| A Letter from the CEO |

|

|

Juan R. Luciano

B O A R D C H A I R A N D C E O

|

Dear Stockholders,

ADM’s 2023 performance continued to demonstrate the strength of our business fundamentals and the overall effectiveness of our strategy. Over the last decade, we’ve extended our value chain and broadened our portfolio of businesses, building a more resilient ADM that is able to deliver strong results even in challenging operating environments.

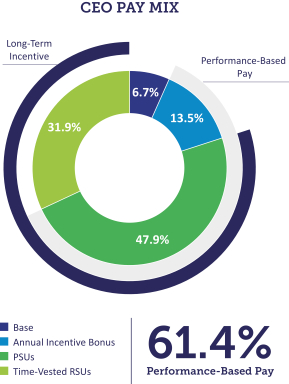

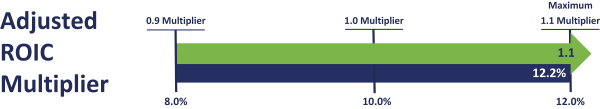

In 2023, we delivered adjusted earnings per share of $6.98 and trailing 4Q average adjusted return on invested capital of 12.2%, all while returning $3.7 billion to shareholders via dividends and share repurchases. Throughout the year, our 42,000 colleagues around the globe continued to advance strategic initiatives that are serving our customers’ evolving needs, from launching regenerative agriculture in South America and Europe, to commissioning our joint venture oilseed facility in North Dakota, to expanding our starch capacity to serve customer needs across food and industrial products. We also continue to drive a path to decarbonization that not only accelerates ADM’s Strive 35 efforts, but also supports our customers’ growing need for low-carbon solutions.

Now, as we advance through 2024, we are focused on continuing to build a stronger ADM for the future, executing strategic initiatives that provide strong growth prospects while remaining firmly committed to our productivity efforts to drive efficiencies, cost savings and cash generation.

Safety is core to ADM’s culture, but our track record for continuous progress suffered a setback in 2023. We remain committed to safety as our highest priority, and we are taking an array of aggressive actions to make sure our future performance returns to the positive trajectory we’ve seen in the past.

Part of building a better ADM is ensuring we take every measure to improve performance where needed, including simplification and optimization within our Nutrition business and a continued strong focus on our manufacturing footprint to ensure we are meeting customer needs effectively, efficiently, and, most of all, safely.

Our purpose – to unlock the power of nature to enrich the quality of life – continues to drive our work and our path forward, and I know that ADM will continue to play its vital role, acting with the highest levels of integrity as we meet vital needs spanning food security, health and well-being and sustainability.

Sincerely yours,

Juan R. Luciano Board Chair, CEO and President

| |||

|

“We are focused on continuing to build a stronger ADM for the future.”

Juan Luciano

| ||||