Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

| ● | Approximate 5 year term if not called prior to maturity. |

| ● | Payments on the Notes will depend on the individual performance of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index (each an “Underlying”). |

| ● | Contingent coupon rate of 6.00% per annum (1.50% per quarter) payable quarterly if the closing level of each Underlying on the applicable Observation Date is greater than or equal to 69% of its Starting Value. |

| ● | Beginning in January 2021, automatically callable quarterly for an amount equal to the principal amount plus the relevant contingent coupon if the closing level of each Underlying is greater than or equal to its Starting Value on any Observation Date (other than the final Observation Date). |

| ● | Assuming the Notes are not called prior to maturity, if any Underlying declines by more than 31% from its Starting Value, at maturity your investment will be exposed on a leveraged basis to any decrease in the Least Performing Underlying, beyond a 31% decline, with up to 100% of the principal at risk; otherwise, at maturity investors will receive the principal amount. At maturity the investor will also receive the final contingent coupon if the closing level of each Underlying on the final Observation Date is greater than or equal to 69% of its Starting Value. |

| ● | All payments on the Notes are subject to the credit risk of BofA Finance LLC (“BofA Finance”) and Bank of America Corporation (“BAC” or the “Guarantor”). |

| ● | The Notes priced on January 17, 2020, will issue on January 23, 2020 and will mature on January 23, 2025. |

| ● | The Notes will not be listed on any securities exchange. |

| ● | CUSIP No. 09709TZA2. |

The initial estimated value of the Notes as of the pricing date is $987.10 per Note, which is less than the public offering price listed below. The actual value of your Notes at any time will reflect many factors and cannot be predicted with accuracy. See “Risk Factors” beginning on page PS-8 of this pricing supplement and “Structuring the Notes” on page PS-22 of this pricing supplement for additional information.

Potential purchasers of the Notes should consider the information in “Risk Factors” beginning on page PS- 8 of this pricing supplement, page PS-5 of the accompanying product supplement, page S-5 of the accompanying prospectus supplement, and page 7 of the accompanying prospectus.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note Prospectus (as defined on page PS-26) is truthful or complete. Any representation to the contrary is a criminal offense.

| Public offering price(1) | Underwriting discount(1)(2) | Proceeds, before expenses, to BofA Finance | |

| Per Note | $1,000.00 | $2.50 | $997.50 |

| Total | $1,300,000.00 | $3,250.00 | $1,296,750.00 |

| (1) | Certain dealers who purchase the Notes for sale to certain fee-based advisory accounts may forgo some or all of their selling concessions, fees or commissions. The public offering price for investors purchasing the Notes in these fee-based advisory accounts may be as low as $997.50 per Note. |

| (2) | In addition to the underwriting discount above, if any, an affiliate of BofA Finance will pay a referral fee of $5.00 per $1,000 in principal amount of the notes in connection with the distribution of the notes to other registered broker-dealers. |

The Notes and the related guarantee:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

Selling Agent

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

Terms of the Notes

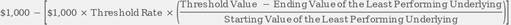

The Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index (the “Notes”) provide a quarterly Contingent Coupon Payment of $15.00 on the applicable Contingent Payment Date if, on any quarterly Observation Date, the Observation Value of each Underlying is greater than or equal to its Coupon Barrier.

Beginning in January 2021, if the Observation Value of each Underlying is greater than or equal to its Starting Value on any Observation Date (other than the final Observation Date), the Notes will be automatically called, in whole but not in part, at 100% of the principal amount, together with the relevant Contingent Coupon Payment. No further amounts will be payable following an Automatic Call. If the Notes are not automatically called prior to maturity and the Least Performing Underlying declines by more than 31% from its Starting Value, there is leveraged exposure to declines in the Least Performing Underlying, beyond a 31% decline, and you will lose some or all of your investment in the Notes. Otherwise, at maturity you will receive the principal amount. At maturity you will also receive the final Contingent Coupon Payment if the Observation Value of each Underlying on the final Observation Date is greater than or equal to its Coupon Barrier. The Notes are not traditional debt securities and it is possible that the Notes will not pay any Contingent Coupon Payments, and you may lose a significant portion or all of your principal amount at maturity. Any payments on the Notes will be calculated based on $1,000 in principal amount of Notes and will depend on the performance of the Underlyings, subject to our and BAC’s credit risk.

| Issuer: | BofA Finance |

| Guarantor: | BAC |

| Denominations: | The Notes will be issued in minimum denominations of $1,000 and whole multiples of $1,000 in excess thereof. |

| Term: | Approximately 5 years, unless previously automatically called. |

| Underlyings: | The EURO STOXX 50® Index (the “SX5E”) (Bloomberg symbol: “SX5E”), the Russell 2000® Index (the “RTY”) (Bloomberg symbol: “RTY”) and the S&P 500® Index (the “SPX”) (Bloomberg symbol: “SPX”), each a price return index. |

| Pricing Date: | January 17, 2020 |

| Issue Date: | January 23, 2020 |

| Valuation Date: | January 17, 2025, subject to postponement as described under “Description of the Notes—Certain Terms of the Notes—Events Relating to Observation Dates” of the accompanying product supplement. |

| Maturity Date: | January 23, 2025 |

| Starting Value: |

SX5E: 3,808.26 RTY: 1,699.635 SPX: 3,329.62 |

| Observation Value: | With respect to each Underlying, its closing level on the applicable Observation Date, as determined by the calculation agent. |

| Ending Value: | With respect to each Underlying, its closing level on the Valuation Date, as determined by the calculation agent. |

| Coupon Barrier: |

SX5E: 2,627.70, which is 69% of its Starting Value (rounded to two decimal places). RTY: 1,172.748, which is 69% of its Starting Value (rounded to three decimal places). SPX: 2,297.44, which is 69% of its Starting Value (rounded to two decimal places). |

| Threshold Value: |

SX5E: 2,627.70, which is 69% of its Starting Value (rounded to two decimal places). RTY: 1,172.748, which is 69% of its Starting Value (rounded to three decimal places). SPX: 2,297.44, which is 69% of its Starting Value (rounded to two decimal places). |

| Threshold Rate: | The quotient of the Starting Value of the Least Performing Underlying divided by its Threshold Value, which equals approximately 144.9%. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-2

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

|

Contingent Coupon Payment: |

If, on any quarterly Observation Date, the Observation Value of each Underlying is greater than or equal to its Coupon Barrier, we will pay a Contingent Coupon Payment of $15.00 per $1,000 in principal amount of Notes (equal to a rate of 1.50% per quarter or 6.00% per annum) on the applicable Contingent Payment Date (including the Maturity Date). |

| Automatic Call: | Beginning in January 2021, all (but not less than all) of the Notes will be automatically called if the Observation Value of each Underlying is greater than or equal to its Starting Value on any Observation Date (other than the final Observation Date). If the Notes are automatically called, the Early Redemption Amount will be paid on the applicable Contingent Payment Date. No further amounts will be payable following an Automatic Call. |

|

Early Redemption Amount: |

For each $1,000 in principal amount of Notes, $1,000 plus the applicable Contingent Coupon Payment. |

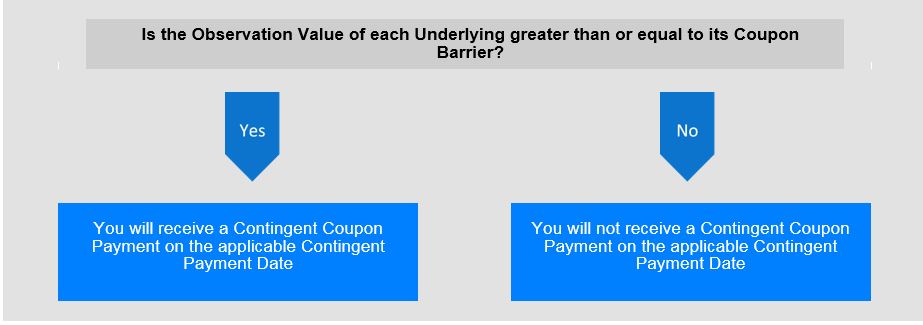

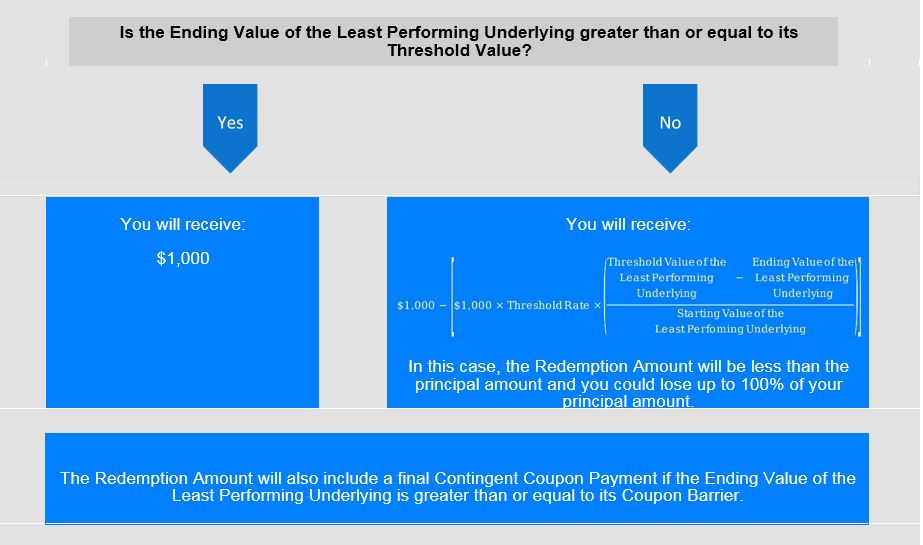

| Redemption Amount: |

If the Notes have not been automatically called prior to maturity, the Redemption Amount per $1,000 in principal amount of Notes will be: a) If the Ending Value of the Least Performing Underlying is greater than or equal to its Threshold Value:

$1,000; or

b) If the Ending Value of the Least Performing Underlying is less than its Threshold Value:

In this case, the Redemption Amount will be less than the principal amount and you could lose up to 100% of your principal amount.

The Redemption Amount will also include the final Contingent Coupon Payment if the Ending Value of the Least Performing Underlying is greater than or equal to its Coupon Barrier. |

| Observation Dates: | As set forth on page PS-4. |

|

Contingent Payment Dates: |

As set forth on page PS-4. |

| Calculation Agent: | BofA Securities, Inc. (“BofAS”), an affiliate of BofA Finance. |

| Selling Agent: | BofAS |

| CUSIP: | 09709TZA2 |

| Underlying Return: |

With respect to each Underlying,

|

|

Least Performing Underlying: |

The Underlying with the lowest Underlying Return. |

| Events of Default and Acceleration: | If an Event of Default, as defined in the senior indenture and in the section entitled “Events of Default and Rights of Acceleration” beginning on page 22 of the accompanying prospectus, with respect to the Notes occurs and is continuing, the amount payable to a holder of the Notes upon any acceleration permitted under the senior indenture will be equal to the amount described under the caption “—Redemption Amount” above, calculated as though the date of acceleration were the Maturity Date of the Notes and as though the Valuation Date were the third trading day prior to the date of acceleration. We will also determine whether the final Contingent Coupon Payment is payable based upon the levels of the Underlyings on the deemed Valuation Date; any such final Contingent Coupon Payment will be prorated by the calculation agent to reflect the length of the final contingent payment period. In case of a default in the payment of the Notes, whether at their maturity or upon acceleration, the Notes will not bear a default interest rate. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-3

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

Observation Dates and Contingent Payment Dates

| Observation Dates* | Contingent Payment Dates | |||

| April 17, 2020 | April 22, 2020 | |||

| July 17, 2020 | July 22, 2020 | |||

| October 19, 2020 | October 22, 2020 | |||

| January 19, 2021 | January 22, 2021 | |||

| April 19, 2021 | April 22, 2021 | |||

| July 19, 2021 | July 22, 2021 | |||

| October 18, 2021 | October 21, 2021 | |||

| January 18, 2022 | January 21, 2022 | |||

| April 19, 2022 | April 22, 2022 | |||

| July 18, 2022 | July 21, 2022 | |||

| October 17, 2022 | October 20, 2022 | |||

| January 17, 2023 | January 20, 2023 | |||

| April 17, 2023 | April 20, 2023 | |||

| July 17, 2023 | July 20, 2023 | |||

| October 17, 2023 | October 20, 2023 | |||

| January 17, 2024 | January 22, 2024 | |||

| April 17, 2024 | April 22, 2024 | |||

| July 17, 2024 | July 22, 2024 | |||

| October 17, 2024 | October 22, 2024 | |||

| January 17, 2025 (the “Valuation Date”) | January 23, 2025 (the “Maturity Date”) |

* The Observation Dates are subject to postponement as set forth in “Description of the Notes—Certain Terms of the Notes—Events Relating to Observation Dates” on page PS-19 of the accompanying product supplement.

.

Any payments on the Notes depend on the credit risk of BofA Finance, as Issuer, and BAC, as Guarantor, and on the performance of the Underlyings. The economic terms of the Notes are based on BAC’s internal funding rate, which is the rate it would pay to borrow funds through the issuance of market-linked notes, and the economic terms of certain related hedging arrangements BAC’s affiliates enter into. BAC’s internal funding rate is typically lower than the rate it would pay when it issues conventional fixed or floating rate debt securities. This difference in funding rate, as well as the underwriting discount, referral fee and the hedging related charges described below (see “Risk Factors” beginning on page PS-8), reduced the economic terms of the Notes to you and the initial estimated value of the Notes. Due to these factors, the public offering price you are paying to purchase the Notes is greater than the initial estimated value of the Notes as of the pricing date.

The initial estimated value of the Notes as of the pricing date is set forth on the cover page of this pricing supplement. For more information about the initial estimated value and the structuring of the Notes, see “Risk Factors” beginning on page PS-8 and “Structuring the Notes” on page PS-22.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-4

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

Contingent Coupon Payment and Redemption Amount Determination

On each Contingent Payment Date, you may receive a

Contingent Coupon Payment per $1,000 in principal amount of Notes determined as follows:

Assuming the Notes have not been automatically called,

on the Maturity Date, you will receive a cash payment per $1,000 in principal amount of Notes determined as follows:

All payments described above are subject to Issuer and Guarantor credit risk.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-5

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

Total Contingent Coupon Payment Examples

The table below illustrates the total Contingent Coupon Payments per $1,000 in principal amount of Notes over the term of the Notes, based on the Contingent Coupon Payment of $15.00, depending on how many Contingent Coupon Payments are payable prior to an Automatic Call or maturity. Depending on the performance of the Underlyings, you may not receive any Contingent Coupon Payments during the term of the Notes.

| Number of Contingent Coupon Payments | Total Contingent Coupon Payments |

|||

| 0 | $0.00 | |||

| 2 | $30.00 | |||

| 4 | $60.00 | |||

| 6 | $90.00 | |||

| 8 | $120.00 | |||

| 10 | $150.00 | |||

| 12 | $180.00 | |||

| 14 | $210.00 | |||

| 16 | $240.00 | |||

| 18 | $270.00 | |||

| 20 | $300.00 |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-6

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

Hypothetical Payout Profile and Examples of Payments at Maturity

Contingent Income Buffered Auto-Callable Yield Notes Table

The following table is for purposes of illustration only. It assumes the Notes have not been automatically called prior to maturity and is based on hypothetical values and shows hypothetical returns on the Notes. The table illustrates the calculation of the Redemption Amount and the return on the Notes based on a hypothetical Starting Value of 100, a hypothetical Coupon Barrier of 69 for the Least Performing Underlying, a hypothetical Threshold Value of 69 for the Least Performing Underlying, the Contingent Coupon Payment of $15.00 per $1,000 in principal amount of Notes, the Threshold Rate of approximately 144.9% and a range of hypothetical Ending Values of the Least Performing Underlying. The actual amount you receive and the resulting return will depend on the actual Starting Values, Coupon Barriers, Threshold Values, Observation Values and Ending Values of the Underlyings, whether the Notes are automatically called prior to maturity, and whether you hold the Notes to maturity. The following examples do not take into account any tax consequences from investing in the Notes.

For recent actual levels of the Underlyings, see “The Underlyings” section below. Each Underlying is a price return index and as such its Ending Value will not include any income generated by dividends paid on the stocks included in that Underlying, which you would otherwise be entitled to receive if you invested in those stocks directly. In addition, all payments on the Notes are subject to Issuer and Guarantor credit risk.

| Ending Value of the Least Performing Underlying | Underlying Return of the Least Performing Underlying | Redemption Amount per Note (including any final Contingent Coupon Payment) | Return on the Notes(1) |

| 160.00 | 60.00% | $1,015.00000(2) | 1.50000% |

| 150.00 | 50.00% | $1,015.00000 | 1.50000% |

| 140.00 | 40.00% | $1,015.00000 | 1.50000% |

| 130.00 | 30.00% | $1,015.00000 | 1.50000% |

| 120.00 | 20.00% | $1,015.00000 | 1.50000% |

| 110.00 | 10.00% | $1,015.00000 | 1.50000% |

| 105.00 | 5.00% | $1,015.00000 | 1.50000% |

| 102.00 | 2.00% | $1,015.00000 | 1.50000% |

| 100.00(3) | 0.00% | $1,015.00000 | 1.50000% |

| 90.00 | -10.00% | $1,015.00000 | 1.50000% |

| 80.00 | -20.00% | $1,015.00000 | 1.50000% |

| 70.00 | -30.00% | $1,015.00000 | 1.50000% |

| 69.00(4) | -31.00% | $1,015.00000 | 1.50000% |

| 68.99 | -31.01% | $999.85507 | -0.01449% |

| 50.00 | -50.00% | $724.63768 | -27.53623% |

| 0.00 | -100.00% | $0.00000 | -100.00000% |

| (1) | The “Return on the Notes” is calculated based on the Redemption Amount and potential final Contingent Coupon Payment, not including any Contingent Coupon Payments paid prior to maturity. |

| (2) | This amount represents the sum of the principal amount and the final Contingent Coupon Payment. |

| (3) | The hypothetical Starting Value of 100 used in the table above has been chosen for illustrative purposes only. The actual Starting Value for each Underlying is set forth on page PS-2 above. |

| (4) | This is the hypothetical Coupon Barrier and Threshold Value of the Least Performing Underlying. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-7

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

Risk Factors

Your investment in the Notes entails significant risks, many of which differ from those of a conventional debt security. Your decision to purchase the Notes should be made only after carefully considering the risks of an investment in the Notes, including those discussed below, with your advisors in light of your particular circumstances. The Notes are not an appropriate investment for you if you are not knowledgeable about significant elements of the Notes or financial matters in general. You should carefully review the more detailed explanation of risks relating to the Notes in the “Risk Factors” sections beginning on page PS-5 of the accompanying product supplement, page S-5 of the accompanying prospectus supplement and page 7 of the accompanying prospectus, each as identified on page PS-27 below.

| ● | Your investment may result in a loss; there is no guaranteed return of principal. There is no fixed principal repayment amount on the Notes at maturity. If the Notes are not automatically called prior to maturity and the Ending Value of any Underlying is less than its Threshold Value, at maturity, you will be exposed on a leveraged basis to declines in the Least Performing Underlying beyond its Threshold Value. In that case, you will lose some or all of your investment in the Notes. |

| ● | Your return on the Notes is limited to the return represented by the Contingent Coupon Payments, if any, over the term of the Notes. Your return on the Notes is limited to the Contingent Coupon Payments paid over the term of the Notes, regardless of the extent to which the Observation Value or Ending Value of any Underlying exceeds its Coupon Barrier or Starting Value, as applicable. Similarly, the amount payable at maturity or upon an Automatic Call will never exceed the sum of the principal amount and the applicable Contingent Coupon Payment, regardless of the extent to which the Observation Value of any Underlying exceeds its Starting Value. In contrast, a direct investment in the securities included in one or more of the Underlyings would allow you to receive the benefit of any appreciation in their values. Thus, any return on the Notes will not reflect the return you would realize if you actually owned those securities and received the dividends paid or distributions made on them. |

| ● | The Notes are subject to a potential Automatic Call, which would limit your ability to receive the Contingent Coupon Payments over the full term of the Notes. The Notes are subject to a potential Automatic Call. Beginning in January 2021, the Notes will be automatically called if, on any Observation Date (other than the final Observation Date), the Observation Value of each Underlying is greater than or equal to its Starting Value. If the Notes are automatically called prior to the Maturity Date, you will be entitled to receive the principal amount and the Contingent Coupon Payment with respect to the applicable Observation Date. In this case, you will lose the opportunity to continue to receive Contingent Coupon Payments after the date of the Automatic Call. If the Notes are called prior to the Maturity Date, you may be unable to invest in other securities with a similar level of risk that could provide a return that is similar to the Notes. |

| ● | You may not receive any Contingent Coupon Payments. The Notes do not provide for any regular fixed coupon payments. Investors in the Notes will not necessarily receive any Contingent Coupon Payments on the Notes. If the Observation Value of any Underlying is less than its Coupon Barrier on an Observation Date, you will not receive the Contingent Coupon Payment applicable to that Observation Date. If the Observation Value of any Underlying is less than its Coupon Barrier on all the Observation Dates during the term of the Notes, you will not receive any Contingent Coupon Payments during the term of the Notes, and will not receive a positive return on the Notes. |

| ● | Your return on the Notes may be less than the yield on a conventional debt security of comparable maturity. Any return that you receive on the Notes may be less than the return you would earn if you purchased a conventional debt security with the same Maturity Date. As a result, your investment in the Notes may not reflect the full opportunity cost to you when you consider factors, such as inflation, that affect the time value of money. In addition, if interest rates increase during the term of the Notes, the Contingent Coupon Payment (if any) may be less than the yield on a conventional debt security of comparable maturity. |

| ● | Any payment on the Notes is subject to the credit risk of BofA Finance and the Guarantor, and actual or perceived changes in BofA Finance or the Guarantor’s creditworthiness are expected to affect the value of the Notes. The Notes are our senior unsecured debt securities. Any payment on the Notes will be fully and unconditionally guaranteed by the Guarantor. The Notes are not guaranteed by any entity other than the Guarantor. As a result, your receipt of the Early Redemption Amount or the Redemption Amount at maturity, as applicable, will be dependent upon our ability and the ability of the Guarantor to repay our respective obligations under the Notes on the applicable Contingent Payment Date or the Maturity Date, regardless of the Ending Value of the Least Performing Underlying as compared to its Starting Value. |

In addition, our credit ratings and the credit ratings of the Guarantor are assessments by ratings agencies of our respective abilities to pay our obligations. Consequently, our or the Guarantor’s perceived creditworthiness and actual or anticipated decreases in our or the Guarantor’s credit ratings or increases in the spread between the yield on our respective securities and the yield on U.S. Treasury securities (the “credit spread”) prior to the Maturity Date may adversely affect the market value of the Notes. However, because your return on the Notes depends upon factors in addition to our ability and the ability of the Guarantor to pay our respective obligations, such as the values of the Underlyings, an improvement in our or the Guarantor’s credit ratings will not reduce the other investment risks related to the Notes.

| ● | We are a finance subsidiary and, as such, have no independent assets, operations or revenues. We are a finance subsidiary of BAC, have no operations other than those related to the issuance, administration and repayment of our debt securities that are guaranteed by the Guarantor, and are dependent upon the Guarantor and/or its other subsidiaries to meet our obligations under the Notes in the ordinary course. Therefore, our ability to make payments on the Notes may be limited. |

| ● | The public offering price you are paying for the Notes exceeds their initial estimated value. The initial estimated value of the Notes that is provided on the cover page of this pricing supplement is an estimate only, determined as of the pricing date by reference to our and our affiliates’ |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-8

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

pricing models. These pricing models consider certain assumptions and variables, including our credit spreads and those of the Guarantor, changes in the Guarantor’s internal funding rate, mid-market terms on hedging transactions, expectations on interest rates, dividends and volatility, price-sensitivity analysis, and the expected term of the Notes. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. If you attempt to sell the Notes prior to maturity, their market value may be lower than the price you paid for them and lower than their initial estimated value. This is due to, among other things, changes in the levels of the Underlyings, the Guarantor’s internal funding rate, and the inclusion in the public offering price of the underwriting discount and the hedging related charges, all as further described in “Structuring the Notes” below. These factors, together with various credit, market and economic factors over the term of the Notes, are expected to reduce the price at which you may be able to sell the Notes in any secondary market and will affect the value of the Notes in complex and unpredictable ways.

| ● | The initial estimated value does not represent a minimum or maximum price at which we, BAC, BofAS or any of our other affiliates would be willing to purchase your Notes in any secondary market (if any exists) at any time. The value of your Notes at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Underlyings, our and BAC’s creditworthiness and changes in market conditions. |

| ● | We cannot assure you that a trading market for your Notes will ever develop or be maintained. We will not list the Notes on any securities exchange. We cannot predict how the Notes will trade in any secondary market or whether that market will be liquid or illiquid. |

| ● | The Contingent Coupon Payment, Early Redemption Amount or Redemption Amount, as applicable, will not reflect the levels of the Underlyings other than on the Observation Dates. The levels of the Underlyings during the term of the Notes other than on the Observation Dates will not affect payments on the Notes. Notwithstanding the foregoing, investors should generally be aware of the performance of the Underlyings while holding the Notes, as the performance of the Underlyings may influence the market value of the Notes. The calculation agent will determine whether each Contingent Coupon Payment is payable and will calculate the Early Redemption Amount or the Redemption Amount, as applicable, by comparing only the Starting Value, the Coupon Barrier or the Threshold Value, as applicable, to the Observation Value or the Ending Value for each Underlying. No other levels of the Underlyings will be taken into account. As a result, if the Notes are not automatically called prior to maturity, and the Ending Value of the Least Performing Underlying is less than the Threshold Value, you will receive less than the principal amount at maturity even if the level of each Underlying was always above its Threshold Value prior to the Valuation Date. |

| ● | Because the Notes are linked to the least performing (and not the average performance) of the Underlyings, you may not receive any return on the Notes and may lose some or all of your principal amount even if the Observation Value or Ending Value of one Underlying is always greater than or equal to its Coupon Barrier or Threshold Value, as applicable. Your Notes are linked to the least performing of the Underlyings, and a change in the level of one Underlying may not correlate with changes in the level of the other Underlying(s). The Notes are not linked to a basket composed of the Underlyings, where the depreciation in the level of one Underlying could be offset to some extent by the appreciation in the level of the other Underlying(s). In the case of the Notes, the individual performance of each Underlying would not be combined, and the depreciation in the level of one Underlying would not be offset by any appreciation in the level of the other Underlying(s). Even if the Observation Value of an Underlying is at or above its Coupon Barrier on an Observation Date, you will not receive the Contingent Coupon Payment with respect to that Observation Date if the Observation Value of another Underlying is below its Coupon Barrier on that day. In addition, even if the Ending Value of an Underlying is at or above its Threshold Value, you will lose a portion of your principal if the Ending Value of the Least Performing Underlying is below its Threshold Value. |

| ● | The Notes are subject to risks associated with foreign securities markets. The SX5E includes certain foreign equity securities. You should be aware that investments in securities linked to the value of foreign equity securities involve particular risks. The foreign securities markets comprising the SX5E may have less liquidity and may be more volatile than U.S. or other securities markets and market developments may affect foreign markets differently from U.S. or other securities markets. Direct or indirect government intervention to stabilize these foreign securities markets, as well as cross-shareholdings in foreign companies, may affect trading prices and volumes in these markets. Also, there is generally less publicly available information about foreign companies than about those U.S. companies that are subject to the reporting requirements of the U.S. Securities and Exchange Commission, and foreign companies are subject to accounting, auditing and financial reporting standards and requirements that differ from those applicable to U.S. reporting companies. Prices of securities in foreign countries are subject to political, economic, financial and social factors that apply in those geographical regions. These factors, which could negatively affect those securities markets, include the possibility of recent or future changes in a foreign government’s economic and fiscal policies, the possible imposition of, or changes in, currency exchange laws or other laws or restrictions applicable to foreign companies or investments in foreign equity securities and the possibility of fluctuations in the rate of exchange between currencies, the possibility of outbreaks of hostility and political instability and the possibility of natural disaster or adverse public health developments in the region. Moreover, foreign economies may differ favorably or unfavorably from the U.S. economy in important respects such as growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency. |

| ● | The Notes are subject to risks associated with small-size capitalization companies. The stocks composing the RTY are issued by companies with small-sized market capitalization. The stock prices of small-size companies may be more volatile than stock prices of large capitalization companies. Small-size capitalization companies may be less able to withstand adverse economic, market, trade and competitive conditions relative to larger companies. Small-size capitalization companies may also be more susceptible to adverse developments related to their products or services. |

| ● | The publisher of an Underlying may adjust that Underlying in a way that affects its levels, and the publisher has no obligation to consider your interests. The publisher of an Underlying can add, delete, or substitute the components included in that Underlying or make other methodological changes that could change its level. Any of these actions could adversely affect the value of your Notes. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-9

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

| ● | Trading and hedging activities by us, the Guarantor and any of our other affiliates, including BofAS, may create conflicts of interest with you and may affect your return on the Notes and their market value. We, the Guarantor or one or more of our other affiliates, including BofAS, may buy or sell the securities held by or included in the Underlyings, or futures or options contracts on the Underlyings or those securities, or other listed or over-the-counter derivative instruments linked to the Underlyings or those securities. While we, the Guarantor or one or more of our other affiliates, including BofAS, may from time to time own securities represented by the Underlyings, except to the extent that BAC’s common stock may be included in the Underlyings, we, the Guarantor and our other affiliates, including BofAS, do not control any company included in the Underlyings, and have not verified any disclosure made by any other company. We, the Guarantor or one or more of our other affiliates, including BofAS, may execute such purchases or sales for our own or their own accounts, for business reasons, or in connection with hedging our obligations under the Notes. These transactions may present a conflict of interest between your interest in the Notes and the interests we, the Guarantor and our other affiliates, including BofAS, may have in our or their proprietary accounts, in facilitating transactions, including block trades, for our or their other customers, and in accounts under our or their management. These transactions may adversely affect the value of the Underlyings in a manner that could be adverse to your investment in the Notes. On or before the pricing date, any purchases or sales by us, the Guarantor or our other affiliates, including BofAS or others on its behalf (including for the purpose of hedging some or all of our anticipated exposure in connection with the Notes), may have affected the value of the Underlyings. Consequently, the value of the Underlyings may change subsequent to the pricing date, which may adversely affect the market value of the Notes. |

We, the Guarantor or one or more of our other affiliates, including BofAS, may also have engaged in hedging activities that could have affected the value of the Underlyings on the pricing date. In addition, these hedging activities, including the unwinding of a hedge, may decrease the market value of your Notes prior to maturity, and may affect the amounts to be paid on the Notes. We, the Guarantor or one or more of our other affiliates, including BofAS, may purchase or otherwise acquire a long or short position in the Notes and may hold or resell the Notes. For example, BofAS may enter into these transactions in connection with any market making activities in which it engages. We cannot assure you that these activities will not adversely affect the value of the Underlyings, the market value of your Notes prior to maturity or the amounts payable on the Notes.

| ● | There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours. We have the right to appoint and remove the calculation agent. One of our affiliates will be the calculation agent for the Notes and, as such, will make a variety of determinations relating to the Notes, including the amounts that will be paid on the Notes. Under some circumstances, these duties could result in a conflict of interest between its status as our affiliate and its responsibilities as calculation agent. |

| ● | The U.S. federal income tax consequences of an investment in the Notes are uncertain, and may be adverse to a holder of the Notes. No statutory, judicial, or administrative authority directly addresses the characterization of the Notes or securities similar to the Notes for U.S. federal income tax purposes. As a result, significant aspects of the U.S. federal income tax consequences of an investment in the Notes are not certain. Under the terms of the Notes, you will have agreed with us to treat the Notes as contingent income-bearing single financial contracts, as described below under “U.S. Federal Income Tax Summary—General.” If the Internal Revenue Service (the “IRS”) were successful in asserting an alternative characterization for the Notes, the timing and character of income, gain or loss with respect to the Notes may differ. No ruling will be requested from the IRS with respect to the Notes and no assurance can be given that the IRS will agree with the statements made in the section entitled “U.S. Federal Income Tax Summary.” You are urged to consult with your own tax advisor regarding all aspects of the U.S. federal income tax consequences of investing in the Notes. |

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-10

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

The Underlyings

All disclosures contained in this pricing supplement regarding the Underlyings, including, without limitation, their make-up, method of calculation, and changes in their components, have been derived from publicly available sources. The information reflects the policies of, and is subject to change by, each of STOXX Limited (“STOXX”), the sponsor of the SX5E, FTSE Russell, the sponsor of the RTY, and S&P Dow Jones Indices LLC (“SPDJI”), the sponsor of the SPX. We refer to STOXX, FTSE Russell and SPDJI as the “Underlying Sponsors”. The Underlying Sponsors, which license the copyright and all other rights to the Underlyings, have no obligation to continue to publish, and may discontinue publication of, the Underlyings. The consequences of any Underlying Sponsor discontinuing publication of the applicable Underlying are discussed in “Description of the Notes — Discontinuance of an Index” in the accompanying product supplement. None of us, the Guarantor, the calculation agent, or BofAS accepts any responsibility for the calculation, maintenance or publication of any Underlying or any successor index. None of us, the Guarantor, BofAS or any of our other affiliates makes any representation to you as to the future performance of the Underlyings. You should make your own investigation into the Underlyings.

The EURO STOXX 50® Index

The SX5E was created by STOXX, which is owned by Deutsche Börse AG. Publication of the SX5E began in February 1998, based on an initial index level of 1,000 at December 31, 1991.

Index Composition and Maintenance

The SX5E is composed of 50 stocks from 11 Eurozone countries (Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain) of the STOXX Europe 600 Supersector indices. The STOXX 600 Supersector indices contain the 600 largest stocks traded on the major exchanges of 18 European countries and are organized into the following 19 Supersectors: automobiles & parts; banks; basic resources; chemicals; construction & materials; financial services; food & beverage; health care; industrial goods & services; insurance; media; oil & gas; personal & household goods; real estate; retail; technology; telecommunications; travel & leisure and utilities.

For each of the 19 EURO STOXX regional supersector indices, the stocks are ranked in terms of free-float market capitalization. The largest stocks are added to the selection list until the coverage is close to, but still less than, 60% of the free-float market capitalization of the corresponding supersector index. If the next highest-ranked stock brings the coverage closer to 60% in absolute terms, then it is also added to the selection list. All current stocks in the SX5E are then added to the selection list. All of the stocks on the selection list are then ranked in terms of free-float market capitalization to produce the final index selection list. The largest 40 stocks on the selection list are selected; the remaining 10 stocks are selected from the largest remaining current stocks ranked between 41 and 60; if the number of stocks selected is still below 50, then the largest remaining stocks are selected until there are 50 stocks. In exceptional cases, STOXX’s management board can add stocks to and remove them from the selection list.

The index components are subject to a capped maximum index weight of 10%, which is applied on a quarterly basis.

The composition of the SX5E is reviewed annually, based on the closing stock data on the last trading day in August. Changes in the composition of the SX5E are made to ensure that the SX5E includes the 50 market sector leaders from within the EURO STOXX® Index.

The free float factors for each component stock used to calculate the SX5E, as described below, are reviewed, calculated, and implemented on a quarterly basis and are fixed until the next quarterly review.

The SX5E is subject to a “fast exit rule.” The index components are monitored for any changes based on the monthly selection list ranking. A stock is deleted from the SX5E if: (a) it ranks 75 or below on the monthly selection list and (b) it has been ranked 75 or below for a consecutive period of two months in the monthly selection list. The highest-ranked stock that is not an index component will replace it. Changes will be implemented on the close of the fifth trading day of the month, and are effective the next trading day.

The SX5E is also subject to a “fast entry rule.” All stocks on the latest selection lists and initial public offering (IPO) stocks are reviewed for a fast-track addition on a quarterly basis. A stock is added, if (a) it qualifies for the latest STOXX blue-chip selection list generated end of February, May, August or November and (b) it ranks within the “lower buffer” on this selection list.

The SX5E is also reviewed on an ongoing monthly basis. Corporate actions (including initial public offerings, mergers and takeovers, spin-offs, delistings, and bankruptcy) that affect the index composition are announced immediately, implemented two trading days later and become effective on the next trading day after implementation.

Index Calculation

The SX5E is calculated with the “Laspeyres formula,” which measures the aggregate price changes in the component stocks against a fixed base quantity weight. The formula for calculating the index value can be expressed as follows:

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-11

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

EURO STOXX 50® Index = Free float market capitalization of the EURO STOXX 50® Index

Divisor

The “free float market capitalization of the Index” is equal to the sum of the product of the price, the number of shares and the free float factor and the weighting cap factor for each component stock as of the time the SX5E is being calculated.

The SX5E is also subject to a divisor, which is adjusted to maintain the continuity of the index values across changes due to corporate actions, such as the deletion and addition of stocks, the substitution of stocks, stock dividends, and stock splits.

Neither we nor any of our affiliates, including Merrill Lynch, Pierce, Fenner & Smith Incorporated, accepts any responsibility for the calculation, maintenance, or publication of, or for any error, omission, or disruption in, the SX5E or any successor to the SX5E. STOXX does not guarantee the accuracy or the completeness of the SX5E or any data included in the SX5E. STOXX assumes no liability for any errors, omissions, or disruption in the calculation and dissemination of the SX5E. STOXX disclaims all responsibility for any errors or omissions in the calculation and dissemination of the SX5E or the manner in which the SX5E is applied in determining the amount payable on the Notes at maturity.

Historical Performance of the SX5E

The following graph sets forth the daily historical performance of the SX5E in the period from January 1, 2008 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. The horizontal line in the graph represents the SX5E’s Coupon Barrier and Threshold Value of 2,627.70 (rounded to two decimal places), which is 69% of the SX5E’s Starting Value of 3,808.26.

This historical data on the SX5E is not necessarily indicative of the future performance of the SX5E or what the value of the Notes may be. Any historical upward or downward trend in the level of the SX5E during any period set forth above is not an indication that the level of the SX5E is more or less likely to increase or decrease at any time over the term of the Notes.

Before investing in the Notes, you should consult publicly available sources for the levels of the SX5E.

License Agreement

One of our affiliates has entered into a non-exclusive license agreement with STOXX providing for the license to it and certain of its affiliated companies, including us, of the right to use indices owned and published by STOXX (including the SX5E) in connection with certain securities, including the Notes.

The license agreement requires that the following language be stated in this pricing supplement:

“STOXX Limited, Deutsche Börse Group and their licensors, research partners or data providers have no relationship to us other than the licensing of the SX5E and the related trademarks for use in connection with the Notes.

STOXX, Deutsche Börse Group and their licensors, research partners or data providers do not:

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-12

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

| ● | sponsor, endorse, sell or promote the Notes. |

| ● | recommend that any person invest in the Notes or any other securities. |

| ● | have any responsibility or liability for or make any decisions about the timing, amount or pricing of the Notes. |

| ● | have any responsibility or liability for the administration, management or marketing of the Notes. |

| ● | consider the needs of the Notes or the owners of the Notes in determining, composing or calculating the SX5E or have any obligation to do so. |

STOXX, Deutsche Börse Group and their licensors, research partners or data providers give no warranty, and exclude any liability (whether in negligence or otherwise), in connection with the Notes or their performance.

STOXX does not assume any contractual relationship with the purchasers of the Notes or any other third parties.

Specifically,

| ● | STOXX, Deutsche Börse Group and their licensors, research partners or data providers do not give any warranty, express or implied, and exclude any liability about: |

| ● | The results to be obtained by the Notes, the owner of the Notes or any other person in connection with the use of the SX5E and the data included in the SX5E; |

| ● | The accuracy, timeliness, and completeness of the SX5E and its data; |

| ● | The merchantability and the fitness for a particular purpose or use of the SX5E and its data; |

| ● | The performance of the Notes generally. |

| ● | STOXX, Deutsche Börse Group and their licensors, research partners or data providers give no warranty and exclude any liability, for any errors, omissions or interruptions in the SX5E or its data; |

| ● | Under no circumstances will STOXX, Deutsche Börse Group or their licensors, research partners or data providers be liable (whether in negligence or otherwise) for any lost profits or indirect, punitive, special or consequential damages or losses, arising as a result of such errors, omissions or interruptions in the SX5E or its data or generally in relation to the Notes, even in circumstances where STOXX, Deutsche Börse Group or their licensors, research partners or data providers are aware that such loss or damage may occur. |

The licensing agreement discussed above is solely for our benefit and that of STOXX, and not for the benefit of the owners of the Notes or any other third parties.”

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-13

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

The Russell 2000® Index

The RTY was developed by Russell Investments (“Russell”) before FTSE International Limited and Russell combined in 2015 to create FTSE Russell, which is wholly owned by London Stock Exchange Group. Additional information on the RTY is available at the following website: http://www.ftserussell.com. No information on that website is deemed to be included or incorporated by reference in this pricing supplement.

Russell began dissemination of the RTY (Bloomberg L.P. index symbol “RTY”) on January 1, 1984. FTSE Russell calculates and publishes the RTY. The RTY was set to 135 as of the close of business on December 31, 1986. The RTY is designed to track the performance of the small capitalization segment of the U.S. equity market. As a subset of the Russell 3000® Index, the RTY consists of the smallest 2,000 companies included in the Russell 3000® Index. The Russell 3000® Index measures the performance of the largest 3,000 U.S. companies, representing approximately 98% of the investable U.S. equity market. The RTY is determined, comprised, and calculated by FTSE Russell without regard to the Notes.

Selection of Stocks Comprising the RTY

All companies eligible for inclusion in the RTY must be classified as a U.S. company under FTSE Russell’s country-assignment methodology. If a company is incorporated, has a stated headquarters location, and trades in the same country (American Depositary Receipts and American Depositary Shares are not eligible), then the company is assigned to its country of incorporation. If any of the three factors are not the same, FTSE Russell defines three Home Country Indicators (“HCIs”): country of incorporation, country of headquarters, and country of the most liquid exchange (as defined by a two-year average daily dollar trading volume) (“ADDTV”) from all exchanges within a country. Using the HCIs, FTSE Russell compares the primary location of the company’s assets with the three HCIs. If the primary location of its assets matches any of the HCIs, then the company is assigned to the primary location of its assets. If there is insufficient information to determine the country in which the company’s assets are primarily located, FTSE Russell will use the country from which the company’s revenues are primarily derived for the comparison with the three HCIs in a similar manner. FTSE Russell uses the average of two years of assets or revenues data to reduce potential turnover. If conclusive country details cannot be derived from assets or revenues data, FTSE Russell will assign the company to the country of its headquarters, which is defined as the address of the company’s principal executive offices, unless that country is a Benefit Driven Incorporation “BDI” country, in which case the company will be assigned to the country of its most liquid stock exchange. BDI countries include: Anguilla, Antigua and Barbuda, Bahamas, Barbados, Belize, Bermuda, Bonaire, British Virgin Islands, Cayman Islands, Channel Islands, Cook Islands, Curacao, Faroe Islands, Gibraltar, Guernsey, Isle of Man, Jersey, Liberia, Marshall Islands, Panama, Saba, Sint Eustatius, Sint Maarten, and Turks and Caicos Islands. For any companies incorporated or headquartered in a U.S. territory, including Puerto Rico, Guam, and U.S. Virgin Islands, a U.S. HCI is assigned.

All securities eligible for inclusion in the RTY must trade on a major U.S. exchange. Stocks must have a closing price at or above $1.00 on their primary exchange on the last trading day in May to be eligible for inclusion during annual reconstitution. However, in order to reduce unnecessary turnover, if an existing member’s closing price is less than $1.00 on the last day of May, it will be considered eligible if the average of the daily closing prices (from its primary exchange) during the month of May is equal to or greater than $1.00. Initial public offerings are added each quarter and must have a closing price at or above $1.00 on the last day of their eligibility period in order to qualify for index inclusion. If an existing stock does not trade on the “rank day” (typically the last trading day in May but a confirmed timetable is announced each spring) but does have a closing price at or above $1.00 on another eligible U.S. exchange, that stock will be eligible for inclusion.

An important criterion used to determine the list of securities eligible for the RTY is total market capitalization, which is defined as the market price as of the last trading day in May for those securities being considered at annual reconstitution times the total number of shares outstanding. Where applicable, common stock, non-restricted exchangeable shares and partnership units/membership interests are used to determine market capitalization. Any other form of shares such as preferred stock, convertible preferred stock, redeemable shares, participating preferred stock, warrants and rights, installment receipts or trust receipts, are excluded from the calculation. If multiple share classes of common stock exist, they are combined. In cases where the common stock share classes act independently of each other (e.g., tracking stocks), each class is considered for inclusion separately. If multiple share classes exist, the pricing vehicle will be designated as the share class with the highest two-year trading volume as of the rank day in May.

Companies with a total market capitalization of less than $30 million are not eligible for the RTY. Similarly, companies with only 5% or less of their shares available in the marketplace are not eligible for the RTY. Royalty trusts, limited liability companies, closed-end investment companies (companies that are required to report Acquired Fund Fees and Expenses, as defined by the SEC, including business development companies), blank check companies, special purpose acquisition companies, and limited partnerships are also ineligible for inclusion. Bulletin board, pink sheets, and over-the-counter (“OTC”) traded securities are not eligible for inclusion. Exchange traded funds and mutual funds are also excluded.

Annual reconstitution is a process by which the RTY is completely rebuilt. Based on closing levels of the company’s common stock on its primary exchange on the rank day of May of each year, FTSE Russell reconstitutes the composition of the RTY using the then existing market capitalizations of eligible companies. Reconstitution of the RTY occurs on the last Friday in June or, when the last Friday in June is the 29th or 30th, reconstitution occurs on the prior Friday. In addition, FTSE Russell adds initial public offerings to the RTY on a quarterly basis based on total market capitalization ranking within the market-adjusted capitalization breaks established during the most recent reconstitution. After membership is determined, a security’s shares are adjusted to include only those shares available to the public. This is often referred to as “free float.” The purpose of the adjustment is to exclude from market calculations the capitalization that is not available for purchase and is not part of the investable opportunity set.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-14

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

Historical Performance of the RTY

The following graph sets forth the daily historical performance of the RTY in the period from January 1, 2008 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. The horizontal line in the graph represents the RTY’s Coupon Barrier and Threshold Value of 1,172.748 (rounded to three decimal places), which is 69% of the RTY’s Starting Value of 1,699.635.

This historical data on the RTY is not necessarily indicative of the future performance of the RTY or what the value of the Notes may be. Any historical upward or downward trend in the level of the RTY during any period set forth above is not an indication that the level of the RTY is more or less likely to increase or decrease at any time over the term of the Notes.

Before investing in the Notes, you should consult publicly available sources for the levels of the RTY.

License Agreement

“Russell 2000®” and “Russell 3000®” are trademarks of FTSE Russell and have been licensed for use by our affiliate, Merrill Lynch, Pierce, Fenner & Smith Incorporated. The Notes are not sponsored, endorsed, sold, or promoted by FTSE Russell, and FTSE Russell makes no representation regarding the advisability of investing in the Notes.

FTSE Russell and Merrill Lynch, Pierce, Fenner & Smith Incorporated have entered into a non-exclusive license agreement providing for the license to Merrill Lynch, Pierce, Fenner & Smith Incorporated and its affiliates, including us, in exchange for a fee, of the right to use indices owned and published by FTSE Russell in connection with some securities, including the Notes. The license agreement provides that the following language must be stated in this pricing supplement:

The Notes are not sponsored, endorsed, sold, or promoted by FTSE Russell. FTSE Russell makes no representation or warranty, express or implied, to the holders of the Notes or any member of the public regarding the advisability of investing in securities generally or in the Notes particularly or the ability of the RTY to track general stock market performance or a segment of the same. FTSE Russell’s publication of the RTY in no way suggests or implies an opinion by FTSE Russell as to the advisability of investment in any or all of the securities upon which the RTY is based. FTSE Russell’s only relationship to Merrill Lynch, Pierce, Fenner & Smith Incorporated and to us is the licensing of certain trademarks and trade names of FTSE Russell and of the RTY, which is determined, composed, and calculated by FTSE Russell without regard to Merrill Lynch, Pierce, Fenner & Smith Incorporated, us, or the Notes. FTSE Russell is not responsible for and has not reviewed the Notes nor any associated literature or publications and FTSE Russell makes no representation or warranty express or implied as to their accuracy or completeness, or otherwise. FTSE Russell reserves the right, at any time and without notice, to alter, amend, terminate, or in any way change the RTY. FTSE Russell has no obligation or liability in connection with the administration, marketing, or trading of the Notes.

FTSE RUSSELL DOES NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE RTY OR ANY DATA INCLUDED THEREIN AND FTSE RUSSELL SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. FTSE RUSSELL MAKES NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED, US, HOLDERS OF THE NOTES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE RTY OR ANY DATA INCLUDED THEREIN. FTSE RUSSELL MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE RTY OR ANY DATA INCLUDED

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-15

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL FTSE RUSSELL HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-16

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

The S&P 500® Index

The SPX includes a representative sample of 500 companies in leading industries of the U.S. economy. The SPX is intended to provide an indication of the pattern of common stock price movement. The calculation of the level of the SPX is based on the relative value of the aggregate market value of the common stocks of 500 companies as of a particular time compared to the aggregate average market value of the common stocks of 500 similar companies during the base period of the years 1941 through 1943.

The SPX includes companies from eleven main groups: Communication Services; Consumer Discretionary; Consumer Staples; Energy; Financials; Health Care; Industrials; Information Technology; Real Estate; Materials; and Utilities. SPDJI may from time to time, in its sole discretion, add companies to, or delete companies from, the SPX to achieve the objectives stated above.

Company additions to the SPX must have an unadjusted company market capitalization of $8.2 billion or more (an increase from the previous requirement of an unadjusted company market capitalization of $6.1 billion or more).

SPDJI calculates the SPX by reference to the prices of the constituent stocks of the SPX without taking account of the value of dividends paid on those stocks. As a result, the return on the Notes will not reflect the return you would realize if you actually owned the SPX constituent stocks and received the dividends paid on those stocks.

Computation of the SPX

While SPDJI currently employs the following methodology to calculate the SPX, no assurance can be given that SPDJI will not modify or change this methodology in a manner that may affect the Redemption Amount.

Historically, the market value of any component stock of the SPX was calculated as the product of the market price per share and the number of then outstanding shares of such component stock. In March 2005, SPDJI began shifting the SPX halfway from a market capitalization weighted formula to a float-adjusted formula, before moving the SPX to full float adjustment on September 16, 2005. SPDJI’s criteria for selecting stocks for the SPX did not change with the shift to float adjustment. However, the adjustment affects each company’s weight in the SPX.

Under float adjustment, the share counts used in calculating the SPX reflect only those shares that are available to investors, not all of a company’s outstanding shares. Float adjustment excludes shares that are closely held by control groups, other publicly traded companies or government agencies.

In September 2012, all shareholdings representing more than 5% of a stock’s outstanding shares, other than holdings by “block owners,” were removed from the float for purposes of calculating the SPX. Generally, these “control holders” will include officers and directors, private equity, venture capital and special equity firms, other publicly traded companies that hold shares for control, strategic partners, holders of restricted shares, ESOPs, employee and family trusts, foundations associated with the company, holders of unlisted share classes of stock, government entities at all levels (other than government retirement/pension funds) and any individual person who controls a 5% or greater stake in a company as reported in regulatory filings. However, holdings by block owners, such as depositary banks, pension funds, mutual funds and ETF providers, 401(k) plans of the company, government retirement/pension funds, investment funds of insurance companies, asset managers and investment funds, independent foundations and savings and investment plans, will ordinarily be considered part of the float.

Treasury stock, stock options, restricted shares, equity participation units, warrants, preferred stock, convertible stock, and rights are not part of the float. Shares held in a trust to allow investors in countries outside the country of domicile, such as depositary shares and Canadian exchangeable shares are normally part of the float unless those shares form a control block. If a company has multiple classes of stock outstanding, shares in an unlisted or non-traded class are treated as a control block.

For each stock, an investable weight factor (“IWF”) is calculated by dividing the available float shares by the total shares outstanding. Available float shares are defined as the total shares outstanding less shares held by control holders. This calculation is subject to a 5% minimum threshold for control blocks. For example, if a company’s officers and directors hold 3% of the company’s shares, and no other control group holds 5% of the company’s shares, SPDJI would assign that company an IWF of 1.00, as no control group meets the 5% threshold. However, if a company’s officers and directors hold 3% of the company’s shares and another control group holds 20% of the company’s shares, SPDJI would assign an IWF of 0.77, reflecting the fact that 23% of the company’s outstanding shares are considered to be held for control. As of July 31, 2017, companies with multiple share class lines are no longer eligible for inclusion in the SPX. Constituents of the SPX prior to July 31, 2017 with multiple share class lines will be grandfathered in and continue to be included in the SPX. If a constituent company of the SPX reorganizes into a multiple share class line structure, that company will remain in the SPX at the discretion of the S&P Index Committee in order to minimize turnover.

The SPX is calculated using a base-weighted aggregate methodology. The level of the SPX reflects the total market value of all component stocks relative to the base period of the years 1941 through 1943. An indexed number is used to represent the results of this calculation in order to make the level easier to work with and track over time. The actual total market value of the component stocks during the base period of the years 1941 through 1943 has been set to an indexed level of 10. This is often indicated by the notation 1941- 43 = 10. In practice, the daily calculation of the SPX is computed by dividing the total market value of the component stocks by the “index divisor.” By itself, the index divisor is an arbitrary number. However,

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-17

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

in the context of the calculation of the SPX, it serves as a link to the original base period level of the SPX. The index divisor keeps the SPX comparable over time and is the manipulation point for all adjustments to the SPX, which is index maintenance.

Index Maintenance

Index maintenance includes monitoring and completing the adjustments for company additions and deletions, share changes, stock splits, stock dividends, and stock price adjustments due to company restructuring or spinoffs. Some corporate actions, such as stock splits and stock dividends, require changes in the common shares outstanding and the stock prices of the companies in the SPX, and do not require index divisor adjustments.

To prevent the level of the SPX from changing due to corporate actions, corporate actions which affect the total market value of the SPX require an index divisor adjustment. By adjusting the index divisor for the change in market value, the level of the SPX remains constant and does not reflect the corporate actions of individual companies in the SPX. Index divisor adjustments are made after the close of trading and after the calculation of the SPX closing level.

Changes in a company’s shares outstanding of 5.00% or more due to mergers, acquisitions, public offerings, tender offers, Dutch auctions, or exchange offers are made as soon as reasonably possible. Share changes due to mergers or acquisitions of publicly held companies that trade on a major exchange are implemented when the transaction occurs, even if both of the companies are not in the same headline index, and regardless of the size of the change. All other changes of 5.00% or more (due to, for example, company stock repurchases, private placements, redemptions, exercise of options, warrants, conversion of preferred stock, notes, debt, equity participation units, at-the-market offerings, or other recapitalizations) are made weekly and are announced on Fridays for implementation after the close of trading on the following Friday. Changes of less than 5.00% are accumulated and made quarterly on the third Friday of March, June, September, and December, and are usually announced two to five days prior.

If a change in a company’s shares outstanding of 5.00% or more causes a company’s IWF to change by five percentage points or more, the IWF is updated at the same time as the share change. IWF changes resulting from partial tender offers are considered on a case by case basis.

Historical Performance of the SPX

The following graph sets forth the daily historical performance of the SPX in the period from January 1, 2008 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. The horizontal line in the graph represents the SPX’s Coupon Barrier and Threshold Value of 2,297.44 (rounded to two decimal places), which is 69% of the SPX’s Starting Value of 3,329.62.

This historical data on the SPX is not necessarily indicative of the future performance of the SPX or what the value of the Notes may be. Any historical upward or downward trend in the level of the SPX during any period set forth above is not an indication that the level of the SPX is more or less likely to increase or decrease at any time over the term of the Notes.

Before investing in the Notes, you should consult publicly available sources for the levels of the SPX.

License Agreement

S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). These trademarks have been licensed for use by S&P Dow Jones Indices LLC. “Standard & Poor’s®,” “S&P

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-18

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

500®” and “S&P®” are trademarks of S&P. These trademarks have been sublicensed for certain purposes by our affiliate, Merrill Lynch, Pierce, Fenner & Smith Incorporated. The Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Merrill Lynch, Pierce, Fenner & Smith Incorporated.

The Notes are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P or any of their respective affiliates (collectively, “S&P Dow Jones Indices”). S&P Dow Jones Indices make no representation or warranty, express or implied, to the holders of the Notes or any member of the public regarding the advisability of investing in securities generally or in the Notes particularly or the ability of the SPX to track general market performance. S&P Dow Jones Indices’ only relationship to Merrill Lynch, Pierce, Fenner & Smith Incorporated with respect to the SPX is the licensing of the SPX and certain trademarks, service marks and/or trade names of S&P Dow Jones Indices and/or its third party licensors. The SPX is determined, composed and calculated by S&P Dow Jones Indices without regard to us, Merrill Lynch, Pierce, Fenner & Smith Incorporated, or the Notes. S&P Dow Jones Indices have no obligation to take our needs, BAC’s needs or the needs of Merrill Lynch, Pierce, Fenner & Smith Incorporated or holders of the Notes into consideration in determining, composing or calculating the SPX. S&P Dow Jones Indices are not responsible for and have not participated in the determination of the prices, and amount of the Notes or the timing of the issuance or sale of the Notes or in the determination or calculation of the equation by which the Notes are to be converted into cash. S&P Dow Jones Indices have no obligation or liability in connection with the administration, marketing or trading of the Notes. There is no assurance that investment products based on the SPX will accurately track index performance or provide positive investment returns. S&P Dow Jones Indices LLC and its subsidiaries are not investment advisors. Inclusion of a security or futures contract within an index is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such security or futures contract, nor is it considered to be investment advice. Notwithstanding the foregoing, CME Group Inc. and its affiliates may independently issue and/or sponsor financial products unrelated to the Notes currently being issued by us, but which may be similar to and competitive with the Notes. In addition, CME Group Inc. and its affiliates may trade financial products which are linked to the performance of the SPX. It is possible that this trading activity will affect the value of the Notes.

S&P DOW JONES INDICES DO NOT GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY US, BAC, MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED HOLDERS OF THE NOTES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

| CONTINGENT INCOME AUTO-CALLABLE YIELD NOTES | PS-19

|

Contingent Income Buffered Auto-Callable Yield Notes Linked to the Least Performing of the EURO STOXX 50® Index, the Russell 2000® Index and the S&P 500® Index

Supplement to the Plan of Distribution; Role of BofAS and Conflicts of Interest

BofAS, a broker-dealer affiliate of ours, is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and will participate as selling agent in the distribution of the Notes. Accordingly, the offering of the Notes will conform to the requirements of FINRA Rule 5121. BofAS may not make sales in this offering to any of its discretionary accounts without the prior written approval of the account holder.

We will deliver the Notes against payment therefor in New York, New York on a date that is greater than two business days following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes more than two business days prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement.