Filed Pursuant to Rule 433

Registration No. 333-180488

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Dear Client: Thank you for your interest in Market-Linked Investments (“MLI”). Merrill Lynch has created this MLI Performance Summary to provide transparency regarding the historical performance of regularly issued types of MLIs that have matured or been automatically redeemed over the last 10-plus years. These results are displayed on a deal-by-deal basis to provide you with the ability to consider how these investments performed relative to the performance of the underlying linked asset. The summary is organized by MLI product type, with product performance summaries at the end of each respective section. When used as a complement to traditional investments (e.g., mutual funds, ETFs, individual securities, professional money managers) within core asset classes, MLIs may deliver significant value by providing a way to potentially mitigate downside investment risk in volatile markets, enhance asset class performance in low-return markets or a combination of both. We hope this MLI Performance Summary helps promote understanding of MLI performance in a variety of market environments over the last 10-plus years. This presentation is historical and is provided for informational and educational purposes only. Past performance is not indicative of future performance. We encourage you to read the entire summary, including the methodology, important considerations and risk factors that are set forth in the summary. And before investing in any MLI, you should consult your financial advisor and you should carefully read the related prospectus and other offering documents, including the risk factors, to determine whether that investment is right for you given your investment objectives, need for liquidity and other factors. Merrill Lynch makes available products and services offered by Merrill Lynch, Pierce, Fenner & Smith Incorporated, a registered broker-dealer and Member SIPC, and other subsidiaries of Bank of America Corporation. Investment products: Are Not FDIC Insured Are Not Bank Guaranteed May Lose Value

Market-Linked Investments Performance Summary December 2013

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Table of contents Overview1 Important Considerations 2 Performance Summary3–45 Accelerated Return Notes® (ARNs®) 3 Bear Accelerated Return Notes® (Bear ARNs®) 14 Leveraged Index Return Notes® (LIRNs®) 16 Capped Leveraged Index Return Notes® (Capped LIRNs®) 18 Market-Linked Step Up Notes 23 Autocallable Market-Linked Step Up Notes 26 Strategic Accelerated Redemption Securities® (STARS®)28 Bear Strategic Accelerated Redemption Securities® (Bear STARS® 34 Market Index Target-Term Securities® (MITTS®)35 STEP Income Securities® (STEPS®) 41 Coupon-Bearing Notes 45 Risk Factors 46

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Overview THE PURPOSE OF THIS PERFORMANCE SUMMARY is to illustrate the performance of Market-Linked Investments (“MLIs”) when compared with the assets to which they are linked (“Linked Assets”). This performance summary includes 1,232 MLIs, distributed by Merrill Lynch, Pierce, Fenner & Smith Incorporated and issued by Bank of America Corporation, Merrill Lynch & Co., Inc., or a third-party issuer, that have matured or were automatically redeemed between September 20, 2002, and December 31, 2013. For a variety of reasons, as described in more detail in the “Risk Factors” section of this document, prior results, including the results illustrated in this document, are not indicative of the performance of any MLI that you may purchase in the future. This Performance Summary is not intended to provide the sole basis for evaluating, and should not be considered a recommendation with respect to, any MLI, any transaction or any other matter, and it is not indicative of the future performance of any MLI. As in the case of any investment, you should carefully review the applicable prospectus or offering documents before making an investment decision. The following methodology was used as the basis of this Performance Summary: •1,232 MLIs, issued by Bank of America Corporation, reflects a bearish strategy, the “Average Strategy Return” is Merrill Lynch & Co., Inc., or a third-party issuer, that have assumed to reflect a bearish position in the Linked Asset. matured or were automatically redeemed between September •The “Average MLI Return” is equal to the simple arithmetic 20, 2002, and December 31, 2013, are included in this summary. average of the annualized returns for the MLIs included in that •MLIs are grouped by Product Type. group and does not reflect the principal amount of each MLI. •The “Average MLI Outperformance/Underperformance” Product Types Eleven different Product Types were selected: ARNs®, Bear equals the “Average MLI Return” minus the “Average Linked ARNs®, LIRNs®, Capped LIRNs®, Market-Linked Step Up Notes, Asset Return” for that group. •The “% of Offerings Where MLI Underperforms Linked Autocallable Market-Linked Step Up Notes, STARS®, Bear STARS®, Asset” is the percentage of the offerings in which the MLI MITTS®, STEPS® and Coupon-Bearing Notes. had a lower return than the Linked Asset. Linked Asset Classes •The “% of Offerings Where Performance Is Equal” is the percentage of the offerings in which the MLI had a return Three different Linked Asset Classes were selected: Equity, equal to that of the Linked Asset. Commodity and Currency. Please note that each of these Linked Asset Classes may perform differently when linked to different •The “% of Offerings Where MLI Outperformed Linked Product Types. Asset” is the percentage of the offerings in which the MLI had a higher return than the Linked Asset. For each respective group: Please note that the outperformance and underperformance •The “Average Linked Asset Return” is equal to the simple figures represent only comparisons against the Linked Asset arithmetic average of the annualized returns of the Linked Assets and are not in any way an indication of absolute positive or for the MLI issuances in that group. In instances where the MLI negative performance by the MLI. 1

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Important considerations •The Product Performance Summary tables on the •If the MLI pays periodic interest payments or following pages set forth the average performance of a large coupons, those payments or coupons are included number of MLIs. Because these amounts reflect the average in the MLI Return. performance of the indicated offerings, a significant number •The MITTS® Product Type includes MLIs that were of MLIs performed worse than these averages. not named MITTS but are included in the MITTS Product •MLIs that were redeemed or called early and would have Type because they included a significant market downside matured according to their terms after December 2013 were protection feature. included in this summary. This factor may introduce upward •The returns on the MLIs reflect the underwriting or downward bias to the Average MLI Return. compensation and other fees that are included in the terms •Returns for MLIs that were outstanding for more than one of the MLIs. year are annualized. •A wide variety of MLIs may be offered in the future. The •All MLI Returns are calculated pretax. performance of MLIs offered in the future is unlikely to be the •Returns are not asset weighted. Therefore, the returns same as the MLIs issued in the past. Accordingly, the results on each MLI count equally in determining the average MLI demonstrated in the performance tables may improve, or return, without regard to the aggregate principal amount of become worse, over time. each issuance. •The Product Types do not include all MLIs types that have •The Linked Asset for each MLI is the index, basket, equity, been offered historically. Additionally, MLIs based on interest commodity or currency referenced by the MLI. The Linked rates or inflation measures are not included in this summary. Asset Returns do not include dividends paid on the Linked •There are MLIs that have been offered that have not Asset. Such dividends would increase the return on the matured or been redeemed as of the date of this document. Linked Asset and decrease any outperformance or increase any You may contact a Merrill Lynch financial advisor to learn underperformance of the MLI. In some cases, the inclusion of more about the performance of MLI offerings that are not dividends in the return on a Linked Asset would cause it to included in this document. outperform the MLI, and not to underperform the MLI. 2

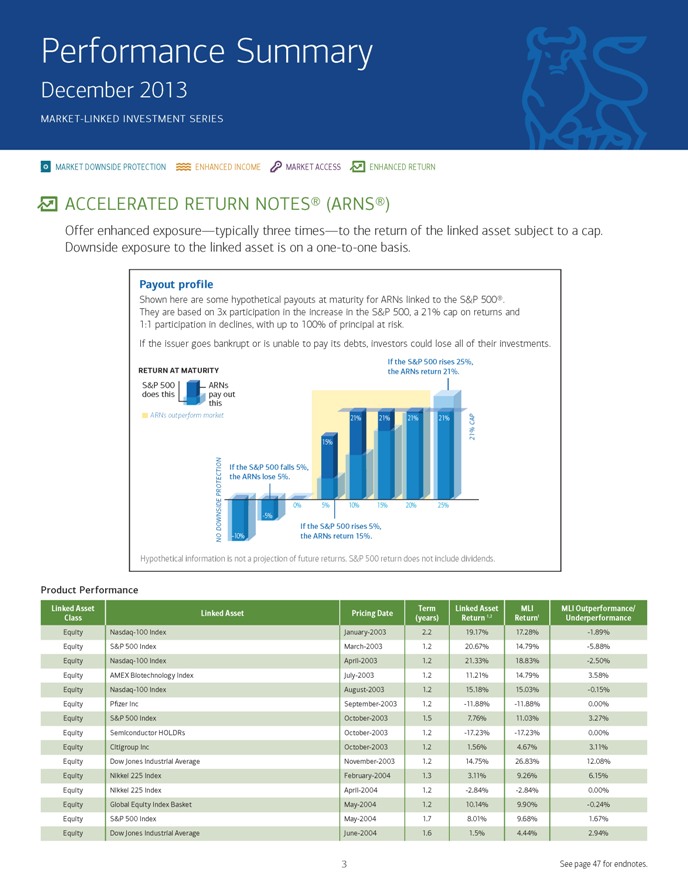

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN ACCELERATED RETURN NOTES® (ARNS®) Offer enhanced exposure—typically three times—to the return of the linked asset subject to a cap. Downside exposure to the linked asset is on a one-to-one basis. Payout profile Shown here are some hypothetical payouts at maturity for ARNs linked to the S&P 500®. They are based on 3x participation in the increase in the S&P 500, a 21% cap on returns and 1:1 participation in declines, with up to 100% of principal at risk. If the issuer goes bankrupt or is unable to pay its debts, investors could lose all of their investments. If the S&P 500 rises 25%, ReTuRn AT MATuRiTy the ARNs return 21%. S&P 500 ARNs does this pay out this ARNs outperform market 21%21% 21%21% CAP 21% 15% If the S&P 500 falls 5%, PROTECTION the ARNs lose 5%. 0% 5% 10%15% 20%25% -5% DOWNSIDE If the S&P 500 rises 5%, NO –10% the ARNs return 15%. Hypothetical information is not a projection of future returns. S&P 500 return does not include dividends. Product Performance Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity Nasdaq-100 Index January-2003 2.2 19.17% 17.28% -1.89% Equity S&P 500 Index March-2003 1.2 20.67% 14.79% -5.88% Equity Nasdaq-100 Index April-2003 1.2 21.33% 18.83% -2.50% Equity AMEX Biotechnology Index July-2003 1.2 11.21% 14.79% 3.58% Equity Nasdaq-100 Index August-2003 1.2 15.18% 15.03% -0.15% Equity P?zer Inc September-2003 1.2 -11.88% -11.88% 0.00% Equity S&P 500 Index October-2003 1.5 7.76% 11.03% 3.27% Equity Semiconductor HOLDRs October-2003 1.2 -17.23% -17.23% 0.00% Equity Citigroup Inc October-2003 1.2 1.56% 4.67% 3.11% Equity Dow Jones Industrial Average November-2003 1.2 14.75% 26.83% 12.08% Equity Nikkei 225 Index February-2004 1.3 3.11% 9.26% 6.15% Equity Nikkei 225 Index April-2004 1.2 -2.84% -2.84% 0.00% Equity Global Equity Index Basket May-2004 1.2 10.14% 9.90% -0.24% Equity S&P 500 Index May-2004 1.7 8.01% 9.68% 1.67% Equity Dow Jones Industrial Average June-2004 1.6 1.5% 4.44% 2.94% 3 See page 47 for endnotes.

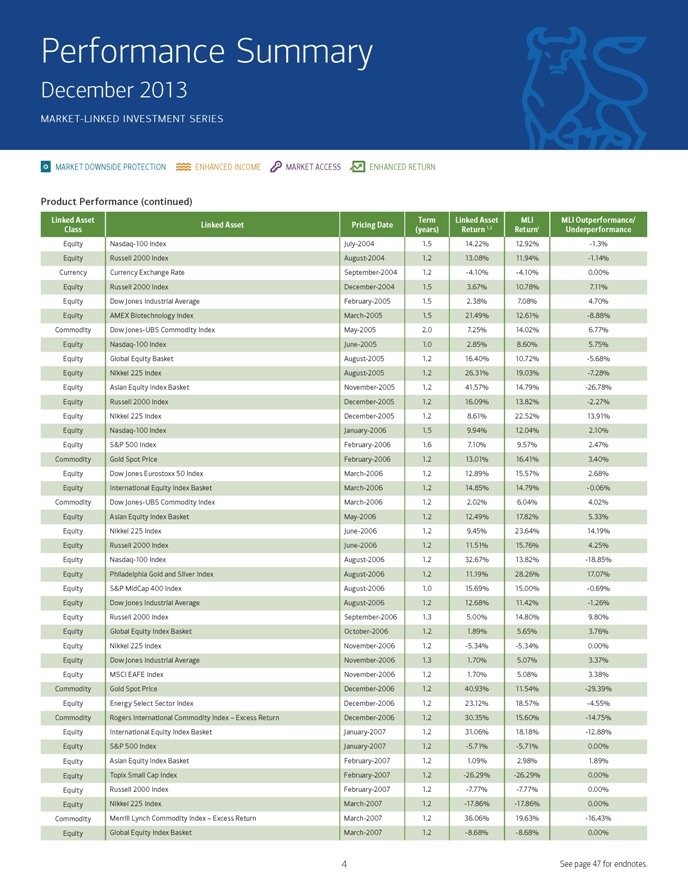

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity Nasdaq-100 Index July-2004 1.5 14.22% 12.92% -1.3% Equity Russell 2000 Index August-2004 1.2 13.08% 11.94% -1.14% Currency Currency Exchange Rate September-2004 1.2 -4.10% -4.10% 0.00% Equity Russell 2000 Index December-2004 1.5 3.67% 10.78% 7.11% Equity Dow Jones Industrial Average February-2005 1.5 2.38% 7.08% 4.70% Equity AMEX Biotechnology Index March-2005 1.5 21.49% 12.61% -8.88% Commodity Dow Jones-UBS Commodity Index May-2005 2.0 7.25% 14.02% 6.77% Equity Nasdaq-100 Index June-2005 1.0 2.85% 8.60% 5.75% Equity Global Equity Basket August-2005 1.2 16.40% 10.72% -5.68% Equity Nikkei 225 Index August-2005 1.2 26.31% 19.03% -7.28% Equity Asian Equity Index Basket November-2005 1.2 41.57% 14.79% -26.78% Equity Russell 2000 Index December-2005 1.2 16.09% 13.82% -2.27% Equity Nikkei 225 Index December-2005 1.2 8.61% 22.52% 13.91% Equity Nasdaq-100 Index January-2006 1.5 9.94% 12.04% 2.10% Equity S&P 500 Index February-2006 1.6 7.10% 9.57% 2.47% Commodity Gold Spot Price February-2006 1.2 13.01% 16.41% 3.40% Equity Dow Jones Eurostoxx 50 Index March-2006 1.2 12.89% 15.57% 2.68% Equity International Equity Index Basket March-2006 1.2 14.85% 14.79% -0.06% Commodity Dow Jones-UBS Commodity Index March-2006 1.2 2.02% 6.04% 4.02% Equity Asian Equity Index Basket May-2006 1.2 12.49% 17.82% 5.33% Equity Nikkei 225 Index June-2006 1.2 9.45% 23.64% 14.19% Equity Russell 2000 Index June-2006 1.2 11.51% 15.76% 4.25% Equity Nasdaq-100 Index August-2006 1.2 32.67% 13.82% -18.85% Equity Philadelphia Gold and Silver Index August-2006 1.2 11.19% 28.26% 17.07% Equity S&P MidCap 400 Index August-2006 1.0 15.69% 15.00% -0.69% Equity Dow Jones Industrial Average August-2006 1.2 12.68% 11.42% -1.26% Equity Russell 2000 Index September-2006 1.3 5.00% 14.80% 9.80% Equity Global Equity Index Basket October-2006 1.2 1.89% 5.65% 3.76% Equity Nikkei 225 Index November-2006 1.2 -5.34% -5.34% 0.00% Equity Dow Jones Industrial Average November-2006 1.3 1.70% 5.07% 3.37% Equity MSCI EAFE Index November-2006 1.2 1.70% 5.08% 3.38% Commodity Gold Spot Price December-2006 1.2 40.93% 11.54% -29.39% Equity Energy Select Sector Index December-2006 1.2 23.12% 18.57% -4.55% Commodity Rogers International Commodity Index – Excess Return December-2006 1.2 30.35% 15.60% -14.75% Equity International Equity Index Basket January-2007 1.2 31.06% 18.18% -12.88% Equity S&P 500 Index January-2007 1.2 -5.71% -5.71% 0.00% Equity Asian Equity Index Basket February-2007 1.2 1.09% 2.98% 1.89% Equity Topix Small Cap Index February-2007 1.2 -26.29% -26.29% 0.00% Equity Russell 2000 Index February-2007 1.2 -7.77% -7.77% 0.00% Equity Nikkei 225 Index March-2007 1.2 -17.86% -17.86% 0.00% Commodity Merrill Lynch Commodity Index – Excess Return March-2007 1.2 36.06% 19.63% -16.43% Equity Global Equity Index Basket March-2007 1.2 -8.68% -8.68% 0.00% 4 See page 47 for endnotes.

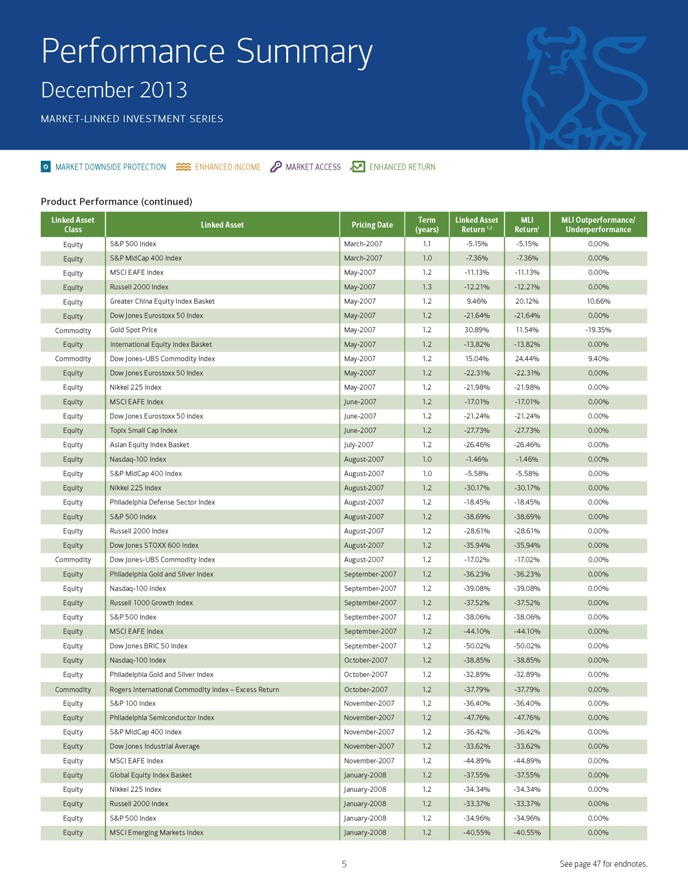

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity S&P 500 Index March-2007 1.1 -5.15% -5.15% 0.00% Equity S&P MidCap 400 Index March-2007 1.0 -7.36% -7.36% 0.00% Equity MSCI EAFE Index May-2007 1.2 -11.13% -11.13% 0.00% Equity Russell 2000 Index May-2007 1.3 -12.21% -12.21% 0.00% Equity Greater China Equity Index Basket May-2007 1.2 9.46% 20.12% 10.66% Equity Dow Jones Eurostoxx 50 Index May-2007 1.2 -21.64% -21.64% 0.00% Commodity Gold Spot Price May-2007 1.2 30.89% 11.54% -19.35% Equity International Equity Index Basket May-2007 1.2 -13.82% -13.82% 0.00% Commodity Dow Jones-UBS Commodity Index May-2007 1.2 15.04% 24.44% 9.40% Equity Dow Jones Eurostoxx 50 Index May-2007 1.2 -22.31% -22.31% 0.00% Equity Nikkei 225 Index May-2007 1.2 -21.98% -21.98% 0.00% Equity MSCI EAFE Index June-2007 1.2 -17.01% -17.01% 0.00% Equity Dow Jones Eurostoxx 50 Index June-2007 1.2 -21.24% -21.24% 0.00% Equity Topix Small Cap Index June-2007 1.2 -27.73% -27.73% 0.00% Equity Asian Equity Index Basket July-2007 1.2 -26.46% -26.46% 0.00% Equity Nasdaq-100 Index August-2007 1.0 -1.46% -1.46% 0.00% Equity S&P MidCap 400 Index August-2007 1.0 -5.58% -5.58% 0.00% Equity Nikkei 225 Index August-2007 1.2 -30.17% -30.17% 0.00% Equity Philadelphia Defense Sector Index August-2007 1.2 -18.45% -18.45% 0.00% Equity S&P 500 Index August-2007 1.2 -38.69% -38.69% 0.00% Equity Russell 2000 Index August-2007 1.2 -28.61% -28.61% 0.00% Equity Dow Jones STOXX 600 Index August-2007 1.2 -35.94% -35.94% 0.00% Commodity Dow Jones-UBS Commodity Index August-2007 1.2 -17.02% -17.02% 0.00% Equity Philadelphia Gold and Silver Index September-2007 1.2 -36.23% -36.23% 0.00% Equity Nasdaq-100 Index September-2007 1.2 -39.08% -39.08% 0.00% Equity Russell 1000 Growth Index September-2007 1.2 -37.52% -37.52% 0.00% Equity S&P 500 Index September-2007 1.2 -38.06% -38.06% 0.00% Equity MSCI EAFE Index September-2007 1.2 -44.10% -44.10% 0.00% Equity Dow Jones BRIC 50 Index September-2007 1.2 -50.02% -50.02% 0.00% Equity Nasdaq-100 Index October-2007 1.2 -38.85% -38.85% 0.00% Equity Philadelphia Gold and Silver Index October-2007 1.2 -32.89% -32.89% 0.00% Commodity Rogers International Commodity Index – Excess Return October-2007 1.2 -37.79% -37.79% 0.00% Equity S&P 100 Index November-2007 1.2 -36.40% -36.40% 0.00% Equity Philadelphia Semiconductor Index November-2007 1.2 -47.76% -47.76% 0.00% Equity S&P MidCap 400 Index November-2007 1.2 -36.42% -36.42% 0.00% Equity Dow Jones Industrial Average November-2007 1.2 -33.62% -33.62% 0.00% Equity MSCI EAFE Index November-2007 1.2 -44.89% -44.89% 0.00% Equity Global Equity Index Basket January-2008 1.2 -37.55% -37.55% 0.00% Equity Nikkei 225 Index January-2008 1.2 -34.34% -34.34% 0.00% Equity Russell 2000 Index January-2008 1.2 -33.37% -33.37% 0.00% Equity S&P 500 Index January-2008 1.2 -34.96% -34.96% 0.00% Equity MSCI Emerging Markets Index January-2008 1.2 -40.55% -40.55% 0.00% 5 See page 47 for endnotes.

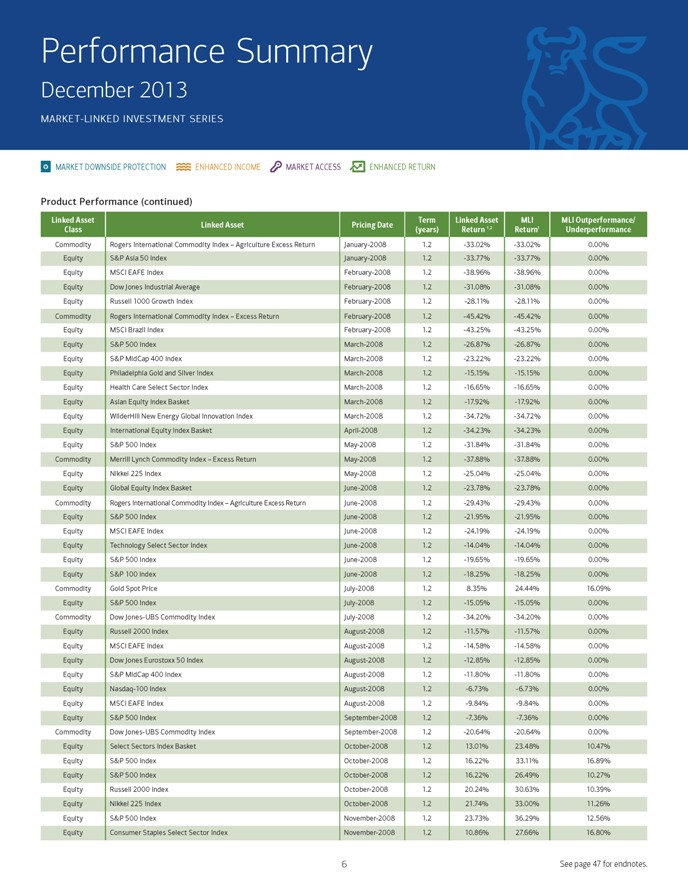

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Commodity Rogers International Commodity Index – Agriculture Excess Return January-2008 1.2 -33.02% -33.02% 0.00% Equity S&P Asia 50 Index January-2008 1.2 -33.77% -33.77% 0.00% Equity MSCI EAFE Index February-2008 1.2 -38.96% -38.96% 0.00% Equity Dow Jones Industrial Average February-2008 1.2 -31.08% -31.08% 0.00% Equity Russell 1000 Growth Index February-2008 1.2 -28.11% -28.11% 0.00% Commodity Rogers International Commodity Index – Excess Return February-2008 1.2 -45.42% -45.42% 0.00% Equity MSCI Brazil Index February-2008 1.2 -43.25% -43.25% 0.00% Equity S&P 500 Index March-2008 1.2 -26.87% -26.87% 0.00% Equity S&P MidCap 400 Index March-2008 1.2 -23.22% -23.22% 0.00% Equity Philadelphia Gold and Silver Index March-2008 1.2 -15.15% -15.15% 0.00% Equity Health Care Select Sector Index March-2008 1.2 -16.65% -16.65% 0.00% Equity Asian Equity Index Basket March-2008 1.2 -17.92% -17.92% 0.00% Equity WilderHill New Energy Global Innovation Index March-2008 1.2 -34.72% -34.72% 0.00% Equity International Equity Index Basket April-2008 1.2 -34.23% -34.23% 0.00% Equity S&P 500 Index May-2008 1.2 -31.84% -31.84% 0.00% Commodity Merrill Lynch Commodity Index – Excess Return May-2008 1.2 -37.88% -37.88% 0.00% Equity Nikkei 225 Index May-2008 1.2 -25.04% -25.04% 0.00% Equity Global Equity Index Basket June-2008 1.2 -23.78% -23.78% 0.00% Commodity Rogers International Commodity Index – Agriculture Excess Return June-2008 1.2 -29.43% -29.43% 0.00% Equity S&P 500 Index June-2008 1.2 -21.95% -21.95% 0.00% Equity MSCI EAFE Index June-2008 1.2 -24.19% -24.19% 0.00% Equity Technology Select Sector Index June-2008 1.2 -14.04% -14.04% 0.00% Equity S&P 500 Index June-2008 1.2 -19.65% -19.65% 0.00% Equity S&P 100 Index June-2008 1.2 -18.25% -18.25% 0.00% Commodity Gold Spot Price July-2008 1.2 8.35% 24.44% 16.09% Equity S&P 500 Index July-2008 1.2 -15.05% -15.05% 0.00% Commodity Dow Jones-UBS Commodity Index July-2008 1.2 -34.20% -34.20% 0.00% Equity Russell 2000 Index August-2008 1.2 -11.57% -11.57% 0.00% Equity MSCI EAFE Index August-2008 1.2 -14.58% -14.58% 0.00% Equity Dow Jones Eurostoxx 50 Index August-2008 1.2 -12.85% -12.85% 0.00% Equity S&P MidCap 400 Index August-2008 1.2 -11.80% -11.80% 0.00% Equity Nasdaq-100 Index August-2008 1.2 -6.73% -6.73% 0.00% Equity MSCI EAFE Index August-2008 1.2 -9.84% -9.84% 0.00% Equity S&P 500 Index September-2008 1.2 -7.36% -7.36% 0.00% Commodity Dow Jones-UBS Commodity Index September-2008 1.2 -20.64% -20.64% 0.00% Equity Select Sectors Index Basket October-2008 1.2 13.01% 23.48% 10.47% Equity S&P 500 Index October-2008 1.2 16.22% 33.11% 16.89% Equity S&P 500 Index October-2008 1.2 16.22% 26.49% 10.27% Equity Russell 2000 Index October-2008 1.2 20.24% 30.63% 10.39% Equity Nikkei 225 Index October-2008 1.2 21.74% 33.00% 11.26% Equity S&P 500 Index November-2008 1.2 23.73% 36.29% 12.56% Equity Consumer Staples Select Sector Index November-2008 1.2 10.86% 27.66% 16.80% 6 See page 47 for endnotes.

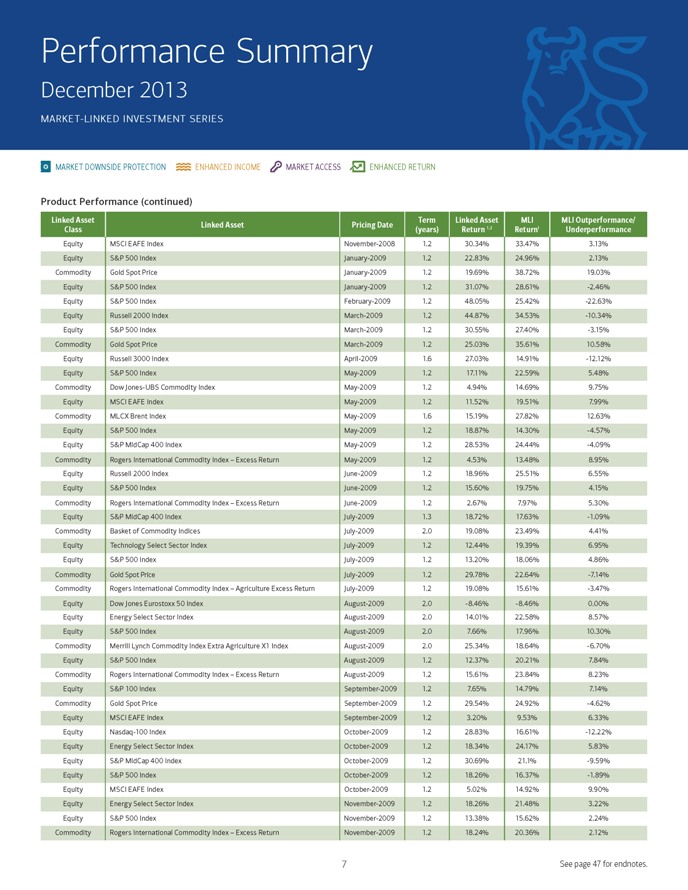

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity MSCI EAFE Index November-2008 1.2 30.34% 33.47% 3.13% Equity S&P 500 Index January-2009 1.2 22.83% 24.96% 2.13% Commodity Gold Spot Price January-2009 1.2 19.69% 38.72% 19.03% Equity S&P 500 Index January-2009 1.2 31.07% 28.61% -2.46% Equity S&P 500 Index February-2009 1.2 48.05% 25.42% -22.63% Equity Russell 2000 Index March-2009 1.2 44.87% 34.53% -10.34% Equity S&P 500 Index March-2009 1.2 30.55% 27.40% -3.15% Commodity Gold Spot Price March-2009 1.2 25.03% 35.61% 10.58% Equity Russell 3000 Index April-2009 1.6 27.03% 14.91% -12.12% Equity S&P 500 Index May-2009 1.2 17.11% 22.59% 5.48% Commodity Dow Jones-UBS Commodity Index May-2009 1.2 4.94% 14.69% 9.75% Equity MSCI EAFE Index May-2009 1.2 11.52% 19.51% 7.99% Commodity MLCX Brent Index May-2009 1.6 15.19% 27.82% 12.63% Equity S&P 500 Index May-2009 1.2 18.87% 14.30% -4.57% Equity S&P MidCap 400 Index May-2009 1.2 28.53% 24.44% -4.09% Commodity Rogers International Commodity Index – Excess Return May-2009 1.2 4.53% 13.48% 8.95% Equity Russell 2000 Index June-2009 1.2 18.96% 25.51% 6.55% Equity S&P 500 Index June-2009 1.2 15.60% 19.75% 4.15% Commodity Rogers International Commodity Index – Excess Return June-2009 1.2 2.67% 7.97% 5.30% Equity S&P MidCap 400 Index July-2009 1.3 18.72% 17.63% -1.09% Commodity Basket of Commodity Indices July-2009 2.0 19.08% 23.49% 4.41% Equity Technology Select Sector Index July-2009 1.2 12.44% 19.39% 6.95% Equity S&P 500 Index July-2009 1.2 13.20% 18.06% 4.86% Commodity Gold Spot Price July-2009 1.2 29.78% 22.64% -7.14% Commodity Rogers International Commodity Index – Agriculture Excess Return July-2009 1.2 19.08% 15.61% -3.47% Equity Dow Jones Eurostoxx 50 Index August-2009 2.0 -8.46% -8.46% 0.00% Equity Energy Select Sector Index August-2009 2.0 14.01% 22.58% 8.57% Equity S&P 500 Index August-2009 2.0 7.66% 17.96% 10.30% Commodity Merrill Lynch Commodity Index Extra Agriculture X1 Index August-2009 2.0 25.34% 18.64% -6.70% Equity S&P 500 Index August-2009 1.2 12.37% 20.21% 7.84% Commodity Rogers International Commodity Index – Excess Return August-2009 1.2 15.61% 23.84% 8.23% Equity S&P 100 Index September-2009 1.2 7.65% 14.79% 7.14% Commodity Gold Spot Price September-2009 1.2 29.54% 24.92% -4.62% Equity MSCI EAFE Index September-2009 1.2 3.20% 9.53% 6.33% Equity Nasdaq-100 Index October-2009 1.2 28.83% 16.61% -12.22% Equity Energy Select Sector Index October-2009 1.2 18.34% 24.17% 5.83% Equity S&P MidCap 400 Index October-2009 1.2 30.69% 21.1% -9.59% Equity S&P 500 Index October-2009 1.2 18.26% 16.37% -1.89% Equity MSCI EAFE Index October-2009 1.2 5.02% 14.92% 9.90% Equity Energy Select Sector Index November-2009 1.2 18.26% 21.48% 3.22% Equity S&P 500 Index November-2009 1.2 13.38% 15.62% 2.24% Commodity Rogers International Commodity Index – Excess Return November-2009 1.2 18.24% 20.36% 2.12% 7 See page 47 for endnotes.

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Commodity Crude Oil Futures Contract December-2009 1.2 14.20% 14.79% 0.59% Equity MSCI EAFE Index December-2009 1.2 10.07% 15.15% 5.08% Equity Dow Jones U.S. Real Estate Index January-2010 1.2 23.74% 27.62% 3.88% Equity Russell 2000 Index January-2010 1.2 23.52% 18.31% -5.21% Equity S&P 500 Index January-2010 1.2 13.71% 14.23% 0.52% Equity Financial Select Sector Index January-2010 1.2 10.53% 19.63% 9.10% Equity MSCI EAFE Index January-2010 1.2 6.18% 14.91% 8.73% Commodity Gold Spot Price January-2010 1.2 25.29% 18.43% -6.86% Equity Energy Select Sector Index February-2010 1.2 32.89% 18.06% -14.83% Equity S&P 500 Index February-2010 1.2 16.87% 13.28% -3.59% Equity S&P MidCap 400 Index February-2010 1.2 27.95% 15.45% -12.50% Equity Russell 2000 Index February-2010 1.2 27.15% 17.48% -9.67% Equity MSCI EAFE Index February-2010 1.2 14.09% 15.03% 0.94% Commodity Silver Spot Price February-2010 1.2 139.83% 27.83% -112.0% Commodity Rogers International Commodity Index – Excess Return February-2010 1.2 32.37% 16.00% -16.37% Commodity Silver Spot Price March-2010 1.3 68.57% 26.25% -42.32% Equity PHLX Oil Service Sector Index March-2010 1.2 24.23% 20.03% -4.20% Equity S&P 500 Index March-2010 1.2 11.47% 11.91% 0.44% Equity Industrial Select Sector Index March-2010 1.2 16.17% 13.72% -2.45% Commodity Platinum Spot Price March-2010 1.2 8.30% 24.54% 16.24% Equity MSCI EAFE Index March-2010 1.2 6.55% 14.42% 7.87% Commodity Gold Spot Price March-2010 1.2 32.08% 15.15% -16.93% Equity MSCI Emerging Markets Index March-2010 1.2 9.97% 14.06% 4.09% Commodity Merrill Lynch Commodity Index Extra A01 Index March-2010 1.2 23.65% 12.35% -11.3% Commodity MLCX – eXtra Agriculture ER Index March-2010 3.0 8.37% 17.03% 8.66% Equity S&P 500 Index April-2010 1.2 4.74% 12.99% 8.25% Equity Financial Select Sector Index April-2010 1.2 -8.56% -8.56% 0.00% Equity Philadelphia Oil Service Sector Index April-2010 1.2 12.70% 22.48% 9.78% Equity Russell 2000 Index April-2010 1.2 5.59% 16.60% 11.01% Commodity Rogers International Commodity Index – Excess Return April-2010 1.2 17.57% 15.15% -2.42% Commodity Silver Spot Price April-2010 1.2 68.76% 20.68% -48.08% Equity Energy Select Sector Index May-2010 2.0 11.56% 20.04% 8.48% Equity PHLX Housing Sector Index May-2010 1.2 0.65% 1.96% 1.31% Equity Russell 2000 Index May-2010 1.2 24.30% 23.24% -1.06% Equity S&P 500 Index May-2010 1.2 20.58% 17.70% -2.88% Commodity Gold Spot Price May-2010 1.2 26.97% 15.29% -11.68% Equity MSCI EAFE Index May-2010 1.2 20.74% 18.91% -1.83% Equity Brazil and China Index Basket May-2010 1.2 10.15% 24.28% 14.13% Equity Apple Inc./Technology Select Sector May-2010 1.2 29.57% 12.39% -17.18% Commodity Copper Spot Price June-2010 1.1 41.36% 25.07% -16.29% Equity S&P 500 Index June-2010 1.2 5.80% 15.57% 9.77% Equity S&P MidCap 400 Index June-2010 1.2 8.12% 18.43% 10.31% 8 See page 47 for endnotes.

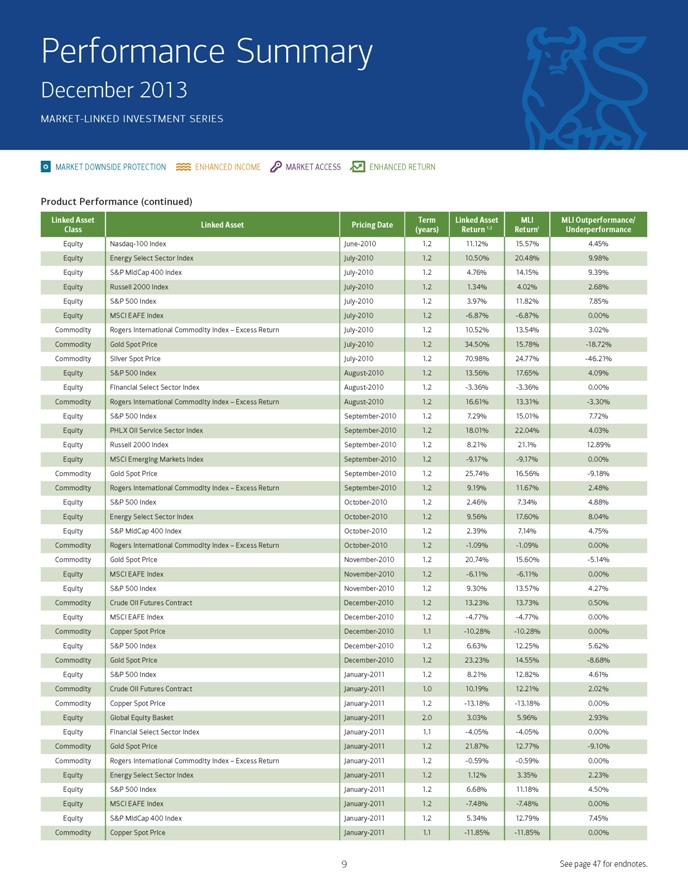

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity Nasdaq-100 Index June-2010 1.2 11.12% 15.57% 4.45% Equity Energy Select Sector Index July-2010 1.2 10.50% 20.48% 9.98% Equity S&P MidCap 400 Index July-2010 1.2 4.76% 14.15% 9.39% Equity Russell 2000 Index July-2010 1.2 1.34% 4.02% 2.68% Equity S&P 500 Index July-2010 1.2 3.97% 11.82% 7.85% Equity MSCI EAFE Index July-2010 1.2 -6.87% -6.87% 0.00% Commodity Rogers International Commodity Index – Excess Return July-2010 1.2 10.52% 13.54% 3.02% Commodity Gold Spot Price July-2010 1.2 34.50% 15.78% -18.72% Commodity Silver Spot Price July-2010 1.2 70.98% 24.77% -46.21% Equity S&P 500 Index August-2010 1.2 13.56% 17.65% 4.09% Equity Financial Select Sector Index August-2010 1.2 -3.36% -3.36% 0.00% Commodity Rogers International Commodity Index – Excess Return August-2010 1.2 16.61% 13.31% -3.30% Equity S&P 500 Index September-2010 1.2 7.29% 15.01% 7.72% Equity PHLX Oil Service Sector Index September-2010 1.2 18.01% 22.04% 4.03% Equity Russell 2000 Index September-2010 1.2 8.21% 21.1% 12.89% Equity MSCI Emerging Markets Index September-2010 1.2 -9.17% -9.17% 0.00% Commodity Gold Spot Price September-2010 1.2 25.74% 16.56% -9.18% Commodity Rogers International Commodity Index – Excess Return September-2010 1.2 9.19% 11.67% 2.48% Equity S&P 500 Index October-2010 1.2 2.46% 7.34% 4.88% Equity Energy Select Sector Index October-2010 1.2 9.56% 17.60% 8.04% Equity S&P MidCap 400 Index October-2010 1.2 2.39% 7.14% 4.75% Commodity Rogers International Commodity Index – Excess Return October-2010 1.2 -1.09% -1.09% 0.00% Commodity Gold Spot Price November-2010 1.2 20.74% 15.60% -5.14% Equity MSCI EAFE Index November-2010 1.2 -6.11% -6.11% 0.00% Equity S&P 500 Index November-2010 1.2 9.30% 13.57% 4.27% Commodity Crude Oil Futures Contract December-2010 1.2 13.23% 13.73% 0.50% Equity MSCI EAFE Index December-2010 1.2 -4.77% -4.77% 0.00% Commodity Copper Spot Price December-2010 1.1 -10.28% -10.28% 0.00% Equity S&P 500 Index December-2010 1.2 6.63% 12.25% 5.62% Commodity Gold Spot Price December-2010 1.2 23.23% 14.55% -8.68% Equity S&P 500 Index January-2011 1.2 8.21% 12.82% 4.61% Commodity Crude Oil Futures Contract January-2011 1.0 10.19% 12.21% 2.02% Commodity Copper Spot Price January-2011 1.2 -13.18% -13.18% 0.00% Equity Global Equity Basket January-2011 2.0 3.03% 5.96% 2.93% Equity Financial Select Sector Index January-2011 1.1 -4.05% -4.05% 0.00% Commodity Gold Spot Price January-2011 1.2 21.87% 12.77% -9.10% Commodity Rogers International Commodity Index – Excess Return January-2011 1.2 -0.59% -0.59% 0.00% Equity Energy Select Sector Index January-2011 1.2 1.12% 3.35% 2.23% Equity S&P 500 Index January-2011 1.2 6.68% 11.18% 4.50% Equity MSCI EAFE Index January-2011 1.2 -7.48% -7.48% 0.00% Equity S&P MidCap 400 Index January-2011 1.2 5.34% 12.79% 7.45% Commodity Copper Spot Price January-2011 1.1 -11.85% -11.85% 0.00% 9 See page 47 for endnotes.

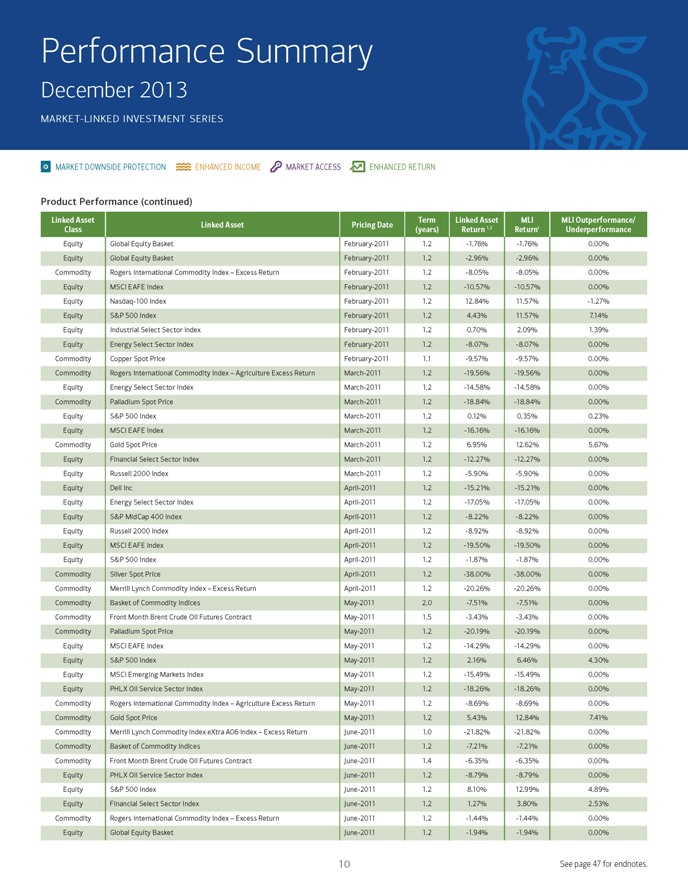

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity Global Equity Basket February-2011 1.2 -1.76% -1.76% 0.00% Equity Global Equity Basket February-2011 1.2 -2.96% -2.96% 0.00% Commodity Rogers International Commodity Index – Excess Return February-2011 1.2 -8.05% -8.05% 0.00% Equity MSCI EAFE Index February-2011 1.2 -10.57% -10.57% 0.00% Equity Nasdaq-100 Index February-2011 1.2 12.84% 11.57% -1.27% Equity S&P 500 Index February-2011 1.2 4.43% 11.57% 7.14% Equity Industrial Select Sector Index February-2011 1.2 0.70% 2.09% 1.39% Equity Energy Select Sector Index February-2011 1.2 -8.07% -8.07% 0.00% Commodity Copper Spot Price February-2011 1.1 -9.57% -9.57% 0.00% Commodity Rogers International Commodity Index – Agriculture Excess Return March-2011 1.2 -19.56% -19.56% 0.00% Equity Energy Select Sector Index March-2011 1.2 -14.58% -14.58% 0.00% Commodity Palladium Spot Price March-2011 1.2 -18.84% -18.84% 0.00% Equity S&P 500 Index March-2011 1.2 0.12% 0.35% 0.23% Equity MSCI EAFE Index March-2011 1.2 -16.16% -16.16% 0.00% Commodity Gold Spot Price March-2011 1.2 6.95% 12.62% 5.67% Equity Financial Select Sector Index March-2011 1.2 -12.27% -12.27% 0.00% Equity Russell 2000 Index March-2011 1.2 -5.90% -5.90% 0.00% Equity Dell Inc April-2011 1.2 -15.21% -15.21% 0.00% Equity Energy Select Sector Index April-2011 1.2 -17.05% -17.05% 0.00% Equity S&P MidCap 400 Index April-2011 1.2 -8.22% -8.22% 0.00% Equity Russell 2000 Index April-2011 1.2 -8.92% -8.92% 0.00% Equity MSCI EAFE Index April-2011 1.2 -19.50% -19.50% 0.00% Equity S&P 500 Index April-2011 1.2 -1.87% -1.87% 0.00% Commodity Silver Spot Price April-2011 1.2 -38.00% -38.00% 0.00% Commodity Merrill Lynch Commodity Index – Excess Return April-2011 1.2 -20.26% -20.26% 0.00% Commodity Basket of Commodity Indices May-2011 2.0 -7.51% -7.51% 0.00% Commodity Front Month Brent Crude Oil Futures Contract May-2011 1.5 -3.43% -3.43% 0.00% Commodity Palladium Spot Price May-2011 1.2 -20.19% -20.19% 0.00% Equity MSCI EAFE Index May-2011 1.2 -14.29% -14.29% 0.00% Equity S&P 500 Index May-2011 1.2 2.16% 6.46% 4.30% Equity MSCI Emerging Markets Index May-2011 1.2 -15.49% -15.49% 0.00% Equity PHLX Oil Service Sector Index May-2011 1.2 -18.26% -18.26% 0.00% Commodity Rogers International Commodity Index – Agriculture Excess Return May-2011 1.2 -8.69% -8.69% 0.00% Commodity Gold Spot Price May-2011 1.2 5.43% 12.84% 7.41% Commodity Merrill Lynch Commodity index eXtra A06 Index – Excess Return June-2011 1.0 -21.82% -21.82% 0.00% Commodity Basket of Commodity Indices June-2011 1.2 -7.21% -7.21% 0.00% Commodity Front Month Brent Crude Oil Futures Contract June-2011 1.4 -6.35% -6.35% 0.00% Equity PHLX Oil Service Sector Index June-2011 1.2 -8.79% -8.79% 0.00% Equity S&P 500 Index June-2011 1.2 8.10% 12.99% 4.89% Equity Financial Select Sector Index June-2011 1.2 1.27% 3.80% 2.53% Commodity Rogers International Commodity Index – Excess Return June-2011 1.2 -1.44% -1.44% 0.00% Equity Global Equity Basket June-2011 1.2 -1.94% -1.94% 0.00% 10 See page 47 for endnotes.

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity Russell 2000 Index June-2011 1.2 0.81% 2.43% 1.62% Commodity Rogers International Commodity Index – Agriculture Excess Return July-2011 1.2 -3.52% -3.52% 0.00% Equity S&P 500 Index July-2011 1.2 9.86% 11.99% 2.13% Equity PHLX Semiconductor Sector Index July-2011 1.2 0.17% 0.52% 0.35% Commodity Rogers International Commodity Index – Excess Return July-2011 1.2 -5.14% -5.14% 0.00% Equity MSCI EAFE Index July-2011 1.2 -6.56% -6.56% 0.00% Equity MSCI Brazil Index July-2011 1.2 -16.93% -16.93% 0.00% Equity Russell 2000 Index July-2011 1.2 5.34% 15.85% 10.51% Commodity Copper Spot Price July-2011 1.2 -12.72% -12.72% 0.00% Equity Russell 2000 July-2011 2.0 -17.13% -11.30% 5.83% Commodity Gold Spot Price August-2011 1.2 -0.65% -0.65% 0.00% Commodity Front Month Palladium Futures Contract August-2011 1.3 -11.74% -11.74% 0.00% Equity S&P MidCap 400 Index August-2011 1.2 11.21% 16.00% 4.79% Equity S&P 500 Index August-2011 1.2 15.35% 15.11% -0.24% Commodity Rogers International Commodity Index – Excess Return September-2011 1.2 -5.23% -5.23% 0.00% Commodity Front Month Platinum Futures Contract September-2011 1.2 2.43% 7.26% 4.83% Equity Energy Select Sector Index September-2011 1.2 13.80% 24.73% 10.93% Equity S&P MidCap 400 Index September-2011 1.2 18.28% 21.51% 3.23% Equity S&P 500 Index September-2011 1.2 16.84% 18.40% 1.56% Equity Russell 2000 Index September-2011 1.2 17.37% 25.42% 8.05% Equity NYSE Arca Gold Miners Index September-2011 1.2 -10.79% -10.79% 0.00% Equity MSCI EAFE Index September-2011 1.2 7.17% 21.23% 14.06% Commodity Dow Jones-UBS Commodity Index – Excess Return September-2011 1.2 0.04% 0.13% 0.09% Commodity Dow Jones-UBS Agriculture Index September-2011 2.0 -9.88% -9.88% 0.00% Commodity Dow Jones-UBS Agriculture Sub-Index – Excess Return October-2011 1.2 1.49% 4.46% 2.97% Commodity Rogers International Commodity Index – Excess Return October-2011 1.2 -1.27% -1.27% 0.00% Equity Technology Select Sector Index October-2011 1.2 9.99% 21.24% 11.25% Equity MSCI Emerging Markets Index October-2011 1.2 6.92% 20.36% 13.44% Equity S&P 500 Index November-2011 1.2 14.84% 17.36% 2.52% Equity NYSE Arca Gold Miners Index November-2011 1.2 -20.50% -20.50% 0.00% Equity Russell 2000 Index November-2011 1.2 22.69% 25.49% 2.80% Equity S&P 500 Index November-2011 1.2 20.16% 19.44% -0.72% Equity PHLX Oil Service Sector Index November-2011 1.2 7.13% 21.11% 13.98% Equity MSCI EAFE Index November-2011 1.2 17.98% 29.32% 11.34% Commodity Rogers International Commodity Index – Excess Return November-2011 1.2 3.44% 10.26% 6.82% Commodity Gold Spot Price November-2011 1.2 -2.09% -2.09% 0.00% Commodity Gold Spot Price December-2011 1.2 -0.61% -0.61% 0.00% Equity S&P 500 Index December-2011 1.2 18.35% 22.74% 4.39% Equity S&P 500 Index January-2012 1.1 17.30% 16.08% -1.22% Equity S&P MidCap 400 Index January-2012 1.1 23.46% 18.65% -4.81% Equity Consumer Staples Select Sector Index January-2012 1.1 14.64% 16.40% 1.76% Equity Energy Select Sector Index January-2012 1.1 9.46% 21.92% 12.46% 11 See page 47 for endnotes.

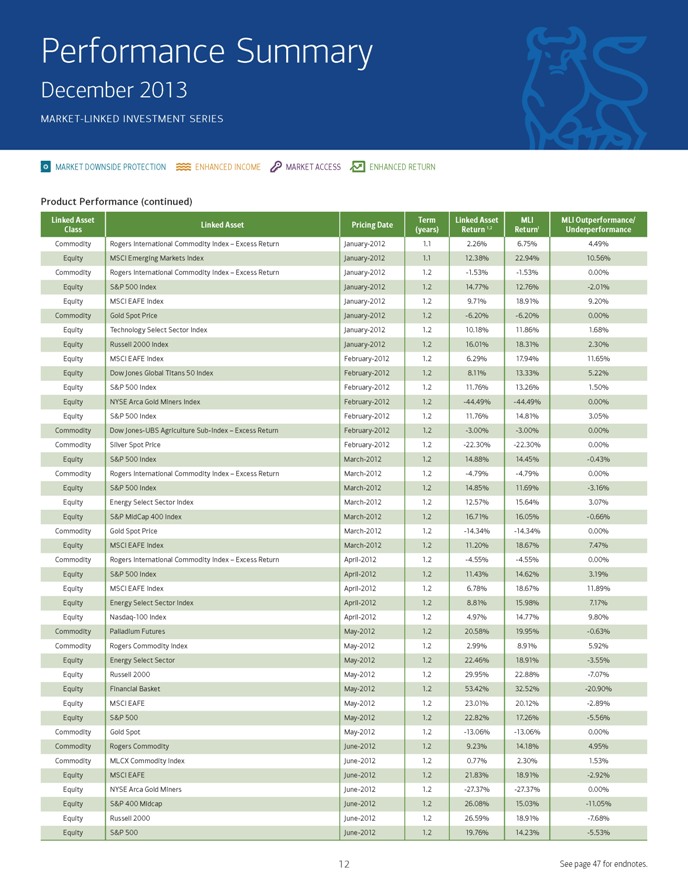

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Commodity Rogers International Commodity Index – Excess Return January-2012 1.1 2.26% 6.75% 4.49% Equity MSCI Emerging Markets Index January-2012 1.1 12.38% 22.94% 10.56% Commodity Rogers International Commodity Index – Excess Return January-2012 1.2 -1.53% -1.53% 0.00% Equity S&P 500 Index January-2012 1.2 14.77% 12.76% -2.01% Equity MSCI EAFE Index January-2012 1.2 9.71% 18.91% 9.20% Commodity Gold Spot Price January-2012 1.2 -6.20% -6.20% 0.00% Equity Technology Select Sector Index January-2012 1.2 10.18% 11.86% 1.68% Equity Russell 2000 Index January-2012 1.2 16.01% 18.31% 2.30% Equity MSCI EAFE Index February-2012 1.2 6.29% 17.94% 11.65% Equity Dow Jones Global Titans 50 Index February-2012 1.2 8.11% 13.33% 5.22% Equity S&P 500 Index February-2012 1.2 11.76% 13.26% 1.50% Equity NYSE Arca Gold Miners Index February-2012 1.2 -44.49% -44.49% 0.00% Equity S&P 500 Index February-2012 1.2 11.76% 14.81% 3.05% Commodity Dow Jones-UBS Agriculture Sub-Index – Excess Return February-2012 1.2 -3.00% -3.00% 0.00% Commodity Silver Spot Price February-2012 1.2 -22.30% -22.30% 0.00% Equity S&P 500 Index March-2012 1.2 14.88% 14.45% -0.43% Commodity Rogers International Commodity Index – Excess Return March-2012 1.2 -4.79% -4.79% 0.00% Equity S&P 500 Index March-2012 1.2 14.85% 11.69% -3.16% Equity Energy Select Sector Index March-2012 1.2 12.57% 15.64% 3.07% Equity S&P MidCap 400 Index March-2012 1.2 16.71% 16.05% -0.66% Commodity Gold Spot Price March-2012 1.2 -14.34% -14.34% 0.00% Equity MSCI EAFE Index March-2012 1.2 11.20% 18.67% 7.47% Commodity Rogers International Commodity Index – Excess Return April-2012 1.2 -4.55% -4.55% 0.00% Equity S&P 500 Index April-2012 1.2 11.43% 14.62% 3.19% Equity MSCI EAFE Index April-2012 1.2 6.78% 18.67% 11.89% Equity Energy Select Sector Index April-2012 1.2 8.81% 15.98% 7.17% Equity Nasdaq-100 Index April-2012 1.2 4.97% 14.77% 9.80% Commodity Palladium Futures May-2012 1.2 20.58% 19.95% -0.63% Commodity Rogers Commodity Index May-2012 1.2 2.99% 8.91% 5.92% Equity Energy Select Sector May-2012 1.2 22.46% 18.91% -3.55% Equity Russell 2000 May-2012 1.2 29.95% 22.88% -7.07% Equity Financial Basket May-2012 1.2 53.42% 32.52% -20.90% Equity MSCI EAFE May-2012 1.2 23.01% 20.12% -2.89% Equity S&P 500 May-2012 1.2 22.82% 17.26% -5.56% Commodity Gold Spot May-2012 1.2 -13.06% -13.06% 0.00% Commodity Rogers Commodity June-2012 1.2 9.23% 14.18% 4.95% Commodity MLCX Commodity Index June-2012 1.2 0.77% 2.30% 1.53% Equity MSCI EAFE June-2012 1.2 21.83% 18.91% -2.92% Equity NYSE Arca Gold Miners June-2012 1.2 -27.37% -27.37% 0.00% Equity S&P 400 Midcap June-2012 1.2 26.08% 15.03% -11.05% Equity Russell 2000 June-2012 1.2 26.59% 18.91% -7.68% Equity S&P 500 June-2012 1.2 19.76% 14.23% -5.53% 12 See page 47 for endnotes.

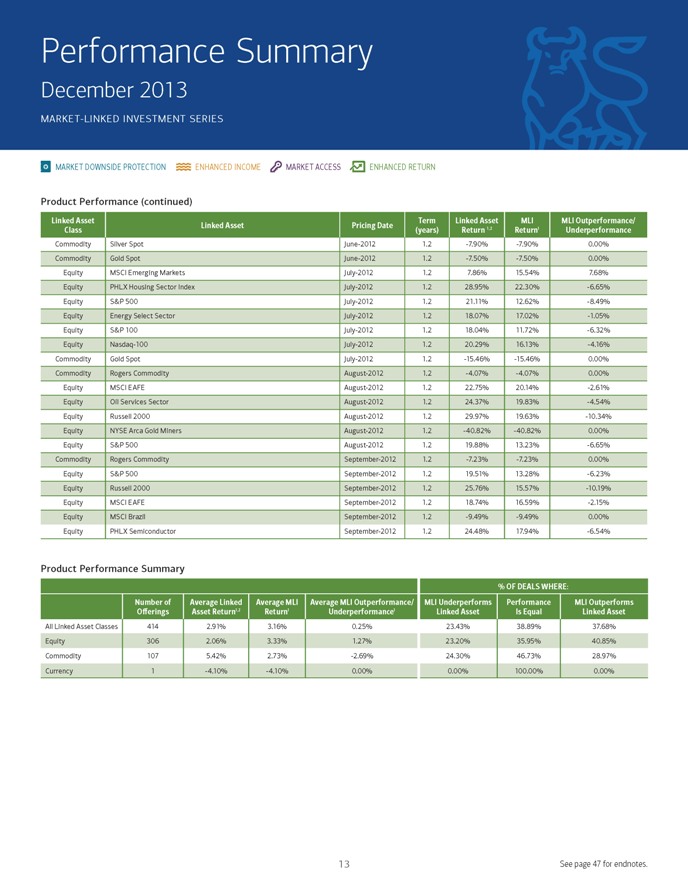

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Commodity Silver Spot June-2012 1.2 -7.90% -7.90% 0.00% Commodity Gold Spot June-2012 1.2 -7.50% -7.50% 0.00% Equity MSCI Emerging Markets July-2012 1.2 7.86% 15.54% 7.68% Equity PHLX Housing Sector Index July-2012 1.2 28.95% 22.30% -6.65% Equity S&P 500 July-2012 1.2 21.11% 12.62% -8.49% Equity Energy Select Sector July-2012 1.2 18.07% 17.02% -1.05% Equity S&P 100 July-2012 1.2 18.04% 11.72% -6.32% Equity Nasdaq-100 July-2012 1.2 20.29% 16.13% -4.16% Commodity Gold Spot July-2012 1.2 -15.46% -15.46% 0.00% Commodity Rogers Commodity August-2012 1.2 -4.07% -4.07% 0.00% Equity MSCI EAFE August-2012 1.2 22.75% 20.14% -2.61% Equity Oil Services Sector August-2012 1.2 24.37% 19.83% -4.54% Equity Russell 2000 August-2012 1.2 29.97% 19.63% -10.34% Equity NYSE Arca Gold Miners August-2012 1.2 -40.82% -40.82% 0.00% Equity S&P 500 August-2012 1.2 19.88% 13.23% -6.65% Commodity Rogers Commodity September-2012 1.2 -7.23% -7.23% 0.00% Equity S&P 500 September-2012 1.2 19.51% 13.28% -6.23% Equity Russell 2000 September-2012 1.2 25.76% 15.57% -10.19% Equity MSCI EAFE September-2012 1.2 18.74% 16.59% -2.15% Equity MSCI Brazil September-2012 1.2 -9.49% -9.49% 0.00% Equity PHLX Semiconductor September-2012 1.2 24.48% 17.94% -6.54% Product Performance Summary % OF DEALS WHERE: Number of Average Linked Average MLI Average MLI Outperformance/ MLI Underperforms Performance MLI Outperforms O?erings Asset Return1,2 Return1 Underperformance1 Linked Asset Is Equal Linked Asset All Linked Asset Classes 414 2.91% 3.16% 0.25% 23.43% 38.89% 37.68% Equity 306 2.06% 3.33% 1.27% 23.20% 35.95% 40.85% Commodity 107 5.42% 2.73% -2.69% 24.30% 46.73% 28.97% Currency 1 -4.10% -4.10% 0.00% 0.00% 100.00% 0.00% 13 See page 47 for endnotes.

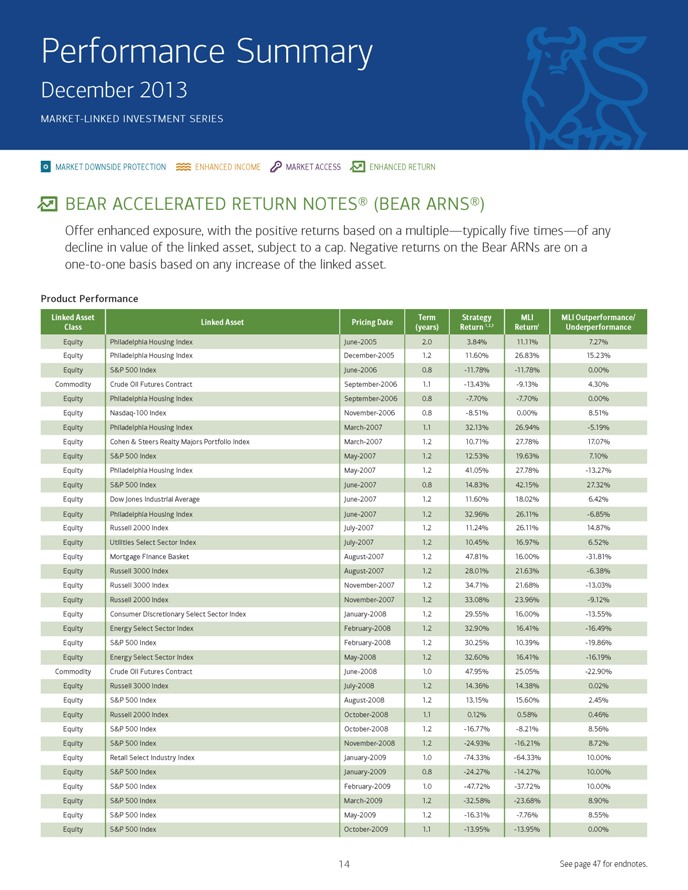

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN BEAR ACCELERATED RETURN NOTES® (BEAR ARNS®) Offer enhanced exposure, with the positive returns based on a multiple—typically five times—of any decline in value of the linked asset, subject to a cap. Negative returns on the Bear ARNs are on a one-to-one basis based on any increase of the linked asset. Product Performance Linked Asset Term Strategy MLI MLI Outperformance/ Linked Asset Pricing Date 1,2,3 1 Class (years) Return Return Underperformance Equity Philadelphia Housing Index June-2005 2.0 3.84% 11.11% 7.27% Equity Philadelphia Housing Index December-2005 1.2 11.60% 26.83% 15.23% Equity S&P 500 Index June-2006 0.8 -11.78% -11.78% 0.00% Commodity Crude Oil Futures Contract September-2006 1.1 -13.43% -9.13% 4.30% Equity Philadelphia Housing Index September-2006 0.8 -7.70% -7.70% 0.00% Equity Nasdaq-100 Index November-2006 0.8 -8.51% 0.00% 8.51% Equity Philadelphia Housing Index March-2007 1.1 32.13% 26.94% -5.19% Equity Cohen & Steers Realty Majors Portfolio Index March-2007 1.2 10.71% 27.78% 17.07% Equity S&P 500 Index May-2007 1.2 12.53% 19.63% 7.10% Equity Philadelphia Housing Index May-2007 1.2 41.05% 27.78% -13.27% Equity S&P 500 Index June-2007 0.8 14.83% 42.15% 27.32% Equity Dow Jones Industrial Average June-2007 1.2 11.60% 18.02% 6.42% Equity Philadelphia Housing Index June-2007 1.2 32.96% 26.11% -6.85% Equity Russell 2000 Index July-2007 1.2 11.24% 26.11% 14.87% Equity Utilities Select Sector Index July-2007 1.2 10.45% 16.97% 6.52% Equity Mortgage Finance Basket August-2007 1.2 47.81% 16.00% -31.81% Equity Russell 3000 Index August-2007 1.2 28.01% 21.63% -6.38% Equity Russell 3000 Index November-2007 1.2 34.71% 21.68% -13.03% Equity Russell 2000 Index November-2007 1.2 33.08% 23.96% -9.12% Equity Consumer Discretionary Select Sector Index January-2008 1.2 29.55% 16.00% -13.55% Equity Energy Select Sector Index February-2008 1.2 32.90% 16.41% -16.49% Equity S&P 500 Index February-2008 1.2 30.25% 10.39% -19.86% Equity Energy Select Sector Index May-2008 1.2 32.60% 16.41% -16.19% Commodity Crude Oil Futures Contract June-2008 1.0 47.95% 25.05% -22.90% Equity Russell 3000 Index July-2008 1.2 14.36% 14.38% 0.02% Equity S&P 500 Index August-2008 1.2 13.15% 15.60% 2.45% Equity Russell 2000 Index October-2008 1.1 0.12% 0.58% 0.46% Equity S&P 500 Index October-2008 1.2 -16.77% -8.21% 8.56% Equity S&P 500 Index November-2008 1.2 -24.93% -16.21% 8.72% Equity Retail Select Industry Index January-2009 1.0 -74.33% -64.33% 10.00% Equity S&P 500 Index January-2009 0.8 -24.27% -14.27% 10.00% Equity S&P 500 Index February-2009 1.0 -47.72% -37.72% 10.00% Equity S&P 500 Index March-2009 1.2 -32.58% -23.68% 8.90% Equity S&P 500 Index May-2009 1.2 -16.31% -7.76% 8.55% Equity S&P 500 Index October-2009 1.1 -13.95% -13.95% 0.00% 14 See page 47 for endnotes.

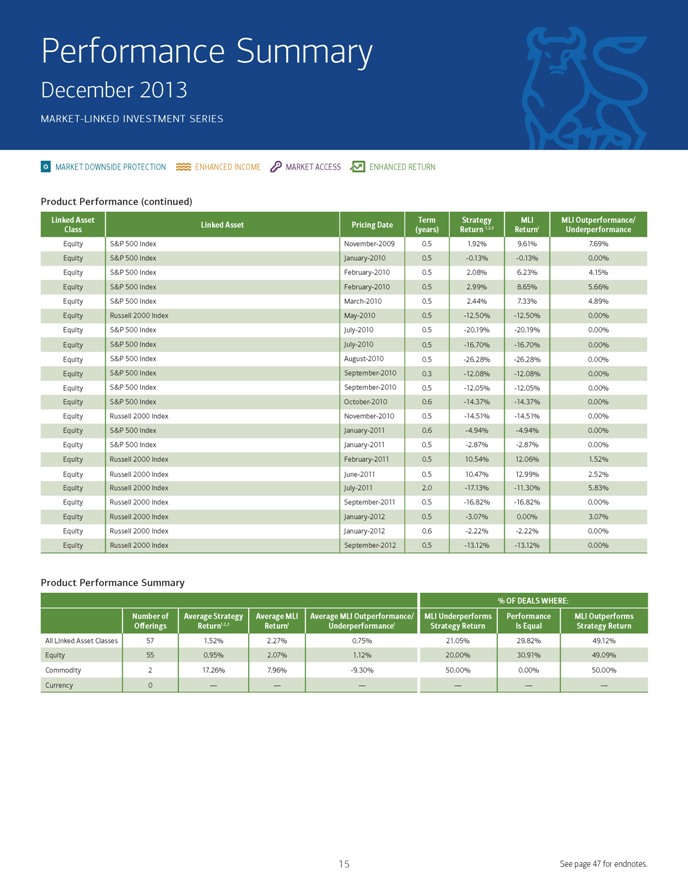

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Strategy MLI MLI Outperformance/ Linked Asset Pricing Date 1,2,3 1 Class (years) Return Return Underperformance Equity S&P 500 Index November-2009 0.5 1.92% 9.61% 7.69% Equity S&P 500 Index January-2010 0.5 -0.13% -0.13% 0.00% Equity S&P 500 Index February-2010 0.5 2.08% 6.23% 4.15% Equity S&P 500 Index February-2010 0.5 2.99% 8.65% 5.66% Equity S&P 500 Index March-2010 0.5 2.44% 7.33% 4.89% Equity Russell 2000 Index May-2010 0.5 -12.50% -12.50% 0.00% Equity S&P 500 Index July-2010 0.5 -20.19% -20.19% 0.00% Equity S&P 500 Index July-2010 0.5 -16.70% -16.70% 0.00% Equity S&P 500 Index August-2010 0.5 -26.28% -26.28% 0.00% Equity S&P 500 Index September-2010 0.3 -12.08% -12.08% 0.00% Equity S&P 500 Index September-2010 0.5 -12.05% -12.05% 0.00% Equity S&P 500 Index October-2010 0.6 -14.37% -14.37% 0.00% Equity Russell 2000 Index November-2010 0.5 -14.51% -14.51% 0.00% Equity S&P 500 Index January-2011 0.6 -4.94% -4.94% 0.00% Equity S&P 500 Index January-2011 0.5 -2.87% -2.87% 0.00% Equity Russell 2000 Index February-2011 0.5 10.54% 12.06% 1.52% Equity Russell 2000 Index June-2011 0.5 10.47% 12.99% 2.52% Equity Russell 2000 Index July-2011 2.0 -17.13% -11.30% 5.83% Equity Russell 2000 Index September-2011 0.5 -16.82% -16.82% 0.00% Equity Russell 2000 Index January-2012 0.5 -3.07% 0.00% 3.07% Equity Russell 2000 Index January-2012 0.6 -2.22% -2.22% 0.00% Equity Russell 2000 Index September-2012 0.5 -13.12% -13.12% 0.00% Product Performance Summary % OF DEALS WHERE: Number of Average Strategy Average MLI Average MLI Outperformance/ MLI Underperforms Performance MLI Outperforms O?erings Return1,2,3 Return1 Underperformance1 Strategy Return Is Equal Strategy Return All Linked Asset Classes 57 1.52% 2.27% 0.75% 21.05% 29.82% 49.12% Equity 55 0.95% 2.07% 1.12% 20.00% 30.91% 49.09% Commodity 2 17.26% 7.96% -9.30% 50.00% 0.00% 50.00% Currency 0 — — — — — — 15 See page 47 for endnotes.

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN LEVERAGED INDEX RETURN NOTES® (LIRNS®) Offer enhanced exposure to a linked asset, while offering some buffer against the risk of losses. Beyond the buffer, downside exposure to the linked asset is on a one-to-one basis. Payout profile Shown here are some hypothetical payouts at maturity for LIRNs tied to the S&P 500. They are based on 1.25x participation in the increase in the S&P 500 and 1:1 participation in declines beyond a 10% buffer, with up to 90% of the principal at risk. If the issuer goes bankrupt or is unable to pay its debts, investors could lose all of their investments. If the S&P 500 rises 30%, LIRNs return 37.5%. ReTuRn AT MATuRiTy 50% S&P 500 LIRNs 37.5% does this pay out this 25% LIRNs outperform market 12.5% 0% 0% –10% 0% 10% 20% 30% 40% –10% DOWNSIDE –20% PROTECTION –30% –20% If the S&P 500 falls 10%, you still receive your principal. 10% –40% –30% –40% If the S&P 500 falls 30%, LIRNs lose 20%. –50% Hypothetical information is not a projection of future returns. S&P 500 return does not include dividends. Product Performance Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity Nikkei 225 Index August-2004 4.5 -8.63% -3.98% 4.65% Equity Dow Jones Industrial Average September-2004 5.0 -0.63% 0.00% 0.63% Commodity Dow Jones-UBS Commodity Index December-2004 5.1 -1.61% 0.00% 1.61% Equity Global Equity Index Basket December-2004 5.0 -1.01% 0.00% 1.01% Commodity Dow Jones-UBS Commodity Index February-2005 5.0 -2.10% 0.00% 2.10% Equity Emerging Market Equity Basket March-2006 3.5 2.56% 2.70% 0.14% Commodity Rogers International Commodity Index – Excess Return November-2006 3.5 -6.63% -0.48% 6.15% Equity MSCI Emerging Markets Index March-2007 3.5 3.04% 3.34% 0.30% Commodity Rogers International Commodity Index – Agriculture Excess Return March-2007 3.0 -7.08% 0.00% 7.08% Commodity Rogers International Commodity Index – Agriculture Excess Return August-2007 2.5 -9.01% -0.41% 8.60% Equity Global Equity Index Basket August-2007 2.0 -18.50% -12.58% 5.92% Equity Global Equity Index Basket November-2007 2.4 -12.52% -7.68% 4.84% Commodity MLCX Biofuels-Excess Return Index November-2007 2.3 -2.94% 0.00% 2.94% Equity Merrill Lynch Commodity Index – Excess Return February-2008 4.0 -6.18% -2.29% 3.89% Equity Global Equity Index Basket March-2008 3.0 -5.28% -1.70% 3.58% 16 See page 47 for endnotes.

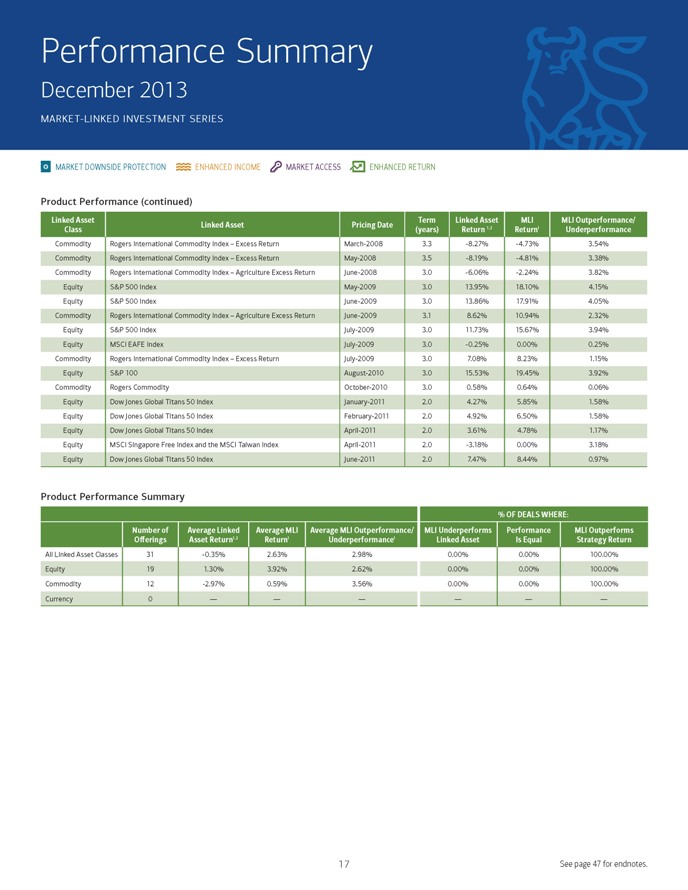

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Commodity Rogers International Commodity Index – Excess Return March-2008 3.3 -8.27% -4.73% 3.54% Commodity Rogers International Commodity Index – Excess Return May-2008 3.5 -8.19% -4.81% 3.38% Commodity Rogers International Commodity Index – Agriculture Excess Return June-2008 3.0 -6.06% -2.24% 3.82% Equity S&P 500 Index May-2009 3.0 13.95% 18.10% 4.15% Equity S&P 500 Index June-2009 3.0 13.86% 17.91% 4.05% Commodity Rogers International Commodity Index – Agriculture Excess Return June-2009 3.1 8.62% 10.94% 2.32% Equity S&P 500 Index July-2009 3.0 11.73% 15.67% 3.94% Equity MSCI EAFE Index July-2009 3.0 -0.25% 0.00% 0.25% Commodity Rogers International Commodity Index – Excess Return July-2009 3.0 7.08% 8.23% 1.15% Equity S&P 100 August-2010 3.0 15.53% 19.45% 3.92% Commodity Rogers Commodity October-2010 3.0 0.58% 0.64% 0.06% Equity Dow Jones Global Titans 50 Index January-2011 2.0 4.27% 5.85% 1.58% Equity Dow Jones Global Titans 50 Index February-2011 2.0 4.92% 6.50% 1.58% Equity Dow Jones Global Titans 50 Index April-2011 2.0 3.61% 4.78% 1.17% Equity MSCI Singapore Free Index and the MSCI Taiwan Index April-2011 2.0 -3.18% 0.00% 3.18% Equity Dow Jones Global Titans 50 Index June-2011 2.0 7.47% 8.44% 0.97% Product Performance Summary % OF DEALS WHERE: Number of Average Linked Average MLI Average MLI Outperformance/ MLI Underperforms Performance MLI Outperforms O?erings Asset Return1,2 Return1 Underperformance1 Linked Asset Is Equal Strategy Return All Linked Asset Classes 31 -0.35% 2.63% 2.98% 0.00% 0.00% 100.00% Equity 19 1.30% 3.92% 2.62% 0.00% 0.00% 100.00% Commodity 12 -2.97% 0.59% 3.56% 0.00% 0.00% 100.00% Currency 0 — — — — — — 17 See page 47 for endnotes.

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN CAPPED LEVERAGED INDEX RETURN NOTES® (CAPPED LIRNS®) Offer enhanced exposure—typically two times—to the return of the linked asset subject to a cap, while offering some buffer against the risk of losses. Beyond the buffer, downside exposure to the linked asset is on a one-to-one basis. Payout profile Shown here are some hypothetical payouts at maturity for Capped LIRNs tied to the S&P 500. They are based on 2x participation in the increase in the S&P 500 with a 16% cap on returns and 1:1 participation in declines beyond a 10% buffer, with up to 90% of the principal at risk. If the issuer goes bankrupt or is unable to pay its debts, investors could lose all of their investments. If the S&P 500 rises 40%, the CLIRNs return 16%. RETURN AT MATURITY S&P 500 CLIRNs does this pay out this CLIRNs outperform market 16% 16% 16% 16% 16% CAP 10% 0% 0% 0% 16% –5% 0% 5% 8% 15% 20% 30% 40% –10% –5% –15% –10% DOWNSIDE If the S&P 500 rises 8%, the CLIRNs return 16%. PROTECTION –20% –15% 10% –20% –30% –25% If the S&P 500 falls 15%, the CLIRNs lose 5%. Hypothetical information is not a projection of future returns. S&P 500 return does not include dividends. Product Performance Linked Asset Term Linked Asset MLI MLI Outperformance/Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity Russell 2000 Index May-2008 1.5 -12.24% -5.26% 6.98% Commodity Natural Gas June-2008 2.3 -34.26% -24.05% 10.21% Equity International Small Cap Basket June-2008 1.5 -14.12% -7.06% 7.06% Equity Russell 2000 Index June-2008 1.6 -6.54% -0.16% 6.38% Equity MSCI Brazil Index June-2008 1.6 -7.74% -1.32% 6.42% Equity MSCI China Index July-2008 1.5 -3.72% 0.00% 3.72% Equity MSCI EAFE Index July-2008 1.5 -12.66% -2.26% 10.40% Equity MSCI Emerging Markets Index July-2008 1.5 -4.79% 0.00% 4.79% Equity S&P 500 Index August-2008 1.5 -9.49% -2.61% 6.88% Equity S&P BRIC 40 Index August-2008 1.5 -3.89% 0.00% 3.89% Equity Stowe Global Coal Index August-2008 1.5 -15.79% -5.22% 10.57% Equity S&P 500 Index September-2008 1.5 -4.45% 0.00% 4.45% Equity S&P 500 Index September-2008 1.5 -2.21% 0.00% 2.21% 18 See page 47 for endnotes.

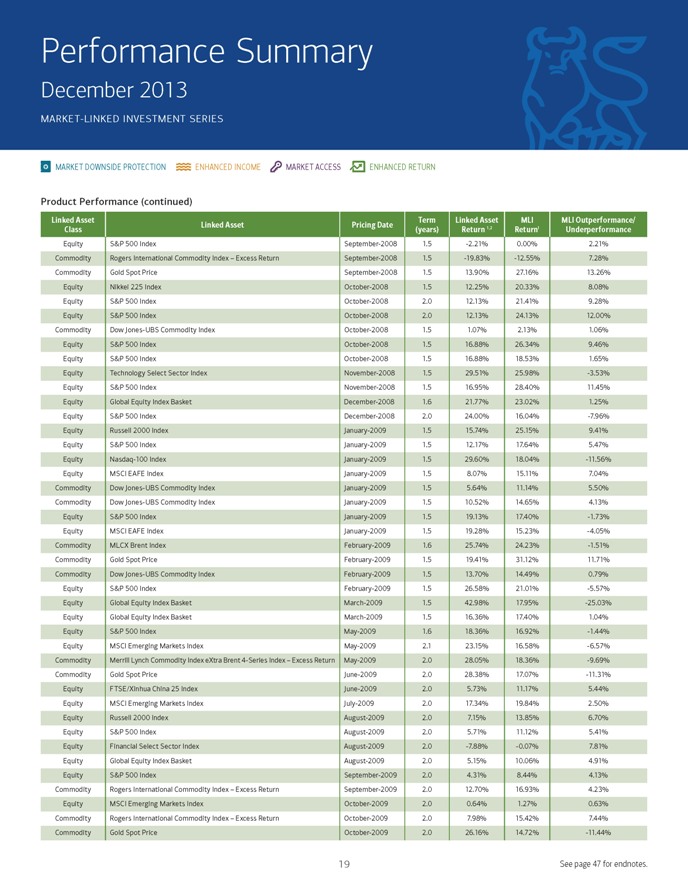

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity S&P 500 Index September-2008 1.5 -2.21% 0.00% 2.21% Commodity Rogers International Commodity Index – Excess Return September-2008 1.5 -19.83% -12.55% 7.28% Commodity Gold Spot Price September-2008 1.5 13.90% 27.16% 13.26% Equity Nikkei 225 Index October-2008 1.5 12.25% 20.33% 8.08% Equity S&P 500 Index October-2008 2.0 12.13% 21.41% 9.28% Equity S&P 500 Index October-2008 2.0 12.13% 24.13% 12.00% Commodity Dow Jones-UBS Commodity Index October-2008 1.5 1.07% 2.13% 1.06% Equity S&P 500 Index October-2008 1.5 16.88% 26.34% 9.46% Equity S&P 500 Index October-2008 1.5 16.88% 18.53% 1.65% Equity Technology Select Sector Index November-2008 1.5 29.51% 25.98% -3.53% Equity S&P 500 Index November-2008 1.5 16.95% 28.40% 11.45% Equity Global Equity Index Basket December-2008 1.6 21.77% 23.02% 1.25% Equity S&P 500 Index December-2008 2.0 24.00% 16.04% -7.96% Equity Russell 2000 Index January-2009 1.5 15.74% 25.15% 9.41% Equity S&P 500 Index January-2009 1.5 12.17% 17.64% 5.47% Equity Nasdaq-100 Index January-2009 1.5 29.60% 18.04% -11.56% Equity MSCI EAFE Index January-2009 1.5 8.07% 15.11% 7.04% Commodity Dow Jones-UBS Commodity Index January-2009 1.5 5.64% 11.14% 5.50% Commodity Dow Jones-UBS Commodity Index January-2009 1.5 10.52% 14.65% 4.13% Equity S&P 500 Index January-2009 1.5 19.13% 17.40% -1.73% Equity MSCI EAFE Index January-2009 1.5 19.28% 15.23% -4.05% Commodity MLCX Brent Index February-2009 1.6 25.74% 24.23% -1.51% Commodity Gold Spot Price February-2009 1.5 19.41% 31.12% 11.71% Commodity Dow Jones-UBS Commodity Index February-2009 1.5 13.70% 14.49% 0.79% Equity S&P 500 Index February-2009 1.5 26.58% 21.01% -5.57% Equity Global Equity Index Basket March-2009 1.5 42.98% 17.95% -25.03% Equity Global Equity Index Basket March-2009 1.5 16.36% 17.40% 1.04% Equity S&P 500 Index May-2009 1.6 18.36% 16.92% -1.44% Equity MSCI Emerging Markets Index May-2009 2.1 23.15% 16.58% -6.57% Commodity Merrill Lynch Commodity Index eXtra Brent 4-Series Index – Excess Return May-2009 2.0 28.05% 18.36% -9.69% Commodity Gold Spot Price June-2009 2.0 28.38% 17.07% -11.31% Equity FTSE/Xinhua China 25 Index June-2009 2.0 5.73% 11.17% 5.44% Equity MSCI Emerging Markets Index July-2009 2.0 17.34% 19.84% 2.50% Equity Russell 2000 Index August-2009 2.0 7.15% 13.85% 6.70% Equity S&P 500 Index August-2009 2.0 5.71% 11.12% 5.41% Equity Financial Select Sector Index August-2009 2.0 -7.88% -0.07% 7.81% Equity Global Equity Index Basket August-2009 2.0 5.15% 10.06% 4.91% Equity S&P 500 Index September-2009 2.0 4.31% 8.44% 4.13% Commodity Rogers International Commodity Index – Excess Return September-2009 2.0 12.70% 16.93% 4.23% Equity MSCI Emerging Markets Index October-2009 2.0 0.64% 1.27% 0.63% Commodity Rogers International Commodity Index – Excess Return October-2009 2.0 7.98% 15.42% 7.44% Commodity Gold Spot Price October-2009 2.0 26.16% 14.72% -11.44% 19 See page 47 for endnotes.

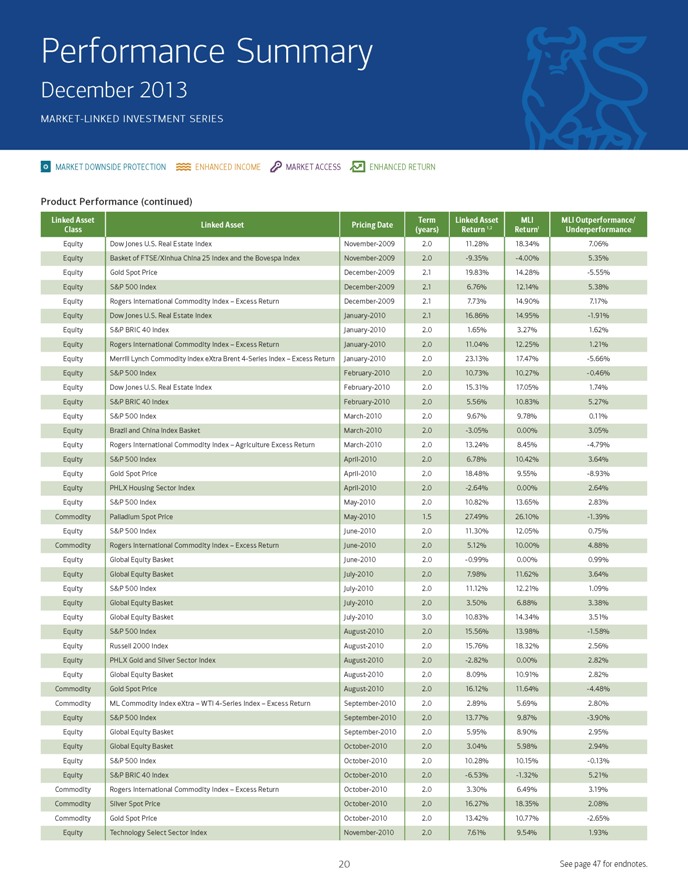

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity Dow Jones U.S. Real Estate Index November-2009 2.0 11.28% 18.34% 7.06% Equity Basket of FTSE/Xinhua China 25 Index and the Bovespa Index November-2009 2.0 -9.35% -4.00% 5.35% Equity Gold Spot Price December-2009 2.1 19.83% 14.28% -5.55% Equity S&P 500 Index December-2009 2.1 6.76% 12.14% 5.38% Equity Rogers International Commodity Index – Excess Return December-2009 2.1 7.73% 14.90% 7.17% Equity Dow Jones U.S. Real Estate Index January-2010 2.1 16.86% 14.95% -1.91% Equity S&P BRIC 40 Index January-2010 2.0 1.65% 3.27% 1.62% Equity Rogers International Commodity Index – Excess Return January-2010 2.0 11.04% 12.25% 1.21% Equity Merrill Lynch Commodity index eXtra Brent 4-Series Index – Excess Return January-2010 2.0 23.13% 17.47% -5.66% Equity S&P 500 Index February-2010 2.0 10.73% 10.27% -0.46% Equity Dow Jones U.S. Real Estate Index February-2010 2.0 15.31% 17.05% 1.74% Equity S&P BRIC 40 Index February-2010 2.0 5.56% 10.83% 5.27% Equity S&P 500 Index March-2010 2.0 9.67% 9.78% 0.11% Equity Brazil and China Index Basket March-2010 2.0 -3.05% 0.00% 3.05% Equity Rogers International Commodity Index – Agriculture Excess Return March-2010 2.0 13.24% 8.45% -4.79% Equity S&P 500 Index April-2010 2.0 6.78% 10.42% 3.64% Equity Gold Spot Price April-2010 2.0 18.48% 9.55% -8.93% Equity PHLX Housing Sector Index April-2010 2.0 -2.64% 0.00% 2.64% Equity S&P 500 Index May-2010 2.0 10.82% 13.65% 2.83% Commodity Palladium Spot Price May-2010 1.5 27.49% 26.10% -1.39% Equity S&P 500 Index June-2010 2.0 11.30% 12.05% 0.75% Commodity Rogers International Commodity Index – Excess Return June-2010 2.0 5.12% 10.00% 4.88% Equity Global Equity Basket June-2010 2.0 -0.99% 0.00% 0.99% Equity Global Equity Basket July-2010 2.0 7.98% 11.62% 3.64% Equity S&P 500 Index July-2010 2.0 11.12% 12.21% 1.09% Equity Global Equity Basket July-2010 2.0 3.50% 6.88% 3.38% Equity Global Equity Basket July-2010 3.0 10.83% 14.34% 3.51% Equity S&P 500 Index August-2010 2.0 15.56% 13.98% -1.58% Equity Russell 2000 Index August-2010 2.0 15.76% 18.32% 2.56% Equity PHLX Gold and Silver Sector Index August-2010 2.0 -2.82% 0.00% 2.82% Equity Global Equity Basket August-2010 2.0 8.09% 10.91% 2.82% Commodity Gold Spot Price August-2010 2.0 16.12% 11.64% -4.48% Commodity ML Commodity Index eXtra – WTI 4-Series Index – Excess Return September-2010 2.0 2.89% 5.69% 2.80% Equity S&P 500 Index September-2010 2.0 13.77% 9.87% -3.90% Equity Global Equity Basket September-2010 2.0 5.95% 8.90% 2.95% Equity Global Equity Basket October-2010 2.0 3.04% 5.98% 2.94% Equity S&P 500 Index October-2010 2.0 10.28% 10.15% -0.13% Equity S&P BRIC 40 Index October-2010 2.0 -6.53% -1.32% 5.21% Commodity Rogers International Commodity Index – Excess Return October-2010 2.0 3.30% 6.49% 3.19% Commodity Silver Spot Price October-2010 2.0 16.27% 18.35% 2.08% Commodity Gold Spot Price October-2010 2.0 13.42% 10.77% -2.65% Equity Technology Select Sector Index November-2010 2.0 7.61% 9.54% 1.93% 20 See page 47 for endnotes.

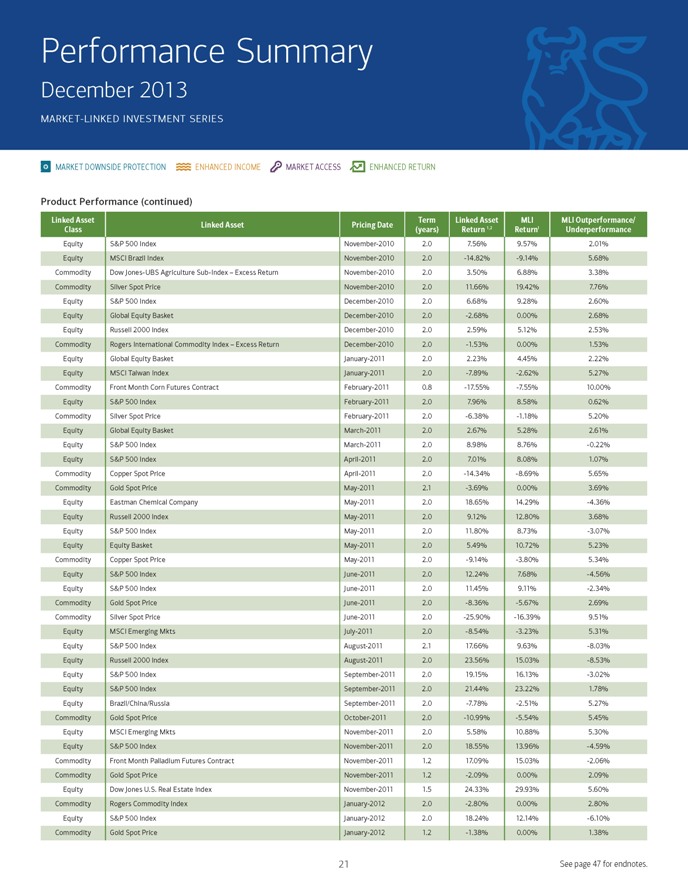

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity S&P 500 Index November-2010 2.0 7.56% 9.57% 2.01% Equity MSCI Brazil Index November-2010 2.0 -14.82% -9.14% 5.68% Commodity Dow Jones-UBS Agriculture Sub-Index – Excess Return November-2010 2.0 3.50% 6.88% 3.38% Commodity Silver Spot Price November-2010 2.0 11.66% 19.42% 7.76% Equity S&P 500 Index December-2010 2.0 6.68% 9.28% 2.60% Equity Global Equity Basket December-2010 2.0 -2.68% 0.00% 2.68% Equity Russell 2000 Index December-2010 2.0 2.59% 5.12% 2.53% Commodity Rogers International Commodity Index – Excess Return December-2010 2.0 -1.53% 0.00% 1.53% Equity Global Equity Basket January-2011 2.0 2.23% 4.45% 2.22% Equity MSCI Taiwan Index January-2011 2.0 -7.89% -2.62% 5.27% Commodity Front Month Corn Futures Contract February-2011 0.8 -17.55% -7.55% 10.00% Equity S&P 500 Index February-2011 2.0 7.96% 8.58% 0.62% Commodity Silver Spot Price February-2011 2.0 -6.38% -1.18% 5.20% Equity Global Equity Basket March-2011 2.0 2.67% 5.28% 2.61% Equity S&P 500 Index March-2011 2.0 8.98% 8.76% -0.22% Equity S&P 500 Index April-2011 2.0 7.01% 8.08% 1.07% Commodity Copper Spot Price April-2011 2.0 -14.34% -8.69% 5.65% Commodity Gold Spot Price May-2011 2.1 -3.69% 0.00% 3.69% Equity Eastman Chemical Company May-2011 2.0 18.65% 14.29% -4.36% Equity Russell 2000 Index May-2011 2.0 9.12% 12.80% 3.68% Equity S&P 500 Index May-2011 2.0 11.80% 8.73% -3.07% Equity Equity Basket May-2011 2.0 5.49% 10.72% 5.23% Commodity Copper Spot Price May-2011 2.0 -9.14% -3.80% 5.34% Equity S&P 500 Index June-2011 2.0 12.24% 7.68% -4.56% Equity S&P 500 Index June-2011 2.0 11.45% 9.11% -2.34% Commodity Gold Spot Price June-2011 2.0 -8.36% -5.67% 2.69% Commodity Silver Spot Price June-2011 2.0 -25.90% -16.39% 9.51% Equity MSCI Emerging Mkts July-2011 2.0 -8.54% -3.23% 5.31% Equity S&P 500 Index August-2011 2.1 17.66% 9.63% -8.03% Equity Russell 2000 Index August-2011 2.0 23.56% 15.03% -8.53% Equity S&P 500 Index September-2011 2.0 19.15% 16.13% -3.02% Equity S&P 500 Index September-2011 2.0 21.44% 23.22% 1.78% Equity Brazil/China/Russia September-2011 2.0 -7.78% -2.51% 5.27% Commodity Gold Spot Price October-2011 2.0 -10.99% -5.54% 5.45% Equity MSCI Emerging Mkts November-2011 2.0 5.58% 10.88% 5.30% Equity S&P 500 Index November-2011 2.0 18.55% 13.96% -4.59% Commodity Front Month Palladium Futures Contract November-2011 1.2 17.09% 15.03% -2.06% Commodity Gold Spot Price November-2011 1.2 -2.09% 0.00% 2.09% Equity Dow Jones U.S. Real Estate Index November-2011 1.5 24.33% 29.93% 5.60% Commodity Rogers Commodity Index January-2012 2.0 -2.80% 0.00% 2.80% Equity S&P 500 Index January-2012 2.0 18.24% 12.14% -6.10% Commodity Gold Spot Price January-2012 1.2 -1.38% 0.00% 1.38% 21 See page 47 for endnotes.

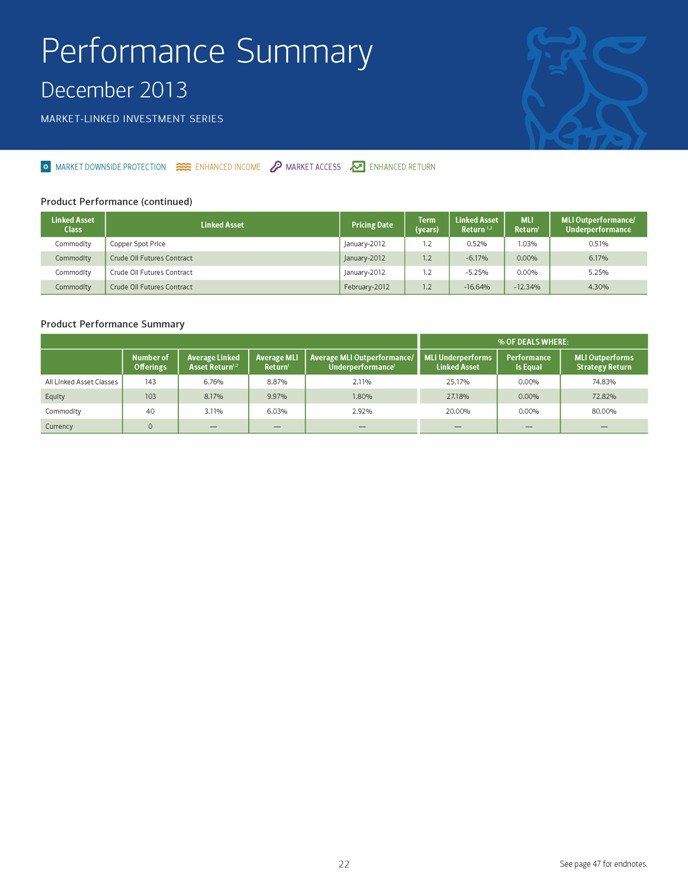

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Commodity Copper Spot Price January-2012 1.2 0.52% 1.03% 0.51% Commodity Crude Oil Futures Contract January-2012 1.2 -6.17% 0.00% 6.17% Commodity Crude Oil Futures Contract January-2012 1.2 -5.25% 0.00% 5.25% Commodity Crude Oil Futures Contract February-2012 1.2 -16.64% -12.34% 4.30% Product Performance Summary % OF DEALS WHERE: Number of Average Linked Average MLI Average MLI Outperformance/ MLI Underperforms Performance MLI Outperforms Offerings Asset Return1,2 Return1 Underperformance1 Linked Asset Is Equal Strategy Return All Linked Asset Classes 143 6.76% 8.87% 2.11% 25.17% 0.00% 74.83% Equity 103 8.17% 9.97% 1.80% 27.18% 0.00% 72.82% Commodity 40 3.11% 6.03% 2.92% 20.00% 0.00% 80.00% Currency 0 — — — — — — 22 See page 47 for endnotes.

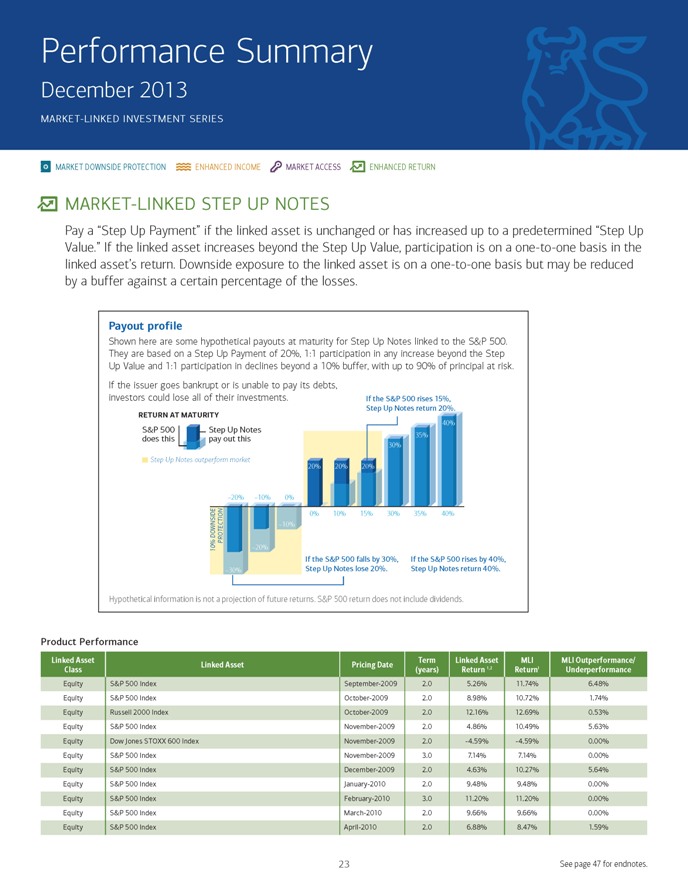

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN MARKET-LINKED STEP UP NOTES Pay a “Step Up Payment” if the linked asset is unchanged or has increased up to a predetermined “Step Up Value.” If the linked asset increases beyond the Step Up Value, participation is on a one-to-one basis in the linked asset’s return. Downside exposure to the linked asset is on a one-to-one basis but may be reduced by a buffer against a certain percentage of the losses. Payout profile Shown here are some hypothetical payouts at maturity for Step Up Notes linked to the S&P 500. They are based on a Step Up Payment of 20%, 1:1 participation in any increase beyond the Step Up Value and 1:1 participation in declines beyond a 10% buffer, with up to 90% of principal at risk. If the issuer goes bankrupt or is unable to pay its debts, investors could lose all of their investments. If the S&P 500 rises 15%, ReTuRn AT MATuRiTy Step Up Notes return 20%. 40% S&P 500 Step Up Notes does this pay out this 35% 30% Step Up Notes outperform market 20% 20% 20% –20% –10% 0% 0% 10% 15% 30% 35% 40% DOWNSIDE –10% PROTECTION 10% –20% If the S&P 500 falls by 30%, If the S&P 500 rises by 40%, –30% Step Up Notes lose 20%. Step Up Notes return 40%. Hypothetical information is not a projection of future returns. S&P 500 return does not include dividends. Product Performance Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity S&P 500 Index September-2009 2.0 5.26% 11.74% 6.48% Equity S&P 500 Index October-2009 2.0 8.98% 10.72% 1.74% Equity Russell 2000 Index October-2009 2.0 12.16% 12.69% 0.53% Equity S&P 500 Index November-2009 2.0 4.86% 10.49% 5.63% Equity Dow Jones STOXX 600 Index November-2009 2.0 -4.59% -4.59% 0.00% Equity S&P 500 Index November-2009 3.0 7.14% 7.14% 0.00% Equity S&P 500 Index December-2009 2.0 4.63% 10.27% 5.64% Equity S&P 500 Index January-2010 2.0 9.48% 9.48% 0.00% Equity S&P 500 Index February-2010 3.0 11.20% 11.20% 0.00% Equity S&P 500 Index March-2010 2.0 9.66% 9.66% 0.00% Equity S&P 500 Index April-2010 2.0 6.88% 8.47% 1.59% 23 See page 47 for endnotes.

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity S&P 500 Index May-2010 2.0 10.13% 10.13% 0.00% Equity S&P 500 Index June-2010 2.0 11.83% 11.83% 0.00% Equity MSCI EAFE Index June-2010 2.0 -0.56% -0.56% 0.00% Equity S&P 500 Index July-2010 2.0 11.22% 11.22% 0.00% Equity P?zer, Inc August-2010 1.0 18.48% 18.48% 0.00% Equity S&P 500 Index September-2010 2.0 13.93% 13.93% 0.00% Equity Global Equity Basket September-2010 2.0 5.94% 9.32% 3.38% Equity S&P 500 Index October-2010 2.0 10.03% 10.03% 0.00% Equity DJIA November-2010 3.0 13.09% 13.09% 0.00% Equity Global Equity Basket December-2010 2.0 1.82% 8.07% 6.25% Equity S&P 500 Index January-2011 2.0 6.93% 8.35% 1.42% Equity DAX Price Return Index February-2011 2.0 -0.36% -0.36% 0.00% Equity DAX Price Return Index March-2011 2.0 2.41% 7.05% 4.64% Equity S&P 500 Index March-2011 2.0 9.16% 9.16% 0.00% Equity S&P 500 Index June-2011 2.0 11.39% 11.39% 0.00% Equity S&P 500 Index July-2011 2.0 14.06% 14.06% 0.00% Equity S&P 500 Index August-2011 2.0 19.51% 19.51% 0.00% Equity DJ Global Titans August-2011 2.0 13.69% 13.69% 0.00% Equity DAX Index September-2011 2.0 19.03% 19.03% 0.00% Equity S&P 500 Index September-2011 2.0 21.39% 21.39% 0.00% Equity S&P 500 Index October-2011 1.1 5.31% 7.25% 1.94% Equity S&P 500 Index October-2011 2.0 16.53% 16.53% 0.00% Equity Russell 2000 Index October-2011 2.0 20.68% 20.68% 0.00% Equity MSCI EAFE October-2011 2.0 9.97% 12.17% 2.20% Currency USD/NCR October-2011 2.0 1.72% 6.30% 4.58% Currency BRIC Currency Basket October-2011 2.0 -5.52% -5.13% 0.39% Equity S&P 500 Index November-2011 1.1 18.37% 19.81% 1.44% Equity S&P 500 Index November-2011 2.0 18.71% 18.71% 0.00% Equity DJ Global Titans November-2011 2.0 18.23% 18.64% 0.41% Equity MSCI EAFE November-2011 2.0 17.54% 17.54% 0.00% Equity S&P 500 Index November-2011 2.0 23.03% 23.03% 0.00% Equity S&P 500 Index December-2011 1.1 20.02% 20.02% 0.00% Currency Emerging Markets Currency Basket December-2011 2.0 -2.35% -2.35% 0.00% Equity S&P 500 Index January-2012 1.0 14.97% 14.97% 0.00% Equity S&P 500 Index January-2012 2.0 19.31% 19.31% 0.00% Equity DJIA December-2012 1.0 40.65% 40.65% 0.00% 24 See page 47 for endnotes.

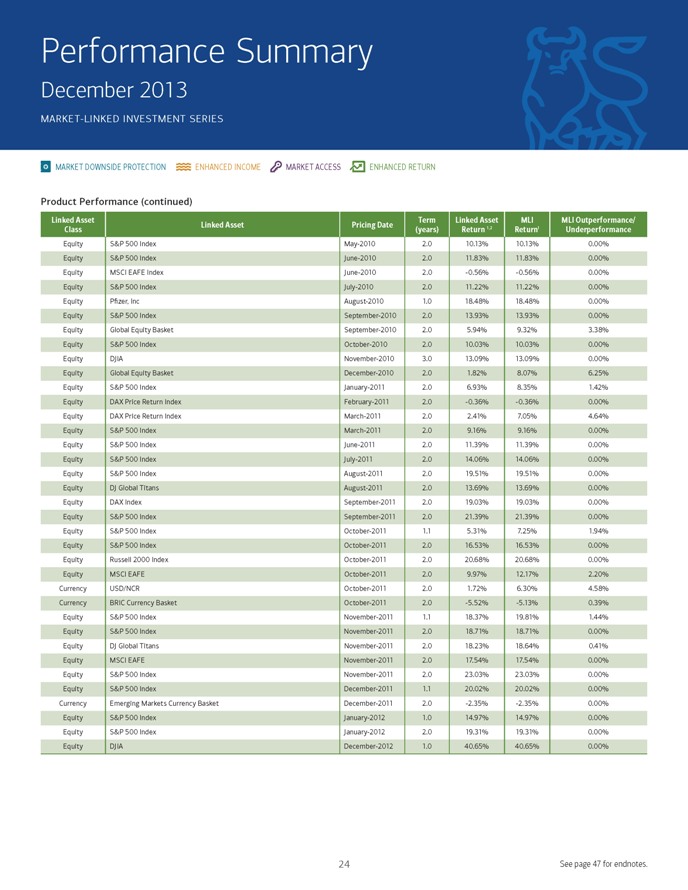

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance Summary % OF DEALS WHERE: Number of Average Linked Average MLI Average MLI Outperformance/ MLI Underperforms Performance MLI Outperforms Offerings Asset Return1,2 Return1 Underperformance1 Linked Asset Is Equal Strategy Return All Linked Asset Classes 47 11.19% 12.22% 1.03% 0.00% 65.96% 34.04% Equity 44 12.09% 13.08% 0.99% 0.00% 68.18% 31.82% Commodity 0 — — — — — —Currency 3 -2.05% -0.39% 1.66% 0.00% 33.33% 66.67% 25 See page 47 for endnotes.

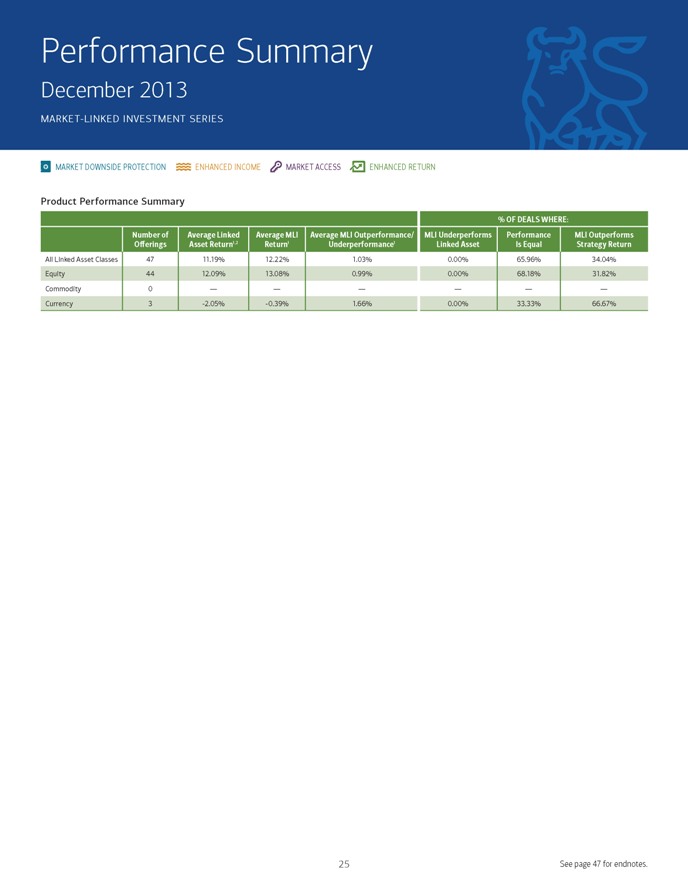

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN AUTOCALLABLE MARKET-LINKED STEP UP NOTES Pay a “Call Premium” if the linked asset is at or above its starting value on any of the applicable call dates. If not called on any of the applicable call dates, pay a “Step Up Payment” if the linked asset is unchanged or has increased up to a predetermined “Step Up Value.” If the linked asset increases beyond the Step Up Value, participation is on a one-to-one basis in the linked asset’s return. Downside exposure to the linked asset is on a one-to-one basis but may be reduced by a buffer against a certain percentage of the losses. Payout profile Shown here are some hypothetical payouts at call or at maturity for a three-year Autocallable Step Up Note linked to the S&P 500. They are based on a call premium of 8.5% at year one, a call premium of 17% at year two, a Step Up Payment at maturity of 24%, 1:1 participation in any increase beyond the Step Up Value and 1:1 participation in declines of the S&P 500. If the issuer goes bankrupt or is unable to pay its debts, investors could lose their entire investment. Year One Year Two Year Three/Maturity Note return is equal to the return of the S&P 500. S&P 500 up 24% or more S&P 500 ?at or up NO: S&P 500 ?at or up NO: from the starting value from starting value? The note from starting value? The note Note returns 24%. remains remains outstanding. outstanding. S&P 500 up 0–24% from starting value YES: YES: The note loses 1% for every Note called and returns Note called and returns S&P 500 down 1% decline in the S&P 500. 8.5%. The notes will 17%. The notes will from starting value underperform if the underperform if the S&P 500 rises more than S&P 500 rises more than 8.5% from the starting value. 17% from the starting value. Hypothetical information is not a projection of future returns. S&P 500 return does not include dividends. Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 1,2 1 Class (years) Return Return Underperformance Equity S&P 500 Index January-2012 1.0 16.34% 10.00% -6.34% Equity S&P 500 Index January-2012 1.0 13.38% 10.00% -3.38% Equity S&P 500 Index March-2012 1.0 10.87% 10.00% -0.87% Equity S&P 500 Index March-2012 1.0 10.69% 10.00% -0.69% Equity S&P 500 Index April-2012 1.0 12.08% 10.00% -2.08% Equity S&P 500 Index April-2012 1.0 15.32% 10.00% -5.32% Equity S&P 500 Index May-2012 1.0 24.91% 10.00% -14.91% Equity S&P 500 Index June-2012 1.0 20.86% 10.00% -10.86% Equity S&P 500 Index July-2012 1.0 25.71% 10.00% -15.71% Equity S&P 500 Index August-2012 1.0 17.52% 10.00% -7.52% Equity S&P 500 Index August-2012 1.0 16.68% 10.00% -6.68% Equity S&P 500 Index September-2012 1.1 15.18% 9.05% -6.13% Equity S&P 500 Index October-2012 1.0 21.78% 9.00% -12.78% Equity S&P 500 Index October-2012 1.0 24.68% 8.50% -16.18% Equity S&P 500 Index November-2012 1.0 32.66% 8.50% -24.16% Equity S&P 500 Index November-2012 1.0 27.48% 8.50% -18.98% Equity Russell 2000 Index November-2012 1.0 37.44% 10.00% -27.44% 26 See page 47 for endnotes.

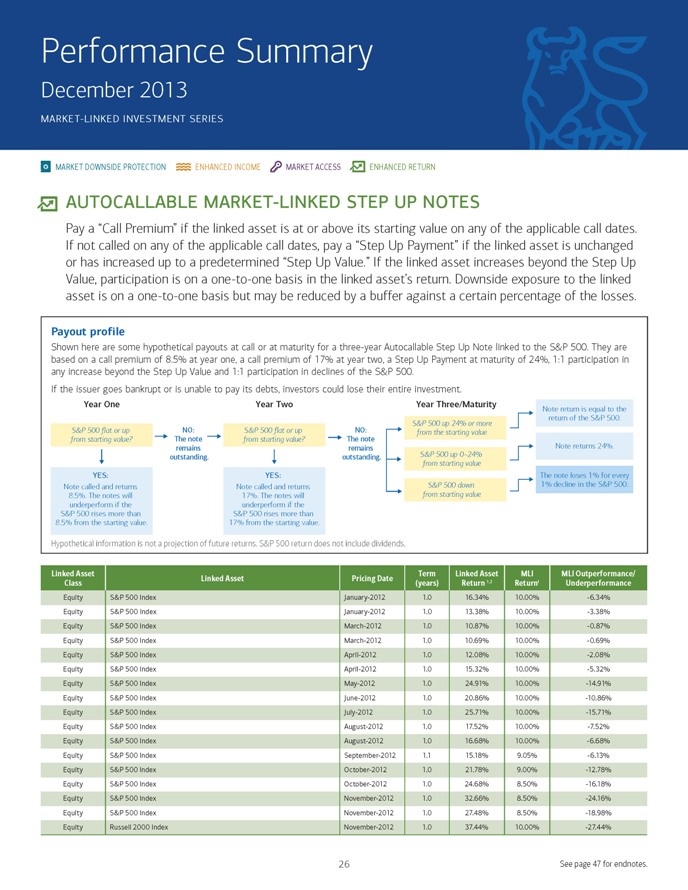

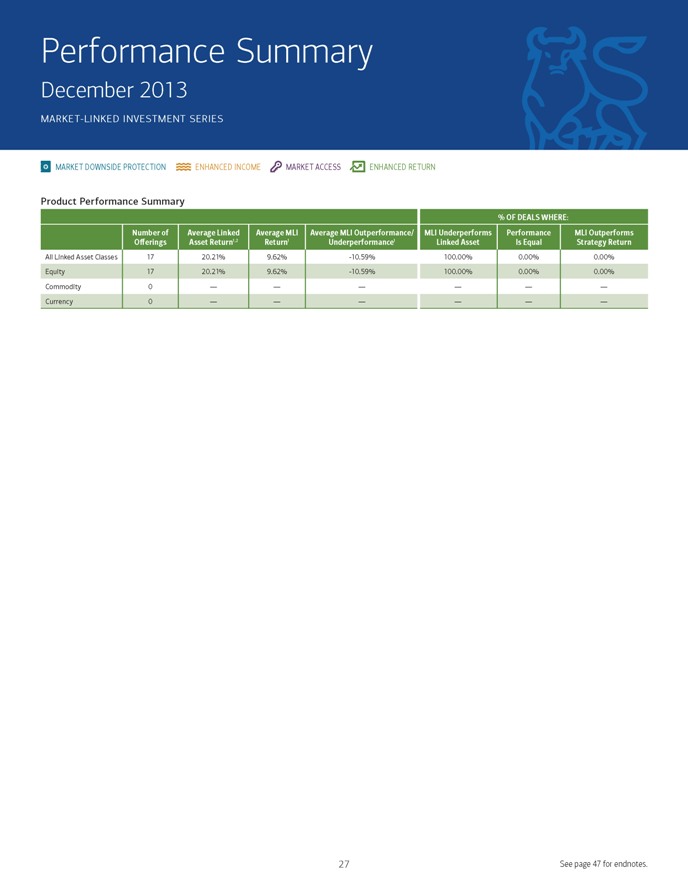

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance Summary % OF DEALS WHERE: Number of Average Linked Average MLI Average MLI Outperformance/ MLI Underperforms Performance MLI Outperforms Offerings Asset Return1,2 Return1 Underperformance1 Linked Asset Is Equal Strategy Return All Linked Asset Classes 17 20.21% 9.62% -10.59% 100.00% 0.00% 0.00% Equity 17 20.21% 9.62% -10.59% 100.00% 0.00% 0.00% Commodity 0 — — — — — —Currency 0 — — — — — — 27 See page 47 for endnotes.

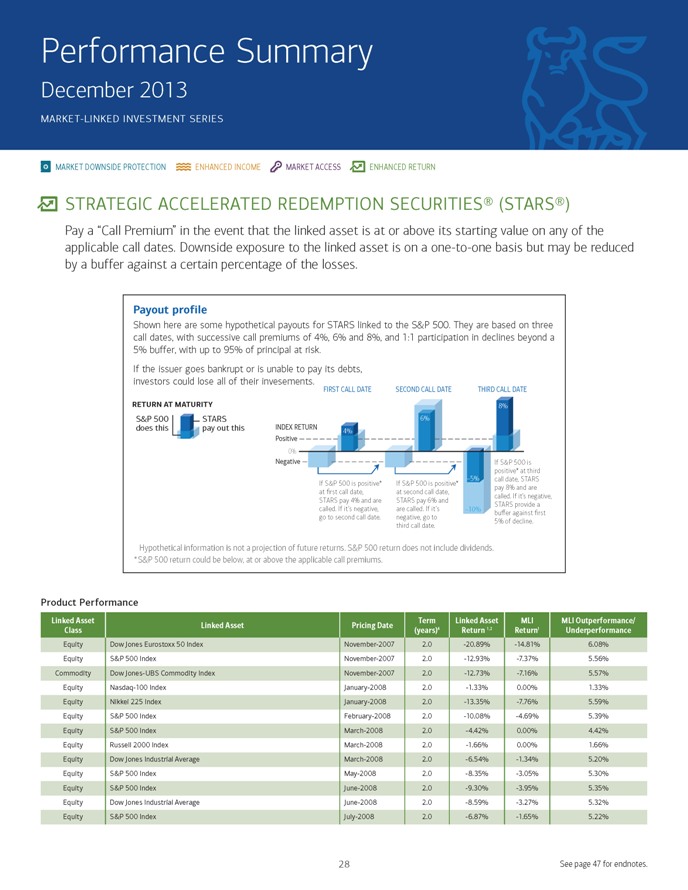

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN STRATEGIC ACCELERATED REDEMPTION SECURITIES® (STARS®) Pay a “Call Premium” in the event that the linked asset is at or above its starting value on any of the applicable call dates. Downside exposure to the linked asset is on a one-to-one basis but may be reduced by a buffer against a certain percentage of the losses. Payout profile Shown here are some hypothetical payouts for STARS linked to the S&P 500. They are based on three call dates, with successive call premiums of 4%, 6% and 8%, and 1:1 participation in declines beyond a 5% buffer, with up to 95% of principal at risk. If the issuer goes bankrupt or is unable to pay its debts, investors could lose all of their invesements. FIRST CALL DATE SECOND CALL DATE THIRD CALL DATE ReTuRn AT MATuRiTy 8% S&P 500 STARS 6% does this pay out this INDEX RETURN 4% Positive 0% Negative If S&P 500 is positive* at third –5% call date, STARS If S&P 500 is positive* If S&P 500 is positive* pay 8% and are at first call date, at second call date, called. If it’s negative, STARS pay 4% and are STARS pay 6% and STARS provide a called. If it’s negative, are called. If it’s –10% bu?er against ?rst go to second call date. negative, go to 5% of decline. third call date. Hypothetical information is not a projection of future returns. S&P 500 return does not include dividends. * S&P 500 return could be below, at or above the applicable call premiums. Product Performance Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 4 1,2 1 Class (years) Return Return Underperformance Equity Dow Jones Eurostoxx 50 Index November-2007 2.0 -20.89% -14.81% 6.08% Equity S&P 500 Index November-2007 2.0 -12.93% -7.37% 5.56% Commodity Dow Jones-UBS Commodity Index November-2007 2.0 -12.73% -7.16% 5.57% Equity Nasdaq-100 Index January-2008 2.0 -1.33% 0.00% 1.33% Equity Nikkei 225 Index January-2008 2.0 -13.35% -7.76% 5.59% Equity S&P 500 Index February-2008 2.0 -10.08% -4.69% 5.39% Equity S&P 500 Index March-2008 2.0 -4.42% 0.00% 4.42% Equity Russell 2000 Index March-2008 2.0 -1.66% 0.00% 1.66% Equity Dow Jones Industrial Average March-2008 2.0 -6.54% -1.34% 5.20% Equity S&P 500 Index May-2008 2.0 -8.35% -3.05% 5.30% Equity S&P 500 Index June-2008 2.0 -9.30% -3.95% 5.35% Equity Dow Jones Industrial Average June-2008 2.0 -8.59% -3.27% 5.32% Equity S&P 500 Index July-2008 2.0 -6.87% -1.65% 5.22% 28 See page 47 for endnotes.

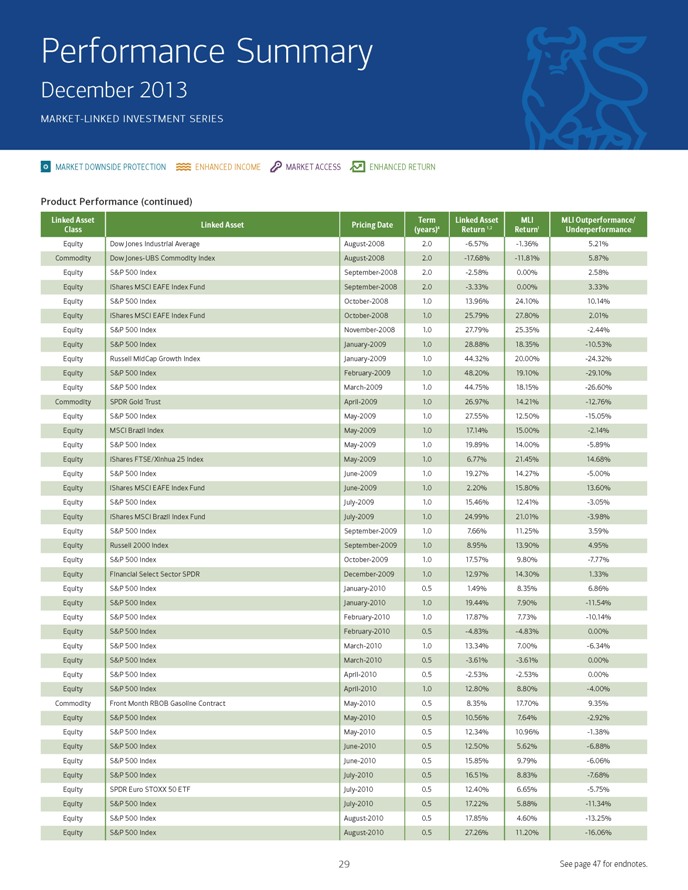

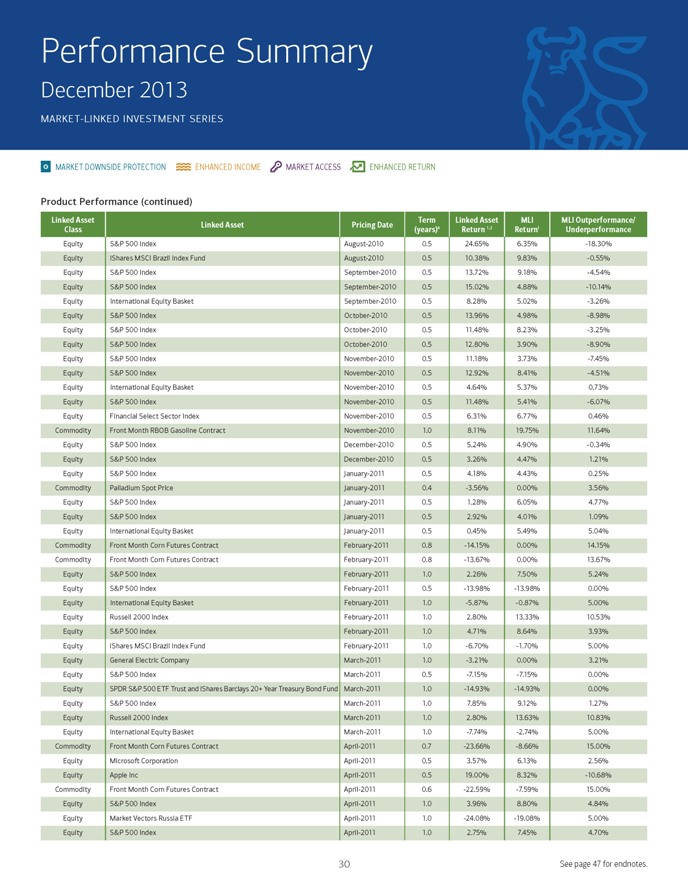

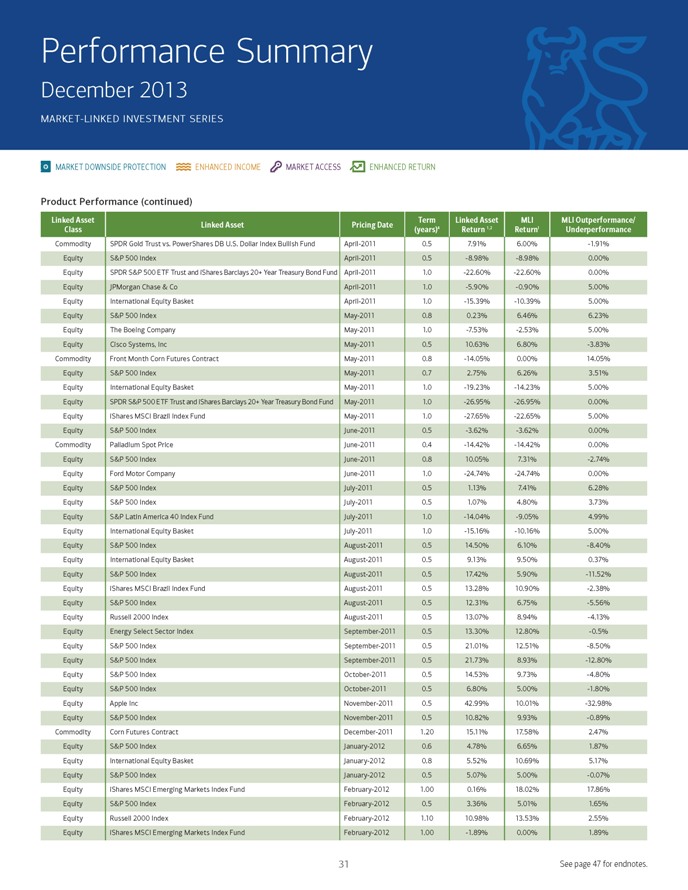

Performance Summary December 2013 MARKET-LINKED INVESTMENT SERIES MARKET DOWNSIDE PROTECTION ENHANCED INCOME MARKET ACCESS ENHANCED RETURN Product Performance (continued) Linked Asset Term Linked Asset MLI MLI Outperformance/ Linked Asset Pricing Date 4 1,2 1 Class (years) Return Return Underperformance Equity Dow Jones Industrial Average August-2008 2.0 -6.57% -1.36% 5.21% Commodity Dow Jones-UBS Commodity Index August-2008 2.0 -17.68% -11.81% 5.87% Equity S&P 500 Index September-2008 2.0 -2.58% 0.00% 2.58% Equity iShares MSCI EAFE Index Fund September-2008 2.0 -3.33% 0.00% 3.33% Equity S&P 500 Index October-2008 1.0 13.96% 24.10% 10.14% Equity iShares MSCI EAFE Index Fund October-2008 1.0 25.79% 27.80% 2.01% Equity S&P 500 Index November-2008 1.0 27.79% 25.35% -2.44% Equity S&P 500 Index January-2009 1.0 28.88% 18.35% -10.53% Equity Russell MidCap Growth Index January-2009 1.0 44.32% 20.00% -24.32% Equity S&P 500 Index February-2009 1.0 48.20% 19.10% -29.10% Equity S&P 500 Index March-2009 1.0 44.75% 18.15% -26.60% Commodity SPDR Gold Trust April-2009 1.0 26.97% 14.21% -12.76% Equity S&P 500 Index May-2009 1.0 27.55% 12.50% -15.05% Equity MSCI Brazil Index May-2009 1.0 17.14% 15.00% -2.14% Equity S&P 500 Index May-2009 1.0 19.89% 14.00% -5.89% Equity iShares FTSE/Xinhua 25 Index May-2009 1.0 6.77% 21.45% 14.68% Equity S&P 500 Index June-2009 1.0 19.27% 14.27% -5.00% Equity iShares MSCI EAFE Index Fund June-2009 1.0 2.20% 15.80% 13.60% Equity S&P 500 Index July-2009 1.0 15.46% 12.41% -3.05% Equity iShares MSCI Brazil Index Fund July-2009 1.0 24.99% 21.01% -3.98% Equity S&P 500 Index September-2009 1.0 7.66% 11.25% 3.59% Equity Russell 2000 Index September-2009 1.0 8.95% 13.90% 4.95% Equity S&P 500 Index October-2009 1.0 17.57% 9.80% -7.77% Equity Financial Select Sector SPDR December-2009 1.0 12.97% 14.30% 1.33% Equity S&P 500 Index January-2010 0.5 1.49% 8.35% 6.86% Equity S&P 500 Index January-2010 1.0 19.44% 7.90% -11.54% Equity S&P 500 Index February-2010 1.0 17.87% 7.73% -10.14% Equity S&P 500 Index February-2010 0.5 -4.83% -4.83% 0.00% Equity S&P 500 Index March-2010 1.0 13.34% 7.00% -6.34% Equity S&P 500 Index March-2010 0.5 -3.61% -3.61% 0.00% Equity S&P 500 Index April-2010 0.5 -2.53% -2.53% 0.00% Equity S&P 500 Index April-2010 1.0 12.80% 8.80% -4.00% Commodity Front Month RBOB Gasoline Contract May-2010 0.5 8.35% 17.70% 9.35% Equity S&P 500 Index May-2010 0.5 10.56% 7.64% -2.92% Equity S&P 500 Index May-2010 0.5 12.34% 10.96% -1.38% Equity S&P 500 Index June-2010 0.5 12.50% 5.62% -6.88% Equity S&P 500 Index June-2010 0.5 15.85% 9.79% -6.06% Equity S&P 500 Index July-2010 0.5 16.51% 8.83% -7.68% Equity SPDR Euro STOXX 50 ETF July-2010 0.5 12.40% 6.65% -5.75% Equity S&P 500 Index July-2010 0.5 17.22% 5.88% -11.34% Equity S&P 500 Index August-2010 0.5 17.85% 4.60% -13.25% Equity S&P 500 Index August-2010 0.5 27.26% 11.20% -16.06% 29 See page 47 for endnotes.