|

|

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-234425

(To Prospectus dated December 31, 2019,

Prospectus Supplement dated December 31, 2019 and Product Supplement COMM MITTS-1 dated April 12, 2022)

|

2,021,764 Units

$10 principal amount per unit

CUSIP No. 09710F496

|

Pricing Date

Settlement Date

Maturity Date

|

April 22, 2022

April 29, 2022

April 17, 2025

|

|

|

|

|

|

|

|

|

BofA Finance LLC

Market Index Target-Term Securities® Linked to a Basket of Four Commodity Futures Contracts

Fully and Unconditionally Guaranteed by Bank of America Corporation

■

Maturity of approximately three years

■

135.00% participation in increases in the Basket

■

The Basket is comprised of the WTI Crude Oil Futures Contract, the Natural Gas Futures Contract, the Corn Futures Contract and the Soybeans Futures Contract. Each Basket Component was given an equal weight.

■

If the Basket is flat or decreases, payment at maturity will be the principal amount

■

All payments occur at maturity and are subject to the credit risk of BofA Finance LLC, as issuer of the notes, and the credit risk of Bank of America Corporation, as guarantor of the notes

■

No periodic interest payments

■

In addition to the underwriting discount set forth below, the notes include a hedging-related charge of $0.075 per unit. See “Structuring the Notes”

■

Limited secondary market liquidity, with no exchange listing

|

|

|

The notes are being issued by BofA Finance LLC (“BofA Finance”) and are fully and unconditionally guaranteed by Bank of America Corporation (“BAC”). There are important differences between the notes and a conventional debt security, including different investment risks and certain additional costs. See “Risk Factors” and “Additional Risk Factors” beginning on page TS-7 and page TS-9 of this term sheet, respectively, and "Risk Factors" beginning on page PS-6 of the accompanying product supplement, page S-5 of the accompanying Series A MTN prospectus supplement and page 7 of the accompanying prospectus.

The initial estimated value of the notes as of the pricing date is $9.36 per unit, which is less than the public offering price listed below. See “Summary” on the following page, “Risk Factors” beginning on page TS-7 of this term sheet and “Structuring the Notes” on page TS-18 of this term sheet for additional information. The actual value of your notes at any time will reflect many factors and cannot be predicted with accuracy.

_________________________

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note Prospectus (as defined below) is truthful or complete. Any representation to the contrary is a criminal offense.

_________________________

|

|

Per Unit

|

Total

|

|

Public offering price(1)

|

$10.000

|

$20,202,140.00

|

|

Underwriting discount(1)

|

$ 0.225

|

$ 439,396.90

|

|

Proceeds, before expenses, to BofA Finance

|

$ 9.775

|

$19,762,743.10

|

|

(1)

|

The public offering pricing and underwriting discount for an aggregate of 310,000 units purchased in a transaction of 300,000 units or more in a single transaction by an individual investor or in combined transactions with the investor’s household in this offering is $9.95 per unit and $0.175 per unit, respectively. See “Supplement to the Plan of Distribution; Conflicts of Interest” below.

|

The notes and the related guarantee:

|

Are Not FDIC Insured

|

Are Not Bank Guaranteed

|

May Lose Value

|

BofA Securities

April 22, 2022

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

Summary

The Market Index Target-Term Securities® Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025 (the “notes”) are our senior unsecured debt securities. Payments on the notes are fully and unconditionally guaranteed by BAC. The notes and the related guarantee are not insured by the Federal Deposit Insurance Corporation or secured by collateral. The notes will rank equally in right of payment with all of BofA Finance’s other unsecured and unsubordinated debt, and the related guarantee will rank equally in right of payment with all of BAC’s other unsecured and unsubordinated obligations, in each case, except obligations that are subject to any priorities or preferences by law. Any payments due on the notes, including any repayment of principal, will be subject to the credit risk of BofA Finance, as issuer, and BAC, as guarantor. The notes provide you with 135% participation in increases in the value of the Market Measure, which is the basket of four commodity futures contracts described below (the “Basket”). If the Basket is flat or decreases, you will receive only the principal amount of your notes. Any payments on the notes will be calculated based on the $10 principal amount per unit and will depend on the performance of the Basket, subject to our and BAC’s credit risk. See “Terms of the Notes” below.

The Basket will be comprised of (i) the official price per barrel of West Texas Intermediate (“WTI”) light sweet crude oil traded on the New York Mercantile Exchange (the “NYMEX”), stated in U.S. dollars, of the first nearby month futures contract, as displayed on Bloomberg Page “CL1 <CMDTY>” (or any applicable successor page) (the “WTI Crude Oil Futures Contract”), (ii) the official price per MMBTU of deliverable grade natural gas traded on the NYMEX, stated in U.S. dollars, of the first nearby month futures contract, as displayed on Bloomberg Page “NG1 <CMDTY>” (or any applicable successor page) (the “Natural Gas Futures Contract”), (iii) the official price per bushel of deliverable grade corn traded on the Chicago Board of Trade (“CBOT”), stated in U.S. cents, of the first nearby month futures contract, as displayed on Bloomberg Page “C 1 <CMDTY>” (or any applicable successor page) (the “Corn Futures Contract”) and (iv) the official price per bushel of deliverable grade soybeans traded on the CBOT, stated in U.S. cents, of the first nearby month futures contract, as displayed on Bloomberg Page “S 1 <CMDTY>” (or any applicable successor page) (the “Soybeans Futures Contract”) (each, a “Basket Component”). On the pricing date, each Basket Component was given an equal weight.

The economic terms of the notes (including the Participation Rate) are based on BAC’s internal funding rate, which is the rate it would pay to borrow funds through the issuance of market-linked notes and the economic terms of certain related hedging arrangements. BAC’s internal funding rate is typically lower than the rate it would pay when it issues conventional fixed or floating rate debt securities. This difference in funding rate, as well as the underwriting discount and the hedging-related charge described below, reduced the economic terms of the notes to you and the initial estimated value of the notes on the pricing date. Due to these factors, the public offering price you are paying to purchase the notes is greater than the initial estimated value of the notes.

On the cover page of this term sheet, we have provided the initial estimated value for the notes. This initial estimated value was determined based on our, BAC’s and our other affiliates’ pricing models, which take into consideration BAC’s internal funding rate and the market prices for the hedging arrangements related to the notes. For more information about the initial estimated value and the structuring of the notes, see “Structuring the Notes” on page TS-17.

|

Terms of the Notes

|

|

Redemption Amount Determination

|

|

Issuer:

|

BofA Finance LLC (“BofA Finance”)

|

|

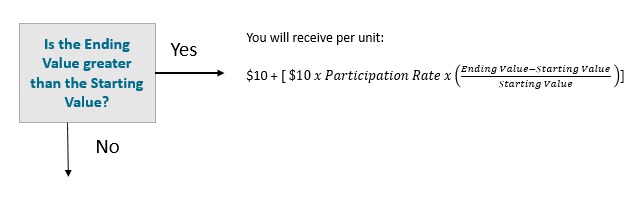

On the maturity date, you will receive a cash payment per unit determined as follows:

You will receive the Minimum Redemption Amount per unit of $10.00

|

|

Guarantor:

|

Bank of America Corporation (“BAC”)

|

|

Principal Amount:

|

$10.00 per unit

|

|

Term:

|

Approximately three years

|

|

Market Measure:

|

An equally weighted basket comprised of the WTI Crude Oil Futures Contract (Bloomberg symbol “CL1”), the Natural Gas Futures Contract (Bloomberg symbol: “NG1”), the Corn Futures Contract (Bloomberg symbol: “C 1”), and the Soybeans Futures Contract (Bloomberg symbol: “S 1”).

The contracts that were used to determine the prices of the Basket Components on the pricing date and the contracts that will be used to determine the prices of the Basket Components on each calculation day occurring during the Maturity Valuation Period were or will be (as applicable) the contracts scheduled for delivery as set forth below, subject to adjustment depending on when the calculation days occur:

Calculation Days Contract*†

Crude Oil Futures Contract

Natural Gas Futures Contract

Soybeans Futures Contract

*Denotes expiration date of applicable futures contract.

†The exact expiration dates of these futures contracts are not yet known as of the date of this document and are therefore expressed in Month/Year format.

|

|

Starting Value:

|

100.00

|

|

Market Index Target-Term Securities®

|

TS-2

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

|

Ending Value:

|

The average of the values of the Basket on each calculation day occurring during the Maturity Valuation Period. The scheduled calculation days are subject to postponement in the event of Market Disruption Events, as described beginning on page PS-29 of product supplement COMM MITTS-1.

|

|

|

Minimum Redemption Amount:

|

$10.00 per unit. If you sell your notes before the maturity date, you may receive less than the Minimum Redemption Amount per unit.

|

|

Participation Rate:

|

135%

|

|

Maturity Valuation Period:

|

April 8, 2025; April 9, 2025; April 10,2025; April 11, 2025; and April 14, 2025

|

|

Fees and Charges:

|

The underwriting discount of $0.225 per unit listed on the cover page and the hedging related charge of $0.075 per unit described in “Structuring the Notes” on page TS-18.

|

|

Calculation Agent:

|

BofA Securities Inc. (“BofAS”), an affiliate of BofA Finance.

|

|

Market Index Target-Term Securities®

|

TS-3

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

The terms and risks of the notes are contained in this term sheet and in the following:

These documents (together, the “Note Prospectus”) have been filed as part of a registration statement with the SEC, which may, without cost, be accessed on the SEC website at www.sec.gov or obtained from Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) or BofAS by calling 1-800-294-1322. Before you invest, you should read the Note Prospectus, including this term sheet, for information about us, BAC and this offering. Any prior or contemporaneous oral statements and any other written materials you may have received are superseded by the Note Prospectus. Certain terms used but not defined in this term sheet have the meanings set forth in the accompanying product supplement. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our,” or similar references are to BofA Finance, and not to BAC.

Investor Considerations

|

You may wish to consider an investment in the notes if:

|

The notes may not be an appropriate investment for you if:

|

■

You anticipate that the value of the Basket will increase from the Starting Value to the Ending Value.

■

You accept that the return on the notes will be zero if the Basket does not increase from the Starting Value to the Ending Value.

■

You are willing to forgo the interest payments that are paid on conventional interest bearing debt securities.

■

You are willing to forgo the rights and benefits of owning a Basket Component or any related commodity.

■

You are willing to accept a limited or no market for sales prior to maturity, and understand that the market prices for the notes, if any, will be affected by various factors, including our and BAC’s actual and perceived creditworthiness, BAC’s internal funding rate and fees and charges on the notes.

■

You are willing to assume our credit risk, as issuer of the notes, and BAC’s credit risk, as guarantor of the notes, for all payments under the notes, including the Redemption Amount.

|

■

You believe that the value of the Basket will be flat or decrease from the Starting Value to the Ending Value or that it will not increase sufficiently over the term of the notes to provide you with your desired return.

■

You seek a guaranteed return beyond the Minimum Redemption Amount.

■

You seek interest payments or other current income on your investment.

■

You want to receive the rights and benefits of owning a Basket Component or any related commodity.

■

You seek an investment for which there will be a liquid secondary market.

■

You are unwilling or are unable to take market risk on the notes, to take our credit risk, as issuer of the notes, or to take BAC’s credit risk, as guarantor of the notes.

|

We urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

|

Market Index Target-Term Securities®

|

TS-4

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

Hypothetical Payout Profile and Examples of Payments at Maturity

|

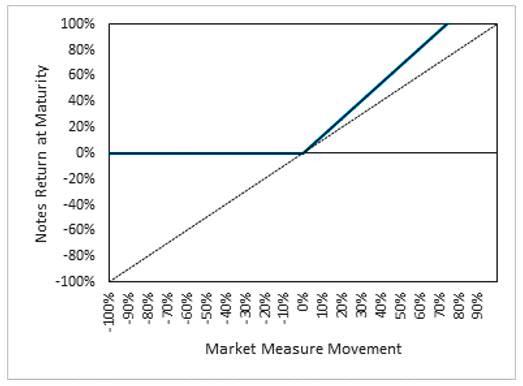

Market Index Target-Term Securities

|

This graph reflects the returns on the notes, based on the Participation Rate of 135% and the Minimum Redemption Amount of $10.00 The blue line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct investment in futures contracts for WTI light sweet crude oil, natural gas, corn and soybeans, as measured by the Basket Components.

This graph has been prepared for purposes of illustration only.

|

The following table and examples are for purposes of illustration only. They are based on hypothetical values and show hypothetical returns on the notes. They illustrate the calculation of the Redemption Amount and total rate of return based on the Starting Value of 100, the Participation Rate of 135.00%, the Minimum Redemption Amount of $10.00 per unit and a range of hypothetical Ending Values. The actual amount you receive and the resulting total rate of return will depend on the actual Ending Value and whether you hold the notes to maturity. The following examples do not take into account any tax consequences from investing in the notes.

For recent hypothetical values of the Basket, see “The Basket” section below. For recent actual prices of the Basket Components, see “The Basket Components” section below. All payments on the notes are subject to issuer and guarantor credit risk.

|

Ending Value

|

Percentage Change from the Starting Value to the Ending Value

|

Redemption Amount per Unit(1)

|

Total Rate of Return on the Notes

|

|

0.00

|

-100.00%

|

$10.000(2)

|

0.00%

|

|

25.00

|

-75.00%

|

$10.000

|

0.00%

|

|

50.00

|

-50.00%

|

$10.000

|

0.00%

|

|

75.00

|

-25.00%

|

$10.000

|

0.00%

|

|

100.00(3)

|

0.00%

|

$10.000

|

0.00%

|

|

105.00

|

5.00%

|

$10.675

|

6.75%

|

|

110.00

|

10.00%

|

$11.350

|

13.50%

|

|

120.00

|

20.00%

|

$12.700

|

27.00%

|

|

130.00

|

30.00%

|

$14.050

|

40.50%

|

|

140.00

|

40.00%

|

$15.400

|

54.00%

|

|

150.00

|

50.00%

|

$16.750

|

67.50%

|

|

160.00

|

60.00%

|

$18.100

|

81.00%

|

|

170.00

|

70.00%

|

$19.450

|

94.50%

|

|

(1)

|

The Redemption Amount per unit is based on the Participation Rate.

|

|

(2)

|

The Redemption Amount per unit will not be less than the Minimum Redemption Amount.

|

|

(3)

|

The Starting Value was set to 100.00 on the pricing date.

|

|

Market Index Target-Term Securities®

|

TS-5

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

Redemption Amount Calculation Examples

|

Example 1

|

|

The Ending Value is 50.00, or 50.00% of the Starting Value:

|

|

Starting Value: 100.00

|

|

Ending Value: 50.00

|

|

Redemption Amount per unit = $10.00, the Minimum Redemption Amount, since the Ending Value is less than the Starting Value.

|

|

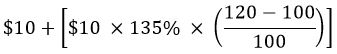

Example 2

|

|

The Ending Value is 120.00, or 120.00% of the Starting Value:

|

|

Starting Value: 100.00

|

|

Ending Value: 120.00

|

|

|

= $12.70 Redemption Amount per unit

|

|

Market Index Target-Term Securities®

|

TS-6

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

Risk Factors

There are important differences between the notes and a conventional debt security. An investment in the notes involves significant risks, including those listed below. You should carefully review the more detailed explanation of risks relating to the notes in the “Risk Factors” sections beginning on page PS-6 of the accompanying product supplement, page S-5 of the Series A MTN prospectus supplement, and page 7 of the prospectus identified above. We also urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

Structure-related Risks

|

■

|

Depending on the performance of the Basket as measured shortly before the maturity date, you may not earn a return on your investment.

|

|

■

|

Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of comparable maturity.

|

|

■

|

Payments on the notes are subject to our credit risk and the credit risk of BAC, and any actual or perceived changes in our or BAC’s creditworthiness are expected to affect the value of the notes. If we and BAC become insolvent or are unable to pay our respective obligations, you may lose your entire investment.

|

|

■

|

We are a finance subsidiary and, as such, have no independent assets, operations or revenues.

|

|

■

|

BAC’s obligations under its guarantee of the notes will be structurally subordinated to liabilities of its subsidiaries.

|

|

■

|

The notes issued by us will not have the benefit of any cross-default or cross-acceleration with other indebtedness of BofA Finance or BAC; and events of bankruptcy or insolvency or resolution proceedings relating to BAC and covenant breach by BAC will not constitute an event of default with respect to the notes.

|

Valuation- and Market-related Risks

|

■

|

The initial estimated value of the notes considers certain assumptions and variables and relies in part on certain forecasts about future events, which may prove to be incorrect. The initial estimated value of the notes is an estimate only, determined as of the pricing date by reference to our and our affiliates’ pricing models. These pricing models consider certain assumptions and variables, including our credit spreads, and those of BAC, BAC’s internal funding rate on the pricing date, mid-market terms on hedging transactions, expectations on interest rates and volatility, price-sensitivity analysis, and the expected term of the notes. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect.

|

|

■

|

The public offering price you are paying for the notes exceeds the initial estimated value. If you attempt to sell the notes prior to maturity, their market value may be lower than the price you paid for them and lower than the initial estimated value. This is due to, among other things, changes in the value of the Basket, changes in BAC’s internal funding rate, and the inclusion in the public offering price of the underwriting discount and the hedging-related charge, all as further described in “Structuring the Notes” beginning on page TS-18. These factors, together with various credit, market and economic factors over the term of the notes, are expected to reduce the price at which you may be able to sell the notes in any secondary market and will affect the value of the notes in complex and unpredictable ways.

|

|

■

|

The initial estimated value does not represent a minimum or maximum price at which we, BAC, MLPF&S, BofAS or any of our other affiliates would be willing to purchase your notes in any secondary market (if any exists) at any time. The value of your notes at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Basket, our and BAC’s creditworthiness and changes in market conditions.

|

|

■

|

A trading market is not expected to develop for the notes. None of us, BAC, MLPF&S or BofAS is obligated to make a market for, or to repurchase, the notes. There is no assurance that any party will be willing to purchase the notes at any price in any secondary market.

|

Conflict-related Risks

|

■

|

BAC and its affiliates’ hedging and trading activities (including trades related to the Basket Components and the related commodities) and any hedging and trading activities BAC or its affiliates engage in that are not for your account or on your behalf, may affect the market value and return of the notes and may create conflicts of interest with you.

|

|

■

|

There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours. We have the right to appoint and remove the calculation agent.

|

Market Measure-related Risks

|

■

|

Changes in the price of one of the Basket Components may be offset by changes in the prices of the other Basket Components.

|

|

■

|

Ownership of the notes will not entitle you to any rights with respect to any Basket Component or any related commodity.

|

|

■

|

Suspensions or disruptions of trading in any Basket Component and any related commodity may adversely affect the value of the notes

|

|

■

|

Changes in exchange methodology related to a Basket Component may adversely affect the value of the notes prior to maturity.

|

|

Market Index Target-Term Securities®

|

TS-7

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

|

■

|

Legal and regulatory changes could adversely affect the return on and value of your notes.

|

|

■

|

The notes will not be regulated by the U.S. Commodity Futures Trading Commission.

|

Tax-related Risks

|

■

|

The U.S. federal income tax consequences of the notes are uncertain and may be adverse to a holder of the notes. See “Summary Tax Consequences” below and “U.S. Federal Income Tax Summary” beginning on page PS-32 of the accompanying product supplement.

|

Additional Risk Factors

Commodity prices of a single commodity, such as each Basket Component, tend to be more volatile than, and may not correlate with, the prices of commodities generally.

The notes are linked to a basket of the WTI Crude Oil Futures Contract, the Natural Gas Futures Contract, the Corn Futures Contract and the Soybeans Futures Contract, and not to a diverse basket of commodities or a broad-based commodity index. The prices of the Basket Components may not correlate to the prices of commodities generally and may diverge significantly from the prices of commodities generally. Because the notes are linked to the prices of a limited number of commodities, they carry greater risk and may be more volatile than securities linked to the prices of a larger number of commodities or a broad-based commodity index. In addition, the prices of many individual commodities, including the Basket Components, have recently been highly volatile and there can be no assurance that the volatility will lessen.

The price movements in each of the Basket Components may not correlate with changes in its corresponding commodity’s spot price.

Each of the Basket Components is a futures contract for specific commodities. Unlike equities, which typically entitle the holder to a continuing stake in a corporation, a commodity futures contract is typically an agreement to buy a set amount of an underlying physical commodity at a predetermined price during a stated delivery period. A futures contract reflects the expected value of the underlying physical commodity upon delivery in the future. In contrast, the underlying physical commodity’s current or “spot” price reflects the immediate delivery value of the commodity.

The notes are linked to the Basket Components and not to the spot price of commodities, and an investment in the notes is not the same as buying and holding the physical commodity represented by each Basket Component. While price movements in each of the Basket Components may correlate with changes in its corresponding commodity’s spot price, the correlation will not be perfect and price movements in the spot market may not be reflected in the futures market (and vice versa). Accordingly, an increase in the spot price of a commodity may not result in an increase in the price of the corresponding futures contract. The price of a futures contract may decrease while the spot price of its corresponding commodity remains stable or increases, or does not decrease to the same extent.

The market value of the notes may be affected by price movements in distant-delivery futures contracts associated with the Basket Components.

The price movements in the Basket Components may not be reflected in the market value of the notes. If you are able to sell your notes, the price you receive could be affected by changes in the values of futures contracts for WTI light sweet crude oil, natural gas, corn and soybeans that have more distant delivery dates than the Basket Components. The prices for these distant-delivery futures contracts may not increase to the same extent as the prices of the Basket Components, or may decrease to a greater extent, which may adversely affect the value of the notes.

The Notes provide exposure to futures contracts on WTI light sweet crude oil, natural gas, corn and soybeans and not direct exposure to such commodities.

The price of a futures contract reflects the expected value of the underlying commodity upon delivery in the future, whereas the spot price of the commodity reflects the immediate delivery value of that commodity. A variety of factors can lead to a disparity between the expected future price of a commodity and its spot price at a given point in time, such as the cost of storing the commodity for the term of the futures contract, interest charges incurred to finance the purchase of the commodity and expectations concerning supply and demand for the commodity. The price movement of a futures contract is typically correlated with the movements of the spot price of the reference commodity, but the correlation is generally imperfect and price movements of the spot price may not be reflected in the futures market (and vice versa).

In addition, the difference between a futures price and a spot price is typically greater the longer the remaining term of the futures contract (in other words, futures prices converge toward spot prices as the expiration of the futures contract nears). As a result, the price of each of the futures contracts on WTI light sweet crude oil, natural gas, corn and soybeans during the Maturity Valuation Period will be influenced in part by how much time remains to expiration of the futures contracts during the Maturity Valuation Period. Had the Maturity Valuation Period occurred with a different length of time remaining to expiration of the futures contracts, your return on the notes might have been more favorable.

The market price of each Basket Component will affect the value of the Notes.

The value of the notes will depend on the price of each Basket Component. Specific factors related to each Basket Component that may affect its price are:

|

Market Index Target-Term Securities®

|

TS-8

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

|

■

|

WTI light sweet crude oil. WTI light sweet crude oil futures are primarily affected by the demand for and supply of crude oil, but are also influenced significantly from time to time by speculative actions and by currency exchange rates. Crude oil prices are generally highly volatile and subject to dislocation. Demand for refined petroleum products by consumers, as well as the agricultural, manufacturing and transportation industries, affects the price of crude oil. Crude oil’s end-use as a refined product is often as transport fuel, industrial fuel and in-home heating fuel. Potential for substitution in most areas exists. Because the precursors of demand for petroleum products are linked to economic activity, demand will tend to reflect economic conditions. Demand is also influenced by government regulations, such as environmental or consumption policies. In addition to general economic activity and demand, prices for crude oil are affected by political events, labor activity and, in particular, direct government intervention (such as embargos) or supply disruptions in major oil-producing regions of the world. Such events tend to affect oil prices worldwide, regardless of the location of the event. Supply for crude oil may increase or decrease depending on many factors. These include production decisions by OPEC and other crude oil producers. Crude oil prices are determined with significant influence by OPEC. OPEC has the potential to influence oil prices worldwide because its members possess a significant portion of the world’s oil supply. In the event of sudden disruptions in the supplies of oil, such as those caused by war, natural events, accidents or acts of terrorism, prices of oil futures contracts could become extremely volatile and unpredictable. Also, sudden and dramatic changes in the futures market may occur, for example, upon a cessation of hostilities that may exist in countries producing oil, the introduction of new or previously withheld supplies into the market or the introduction of substitute products or commodities. Crude oil prices may also be affected by short-term changes in supply and demand because of trading activities in the oil market and seasonality (e.g., weather conditions such as hurricanes).

|

|

■

|

Natural gas. The price of natural gas futures is primarily affected by the global demand for, and supply of, natural gas. Natural gas is used primarily for residential and commercial heating and in the production of electricity. Natural gas has also become an increasingly popular source of energy in the United States, both for consumers and industry. However, because natural gas can be used as a substitute for coal and oil in certain circumstances, the price of coal and oil influence the price of natural gas. The level of global industrial activity influences the demand for natural gas. The demand for natural gas has traditionally been cyclical, with higher demand during the winter months and lower demand during relatively warmer summer months. Seasonal temperatures in countries throughout the world can also heavily influence the demand for natural gas. The world’s supply of natural gas is concentrated in the former Soviet Union, the Middle East, Europe and Africa. In general, the supply of natural gas is based on competitive market forces. Inadequate supply at any one time leads to price increases, which signal to production companies the need to increase the supply of natural gas to the market. The ability of production companies to supply natural gas, however, is dependent on a number of factors. Factors that affect the short term supply of natural gas include the availability of skilled workers and equipment, permitting and well development, as well as weather and delivery disruptions (e.g., hurricanes, labor strikes and wars). In addition, production companies face more general barriers to their ability to increase the supply of natural gas, including access to land, the expansion of pipelines and the financial environment. These factors, which are not exhaustive, are interrelated and can have complex and unpredictable effects on the supply for, and the price of, natural gas.

|

|

■

|

Corn. The price of corn futures is primarily affected by the global demand for, and supply of, corn. The demand for corn is in part linked to the development of industrial and energy uses for corn. This includes the use of corn in the production of ethanol. The demand for corn is also affected by the production and profitability of the pork and poultry sectors, which use corn for feed. Negative developments in those industries may lessen the demand for corn. For example, if avian flu were to have a negative effect on world poultry markets, the demand for corn might decrease. The supply of corn is dependent on many factors including weather patterns, government regulation, the price of fuel and fertilizers and the current and previous price of corn. The United States is the world’s largest supplier of corn, followed by China and Brazil. The supply of corn is particularly sensitive to weather patterns in the United States and China. In addition, technological advances could lead to increases in worldwide production of corn and corresponding decreases in the price of corn. Furthermore, any changes in the policies or regulations of CBOT or other regulators could also affect the price of corn.

|

|

■

|

Soybeans. The price of soybeans futures is primarily affected by the global demand for, and supply of, soybeans, but is also influenced significantly from time to time by speculative actions and by currency exchange rates. The demand for soybeans is in part linked to the development of industrial and energy uses for soybeans. This includes the use of soybeans in the production of biodiesels. The supply of soybeans is dependent on many factors including weather patterns, government regulation, the price of fuel and fertilizers and the current and previous price of soybeans. The United States is the world’s largest supplier of soybeans, followed by Brazil. The supply of soybeans is particularly sensitive to weather patterns in the United States and Brazil. In addition, technological advances could lead to increases in worldwide production of soybeans and corresponding decreases in the price of soybeans. Furthermore, any changes in the policies or regulations of the CBOT or other regulators could also affect the price of soybeans futures.

|

|

Market Index Target-Term Securities®

|

TS-9

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

The Basket

The Basket is designed to allow investors to participate in the percentage changes in the prices of the Basket Components from the Starting Value to the Ending Value of the Basket. The Basket Components are described in the section “The Basket Components” below. Each Basket Component will be assigned an initial weight on the pricing date, as set forth in the table below.

For more information on the calculation of the value of the Basket, please see the section entitled “Description of MITTS—Basket Market Measures" beginning on page PS-27 of the accompanying product supplement.

On the pricing date, the Initial Component Weight, the closing price, the Component Ratio and the initial contribution to the Basket value for each Basket Component are as follows:

|

Basket Component

|

|

Bloomberg Symbol

|

|

Initial Component Weight

|

|

Closing Price(1)

|

|

Component Ratio(2)

|

|

Initial Basket Value Contribution

|

|

WTI Crude Oil Futures Contract

|

|

CL1

|

|

25.00%

|

|

$102.07

|

|

0.24492995

|

|

25.00

|

|

Natural Gas Futures Contract

|

|

NG1

|

|

25.00%

|

|

$6.534

|

|

3.82614019

|

|

25.00

|

|

Corn Futures Contract

|

|

C 1

|

|

25.00%

|

|

$7.9300

|

|

3.15258512

|

|

25.00

|

|

Soybeans Futures Contract

|

|

S 1

|

|

25.00%

|

|

$17.1600

|

|

1.45687646

|

|

25.00

|

|

|

|

|

|

|

|

|

|

Starting Value

|

|

100.00

|

|

(1)

|

These were the closing prices of the Basket Components on the pricing date.

|

|

(2)

|

Each Component Ratio equals the Initial Component Weight of the relevant Basket Component (as a percentage) multiplied by 100, and then divided by the closing price of that Basket Component on pricing date and rounded to eight decimal places.

|

The Ending Value of the Basket will equal the average of the values of the Basket on each calculation day during the Maturity Valuation Period. The calculation agent will calculate the value of the Basket on each calculation day during the Maturity Valuation Period by summing the products of the closing price for each Basket Component on such calculation day and the Component Ratio applicable to such Basket Component. If a Market Disruption Event occurs as to any Basket Component on any scheduled calculation day, or if any scheduled calculation day is not a Market Measure Business Day with respect to any Basket Component, the closing price of that Basket Component will be determined as more fully described beginning on page PS-29 of the accompanying product supplement in the section “Description of MITTS—Basket Market Measures—Ending Value of the Basket.”

|

Market Index Target-Term Securities®

|

TS-10

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

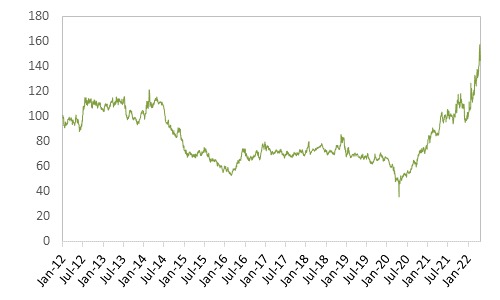

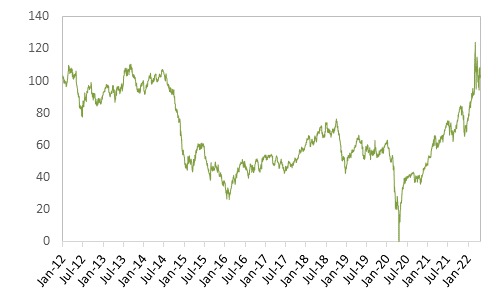

While actual historical information on the Basket does not exist before the pricing date, the following graph sets forth the hypothetical historical daily performance of the Basket from January 1, 2012 through April 22, 2022. The graph is based upon actual daily historical prices of the Basket Components, the Component Ratios based on the closing prices of the Basket Components as of December 31, 2011, and a Basket value of 100.00 as of that date. This hypothetical historical data on the Basket is not necessarily indicative of the future performance of the Basket or what the value of the notes may be. Any hypothetical historical upward or downward trend in the value of the Basket during any period set forth below is not an indication that the value of the Basket is more or less likely to increase or decrease at any time over the term of the notes.

Hypothetical Historical Performance of the Basket

|

Market Index Target-Term Securities®

|

TS-11

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

The Basket Components

All disclosures contained in this term sheet regarding the Basket Components have been derived from publicly available sources. The information reflects the policies of, and is subject to change by, the relevant exchange. The consequences of any exchange discontinuing publication or determination of a Basket Component are discussed in the section entitled “Description of MITTS— Discontinuance of a Market Measure” beginning on page PS-26 of the accompanying product supplement. None of us, the calculation agent, MLPF&S or BofAS accepts any responsibility for the calculation, maintenance or publication of any Basket Component or any successor exchange.

The Futures Market

An exchange-traded futures contract, such as each of the Basket Components, provides for the future purchase and sale of a specified type and quantity of a commodity, at a particular price and on a specific date. Futures contracts are standardized so that each investor trades contracts with the same requirements as to quality, quantity, and delivery terms. Rather than settlement by physical delivery of the commodity, futures contracts may be settled for the cash value of the right to receive or sell the specified commodity on the specified date. Exchange-traded futures contracts are traded on organized exchanges such as the NYMEX, known as “contract markets,” through the facilities of a centralized clearing house and a brokerage firm which is a member of the clearing house.

The WTI Crude Oil Futures Contract

WTI light sweet crude oil futures contracts trade on the NYMEX. The price of the WTI Crude Oil Futures Contract is based on the official price per barrel of WTI light sweet crude oil traded on the NYMEX, stated in U.S. dollars, of the first nearby month futures contract.

A WTI light sweet crude oil futures contract traded on the NYMEX is an agreement to buy or sell 1,000 barrels of crude oil (as defined under the NYMEX’s rules) within a specified expiration month in the future at a price specified at the time of entering into the contract. At any given time, the NYMEX lists crude oil futures contracts with expiration months occurring in each month over the next ten years (and less frequently thereafter).

The NYMEX determines an official settlement price for NYMEX crude oil futures contracts on each trading day as of 2:30 p.m., New York City time. The daily settlement price of the nearest-to-expiration NYMEX crude oil futures contract is the volume-weighted average price of all trades in that contract that are executed between 2:28:00 and 2:30:00 p.m., New York City time. The daily settlement price of the next expiring NYMEX crude oil futures contract is the price implied from the volume-weighted average price of all trades executed in the spread between the nearest-to-expiration contract and the next expiring contract between 2:28:00 and 2:30:00 p.m., New York City time, using the daily settlement price of the nearest-to-expiration contract as the anchor price and adding to it the spread.

|

Market Index Target-Term Securities®

|

TS-12

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

The following graph shows the daily historical performance of the WTI Crude Oil Futures Contract in the period from January 1, 2012 through April 22, 2022. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On April 22, 2022, the closing price of the WTI Crude Oil Futures Contract was $102.07.

Historical Performance of the WTI Crude Oil Futures Contract

This historical data on the WTI Crude Oil Futures Contract is not necessarily indicative of the future performance of the WTI Crude Oil Futures Contract or what the value of the notes may be. Any historical upward or downward trend in the price of the WTI Crude Oil Futures Contract during any period set forth above is not an indication that the price of the WTI Crude Oil Futures Contract is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices of the WTI Crude Oil Futures Contract.

|

Market Index Target-Term Securities®

|

TS-13

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

Natural Gas Futures Contract

Natural gas futures contracts trade on the NYMEX. The price of the Natural Gas Futures Contract is based on the official price per MMBTU of deliverable grade natural gas traded on the NYMEX, stated in U.S. dollars, of the first nearby month futures contract.

A natural gas futures contract traded on the NYMEX is an agreement to buy or sell 10,000 million British thermal units (as defined under the NYMEX’s rules) within a specified expiration month in the future at a price specified at the time of entering into the contract. The price of the natural gas contract is based on delivery at the Henry Hub, which refers to piping and related facilities owned and/or leased by Sabine Pipe Line LLC near Erath, Louisiana. Natural gas trades in contracts for 10,000 million British thermal units and must meet the specifications set forth in the FERC-approved tariff of Sabine Pipe Line LLC as then in effect at the time of delivery.

The NYMEX determines an official settlement price for natural gas futures contracts on each trading day as of 2:30 p.m., New York City time. The daily settlement price of the nearest-to-expiration NYMEX natural gas futures contract is the volume-weighted average price of all trades in that contract that are executed between 2:28:00 and 2:30:00 p.m., New York City time. The daily settlement price of the next expiring NYMEX natural gas futures contract is the price implied from the volume-weighted average price of all trades executed in the spread between the nearest-to-expiration contract and the next expiring contract between 2:28:00 and 2:30:00 p.m., New York City time, using the daily settlement price of the nearest-to-expiration contract as the anchor price and adding to it the spread.

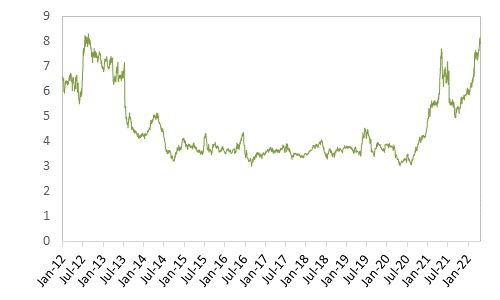

The following graph shows the daily historical performance of the Natural Gas Futures Contract in the period from January 1, 2012 through April 22, 2022. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On April 22, 2022, the closing value of the Natural Gas Futures Contract was $6.534.

Historical Performance of the Natural Gas Futures Contract

This historical data on the Natural Gas Futures Contract is not necessarily indicative of the future performance of the Natural Gas Futures Contract or what the value of the notes may be. Any historical upward or downward trend in the price of the Natural Gas Futures Contract during any period set forth above is not an indication that the price of the Natural Gas Futures Contract is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices of the Natural Gas Futures Contract.

|

Market Index Target-Term Securities®

|

TS-14

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

Corn Futures Contract

Corn futures contracts trade on the CBOT. The price of the Corn Futures Contract is based on the official price per bushel of deliverable grade corn traded on the CBOT, stated in U.S. cents, of the first nearby month futures contract.

A corn futures contract trades on the CBOT in 5,000 bushel increments, and delivery is on the No. 2 yellow corn at par with substitutions deliverable at various differentials established by the exchange. Contract months are March, May, July, September and December. The CBOT determines an official settlement price for corn futures contracts on each trading day as of 2:15 p.m., New York time. The daily settlement price of the nearest-to-expiration corn futures contract is the volume-weighted average price of all trades in that contract that are executed between 2:14:00 and 2:15:00 p.m., New York City time. The daily settlement price of the next expiring corn futures contract is the price implied from the volume-weighted average price of all trades executed in the spread between the nearest-to-expiration contract and the next expiring contract between 2:14:00 and 2:15:00 p.m., New York City time, using the daily settlement price of the nearest-to-expiration contract as the anchor price and adding to it the spread.

The following graph shows the daily historical performance of the Corn Futures Contract in the period from January 1, 2012 through April 22, 2022. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On April 22, 2022, the closing value of the Corn Futures Contract was $7.9300.

Historical Performance of the Corn Futures Contract

This historical data on the Corn Futures Contract is not necessarily indicative of the future performance of the Corn Futures Contract or what the value of the notes may be. Any historical upward or downward trend in the price of the Corn Futures Contract during any period set forth above is not an indication that the price of the Corn Futures Contract is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices of the Corn Futures Contract.

|

Market Index Target-Term Securities®

|

TS-15

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

Soybeans Futures Contract

Soybeans futures contracts trade on the CBOT. The price of the Soybeans Futures Contract is based on the official price per bushel of deliverable grade soybeans traded on the CBOT, stated in U.S. cents, of the first nearby month futures contract.

A soybeans futures contract trades on the CBOT in 5,000 bushel increments, and delivery is on the No. 2 yellow soybean at par with substitutions deliverable at various differentials established by the exchange. Contract months are January, March, May, July, August, September and November. The CBOT determines an official settlement price for soybeans futures contracts on each trading day as of 2:15 p.m., New York time. The daily settlement price of the nearest-to-expiration soybeans futures contract is the volume-weighted average price of all trades in that contract that are executed between 2:14:00 and 2:15:00 p.m., New York City time. The daily settlement price of the next expiring soybeans futures contract is the price implied from the volume-weighted average price of all trades executed in the spread between the nearest-to-expiration contract and the next expiring contract between 2:14:00 and 2:15:00 p.m., New York City time, using the daily settlement price of the nearest-to-expiration contract as the anchor price and adding to it the spread.

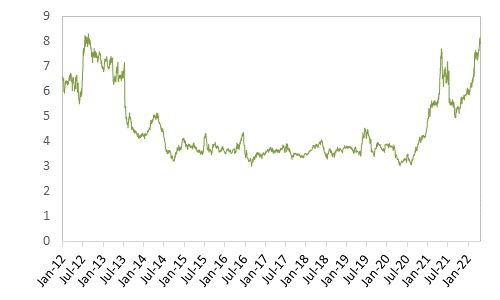

The following graph shows the daily historical performance of the Soybeans Futures Contract in the period from January 1, 2012 through April 22, 2022. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On April 22, 2022, the closing value of the Soybeans Futures Contract was $17.1600.

Historical Performance of the Soybeans Futures Contract

This historical data on the Soybeans Futures Contract is not necessarily indicative of the future performance of the Soybeans Futures Contract or what the value of the notes may be. Any historical upward or downward trend in the price of the Soybeans Futures Contract during any period set forth above is not an indication that the price of the Soybeans Futures Contract is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices of the Soybeans Futures Contract.

|

Market Index Target-Term Securities®

|

TS-16

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

Supplement to the Plan of Distribution; Conflicts of Interest

Under our distribution agreement with BofAS, BofAS will purchase the notes from us as principal at the public offering price indicated on the cover of this term sheet, less the indicated underwriting discount.

MLPF&S will purchase the notes from BofAS for resale, and will receive a selling concession in connection with the sale of the notes in an amount up to the full amount of underwriting discount set forth on the cover of this term sheet.

MLPF&S and BofAS, each a broker-dealer subsidiary of BAC, are members of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and will participate as selling agent in the case of BofAS and as dealer in the case of MLPF&S in the distribution of the notes. Accordingly, offerings of the notes will conform to the requirements of Rule 5121 applicable to FINRA members. Neither BofAS nor MLPF&S may make sales in this offering to any of its discretionary accounts without the prior written approval of the account holder.

We will deliver the notes against payment therefor in New York, New York on a date that is greater than two business days following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes more than two business days prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement.

The notes will not be listed on any securities exchange. In the original offering of the notes, the notes will be sold in minimum investment amounts of 100 units. If you place an order to purchase the notes, you are consenting to MLPF&S acting as a principal in effecting the transaction for your account.

MLPF&S and BofAS may repurchase and resell the notes, with repurchases and resales being made at prices related to then-prevailing market prices or at negotiated prices, and these will include MLPF&S’s and BofAS’s trading commissions and mark-ups or mark-downs. MLPF&S and BofAS may act as principal or agent in these market-making transactions; however, neither is obligated to engage in any such transactions. At their discretion, for a short, undetermined initial period after the issuance of the notes, MLPF&S and BofAS may offer to buy the notes in the secondary market at a price that may exceed the initial estimated value of the notes. Any price offered by MLPF&S or BofAS for the notes will be based on then-prevailing market conditions and other considerations, including the performance of the Basket and the remaining term of the notes. However, neither we nor any of our affiliates is obligated to purchase your notes at any price, or at any time, and we cannot assure you that we or any of our affiliates will purchase your notes at a price that equals or exceeds the initial estimated value of the notes.

The value of the notes shown on your account statement will be based on BofAS’s estimate of the value of the notes if BofAS or another of our affiliates were to make a market in the notes, which it is not obligated to do. That estimate will be based upon the price that BofAS may pay for the notes in light of then-prevailing market conditions and other considerations, as mentioned above, and will include transaction costs. At certain times, this price may be higher than or lower than the initial estimated value of the notes.

An investor’s household, as referenced on the cover of this term sheet, will generally include accounts held by any of the following, as determined by MLPF&S in its discretion and acting in good faith based upon information then available to MLPF&S:

|

●

|

the investor’s spouse (including a domestic partner), siblings, parents, grandparents, spouse’s parents, children and grandchildren, but excluding accounts held by aunts, uncles, cousins, nieces, nephews or any other family relationship not directly above or below the individual investor;

|

|

●

|

a family investment vehicle, including foundations, limited partnerships and personal holding companies, but only if the beneficial owners of the vehicle consist solely of the investor or members of the investor’s household as described above; and

|

|

●

|

a trust where the grantors and/or beneficiaries of the trust consist solely of the investor or members of the investor’s household as described above; provided that, purchases of the notes by a trust generally cannot be aggregated together with any purchases made by a trustee’s personal account.

|

Purchases in retirement accounts will not be considered part of the same household as an individual investor’s personal or other non-retirement account, except for individual retirement accounts (“IRAs”), simplified employee pension plans (“SEPs”), savings incentive match plan for employees (“SIMPLEs”), and single-participant or owners only accounts (i.e., retirement accounts held by self-employed individuals, business owners or partners with no employees other than their spouses).

Please contact your Merrill Lynch financial advisor if you have any questions about the application of these provisions to your specific circumstances or think you are eligible.

|

Market Index Target-Term Securities®

|

TS-17

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

Structuring the Notes

The notes are our debt securities, the return on which is linked to the performance of the Basket. The related guarantees are BAC’s obligations. As is the case for all of our and BAC’s respective debt securities, including our market-linked notes, the economic terms of the notes reflect our and BAC’s actual or perceived creditworthiness at the time of pricing. In addition, because market-linked notes result in increased operational, funding and liability management costs to us and BAC, BAC typically borrows the funds under these types of notes at a rate that is more favorable to BAC than the rate that it might pay for a conventional fixed or floating rate debt security. This rate, which we refer to in this term sheet as BAC’s internal funding rate, is typically lower than the rate BAC would pay when it issues conventional fixed or floating rate debt securities. This generally relatively lower internal funding rate, which is reflected in the economic terms of the notes, along with the fees and charges associated with market-linked notes, resulted in the initial estimated value of the notes on the pricing date being less than their public offering price.

At maturity, we are required to pay the Redemption Amount to holders of the notes, which will be calculated based on the performance of the Basket and the $10 per unit principal amount. In order to meet these payment obligations, at the time we issue the notes, we may choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives) with BofAS or one of our other affiliates. The terms of these hedging arrangements are determined by seeking bids from market participants, including BofAS and its affiliates, and take into account a number of factors, including our and BAC’s creditworthiness, interest rate movements, the volatility of the Basket Components, the tenor of the notes and the tenor of the hedging arrangements. The economic terms of the notes and their initial estimated value depend in part on the terms of these hedging arrangements.

BofAS has advised us that the hedging arrangements will include a hedging-related charge of $0.075 per unit, reflecting an estimated profit to be credited to BofAS from these transactions. Since hedging entails risk and may be influenced by unpredictable market forces, additional profits and losses from these hedging arrangements may be realized by BofAS or any third party hedge providers.

For further information, see “Risk Factors” beginning on page PS-6 and “Use of Proceeds” on page PS-20 of the accompanying product supplement.

Validity of the Notes

In the opinion of McGuireWoods LLP, as counsel to BofA Finance and BAC, when the trustee has made the appropriate entries or notations on the applicable schedule to the master global note that represents the notes (the “master note”) identifying the notes offered hereby as supplemental obligations thereunder in accordance with the instructions of BofA Finance and the provisions of the indenture governing the notes and the related guarantee, and the notes have been delivered against payment therefor as contemplated in this term sheet and the related prospectus, prospectus supplement and product supplement, such notes will be the legal, valid and binding obligations of BofA Finance, and the related guarantee will be the legal, valid and binding obligation of BAC, subject, in each case, to the effects of applicable bankruptcy, insolvency (including laws relating to preferences, fraudulent transfers and equitable subordination), reorganization, moratorium and other similar laws affecting creditors’ rights generally, and to general principles of equity. This opinion is given as of the date of this term sheet and is limited to the laws of the State of New York and the Delaware Limited Liability Company Act and the Delaware General Corporation Law (including the statutory provisions, all applicable provisions of the Delaware Constitution and reported judicial decisions interpreting the foregoing) as in effect on the date hereof. In addition, this opinion is subject to customary assumptions about the trustee’s authorization, execution and delivery of the indenture governing the notes and due authentication of the master note, the validity, binding nature and enforceability of the indenture governing the notes and the related guarantee with respect to the trustee, the legal capacity of individuals, the genuineness of signatures, the authenticity of all documents submitted to McGuireWoods LLP as originals, the conformity to original documents of all documents submitted to McGuireWoods LLP as copies thereof, the authenticity of the originals of such copies and certain factual matters, all as stated in the letter of McGuireWoods LLP dated December 30, 2019, which has been filed as an exhibit to Pre-Effective Amendment No. 1 to the Registration Statement (File No. 333-234425) of BofA Finance and BAC, filed with the SEC on December 30, 2019.

Sidley Austin LLP, New York, New York, is acting as counsel to BofAS and MLPF&S and as special tax counsel to BofA Finance and BAC.

|

Market Index Target-Term Securities®

|

TS-18

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

Summary Tax Consequences

The following summary of the material U.S. federal income tax considerations of the acquisition, ownership, and disposition of the Notes supplements, and to the extent inconsistent supersedes, the discussions under “U.S. Federal Income Tax Considerations” in the accompanying prospectus and under “U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement and is not exhaustive of all possible tax considerations. This summary is based upon the Internal Revenue Code of 1986, as amended (the “Code”), regulations promulgated under the Code by the U.S. Treasury Department (“Treasury”) (including proposed and temporary regulations), rulings, current administrative interpretations and official pronouncements of the Internal Revenue Service (“IRS”), and judicial decisions, all as currently in effect and all of which are subject to differing interpretations or to change, possibly with retroactive effect. No assurance can be given that the IRS would not assert, or that a court would not sustain, a position contrary to any of the tax consequences described below. This summary does not include any description of the tax laws of any state or local governments, or of any foreign government, that may be applicable to a particular holder.

Although the Notes are issued by us, they will be treated as if they were issued by Bank of America Corporation for U.S. federal income tax purposes. Accordingly throughout this tax discussion, references to “we,” “our” or “us” are generally to Bank of America Corporation unless the context requires otherwise.

This summary is directed solely to U.S. Holders and Non-U.S. Holders that, except as otherwise specifically noted, will purchase the Notes upon original issuance and will hold the Notes as capital assets within the meaning of Section 1221 of the Code, which generally means property held for investment, and that are not excluded from the discussion under “U.S. Federal Income Tax Considerations” in the accompanying prospectus. This discussion does not address the tax consequences applicable to holders subject to Section 451(b) of the Code. This summary assumes that the issue price of the Notes, as determined for U.S. federal income tax purposes, equals the principal amount thereof.

You should consult your own tax advisor concerning the U.S. federal income tax consequences to you of acquiring, owning, and disposing of the Notes, as well as any tax consequences arising under the laws of any state, local, foreign, or other tax jurisdiction and the possible effects of changes in U.S. federal or other tax laws.

General

No statutory, judicial, or administrative authority directly addresses the characterization of the Notes or securities similar to the Notes for U.S. federal income tax purposes. As a result, certain aspects of the U.S. federal income tax consequences of an investment in the Notes are not certain. We intend to treat the Notes as “contingent payment debt instruments” for U.S. federal income tax purposes, subject to taxation under the “noncontingent bond method.” The balance of this discussion assumes that this characterization is proper and will be respected.

U.S. Holders

If the Notes are properly characterized as contingent payment debt instruments for U.S. federal income tax purposes, such Notes generally will be subject to Treasury regulations governing contingent payment debt instruments. Under those regulations, and as further described under “U.S Federal Income Tax Considerations—General—Consequences to U.S. Holders—Debt Securities Subject to Contingences” in the accompanying prospectus, a U.S. Holder will be required to report original issue discount (“OID”) or interest income based on a “comparable yield” and a “projected payment schedule,” established by us for determining interest accruals and adjustments with respect to the Notes. A U.S. Holder of the Notes may be required to include in income OID in excess of actual cash payments received for certain taxable years.

The following table is based upon a hypothetical projected payment schedule (including estimates of the annual interest payments) and a hypothetical comparable yield equal to 3.2500% per annum (compounded semi-annually). The hypothetical comparable yield is our current estimate of the comparable yield based upon market conditions as of the date of this preliminary pricing supplement. It has been determined by us for purposes of illustrating the application of the Code and the Treasury regulations to the Notes as if the Notes had been issued on Issue Date and were scheduled to mature on Maturity Date. This tax accrual table is based upon a hypothetical projected payment schedule per $10.0000 principal amount of the Notes, which would consist of estimates of the annual interest payments and a repayment of $10.9980 at maturity. The following table is for tax purposes only, and we make no representations or predictions as to what the actual payments will be. The actual “projected payment schedule” will be completed on the pricing date, and included in the final pricing supplement.

|

Market Index Target-Term Securities®

|

TS-19

|

|

Market Index Target-Term Securities®

Linked to a Basket of Four Commodity Futures Contracts, due April 17, 2025

|

|

|

Accrual Period

|

Interest Deemed to Accrue During Accrual Period

(per $10 principal amount of the Notes)

|

Total Interest Deemed to Have Accrued from Original Issue Date (per $10 principal amount of the Notes)

|

|

May 5, 2022 through December 31, 2022

|

$0.2132

|

$0.2132

|

|

January 1, 2023 through December 31, 2023

|

$0.3347

|

$0.5479

|

|

January 1, 2024 through December 31, 2024

|

$0.3456

|

$0.8935

|

|

January 1, 2025 through April 17, 2025

|

$0.1045

|

$0.9980

|

Upon a sale, exchange, redemption, retirement, or other disposition of the Notes, a U.S. Holder generally will recognize taxable gain or loss equal to the difference between the amount realized and that holder’s tax basis in the Notes. A U.S. Holder’s tax basis in the Notes generally will equal the cost of the Notes, increased by the amount of OID previously accrued by the holder for the Notes. A U.S. Holder generally will treat any gain as interest income, and will treat any loss as ordinary loss to the extent of the excess of previous interest inclusions over the total negative adjustments previously taken into account as ordinary losses, and the balance as long-term or short-term capital loss depending upon the U.S. Holder’s holding period for the note. The deductibility of capital losses by a U.S. Holder is subject to limitations.

Non-U.S. Holders

Please see the discussion under “U.S. Federal Income Tax Considerations—General—Consequences to Non-U.S. Holders” in the accompanying prospectus for the material U.S. federal income tax consequences that will apply to Non-U.S. Holders of the Notes, except that the following disclosure supplements the discussion in the prospectus.

Backup Withholding and Information Reporting

Please see the discussion under “U.S. Federal Income Tax Considerations — General — Backup Withholding and Information Reporting” in the accompanying prospectus for a description of the applicability of the backup withholding and information reporting rules to payments made on the Notes.

Where You Can Find More Information

We and BAC have filed a registration statement (including a product supplement, a prospectus supplement and a prospectus) with the SEC for the offering to which this term sheet relates. Before you invest, you should read the Note Prospectus, including this term sheet, and the other documents relating to this offering that we and BAC have filed with the SEC, for more complete information about us, BAC and this offering. You may get these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, we, any agent or any dealer participating in this offering will arrange to send you these documents if you so request by calling MLPF&S or BofAS toll-free at 1-800-294-1322.

"Market Index Target-Term Securities®" and "MITTS®" are registered service marks of Bank of America Corporation, the parent company of MLPF&S and BofAS.

|

Market Index Target-Term Securities®

|

TS-20

|