UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM | |||||

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended May 31 , 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number: 1-7102

__________________________

(Exact name of registrant as specified in its charter)

__________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification no.) | |||||||

| (Address of principal executive offices) (Zip Code) | |||||||||||

Registrant’s telephone number, including area code: (703) 467-1800

__________________________

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

| | ||||||||

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x Smaller reporting company ¨ Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transaction period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The Registrant is a tax-exempt cooperative and therefore does not issue capital stock.

TABLE OF CONTENTS

| Page | ||||||||||||||

i

| Page | ||||||||||||||

ii

CROSS REFERENCE INDEX OF MD&A TABLES

| Table | Description | Page | ||||||||||||

| 1 | Summary of Selected Financial Data | 26 | ||||||||||||

| 2 | Average Balances, Interest Income/Interest Expense and Average Yield/Cost | 39 | ||||||||||||

| 3 | Rate/Volume Analysis of Changes in Interest Income/Interest Expense | 41 | ||||||||||||

| 4 | Non-Interest Income | 43 | ||||||||||||

| 5 | Derivative Gains (Losses) | 44 | ||||||||||||

| 6 | Derivatives—Average Notional Amounts and Interest Rates | 45 | ||||||||||||

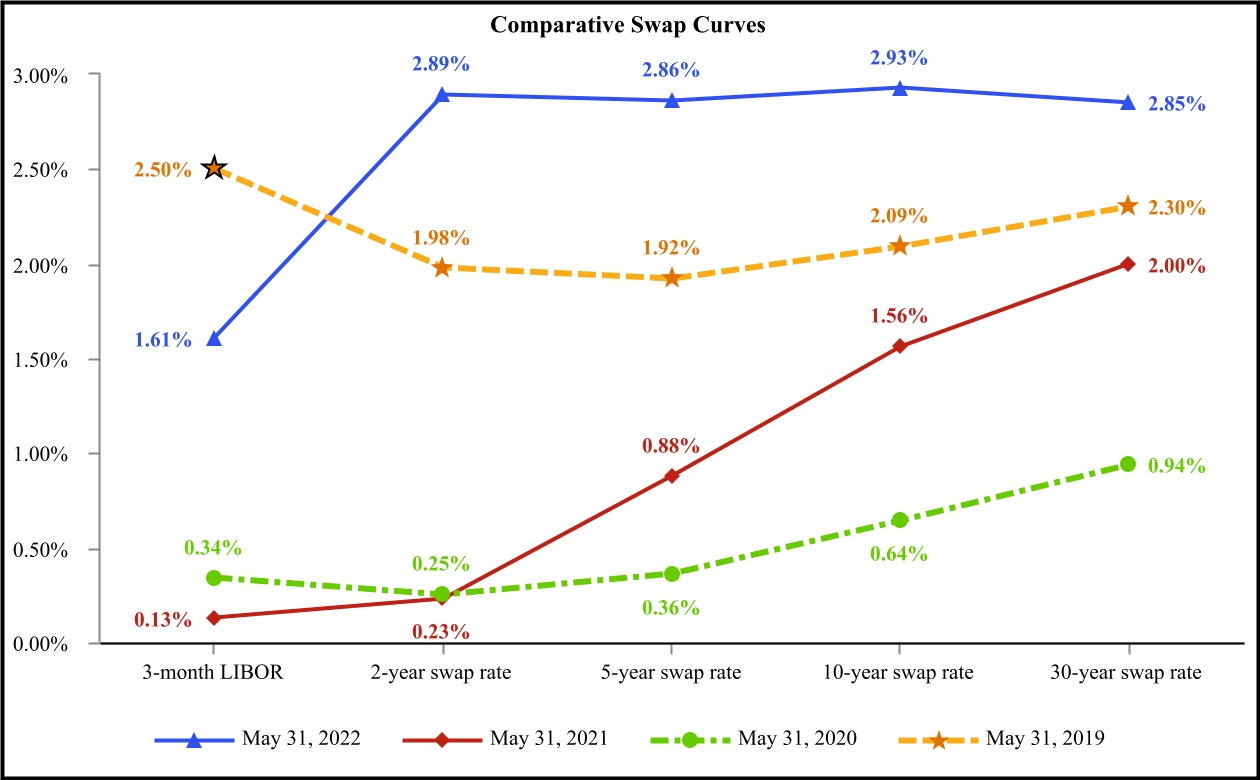

| 7 | Comparative Swap Curves | 46 | ||||||||||||

| 8 | Non-Interest Expense | 47 | ||||||||||||

| 9 | Loans—Outstanding Amount by Member Class and Loan Type | 48 | ||||||||||||

| 10 | Debt—Debt Product Types | 50 | ||||||||||||

| 11 | Total Debt Outstanding and Weighted-Average Interest Rates | 51 | ||||||||||||

| 12 | Member Investments | 53 | ||||||||||||

| 13 | Equity | 54 | ||||||||||||

| 14 | Loans—Loan Portfolio Security Profile | 58 | ||||||||||||

| 15 | Loans—Loan Exposure to 20 Largest Borrowers | 59 | ||||||||||||

| 16 | Loans—Loan Geographic Concentration | 61 | ||||||||||||

| 17 | Loans—Troubled Debt Restructured Loans | 62 | ||||||||||||

| 18 | Loans—Nonperforming Loans | 63 | ||||||||||||

| 19 | Allowance for Credit Losses by Borrower Member Class and Evaluation Methodology | 65 | ||||||||||||

| 20 | Available Liquidity | 68 | ||||||||||||

| 21 | Liquidity Coverage Ratios | 69 | ||||||||||||

| 22 | Committed Bank Revolving Line of Credit Agreements | 70 | ||||||||||||

| 23 | Short-Term Borrowings—Outstanding Amount and Weighted-Average Interest Rates | 72 | ||||||||||||

| 24 | Short-Term Borrowings—Funding Sources | 72 | ||||||||||||

| 25 | Long-Term and Subordinated Debt— Issuances and Repayments | 73 | ||||||||||||

| 26 | Collateral Pledged | 74 | ||||||||||||

| 27 | Loans—Unencumbered Loans | 74 | ||||||||||||

| 28 | Loans—Maturities of Scheduled Principal Payments | 75 | ||||||||||||

| 29 | Contractual Obligations | 76 | ||||||||||||

| 30 | Liquidity—Projected Sources and Uses of Funds | 77 | ||||||||||||

| 31 | Credit Ratings | 78 | ||||||||||||

| 32 | Interest Rate Sensitivity Analysis | 80 | ||||||||||||

| 33 | LIBOR-Indexed Financial Instruments | 81 | ||||||||||||

| 34 | Selected Quarterly Financial Data | 83 | ||||||||||||

| 35 | Adjusted Net Income | 86 | ||||||||||||

| 36 | TIER and Adjusted TIER | 86 | ||||||||||||

| 37 | Adjusted Liabilities and Equity | 88 | ||||||||||||

| 38 | Debt-to-Equity Ratio and Adjusted Debt-to-Equity Ratio | 89 | ||||||||||||

| 39 | Members’ Equity | 89 | ||||||||||||

iii

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K for the fiscal year ended May 31, 2022 (“this Report” or “2022 Form 10-K”) contains certain statements that are considered “forward-looking statements” as defined in and within the meaning of the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements do not represent historical facts or statements of current conditions. Instead, forward-looking statements represent management’s current beliefs and expectations, based on certain assumptions and estimates made by, and information available to, management at the time the statements are made, regarding our future plans, strategies, operations, financial results or other events and developments, many of which, by their nature, are inherently uncertain and outside our control. Forward-looking statements are generally identified by the use of words such as “intend,” “plan,” “may,” “should,” “will,” “project,” “estimate,” “anticipate,” “believe,” “expect,” “continue,” “potential,” “opportunity” and similar expressions, whether in the negative or affirmative. All statements about future expectations or projections, including statements about loan volume, the adequacy of the allowance for credit losses, operating income and expenses, leverage and debt-to-equity ratios, borrower financial performance, impaired loans, and sources and uses of liquidity, are forward-looking statements. Although we believe the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual results and performance may differ materially from our forward-looking statements. Therefore, you should not place undue reliance on any forward-looking statement and should consider the risks and uncertainties that could cause our current expectations to vary from our forward-looking statements, including, but not limited to, legislative changes that could affect our tax status and other matters, demand for our loan products, lending competition, changes in the quality or composition of our loan portfolio, changes in our ability to access external financing, changes in the credit ratings on our debt, valuation of collateral supporting impaired loans, charges associated with our operation or disposition of foreclosed assets, nonperformance of counterparties to our derivative agreements, economic conditions and regulatory or technological changes within the rural electric industry, the costs and impact of legal or governmental proceedings involving us or our members, general economic conditions, governmental monetary and fiscal policies, the occurrence and effect of natural disasters, including severe weather events or public health emergencies, such as the emergence and spread since 2019 of a novel coronavirus (“COVID-19”) and the factors listed and described under “Item 1A. Risk Factors” in this Report. Forward-looking statements speak only as of the date they are made, and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect the impact of events, circumstances or changes in expectations that arise after the date any forward-looking statement is made.

PART I

Item 1. Business

| OVERVIEW | ||

Our financial statements include the consolidated accounts of National Rural Utilities Cooperative Finance Corporation (“CFC”), National Cooperative Services Corporation (“NCSC”), Rural Telephone Finance Cooperative (“RTFC”) and subsidiaries created and controlled by CFC to hold foreclosed assets resulting from defaulted loans or bankruptcy. CFC and its consolidated entities have not held any foreclosed assets since the fiscal year ended May 31, 2017. Our principal operations are currently organized for management reporting purposes into three business segments, which are based on the accounts of each of the legal entities included in our consolidated financial statements and discussed below.

The business affairs of CFC, NCSC and RTFC are governed by separate boards of directors for each entity. We provide information on CFC’s corporate governance in “Item 10. Directors, Executive Officers and Corporate Governance.” We provide information on the members of each of these entities below in “Item 1. Business—Members” and describe the financing products offered to members by each entity under “Item 1. Business—Loan and Guarantee Programs.” Information on the financial performance of our business segments is disclosed in “Note 16—Business Segments.” Unless stated otherwise, references to “we,” “our” or “us” relate to CFC and its consolidated entities. All references to members within this document include members, associates and affiliates of CFC and its consolidated entities, except where indicated otherwise.

1

CFC

CFC is a member-owned, nonprofit finance cooperative association incorporated under the laws of the District of Columbia in April 1969. CFC’s principal purpose is to provide its members with financing to supplement the loan programs of the Rural Utilities Service (“RUS”) of the United States Department of Agriculture (“USDA”). CFC extends loans to its rural electric members for construction, acquisitions, system and facility repairs and maintenance, enhancements and ongoing operations to support the goal of electric distribution and generation and transmission (“power supply”) systems of providing reliable, affordable power to the customers they service. CFC also provides its members with credit enhancements in the form of letters of credit and guarantees of debt obligations. As a cooperative, CFC is owned by and exclusively serves its membership, which consists of not-for-profit entities or subsidiaries or affiliates of not-for-profit entities. CFC is exempt from federal income taxes under Section 501(c)(4) of the Internal Revenue Code. As a member-owned cooperative, CFC’s objective is not to maximize profit, but rather to offer members cost-based financial products and services. As described below under “Allocation and Retirement of Patronage Capital,” CFC annually allocates its net earnings, which consist of net income excluding the effect of certain noncash accounting entries, to: (i) a cooperative educational fund; (ii) a general reserve, if necessary; (iii) members based on each member’s patronage of CFC’s loan programs during the year; and (iv) a members’ capital reserve. CFC funds its activities primarily through a combination of public and private issuances of debt securities, member investments and retained equity. As a Section 501(c)(4) tax-exempt, member-owned cooperative, CFC cannot issue equity securities.

NCSC

NCSC is a taxable cooperative incorporated in 1981 in the District of Columbia as a member-owned cooperative association. The principal purpose of NCSC is to provide financing to its members, entities eligible to be members of CFC and the for-profit and not-for-profit entities that are owned, operated or controlled by, or provide significant benefit to Class A, B and C members of CFC. See “Members” below for a description of our member classes. NCSC’s membership consists of distribution systems, power supply systems and statewide and regional associations that were members of CFC as of May 31, 2022. CFC, which is the primary source of funding for NCSC, manages NCSC’s business operations under a management agreement that is automatically renewable on an annual basis unless terminated by either party. NCSC pays CFC a fee and, in exchange, CFC reimburses NCSC for loan losses under a guarantee agreement. As a taxable cooperative, NCSC pays income tax based on its reported taxable income and deductions. NCSC is headquartered with CFC in Dulles, Virginia.

RTFC

RTFC is a taxable Subchapter T cooperative association originally incorporated in South Dakota in 1987 and reincorporated as a member-owned cooperative association in the District of Columbia in 2005. RTFC’s principal purpose is to provide financing for its rural telecommunications members and their affiliates. RTFC’s membership consists of a combination of not-for-profit and for-profit entities. CFC is the sole lender to and manages RTFC’s business operations through a management agreement that is automatically renewable on an annual basis unless terminated by either party. RTFC pays CFC a fee and, in exchange, CFC reimburses RTFC for loan losses under a guarantee agreement. As permitted under Subchapter T of the Internal Revenue Code, RTFC pays income tax based on its taxable income, excluding patronage-sourced earnings allocated to its patrons. RTFC is headquartered with CFC in Dulles, Virginia.

| OUR BUSINESS | ||

CFC was established by and for the rural electric cooperative network to provide affordable financing alternatives to electric cooperatives. While our business strategy and policies are set by the CFC Board of Directors and may be amended or revised from time to time, the fundamental goal of our overall business model is to work with our members to ensure that CFC is able to meet their financing needs, as well as provide industry expertise and strategic services to aid them in delivering affordable and reliable essential services to their communities.

2

Focus on Electric Lending

As a member-owned, nonprofit finance cooperative, our primary objective is to provide our members with the credit products they need to fund their operations. As such, we primarily focus on lending to electric systems and securing access to capital through diverse funding sources at rates that allow us to offer cost-based credit products to our members. Rural electric cooperatives, most of which are not-for-profit entities, were established to provide electricity in rural areas historically deemed too costly to be served by investor-owned utilities. As such, our electric cooperative members experience limited competition because they generally operate in exclusive territories, the majority of which are not rate regulated. Loans to electric utility organizations accounted for approximately 98% and 99% of our total loans outstanding as of May 31, 2022 and 2021, respectively. Substantially all of our electric cooperative borrowers continued to demonstrate stable operating performance and strong financial ratios as of May 31, 2022.

Maintain Diversified Funding Sources

We strive to maintain diversified funding sources beyond capital market offerings of debt securities. We offer various short- and long-term unsecured investment products to our members and affiliates, including commercial paper, select notes, daily liquidity fund notes, medium-term notes and subordinated certificates. We continue to issue debt securities, such as secured collateral trust bonds, unsecured medium-term notes and dealer commercial paper, in the capital markets. We also have access to funds through bank revolving line of credit arrangements, government-guaranteed programs such as funding from the Federal Financing Bank that is guaranteed by RUS through the Guaranteed Underwriter Program of the USDA (the “Guaranteed Underwriter Program”), as well as private placement note purchase agreements with the Federal Agricultural Mortgage Corporation (“Farmer Mac”). We provide additional information on our funding sources in “Item 7. MD&A—Consolidated Balance Sheet Analysis,” “Item 7. MD&A—Liquidity Risk,” “Note 6—Short-Term Borrowings,” “Note 7—Long-Term Debt,” “Note 8—Subordinated Deferrable Debt” and “Note 9—Members’ Subordinated Certificates.”

| MEMBERS | ||

Our consolidated membership, after taking into consideration entities that are members of both CFC and NCSC and eliminating overlapping members between CFC, NCSC and RTFC, totaled 1,425 members and 248 associates as of May 31, 2022, compared with 1,424 members and 246 associates as of May 31, 2021.

CFC

CFC lends to its members and associates and also provides credit enhancements in the form of guarantees of debt obligations and letters of credit. Membership in CFC is limited to cooperative or not-for-profit rural electric systems that are eligible to borrow from RUS under its Electric Loan Program and affiliates of these entities. CFC categorizes its members, all of which are not-for-profit entities or subsidiaries or affiliates of not-for-profit entities, into classes based on member type because the demands and needs of each member class differs. Affiliates represent holding companies, subsidiaries and other entities that are owned, controlled or operated by members. Members are not required to have outstanding loans from RUS as a condition of borrowing from CFC. CFC membership consists of members in 50 states and three U.S. territories. In addition to members, CFC has associates that are nonprofit groups or entities organized on a cooperative basis that are owned, controlled or operated by members and are engaged in or plan to engage in furnishing non-electric services primarily for the benefit of the ultimate consumers of CFC members. Associates are not eligible to vote on matters put to a vote of the membership. CFC’s members, by member class, and associates were as follows as of May 31, 2022.

3

| CFC Member | ||||||||||||||

| Member Type | Class | May 31, 2022 | ||||||||||||

| Distribution systems | A | 842 | ||||||||||||

| Power supply systems | B | 68 | ||||||||||||

| Statewide and regional associations, including NCSC | C | 62 | ||||||||||||

National association of cooperatives(1) | D | 1 | ||||||||||||

| Total CFC members | 973 | |||||||||||||

| Associates, including RTFC | 45 | |||||||||||||

| Total CFC members and associates | 1,018 | |||||||||||||

____________________________

(1) National Rural Electric Cooperative Association is our sole class D member.

NCSC

Membership in NCSC includes organizations that are Class A, B and C members of CFC, or eligible for such membership and are approved for membership by the NCSC Board of Directors. In addition to members, NCSC has associates that may include members of CFC, entities eligible to be members of CFC and for-profit and not-for-profit entities owned, controlled or operated by, or provide significant benefit to, Class A, B and C members of CFC. All of NCSC’s members also were CFC members as of May 31, 2022. CFC is not, however, a member of NCSC. NCSC’s members and associates were as follows as of May 31, 2022.

| CFC Member | ||||||||||||||

| Member Type | Class | May 31, 2022 | ||||||||||||

| Distribution systems | A | 447 | ||||||||||||

| Power supply systems | B | 3 | ||||||||||||

| Statewide associations | C | 6 | ||||||||||||

| Total NCSC members | 456 | |||||||||||||

| Associates | 198 | |||||||||||||

| Total NCSC members and associates | 654 | |||||||||||||

RTFC

Membership in RTFC is limited to cooperative corporations, nonprofit corporations, private corporations, public corporations, utility districts and other public bodies that are approved by the RTFC Board of Directors and are actively borrowing or are eligible to borrow from RUS’s traditional infrastructure loan program. These companies must be engaged directly or indirectly in furnishing telephone services as the licensed incumbent carrier. Holding companies, subsidiaries and other organizations that are owned, controlled or operated by members, which are referred to as affiliates, are eligible to borrow from RTFC. Associates are organizations that provide non-telephone or non-telecommunications services to rural telecommunications companies that are approved by the RTFC Board of Directors. Neither affiliates nor associates are eligible to vote on matters put to a vote of the membership. CFC and NCSC are not members of RTFC. RTFC’s members and associates were as follows as of May 31, 2022.

| Member Type | May 31, 2022 | |||||||

| Members | 453 | |||||||

| Associates | 6 | |||||||

| Total RTFC members and associates | 459 | |||||||

4

| LOAN AND GUARANTEE PROGRAMS | ||

CFC lends to its members and associates and also provides credit enhancements in the form of guarantees of debt obligations and letters of credit. NCSC and RTFC also lend and provide credit enhancements to their members and associates. For information on the membership of CFC, NCSC and RTFC, see “Item 1. Business—Members.”

CFC, NCSC and RTFC loan commitments generally contain provisions that restrict borrower advances or trigger an event of default if there is any material adverse change in the business or condition, financial or otherwise, of the borrower. Below is additional information on the loan and guarantee programs offered by CFC, NCSC and RTFC.

CFC Loan Programs

Long-Term Loans

CFC’s long-term loans generally have the following characteristics:

•terms of up to 35 years on a senior secured basis and terms of up to five years on an unsecured basis;

•amortizing, bullet maturity or serial payment structures;

•the property, plant and equipment financed by and securing the long-term loan has a useful life generally equal to or in excess of the loan maturity;

•flexibility for the borrower to select a fixed interest rate for periods of one to 35 years or a variable interest rate; and

•the ability for the borrower to select various tranches with either a fixed or variable interest rate for each tranche.

Borrowers typically have the option of selecting a fixed or variable interest rate at the time of each advance on long-term loan facilities. When selecting a fixed rate, the borrower has the option to choose a fixed rate for a term of one year through the final maturity of the loan. When the selected fixed interest rate term expires, the borrower may select another fixed rate for a term of one year through the remaining loan maturity or the current variable rate.

To be in compliance with the covenants in the loan agreement and eligible for loan advances, distribution systems generally must maintain an average modified debt service coverage ratio, as defined in the loan agreement, of 1.35 or greater. CFC may make long-term loans to distribution systems, on a case-by-case basis, that do not meet this general criterion. Power supply systems generally are required: (i) to maintain an average debt service coverage ratio, as defined in the loan agreement, of 1.00 or greater; (ii) to establish and collect rates and other revenue in an amount to yield margins for interest, as defined in an indenture, in each fiscal year sufficient to equal at least 1.00; or (iii) both. CFC may make long-term loans to power supply systems, on a case-by-case basis, that may include other requirements, such as maintenance of a minimum equity level.

Line of Credit Loans

Line of credit loans are designed primarily to assist borrowers with liquidity and cash management and are generally advanced at variable interest rates. Line of credit loans are typically revolving facilities. Certain line of credit loans require the borrower to pay off the principal balance for at least five consecutive business days at least once during each 12-month period. Line of credit loans are generally unsecured and may be conditional or unconditional facilities.

Line of credit loans can be made on an emergency basis when financing is needed quickly to address weather-related or other unexpected events and can also be made available as interim financing when a member either receives RUS approval to obtain a loan and is awaiting its initial advance of funds or submits a loan application that is pending approval from RUS (sometimes referred to as “bridge loans”). In these cases, when the borrower receives the RUS loan advance, the funds must be used to repay the bridge loans.

Syndicated Line of Credit and Term Loans

Syndicated line of credit and term loans are typically large financings offered by a group of lenders that work together to provide funds for a single borrower. Syndicated loans are generally unsecured, floating-rate loans that can be provided on a

5

revolving or term basis for tenors that range from several months to five years. Syndicated financings are arranged for borrowers on a case-by-case basis. CFC may act as lead lender, arranger and/or administrative agent for the syndicated facilities. CFC will syndicate these line of credit facilities on a best effort basis.

NCSC Loan Programs

NCSC makes loans to electric cooperatives and their subsidiaries that provide non-electric services in the energy and telecommunication industries as well as to entities that provide substantial benefit to CFC members, including eligible solar energy providers and investor-owned utilities. Loans to NCSC associates may require a guarantee of repayment to NCSC from the CFC member cooperative with which it is affiliated.

Long-Term Loans

NCSC’s long-term loans generally have the following characteristics:

•terms up to 30 years on a senior secured basis and terms of up to five years on an unsecured basis;

•amortizing, balloon, bullet maturity or serial payment structures;

•the property, plant and equipment financed by and securing the long-term loan has a useful life equal to or in excess of the loan maturity;

•flexibility for the borrower to select a fixed interest rate for periods of one to 30 years or a variable interest rate; and

•the ability for the borrower to select various tranches with either a fixed or variable interest rate for each tranche.

NCSC allows borrowers to select a fixed interest rate or a variable interest rate at the time of each advance on long-term loan facilities. When selecting a fixed rate, the borrower has the option to choose a fixed rate for a term of one year through the final maturity of the loan. When the selected fixed interest rate term expires, the borrower may select another fixed rate for a term of one year through the remaining loan maturity or the current variable rate. The fixed rate on a loan generally is determined on the day the loan is advanced or repriced based on the term selected.

Line of Credit Loans

NCSC also provides revolving line of credit loans to assist borrowers with liquidity and cash management on terms similar to those provided by CFC as described herein.

RTFC Loan Programs

RTFC primarily makes long-term loans to rural local exchange carriers or holding companies of rural local exchange carriers for debt refinancing, construction or upgrades of infrastructure, acquisitions and other corporate purposes. Most of these rural telecommunications companies have diversified their operations and also provide broadband services.

Long-Term Loans

RTFC’s long-term loans generally have the following characteristics:

•terms not exceeding 10 years on a senior secured basis and terms of up to five years on an unsecured basis;

•amortizing or bullet maturity payment structures;

•the property, plant and equipment financed by and securing the long-term loan has a useful life generally equal to or in excess of the loan maturity;

•flexibility for the borrower to select a fixed interest rate for periods from one year to the final loan maturity or a variable interest rate; and

•the ability for the borrower to select various tranches with either a fixed or variable interest rate for each tranche.

When a selected fixed interest rate term expires, generally the borrower may select another fixed-rate term or the current variable rate. The fixed rate on a loan is generally determined on the day the loan is advanced or converted to a fixed rate based on the term selected.

6

To borrow from RTFC, a rural telecommunication system generally must be able to demonstrate the ability to achieve and maintain an annual debt service coverage ratio of 1.25. RTFC may make long-term loans to rural telecommunication systems, on a case-by-case basis, that do not meet this general criterion.

Line of Credit Loans

RTFC also provides revolving line of credit loans to assist borrowers with liquidity and cash management on terms similar to those provided by CFC as described herein.

Loan Features and Options

Interest Rates

As a member-owned cooperative finance organization, CFC is a cost-based lender. As such, our interest rates are set based on a yield that we believe will generate a reasonable level of earnings to cover our cost of funding, general and administrative expenses and provision for credit losses. Long-term fixed rates are set daily for new loan advances and loans that reprice. The fixed rate on each loan is generally determined on the day the loan is advanced or repriced based on the term selected. The variable rate is established monthly. Various standardized discounts may reduce the stated interest rates for borrowers meeting certain criteria related to performance, volume, collateral and equity requirements.

Conversion Option

Generally, a borrower may convert a long-term loan from a variable interest rate to a fixed interest rate at any time without a fee and convert a long-term loan from a fixed rate to another fixed rate or to a variable rate at any time generally subject to a make-whole premium.

Prepayment Option

Generally, borrowers may prepay long-term fixed-rate loans at any time, subject to payment of an administrative fee and a make-whole premium, and prepay long-term variable-rate loans at any time, subject to payment of an administrative fee. Line of credit loans may be prepaid at any time without a fee.

Loan Security

Long-term loans made by CFC typically are senior secured on parity with other secured lenders (primarily RUS), if any, by all assets and revenue of the borrower, subject to standard liens typical in utility mortgages such as those related to taxes, worker’s compensation awards, mechanics’ and similar liens, rights-of-way and governmental rights. We are able to obtain liens on parity with liens for the benefit of RUS because RUS’ form of mortgage expressly provides for other lenders such as CFC to have a parity lien position if the borrower satisfies certain conditions or obtains a written lien accommodation from RUS. When we make loans to borrowers that have existing loans from RUS, we generally require those borrowers to either obtain such a lien accommodation or satisfy the conditions necessary for our loan to be secured on parity under the mortgage with the loan from RUS. As noted above, CFC line of credit loans generally are unsecured.

We provide additional information on our loan programs in the sections “Item 7. MD&A—Consolidated Balance Sheet Analysis,” and “Item 7. MD&A—Credit Risk.”

Guarantee Programs

When we guarantee our members’ debt obligations, we use the same credit policies and monitoring procedures for guarantees as for loans. If a member system defaults in its obligation to pay debt service, then we are obligated to pay any required amounts under our guarantees. Meeting our guarantee obligations satisfies the underlying obligation of our member systems and prevents the exercise of remedies by the guarantee beneficiary based upon a payment default by a member system. The member system is required to repay any amount advanced by us with interest pursuant to the documents evidencing the member system’s reimbursement obligation.

7

Guarantees of Long-Term Tax-Exempt Bonds

We guarantee debt issued for our members’ construction or acquisition of pollution control, solid waste disposal, industrial development and electric distribution facilities. Governmental authorities issue such debt on a nonrecourse basis and the interest thereon is exempt from federal taxation. The proceeds of the offering are made available to the member system, which in turn is obligated to pay the governmental authority amounts sufficient to service the debt.

If a system defaults for failure to make the debt payments and any available debt service reserve funds have been exhausted, we are obligated to pay scheduled debt service under our guarantee. Such payment will prevent the occurrence of an event of payment default that would otherwise permit acceleration of the bond issue. The system is required to repay any amount that we advance pursuant to our guarantee plus interest on that advance. This repayment obligation, together with the interest thereon, is typically senior secured on parity with other lenders (including, in most cases, RUS), by a lien on substantially all of the system’s assets. If the security instrument is a common mortgage with RUS, then in general, we may not exercise remedies for up to two years following default. However, if the debt is accelerated under the common mortgage because of a determination that the related interest is not tax-exempt, the system’s obligation to reimburse us for any guarantee payments will be treated as a long-term loan. The system is required to pay us initial and/or ongoing guarantee fees in connection with these transactions.

Certain guaranteed long-term debt bears interest at variable rates that are adjusted at intervals of one to 270 days including weekly, every five weeks or semi-annually to a level favorable to their resale or auction at par. If funding sources are available, the member that issued the debt may choose a fixed interest rate on the debt. When the variable rate is reset, holders of variable-rate debt have the right to tender the debt for purchase at par. In some transactions, we have committed to purchase this debt as liquidity provider if it cannot otherwise be re-marketed. If we hold the securities, the member cooperative pays us the interest earned on the bonds or interest calculated based on our short-term variable interest rate, whichever is greater. The system is required to pay us stand-by liquidity fees in connection with these transactions.

Letters of Credit

In exchange for a fee, we issue irrevocable letters of credit to support members’ obligations to energy marketers, other third parties and to the USDA Rural Business-Cooperative Service. Each letter of credit is supported by a reimbursement agreement with the member on whose behalf the letter of credit was issued. In the event a beneficiary draws on a letter of credit, the agreement generally requires the member to reimburse us within one year from the date of the draw, with interest accruing from the draw date at our line of credit variable interest rate.

The U.S. Federal Communications Commission (“FCC”) has designated CFC as an acceptable source for letters of credit in support of USDA and FCC programs that encourage deployment of high-speed broadband services throughout rural America. The designation allows CFC to provide credit support for rural electric cooperatives and telecommunication providers that participate in programs designed to increase deployment of broadband services to underserved rural areas.

Other Guarantees

We may provide other guarantees as requested by our members. Other guarantees are generally unsecured with guarantee fees payable to us.

We provide additional information on our guarantee programs and outstanding guarantee amounts as of May 31, 2022 and 2021 in “Note 13—Guarantees.”

8

| INVESTMENT POLICY | ||

We invest funds in accordance with policies adopted by our board of directors. Pursuant to our current investment policy, an Investment Management Committee was established to oversee and administer our investments with the objective of seeking returns consistent with the preservation of principal and to provide a supplementary source of liquidity. The Investment Management Committee may direct funds to be invested in direct obligations of, or obligations guaranteed by, the United States (“U.S.”) or agencies thereof and investments in relatively short-term U.S. dollar-denominated fixed-income securities such as government-sponsored enterprises, certain financial institutions in the form of overnight investment products and Eurodollar deposits, bankers’ acceptances, certificates of deposit, working capital acceptances or other deposits. Other permitted investments include highly rated obligations, such as commercial paper, certain obligations of foreign governments, municipal securities, asset-backed securities, mortgage-backed securities and certain corporate bonds. In addition, we may invest in overnight or term repurchase agreements. Investments are denominated in U.S. dollars exclusively. All of these investments are subject to requirements and limitations set forth in our board investment policy.

| INDUSTRY | ||

Overview

Our rural electric cooperative members operate in the energy sector, which is one of 16 critical infrastructure sectors identified by the U.S. government because the services provided by each sector, all of which have an impact on other sectors, are deemed as essential in supporting and maintaining the overall functioning of the U.S. economy. Rural electric cooperatives are an integral part of the U.S. electric utility industry, a sub-sector of the energy sector. According to the National Rural Electric Cooperative Association (“NRECA”,) electric cooperatives serve as power providers for approximately 1 in 8 individuals in the U.S., totaling approximately 42 million people, including over 20 million businesses, homes, schools and farms across 48 states. Electric cooperatives provide power to approximately 56% of the nation’s land mass. Based on the latest annual data reported by the U.S. Energy Information Administration, a statistical and analytical agency within the U.S. Department of Energy, the electric utility industry had revenue of approximately $394 billion in 2020.

CFC was established by electric utility cooperatives to serve as a supplemental financing source to RUS loan programs and to mitigate uncertainty related to government funding. CFC aggregates the combined strength of its rural electric member cooperatives to access the public capital markets and other funding sources. CFC works cooperatively with RUS; however, CFC is not a federal agency or a government-sponsored enterprise. CFC meets the financial needs of its rural electric members by:

•providing financing to RUS-eligible rural electric utility systems for infrastructure, including for those facilities that are not eligible for financing from RUS;

•providing bridge loans required by borrowers in anticipation of receiving RUS funding;

•providing financial products not otherwise available from RUS, including lines of credit, letters of credit, guarantees on tax-exempt financing, weather-related emergency lines of credit, unsecured loans and investment products such as commercial paper, select notes, medium-term notes and member capital securities; and

•meeting the financing needs of those rural electric systems that repay or prepay their RUS loans and replace the government loans with private capital.

Electric Member Operating Environment

In general, electric cooperatives have not been significantly impacted by the effects of retail deregulation. There were 19 states that had adopted programs that allow consumers to choose their supplier of electricity as of May 31, 2022. Depending on the state, the choices can range from being limited to commercial and industrial consumers to “retail choice” for all consumers. In most states, cooperatives have been exempted from or have been allowed to opt out of the regulations allowing for competition. In states offering retail competition, it is important to note that while consumers may be able to

9

choose their energy supplier, the electric utility still receives compensation for the necessary service of delivering electricity to consumers through its utility transmission and distribution plant.

The electric utility industry is facing a potential decrease to kilowatt-hour sales due to technology advances that increase energy efficiency of all appliances and devices used in the home and in businesses as well as from distributed generation in the form of rooftop solar and home generators (“behind-the-meter generation”). Electric cooperatives are facing the same issues, but in general to a lesser extent than investor-owned power systems. To date, we have not seen negative impacts in the electric cooperative financial results due to behind-the-meter generation.

Electric cooperatives have options to mitigate the impact of such issues, such as rate structures to ensure that costs are appropriately recovered for grid and other necessary ancillary services and the use of electricity for end-uses that would otherwise be powered by fossil fuels where doing so reduces emissions and saves consumers money (“beneficial electrification”). The push away from fossil fuel use may continue the trend toward beneficial electrification such as the adoption of electric vehicles, which may increase kilowatt-hour sales to many utilities. Beneficial electrification may also improve the utilities’ ability to balance load profiles by leveraging and balancing consumer and system assets such as electric vehicles and battery storage.

Facilitation of Rural Broadband Expansion by Electric Cooperatives

Many electric cooperatives are making investments in fiber to support core electric plant communications. Some of these electric cooperatives are leveraging these fiber assets to offer broadband services, either directly or through partnering with local telecommunication companies and others. Over 30 electric cooperatives were awarded approximately $250 million in federal funding through the Connect America Fund Phase II auction (“CAF II”) process by the FCC that was held in 2018. The awarded funds are being distributed over a 10-year period. More than 190 electric cooperatives, many of which are already offering or building out projects, were awarded approximately $1.6 billion though the FCC’s Rural Development Opportunity Fund (“RDOF”). Those funds also will be distributed over a 10-year period. As federal and state governments increase funding opportunities for electric cooperatives in order to offer broadband services, we will continue to increase our credit support, which may include loans and/or letters of credit, to borrowers who participate in CAF II, RDOF and other programs designed to increase broadband services in rural areas. CFC began tracking loans for broadband services in October 2017. We estimate, based on information available to us, loans outstanding to our members related to the construction and operation of broadband services increased to approximately $1,647 million as of May 31, 2022, from approximately $854 million as of May 31, 2021.

Regulatory Oversight of Electric Cooperatives

There are 11 states in which some or all electric cooperatives are subject to state regulatory oversight of their rates and tariffs by state utility commissions and do not have a right to opt out of regulation. Those states are Arizona, Arkansas, Hawaii, Kentucky, Louisiana, Maine, Maryland, New Mexico, Vermont, Virginia and West Virginia. Regulatory jurisdiction by state commissions generally includes rate and tariff regulation, the issuance of securities and the enforcement of service territory as provided for by state law.

The Federal Energy Regulatory Commission (“FERC”) has regulatory authority over three aspects of electric power, as provided for under Parts II and III of the Federal Power Act (“FPA”):

•the transmission of electric energy in interstate commerce;

•the sale of electric energy at wholesale in interstate commerce; and

•the approval and enforcement of reliability standards affecting all users, owners and operators of the bulk power system.

In addition, FERC regulates the issuance of securities by public utilities under the FPA in the event the applicable state commission does not.

Our electric distribution and power supply members are subject to regulation by various federal, regional, state and local authorities with respect to the environmental effects of their operations. At the federal level, the U.S. Environmental Protection Agency (“EPA”) from time to time proposes rulemakings that could force the electric utility industry to incur capital costs to comply with potential new regulations and possibly retire coal-fired generating capacity. Since there are only

10

11 states in which some or all electric cooperatives are subject to state regulatory oversight of their rates and tariffs, in most cases any associated costs of compliance can be passed on to cooperative consumers without additional regulatory approval.

On June 30, 2022, the Supreme Court limited the power of the EPA to regulate greenhouse gas emissions from existing power plants. The Supreme Court noted that Congress did not give the EPA the authority to adopt a regulatory scheme that devised emissions caps based on the generation-shifting approach the EPA took in the Clean Power Plan, a 2015 rule that was previously repealed. However, the Supreme Court also noted that it was not deciding whether EPA's authority was limited solely to measures that improve the pollution performance of specific individual sources.

| LENDING COMPETITION | ||

Overview

RUS is the largest lender to electric cooperatives, providing them with long-term secured loans. CFC provides financial products and services to its members, primarily in the form of long-term secured and short-term unsecured loans, to supplement RUS financing, to provide loans to members that have elected not to borrow from RUS, and to bridge long-term financing provided by RUS. We also offer other financing options, such as credit support in the form of letters of credit and guarantees, loan syndications and loan participations. Our credit products are tailored to meet the specific needs of each borrower, and we often offer specific transaction structures that our competitors do not provide. CFC also offers certain risk-mitigation products and interest rate discounts on secured, long-term loans for its members that meet performance, volume, collateral and equity requirements.

Primary Lending Competitors

CFC’s primary competitor is CoBank, ACB, a federally chartered instrumentality of the U.S. that is a member of the Farm Credit System. CFC also competes with banks, other financial institutions and the capital markets to provide loans and other financial products to our members. As a result, we are competing with the customer service, pricing and funding options our members are able to obtain from these sources. We attempt to minimize the effect of competition by offering a variety of loan options and value-added services and by leveraging the working relationships developed with the majority of our members over the past 53 years. Further, on an annual basis, we allocate substantially all net earnings to members (i) in the form of patronage capital, which reduces our members’ effective cost of borrowing, and (ii) through the members’ capital reserve. The value-added services that we provide include, but are not limited to, benchmarking tools, financial models, publications and various conferences, meetings, facilitation services and training workshops.

We are not able to specifically identify the amount of debt our members have outstanding to CoBank, ACB from either the annual financial and statistical reports our members file with us or from CoBank, ACB’s public disclosure; however, we believe CoBank, ACB is the additional lender, along with CFC and RUS, with significant long-term debt outstanding to rural electric cooperatives.

Rural Electric Lending Market

Most of our rural electric borrowers are non-for-profit, private companies owned by the members they serve. As such, there is limited publicly available information to accurately determine the overall size of the rural electric lending market. We utilize the annual financial and statistical reports submitted to us by our members to estimate the overall size of the rural electric lending market. The substantial majority of our members have a fiscal year-end that corresponds with the calendar year-end. Therefore, the annual information we use to estimate the size of the rural electric market is typically based on the calendar year-end rather than CFC’s fiscal year-end.

Based on financial data submitted to us by our electric utility members, we present the long-term debt outstanding to CFC by member class, RUS and other lenders in the electric cooperative industry as of December 31, 2021 and 2020 in the table below. The data presented as of December 31, 2021, were based on information reported by 812 distribution systems and 47 power supply systems. The data presented as of December 31, 2020, were based on information reported by 811 distribution systems and 52 power supply systems.

11

| December 31, | ||||||||||||||||||||||||||

| 2021 | 2020 | |||||||||||||||||||||||||

| (Dollars in thousands) | Debt Outstanding | % of Total | Debt Outstanding | % of Total | ||||||||||||||||||||||

Total long-term debt reported by members:(1) | ||||||||||||||||||||||||||

| Distribution | $ | 54,909,778 | $ | 52,274,309 | ||||||||||||||||||||||

| Power supply | 39,789,348 | 44,830,704 | ||||||||||||||||||||||||

| Less: Long-term debt funded by RUS | (41,511,338) | (39,660,041) | ||||||||||||||||||||||||

| Members’ non-RUS long-term debt | $ | 53,187,788 | $ | 57,444,972 | ||||||||||||||||||||||

| Funding sources of members’ long-term debt: | ||||||||||||||||||||||||||

| Long-term debt funded by CFC by member class: | ||||||||||||||||||||||||||

| Distribution | $ | 21,287,049 | 40 | % | $ | 20,382,616 | 36 | % | ||||||||||||||||||

| Power supply | 4,791,465 | 9 | 4,723,956 | 8 | ||||||||||||||||||||||

| Long-term debt funded by CFC | 26,078,514 | 49 | 25,106,572 | 44 | ||||||||||||||||||||||

| Long-term debt funded by other lenders | 27,109,274 | 51 | 32,338,400 | 56 | ||||||||||||||||||||||

| Members’ non-RUS long-term debt | $ | 53,187,788 | 100 | % | $ | 57,444,972 | 100 | % | ||||||||||||||||||

____________________________

(1) Reported amounts are based on member-provided financial information, which may not have been subject to audit by an independent accounting firm.

While we believe our estimates of the overall size of the rural electric lending market serve as a useful tool in gauging the size of this lending sector, they should be viewed as estimates rather than precise measures as there are certain limitations in our estimation methodology, including, but not limited to, the following:

•Although certain underlying data included in the financial and statistical reports provided to us by members may have been audited by an independent accounting firm, our accumulation of the data from these reports has not been subject to a review for accuracy by an independent accounting firm.

•The data presented is not necessarily inclusive of all members because in some cases our receipt of annual member financial and statistical reports may be delayed and not received in a timely manner to incorporate into our market estimates.

•The financial and statistical reports submitted by members include information on indebtedness to RUS, but the reports do not include comprehensive data on indebtedness to other lenders and are not on a consolidated basis.

| REGULATION | ||

General

CFC, NCSC and RTFC are not subject to direct federal regulatory oversight or supervision with regard to lending. CFC, NCSC and RTFC are subject to state and local jurisdiction commercial lending and tax laws that pertain to business conducted in each state, including but not limited to lending laws, usury laws and laws governing mortgages. These state and local laws regulate the manner in which we make loans and conduct other types of transactions. The statutes, regulations and policies to which the companies are subject may change at any time. In addition, the interpretation and application by regulators of the laws and regulations to which we are subject may change from time to time. Certain of our contractual arrangements, such as those pertaining to funding obtained through the Guaranteed Underwriter Program, provide for the Federal Financing Bank and RUS to periodically review and assess CFC’s compliance with program terms and conditions.

Derivatives Regulation

CFC engages in over-the-counter (“OTC”) derivative transactions, primarily interest rate swaps, to hedge interest rate risk. As an end user of derivative financial instruments, CFC is subject to regulations that apply to derivatives generally. The Dodd-Frank Act (“DFA”), enacted July 2010, resulted in, among other things, comprehensive regulation of the OTC

12

derivatives market. The DFA provides for an extensive framework for the regulation of OTC derivatives, including mandatory clearing, exchange trading and transaction reporting of certain OTC derivatives. Subsequent to the enactment of the DFA, the U.S. Commodity Futures Trading Commission (“CFTC”) issued a final rule, “Clearing Exemption for Certain Swaps Entered into by Cooperatives,” which created an exemption from mandatory clearing for cooperatives. The CFTC’s final rule, “Margin Requirements for Uncleared Swaps for Swap Dealers and Major Swap Participants,” includes an exemption from margin requirements for uncleared swaps for cooperatives that are financial end users. CFC is an exempt cooperative end user of derivative financial instruments and does not participate in the derivatives markets for speculative, trading or investing purposes and does not make a market in derivatives.

| HUMAN CAPITAL MANAGEMENT | ||

CFC’s success in providing industry expertise and responsive service to meet the needs of our members across the U.S. is dependent on the quality of service provided by our employees and their relationships with our members. We therefore strive to align our human capital management strategy with our member-focused mission and core values of service, integrity and excellence. Our objectives are (i) to attract, develop and retain a highly qualified workforce with diverse backgrounds and experience in multiple areas whose skills and strengths are consistent with CFC’s mission, and (ii) to create an engaged, inclusive and collaborative work culture, both of which we believe are critical to deliver exceptional service to our members.

Governance of Human Capital

CFC’s executive leadership team and board of directors work together to provide oversight on most human capital matters. The compensation committee of the board of directors meets quarterly to review updates to our compensation programs including our salary structure, incentive plans and executive compensation. Our board is provided with periodic updates on succession planning efforts, current human capital management risks and mitigation efforts in addition to any other matters that affect our ability to attract, develop and maintain the talent needed to execute on our corporate objectives.

Recruiting and Retaining Talent

As a financial services organization, our recruitment goal is to attract and retain a highly skilled workforce in a highly competitive talent market. We strive to provide both external candidates and internal employees who are seeking a different role with challenging and stimulating career opportunities ranging from entry-level to management and executive positions.

We use a variety of methods to attract highly talented and engaged professionals, including outreach to local universities, recruitment job boards including sites focusing on diversity, a referral bonus program and targeted industry-related job posting sites. When appropriate, we engage with recruiting firms to ensure that we have surveyed a broad scope of active and passive candidates for certain critical positions. We strive to ensure that our employment value proposition presented to candidates accurately reflects the features of working for a mission-driven cooperative like CFC so that we can attract individuals who are highly engaged with our vision to be our members’ most trusted financial resource.

Because much of our business operations involves significant member-facing interaction with a relatively stable base of long-standing member borrowers, we place a priority on the retention of high-performing employees who have extensive, in-depth experience serving the needs of our members. In the prior four fiscal years, our voluntary turnover rate has remained at or below 10%; however, in fiscal year 2022 it substantially increased to 19%. Multiple factors including the COVID-19 pandemic, competition in the labor market, as well as increased CFC staff retirements contributed to the staff turnover increase. Our total turnover remains lower than the average annual financial industry sector separation rates reported by the U.S. Bureau of Labor Statistics. Retirements represented 37% of the departures from CFC in fiscal year 2022, which is a 7% increase over last year. We welcomed 55 new hires this fiscal year and employed 259 staff members as of May 31, 2022, all of which were located in the U.S. The majority of our workforce is located in our headquarters in Dulles, Virginia.

CFC’s organizational structure has experienced significant changes this fiscal year resulting from the appointment of a new chief executive officer in May 2021 and subsequent changes to the executive team composition. Four senior vice president positions were filled through promotions and one was an external hire. This change in the executive level has also resulted

13

in many new opportunities for advancement at other levels within the organization. Of the positions filled by promotion or external hire this fiscal year, 43% were through internal promotions.

Employee Engagement and Development

As part of our efforts to promote an engaged, inclusive and collaborative workplace culture, we encourage employees to expand their capabilities and enhance their career potential through employer-funded onsite training, external training, tuition assistance and professional events. In fiscal year 2022, CFC employees completed more than 3,000 training hours through our internal corporate training as well as through our support of employees’ enrollment in external professional training opportunities. We seek to tailor our training programs to evolving events and employee interests. Examples of training programs offered in the reporting period include Developing Resilience—Balancing Work and Life, Developing Your Leadership Potential, Advanced Leadership Skills, professional and technical topics, and mental health awareness workshops to promote employee well-being. CFC also supports employee development though a company-sponsored Toastmasters chapter, guest speakers from cooperative partners and, when feasible, staff trips to local electric cooperatives to allow new employees to learn first-hand how their efforts contribute to our members’ success.

Compensation and Benefits Packages

Attracting, developing and retaining high-level talent is a key component of our human capital objectives, so we seek to provide competitive compensation and benefits packages. CFC launched an employee Total Rewards survey this fiscal year to solicit feedback on our Total Rewards components, including compensation, benefits and employee development, to determine which offerings are most valued by our staff. In response to employee feedback and talent market conditions, we have implemented several changes to our compensation programs. Effective June 1, 2022, we transitioned to a base salary range structure, which provides greater flexibility in meeting labor market demands and enhances our ability to differentiate pay based on experience and performance. The salary ranges are structured in zones aligned with median market pay for the positions in each zone. We have increased our fiscal year 2023 merit increase budget in order to retain and attract exceptional staff in a highly competitive talent market.

We have also made prospective changes to our incentive compensation program. The short-term and long-term incentive programs will be replaced by a single annual incentive bonus plan in fiscal year 2023. These changes were initiated based on feedback received in our employee Total Rewards survey that our current incentive plans did not adequately differentiate pay based on performance and were not achieving the intended purpose of promoting long-term retention and alignment with company performance that employees could directly influence. The new annual incentive plan is based on attainment of our targeted corporate scorecard goals as established at the beginning of each fiscal year and individual performance ratings from our annual review process. Attainment of the annual scorecard goals requires the collective engagement and effort of employees across the company, which we believe incentivizes teamwork and fosters a collaborative working environment. The addition of a performance rating component will enable the organization to differentiate a portion of incentive compensation, which demonstrates the value of a high-performance culture on behalf of our members. The new annual incentive plan was approved by the CFC Board of Directions in May 2022 and will be in place for fiscal year 2023.

The employee benefits components of our Total Rewards package include vacation and leave programs; health, dental, vision, life and disability insurance coverage; and flexible spending and health savings plans, most of which are funded in whole or in part by CFC. We make investments in the future financial security of our employees by offering retirement plans that consist of a 401(k) plan with a company match component and an employer-funded defined benefit retirement plan in which CFC makes an annual contribution in an amount that approximates 18% of each employee’s base salary, which we believe helps in our efforts to engage employees, retain high-performing employees and reduce turnover. We also offer programs and resources intended to promote work-life balance, assist in navigating life events and improve employee well-being, such as flexible work schedules, remote work options, an employee assistance program, legal insurance and identity theft coverage services.

COVID-19 Response

We continue to place a high priority on the health and safety of our employees, and also ensure that we are able to meet the needs of our members in an effective and efficient manner. In July 2021, the majority of our staff returned to work at CFC’s corporate headquarters building, while continuing to adhere to the COVID-19 workplace safety and health standards

14

established by Virginia and guidance provided by the CDC. We have been able to maintain business continuity throughout the pandemic and experienced no pandemic-related employee furloughs or layoffs, providing the highest quality of service and delivering effectively on our member-focused mission. We implemented an updated remote work practice that allows for a hybrid work arrangement, providing for employee flexibility while promoting collaboration and efficiency in serving our members.

Open-Door Communications

CFC maintains a strong focus on our core value of integrity in pursuit of our mission. To promote open communications, we maintain an open-door policy and provide multiple avenues for employees to voice their concerns and offer suggestions. Employees are encouraged to report any issues to their manager, senior vice president, corporate compliance, human resources or our corporate ethics helpline. All new employees receive Code of Conduct & Business Ethics training, and we maintain a practice of annual employee review and training to foster a culture of integrity and accountability.

| CORPORATE RESPONSIBILITY | ||

For more than half a century, CFC has helped electric cooperatives provide essential services to rural America. Since their creation in the 1930s to bring electricity to rural homes, electric cooperatives have been essential to the economic vitality and quality of life in communities nationwide, including those in persistent poverty counties.

As a value-based, financial services cooperative, CFC is engaged in sustaining our environment across multiple fronts—from our Leadership in Energy and Environmental Design (“LEED”) Gold-certified building and 42-acre ecofriendly campus that serves as CFC’s headquarters to the renewable energy projects we’ve helped finance for the electric cooperative network. CFC’s members are moving forward with renewable energy adoption, and we continue to support them by funding renewable energy initiatives that will help build out greater renewable infrastructure in the United States.

CFC has developed a Sustainability Bond Framework, which aligns with the Sustainability Bond Guidelines (“SBG”), as administered by the International Capital Markets Association (“ICMA”), under which we can issue sustainability bonds and use the proceeds to finance or refinance projects to enhance access to broadband services and renewable energy projects that will provide positive environmental and social impact in rural America. CFC issued its first sustainability bond in October 2020, the first sustainability bond issued for the electric cooperative industry. Today, CFC is proud to support the electric cooperatives by providing approximately $1,647 million in outstanding loans to support broadband expansion. These efforts have opened new opportunities in many rural communities by providing access to affordable high-speed internet service for the first time.

True to our core values of service, integrity and excellence, CFC continues to help electric cooperatives support the communities that created them, whether it’s through contributions from the CFC Educational Fund or helping them access capital from the USDA’s Rural Economic Development Loan and Grant (“REDL&G”) program, which fosters economic development. Over the past 20 years, CFC has contributed an estimated $203 million to the REDL&G program.

CFC and electric cooperatives operate under seven cooperative principles: open and voluntary membership; democratic member control; members’ economic participation; autonomy and independence; education, training and information; cooperation among cooperatives; and concern for community. Through our “Commitment to Excellence” workshops, CFC has trained electric cooperative directors and executive staff on governance best practices, including how electric cooperative leaders should demonstrate principled leadership, financial stewardship, and effective governance and management risk oversight.

With these efforts CFC empowers electric cooperatives to fulfill their historic mission of service and contribute to sustainability efforts.

15

| AVAILABLE INFORMATION | ||

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports, are available for free at www.nrucfc.coop as soon as reasonably practicable after they are electronically filed with or furnished to the U.S. Securities and Exchange Commission (“SEC”). These reports also are available for free on the SEC’s website at www.sec.gov. Information posted on our website is not incorporated by reference into this Form 10-K.

Item 1A. Risk Factors

Our financial condition, results of operations and liquidity are subject to various risks and uncertainties, some of which are inherent in the financial services industry and others of which are more specific to our own business. The discussion below addresses the most significant risks, of which we are currently aware, that could have a material adverse impact on our business, financial condition, results of operations or liquidity. However, other risks and uncertainties, including those not currently known to us, could also negatively impact our business, financial condition, results of operations and liquidity. Therefore, the following should not be considered a complete discussion of all the risks and uncertainties we may face. For information on how we manage our key risks, see “Item 7. MD&A—Enterprise Risk Management.” You should consider the following risks together with all of the other information in this report.

| RISK FACTORS | ||

Credit Risks

We are subject to credit risk that borrowers may not be able to meet their contractual obligations in accordance with agreed-upon terms, which could have a material adverse effect on our financial condition, results of operations and liquidity. Because we lend primarily to U.S. rural electric utility systems, we also are inherently subject to single-industry and single-obligor concentration risks.

As a lender, our primary credit risk arises from the extension of credit to borrowers. Our loan portfolio, which represents the largest component of assets on our balance sheet, accounts for the substantial majority of our credit risk exposure. Loans outstanding to electric utility organizations represented approximately 98% of our total loans outstanding as of May 31, 2022. We had 883 borrowers with loans outstanding as of May 31, 2022, and our 20 largest borrowers accounted for 21% of total loans outstanding as of May 31, 2022. The largest total exposure to a single borrower or controlled group represented less than 2% of total loans outstanding as of May 31, 2022. Texas historically has had the largest number of borrowers with loans outstanding and the largest loan concentration in any one state. Loans outstanding to Texas borrowers represented 17% of total loans outstanding as of May 31, 2022.

We face the risk that the principal of, or interest on, a loan will not be paid on a timely basis or at all or that the value of any underlying collateral securing a loan will be insufficient to cover our outstanding exposure. A deterioration in the financial condition of a borrower or underlying collateral could impair the ability of a borrower to repay a loan or our ability to recover unpaid amounts from the underlying collateral. We maintain an internal borrower risk rating system in which we assign a rating to each borrower and credit facility that are intended to reflect the ability of a borrower to repay its obligations and assess the probability of default and loss given default. The borrower risk rating system comprises both quantitative metrics and qualitative considerations. Each component is risk weighted in accordance with its importance. Unforeseen events and developments that affect specific borrowers or that occur in a region where we have a high concentration of credit risk may result in risk rating downgrades. Such an event may result in an increase in the allowance for credit losses; delinquent, nonperforming and criticized loans; net charge-offs; and an increase in our credit risk.

We establish an allowance for credit losses based on management’s current estimate of credit losses that are expected to occur over the remaining life of the loans in our portfolio. Because the process for determining our allowance for credit losses requires informed judgments about the ability of borrowers to repay their loans, we identify the estimation of our allowance for credit losses as a critical accounting estimate. Our borrower risk ratings are a key input in establishing our allowance for credit losses. Therefore, the deterioration in the financial condition of a borrower may result in a significant increase in our allowance for credit losses and provision for credit losses and may have a material adverse impact on our results of operations, financial condition and liquidity. In addition, we might underestimate expected credit losses and have

16

credit losses in excess of the established allowance for credit losses if we fail to timely identify a deterioration in a borrower’s financial condition or due to other factors, such as if the methodology and process we use in assigning borrower risk ratings and making judgments in extending credit to our borrowers does not accurately capture the level of our credit risk exposure or our historical loss experience proves to be not indicative of our expected future losses.

Adverse changes, developments or uncertainties in the rural electric utility industry could adversely impact the operations or financial performance of our member electric cooperatives, which, in turn, could have an adverse impact on our financial results.

Our focus as a member-owned finance cooperative is on lending to our rural member electric utility cooperatives, which is the primary source of our revenue. As a result of lending primarily to our members, we have a loan portfolio with single-industry concentration. Loans to rural electric utility cooperatives accounted for approximately 98% of our total loans outstanding as of May 31, 2022. While we historically have experienced limited defaults and very low credit losses in our electric utility loan portfolio, factors that may have a negative impact on the operations of our member rural electric cooperatives include but are not limited to, the price and availability of distributed energy resources, regulatory or compliance factors related to managing greenhouse gas emissions (including the potential for stranded assets) and extreme weather conditions, including weather conditions related to climate change. The factors listed above, individually or in combination, could result in declining sales or increased power supply and operating costs and could potentially cause a deterioration in the financial performance of our members and the value of the collateral securing their loans. This could impair their ability to repay us in accordance with the terms of their loans. In such case, it may lead to risk rating downgrades, which may result in an increase in our allowance for credit losses and a decrease in our net income.

The threat of weather-related events or shifts in climate patterns resulting from climate change, including, but not limited to, increases in storm intensity, number of intense storms and temperature extremes in areas in which our member rural electric cooperatives operate, could result in increased power supply and operating costs, adversely impacting our members’ results of operations, liquidity and ability to make payments to us. While we believe our members would largely be reimbursed by Federal Emergency Management Agency (“FEMA”) relief programs for storm-related damages, such programs may not be implemented as currently constructed or payments may not be received on a timely basis. For increased power costs, although we believe our members have the ability to pass through increased costs to their members, in some cases it may be difficult to pass through the entire costs on a timely basis if they are significant. To the extent CFC makes bridge loans to members as they wait for FEMA payments, changes to FEMA programs or delays in payments from FEMA could adversely impact the quality of our loan portfolio and our financial condition. Additionally, our member rural electric cooperatives are subject to evolving local, state and federal laws, regulations and expectations regarding the environment. These requirements and expectations may increase the time and costs of efforts to monitor and comply with such obligations and expose them to liability. The impacts of climate change present notable risks, including damage to the assets of our members, which could adversely impact the quality of our loan portfolio and our financial condition.

Advances in technology may change the way electricity is generated and transmitted, which could adversely affect the business operations of our members and negatively impact the credit quality of our loan portfolio and financial results.