appoint and remove the calculation agent.

|

|

■

|

Ownership of the notes will not entitle you to any rights with respect to the WTI Crude Oil Futures Contract or the related commodity.

|

|

■

|

An investment linked to commodity futures contracts is not equivalent to an investment linked to the spot prices of physical commodities.

|

|

■

|

Suspensions or disruptions of trading in the WTI Crude Oil Futures Contract or the related commodity may adversely affect the value of the notes.

|

|

Market-Linked One Look Notes with Enhanced Buffer

|

TS-6

|

|

Market-Linked One Look Notes with Enhanced Buffer

Linked to the WTI Crude Oil Futures Contract, due December 21, 2023 |

|

|

■

|

Changes in the exchange methodology related to the WTI Crude Oil Futures Contract may adversely affect the value of the notes prior to maturity.

|

|

■

|

The notes will not be regulated by the U.S. Commodity Futures Trading Commission.

|

|

■

|

Legal and regulatory changes could adversely affect the return on and value of your notes.

|

|

■

|

The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a holder of the notes. See “Summary Tax Consequences” below and “U.S. Federal Income Tax Summary” beginning on page PS-34 of the accompanying product supplement.

|

|

Market-Linked One Look Notes with Enhanced Buffer

|

TS-7

|

|

Market-Linked One Look Notes with Enhanced Buffer

Linked to the WTI Crude Oil Futures Contract, due December 21, 2023 |

|

|

Market-Linked One Look Notes with Enhanced Buffer

|

TS-8

|

|

Market-Linked One Look Notes with Enhanced Buffer

Linked to the WTI Crude Oil Futures Contract, due December 21, 2023 |

|

|

Market-Linked One Look Notes with Enhanced Buffer

|

TS-9

|

|

Market-Linked One Look Notes with Enhanced Buffer

Linked to the WTI Crude Oil Futures Contract, due December 21, 2023 |

|

|

Market-Linked One Look Notes with Enhanced Buffer

|

TS-10

|

|

Market-Linked One Look Notes with Enhanced Buffer

Linked to the WTI Crude Oil Futures Contract, due December 21, 2023 |

|

|

Market-Linked One Look Notes with Enhanced Buffer

|

TS-11

|

|

Market-Linked One Look Notes with Enhanced Buffer

Linked to the WTI Crude Oil Futures Contract, due December 21, 2023 |

|

|

■

|

There is no statutory, judicial, or administrative authority directly addressing the characterization of the notes.

|

|

■

|

You agree with us (in the absence of an administrative determination, or judicial ruling to the contrary) to characterize and treat the notes for all tax purposes as a callable single financial contract with respect to the Market Measure.

|

|

■

|

Under this characterization and tax treatment of the notes, a U.S. Holder (as defined beginning on page 38 of the prospectus) generally will recognize capital gain or loss upon maturity or upon a sale, exchange, or redemption of the notes prior to maturity. This capital gain or loss generally will be long-term capital gain or loss if you held the notes for more than one year.

|

|

■

|

No assurance can be given that the Internal Revenue Service (“IRS”) or any court will agree with this characterization and tax treatment.

|

|

Market-Linked One Look Notes with Enhanced Buffer

|

TS-12

|