Filed Pursuant to Rule 433

Registration No. 333-158663

| Market-Linked Step Up Notes (MLSU Notes) are Market-Linked Investments designed to give you the opportunity to enhance modest market returns. MLSU Notes are debt securities of an issuing company that are linked to a market index, such as the S&P 500, or to a specific asset, such as a stock, currencies or commodities. |

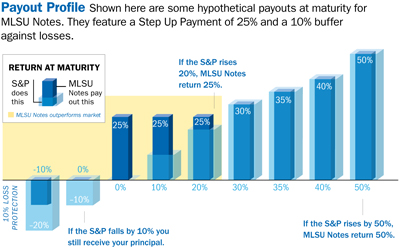

| As long as the linked asset has not decreased when the MLSU Notes mature, they will pay a positive return. If the linked asset is unchanged or has increased by an amount less than a stated percentage—the “Step Up Value”—you’ll receive a fixed “Step Up Payment” equal to that percentage. If the asset increases by more than the Step Up, you’ll participate one-to-one | in the asset’s return. If it decreases, you’ll participate one-to-one in the decline, unless the notes include a buffer against a certain percentage of the losses. Either way, these notes do involve risk to principal. Like other corporate bonds, they’re also subject to issuer credit risk. MLSU Notes are available in $10 increments (minimum purchase of |

$1,000 required), with maturities ranging from 18 months to four years. They can be purchased in new-issue offerings or in the secondary market. They’re registered with the Securities and Exchange Commission and may be listed on public exchanges such as NYSE Arca. And they can express a bullish or bearish view, with the positive return of bearish MLSU Notes based on the percentage decline of the underlying asset. |

|

How can MLSU Notes play a role in my investment strategy? MLSU Notes offer investors with bullish (or in the case of bearish notes, bearish) views of a given asset an opportunity to optimize their returns. For example, if you believe the S&P 500 will trend modestly upward during the next two years, you might consider a two-year MLSU Note linked to the S&P 500 with a Step Up Payment of 20%. Even if the S&P remains flat or increases by just a few percentage points, you will receive the principal of the note back at maturity plus a |

Hypothetical information is not a projection of future returns.

IMPORTANT NOTICE: This fact sheet is intended to provide an overview of MLSU Notes and does not provide terms of any specific series. Merrill Lynch will furnish you with a prospectus that contains the terms of the relevant offering. Prior to making any decision to invest, you should read that prospectus for a detailed explanation of the terms, risks, tax treatment and other relevant information. Additionally, you should consult your accounting, legal, or tax advisors before investing in MLSU Notes.

Prior to selling any particular MLSU, the issuer will have filed a registration statement, including a prospectus, with the Securities and Exchange Commission (SEC) containing more complete information about the potential offerings described in this Investor Education Guide. Before investing, you should carefully read the relevant prospectus and the other documents filed by the issuer with the SEC. You may obtain these documents without cost by visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, the issuer or Merrill Lynch will arrange to have the documents sent to you by calling Merrill Lynch toll-free at 1-866-500-5408.

| 20% return—substantially higher than what you would have achieved had you invested directly in an S&P mutual fund.

What advantages do MLSU Notes provide?

¡ Enhanced growth potential. If the underlying asset remains flat or increases less than the Step Up Value, you will still receive the full value of the Step Up Payment without sacrificing the ability to participate fully in any growth of the asset beyond the Step Up.

n Diversification. MLSU Notes can be linked to a wide variety of underlying assets, including some not readily available through mutual funds or exchange-traded funds.

n Simplification. Because Market-Linked Investments such as MLSU Notes offer a single packaged solution, they can reduce complicated financial, tax, legal and operational issues surrounding the execution of sophisticated investment strategies.

n Complement to long-term strategies. MLSU Notes can help you enhance market returns to pursue the growth you need to meet long-term financial objectives.

What risks do MLSU Notes carry?

n Loss of principal and no income. If the linked asset declines, you could lose some, or all, of your principal. Even |

MLSU Notes with a buffer provide downside market protection only up to a point. For example, for MLSU Notes with a 10% buffer, you’re at risk of losing up to 90% of your principal. Also, since you receive no regular interest payments, any losses you incur will not be mitigated by income.

n Limited liquidity. A secondary market may or may not develop for MLSU Notes, so you may not be able to sell them prior to maturity. And if you are able to sell them on the secondary market, you may receive less than you paid.

n Credit risk. If the issuing company goes bankrupt or is unable to pay its debts, you could lose your full investment, even if the linked asset is performing well. The notes are not secured or backed by FDIC insurance or other governmental support.

n Tax consequences. The appreciation on the notes will be taxed as capital gains. |

What charges do I pay when purchasing an MLSU Note, and how does Merrill Lynch benefit?

Part of the $10 you pay for each new-issue MLSU unit goes to the Financial Advisor selling you the investment and to cover the purchase of the underlying instruments that make it possible. For example, if these fees total $0.20, the actual unit you hold will be worth $9.80 on the day of purchase. If you buy or sell MLSU Notes on the secondary market, you will pay transaction costs similar to what you pay for traditional debt securities. The trading, hedging and investment activities conducted by Merrill Lynch and its affiliated companies in the ordinary course of business, may affect the return on the MLSU Notes. When they’re issued by Bank of America Corporation (the parent company of Merrill Lynch), the proceeds will be used for the company’s operating or funding needs.n |

||||||||

|

MERRILL LYNCH OFFERS A VARIETY OF MARKET-LINKED INVESTMENTS IN FOUR BASIC CATEGORIES...

|

||||||||||

|

Offer exposure to the upside performance of the linked market measure or asset with no or only partial exposure to declines. Payments remain subject to issuer credit risk. |

May offer access to markets not even available through the other categories. Usually have one-to-one upside and downside exposure similar to a direct investment in the linked asset. |

|||||||||

|

Offer periodic, variable or fixed interest payments with an added payout at maturity based on the performance of the linked asset. Generally offer no or limited market downside protection. |

Offer the potential to receive better-than-market returns if the linked asset performs well, up to a cap. Generally offer no or limited market downside protection. |

|||||||||

Merrill Lynch Wealth Management makes available products and services offered by Merrill Lynch, Pierce, Fenner & Smith Incorporated (MLPF&S) and other subsidiaries of Bank of America Corporation (BAC). Investment products provided:

|

Are Not FDIC Insured

|

Are Not Bank Guaranteed

|

May Lose Value

|

| MLPF&S is a registered broker-dealer, Member SIPC and a wholly owned subsidiary of BAC. | ||||

| © 2010 Bank of America Corp. All rights reserved. | AR26Z2N3 408001PM-1110 |

MARKET DOWNSIDE PROTECTION

MARKET DOWNSIDE PROTECTION MARKET ACCESS

MARKET ACCESS ENHANCED INCOME

ENHANCED INCOME ENHANCED RETURN

ENHANCED RETURN