Table of Contents

As filed with the Securities and Exchange Commission on April 25, 2012.

File No. 033-19605

File No. 811-03542

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-6

REGISTRATION STATEMENT

| UNDER THE SECURITIES ACT OF 1933 |

||||

| ¨ Pre-Effective Amendment No. | ||||

| x Post-Effective Amendment No. 29 | ||||

and/or

REGISTRATION STATEMENT

UNDER

THE INVESTMENT COMPANY ACT OF 1940

Amendment No. 22

MML Bay State Variable Life Separate Account I

(Exact Name of Registrant)

MML Bay State Life Insurance Company

(Name of Depositor)

100 Bright Meadow Boulevard

Enfield, CT 06082-1981

(Address of Depositor’s Principal Executive Offices)

(413) 788-8411

John E. Deitelbaum

Senior Vice President and Deputy General Counsel

Massachusetts Mutual Life Insurance Company

1295 State Street

Springfield, Massachusetts 01111

(Name and Address of Agent for Service)

Approximate date of proposed public offering: Continuous

It is proposed that this filing will become effective (check appropriate box)

| ¨ | immediately upon filing pursuant to paragraph (b) of Rule 485. |

| x | on May 1, 2012, pursuant to paragraph (b) of Rule 485. |

| ¨ | 60 days after filing pursuant to paragraph (a)(1) of Rule 485. |

| ¨ | on pursuant to paragraph (a)(1) of Rule 485. |

If appropriate, check the following box:

| ¨ | this post effective amendment designates a new effective date for a previously filed post effective amendment. |

Table of Contents

Variable Life Plus (VLP), a Flexible Premium Variable Whole Life Insurance Policy*

Issued by MML Bay State Life Insurance Company

MML Bay State Variable Life Separate Account I

This prospectus describes an individual, flexible premium, variable, whole life insurance policy (the policy) issued by MML Bay State Life Insurance Company. While this policy is in force, it provides lifetime insurance protection on the insured.

The owner (you or your) has a number of investment choices in this policy. They include a guaranteed principal account (the GPA) and the funds offered through our separate account, MML Bay State Variable Life Separate Account I (the Separate Account). These funds are listed on the following page.

You bear the investment risk of any premium allocated to these investment funds. The death benefit may vary and the cash surrender value will vary, depending on the investment performance of the funds.

This prospectus is not an offer to sell the policy in any jurisdiction where it is illegal to offer the policy or to anyone to whom it is illegal to offer the policy. MML Bay State no longer offers this policy for sale. Owners may, however, continue to make premium payments under existing policies.

The prospectus and Statement of Additional Information (SAI) describe all material terms and features of the policy. Certain non-material provisions of your policy may be different than the general description in the prospectus and the SAI, and certain riders may not be available because of legal requirements in your state. See your policy for specific variations since any such state variation will be included in your policy or in riders or endorsements attached to your policy.

The policy provides life insurance protection. It is not a way to invest in mutual funds. Replacing an existing life insurance policy with this policy or financing the purchase of the policy through a loan or through withdrawals from another policy may not be to your advantage. Before purchasing, you should consider the policy in conjunction with other insurance you own.

The policy:

| Ÿ | is not a bank or credit union deposit or obligation. |

| Ÿ | is not FDIC or NCUA insured. |

| Ÿ | is not insured by any federal government agency. |

| Ÿ | is not guaranteed by any bank or credit union. |

| Ÿ | may go down in value. |

| Ÿ | provides guarantees that are subject to our financial strength and claims-paying ability. |

To learn more about the policy, you can obtain a copy of the Statement of Additional Information (SAI), dated May 1, 2012. The SAI is legally incorporated into this prospectus by reference and is legally part of this document. We file the SAI with the Securities and Exchange Commission (SEC). The SEC maintains a Web site (www.sec.gov) that contains the SAI, material incorporated by reference and other information regarding companies that file electronically with the SEC. For a free copy of the SAI, or for general inquiries, contact our “Administrative Office” at the address and phone number below:

MassMutual Customer Service Center

PO Box 1865

Springfield, MA 01102-1865

1-800-272-2216

(FAX) 1-866-329-4527

www.massmutual.com

You may request a free personalized illustration of death benefits, surrender values, and cash values from your registered representative or by calling the MassMutual Customer Service Center.

| The SEC has not approved or disapproved this policy or determined that this prospectus is accurate or complete. Any representation that it has is a criminal offense. |

Please read this prospectus carefully before investing. You should keep it for future reference.

EFFECTIVE: May 1, 2012

| * | Title may vary in some jurisdictions. |

1

Table of Contents

MML Bay State Variable Life Separate Account I

The Separate Account invests in the following funds. You may allocate premium to any of the divisions in the Separate Account and the Separate Account will purchase equivalent shares in the corresponding funds listed below. You may also allocate premium to the guaranteed principal account.

We will deliver to you copies of the current fund prospectuses and/or summary prospectuses, which contain detailed information about the funds and their investment objectives, strategies, policies, risks and expenses. You may also visit our website (massmutual.com) to access this prospectus, as well as the current fund prospectuses and summary prospectuses, or contact the MassMutual Customer Service Center to request copies.

MML Series Investment Fund

MML Equity Index Fund (Class II)

MML Series Investment Fund II

MML Blend Fund (Initial Class)

MML Equity Fund (Initial Class)

MML Managed Bond Fund (Initial Class)

MML Money Market Fund (Initial Class)

Oppenheimer Variable Account Funds

Oppenheimer Global Securities Fund/VA (Non-Service)

T. Rowe Price Equity Series, Inc.

T. Rowe Price Mid-Cap Growth Portfolio

2

Table of Contents

Table of Contents

3

Table of Contents

We have tried to make this prospectus as readable and understandable for you as possible. By the very nature of the policy, however, certain technical words or terms are unavoidable. We have identified the following as some of these words or terms. The page that is indicated here is where we believe you will find the best explanation for the word or term.

| Page | ||||

| account value |

20 | |||

| Administrative Office |

1 | |||

| attained age |

28 | |||

| cash surrender value |

26 | |||

| division |

5, 17 | |||

| free look |

5, 12 | |||

| general investment account |

17 | |||

| good order |

10 | |||

| grace period |

21 | |||

| in force |

5 | |||

| initial selected face amount |

11 | |||

| insurance risk |

9 | |||

| issue date |

15 | |||

| modified endowment contract (MEC) |

6, 38 | |||

| monthly calculation date |

34 | |||

| net investment experience |

20 | |||

| net premium |

15 | |||

| planned premium |

13 | |||

| policy date |

15 | |||

| policy debt |

21 | |||

| policy debt limit |

27 | |||

| register date |

15 | |||

| selected face amount |

11 | |||

| valuation date |

10 | |||

| 7-pay test |

39 | |||

4

Table of Contents

The following is a summary of the principal benefits and risks of the policy. It is only a summary. Additional information on the policy’s benefits and risks can be found in the later sections of this prospectus.

Benefits of the Policy

| DEATH BENEFIT | The primary benefit of your policy is life insurance coverage. While the policy is “in force”, which means the policy has not terminated, the current selected face amount typically will be paid as a death benefit to the beneficiary when the insured dies. | |

| RIGHT TO RETURN THE POLICY | You had a limited period of time after the policy was delivered during which you could cancel the policy and receive a refund (free look). You also have a limited period of time after any selected face amount increase during which you can cancel the increase and receive a refund of premium paid on or after the date of application for that increase. | |

| VARIABLE INVESTMENT CHOICES | The policy offers a choice of seven investment divisions within its Separate Account. Each “division” invests in shares of a designated investment fund. | |

| GUARANTEED PRINCIPAL ACCOUNT | In addition to the above mentioned variable investment choices, you may also invest in the guaranteed principal account (GPA). Amounts allocated to the GPA are guaranteed and earn interest daily. Certain restrictions apply to transfers to and from the GPA. | |

| FLEXIBILITY | The policy is designed to be flexible to help meet your specific life insurance needs. Within limitations, you can: Ÿ choose the timing, amount and frequency of premium payments; Ÿ increase or decrease the policy’s selected face amount (higher selected face amount can result in higher charges); Ÿ change the beneficiary; Ÿ change your investment selections. | |

| TRANSFERS | Generally, you may transfer funds among the investment divisions and the guaranteed principal account. Limitations on transfers are described in the “Risks of the Policy” table and Policy Transactions sections of the prospectus. | |

| SURRENDERS AND WITHDRAWALS | You may surrender your policy and we will pay you its cash surrender value (account value less any surrender charges and policy debt). You may also withdraw a part of the account value. A withdrawal reduces the policy values, may reduce the face amount of the policy, and may increase the risk that the policy will terminate. Surrenders and withdrawals may have adverse tax consequences. | |

| LOANS | You may take a loan on the policy. The policy secures the loan. Taking a loan may have adverse tax consequences and may increase the risk that your policy may terminate. | |

| ASSIGNABILITY | You may generally assign the policy as collateral for a loan or other obligation. | |

| TAX BENEFITS | You are not generally taxed on the policy’s earnings until you withdraw account value from your policy. This is known as tax deferral. | |

| ADDITIONAL BENEFITS | There are additional benefits you may add to your policy by way of riders. The riders available with this policy are listed in the “Other Benefits Available Under the Policy” section. If you elect a rider, an additional charge will apply. |

5

Table of Contents

Risks of the Policy

| INVESTMENT RISKS | The value of your policy will fluctuate with the performance of the variable investment divisions you select. Your variable investment divisions may decline in value or they may not perform to your expectations. You bear the investment risk of any account value invested in the variable investment divisions. It is possible you could lose your entire investment. | |

| SUITABILITY | Variable life insurance is designed to help meet long-term financial goals. It is not suitable as a vehicle for short-term savings. You should not purchase the policy if you will need the premium payment in a short period of time. Short-term investment strategies may be restricted by the Company. | |

| EARLY SURRENDER | If you surrender your policy, you will be subject to surrender charges during the first 15 policy years and during the first 15 years after an increase in the policy’s selected face amount. Surrender charges are also known as “deferred sales loads”. The surrender charge will reduce the proceeds payable to you. In some situations, it is possible that there will be little or no value in the policy after the surrender charges are deducted. An early surrender can also result in adverse tax consequences. | |

| WITHDRAWALS | A withdrawal will reduce your policy’s account value by the amount withdrawn, including the withdrawal fee. If the policy’s account value is reduced to a point where it cannot meet a monthly deduction your policy may terminate. A withdrawal may also reduce your policy’s face amount and may have adverse tax consequences. | |

| TERMINATION | Your policy could terminate if the account value of the policy becomes too low to support the policy’s monthly charges or if total policy debt exceeds the account value. Factors that may cause your policy to terminate include: insufficient premium payments, poor investment performance, withdrawals, and unpaid loans or loan interest. Before the policy terminates, however, you will receive a grace period during which you will be notified in writing that your coverage may terminate unless you pay additional premium. | |

| LIMITATIONS ON ACCESS TO CASH VALUE |

Ÿ Withdrawals were not available during the first six months of the first policy year. Ÿ A withdrawal reduces the policy values and may reduce the face amount of the policy. Ÿ A withdrawal may have adverse tax consequences. Ÿ We may not allow a withdrawal if it would reduce the selected face amount to less than the policy’s minimum face amount. Ÿ The minimum withdrawal is $100, including the withdrawal fee, which is the lesser of $25 or 2% of the amount withdrawn. Ÿ The account value remaining after a withdrawal is processed must be at least equal to the sum of the planned minimum annual premiums to date. Ÿ The maximum loan and withdrawal amounts are generally lower in the policy’s early years. Therefore, there may be little to no cash value available for loans and withdrawals in the policy’s early years. | |

| LIMITATIONS ON TRANSFERS |

Ÿ Transfers from the guaranteed principal account are generally limited to one per policy year and may not exceed 25% of your account value in the guaranteed principal account (less any policy debt). Ÿ We reserve the right to reject or restrict transfers if we determine the transfers reflect frequent trading or a market-timing strategy or we are required to reject or restrict by the applicable fund. | |

| IMPACT OF LOANS | Taking a loan from your policy may increase the risk that your policy will terminate. It will have a permanent effect on the policy’s cash surrender value and will reduce the death benefit paid. Also, policy termination with an outstanding loan can result in adverse tax consequences. | |

| ADVERSE TAX CONSEQUENCES | Certain transactions (including, but not limited to, withdrawals, surrenders and loans) may lead to a taxable event. Under certain circumstances (usually if your premium payments in the first seven years exceed specified limits), your policy may become a “modified endowment contract” (MEC). Under federal tax law, loans, collateral assignments, withdrawals, and other pre-death distributions received from a MEC policy are taxed as income first and recovery of basis second. Also, distributions includible in income received before you attain age 59 1/2 are subject to a 10% penalty tax. Existing tax laws that benefit this policy may change at any time. | |

| ADDITIONAL RISKS | The type of investments that a fund company makes will also create risk. A comprehensive discussion of the risks of each of the funds underlying the divisions of the Separate Account may be found in that fund’s prospectus. You should read the fund’s prospectus carefully before investing. | |

| POLICY CHARGE INCREASE | We have the right to increase certain policy and rider charges; however, the charges will not exceed the maximum charges identified in the fee tables. If we increase a policy or rider charge, you may need to increase the amount and/or frequency of your premiums to keep your policy in force. |

6

Table of Contents

The following tables describe the fees and expenses that you will pay during the time you own the policy, and if you surrender the policy. A more detailed description of these fees can be found in the “Charges and Deductions” section of this prospectus.

This table describes fees and expenses that you will pay at the time you pay premium, take account value out of the policy, or exercise certain riders.

| Charge | When Charge is Deducted |

Current Amount Deducted |

Maximum Amount Deducted | |||

| Premium Expense Charge | When you pay premium. | 5.0% of premium (2.5% Sales Charge plus 2.5% Premium Tax Charge) | 7.5% of premium (5.0% Sales Charge plus 2.5% Premium Tax Charge) | |||

| Surrender Charges1, 2, 3 |

When you surrender the policy for its net surrender value. | Coverage Years 1-15 Administrative Surrender Charge Ÿ Year 1: $5 per $1000 of selected face amount Ÿ Year 2-10: grades to $0 per $1000 of selected face amount Ÿ Year 11+: $0.00 Plus Sales Load Surrender Charge Ÿ Years 1-10: 25% of premium paid for the coverage up to the Surrender Charge Band, 5% of premium paid for the coverage in excess of the Band up to twice the Band, and 4% of premium paid for the coverage in excess of twice the Band up to three times the Band Ÿ Years 11-15: these percentages are reduced, by factors set forth in the policy, to zero by the end of the 15th Year Coverage Years 16+ Ÿ $0.00 |

same as current | |||

| Surrender charge for a 35-year-old male, non-smoker, and a policy face amount of $500,000.1, 2, 3, 4 | When you surrender the policy for its net surrender value. | First Coverage Year Administrative Surrender Charge Ÿ $5.00 per $1000 of selected face amount Sales Load Surrender Charge Ÿ 25% of premium paid |

First Coverage Year Administrative Surrender Charge Ÿ $5.00 per $1000 of selected face amount Sales Load Surrender Charge Ÿ 25% of premium paid |

| Processing Fees | When Fee is Deducted |

Current Amount Deducted |

Maximum Amount Deducted | |||

| Withdrawal Fee | When you withdraw a portion of your account value from the policy. | The lesser of: $25 per withdrawal or 2% of the amount |

The lesser of: $25 per withdrawal or 2% of the amount | |||

| Accelerated Death Benefit Rider | When you elect an accelerated death benefit. | $150 | $250 |

| 1 | For the initial face amount, the rates vary by the insured’s gender, issue age, and year of coverage. For each increase in the face amount, the rates are based on the attained age and gender of the insured on the effective date of the increase and the year of coverage. The surrender charge is shown in the policy’s Specifications Pages. The rates in this table may not be representative of the charge that a particular policy owner will pay. If you would like information on the surrender charge rates for your particular situation, you can request a personalized illustration from your registered representative or by calling the MassMutual Customer Service Center at 1-800-272-2216. |

7

Table of Contents

| 2 | Under certain circumstances, the surrender charge may not apply when exchanging this policy for a qualifying non-variable life insurance policy offered by MassMutual or one of its subsidiaries. Please see the “Surrender Charges” section for more information. |

| 3 | Surrender charges generally apply for the first 15 years of a segment’s coverage. The administrative surrender charge remains level for the first year and then decreases by 0.833% each month during years two through ten. The Administrative Surrender Charge is zero in years eleven and beyond. |

| The sales load surrender charge is a percentage of premiums paid. The percentages remain level for the first ten years, then decrease starting in year eleven, reaching zero by the end of the fifteenth year. The Surrender Charge Band is set forth in the policy and is a series of premium thresholds (that vary by issue age and gender) that are used when calculating the sales load component of the surrender charge. |

| 4 | The rates shown for the “representative insured” are first year rates only. The “representative insured” is based on the expected policy owner characteristics as the policy was initially marketed. |

Periodic Charges Other than Fund Operating Expenses

This table describes the fees and expenses that you will pay periodically, other than fund operating expenses, during the time that you own the policy.

| Charge | When Charge is Deducted |

Current Amount Deducted |

Maximum Amount Deducted | |||||||

| Mortality charge1 | Monthly, on the policy’s monthly charge date. | Current Range of Rates per $1000 of Insurance Risk Ÿ $0.05669 – $26.19054 |

Ÿ $83.33

per $1000 | |||||||

| Mortality charge for a 35-year-old male, non-smoker.1,2 | Monthly, on the policy’s monthly charge date. | Ÿ $0.13178 per $1000 of Insurance Risk |

Ÿ $0.14096 per $1000 of Insurance Risk | |||||||

| Administrative Charge | Monthly, on the policy’s monthly charge date. | All Policy Years Tax Qualified policies and policies issued under our simplified underwriting: per policy All

other policies: |

All Policy Years Ÿ $8 per policy | |||||||

| Mortality & Expense Risk Charge | Daily | Annual Rate Ÿ 0.40% of the policy’s daily net assets in the Separate Account |

same as current | |||||||

| Additional mortality fees may be assessed for risks associated with certain health conditions, occupations or avocations.3 | Monthly, on the policy’s monthly charge date. | Current Range of Rates per $1000 of Insurance Risk Ÿ $0.014 – $83.33 |

Ÿ $83.33

per $1000 | |||||||

| Loan Interest Rate Expense Charge4 | Reduces the interest we credit on the loaned value. We credit loan interest daily. | All Policy Years Ÿ 0.90% of loaned amount |

All Policy Years Ÿ 2.00% of loaned amount | |||||||

| Riders | When Rider Charge Is Deducted |

Current Amount Deducted |

Maximum Amount Deducted | |||||||

| Accidental Death Benefit5 This Rider is no longer issued. |

Monthly, on the policy’s monthly charge date. | Current Range of Rates per $1000 of rider face amount Ÿ $0.06591 – $0.12929 |

same as current | |||||||

| Rider charge for a 35-year-old male, non-smoker, and a policy face amount of $500,000.2,5 | Monthly, on the policy’s monthly charge date. | Ÿ $0.06591 per $1000 of rider face amount |

Ÿ $0.06591 per $1000 of rider face amount | |||||||

| Insurability Protection6 This Rider is no longer issued. |

Monthly, on the policy’s monthly charge date. | Current Range of Rates per $1000 of rider face amount Ÿ $0.043 – $0.179 |

same as current | |||||||

| Rider charge for a 35-year-old male, non-smoker and a policy face amount of $500,000.2,6 | Monthly, on the policy’s monthly charge date. | Ÿ $0.154 per $1000 of rider face amount |

Ÿ $0.154 per $1000 of rider face amount | |||||||

8

Table of Contents

| Riders | When Rider Charge Is Deducted |

Current Amount Deducted |

Maximum Amount Deducted | |||||||

| Waiver of Monthly Charges7 | Monthly, on the policy’s monthly charge date. | Current Range of Rates per $1 of Monthly Deduction Ÿ $0.036 – $0.349 |

same as current | |||||||

| Rider charge for a 35-year-old male, non-smoker and a policy face amount of $500,000.2,7 | Monthly, on the policy’s monthly charge date. | Ÿ $0.058 per $1 of Monthly Deduction |

Ÿ $0.058 per $1 of Monthly Deduction | |||||||

All of the monthly charges listed in the table above are deducted proportionately from the then current account values in the Separate Account and the guaranteed principal account. The mortality and expense charge is deducted from the assets of the Separate Account only.

| 1 | The rates vary by the insured’s gender, attained age and risk classification. The rates may not be representative of the charge that a particular policy owner will pay. If you would like information on the rates for your particular situation, you can request a personalized illustration from your registered representative or by calling the MassMutual Customer Service Center at 1-800-272-2216. The mortality charge rates reflected in this table are for standard risks; the maximum insurance charges are based on the 1980 Commissioners Standard Ordinary (1980 CSO) Tables. Insurance risk is a liability of the insurance company and is equal to the difference between the death benefit and the account value. |

| 2 | The rates shown for the “representative insured” are first year rates only. |

| 3 | The rates vary in amount and duration by the insured’s gender, attained age and risk classification. The combined monthly mortality charges will not exceed $83.33 per $1,000 of insurance risk. |

| 4 | We charge interest on policy loans, but we also credit interest on the cash value we hold as collateral on policy loans. The Loan Interest Rate Expense Charge represents the difference (cost) between the loan interest rate charged and the interest credited on loaned amounts. |

| 5 | The rates for the Accidental Death Benefit Rider vary by the insured’s attained age. |

| 6 | The rates for the Insurability Protection Rider vary by the insured’s issue age. |

| 7 | The rates for the Waiver of Monthly Charges Rider vary by the insured’s gender and attained age. The policy’s “monthly deduction” is the sum of the following current monthly charges: (a) administrative charge, (b) mortality charge and (c) any applicable rider charges. |

Annual Fund Operating Expenses

While you own the policy, if your assets are invested in any of the divisions of the Separate Account, you will be subject to the fees and expenses charged by the fund in which that division invests. The table below shows the minimum and maximum total operating expenses charged by any of the funds, expressed as a percentage of average net assets, for the year ended December 31, 2011 (before any waivers or reimbursements).1 More detail concerning each fund’s fees and expenses that you may periodically be charged during the time that you own the policy, is contained in each fund prospectus.

| Charge | Minimum | Maximum | ||

| Total Annual Fund Operating Expenses that are deducted from fund assets, including management fees, distribution, and/or 12b-1 fees, and other expenses. |

0.33% | 0.85% |

| 1 | The fund expenses used to prepare this table were provided to us by the funds. We have not independently verified such information. |

In this prospectus, the “Company,” “we,” “us,” and “our” refer to MML Bay State Life Insurance Company (MML Bay State). MML Bay State is a wholly-owned stock life insurance subsidiary of C.M. Life Insurance Company (C.M. Life) and an indirect subsidiary of Massachusetts Mutual Life Insurance Company (MassMutual). MML Bay State provides life insurance and annuities to individuals and group life insurance to institutions. MassMutual is a diversified financial services company providing life insurance, disability income insurance, long-term care insurance, annuities, retirement products and other products to individual and institutional customers. MassMutual is organized as a mutual life insurance company. MML Bay State’s home office is located at 100 Bright Meadow Boulevard, Enfield, Connecticut 06082-1981.

9

Table of Contents

The policy is a life insurance contract between you (the owner) and MML Bay State. In exchange for your premium payments, we agree to pay a death benefit to the beneficiary when the insured dies while the policy is in force.

The policy provides premium payment and death benefit flexibility. It permits you to vary the frequency and amount of premium payments and to increase or decrease the policy’s selected face amount. This flexibility allows you to meet changing insurance needs under a single life insurance policy. The policy also provides additional amounts payable upon death of the insured through certain riders that may be added to your policy with additional charges.

Generally, you are not taxed on policy earnings until you take money out of the policy. In most cases, you will not be taxed on the amounts you take out until the total of all your withdrawals exceeds the amount of all your premium payments. This is known as tax deferral.

The policy is called variable life insurance because you can choose to allocate your net premium payments among various investment choices. Your choices include the funds listed in this prospectus and a guaranteed principal account (GPA). Your policy value and the amount of the death benefit we pay may vary due to a number of factors including, but not limited to, the investment performance of the funds you select and the interest we credit on the GPA.

From time to time you may want to submit a written request for a change of beneficiary, a transfer, or some other action. We can only act upon your request if we receive it in “good order.” “Good order” means that all the documents and forms necessary to process a request are complete and received by us at the location designated by us for the particular transaction (e.g., our Administrative Office; bank lockboxes; our secure website). Contact our Administrative Office to learn what information we require for your request to be in good order. Generally, your request must include the information, documentation, instructions, and/or authorization we need to complete the action without using our own discretion to carry it out. Additionally, some actions may require that you submit your request on our form. We may, in our sole discretion, determine whether any particular transaction request is in good order, and we reserve the right to change or waive any good order requirements at any time.

All financial transactions (including premium payments, surrenders, withdrawals, loan related transactions, and transfers) received in good order will be effective on a valuation date. A “valuation date” is any day on which the net asset value of the units of each division of the Separate Account is determined. Generally, this will be any date on which the New York Stock Exchange (NYSE), or its successor, is open for trading. Our valuation date ends when the NYSE closes. This is usually at 4:00 p.m. Eastern Time. Any financial transaction request (including telephone, fax, and website requests) received after the close of the NYSE is processed as of the next valuation date. Under certain circumstances we may defer payment of certain financial transactions. See “When We Pay Death Benefit Proceeds” and “Other Policy Rights and Limitations”. Valuation dates do not include days when the NYSE is closed, which generally includes weekends and major U.S. holidays.

When the insured dies, if the policy is in force, we will pay the beneficiary a death benefit. The policy offers a number of death benefit payment methods.

Your life insurance policy provides coverage for as long as the policy has sufficient account value. It does not “mature” or provide an endowment in a specific policy year as some traditional life insurance policies do.

Owner

The owner is the person who will generally make the choices that determine how the policy operates while it is in force. You name the owner in the application. However, the owner may be changed while the policy is in force; therefore, the owner is the person we have listed as such in our records. Generally, the change of owner will take effect as of the date the request is signed. Each change will be subject to any payment we made or other action we took before receiving the written request. When we use the terms “you” or “your”, in this prospectus, we are referring to the owner.

The sale of your policy to an unrelated investor, sometimes called a viatical or life settlement, typically has high transaction costs that may significantly reduce the value of your estate. Discuss the benefits and risks of selling your life insurance policy with your registered representative and estate planner before you enter into a life settlement. Such a sale may also have

10

Table of Contents

adverse tax consequences. Refer to the subsection “Sales to Third Parties” under the “Federal Income Tax Considerations” section of this prospectus for more information.

Insured

The insured is the person on whose life the policy is issued. The policy owner must have an insurable interest in the life of the insured in order for the policy to be valid under state law and for the policy to be considered life insurance for income tax purposes. If the policy does not comply with the insurable interest requirements of the issue state at the time of issue, the policy may be deemed void from the beginning. As a result, the policy would not provide the intended benefits. It is the responsibility of the policy owner to determine whether proper insurable interest exists at the time of policy issuance.

You named the insured in the application for the policy. We did not issue a policy for an insured who was more than 82 years old. Before issuing a policy, we required evidence to determine the insurability of the insured. This usually required a medical examination.

Beneficiary

You named a beneficiary in the application to receive any death benefit. Unless an irrevocable beneficiary has been named, you can change the beneficiary at any time before the insured dies by sending a written request to our Administrative Office. The owner must have the consent of an irrevocable beneficiary to change the beneficiary. Generally, the change will take effect as of the date your request is signed. Each change will be subject to any payment we made or other action we took before receiving the written request.

You may name different classes of beneficiaries, such as primary and secondary. These classes will set the order of payment. There may be more than one beneficiary in a class.

If no beneficiary is living when the insured dies, we will pay you the death benefit unless you have given us different instructions. If you are deceased, the death benefit will be paid to your estate.

The policy is no longer offered for sale. Owners may, however, continue to make premium payments under existing policies. To purchase a policy you had to send us a completed application. The minimum “initial selected face amount” of a policy depends on the market in which it was sold, the underwriting process used, and the Issue Age of the Insured:

| Ÿ | Tax-qualified Market (used in a retirement plan qualifying for tax benefits under the Internal Revenue Code), Any Underwriting Process: $15,000 for Ages 0-55; $14,000 for Age 56; $13,000 for Age 57; $12,000 for Age 58, $11,000 for Age 59; and $10,000 for ages 60 and higher. |

| Ÿ | Non-qualified Markets, Simplified Underwriting: Same as tax-qualified market. |

| Ÿ | Non-qualified Markets, Any Other Underwriting Process: $50,000 for Ages 0-35; $40,000 for Ages 36-40; $30,000 for Ages 41-45; $20,000 for ages 46-50; and $15,000 for Ages 51 and higher. |

The owner selected, within our limits, the policy’s “selected face amount”. The selected face amount is used to determine the amount of insurance coverage the policy provides while it is in force. The initial selected face amount is the selected face amount that was in effect on the policy date. It was listed on the first page of your policy.

We determined whether to accept or reject the application for the policy and the insured’s risk classification. Coverage under the policy generally became effective on the policy’s issue date. However, if we did not receive the first premium and all documents necessary to process the premium by the issue date, coverage began on the date those items were received, in good order, at our Administrative Office.

Policies generally were issued with values that vary based on the gender of the insured. In some situations, however, we may have issued unisex policies, that is policies whose values do not vary by the gender of the insured. Policies issued in Massachusetts and Montana are unisex and policies issued as part of an employee benefit plan may be unisex. References in this prospectus to sex-distinct policy values are not applicable to unisex policies.

11

Table of Contents

Your Right to Return the Policy

You had the right to examine your policy. If you changed your mind about owning it, generally, you could have cancelled it (free look) within 10 calendar days after you received it, or 10 calendar days after you received a written notice of withdrawal right, or 45 days after you signed Part 1 of your Application, whichever was latest. You may also have cancelled increases in Selected Face Amount under the same time limitations. (This period of time may vary by state.)

If you cancelled the policy, we issued you a refund. The free look period and the amount refunded vary. You should refer to your policy for the refund that applies in your state of issue; however, the following information will give you a general understanding of our refund procedures if you cancelled your policy.

In most states we refunded the sum of:

| 1. | any premium paid for the policy; plus |

| 2. | any interest credited to the policy under the GPA; plus or minus |

| 3. | an amount reflecting the investment experience of the divisions of the Separate Account under this policy to the date we received the policy. |

In other states, the refund was equal to any premium paid for the policy.

To cancel the policy, you had to return it to us at our Administrative Office, to the registered representative who sold the policy, or to one of our agency offices.

A “replacement” occurs when a new policy or contract is purchased and, in connection with the sale, an existing policy or contract is surrendered, lapsed, forfeited, assigned to the replacing insurer, otherwise terminated, or used in a financed purchase. A “financed purchase” occurs when the purchase of a new life insurance policy or annuity contract involves the use of funds obtained from the values of an existing life insurance policy or annuity contract through withdrawal, surrender, or loan.

There are circumstances in which replacing your existing life insurance policy or annuity contract can benefit you. As a general rule, however, replacement is not in your best interest. Accordingly, you should make a careful comparison of the costs and benefits of your existing policy or contract and the proposed policy or contract to determine whether replacement is in your best interest. You should be aware that the person selling you the new policy will generally earn a commission if you buy the new policy through a replacement. Remember that if you replace a policy with another policy, you might have to pay a surrender charge on the policy surrendered, and there may be a new surrender charge for the new policy. In addition, other charges may be higher (or lower) and the benefits may be different.

You should also note that once you have replaced your variable life insurance policy or annuity contract, you generally cannot reinstate it even if you choose not to accept your new variable life insurance policy or annuity contract during your “free look” period. The only exception to this rule would be if you live in a state that requires the insurer to reinstate the previously surrendered policy or contract if the owner chooses to reject their new variable life insurance policy or annuity contract during the “free look” period.

The planned premium amount you pay is based on a number of factors including, but not limited to:

| Ÿ | the selected face amount, |

| Ÿ | the insured’s gender, |

| Ÿ | the insured’s issue age, |

| Ÿ | the insured’s risk classification, |

| Ÿ | premium frequency, |

| Ÿ | policy charges, and |

| Ÿ | whether or not any riders apply to the policy. |

12

Table of Contents

Generally, you determined the first premium you wanted to pay for the policy, but it must have been at least equal to the minimum initial premium. The minimum initial premium depended on:

| Ÿ | your chosen premium frequency, |

| Ÿ | the policy’s initial selected face amount, |

| Ÿ | the issue age, gender, and risk classification of the insured, and |

| Ÿ | any riders on the policy. |

When applying for the policy, you selected (within the policy limitations) the planned premium and payment frequency (annual, semiannual, quarterly, or monthly).

We will send premium notices for the planned premium based on the payment frequency in effect. If a planned premium payment is not made, the policy will not necessarily terminate. Conversely, making planned premium payments does not necessarily guarantee the policy will remain in force. To keep policy in force, it must have sufficient account value. See “Grace Period and Termination”. We will send a notice of any premium needed to prevent termination of this policy; however, regular billing notices for planned premiums will be sent only while the policy is in full force.

To change the amount and frequency of planned premiums, you must submit your request to our Administrative Office.

If you change the frequency of your planned premiums, your policy may be at risk of lapsing because we do not bill for fractional payment periods.

| Example:

|

| Your policy anniversary is on January 2 and you make planned quarterly premium payments. We have been sending you a bill each quarter for the applicable premium. In June, you notify us that you want to change your planned premium from quarterly payments to annual payments. In this situation, we would have sent you bills for the first and second quarterly payments of that year. After receiving your notification, however, we would not send you a bill for the last two quarterly payments of that year. We will send your next bill on the following policy anniversary date (January 2). If you choose not to make a premium payment between July and January 2, your policy may lapse before you receive your next bill. For more information on what happens if your policy lapses, please read the section titled “Policy Termination and Reinstatement”. |

If mailing a subsequent premium payment, you must send it to the appropriate lockbox (premium payment processing service). Premium payments sent to an incorrect lockbox will be considered not in good order. We will reroute the payment and apply it on the valuation date when it is determined to be in good order. See below for lockbox address details.

Premium payments for VLP policies issued in all jurisdictions, except New York, must be sent to the appropriate address:

Regular Mail:

MML Bay State VL Plus

PO Box 75302

Chicago, IL 60675-5302

Overnight Mail:

MML Bay State VL Plus

350 North Orleans Street

Receipt & Dispatch 8th Floor

Lockbox 75302

Chicago, IL 60654

You may also make premium payments by wire transfer. For instructions on how to make a premium payment by wire transfer, please call the MassMutual Customer Service Center at 1-800-272-2216.

13

Table of Contents

For recurring withdrawals from a bank account, you may elect to pay premiums by pre-authorized check. Under this procedure, we automatically deduct premium payments each month from a bank account you designate. We will not send a bill for these automatic payments. You may commence the pre-authorized check service at any time, unless your policy has entered its grace period (see “Policy Termination and Reinstatement” for more information). You can discontinue this service by contacting our Administrative Office.

We must receive notification of account changes at our Administrative Office at least 10 business days before the next draft. Withdrawals from the designated bank account may be selected for any date between the 1st and the 28th of the month. If you do not specify a date, we will select a date and provide notice 10 days in advance of the first draft. We may automatically switch you to quarterly payments if (1) your policy has insufficient value to cover the monthly charges due and your elected premium is below the current monthly deductions or (2) we are unable to obtain the premium payment from your bank account.

After you paid the first premium, within limits you may pay any amount at any time while the insured is living. Although you must maintain sufficient account value to keep the policy in force, there is no required schedule of premium payments.

We reserve the right to return any premium payment under $10.

If, on the monthly calculation date following the date we apply a subsequent premium payment, we determine that your policy has become a “modified endowment contract” (MEC), we will refund that portion of your premium payment that causes the policy to become a MEC. No interest or investment performance will be earned under the contract on the portion of the payment that is refunded to you.

When we mail you the refund, we will give you the option to accept your policy as a MEC. If, you want to accept the policy as a MEC you must complete and sign a MEC Acknowledgment Notice and return it, along with the refunded premium payment, to our Administrative Office. The payment will be applied on the valuation date that is on or next follows the date we receive it, in good order, at our Administrative Office.

It is possible that a policy that was going to become a MEC will not become a MEC, if you return the refunded premium payment and we receive it, in good order, after the next policy anniversary has occurred or after a material change to the policy has taken place. In those cases you will not be notified of this change in the policy’s status. You can, however, call our Administrative Office to request the MEC status of your policy.

For more information on MEC policies, material changes, 7-pay limit, and 7-pay test, you should consult your tax adviser. These terms are also discussed under “Modified Endowment Contracts” in the “Federal Income Tax Considerations” section of this prospectus.

If your policy terminated and it was reinstated, the above procedures will not apply. If you would like information on how reinstated policies are tested for their MEC status, please contact our Administrative Office.

The Internal Revenue Code (IRC) has limits on the amount of money you may put into a life insurance contract and still meet the definition of life insurance for tax purposes. The maximum premium you can pay each policy year is the greater of:

| (a) | an amount equal to $100 plus double the annual minimum annual premium for the policy; or |

| (b) | the highest premium payment amount that would not increase the insurance risk. |

The maximum premium you may pay in any policy year is shown on the schedule page for your policy. You may also contact our Administrative Office to obtain the amount of the maximum premium you can apply to your policy.

We will credit that portion of the payment that will not exceed the maximum limit. We will return the remaining payment to the premium payer. No premium notices will be generated until the next policy anniversary. If we did not refund the excess premium, the policy may no longer qualify as life insurance under federal tax law.

For more information on the test, please read the “Minimum Face Amount” section.

14

Table of Contents

How and When Your Premium is Allocated

Net Premium

Net premium is a premium payment received in good order minus the premium expense charge.

Premiums that would cause the policy to be a MEC may not be considered to be in good order, depending on when they are received.

The net premium is allocated among the divisions of the Separate Account and the guaranteed principal account according to your current instructions on our Net Premium Allocation Request form.

Net Premium Allocation

When applying for the policy, you indicated how you wanted net premiums allocated among the divisions and the guaranteed principal account. Net premium allocations must be whole-number percentages that add up to 100%.

You may change your net premium allocation at any time by sending a Net Premium Allocation Request form to us at our Administrative Office. You may also change your net premium allocation by telephone, fax transmission, or through our Web site, subject to certain restrictions. Please note that telephone, fax, or website transactions may not always be available. Telephone, fax, and computer systems can experience outages or slowdowns for a variety of reasons. These outages or slowdowns may prevent or delay our receipt of your request. To help protect against unauthorized or fraudulent instructions, we will take reasonable steps to confirm that instructions given to us are genuine. We may record all telephone conversations.

A request to change your net premium allocation will become effective on the valuation date we receive your request, in good order, at our Administrative Office. If we receive your request in good order on a non-valuation date or after the end of a valuation date, the change will become effective on the next valuation date.

When Net Premium Is Allocated

The policy date, issue date, and register date of your policy may affect the allocation of your net premiums. This, in turn, can affect the investment earnings and interest credited on your policy account value.

The “issue date” is the date we actually issued the policy. The “policy date” normally is the same date as the issue date. However, you may have requested in your application that we set the policy date to be a specific date earlier than the issue date. In this case, monthly charges were deducted as of the requested policy date. These deductions covered a period of time during which the policy was not in effect.

The “register date” is the first date premiums were allocated. It is the valuation date that was on the latest of:

| a. | the policy date; |

| b. | the day we received your completed Part 1 of the application for the policy, or |

| c. | the day we received the first premium payment in good order. |

We apply subsequent premium payments that are received on or after the register date, on the valuation date we receive them in good order. Subsequent premium payments will be applied in accordance with your premium allocation instructions. If we receive a subsequent premium payment in good order on a non-valuation date or after the end of a valuation date, we will apply the premium payment on the next valuation date. If a payment is dishonored by your bank after we have applied the premium payment to your policy, the transaction will be deemed void and your payment will be reversed.

15

Table of Contents

The following diagram provides an overview of how premium payments flow through your policy and where deductions for fees and expenses are taken. The shaded boxes indicate fees and expenses you pay directly or indirectly under your policy. Refer to the “Charges and Deductions” section for more information.

| 1 | We charge interest on policy loans, but we also credit interest on the cash value we hold as collateral on policy loans. The Loan Interest Rate Expense Charge represents the difference (cost) between the loan interest rate charged and the interest credited on loaned amounts. |

16

Table of Contents

The Company’s assets are held in its general investment account. The general investment account is not registered under federal or state securities law and, subject to applicable law, the Company has sole discretion over the assets in its general investment account.

The part of your premium that you invest in your policy’s variable investment divisions, however, is held in an account that is separate from the general assets of the Company. This account is called the MML Bay State Variable Life Separate Account I. In this prospectus we will refer to it simply as the “Separate Account”. The Company owns the assets in the Separate Account.

We established the Separate Account on June 9, 1982, according to the laws of the State of Connecticut. We registered it with the Securities and Exchange Commission as a unit investment trust under the Investment Company Act of 1940.

The Separate Account exists to keep your life insurance assets separate from our other Company assets. As such, any income, gains, or losses credited to, or charged against, the Separate Account reflect only the Separate Account’s own investment experience. At no time will the Separate Account reflect the investment experience of the Company’s other assets.

We may not use the assets in the Separate Account to pay any liabilities of the Company other than those arising from the VLP policies. We may, however, transfer to our general investment account any assets that exceed anticipated obligations of the Separate Account. We are required to pay, from our general assets, if necessary, all amounts promised under the VLP policies.

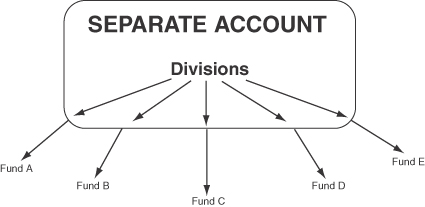

We have established a segment within the Separate Account to receive and invest premium payments for the VLP policies. Currently, the VLP segment is divided into seven divisions, subject to state availability. Each “division” purchases shares in a corresponding fund. The underlying funds are listed in the next section.

Some of the underlying funds offered are similar to mutual funds offered in the retail marketplace. They may have the same investment objectives and portfolio managers as the retail funds. The funds offered in the VLP policy, however, are set up exclusively for variable annuity and variable life insurance products. Their shares are not offered for sale to the general public and their performance results will differ from the performance of the retail funds.

Policy owners do not invest directly into the underlying funds. Instead, as shown in the example below, they invest in the Separate Account divisions which then purchase shares of the corresponding underlying fund. The Separate Account owns the fund shares; the Company owns the Separate Account.

17

Table of Contents

You are responsible for choosing the funds, and the amounts allocated to each, that are appropriate for your own individual circumstances and your investment goals, financial situation, and risk tolerance. Since investment risk is borne by you, decisions regarding investment allocations should be carefully considered. In making your investment selections, we encourage you to thoroughly investigate all of the information regarding the funds that is available to you, including each fund’s prospectus, statement of additional information, and annual and semiannual reports. After you select funds for your initial premium, you should monitor and periodically re-evaluate your allocations to determine if they are still appropriate. We do not recommend or endorse any particular fund and we do not provide investment advice.

Following is a table listing the investment funds in which the divisions of the Separate Account invest, information on each fund’s adviser and sub-adviser, if applicable, as well as the type of fund being offered. More detailed information concerning the funds and their investment objectives, strategies, policies, risks and expenses is contained in each fund’s prospectuses. You should read the information contained in the fund prospectuses carefully. Each year while you own the policy, we will send you the current fund prospectuses and/or summary prospectuses. You may also visit our website (massmutual.com) to access this prospectus, the current fund prospectuses and summary prospectuses, or contact the MassMutual Service Center to request copies. There can be no assurance that any of the funds will achieve its stated objective(s). For example, during extended periods of low interest rates, and partly as a result of insurance charges, the yield on the money market investment fund may become extremely low and possibly negative.

| Type of Fund |

Investment Funds in Which the Divisions Purchase Shares |

Investment Fund’s Adviser and Sub-Adviser | ||

| Money Market | ||||

| MML Money Market Fund1 (Initial Class) | Adviser: MassMutual

Sub-Adviser: Babson Capital Management LLC | |||

| Fixed Income | ||||

| MML Managed Bond Fund (Initial Class) | Adviser: MassMutual

Sub-Adviser: Babson Capital Management LLC | |||

| Balanced | ||||

| MML Blend Fund (Initial Class) | Adviser: MassMutual

Sub-Adviser: Babson Capital Management LLC | |||

| Large-Cap Value | ||||

| MML Equity Fund (Initial Class) | Adviser: MassMutual

Sub-Advisers: Loomis, Sayles & Company, L.P.

and | |||

| Large-Cap Blend | ||||

| MML Equity Index Fund (Class II) | Adviser: MassMutual

Sub-Adviser: Northern Trust Investments, Inc. | |||

| Small/Mid-Cap Growth | ||||

| T. Rowe Price Mid-Cap Growth Portfolio | Adviser: T. Rowe Price Associates, Inc.

Sub-Adviser: N/A | |||

| International/Global | ||||

| Oppenheimer Global Securities Fund/VA (Non-Service) | Adviser: OppenheimerFunds, Inc.

Sub-Adviser: N/A | |||

| 1 | An investment in the MML Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to maintain a stable net asset value per share, it is possible to lose money by investing in the Fund. The yield of this Fund may become very low during periods of low interest rates. After deduction of Separate Account charges, the yield in the division that invests in this Fund could be negative. |

You bear the risk of any decline in your policy account value resulting from the performance of the funds you have chosen.

18

Table of Contents

Addition, Removal, or Substitution of Funds

We do not guarantee that each fund will always be available for investment through the policy. We reserve the right, subject to compliance with applicable law, to add new funds or fund classes, close existing funds or fund classes, or substitute fund shares that are held by any variable investment division for shares of a different fund. New or substitute funds may have different fees and expenses and their availability may be limited to certain classes of purchasers. We will not add, remove or substitute any shares attributable to your interest in a division of the Separate Account without notice to you and prior approval of the SEC, to the extent required by the 1940 Act or other applicable law. We may also decide to purchase for the Separate Account securities from other funds. We reserve the right to transfer Separate Account assets to another separate account that we determine to be associated with the class of contracts to which the policy belongs.

Compensation We Receive From Funds, Advisers and Sub-Advisers

Compensation We Receive From Funds

We and certain of our affiliates receive compensation from certain funds pursuant to Rule 12b-1 under the Investment Company Act of 1940. This compensation is paid out of the fund’s assets and may be as much as 0.25% of the average net assets of an underlying fund which are attributable to MassMutual’s variable contracts. This compensation is specified as 12b-1 fees in the “Investment Management Fees and Other Expenses” table. An investment in a fund with a 12b-1 fee will increase the cost of your investment in this policy.

Compensation We Receive From Advisers and Sub-Advisers

We and certain of our insurance affiliates also receive compensation from the advisers and sub-advisers to some of the funds. We may use this compensation for any corporate purpose, including paying expenses that we incur in promoting, issuing, distributing and administering the policy, and providing services, on behalf of the funds, in our role as intermediary to the funds. The amount of this compensation is determined by multiplying a specified annual percentage rate by the average net assets held in that fund that are attributable to the variable annuity and variable life insurance products issued by us and our affiliates that offer the particular fund (“MassMutual’s variable contracts”). These percentage rates differ, but currently do not exceed 0.30%. Some advisers and sub-advisers pay us more than others; some advisers and sub-advisers do not pay us any such compensation.

The compensation is not reflected in the expenses that are disclosed for the funds in the “Investment Management and Other Expenses” table, because this compensation is not paid directly out of the funds’ assets. However, these payments may be derived, in whole or in part, from the advisory fee deducted from fund assets. Policy owners, through their indirect investment in the funds, bear the costs of these advisory fees (see the funds’ prospectuses for more information). For a list of the funds whose advisers currently pay such compensation, visit www.massmutual.com/legal/compagreements.

In addition, we may receive fixed dollar payments from the advisers and sub-advisers to certain funds so that the adviser and sub-adviser can participate in sales meetings conducted by MassMutual. Attending such meetings provides advisers and sub-advisers with opportunities to discuss and promote their funds.

Compensation In General

The compensation that we receive may be significant and we may profit from this compensation. In addition to compensation described above, when selecting the funds that will be available with MassMutual’s variable contracts, we consider the amount of compensation that we receive from the funds, their advisers, sub-advisers, or their distributors along with the funds’ name recognition, asset class, the manager’s reputation, and fund performance. We review the funds periodically and may remove a fund, or limit its availability to new premiums and/or transfers of account value if we determine that a fund no longer satisfies one or more of the selection criteria; and/or if the fund has not attracted significant allocations from policy owners. We have included certain funds at least in part because they are managed by us or an affiliate. For further details about the compensation payments we make in connection with the sale of the policies, see “Other Information – Distribution” in this prospectus.

The Guaranteed Principal Account

Net premium and account value allocated to the guaranteed principal account (GPA) become part of the general investment account of the Company, which supports life insurance and annuity obligations. Assets of our general investment account may be used to pay any of our liabilities.

The assets in the Separate Account or our other separate accounts are not part of our general investment account. Subject to applicable law, we have sole discretion over the investment assets in our general investment account.

19

Table of Contents

You do not participate in the investment performance of the assets in our general investment account. Instead, we guarantee that amounts allocated to the GPA, in excess of policy debt, will earn interest at a minimum rate of 4% per year. We may credit a higher rate of interest at our discretion. The interest rate is declared monthly and becomes effective on your policy’s monthly charge date. You bear the risk that no higher rates of interest will be credited.

For amounts in the GPA equal to any policy debt, the guaranteed minimum interest rate per year is the greater of:

| Ÿ | 4%, or |

| Ÿ | The policy loan rate less the maximum loan interest rate expense charge. |

For more information about our general investment account, refer to the “Our Ability to Make Payments Under the Policy” section.

How The Value of your Policy is Calculated

Your value of your policy is called its “account value.” The account value has two components:

| 1. | The variable account value, and |

| 2. | The fixed account value. |

We will calculate your policy value on each valuation date.

Variable Account Value

Transactions in your variable divisions are all reflected through the purchase and sale of “accumulation units”. For instance, before we invest your net premium payment in a division, we convert your net premium payment into accumulation units and then purchase an appropriate number of shares in the designated fund.

The variable account value is the sum of your values in each of the divisions of the Separate Account. It reflects:

| Ÿ | net premiums allocated to the Separate Account; |

| Ÿ | transfers to the Separate Account from the guaranteed principal account; |

| Ÿ | transfers and withdrawals from the Separate Account; |

| Ÿ | loans deducted from the Separate Account; |

| Ÿ | fees and charges deducted from the Separate Account; and |

| Ÿ | the net investment experience of the Separate Account. |

Net Investment Experience

The net investment experience of the variable account value is reflected in the value of the accumulation units.

Every valuation date we determine the value of an accumulation unit for each of the separate account divisions. Changes in the accumulation unit value reflect the investment performance of the fund as well as deductions for the mortality and expense risk charge, and fund expenses.

The value of an accumulation unit may go up or down from valuation date to valuation date.

When you make a premium payment, we credit your policy with accumulation units. We determine the number of accumulation units to credit by dividing the amount of the net premium payment allocated to a division by the unit value for that Separate Account division. When you make a withdrawal, we deduct accumulation units representing the withdrawal amount from your policy. We deduct accumulation units for insurance and other policy charges.

We calculate the value of an accumulation unit for each division at the end of each valuation date. Any change in the accumulation unit value will be reflected in your policy’s account value.

20

Table of Contents

Fixed Account Value

The fixed account value is the accumulation of:

| Ÿ | net premiums allocated to the guaranteed principal account (GPA); plus |

| Ÿ | amounts transferred into the GPA; minus |

| Ÿ | amounts transferred or withdrawn from the GPA; minus |

| Ÿ | fees and charges deducted from the GPA; plus |

| Ÿ | interest credited to the GPA. |

Interest on the Fixed Account Value

The fixed account value earns interest at an effective annual rate, credited daily.

For the part of the fixed account value equal to any policy loan, the daily rate we use is the daily equivalent of:

| Ÿ | The annual loan interest rate minus the current loan interest rate expense charge; or |

| Ÿ | 4%, if greater. |

On each monthly calculation date, the interest earned on any outstanding loan is credited to the GPA.

For the part of the fixed account value in excess of any policy loan, the daily rate we use is the daily equivalent of:

| Ÿ | The current interest rate we declare; or |

| Ÿ | The guaranteed interest rate of 4%, if greater. |

The current interest rate may change as often as monthly and becomes effective on your policy’s monthly charge date.

Policy Termination and Reinstatement

The policy will not terminate simply because you do not make planned premium payments. In addition, making planned premium payments will not guarantee that the policy will remain in force (for example, if the investment experience of the underlying funds has been unfavorable, your cash surrender value may decrease even if you make periodic premium payments). If the policy does terminate, you may be permitted to reinstate it.

Policy termination could have adverse tax consequences for you. To avoid policy termination and potential tax consequences in these situations, you may need to make substantial premium payments or loan repayments to keep your policy in force. For more information on the effect of policy termination, refer to the “Federal Income Tax Considerations” section.

Grace Period and Termination

The policy may terminate without value if its account value (less policy debt which includes accrued interest) on a monthly calculation date cannot cover the monthly charges due. We refer to all outstanding loans plus accrued interest as “policy debt”. Before your policy terminates, we allow a “grace period” during which you can pay the amount of premium needed to increase the account value so that the monthly charges can be paid. We will mail you a notice stating this amount.

The grace period begins on the date the monthly charges are due. It ends 61 days after the date we mail you the notice.

During the grace period, the policy will stay in force; however, policy transactions (as described below) cannot be processed. If the insured dies during this period and the necessary premium has not been paid, we will pay the death benefit proceeds, reduced by the amount of the unpaid monthly charges.

If we do not receive the required payment by the end of the grace period, the policy will terminate without value at the end of the grace period.

The Company mailing a termination or a lapse notice to you constitutes sufficient notice of cancellation of coverage.

Reinstating Your Policy

If your policy terminates, you may be able to reinstate it. You may not, however, reinstate your policy if:

| Ÿ | you surrendered it (unless required by law); or |

| Ÿ | five years have passed since it terminated. |

21

Table of Contents

To reinstate your policy, we will need:

| 1. | a written application to reinstate; |

| 2. | evidence, satisfactory to us, that the insured is still insurable; |

| 3. | a premium payment sufficient to keep the policy in force for three months after reinstatement. The minimum amount of this premium payment will be quoted on request; and |

| 4. | a MEC Notice and Acknowledgement form, if the reinstated policy would be a MEC (see “Policy After You Reinstate” below, and the “Federal Income Tax Considerations” section). |

We will not apply the required premium for reinstatement to an investment option until we have approved your reinstatement application.

The policy will be reinstated after your application has been approved by us and the required premium is received in good order at our Administrative Office. The reinstatement date will be the valuation date on or immediately following the date we determine the application and payment to be in good order. We will assess monthly charges due to us upon reinstatement of your policy as of the reinstatement date.

Policy After You Reinstate

If you reinstate your policy, the selected face amount will be the same as it was when the policy terminated. Your account value at reinstatement will be:

| Ÿ | the premium paid to reinstate your policy, minus |

| Ÿ | the premium expense charge, minus |

| Ÿ | applicable monthly charges due. |

Additionally, if the policy lapsed during a period when a surrender charge applied, surrender charges equal to the amount and period applicable when the policy lapsed will apply to the reinstated policy.

We do not reinstate policy debt.

If you reinstate your policy, it may become a modified endowment contract under current federal tax law. Please consult your tax adviser. More information on modified endowment contracts is included in the “Federal Income Tax Considerations” section.

Reinstatement will not reverse any adverse tax consequences caused by policy termination unless it occurs within 90 days of the end of the grace period. In no situation, however, can adverse tax consequences that are a result of policy debt be reversed.

While your policy is in force, you may generally transfer funds among the variable investment divisions and to or from the guaranteed principal account. You may also borrow against, make withdrawals from, or surrender the policy. However, these transactions, which are discussed more fully below, cannot be processed during a grace period. You must pay any premium due before subsequent financial transaction requests can be processed.

All transaction requests must be submitted in good order to our Administrative Office. Please note that telephone, fax, or website transactions may not always be available. Telephone, fax, and computer systems can experience outages or slowdowns for a variety of reasons. These outages or slowdowns may prevent or delay our receipt of your request. We reserve the right to suspend telephone, website, and/or fax privileges at any time.

You may generally transfer all or part of a division’s account value to any other division or the guaranteed principal account by indicating the dollar amount or the percentage (in whole numbers) you wish to transfer. Transfers are effective as of the valuation date we receive your request in good order at our Administrative Office. If we receive your request in good order on a non-valuation date or after the end of a valuation date, your transfer request will be effective as of the next valuation date.

We do not charge for transfers.

22

Table of Contents

You can submit transfer requests by sending us a written request on our transfer request form. You may also submit transfer requests by telephone or through our website, subject to certain restrictions. To help protect against unauthorized or fraudulent instructions, we will take reasonable steps to confirm that instructions given to us are genuine. We may record all telephone conversations.

Generally, there is no limit on the number of transfers you may make among the Separate Account divisions. However, as discussed more fully in the section below, we may terminate, limit, or modify your ability to make such transfers due to frequent trading or market timing activity.

We limit transfers from the guaranteed principal account to the divisions to one each policy year. You may not transfer more than 25% of the fixed account value (less any policy debt) at the time of transfer. There is one exception to this rule. If:

| Ÿ | you have transferred 25% of the fixed account value (less any policy debt) each year for three consecutive policy years; and |

| Ÿ | you have not added any net premiums or transferred amounts to the guaranteed principal account during these three years; |

then you may transfer the remainder of the fixed account value (less any policy debt) out of the guaranteed principal account in the succeeding policy year.

Limits on Frequent Trading and Market Timing Activity

This policy and its investment choices are not designed to serve as vehicles for what we have determined to be frequent trading or market timing trading activity. We consider these activities to be abusive trading practices that can disrupt the management of a fund in the following ways:

| Ÿ | by requiring the fund to keep more of its assets liquid rather than investing them for long-term growth, resulting in lost investment opportunity; and |

| Ÿ | by causing unplanned portfolio turnover. |

These disruptions, in turn, can result in increased expenses and can have an adverse effect on fund performance that could impact all owners and beneficiaries under the policy, including long-term owners who do not engage in these activities. Therefore, we discourage frequent trading and market timing trading activity and will not accommodate frequent transfers among the funds. Organizations and individuals that intend to trade frequently and/or use market timing investment strategies should not purchase this policy. We have adopted policies and procedures to help us identify those individuals or entities that we determine may be engaging in frequent trading and/or market timing trading activities. We monitor trading activity to uniformly enforce those procedures. However, those who engage in such activities may employ a variety of techniques to avoid detection. Our ability to detect frequent trading or market timing may be limited by operational or technological systems, as well as by our ability to predict strategies employed by policy owners (or those acting on their behalf) to avoid detection. Therefore, despite our efforts to prevent frequent trading and the market timing of funds among the divisions of the Separate Account, there can be no assurance that we will be able to identify all those who trade frequently or those who employ a market timing strategy (or any intermediaries acting on behalf of such persons), and curtail their trading in every instance. Moreover, our ability to discourage and restrict frequent trading or market timing may be limited by decisions of state regulatory bodies and court orders that we cannot predict. In addition, some of the funds are available with variable products issued by other insurance companies. We do not know the effectiveness of the policies and procedures used by these other insurance companies to detect frequent trading and/or market timing. As a result of these factors, the funds may reflect lower performance and higher expenses across all policies as a result of undetected abusive trading practices. If we, or the investment adviser to any of the funds available with this contract, determine that an owner’s transfer patterns reflect frequent trading or employment of a market timing strategy, we will not allow the owner to submit transfer requests by overnight mail, facsimile transmissions, the telephone, our web site, or any other type of electronic medium. Additionally, we may reject any single trade that we determine to be abusive or harmful to the fund.