SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

of the Securities Exchange Act of 1934

|

Filed by the Registrant

|

☒

|

|

Filed by a Party other than the Registrant

|

☐

|

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Solicitation Material Under Rule 14a-12

Utah Medical Products, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee

required.

☐ Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11:

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

5)

|

Total fee paid:

|

☐ Fee

paid previously with preliminary materials.

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and

the date of its filing.

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

March 8, 2019

Dear UTMD Stockholder:

You are cordially invited to attend the 2019 Annual Meeting of Stockholders of Utah Medical Products, Inc.

(UTMD). The meeting will be held promptly at 12:00 noon (Mountain time), on Friday, May 3, 2019 at the corporate offices of UTMD, 7043 South 300 West, Midvale, Utah USA. Please use the North Entrance.

Please note that attendance at the Annual Meeting will be limited to stockholders as of the record date (or their

authorized representatives) and guests of the Company. Proof of ownership can be a copy of the enclosed proxy card. You may wish to refer to page one of this Proxy Statement for information about voting your proxy, including voting at the Annual

Meeting.

At the Annual Meeting, we seek the approval of UTMD stockholders in electing one director and ratifying the

selection of an independent accounting firm. In an advisory vote, we are also asking UTMD stockholders to approve UTMD’s executive compensation program. If you think you will be unable to attend the meeting, please complete your proxy and return

it as soon as possible. If you decide later to attend the meeting, you may revoke the proxy and vote in person.

You have several options for obtaining UTMD’s public announcements and other disclosures including financial

information, such as SEC Forms 10-K and 10-Q. You can be added to the Company email or regular mail lists by contacting Crystal Rios with your email or mailing address, by sending an instruction letter to the corporate address, by calling

(801-569-4109) with instructions, or by e-mailing your contact information to info@utahmed.com. As an alternative, you can view and print Company

financial and other information directly from UTMD’s website; http://www.utahmed.com.

Thank you for your ownership in UTMD!

Sincerely

Kevin L. Cornwell

Chairman & CEO

UTAH MEDICAL PRODUCTS, INC.

7043 South 300 West

Midvale, Utah 84047

(801) 566-1200

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 3, 2019

TO THE STOCKHOLDERS OF UTAH MEDICAL PRODUCTS, INC.

The Annual Meeting of Stockholders (the “Annual Meeting”) of UTAH MEDICAL PRODUCTS, INC. (the

“Company” or “UTMD”), will be held at the corporate offices of the Company, 7043 South 300 West, Midvale, Utah, on May 3, 2019, at 12:00 noon local time, for the following purposes:

|

(1)

|

To elect one director to serve a term expiring at the 2022 Annual Meeting and until a successor is elected

and qualified;

|

|

(2)

|

To ratify the selection of Haynie & Company as the Company’s independent public accounting firm for

the year ending December 31, 2019; and

|

|

(3)

|

To hold an advisory vote on the Company’s executive compensation program.

|

UTMD’s Board of Directors recommends a vote “FOR” the nominated director, whose background is

described in the accompanying Proxy Statement, “FOR” the ratification of Haynie & Company and in support of the Company’s executive compensation program.

Only stockholders of record at the close of business on March 1, 2019 (the

“Record Date”), are entitled to notice of and to vote at the Annual Meeting.

This Proxy Statement and form of proxy are being first furnished to stockholders of the Company

on approximately April 2, 2019.

THE ATTENDANCE AT AND/OR VOTE OF EACH STOCKHOLDER AT THE ANNUAL MEETING IS

IMPORTANT, AND EACH STOCKHOLDER IS ENCOURAGED TO ATTEND.

|

BY ORDER OF THE BOARD OF DIRECTORS

|

|

|

|

|

Kevin L. Cornwell, Secretary

|

Salt Lake City, Utah

Dated: March 8, 2019

PLEASE PROMPTLY FILL IN, SIGN, DATE AND RETURN THE ENCLOSED PROXY, WHETHER

OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING.

If your shares are held in the name of a third party brokerage firm,

nominee, or other institution, only that third party can vote your shares. In that case, please promptly contact the third party responsible for

your account and give instructions how your shares should be voted.

TABLE OF CONTENTS

|

PAGE

|

||

|

PROXY STATEMENT

|

1 | |

|

PROPOSAL NO. 1. ELECTION OF DIRECTOR

|

2 | |

|

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN PERSONS

|

4 | |

|

EXECUTIVE OFFICER COMPENSATION

|

5 | |

|

2018 Summary Compensation Table

|

5 | |

|

2018 Grants of Equity Incentive Plan-Based Awards

|

5 | |

|

2018 Grants of Non-Equity Incentive Plan-Based Awards

|

6 | |

|

Outstanding Equity Awards at 2018 Fiscal Year End

|

7 | |

|

2018 Option Exercises and Stock Vested

|

7 | |

|

2018 Pension Benefits

|

7 | |

|

2018 Nonqualified Deferred Compensation

|

7 | |

|

2018 Director Compensation

|

7 | |

|

CEO PAY RATIO DISCLOSURE

|

8 | |

|

DISCLOSURE RESPECTING THE COMPANY’S EQUITY COMPENSATION PLANS

|

8 | |

|

COMPENSATION DISCUSSION AND ANALYSIS

|

9 | |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

14 | |

|

BOARD OF DIRECTORS AND BOARD COMMITTEE REPORTS

|

14 | |

|

Stockholder Communications with Directors

|

17 | |

|

Report of the Compensation and Benefits Committee

|

17 | |

|

Report of the Audit Committee

|

18 | |

|

STOCK PERFORMANCE CHART

|

19 | |

|

PROPOSAL NO. 2. RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

|

19 | |

|

PROPOSAL NO. 3. ADVISORY VOTE ON EXECUTIVE COMPENSATION

|

20 |

|

|

|

||

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 3, 2019

|

21 | |

|

STOCKHOLDER PROPOSALS

|

21 | |

|

MISCELLANEOUS

|

21 | |

UTAH MEDICAL PRODUCTS, INC.

PROXY STATEMENT

This Proxy Statement is furnished to stockholders of UTAH MEDICAL PRODUCTS, INC. (the “Company”

or “UTMD”) in connection with the Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the corporate offices of the Company, 7043 South 300 West, Midvale, Utah, on May 3, 2019 at 12:00 noon local time, and any postponement or

adjournment(s) thereof. The enclosed proxy, when properly executed and returned in a timely manner, will be voted at the Annual Meeting in accordance with the directions set forth thereon. If the enclosed proxy is signed and timely returned

without specific instructions, it will be voted at the Annual Meeting:

|

(1)

|

FOR the election of Dr. Barbara A. Payne as director;

|

|

(2)

|

FOR the ratification of Haynie & Company as the Company’s independent registered public accounting firm; and

|

|

(3)

|

IN support of the Company’s executive compensation program.

|

The Board of Directors has approved proposals 1-3 and recommends that the

stockholders vote in favor of those proposals. Proxies solicited by the Company will be voted FOR proposals 1-3 unless a vote against, or an abstention from, one or more of the proposals is specifically indicated on the proxy.

A proxy for the Annual Meeting is enclosed. It is important that each

stockholder complete, sign, date and return the enclosed proxy promptly, whether or not she/he plans to attend the Annual Meeting. Any stockholder who executes and delivers a proxy has the right to revoke it at any time prior to its exercise by

providing the Secretary of the Company with an instrument revoking the proxy or by providing the Secretary of the Company with a duly executed proxy bearing a later date. In addition, a stockholder may revoke her/his proxy by attending the Annual

Meeting and electing to vote in person.

Proxies are being solicited by the Company. All costs and expenses incurred

in connection with the solicitation will be paid by the Company. Proxies are being solicited by mail, but in certain circumstances, officers and directors of the Company may make further solicitation in person, by telephone, email, facsimile

transmission, telegraph or overnight courier.

Only holders of the 3,722,610 shares of common stock, par value $0.01 per share, of the Company

(the “Common Stock”) issued and outstanding as of the close of business on March 1, 2019 (the “Record Date”), will be entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote. Holders of at least a majority of

the 3,722,610 shares of Common Stock outstanding on the Record Date must be represented at the Annual Meeting to constitute a quorum for conducting business.

All properly executed and returned proxies, as well as shares represented in person at the

meeting, will be counted for purposes of determining if a quorum is present, whether or not the proxies are instructed to abstain from voting or consist of broker non-votes. Under the Utah Revised Business Corporation Act, matters other than the

election of directors and certain specified extraordinary matters are approved if the number of votes cast FOR exceed the number of votes cast AGAINST. Directors are elected by a plurality of the votes cast. Abstentions and broker non-votes are

not counted for purposes of determining whether a matter has been approved or a director has been elected.

Executive officers and directors holding an aggregate of 271,116 shares, or approximately 7% of

the issued and outstanding stock have indicated their intent to vote in favor of proposals 1-3.

1

PROPOSAL NO. 1. ELECTION OF DIRECTORS

General

The Company’s Articles of Incorporation provide that the Board of Directors is divided into

three classes as nearly equal in size as possible, with the term of each director being three years and until such director’s successor is elected and qualified. One class of the Board of Directors shall be elected each year at the annual meeting

of the stockholders of the Company. The Board of Directors has nominated Dr. Barbara A. Payne for reelection as director, for a three-year term expiring at the 2022 Annual Meeting. The seat up for election is uncontested, i.e. no other nominees

have been submitted. Under UTMD’s Bylaws, the nominee will be elected by a plurality of votes cast. Since there are no other nominees, as a practical matter, one FOR vote will elect the director. However, under a policy adopted in 2018, any nominee for the board of directors receiving less than a majority of the votes cast in an uncontested

election shall submit her or his resignation to the board of directors, which shall accept or decline to accept that resignation in its sole discretion.

It is intended that votes will be cast, pursuant to authority granted by the enclosed proxy,

for the election of the nominee named above as a director of the Company, except as otherwise specified in the proxy. In the event a nominee shall be unable to serve, votes will be cast, pursuant to authority granted by the enclosed proxy, for

such other person as may be designated by the Board of Directors. The officers of the Company are elected to serve at the pleasure of the Board of Directors. The information concerning the nominees and other directors and their security holdings

has been furnished by them to the Company. (See “PRINCIPAL STOCKHOLDERS” below.)

Directors and Nominees

The Board of Directors’ nominee for election as director of the Company at the Annual Meeting

is Barbara A. Payne. Other members of the Board of Directors were elected at the Company’s 2017 and 2018 meetings for terms of three years, and therefore, are not standing for election at the Annual Meeting. The terms of Mr. Hoyer and Dr.

Beeson expire at the 2020 Annual Meeting, the terms of Mr. Cornwell and Mr. Richins expire at the 2021 Annual Meeting. The Board of Directors has determined that Dr. Payne, Mr. Hoyer and Dr. Beeson are independent directors within the meaning of

NASD Rule 5600(a)(2). None of the directors has served on the board of another public company during the past five years. None of the directors has been a party in a legal proceeding during the past ten years related to securities, financial

institutions, or fraud in connection with any business entity or agency or organization, as defined in the Exchange Act that has disciplinary authority over its members. Background information appears below with respect to the incumbent directors

whose terms have not expired, as well as the director standing for reelection to the Board.

2

|

Name

|

Age

|

Year First

Elected

|

Business Experience during Past Five Years and Other Information |

|

Kevin L. Cornwell

|

72

|

1993

|

Chairman of UTMD since 1996. President and CEO since December 1992. Secretary since 1993. Has served

in various senior operating management positions in several technology-based companies over a 40-year time span, including as a director on seven other company boards. Received B.S. degree in Chemical Engineering from Stanford

University, M.S. degree in Management Science from the Stanford Graduate School of Engineering, and MBA degree specializing in Finance and Operations Management from the Stanford Graduate School of Business. Among other personal and

professional attributes, the board considers Mr. Cornwell’s decades of strategic and operational experience in the medical device industry and the Company’s many years of success and profitability under his guidance to be key reasons why

he should continue as a member of the board.

|

|

Ernst G. Hoyer

|

81

|

1996

|

Retired. Chairman of the Audit Committee. Served fifteen years as General Manager of Petersen Precision

Engineering Company, Redwood City, CA. Previously served in engineering and general management positions for four technology-based companies over a 35-year time span. Received B.S. degree in process engineering from the University of

California, Berkeley, and MBA degree from the University of Santa Clara. Among other personal and professional attributes, the board considers Mr. Hoyer’s experience with and understanding of manufacturing operations, along with his

financial and accounting expertise, to be key reasons why he should continue as a member of the board.

|

|

Barbara A. Payne

|

72

|

1997

|

Retired. Served over eighteen years as corporate research scientist for a Fortune 50 firm, as an

environmental scientist at a national laboratory and as a consulting environmental sociologist. Received B.A. degree in psychology from Stanford University, M.A. degree from Cornell University, and M.A. and Ph.D. degrees in sociology

from Stanford University. Among other personal and professional attributes, the board considers Dr. Payne’s experience with and understanding of scientific research, her expertise in helping develop organizational excellence and her

understanding of UTMD to be key reasons why she should continue as a member of the board.

|

|

James H. Beeson

|

77

|

2007

|

Retired. Maternal-Fetal Medicine Physician, St. Joseph Medical Center, Houston, Texas. Professor of Maternal-Fetal Medicine at the McGovern Medical School at the University of Texas Health Science Center at Houston.

Received B.S. degree in Chemistry from Indiana University, Ph.D. degree in Organic Chemistry from M.I.T., MBA from Michigan State University, and MD from the University of Chicago Pritzker School of Medicine. Served four year residency in

Ob/Gyn at Chicago Lying-In Hospital, a fellowship in maternal-fetal medicine at the University of Utah and has actively practiced Obstetrics and Gynecology for over 35 years. Currently licensed to practice medicine in the states of Utah,

Oklahoma and Texas. Has published numerous articles and other technical papers. Has industrial experience in product development of in vitro diagnostics at the Ames Company division of Miles Laboratory (now Bayer). Among other personal

and professional attributes, the board considers Dr. Beeson’s experience as an Ob/Gyn physician as well as his general understanding of clinical practice and healthcare delivery to be key reasons why he should continue as a member of the

board.

|

|

Paul O. Richins

|

58

|

1998

|

Retired. Chief Administrative Officer of UTMD from 1997 to 2018. UTMD Treasurer and Assistant Secretary

from 1994 to 2018. Received B.S. degree in finance from Weber State University, and MBA degree from Pepperdine University. Among other personal and professional attributes, the board considers Mr. Richins’ twenty-eight years of

experience with the Company and his successful tenure as Principal Financial Officer and Manager of Stockholder Relations to be key reasons he should continue as a member of the board.

|

Code of Ethics

The Company has adopted a Code of Ethics specifically for its Board of Directors. The Company

also has a Code of Conduct that applies to all of its employees, including its named executive officers, principal financial officer and Board of Directors. The Code of Ethics and Code of Conduct are available on the Company’s website, www.utahmed.com.

3

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN PERSONS

The following table furnishes information concerning the ownership of the Company’s Common

Stock as of March 1, 2019, by the directors, the nominees for director, the executive officers named in the compensation tables on page 5, all directors and executive officers as a group, and those known by the Company to own beneficially more than

5% of the Company’s outstanding Common Stock as of December 31, 2018.

|

Name

|

Nature of Ownership |

Number

of Shares

Owned

|

Percent

|

||||||

|

Principal Stockholders

|

|||||||||

|

FMR LLC

|

Direct |

477,007

|

12.8

|

%

|

|||||

|

245 Summer Street

|

|||||||||

|

Boston, Massachusetts 02210

|

|||||||||

|

T. Rowe Price Associates, Inc.

|

Direct |

292,592

|

7.9

|

%

|

|||||

|

100 East Pratt Street

|

|||||||||

|

Baltimore, Maryland 21202-1009

|

|||||||||

|

Renaissance Technologies LLC

|

Direct |

239,214

|

6.4

|

%

|

|||||

|

800 Third Ave

|

|||||||||

| New York, New York 10022 | |||||||||

| Lazard Asset Management LLC | |||||||||

| 30 Rockefeller Plaza | |||||||||

| New York, NY 10112 |

Direct |

187,162

|

5.0

|

%

|

|||||

|

Directors and Executive Officers

|

|||||||||

| Kevin L. Cornwell (1) | Direct |

202,992

|

5.5

|

%

|

|||||

| Ernst G. Hoyer (1)(2)(3)(4) | Direct |

10,000

|

0.3

|

%

|

|||||

| Barbara A. Payne (2)(3)(4) | Direct |

19,838

|

0.5

|

%

|

|||||

| Paul O. Richins(2)(3) | Direct |

24,254

|

0.7

|

%

|

|||||

| Options |

62

|

0.0

|

%

|

||||||

| Total |

24,316

|

0.7

|

%

|

||||||

| James H. Beeson (2)(4) | Direct |

13,125

|

0.4

|

%

|

|||||

| Brian L. Koopman | Direct |

907

|

0.0

|

% |

|||||

| Options | 2,348 |

0.1 |

% | ||||||

| Total | 3,255 |

0.1 |

% | ||||||

| All executive officers and directors | Direct | 271,116 | 7.3 |

%

|

|||||

| as a group (5 persons) | Options | 2,410 |

0.1 |

% | |||||

| Total |

273,526

|

7.3

|

%

|

||||||

|

(1)

|

Executive Committee member

|

|

(2)

|

Audit Committee member

|

|

(3)

|

Governance and Nominating Committee member

|

|

(4)

|

Compensation and Benefits Committee member

|

In the previous table, shares owned directly by directors and executive officers are owned beneficially

and of record, and such record stockholder has sole voting, investment and dispositive power. Calculations of percentage of shares outstanding assumes the exercise of options to which the percentage relates. Percentages calculated for totals

assume the exercise of options comprising such totals.

4

Section 16(a)

Beneficial Ownership Reporting Requirements

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s

directors and executive officers, and persons who own more than 10% of a registered class of the Company’s equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of

equity securities of the Company. Officers, directors and greater than 10% stockholders are required to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on review of the copies of such

reports furnished to the Company, all Section 16(a) requirements applicable to persons who were officers, directors and greater than 10%

stockholders during the preceding fiscal year were complied with.

EXECUTIVE OFFICER COMPENSATION

The following table sets forth, for the last three fiscal years, compensation received by the

Company’s Chief Executive Officer and Principal Financial Officer. There are no other named executive officers.

2018 Summary Compensation Table

|

Name and Principal Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Option

Awards

($)

|

Non-equity

Incentive Plan

Compensation

($)

|

All

Other

Compensation

($)

|

Total

($)

|

|

Kevin L. Cornwell

|

2018

|

156,000

|

--

|

--

|

338,100

|

7,200

|

501,300

|

| Chairman & CEO | 2017 | 156,000 | -- | -- | 338,100 | 7,080 | 501,180 |

| 2016 | 156,000 | -- | -- | 282,450 | 7,460 | 445,910 | |

|

Paul O. Richins

|

2018

|

39,827

|

--

|

--

|

--

|

1,702

|

41,529

|

| VP & Principal Financial Officer | 2017 | 118,507 | -- | -- | 24,292 | 3,931 | 146,730 |

|

2016

|

116,678

|

--

|

--

|

20,293

|

3,876

|

140,847

|

|

|

Brian L. Koopman

|

2018

|

103,141

|

--

|

--

|

13,814

|

3,388

|

120,343

|

|

Principal Financial Officer

|

Narrative disclosure to the

Summary Compensation Table:

|

1.

|

Mr. Richins retired from employment on April 2, 2018. The Board of Directors appointed Brian Koopman, who

served as UTMD’s Controller since 2006, to replace Mr. Richins as UTMD’s Principal Financial Officer.

|

|

2.

|

Amounts included in All Other Compensation represent the aggregate total of Company 401(k) matching

contributions, Company Section 125 matching contributions, and reimbursements under UTMD’s pet insurance plan to each named executive officer, all of which are benefits available to regular full-time employees. During 2020, each named

executive officer will be eligible to receive payment of eligible medical expenses under the employee Health Plan, up to $6,600 in 401(k) matching contributions, up to $500 in pet health cost reimbursements and up to $600 in matching

Section 125 matching contributions.

|

|

3.

|

Medical, dental and vision expenses paid under the Company’s Health Plan, which are available to regular

full-time employees, are not included in the above table.

|

|

4.

|

Non-equity Incentive Plan Compensation amounts, as described in more detail starting on page 10 under

Bonuses were paid in early February of the applicable following calendar year, representing Management Bonuses earned during the fiscal year reported.

|

2018 Grants of Equity Incentive Plan-Based Awards

Mr. Koopman received a 2018 stock option award for 1,600 shares. No other awards were made in

2018 to the named executive officers listed in the Summary Compensation Table. The Company’s only equity incentive plan is its 2013 Employees’ and Directors’ Incentive Plan, under which a total of 22,400 option awards were issued in 2018 to 45

employees.

5

2018 Grants of Non-Equity Incentive Plan-Based Awards

Named Executive Officers participated in the Profit-Sharing Management Bonus (MB) Plan,

generally available to all exempt, as well as key nonexempt, employees. The structure of the performance-based MB Plan is described in the following Compensation Discussion and Analysis. The 2018 awards under the MB Plan to the named executive officers were recommended by the Compensation and Benefits Committee in early 2019, after the independent audit of financial results

had been concluded. The awards were subsequently approved by the Board of Directors. The structure of the MB Plan remains the same for 2019.

Additional disclosure regarding executive and employee compensation

The Compensation and Benefits Committee establishes the criteria, and

directs the implementation, of all compensation program elements for the CEO. The CEO’s base salary is set early in each calendar year by the Board of Directors after review of the recommendation of the Compensation and Benefits Committee. Mr.

Cornwell’s base salary in 2019 will be $156,000, the same as in 2018 and 2017. The annual MB paid to Mr. Cornwell in early 2019 for 2018 performance represented 67% of his total 2018 compensation. Mr. Cornwell’s 2018 MB was the same as in 2017. In

2018, the Company’s consolidated EBT prior to accrual of the annual MB was up 2%. The MB, based by formula on 5% of the Company’s EBT plus a 10% kicker for growth in EBT, was the same in 2018 as in 2017 for participants who had met their objectives

for the year. As in prior years, Mr. Cornwell’s MB was consistent with other participants in the MB Plan.

For all other employees, in collaboration with the other executive officer(s), the CEO develops

compensation policies, plans and programs that are intended to meet the objectives of the Company’s overall compensation program. The Compensation and Benefits Committee annually reviews and approves the elements of the compensation program

recommended by the CEO. In addition, the committee periodically reviews any proposed changes within a calendar year. The compensation of employees other than the CEO, including other named executive officer(s), is administered by the CEO under the

review and ratification of the Compensation and Benefits Committee comprised of all the independent directors. All UTMD employees, including employees of its subsidiaries, received profit-sharing bonuses for 2018 performance.

Employment Agreements, Termination of Employment, and Change in Control.

Except for Mr. Cornwell, the Company has no employment agreements in the

United States. In Ireland and Canada, UTMD is subject to providing certain statutory advance notice and severance benefits to its employees in the event of redundancy termination. In the United Kingdom (UK) and Australia (AUS), Femcare has

employment agreements with each of its employees that typically include a three month termination notice or pay in lieu of notice.

In May 1998, the Company entered into an agreement with the CEO to provide

a long term incentive to increase stockholder value. The Company is required to pay Mr. Cornwell additional compensation in the event his employment is terminated as a result of a change in control at the election of the Company or by the mutual

agreement of Mr. Cornwell and the Company. Under the agreement, the additional compensation that the Company is required to pay Mr. Cornwell is equal to his last three years’ salary and bonuses. Based on actual salary plus bonuses for the three

years of 2016-2018, the additional compensation would be $1,426,650.

In the event of a change in control, the Company will also pay Mr. Cornwell

incentive compensation under the agreement equal to about 2% of the enterprise value paid by an acquiring entity that exceeds $14.00 per share. For example, at the $83.08 per share closing price at the end of 2018, the amount of incentive

compensation in the event of an acquisition of UTMD would be $5,181,000. At the time of the execution of the agreement, the value per UTMD share was $7.75.

Except for statutory notice, or payment in lieu provisions in UK employee

contracts, UTMD’s CEO is the only employee with a formal termination benefit agreement, which was last modified in 1998. The Board of Directors does not anticipate the need for any other agreements for the indefinite future. In the absence of any

practical requirement, UTMD has no general policies regarding termination benefits.

The Company is also required to pay all optionees under employee and

outside director’s option plans, the appreciation of stock value for awarded options above the option exercise price (“in the money”) in the event of a change of control of the Company. The number of options outstanding as of December 31, 2018,

was 61,018 at an average exercise price of $56.78/ share. At the year-end 2018 per share closing price of $83.08, the amount of change of control pay due all optionees would be $1,604,651.

6

Outstanding Equity Awards at 2018 Fiscal Year End

|

Option Awards

|

|||||||||||||

|

Number of

Securities

Underlying Unexercised

Options (#)

|

Number of

Securities

Underlying Unexercised

Options

(#)

|

Option

Exercise Price

($)

|

Option

Expiration Date

|

||||||||||

|

Named Executive Officer

|

Exercisable

|

Unexercisable

|

|||||||||||

|

Brian L. Koopman

|

62

|

0

|

49.18

|

5/8/2024

|

|||||||||

| 250 | 437 | 58.50 | 11/8/2026 | ||||||||||

| 0 | 1600 | 74.64 | 12/24/2028 | ||||||||||

The Company has no outstanding Stock Awards.

2018 Option Exercises and Stock Vested

Mr. Richins exercised 938 option shares in 2018, with 501 shares immediately being retired as a

result of trading the shares in payment of the exercise price of the options. Mr. Koopman exercised 438 option shares in 2018, with 246 shares immediately being retired as a result of trading the shares in payment of the exercise price of the

options. The Company has made no Stock Awards.

2018 Pension Benefits

The Company does not provide a defined benefit pension plan to any employee.

2018 Nonqualified Deferred Compensation

The Company does not provide nonqualified deferred compensation to any employee.

2018 Outside Director Compensation

|

Name

|

Fees Earned

or Paid in Cash

($)

|

Stock Awards

($)

|

Option Awards

($)

|

All Other Compensation

($)

|

Total

($)

|

|||||||||||||||

|

James Beeson

|

25,000

|

--

|

--

|

--

|

25,000

|

|||||||||||||||

|

Ernst Hoyer

|

32,000

|

--

|

--

|

--

|

32,000

|

|||||||||||||||

|

Barbara Payne

|

25,000

|

--

|

--

|

--

|

25,000

|

|||||||||||||||

|

Paul Richins

|

18,750

|

18,750

|

||||||||||||||||||

7

Directors of UTMD and/or its corporate subsidiaries who are also employees do not receive a separate director’s fee.

Narrative

disclosure to the Outside Director Compensation Table:

|

1.

|

Mr. Hoyer received $4,000 for participating as a member of the Executive Committee, $3,000 as Chairman of the Audit

Committee and $25,000 as the base annual outside director’s fee.

|

|

2.

|

Dr. Beeson received the $25,000 base annual outside director’s fee.

|

|

3.

|

Dr. Payne received the $25,000 base annual outside director’s fee.

|

|

4.

|

After termination of employment, Mr. Richins received 75% of the annual base outside director’s fee for service as an

outside director following his retirement.

|

At the 2003 Annual Meeting, stockholders approved the 2003 Employees’ and Directors’ Incentive Plan, under

which up to 1.2 million shares could have been granted over the ten-year life of the plan. The Board of Directors did not approve an award of outside director options in the three preceding years 2000-2002, or in the ensuing years of 2004-2017,

except for a 10,000 share award to Dr. Beeson upon joining the board in 2007 and an ensuing 10,000 share award to Dr. Beeson in 2008. The 2003 Plan expired in February 2013.

At the 2013 Annual Meeting, stockholders approved the 2013 Employees’ and Directors’ Incentive

Plan, under which up to 600,000 shares may be granted over the ten-year life of the plan.

At December 31, 2018, sixty-two unexercised outside director options were

outstanding.

8

CEO PAY RATIO DISCLOSURE

The median annual total compensation of all employees of the Company in 2018, other than Mr.

Cornwell, was $33,790. Mr. Cornwell’s total annual compensation in 2018 was $501,300. The ratio of these two amounts is 1:15.

To identify the median employee, UTMD compared annual pay, as of December 31, 2018, for all of

its employees excluding the CEO, wherever they reside in the world. In addition to the United States, the Company has employees in the United Kingdom, Ireland, Australia and Canada. Employee pay rates in foreign currencies were converted to U.S.

Dollars using exchange rates on December 31, 2018. The median annual pay was identified and that employee’s total annual compensation in 2018 was subsequently calculated using the same methodology as that used for calculating Mr. Cornwell’s

compensation as shown in the 2018 Summary Compensation table.

DISCLOSURE RESPECTING THE COMPANY’S EQUITY COMPENSATION PLANS

The following table summarizes, as of the end of the most recent fiscal year, compensation

plans, including individual compensation arrangements, under which equity securities of the Company are authorized for issuance, aggregated for all compensation plans previously approved by stockholders and for all plans not previously approved by

stockholders:

|

Plan Category

|

Number of

Securities To Be Issued upon

Exercise of Outstanding Options,

Warrants

and Rights

(a)

|

Weighted-Average Exercise

Price of

Outstanding Options,

Warrants

and Rights

(b)

|

Number of

Securities

Remaining

Available for

Future Issuance under Equity Compensation

Plans (excluding securities

reflected in

column (a))

(c)

|

|||||||||

|

Equity compensation plans approved by security holders

|

61,018

|

$

|

56.78

|

530,600

|

||||||||

|

Equity compensation plans not approved by security holders

|

-

|

(Not

applicable)

|

-

|

|||||||||

|

Total

|

61,018

|

$

|

56.78

|

530,600

|

||||||||

Additional disclosure regarding dilution from equity awards:

In 2003 and 2013, stockholders approved incentive stock option plans for employees and

directors summarized in the table above. The Company currently has no other equity award programs. The dilutive impact to stockholders

of stock option awards is provided in the tables below:

|

2016

|

2017

|

2018

|

||||||||||

|

Option shares available for award per stockholder approved option plans

(beginning of year)

|

216,800

|

241,300

|

303,000

|

|||||||||

|

Option shares allocated by the Board of Directors

|

40,000

|

40,000

|

40,000

|

|||||||||

|

Total option shares awarded

|

28,000

|

0

|

22,400

|

|||||||||

|

2016

|

2017

|

2018

|

||||||||||

|

Total unexercised awarded option shares (end of year)

|

74,672

|

54,340

|

61,018

|

|||||||||

|

Weighted-average unexercised option exercise price

|

$

|

46.62

|

$

|

45.50

|

$

|

56.78

|

||||||

|

Closing market price of UTMD stock per share (end of year)

|

$

|

72.75

|

$

|

81.40

|

$

|

83.08

|

||||||

|

(A) Dilution from options (shares)

|

14,634

|

19,430

|

18,344

|

|||||||||

|

(B) Weighted average shares outstanding

|

3,751,395

|

3,717,492

|

3,730,303

|

|||||||||

|

Total diluted shares outstanding (A+B), used for EPS calculation

|

3,766,029

|

3,736,922

|

3,748,647

|

|||||||||

9

COMPENSATION DISCUSSION AND ANALYSIS

General

Under the supervision of the Compensation and Benefits Committee, UTMD has developed and

implemented compensation policies, plans and programs that seek to enhance the long-term profitability, EPS growth and return on stockholders’ equity (ROE) of the Company, and thus stockholder value, by aligning closely the financial interests of

the Company’s senior management and other key employees with those of its stockholders. The long term key financial performance objectives are a 15% annually compounded rate of increase in EPS and an average ROE prior to payment of cash dividends

greater than 20%. The Company has actually achieved a 15% annually compounded rate of increase in EPS and an average of 28% ROE (prior to payment of stockholder dividends) over the thirty-two years since 1986, its first year of profitability since

becoming a publicly-traded company.

At the beginning of each year, the Board of Directors approves an operating plan which sets the

standards for the Company’s financial and nonfinancial performance. The performance each year may vary according to global economic conditions, competitive environment, life cycle of products, new product development, manufacturing costs and other

factors. The Compensation and Benefits Committee then approves compensation criteria set in relation to the Company’s annual operating plan which includes numerous income statement, balance sheet and cash flow measures, in addition to nonfinancial

objectives established for each employee participating in the annual MB program.

The Company applies a consistent philosophy to compensation for all employees, including senior

management. The philosophy is based on the premise that the achievements of the Company result from the coordinated efforts of all individual employees working toward common objectives. The Company strives to achieve those objectives through

teamwork that is focused on meeting the needs and expectations of customers and stockholders.

The Company believes that its compensation policies, in particular its profit-sharing MB

program and employee stock option awards, align key employee compensation with stockholder interest in creating longer term stockholder value and consistent profitability. There are no compensation programs or policies that create risks that are

reasonably likely to have a material adverse effect on the Company.

There are seven basic objectives for the Company’s compensation program:

(1) Pay for Performance. The basic

philosophy is that rewards are provided for the long-term value of individual contribution and performance to the Company. Rewards are both recurring (e.g., base salary) and non-recurring (e.g., bonuses), and both financial and non-financial (e.g., recognition and time off).

(2) Provide for Fairness and Consistency in the

Administration of Pay. Compensation is based on the value of the job, what each individual brings to the job, and how well each individual performs on the job, consistently applied across all functions and subsidiaries of the

Company.

(3) Pay Competitively. The Company

believes it needs to attract and retain the best people in the industry in order to achieve one of the best performance records in the industry. In doing so, the Company needs to be perceived as rewarding well, where competitive compensation

includes the total package of base pay, bonuses, awards and other benefits.

(4) Conduct an Effective Performance Review

Process. The Company believes it needs to encourage individual employee growth and candidly review each individual’s performance in a timely way. This feedback process is bilateral, providing management with an evaluation of the

Company through the eyes of its employees.

(5) Effectively Plan and Administer the

Compensation Program. Expenditures for employee compensation must be managed to what the Company can afford and in a way that meets management goals for overall performance and return on stockholder equity.

(6) Communicate Effectively. The

Company believes that an effective communication process must be employed to assure that its employees understand how compensation objectives are being administered and met.

10

(7) Meet All Legal Requirements. The

compensation program must conform to all statutory employment laws and rules.

The Company uses essentially five vehicles in its compensation program.

(1) Salary. UTMD sets base salaries

by reviewing the aggregate of base salary and annual MB for competitive positions in the market. The CEO’s base salary is set early in each calendar year by the Board of Directors. Because UTMD is a small company where responsibilities are fluid

and cross functional lines, there may not be a one for one comparison with other companies’ job positions. Based on the knowledge and experience of members of senior management and the Compensation and Benefits Committee, base salaries are fixed

at levels somewhat below the competitive amounts paid to management with comparable qualifications, experience and responsibilities at other similarly profitable companies engaged in the same or similar businesses. Then, annual bonuses and longer term incentive compensation are more highly leveraged and tied closely to the Company’s success in achieving significant

financial and non-financial goals.

(2) Bonuses. UTMD’s Profit-Sharing

Management Bonus (MB) Plan, which funds annual management bonuses, along with other contemporaneous incentives during the year, is generated out of a pretax/prebonus profit-sharing pool accrued throughout the year, and finalized, where the annual

MB portion is concerned, after the year-end independent financial audit has been completed. Prior to 2006, the Board of Directors had approved an accrual guideline of 4% of pretax, prebonus earnings, plus 10% of pretax, prebonus earnings

improvements over the prior year’s results, as an allocation for the plan. For example, if the Company achieved 20% growth in pretax/prebonus accrual earnings, the MB Plan would accrue 6% of pretax, prebonus earnings during the applicable year

into a “pool.” The pool would then be distributed after the completed independent audit after recommendation of the Compensation and Benefits Committee and approval by the Board. Beginning in 2006, although the mechanism for the MB Plan remains

unchanged, in order to compensate for the decrease in the number of option shares granted key employees (as the result of the requirement to expense the estimated “value” of options), the Board of Directors increased the base percent of the annual

Management Bonus accrual formula from 4% to 5% of pretax/prebonus profits, and, except for the CEO, added an additional bonus inflating factor ranging from 7-15%.

UTMD’s management personnel, beginning with the first level of supervision and professional

management, and including certain non-management specialists and technical people, together with all direct sales representatives, are eligible participants in the MB Plan. At the beginning of the year, plan participants were generally awarded

participation units in the bonus plan, proportional to base salary and responsibility, based on senior management’s determination of the relative contribution expected from each person toward attaining Company goals. Each individual’s performance

objectives, derived as the applicable contribution needed from that key employee to achieve the Company’s overall business plan for the year, are available for review as needed by the Committee. As part of the planning process, each eligible

employee develops a set of measurable and dated objectives for the ensuing year. Achieving the Company’s plan sets an expected value per bonus unit. After the end of the year, each individual participant’s contribution to the Company’s

performance is assessed by senior management in order to determine an additional allocation of units for individual contributions, with the accomplishment of the beginning of year objectives as a key component. Because of the Company’s excellent

performance in 2018, all employees of the Company participated in the distribution of a $671,000 annual MB Plan payout, not including payroll taxes. The MB Plan also funded $44,000 in payroll taxes resulting from bonuses, $8,000 in extraordinary

bonuses paid contemporaneously to non-executive employees during the year, $12,700 in non-exempt employee attendance bonuses, $500 for special education programs and $30,000 to help subsidize the cost of the U.S. employee medical plan.

The Company makes occasional cash awards, in amounts determined on an individual basis, to employees who make extraordinary contributions to the performance of the Company at any time during the year. These contemporaneous

payments are made as frequently as possible to recognize excellent accomplishments when they occur. The awards are funded from the accrued MB plan described above, and therefore do not otherwise impact the Company’s financial performance. Senior

management is not eligible for these awards.

(3) Employee Stock Options. The

Compensation and Benefits Committee believes that its awards of stock options have successfully focused the Company’s management personnel on building profitability and stockholder value. The Board of Directors considers this policy highly

contributory to growth in future stockholder value. The number of options awarded in 2018 reflects the judgment of the Board of the number of options sufficient to constitute a material, recognizable benefit to recipients. No explicit formula

criteria are utilized, other than minimizing dilution to stockholder interests and the impact on earnings per share for option expense. When taken together with the share repurchase program, the net result of the option program over the last

twenty-five years has been awarding option shares to key employees at a higher price, and in substantially smaller amounts, than shares actually repurchased in the open market during the same time period.

11

At the 2003 Annual Meeting, stockholders approved the 2003 Employees’ and Directors’ Incentive

Plan, under which up to 1.2 million shares could have been granted over the ten-year life of the plan. During the same period of time that 153,000 (uncancelled) option shares were granted to employees under the 2003 Plan, UTMD repurchased 1.4

million of its shares in the open market. As of December 31, 2018, 11,624 unexercised option shares remained outstanding under the 2003 Plan.

At the 2013 Annual Meeting, stockholders approved the 2013 Employees’ and Directors’ Incentive

Plan, under which up to 600,000 shares may be granted over the ten-year life of the plan. As of December 31, 2018, 49,394 unexercised option shares were outstanding under the 2013 Plan.

After the first five years of the ten year plan approved by stockholders in 2013, the plan

allowed 350,000 shares cumulatively available for grant out of the 600,000 total. In the first five years of the plan, UTMD awarded 89,400 option shares at an average exercise price of $58.48 per share. (As an aside, 20,042 option shares of the

89,400 awarded have been cancelled as the result of employees leaving the Company prior to vesting in the right to exercise.) During the same five years, UTMD repurchased 100,207 shares in the open market at an average price including commissions

and fees of $57.81/ share. In other words, UTMD has repurchased more shares at a lower price per share than it has “sold” in the form of option awards under the 2013 plan. In combination with share repurchases, the plan has been non-dilutive to

stockholders while providing a substantial incentive to key employees.

After the conclusion of the annual independent audit and public announcement of financial

results, the Board of Directors typically allocates an annual amount of shares for employee options each year at its regularly scheduled Board meeting following the audited close of the prior year’s financial performance. Allocated shares are

usually reserved for awards later in the year to employees, including new or key employees with increased responsibilities. The Compensation and Benefits Committee approves all awards, and the closing price on the date of the approval is the

exercise price of the option shares. According to policy, awards are not made in advance of material news events, or when material non-public information is known.

In December 2018, option awards were granted to 45 U.S., Ireland, UK, Canada and Australia

employees to purchase a total of 22,400 shares at an exercise price of $74.64 per share. Five hundred of the 2018 awarded shares have been cancelled as of March 2019.

Employee and director options vest over a four-year period, with a ten-year exercise period as

long as the employee remains employed. Management expects to recommend additional options be awarded on an annual basis to the Company’s key employees based on its belief that sharing ownership of the Company with those who help create its success

is the best way to assure growth in stockholder value.

(4) Retirement Plans. The Company has

sponsored a 401(k) retirement plan for U.S. employees since 1985, a contributory retirement plan for Irish employees since 1998, a contributory retirement plan for Femcare UK employees since 2011, a contributory retirement plan for Femcare

Australia employees since 2013, and a contributory retirement plan for Femcare Canada employees since 2017. In addition to meeting statutory requirements, the Compensation and Benefits Committee believes that a continuance of the retirement plans

is consistent with ensuring a stable employment base by helping to provide Company employees with a vehicle to build long-term financial security. In 2018, the Company contributed and paid administrative costs at a total expense, including all of

its subsidiaries, of $176,000. For 2019, the Board of Directors has approved continuing the retirement plan contributions on the same basis as in 2018.

(5) Group Benefit Plans. In the U.S.,

the Company provides group medical, dental and life insurance benefit plans for its employees. For U.S. employees, the health benefits plan is consistent with self-funded group plans offered by other companies. The portion of the monthly premium

cost is paid by U.S. plan participants on a graduated scale so that higher paid employees pay a higher premium. In Ireland, the UK, Canada and Australia, employees do not pay premiums, and are provided medical and life coverages consistent with

benefits provided to employees of similar companies.

12

Structure for Executive Officer Compensation

The structure and activities of the Compensation and Benefits Committee meet the requirements

of SEC Rule 10C-1, as mandated by Section 952 of the Dodd-Frank Act. In regard to Item 407 of Regulation S-K, in 2017 and to-date in 2018, the company has not retained or obtained the advice of a compensation advisor.

Utilizing the compensation objectives and vehicles outlined previously, the Compensation and

Benefits Committee, comprised of three outside directors, establishes the annual base salary for the CEO. All other employees’ salaries are set by the CEO, and reviewed by the Committee for consistency with the Company’s compensation objectives.

The Committee periodically uses surveys of similar companies selected from among the companies with which UTMD’s stock is compared in the Stock Performance Chart, based on variations in industry type, geographic location, size, and profitability as

the Committee deems appropriate. Base salary is fixed at a level somewhat below the competitive amounts paid to executive officers with comparable qualifications, experience and responsibilities at other similarly sized companies engaged in the

same or similar businesses. The annual MB and long-term incentive compensation in the form of stock options were more highly leveraged and tied closely to the Company’s success in achieving significant financial and non-financial goals.

The annual MB for the named executive officers are awarded using the same basis as all

employees included in the annual profit-sharing MB Plan, except a bonus inflating factor related to stock option awards is not included for the CEO. The goals for executive officers include financial and non-financial goals. Financial goals

include net sales, gross profit margin, operating margin, EBITDA, after-tax profits, return on equity and earnings per share.

Non-financial goals include continuing the development of a talented and motivated team of employees, conceiving and implementing programs to maintain competitive advantages and to achieve consistent earnings per share growth, reacting to

competitive challenges, developing business initiatives to further support critical mass in a consolidating marketplace, promoting the Company’s participation in socially responsible programs, protecting intellectual property rights, maintaining

compliance with regulatory requirements, achieving a high regard for the integrity of the Company and its management, and minimizing issues that represent significant business risk factors such as overly burdensome administrative programs and

product liability exposure. In 2018, UTMD exceeded its beginning of year financial objectives. Based primarily on the Company’s 2% higher pretax/prebonus profit, annual management bonuses were the same as in 2017 for the same level of

responsibility and contribution of employees regularly participating in the MB plan. The 2% EBT increase offset the added MB growth factor in 2017.

The Committee intends that stock options serve as an important component of executive officers’

total compensation in order to retain critical efforts on behalf of the Company and to focus efforts on enhancing stockholder value. The Committee believes that past option awards have successfully provided this incentive. An option for 50,000

shares was awarded the CEO in January 2004, at an exercise price of $25.59 per share. Except for the 2004 award, no CEO options were awarded during the last twenty years.

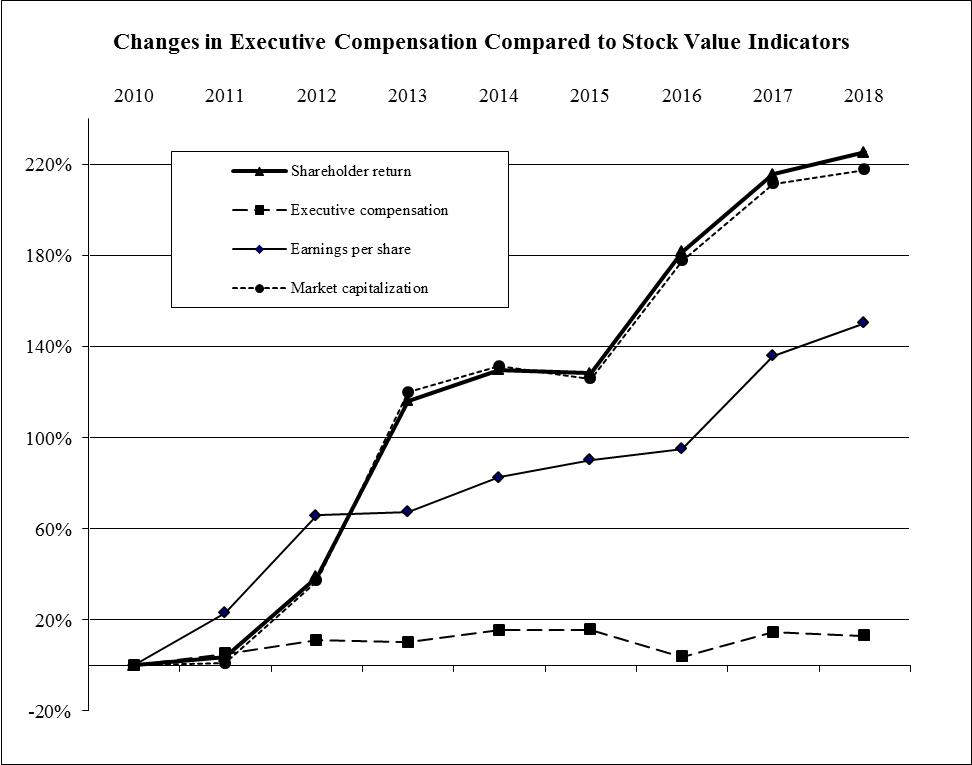

The following chart compares annual changes in total executive compensation with changes in

non-GAAP earnings per share, stockholder return (year-end share price plus cash dividends paid during the year) and UTMD year-end market capitalization, starting at December 31, 2010:

13

Compensation and Benefits Committee Interlocks and Insider Participation

The members of the Compensation and Benefits Committee are Ernst G. Hoyer, Barbara A. Payne and

James H. Beeson. No member of the committee is a present or former officer of the Company or any subsidiary. There are no interlocks. No member of the Committee, his or her family, or his or her affiliate was a party to any material transactions

with the Company or any subsidiary since the beginning of the last completed fiscal year. No executive officer of the Company serves as an executive officer, director or member of a compensation committee of any other entity, an executive officer

or director of which is a member of the Compensation and Benefits Committee of UTMD.

Third Party Payments for Board Service

None of UTMD’s board members has received payments from, or has any agreement or arrangement

with, third parties related to his or her service on the UTMD Board.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

None.

BOARD OF DIRECTORS AND BOARD COMMITTEE REPORTS

Director Independence

UTMD’s Board of Directors has determined that a majority of its directors are independent, as

that term is defined in NASD Rule 5605(a)(2), which satisfies the independence requirement of NASD Rule 5605(b)(1). The Board of Directors was not aware of any transactions, relationships or arrangements to be considered in determining that Dr.

Payne, Mr. Hoyer and Dr. Beeson were independent under the NASD Rules.

Board Leadership

The roles of CEO and Chairman are held by Mr. Cornwell. Because of Mr. Cornwell’s training and

experience in the organization of functions of a Board of Directors, his successful tenure on the board since 1993 and the small size of the Company’s board membership, the Board of Directors believes this structure is most appropriate at this

time. Mr. Hoyer serves as the lead director of the outside directors because of his tenure as the longest serving outside director and his roles as Chairman of the Audit Committee and outside director representative on the Executive Committee. As the lead outside director, Mr. Hoyer coordinates independent meetings of the outside directors, and assimilates outside director

questions and company management responses.

14

Risk Oversight

The Board of Directors takes a key role in overseeing the Company’s risks. The board receives

frequent timely reports of the Company’s financial performance, changes in and composition of balance sheet accounts, quality assurance program effectiveness, product liability risks and status of relationships with all business constituencies

including customers, employees, suppliers and government entities. The board reviews and authorizes all material contracts in which the Company enters, including banking relationships. The Governance and Nominating Committee receives regular

reports on UTMD’s compliance with securities laws and communications with the SEC and stockholders. The Audit Committee has established an independent whistleblower hot line to encourage early and anonymous reporting of accounting irregularities

or other violations of UTMD’s codes of ethics. The Board of Directors routinely reviews litigation threats, regulatory compliance, product/market strategies and operational activities of the Company.

Board Committees and Meetings

The Board of Directors held three formal meetings during 2018, and one meeting to date in

2019. The independent directors also met informally with the CEO during the year. All of the directors attended all applicable meetings during their respective incumbencies, with one exception. Dr. Beeson was unable to attend the May 2018 Annual

Stockholders’ Meeting and concomitant board meeting. The independent outside directors also met without executive management four times during 2018, and once to date in 2019.

The Company has Executive, Audit, Governance and Nominating and Compensation and Benefits

Committees. The current members of the Company’s committees are identified in the preceding Security Ownership table. In May 2014, the Board of Directors revised and readopted its standing committee charters. The written committee charters,

composition, schedule of meetings and attendance are available for public review at www.utahmed.com/governance.htm.

During 2018 and to-date in 2019, the Executive Committee has held at least one informal meeting

per month. Any formal actions taken on of behalf of the Board of Directors by the Executive Committee were subsequently presented to the full board for ratification.

The Audit Committee formally met four times during 2018 and once to date in 2019 to review the

quarterly financial reports, periodic independent accounting reviews and financial and internal control audits by UTMD’s independent audit firms. The Audit Committee selects the Company’s independent accountants, approves the scope of audit and

related fees and reviews financial reports, audit results, internal accounting procedures, internal controls and other programs to comply with applicable requirements relating to financial accountability. The Audit Committee Chairman on behalf of

the Audit Committee reviewed and selected independent auditors for the UK, Ireland, Canada and Australia subsidiaries’ financial audits and tax returns.

The Governance and Nominating Committee met formally three times during 2018, and once to date

in 2019. The Governance and Nominating Committee takes the lead in developing and implementing policies that are intended to ensure that the Board of Directors will be appropriately constituted and organized to meet its fiduciary obligations to

the Company and its stockholders, identify individuals qualified to become members of the Board of Directors, and develop and recommend to the Board of Directors a set of corporate governance principles applicable to the Company. During its

meetings, after receiving the Company’s routine compliance reports, the Governance and Nominating Committee reviewed compliance by UTMD and its personnel, including executive officers and directors, with applicable regulatory requirements as well

as the Company’s own compliance policies, and compared its established policies and procedures for compliance with current applicable laws and regulations, under the guidance of corporate counsel, as needed.

The Governance and Nominating Committee will consider nominees recommended by stockholders. In

accordance with the Company’s Bylaws, stockholders’ nominations for election as directors must be submitted in writing to the Company at its principal offices not less than 30 days prior to the Annual Meeting at which the election is to be held (or

if less than 40 days’ notice of the date of the Annual Meeting is given or made to stockholders, not later than the tenth day following the date on which the notice of the Annual Meeting was mailed).

When considering candidates for directors, the Governance and Nominating Committee takes into

account a number of factors, including the following:

| ● |

judgment, skill, integrity and reputation;

|

| ● |

whether the candidate has relevant business experience;

|

| ● |

whether the candidate has achieved a high level of professional accomplishment;

|

| ● |

independence from management under both Nasdaq and Securities and Exchange Commission definitions;

|

| ● |

existing commitments to other businesses;

|

| ● |

potential conflicts of interest with other pursuits;

|

| ● |

corporate governance background and experience;

|

| ● |

financial and accounting background that would permit the candidate to serve effectively on the Audit Committee;

and

|

| ● |

size, composition, and experience of the existing Board of Directors.

|

15

When considering director candidates, the committee looks for diversity in

experience, education, knowledge of industry and geography that when taken in the aggregate of all directors provides a robust scope of understanding of the functional and strategic challenges that the Company faces.

The committee will consider candidates for directors suggested by stockholders using the same

considerations. Stockholders wishing to suggest a candidate for director should write to Governance and Nominating Committee, Utah Medical Products, Inc., 7043 South 300 West, Midvale, UT 84047 and include:

| ● |

a statement that the writer is a stockholder and is proposing a candidate for consideration by the committee;

|

| ● |

the name of and contact information for the candidate;

|

| ● |

a statement that the candidate is willing to be considered and would serve as a director if elected;

|

| ● |

a statement of the candidate’s business and educational experience preferably in the form of a resume or curriculum

vitae;

|

| ● |

information regarding each of the factors identified above, other than facts regarding the existing Board of

Directors, that would enable the committee to evaluate the candidate;

|

| ● |

a statement detailing any relationship between the candidate and any customer, supplier, or competitor of the

Company;

|

| ● |

detailed information about any relationship or understanding between the stockholder and the proposed candidate; and

|

| ● |

confirmation of the candidate’s willingness to sign the Company’s code of ethics and other restrictive covenants, and

abide by all applicable laws and regulations.

|

Before nominating a sitting director for reelection at an annual meeting, the committee will consider:

| ● |

the director’s performance on the Board of Directors and attendance at Board of Directors’ meetings; and

|

| ● |

whether the director’s reelection would be consistent with the Company’s governance guidelines and ability to meet

all applicable corporate governance requirements.

|

When seeking candidates for director, the committee may solicit suggestions from incumbent

directors, management or others. After conducting an initial evaluation of the candidates, the committee will interview that candidate if it believes the candidate might be suitable for a position on the Board of Directors. The committee may also

ask the candidate to meet with management. If the committee believes the candidate would be a valuable addition to the Board of Directors, it will recommend to the full Board of Directors that candidate’s nomination.

The Compensation and Benefits Committee consulted by telephone and met formally in early 2018

and again in early 2019 to review management performance relative to objectives, recommend compensation and develop compensation strategies and alternatives throughout the Company, including those discussed in the Compensation Discussion and

Analysis section of this Proxy Statement. The deliberations culminated in recommendations ratified at the February 2018 and February 2019 Board of Directors meetings. None of the members of the Compensation and Benefits Committee or executive

management has engaged a compensation consultant within the past five years.

The policy of the Company is that each member of the Board of Directors is encouraged, but not

required, to attend the Annual Meeting. Four of five directors attended the 2018 Annual Meeting.

16

Stockholder Communications

with Directors

UTMD stockholders who wish to communicate with the Board, any of its committees, or with any

individual director may write to the Company at 7043 South 300 West, Midvale, UT 84047. Such letter should confirm that it is from a UTMD stockholder. Depending upon the subject matter, management will:

| ● |

forward the communication to the director, directors, or committee to whom it is addressed;

|

| ● |

attempt to handle the inquiry directly if it is a request for information about UTMD or other matter appropriately

dealt with by management; or

|

| ● |

not forward the communication if it is primarily commercial in nature, or if it relates to an improper or

irrelevant topic.

|

At each Board of Directors’ meeting, a member of management presents a summary of communications received

since the last meeting that were not forwarded to the directors, and makes those communications available to the directors on request.

Report of the

Compensation and Benefits Committee

The Compensation and Benefits Committee has reviewed and discussed the CD&A with UTMD management.

Based on that review, the Committee recommended to the Board of Directors that the CD&A be included in the Company’s annual report on Form 10-K and this Proxy Statement. In August 2008, the Board of Directors adopted an updated Compensation

and Benefits Committee charter. In May 2014, the Board of Directors revised and readopted the August 2008 charter, which is available at www.utahmed.com.

|

Submitted by the Compensation and Benefits Committee:

|

Ernst G. Hoyer

|

|

|

Barbara A. Payne

|

||

|

James H. Beeson

|

17

Report of the Audit

Committee

The Audit Committee of the Board of Directors is composed of all four outside directors, all of

whom except one are independent as defined in Nasdaq Stock Market Rule 5605(a)(2) and under Rule 10A-3(b)(1) adopted pursuant to the Securities Exchange Act of 1934. The exception is Paul Richins, who prior to April 2018 had been an employee

member of the board of directors since 1998 and had served as the Principal Financial Officer of UTMD. Under Nasdaq Rule 5605, Mr. Richins is not considered independent until three years after his employment ended. That notwithstanding, at the

Annual Stockholder Meeting in May 2018, Mr. Richins was elected to continue as an outside director. Nasdaq Rule 5605(c)(2)(B) has an exception that allows one non-independent member of the Audit Committee “if the board, under exceptional and

limited circumstances, determines that membership on the committee is required by the best interests of the Company and its Shareholders.” The board of directors made that determination based on Mr. Richins’ deep understanding of the Company’s

internal control systems and financial reporting. Mr. Richins may not serve longer than two years and may not chair the Audit Committee. The remaining three members of the Audit Committee are independent and comprise a majority of the Board of

Directors.

In August 2008, the Board of Directors adopted an updated Audit Committee charter. In May

2014, the Board of Directors revised and readopted the August 2008 charter, which is available at www.utahmed.com. Ernst G. Hoyer is the Board of Directors’ designated Audit Committee Chairman and Financial Expert consistent with The

Sarbanes-Oxley Act of 2002.

The Audit Committee oversees the financial reporting and internal controls processes for UTMD

on behalf of the Board of Directors. In fulfilling its oversight responsibilities, the Audit Committee reviewed the quarterly and annual financial statements included in the Annual Report to Stockholders and reports filed with the Securities and

Exchange Commission.

The Audit Committee formally met four times during 2018 and once to date in 2019 to review the

quarterly financial reports, quarterly reviews by Jones Simkins LLC, and the 2018 annual internal controls audit and financial audit by Haynie & Company, UTMD’s new independent lead auditor. The Committee also met informally as needed during

the year. In accordance with Statement on Auditing Standards No. 61, discussions were held with management and the independent auditors as needed regarding the acceptability and the quality of the accounting principles used in the reports. These

discussions included the clarity of the disclosures, the underlying estimates and assumptions used in the financial reporting and the reasonableness of the significant judgments and management decisions made in developing the financial statements.

In addition, the Audit Committee has discussed with the independent auditors their independence from the Company and its management, including the matters in the written disclosures required by Independence Standards Board Standard No. 1 and The

Sarbanes-Oxley Act of 2002.

The Audit Committee has also met with Company management and its independent auditors and

discussed issues related to the overall scope and objectives of the audits conducted, the internal controls used by the Company, the openness and honesty of management, auditor verification of information provided by management, quality control

procedures used by auditors in performing the independent audit and any possible conflicts of interest. The Committee elicited recommendations for improving UTMD’s internal control procedures. The independent auditors completed a formal review of

the scope and effectiveness of the Company’s internal control procedures, and made a couple of informal suggestions.

Pursuant to the reviews and discussions described above, the Audit Committee recommended to the

Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018, for filing with the Securities and Exchange Commission.

|

Submitted by the Audit Committee:

|

Ernst G. Hoyer

|

|

|

Barbara A. Payne

|

||

|

James H. Beeson

|

||

|

Paul O. Richins

|

18

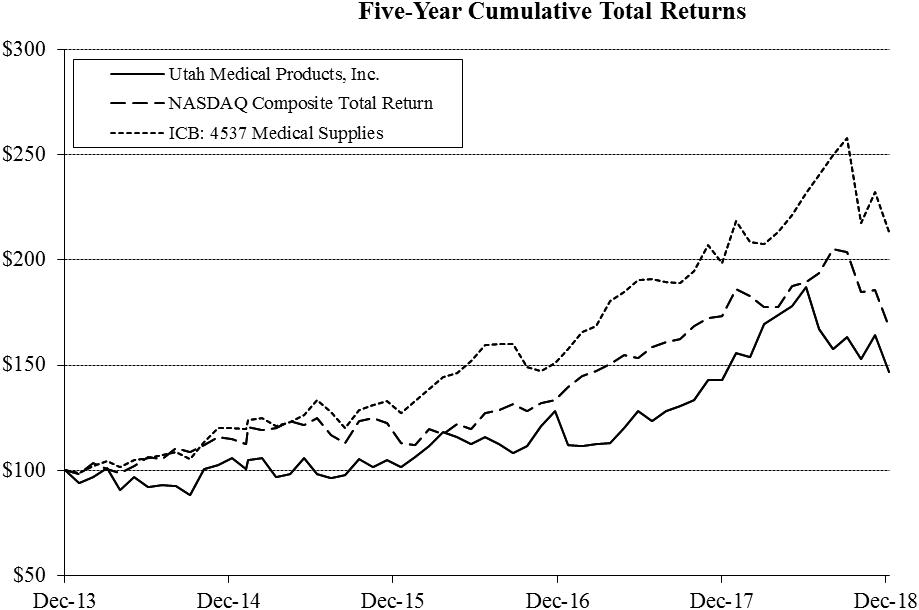

STOCK PERFORMANCE CHART