• | Deposit Balances up 4 Percent Companywide From Q2-12 to $1.1 Trillion |

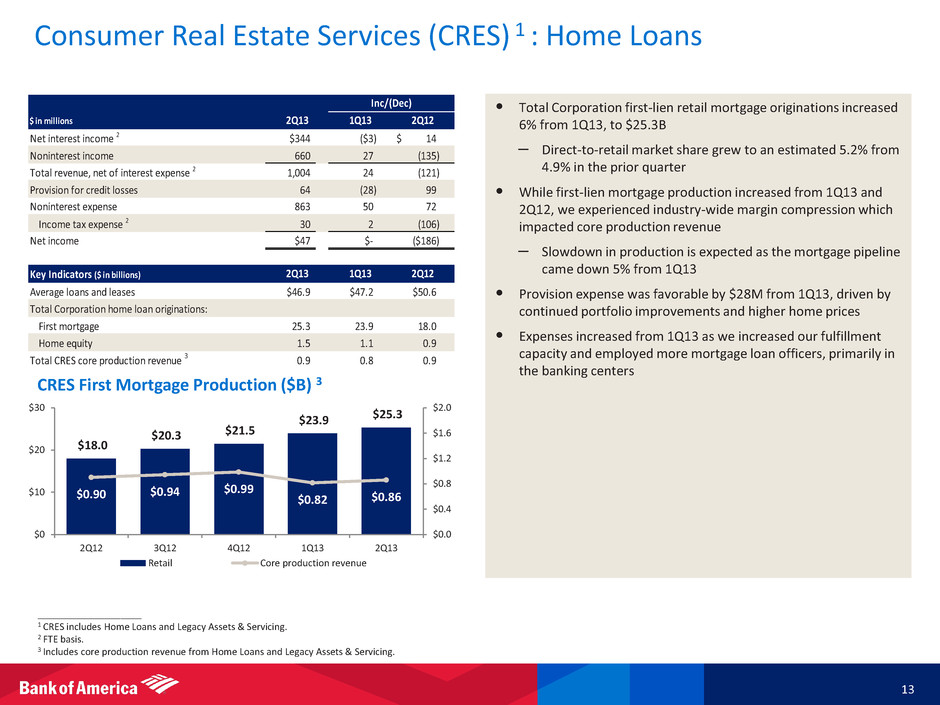

• | First-lien Mortgage Production up 40 Percent From Q2-12 to $25 Billion |

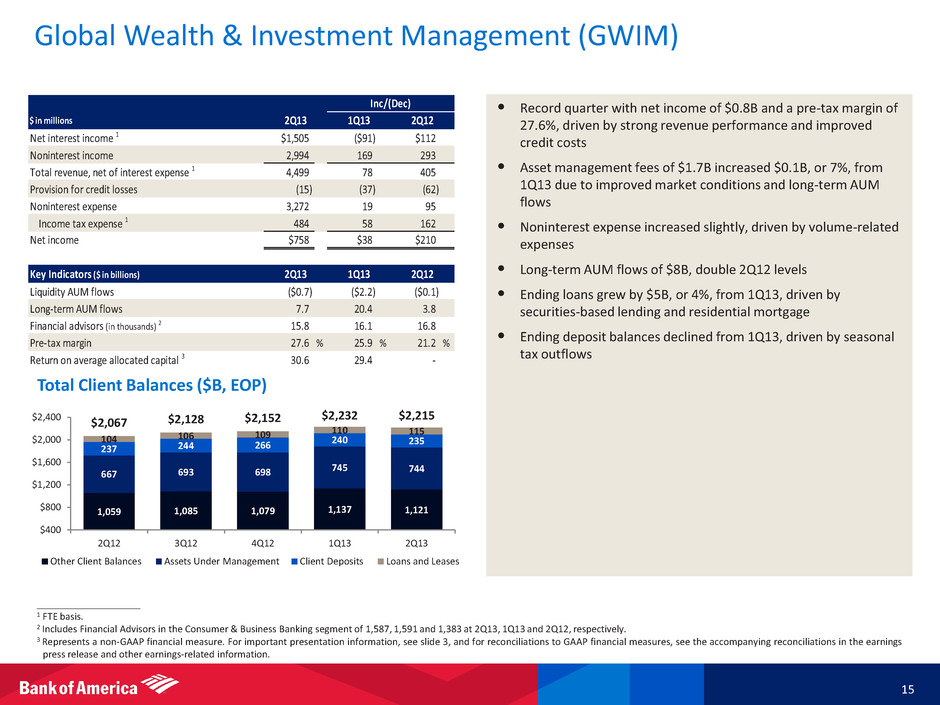

• | Global Wealth and Investment Management Reports Record Revenue, Pretax Margin, Net Income, Asset Management Fees and Loan Balances |

• | Commercial Loan Balances up 20 Percent From Q2-12 to $381 Billion |

• | Global Investment Banking Fees up 36 Percent From Q2-12 to $1.6 Billion; Maintained No. 2 Ranking in Global Investment Banking Fees |

• | Total Noninterest Expense of $16 Billion, Down $1 Billion From Q2-12 |

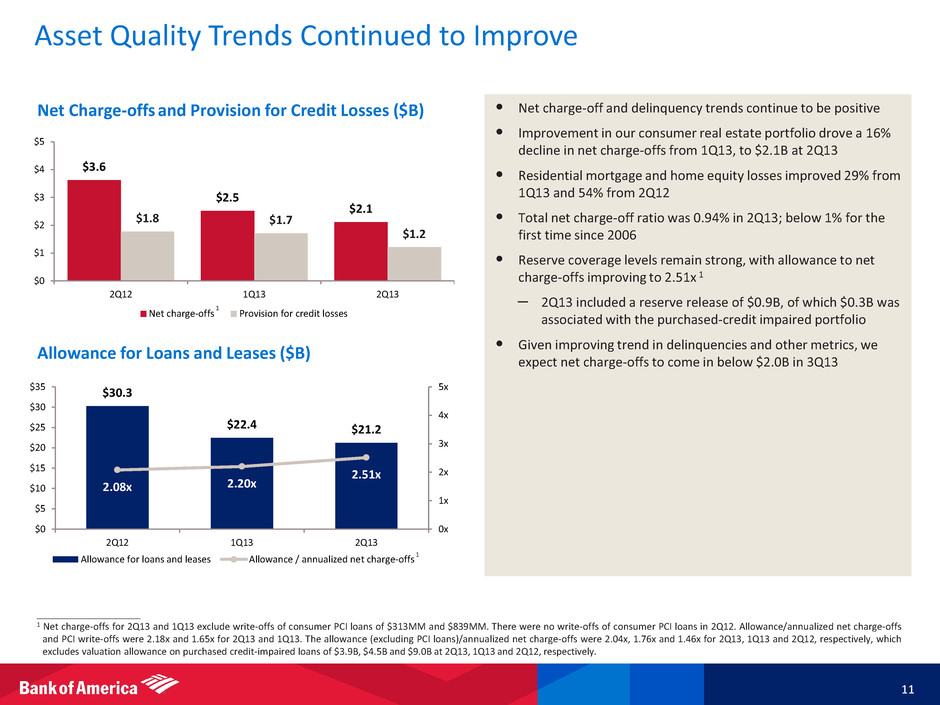

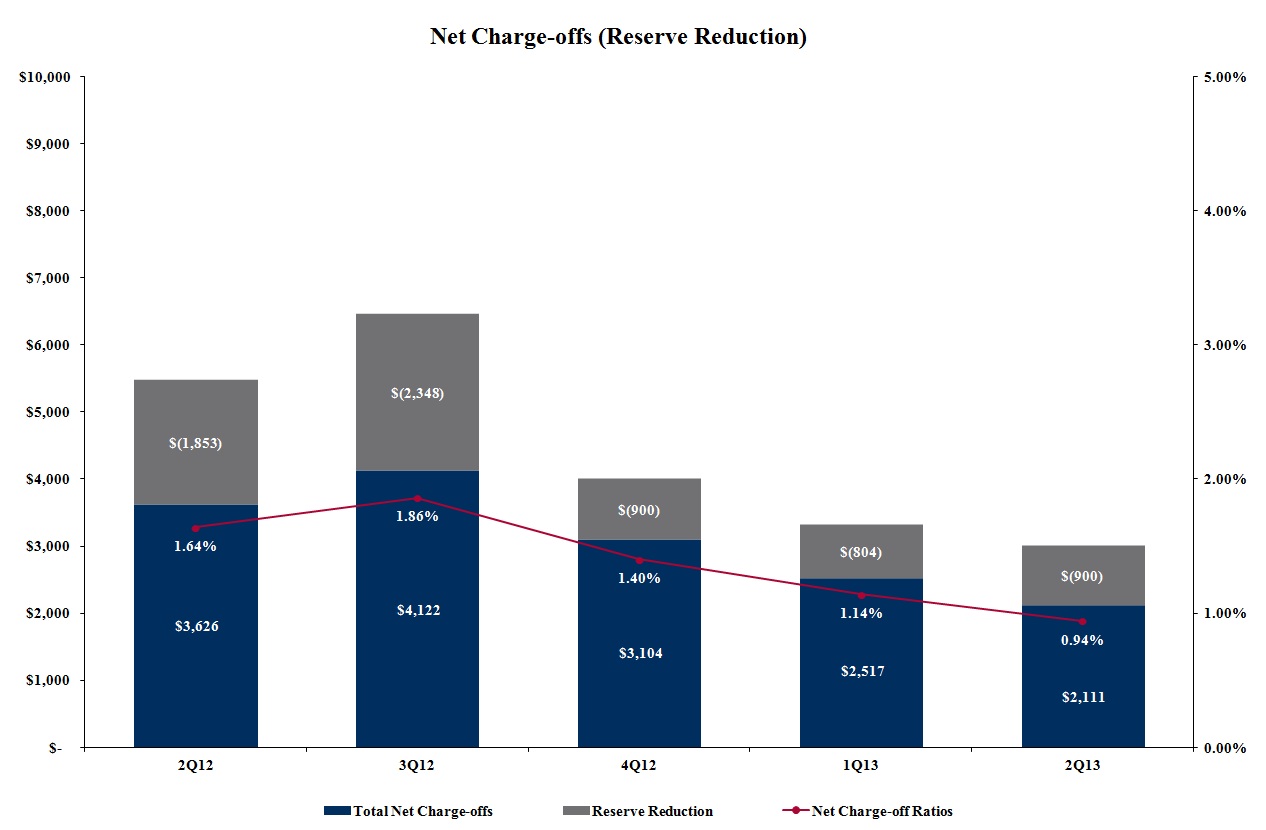

• | Credit Quality Continued to Improve With Net Credit Loss Rates Below 1 Percent for the First Time Since Second Quarter of 2006 |

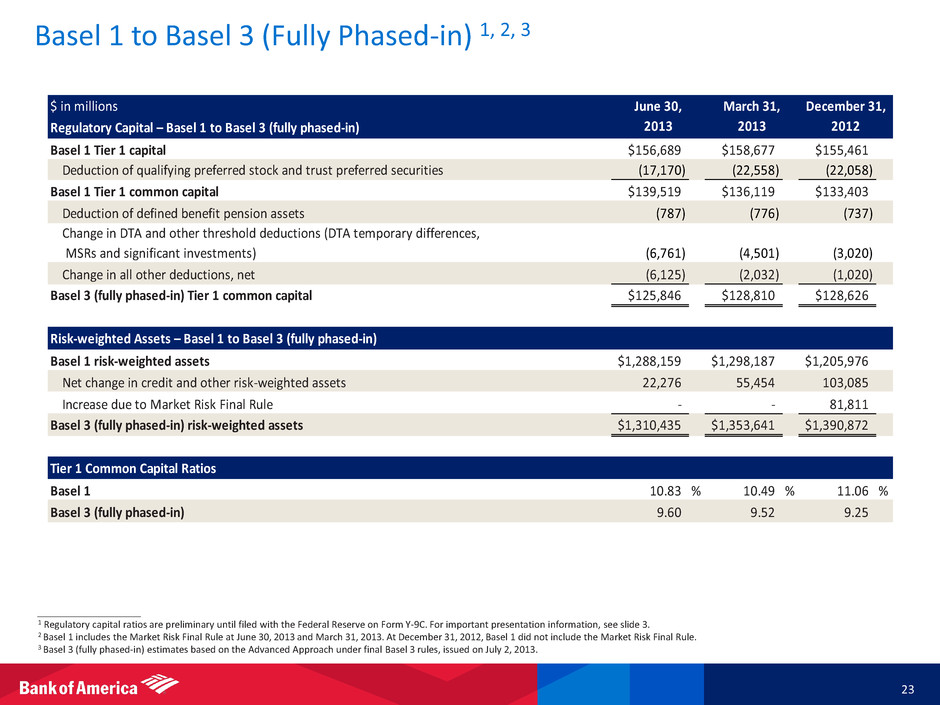

• | Basel 1 Tier 1 Common Capital Ratio of 10.83 Percent, up From 10.49 Percent in Prior Quarter |

• | Estimated Basel 3 Tier 1 Common Capital Ratio of 9.60 Percent, up From 9.52 Percent in Prior QuarterB |

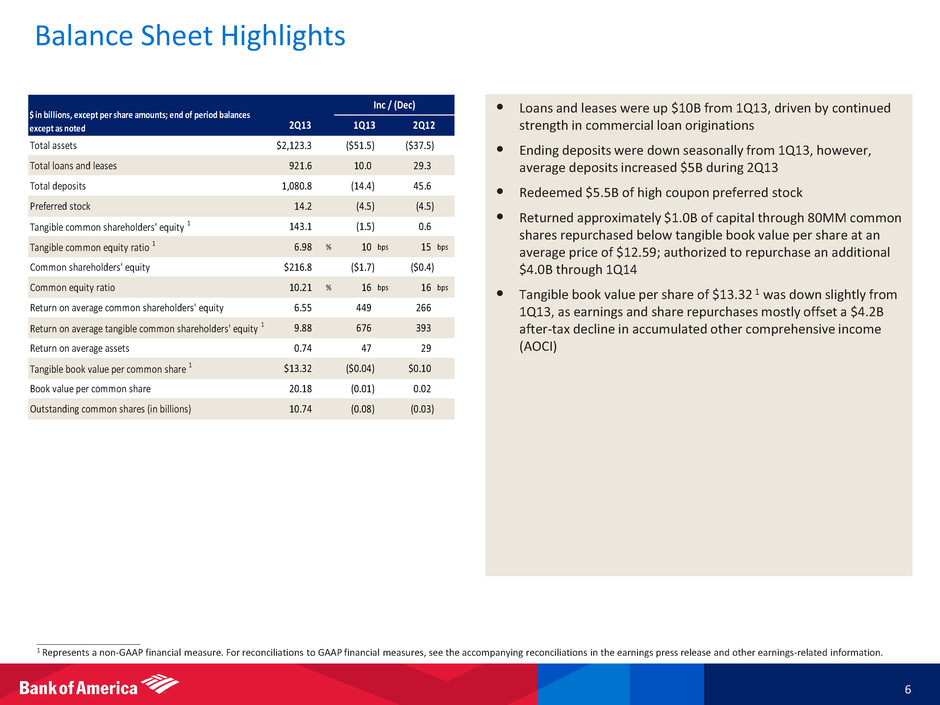

• | Long-term Debt Down $39 Billion From Year-ago Quarter, Driven by Maturities and Liability Management Actions |

• | Parent Company Liquidity Remained Strong With Time-to-required Funding at 32 Months |

Three Months Ended | |||||||||||

(Dollars in millions, except per share data) | June 30 2013 | March 31 2013 | June 30 2012 | ||||||||

Net interest income, FTE basis1 | $ | 10,771 | $ | 10,875 | $ | 9,782 | |||||

Noninterest income | 12,178 | 12,533 | 12,420 | ||||||||

Total revenue, net of interest expense, FTE basis | 22,949 | 23,408 | 22,202 | ||||||||

Provision for credit losses | 1,211 | 1,713 | 1,773 | ||||||||

Noninterest expense | 16,018 | 19,500 | 17,048 | ||||||||

Net income | $ | 4,012 | $ | 1,483 | $ | 2,463 | |||||

Diluted earnings per common share | $ | 0.32 | $ | 0.10 | $ | 0.19 | |||||

1 | Fully taxable-equivalent (FTE) basis is a non-GAAP financial measure. For reconciliations to GAAP financial measures, refer to pages 22-24 of this press release. Net interest income on a GAAP basis was $10.5 billion, $10.7 billion and $9.5 billion for the three months ended June 30, 2013, March 31, 2013 and June 30, 2012, respectively. Total revenue, net of interest expense, on a GAAP basis was $22.7 billion, $23.2 billion and $22.0 billion for the three months ended June 30, 2013, March 31, 2013 and June 30, 2012, respectively. |

Three Months Ended | |||||||||||

(Dollars in millions) | June 30 2013 | March 31 2013 | June 30 2012 | ||||||||

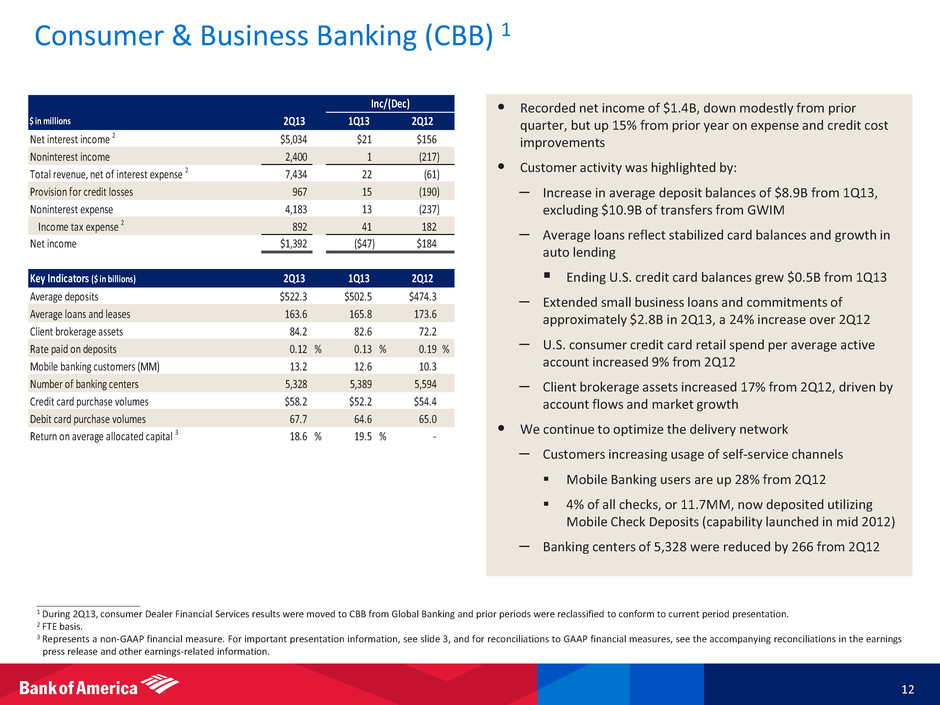

Total revenue, net of interest expense, FTE basis | $ | 7,434 | $ | 7,412 | $ | 7,495 | |||||

Provision for credit losses | 967 | 952 | 1,157 | ||||||||

Noninterest expense | 4,183 | 4,170 | 4,420 | ||||||||

Net income | $ | 1,392 | $ | 1,439 | $ | 1,208 | |||||

Return on average allocated capital2, 3 | 18.64 | % | 19.48 | % | — | ||||||

Return on average economic capital2, 3 | — | — | 20.46 | % | |||||||

Average loans | $ | 163,593 | $ | 165,845 | $ | 173,565 | |||||

Average deposits | 522,259 | 502,508 | 474,328 | ||||||||

At period-end | |||||||||||

Brokerage assets | $ | 84,182 | $ | 82,616 | $ | 72,226 | |||||

1 | During the second quarter of 2013, the results of consumer Dealer Financial Services (DFS), previously reported in Global Banking, were moved into CBB and prior periods have been reclassified to conform to current period presentation. |

2 | Effective January 1, 2013, the company revised, on a prospective basis, its methodology for allocating capital to the business segments. In connection with this change in methodology, the company updated the applicable terminology to allocated capital from economic capital as reported in prior periods. For reconciliation of allocated capital, refer to pages 22-24 of this press release. |

3 | Return on average allocated capital and return on average economic capital are non-GAAP financial measures. The company believes the use of these non-GAAP financial measures provides additional clarity in assessing the results of the segments. Other companies may define or calculate these measures differently. For reconciliation to GAAP financial measures, refer to pages 22-24 of this press release. |

• | Average deposit balances of $522.3 billion increased $47.9 billion, or 10 percent, from the same period a year ago. The increase was driven by growth in liquid products in a low-rate environment and an $18 billion average impact of deposit transfers primarily from Global Wealth and Investment Management. The average rate paid on deposits in the second quarter of 2013 declined 7 basis points from the year-ago quarter due to pricing discipline and a shift in the mix of deposits. |

• | The number of mobile banking customers increased 28 percent from the year-ago quarter to 13.2 million, and 11.7 million checks were deposited this quarter via Mobile Check Deposits, reflecting a continued focus on enhancing the customer experience. |

• | U.S. consumer credit card retail spending per average active account increased 9 percent from the second quarter of 2012. |

• | Merrill Edge brokerage assets increased 17 percent from the same period a year ago to $84.2 billion due to positive account flows and market growth. |

• | Small business loan originations and commitments rose 24 percent from the year-ago quarter to $2.8 billion. |

• | The company's specialized sales force of financial solutions advisors, mortgage loan officers and small business bankers increased to more than 6,800 specialists in the second quarter of 2013, up 21 percent from the same period a year ago, reflecting the company's continued commitment to deepening customer relationships. |

Three Months Ended | |||||||||||

(Dollars in millions) | June 30 2013 | March 31 2013 | June 30 2012 | ||||||||

Total revenue, net of interest expense, FTE basis | $ | 2,115 | $ | 2,312 | $ | 2,529 | |||||

Provision for credit losses | 291 | 335 | 187 | ||||||||

Noninterest expense | 3,394 | 5,406 | 3,524 | ||||||||

Net loss | $ | (937 | ) | $ | (2,157 | ) | $ | (744 | ) | ||

Average loans and leases | 90,114 | 92,963 | 105,507 | ||||||||

At period-end | |||||||||||

Loans and leases | $ | 89,257 | $ | 90,971 | $ | 104,079 | |||||

• | Bank of America funded $26.8 billion in residential home loans and home equity loans during the second quarter of 2013, up 7 percent from the first quarter of 2013, and 41 percent higher than the second quarter of 2012. |

• | The residential fundings helped more than 112,000 homeowners either refinance an existing mortgage or purchase a home through our retail channels, including more than 4,600 first-time homebuyer mortgages and more than 40,000 mortgages to low- and moderate-income borrowers. |

• | The number of 60+ days delinquent first mortgage loans serviced by LAS declined 26 percent during the second quarter of 2013 to 492,000 loans from 667,000 loans at the end of the first quarter of 2013, and declined 54 percent from 1.06 million loans at the end of the second quarter of 2012. |

Three Months Ended | |||||||||||

(Dollars in millions) | June 30 2013 | March 31 2013 | June 30 2012 | ||||||||

Total revenue, net of interest expense, FTE basis | $ | 4,499 | $ | 4,421 | $ | 4,094 | |||||

Provision for credit losses | (15 | ) | 22 | 47 | |||||||

Noninterest expense | 3,272 | 3,253 | 3,177 | ||||||||

Net income | $ | 758 | $ | 720 | $ | 548 | |||||

Return on average allocated capital1, 2 | 30.57 | % | 29.38 | % | — | ||||||

Return on average economic capital1, 2 | — | — | 31.76 | % | |||||||

Average loans and leases | $ | 109,589 | $ | 106,082 | $ | 98,964 | |||||

Average deposits | 235,344 | 253,413 | 238,540 | ||||||||

At period-end (Dollars in billions) | |||||||||||

Assets under management | $ | 743.6 | $ | 745.3 | $ | 667.5 | |||||

Total client balances3 | 2,215.1 | 2,231.7 | 2,066.6 | ||||||||

1 | Effective January 1, 2013, the company revised, on a prospective basis, its methodology for allocating capital to the business segments. In connection with this change in methodology, the company updated the applicable terminology to allocated capital from economic capital as reported in prior periods. For reconciliation of allocated capital, refer to pages 22-24 of this press release. |

2 | Return on average allocated capital and return on average economic capital are non-GAAP financial measures. The company believes the use of these non-GAAP financial measures provides additional clarity in assessing the results of the segments. Other companies may define or calculate these measures differently. For reconciliation to GAAP financial measures, refer to pages 22-24 of this press release. |

3 | Total client balances are defined as assets under management, assets in custody, client brokerage assets, client deposits and loans (including margin receivables). |

• | Record quarterly results in revenue, pretax margin, net income, asset management fees and loan balances. |

• | Client balances rose 8 percent (excluding balances transferred to Consumer and Business Banking) from the year-ago quarter to $2.22 trillion. |

• | Asset management fees grew to $1.7 billion, up 10 percent from the year-ago quarter. |

• | Long-term assets under management (AUM) flows more than doubled from the year-ago quarter to $7.7 billion, marking the 16th consecutive quarter of positive flows. |

• | Period-end loan balances increased to $111.8 billion, up 11 percent from the year-ago quarter. |

• | Period-end deposit balances decreased $2.3 billion to $235.0 billion from the year-ago quarter as $15 billion of organic growth was offset by $17 billion of net transfers of deposits to Consumer and Business Banking. |

Three Months Ended | |||||||||||

(Dollars in millions) | June 30 2013 | March 31 2013 | June 30 2012 | ||||||||

Total revenue, net of interest expense, FTE basis | $ | 4,139 | $ | 4,030 | $ | 3,908 | |||||

Provision for credit losses | 163 | 149 | (152 | ) | |||||||

Noninterest expense | 1,859 | 1,837 | 1,967 | ||||||||

Net income | $ | 1,291 | $ | 1,284 | $ | 1,318 | |||||

Return on average allocated capital2, 3 | 22.52 | % | 22.65 | % | — | ||||||

Return on average economic capital2, 3 | — | — | 27.24 | % | |||||||

Average loans and leases | $ | 255,674 | $ | 244,068 | $ | 219,504 | |||||

Average deposits | 227,668 | 222,120 | 213,862 | ||||||||

1 | During the second quarter of 2013, the results of consumer Dealer Financial Services (DFS), previously reported in Global Banking, were moved into CBB and prior periods have been reclassified to conform to current period presentation. |

2 | Effective January 1, 2013, the company revised, on a prospective basis, its methodology for allocating capital to the business segments. In connection with this change in methodology, the company updated the applicable terminology to allocated capital from economic capital as reported in prior periods. For reconciliation of allocated capital, refer to pages 22-24 of this press release. |

3 | Return on average allocated capital and return on average economic capital are non-GAAP financial measures. The company believes the use of these non-GAAP financial measures provides additional clarity in assessing the results of the segments. Other companies may define or calculate these measures differently. For reconciliation to GAAP financial measures, refer to pages 22-24 of this press release. |

• | Bank of America Merrill Lynch (BAML) maintained its No. 2 ranking in global net investment banking fees in the second quarter of 2013, with a 7.4 percent market share, according to Dealogic. BAML was also ranked among the top three financial institutions in high-yield corporate debt, leveraged loans, investment-grade corporate debt, asset-backed securities, mortgage-backed securities and syndicated loans during the second quarter, according to Dealogic. |

• | Average loan and lease balances increased $36.2 billion, or 16 percent, from the year-ago quarter to $255.7 billion and $11.6 billion, or 5 percent, from the prior quarter with growth primarily in the commercial and industrial portfolio and the commercial real estate portfolio. Average international loans increased 29 percent from the year-ago quarter, driven by gains across all regions. |

• | Average deposits rose $13.8 billion, or 6 percent, from the year-ago quarter to $227.7 billion, due to growth in international deposits, which increased 22 percent from the year-ago quarter, reflecting the strength of the international franchise. |

Three Months Ended | |||||||||||

(Dollars in millions) | June 30 2013 | March 31 2013 | June 30 2012 | ||||||||

Total revenue, net of interest expense, FTE basis | $ | 4,189 | $ | 4,869 | $ | 3,578 | |||||

Total revenue, net of interest expense, FTE basis, excluding DVA1 | 4,151 | 4,924 | 3,734 | ||||||||

Provision for credit losses | (16 | ) | 5 | (1 | ) | ||||||

Noninterest expense | 2,769 | 3,073 | 2,855 | ||||||||

Net income | $ | 959 | $ | 1,169 | $ | 497 | |||||

Net income, excluding DVA1 | 935 | 1,204 | 595 | ||||||||

Return on average allocated capital2, 3 | 12.85 | % | 15.83 | % | — | ||||||

Return on average economic capital2, 3 | — | — | 15.10 | % | |||||||

Total average assets | $ | 653,116 | $ | 667,265 | $ | 596,861 | |||||

1 | Total revenue, net of interest expense, on an FTE basis excluding DVA and net income excluding DVA are non-GAAP financial measures. DVA gains (losses) were $38 million, $(55) million and $(156) million for the three months ended June 30, 2013, March 31, 2013 and June 30, 2012, respectively. |

2 | Effective January 1, 2013, the company revised, on a prospective basis, its methodology for allocating capital to the business segments. In connection with this change in methodology, the company updated the applicable terminology to allocated capital from economic capital as reported in prior periods. For reconciliation of allocated capital, refer to pages 22-24 of this press release. |

3 | Return on average allocated capital and return on average economic capital are non-GAAP financial measures. The company believes the use of these non-GAAP financial measures provides additional clarity in assessing the results of the segments. Other companies may define or calculate these measures differently. For reconciliation to GAAP financial measures, refer to pages 22-24 of this press release. |

• | Equities revenue, excluding DVAD, rose 53 percent from the second quarter of 2012, and was the highest since the first quarter of 2011, driven by increased market share and improved trading performance. |

• | International revenue, excluding DVAC, increased to 43 percent of global revenue compared to 34 percent in the year-ago quarter. |

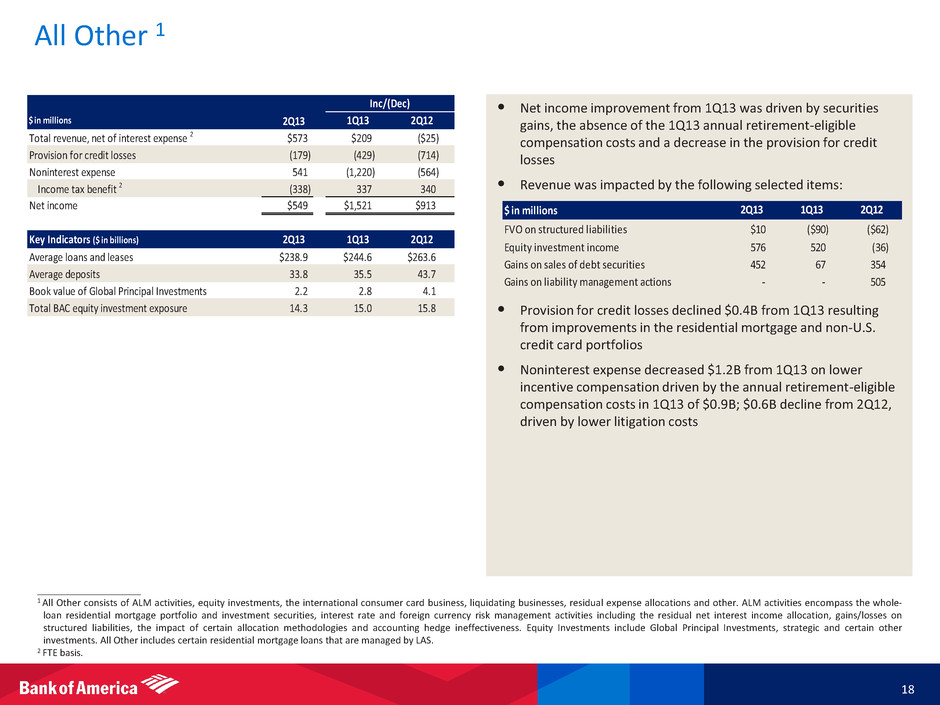

Three Months Ended | |||||||||||

(Dollars in millions) | June 30 2013 | March 31 2013 | June 30 2012 | ||||||||

Total revenue, net of interest expense, FTE basis2 | $ | 573 | $ | 364 | $ | 598 | |||||

Provision for credit losses | (179 | ) | 250 | 535 | |||||||

Noninterest expense | 541 | 1,761 | 1,105 | ||||||||

Net income (loss) | $ | 549 | $ | (972 | ) | $ | (364 | ) | |||

Total average loans | 238,910 | 244,557 | 263,649 | ||||||||

1 | All Other consists of ALM activities, equity investments, the international consumer card business, liquidating businesses and other. ALM activities encompass the whole-loan residential mortgage portfolio and investment securities, interest rate and foreign currency risk management activities including the residual net interest income allocation, gains/losses on structured liabilities, and the impact of certain allocation methodologies and accounting hedge ineffectiveness. Equity Investments includes Global Principal Investments (GPI), strategic and certain other investments. Other includes certain residential mortgage loans that are managed by Legacy Assets and Servicing within CRES. |

2 | Revenue includes equity investment income (loss) of $576 million, $520 million and ($36) million for the three months ended June 30, 2013, March 31, 2013 and June 30, 2012, respectively, and gains on sales of debt securities of $452 million, $67 million and $354 million for the three months ended June 30, 2013, March 31, 2013 and June 30, 2012, respectively. |

Three Months Ended | |||||||||||

(Dollars in millions) | June 30 2013 | March 31 2013 | June 30 2012 | ||||||||

Provision for credit losses | $ | 1,211 | $ | 1,713 | $ | 1,773 | |||||

Net charge-offs1 | 2,111 | 2,517 | 3,626 | ||||||||

Net charge-off ratio1, 2 | 0.94 | % | 1.14 | % | 1.64 | % | |||||

Net charge-off ratio, excluding the PCI loan portfolio2, 3 | 0.97 | 1.18 | 1.69 | ||||||||

Net charge-off ratio, including PCI write-offs2, 3 | 1.07 | 1.52 | n/a | ||||||||

At period-end | |||||||||||

Nonperforming loans, leases and foreclosed properties | $ | 21,280 | $ | 22,842 | $ | 25,377 | |||||

Nonperforming loans, leases and foreclosed properties ratio3 | 2.33 | % | 2.53 | % | 2.87 | % | |||||

Allowance for loan and lease losses | $ | 21,235 | $ | 22,441 | $ | 30,288 | |||||

Allowance for loan and lease losses ratio4 | 2.33 | % | 2.49 | % | 3.43 | % | |||||

1 | Excludes write-offs of PCI loans of $313 million and $839 million for the three months ended June 30, 2013 and March 31, 2013. There were no write-offs of PCI loans for the three months ended June 30, 2012. |

2 | Net charge-off ratios are calculated as net charge-offs divided by average outstanding loans and leases during the period; quarterly results are annualized. |

3 | Nonperforming loans, leases and foreclosed properties ratios are calculated as nonperforming loans, leases and foreclosed properties divided by outstanding loans, leases and foreclosed properties at the end of the period. |

4 | Allowance for loan and lease losses ratios are calculated as allowance for loan and lease losses divided by loans and leases outstanding at the end of the period. |

(Dollars in millions, except per share information) | At June 30 2013 | At March 31 2013 | At June 30 2012 | ||||||||

Total shareholders’ equity | $ | 231,032 | $ | 237,293 | $ | 235,975 | |||||

Tier 1 common capital | 139,519 | 136,119 | 134,082 | ||||||||

Tier 1 common capital ratio including Market Risk Final Rule2 | 10.83 | % | 10.49 | % | n/a | ||||||

Tangible common equity ratio1 | 6.98 | 6.88 | 6.83 | ||||||||

Common equity ratio | 10.21 | 10.05 | 10.05 | ||||||||

Tangible book value per share1 | $ | 13.32 | $ | 13.36 | $ | 13.22 | |||||

Book value per share | 20.18 | 20.19 | 20.16 | ||||||||

1 | Tangible common equity ratio and tangible book value per share are non-GAAP financial measures. For reconciliation to GAAP financial measures, refer to pages 22-24 of this press release. |

2 | As of January 1, 2013, the Market Risk Final Rule became effective under Basel 1. The Market Risk Final Rule introduces new measures of market risk including a charge related to stressed Value-at-Risk (VaR), an incremental risk charge and a comprehensive risk measure, as well as other technical modifications. The Basel 1 Tier 1 common capital ratio for June 30, 2012 is not presented as the Market Risk Final Rule did not apply during that period. |

B | Basel 3 Tier 1 common capital ratio is a non-GAAP financial measure. For reconciliation to GAAP financial measures, refer to page 18 of this press release. Fully phased-in Basel 3 estimates for June 30, 2013 were calculated under the final advanced approach of the Basel 3 rules recently released by the Federal Reserve, assuming all regulatory model approvals, except for the potential reduction to risk-weighted assets resulting from the Comprehensive Risk Measure after one year. |

C | Sales and trading revenue, international revenue and net income (loss) excluding the impact of DVA are non-GAAP financial measures. DVA gains (losses) were $38 million, $(55) million and $(156) million for the three months ended June 30, 2013, March 31, 2013 and June 30, 2012, respectively. |

D | Fixed Income, Currency and Commodities (FICC) sales and trading revenue, excluding DVA, and Equity sales and trading revenue, excluding DVA, are non-GAAP financial measures. FICC DVA gains (losses) were $33 million, $(65) million and $(137) million for the three months ended June 30, 2013, March 31, 2013 and June 30, 2012, respectively. Equities DVA gains (losses) were $5 million, $10 million and $(19) million for the three months ended June 30, 2013, March 31, 2013 and June 30, 2012, respectively. |

E | Tangible book value per share of common stock is a non-GAAP measure. Other companies may define or calculate this measure differently. For reconciliation to GAAP measures, refer to pages 22-24 of this press release. |

Bank of America Corporation and Subsidiaries | |||||||||||||||||||

Selected Financial Data | |||||||||||||||||||

(Dollars in millions, except per share data; shares in thousands) | |||||||||||||||||||

Summary Income Statement | Six Months Ended June 30 | Second Quarter 2013 | First Quarter 2013 | Second Quarter 2012 | |||||||||||||||

2013 | 2012 | ||||||||||||||||||

Net interest income | $ | 21,213 | $ | 20,394 | $ | 10,549 | $ | 10,664 | $ | 9,548 | |||||||||

Noninterest income | 24,711 | 23,852 | 12,178 | 12,533 | 12,420 | ||||||||||||||

Total revenue, net of interest expense | 45,924 | 44,246 | 22,727 | 23,197 | 21,968 | ||||||||||||||

Provision for credit losses | 2,924 | 4,191 | 1,211 | 1,713 | 1,773 | ||||||||||||||

Noninterest expense | 35,518 | 36,189 | 16,018 | 19,500 | 17,048 | ||||||||||||||

Income before income taxes | 7,482 | 3,866 | 5,498 | 1,984 | 3,147 | ||||||||||||||

Income tax expense | 1,987 | 750 | 1,486 | 501 | 684 | ||||||||||||||

Net income | $ | 5,495 | $ | 3,116 | $ | 4,012 | $ | 1,483 | $ | 2,463 | |||||||||

Preferred stock dividends | 814 | 690 | 441 | 373 | 365 | ||||||||||||||

Net income applicable to common shareholders | $ | 4,681 | $ | 2,426 | $ | 3,571 | $ | 1,110 | $ | 2,098 | |||||||||

Earnings per common share | $ | 0.43 | $ | 0.23 | $ | 0.33 | $ | 0.10 | $ | 0.19 | |||||||||

Diluted earnings per common share | 0.42 | 0.22 | 0.32 | 0.10 | 0.19 | ||||||||||||||

Summary Average Balance Sheet | Six Months Ended June 30 | Second Quarter 2013 | First Quarter 2013 | Second Quarter 2012 | |||||||||||||||

2013 | 2012 | ||||||||||||||||||

Total loans and leases | $ | 910,269 | $ | 906,610 | $ | 914,234 | $ | 906,259 | $ | 899,498 | |||||||||

Debt securities | 349,794 | 349,350 | 343,260 | 356,399 | 357,081 | ||||||||||||||

Total earning assets | 1,784,975 | 1,770,336 | 1,769,336 | 1,800,786 | 1,772,568 | ||||||||||||||

Total assets | 2,198,443 | 2,190,868 | 2,184,610 | 2,212,430 | 2,194,563 | ||||||||||||||

Total deposits | 1,077,631 | 1,031,500 | 1,079,956 | 1,075,280 | 1,032,888 | ||||||||||||||

Common shareholders’ equity | 218,509 | 215,466 | 218,790 | 218,225 | 216,782 | ||||||||||||||

Total shareholders’ equity | 236,024 | 234,062 | 235,063 | 236,995 | 235,558 | ||||||||||||||

Performance Ratios | Six Months Ended June 30 | Second Quarter 2013 | First Quarter 2013 | Second Quarter 2012 | |||||||||||||||

2013 | 2012 | ||||||||||||||||||

Return on average assets | 0.50 | % | 0.29 | % | 0.74 | % | 0.27 | % | 0.45 | % | |||||||||

Return on average tangible shareholders’ equity (1) | 6.84 | 3.94 | 9.98 | 3.69 | 6.16 | ||||||||||||||

Credit Quality | Six Months Ended June 30 | Second Quarter 2013 | First Quarter 2013 | Second Quarter 2012 | |||||||||||||||

2013 | 2012 | ||||||||||||||||||

Total net charge-offs | $ | 4,628 | $ | 7,682 | $ | 2,111 | $ | 2,517 | $ | 3,626 | |||||||||

Net charge-offs as a % of average loans and leases outstanding (2) | 1.04 | % | 1.72 | % | 0.94 | % | 1.14 | % | 1.64 | % | |||||||||

Provision for credit losses | $ | 2,924 | $ | 4,191 | $ | 1,211 | $ | 1,713 | $ | 1,773 | |||||||||

June 30 2013 | March 31 2013 | June 30 2012 | |||||||||||||||||

Total nonperforming loans, leases and foreclosed properties (3) | $ | 21,280 | $ | 22,842 | $ | 25,377 | |||||||||||||

Nonperforming loans, leases and foreclosed properties as a % of total loans, leases and foreclosed properties (2) | 2.33 | % | 2.53 | % | 2.87 | % | |||||||||||||

Allowance for loan and lease losses | $ | 21,235 | $ | 22,441 | $ | 30,288 | |||||||||||||

Allowance for loan and lease losses as a % of total loans and leases outstanding (2) | 2.33 | % | 2.49 | % | 3.43 | % | |||||||||||||

For footnotes see page 18. | |||||||||||||||||||

More | This information is preliminary and based on company data available at the time of the presentation. |

Bank of America Corporation and Subsidiaries | |||||||||||||||||||

Selected Financial Data (continued) | |||||||||||||||||||

(Dollars in millions, except per share data; shares in thousands) | |||||||||||||||||||

Capital Management | June 30 2013 | March 31 2013 | June 30 2012 | ||||||||||||||||

Risk-based capital (4, 5): | |||||||||||||||||||

Tier 1 common capital | $ | 139,519 | $ | 136,119 | $ | 134,082 | |||||||||||||

Tier 1 common capital ratio (6) | 10.83 | % | 10.49 | % | 11.24 | % | |||||||||||||

Tier 1 leverage ratio | 7.49 | 7.49 | 7.84 | ||||||||||||||||

Tangible equity ratio (7) | 7.67 | 7.78 | 7.73 | ||||||||||||||||

Tangible common equity ratio (7) | 6.98 | 6.88 | 6.83 | ||||||||||||||||

Period-end common shares issued and outstanding | 10,743,098 | 10,822,380 | 10,776,869 | ||||||||||||||||

Basel 1 to Basel 3 (fully phased-in) Reconciliation (5, 8) | June 30 2013 | March 31 2013 | June 30 2012 | ||||||||||||||||

Regulatory capital – Basel 1 to Basel 3 (fully phased-in) | |||||||||||||||||||

Basel 1 Tier 1 capital | $ | 156,689 | $ | 158,677 | $ | 164,665 | |||||||||||||

Deduction of qualifying preferred stock and trust preferred securities | (17,170 | ) | (22,558 | ) | (30,583 | ) | |||||||||||||

Basel 1 Tier 1 common capital | 139,519 | 136,119 | 134,082 | ||||||||||||||||

Deduction of defined benefit pension assets | (787 | ) | (776 | ) | (3,057 | ) | |||||||||||||

Change in deferred tax assets and threshold deductions (deferred tax asset temporary differences, MSRs and significant investments) | (6,761 | ) | (4,501 | ) | (3,745 | ) | |||||||||||||

Change in all other deductions, net | (6,125 | ) | (2,032 | ) | (2,459 | ) | |||||||||||||

Basel 3 (fully phased-in) Tier 1 common capital | $ | 125,846 | $ | 128,810 | $ | 124,821 | |||||||||||||

Risk-weighted assets – Basel 1 to Basel 3 (fully phased-in) | |||||||||||||||||||

Basel 1 risk-weighted assets | $ | 1,288,159 | $ | 1,298,187 | $ | 1,193,422 | |||||||||||||

Net change in credit and other risk-weighted assets | 22,276 | 55,454 | 298,003 | ||||||||||||||||

Increase due to Market Risk Final Rule | — | — | 79,553 | ||||||||||||||||

Basel 3 (fully phased-in) risk-weighted assets | $ | 1,310,435 | $ | 1,353,641 | $ | 1,570,978 | |||||||||||||

Tier 1 common capital ratios | |||||||||||||||||||

Basel 1 | 10.83 | % | 10.49 | % | 11.24 | % | |||||||||||||

Basel 3 (fully phased-in) | 9.60 | 9.52 | 7.95 | ||||||||||||||||

Six Months Ended June 30 | Second Quarter 2013 | First Quarter 2013 | Second Quarter 2012 | ||||||||||||||||

2013 | 2012 | ||||||||||||||||||

Common shares issued | 44,480 | 240,931 | 364 | 44,116 | 1,265 | ||||||||||||||

Average common shares issued and outstanding | 10,787,357 | 10,714,881 | 10,775,867 | 10,798,975 | 10,775,695 | ||||||||||||||

Average diluted common shares issued and outstanding | 11,549,693 | 11,509,945 | 11,524,510 | 11,154,778 | 11,556,011 | ||||||||||||||

Dividends paid per common share | $ | 0.02 | $ | 0.02 | $ | 0.01 | $ | 0.01 | $ | 0.01 | |||||||||

Summary Period-End Balance Sheet | June 30 2013 | March 31 2013 | June 30 2012 | ||||||||||||||||

Total loans and leases | $ | 921,570 | $ | 911,592 | $ | 892,315 | |||||||||||||

Total debt securities | 336,403 | 354,709 | 349,140 | ||||||||||||||||

Total earning assets | 1,719,866 | 1,763,737 | 1,737,809 | ||||||||||||||||

Total assets | 2,123,320 | 2,174,819 | 2,160,854 | ||||||||||||||||

Total deposits | 1,080,783 | 1,095,183 | 1,035,225 | ||||||||||||||||

Total shareholders’ equity | 231,032 | 237,293 | 235,975 | ||||||||||||||||

Common shareholders’ equity | 216,791 | 218,513 | 217,213 | ||||||||||||||||

Book value per share of common stock | $ | 20.18 | $ | 20.19 | $ | 20.16 | |||||||||||||

Tangible book value per share of common stock (1) | 13.32 | 13.36 | 13.22 | ||||||||||||||||

(1) | Return on average tangible shareholders’ equity and tangible book value per share of common stock are non-GAAP financial measures. We believe the use of these non-GAAP financial measures provides additional clarity in assessing the results of the Corporation. Other companies may define or calculate non-GAAP financial measures differently. See Reconciliations to GAAP Financial Measures on pages 22-24. |

(2) | Ratios do not include loans accounted for under the fair value option during the period. Charge-off ratios are annualized for the quarterly presentation. |

(3) | Balances do not include past due consumer credit card, consumer loans secured by real estate where repayments are insured by the Federal Housing Administration and individually insured long-term stand-by agreements (fully-insured home loans), and in general, other consumer and commercial loans not secured by real estate; purchased credit-impaired loans even though the customer may be contractually past due; nonperforming loans held-for-sale; nonperforming loans accounted for under the fair value option; and nonaccruing troubled debt restructured loans removed from the purchased credit-impaired portfolio prior to January 1, 2010. |

(4) | Regulatory capital ratios are preliminary until filed with the Federal Reserve on Form Y-9C. |

(5) | Includes the Market Risk Final Rule at June 30, 2013 and March 31, 2013. At June 30, 2012, the Basel 1 information did not include the Market Risk Final Rule. |

(6) | Tier 1 common capital ratio equals Tier 1 capital excluding preferred stock, trust preferred securities, hybrid securities and minority interest divided by risk-weighted assets. |

(7) | Tangible equity ratio equals period-end tangible shareholders’ equity divided by period-end tangible assets. Tangible common equity equals period-end tangible common shareholders’ equity divided by period-end tangible assets. Tangible shareholders’ equity and tangible assets are non-GAAP financial measures. We believe the use of these non-GAAP financial measures provides additional clarity in assessing the results of the Corporation. Other companies may define or calculate non-GAAP financial measures differently. See Reconciliations to GAAP Financial Measures on pages 22-24. |

(8) | Basel 3 (fully phased-in) estimates as of June 30, 2013 are based on the Advanced Approach under the final Basel 3 rules issued on July 2, 2013. |

More | This information is preliminary and based on company data available at the time of the presentation. |

Bank of America Corporation and Subsidiaries | ||||||||||||||||||||||||

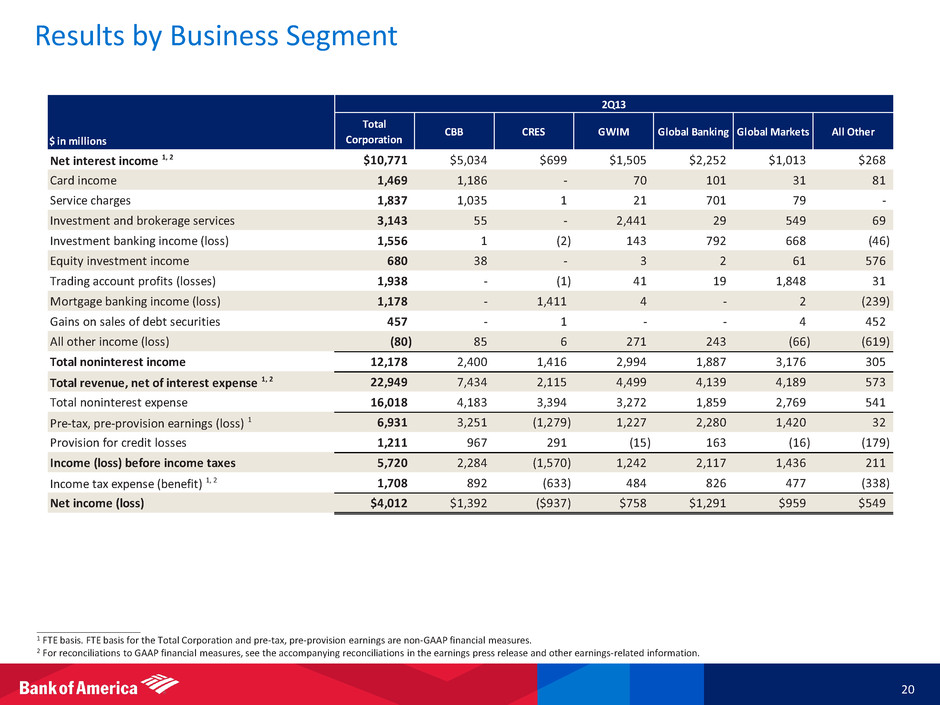

Quarterly Results by Business Segment | ||||||||||||||||||||||||

(Dollars in millions) | ||||||||||||||||||||||||

Second Quarter 2013 | ||||||||||||||||||||||||

Consumer & Business Banking | Consumer Real Estate Services | Global Banking | Global Markets | GWIM | All Other | |||||||||||||||||||

Total revenue, net of interest expense (FTE basis) (1) | $ | 7,434 | $ | 2,115 | $ | 4,139 | $ | 4,189 | $ | 4,499 | $ | 573 | ||||||||||||

Provision for credit losses | 967 | 291 | 163 | (16 | ) | (15 | ) | (179 | ) | |||||||||||||||

Noninterest expense | 4,183 | 3,394 | 1,859 | 2,769 | 3,272 | 541 | ||||||||||||||||||

Net income (loss) | 1,392 | (937 | ) | 1,291 | 959 | 758 | 549 | |||||||||||||||||

Return on average allocated capital (2, 3) | 18.64 | % | n/m | 22.52 | % | 12.85 | % | 30.57 | % | n/m | ||||||||||||||

Balance Sheet | ||||||||||||||||||||||||

Average | ||||||||||||||||||||||||

Total loans and leases | $ | 163,593 | $ | 90,114 | $ | 255,674 | n/m | $ | 109,589 | $ | 238,910 | |||||||||||||

Total deposits | 522,259 | n/m | 227,668 | n/m | 235,344 | 33,774 | ||||||||||||||||||

Allocated capital (2, 3) | 30,000 | 24,000 | 23,000 | $ | 30,000 | 10,000 | n/m | |||||||||||||||||

Period end | ||||||||||||||||||||||||

Total loans and leases | $ | 164,851 | $ | 89,257 | $ | 258,502 | n/m | $ | 111,785 | $ | 234,047 | |||||||||||||

Total deposits | 525,099 | n/m | 229,586 | n/m | 235,012 | 34,597 | ||||||||||||||||||

First Quarter 2013 | ||||||||||||||||||||||||

Consumer & Business Banking | Consumer Real Estate Services | Global Banking | Global Markets | GWIM | All Other | |||||||||||||||||||

Total revenue, net of interest expense (FTE basis) (1) | $ | 7,412 | $ | 2,312 | $ | 4,030 | $ | 4,869 | $ | 4,421 | $ | 364 | ||||||||||||

Provision for credit losses | 952 | 335 | 149 | 5 | 22 | 250 | ||||||||||||||||||

Noninterest expense | 4,170 | 5,406 | 1,837 | 3,073 | 3,253 | 1,761 | ||||||||||||||||||

Net income (loss) | 1,439 | (2,157 | ) | 1,284 | 1,169 | 720 | (972 | ) | ||||||||||||||||

Return on average allocated capital (2, 3) | 19.48 | % | n/m | 22.65 | % | 15.83 | % | 29.38 | % | n/m | ||||||||||||||

Balance Sheet | ||||||||||||||||||||||||

Average | ||||||||||||||||||||||||

Total loans and leases | $ | 165,845 | $ | 92,963 | $ | 244,068 | n/m | $ | 106,082 | $ | 244,557 | |||||||||||||

Total deposits | 502,508 | n/m | 222,120 | n/m | 253,413 | 35,549 | ||||||||||||||||||

Allocated capital (2, 3) | 30,000 | 24,000 | 23,000 | $ | 30,000 | 10,000 | n/m | |||||||||||||||||

Period end | ||||||||||||||||||||||||

Total loans and leases | $ | 163,820 | $ | 90,971 | $ | 250,985 | n/m | $ | 107,048 | $ | 241,406 | |||||||||||||

Total deposits | 530,581 | n/m | 228,248 | n/m | 239,853 | 35,759 | ||||||||||||||||||

Second Quarter 2012 | ||||||||||||||||||||||||

Consumer & Business Banking | Consumer Real Estate Services | Global Banking | Global Markets | GWIM | All Other | |||||||||||||||||||

Total revenue, net of interest expense (FTE basis) (1) | $ | 7,495 | $ | 2,529 | $ | 3,908 | $ | 3,578 | $ | 4,094 | $ | 598 | ||||||||||||

Provision for credit losses | 1,157 | 187 | (152 | ) | (1 | ) | 47 | 535 | ||||||||||||||||

Noninterest expense | 4,420 | 3,524 | 1,967 | 2,855 | 3,177 | 1,105 | ||||||||||||||||||

Net income (loss) | 1,208 | (744 | ) | 1,318 | 497 | 548 | (364 | ) | ||||||||||||||||

Return on average economic capital (2, 3) | 20.46 | % | n/m | 27.24 | % | 15.10 | % | 31.76 | % | n/m | ||||||||||||||

Balance Sheet | ||||||||||||||||||||||||

Average | ||||||||||||||||||||||||

Total loans and leases | $ | 173,565 | $ | 105,507 | $ | 219,504 | n/m | $ | 98,964 | $ | 263,649 | |||||||||||||

Total deposits | 474,328 | n/m | 213,862 | n/m | 238,540 | 43,722 | ||||||||||||||||||

Economic capital (2, 3) | 23,807 | 14,120 | 19,472 | $ | 13,316 | 7,011 | n/m | |||||||||||||||||

Period end | ||||||||||||||||||||||||

Total loans and leases | $ | 171,094 | $ | 104,079 | $ | 218,681 | n/m | $ | 100,261 | $ | 259,830 | |||||||||||||

Total deposits | 479,795 | n/m | 216,529 | n/m | 237,339 | 39,362 | ||||||||||||||||||

(1) | Fully taxable-equivalent basis is a performance measure used by management in operating the business that management believes provides investors with a more accurate picture of the interest margin for comparative purposes. |

(2) | Effective January 1, 2013, the Corporation revised, on a prospective basis, its methodology for allocating capital to the business segments. In connection with the change in methodology, the Corporation updated the applicable terminology in the above table to allocated capital from economic capital as reported in prior periods. For more information, see Exhibit A: Non-GAAP Reconciliations - Reconciliations to GAAP Financial Measures on pages 22-24. |

More | This information is preliminary and based on company data available at the time of the presentation. |

Bank of America Corporation and Subsidiaries | ||||||||||||||||||||||||

Year-to-Date Results by Business Segment | ||||||||||||||||||||||||

(Dollars in millions) | ||||||||||||||||||||||||

Six Months Ended June 30, 2013 | ||||||||||||||||||||||||

Consumer & Business Banking | Consumer Real Estate Services | Global Banking | Global Markets | GWIM | All Other | |||||||||||||||||||

Total revenue, net of interest expense (FTE basis) (1) | $ | 14,846 | $ | 4,427 | $ | 8,169 | $ | 9,058 | $ | 8,920 | $ | 937 | ||||||||||||

Provision for credit losses | 1,919 | 626 | 312 | (11 | ) | 7 | 71 | |||||||||||||||||

Noninterest expense | 8,353 | 8,800 | 3,696 | 5,842 | 6,525 | 2,302 | ||||||||||||||||||

Net income (loss) | 2,831 | (3,094 | ) | 2,575 | 2,128 | 1,478 | (423 | ) | ||||||||||||||||

Return on average allocated capital (2, 3) | 19.06 | % | n/m | 22.58 | % | 14.33 | % | 29.98 | % | n/m | ||||||||||||||

Balance Sheet | ||||||||||||||||||||||||

Average | ||||||||||||||||||||||||

Total loans and leases | $ | 164,713 | $ | 91,531 | $ | 249,903 | n/m | $ | 107,845 | $ | 241,718 | |||||||||||||

Total deposits | 512,438 | n/m | 224,909 | n/m | 244,329 | 34,657 | ||||||||||||||||||

Allocated capital (2, 3) | 30,000 | 24,000 | 23,000 | $ | 30,000 | 10,000 | n/m | |||||||||||||||||

Period end | ||||||||||||||||||||||||

Total loans and leases | $ | 164,851 | $ | 89,257 | $ | 258,502 | n/m | $ | 111,785 | $ | 234,047 | |||||||||||||

Total deposits | 525,099 | n/m | 229,586 | n/m | 235,012 | 34,597 | ||||||||||||||||||

Six Months Ended June 30, 2012 | ||||||||||||||||||||||||

Consumer & Business Banking | Consumer Real Estate Services | Global Banking | Global Markets | GWIM | All Other | |||||||||||||||||||

Total revenue, net of interest expense (FTE basis) (1) | $ | 15,128 | $ | 5,193 | $ | 7,937 | $ | 7,985 | $ | 8,241 | $ | 203 | ||||||||||||

Provision for credit losses | 2,064 | 694 | (427 | ) | (14 | ) | 93 | 1,781 | ||||||||||||||||

Noninterest expense | 8,725 | 7,404 | 3,928 | 6,090 | 6,409 | 3,633 | ||||||||||||||||||

Net income (loss) | 2,740 | (1,879 | ) | 2,802 | 1,326 | 1,098 | (2,971 | ) | ||||||||||||||||

Return on average economic capital (2, 3) | 23.32 | % | n/m | 29.31 | % | 19.32 | % | 33.24 | % | n/m | ||||||||||||||

Balance Sheet | ||||||||||||||||||||||||

Average | ||||||||||||||||||||||||

Total loans and leases | $ | 177,971 | $ | 107,554 | $ | 221,854 | n/m | $ | 98,490 | $ | 266,938 | |||||||||||||

Total deposits | 469,181 | n/m | 212,638 | n/m | 239,200 | 48,125 | ||||||||||||||||||

Economic capital (2, 3) | 23,682 | 14,455 | 19,243 | $ | 13,849 | 6,716 | n/m | |||||||||||||||||

Period end | ||||||||||||||||||||||||

Total loans and leases | $ | 171,094 | $ | 104,079 | $ | 218,681 | n/m | $ | 100,261 | $ | 259,830 | |||||||||||||

Total deposits | 479,795 | n/m | 216,529 | n/m | 237,339 | 39,362 | ||||||||||||||||||

(1) | Fully taxable-equivalent basis is a performance measure used by management in operating the business that management believes provides investors with a more accurate picture of the interest margin for comparative purposes. |

(2) | Effective January 1, 2013, the Corporation revised, on a prospective basis, its methodology for allocating capital to the business segments. In connection with the change in methodology, the Corporation updated the applicable terminology in the above table to allocated capital from economic capital as reported in prior periods. For more information, see Exhibit A: Non-GAAP Reconciliations - Reconciliations to GAAP Financial Measures on pages 22-24. |

More | This information is preliminary and based on company data available at the time of the presentation. |

Bank of America Corporation and Subsidiaries | ||||||||||||||||||||

Supplemental Financial Data | ||||||||||||||||||||

(Dollars in millions) | ||||||||||||||||||||

Fully taxable-equivalent (FTE) basis data (1) | Six Months Ended June 30 | Second Quarter 2013 | First Quarter 2013 | Second Quarter 2012 | ||||||||||||||||

2013 | 2012 | |||||||||||||||||||

Net interest income | $ | 21,646 | $ | 20,835 | $ | 10,771 | $ | 10,875 | $ | 9,782 | ||||||||||

Total revenue, net of interest expense | 46,357 | 44,687 | 22,949 | 23,408 | 22,202 | |||||||||||||||

Net interest yield (2) | 2.44 | % | 2.36 | % | 2.44 | % | 2.43 | % | 2.21 | % | ||||||||||

Efficiency ratio | 76.62 | 80.98 | 69.80 | 83.31 | 76.79 | |||||||||||||||

Other Data | June 30, 2013 | March 31, 2013 | June 30, 2012 | |||||||||||||||||

Number of banking centers - U.S. | 5,328 | 5,389 | 5,594 | |||||||||||||||||

Number of branded ATMs - U.S. | 16,354 | 16,311 | 16,220 | |||||||||||||||||

Ending full-time equivalent employees | 257,158 | 262,812 | 275,460 | |||||||||||||||||

(1) | FTE basis is a non-GAAP financial measure. FTE basis is a performance measure used by management in operating the business that management believes provides investors with a more accurate picture of the interest margin for comparative purposes. See Reconciliations to GAAP Financial Measures on pages 22-24. |

(2) | Calculation includes fees earned on overnight deposits placed with the Federal Reserve and, beginning in the third quarter of 2012, fees earned on deposits, primarily overnight, placed with certain non-U.S. central banks, of $73 million and $99 million for the six months ended June 30, 2013 and 2012; $40 million and $33 million for the second and first quarters of 2013, and $52 million for the second quarter of 2012, respectively. |

More | This information is preliminary and based on company data available at the time of the presentation. |

Bank of America Corporation and Subsidiaries | ||||

Reconciliations to GAAP Financial Measures | ||||

(Dollars in millions) | ||||

Six Months Ended June 30 | Second Quarter 2013 | First Quarter 2013 | Second Quarter 2012 | ||||||||||||||||||

2013 | 2012 | ||||||||||||||||||||

Reconciliation of net interest income to net interest income on a fully taxable-equivalent basis | |||||||||||||||||||||

Net interest income | $ | 21,213 | $ | 20,394 | $ | 10,549 | $ | 10,664 | $ | 9,548 | |||||||||||

Fully taxable-equivalent adjustment | 433 | 441 | 222 | 211 | 234 | ||||||||||||||||

Net interest income on a fully taxable-equivalent basis | $ | 21,646 | $ | 20,835 | $ | 10,771 | $ | 10,875 | $ | 9,782 | |||||||||||

Reconciliation of total revenue, net of interest expense to total revenue, net of interest expense on a fully taxable-equivalent basis | |||||||||||||||||||||

Total revenue, net of interest expense | $ | 45,924 | $ | 44,246 | $ | 22,727 | $ | 23,197 | $ | 21,968 | |||||||||||

Fully taxable-equivalent adjustment | 433 | 441 | 222 | 211 | 234 | ||||||||||||||||

Total revenue, net of interest expense on a fully taxable-equivalent basis | $ | 46,357 | $ | 44,687 | $ | 22,949 | $ | 23,408 | $ | 22,202 | |||||||||||

Reconciliation of income tax expense to income tax expense on a fully taxable-equivalent basis | |||||||||||||||||||||

Income tax expense | $ | 1,987 | $ | 750 | $ | 1,486 | $ | 501 | $ | 684 | |||||||||||

Fully taxable-equivalent adjustment | 433 | 441 | 222 | 211 | 234 | ||||||||||||||||

Income tax expense on a fully taxable-equivalent basis | $ | 2,420 | $ | 1,191 | $ | 1,708 | $ | 712 | $ | 918 | |||||||||||

Reconciliation of average common shareholders’ equity to average tangible common shareholders’ equity | |||||||||||||||||||||

Common shareholders’ equity | $ | 218,509 | $ | 215,466 | $ | 218,790 | $ | 218,225 | $ | 216,782 | |||||||||||

Goodwill | (69,937 | ) | (69,971 | ) | (69,930 | ) | (69,945 | ) | (69,976 | ) | |||||||||||

Intangible assets (excluding mortgage servicing rights) | (6,409 | ) | (7,701 | ) | (6,270 | ) | (6,549 | ) | (7,533 | ) | |||||||||||

Related deferred tax liabilities | 2,393 | 2,663 | 2,360 | 2,425 | 2,626 | ||||||||||||||||

Tangible common shareholders’ equity | $ | 144,556 | $ | 140,457 | $ | 144,950 | $ | 144,156 | $ | 141,899 | |||||||||||

Reconciliation of average shareholders’ equity to average tangible shareholders’ equity | |||||||||||||||||||||

Shareholders’ equity | $ | 236,024 | $ | 234,062 | $ | 235,063 | $ | 236,995 | $ | 235,558 | |||||||||||

Goodwill | (69,937 | ) | (69,971 | ) | (69,930 | ) | (69,945 | ) | (69,976 | ) | |||||||||||

Intangible assets (excluding mortgage servicing rights) | (6,409 | ) | (7,701 | ) | (6,270 | ) | (6,549 | ) | (7,533 | ) | |||||||||||

Related deferred tax liabilities | 2,393 | 2,663 | 2,360 | 2,425 | 2,626 | ||||||||||||||||

Tangible shareholders’ equity | $ | 162,071 | $ | 159,053 | $ | 161,223 | $ | 162,926 | $ | 160,675 | |||||||||||

More | This information is preliminary and based on company data available at the time of the presentation. |

Bank of America Corporation and Subsidiaries | |||||||||||||||||||||

Reconciliations to GAAP Financial Measures (continued) | |||||||||||||||||||||

(Dollars in millions) | |||||||||||||||||||||

Six Months Ended June 30 | Second Quarter 2013 | First Quarter 2013 | Second Quarter 2012 | ||||||||||||||||||

2013 | 2012 | ||||||||||||||||||||

Reconciliation of period-end common shareholders’ equity to period-end tangible common shareholders’ equity | |||||||||||||||||||||

Common shareholders’ equity | $ | 216,791 | $ | 217,213 | $ | 216,791 | $ | 218,513 | $ | 217,213 | |||||||||||

Goodwill | (69,930 | ) | (69,976 | ) | (69,930 | ) | (69,930 | ) | (69,976 | ) | |||||||||||

Intangible assets (excluding mortgage servicing rights) | (6,104 | ) | (7,335 | ) | (6,104 | ) | (6,379 | ) | (7,335 | ) | |||||||||||

Related deferred tax liabilities | 2,297 | 2,559 | 2,297 | 2,363 | 2,559 | ||||||||||||||||

Tangible common shareholders’ equity | $ | 143,054 | $ | 142,461 | $ | 143,054 | $ | 144,567 | $ | 142,461 | |||||||||||

Reconciliation of period-end shareholders’ equity to period-end tangible shareholders’ equity | |||||||||||||||||||||

Shareholders’ equity | $ | 231,032 | $ | 235,975 | $ | 231,032 | $ | 237,293 | $ | 235,975 | |||||||||||

Goodwill | (69,930 | ) | (69,976 | ) | (69,930 | ) | (69,930 | ) | (69,976 | ) | |||||||||||

Intangible assets (excluding mortgage servicing rights) | (6,104 | ) | (7,335 | ) | (6,104 | ) | (6,379 | ) | (7,335 | ) | |||||||||||

Related deferred tax liabilities | 2,297 | 2,559 | 2,297 | 2,363 | 2,559 | ||||||||||||||||

Tangible shareholders’ equity | $ | 157,295 | $ | 161,223 | $ | 157,295 | $ | 163,347 | $ | 161,223 | |||||||||||

Reconciliation of period-end assets to period-end tangible assets | |||||||||||||||||||||

Assets | $ | 2,123,320 | $ | 2,160,854 | $ | 2,123,320 | $ | 2,174,819 | $ | 2,160,854 | |||||||||||

Goodwill | (69,930 | ) | (69,976 | ) | (69,930 | ) | (69,930 | ) | (69,976 | ) | |||||||||||

Intangible assets (excluding mortgage servicing rights) | (6,104 | ) | (7,335 | ) | (6,104 | ) | (6,379 | ) | (7,335 | ) | |||||||||||

Related deferred tax liabilities | 2,297 | 2,559 | 2,297 | 2,363 | 2,559 | ||||||||||||||||

Tangible assets | $ | 2,049,583 | $ | 2,086,102 | $ | 2,049,583 | $ | 2,100,873 | $ | 2,086,102 | |||||||||||

Book value per share of common stock | |||||||||||||||||||||

Common shareholders’ equity | $ | 216,791 | $ | 217,213 | $ | 216,791 | $ | 218,513 | $ | 217,213 | |||||||||||

Ending common shares issued and outstanding | 10,743,098 | 10,776,869 | 10,743,098 | 10,822,380 | 10,776,869 | ||||||||||||||||

Book value per share of common stock | $ | 20.18 | $ | 20.16 | $ | 20.18 | $ | 20.19 | $ | 20.16 | |||||||||||

Tangible book value per share of common stock | |||||||||||||||||||||

Tangible common shareholders’ equity | $ | 143,054 | $ | 142,461 | $ | 143,054 | $ | 144,567 | $ | 142,461 | |||||||||||

Ending common shares issued and outstanding | 10,743,098 | 10,776,869 | 10,743,098 | 10,822,380 | 10,776,869 | ||||||||||||||||

Tangible book value per share of common stock | $ | 13.32 | $ | 13.22 | $ | 13.32 | $ | 13.36 | $ | 13.22 | |||||||||||

More | This information is preliminary and based on company data available at the time of the presentation. |

Bank of America Corporation and Subsidiaries | |||||||||||||||||||||

Reconciliations to GAAP Financial Measures (continued) | |||||||||||||||||||||

(Dollars in millions) | |||||||||||||||||||||

Six Months Ended June 30 | Second Quarter 2013 | First Quarter 2013 | Second Quarter 2012 | ||||||||||||||||||

2013 | 2012 | ||||||||||||||||||||

Reconciliation of return on average allocated capital/economic capital (1) | |||||||||||||||||||||

Consumer & Business Banking | |||||||||||||||||||||

Reported net income | $ | 2,831 | $ | 2,740 | $ | 1,392 | $ | 1,439 | $ | 1,208 | |||||||||||

Adjustment related to intangibles (2) | 4 | 7 | 2 | 2 | 4 | ||||||||||||||||

Adjusted net income | $ | 2,835 | $ | 2,747 | $ | 1,394 | $ | 1,441 | $ | 1,212 | |||||||||||

Average allocated equity (3) | $ | 62,070 | $ | 55,880 | $ | 62,058 | $ | 62,083 | $ | 55,987 | |||||||||||

Adjustment related to goodwill and a percentage of intangibles | (32,070 | ) | (32,198 | ) | (32,058 | ) | (32,083 | ) | (32,180 | ) | |||||||||||

Average allocated capital/economic capital | $ | 30,000 | $ | 23,682 | $ | 30,000 | $ | 30,000 | $ | 23,807 | |||||||||||

Global Banking | |||||||||||||||||||||

Reported net income | $ | 2,575 | $ | 2,802 | $ | 1,291 | $ | 1,284 | $ | 1,318 | |||||||||||

Adjustment related to intangibles (2) | 1 | 2 | — | 1 | 1 | ||||||||||||||||

Adjusted net income | $ | 2,576 | $ | 2,804 | $ | 1,291 | $ | 1,285 | $ | 1,319 | |||||||||||

Average allocated equity (3) | $ | 45,412 | $ | 41,677 | $ | 45,416 | $ | 45,407 | $ | 41,903 | |||||||||||

Adjustment related to goodwill and a percentage of intangibles | (22,412 | ) | (22,434 | ) | (22,416 | ) | (22,407 | ) | (22,431 | ) | |||||||||||

Average allocated capital/economic capital | $ | 23,000 | $ | 19,243 | $ | 23,000 | $ | 23,000 | $ | 19,472 | |||||||||||

Global Markets | |||||||||||||||||||||

Reported net income | $ | 2,128 | $ | 1,326 | $ | 959 | $ | 1,169 | $ | 497 | |||||||||||

Adjustment related to intangibles (2) | 4 | 5 | 2 | 2 | 3 | ||||||||||||||||

Adjusted net income | $ | 2,132 | $ | 1,331 | $ | 961 | $ | 1,171 | $ | 500 | |||||||||||

Average allocated equity (3) | $ | 35,372 | $ | 19,207 | $ | 35,372 | $ | 35,372 | $ | 18,655 | |||||||||||

Adjustment related to goodwill and a percentage of intangibles | (5,372 | ) | (5,358 | ) | (5,372 | ) | (5,372 | ) | (5,339 | ) | |||||||||||

Average allocated capital/economic capital | $ | 30,000 | $ | 13,849 | $ | 30,000 | $ | 30,000 | $ | 13,316 | |||||||||||

Global Wealth & Investment Management | |||||||||||||||||||||

Reported net income | $ | 1,478 | $ | 1,098 | $ | 758 | $ | 720 | $ | 548 | |||||||||||

Adjustment related to intangibles (2) | 9 | 12 | 5 | 4 | 6 | ||||||||||||||||

Adjusted net income | $ | 1,487 | $ | 1,110 | $ | 763 | $ | 724 | $ | 554 | |||||||||||

Average allocated equity (3) | $ | 20,311 | $ | 17,107 | $ | 20,300 | $ | 20,323 | $ | 17,391 | |||||||||||

Adjustment related to goodwill and a percentage of intangibles | (10,311 | ) | (10,391 | ) | (10,300 | ) | (10,323 | ) | (10,380 | ) | |||||||||||

Average allocated capital/economic capital | $ | 10,000 | $ | 6,716 | $ | 10,000 | $ | 10,000 | $ | 7,011 | |||||||||||

(1) | There are no adjustments to reported net income (loss) or average allocated equity for Consumer Real Estate Services. |

(2) | Represents cost of funds, earnings credits and certain expenses related to intangibles. |

(3) | Average allocated equity is comprised of average allocated capital (or economic capital prior to 2013) plus capital for the portion of goodwill and intangibles specifically assigned to the business segment. |

More | This information is preliminary and based on company data available at the time of the presentation. |