UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

PALMETTO BANCSHARES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|

1) |

Title of each class of securities to which transaction applies: | |

|

2) |

Aggregate number of securities to which transaction applies: | |

|

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

|

4) |

Proposed maximum aggregate value of transaction: | |

|

5) |

Total fee paid: | |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

1) |

Amount Previously Paid: | |

|

2) |

Form, Schedule or Registration Statement No.: | |

|

3) |

Filing Party: | |

|

4) |

Date Filed: | |

April 4, 2014

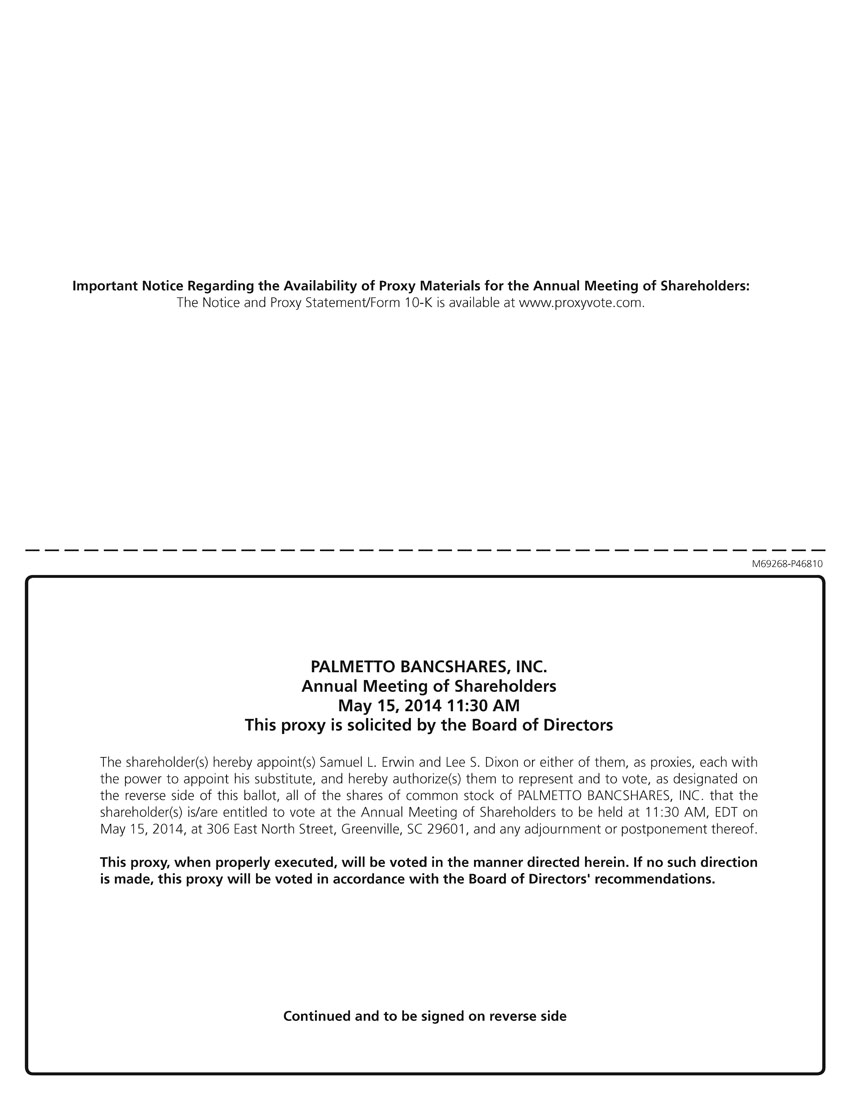

Dear Shareholder:

You are cordially invited to attend the 2014 Annual Meeting of Shareholders (the “Annual Meeting”) of Palmetto Bancshares, Inc. to be held on May 15, 2014 at 11:30 a.m., Eastern time, at The Palmetto Bank, Corporate Center, 306 East North Street, Greenville, South Carolina 29601. Please carefully read the Notice and Proxy Statement for the Annual Meeting of Shareholders accompanying this letter so that you will know what you are being asked to vote on at the Annual Meeting and what you will need to do if you want to attend the Annual Meeting in person.

Your vote is extremely important. To ensure proper representation of your shares at the Annual Meeting, please vote as soon as possible even if you currently plan to attend the Annual Meeting in person. This will not prevent you from voting in person but will ensure that your vote will be counted in the event that you are unable to attend. The Notice and Proxy Statement contain instructions on how you can vote your shares online over the internet, by telephone or through the mail.

If you need help at the Annual Meeting because of a disability, please contact us at least one week in advance of the Annual Meeting at (800) 725-2265.

Overall, we are pleased with our continued progress on returning The Palmetto Bank to a high performing bank. During 2013, we achieved our first annual profit since 2008 and the trading price of our common stock increased 56%, both of which reflect the hard work of our team and our focus on increasing the value of The Palmetto Bank franchise. We achieved loan growth in both our Commercial and Retail lines of business as a result of our strategies to focus on new niche lending specialties in addition to our traditional lending focus as a community bank. As the economy strengthens and interest rates rise, we are also focused on attracting and retaining deposits to fund our growth. We believe that building on our existing strong client relationships, bringing in new relationships, and providing services that allow our clients to bank whenever they want, wherever they want, is critical to our continued success. During 2014 we will continue to focus on providing a positive personal experience for our clients in every interaction with The Palmetto Bank, and executing our strategies related to loan growth, deposit funding, generation of noninterest income, expense management, and improving asset quality.

On behalf of the Board of Directors and our team, thank you for your support as we continue our hard work to return to our historical status as a high performing bank. We look forward to meeting with you at our Annual Meeting and providing you an update on the status of our strategic plan and our plans for the future.

Sincerely,

|

/s/ Samuel L. Erwin |

/s/ Robert B. Goldstein |

|

Samuel L. Erwin |

Robert B. Goldstein |

|

Chairman of the Board of Directors Chief Executive Officer |

Independent Lead Director |

PALMETTO BANCSHARES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

DATE AND TIME: |

Thursday, May 15, 2014, at 11:30 a.m., Eastern time | |

|

PLACE: |

The Palmetto Bank Corporate Center 306 East North Street Greenville, South Carolina 29601 | |

|

ITEMS OF BUSINESS: |

1. |

Elect as directors the nominees named in the accompanying Proxy Statement; |

| 2. |

Approve, on an advisory, nonbinding basis, the compensation of our Named Executive Officers as disclosed in this Proxy Statement; | |

|

|

3. |

Ratify the appointment of Elliott Davis, LLC as our independent registered public accounting firm for fiscal year 2014; and |

| 4. |

Consider any other business properly brought before the Annual Meeting of Shareholders. | |

|

WHO CAN VOTE: |

You may vote only if you owned shares of common stock at the close of business on March 17, 2014. | |

|

VOTING: |

It is important that your shares be represented and voted at the Annual Meeting of Shareholders (the “Annual Meeting”). You can vote your shares over the internet or by telephone. If you requested or received a paper Proxy Card or voting instruction form by mail, you may also vote by signing, dating and returning your Proxy Card or voting instruction form. Voting in any of these ways will not prevent you from attending the Annual Meeting or voting your shares at the Annual Meeting. For specific instructions regarding the voting of your shares, see pages 2 through 5 of the accompanying Proxy Statement. Please call (800) 725-2265 if you need directions to attend the Annual Meeting and vote in person. | |

|

MEETING ADMISSION: |

You may attend the Annual Meeting only if you owned shares of our common stock at the close of business on March 17, 2014. If you or your legal proxy holder plan to attend the Annual Meeting in person, you must follow the admission procedures described on page 3 of the accompanying Proxy Statement. If you do not comply with these procedures, you will not be admitted to the Annual Meeting. | |

|

INTERNET AVAILABILITY OF PROXY MATERIALS: |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 15, 2014. This Notice of Annual Meeting of Shareholders and the accompanying Proxy Statement for Annual Meeting of Shareholders, Annual Report on Form 10-K for the year ended December 31, 2013 and Proxy Card are available through the internet at www.proxyvote.com. If you choose to view our proxy materials through the internet, you may incur costs, such as telephone and internet access charges, for which you will be responsible. | |

By Order of the Board of Directors,

/s/ Lee S. Dixon

Lee S. Dixon

Corporate Secretary

This Notice of Annual Meeting of Shareholders and the accompanying Proxy Statement for Annual Meeting of Shareholders, Annual Report on Form 10-K for the year ended December 31, 2013 and Proxy Card or voting instruction form were made available to you beginning on or about April 4, 2014.

PALMETTO BANCSHARES, INC.

306 EAST NORTH STREET

GREENVILLE, SOUTH CAROLINA 29601

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

|

GENERAL MEETING AND PROXY INFORMATION |

You are invited to attend Palmetto Bancshares, Inc.’s 2014 Annual Meeting of Shareholders (the “Annual Meeting”) and are entitled and requested to vote on the items of business described in this Proxy Statement. Please read this Proxy Statement carefully. You should consider the information contained in this Proxy Statement when deciding how to vote your shares at the Annual Meeting. In this Proxy Statement, we refer to the Notice of Annual Meeting of Shareholders, this Proxy Statement, our Annual Report on Form 10-K for the year ended December 31, 2013 and the Proxy Card or voting instruction form as our “Proxy Materials.”

In this Proxy Statement, we use terms such as “we,” “us,” “our” and the “Company” to refer to Palmetto Bancshares, Inc. and its subsidiary, The Palmetto Bank. We also sometimes refer to the Board of Directors of Palmetto Bancshares, Inc. and its subsidiary as the “Board.” Additionally, we use terms such as “you” and “your” to refer to our shareholders.

|

INFORMATION ABOUT THE PROXY MATERIALS |

We have made the Proxy Materials available to you because the Board is soliciting your proxy to vote your shares of our common stock at the Annual Meeting to be held on Thursday, May 15, 2014 or at any adjournments or postponements of the Annual Meeting. The Proxy Materials were made available to you beginning on or about April 4, 2014.

What is a proxy?

The Board is asking you to give us your proxy. Giving us your proxy means that you authorize another person or persons to vote your shares of our common stock at the Annual Meeting in the manner you direct. You designate someone as your proxy through a “Proxy Card” or a “voting instruction form” depending on how the ownership of your shares is reflected in our records. If you are the record holder of your shares (as explained below), a “Proxy Card” is the document used to designate your proxy to vote your shares. If you hold your shares in street name (as explained below), a “voting instruction form” is the document used to designate your proxy to vote your shares. In this Proxy Statement, the term “Proxy Card” means the proxy card and / or voting instruction form unless otherwise indicated.

Any shareholder of record submitting a Proxy Card may revoke his or her proxy at any time by (a) giving written notice to the Company of such revocation, (b) voting in person at the Annual Meeting or (c) executing and delivering to the Company a later dated Proxy Card. Attendance at the Annual Meeting will not in itself constitute revocation of a proxy. Any written notice or Proxy Card revoking a proxy should be sent to Palmetto Bancshares, Inc., 306 East North Street, Greenville, South Carolina, 29601 Attention: Corporate Secretary. Written notice of revocation or delivery of a later dated Proxy Card will be effective upon receipt thereof by the Company.

What is the difference between holding shares as a “record” holder and in “street name?”

|

● |

Record Holders: If your shares of common stock are registered directly in your name on our stock records, you are considered the shareholder of record or the “record” holder of those shares. As the record holder, you have the right to vote your shares by proxy or in person at the Annual Meeting. |

|

● |

Street Name Holders: If your shares of common stock are held in an account at a brokerage firm, bank or other similar entity, then you are the beneficial owner of shares held in “street name.” The entity holding your account is considered the record holder for purposes of voting. As the beneficial owner, you have the right to direct this entity on how to vote the shares held in your account. However, as described below, you may not vote these shares in person at the Annual Meeting unless you obtain a legal proxy from the entity that holds your shares giving you the right to vote the shares at the Annual Meeting. |

Who pays the cost of soliciting proxies?

We pay the cost of soliciting proxies. We have not retained a proxy solicitation firm to help us solicit proxies, although, if we elect to do so, we will pay reasonable expenses and charges of such third parties for their services. Executive Officers (as defined by Rule 3b-7 under the Securities Exchange Act of 1934) and members of the Board may also solicit proxies for us by mail, telephone, fax, email or in person. We will not pay our Executive Officers or directors any additional fees for soliciting proxies. We may, upon request, reimburse brokerage firms, banks or similar entities representing street name holders for their expenses in providing the Proxy Materials to their clients who are street name holders and obtaining their voting instructions.

|

INFORMATION ABOUT THE ANNUAL MEETING |

What will I be voting on at the Annual Meeting?

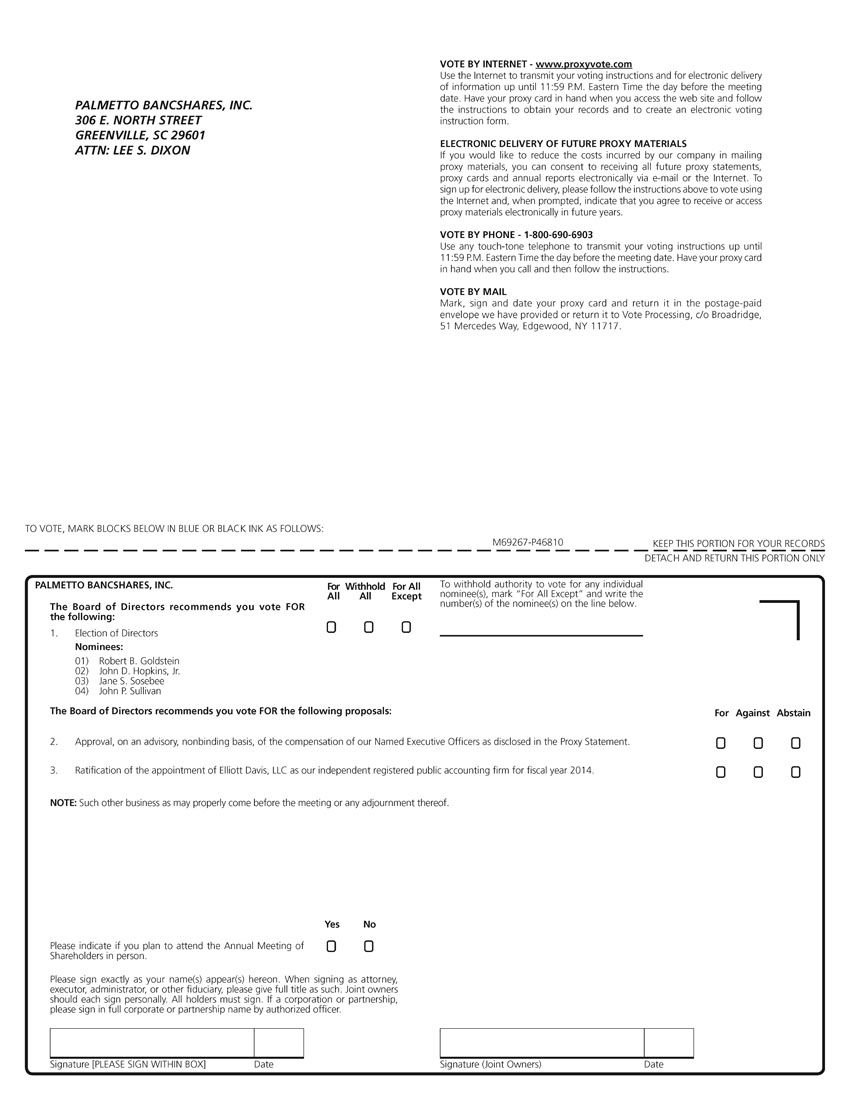

This year you will be asked to vote on the following items of business:

|

● |

Item 1: The election of the director nominees named in this Proxy Statement; |

|

● |

Item 2: The approval, on an advisory, nonbinding basis, of the compensation of our Named Executive Officers as disclosed in this Proxy Statement; and |

|

● |

Item 3: The ratification of the appointment of Elliott Davis, LLC as our independent registered public accounting firm for fiscal year 2014. |

We anticipate that shareholders will vote at the Annual Meeting only on the items listed above. However, if any other business properly comes before the Annual Meeting, the persons named as proxies for shareholders will vote on those matters in a manner they consider appropriate.

How does the Board recommend I vote?

For the reasons set forth in more detail later in this Proxy Statement, the Board recommends you vote:

|

● |

“FOR” Item 1, all the nominees for directors named in this Proxy Statement; |

|

● |

“FOR” Item 2, the approval , on an advisory, nonbinding basis, of the compensation of our Named Executive Officers as disclosed in this Proxy Statement (this is a nonbinding, advisory vote); and |

|

● |

“FOR” Item 3, the ratification of Elliott Davis, LLC as our independent registered public accounting firm for fiscal year 2014. |

Who can vote at the Annual Meeting?

We are required under South Carolina law to establish a record date for the Annual Meeting, so we can determine which shareholders are entitled to notice of and to vote at the Annual Meeting. The Board has determined that the record date for the Annual Meeting is March 17, 2014. Shareholders who owned shares of our common stock as of the close of business on that date can vote at the Annual Meeting. On that date, we had 12,792,509 shares of common stock outstanding and entitled to vote. Each share of common stock outstanding on the record date is entitled to one vote on each of the four director nominees and one vote on each other item to be voted on at the Annual Meeting. There is no cumulative voting.

How do I vote if I don’t attend the Annual Meeting?

You may vote by proxy over the internet, by telephone or through the mail, each as described below. If you hold shares of our common stock in more than one account, you must vote all shares over the internet, by telephone or through the mail. If you vote over the internet or by telephone, you need not return any documents through the mail.

If you vote using one of the methods described below, you will be designating Samuel L. Erwin and Lee S. Dixon as your proxies to vote your shares as you instruct. If you vote over the internet or by telephone or by signing and returning your Proxy Card without giving specific voting instructions, these individuals will vote your shares by following the Board’s recommendations. If any other business properly comes before the Annual Meeting, these individuals will vote on those matters in a manner they consider appropriate.

Registered Holder: You do not have to attend the Annual Meeting to vote. The Board is soliciting proxies so that you can vote before the Annual Meeting. Even if you currently plan to attend the Annual Meeting, we recommend that you vote by proxy before the Annual Meeting so that your vote will be counted if you later decide not to attend. However, if you attend the Annual Meeting and vote your shares by ballot, your vote at the Annual Meeting will revoke any vote you submitted previously by proxy. If you are the record holder of your shares, there are three ways you can vote by proxy:

|

● |

By Internet: You may vote over the internet by going to www.proxyvote.com and following the instructions when prompted; |

|

● |

By Telephone: Once you have reviewed the Proxy Materials, you may vote by telephone by calling toll free 1-800-690-6903; or |

|

● |

By Mail: You may request a paper or email copy of the Proxy Materials and vote by completing, signing, dating and returning the Proxy Card you receive. |

Street Holder: If your shares are held in street name, you may vote your shares before the Annual Meeting by mail, by completing, signing, and returning the voting instruction form you received from your brokerage firm, bank or other similar entity. You should check your voting instruction form to see if any alternative method, such as internet or telephone voting, is available to you.

Can I vote in person at the Annual Meeting?

Yes. If you are a shareholder of record on the record date, you can vote your shares of common stock in person at the Annual Meeting. If your shares are held in street name, you may vote your shares in person only if you have a legal proxy from the entity that holds your shares giving you the right to vote the shares. A legal proxy is a written document from your brokerage firm or bank authorizing you to vote the shares it holds for you in its name. If you attend the Annual Meeting and vote your shares by ballot, your vote at the Annual Meeting will revoke any vote you submitted previously over the internet, by telephone or through the mail. Even if you currently plan to attend the Annual Meeting, we recommend that you vote by proxy as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

May I change my vote?

Yes. If you are the record holder of the shares, you may change your vote by:

|

● |

If you voted over the internet or by telephone, voting again over the internet or by telephone by the applicable deadline described below; |

|

● |

If you previously completed and returned a Proxy Card, submitting a new Proxy Card with a later date and returning it to the Company prior to the vote at the Annual Meeting; |

|

● |

Submitting timely written notice of revocation to our Corporate Secretary, Lee S. Dixon, at 306 East North Street, Greenville, South Carolina at any time prior to the vote at the Annual Meeting; or |

|

● |

Attending the Annual Meeting in person and voting your shares at the Annual Meeting. |

If your shares are held in street name, you may change your vote by submitting new voting instructions to your brokerage firm, bank or other similar entity or, if you have obtained a legal proxy from your brokerage firm, bank, or other similar entity giving you the right to vote your shares, you may change your vote by attending the Annual Meeting and voting in person.

What is the deadline for voting?

If you are the record holder of the shares, you may vote by mail at any time prior to the Annual Meeting as long as we are able to receive your proxy through the mail by the day of the Annual Meeting. In addition, as a record holder, you may vote by internet or telephone until 11:59 p.m., Eastern time, on May 14, 2014. If your shares are held in street name, you must vote your shares in accordance with the deadline set by your brokerage firm, bank or other similar entity.

Are there any rules regarding admission to the Annual Meeting?

Yes. You are entitled to attend the Annual Meeting only if you were, or you hold a valid legal proxy naming you to act for, one of our shareholders on the record date. The Board has determined that the record date for the Annual Meeting is March 17, 2014. In order to be admitted to the Annual Meeting, we may confirm:

|

● |

Your identity by reviewing a valid form of photo identification, such as a driver’s license; and / or |

|

● |

That you were, or are validly acting for, a shareholder of record on the record date by: |

|

o |

Verifying your name and stock ownership against our list of registered shareholders if you are the record holder of your shares; |

|

o |

Reviewing other evidence of your stock ownership, such as your most recent brokerage or bank statement, if you hold your shares in street name; or |

|

o |

Reviewing a written proxy that shows your name and is signed by the shareholder you are representing, in which case either the shareholder must be a registered shareholder or you must have a brokerage or bank statement for that shareholder as described above. |

What is a broker nonvote?

Brokers are members of the New York Stock Exchange (the “NYSE”), which allows its member-brokers to vote shares held by them for their clients on matters the NYSE determines are routine even though the brokers have not received voting instructions from their clients. If the NYSE does not consider a matter routine, then your broker is prohibited from voting your shares on the matter unless you have given voting instructions on that matter to your broker. This is referred to as a “broker nonvote.”

Because the NYSE does not consider the election of directors or the approval, , on an advisory, nonbinding basis, of named executive officer compensation to be routine matters, it is important that you provide instructions to your broker, if your shares are held in street name, so that your vote with respect to these matters is counted. Your broker will be unable to vote on your behalf with regard to these nonroutine matters if you do not give voting instructions with respect to these matters.

How many votes must be present to hold the Annual Meeting?

A quorum must be present before we can conduct any business at the Annual Meeting. This means we need the holders of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting as of the record date to be present in person or represented by proxy at the Annual Meeting. We urge you to vote promptly by proxy even if you plan to attend the Annual Meeting so that we will know as soon as possible that enough shares will be present for us to hold the Annual Meeting. Solely for purposes of determining whether we have a quorum, we will count:

|

● |

Shares present in person or by proxy and voting; |

|

● |

Shares present in person and not voting; and |

|

● |

Shares for which we have received proxies but for which shareholders have abstained from voting or that represent broker nonvotes. |

If a quorum is not present or represented at the Annual Meeting, the shareholders entitled to vote, present in person or represented by proxy, have the power to adjourn the meeting from time to time until a quorum is present or represented. If any such adjournment is for a period of less than 30 days, no notice, other than an announcement at the Annual Meeting, will be given of the adjournment. If the adjournment is for 30 days or more, notice of the adjourned meeting will be given in accordance with the Company’s Bylaws. Directors, officers and employees (which we refer to as “teammates”) of the Company may solicit proxies for the reconvened meeting in person, by mail, by telephone or other means. At any such reconvened meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the Annual Meeting as originally noticed. Once a quorum has been established, it will not be destroyed by the departure of shares prior to the adjournment of the Annual Meeting.

What vote is required to approve each item of business?

|

● |

Item 1: Election of Directors. Under our Bylaws, a nominee for director will be elected to the Board by a plurality of the votes of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. This means that the individuals who receive the highest number of votes are selected as directors up to the maximum number of directors to be elected at the Annual Meeting. |

|

● |

Item 2: Advisory, Nonbinding Approval of Named Executive Officer Compensation. If a quorum is present at the Annual Meeting, the proposal to approve, on an advisory nonbinding basis, the compensation of our Named Executive Officers will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal. |

|

● |

Item 3: Ratification of Independent Registered Public Accounting Firm. If a quorum is present at the Annual Meeting, this proposal will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal. |

How are votes counted?

|

● |

Item 1: Election of Directors. You may vote “FOR” or “AGAINST” each director nominee or “ABSTAIN” from voting on a director nominee. We will not count abstentions or broker nonvotes as either for or against a director, so abstentions and broker nonvotes have no impact on the election of a director. |

|

● |

Item 2: Advisory, Nonbinding Approval of Named Executive Officer Compensation. You may vote “FOR” or “AGAINST” this item of business, or “ABSTAIN” from voting on this item of business. If a shareholder submits a proxy but does not specify how he or she would like it to be voted, then the proxy will be voted “FOR” the approval, on an advisory, nonbinding basis, of the compensation of our Named Executive Officers. We will not count abstentions or broker nonvotes as either for or against this proposal, so abstentions and broker nonvotes will not affect the approval, on an advisory, nonbinding basis, of the compensation of our Named Executive Officers. |

|

● |

Item 3: Ratification of Independent Registered Public Accounting Firm. You may vote “FOR” or “AGAINST” this item of business or “ABSTAIN” from voting on this item of business. If a shareholder submits a proxy but does not specify how he or she would like it to be voted, the proxy will be voted “FOR” the ratification of our independent registered public accounting firm. We will not count abstentions or broker nonvotes as either “FOR” or “AGAINST” this proposal, so abstentions and broker nonvotes have no impact on the ratification of our independent registered public accounting firm. |

As to any other matter of business that may be brought before the Annual Meeting, a vote may be cast pursuant to the accompanying proxy in accordance with the best judgment of the persons voting the same. However, the Board of Directors does not currently know of any such other business.

Is my vote confidential?

Yes. It is our policy that documents identifying your vote are confidential. The vote of any shareholder will not be disclosed to any third party before the final vote count at the Annual Meeting except:

|

● |

To meet legal requirements; |

|

● |

To assert claims for, or defend claims against, the Company; |

|

● |

To allow authorized individuals to count and certify the results of the shareholder vote; |

|

● |

If a proxy solicitation in opposition to the Board takes place; or |

|

● |

To respond to shareholders who have written comments on Proxy Cards or who have requested disclosure |

|

ITEM 1: ELECTION OF DIRECTORS |

The Board of Directors currently has nine members divided into three classes. Our current directors and their classes are:

|

Terms Expiring at the 2014 Annual Meeting |

Terms Expiring at the 2015 |

Terms Expiring at the 2016 |

||

|

Robert B. Goldstein * |

Michael D. Glenn |

Lee S. Dixon |

||

|

John D. Hopkins, Jr. * |

J. David Wasson, Jr. |

Samuel L. Erwin |

||

|

Jane S. Sosebee * |

James J. Lynch |

|||

|

John P. Sullivan * |

||||

| ____________________

* Standing for election by the shareholders at the 2014 Annual Meeting. | ||||

The directors whose terms expire at the 2014 Annual Meeting, Messrs. Goldstein, Hopkins and Sullivan and Ms. Sosebee, have been nominated by the Board to be elected at the Annual Meeting to hold office until their terms expire and until their successors are elected and qualified. The nominees have told us that they are willing to serve as directors. If any nominee is no longer a candidate for director at the Annual Meeting, the proxy holders will vote for the rest of the nominees and may vote for a substitute nominee in their discretion. The Company’s Governance Guidelines require a minimum of eight and a maximum of 15 directors, with the number of directors to be determined at the discretion of the Board.

As a requirement of the private placement of the Company’s common stock in 2010, the Board appointed two designees of CapGen Financial Partners (“CapGen”) and one designee of Patriot Financial Partners, L.P. and Patriot Financial Partners Parallel, L.P. (collectively, “Patriot”) to serve on the Boards of each of the Company and its subsidiary, The Palmetto Bank (the “Bank”). For so long as CapGen or Patriot, as applicable, owns more than 9.9% of the Company’s outstanding shares of common stock, and subject to satisfaction of all legal and governance requirements applicable to all Board members regarding service as a director of the Company, the Company will be required to nominate two people designated by CapGen and one person designated by Patriot for election to the Board at each annual meeting of shareholders at which the term of each such director expires, or upon the death, resignation, removal or disqualification of each such director, if earlier. Each of the CapGen designees’ (Messrs. Goldstein and Sullivan) term expires at the Annual Meeting and each has been nominated by the Board for re-election at the Annual Meeting. The Patriot designee (Mr. Lynch) was re-elected to the Board at the 2013 Annual Meeting. As of March 10, 2014, CapGen and Patriot own 44.8% and 19.2% of the Company's outstanding shares of common stock, respectively.

As described below under Corporate Governance, Process for Evaluating Director Candidates, the Board has identified certain qualifications for its directors. The Board believes that these particular qualifications provide our directors with substantial experience relevant to serving as a director of our Company. The Board has determined that each nominee for election as a director at the Annual Meeting is an independent director as discussed below under Corporate Governance, Director Independence.

Each of our nominees satisfies our director qualifications and during the course of their business and professional careers has acquired business management experience in these and other areas. In addition, the Corporate Governance and Nominating Committee and the Board believe that each nominee brings to the Board his or her own unique background and particular expertise, knowledge and experience that provide the Board as a whole with the necessary and appropriate mix of skills, characteristics and attributes that enable the Board to work together in a professional and collegial atmosphere and that are required for the Board to fulfill its oversight responsibility to the Company’s shareholders.

The Board recommends you vote “FOR” each of the nominees set forth below.

DIRECTOR NOMINEES

The following provides information regarding each of our directors to be elected at the 2014 Annual Meeting, including their age and the year in which they first became a director of the Company, the year in which their term expires, their business experience for at least the past five years, the names of other publicly-held companies where they currently serve as a director or served as a director during the past five years and additional information about the specific experience, qualifications, attributes or skills that led to the Board’s conclusion that such person should serve as a director for the Company.

|

Business Experience: Mr. Goldstein has worked in the banking industry since 1963 in various capacities. In 2007, Mr. Goldstein partnered with three other individuals to form a bank holding company and private equity fund that invests in banks and financial services companies, CapGen Capital Advisors, LLC, and currently serves as a Principal. Immediately prior to this, he served as Chairman and Chief Executive Officer of a $6 billion bank holding company in the San Francisco Bay area from 2001-2006. His experience includes many years in commercial banks, savings and loan associations and other financial institutions including serving as Chief Executive Officer of numerous banks and thrifts. Mr. Goldstein’s extensive experience in the financial services industry provides us with beneficial leadership and counsel. Other Public Company Directorships: Mr. Goldstein currently holds the following directorships: ● F.N.B. Corporation (Chair of Compensation Committee); ● Seacoast Banking Corp of Florida (Co-chair of Nominating, Governance & Compensation Committee); and ● Hampton Roads Bankshares, Inc.

Additional Information: Through the various capacities in which he has served during his career, Mr. Goldstein has become nationally recognized for his expert investing and operational experience in turning around and implementing growth strategies for banks under the most challenging circumstances. He is also highly regarded for identifying new opportunities for investment in community and regional banking.

A consistently successful investor for himself and others, Mr. Goldstein has been a senior executive and/or director at 14 financial institutions over a career that has spanned more than 40 years. Mr. Goldstein is often the “first call” when community and regional banks encounter difficulties that require outside operational and investing expertise. His network of relationships in banking and financial services is a key competitive feature of the CapGen Program.

Mr. Goldstein is the Chairman of the Board of Directors of The BANKshares, Inc. and a director of its subsidiary, BankFIRST of Winter Park, FL. The BANKshares, Inc. is a privately-owned bank holding company doing business in the greater Orlando and Brevard County areas of Florida.

Previously, Mr. Goldstein successfully raised capital, injected new management, and reenergized banks and thrifts in Connecticut, New Jersey, New York, and Pennsylvania. These activities have earned him a widely known and respected reputation in the domestic financial services industry.

As a private investor, Mr. Goldstein has also invested in de novo banks, recapitalizations of existing institutions and in other successful endeavors related to financial entities.

Mr. Goldstein is a graduate of Texas Christian University. He also served for seven years on the faculty of the Southwestern Graduate School of Banking at Southern Methodist University. | |

|

Robert B. Goldstein Age Director Since Term Expiring |

73 2010 2014 | |

|

|

| |

|

|

| |

|

|

||

|

Business Experience: Mr. Hopkins has served as owner of The Fieldstone Group, a diversified investment and development company with real estate, farm, land, and timber holdings, since 2000. Prior to 2000, Mr. Hopkins was employed for 26 years at Owens Corning, a Fortune 500 company, the last 10 of which he served as an officer.

Other Public Company Directorships: None

Additional Information: As the owner and officer of two companies during the past 37 years, including recently with a company involved in real estate activities, Mr. Hopkins brings leadership and business management experience to the Board. In addition, he has extensive expertise that he gained through this business experience as well as through his current service as a member of the Company’s Compensation, Corporate Governance and Nominating and Regulatory Oversight and Risk Management Committees. Mr. Hopkins serves as Chairman of the Board for the South Carolina Technology and Aviation Center and Anderson University Board of Regents, and serves on the Board of the Greenville County Research and Technological Development Corporation. Mr. Hopkins also serves as a director of the International Transportation Innovation Center. Mr. Hopkins provides entrepreneurial experience to the Board, which is important to our many consumer businesses. Mr. Hopkins is a graduate of Clemson University and the South Carolina Bankers Association Director’s College. | |

|

John D. Hopkins, Jr. Age Director Since Term Expiring |

62 |

|

Business Experience: Ms. Sosebee is Director of Legislative Affairs, AT&T South Carolina. Through this position, Ms. Sosebee works directly with members of the South Carolina General Assembly and is responsible for the company’s legislative and public policy activities in the state. Ms. Sosebee has over 35 years in the telecommunications industry, having also worked with AT&T’s predecessor companies, Southern Bell and BellSouth, and initially served in the business marketing group and was responsible for the company’s relationships with business, education and government clients in Upstate, South Carolina. She subsequently became the Regional Director of External Affairs through which she was responsible for community affairs, philanthropy and economic development in the region. She was selected to lead the state team for External Affairs in 2007 and assumed her current position in Government Relations in 2010. Additional Information: Ms. Sosebee brings extensive leadership and business management skills to the Board obtained through her years of employment with AT&T and her service with numerous not-for-profit organizations. She has been involved in leadership roles in many economic development and community organizations, including serving as Chairman of the Clemson University Foundation, Chairman of the Greenville Chamber of Commerce, Chairman of the Upstate Alliance and Chairman of Anderson County Development Partnership. Her experience in the telecommunications industry provides valuable insight to the Board on regulatory issues. Accordingly, Ms. Sosebee chairs the Board’s Compensation Committee and is a member of the Audit Committee. A native of Laurens, South Carolina, Ms. Sosebee is a graduate of Clemson University and the South Carolina Bankers Association Director’s College. Ms. Sosebee holds several not-for-profit directorships. | |

|

Jane S. Sosebee Age Director Since Term Expiring |

57 |

|

Business Experience: In 2007, Mr. Sullivan joined with three other individuals to form a bank holding company and private equity fund that invests in banks and financial services companies, CapGen Capital Advisors, LLC, and currently serves as Managing Director. Immediately prior to this, he served as a senior advisor to the global financial services practice of a “big four” accounting firm. Other Public Company Directorships: Mr. Sullivan currently holds the following directorships: ● Jacksonville Bancorp, Inc. (Chair of Audit Committee); and ● Hampton Roads Bankshares (Board Observer). Additional Information: Mr. Sullivan has extensive experience and a diverse background in all facets of bank and financial management. He served as Chairman, President, Chief Executive, and Chief Operating Officer of various financial institutions in the New York metropolitan area, including Hamilton Bancorp, River Bank America (East River Savings Bank), Continental Bank and the Olympian New York Corp. Mr. Sullivan is a senior advisor and member of the advisory board for New York State’s largest de novo banking effort, Signature Bank. Prior to joining CapGen, he served as a senior advisor to the global financial services practice of a “big four” accounting firm. In this capacity, he provided guidance and thought leadership to some of the firm’s largest financial services clients on banking matters, such as merger and acquisition activity, capital transactions, regulatory issues, credit quality, and credit risk. He is frequently called upon to provide guidance and expertise in highly complex financial and operational situations for banks and other financial services companies. Mr. Sullivan has successfully raised capital at all of the banks with which he has been affiliated and is a member of or a board observer on a number of corporate boards and serves on the Audit, Compensation, Loan, and Executive Committees on several of those entities. Mr. Sullivan is a graduate of Niagara University and a Certified Public Accountant.

| |

|

John P. Sullivan Age Director Since Term Expiring |

57 | |

OTHER DIRECTORS

The following provides information regarding each of our other directors (elected by the Company’s shareholders at previous annual meetings of shareholders and continuing in office subsequent to the 2014 Annual Meeting), including their age and the year in which they first became a director of the Company, the year in which their term expires, their business experience for at least the past five years, the names of other publicly-held companies where they currently serve as a director or served as a director during the past five years and additional information about the specific experience, qualifications, attributes or skills that led to the Board’s conclusion that such person should serve as a director for the Company.

|

Business Experience: Mr. Dixon serves as Chief Operating Officer (since July 2009), Chief Risk Officer (since October 2009) and Corporate Secretary (since January 2012) of the Company and the Bank. In addition, Mr. Dixon has served in various other executive management roles of the Company and the Bank including from January 2012 to December 2013 as the interim Wealth Management Executive, from July to September 2013 as the interim Human Resources Executive, from February 2011 to May 2011 as the interim Chief Information Officer, from July 2010 to February 2011 as the interim Chief Financial Officer, and from May 2009 to June 2009 as Senior Executive Vice President. Previously, Mr. Dixon served as Chief Operating Officer of First Presbyterian Church of Winston-Salem from July 2006 through May 2009, and he was in the Banking and Capital Markets practice of PricewaterhouseCoopers LLP from January 1989 through June 2006 (admitted as a Partner in July 1999). Other Public Company Directorships: None Additional Information: Mr. Dixon brings extensive operational, accounting and financial reporting expertise to the Board from his 26 years of business experience, 18 years of which he served in the Banking and Capital Markets practice at PricewaterhouseCoopers LLP. Mr. Dixon has worked with banking clients ranging from small community banks to some of the largest national banks, and he has extensive operational experience covering all aspects of banking and financial services. Mr. Dixon’s background with PricewaterhouseCoopers LLP has provided him with substantial banking, regulatory, financial reporting and risk management experience. Mr. Dixon also has extensive leadership and business management experience and skills. Mr. Dixon is a graduate of the University of South Carolina and graduated “with distinction” from the Stonier Graduate School of Banking. Mr. Dixon is a Certified Public Accountant. Mr. Dixon also serves on the Boards of Directors of not-for-profit entities. | |

|

Lee S. Dixon Age Director Since Term Expiring |

48 | |

|

Business Experience: Mr. Erwin has served as Chairman of the Board of the Company and the Bank since January 1, 2014, Chief Executive Officer of the Company since January 2010 and Chief Executive Officer and President of the Bank since July 2009. In addition, Mr. Erwin served as Senior Executive Vice President of the Company and the Bank from March 2009 through June 2009. Mr. Erwin began his banking career at First Union National Bank in July 1990. At the time of his departure from First Union in January 1997, he served as Vice President and City Executive in Orangeburg, South Carolina. He worked with First National Bank (now South Carolina Bank and Trust) from January 1997 until January 2000 where he held the position of Senior Vice President and Region Executive in Orangeburg, South Carolina. From January 2000 until June 2002, he held the position of Senior Vice President and Market President in Columbia, South Carolina with First Union National Bank (now Wells Fargo). From June 2002 until December 2004, he served as Senior Vice President and Commercial Relationship Manager for Carolina National Bank, a start-up bank in Columbia, South Carolina. From January 2005 to October 2008, Mr. Erwin served as Chief Executive Officer of Community Bancshares, Inc. in Orangeburg, South Carolina. Other Public Company Directorships: Mr. Erwin served on the Board of Community Bankshares, Inc. from 2005 until 2008. Additional Information: Mr. Erwin has extensive knowledge and experience in finance and the banking and financial services industry. In addition to his experience at the Company and the Bank, Mr. Erwin has 23 years of banking experience. At Community Bankshares, Mr. Erwin addressed significant asset quality and organizational issues associated with a multi-bank holding company with decentralized policies, procedures, and operations. With Mr. Erwin’s leadership and experience, Community Bankshares successfully resolved asset quality issues which ultimately resulted in a sale of the bank in October 2008 at two times book value despite a depressed market. Mr. Erwin’s experience brings a unique perspective to the Board including, but not limited to, banking, regulatory, governmental, financial and economic matters. Mr. Erwin is a graduate of Clemson University. | |

|

Samuel L. Erwin Age Director Since Term Expiring |

46 | |

|

Business Experience: Mr. Glenn has been engaged in the practice of law since 1965. He has worked as an active trial attorney since 1978 with a concentration in complicated business and class action litigation. Mr. Glenn has been a partner with the law firm of Glenn, Haigler & Stathakis, LLP since 1993. Mr. Glenn served as Chairman of the Board of Directors of the Company and the Bank from January 2012 through December 2013. Mr. Glenn served as the Lead Director of the Company and the Bank prior to being named Chairman of the Board in January 2012. Other Public Company Directorships: None

Additional Information: During his career, Mr. Glenn served on numerous boards and commissions upon appointment by the South Carolina Supreme Court and the South Carolina Bar Association and has served on numerous private and public agency boards. In addition, he has served in three judgeships for ten years. Additionally, Mr. Glenn’s professional experience as a business owner provides the Board with business insight and analytical skills that are necessary to manage the Company’s affairs in this difficult economic environment. Mr. Glenn is a graduate of Furman University and received his law degree from the University of South Carolina. Mr. Glenn’s law experience and education provides him with additional perspective on the legal, regulatory and risk matters impacting the Company. | |

|

Michael D. Glenn Age Director Since Term Expiring |

73 |

|

Business Experience: Mr. Lynch has over 40 years of bank management experience. Since 2007, he has served as Managing Partner of Patriot Financial Partners, L.P., a private equity investment fund focusing on investments in the community banking sector throughout the United States. Mr. Lynch was a founding partner of this fund. Prior to Patriot, from 2003 to 2007, he served as Vice Chairman of Sovereign Bancorp and Chief Executive Officer of the Mid-Atlantic Division for Sovereign Bank. Other Public Company Directorships: Mr. Lynch currently holds the following directorships: ● Heritage Oaks Bancorp; and ● Cape Bancorp. Additional Information: Mr. Lynch has considerable experience in and knowledge of the capital markets, as well as significant executive level banking experience, which is valuable to the Board of Directors in its assessment of the Company’s sources and uses of capital. Mr. Lynch is active in several professional and civic organizations and is a graduate of LaSalle University in Philadelphia. His graduate studies were at Drexel University. He received an Honorary Doctorate from La Salle University in 2010. In addition to the public company directorships summarized above, Mr. Lynch holds several private and not-for-profit directorships. | |

|

James J. Lynch Age Director Since Term Expiring |

64 |

|

Business Experience: Mr. Wasson has been President and Chief Executive Officer of Laurens Electric Cooperative, Inc., a member-owned rural electric cooperative in Upstate, South Carolina, since 1974. Other Public Company Directorships: None

Additional Information: Through his service as Chief Executive Officer of Laurens Electric over the past 40 years, Mr. Wasson brings leadership and business management experience to the Board. Mr. Wasson possesses financial management expertise that he gained through his position and as a member of the Audit Committee of a nonpublic entity as well as a current member of the Company’s Audit Committee. As a member of the Board since 1979, Mr. Wasson has extensive knowledge and experience regarding our business. In addition, Mr. Wasson provides unique insight into the Company’s Laurens County market. Mr. Wasson is a graduate of Clemson University and earned a graduate degree from the University of South Carolina. | |

|

J. David Wasson, Jr. Age Director Since Term Expiring |

68 |

OTHER EXECUTIVE OFFICER

Other than Messrs. Dixon and Erwin, for which disclosure was provided above, the following provides information regarding our other Executive Officer:

|

|

Business Experience: Mr. Jones serves as Chief Financial Officer (since February 2011) and Chief Accounting Officer (since November 2010) of the Company and the Bank. Prior to joining the Company and the Bank, Mr. Jones was employed by The South Financial Group from 2004 to 2010, most recently as Executive Vice President – Director of Finance and Investor Relations. While at The South Financial Group, Mr. Jones also served in the role of Senior Vice President – Director of Money Markets and Derivatives. Between 2001 and 2004, Mr. Jones served as Chief Financial Officer and Senior Vice President – Corporate Development for CNB Florida Bancshares, Inc. (acquired by The South Financial Group in 2004). Mr. Jones served in various capacities for Bank of America and predecessor organizations from 1997 until 2001. Prior to his service with Bank of America, he served in financial reporting roles for two companies. Mr. Jones began his career with Price Waterhouse LLP in 1990. Additional Information: Mr. Jones has extensive accounting and financial reporting expertise from his years of business experience and has worked with small community banks to some of the largest national banks. His background has provided him with substantial banking, regulatory, management and financial reporting, and risk management experience. Mr. Jones received a Bachelor of Business Administration with a major in accounting from the University of North Florida and a Master of Accounting degree from the University of Florida and is a Certified Public Accountant.

| |

|

Roy D. Jones Age

|

45 |

CORPORATE GOVERNANCE

The Board is committed to sound and effective corporate governance principles and practices. Annually, the Board performs self-assessments, including comparisons to best practices from recognized authorities such as the Business Roundtable, CalPERS, and the national stock exchanges. The results of the Board’s self-assessments and enhancements to its oversight of the Company are described in more detail below.

Codes of Ethics

Each member of the Board is held to the standards outlined in the Code of Ethics for the Senior Leadership Team, Board of Directors and Senior Financial Officers, which states our policy and standards for ethical conduct and our expectation that all subjected parties will act in a manner that serves the best interests of the Company. We expect all of our teammates to adhere to these standards of ethics and business conduct with other teammates, clients, shareholders, and the communities we serve and to comply with all applicable laws, rules and regulations that govern our business. Accordingly, we have in effect a code of ethics for all teammates. Shareholders and other interested persons may view our codes of ethics on the Investor Relations section of our website, www.palmettobank.com.

Director Election Standard

Our Bylaws provide that directors will be elected by a plurality of the votes of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. This means that the individuals who receive the highest number of votes are selected as directors up to the maximum number of directors to be elected at the Annual Meeting.

Director Independence

Annually, the Board affirmatively determines the independence of each director and each nominee for election as a director based on Item 407(a) of Regulation S-K and NASDAQ rules. It is important for investors to have confidence that individuals serving as independent directors do not have a relationship with the Company that would impair independence. The Board has a responsibility to make an affirmative determination that no such relationships exist through the application of NASDAQ Listing Rule 5605.

To determine each director’s independence, the Board considered information in 2013 regarding banking and financial services, commercial, charitable, familial and other ordinary course relationships with the Company. The Board also considered relationships between each director, his or her respective immediate family members and/or certain entities affiliated with such directors and immediate family members and the Company. The Board has considered and determined that the following types of relationships between a director, his or her immediate family members and / or certain entities affiliated with a director and his or her immediate family members and the Company are not material relationships for purposes of determining whether a director is independent:

|

● |

A relationship, transaction, or arrangement involving any banking or financial services the Company offers to its clients, if such relationship, transaction, or arrangement is in the ordinary course of business, is on substantially the same terms as those prevailing for comparable transactions with persons not affiliated with the Company, complies with applicable banking laws, and, to the extent applicable, if such relationship, transaction or arrangement is with an entity where the director is an employee or an immediate family member is an Executive Officer, the payments to, or payments received from, the Company for such banking or financial services are, in any fiscal year, less than the greater of $1 million or 2% of such other entity’s consolidated gross revenues; |

|

● |

A business relationship, transaction, or arrangement involving property or nonfinancial services, or other standard contractual arrangements (including standard lease agreements for the Company’s branch offices or other premises), if such relationship, transaction, or arrangement is in the ordinary course of business, is on substantially the same terms as those prevailing for comparable transactions with persons not affiliated with the Company, and the payments to, or payments received from, the Company for such property or nonfinancial services, or under such contractual arrangement, are, in any fiscal year, less than the greater of $1 million or 2% of such other entity’s consolidated gross revenues; |

|

● |

A relationship, transaction or arrangement with an entity that is providing legal services to the Company, if neither the director nor the immediate family member performs the services to the Company, and such relationship, transaction or arrangement is otherwise immaterial under the Board’s categorical standards; |

|

● |

Contributions made by the Company or a Company-sponsored charitable foundation to a tax-exempt organization where a director or an immediate family member of the director serves or is employed as an Executive Officer, or where a director serves as chairman of the board, if the contributions in any fiscal year, excluding the Company’s matching funds, are less than the greater of $1 million or 2% of the tax-exempt organization’s consolidated gross revenues; |

|

● |

Employment by the Company of an immediate family member if the family member was not or is not one of our Executive Officers, does not reside in the same home as the director, and we provide compensation and benefits to the person in accordance with our employment and compensation practices applicable to employees holding comparable positions; and |

|

● |

Any other relationship, transaction, or arrangement between the Company and an entity where a director or an immediate family member serves solely as a non-management board member, a member of a trade or other similar association, an advisor or a member of an advisory board, a trustee, a limited partner, an honorary board member or trustee, or in any other similar capacity with such entity, or where an immediate family member is employed by such entity in a non-Executive Officer position. |

The Board determined that there were no such relationships that impaired the independence of any current directors or director nominees. Accordingly, after reviewing this information, the Board determined that during 2013, except for Mr. Erwin and Mr. Dixon, who were employed by the Company during 2013, all current directors and director nominees were independent under the NASDAQ rules.

Board Leadership Structure and Independent Lead Director

Mr. Erwin was named Chief Executive Officer in January 2010 and has continued to serve in that capacity since that time. Effective January 1, 2012, Mr. Glenn was elected to serve as Chairman of the Board and served in that capacity during 2012 and 2013. Prior to being appointed as Chairman, Mr. Glenn served as the Board’s independent Lead Director.

As discussed further below, Mr. Erwin was elected Chairman of the Board effective January 1, 2014. In addition, the Board elected Mr. Goldstein as the independent Lead Director of the Board effective January 1, 2014. The election of Mr. Erwin and Mr. Goldstein to their respective roles also applies to the Bank. Mr. Erwin will continue in his role as Chief Executive Officer of the Company and the Bank.

During Mr. Glenn’s term as an independent Chairman of the Board, the role of Lead Director was not filled. As the Chairman of the Board of Directors, Mr. Glenn’s duties and responsibilities included, among other things:

|

● |

Together with the Chief Executive Officer, with input from the other directors, approving Board meeting agendas; |

|

● |

Together with the Chief Executive Officer, with input from the other directors, approving meeting schedules to ensure that there is sufficient time for discussion of all agenda items; |

|

● |

Presiding at executive sessions or special meetings of independent directors and, as appropriate, providing feedback to the Chief Executive Officer and otherwise serving as a liaison between the independent directors and the Chief Executive Officer; |

|

● |

Calling executive sessions of the independent directors of the Board and advising the Chief Executive Officer of actions or deliberations at such sessions; |

|

● |

Working with Committee chairs to ensure coordinated coverage of Board responsibilities; |

|

● |

Facilitating communication between the Board and management, including advising the Chief Executive Officer of the Board’s informational needs and approving the types and forms of information sent to the Board; |

| ● | Serving as an additional point of contact for Board members and shareholders; | |

|

● |

Acting as a “sounding board” and mentor to the Chief Executive Officer; and |

|

● |

Staying informed about the strategy and performance of the Company and reinforcing that expectation for all Board members. |

During 2010 through 2013, the Board believed it was appropriate to operate with the roles of the Chairman of the Board and Chief Executive Officer separated in order to allow the Chief Executive Officer to focus his time and energy on the day-to-day operations of the Company, with particular emphasis on the execution of our Strategic Project Plan in place to address issues related to asset quality, earnings, liquidity, and the regulatory Consent Order that the Bank entered into with its primary regulatory authorities in 2010. However, following the Company’s return to sustained profitability starting in the third quarter 2012, the removal of the Consent Order in January 2013, and a more stable economic environment, the Board believes that once again combining the roles of the Chairman of the Board and Chief Executive Officer will allow a more efficient development and execution of the Company’s strategic plan and leadership of the Board.

The Board recognizes the importance of strong independent leadership on the Board. Accordingly, in addition to maintaining a significant majority of independent directors, effective January 1, 2104 the Board named Mr. Goldstein to the role of independent Lead Director since the Chairman of the Board and Chief Executive roles are now filled by the same person as of that date. The Board believes that the independent Lead Director structure will provide additional leadership, oversight, and benefits for the Company. The duties and responsibilities of Mr. Goldstein as the independent Lead Director include those listed above for Mr. Glenn during his term as independent Chairman of the Board.

The Company is a financial institution and Messrs. Glenn, Goldstein and Erwin have extensive years of banking experience, both other financial institutions (see Director Nominees and Other Directors herein for discussion regarding the business experience of Messrs. Glenn, Goldstein and Erwin) and at the Company (through Board and management experience, respectively). They also have the knowledge, expertise and experience to understand the opportunities and challenges facing the Company as well as the leadership and management skills to promote and execute the Company’s values and strategy, particularly during the current challenging economic and regulatory environment.

The Board’s Role in Risk Oversight

The role of the Board in risk oversight has become increasingly important given the economic challenges of the past several years, increased regulatory obligations and as public expectations for board engagement increased. Risk is a pervasive part of everyday business and organizational strategy, and the complexity and overall pace of change have increased the volume and complexities of risks facing financial institutions. The financial services crisis and challenging economy over the past several years, including the significant impact on the banking industry, have demonstrated that the Board must play a critical role in overseeing the risk management of the Company.

The challenge facing boards is how to effectively oversee an organization’s enterprise risk management in a way that balances risks while also taking appropriate risks that add value to an organization. Management and the Board are focused on enterprise risk management to better connect risk oversight and shareholder value. Enterprise risk management is a process that provides a robust and holistic top-down view of key risks facing the Company, including a more proactive and forward-looking approach to identify and manage risks before they negatively impact the Company. Through a more intentional and structured risk management approach, we believe the Board is better positioned to ensure the achievement of the Company’s strategic objectives that will result in improved longer-term Company performance.

The Board plays a critical role in overseeing our enterprise risk management program. This program was developed taking into consideration guidance from a variety of sources, including the enterprise risk management framework from the Committee of Sponsoring Organizations (COSO) of the Treadway Commission, expectations from rating agencies (for example, Standard & Poor’s enterprise risk management guidance) and shareholder advocacy groups (for example, Institutional Shareholder Services and the National Association of Corporate Directors), banking industry specialists (such as SNL and the Risk Management Association), and the internal control over financial reporting requirements of Section 404 of the Sarbanes–Oxley Act of 2002 and Section 112 of the Federal Deposit Insurance Corporation Improvement Act.

Management is accountable to the Board, and the Board’s focus on effective risk oversight is critical to setting the tone and culture towards effective risk management through strategy setting, formulating high level objectives and approving broad-based resource allocations and investments. The Board uses its Committees to carry out certain of its risk oversight duties. While risk oversight is a responsibility of the entire Board, a key component of this process is ensuring that the appropriate Board Committees address the relevant risks in their areas of governance while focusing on strategic risk issues in full Board discussions. The Board Committee primarily charged with enterprise risk management is the Regulatory Oversight and Risk Management Committee. See Committees of the Board herein for a discussion of how each of the Board’s Committees is responsible for oversight of specific risks as outlined in each of its charters.

Each Board Committee and its chair work with management in overseeing particular risks, and each Committee receives reports and information regarding risk issues directly from management. Committee chairs also talk with management outside of regular Committee meetings and receive updates on risk issues. The full Board receives written and oral reports at each of its meetings from the Committee chairs about Committee activities. The Board and each Committee also regularly meet in executive sessions without management present.

While the Board oversees the Company’s enterprise risk management, management is responsible for the day-to-day risk management processes. We believe this division of responsibility is the most effective approach for addressing the risks facing our Company and our Board leadership structure supports this approach.

To ensure regular focus on risk management, in 2009, the Board appointed a Chief Risk Officer for the Company and the Bank. The Chief Risk Officer reports to the Board at each regular Board meeting and also attends most Committee meetings of the Board to discuss risk and internal control matters. In addition, the lines of business and support groups of the Company provide to Committees and the Board various monthly dashboards to inform the Board and Committees about specific risk information and trends.

The Company believes that increased engagement by the Board in enterprise risk management has improved our overall risk management approach and will avoid the recurrence of the significant negative issues that impacted the Company from 2009 to 2012. The Board will continue to focus on significant risk exposures and the inter-related nature of risks across the Company.

Communications from Shareholders to Directors

The Board believes that it is important that a direct and open line of communication exist between the Board and its shareholders and other interested parties. Therefore, shareholders may communicate with the Chairman of the Board, independent Lead Director, chairpersons of the Board’s Committees or with the directors as a group by sending an email to directorcommunications@palmettobank.com or by sending written correspondence to 306 East North Street, Greenville, South Carolina, 29601 Attention: Corporate Secretary. The email or written correspondence should specify which of the foregoing persons or group is the intended recipient. All communications received in accordance with these procedures will be forwarded to the intended recipient unless it is determined that the communication does not relate to the business or affairs of the Company or the functioning or constitution of the Board or any of its Committees, relates to routine or insignificant matters that do not warrant the attention of the Board, is an advertisement or other commercial solicitation or communication, is frivolous or offensive, or is otherwise not appropriate for delivery to the intended recipient.

The recipient who ultimately receives any such communication has discretion to determine whether the subject matter of the communication should be brought to the attention of the Chairman of the Board, independent Lead Director, full Board or one of its Committees and whether any response to the person sending the communication is appropriate. Any such response will be made in accordance with the Company’s policies and procedures and applicable law and regulations relating to the disclosure of information.

Process of Evaluating Director Candidates

The Corporate Governance and Nominating Committee is responsible for managing the director nomination process, which includes identifying, evaluating and recommending for nomination candidates for election as new directors and re-election of incumbent directors. The Corporate Governance and Nominating Committee’s nominating process assists the Board in attracting and retaining competent individuals with the requisite expertise who will act as directors in the best interests of the Company and its shareholders. As required by its charter, the Corporate Governance and Nominating Committee reviews the composition of the Board in light of its understanding of the backgrounds, industry, professional experience and various geographic and demographic communities represented by current members. The Corporate Governance and Nominating Committee also reviews Board self-evaluations and skills matrices with respect to the business and professional expertise represented by current directors in order to identify any specific skills desirable for future Board members. It also monitors the expected service dates of Board members, any planned retirement dates and other anticipated events that may impact a director’s continued ability or desire to serve.

Although the Corporate Governance and Nominating Committee does not have a specific policy regarding diversity, the Corporate Governance and Nominating Committee will consider, in identifying first-time candidates, nominees for director or evaluating individuals recommended by shareholders, the current composition of the Board in light of the communities and geographies we serve and the interplay of the candidate’s or nominee’s diverse individual experience, education, skills, background and other qualities and attributes with those of the other Board members. The Corporate Governance and Nominating Committee incorporates this broad view of diversity into its review and evaluation of new candidates and incumbent nominees in its director nomination process to ensure that the Board’s composition reflects the particular needs of the Board and the Company. The Corporate Governance and Nominating Committee and the Board monitor its effectiveness through the Corporate Governance and Nominating Committee’s and Board’s self-evaluation process. As described above under Item 1: Election of Directors, the Corporate Governance and Nominating Committee and the Board believes that the current composition of the Board reflects a group of highly talented individuals with diverse backgrounds, skills, professional and industry experience and other personal qualities and attributes best suited to perform oversight responsibilities for the Company and its shareholders.

The Corporate Governance and Nominating Committee identifies potential candidates for first-time nomination as a director primarily through recommendations it receives from current Board members and contacts in the communities we serve. The Corporate Governance and Nominating Committee also has the authority to conduct a formal search using an outside search firm selected and engaged by the Corporate Governance and Nominating Committee to identify potential candidates. While the Committee may receive nominations from other Board members and the Chief Executive Officer, the Committee retains the sole discretion to determine whether these candidates will be nominated for appointment to the Board.

The Corporate Governance and Nominating Committee and the Board strive to maintain a Board that demonstrates objectivity and integrity on an individual and collective basis. The Corporate Governance and Nominating Committee considers the needs of the Board and the Company in light of the current mix of director skills and attributes. The Corporate Governance and Nominating Committee seeks the following qualifications and characteristics when evaluating a director candidate:

|

● |

A reputation for integrity, honesty, candor, fairness and discretion; |

|

● |

A high degree of expertise in his or her chosen field of endeavor, which area of expertise should have some relevance to the Company’s business activities; |

|

● |

A knowledge, or willingness and ability to obtain knowledge, of the critical aspects of banking; and / or |

|

● |

Experience and skill in serving as a competent overseer of, and trusted advisor to, senior management of a publicly-held corporation. |

Additionally, nominees for the Board should contribute to the mix of skills, core competencies and qualifications of the Board through expertise in one or more of the following areas: corporate business acumen, strategic planning, banking, accounting and finance, legal, corporate governance, leadership development, crisis management, geographical market influence, governmental and regulatory relations, mergers and acquisitions, information technology, investor relations, human resources and marketing.

The Corporate Governance and Nominating Committee will determine, in its discretion after considering all factors it considers appropriate, whether a potential nominee meets these qualifications and also will consider the composition of the entire Board in light of the various other factors described above. If a candidate meets these requirements, the Corporate Governance and Nominating Committee will arrange an introductory meeting with the candidate and our independent Lead Director, Chairman of the Board and Chief Executive Officer, the Corporate Governance and Nominating Committee Chair

and/or other directors to determine the candidate’s interest in serving on our Board. If the candidate is interested in serving on our Board, members of the Corporate Governance and Nominating Committee, together with other members of the Board, our independent Lead Director, Chairman of the Board and Chief Executive Officer, and, if appropriate, other executives of the Company then conduct an interview with the candidate. If the Board and the candidate are both interested in proceeding, the candidate will provide additional information for use in determining whether the candidate satisfies the requirements applicable to members of the Board and its Committees and for making any required disclosures in our Proxy Statement. Assuming a satisfactory conclusion to the process outlined above, the Corporate Governance and Nominating Committee then presents the candidate’s name for approval by the Board or for nomination for approval by the shareholders at the next annual meeting of shareholders, as applicable.

The Corporate Governance and Nominating Committee will consider an individual recommended by one of our shareholders for nomination as a new director if the shareholder making the recommendation follows the procedures for submitting a proposed nominee’s name required by our Bylaws and as described under Shareholder Information for Future Annual Meetings, Advance Notice Procedures. In order for the Corporate Governance and Nominating Committee to consider a shareholder-proposed nominee for election as a director, the shareholder must submit the name of the proposed nominee, in writing, by sending an email to directorcommunications@palmettobank.com or written notice to 306 East North Street, Greenville, South Carolina, 29601 Attention: Corporate Secretary. All such submissions must include the following information:

|

● |

The shareholder’s name and address and the number of shares of our common stock he or she beneficially owns; |

|

● |

The name of the proposed nominee and the number of shares of our common stock he or she beneficially owns, if applicable; |

|

● |

Sufficient information about the nominee’s experience and qualifications for the Corporate Governance and Nominating Committee to make a determination whether the individual would meet the qualifications for directors; and |

|

● |

Such individual’s written consent to serve as a director of the Company, if elected |