Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

| • | Approximate 5 year term if not called prior to maturity. |

| • | Payments on the Notes will depend on the individual performance of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund (each an “Underlying”). |

| • | Contingent coupon rate of 8.15% per annum (2.0375% per quarter) payable quarterly if the Observation Value of each Underlying on the applicable Observation Date is greater than or equal to 70% of its Starting Value. |

| • | Beginning in July 2020, automatically callable quarterly for an amount equal to the principal amount plus the relevant contingent coupon if the Observation Value of each Underlying is greater than or equal to its Starting Value on any Observation Date (other than the final Observation Date). |

| • | Assuming the Notes are not called prior to maturity, if any Underlying declines by more than 40% from its Starting Value, at maturity your investment will be subject to a 1:1 downside, with up to 100% of the principal at risk; otherwise, at maturity investors will receive the principal amount. At maturity the investor will also receive the final contingent coupon if the Observation Value of each Underlying on the final Observation Date is greater than or equal to 70% of its Starting Value. |

| • | All payments on the Notes are subject to the credit risk of BofA Finance LLC (“BofA Finance”) and Bank of America Corporation (“BAC” or the “Guarantor”). |

| • | The Notes priced on January 29, 2020, will issue on January 31, 2020 and will mature on February 3, 2025. The Notes will not be listed on any securities exchange. |

| • | CUSIP No. 09709TZD6 |

The initial estimated value of the Notes as of the pricing date is $957.30 per Note, which is less than the public offering price listed below. The actual value of your Notes at any time will reflect many factors and cannot be predicted with accuracy. See “Risk Factors” beginning on page PS-8 of this pricing supplement and “Structuring the Notes” on page PS-23 of this pricing supplement for additional information.

Potential purchasers of the Notes should consider the information in “Risk Factors” beginning on page PS- 8 of this pricing supplement, page PS-5 of the accompanying product supplement, page S-5 of the accompanying prospectus supplement, and page 7 of the accompanying prospectus.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note Prospectus (as defined on page PS-28) is truthful or complete. Any representation to the contrary is a criminal offense.

| Public offering price(1) | Underwriting discount(1) | Proceeds, before expenses, to BofA Finance | |

| Per Note | $1,000.00 | $32.50 | $967.50 |

| Total | $932,000.00 | $30,290.00 | $901,710.00 |

| (1) | Certain dealers who purchase the Notes for sale to certain fee-based advisory accounts may forgo some or all of their selling concessions, fees or commissions. |

The public offering price for investors purchasing the Notes in these fee-based advisory accounts may be as low as $967.50 per note.

The Notes and the related guarantee:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

BofA Securities

Selling Agent

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

Terms of the Notes

The Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund (the “Notes”) provide a quarterly Contingent Coupon Payment of $20.375 on the applicable Contingent Payment Date if, on any quarterly Observation Date, the Observation Value of each Underlying is greater than or equal to its Coupon Barrier. Beginning in July 2020, if the Observation Value of each Underlying is greater than or equal to its Starting Value on any Observation Date (other than the final Observation Date), the Notes will be automatically called, in whole but not in part, at 100% of the principal amount, together with the relevant Contingent Coupon Payment. No further amounts will be payable following an Automatic Call. If the Notes are not automatically called prior to maturity and the Least Performing Underlying declines by more than 40% from its Starting Value, there is full exposure to declines in the Least Performing Underlying, and you will lose a significant portion or all of your investment in the Notes. Otherwise, at maturity you will receive the principal amount. At maturity you will also receive the final Contingent Coupon Payment if the Observation Value of each Underlying on the final Observation Date is greater than or equal to its Coupon Barrier. The Notes are not traditional debt securities and it is possible that the Notes will not pay any Contingent Coupon Payments, and you may lose a significant portion or all of your principal amount at maturity. Any payments on the Notes will be calculated based on $1,000 in principal amount of Notes and will depend on the performance of the Underlyings, subject to our and BAC’s credit risk.

| Issuer: | BofA Finance |

| Guarantor: | BAC |

| Denominations: | The Notes will be issued in minimum denominations of $1,000 and whole multiples of $1,000 in excess thereof. |

| Term: | Approximately 5 years, unless previously automatically called. |

| Underlyings: | The Utilities Select Sector SPDR® Fund (Bloomberg symbol: “XLU”), the Energy Select Sector SPDR® Fund (Bloomberg symbol: “XLE”) and the Financial Select Sector SPDR® Fund (Bloomberg symbol: “XLF”) |

| Pricing Date: | January 29, 2020 |

| Issue Date: | January 31, 2020 |

| Valuation Date: | January 29, 2025, subject to postponement as described under “Description of the Notes—Certain Terms of the Notes—Events Relating to Observation Dates” of the accompanying product supplement. |

| Maturity Date: | February 3, 2025 |

| Starting Value: |

XLE: $54.72 XLF: $30.22 XLU: $68.65 |

| Observation Value: | With respect to each Underlying, its Closing Market Price on the applicable Observation Date, multiplied by its Price Multiplier, as determined by the calculation agent. |

| Ending Value: | With respect to each Underlying, its Observation Value on the Valuation Date. |

| Price Multiplier | With respect to each Underlying, 1, subject to adjustment for certain events as described in “Description of the Notes—Anti-Dilution and Discontinuance Adjustments Relating to ETFs” beginning on page PS-27 of the accompanying product supplement. |

| Coupon Barrier: |

XLE: $38.30, which is 70% of its Starting Value (rounded to two decimal places). XLF: $21.15, which is 70% of its Starting Value (rounded to two decimal places). XLU: $48.06, which is 70% of its Starting Value (rounded to two decimal places). |

| Threshold Value: |

XLE: $32.83, which is 60% of its Starting Value (rounded to two decimal places). XLF: $18.13, which is 60% of its Starting Value (rounded to two decimal places). XLU: $41.19, which is 60% of its Starting Value. |

| Contingent Coupon Payment: | If, on any quarterly Observation Date, the Observation Value of each Underlying is greater than or equal to its Coupon Barrier, we will pay a Contingent Coupon Payment of $20.375 per $1,000 in principal amount of Notes (equal to a rate of 2.0375% per quarter or 8.15% per annum) on the applicable Contingent Payment Date. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-2

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

| Automatic Call: | Beginning in July 2020, all (but not less than all) of the Notes will be automatically called if the Observation Value of each Underlying is greater than or equal to its Starting Value on any Observation Date (other than the final Observation Date). If the Notes are automatically called, the Early Redemption Amount will be paid on the applicable Contingent Payment Date. No further amounts will be payable following an Automatic Call. |

| Early Redemption Amount: | For each $1,000 principal amount of Notes, $1,000 plus the applicable Contingent Coupon Payment. |

| Redemption Amount: |

If the Notes have not been automatically called prior to maturity, the Redemption Amount per $1,000 principal amount of Notes will be: a) If the Ending Value of the Least Performing Underlying is greater than or equal to its Threshold Value: $1,000. b) If the Ending Value of the Least Performing Underlying is less than its Threshold Value: $1,000 + ($1,000 x Underlying Return of the Least Performing Underlying) In this case, the Redemption Amount will be less than 60% of the principal amount and could be zero. The Redemption Amount will also include the final Contingent Coupon Payment if the Ending Value of the Least Performing Underlying is greater than or equal to its Coupon Barrier. |

| Observation Dates: | As set forth on page PS-4. |

| Contingent Payment Dates: | As set forth on page PS-4. |

| Calculation Agent: | BofA Securities, Inc. (“BofAS”), an affiliate of BofA Finance. |

| Selling Agent: | BofAS. |

| CUSIP: | 09709TZD6 |

| Underlying Return: |

With respect to

each Underlying, |

| Least Performing Underlying: | The Underlying with the lowest Underlying Return. |

| Events of Default and Acceleration: | If an Event of Default, as defined in the senior indenture and in the section entitled “Description of Debt Securities—Events of Default and Rights of Acceleration” beginning on page 22 of the accompanying prospectus, with respect to the Notes occurs and is continuing, the amount payable to a holder of the Notes upon any acceleration permitted under the senior indenture will be equal to the amount described under the caption “—Redemption Amount,” above, calculated as though the date of acceleration were the Maturity Date of the Notes and as though the Valuation Date were the third trading day prior to the date of acceleration. We will also determine whether the final Contingent Coupon Payment is payable based upon the prices of the Underlyings on the deemed Valuation Date; any such final Contingent Coupon Payment will be prorated by the calculation agent to reflect the length of the final contingent payment period. In case of a default in the payment of the Notes, whether at their maturity or upon acceleration, the Notes will not bear a default interest rate. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-3

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

Observation Dates and Contingent Payment Dates

| Observation Dates* | Contingent Payment Dates | |

| April 29, 2020 | May 4, 2020 | |

| July 29, 2020 | August 3, 2020 | |

| October 29, 2020 | November 3, 2020 | |

| January 29, 2021 | February 3, 2021 | |

| April 29, 2021 | May 4, 2021 | |

| July 29, 2021 | August 3, 2021 | |

| October 29, 2021 | November 3, 2021 | |

| January 31, 2022 | February 3, 2022 | |

| April 29, 2022 | May 4, 2022 | |

| July 29, 2022 | August 3, 2022 | |

| October 31, 2022 | November 3, 2022 | |

| January 30, 2023 | February 2, 2023 | |

| May 1, 2023 | May 4, 2023 | |

| July 31, 2023 | August 3, 2023 | |

| October 30, 2023 | November 2, 2023 | |

| January 29, 2024 | February 1, 2024 | |

| April 29, 2024 | May 2, 2024 | |

| July 29, 2024 | August 1, 2024 | |

| October 29, 2024 | November 1, 2024 | |

| January 29, 2025 (the “Valuation Date”) | February 3, 2025 (the “Maturity Date”) |

* The Observation Dates are subject to postponement as set forth in “Description of the Notes—Certain Terms of the Notes—Events Relating to Observation Dates” beginning on page PS-22 of the accompanying product supplement.

Any payments on the Notes depend on the credit risk of BofA Finance, as Issuer, and BAC, as Guarantor, and on the performance of the Underlyings. The economic terms of the Notes are based on BAC’s internal funding rate, which is the rate it would pay to borrow funds through the issuance of market-linked notes, and the economic terms of certain related hedging arrangements BAC’s affiliates enter into. BAC’s internal funding rate is typically lower than the rate it would pay when it issues conventional fixed or floating rate debt securities. This difference in funding rate, as well as the underwriting discount and the hedging related charges described below (see “Risk Factors” beginning on page PS-8), reduced the economic terms of the Notes to you and the initial estimated value of the Notes. Due to these factors, the public offering price you are paying to purchase the Notes is greater than the initial estimated value of the Notes as of the pricing date.

The initial estimated value of the Notes as of the pricing date is set forth on the cover page of this pricing supplement. For more information about the initial estimated value and the structuring of the Notes, see “Risk Factors” beginning on page PS-8 and “Structuring the Notes” on page PS-23.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-4

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

Contingent Coupon Payment and Redemption Amount Determination

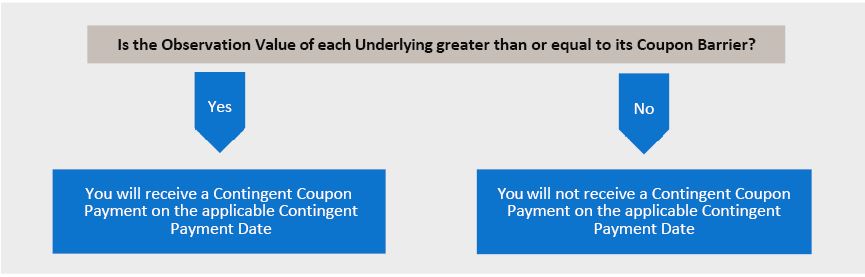

On each Contingent Payment Date, you may receive a Contingent Coupon Payment per $1,000 in principal amount of Notes determined as follows:

Assuming the Notes have not been automatically called, on the Maturity Date, you will receive a cash payment per $1,000 in principal amount of Notes determined as follows:

All payments described above are subject to Issuer and Guarantor credit risk.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-5

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

Total Contingent Coupon Payment Examples

The table below illustrates the hypothetical total Contingent Coupon Payments per $1,000 in principal of Notes over the term of the Notes, based on the Contingent Coupon Payment of $20.375, depending on how many Contingent Coupon Payments are payable prior to an Automatic Call or maturity. Depending on the performance of the Underlyings, you may not receive any Contingent Coupon Payments during the term of the Notes.

| Number of Contingent Coupon Payments | Total Contingent Coupon Payments |

| 0 | $0.00 |

| 4 | $81.50 |

| 8 | $163.00 |

| 12 | $244.50 |

| 16 | $326.00 |

| 20 | $407.50 |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-6

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

Hypothetical Payout Profile and Examples of Payments at Maturity

Contingent Income Auto-Callable Yield Notes Table

The following table is for purposes of illustration only. It assumes the Notes have not been automatically called prior to maturity and is based on hypothetical values and shows hypothetical returns on the Notes. The table illustrates the calculation of the Redemption Amount and the return on the Notes based on a hypothetical Starting Value of 100, a hypothetical Coupon Barrier of 70 for the Least Performing Underlying, a hypothetical Threshold Value of 60 for the Least Performing Underlying, the Contingent Coupon Payment of $20.375 per Note and a range of hypothetical Ending Values of the Least Performing Underlying. The actual amount you receive and the resulting return will depend on the actual Starting Values, Coupon Barriers, Threshold Values, Observation Values and Ending Values of the Underlyings, whether the Notes are automatically called prior to maturity, and whether you hold the Notes to maturity. The following examples do not take into account any tax consequences from investing in the Notes.

For recent actual prices of the Underlyings, see “The Underlyings” section below. The Ending Value of each Underlying will not include any income generated by dividends paid on the stocks represented by that Underlying, which you would otherwise be entitled to receive if you invested in those stocks directly. In addition, all payments on the Notes are subject to Issuer and Guarantor credit risk.

| Ending Value of the Least Performing Underlying |

Underlying Return of the Least Performing Underlying |

Redemption Amount per Note (including any final Contingent Coupon Payment) | Return on the Notes(1) |

| 160.00 | 60.00% | $1,020.375(2) | 2.0375% |

| 150.00 | 50.00% | $1,020.375 | 2.0375% |

| 140.00 | 40.00% | $1,020.375 | 2.0375% |

| 130.00 | 30.00% | $1,020.375 | 2.0375% |

| 120.00 | 20.00% | $1,020.375 | 2.0375% |

| 110.00 | 10.00% | $1,020.375 | 2.0375% |

| 105.00 | 5.00% | $1,020.375 | 2.0375% |

| 102.00 | 2.00% | $1,020.375 | 2.0375% |

| 100.00(3) | 0.00% | $1,020.375 | 2.0375% |

| 90.00 | -10.00% | $1,020.375 | 2.0375% |

| 80.00 | -20.00% | $1,020.375 | 2.0375% |

| 70.00(4) | -30.00% | $1,020.375 | 2.0375% |

| 69.99 | -30.01% | $1,000.000 | 0.0000% |

| 60.00(5) | -40.00% | $1,000.000 | 0. 0000% |

| 59.99 | -40.01% | $599.900 | -40.0100% |

| 50.00 | -50.00% | $500.000 | -50.0000% |

| 0.00 | -100.00% | $0.000 | -100.0000% |

| (1) | The “Return on the Notes” is calculated based on the Redemption Amount and potential final Contingent Coupon Payment, not including any Contingent Coupon Payments paid prior to maturity. |

| (2) | This amount represents the sum of the principal amount and the final Contingent Coupon Payment. |

| (3) | The hypothetical Starting Value of 100 used in the table above has been chosen for illustrative purposes only. The actual Starting Value for each Underlying is set forth on page PS-2 above. |

| (4) | This is the hypothetical Coupon Barrier of the Least Performing Underlying. |

| (5) | This is the hypothetical Threshold Value of the Least Performing Underlying. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-7

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

Risk Factors

Your investment in the Notes entails significant risks, many of which differ from those of a conventional debt security. Your decision to purchase the Notes should be made only after carefully considering the risks of an investment in the Notes, including those discussed below, with your advisors in light of your particular circumstances. The Notes are not an appropriate investment for you if you are not knowledgeable about significant elements of the Notes or financial matters in general. You should carefully review the more detailed explanation of risks relating to the Notes in the “Risk Factors” sections beginning on page PS-5 of the accompanying product supplement, page S-5 of the accompanying prospectus supplement and page 7 of the accompanying prospectus, each as identified on page PS-28 below.

| • | Your investment may result in a loss; there is no guaranteed return of principal. There is no fixed principal repayment amount on the Notes at maturity. If the Notes are not automatically called prior to maturity and the Ending Value of any Underlying is less than its Threshold Value, at maturity, you will lose 1% of the principal amount for each 1% that the Ending Value of the Least Performing Underlying is less than its Starting Value. In that case, you will lose a significant portion or all of your investment in the Notes. |

| • | Your return on the Notes is limited to the return represented by the Contingent Coupon Payments, if any, over the term of the Notes. Your return on the Notes is limited to the Contingent Coupon Payments paid over the term of the Notes, regardless of the extent to which the Observation Value or Ending Value of any Underlying exceeds its Coupon Barrier or Starting Value, as applicable. Similarly, the amount payable at maturity or upon an Automatic Call will never exceed the sum of the principal amount and the applicable Contingent Coupon Payment, regardless of the extent to which the Observation Value of any Underlying exceeds its Starting Value. In contrast, a direct investment in the securities included in one or more of the Underlyings would allow you to receive the benefit of any appreciation in their prices. Thus, any return on the Notes will not reflect the return you would realize if you actually owned those securities and received the dividends paid or distributions made on them. |

| • | The Notes are subject to a potential Automatic Call, which would limit your ability to receive the Contingent Coupon Payments over the full term of the Notes. The Notes are subject to a potential Automatic Call. Beginning in July 2020, the Notes will be automatically called if, on any Observation Date (other than the final Observation Date), the Observation Value of each Underlying is greater than or equal to its Starting Value. If the Notes are automatically called prior to the Maturity Date, you will be entitled to receive the principal amount and the Contingent Coupon Payment with respect to the applicable Observation Date. In this case, you will lose the opportunity to continue to receive Contingent Coupon Payments after the date of the Automatic Call. If the Notes are called prior to the Maturity Date, you may be unable to invest in other securities with a similar level of risk that could provide a return that is similar to the Notes. |

| • | You may not receive any Contingent Coupon Payments. The Notes do not provide for any regular fixed coupon payments. Investors in the Notes will not necessarily receive any Contingent Coupon Payments on the Notes. If the Observation Value of any Underlying is less than its Coupon Barrier on an Observation Date, you will not receive the Contingent Coupon Payment applicable to that Observation Date. If the Observation Value of any Underlying is less than its Coupon Barrier on all the Observation Dates during the term of the Notes, you will not receive any Contingent Coupon Payments during the term of the Notes, and will not receive a positive return on the Notes. |

| • | Your return on the Notes may be less than the yield on a conventional debt security of comparable maturity. Any return that you receive on the Notes may be less than the return you would earn if you purchased a conventional debt security with the same Maturity Date. As a result, your investment in the Notes may not reflect the full opportunity cost to you when you consider factors, such as inflation, that affect the time value of money. In addition, if interest rates increase during the term of the Notes, the Contingent Coupon Payment (if any) may be less than the yield on a conventional debt security of comparable maturity. |

| • | Any payment on the Notes is subject to the credit risk of BofA Finance and the Guarantor, and actual or perceived changes in BofA Finance or the Guarantor’s creditworthiness are expected to affect the value of the Notes. The Notes are our senior unsecured debt securities. Any payment on the Notes will be fully and unconditionally guaranteed by the Guarantor. The Notes are not guaranteed by any entity other than the Guarantor. As a result, your receipt of the Early Redemption Amount or the Redemption Amount at maturity, as applicable, will be dependent upon our ability and the ability of the Guarantor to repay our respective obligations under the Notes on the applicable Contingent Payment Date or the Maturity Date, regardless of the Ending Value of the Least Performing Underlying as compared to its Starting Value. |

In addition, our credit ratings and the credit ratings of the Guarantor are assessments by ratings agencies of our respective abilities to pay our obligations. Consequently, our or the Guarantor’s perceived creditworthiness and actual or anticipated decreases in our or the Guarantor’s credit ratings or increases in the spread between the yield on our respective securities and the yield on U.S. Treasury securities (the “credit spread”) prior to the Maturity Date may adversely affect the market value of the Notes. However, because your return on the Notes depends upon factors in addition to our ability and the ability of the Guarantor to pay our respective obligations, such as the values of the Underlyings, an improvement in our or the Guarantor’s credit ratings will not reduce the other investment risks related to the Notes.

| • | We are a finance subsidiary and, as such, have no independent assets, operations or revenues. We are a finance subsidiary of BAC, have no operations other than those related to the issuance, administration and repayment of our debt securities that are guaranteed by the Guarantor, and are dependent upon the Guarantor and/or its other subsidiaries to meet our obligations under the Notes in the ordinary course. Therefore, our ability to make payments on the Notes may be limited. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-8

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

| • | The public offering price you are paying for the Notes exceeds their initial estimated value. The initial estimated value of the Notes that is provided on the cover page of this pricing supplement is an estimate only, determined as of the pricing date by reference to our and our affiliates’ pricing models. These pricing models consider certain assumptions and variables, including our credit spreads and those of the Guarantor, changes in the Guarantor’s internal funding rate, mid-market terms on hedging transactions, expectations on interest rates, dividends and volatility, price-sensitivity analysis, and the expected term of the Notes. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. If you attempt to sell the Notes prior to maturity, their market value may be lower than the price you paid for them and lower than their initial estimated value. This is due to, among other things, changes in the levels of the Underlyings, the Guarantor’s internal funding rate, and the inclusion in the public offering price of the underwriting discount and the hedging related charges, all as further described in “Structuring the Notes” below. These factors, together with various credit, market and economic factors over the term of the Notes, are expected to reduce the price at which you may be able to sell the Notes in any secondary market and will affect the value of the Notes in complex and unpredictable ways. |

| • | The initial estimated value does not represent a minimum or maximum price at which we, BAC, BofAS or any of our other affiliates would be willing to purchase your notes in any secondary market (if any exists) at any time. The value of your Notes at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Underlyings, our and BAC’s creditworthiness and changes in market conditions. |

| • | We cannot assure you that a trading market for your Notes will ever develop or be maintained. We will not list the Notes on any securities exchange. We cannot predict how the Notes will trade in any secondary market or whether that market will be liquid or illiquid. |

| • | The Contingent Coupon Payment, Early Redemption Amount or Redemption Amount, as applicable, will not reflect the prices of the Underlyings other than on the Observation Dates. The prices of the Underlyings during the term of the Notes other than on the Observation Dates will not affect payments on the Notes. Notwithstanding the foregoing, investors should generally be aware of the performance of the Underlyings while holding the Notes. The calculation agent will determine whether each Contingent Coupon Payment is payable and will calculate the Early Redemption Amount or the Redemption Amount, as applicable, by comparing only the Starting Value, the Coupon Barrier or the Threshold Value, as applicable, to the Observation Value or the Ending Value for each Underlying. No other prices of the Underlyings will be taken into account. As a result, if the Notes are not automatically called prior to maturity, you will receive less than the principal amount at maturity even if the price of each Underlying has increased at certain times during the term of the Notes before the Least Performing Underlying decreases to a price that is less than its Threshold Value as of the Valuation Date. |

| • | Because the Notes are linked to the least performing (and not the average performance) of the Underlyings, you may not receive any return on the Notes and may lose some or all of your principal amount even if the Observation Value of one Underlying is always greater than or equal to its Coupon Barrier or Threshold Value, as applicable. Your Notes are linked to the least performing of the Underlyings, and a change in the price of one Underlying may not correlate with changes in the price of the other Underlying(s). The Notes are not linked to a basket composed of the Underlyings, where the depreciation in the price of one Underlying could be offset to some extent by the appreciation in the price of the other Underlying(s). In the case of the Notes, the individual performance of each Underlying would not be combined, and the depreciation in the price of one Underlying would not be offset by any appreciation in the price of the other Underlying(s). Even if the Observation Value of an Underlying is at or above its Coupon Barrier on an Observation Date, you will not receive the Contingent Coupon Payment with respect to that Observation Date if the Observation Value of another Performing Underlying is below its Coupon Barrier on that day. In addition, even if the Ending Value of an Underlying is at or above its Threshold Value, you will lose a portion of your principal if the Ending Value of the Least Performing Underlying is below its Threshold Value. |

| • | The anti-dilution adjustments will be limited. The calculation agent may adjust the Price Multiplier of the Underlyings and other terms of the Notes to reflect certain corporate actions by the Underlyings, as described in the section “Description of the Notes—Anti-Dilution and Discontinuance Adjustments Relating to ETFs” in the accompanying product supplement. The calculation agent will not be required to make an adjustment for every event that may affect the Underlyings and will have broad discretion to determine whether and to what extent an adjustment is required. |

| • | The sponsor or investment advisor of an Underlying may adjust that Underlying in a way that affects its prices, and the sponsor or investment advisor has no obligation to consider your interests. The sponsor or investment advisor of an Underlying can add, delete, or substitute the components included in that Underlying or make other methodological changes that could change its price. Any of these actions could adversely affect the value of your Notes. |

| • | The performance of an Underlying may not correlate with the performance of its underlying index (each, an “Underlying Index”) as well as the net asset value per share of the Underlying, especially during periods of market volatility. The performance of an Underlying and that of its Underlying Index generally will vary due to, for example, transaction costs, management fees, certain corporate actions, and timing variances. Moreover, it is also possible that the performance of an Underlying may not fully replicate or may, in certain circumstances, diverge significantly from the performance of its Underlying Index. This could be due to, for example, the Underlying not holding all or substantially all of the underlying assets included in the Underlying Index and/or holding assets that are not included in the Underlying Index, the temporary unavailability of certain securities in the secondary market, the performance of any derivative instruments held by the Underlying, differences in trading hours between the Underlying (or the underlying assets held by the Underlying) and the |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-9

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

Underlying Index, or due to other circumstances. This variation in performance is called the “tracking error,” and, at times, the tracking error may be significant. In addition, because the shares of each Underlying are traded on a securities exchange and are subject to market supply and investor demand, the market price of one share of the Underlying may differ from its net asset value per share; shares of the Underlying may trade at, above, or below its net asset value per share. During periods of market volatility, securities held by each Underlying may be unavailable in the secondary market, market participants may be unable to calculate accurately the net asset value per share of the Underlying and the liquidity of the Underlying may be adversely affected. Market volatility may also disrupt the ability of market participants to trade shares of the Underlying. Further, market volatility may adversely affect, sometimes materially, the prices at which market participants are willing to buy and sell shares of the Underlying. As a result, under these circumstances, the market value of shares of the Underlying may vary substantially from the net asset value per share of the Underlying.

| • | All of the securities held by each Underlying are concentrated in one industry. The XLE holds securities issued by companies in the energy sector, the XLU holds securities issued by companies in the utilities sector and the XLF holds securities issued by companies in the financial sector. Although an investment in the Notes will not give holders any ownership or other direct interests in the securities held by the Underlyings, the return on an investment in the Notes will be subject to certain risks similar to those associated with direct equity investments in these sectors. Accordingly, by investing in the Notes, you will not benefit from the diversification which could result from an investment linked to companies that operate in multiple sectors. |

| • | The stocks of companies in the energy sector are subject to swift price fluctuations. The issuers of the stocks held by the XLE develop and produce, among other things, crude oil and natural gas, and provide, among other things, drilling services and other services related to energy resources production and distribution. Stock prices for these types of companies are affected by supply and demand both for their specific product or service and for energy products in general. The price of oil and gas, exploration and production spending, government regulation, world events and economic conditions will likewise affect the performance of these companies. Correspondingly, the stocks of companies in the energy sector are subject to swift price fluctuations caused by events relating to international politics, energy conservation, the success of exploration projects and tax and other governmental regulatory policies. Weak demand for the companies’ products or services or for energy products and services in general, as well as negative developments in these other areas, would adversely impact the value of the stocks held by the XLE and, therefore, the price of the XLE and the value of the Notes. |

| • | Adverse conditions in the utilities sector may reduce your return on the Notes. All or substantially all of the equity securities held by the XLU are issued by companies whose primary line of business is directly associated with the utilities sector. Utility companies are affected by supply and demand, operating costs, government regulation, environmental factors, liabilities for environmental damage and general civil liabilities. Due to the capital intensive nature of utilities, many of these companies tend to be more greatly impacted by interest rates due to their relatively high debt ratios. Additionally, certain utility companies have experienced full or partial deregulation in recent years, and are therefore are subject to greater competition. These factors could affect the utilities sector and could affect the value of the equity securities held by the XLU and the price of the XLU during the term of the Notes, which may adversely affect the value of your Notes. |

| • | Adverse conditions in the financial sector may reduce your return on the Notes. All of the stocks held by the XLF are issued by companies whose primary lines of business are directly associated with the financial sector. The profitability of these companies is largely dependent on the availability and cost of capital funds, and can fluctuate significantly, particularly when market interest rates change. Credit losses resulting from financial difficulties of these companies’ customers can negatively impact the sector. In addition, adverse international economic, business, or political developments, including with respect to the insurance sector, or to real estate and loans secured by real estate, could have a major effect on the price of the XLF. As a result of these factors, the value of the Notes may be subject to greater volatility and be more adversely affected by economic, political, or regulatory events relating to the financial services sector. |

| • | Economic conditions have adversely impacted the stock prices of many companies in the financial services sector. In recent years, international economic conditions have resulted, and may continue to result, in significant losses among many companies that operate in the financial services sector. These conditions have also resulted, and may continue to result, in a high degree of volatility in the stock prices of financial institutions, and substantial fluctuations in the profitability of these companies. Numerous financial services companies have experienced substantial decreases in the value of their assets, taken action to raise capital (including the issuance of debt or equity securities), or even ceased operations. Further, companies in the financial services sector have been subject to unprecedented government actions and regulation, which may limit the scope of their operations and, in turn, result in a decrease in value of these companies. Any of these factors may have an adverse impact on the performance of the XLF. As a result, the price of the XLF may be adversely affected by economic, political, or regulatory events affecting the financial services sector or one of the sub-sectors of the financial services sector. This in turn could adversely impact the market value of the Notes and payments on the Notes. |

| • | Trading and hedging activities by us, the Guarantor and any of our other affiliates, including BofAS, may create conflicts of interest with you and may affect your return on the Notes and their market value. We, the Guarantor or one or more of our other affiliates, including BofAS, may buy or sell the securities held by or included in the Underlyings, or futures or options contracts on the Underlyings or those securities, or other listed or over-the-counter derivative instruments linked to the Underlyings or those securities. While we, the Guarantor or one or more of our other affiliates, including BofAS, may from time to time own securities represented by the Underlyings, except to the extent that BAC’s common stock may be included in the Underlyings, we, the Guarantor and our other affiliates, including BofAS, do not control any company included in the Underlyings, and have not verified any disclosure made by any other company. We, the Guarantor or one or more of our other affiliates, including BofAS, may execute such purchases or sales for our own or their own accounts, for business reasons, or in connection with |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-10

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

hedging our obligations under the Notes. These transactions may present a conflict of interest between your interest in the Notes and the interests we, the Guarantor and our other affiliates, including BofAS, may have in our or their proprietary accounts, in facilitating transactions, including block trades, for our or their other customers, and in accounts under our or their management. These transactions may adversely affect the value of the Underlyings in a manner that could be adverse to your investment in the Notes. On or before the pricing date, any purchases or sales by us, the Guarantor or our other affiliates, including BofAS or others on its behalf (including for the purpose of hedging some or all of our anticipated exposure in connection with the Notes), may have affected the value of the Underlyings. Consequently, the value of the Underlyings may change subsequent to the pricing date, which may adversely affect the market value of the Notes.

We, the Guarantor or one or more of our other affiliates, including BofAS, may have also engaged in hedging activities that could have affected the value of the Underlyings on the pricing date. In addition, these hedging activities, including the unwinding of a hedge, may decrease the market value of your Notes prior to maturity, and may affect the amounts to be paid on the Notes. We, the Guarantor or one or more of our other affiliates, including BofAS, may purchase or otherwise acquire a long or short position in the Notes and may hold or resell the Notes. For example, BofAS may enter into these transactions in connection with any market making activities in which it engages. We cannot assure you that these activities will not adversely affect the value of the Underlyings, the market value of your Notes prior to maturity or the amounts payable on the Notes.

| • | There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours. We have the right to appoint and remove the calculation agent. One of our affiliates will be the calculation agent for the Notes and, as such, will make a variety of determinations relating to the Notes, including the amounts that will be paid on the Notes. Under some circumstances, these duties could result in a conflict of interest between its status as our affiliate and its responsibilities as calculation agent. |

| • | The U.S. federal income tax consequences of an investment in the Notes are uncertain, and may be adverse to a holder of the Notes. No statutory, judicial, or administrative authority directly addresses the characterization of the Notes or securities similar to the Notes for U.S. federal income tax purposes. As a result, significant aspects of the U.S. federal income tax consequences of an investment in the Notes are not certain. Under the terms of the Notes, you will have agreed with us to treat the Notes as contingent income-bearing single financial contracts, as described below under “U.S. Federal Income Tax Summary—General.” If the Internal Revenue Service (the “IRS”) were successful in asserting an alternative characterization for the Notes, the timing and character of gain or loss with respect to the Notes may differ. No ruling will be requested from the IRS with respect to the Notes and no assurance can be given that the IRS will agree with the statements made in the section entitled “U.S. Federal Income Tax Summary.” You are urged to consult with your own tax advisor regarding all aspects of the U.S. federal income tax consequences of investing in the Notes. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-11

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

The Underlyings

All disclosures contained in this pricing supplement regarding the Underlyings, including, without limitation, their make-up, method of calculation, and changes in their components, have been derived from publicly available sources. The information reflects the policies of, and is subject to change by, SSGA Funds Management, Inc. (“SSGA”), the advisor to each of the XLU, XLE and XLF. We refer to SSGA as the “Investment Advisor.” The Investment Advisor, which licenses the copyright and all other rights to the Underlyings, has no obligation to continue to publish, and may discontinue publication of, the Underlyings. The consequences of the Investment Advisor discontinuing publication of the applicable Underlying is discussed in “Description of the Notes—Anti-Dilution and Discontinuance Adjustments Relating to ETFs—Discontinuance of or Material Change to an ETF” in the accompanying product supplement. None of us, the Guarantor, the calculation agent, or BofAS accepts any responsibility for the calculation, maintenance or publication of any Underlying or any successor Underlying. None of us, the Guarantor, BofAS or any of our other affiliates makes any representation to you as to the future performance of the Underlyings. You should make your own investigation into the Underlyings.

The Utilities Select Sector SPDR® Fund

The shares of the XLU are issued by Select Sector SPDR® Trust, a registered investment company. The XLU seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Utilities Select Sector Index. The XLU measures the performance of the utilities sector of the U.S. equity market. The XLU is composed of equity securities of companies in the electric utilities, water utilities, multi-utilities, independent power producers and energy traders, and gas utilities industries. The XLU trades on the NYSE Arca under the ticker symbol “XLU.”

Investment Approach

The XLU utilizes a “passive” or “indexing” investment approach in attempting to track the performance of the Utilities Select Sector Index. The XLU will invest in substantially all of the securities which comprise the Utilities Select Sector Index. The XLU will normally invest at least 95% of its total assets in common stocks that comprise the Utilities Select Sector Index.

Investment Objective and Strategy

The XLU seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Utilities Select Sector Index. The investment manager of the XLU uses a replication strategy to try to achieve the XLU’s investment objective, which means that the XLU generally invests in substantially all of the securities represented in the Utilities Select Sector Index in approximately the same proportions as the Utilities Select Sector Index. Under normal market conditions, the XLU generally invests at least 95% of its total assets in the securities comprising the Utilities Select Sector Index. In certain situations or market conditions, the XLU may temporarily depart from its normal investment policies and strategies provided that the alternative is consistent with the XLU’s investment objective and is in the best interest of the XLU. For example, if the XLU is unable to invest directly in a component security or if a derivative investment may provide higher liquidity than other types of investments, it may make larger than normal investments in derivatives to maintain exposure to the Utilities Select Sector Index that it tracks. Consequently, under such circumstances, the XLU may invest in a different mix of investments than it would under normal circumstances. The XLU will provide shareholders with at least 60 days notice prior to any material change in its investment policies. The XLU is managed with a passive investment strategy, attempting to track the performance of an unmanaged index of securities. This differs from an actively managed underlying, which typically seeks to outperform a benchmark index.

Notwithstanding the XLU’s investment objective, the return on your notes will not reflect any dividends paid on shares of the XLU, on the securities purchased by the XLU or on the securities that comprise the Utilities Select Sector Index.

The Select Sector Indices

The Underlying Index of the XLU is part of the Select Sector Indices. The Select Sector Indices are sub-indices of the S&P 500® Index. Each stock in the S&P 500® Index is allocated to at least one Select Sector Index, and the combined companies of the eleven Select Sector Indices represent all of the companies in the S&P 500® Index. The industry indices are sub-categories within each Select Sector Index and represent a specific industry segment of the overall Select Sector Index. The eleven Select Sector Indices seek to represent the eleven S&P 500® Index sectors. The index compilation agent for these indices (the “Index Compilation Agent”) determines the composition of the Select Sector Indices based on S&P’s sector classification methodology. (Sector designations are determined by the index sponsor using criteria it has selected or developed. Index sponsors may use very different standards for determining sector designations. In addition, many companies operate in a number of sectors, but are listed in only one sector and the basis on which that sector is selected may also differ. As a result, sector comparisons between indices with different index sponsors may reflect differences in methodology as well as actual differences in the sector composition of the indices.).

Each Select Sector Index was developed and is maintained in accordance with the following criteria:

| · | Each of the component stocks in a Select Sector Index (the “Component Stocks”) is a constituent company of the S&P 500® Index. |

| · | The eleven Select Sector Indices together will include all of the companies represented in the S&P 500® Index and each of the stocks in the S&P 500® Index will be allocated to at least one of the Select Sector Indices. |

| · | The Index Compilation Agent assigns each constituent stock of the S&P 500® Index to a Select Sector Index. The Index Compilation Agent assigns a company’s stock to a particular Select Sector Index based on S&P Dow Jones Indices’s sector classification methodology as set forth |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-12

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

in its Global Industry Classification Standard.

| · | Each Select Sector Index is calculated by S&P Dow Jones Indices using a modified “market capitalization” methodology. This design ensures that each of the component stocks within a Select Sector Index is represented in a proportion consistent with its percentage with respect to the total market capitalization of that Select Sector Index. |

| · | For reweighting purposes, each Select Sector Index is rebalanced quarterly after the close of business on the second to last calculation day of March, June, September and December using the following procedures: (1) The rebalancing reference date is two business days prior to the last calculation day of each quarter; and (2) With prices reflected on the rebalancing reference date, and membership, shares outstanding, additional weight factor (capping factor) and investable weight factors (as described in the section “Computation of the S&P 500 Index®” below) as of the rebalancing effective date, each company is weighted using the modified market capitalization methodology. Modifications are made as defined below. |

| (i) | The indices are first evaluated to ensure none of the indices breach the maximum allowable limits defined in rules (ii) and (v) below. If any of the allowable limits are breached, the component stocks are reweighted based on their float-adjusted market capitalization weights. |

| (ii) | If any component stock has a weight greater than 24%, that component stock has its float-adjusted market capitalization weight capped at 23%. The 23% weight cap creates a 2% buffer to ensure that no component stock exceeds 25% as of the quarter-end diversification requirement date. |

| (iii) | All excess weight is equally redistributed to all uncapped component stocks within the relevant Select Sector Index. |

| (iv) | After this redistribution, if the float-adjusted market capitalization weight of any other component stock(s) then breaches 23%, the process is repeated iteratively until no component stock breaches the 23% weight cap. |

| (v) | The sum of the component stocks with weight greater than 4.8% cannot exceed 50% of the total index weight. These caps are set to allow for a buffer below the 5% limit. |

| (vi) | If the rule in step (v) is breached, all the component stocks are ranked in descending order of their float-adjusted market capitalization weights and the first component stock that causes the 50% limit to be breached has its weight reduced to 4.6%. |

| (vii) | This excess weight is equally redistributed to all component stocks with weights below 4.6%. This process is repeated iteratively until step (v) is satisfied. |

| (viii) | Index share amounts are assigned to each component stock to arrive at the weights calculated above. Since index shares are assigned based on prices one business day prior to rebalancing, the actual weight of each component stock at the rebalancing differs somewhat from these weights due to market movements. |

| (ix) | If necessary, the reweighting process may take place more than once prior to the close on the last business day of March, June, September or December to ensure conformity with all diversification requirements. |

Each Select Sector Index is calculated using the same methodology utilized by S&P Dow Jones Indices in calculating the S&P 500® Index, using a base-weighted aggregate methodology. The daily calculation of each Select Sector Index is computed by dividing the total market value of the companies in the Select Sector Index by a number called the index divisor.

The Index Compilation Agent at any time may determine that a Component Stock which has been assigned to one Select Sector Index has undergone such a transformation in the composition of its business, and should be removed from that Select Sector Index and assigned to a different Select Sector Index. In the event that the Index Compilation Agent notifies S&P Dow Jones Indices that a Component Stock’s Select Sector Index assignment should be changed, S&P Dow Jones Indices will disseminate notice of the change following its standard procedure for announcing index changes and will implement the change in the affected Select Sector Indices on a date no less than one week after the initial dissemination of information on the sector change to the maximum extent practicable. It is not anticipated that Component Stocks will change sectors frequently.

Component Stocks removed from and added to the S&P 500® Index will be deleted from and added to the appropriate Select Sector Index on the same schedule used by S&P Dow Jones Indices for additions and deletions from the S&P 500® Index insofar as practicable.

The S&P 500® Index

The SPX is sponsored by S&P Dow Jones Indices LLC (“SPDJI”) and includes a representative sample of 500 companies in leading industries of the U.S. economy. The SPX is intended to provide an indication of the pattern of common stock price movement. The calculation of the level of the SPX is based on the relative value of the aggregate market value of the common stocks of 500 companies as of a particular time compared to the aggregate average market value of the common stocks of 500 similar companies during the base period of the years 1941 through 1943.

The SPX includes companies from eleven main groups: Communication Services; Consumer Discretionary; Consumer Staples; Energy; Financials; Health Care; Industrials; Information Technology; Real Estate; Materials; and Utilities. The SPDJI may from time to time, in its sole discretion, add companies to, or delete companies from, the SPX to achieve the objectives stated above.

Company additions to the SPX must have an unadjusted company market capitalization of $8.2 billion or more (an increase from the previous

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-13

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

requirement of an unadjusted company market capitalization of $6.1 billion or more).

SPDJI calculates the SPX by reference to the prices of the constituent stocks of the SPX without taking account of the value of dividends paid on those stocks. As a result, the return on the Notes will not reflect the return you would realize if you actually owned the SPX constituent stocks and received the dividends paid on those stocks.

Computation of the SPX

While the SPDJI currently employs the following methodology to calculate the SPX, no assurance can be given that the SPDJI will not modify or change this methodology in a manner that may affect the payments on the Notes.

Historically, the market value of any component stock of the SPX was calculated as the product of the market price per share and the number of then outstanding shares of such component stock. In March 2005, SPDJI began shifting the SPX halfway from a market capitalization weighted formula to a float-adjusted formula, before moving the SPX to full float adjustment on September 16, 2005. SPDJI’s criteria for selecting stocks for the SPX did not change with the shift to float adjustment. However, the adjustment affects each company’s weight in the SPX.

Under float adjustment, the share counts used in calculating the SPX reflect only those shares that are available to investors, not all of a company’s outstanding shares. Float adjustment excludes shares that are closely held by control groups, other publicly traded companies or government agencies.

In September 2012, all shareholdings representing more than 5% of a stock’s outstanding shares, other than holdings by “block owners,” were removed from the float for purposes of calculating the SPX. Generally, these “control holders” will include officers and directors, private equity, venture capital and special equity firms, other publicly traded companies that hold shares for control, strategic partners, holders of restricted shares, ESOPs, employee and family trusts, foundations associated with the company, holders of unlisted share classes of stock, government entities at all levels (other than government retirement/pension funds) and any individual person who controls a 5% or greater stake in a company as reported in regulatory filings. However, holdings by block owners, such as depositary banks, pension funds, mutual funds and ETF providers, 401(k) plans of the company, government retirement/pension funds, investment funds of insurance companies, asset managers and investment funds, independent foundations and savings and investment plans, will ordinarily be considered part of the float.

Treasury stock, stock options, restricted shares, equity participation units, warrants, preferred stock, convertible stock, and rights are not part of the float. Shares held in a trust to allow investors in countries outside the country of domicile, such as depositary shares and Canadian exchangeable shares are normally part of the float unless those shares form a control block. If a company has multiple classes of stock outstanding, shares in an unlisted or non-traded class are treated as a control block.

For each stock, an investable weight factor (“IWF”) is calculated by dividing the available float shares by the total shares outstanding. Available float shares are defined as the total shares outstanding less shares held by control holders. This calculation is subject to a 5% minimum threshold for control blocks. For example, if a company’s officers and directors hold 3% of the company’s shares, and no other control group holds 5% of the company’s shares, SPDJI would assign that company an IWF of 1.00, as no control group meets the 5% threshold. However, if a company’s officers and directors hold 3% of the company’s shares and another control group holds 20% of the company’s shares, SPDJI would assign an IWF of 0.77, reflecting the fact that 23% of the company’s outstanding shares are considered to be held for control. As of July 31, 2017, companies with multiple share class lines are no longer eligible for inclusion in the SPX. Constituents of the SPX prior to July 31, 2017 with multiple share class lines will be grandfathered in and continue to be included in the SPX. If a constituent company of the SPX reorganizes into a multiple share class line structure, that company will remain in the SPX at the discretion of the S&P Index Committee in order to minimize turnover.

The SPX is calculated using a base-weighted aggregate methodology. The level of the SPX reflects the total market value of all component stocks relative to the base period of the years 1941 through 1943. An indexed number is used to represent the results of this calculation in order to make the level easier to work with and track over time. The actual total market value of the component stocks during the base period of the years 1941 through 1943 has been set to an indexed level of 10. This is often indicated by the notation 1941- 43 = 10. In practice, the daily calculation of the SPX is computed by dividing the total market value of the component stocks by the “index divisor.” By itself, the index divisor is an arbitrary number. However, in the context of the calculation of the SPX, it serves as a link to the original base period level of the SPX. The index divisor keeps the SPX comparable over time and is the manipulation point for all adjustments to the SPX, which is index maintenance.

Index Maintenance

Index maintenance includes monitoring and completing the adjustments for company additions and deletions, share changes, stock splits, stock dividends, and stock price adjustments due to company restructuring or spinoffs. Some corporate actions, such as stock splits and stock dividends, require changes in the common shares outstanding and the stock prices of the companies in the SPX, and do not require index divisor adjustments.

To prevent the level of the SPX from changing due to corporate actions, corporate actions which affect the total market value of the SPX require an index divisor adjustment. By adjusting the index divisor for the change in market value, the level of the SPX remains constant and does not reflect the corporate actions of individual companies in the SPX. Index divisor adjustments are made after the close of trading and after the calculation of the SPX closing level.

Changes in a company’s shares outstanding of 5.00% or more due to mergers, acquisitions, public offerings, tender offers, Dutch auctions, or exchange offers are made as soon as reasonably possible. Share changes due to mergers or acquisitions of publicly held companies that trade

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-14

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

on a major exchange are implemented when the transaction occurs, even if both of the companies are not in the same headline index, and regardless of the size of the change. All other changes of 5.00% or more (due to, for example, company stock repurchases, private placements, redemptions, exercise of options, warrants, conversion of preferred stock, notes, debt, equity participation units, at-the-market offerings, or other recapitalizations) are made weekly and are announced on Fridays for implementation after the close of trading on the following Friday.

Changes of less than 5.00% are accumulated and made quarterly on the third Friday of March, June, September, and December, and are usually announced two to five days prior.

If a change in a company’s shares outstanding of 5.00% or more causes a company’s IWF to change by five percentage points or more, the IWF is updated at the same time as the share change. IWF changes resulting from partial tender offers are considered on a case by case basis.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-15

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

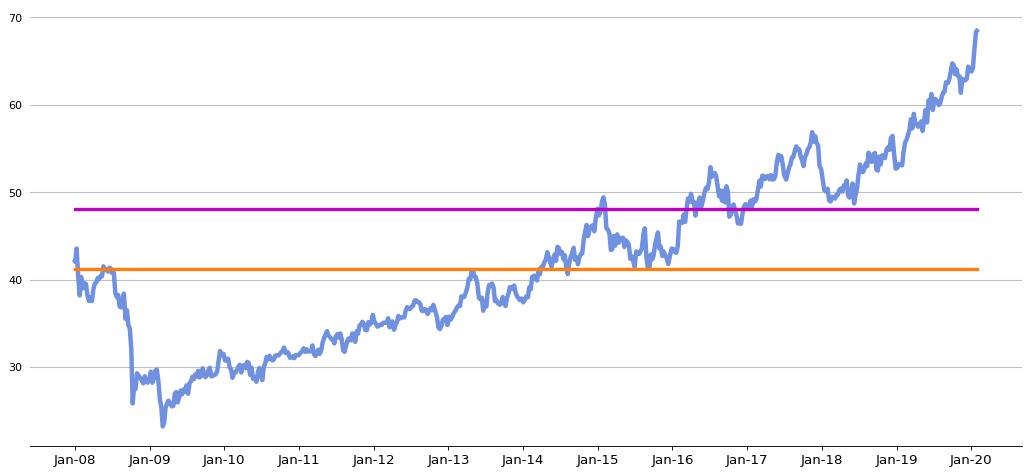

Historical Performance of the XLU

The following graph sets forth the daily historical performance of the XLU in the period from January 1, 2008 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. The horizontal purple line in the graph represents the XLU’s Coupon Barrier of $48.06 (rounded to two decimal places), which is 70% of the XLU’s Starting Value of $68.65. The horizontal orange line in the graph represents the XLU’s Threshold Value of $41.19, which is 60% of the XLU’s Starting Value.

This historical data on the XLU is not necessarily indicative of the future performance of the XLU or what the value of the Notes may be. Any historical upward or downward trend in the price of the XLU during any period set forth above is not an indication that the price of the XLU is more or less likely to increase or decrease at any time over the term of the Notes.

Before investing in the Notes, you should consult publicly available sources for the prices and trading pattern of the XLU.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-16

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

The Financial Select Sector SPDR® Fund

The shares of the XLF are issued by Select Sector SPDR® Trust, a registered investment company. This Underlying seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Financial Select Sector Index (the “Underlying Index”). The XLF measures the performance of the financial sector of the U.S. equity market. The XLF is composed of equity securities of companies in the diversified financial services; insurance; banks; capital markets; mortgage real estate investment trusts (“REITs”); consumer finance; and thrifts and mortgage finance industries. The Underlying trades on the NYSE Arca under the ticker symbol “XLF.”

Investment Approach

The XLF utilizes a “passive” or “indexing” investment approach in attempting to track the performance of the Financial Select Sector Index. The XLF will invest in substantially all of the securities which comprise the Financial Select Sector Index. The XLF will normally invest at least 95% of its total assets in common stocks that comprise the Financial Select Sector Index.

Investment Objective and Strategy

The XLF seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Financial Select Sector Index. The investment manager of the XLF uses a replication strategy to try to achieve the XLF’s investment objective, which means that the XLF generally invests in substantially all of the securities represented in the Financial Select Sector Index in approximately the same proportions as the Financial Select Sector Index. Under normal market conditions, the XLF generally invests at least 95% of its total assets in the securities comprising the Financial Select Sector Index. In certain situations or market conditions, the XLF may temporarily depart from its normal investment policies and strategies provided that the alternative is consistent with the XLF’s investment objective and is in the best interest of the XLF. For example, if the XLF is unable to invest directly in a component security or if a derivative investment may provide higher liquidity than other types of investments, it may make larger than normal investments in derivatives to maintain exposure to the Financial Select Sector Index that it tracks. Consequently, under such circumstances, the XLF may invest in a different mix of investments than it would under normal circumstances. The XLF will provide shareholders with at least 60 days notice prior to any material change in its investment policies. The XLF is managed with a passive investment strategy, attempting to track the performance of an unmanaged index of securities. This differs from an actively managed underlying, which typically seeks to outperform a benchmark index.

Notwithstanding the XLF’s investment objective, the return on your notes will not reflect any dividends paid on shares of the XLF, on the securities purchased by the XLF or on the securities that comprise the Financial Select Sector Index.

The Underlying Index of the XLF is part of the Select Sector Indices. For more information on the Select Sector Indices, please see “The Select Sector Indices” and “The S&P 500® Index” on page PS-12 above.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-17

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

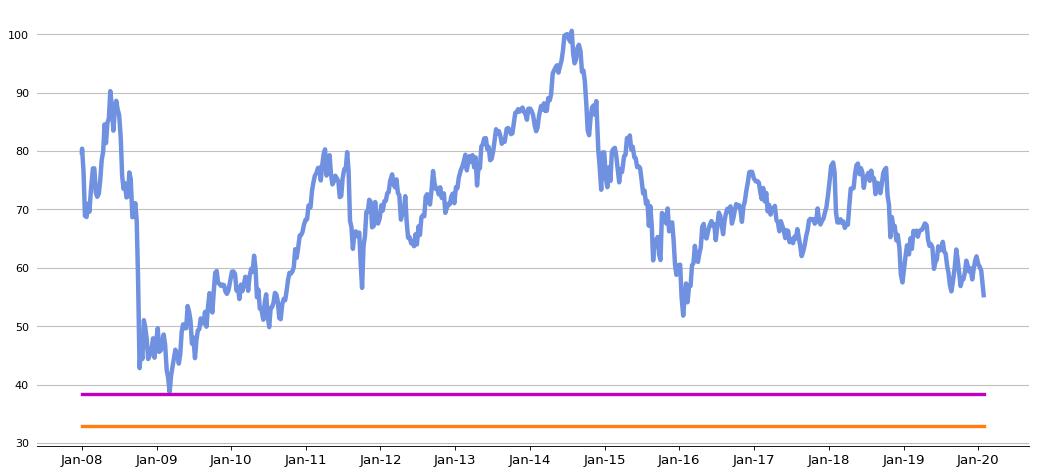

Historical Performance of the XLF

The following graph sets forth the daily historical performance of the XLF in the period from January 1, 2008 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. The horizontal purple line in the graph represents the XLF’s Coupon Barrier of $21.15 (rounded to two decimal places), which is 70% of the XLF’s Starting Value of $30.22. The horizontal orange line in the graph represents the XLF’s Threshold Value of $18.13 (rounded to two decimal places), which is 60% of the XLF’s Starting Value.

This historical data on the XLF is not necessarily indicative of the future performance of the XLF or what the value of the Notes may be. Any historical upward or downward trend in the price of the XLF during any period set forth above is not an indication that the price of the XLF is more or less likely to increase or decrease at any time over the term of the Notes.

Before investing in the Notes, you should consult publicly available sources for the prices and trading pattern of the XLF.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-18

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

The Energy Select Sector SPDR® Fund

The shares of the XLE are issued by Select Sector SPDR® Trust, a registered investment company. The XLE seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Energy Select Sector Index. The Energy Select Sector Index measures the performance of the energy sector of the U.S. equity market. The XLE is composed of equity securities of companies in the oil, gas and consumable fuel, energy equipment and services industries. The XLE trades on the NYSE Arca under the ticker symbol “XLE.”

Investment Approach

The XLE utilizes a “passive” or “indexing” investment approach in attempting to track the performance of The Energy Select Sector Index. The XLE will invest in substantially all of the securities which comprise The Energy Select Sector Index. The XLE will normally invest at least 95% of its total assets in common stocks that comprise The Energy Select Sector Index.

Investment Objective and Strategy

The XLE seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Energy Select Sector Index. The investment manager of the XLE uses a replication strategy to try to achieve the XLE’s investment objective, which means that the XLE generally invests in substantially all of the securities represented in The Energy Select Sector Index in approximately the same proportions as The Energy Select Sector Index. Under normal market conditions, the XLE generally invests at least 95% of its total assets in the securities comprising The Energy Select Sector Index. In certain situations or market conditions, the XLE may temporarily depart from its normal investment policies and strategies provided that the alternative is consistent with the XLE’s investment objective and is in the best interest of the XLE. For example, if the XLE is unable to invest directly in a component security or if a derivative investment may provide higher liquidity than other types of investments, it may make larger than normal investments in derivatives to maintain exposure to The Energy Select Sector Index that it tracks. Consequently, under such circumstances, the XLE may invest in a different mix of investments than it would under normal circumstances. The XLE will provide shareholders with at least 60 days notice prior to any material change in its investment policies. The XLE is managed with a passive investment strategy, attempting to track the performance of an unmanaged index of securities. This differs from an actively managed underlying, which typically seeks to outperform a benchmark index.

Notwithstanding the XLE’s investment objective, the return on your notes will not reflect any dividends paid on shares of the XLE, on the securities purchased by the XLE or on the securities that comprise The Energy Select Sector Index.

The Underlying Index of the XLE is part of the Select Sector Indices. For more information on the Select Sector Indices, please see “The Select Sector Indices” and “The S&P 500® Index” on page PS-12 above.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-19

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

Historical Performance of the XLE

The following graph sets forth the daily historical performance of the XLE in the period from January 1, 2008 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. The horizontal purple line in the graph represents the XLE’s Coupon Barrier of $38.30 (rounded to two decimal places), which is 70% of the XLE’s Starting Value of $54.72. The horizontal orange line in the graph represents the XLE’s Threshold Value of $32.83 (rounded to two decimal places), which is 60% of the XLE’s Starting Value.

This historical data on the XLE is not necessarily indicative of the future performance of the XLE or what the value of the Notes may be. Any historical upward or downward trend in the level of the XLE during any period set forth above is not an indication that the level of the XLE is more or less likely to increase or decrease at any time over the term of the Notes.

Before investing in the Notes, you should consult publicly available sources for the prices and trading pattern of the XLE.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-20

|

Contingent Income Auto-Callable Yield Notes Linked to the Least Performing of the Utilities Select Sector SPDR® Fund, the Energy Select Sector SPDR® Fund and the Financial Select Sector SPDR® Fund

Supplement to the Plan of Distribution; Role of BofAS and Conflicts of Interest

BofAS, a broker-dealer affiliate of ours, is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and will participate as selling agent in the distribution of the Notes. Accordingly, the offering of the Notes will conform to the requirements of FINRA Rule 5121. BofAS may not make sales in this offering to any of its discretionary accounts without the prior written approval of the account holder.

Under our distribution agreement with BofAS, BofAS will purchase the Notes from us as principal at the public offering price indicated on the cover of this pricing supplement, less the indicated underwriting discount. BofAS will sell the Notes to other broker-dealers that will participate in the offering and that are not affiliated with us, at an agreed discount to the principal amount. Each of those broker-dealers may sell the Notes to one or more additional broker-dealers. BofAS has informed us that these discounts may vary from dealer to dealer and that not all dealers will purchase or repurchase the Notes at the same discount. Certain dealers who purchase the Notes for sale to certain fee-based advisory accounts may forgo some or all of their selling concessions, fees or commissions. The public offering price for investors purchasing the Notes in these fee-based advisory accounts may be as low as $967.50 per Note.