| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||||||||

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Bank of America Corporation Floating Rate Non-Cumulative | ||||||||

| Preferred Stock, Series 1 | ||||||||

| Bank of America Corporation Floating Rate Non-Cumulative | ||||||||

| Preferred Stock, Series 2 | ||||||||

| Bank of America Corporation Floating Rate Non-Cumulative | ||||||||

| Preferred Stock, Series 4 | ||||||||

| Bank of America Corporation Floating Rate Non-Cumulative | ||||||||

| Preferred Stock, Series 5 | ||||||||

| November 28, 2031 of BofA Finance LLC (and the guarantee of the | ||||||||

| Registrant with respect thereto) | ||||||||

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2). | |||||

| Emerging growth company | |||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | ||||

| EXHIBIT NO. | DESCRIPTION OF EXHIBIT | |||||||

| 104 | Cover Page Interactive Data File (embedded in the cover page formatted in Inline XBRL) | |||||||

| BANK OF AMERICA CORPORATION | ||||||||

| By: | /s/ Rudolf A. Bless | |||||||

| Rudolf A. Bless | ||||||||

| Chief Accounting Officer | ||||||||

| Bank of America Corporation and Subsidiaries | |||||

| Table of Contents | Page | ||||

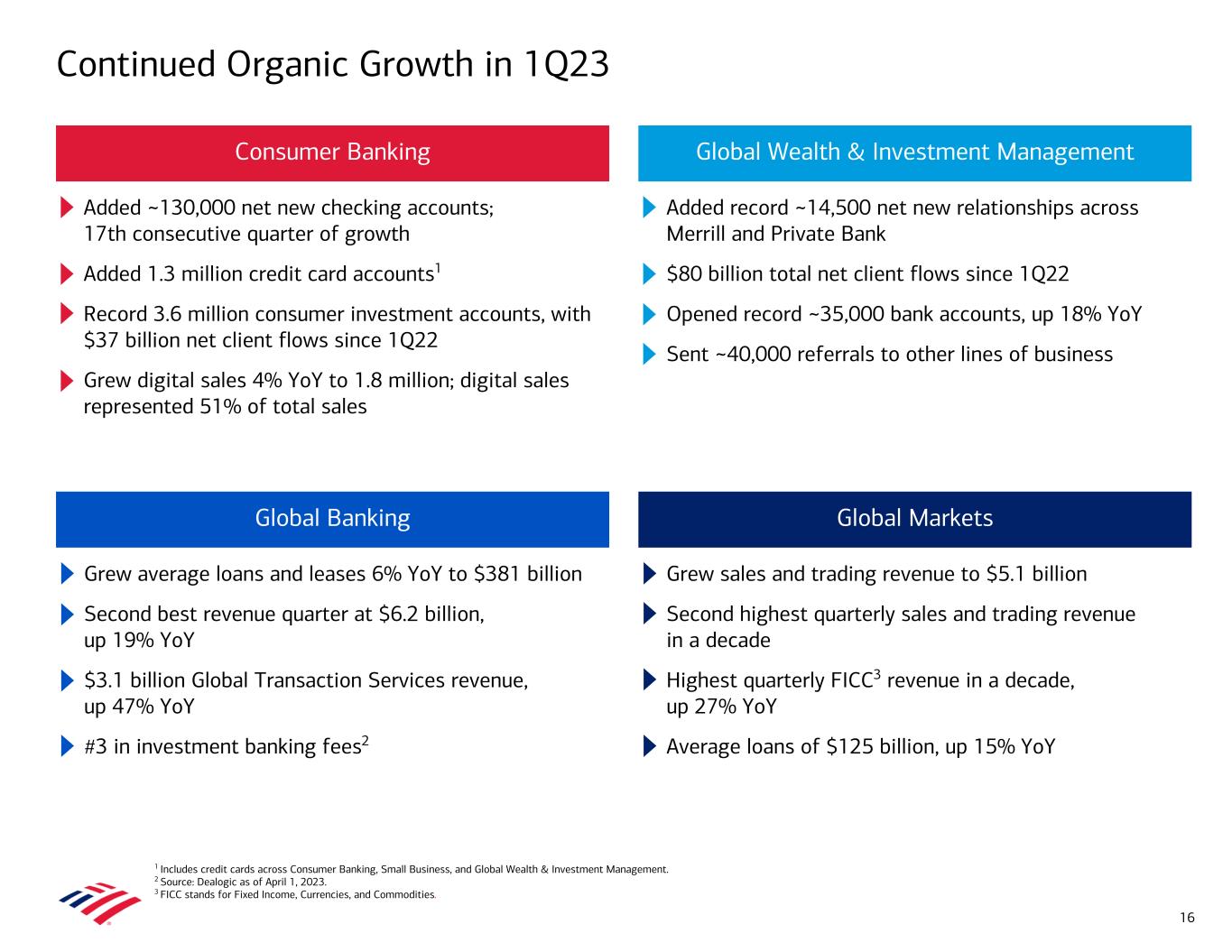

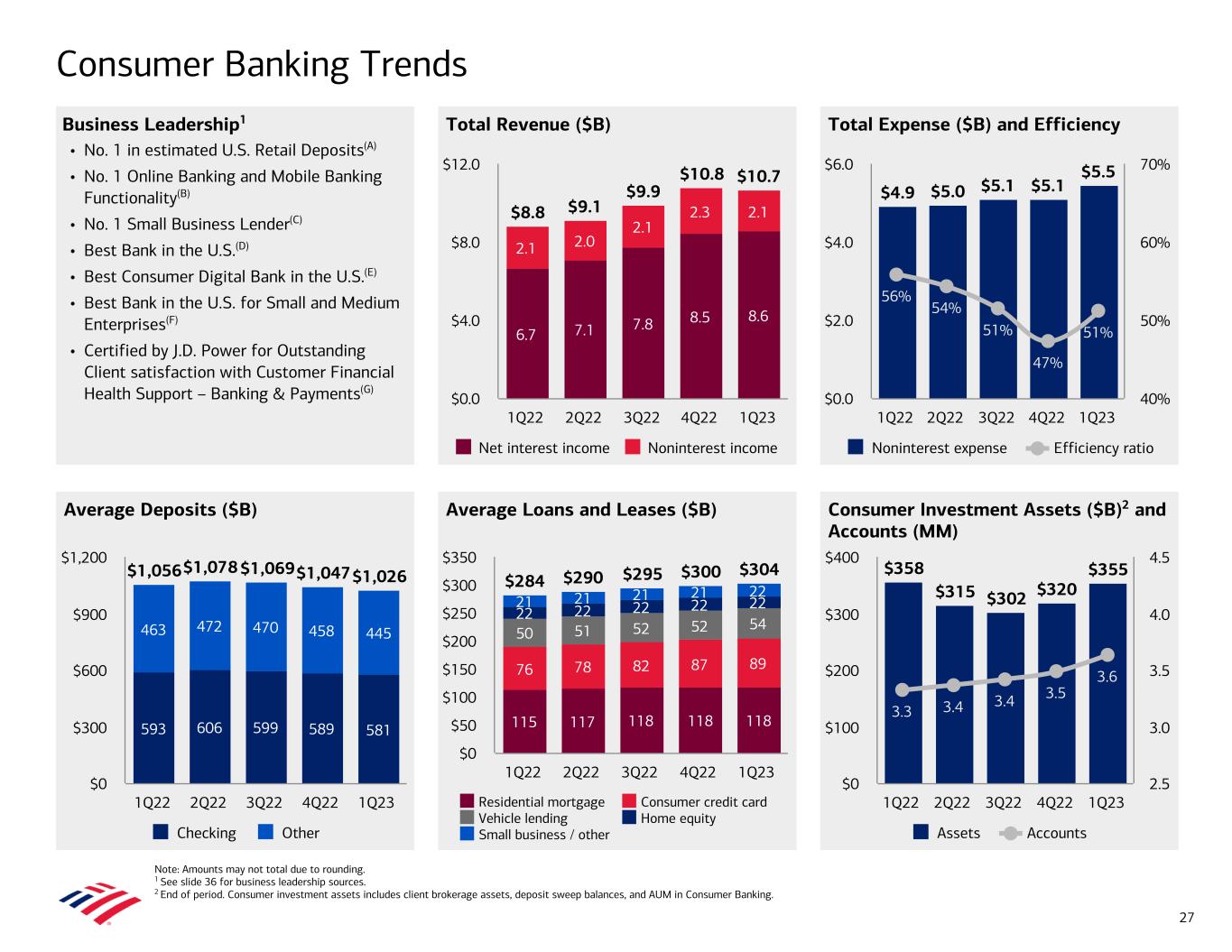

| Consumer Banking | |||||

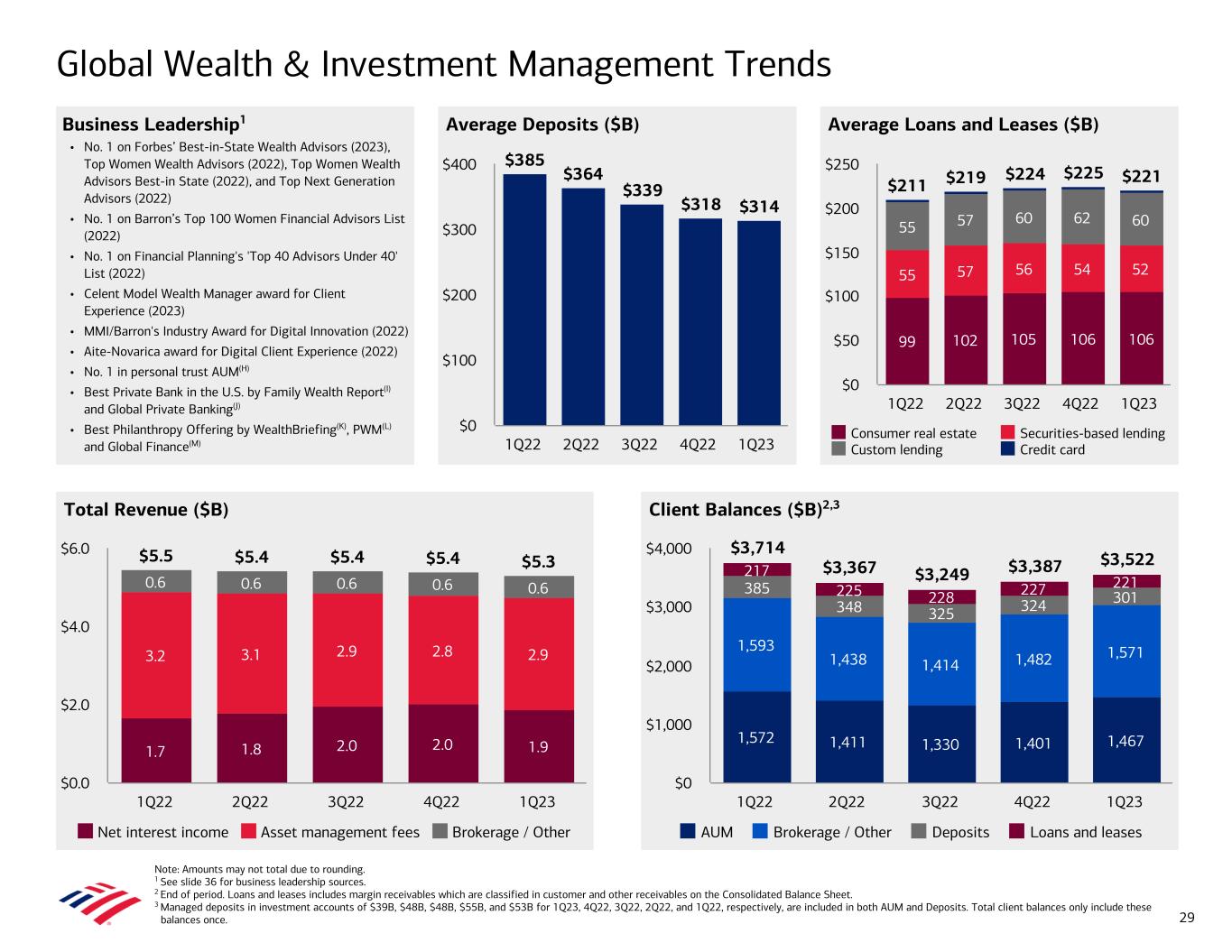

| Global Wealth & Investment Management | |||||

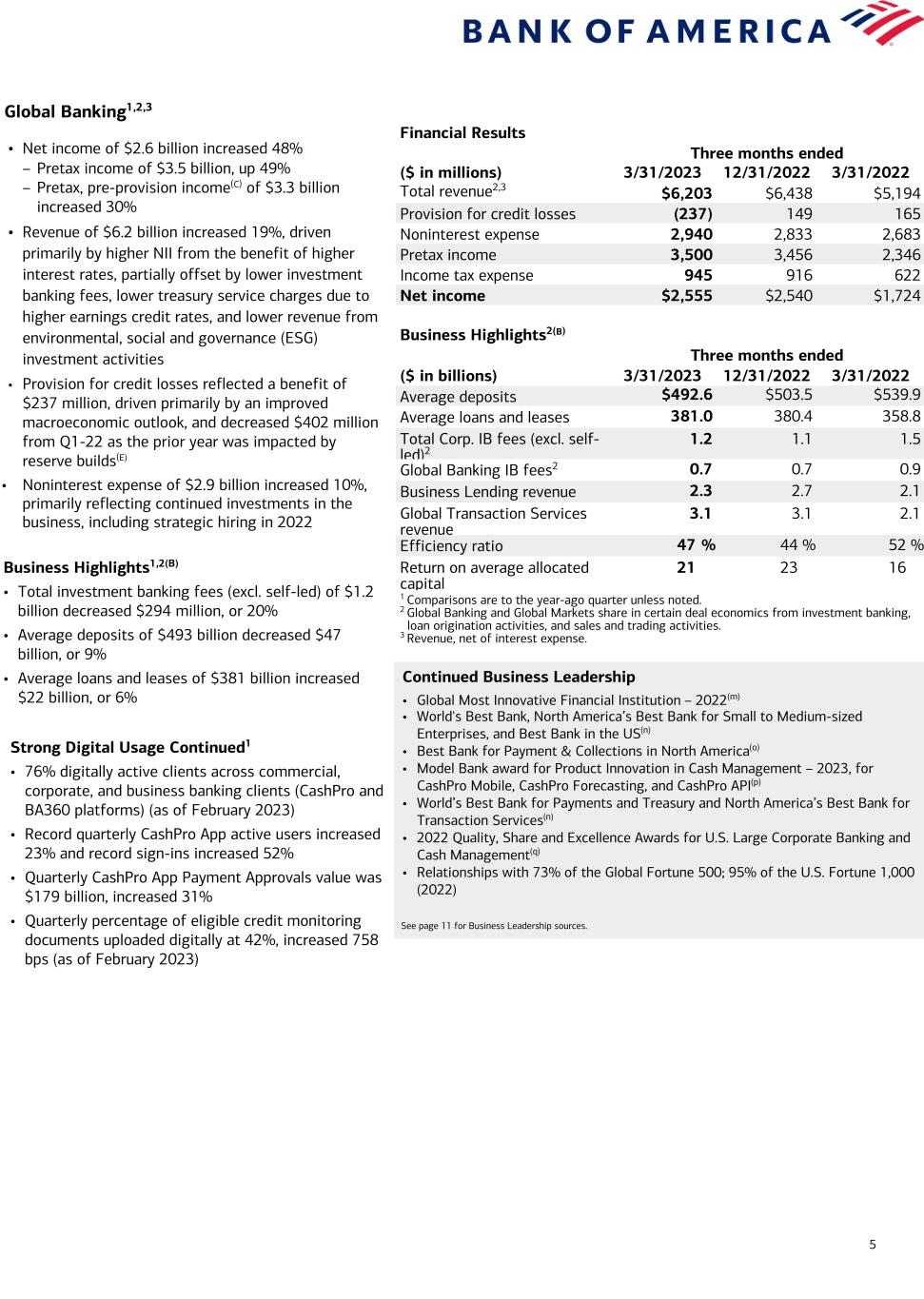

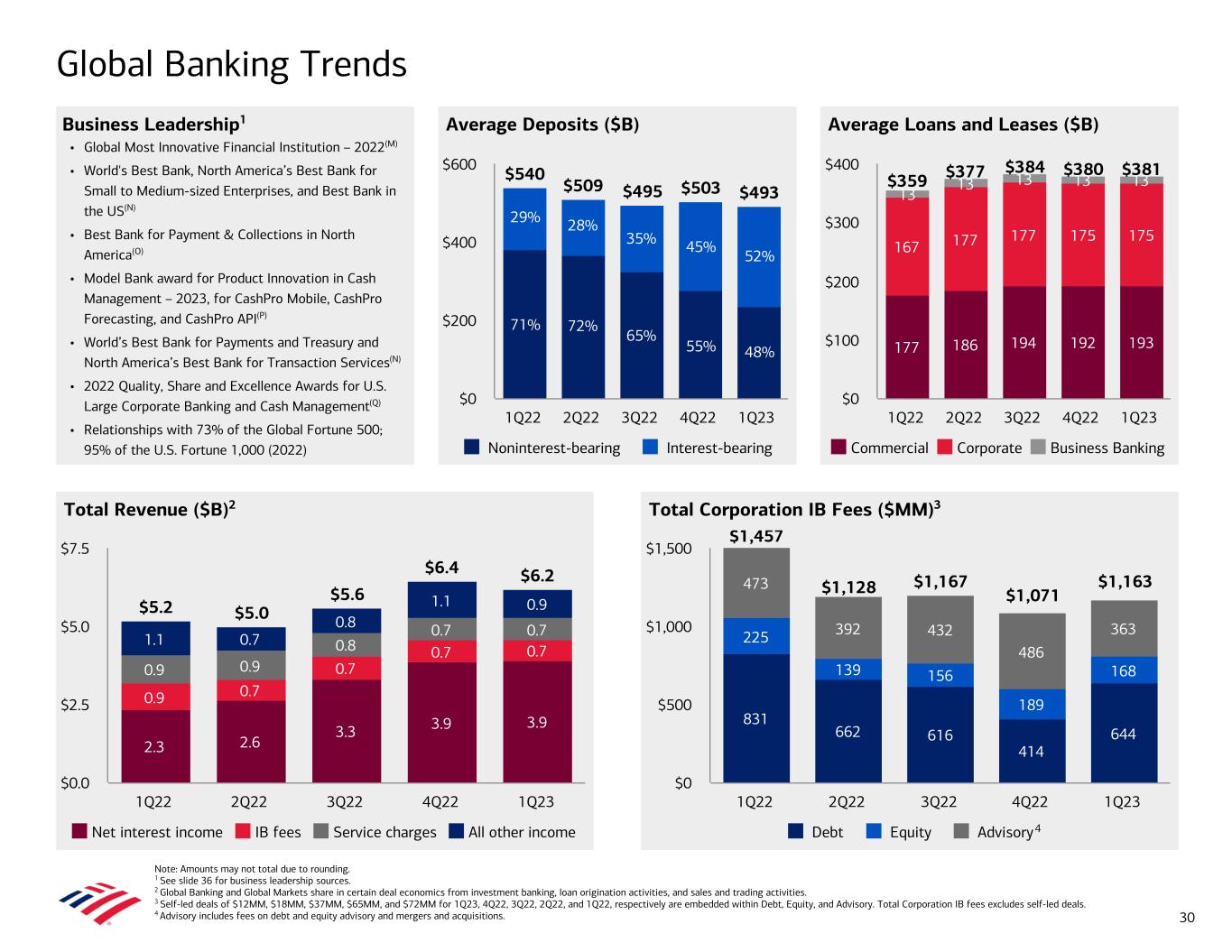

| Global Banking | |||||

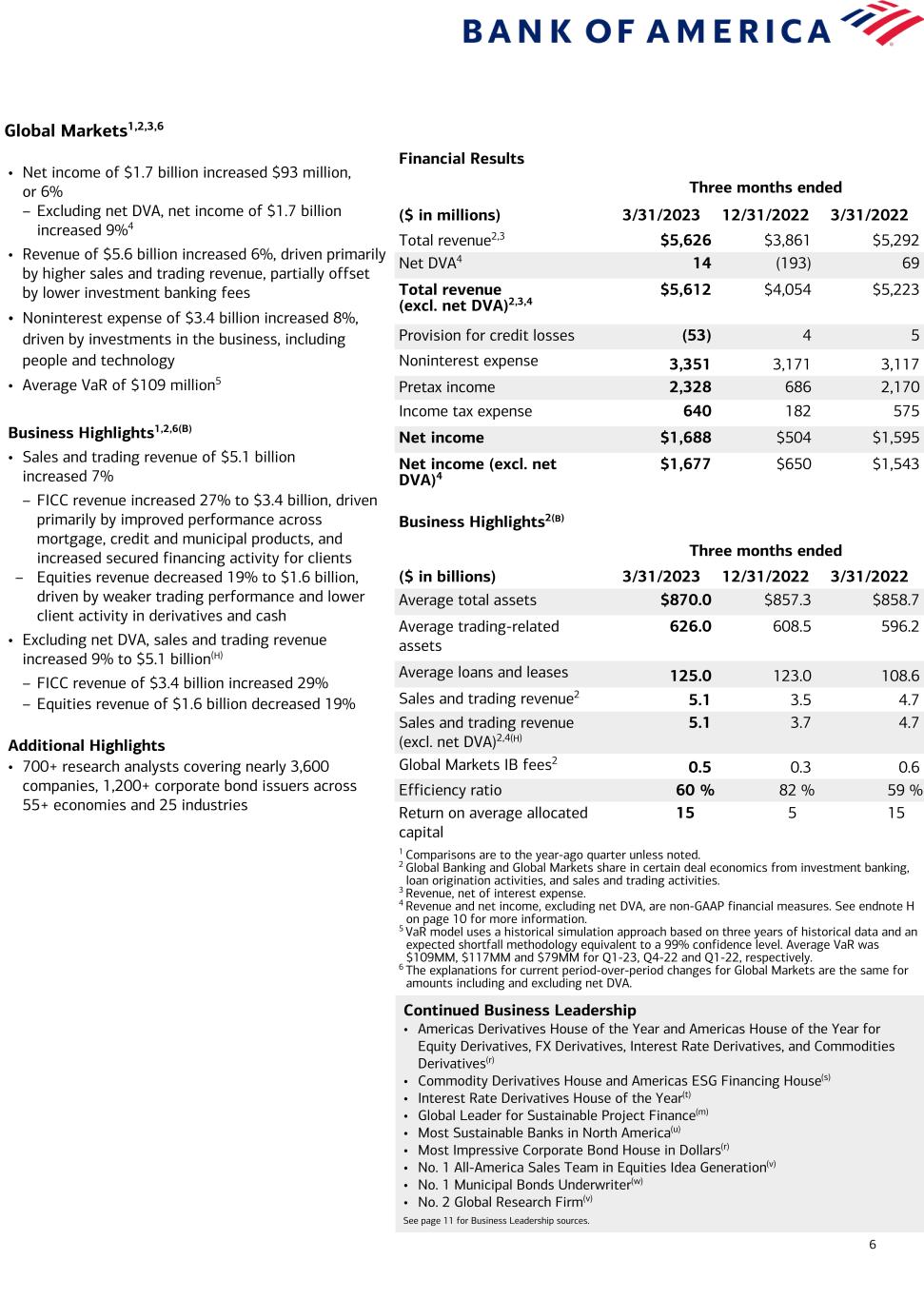

| Global Markets | |||||

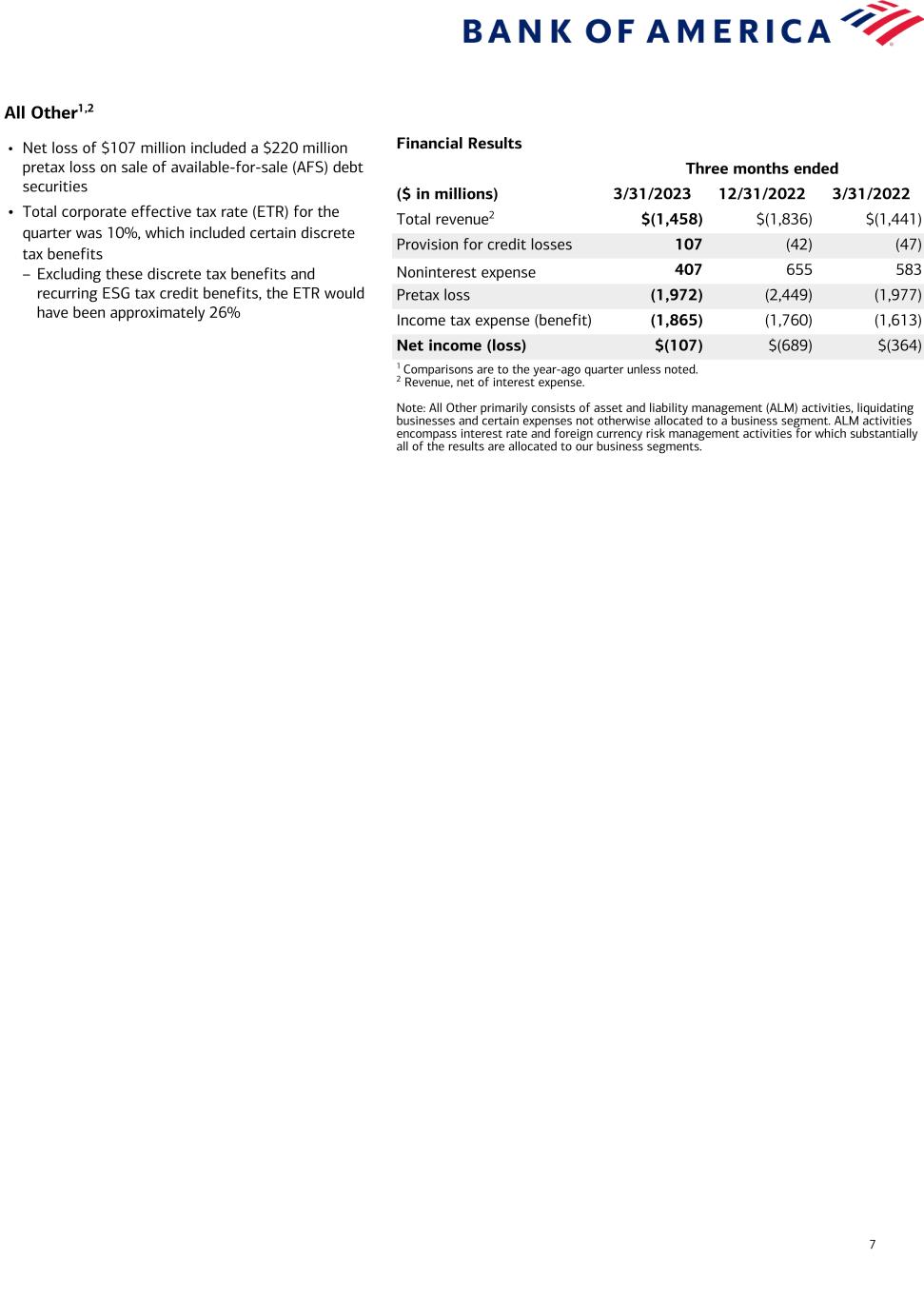

| All Other | |||||

Key Performance Indicators | |||||

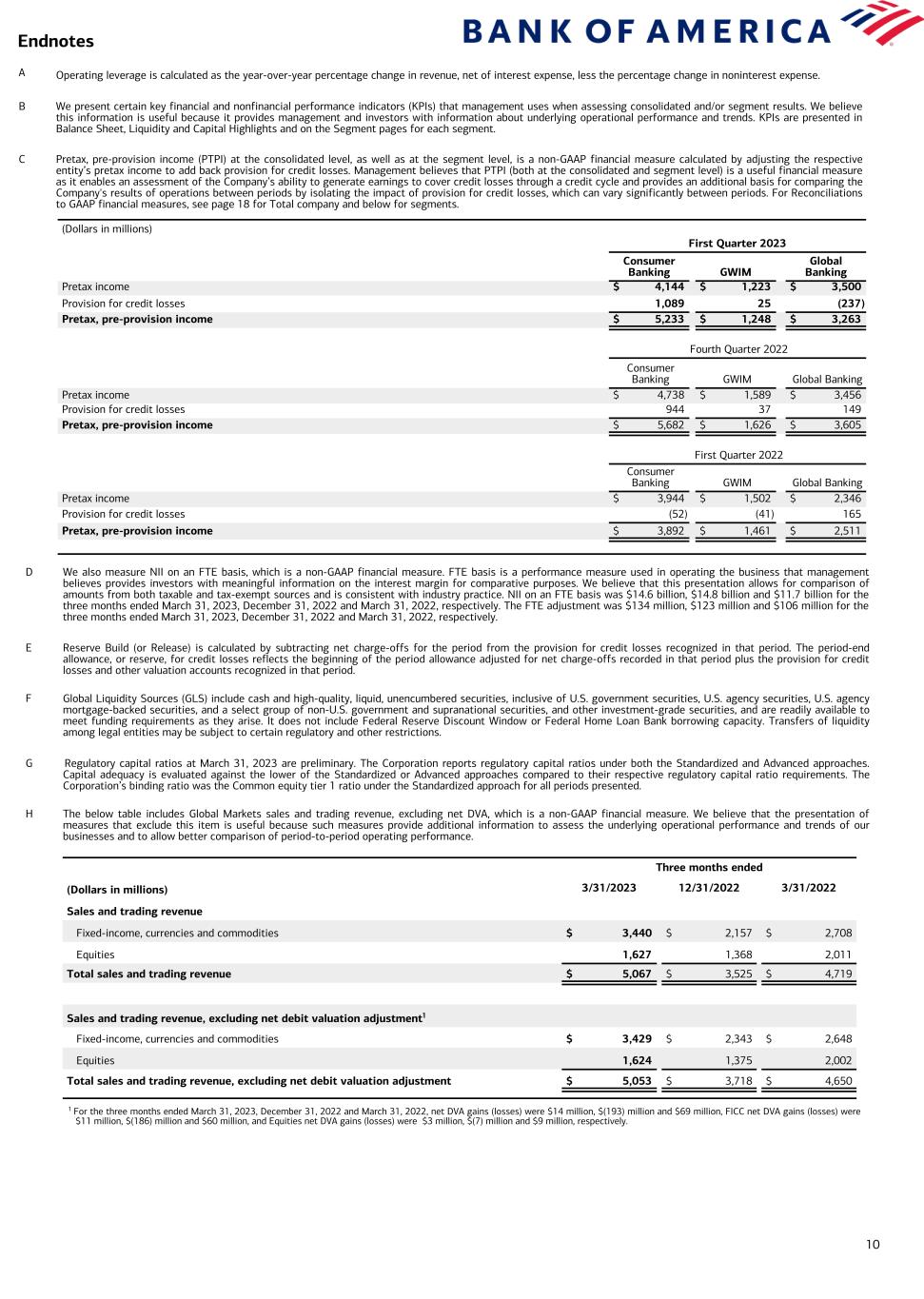

| The Corporation presents certain key financial and nonfinancial performance indicators that management uses when assessing consolidated and/or segment results. The Corporation believes this information is useful because it provides management with information about underlying operational performance and trends. Key performance indicators are presented in Consolidated Financial Highlights on page 2 and on the Key Indicators pages for each segment. | |||||

Business Segment Operations | |||||

The Corporation reports the results of operations of its four business segments and All Other on a fully taxable-equivalent (FTE) basis. Additionally, the results for the total Corporation as presented on pages 11 - 12 are reported on an FTE basis. | |||||

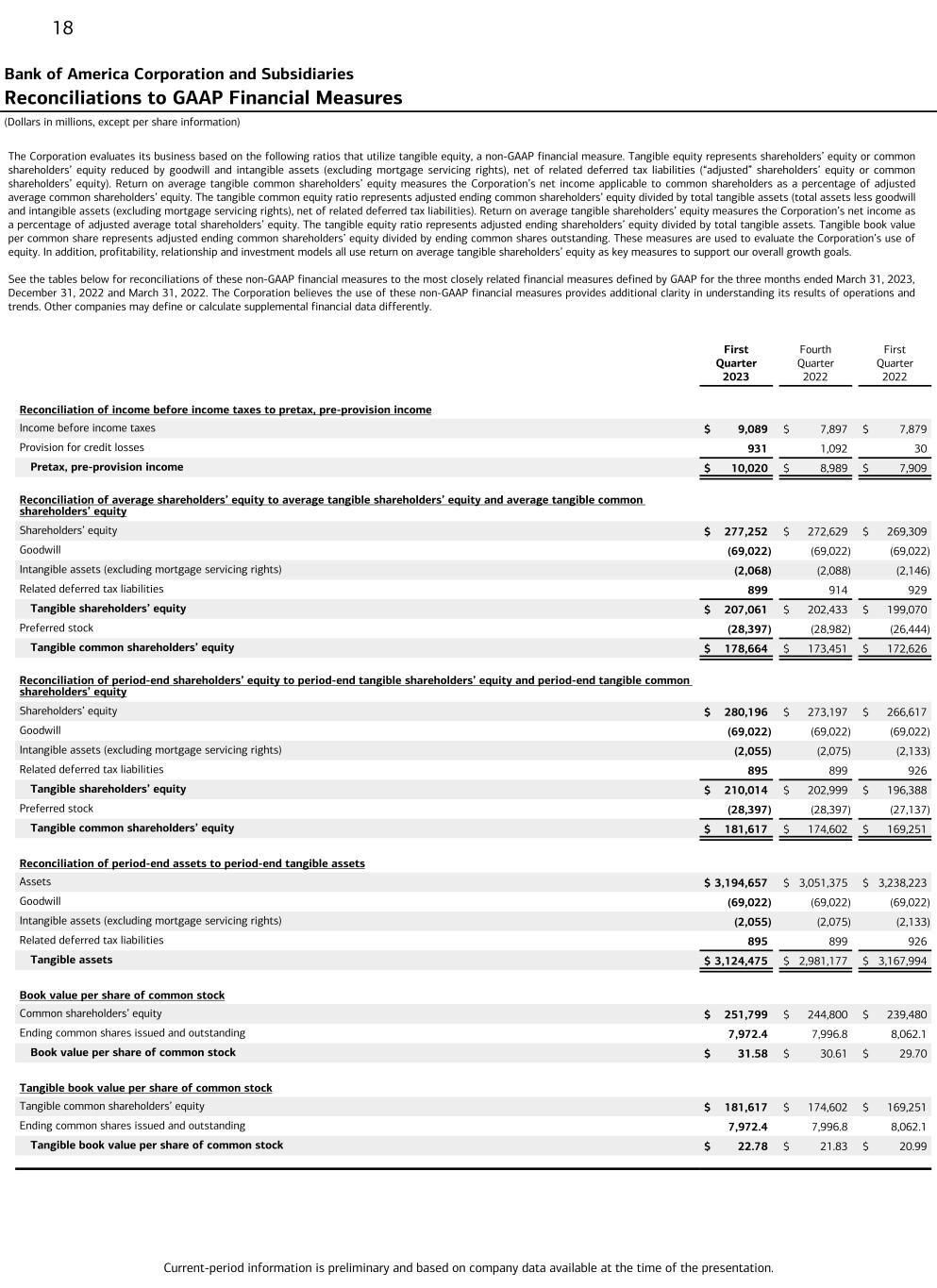

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||

| Consolidated Financial Highlights | |||||||||||||||||||||||||||||

| (In millions, except per share information) | |||||||||||||||||||||||||||||

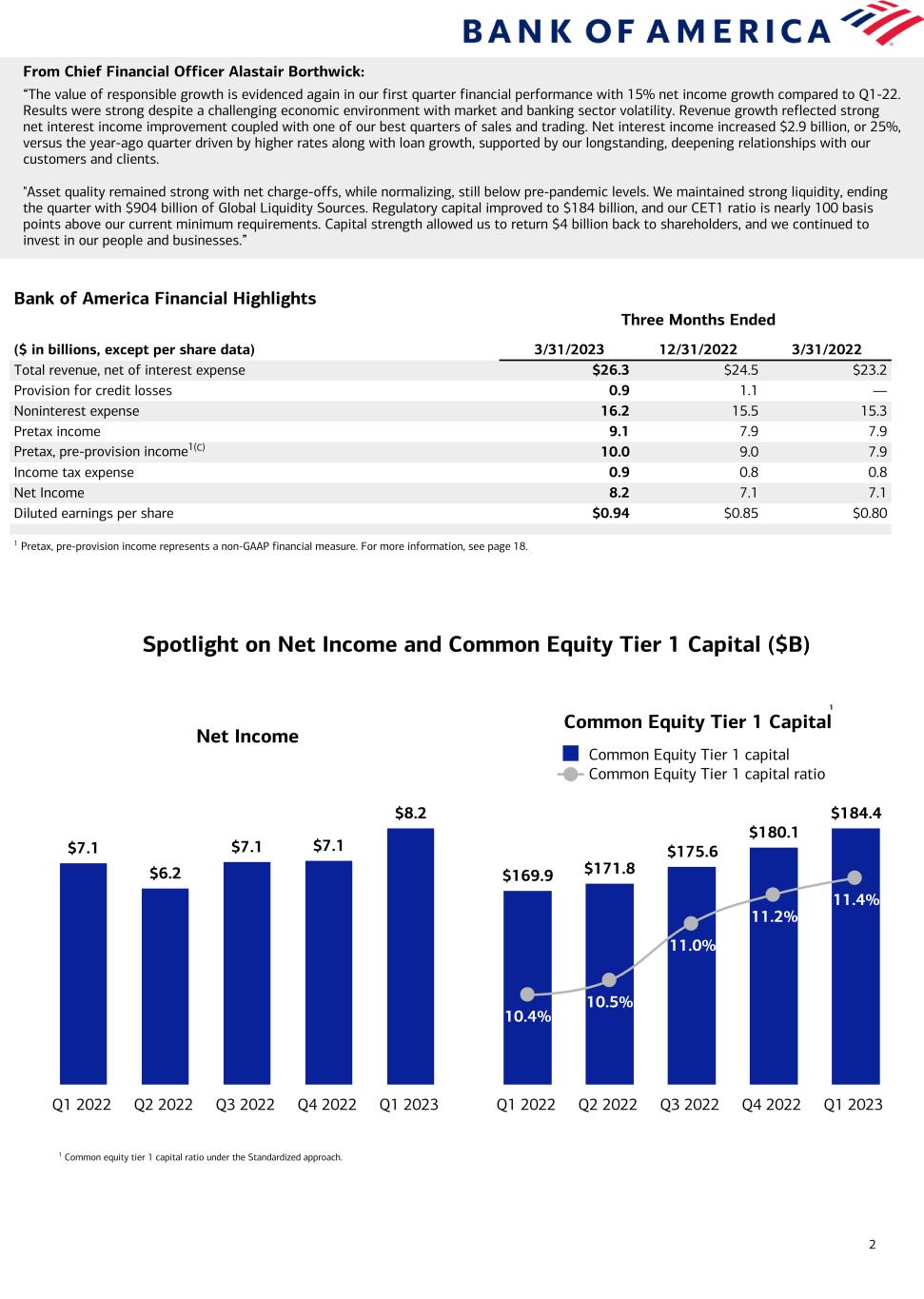

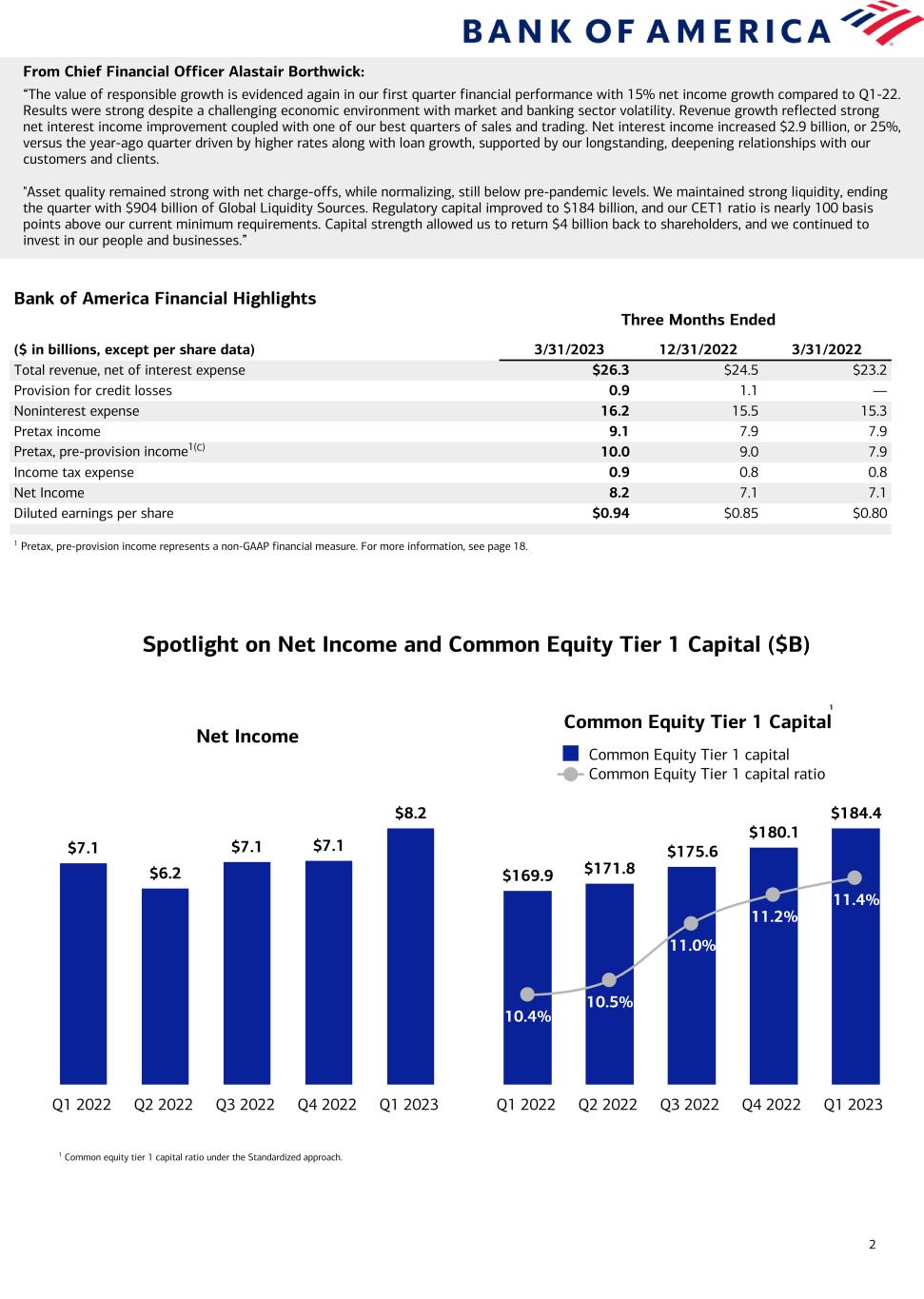

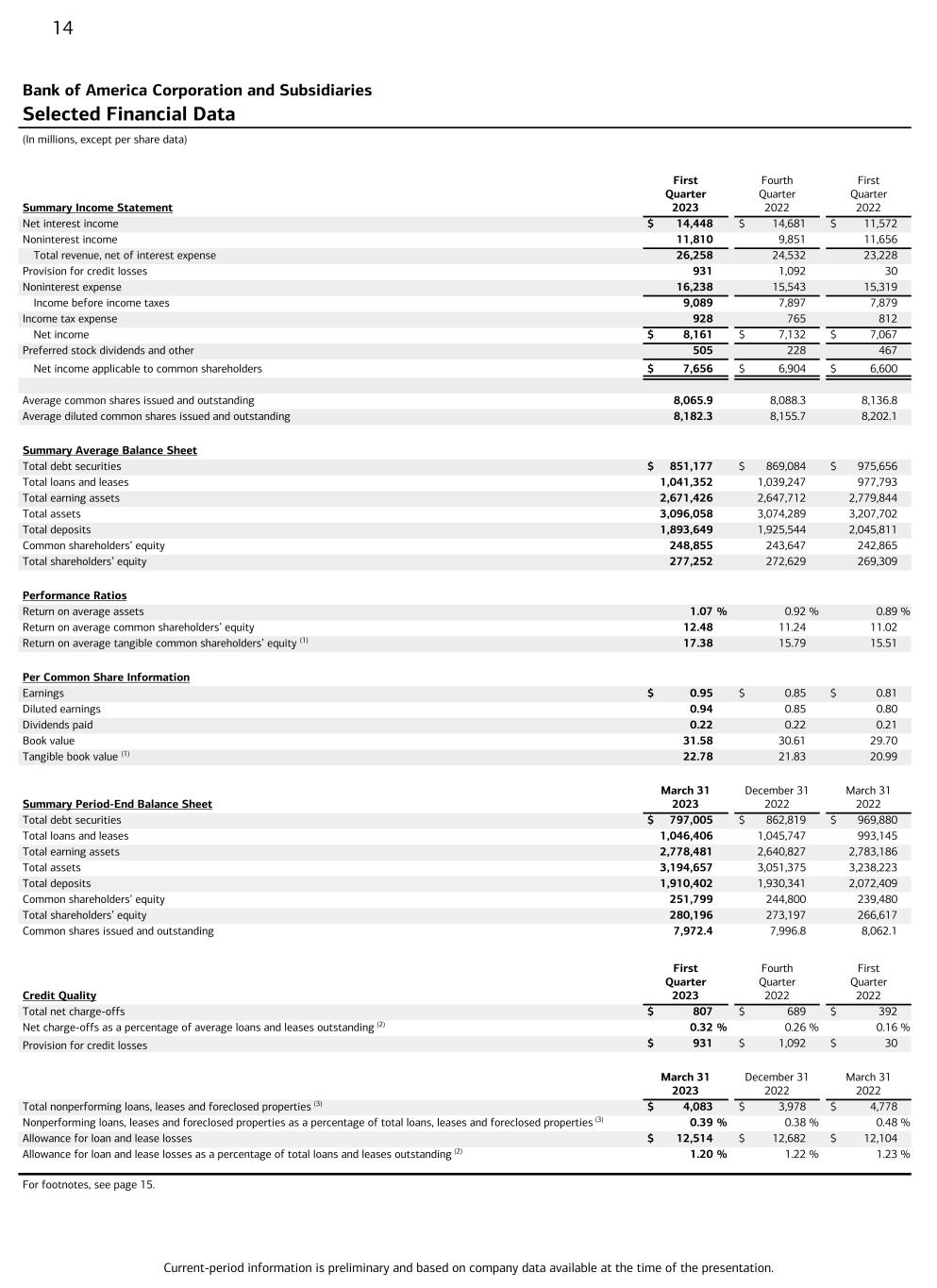

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

| Income statement | |||||||||||||||||||||||||||||

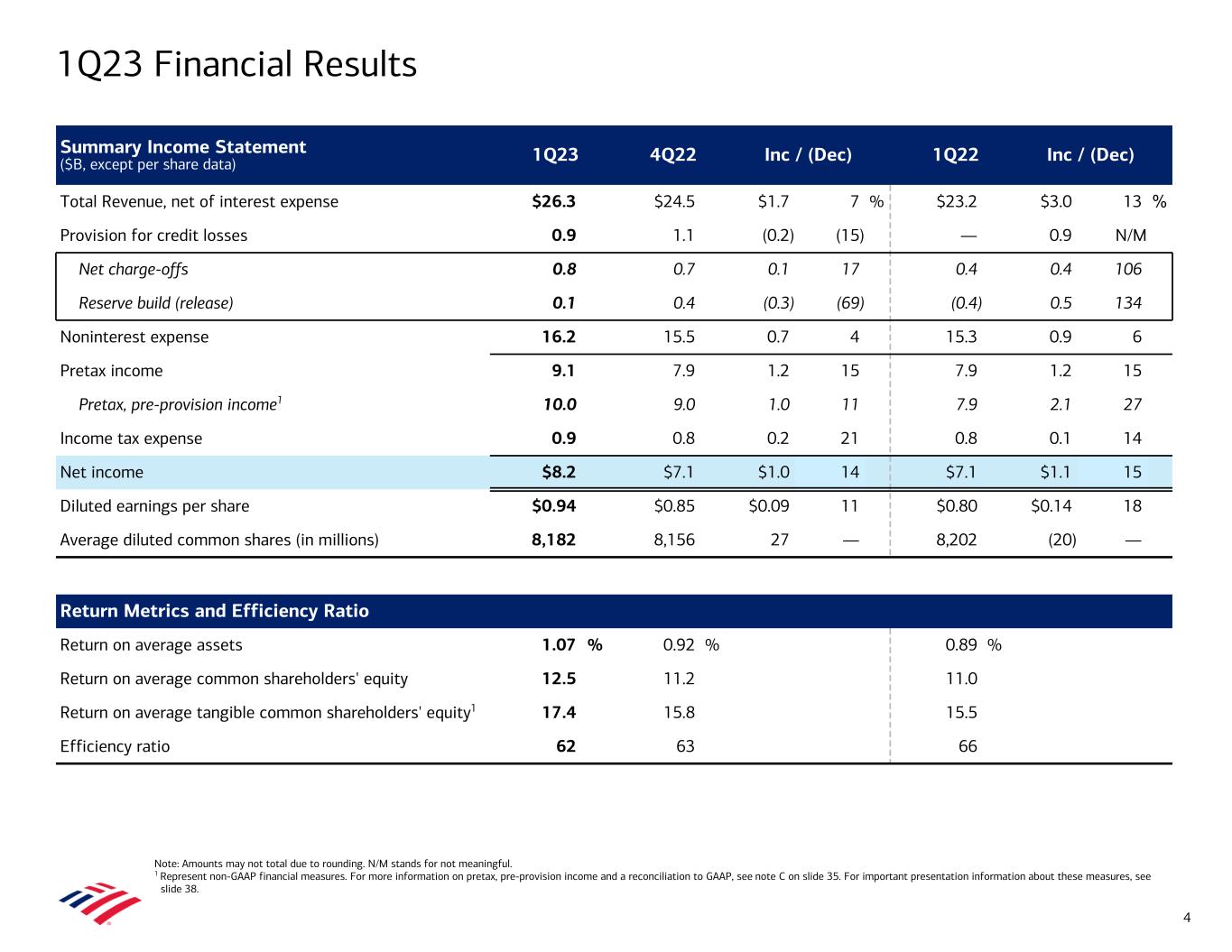

| Net interest income | $ | 14,448 | $ | 14,681 | $ | 13,765 | $ | 12,444 | $ | 11,572 | |||||||||||||||||||

| Noninterest income | 11,810 | 9,851 | 10,737 | 10,244 | 11,656 | ||||||||||||||||||||||||

| Total revenue, net of interest expense | 26,258 | 24,532 | 24,502 | 22,688 | 23,228 | ||||||||||||||||||||||||

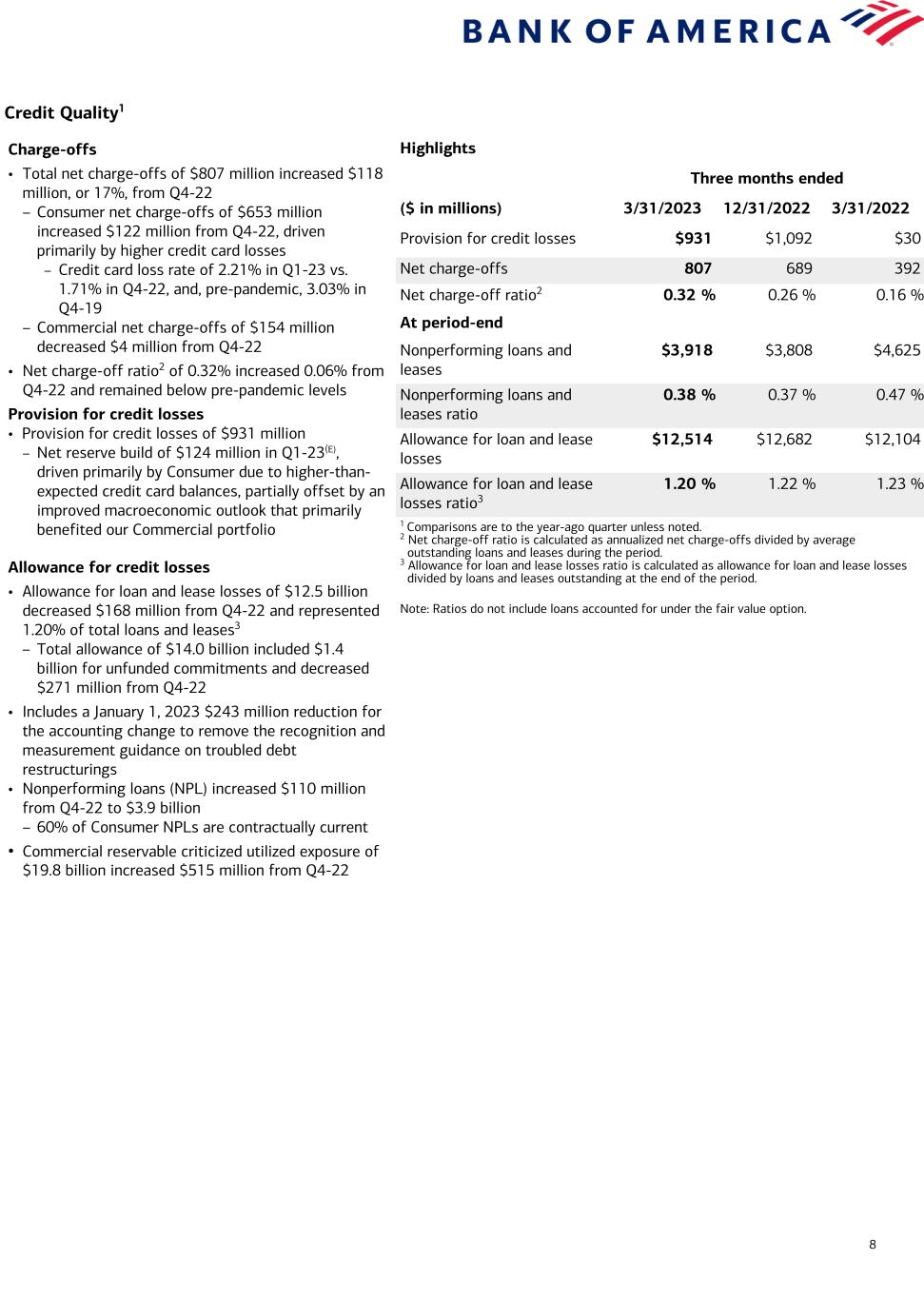

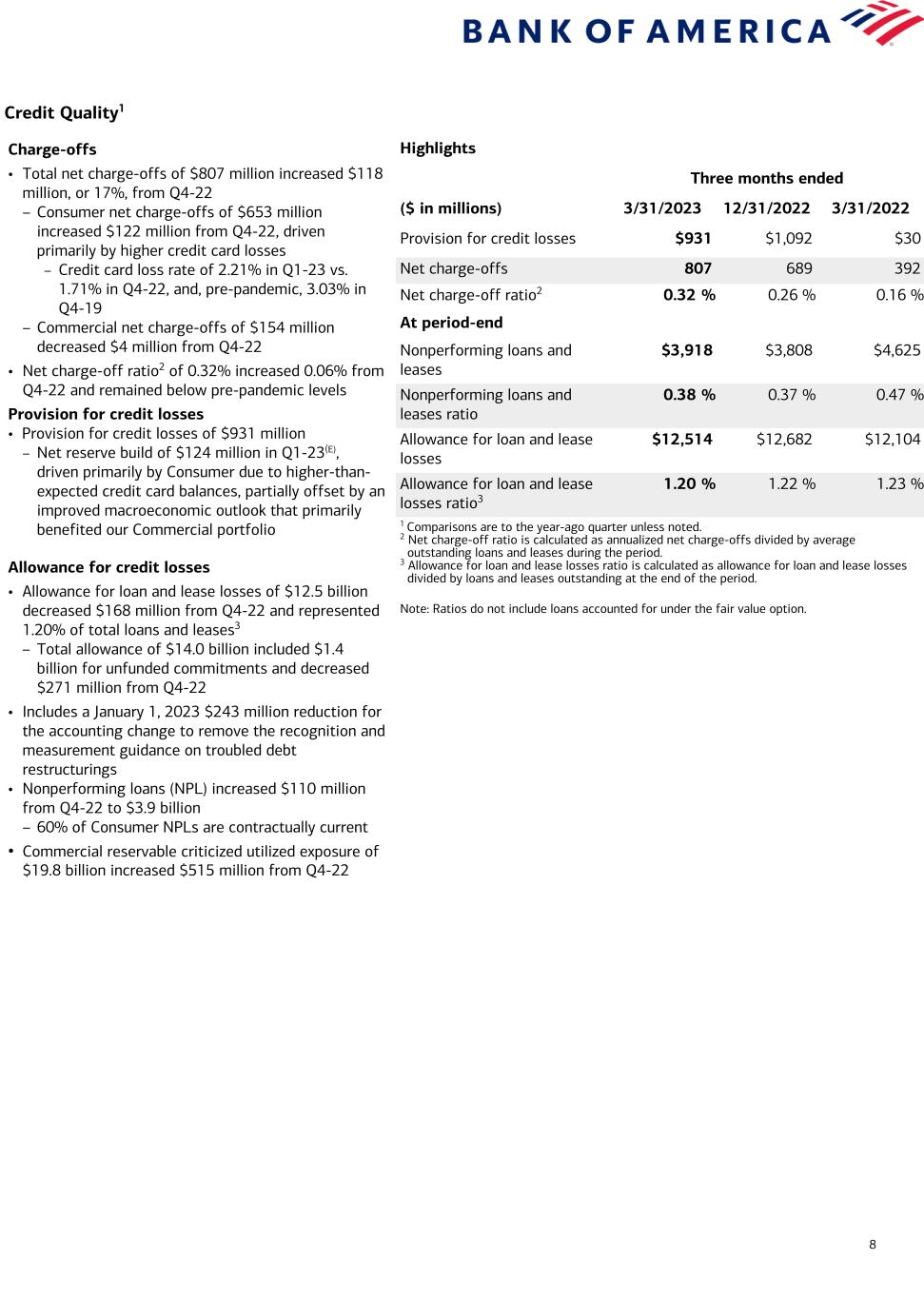

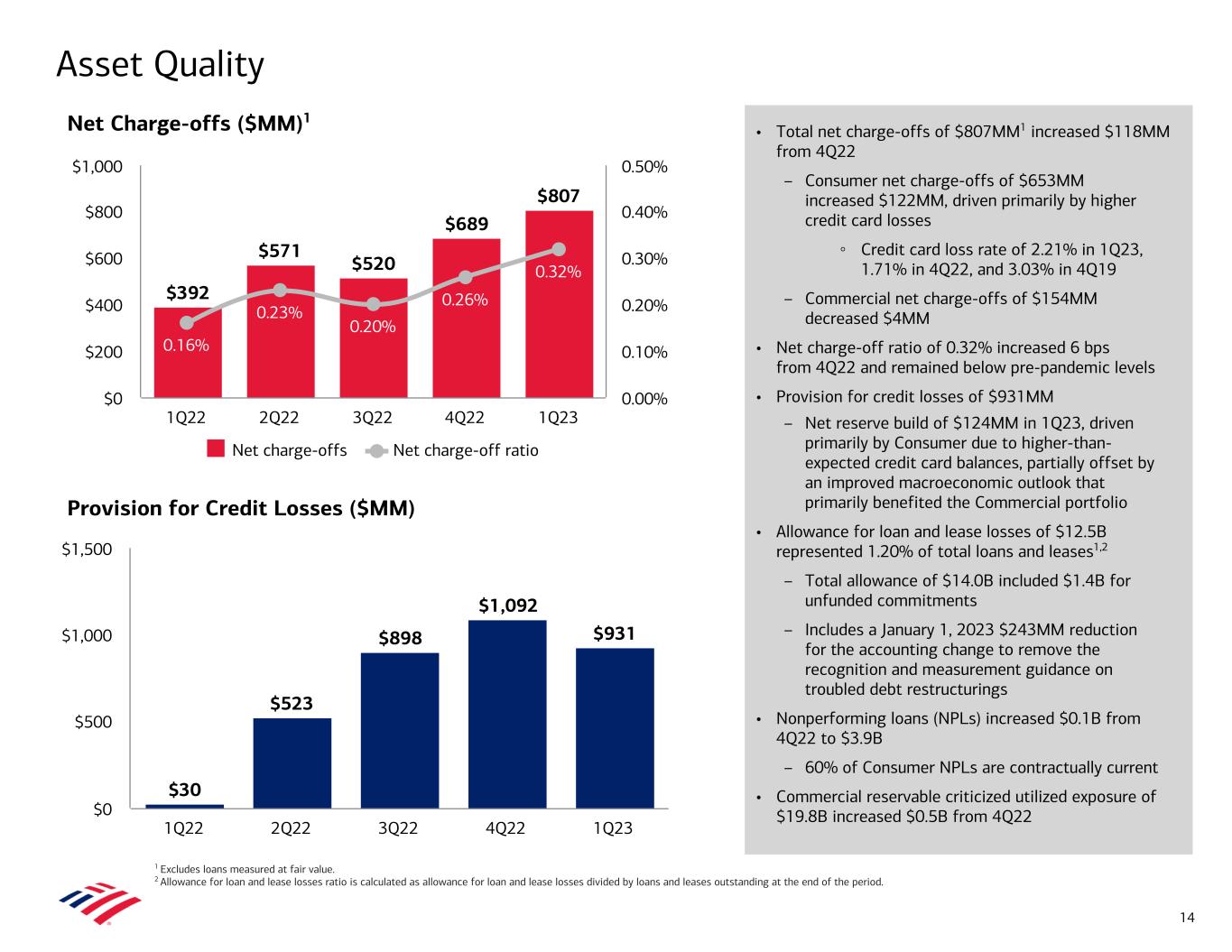

| Provision for credit losses | 931 | 1,092 | 898 | 523 | 30 | ||||||||||||||||||||||||

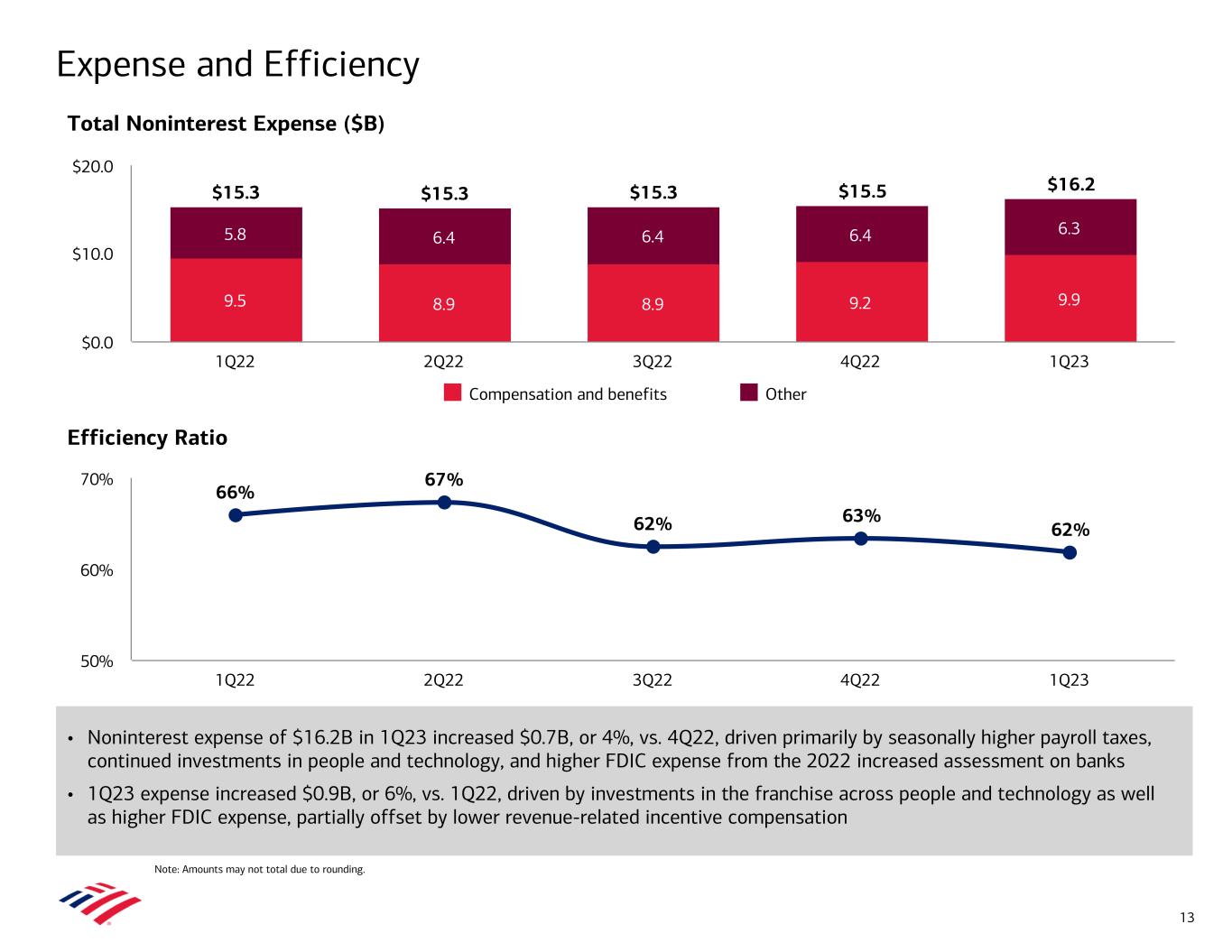

| Noninterest expense | 16,238 | 15,543 | 15,303 | 15,273 | 15,319 | ||||||||||||||||||||||||

| Income before income taxes | 9,089 | 7,897 | 8,301 | 6,892 | 7,879 | ||||||||||||||||||||||||

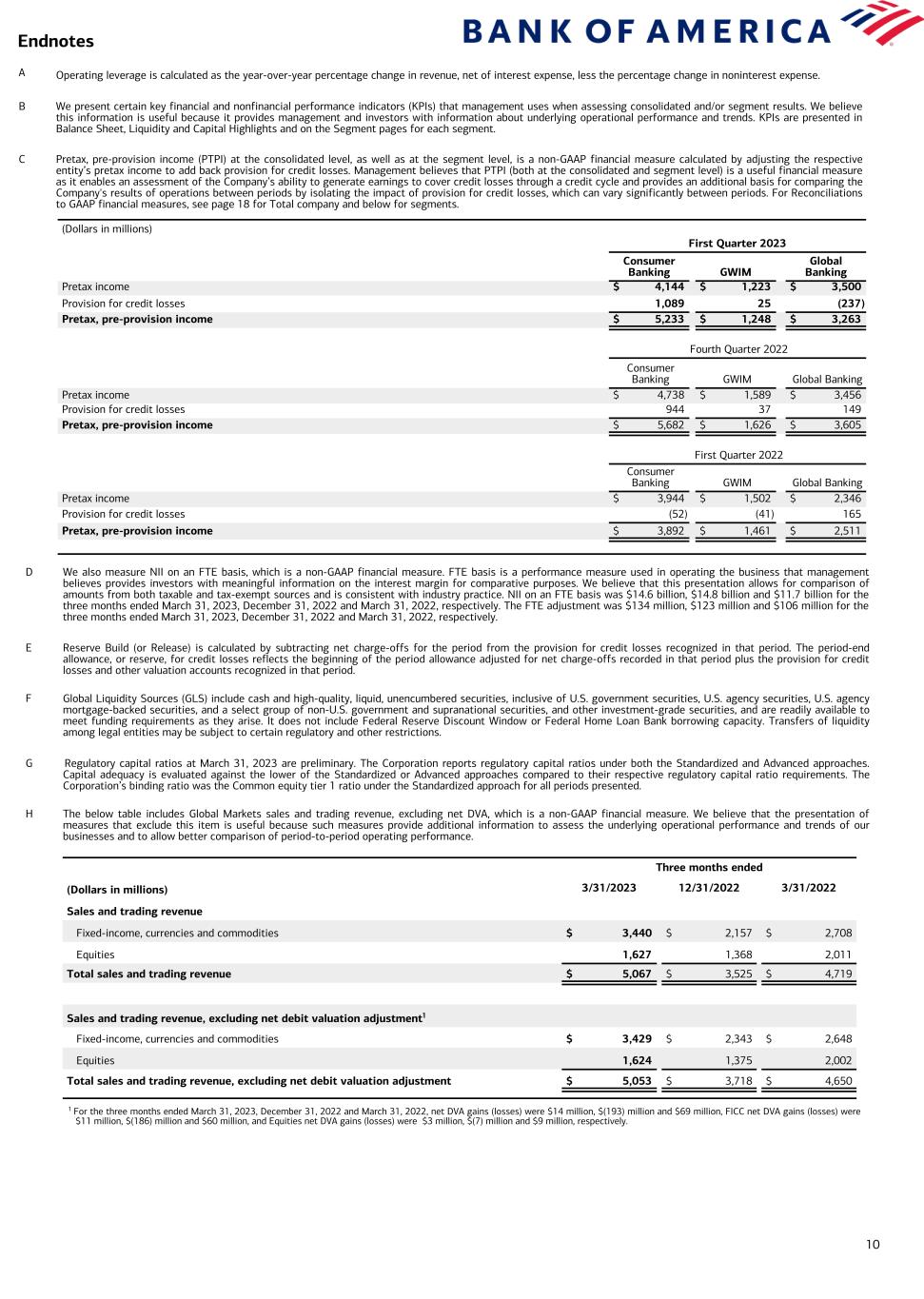

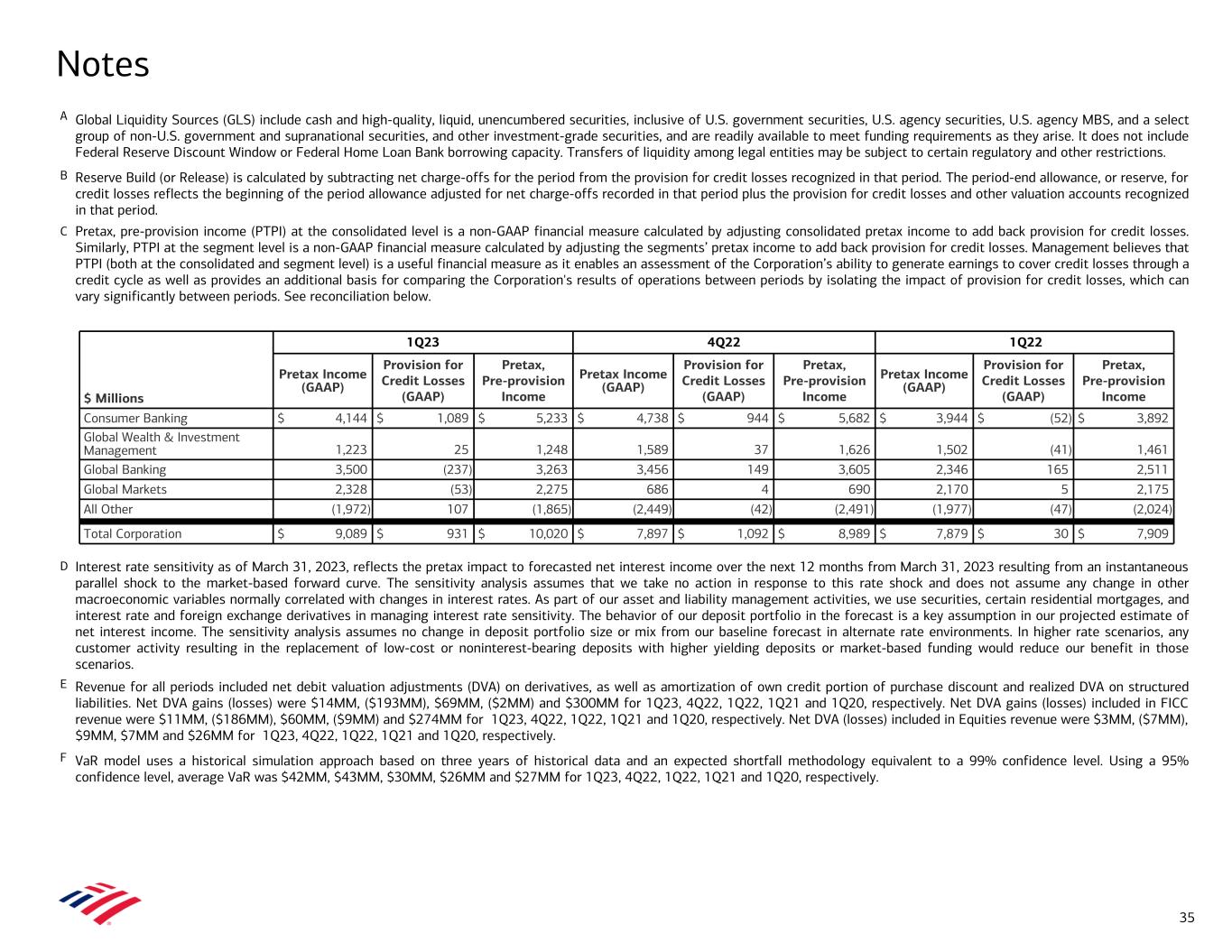

Pretax, pre-provision income (1) | 10,020 | 8,989 | 9,199 | 7,415 | 7,909 | ||||||||||||||||||||||||

| Income tax expense | 928 | 765 | 1,219 | 645 | 812 | ||||||||||||||||||||||||

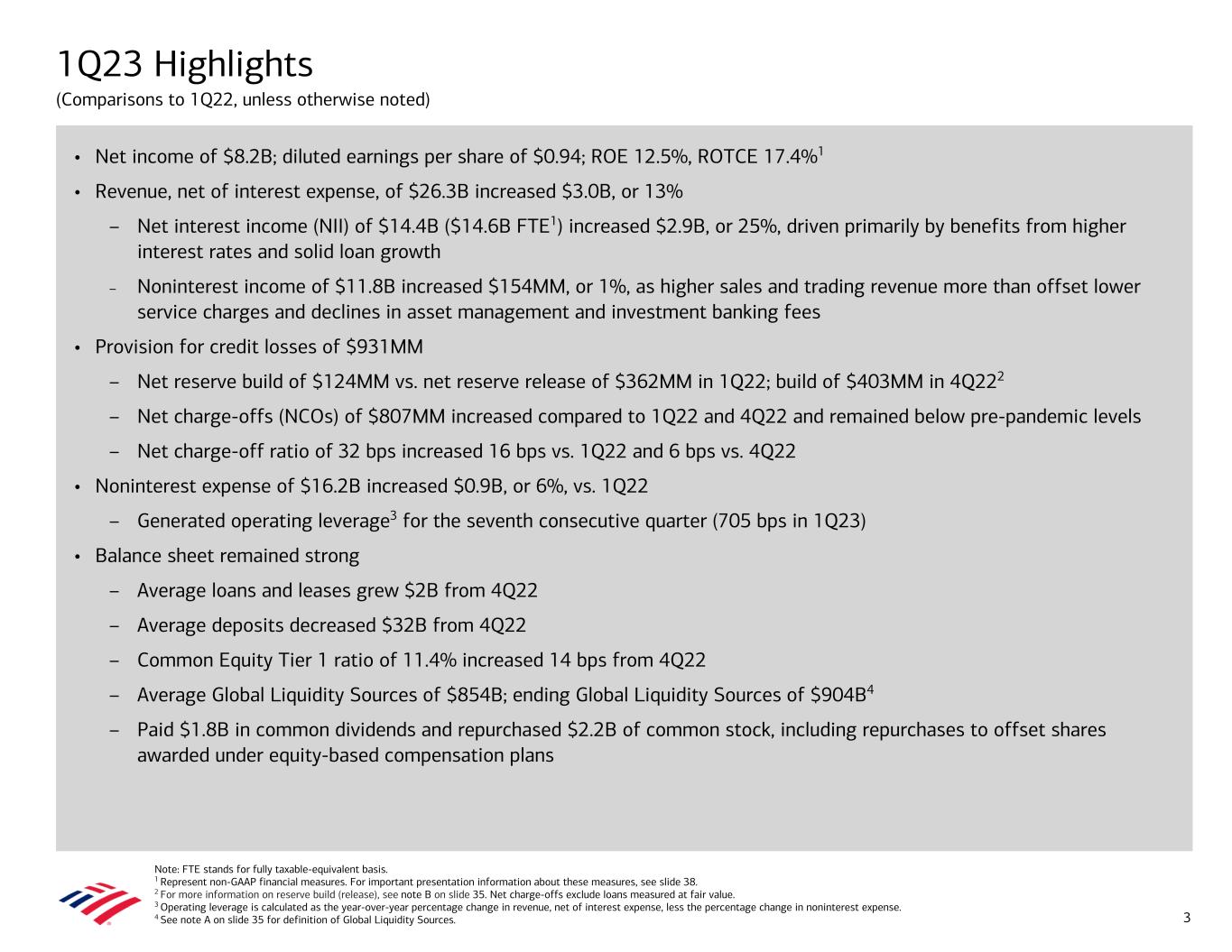

| Net income | 8,161 | 7,132 | 7,082 | 6,247 | 7,067 | ||||||||||||||||||||||||

| Preferred stock dividends and other | 505 | 228 | 503 | 315 | 467 | ||||||||||||||||||||||||

| Net income applicable to common shareholders | 7,656 | 6,904 | 6,579 | 5,932 | 6,600 | ||||||||||||||||||||||||

| Diluted earnings per common share | 0.94 | 0.85 | 0.81 | 0.73 | 0.80 | ||||||||||||||||||||||||

| Average diluted common shares issued and outstanding | 8,182.3 | 8,155.7 | 8,160.8 | 8,163.1 | 8,202.1 | ||||||||||||||||||||||||

| Dividends paid per common share | $ | 0.22 | $ | 0.22 | $ | 0.22 | $ | 0.21 | $ | 0.21 | |||||||||||||||||||

| Performance ratios | |||||||||||||||||||||||||||||

| Return on average assets | 1.07 | % | 0.92 | % | 0.90 | % | 0.79 | % | 0.89 | % | |||||||||||||||||||

| Return on average common shareholders’ equity | 12.48 | 11.24 | 10.79 | 9.93 | 11.02 | ||||||||||||||||||||||||

| Return on average shareholders’ equity | 11.94 | 10.38 | 10.37 | 9.34 | 10.64 | ||||||||||||||||||||||||

Return on average tangible common shareholders’ equity (2) | 17.38 | 15.79 | 15.21 | 14.05 | 15.51 | ||||||||||||||||||||||||

Return on average tangible shareholders’ equity (2) | 15.98 | 13.98 | 13.99 | 12.66 | 14.40 | ||||||||||||||||||||||||

| Efficiency ratio | 61.84 | 63.36 | 62.45 | 67.32 | 65.95 | ||||||||||||||||||||||||

| At period end | |||||||||||||||||||||||||||||

| Book value per share of common stock | $ | 31.58 | $ | 30.61 | $ | 29.96 | $ | 29.87 | $ | 29.70 | |||||||||||||||||||

Tangible book value per share of common stock (2) | 22.78 | 21.83 | 21.21 | 21.13 | 20.99 | ||||||||||||||||||||||||

| Market capitalization | 228,012 | 264,853 | 242,338 | 250,136 | 332,320 | ||||||||||||||||||||||||

| Number of financial centers - U.S. | 3,892 | 3,913 | 3,932 | 3,984 | 4,056 | ||||||||||||||||||||||||

| Number of branded ATMs - U.S. | 15,407 | 15,528 | 15,572 | 15,730 | 15,959 | ||||||||||||||||||||||||

| Headcount | 217,059 | 216,823 | 213,270 | 209,824 | 208,139 | ||||||||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 2 | ||||

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||

| Consolidated Statement of Income | |||||||||||||||||||||||||||||

| (In millions, except per share information) | |||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

| Net interest income | |||||||||||||||||||||||||||||

| Interest income | $ | 28,655 | $ | 25,075 | $ | 19,621 | $ | 14,975 | $ | 12,894 | |||||||||||||||||||

| Interest expense | 14,207 | 10,394 | 5,856 | 2,531 | 1,322 | ||||||||||||||||||||||||

| Net interest income | 14,448 | 14,681 | 13,765 | 12,444 | 11,572 | ||||||||||||||||||||||||

| Noninterest income | |||||||||||||||||||||||||||||

| Fees and commissions | 7,894 | 7,735 | 8,001 | 8,491 | 8,985 | ||||||||||||||||||||||||

| Market making and similar activities | 4,712 | 3,052 | 3,068 | 2,717 | 3,238 | ||||||||||||||||||||||||

| Other income (loss) | (796) | (936) | (332) | (964) | (567) | ||||||||||||||||||||||||

| Total noninterest income | 11,810 | 9,851 | 10,737 | 10,244 | 11,656 | ||||||||||||||||||||||||

| Total revenue, net of interest expense | 26,258 | 24,532 | 24,502 | 22,688 | 23,228 | ||||||||||||||||||||||||

| Provision for credit losses | 931 | 1,092 | 898 | 523 | 30 | ||||||||||||||||||||||||

| Noninterest expense | |||||||||||||||||||||||||||||

| Compensation and benefits | 9,918 | 9,161 | 8,887 | 8,917 | 9,482 | ||||||||||||||||||||||||

| Occupancy and equipment | 1,799 | 1,786 | 1,777 | 1,748 | 1,760 | ||||||||||||||||||||||||

| Information processing and communications | 1,697 | 1,658 | 1,546 | 1,535 | 1,540 | ||||||||||||||||||||||||

| Product delivery and transaction related | 890 | 904 | 892 | 924 | 933 | ||||||||||||||||||||||||

| Professional fees | 537 | 649 | 525 | 518 | 450 | ||||||||||||||||||||||||

| Marketing | 458 | 460 | 505 | 463 | 397 | ||||||||||||||||||||||||

| Other general operating | 939 | 925 | 1,171 | 1,168 | 757 | ||||||||||||||||||||||||

| Total noninterest expense | 16,238 | 15,543 | 15,303 | 15,273 | 15,319 | ||||||||||||||||||||||||

| Income before income taxes | 9,089 | 7,897 | 8,301 | 6,892 | 7,879 | ||||||||||||||||||||||||

| Income tax expense | 928 | 765 | 1,219 | 645 | 812 | ||||||||||||||||||||||||

| Net income | $ | 8,161 | $ | 7,132 | $ | 7,082 | $ | 6,247 | $ | 7,067 | |||||||||||||||||||

| Preferred stock dividends and other | 505 | 228 | 503 | 315 | 467 | ||||||||||||||||||||||||

| Net income applicable to common shareholders | $ | 7,656 | $ | 6,904 | $ | 6,579 | $ | 5,932 | $ | 6,600 | |||||||||||||||||||

| Per common share information | |||||||||||||||||||||||||||||

| Earnings | $ | 0.95 | $ | 0.85 | $ | 0.81 | $ | 0.73 | $ | 0.81 | |||||||||||||||||||

| Diluted earnings | 0.94 | 0.85 | 0.81 | 0.73 | 0.80 | ||||||||||||||||||||||||

| Average common shares issued and outstanding | 8,065.9 | 8,088.3 | 8,107.7 | 8,121.6 | 8,136.8 | ||||||||||||||||||||||||

| Average diluted common shares issued and outstanding | 8,182.3 | 8,155.7 | 8,160.8 | 8,163.1 | 8,202.1 | ||||||||||||||||||||||||

| Consolidated Statement of Comprehensive Income | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

| Net income | $ | 8,161 | $ | 7,132 | $ | 7,082 | $ | 6,247 | $ | 7,067 | |||||||||||||||||||

| Other comprehensive income (loss), net-of-tax: | |||||||||||||||||||||||||||||

| Net change in debt securities | 555 | 353 | (1,112) | (1,822) | (3,447) | ||||||||||||||||||||||||

| Net change in debit valuation adjustments | 10 | (543) | 462 | 575 | 261 | ||||||||||||||||||||||||

| Net change in derivatives | 2,042 | 835 | (3,703) | (2,008) | (5,179) | ||||||||||||||||||||||||

| Employee benefit plan adjustments | 10 | (764) | 37 | 36 | 24 | ||||||||||||||||||||||||

| Net change in foreign currency translation adjustments | 12 | (10) | (37) | (38) | 28 | ||||||||||||||||||||||||

| Other comprehensive income (loss) | 2,629 | (129) | (4,353) | (3,257) | (8,313) | ||||||||||||||||||||||||

| Comprehensive income (loss) | $ | 10,790 | $ | 7,003 | $ | 2,729 | $ | 2,990 | $ | (1,246) | |||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 3 | ||||

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||

| Net Interest Income and Noninterest Income | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

| Net interest income | |||||||||||||||||||||||||||||

| Interest income | |||||||||||||||||||||||||||||

| Loans and leases | $ | 13,097 | $ | 12,114 | $ | 10,231 | $ | 8,222 | $ | 7,352 | |||||||||||||||||||

| Debt securities | 5,460 | 5,016 | 4,239 | 4,049 | 3,823 | ||||||||||||||||||||||||

| Federal funds sold and securities borrowed or purchased under agreements to resell | 3,712 | 2,725 | 1,446 | 396 | (7) | ||||||||||||||||||||||||

| Trading account assets | 2,028 | 1,768 | 1,449 | 1,223 | 1,081 | ||||||||||||||||||||||||

| Other interest income | 4,358 | 3,452 | 2,256 | 1,085 | 645 | ||||||||||||||||||||||||

| Total interest income | 28,655 | 25,075 | 19,621 | 14,975 | 12,894 | ||||||||||||||||||||||||

| Interest expense | |||||||||||||||||||||||||||||

| Deposits | 4,314 | 2,999 | 1,235 | 320 | 164 | ||||||||||||||||||||||||

| Short-term borrowings | 6,180 | 4,273 | 2,264 | 553 | (112) | ||||||||||||||||||||||||

| Trading account liabilities | 504 | 421 | 383 | 370 | 364 | ||||||||||||||||||||||||

| Long-term debt | 3,209 | 2,701 | 1,974 | 1,288 | 906 | ||||||||||||||||||||||||

| Total interest expense | 14,207 | 10,394 | 5,856 | 2,531 | 1,322 | ||||||||||||||||||||||||

| Net interest income | $ | 14,448 | $ | 14,681 | $ | 13,765 | $ | 12,444 | $ | 11,572 | |||||||||||||||||||

| Noninterest income | |||||||||||||||||||||||||||||

| Fees and commissions | |||||||||||||||||||||||||||||

| Card income | |||||||||||||||||||||||||||||

Interchange fees (1) | $ | 956 | $ | 1,029 | $ | 1,060 | $ | 1,072 | $ | 935 | |||||||||||||||||||

| Other card income | 513 | 523 | 513 | 483 | 468 | ||||||||||||||||||||||||

| Total card income | 1,469 | 1,552 | 1,573 | 1,555 | 1,403 | ||||||||||||||||||||||||

| Service charges | |||||||||||||||||||||||||||||

| Deposit-related fees | 1,097 | 1,081 | 1,162 | 1,417 | 1,530 | ||||||||||||||||||||||||

| Lending-related fees | 313 | 308 | 304 | 300 | 303 | ||||||||||||||||||||||||

| Total service charges | 1,410 | 1,389 | 1,466 | 1,717 | 1,833 | ||||||||||||||||||||||||

| Investment and brokerage services | |||||||||||||||||||||||||||||

| Asset management fees | 2,918 | 2,844 | 2,920 | 3,102 | 3,286 | ||||||||||||||||||||||||

| Brokerage fees | 934 | 879 | 875 | 989 | 1,006 | ||||||||||||||||||||||||

| Total investment and brokerage services | 3,852 | 3,723 | 3,795 | 4,091 | 4,292 | ||||||||||||||||||||||||

| Investment banking fees | |||||||||||||||||||||||||||||

| Underwriting income | 569 | 411 | 452 | 435 | 672 | ||||||||||||||||||||||||

| Syndication fees | 231 | 174 | 283 | 301 | 312 | ||||||||||||||||||||||||

| Financial advisory services | 363 | 486 | 432 | 392 | 473 | ||||||||||||||||||||||||

| Total investment banking fees | 1,163 | 1,071 | 1,167 | 1,128 | 1,457 | ||||||||||||||||||||||||

| Total fees and commissions | 7,894 | 7,735 | 8,001 | 8,491 | 8,985 | ||||||||||||||||||||||||

| Market making and similar activities | 4,712 | 3,052 | 3,068 | 2,717 | 3,238 | ||||||||||||||||||||||||

| Other income (loss) | (796) | (936) | (332) | (964) | (567) | ||||||||||||||||||||||||

| Total noninterest income | $ | 11,810 | $ | 9,851 | $ | 10,737 | $ | 10,244 | $ | 11,656 | |||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 4 | ||||

| Bank of America Corporation and Subsidiaries | ||||||||||||||||||||

| Consolidated Balance Sheet | ||||||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||

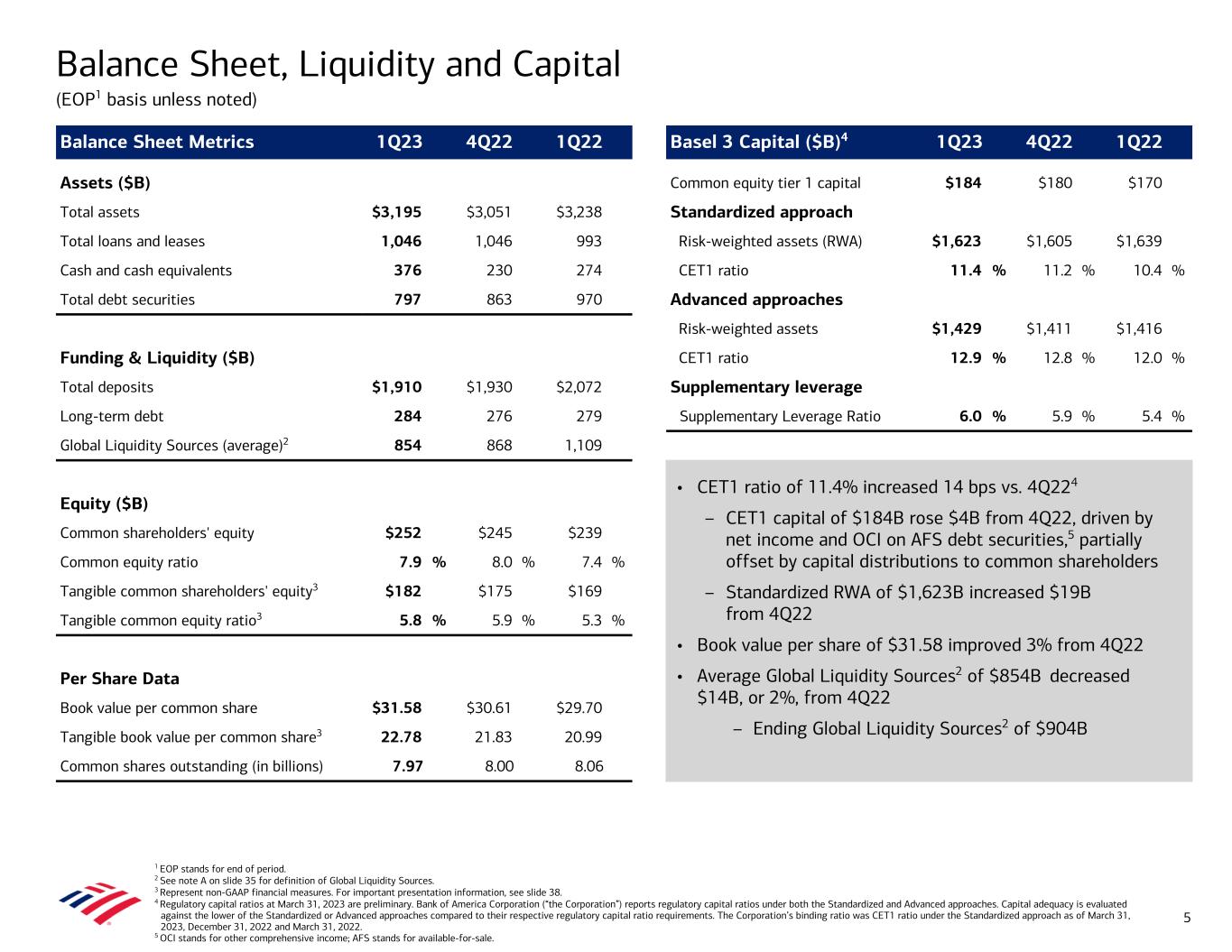

| March 31 2023 | December 31 2022 | March 31 2022 | ||||||||||||||||||

| Assets | ||||||||||||||||||||

| Cash and due from banks | $ | 29,327 | $ | 30,334 | $ | 29,769 | ||||||||||||||

| Interest-bearing deposits with the Federal Reserve, non-U.S. central banks and other banks | 346,891 | 199,869 | 244,165 | |||||||||||||||||

| Cash and cash equivalents | 376,218 | 230,203 | 273,934 | |||||||||||||||||

| Time deposits placed and other short-term investments | 11,637 | 7,259 | 5,645 | |||||||||||||||||

| Federal funds sold and securities borrowed or purchased under agreements to resell | 298,078 | 267,574 | 302,108 | |||||||||||||||||

| Trading account assets | 314,978 | 296,108 | 313,400 | |||||||||||||||||

| Derivative assets | 40,947 | 48,642 | 48,231 | |||||||||||||||||

| Debt securities: | ||||||||||||||||||||

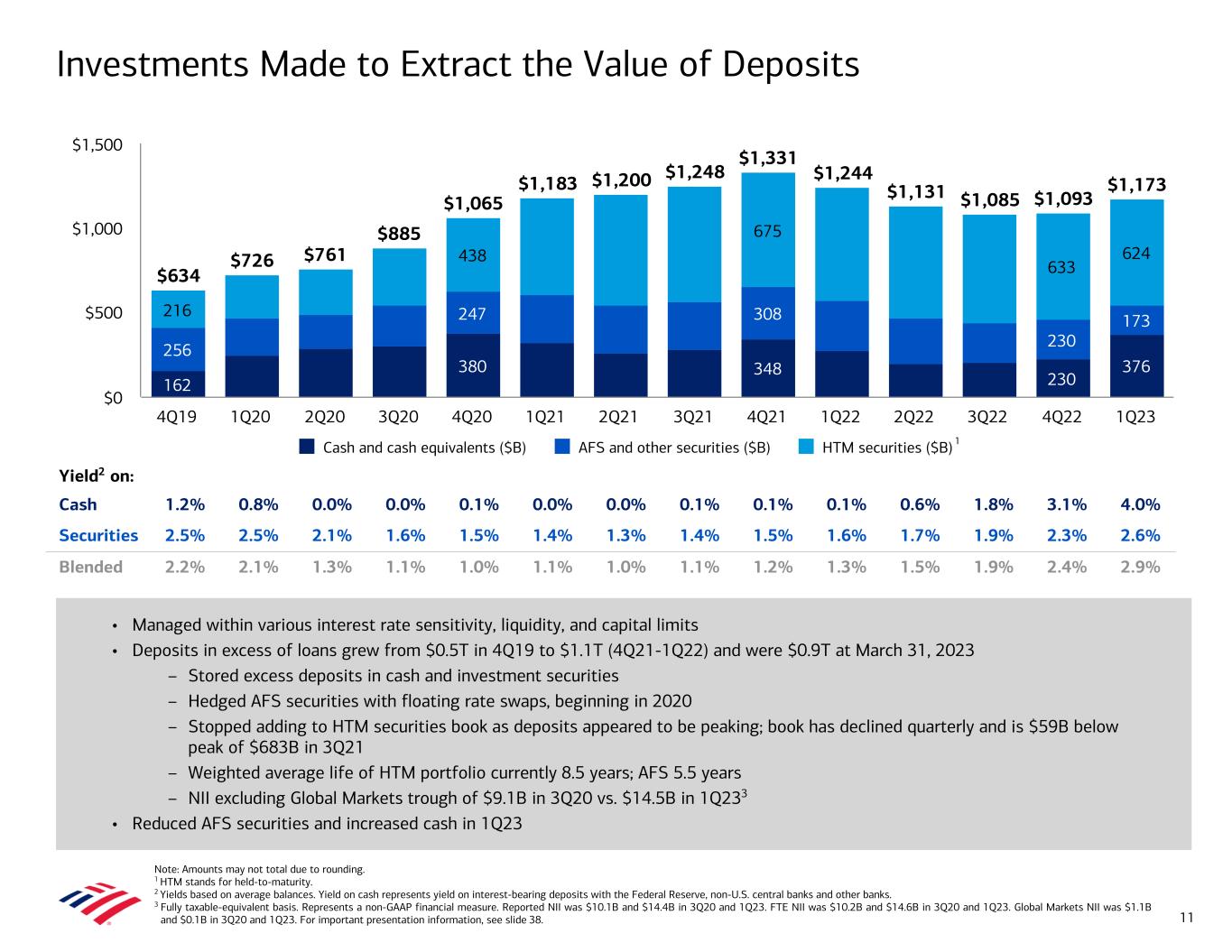

| Carried at fair value | 172,510 | 229,994 | 297,700 | |||||||||||||||||

| Held-to-maturity, at cost | 624,495 | 632,825 | 672,180 | |||||||||||||||||

| Total debt securities | 797,005 | 862,819 | 969,880 | |||||||||||||||||

| Loans and leases | 1,046,406 | 1,045,747 | 993,145 | |||||||||||||||||

| Allowance for loan and lease losses | (12,514) | (12,682) | (12,104) | |||||||||||||||||

| Loans and leases, net of allowance | 1,033,892 | 1,033,065 | 981,041 | |||||||||||||||||

| Premises and equipment, net | 11,708 | 11,510 | 10,820 | |||||||||||||||||

| Goodwill | 69,022 | 69,022 | 69,022 | |||||||||||||||||

| Loans held-for-sale | 6,809 | 6,871 | 10,270 | |||||||||||||||||

| Customer and other receivables | 79,902 | 67,543 | 83,622 | |||||||||||||||||

| Other assets | 154,461 | 150,759 | 170,250 | |||||||||||||||||

| Total assets | $ | 3,194,657 | $ | 3,051,375 | $ | 3,238,223 | ||||||||||||||

| Liabilities | ||||||||||||||||||||

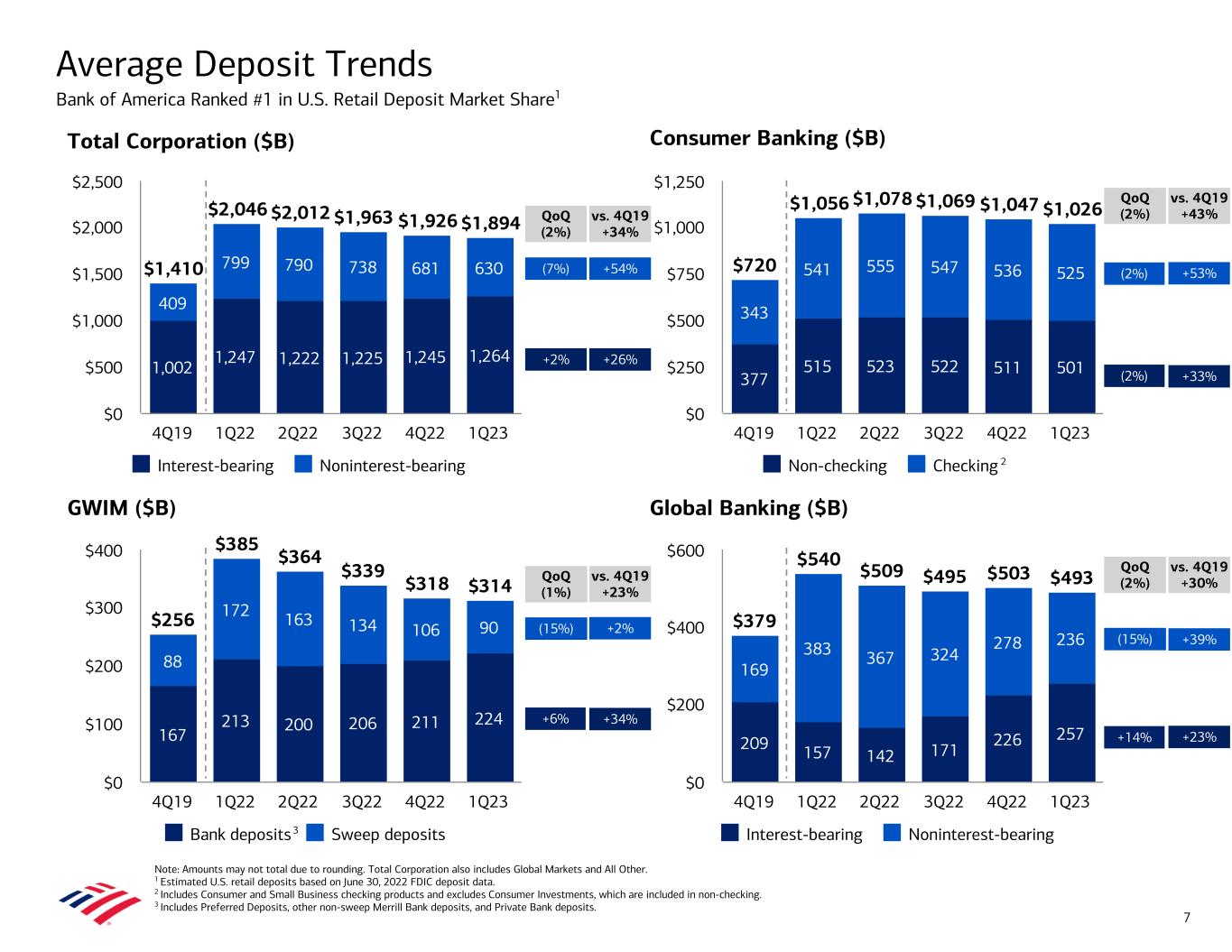

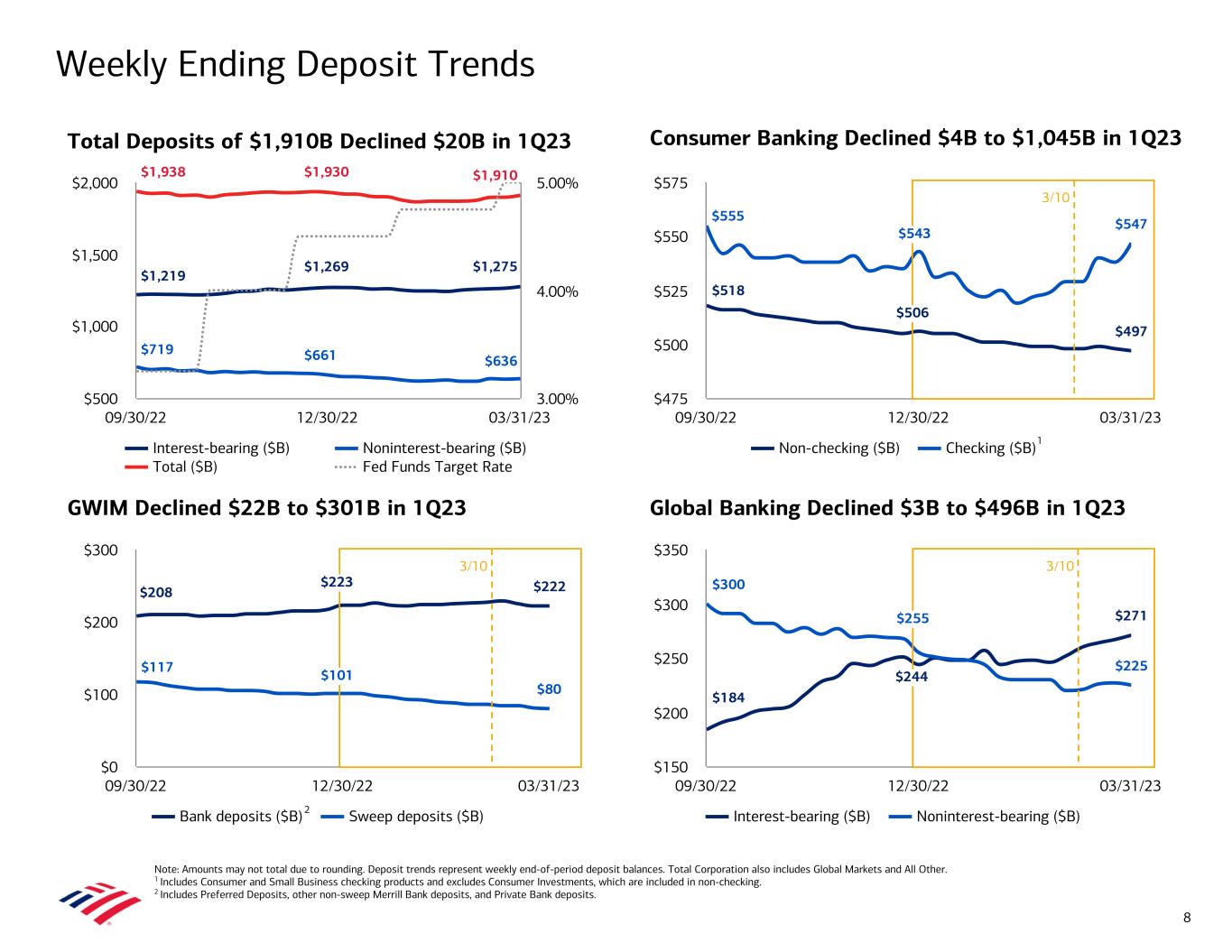

| Deposits in U.S. offices: | ||||||||||||||||||||

| Noninterest-bearing | $ | 617,922 | $ | 640,745 | $ | 787,045 | ||||||||||||||

| Interest-bearing | 1,183,106 | 1,182,590 | 1,178,451 | |||||||||||||||||

| Deposits in non-U.S. offices: | ||||||||||||||||||||

| Noninterest-bearing | 17,686 | 20,480 | 27,589 | |||||||||||||||||

| Interest-bearing | 91,688 | 86,526 | 79,324 | |||||||||||||||||

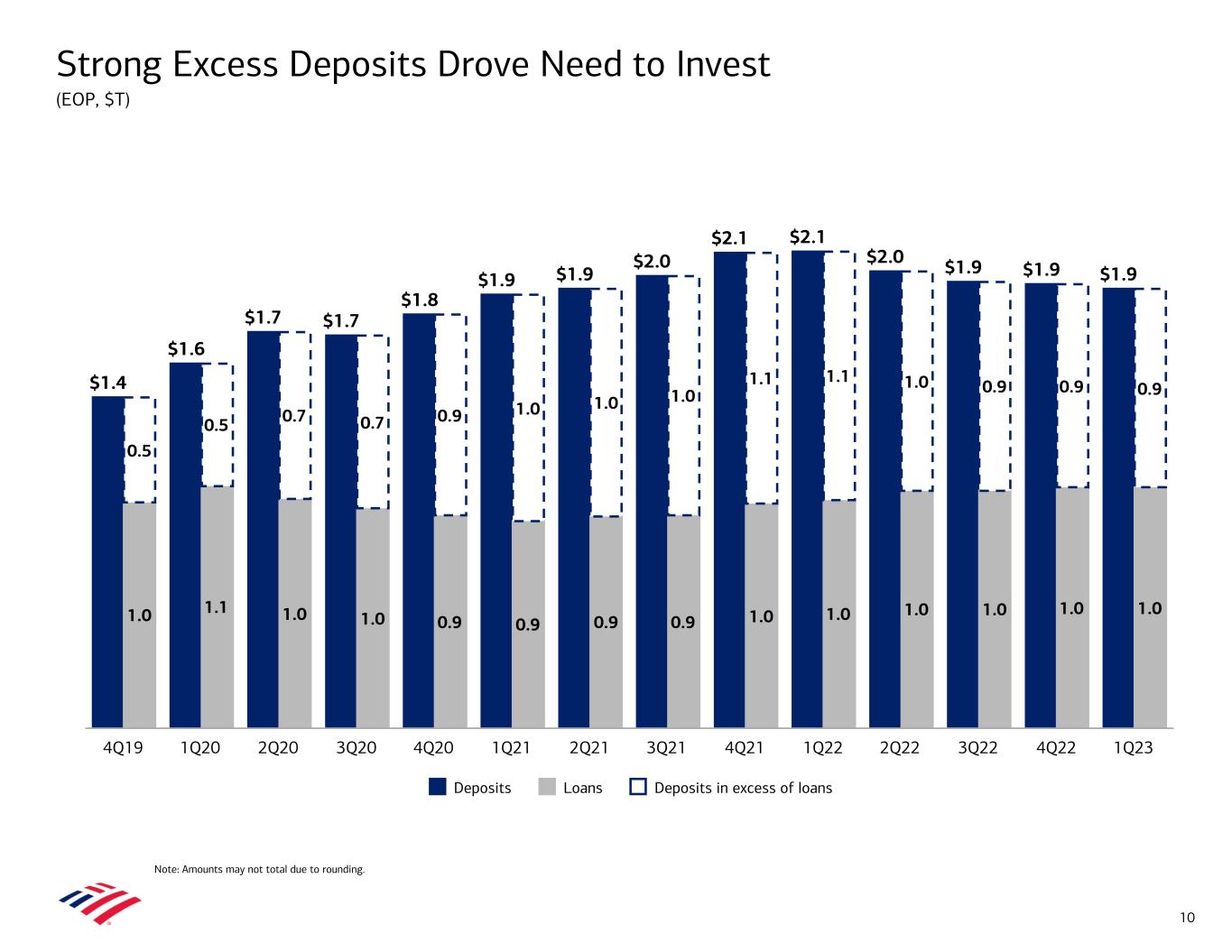

| Total deposits | 1,910,402 | 1,930,341 | 2,072,409 | |||||||||||||||||

| Federal funds purchased and securities loaned or sold under agreements to repurchase | 314,380 | 195,635 | 214,685 | |||||||||||||||||

| Trading account liabilities | 92,452 | 80,399 | 117,122 | |||||||||||||||||

| Derivative liabilities | 40,169 | 44,816 | 44,266 | |||||||||||||||||

| Short-term borrowings | 56,564 | 26,932 | 24,789 | |||||||||||||||||

| Accrued expenses and other liabilities | 216,621 | 224,073 | 219,625 | |||||||||||||||||

| Long-term debt | 283,873 | 275,982 | 278,710 | |||||||||||||||||

| Total liabilities | 2,914,461 | 2,778,178 | 2,971,606 | |||||||||||||||||

| Shareholders’ equity | ||||||||||||||||||||

Preferred stock, $0.01 par value; authorized – 100,000,000 shares; issued and outstanding – 4,088,099, 4,088,101 and 4,037,686 shares | 28,397 | 28,397 | 27,137 | |||||||||||||||||

Common stock and additional paid-in capital, $0.01 par value; authorized – 12,800,000,000 shares; issued and outstanding – 7,972,438,148, 7,996,777,943 and 8,062,102,236 shares | 57,264 | 58,953 | 59,968 | |||||||||||||||||

| Retained earnings | 213,062 | 207,003 | 192,929 | |||||||||||||||||

| Accumulated other comprehensive income (loss) | (18,527) | (21,156) | (13,417) | |||||||||||||||||

| Total shareholders’ equity | 280,196 | 273,197 | 266,617 | |||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 3,194,657 | $ | 3,051,375 | $ | 3,238,223 | ||||||||||||||

| Assets of consolidated variable interest entities included in total assets above (isolated to settle the liabilities of the variable interest entities) | ||||||||||||||||||||

| Trading account assets | $ | 4,276 | $ | 2,816 | $ | 2,160 | ||||||||||||||

| Loans and leases | 15,754 | 16,738 | 15,946 | |||||||||||||||||

| Allowance for loan and lease losses | (797) | (797) | (880) | |||||||||||||||||

| Loans and leases, net of allowance | 14,957 | 15,941 | 15,066 | |||||||||||||||||

| All other assets | 129 | 116 | 417 | |||||||||||||||||

| Total assets of consolidated variable interest entities | $ | 19,362 | $ | 18,873 | $ | 17,643 | ||||||||||||||

| Liabilities of consolidated variable interest entities included in total liabilities above | ||||||||||||||||||||

| Short-term borrowings | $ | 1,339 | $ | 42 | $ | 228 | ||||||||||||||

| Long-term debt | 4,883 | 4,581 | 3,557 | |||||||||||||||||

| All other liabilities | 7 | 13 | 6 | |||||||||||||||||

| Total liabilities of consolidated variable interest entities | $ | 6,229 | $ | 4,636 | $ | 3,791 | ||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 5 | ||||

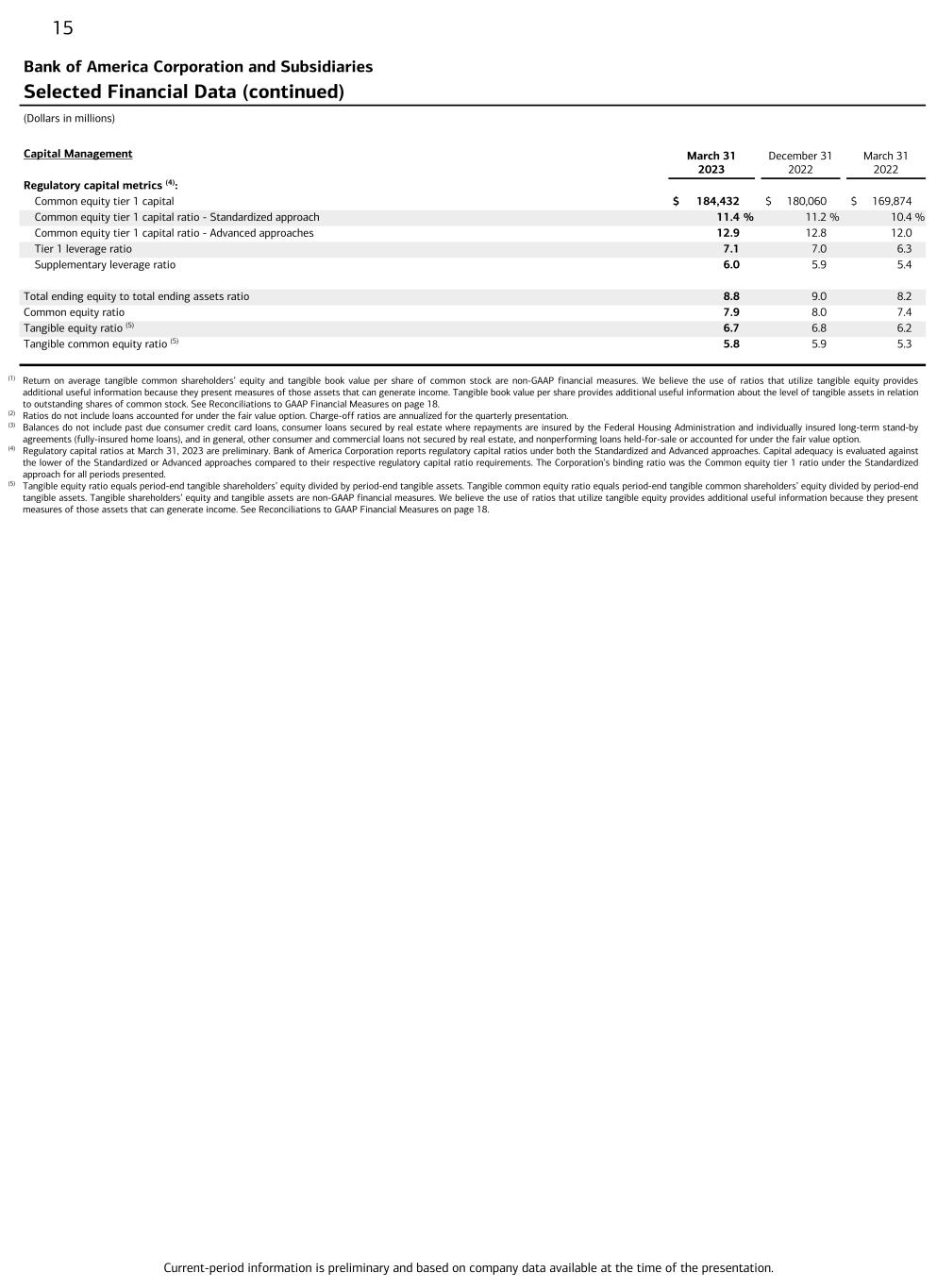

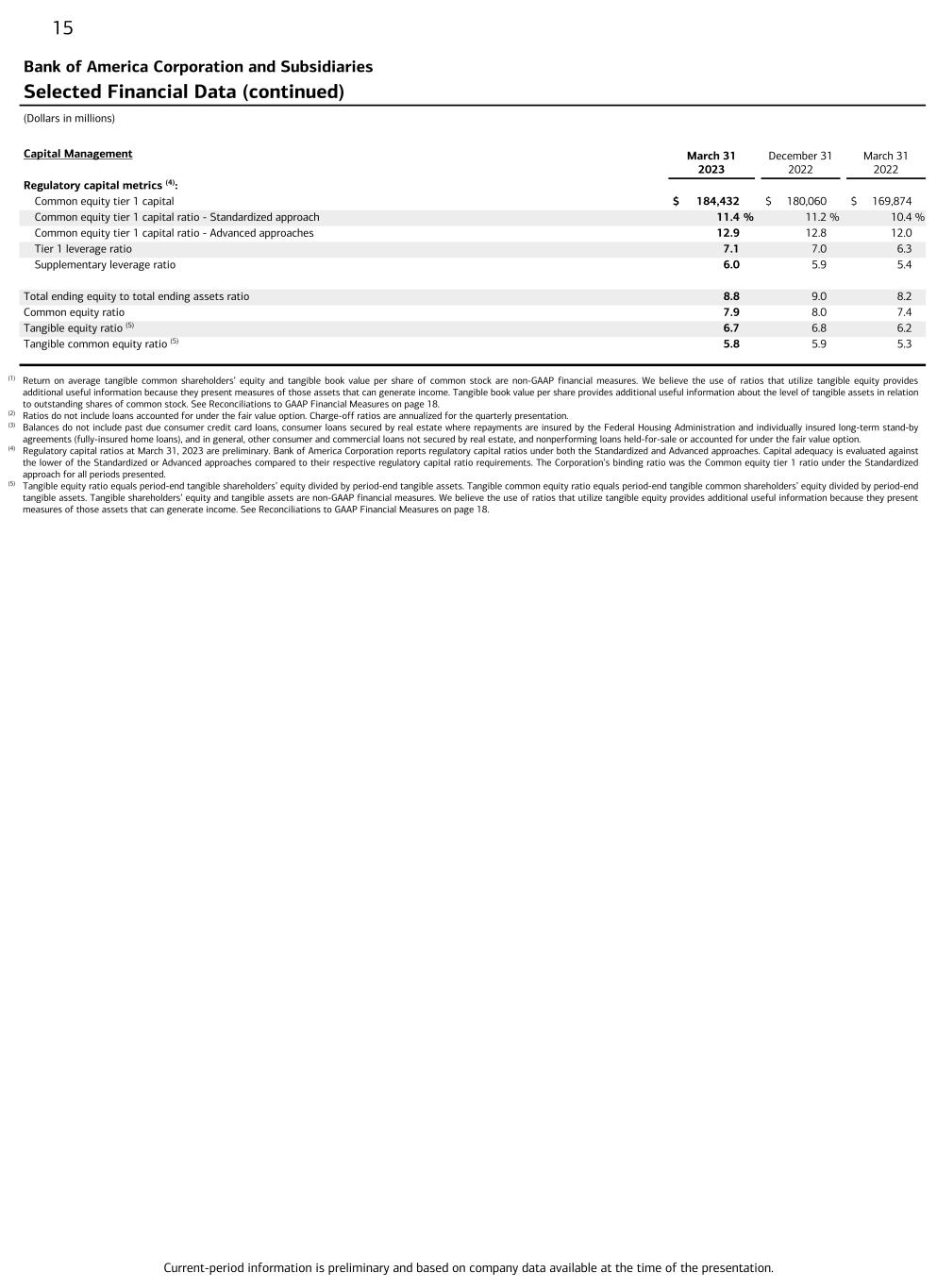

| Bank of America Corporation and Subsidiaries | |||||||||||||||||

| Capital Management | |||||||||||||||||

| (Dollars in millions) | |||||||||||||||||

| March 31 2023 | December 31 2022 | March 31 2022 | |||||||||||||||

Risk-based capital metrics (1): | |||||||||||||||||

| Standardized Approach | |||||||||||||||||

| Common equity tier 1 capital | $ | 184,432 | $ | 180,060 | $ | 169,874 | |||||||||||

| Tier 1 capital | 212,825 | 208,446 | 197,007 | ||||||||||||||

| Total capital | 242,604 | 238,773 | 229,186 | ||||||||||||||

| Risk-weighted assets | 1,623,377 | 1,604,870 | 1,638,958 | ||||||||||||||

| Common equity tier 1 capital ratio | 11.4 | % | 11.2 | % | 10.4 | % | |||||||||||

| Tier 1 capital ratio | 13.1 | 13.0 | 12.0 | ||||||||||||||

| Total capital ratio | 14.9 | 14.9 | 14.0 | ||||||||||||||

| Advanced Approaches | |||||||||||||||||

| Common equity tier 1 capital | $ | 184,432 | $ | 180,060 | $ | 169,874 | |||||||||||

| Tier 1 capital | 212,825 | 208,446 | 197,007 | ||||||||||||||

| Total capital | 233,736 | 230,916 | 222,481 | ||||||||||||||

| Risk-weighted assets | 1,428,647 | 1,411,005 | 1,415,505 | ||||||||||||||

| Common equity tier 1 capital ratio | 12.9 | % | 12.8 | % | 12.0 | % | |||||||||||

| Tier 1 capital ratio | 14.9 | 14.8 | 13.9 | ||||||||||||||

| Total capital ratio | 16.4 | 16.4 | 15.7 | ||||||||||||||

Leverage-based metrics (1): | |||||||||||||||||

| Adjusted average assets | $ | 3,018,318 | $ | 2,997,118 | $ | 3,129,996 | |||||||||||

| Tier 1 leverage ratio | 7.1 | % | 7.0 | % | 6.3 | % | |||||||||||

| Supplementary leverage exposure | $ | 3,554,920 | $ | 3,523,484 | $ | 3,661,948 | |||||||||||

| Supplementary leverage ratio | 6.0 | % | 5.9 | % | 5.4 | % | |||||||||||

| Total ending equity to total ending assets ratio | 8.8 | 9.0 | 8.2 | ||||||||||||||

| Common equity ratio | 7.9 | 8.0 | 7.4 | ||||||||||||||

Tangible equity ratio (2) | 6.7 | 6.8 | 6.2 | ||||||||||||||

Tangible common equity ratio (2) | 5.8 | 5.9 | 5.3 | ||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 6 | ||||

| Bank of America Corporation and Subsidiaries | |||||||||||||||||

| Capital Composition under Basel 3 | |||||||||||||||||

| (Dollars in millions) | |||||||||||||||||

| March 31 2023 | December 31 2022 | March 31 2022 | |||||||||||||||

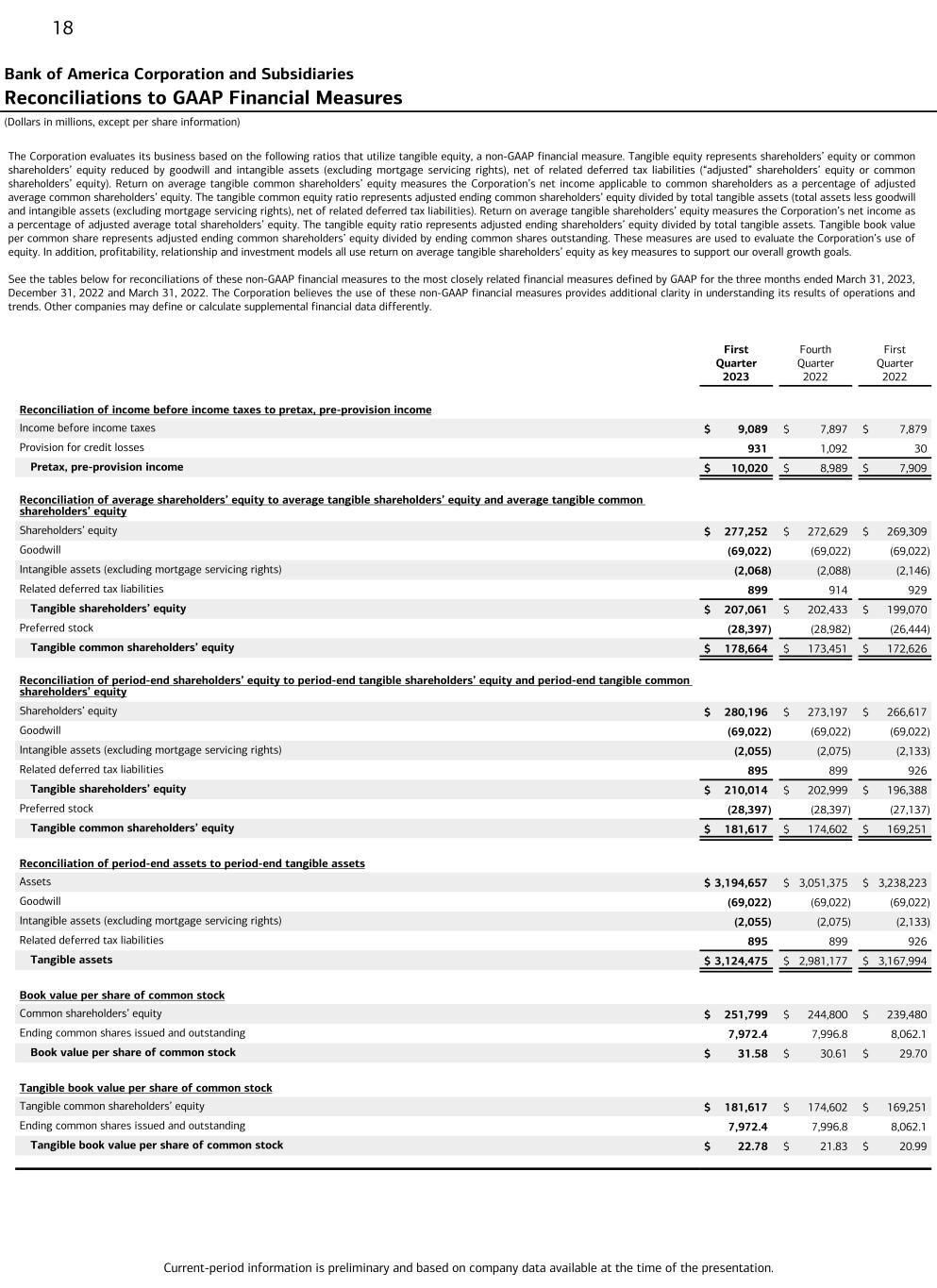

| Total common shareholders' equity | $ | 251,799 | $ | 244,800 | $ | 239,480 | |||||||||||

CECL transitional amount (1) | 1,254 | 1,881 | 1,881 | ||||||||||||||

| Goodwill, net of related deferred tax liabilities | (68,644) | (68,644) | (68,641) | ||||||||||||||

| Deferred tax assets arising from net operating loss and tax credit carryforwards | (7,835) | (7,776) | (7,843) | ||||||||||||||

| Intangibles, other than mortgage servicing rights, net of related deferred tax liabilities | (1,538) | (1,554) | (1,589) | ||||||||||||||

| Defined benefit pension plan net assets, net-of-tax | (882) | (867) | (1,248) | ||||||||||||||

| Cumulative unrealized net (gain) loss related to changes in fair value of financial liabilities attributable to own creditworthiness, net-of-tax | 485 | 496 | 1,047 | ||||||||||||||

Accumulated net (gain) loss on certain cash flow hedges (2) | 9,886 | 11,925 | 7,049 | ||||||||||||||

| Other | (93) | (201) | (262) | ||||||||||||||

| Common equity tier 1 capital | 184,432 | 180,060 | 169,874 | ||||||||||||||

| Qualifying preferred stock, net of issuance cost | 28,396 | 28,396 | 27,136 | ||||||||||||||

| Other | (3) | (10) | (3) | ||||||||||||||

| Tier 1 capital | 212,825 | 208,446 | 197,007 | ||||||||||||||

| Tier 2 capital instruments | 17,840 | 18,751 | 21,737 | ||||||||||||||

Qualifying allowance for credit losses (3) | 12,315 | 11,739 | 11,000 | ||||||||||||||

| Other | (376) | (163) | (558) | ||||||||||||||

| Total capital under the Standardized approach | 242,604 | 238,773 | 229,186 | ||||||||||||||

Adjustment in qualifying allowance for credit losses under the Advanced approaches (3) | (8,868) | (7,857) | (6,705) | ||||||||||||||

| Total capital under the Advanced approaches | $ | 233,736 | $ | 230,916 | $ | 222,481 | |||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 7 | ||||

| Bank of America Corporation and Subsidiaries | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Quarterly Average Balances and Interest Rates – Fully Taxable-equivalent Basis | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | First Quarter 2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance | Interest Income/ Expense (1) | Yield/ Rate | Average Balance | Interest Income/ Expense (1) | Yield/ Rate | Average Balance | Interest Income/ Expense (1) | Yield/ Rate | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Earning assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits with the Federal Reserve, non-U.S. central banks and other banks | $ | 202,700 | $ | 1,999 | 4.00 | % | $ | 175,595 | $ | 1,375 | 3.11 | % | $ | 244,971 | $ | 86 | 0.14 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Time deposits placed and other short-term investments | 10,581 | 108 | 4.16 | 9,558 | 74 | 3.07 | 9,253 | 12 | 0.52 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold and securities borrowed or purchased under agreements to resell | 287,532 | 3,712 | 5.24 | 289,321 | 2,725 | 3.74 | 299,404 | (7) | (0.01) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading account assets | 183,657 | 2,040 | 4.50 | 169,003 | 1,784 | 4.19 | 151,969 | 1,096 | 2.92 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt securities | 851,177 | 5,485 | 2.58 | 869,084 | 5,043 | 2.30 | 975,656 | 3,838 | 1.58 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

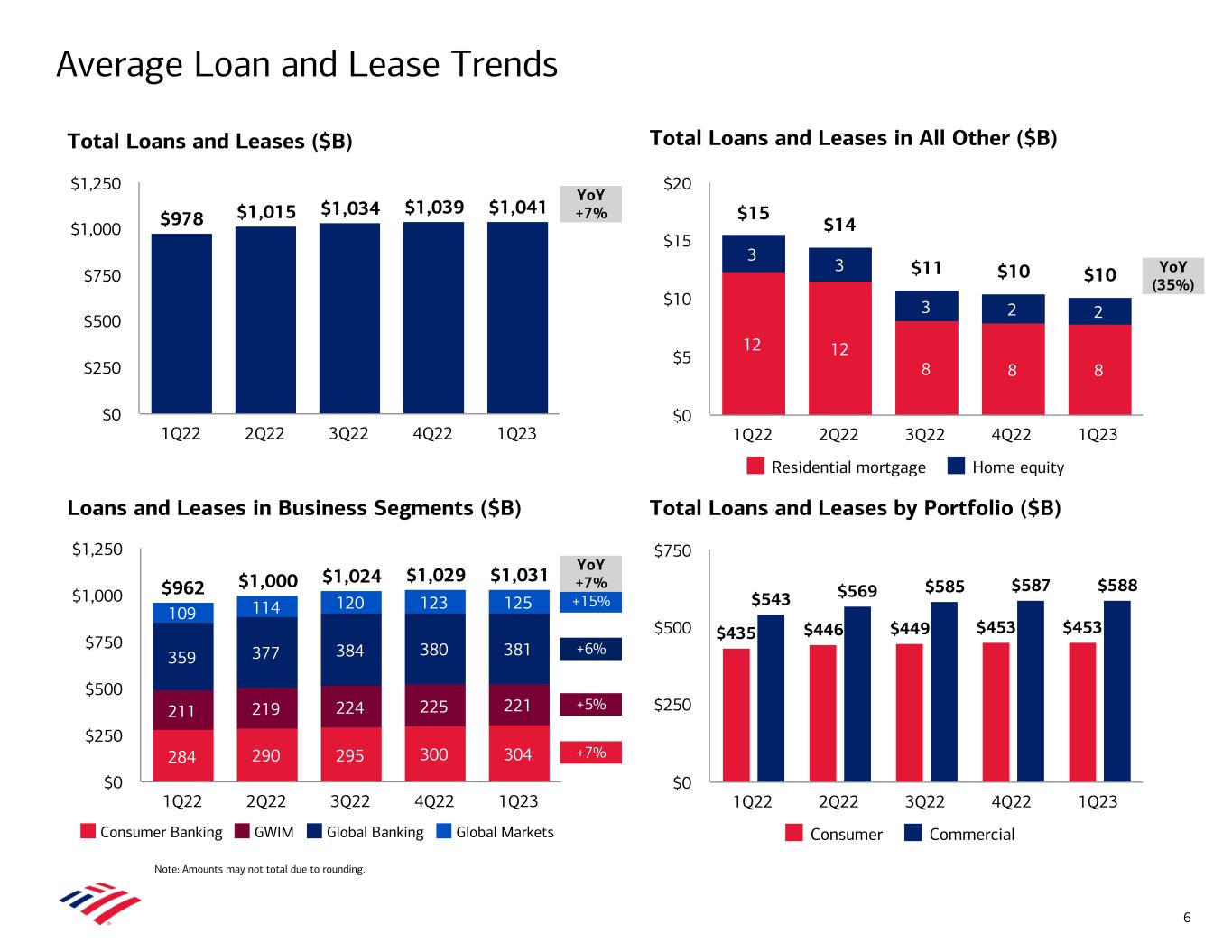

Loans and leases (2) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage | 229,275 | 1,684 | 2.94 | 229,364 | 1,663 | 2.90 | 223,979 | 1,525 | 2.73 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home equity | 26,513 | 317 | 4.84 | 26,983 | 275 | 4.05 | 27,784 | 220 | 3.21 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit card | 91,775 | 2,426 | 10.72 | 89,575 | 2,327 | 10.31 | 78,409 | 1,940 | 10.03 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Direct/Indirect and other consumer | 105,657 | 1,186 | 4.55 | 106,598 | 1,119 | 4.16 | 104,632 | 579 | 2.25 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total consumer | 453,220 | 5,613 | 5.00 | 452,520 | 5,384 | 4.73 | 434,804 | 4,264 | 3.96 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. commercial | 376,852 | 4,471 | 4.81 | 378,850 | 4,172 | 4.37 | 346,510 | 2,127 | 2.49 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-U.S. commercial | 127,003 | 1,778 | 5.68 | 125,983 | 1,474 | 4.64 | 118,767 | 504 | 1.72 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 70,591 | 1,144 | 6.57 | 68,764 | 994 | 5.74 | 63,065 | 387 | 2.49 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial lease financing | 13,686 | 147 | 4.33 | 13,130 | 139 | 4.21 | 14,647 | 106 | 2.92 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total commercial | 588,132 | 7,540 | 5.20 | 586,727 | 6,779 | 4.58 | 542,989 | 3,124 | 2.33 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | 1,041,352 | 13,153 | 5.11 | 1,039,247 | 12,163 | 4.65 | 977,793 | 7,388 | 3.06 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other earning assets | 94,427 | 2,292 | 9.82 | 95,904 | 2,034 | 8.42 | 120,798 | 587 | 1.97 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total earning assets | 2,671,426 | 28,789 | 4.36 | 2,647,712 | 25,198 | 3.78 | 2,779,844 | 13,000 | 1.89 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 27,784 | 27,771 | 28,082 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other assets, less allowance for loan and lease losses | 396,848 | 398,806 | 399,776 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 3,096,058 | $ | 3,074,289 | $ | 3,207,702 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| U.S. interest-bearing deposits | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Demand and money market deposits | $ | 975,085 | $ | 2,790 | 1.16 | % | $ | 980,964 | $ | 2,044 | 0.83 | % | $ | 1,001,184 | $ | 80 | 0.03 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Time and savings deposits | 196,984 | 919 | 1.89 | 180,684 | 543 | 1.19 | 163,981 | 40 | 0.10 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total U.S. interest-bearing deposits | 1,172,069 | 3,709 | 1.28 | 1,161,648 | 2,587 | 0.88 | 1,165,165 | 120 | 0.04 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Non-U.S. interest-bearing deposits | 91,603 | 605 | 2.68 | 83,073 | 412 | 1.97 | 81,879 | 44 | 0.22 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 1,263,672 | 4,314 | 1.38 | 1,244,721 | 2,999 | 0.96 | 1,247,044 | 164 | 0.05 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal funds purchased and securities loaned or sold under agreements to repurchase | 256,015 | 3,551 | 5.63 | 214,267 | 2,246 | 4.16 | 217,152 | 79 | 0.15 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings and other interest-bearing liabilities | 156,887 | 2,629 | 6.79 | 150,351 | 2,027 | 5.35 | 126,454 | (191) | (0.61) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading account liabilities | 43,953 | 504 | 4.65 | 40,393 | 421 | 4.13 | 64,240 | 364 | 2.30 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt | 244,759 | 3,209 | 5.28 | 243,871 | 2,701 | 4.41 | 246,042 | 906 | 1.50 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 1,965,286 | 14,207 | 2.93 | 1,893,603 | 10,394 | 2.18 | 1,900,932 | 1,322 | 0.28 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing sources | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 629,977 | 680,823 | 798,767 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other liabilities (3) | 223,543 | 227,234 | 238,694 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 277,252 | 272,629 | 269,309 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 3,096,058 | $ | 3,074,289 | $ | 3,207,702 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest spread | 1.43 | % | 1.60 | % | 1.61 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Impact of noninterest-bearing sources | 0.77 | 0.62 | 0.08 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest income/yield on earning assets (4) | $ | 14,582 | 2.20 | % | $ | 14,804 | 2.22 | % | $ | 11,678 | 1.69 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 8 | ||||

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||

| Debt Securities | |||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||

| March 31, 2023 | |||||||||||||||||||||||

| Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||||||||||

| Available-for-sale debt securities | |||||||||||||||||||||||

| Mortgage-backed securities: | |||||||||||||||||||||||

| Agency | $ | 24,726 | $ | 5 | $ | (1,479) | $ | 23,252 | |||||||||||||||

| Agency-collateralized mortgage obligations | 2,235 | — | (200) | 2,035 | |||||||||||||||||||

| Commercial | 6,890 | 31 | (481) | 6,440 | |||||||||||||||||||

| Non-agency residential | 459 | 3 | (55) | 407 | |||||||||||||||||||

| Total mortgage-backed securities | 34,310 | 39 | (2,215) | 32,134 | |||||||||||||||||||

| U.S. Treasury and government agencies | 102,943 | 2 | (1,438) | 101,507 | |||||||||||||||||||

| Non-U.S. securities | 13,161 | 2 | (43) | 13,120 | |||||||||||||||||||

| Other taxable securities | 4,830 | 1 | (85) | 4,746 | |||||||||||||||||||

| Tax-exempt securities | 11,105 | 25 | (227) | 10,903 | |||||||||||||||||||

| Total available-for-sale debt securities | 166,349 | 69 | (4,008) | 162,410 | |||||||||||||||||||

Other debt securities carried at fair value (1) | 10,081 | 63 | (44) | 10,100 | |||||||||||||||||||

| Total debt securities carried at fair value | 176,430 | 132 | (4,052) | 172,510 | |||||||||||||||||||

| Held-to-maturity debt securities | |||||||||||||||||||||||

| Agency mortgage-backed securities | 494,998 | — | (80,664) | 414,334 | |||||||||||||||||||

| U.S. Treasury and government agencies | 121,609 | — | (17,511) | 104,098 | |||||||||||||||||||

| Other taxable securities | 7,921 | — | (901) | 7,020 | |||||||||||||||||||

| Total held-to-maturity debt securities | 624,528 | — | (99,076) | 525,452 | |||||||||||||||||||

| Total debt securities | $ | 800,958 | $ | 132 | $ | (103,128) | $ | 697,962 | |||||||||||||||

| December 31, 2022 | |||||||||||||||||||||||

| Available-for-sale debt securities | |||||||||||||||||||||||

| Mortgage-backed securities: | |||||||||||||||||||||||

| Agency | $ | 25,204 | $ | 5 | $ | (1,767) | $ | 23,442 | |||||||||||||||

| Agency-collateralized mortgage obligations | 2,452 | — | (231) | 2,221 | |||||||||||||||||||

| Commercial | 6,894 | 28 | (515) | 6,407 | |||||||||||||||||||

| Non-agency residential | 461 | 15 | (90) | 386 | |||||||||||||||||||

| Total mortgage-backed securities | 35,011 | 48 | (2,603) | 32,456 | |||||||||||||||||||

| U.S. Treasury and government agencies | 160,773 | 18 | (1,769) | 159,022 | |||||||||||||||||||

| Non-U.S. securities | 13,455 | 4 | (52) | 13,407 | |||||||||||||||||||

| Other taxable securities | 4,728 | 1 | (84) | 4,645 | |||||||||||||||||||

| Tax-exempt securities | 11,518 | 19 | (279) | 11,258 | |||||||||||||||||||

| Total available-for-sale debt securities | 225,485 | 90 | (4,787) | 220,788 | |||||||||||||||||||

Other debt securities carried at fair value (1) | 8,986 | 376 | (156) | 9,206 | |||||||||||||||||||

| Total debt securities carried at fair value | 234,471 | 466 | (4,943) | 229,994 | |||||||||||||||||||

| Held-to-maturity debt securities | |||||||||||||||||||||||

| Agency mortgage-backed securities | 503,233 | — | (87,319) | 415,914 | |||||||||||||||||||

| U.S. Treasury and government agencies | 121,597 | — | (20,259) | 101,338 | |||||||||||||||||||

| Other taxable securities | 8,033 | — | (1,018) | 7,015 | |||||||||||||||||||

| Total held-to-maturity debt securities | 632,863 | — | (108,596) | 524,267 | |||||||||||||||||||

| Total debt securities | $ | 867,334 | $ | 466 | $ | (113,539) | $ | 754,261 | |||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 9 | ||||

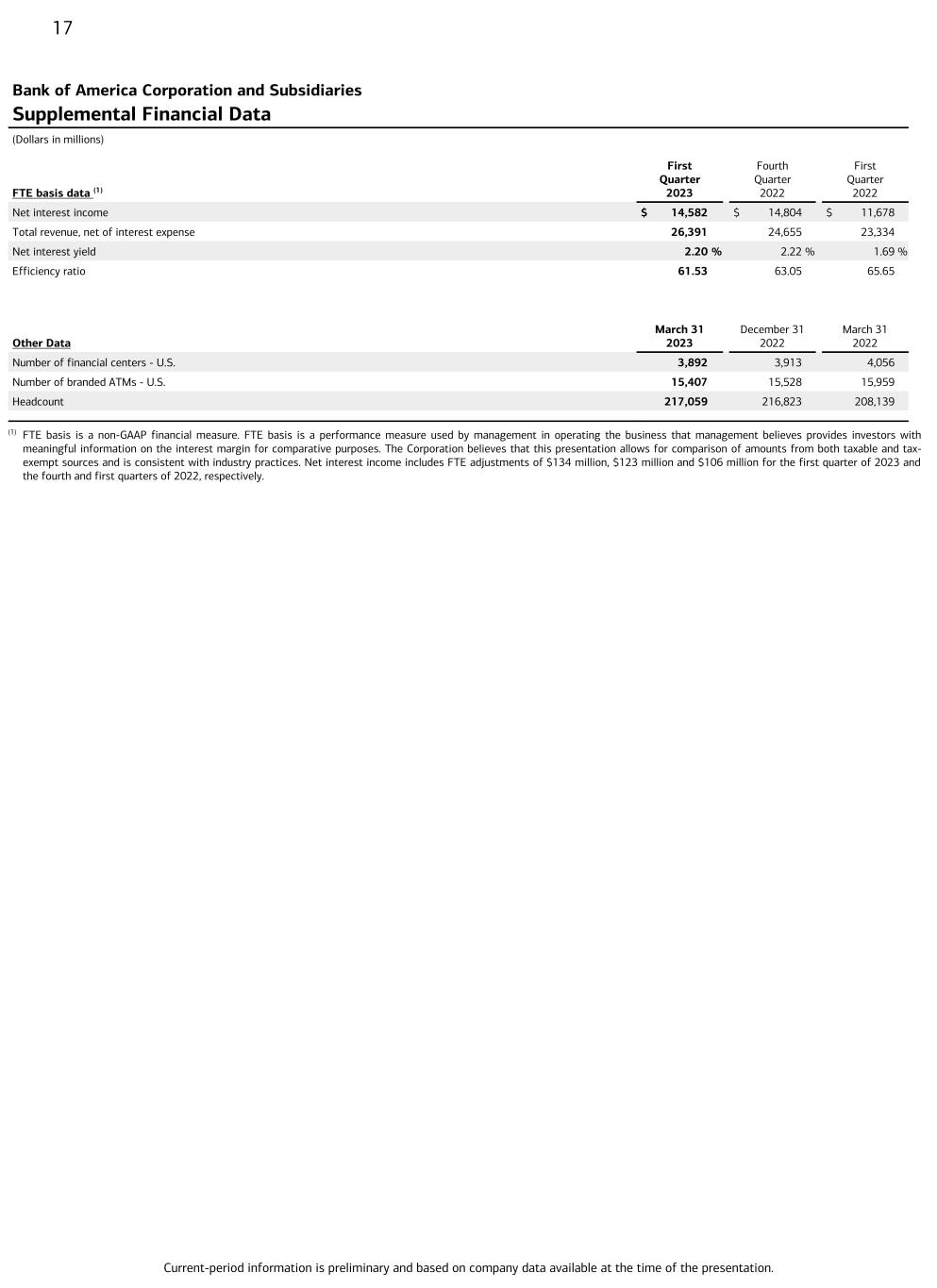

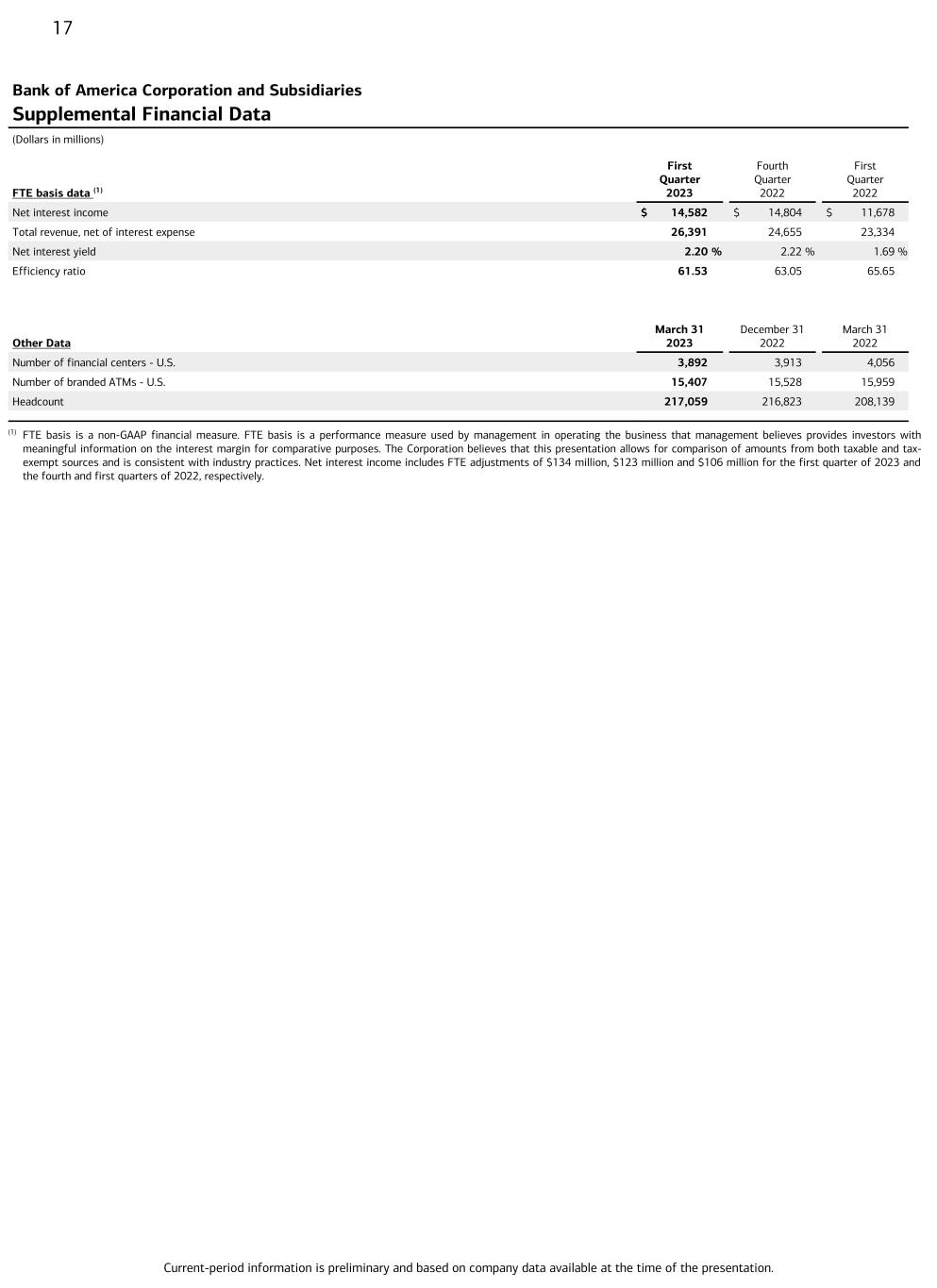

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||

| Supplemental Financial Data | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

FTE basis data (1) | |||||||||||||||||||||||||||||

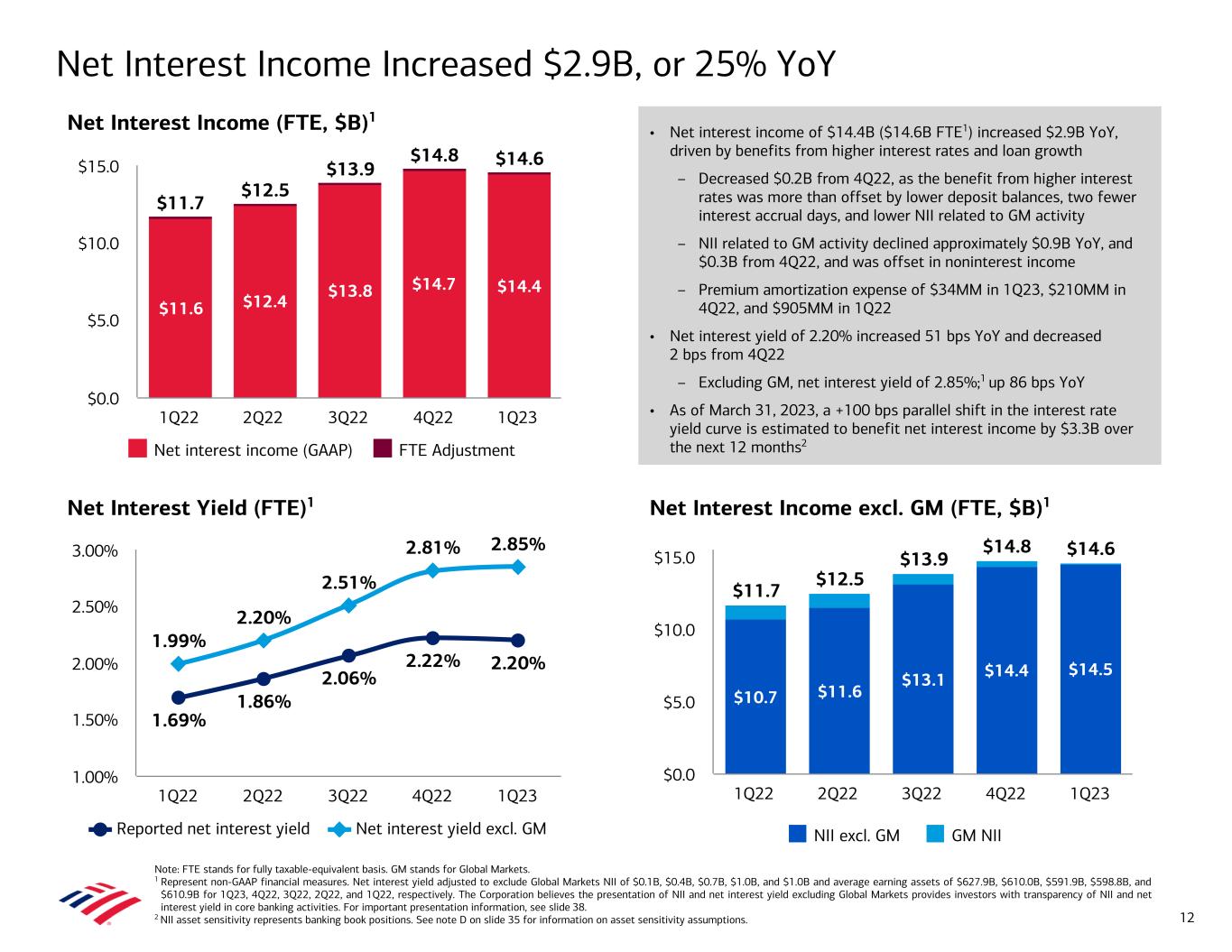

| Net interest income | $ | 14,582 | $ | 14,804 | $ | 13,871 | $ | 12,547 | $ | 11,678 | |||||||||||||||||||

| Total revenue, net of interest expense | 26,391 | 24,655 | 24,608 | 22,791 | 23,334 | ||||||||||||||||||||||||

| Net interest yield | 2.20 | % | 2.22 | % | 2.06 | % | 1.86 | % | 1.69 | % | |||||||||||||||||||

| Efficiency ratio | 61.53 | 63.05 | 62.18 | 67.01 | 65.65 | ||||||||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 10 | ||||

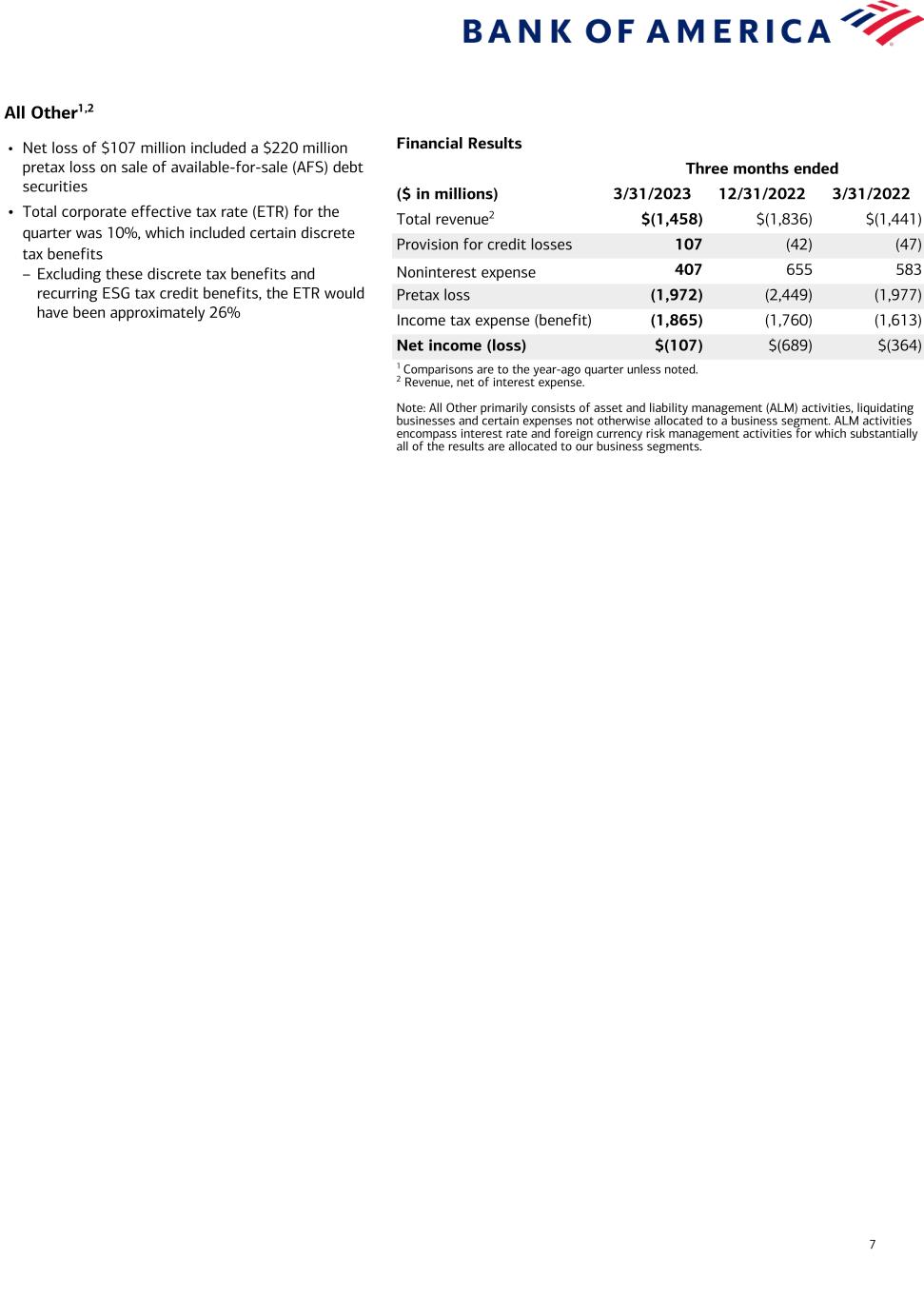

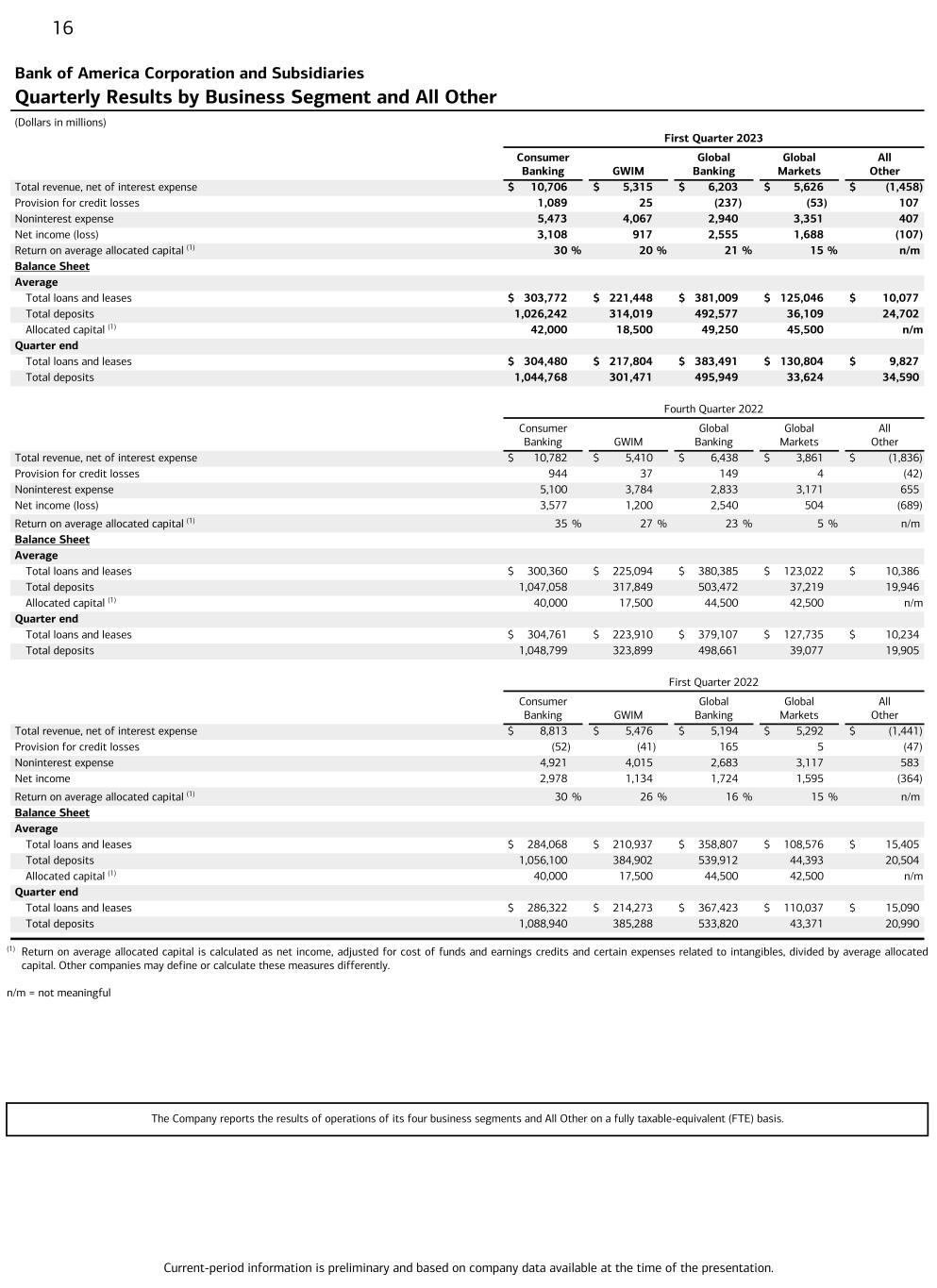

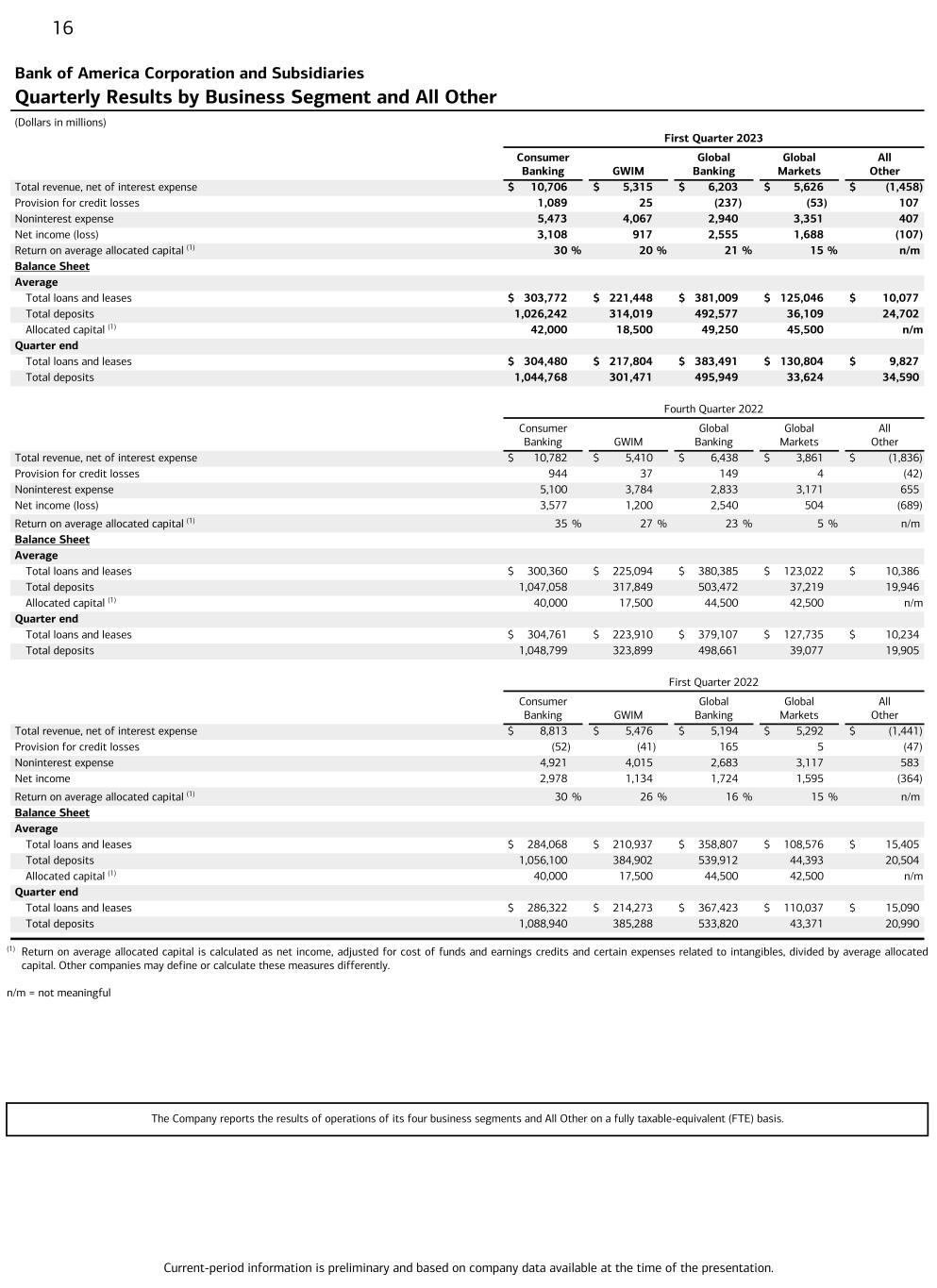

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||||||||||||||

| Quarterly Results by Business Segment and All Other | |||||||||||||||||||||||||||||||||||||||||

(Dollars in millions) | |||||||||||||||||||||||||||||||||||||||||

| First Quarter 2023 | |||||||||||||||||||||||||||||||||||||||||

| Total Corporation | Consumer Banking | GWIM | Global Banking | Global Markets | All Other | ||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 14,582 | $ | 8,593 | $ | 1,876 | $ | 3,907 | $ | 109 | $ | 97 | |||||||||||||||||||||||||||||

| Noninterest income | |||||||||||||||||||||||||||||||||||||||||

| Fees and commissions: | |||||||||||||||||||||||||||||||||||||||||

| Card income | 1,469 | 1,274 | 12 | 190 | 16 | (23) | |||||||||||||||||||||||||||||||||||

| Service charges | 1,410 | 599 | 19 | 714 | 78 | — | |||||||||||||||||||||||||||||||||||

| Investment and brokerage services | 3,852 | 74 | 3,238 | 9 | 533 | (2) | |||||||||||||||||||||||||||||||||||

| Investment banking fees | 1,163 | — | 39 | 668 | 469 | (13) | |||||||||||||||||||||||||||||||||||

| Total fees and commissions | 7,894 | 1,947 | 3,308 | 1,581 | 1,096 | (38) | |||||||||||||||||||||||||||||||||||

| Market making and similar activities | 4,712 | 5 | 34 | 45 | 4,398 | 230 | |||||||||||||||||||||||||||||||||||

Other income (loss) | (796) | 161 | 97 | 670 | 23 | (1,747) | |||||||||||||||||||||||||||||||||||

| Total noninterest income (loss) | 11,810 | 2,113 | 3,439 | 2,296 | 5,517 | (1,555) | |||||||||||||||||||||||||||||||||||

| Total revenue, net of interest expense | 26,392 | 10,706 | 5,315 | 6,203 | 5,626 | (1,458) | |||||||||||||||||||||||||||||||||||

| Provision for credit losses | 931 | 1,089 | 25 | (237) | (53) | 107 | |||||||||||||||||||||||||||||||||||

| Noninterest expense | 16,238 | 5,473 | 4,067 | 2,940 | 3,351 | 407 | |||||||||||||||||||||||||||||||||||

| Income (loss) before income taxes | 9,223 | 4,144 | 1,223 | 3,500 | 2,328 | (1,972) | |||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 1,062 | 1,036 | 306 | 945 | 640 | (1,865) | |||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 8,161 | $ | 3,108 | $ | 917 | $ | 2,555 | $ | 1,688 | $ | (107) | |||||||||||||||||||||||||||||

| Average | |||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 1,041,352 | $ | 303,772 | $ | 221,448 | $ | 381,009 | $ | 125,046 | $ | 10,077 | |||||||||||||||||||||||||||||

Total assets (1) | 3,096,058 | 1,105,245 | 359,164 | 588,886 | 870,038 | 172,725 | |||||||||||||||||||||||||||||||||||

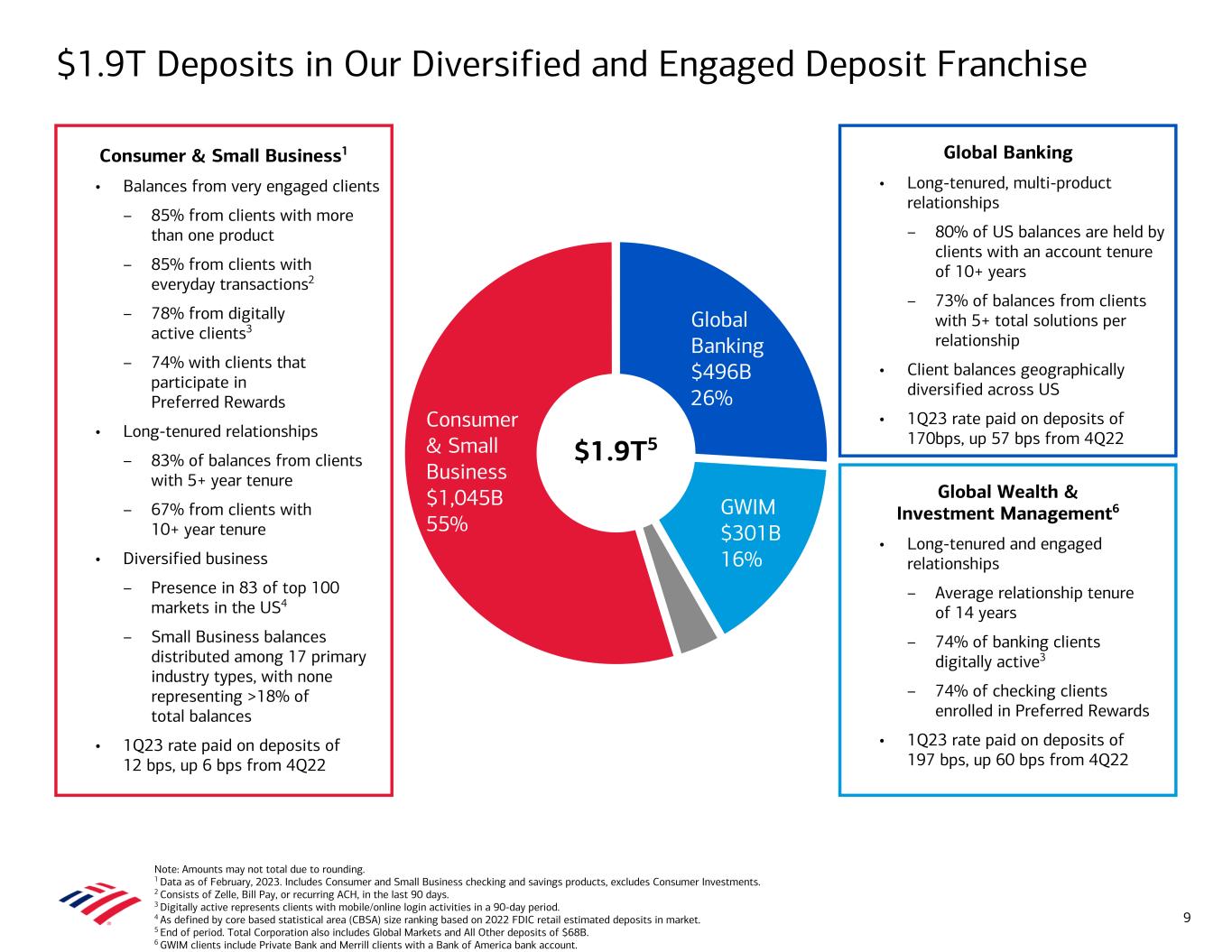

| Total deposits | 1,893,649 | 1,026,242 | 314,019 | 492,577 | 36,109 | 24,702 | |||||||||||||||||||||||||||||||||||

| Quarter end | |||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 1,046,406 | $ | 304,480 | $ | 217,804 | $ | 383,491 | $ | 130,804 | $ | 9,827 | |||||||||||||||||||||||||||||

Total assets (1) | 3,194,657 | 1,124,438 | 349,888 | 591,231 | 861,477 | 267,623 | |||||||||||||||||||||||||||||||||||

| Total deposits | 1,910,402 | 1,044,768 | 301,471 | 495,949 | 33,624 | 34,590 | |||||||||||||||||||||||||||||||||||

| Fourth Quarter 2022 | |||||||||||||||||||||||||||||||||||||||||

| Total Corporation | Consumer Banking | GWIM | Global Banking | Global Markets | All Other | ||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 14,804 | $ | 8,494 | $ | 2,015 | $ | 3,880 | $ | 371 | $ | 44 | |||||||||||||||||||||||||||||

| Noninterest income | |||||||||||||||||||||||||||||||||||||||||

| Fees and commissions: | |||||||||||||||||||||||||||||||||||||||||

| Card income | 1,552 | 1,333 | 19 | 196 | 17 | (13) | |||||||||||||||||||||||||||||||||||

| Service charges | 1,389 | 586 | 17 | 703 | 79 | 4 | |||||||||||||||||||||||||||||||||||

| Investment and brokerage services | 3,723 | 71 | 3,166 | 6 | 482 | (2) | |||||||||||||||||||||||||||||||||||

| Investment banking fees | 1,071 | — | 35 | 706 | 347 | (17) | |||||||||||||||||||||||||||||||||||

| Total fees and commissions | 7,735 | 1,990 | 3,237 | 1,611 | 925 | (28) | |||||||||||||||||||||||||||||||||||

| Market making and similar activities | 3,052 | 5 | 36 | 34 | 2,685 | 292 | |||||||||||||||||||||||||||||||||||

| Other income (loss) | (936) | 293 | 122 | 913 | (120) | (2,144) | |||||||||||||||||||||||||||||||||||

| Total noninterest income (loss) | 9,851 | 2,288 | 3,395 | 2,558 | 3,490 | (1,880) | |||||||||||||||||||||||||||||||||||

| Total revenue, net of interest expense | 24,655 | 10,782 | 5,410 | 6,438 | 3,861 | (1,836) | |||||||||||||||||||||||||||||||||||

| Provision for credit losses | 1,092 | 944 | 37 | 149 | 4 | (42) | |||||||||||||||||||||||||||||||||||

| Noninterest expense | 15,543 | 5,100 | 3,784 | 2,833 | 3,171 | 655 | |||||||||||||||||||||||||||||||||||

| Income (loss) before income taxes | 8,020 | 4,738 | 1,589 | 3,456 | 686 | (2,449) | |||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 888 | 1,161 | 389 | 916 | 182 | (1,760) | |||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 7,132 | $ | 3,577 | $ | 1,200 | $ | 2,540 | $ | 504 | $ | (689) | |||||||||||||||||||||||||||||

| Average | |||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 1,039,247 | $ | 300,360 | $ | 225,094 | $ | 380,385 | $ | 123,022 | $ | 10,386 | |||||||||||||||||||||||||||||

Total assets (1) | 3,074,289 | 1,123,813 | 361,592 | 595,525 | 857,319 | 136,040 | |||||||||||||||||||||||||||||||||||

| Total deposits | 1,925,544 | 1,047,058 | 317,849 | 503,472 | 37,219 | 19,946 | |||||||||||||||||||||||||||||||||||

| Quarter end | |||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 1,045,747 | $ | 304,761 | $ | 223,910 | $ | 379,107 | $ | 127,735 | $ | 10,234 | |||||||||||||||||||||||||||||

Total assets (1) | 3,051,375 | 1,126,453 | 368,893 | 588,466 | 812,489 | 155,074 | |||||||||||||||||||||||||||||||||||

| Total deposits | 1,930,341 | 1,048,799 | 323,899 | 498,661 | 39,077 | 19,905 | |||||||||||||||||||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 11 | ||||

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||||||||||||||

| Quarterly Results by Business Segment and All Other (continued) | |||||||||||||||||||||||||||||||||||||||||

(Dollars in millions) | |||||||||||||||||||||||||||||||||||||||||

| First Quarter 2022 | |||||||||||||||||||||||||||||||||||||||||

| Total Corporation | Consumer Banking | GWIM | Global Banking | Global Markets | All Other | ||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 11,678 | $ | 6,680 | $ | 1,668 | $ | 2,344 | $ | 993 | $ | (7) | |||||||||||||||||||||||||||||

| Noninterest income | |||||||||||||||||||||||||||||||||||||||||

| Fees and commissions: | |||||||||||||||||||||||||||||||||||||||||

| Card income | 1,403 | 1,185 | 18 | 176 | 14 | 10 | |||||||||||||||||||||||||||||||||||

| Service charges | 1,833 | 844 | 19 | 886 | 82 | 2 | |||||||||||||||||||||||||||||||||||

| Investment and brokerage services | 4,292 | 83 | 3,654 | 12 | 545 | (2) | |||||||||||||||||||||||||||||||||||

| Investment banking fees | 1,457 | — | 66 | 880 | 582 | (71) | |||||||||||||||||||||||||||||||||||

| Total fees and commissions | 8,985 | 2,112 | 3,757 | 1,954 | 1,223 | (61) | |||||||||||||||||||||||||||||||||||

| Market making and similar activities | 3,238 | — | 13 | 49 | 3,190 | (14) | |||||||||||||||||||||||||||||||||||

| Other income (loss) | (567) | 21 | 38 | 847 | (114) | (1,359) | |||||||||||||||||||||||||||||||||||

| Total noninterest income (loss) | 11,656 | 2,133 | 3,808 | 2,850 | 4,299 | (1,434) | |||||||||||||||||||||||||||||||||||

| Total revenue, net of interest expense | 23,334 | 8,813 | 5,476 | 5,194 | 5,292 | (1,441) | |||||||||||||||||||||||||||||||||||

| Provision for credit losses | 30 | (52) | (41) | 165 | 5 | (47) | |||||||||||||||||||||||||||||||||||

| Noninterest expense | 15,319 | 4,921 | 4,015 | 2,683 | 3,117 | 583 | |||||||||||||||||||||||||||||||||||

| Income (loss) before income taxes | 7,985 | 3,944 | 1,502 | 2,346 | 2,170 | (1,977) | |||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 918 | 966 | 368 | 622 | 575 | (1,613) | |||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 7,067 | $ | 2,978 | $ | 1,134 | $ | 1,724 | $ | 1,595 | $ | (364) | |||||||||||||||||||||||||||||

| Average | |||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 977,793 | $ | 284,068 | $ | 210,937 | $ | 358,807 | $ | 108,576 | $ | 15,405 | |||||||||||||||||||||||||||||

Total assets (1) | 3,207,702 | 1,133,001 | 431,040 | 630,517 | 858,719 | 154,425 | |||||||||||||||||||||||||||||||||||

| Total deposits | 2,045,811 | 1,056,100 | 384,902 | 539,912 | 44,393 | 20,504 | |||||||||||||||||||||||||||||||||||

| Quarter end | |||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 993,145 | $ | 286,322 | $ | 214,273 | $ | 367,423 | $ | 110,037 | $ | 15,090 | |||||||||||||||||||||||||||||

Total assets (1) | 3,238,223 | 1,166,443 | 433,122 | 623,168 | 883,304 | 132,186 | |||||||||||||||||||||||||||||||||||

| Total deposits | 2,072,409 | 1,088,940 | 385,288 | 533,820 | 43,371 | 20,990 | |||||||||||||||||||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 12 | ||||

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||

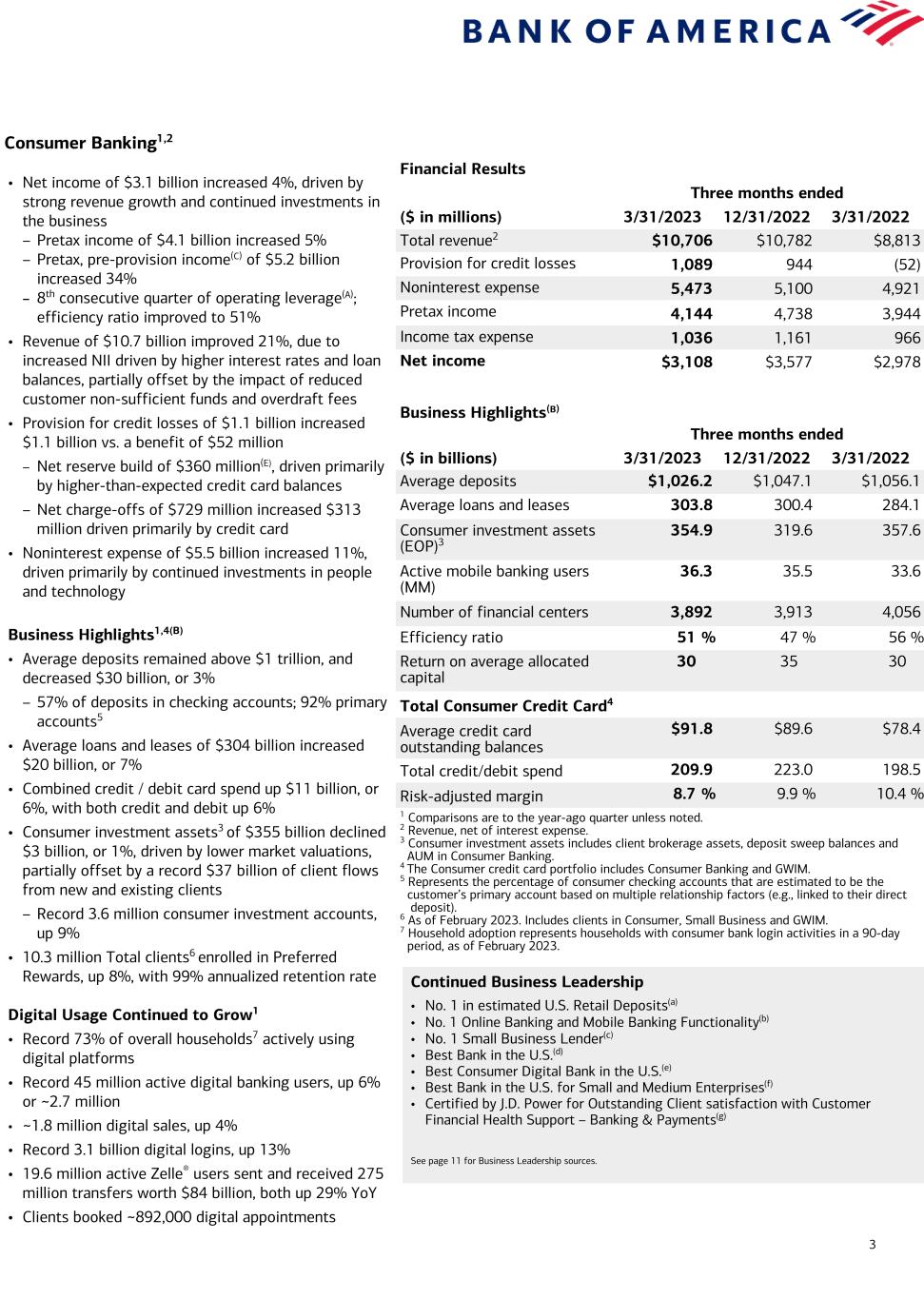

| Consumer Banking Segment Results | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

| Net interest income | $ | 8,593 | $ | 8,494 | $ | 7,784 | $ | 7,087 | $ | 6,680 | |||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||

| Card income | 1,274 | 1,333 | 1,331 | 1,320 | 1,185 | ||||||||||||||||||||||||

| Service charges | 599 | 586 | 597 | 679 | 844 | ||||||||||||||||||||||||

| All other income | 240 | 369 | 192 | 50 | 104 | ||||||||||||||||||||||||

| Total noninterest income | 2,113 | 2,288 | 2,120 | 2,049 | 2,133 | ||||||||||||||||||||||||

| Total revenue, net of interest expense | 10,706 | 10,782 | 9,904 | 9,136 | 8,813 | ||||||||||||||||||||||||

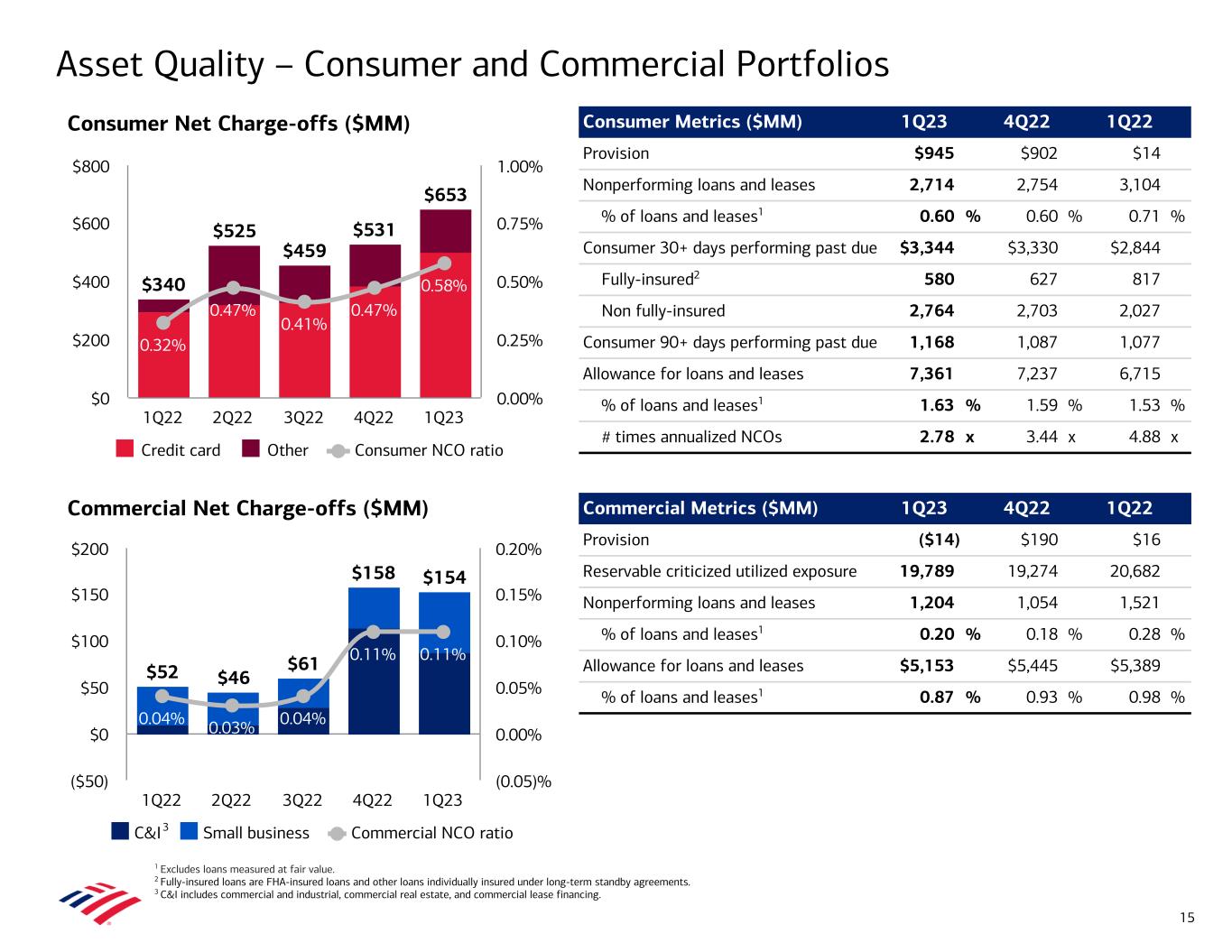

| Provision for credit losses | 1,089 | 944 | 738 | 350 | (52) | ||||||||||||||||||||||||

| Noninterest expense | 5,473 | 5,100 | 5,097 | 4,959 | 4,921 | ||||||||||||||||||||||||

| Income before income taxes | 4,144 | 4,738 | 4,069 | 3,827 | 3,944 | ||||||||||||||||||||||||

| Income tax expense | 1,036 | 1,161 | 997 | 938 | 966 | ||||||||||||||||||||||||

| Net income | $ | 3,108 | $ | 3,577 | $ | 3,072 | $ | 2,889 | $ | 2,978 | |||||||||||||||||||

| Net interest yield | 3.27 | % | 3.11 | % | 2.79 | % | 2.55 | % | 2.48 | % | |||||||||||||||||||

Return on average allocated capital (1) | 30 | 35 | 30 | 29 | 30 | ||||||||||||||||||||||||

| Efficiency ratio | 51.12 | 47.29 | 51.47 | 54.28 | 55.84 | ||||||||||||||||||||||||

| Balance Sheet | |||||||||||||||||||||||||||||

| Average | |||||||||||||||||||||||||||||

| Total loans and leases | $ | 303,772 | $ | 300,360 | $ | 295,231 | $ | 289,595 | $ | 284,068 | |||||||||||||||||||

Total earning assets (2) | 1,065,202 | 1,083,850 | 1,106,513 | 1,114,552 | 1,092,742 | ||||||||||||||||||||||||

Total assets (2) | 1,105,245 | 1,123,813 | 1,145,846 | 1,154,773 | 1,133,001 | ||||||||||||||||||||||||

| Total deposits | 1,026,242 | 1,047,058 | 1,069,093 | 1,078,020 | 1,056,100 | ||||||||||||||||||||||||

Allocated capital (1) | 42,000 | 40,000 | 40,000 | 40,000 | 40,000 | ||||||||||||||||||||||||

| Period end | |||||||||||||||||||||||||||||

| Total loans and leases | $ | 304,480 | $ | 304,761 | $ | 297,825 | $ | 294,570 | $ | 286,322 | |||||||||||||||||||

Total earning assets (2) | 1,081,780 | 1,085,079 | 1,110,524 | 1,114,524 | 1,125,963 | ||||||||||||||||||||||||

Total assets (2) | 1,124,438 | 1,126,453 | 1,149,918 | 1,154,366 | 1,166,443 | ||||||||||||||||||||||||

| Total deposits | 1,044,768 | 1,048,799 | 1,072,580 | 1,077,215 | 1,088,940 | ||||||||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 13 | ||||

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||

| Consumer Banking Key Indicators | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

| Average deposit balances | |||||||||||||||||||||||||||||

| Checking | $ | 580,910 | $ | 588,668 | $ | 599,099 | $ | 606,331 | $ | 593,428 | |||||||||||||||||||

| Savings | 68,327 | 69,790 | 71,933 | 73,295 | 72,413 | ||||||||||||||||||||||||

| MMS | 339,823 | 356,015 | 365,271 | 362,798 | 354,850 | ||||||||||||||||||||||||

| CDs and IRAs | 33,098 | 28,619 | 28,731 | 29,796 | 30,685 | ||||||||||||||||||||||||

| Other | 4,084 | 3,966 | 4,059 | 5,800 | 4,724 | ||||||||||||||||||||||||

| Total average deposit balances | $ | 1,026,242 | $ | 1,047,058 | $ | 1,069,093 | $ | 1,078,020 | $ | 1,056,100 | |||||||||||||||||||

| Deposit spreads (excludes noninterest costs) | |||||||||||||||||||||||||||||

| Checking | 2.22 | % | 2.09 | % | 1.98 | % | 1.93 | % | 1.91 | % | |||||||||||||||||||

| Savings | 2.53 | 2.33 | 2.19 | 2.19 | 2.19 | ||||||||||||||||||||||||

| MMS | 2.99 | 2.25 | 1.64 | 1.29 | 1.23 | ||||||||||||||||||||||||

| CDs and IRAs | 3.27 | 2.91 | 1.85 | 0.98 | 0.46 | ||||||||||||||||||||||||

| Other | 4.37 | 3.35 | 2.04 | 1.04 | 0.41 | ||||||||||||||||||||||||

| Total deposit spreads | 2.54 | 2.19 | 1.88 | 1.70 | 1.65 | ||||||||||||||||||||||||

| Consumer investment assets | $ | 354,892 | $ | 319,648 | $ | 302,413 | $ | 315,243 | $ | 357,593 | |||||||||||||||||||

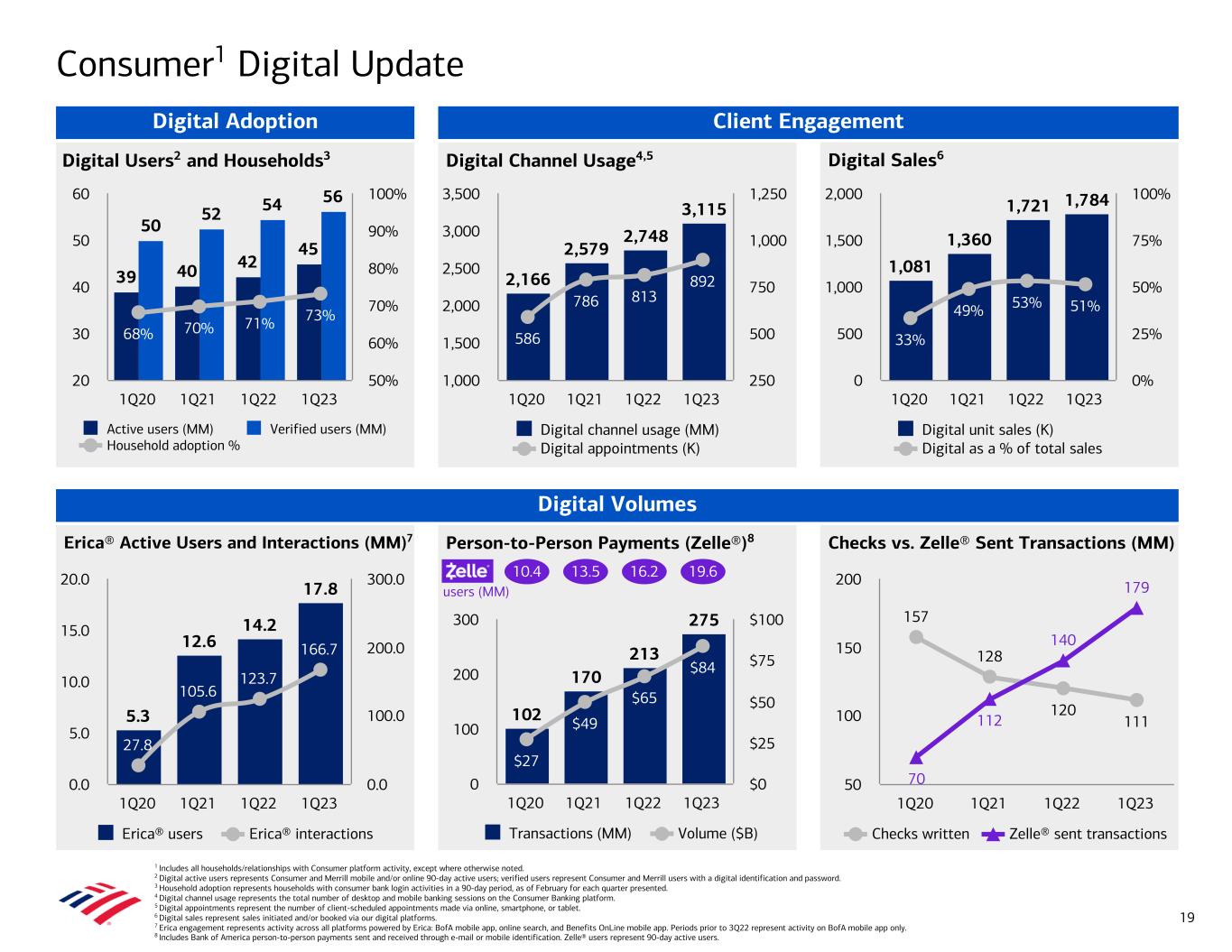

Active digital banking users (in thousands) (1) | 44,962 | 44,054 | 43,496 | 42,690 | 42,269 | ||||||||||||||||||||||||

Active mobile banking users (in thousands) (2) | 36,322 | 35,452 | 34,922 | 34,167 | 33,589 | ||||||||||||||||||||||||

| Financial centers | 3,892 | 3,913 | 3,932 | 3,984 | 4,056 | ||||||||||||||||||||||||

| ATMs | 15,407 | 15,528 | 15,572 | 15,730 | 15,959 | ||||||||||||||||||||||||

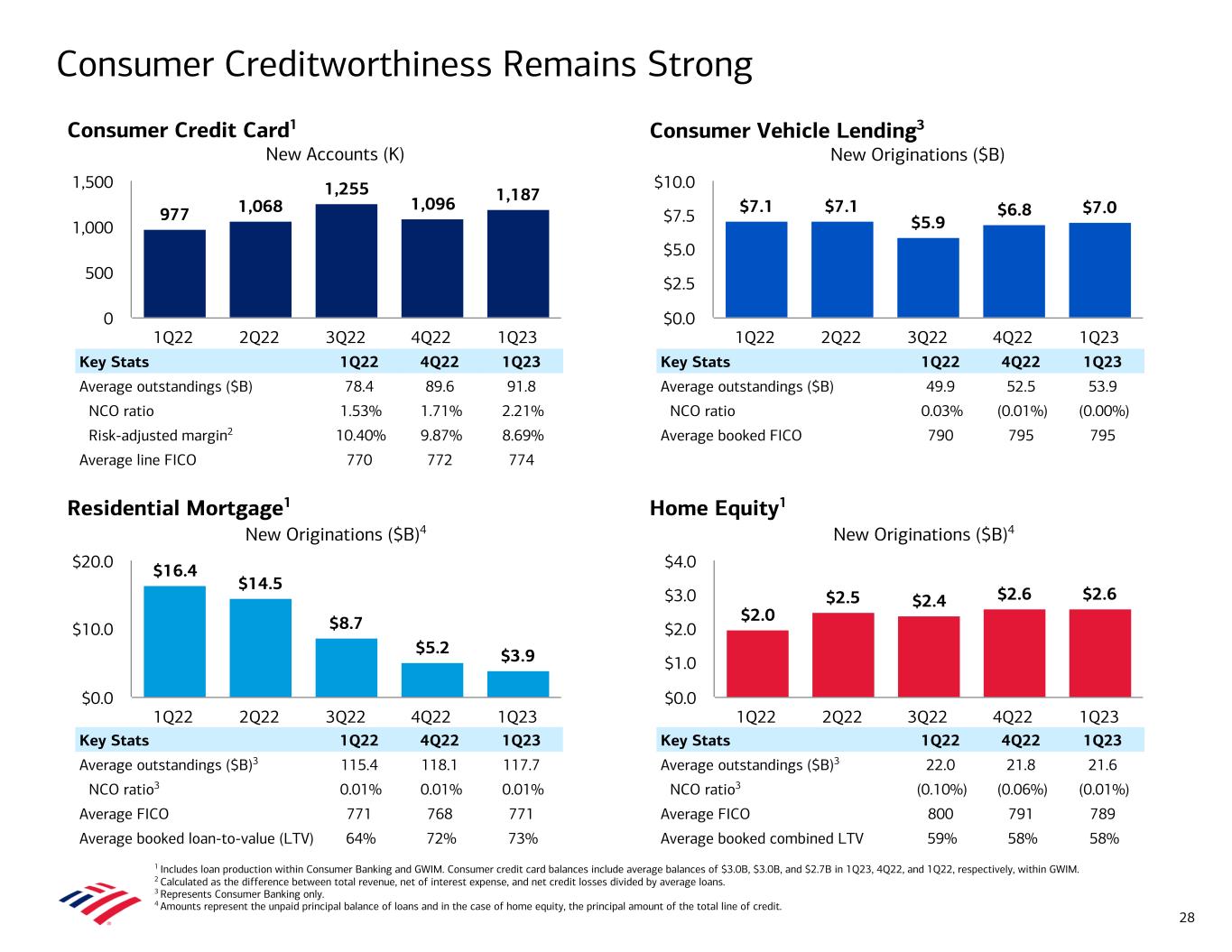

Total credit card (3) | |||||||||||||||||||||||||||||

| Loans | |||||||||||||||||||||||||||||

| Average credit card outstandings | $ | 91,775 | $ | 89,575 | $ | 85,009 | $ | 81,024 | $ | 78,409 | |||||||||||||||||||

| Ending credit card outstandings | 92,469 | 93,421 | 87,296 | 84,010 | 79,356 | ||||||||||||||||||||||||

| Credit quality | |||||||||||||||||||||||||||||

| Net charge-offs | $ | 501 | $ | 386 | $ | 328 | $ | 323 | $ | 297 | |||||||||||||||||||

| 2.21 | % | 1.71 | % | 1.53 | % | 1.60 | % | 1.53 | % | ||||||||||||||||||||

| 30+ delinquency | $ | 1,674 | $ | 1,505 | $ | 1,202 | $ | 1,008 | $ | 1,003 | |||||||||||||||||||

| 1.81 | % | 1.61 | % | 1.38 | % | 1.20 | % | 1.26 | % | ||||||||||||||||||||

| 90+ delinquency | $ | 828 | $ | 717 | $ | 547 | $ | 493 | $ | 492 | |||||||||||||||||||

| 0.90 | % | 0.77 | % | 0.63 | % | 0.59 | % | 0.62 | % | ||||||||||||||||||||

Other total credit card indicators (3) | |||||||||||||||||||||||||||||

| Gross interest yield | 11.85 | % | 11.18 | % | 10.71 | % | 9.76 | % | 9.90 | % | |||||||||||||||||||

| Risk-adjusted margin | 8.69 | 9.87 | 10.07 | 9.95 | 10.40 | ||||||||||||||||||||||||

| New accounts (in thousands) | 1,187 | 1,096 | 1,256 | 1,068 | 977 | ||||||||||||||||||||||||

| Purchase volumes | $ | 85,544 | $ | 92,800 | $ | 91,064 | $ | 91,810 | $ | 80,914 | |||||||||||||||||||

| Debit card data | |||||||||||||||||||||||||||||

| Purchase volumes | $ | 124,376 | $ | 130,157 | $ | 127,135 | $ | 128,707 | $ | 117,584 | |||||||||||||||||||

Loan production (4) | |||||||||||||||||||||||||||||

| Consumer Banking: | |||||||||||||||||||||||||||||

| First mortgage | $ | 1,956 | $ | 2,286 | $ | 4,028 | $ | 6,551 | $ | 8,116 | |||||||||||||||||||

| Home equity | 2,183 | 2,113 | 1,999 | 2,151 | 1,725 | ||||||||||||||||||||||||

Total (5): | |||||||||||||||||||||||||||||

| First mortgage | $ | 3,937 | $ | 5,217 | $ | 8,724 | $ | 14,471 | $ | 16,353 | |||||||||||||||||||

| Home equity | 2,596 | 2,596 | 2,420 | 2,535 | 2,040 | ||||||||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 14 | ||||

| Bank of America Corporation and Subsidiaries | ||||||||||||||||||||||||||||||||||||||||||||

| Consumer Banking Quarterly Results | ||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | |||||||||||||||||||||||||||||||||||||||||||

| Total Consumer Banking | Deposits | Consumer Lending | Total Consumer Banking | Deposits | Consumer Lending | |||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 8,593 | $ | 5,816 | $ | 2,777 | $ | 8,494 | $ | 5,719 | $ | 2,775 | ||||||||||||||||||||||||||||||||

| Noninterest income: | ||||||||||||||||||||||||||||||||||||||||||||

| Card income | 1,274 | (10) | 1,284 | 1,333 | (9) | 1,342 | ||||||||||||||||||||||||||||||||||||||

| Service charges | 599 | 598 | 1 | 586 | 585 | 1 | ||||||||||||||||||||||||||||||||||||||

| All other income | 240 | 197 | 43 | 369 | 214 | 155 | ||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 2,113 | 785 | 1,328 | 2,288 | 790 | 1,498 | ||||||||||||||||||||||||||||||||||||||

| Total revenue, net of interest expense | 10,706 | 6,601 | 4,105 | 10,782 | 6,509 | 4,273 | ||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | 1,089 | 183 | 906 | 944 | 176 | 768 | ||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 5,473 | 3,415 | 2,058 | 5,100 | 3,189 | 1,911 | ||||||||||||||||||||||||||||||||||||||

| Income before income taxes | 4,144 | 3,003 | 1,141 | 4,738 | 3,144 | 1,594 | ||||||||||||||||||||||||||||||||||||||

| Income tax expense | 1,036 | 751 | 285 | 1,161 | 771 | 390 | ||||||||||||||||||||||||||||||||||||||

| Net income | $ | 3,108 | $ | 2,252 | $ | 856 | $ | 3,577 | $ | 2,373 | $ | 1,204 | ||||||||||||||||||||||||||||||||

| Net interest yield | 3.27 | % | 2.31 | % | 3.76 | % | 3.11 | % | 2.18 | % | 3.71 | % | ||||||||||||||||||||||||||||||||

Return on average allocated capital (1) | 30 | 67 | 12 | 35 | 72 | 18 | ||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | 51.12 | 51.76 | 50.10 | 47.29 | 49.00 | 44.70 | ||||||||||||||||||||||||||||||||||||||

| Balance Sheet | ||||||||||||||||||||||||||||||||||||||||||||

| Average | ||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 303,772 | $ | 4,119 | $ | 299,653 | $ | 300,360 | $ | 4,132 | $ | 296,228 | ||||||||||||||||||||||||||||||||

Total earning assets (2) | 1,065,202 | 1,022,445 | 299,794 | 1,083,850 | 1,042,289 | 296,535 | ||||||||||||||||||||||||||||||||||||||

Total assets (2) | 1,105,245 | 1,056,007 | 306,275 | 1,123,813 | 1,075,446 | 303,340 | ||||||||||||||||||||||||||||||||||||||

| Total deposits | 1,026,242 | 1,021,374 | 4,868 | 1,047,058 | 1,041,669 | 5,389 | ||||||||||||||||||||||||||||||||||||||

Allocated capital (1) | 42,000 | 13,700 | 28,300 | 40,000 | 13,000 | 27,000 | ||||||||||||||||||||||||||||||||||||||

| Period end | ||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 304,480 | $ | 4,065 | $ | 300,415 | $ | 304,761 | $ | 4,148 | $ | 300,613 | ||||||||||||||||||||||||||||||||

Total earning assets (2) | 1,081,780 | 1,038,545 | 300,595 | 1,085,079 | 1,043,049 | 300,787 | ||||||||||||||||||||||||||||||||||||||

Total assets (2) | 1,124,438 | 1,074,571 | 307,227 | 1,126,453 | 1,077,203 | 308,007 | ||||||||||||||||||||||||||||||||||||||

| Total deposits | 1,044,768 | 1,039,744 | 5,024 | 1,048,799 | 1,043,194 | 5,605 | ||||||||||||||||||||||||||||||||||||||

| First Quarter 2022 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Consumer Banking | Deposits | Consumer Lending | ||||||||||||||||||||||||||||||||||||||||||

| Net interest income | $ | 6,680 | $ | 4,052 | $ | 2,628 | ||||||||||||||||||||||||||||||||||||||

| Noninterest income: | ||||||||||||||||||||||||||||||||||||||||||||

| Card income | 1,185 | (8) | 1,193 | |||||||||||||||||||||||||||||||||||||||||

| Service charges | 844 | 843 | 1 | |||||||||||||||||||||||||||||||||||||||||

| All other income | 104 | 68 | 36 | |||||||||||||||||||||||||||||||||||||||||

| Total noninterest income | 2,133 | 903 | 1,230 | |||||||||||||||||||||||||||||||||||||||||

| Total revenue, net of interest expense | 8,813 | 4,955 | 3,858 | |||||||||||||||||||||||||||||||||||||||||

| Provision for credit losses | (52) | 73 | (125) | |||||||||||||||||||||||||||||||||||||||||

| Noninterest expense | 4,921 | 3,008 | 1,913 | |||||||||||||||||||||||||||||||||||||||||

| Income before income taxes | 3,944 | 1,874 | 2,070 | |||||||||||||||||||||||||||||||||||||||||

| Income tax expense | 966 | 459 | 507 | |||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 2,978 | $ | 1,415 | $ | 1,563 | ||||||||||||||||||||||||||||||||||||||

| Net interest yield | 2.48 | % | 1.56 | % | 3.79 | % | ||||||||||||||||||||||||||||||||||||||

Return on average allocated capital (1) | 30 | 44 | 23 | |||||||||||||||||||||||||||||||||||||||||

| Efficiency ratio | 55.84 | 60.71 | 49.58 | |||||||||||||||||||||||||||||||||||||||||

| Balance Sheet | ||||||||||||||||||||||||||||||||||||||||||||

| Average | ||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 284,068 | $ | 4,215 | $ | 279,853 | ||||||||||||||||||||||||||||||||||||||

Total earning assets (2) | 1,092,742 | 1,050,490 | 281,255 | |||||||||||||||||||||||||||||||||||||||||

Total assets (2) | 1,133,001 | 1,084,343 | 287,660 | |||||||||||||||||||||||||||||||||||||||||

| Total deposits | 1,056,100 | 1,050,247 | 5,853 | |||||||||||||||||||||||||||||||||||||||||

Allocated capital (1) | 40,000 | 13,000 | 27,000 | |||||||||||||||||||||||||||||||||||||||||

| Period end | ||||||||||||||||||||||||||||||||||||||||||||

| Total loans and leases | $ | 286,322 | $ | 4,165 | $ | 282,157 | ||||||||||||||||||||||||||||||||||||||

Total earning assets (2) | 1,125,963 | 1,083,664 | 284,069 | |||||||||||||||||||||||||||||||||||||||||

Total assets (2) | 1,166,443 | 1,117,241 | 290,972 | |||||||||||||||||||||||||||||||||||||||||

| Total deposits | 1,088,940 | 1,082,885 | 6,055 | |||||||||||||||||||||||||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 15 | ||||

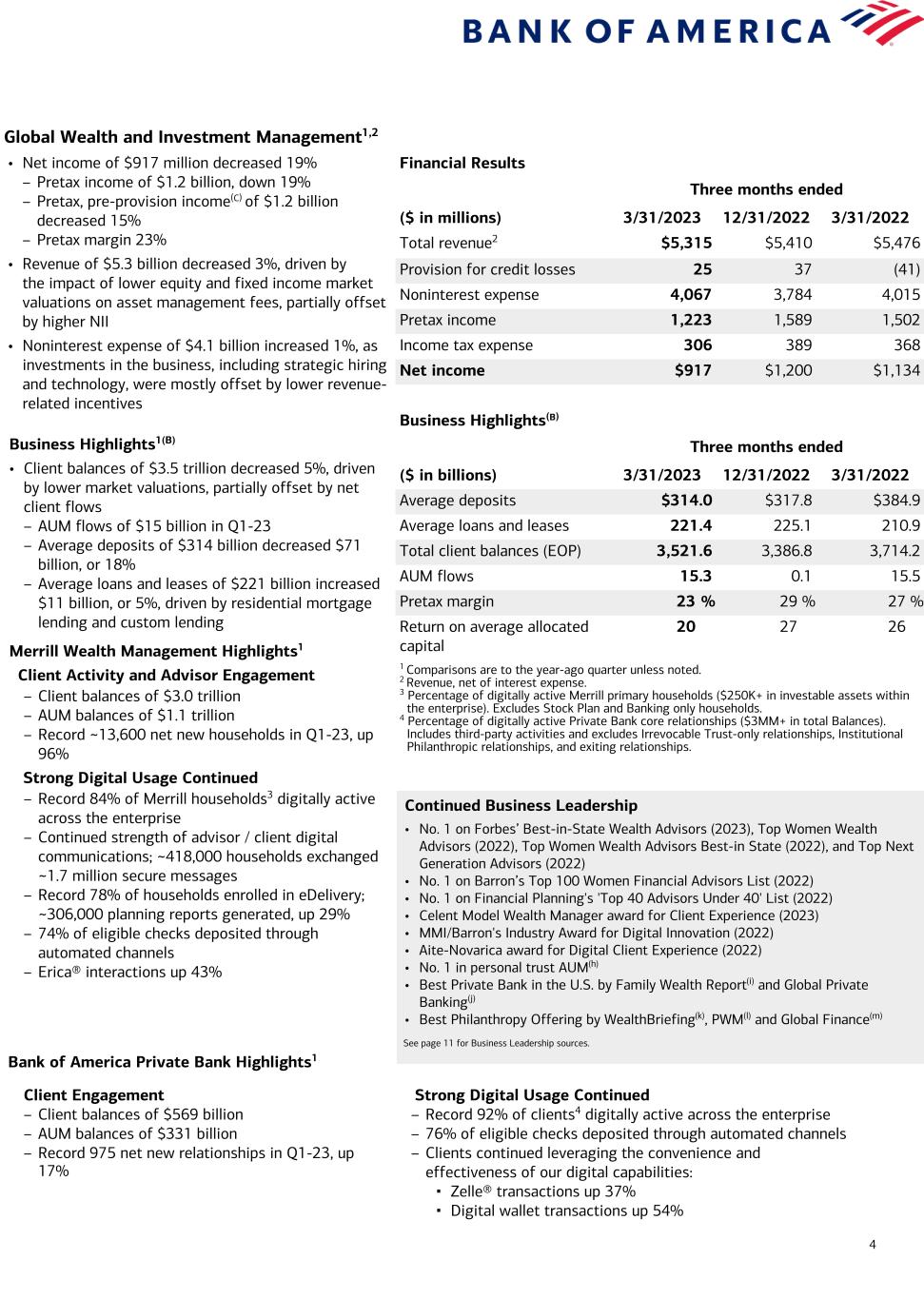

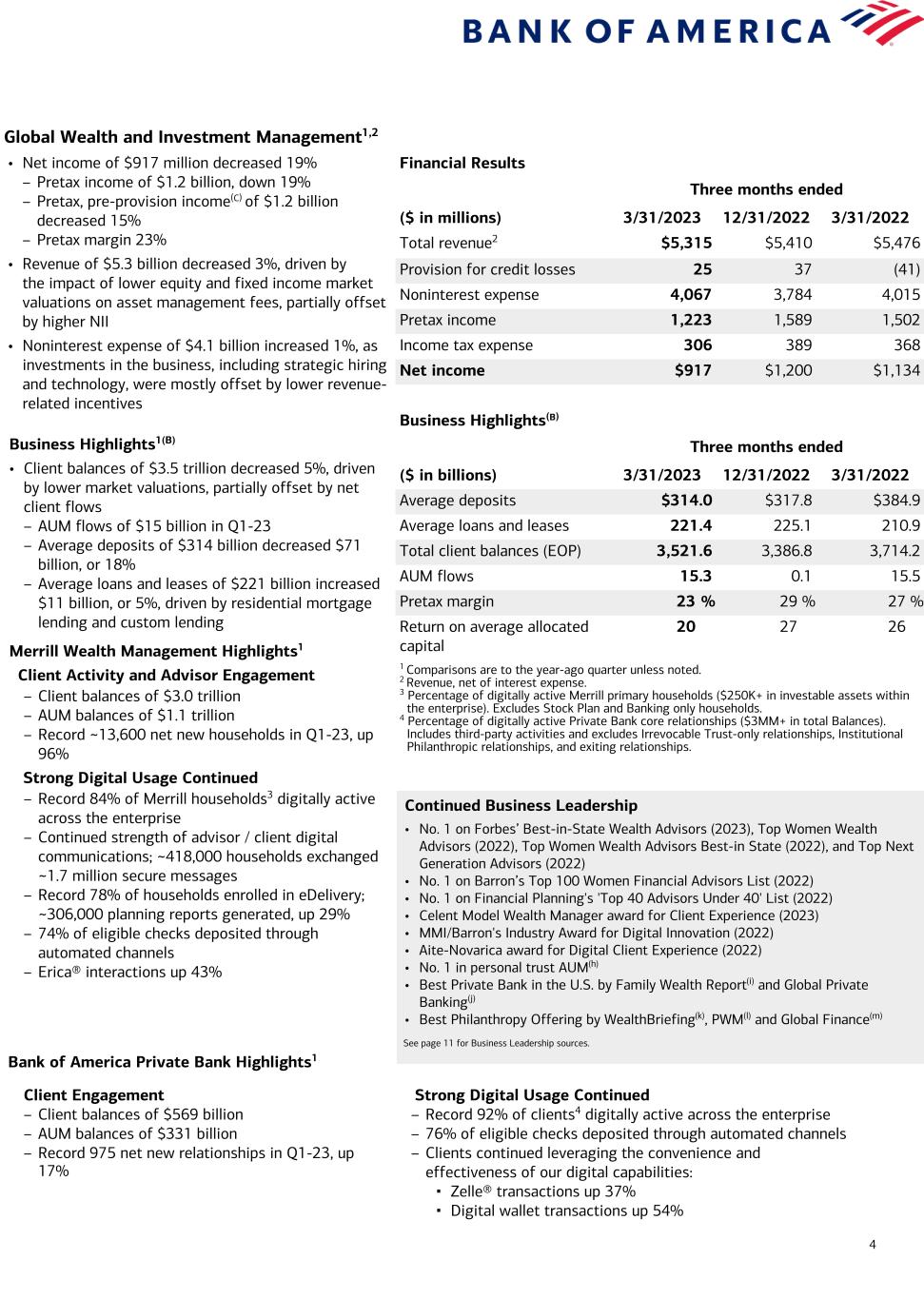

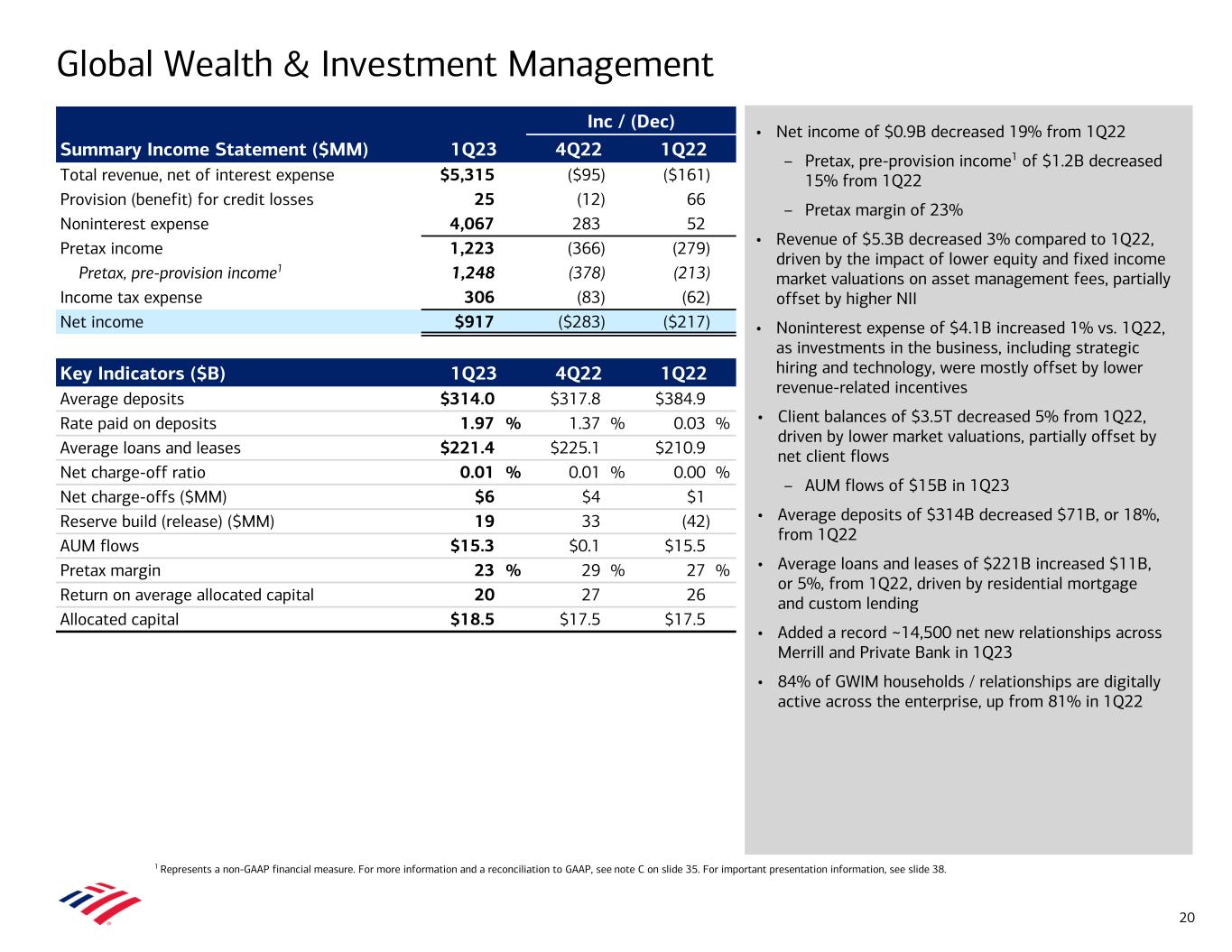

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||

| Global Wealth & Investment Management Segment Results | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

| Net interest income | $ | 1,876 | $ | 2,015 | $ | 1,981 | $ | 1,802 | $ | 1,668 | |||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||

| Investment and brokerage services | 3,238 | 3,166 | 3,255 | 3,486 | 3,654 | ||||||||||||||||||||||||

| All other income | 201 | 229 | 193 | 145 | 154 | ||||||||||||||||||||||||

| Total noninterest income | 3,439 | 3,395 | 3,448 | 3,631 | 3,808 | ||||||||||||||||||||||||

| Total revenue, net of interest expense | 5,315 | 5,410 | 5,429 | 5,433 | 5,476 | ||||||||||||||||||||||||

| Provision for credit losses | 25 | 37 | 37 | 33 | (41) | ||||||||||||||||||||||||

| Noninterest expense | 4,067 | 3,784 | 3,816 | 3,875 | 4,015 | ||||||||||||||||||||||||

| Income before income taxes | 1,223 | 1,589 | 1,576 | 1,525 | 1,502 | ||||||||||||||||||||||||

| Income tax expense | 306 | 389 | 386 | 374 | 368 | ||||||||||||||||||||||||

| Net income | $ | 917 | $ | 1,200 | $ | 1,190 | $ | 1,151 | $ | 1,134 | |||||||||||||||||||

| Net interest yield | 2.20 | % | 2.29 | % | 2.12 | % | 1.82 | % | 1.62 | % | |||||||||||||||||||

Return on average allocated capital (1) | 20 | 27 | 27 | 26 | 26 | ||||||||||||||||||||||||

| Efficiency ratio | 76.53 | 69.96 | 70.28 | 71.34 | 73.31 | ||||||||||||||||||||||||

| Balance Sheet | |||||||||||||||||||||||||||||

| Average | |||||||||||||||||||||||||||||

| Total loans and leases | $ | 221,448 | $ | 225,094 | $ | 223,734 | $ | 219,277 | $ | 210,937 | |||||||||||||||||||

Total earning assets (2) | 346,384 | 348,718 | 370,733 | 396,611 | 418,248 | ||||||||||||||||||||||||

Total assets (2) | 359,164 | 361,592 | 383,468 | 409,472 | 431,040 | ||||||||||||||||||||||||

| Total deposits | 314,019 | 317,849 | 339,487 | 363,943 | 384,902 | ||||||||||||||||||||||||

Allocated capital (1) | 18,500 | 17,500 | 17,500 | 17,500 | 17,500 | ||||||||||||||||||||||||

| Period end | |||||||||||||||||||||||||||||

| Total loans and leases | $ | 217,804 | $ | 223,910 | $ | 224,858 | $ | 221,705 | $ | 214,273 | |||||||||||||||||||

Total earning assets (2) | 336,560 | 355,461 | 357,434 | 380,771 | 419,903 | ||||||||||||||||||||||||

Total assets (2) | 349,888 | 368,893 | 370,790 | 393,948 | 433,122 | ||||||||||||||||||||||||

| Total deposits | 301,471 | 323,899 | 324,859 | 347,991 | 385,288 | ||||||||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 16 | ||||

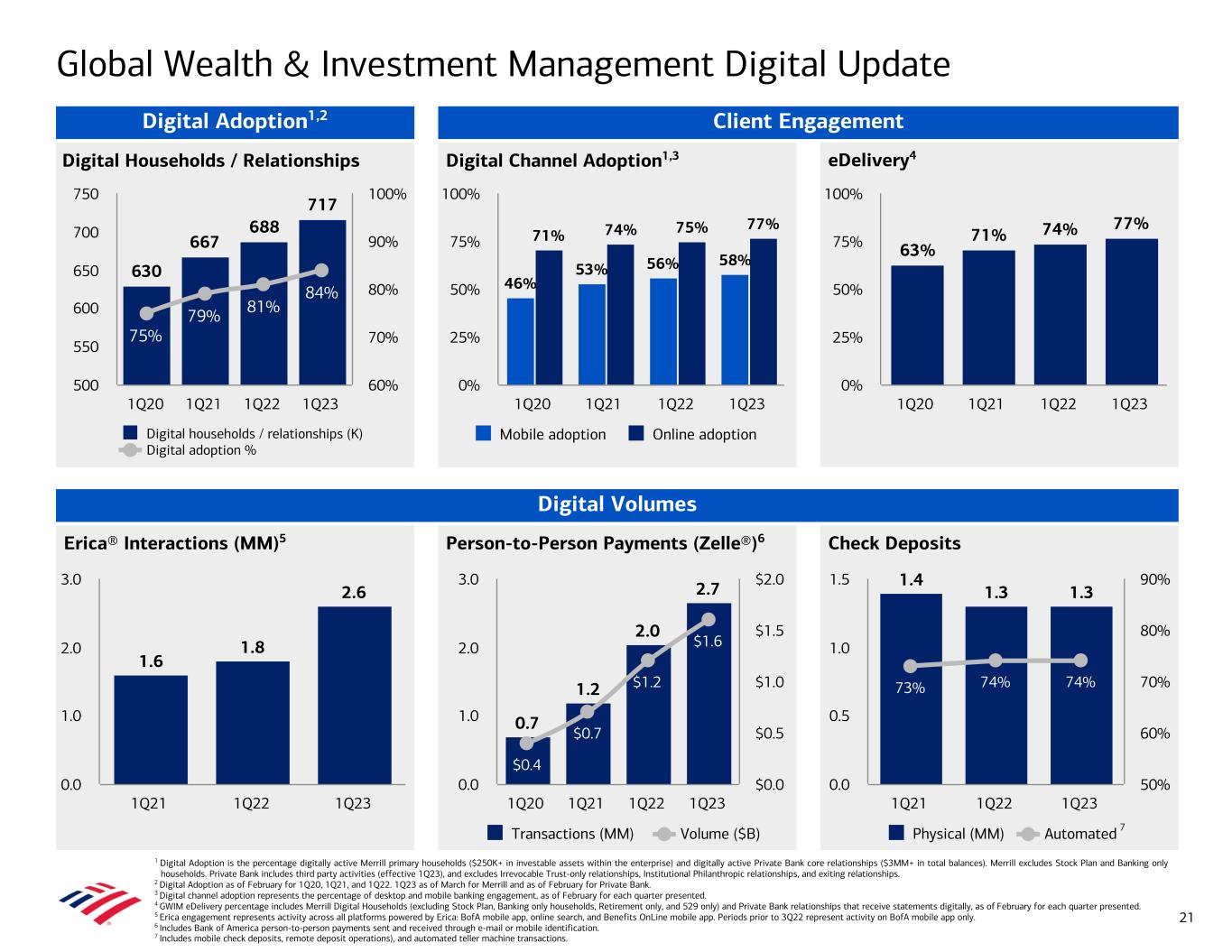

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||

| Global Wealth & Investment Management Key Indicators | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

| Revenue by Business | |||||||||||||||||||||||||||||

| Merrill Wealth Management | $ | 4,397 | $ | 4,486 | $ | 4,524 | $ | 4,536 | $ | 4,589 | |||||||||||||||||||

| Bank of America Private Bank | 918 | 924 | 905 | 897 | 887 | ||||||||||||||||||||||||

| Total revenue, net of interest expense | $ | 5,315 | $ | 5,410 | $ | 5,429 | $ | 5,433 | $ | 5,476 | |||||||||||||||||||

| Client Balances by Business, at period end | |||||||||||||||||||||||||||||

| Merrill Wealth Management | $ | 2,952,681 | $ | 2,822,910 | $ | 2,710,985 | $ | 2,819,998 | $ | 3,116,052 | |||||||||||||||||||

| Bank of America Private Bank | 568,925 | 563,931 | 537,771 | 547,116 | 598,100 | ||||||||||||||||||||||||

| Total client balances | $ | 3,521,606 | $ | 3,386,841 | $ | 3,248,756 | $ | 3,367,114 | $ | 3,714,152 | |||||||||||||||||||

| Client Balances by Type, at period end | |||||||||||||||||||||||||||||

Assets under management (1) | $ | 1,467,242 | $ | 1,401,474 | $ | 1,329,557 | $ | 1,411,344 | $ | 1,571,605 | |||||||||||||||||||

| Brokerage and other assets | 1,571,409 | 1,482,025 | 1,413,946 | 1,437,562 | 1,592,802 | ||||||||||||||||||||||||

| Deposits | 301,471 | 323,899 | 324,859 | 347,991 | 385,288 | ||||||||||||||||||||||||

Loans and leases (2) | 220,633 | 226,973 | 228,129 | 224,847 | 217,461 | ||||||||||||||||||||||||

| Less: Managed deposits in assets under management | (39,149) | (47,530) | (47,735) | (54,630) | (53,004) | ||||||||||||||||||||||||

| Total client balances | $ | 3,521,606 | $ | 3,386,841 | $ | 3,248,756 | $ | 3,367,114 | $ | 3,714,152 | |||||||||||||||||||

| Assets Under Management Rollforward | |||||||||||||||||||||||||||||

| Assets under management, beginning balance | $ | 1,401,474 | $ | 1,329,557 | $ | 1,411,344 | $ | 1,571,605 | $ | 1,638,782 | |||||||||||||||||||

| Net client flows | 15,262 | 105 | 4,110 | 1,033 | 15,537 | ||||||||||||||||||||||||

| Market valuation/other | 50,506 | 71,812 | (85,897) | (161,294) | (82,714) | ||||||||||||||||||||||||

| Total assets under management, ending balance | $ | 1,467,242 | $ | 1,401,474 | $ | 1,329,557 | $ | 1,411,344 | $ | 1,571,605 | |||||||||||||||||||

| Advisors, at period end | |||||||||||||||||||||||||||||

Total wealth advisors (3) | 19,243 | 19,273 | 18,841 | 18,449 | 18,571 | ||||||||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 17 | ||||

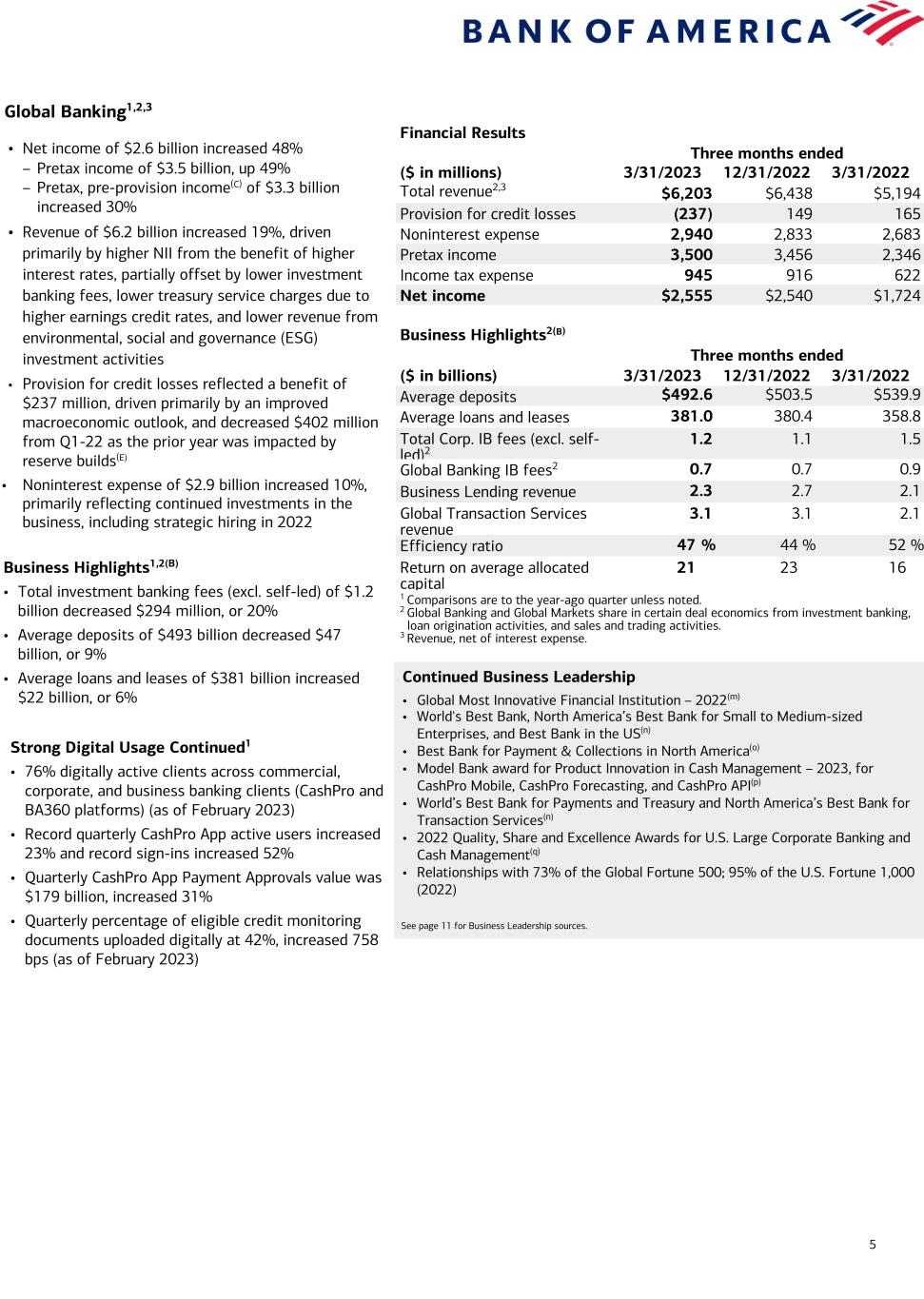

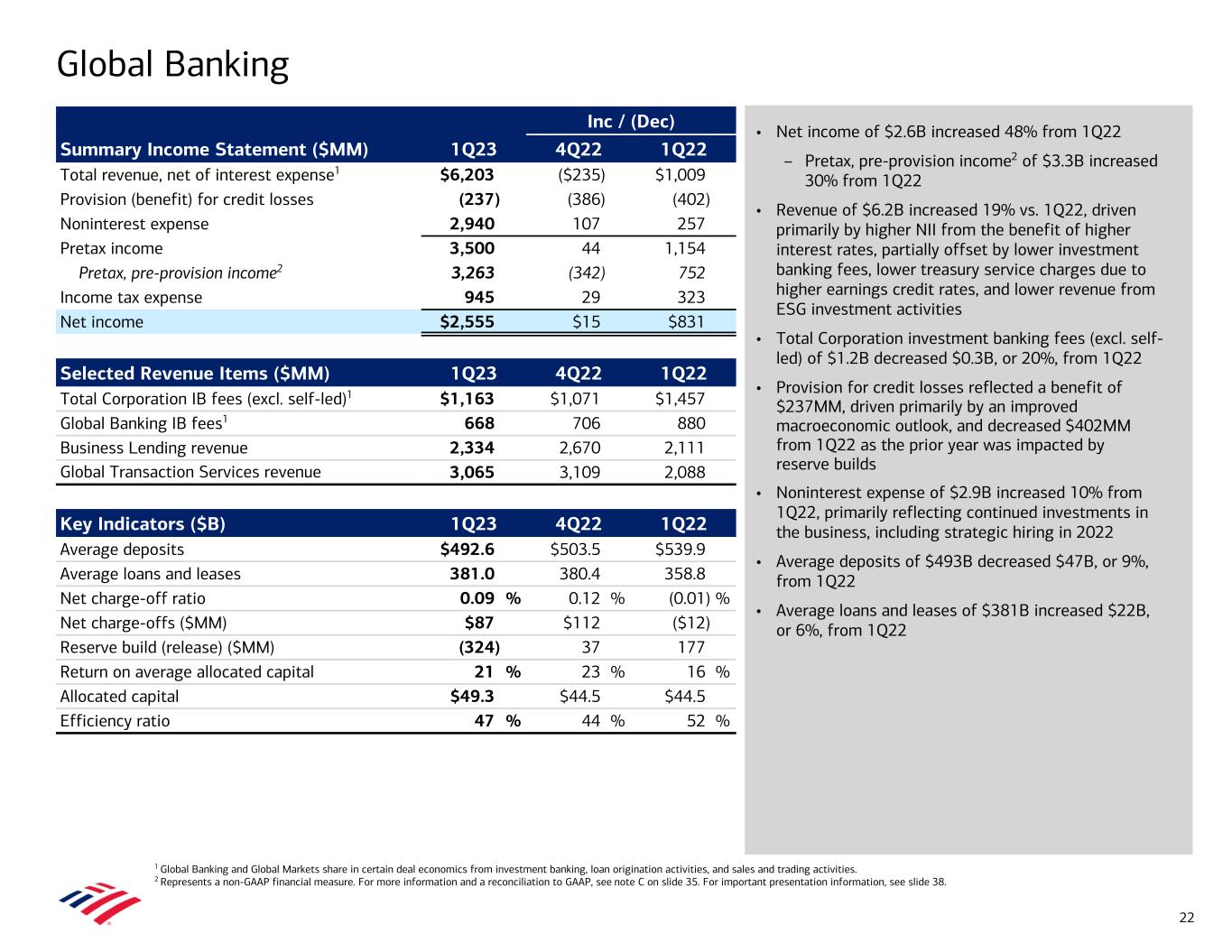

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||

| Global Banking Segment Results | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

| Net interest income | $ | 3,907 | $ | 3,880 | $ | 3,326 | $ | 2,634 | $ | 2,344 | |||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||

| Service charges | 714 | 703 | 771 | 933 | 886 | ||||||||||||||||||||||||

| Investment banking fees | 668 | 706 | 726 | 692 | 880 | ||||||||||||||||||||||||

| All other income | 914 | 1,149 | 768 | 747 | 1,084 | ||||||||||||||||||||||||

| Total noninterest income | 2,296 | 2,558 | 2,265 | 2,372 | 2,850 | ||||||||||||||||||||||||

| Total revenue, net of interest expense | 6,203 | 6,438 | 5,591 | 5,006 | 5,194 | ||||||||||||||||||||||||

| Provision for credit losses | (237) | 149 | 170 | 157 | 165 | ||||||||||||||||||||||||

| Noninterest expense | 2,940 | 2,833 | 2,651 | 2,799 | 2,683 | ||||||||||||||||||||||||

| Income before income taxes | 3,500 | 3,456 | 2,770 | 2,050 | 2,346 | ||||||||||||||||||||||||

| Income tax expense | 945 | 916 | 734 | 543 | 622 | ||||||||||||||||||||||||

| Net income | $ | 2,555 | $ | 2,540 | $ | 2,036 | $ | 1,507 | $ | 1,724 | |||||||||||||||||||

| Net interest yield | 3.03 | % | 2.90 | % | 2.53 | % | 1.97 | % | 1.68 | % | |||||||||||||||||||

Return on average allocated capital (1) | 21 | 23 | 18 | 14 | 16 | ||||||||||||||||||||||||

| Efficiency ratio | 47.41 | 44.03 | 47.41 | 55.90 | 51.65 | ||||||||||||||||||||||||

| Balance Sheet | |||||||||||||||||||||||||||||

| Average | |||||||||||||||||||||||||||||

| Total loans and leases | $ | 381,009 | $ | 380,385 | $ | 384,305 | $ | 377,248 | $ | 358,807 | |||||||||||||||||||

Total earning assets (2) | 522,374 | 531,206 | 521,555 | 537,660 | 566,277 | ||||||||||||||||||||||||

Total assets (2) | 588,886 | 595,525 | 585,683 | 601,945 | 630,517 | ||||||||||||||||||||||||

| Total deposits | 492,577 | 503,472 | 495,154 | 509,261 | 539,912 | ||||||||||||||||||||||||

Allocated capital (1) | 49,250 | 44,500 | 44,500 | 44,500 | 44,500 | ||||||||||||||||||||||||

| Period end | |||||||||||||||||||||||||||||

| Total loans and leases | $ | 383,491 | $ | 379,107 | $ | 377,711 | $ | 385,376 | $ | 367,423 | |||||||||||||||||||

Total earning assets (2) | 524,299 | 522,539 | 511,494 | 526,879 | 558,639 | ||||||||||||||||||||||||

Total assets (2) | 591,231 | 588,466 | 575,442 | 591,490 | 623,168 | ||||||||||||||||||||||||

| Total deposits | 495,949 | 498,661 | 484,309 | 499,714 | 533,820 | ||||||||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 18 | ||||

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||

| Global Banking Key Indicators | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

Investment Banking fees (1) | |||||||||||||||||||||||||||||

Advisory (2) | $ | 313 | $ | 446 | $ | 397 | $ | 361 | $ | 439 | |||||||||||||||||||

| Debt issuance | 290 | 184 | 273 | 283 | 359 | ||||||||||||||||||||||||

| Equity issuance | 65 | 76 | 56 | 48 | 82 | ||||||||||||||||||||||||

Total Investment Banking fees (3) | $ | 668 | $ | 706 | $ | 726 | $ | 692 | $ | 880 | |||||||||||||||||||

| Business Lending | |||||||||||||||||||||||||||||

| Corporate | $ | 1,034 | $ | 1,417 | $ | 902 | $ | 946 | $ | 1,060 | |||||||||||||||||||

| Commercial | 1,233 | 1,188 | 1,111 | 1,024 | 993 | ||||||||||||||||||||||||

| Business Banking | 67 | 65 | 66 | 62 | 58 | ||||||||||||||||||||||||

| Total Business Lending revenue | $ | 2,334 | $ | 2,670 | $ | 2,079 | $ | 2,032 | $ | 2,111 | |||||||||||||||||||

| Global Transaction Services | |||||||||||||||||||||||||||||

| Corporate | $ | 1,549 | $ | 1,546 | $ | 1,369 | $ | 1,138 | $ | 949 | |||||||||||||||||||

| Commercial | 1,129 | 1,185 | 1,112 | 973 | 896 | ||||||||||||||||||||||||

| Business Banking | 387 | 378 | 322 | 270 | 243 | ||||||||||||||||||||||||

| Total Global Transaction Services revenue | $ | 3,065 | $ | 3,109 | $ | 2,803 | $ | 2,381 | $ | 2,088 | |||||||||||||||||||

| Average deposit balances | |||||||||||||||||||||||||||||

| Interest-bearing | $ | 257,012 | $ | 225,671 | $ | 171,203 | $ | 142,366 | $ | 157,126 | |||||||||||||||||||

| Noninterest-bearing | 235,565 | 277,801 | 323,951 | 366,895 | 382,786 | ||||||||||||||||||||||||

| Total average deposits | $ | 492,577 | $ | 503,472 | $ | 495,154 | $ | 509,261 | $ | 539,912 | |||||||||||||||||||

| Loan spread | 1.55 | % | 1.52 | % | 1.51 | % | 1.49 | % | 1.53 | % | |||||||||||||||||||

| Provision for credit losses | $ | (237) | $ | 149 | $ | 170 | $ | 157 | $ | 165 | |||||||||||||||||||

Credit quality (4, 5) | |||||||||||||||||||||||||||||

| Reservable criticized utilized exposure | $ | 18,104 | $ | 17,519 | $ | 15,809 | $ | 15,999 | $ | 18,304 | |||||||||||||||||||

| 4.46 | % | 4.37 | % | 3.95 | % | 3.92 | % | 4.72 | % | ||||||||||||||||||||

| Nonperforming loans, leases and foreclosed properties | $ | 1,023 | $ | 923 | $ | 1,057 | $ | 1,126 | $ | 1,329 | |||||||||||||||||||

| 0.27 | % | 0.25 | % | 0.28 | % | 0.29 | % | 0.37 | % | ||||||||||||||||||||

| Average loans and leases by product | |||||||||||||||||||||||||||||

| U.S. commercial | $ | 229,558 | $ | 230,591 | $ | 233,027 | $ | 225,820 | $ | 211,568 | |||||||||||||||||||

| Non-U.S. commercial | 82,412 | 82,222 | 84,287 | 86,092 | 80,783 | ||||||||||||||||||||||||

| Commercial real estate | 55,019 | 54,104 | 53,042 | 50,973 | 51,400 | ||||||||||||||||||||||||

| Commercial lease financing | 14,019 | 13,467 | 13,948 | 14,362 | 15,055 | ||||||||||||||||||||||||

| Other | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||||||||||

| Total average loans and leases | $ | 381,009 | $ | 380,385 | $ | 384,305 | $ | 377,248 | $ | 358,807 | |||||||||||||||||||

| Total Corporation Investment Banking fees | |||||||||||||||||||||||||||||

Advisory (2) | $ | 363 | $ | 486 | $ | 432 | $ | 392 | $ | 473 | |||||||||||||||||||

| Debt issuance | 644 | 414 | 616 | 662 | 831 | ||||||||||||||||||||||||

| Equity issuance | 168 | 189 | 156 | 139 | 225 | ||||||||||||||||||||||||

| Total investment banking fees including self-led deals | 1,175 | 1,089 | 1,204 | 1,193 | 1,529 | ||||||||||||||||||||||||

| Self-led deals | (12) | (18) | (37) | (65) | (72) | ||||||||||||||||||||||||

| Total Investment Banking fees | $ | 1,163 | $ | 1,071 | $ | 1,167 | $ | 1,128 | $ | 1,457 | |||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 19 | ||||

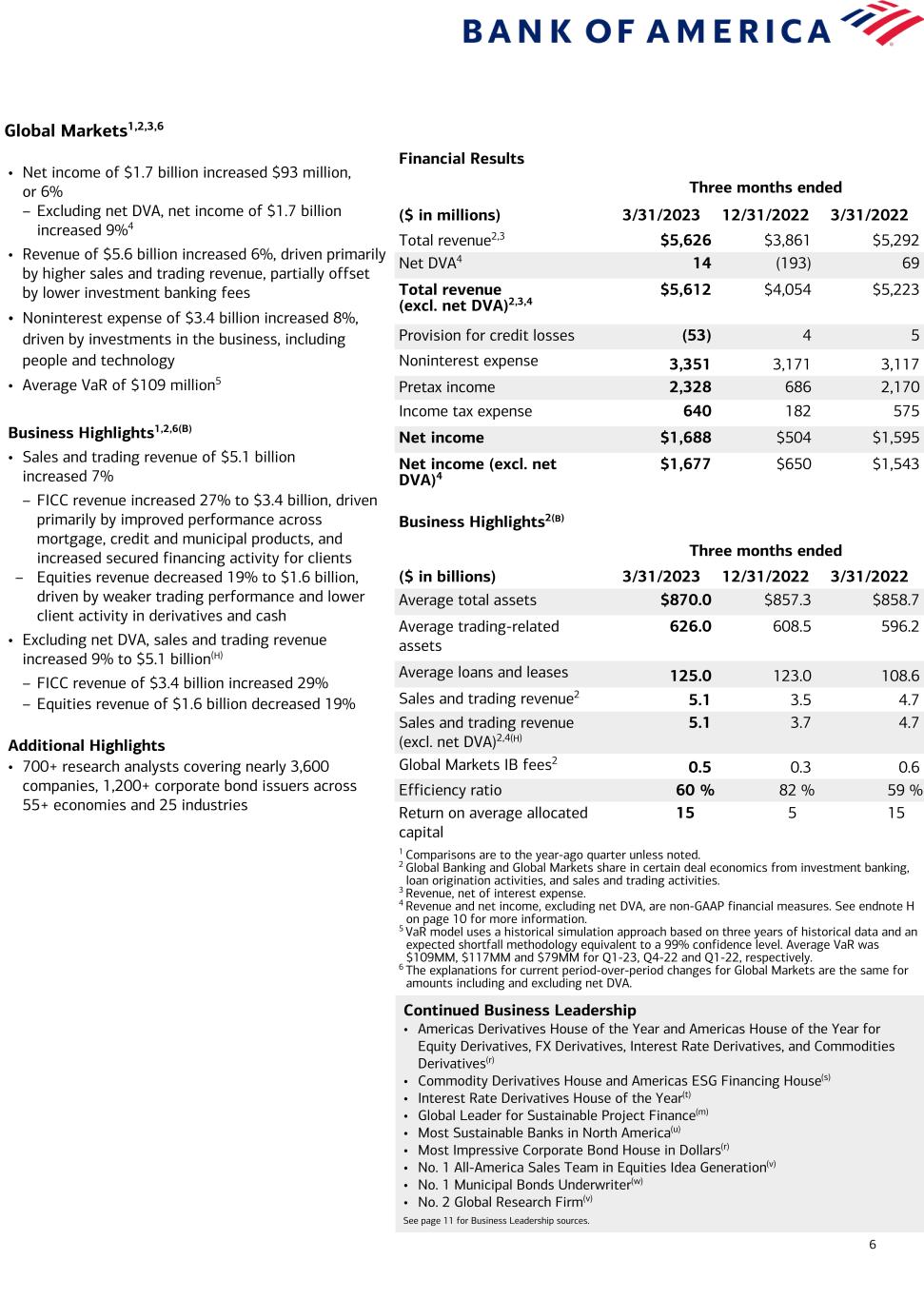

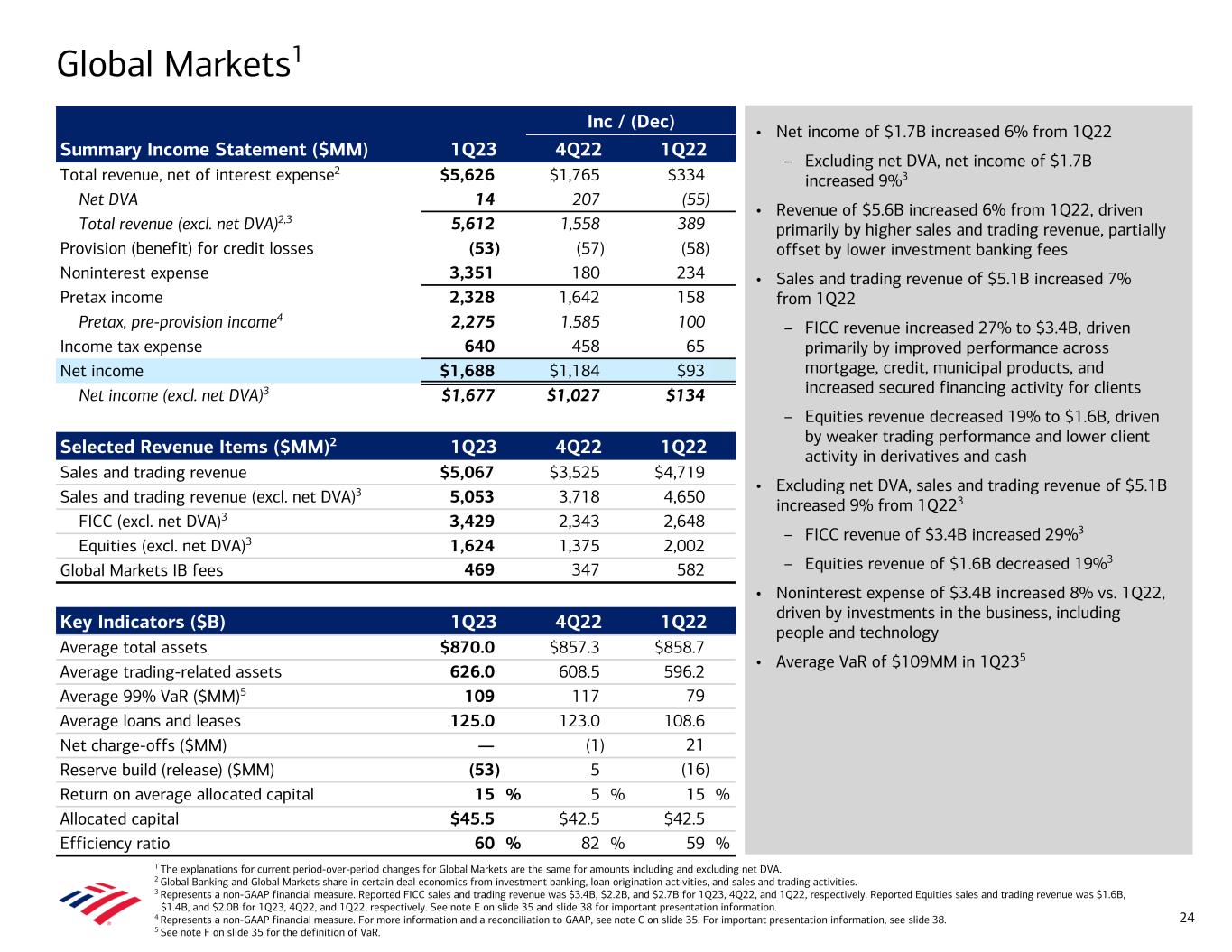

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||

| Global Markets Segment Results | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

| Net interest income | $ | 109 | $ | 371 | $ | 743 | $ | 981 | $ | 993 | |||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||

| Investment and brokerage services | 533 | 482 | 457 | 518 | 545 | ||||||||||||||||||||||||

| Investment banking fees | 469 | 347 | 430 | 461 | 582 | ||||||||||||||||||||||||

| Market making and similar activities | 4,398 | 2,685 | 2,874 | 2,657 | 3,190 | ||||||||||||||||||||||||

| All other income | 117 | (24) | (21) | (115) | (18) | ||||||||||||||||||||||||

| Total noninterest income | 5,517 | 3,490 | 3,740 | 3,521 | 4,299 | ||||||||||||||||||||||||

Total revenue, net of interest expense (1) | 5,626 | 3,861 | 4,483 | 4,502 | 5,292 | ||||||||||||||||||||||||

| Provision for credit losses | (53) | 4 | 11 | 8 | 5 | ||||||||||||||||||||||||

| Noninterest expense | 3,351 | 3,171 | 3,023 | 3,109 | 3,117 | ||||||||||||||||||||||||

| Income before income taxes | 2,328 | 686 | 1,449 | 1,385 | 2,170 | ||||||||||||||||||||||||

| Income tax expense | 640 | 182 | 384 | 367 | 575 | ||||||||||||||||||||||||

| Net income | $ | 1,688 | $ | 504 | $ | 1,065 | $ | 1,018 | $ | 1,595 | |||||||||||||||||||

Return on average allocated capital (2) | 15 | % | 5 | % | 10 | % | 10 | % | 15 | % | |||||||||||||||||||

| Efficiency ratio | 59.56 | 82.14 | 67.42 | 69.07 | 58.90 | ||||||||||||||||||||||||

| Balance Sheet | |||||||||||||||||||||||||||||

| Average | |||||||||||||||||||||||||||||

| Total trading-related assets | $ | 626,035 | $ | 608,493 | $ | 592,391 | $ | 606,135 | $ | 596,154 | |||||||||||||||||||

| Total loans and leases | 125,046 | 123,022 | 120,435 | 114,375 | 108,576 | ||||||||||||||||||||||||

| Total earning assets | 627,935 | 610,045 | 591,883 | 598,832 | 610,926 | ||||||||||||||||||||||||

| Total assets | 870,038 | 857,319 | 847,899 | 866,742 | 858,719 | ||||||||||||||||||||||||

| Total deposits | 36,109 | 37,219 | 38,820 | 41,192 | 44,393 | ||||||||||||||||||||||||

Allocated capital (2) | 45,500 | 42,500 | 42,500 | 42,500 | 42,500 | ||||||||||||||||||||||||

| Period end | |||||||||||||||||||||||||||||

| Total trading-related assets | $ | 599,841 | $ | 564,769 | $ | 592,938 | $ | 577,309 | $ | 616,811 | |||||||||||||||||||

| Total loans and leases | 130,804 | 127,735 | 121,721 | 118,290 | 110,037 | ||||||||||||||||||||||||

| Total earning assets | 632,873 | 587,772 | 595,988 | 571,921 | 609,290 | ||||||||||||||||||||||||

| Total assets | 861,477 | 812,489 | 848,752 | 835,129 | 883,304 | ||||||||||||||||||||||||

| Total deposits | 33,624 | 39,077 | 37,318 | 40,055 | 43,371 | ||||||||||||||||||||||||

| Trading-related assets (average) | |||||||||||||||||||||||||||||

| Trading account securities | $ | 339,248 | $ | 309,217 | $ | 308,514 | $ | 295,190 | $ | 301,285 | |||||||||||||||||||

| Reverse repurchases | 126,760 | 122,753 | 112,828 | 131,456 | 138,581 | ||||||||||||||||||||||||

| Securities borrowed | 116,280 | 119,334 | 114,032 | 119,200 | 114,468 | ||||||||||||||||||||||||

| Derivative assets | 43,747 | 57,189 | 57,017 | 60,289 | 41,820 | ||||||||||||||||||||||||

| Total trading-related assets | $ | 626,035 | $ | 608,493 | $ | 592,391 | $ | 606,135 | $ | 596,154 | |||||||||||||||||||

| Current-period information is preliminary and based on company data available at the time of the presentation. | 20 | ||||

| Bank of America Corporation and Subsidiaries | |||||||||||||||||||||||||||||

| Global Markets Key Indicators | |||||||||||||||||||||||||||||

| (Dollars in millions) | |||||||||||||||||||||||||||||

| First Quarter 2023 | Fourth Quarter 2022 | Third Quarter 2022 | Second Quarter 2022 | First Quarter 2022 | |||||||||||||||||||||||||

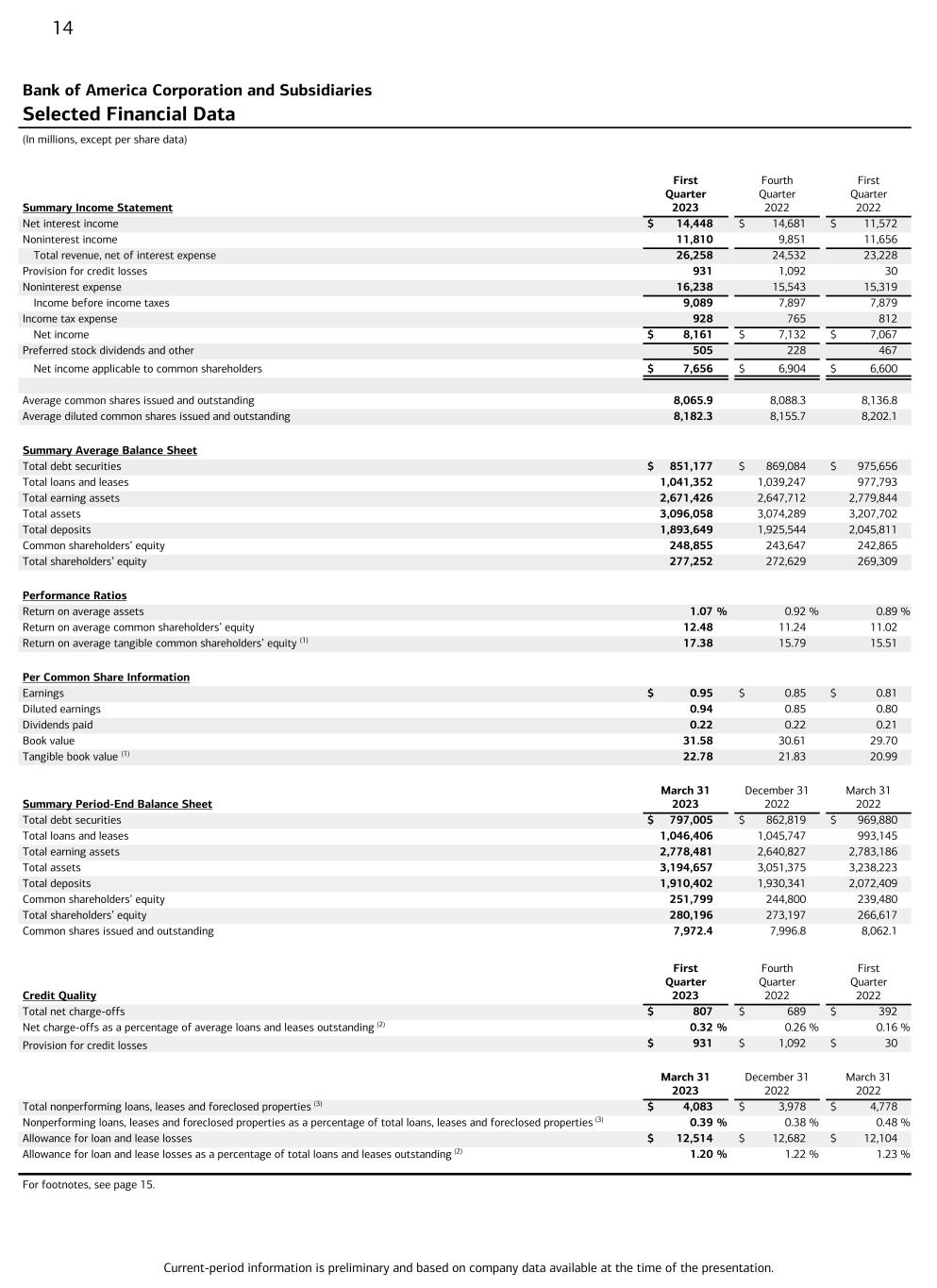

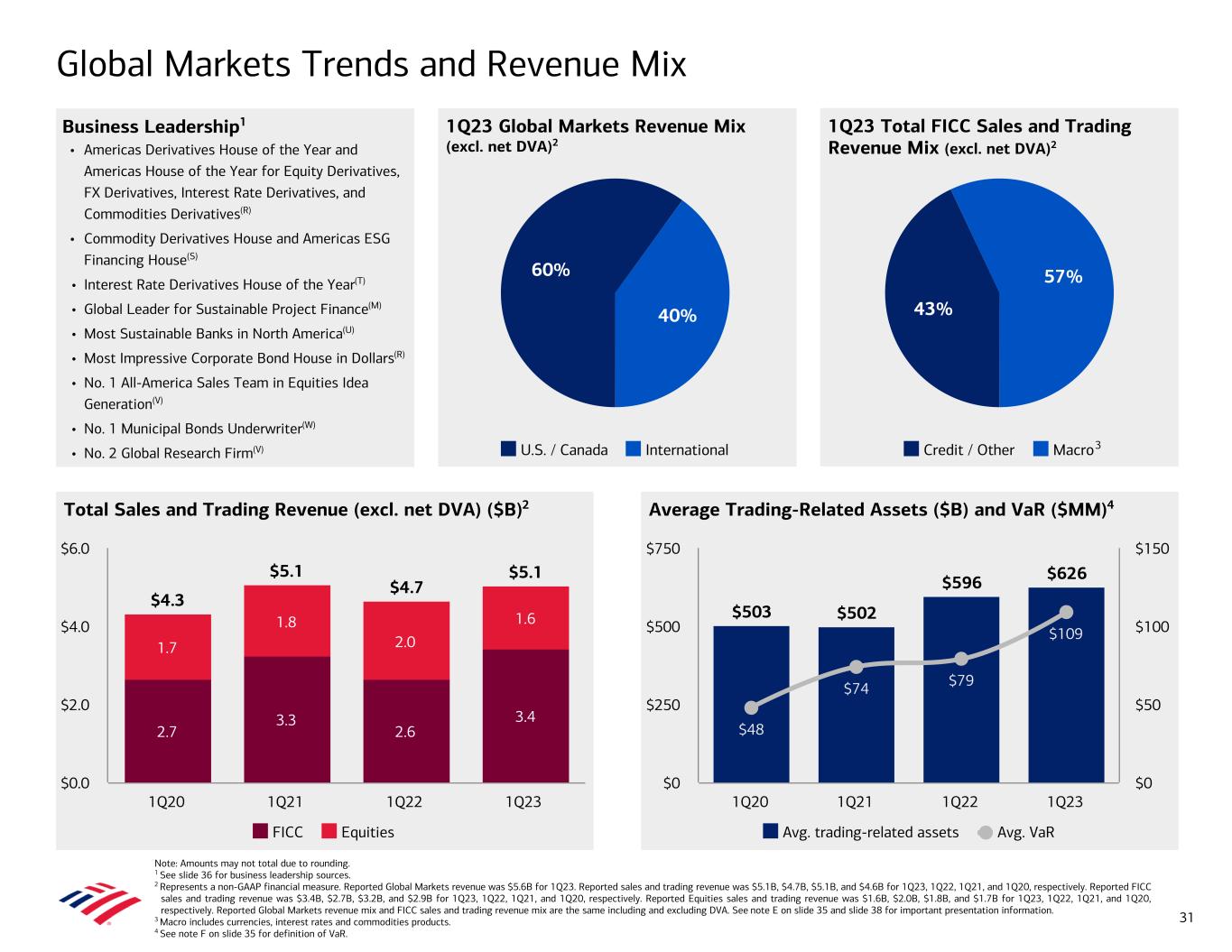

Sales and trading revenue (1) | |||||||||||||||||||||||||||||

| Fixed-income, currencies and commodities | $ | 3,440 | $ | 2,157 | $ | 2,552 | $ | 2,500 | $ | 2,708 | |||||||||||||||||||

| Equities | 1,627 | 1,368 | 1,540 | 1,653 | 2,011 | ||||||||||||||||||||||||

| Total sales and trading revenue | $ | 5,067 | $ | 3,525 | $ | 4,092 | $ | 4,153 | $ | 4,719 | |||||||||||||||||||

Sales and trading revenue, excluding net debit valuation adjustment (2,3) | |||||||||||||||||||||||||||||

| Fixed-income, currencies and commodities | $ | 3,429 | $ | 2,343 | $ | 2,567 | $ | 2,340 | $ | 2,648 | |||||||||||||||||||