0000070487

false

DEF 14A

00000704872022-01-012022-12-31

thunderdome:item

000007048732022-01-012022-12-31

000007048722022-01-012022-12-31

000007048712022-01-012022-12-31

iso4217:USD

00000704872020-01-012020-12-31

0000070487nrc:NEOAddDividendsPaidOnAwardsInTheCoveredFYPriorToTheVestingDateThatAreNotOtherwiseIncludedInTotalCompensationForTheCoveredFYMember2020-01-012020-12-31

0000070487nrc:NEOSubtractAwardsGrantedInAPriorFYThatFailedToMeetTheApplicableVestingConditionsDuringTheCoveredFYMember2020-01-012020-12-31

0000070487nrc:NEOAddChangeInFairValueAsOfTheVestingDateForAwardsGrantedInAPriorFYThatVestedDuringTheCoveredFYMember2020-01-012020-12-31

0000070487nrc:NEOAddChangeInFairValueAsOfTheEndOfTheCoveredFYForAwardsGrantedInAPriorFYThatAreOutstandingAndUnvestedAsOfTheCoveredFYMember2020-01-012020-12-31

0000070487nrc:NEOAddAwardsGrantedDuringTheCoveredFYThatAreOutstandingAndUnvestedAsOfTheEndOfTheCoveredFYMember2020-01-012020-12-31

0000070487nrc:NEODeductStockAndOptionAwardsReportedInTheSummaryCompensationTableMember2020-01-012020-12-31

00000704872021-01-012021-12-31

0000070487nrc:NEOAddDividendsPaidOnAwardsInTheCoveredFYPriorToTheVestingDateThatAreNotOtherwiseIncludedInTotalCompensationForTheCoveredFYMember2021-01-012021-12-31

0000070487nrc:NEOSubtractAwardsGrantedInAPriorFYThatFailedToMeetTheApplicableVestingConditionsDuringTheCoveredFYMember2021-01-012021-12-31

0000070487nrc:NEOAddChangeInFairValueAsOfTheVestingDateForAwardsGrantedInAPriorFYThatVestedDuringTheCoveredFYMember2021-01-012021-12-31

0000070487nrc:NEOAddChangeInFairValueAsOfTheEndOfTheCoveredFYForAwardsGrantedInAPriorFYThatAreOutstandingAndUnvestedAsOfTheCoveredFYMember2021-01-012021-12-31

0000070487nrc:NEOAddAwardsGrantedDuringTheCoveredFYThatAreOutstandingAndUnvestedAsOfTheEndOfTheCoveredFYMember2021-01-012021-12-31

0000070487nrc:NEODeductStockAndOptionAwardsReportedInTheSummaryCompensationTableMember2021-01-012021-12-31

0000070487nrc:NEOAddDividendsPaidOnAwardsInTheCoveredFYPriorToTheVestingDateThatAreNotOtherwiseIncludedInTotalCompensationForTheCoveredFYMember2022-01-012022-12-31

0000070487nrc:NEOSubtractAwardsGrantedInAPriorFYThatFailedToMeetTheApplicableVestingConditionsDuringTheCoveredFYMember2022-01-012022-12-31

0000070487nrc:NEOAddChangeInFairValueAsOfTheVestingDateForAwardsGrantedInAPriorFYThatVestedDuringTheCoveredFYMember2022-01-012022-12-31

0000070487nrc:NEOAddChangeInFairValueAsOfTheEndOfTheCoveredFYForAwardsGrantedInAPriorFYThatAreOutstandingAndUnvestedAsOfTheCoveredFYMember2022-01-012022-12-31

0000070487nrc:NEOAddAwardsGrantedDuringTheCoveredFYThatAreOutstandingAndUnvestedAsOfTheEndOfTheCoveredFYMember2022-01-012022-12-31

0000070487nrc:NEODeductStockAndOptionAwardsReportedInTheSummaryCompensationTableMember2022-01-012022-12-31

0000070487nrc:PEOAddChangeInFairValueAsOfTheVestingDateForAwardsGrantedInAPriorFYThatVestedDuringTheCoveredFYMember2020-01-012020-12-31

0000070487nrc:PEOAddChangeInFairValueAsOfTheEndOfTheCoveredFYForAwardsGrantedInAPriorFYThatAreOutstandingAndUnvestedAsOfTheCoveredFYMember2020-01-012020-12-31

0000070487nrc:PEOAddAwardsGrantedDuringTheCoveredFYThatAreOutstandingAndUnvestedAsOfTheEndOfTheCoveredFYMember2020-01-012020-12-31

0000070487nrc:PEODeductStockAndOptionAwardsReportedInTheSummaryCompensationTableMember2020-01-012020-12-31

0000070487nrc:PEOAddChangeInFairValueAsOfTheVestingDateForAwardsGrantedInAPriorFYThatVestedDuringTheCoveredFYMember2021-01-012021-12-31

0000070487nrc:PEOAddChangeInFairValueAsOfTheEndOfTheCoveredFYForAwardsGrantedInAPriorFYThatAreOutstandingAndUnvestedAsOfTheCoveredFYMember2021-01-012021-12-31

0000070487nrc:PEOAddAwardsGrantedDuringTheCoveredFYThatAreOutstandingAndUnvestedAsOfTheEndOfTheCoveredFYMember2021-01-012021-12-31

0000070487nrc:PEODeductStockAndOptionAwardsReportedInTheSummaryCompensationTableMember2021-01-012021-12-31

0000070487nrc:PEOAddChangeInFairValueAsOfTheVestingDateForAwardsGrantedInAPriorFYThatVestedDuringTheCoveredFYMember2022-01-012022-12-31

0000070487nrc:PEOAddChangeInFairValueAsOfTheEndOfTheCoveredFYForAwardsGrantedInAPriorFYThatAreOutstandingAndUnvestedAsOfTheCoveredFYMember2022-01-012022-12-31

0000070487nrc:PEOAddAwardsGrantedDuringTheCoveredFYThatAreOutstandingAndUnvestedAsOfTheEndOfTheCoveredFYMember2022-01-012022-12-31

0000070487nrc:PEODeductStockAndOptionAwardsReportedInTheSummaryCompensationTableMember2022-01-012022-12-31

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☑

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

National Research Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☑

|

No fee required

|

|

☐

|

Fee paid previously with preliminary materials

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

National Research Corporation

D/B/A NRC Health

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 11, 2023

To the Shareholders of

National Research Corporation:

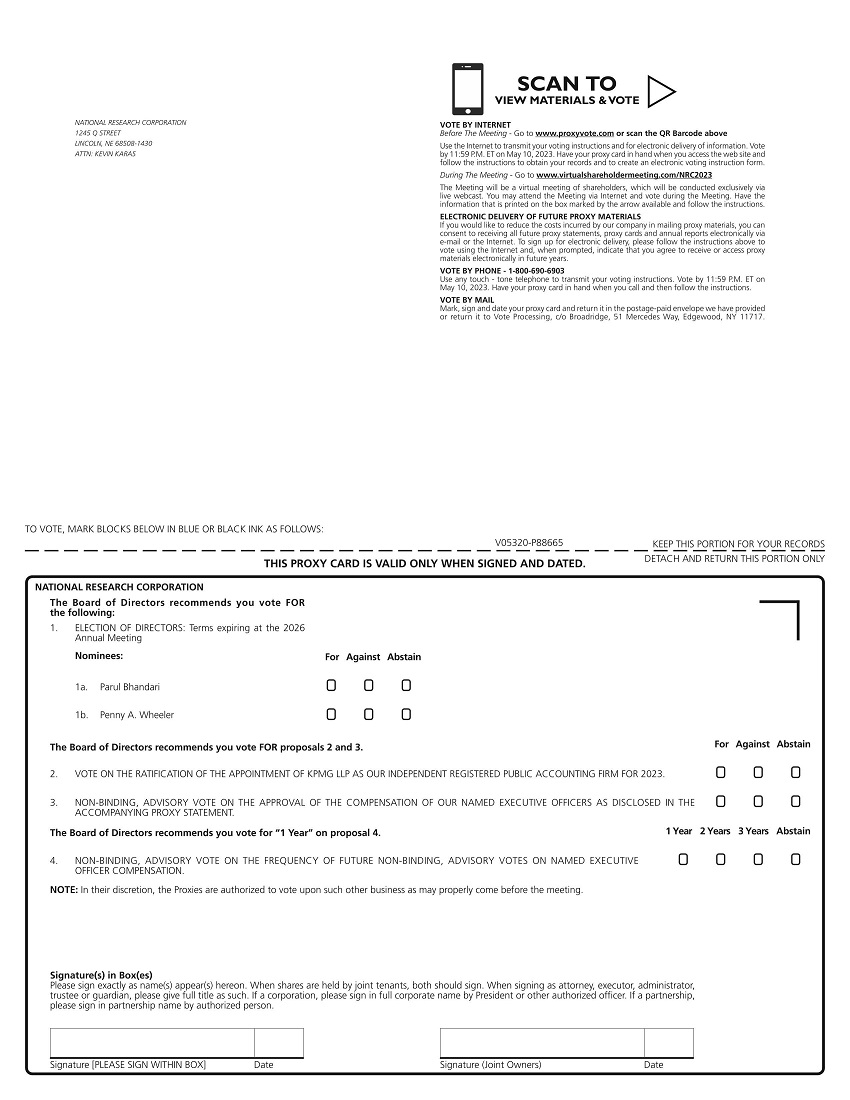

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of National Research Corporation will be held on Thursday, May 11, 2023, at 3:00 P.M., Central Time, via the Internet at www.virtualshareholdermeeting.com/NRC2023, for the following purposes:

1. To elect two directors to hold office until the 2026 annual meeting of shareholders and until their successors are duly elected and qualified.

2. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2023.

3. To conduct a non-binding, advisory vote to approve the compensation of our named executive officers as disclosed in the accompanying proxy statement.

4. To conduct a non-binding, advisory vote on the frequency of future non-binding, advisory votes on named executive officer compensation.

5. To consider and act upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

The close of business on March 24, 2023, has been fixed as the record date for the determination of shareholders entitled to notice of, and to vote at, the meeting and any adjournment or postponement thereof.

A proxy for the meeting and a proxy statement are enclosed herewith.

| |

By Order of the Board of Directors

NATIONAL RESEARCH CORPORATION

|

| |

|

| |

|

| |

/s/ Kevin R. Karas |

| |

Kevin R. Karas

Secretary

|

Lincoln, Nebraska

April 6, 2023

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on May 11, 2023. The National Research Corporation proxy statement for the 2023 Annual Meeting of Shareholders and the 2022 Annual Report to Shareholders are available at www.proxyvote.com.

YOUR VOTE IS IMPORTANT NO MATTER HOW LARGE OR SMALL YOUR HOLDINGS MAY BE. TO ASSURE YOUR REPRESENTATION AT THE MEETING, PLEASE DATE THE ENCLOSED PROXY, WHICH IS SOLICITED BY THE BOARD OF DIRECTORS, SIGN EXACTLY AS YOUR NAME APPEARS THEREON AND RETURN IMMEDIATELY.

YOU MAY ALSO VOTE ON THE INTERNET BY COMPLETING THE ELECTRONIC VOTING INSTRUCTION FORM FOUND AT WWW.PROXYVOTE.COM OR BY TELEPHONE USING A TOUCH-TONE TELEPHONE AND CALLING 1-800-690-6903. VOTE BY 11:59 P.M. ET ON MAY 10, 2023.

TABLE OF CONTENTS

National Research Corporation

D/B/A NRC Health

1245 Q Street

Lincoln, Nebraska 68508

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 11, 2023

This proxy statement is being furnished to shareholders by the Board of Directors (the “Board”) of National Research Corporation, doing business as NRC Health (“NRC Health,” the “Company,” “we,” “our,” “us” or similar terms), beginning on or about April 6, 2023, in connection with a solicitation of proxies by the Board for use at the Annual Meeting of Shareholders to be held on Thursday, May 11, 2023, at 3:00 P.M., Central Time, virtually via the Internet at www.virtualshareholdermeeting.com/NRC2023, and all adjournments or postponements thereof (the “Annual Meeting”) for the purposes set forth in the attached Notice of Annual Meeting of Shareholders.

Execution of a proxy given in response to this solicitation will not affect a shareholder’s right to vote their shares during the Annual Meeting. Participation at the Annual Meeting of a shareholder who has signed a proxy does not in itself revoke a proxy. Any shareholder giving a proxy may revoke it at any time before it is exercised by giving notice thereof to us in writing or in open meeting. You may also vote on the internet by completing the electronic voting instruction form found at www.proxyvote.com or by telephone using a touch-tone telephone and calling 1-800-690-6903. Vote by 11:59 p.m. ET on May 10, 2023. Instructions on how to vote while participating in the Annual Meeting live via the Internet are posted at www.virtualshareholdermeeting.com/NRC2023.

A proxy, in the enclosed form, which is properly executed, duly returned to us and not revoked, will be voted in accordance with the instructions contained therein. The shares represented by executed but unmarked proxies will be voted as follows:

| |

●

|

FOR the two persons nominated for election as directors referred to herein;

|

| |

●

|

FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2023;

|

| |

●

|

FOR the non-binding, advisory vote to approve the compensation of the individuals named in the Summary Compensation Table set forth below in this proxy statement (such group of individuals are sometimes referred to as our named executive officers);

|

| |

●

|

ONE YEAR, regarding the non-binding, advisory vote on the frequency of future non-binding, advisory votes to approve the compensation of our named executive officers; and

|

| |

●

|

On such other business or matters which may properly come before the Annual Meeting in accordance with the best judgment of the persons named as proxies in the enclosed form of proxy.

|

Other than the election of two directors, the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2023, the non-binding, advisory vote to approve the compensation of our named executive officers, and the non-binding, advisory vote on the frequency of future non-binding, advisory votes to approve the compensation of our named executive officers, the Board has no knowledge of any matters to be presented for action by the shareholders at the Annual Meeting.

Only holders of record of our common stock, $.001 par value per share (the “Common Stock”), at the close of business on March 24, 2023 (the “Record Date”), are entitled to vote at the Annual Meeting. On that date, we had outstanding and entitled to vote 24,599,815 shares of Common Stock, each of which is entitled to one vote per share. The presence at the Annual Meeting, via live webcast or by proxy, of a majority of the votes entitled to be cast shall constitute a quorum for the purpose of transacting business at the Annual Meeting. Abstentions and broker non-votes will be counted as present in determining whether there is a quorum.

Information Regarding Participation in the Annual Meeting via the Internet

We will be hosting the Annual Meeting live via the Internet. You will not be able to attend the Annual Meeting in person. Any shareholder can listen to and participate in the Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/NRC2023. The Annual Meeting webcast will begin promptly at 3:00 P.M., Central Time. We encourage you to access the Annual Meeting webcast prior to the start time. Online check-in will begin, and shareholders may begin submitting written questions, at 2:45 P.M., Central Time, and you should allow ample time for the check-in procedures.

You will need the 16-digit control number included on your proxy card or voting instruction form, or included in the e-mail to you if you received the proxy materials by e-mail, in order to be able to vote your shares or submit questions during the Annual Meeting. Instructions on how to connect to the Annual Meeting and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/NRC2023. If you do not have your 16-digit control number, you will be able to access and listen to the Annual Meeting but you will not be able to vote your shares or submit questions during the Annual Meeting. Our virtual meeting platform vendor will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting or submitting questions. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the Virtual Shareholder Meeting login page.

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Our Bylaws provide that the directors shall be divided into three classes, with staggered terms of three years each. At the Annual Meeting, the shareholders will elect two directors to hold office until the 2026 annual meeting of shareholders and until their successors are duly elected and qualified. Unless shareholders otherwise specify, the shares represented by the proxies received will be voted in favor of the election as directors of the two persons named as nominees herein. The Board has no reason to believe that the listed nominees will be unable or unwilling to serve as directors if elected. However, in the event that any nominee should be unable to serve or for good cause will not serve, the shares represented by proxies received will be voted for another nominee selected by the Board. Each director will be elected by a majority of the votes cast at the Annual Meeting (assuming a quorum is present) in an uncontested election. Consequently, any shares not voted at the Annual Meeting, whether due to abstentions, broker non-votes or otherwise, will have no impact on the election of the directors. Votes will be tabulated by an inspector of elections appointed by the Board.

The following sets forth certain information about the Board’s nominees for election at the Annual Meeting and each director of the Company whose term will continue after the Annual Meeting.

Nominees for Election at the Annual Meeting

Term expiring at the 2026 Annual Meeting

Parul Bhandari, 47, has served as a director of the Company since May 2022. Ms. Bhandari has more than 20 years of experience driving growth and innovation at the world’s leading technology and business development companies. Since 2012, she has held various leadership roles at Microsoft Corporation (NASDAQ: MSFT). Currently, Ms. Bhandari is the Director, Partner Strategy, Worldwide Media and Communications at Microsoft, where she contributes to global partner recruiting, enablement and engagement. Previously, Ms. Bhandari was focused on leading Data and AI for Microsoft’'s Worldwide Public Sector. Prior to joining Microsoft, Ms. Bhandari served as Vice President of Business Development and Alliances for the management consulting firm Acelsior, teaming with large defense contractors. Ms. Bhandari has served as a director of Timberland Bancorp, Inc. (NASDAQ: TSBK) since 2021. Ms. Bhandari has also served as a director of Cartica Acquisition Corp (NASDAQ: CITE), a blank check company, since January 2022. Ms. Bhandari’s expertise as an accomplished technology leader, leveraging data and AI, as well as her experience driving industry solutions and engaging in digital transformation initiatives, led to the conclusion that she should serve as a director of the Company.

Penny A. Wheeler, 64, has served as a director of the Company since May 2021. From 2015 to 2021, Dr. Wheeler served as the chief executive officer of Allina Health, a not-for-profit healthcare system serving over 1.5 million individuals in Minnesota and western Wisconsin. Prior to that role she served as chief clinical officer since 2006. For 20 years, Dr. Wheeler has also served as a board certified obstetrician/gynecologist where she spent considerable time interacting with, and caring for, patients and the community. In 2015, Minnesota Governor Mark Dayton appointed Dr. Wheeler to the Taskforce for Health Care Financing, and Dr. Wheeler has been named as one of the top 25 women in health care by Modern Healthcare magazine. Dr. Wheeler also serves on the board of Portico Healthnet, a not-for-profit organization dedicated to helping uninsured Minnesotans receive affordable health coverage and care, St. Thomas University, and the University of Minnesota Foundation. She is also on the Board of Cedar Cares, an organization that eases the patient billing experience through customized engagement. Dr. Wheeler’s past leadership experiences in the healthcare industry led to the conclusion that she should serve as a director of the Company.

THE BOARD UNANIMOUSLY RECOMMENDS THE FOREGOING NOMINEES FOR ELECTION AS DIRECTORS AND URGES EACH SHAREHOLDER TO VOTE “FOR” SUCH NOMINEES. SHARES OF THE COMPANY’S COMMON STOCK REPRESENTED BY EXECUTED BUT UNMARKED PROXIES WILL BE VOTED “FOR” SUCH NOMINEES.

Directors Continuing in Office

Terms expiring at the 2024 Annual Meeting

Michael D. Hays, 68, has served as Chief Executive Officer and a director since he founded the Company in 1981. He also served as President of the Company from 1981 to 2004, from July 2008 to July 2011, and from October 2020 to present. Prior to founding the Company, Mr. Hays served for seven years as a Vice President and a director of SRI Research Center, Inc. (n/k/a the Gallup Organization). Mr. Hays’ background as founder of the Company, and his long and successful tenure as Chief Executive Officer and a director, led to the conclusion that he should serve as a director of the Company.

John N. Nunnelly, 70, has served as a director of the Company since December 1997. Mr. Nunnelly is a retired Group President from McKesson Corporation, a leader in pharmaceutical distribution and healthcare information technology. During his 28-year career at McKesson, Mr. Nunnelly served in a variety of other positions, including Vice President of Strategic Planning and Business Development, Vice President and General Manager of the Amherst Product Group and Vice President of Sales-Decision Support. These responsibilities included leading several business units, including one with over $360 million in annual revenue. In addition, he was involved in managing a number of mergers and acquisitions. Mr. Nunnelly has also served as an adjunct professor at the University of Massachusetts, School of Nursing, advising students and faculty on matters pertaining to healthcare information technology. These experiences and Mr. Nunnelly’s expertise as a professional and educator in the field of healthcare information technology led to the conclusion that he should serve as a director of the Company.

Terms expiring at the 2025 Annual Meeting

Donald M. Berwick, 76, has served as a director of the Company since October 2015. Dr. Berwick is the former President and Chief Executive Officer of the Institute for Healthcare Improvement, which he co-founded and led for almost 20 years, and where he now serves as President Emeritus and Senior Fellow. He is also currently a Lecturer in the Department of Health Care Policy at Harvard Medical School. From July 2010 to December 2011, Dr. Berwick served as the Administrator of the Centers for Medicare and Medicaid Services as an appointee of President Barack Obama. Dr. Berwick previously served on the faculty of the Harvard Medical School and the Harvard School of Public Health (from 1974 to 2010). He was also vice chair of the U.S. Preventive Services Task Force (from 1990 to 1995), the first “Independent Member” of the Board of Trustees of the American Hospital Association (from 1996 to 1999) and the chair of the National Advisory Council of the Agency for Healthcare Research and Quality (from 1995 to 1999). Dr. Berwick’s expertise as a professional, administrator, lecturer and educator in the field of healthcare led to the conclusion that he should serve as a director of the Company.

Stephen H. Lockhart, 64, has served as a director of the Company since May 2021. Dr. Lockhart served as senior vice president and chief medical officer for Sutter Health Network, a not-for-profit system of hospitals, physician organizations, and research institutions in Northern California, from 2015 to 2021. Prior to that role, Dr. Lockhart served as Sutter Health Network’s regional chief medical officer for the East Bay Region from 2010 to 2015. From 2008 to 2010, Dr. Lockhart served as the chief administrative officer at the St. Luke’s campus of Sutter’s California Pacific Medical Center. In 2017, Dr. Lockhart was named to California Governor Brown’s Advisory Committee on Precision Medicine as part of California’s effort to use advanced computing and technology to better understand, treat, and prevent disease. Dr. Lockhart serves on the board of Molina Healthcare, Inc. (NYSE: MOH), a health plan provider under Medicaid and Medicare programs and in state insurance marketplaces. Dr. Lockhart also serves on the boards of the ECRI Institute, Recreational Equipment, Inc., the David and Lucile Packard Foundation, and is chairman of Parks California – a nonprofit dedicated to supporting California's parks and public lands. Dr. Lockhart’s 36 years of experience in the healthcare industry and his background as medical provider and administrator in a large healthcare system led to the conclusion that he should serve as a director of the Company.

Board Diversity Matrix

The Company is committed to diversity and inclusion, and the diverse nature of the Board reflects our commitment. The Company believes that a variety of backgrounds, experiences, perspectives, and points of view contribute to a more effective decision-making process and the Board is committed to considering diversity of race, ethnicity, gender, age, cultural background, and professional experiences in evaluating the composition of the Board. The Board Diversity Matrix below reports self-identified diversity statistics of the Board in accordance with NASDAQ rules.

|

Board Diversity Matrix (as of April 6, 2023)

|

|

Total Number of Directors

|

6

|

| |

Female

|

Male

|

Non-Binary

|

Did Not

Disclose

Gender

|

|

Part I: Gender Identity

|

|

|

Directors

|

2

|

4

|

0

|

0

|

|

Part II: Demographic Background

|

|

|

African American or Black

|

0

|

1

|

0

|

0

|

|

Alaskan Native or Native American

|

0

|

0

|

0

|

0

|

|

Asian

|

1

|

0

|

0

|

0

|

|

Hispanic or Latinx

|

0

|

0

|

0

|

0

|

|

Native Hawaiian or Pacific Islander

|

0

|

0

|

0

|

0

|

|

White

|

1

|

3

|

0

|

0

|

|

Two or More Races or Ethnicities

|

0

|

0

|

0

|

0

|

|

LGBTQ+

|

0

|

|

Did Not Disclose Demographic Background

|

0

|

CORPORATE GOVERNANCE

Independent Directors and Annual Meeting Attendance

Of the six directors currently serving on the Board, the Board has determined that Donald M. Berwick, Parul Bhandari, John N. Nunnelly, Stephen H. Lockhart, and Penny A. Wheeler are “independent directors” as that term is defined in the listing standards of The NASDAQ Stock Market.

Directors are typically expected to attend our annual meeting of shareholders each year. For the 2023 Annual Meeting, such attendance will be through the Internet via live webcast. Each of the directors attended our 2022 annual meeting of shareholders.

Currently, we do not have a chairman, and the Board does not have a policy on whether the roles of chief executive officer and chairman should be separate. The Board has, however, designated a lead director since 2007, with Mr. Nunnelly serving as the lead director since May 2012. The Board believes its current leadership structure is appropriate at this time since it establishes our chief executive officer as the primary executive leader with one vision and eliminates ambiguity as to who has primary responsibility for our performance.

The lead director is an independent director who is appointed by the independent directors and who works closely with the chief executive officer. In addition to serving as the principal liaison between the independent directors and the chief executive officer in matters relating to the Board as a whole, the primary responsibilities of the lead director are as follows:

| |

●

|

Preside at all meetings of the Board at which the chief executive officer is not present, including any executive sessions of the independent directors, and establish agendas for such executive sessions in consultation with the other directors and the chief executive officer;

|

| |

●

|

Advise the chief executive officer as to the quality, quantity, and timeliness of the flow of information from management that is necessary for the independent directors to effectively perform their duties;

|

| |

●

|

Have the authority to call meetings of the independent directors as appropriate; and

|

| |

●

|

Be available to act as the spokesperson for the Company if the chief executive officer is unable to act as the spokesperson.

|

Committees

The Board held seven meetings in 2022. All incumbent directors attended at least 75% of the meetings of the Board and the committees on which they served during 2022.

The Board has a standing Audit Committee, Compensation and Talent Committee, Nominating Committee, and Strategic Planning Committee. Each of these committees has the responsibilities set forth in formal written charters adopted by the Board. We make available copies of each of these charters free of charge on our website located at www.nrchealth.com/investor-relations/corporate-governance/. The contents of our website are not incorporated by reference into this proxy statement.

The Audit Committee’s primary function is to assist the Board in fulfilling its oversight responsibilities by overseeing our systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established; our accounting and financial reporting processes; and the audits of our financial statements. The Audit Committee presently consists of John N. Nunnelly (Chairperson), Penny A. Wheeler, and Donald M. Berwick, each of whom meets the independence standards of The NASDAQ Stock Market and the Securities and Exchange Commission for audit committee members. The Board has determined that John N. Nunnelly qualifies as an “audit committee financial expert,” as Mr. Nunnelly (i) meets the Audit Committee member independence criteria under applicable SEC rules, (ii) is independent, as independence for Audit Committee members is defined under applicable NASDAQ listing standards, and (iii) has sufficient knowledge, experience and sophistication in financial and auditing matters under relevant SEC and NASDAQ rules. The Audit Committee held five meetings in 2022.

The Compensation and Talent Committee determines compensation programs for our executive officers, reviews management’s recommendations as to the compensation to be paid to other key personnel and administers our equity-based compensation plans. The Compensation and Talent Committee presently consists of Stephen H. Lockhart (Chairperson), Donald M. Berwick, Parul Bhandari, and John N. Nunnelly, each of whom meets the independence standards of The NASDAQ Stock Market and the Securities and Exchange Commission for compensation committee members. The Compensation and Talent Committee held three meetings in 2022. From time to time, with the last time being in 2015, the Compensation and Talent Committee or our management has engaged a nationally recognized compensation consultant to assist us in our review of our compensation and benefits programs, including the competitiveness of pay levels against similarly sized companies, executive compensation design issues, market trends and technical considerations. The Compensation and Talent Committee, however, did not use this information in setting the compensation of our executive officers in 2022 and does not use a peer group given the absence of any publicly traded peers.

The Nominating Committee presently consists of Donald M. Berwick (Chairperson), Parul Bhandari, Stephen H. Lockhart, Penny A. Wheeler, and John N. Nunnelly, each of whom meets the independence standards of The NASDAQ Stock Market for nominating committee members. The Nominating Committee’s primary functions are to: (1) recommend persons to be selected by the Board as nominees for election as directors and (2) recommend persons to be elected to fill any vacancies on the Board. The Nominating Committee held one meeting in 2022.

The Strategic Planning Committee assists the Board in reviewing and, as necessary, altering, our strategic plan, reviewing industry trends and their effects, if any, on us and assessing our products, services and offerings and the viability of such portfolio in meeting the needs of the markets that we serve. John N. Nunnelly (Chairperson), Donald M. Berwick, Parul Bhandari, Stephen H. Lockhart, and Penny A. Wheeler are the current members of the Strategic Planning Committee. The Strategic Planning Committee did not hold any meetings in 2022.

Board Oversight of Risk

The full Board is responsible for the oversight of our operational and strategic risk management process. The Board relies on its Audit Committee to address significant financial risk exposures facing us and the steps management has taken to monitor, control, and report such exposures, with appropriate reporting of these risks to be made to the full Board. The Audit Committee also inquires of management, our independent accountants, and our internal auditor about significant risks and exposures, including risks and exposures relating to data privacy, information security, and cybersecurity, and assesses the steps management has taken to minimize such risks and exposures. The Board relies on its Compensation and Talent Committee to address significant risk exposures facing us with respect to compensation, with appropriate reporting of these risks to be made to the full Board. The Board’s role in our risk oversight has not affected the Board’s leadership structure.

Majority Vote Policy

As a matter of robust and effective corporate governance, our Bylaws require that for directors to be elected (or reelected) to serve on the Company’s Board, in an uncontested election, they must receive support from holders of a majority of shares voted. Pursuant to our Bylaws, if a director does not receive at least a majority of the votes cast in an uncontested election, such director is required to submit his or her offer of resignation for consideration by the Board. Following submission of such offer of resignation and within sixty days following certification of the shareholder’s vote, the Nominating Committee shall recommend to the Board the action to be taken with respect to such offer of resignation. In determining whether or not to recommend that the Board accept a resignation offer, the Nominating Committee may consider all factors believed to be relevant by the Committee’s members, including without limitation: (1) any stated reasons for the director not receiving the required majority vote and whether the underlying cause or causes are curable; (2) the factors, if any, set forth in the guidelines or other policies that are to be considered by the Nominating Committee in evaluating potential candidates for the Board as such factors relate to each director who has so offered his or her resignation; (3) the length of service of such director, (4) the effect of such resignation on the Company’s compliance with any law, rule, regulation, stock exchange listing standards, or contractual obligations, (5) such director’s contributions to the Company, and (6) any other factors that the Nominating Committee believes are in the best interest of the Company. Following submission of the Nominating Committee’s recommendation and within ninety days of certification of the shareholder’s vote, the Board shall act on the Nominating Committee’s recommendation and publicly disclose their decision and reasons therefor. In determining whether or not to accept any resignation offer, the Board shall take into account the factors considered by the Nominating Committee and any additional information and factors the Board believes relevant.

Proxy Access

In accordance with our Bylaws, eligible shareholders who have continuously owned at least 3% of our outstanding Common Stock for at least the three immediately preceding years may submit director nominees for inclusion in our proxy materials. Up to 20 eligible shareholders may aggregate their holdings together to reach the 3% ownership threshold. The number of director nominees nominated by an eligible shareholder or a group of eligible shareholders may not be more than 20% of the total number of directors of the Company, but not less than two. Notice of nominations must be received no earlier than 150 days and no later than 120 days prior to the anniversary of the date the Company mailed its proxy for the immediately preceding annual meeting of shareholders, provided that if the current year’s annual meeting is not scheduled to be held within a period that commences 30 days before the anniversary date of the immediately preceding annual meeting of shareholders and ending within 30 days after such anniversary, notice of nominations must be given by the later of the close of business on the date which is 180 days prior to the date of the current year’s annual meeting or the 10th day following the date the current year’s annual meeting is first publicly announced or disclosed.

Nominations of Directors

The Nominating Committee will consider persons recommended by shareholders to become nominees for election as directors. Recommendations for consideration by the Nominating Committee should be sent to the Secretary of the Company in writing together with appropriate biographical information concerning each proposed nominee. Our Bylaws also set forth certain requirements for shareholders wishing to nominate director candidates directly for consideration by the shareholders. With respect to an election of directors to be held at an annual meeting, a shareholder must, among other things, give notice of intent to make such a nomination to the Secretary of the Company not less than 60 days or more than 90 days prior to the second Wednesday in the month of April. In the event, however, that the date of the annual meeting is advanced by more than 30 days or delayed by more than 60 days from the second Wednesday in the month of April, in order to be timely notice by the shareholder must be received not earlier than the 90th day prior to the date of such annual meeting and not later than the close of business on the later of (i) the 60th day prior to such annual meeting and (ii) the 10th day following the day on which public announcement of the date of such meeting is first made.

In identifying and evaluating nominees for director, the Nominating Committee seeks to ensure that the Board possesses, in the aggregate, the strategic, managerial and financial skills and experience necessary to fulfill its duties and to achieve its objectives, and seeks to ensure that the Board is comprised of directors who have broad and diverse backgrounds, possessing knowledge in areas that are of importance to us. The Nominating Committee looks at each nominee on a case‑by‑case basis regardless of who recommended the nominee. In looking at the qualifications of each candidate to determine if their election would further the goals described above, the Nominating Committee takes into account all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills or financial acumen, diversity of viewpoint, and industry knowledge. In addition, the Board and the Nominating Committee believe that the following specific qualities and skills are necessary for all directors to possess:

| |

●

|

A director must display high personal and professional ethics, integrity, and values.

|

| |

●

|

A director must have the ability to exercise sound business judgment.

|

| |

●

|

A director must be accomplished in his or her respective field, with broad experience at the administrative and/or policy-making level in business, government, education, technology, or public interest.

|

| |

●

|

A director must have relevant expertise and experience, and be able to offer advice and guidance based on that expertise and experience.

|

| |

●

|

A director must be independent of any particular constituency, be able to represent all shareholders of the Company, and be committed to enhancing long-term shareholder value.

|

| |

●

|

A director must have sufficient time available to devote to activities of the Board and to enhance his or her knowledge of the Company’s business.

|

The Board also believes the following qualities or skills are necessary for one or more directors to possess:

| |

●

|

At least one independent director must have the requisite experience and expertise to be designated as an “audit committee financial expert,” as defined by applicable rules of the Securities and Exchange Commission, and have past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the member’s financial sophistication, as required by the rules of NASDAQ.

|

| |

●

|

One or more of the directors generally must be active or former executive officers of public or private companies or leaders of major complex organizations, including commercial, scientific, government, educational, and other similar institutions.

|

As noted above, in identifying and evaluating nominees for director, the Nominating Committee seeks to ensure that, among other things, the Board is comprised of directors who have broad and diverse backgrounds, because the Board believes that directors should be selected so that the Board is a diverse body. The Nominating Committee implements this policy by considering how potential directors’ backgrounds would contribute to the diversity of the Board. As part of its annual self-evaluation, the Nominating Committee assesses the effectiveness of its efforts to attain diversity by considering whether it has an appropriate process for identifying and selecting director candidates.

Compensation Committee Interlocks and Insider Participation

Mr. Nunnelly, Dr. Lockhart, Dr. Berwick, and Ms. Bhandari served on the Compensation and Talent Committee during 2022. None of such individuals were our officers or employees at any time during 2022 or as of the date of this Proxy Statement, nor was any such individual a former officer of the Company. In 2022, no member of our Compensation and Talent Committee had any relationship or transaction with us that would require disclosure as a "related person transaction" under Item 404 of Securities and Exchange Commission Regulation S-K in this Proxy Statement under the section entitled Transactions with Related Persons.

During 2022, none of our executive officers served as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served on our Compensation and Talent Committee. Additionally, during 2022, none of our executive officers served as a member of the compensation committee (or other board committee performing equivalent functions) of another entity, one of whose executive officers served as a member of our Board or Compensation and Talent Committee.

Transactions with Related Persons

Except as otherwise disclosed in this section, we had no related person transactions during 2022, and none are currently proposed, in which we were a participant and in which any related person had a direct or indirect material interest. Our Board has adopted written policies and procedures regarding related person transactions. For purposes of these policies and procedures:

| |

●

|

A “related person” means any of our directors, executive officers, nominees for director, any holder of 5% or more of the common stock, or any of their immediate family members; and

|

| |

●

|

A “related person transaction” generally is a transaction (including any indebtedness or a guarantee of indebtedness) in which we were or are to be a participant and the amount involved exceeds $120,000, and in which a related person had or will have a direct or indirect material interest.

|

Each of our executive officers, directors or nominees for director is required to disclose to the Audit Committee certain information relating to related person transactions for review, approval or ratification by the Audit Committee. Disclosure to the Audit Committee should occur before, if possible, or as soon as practicable after the related person transaction is effected, but in any event as soon as practicable after the executive officer, director or nominee for director becomes aware of the related person transaction. The Audit Committee’s decision whether or not to approve or ratify a related person transaction is to be made in light of the Audit Committee’s determination that consummation of the transaction is not or was not contrary to our best interests. Any related person transaction must be disclosed to the full Board.

Mr. Hays, our Chief Executive Officer and director, is an owner of approximately 13% of the equity interests of Nebraska Global Investment Company LLC (“Nebraska Global”). In connection with routine business operations, we purchased certain services from Don’t Panic Labs, LLC (“Don’t Panic Labs”), which was a subsidiary of Nebraska Global for a portion of the year ended December 31, 2022. During the portion of the year ended December 31, 2022 that Don’t Panic Labs was a subsidiary of Nebraska Global, the total value of the purchases from Don’t Panic Labs was $196,000. These transactions were conducted at arms’ length and approved by the Audit Committee pursuant to our related person transaction policies and procedures.

Communications with the Board of Directors

Shareholders may communicate with the Board by writing to NRC Health, Board of Directors (or, at the shareholder’s option, to a specific director), c/o Kevin R. Karas, Secretary, 1245 Q Street, Lincoln, Nebraska 68508. The Secretary will ensure that the communication is delivered to the Board or the specified director, as the case may be.

Information About Our Executive Officers

Set forth below is certain information regarding our current executive officers (other than our CEO and President, Mr. Hays, for whom information is set forth above under Directors Continuing in Office).

Kevin R. Karas, 65, has served as our Chief Financial Officer, Treasurer and Secretary since September 2011, and as Senior Vice President Finance since he joined us in December 2010. From 2005 to 2010, he served as Vice President of Finance for Lifetouch Portrait Studios, Inc., a national retail photography company. Mr. Karas also previously served as Chief Financial Officer at CARSTAR, Inc., an automobile collision repair franchise business, from 2000 to 2005, Chief Financial Officer at Rehab Designs of America, Inc., a provider of orthotic and prosthetic services, from 1993 to 2000, and as a regional Vice President of Finance and Vice President of Operations at Novacare, Inc., a provider of physical rehabilitation services, from 1988 to 1993. He began his career as a Certified Public Accountant at Ernst & Young.

Jona S. Raasch, 64, has served as our Chief Operating Officer from 1988 to 2011 and from 2014 to present. She has also served as Chief Executive Officer of the Governance Institute, one of our divisions, since May 2006.

Helen L. Hrdy, 58, has served as our Chief Growth Officer since January 2020. Prior to that position Ms. Hrdy served as our Senior Vice President, Customer Success, from January 2012 to January 2020. Prior to this Ms. Hrdy held various positions of increasing responsibility with the Company since 2000.

Our executive officers are elected by and serve at the discretion of the Board. There are no family relationships between any of our directors or executive officers. There are no arrangements or understandings between any of our executive officers and any other person pursuant to which any of our executive officers was or is to be selected as an officer.

Employee, Officer and Director Hedging

We do not have practices or policies regarding the ability of employees (including officers) or directors of the Company, or any of their designees, to purchase financial instruments, or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our equity securities. Our officers and Named Executive Officers have not historically engaged in any such hedging transactions and as of the Record Date none of our officers or Named Executive Officers were party to any such hedging transactions.

2022 DIRECTOR COMPENSATION

Directors who are executive officers of the Company receive no compensation for service as members of either the Board or committees thereof. Directors who are not executive officers of the Company receive an annual fixed fee of $75,000 for the lead director and $50,000 for each other director. Directors are also reimbursed for out-of-pocket expenses associated with attending meetings of the Board and committees thereof. Mr. Nunnelly has served as our lead director since May 2012.

Pursuant to the National Research Corporation 2004 Non-Employee Director Stock Plan, as amended (the “Director Plan”), each director who is not an associate (i.e., employee) of the Company also receives an annual grant of an option to purchase shares of our Common Stock on the date of each Annual Meeting of Shareholders. For the period from January 1, 2022 to December 31, 2022, each director continuing in office who was not an associate of the Company received a grant of options to purchase shares of our Common Stock with a target grant date fair value of approximately $100,000, rounded to the nearest whole share and computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation-Stock Compensation (“FASB ASC Topic 718”), or successor rule, on the date of our 2022 annual meeting of shareholders (May 18, 2022). The options were granted with an exercise price equal to the fair market value of our common stock on the date of grant, are scheduled to vest the day immediately preceding the Annual Meeting, and expire on May 18, 2032.

On May 18, 2022 as a discretionary award pursuant to the Director Plan and in connection with her appointment to the Board, the Board granted Ms. Bhandari nonqualified stock options with a grant date fair value of approximately $100,000, rounded to the nearest whole share and computed in accordance with FASB ASC Topic 718. The options become exercisable on the day immediately preceding the Annual Meeting and expire on May 18, 2032. The grant was made to compensate Ms. Bhandari for agreeing to serve and her future service on the Board and to further align the interests, perspectives and decision-making of our Board with the interests of our shareholders. While the grant was discretionary, it has been the Company’s practice to make such grants to newly appointed directors to assure our Board can recruit and retain the best personnel.

The options granted to our directors during 2022 were granted in accordance with our Board’s standard practice of making annual options grants effective on the date of the annual meeting of shareholders (and, in the case of the discretionary award to Ms. Bhandari, the Board’s standard practice of making discretionary option awards on the date a new director joins the Board). The timing of the grants was not tied to the timing of any release of material nonpublic information.

The following table sets forth information regarding the compensation received by each of our directors during 2022:

|

Name

|

|

Fees Earned or

Paid in Cash

|

|

|

Option Awards(1)

|

|

|

Total

|

|

|

Donald M. Berwick

|

|

$ |

50,000 |

|

|

$ |

100,006 |

|

|

$ |

150,006 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Parul Bhandari

|

|

$ |

18,733 |

|

|

$ |

200,012 |

(2) |

|

$ |

218,745 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen H. Lockhart

|

|

$ |

50,000 |

|

|

$ |

100,006 |

|

|

$ |

150,006 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

John N. Nunnelly

|

|

$ |

75,000 |

|

|

$ |

100,006 |

|

|

$ |

175,006 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Penny A. Wheeler

|

|

$ |

50,000 |

|

|

$ |

100,006 |

|

|

$ |

150,006 |

|

_______________________

(1) Represents the aggregate grant date fair value of option awards granted during the year, computed in accordance with FASB ASC Topic 718. See Note 9 to our Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2022, for a discussion of assumptions made in the valuation of share-based compensation. As of December 31, 2022, the outstanding option awards for each director were as follows: Dr. Berwick – 33,367 options; Ms. Bhandari – 24,156 options; Dr. Lockhart – 26,189 options; Mr. Nunnelly – 46,205 options; and Dr. Wheeler – 26,189 options.

(2) Includes a one-time discretionary option award granted to Ms. Bhandari upon becoming a member of the Board.

REPORT OF THE AUDIT COMMITTEE

In accordance with its written charter, the Audit Committee’s primary function is to assist the Board in fulfilling its oversight responsibilities by overseeing the Company’s systems of internal controls regarding finance, accounting, legal compliance, and ethics that management and the Board have established; the Company’s accounting and financial reporting processes; and the audits of the financial statements of the Company.

In fulfilling its responsibilities, the Audit Committee has reviewed and discussed the audited financial statements contained in the 2022 Annual Report on Form 10-K with the Company’s management and independent registered public accounting firm. Management is responsible for the financial statements and the reporting process, including the system of internal controls. The independent registered public accounting firm is responsible for expressing an opinion on the audited financial statements in conformity with U.S. generally accepted accounting principles and on the Company’s internal control over financial reporting.

The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed under the applicable requirements of the Public Company Accounting Oversight Board regarding communications with audit committees. In addition, the Company’s independent registered public accounting firm provided to the Audit Committee the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and the Audit Committee discussed with the independent registered public accounting firm the firm’s independence. The Audit Committee pre-approves all audit and permissible non-audit services provided by the independent registered public accounting firm. The Audit Committee has considered whether the provision of the services relating to the Audit-Related Fees, Tax Fees and All Other Fees set forth in “Miscellaneous – Independent Registered Public Accounting Firm” was compatible with maintaining the independence of the independent registered public accounting firm and determined that such services did not adversely affect the independence of the firm.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board (and the Board has approved) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, for filing with the Securities and Exchange Commission.

This report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, and shall not otherwise be deemed filed under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

AUDIT COMMITTEE

John N. Nunnelly, Chairperson

Donald M. Berwick

Penny A. Wheeler

PRINCIPAL SHAREHOLDERS

The following table sets forth certain information regarding the beneficial ownership of Common Stock as of the Record Date (i.e., March 24, 2023) by: (1) each director and director nominee; (2) each of the executive officers named in the Summary Compensation Table; (3) all of the directors, director nominees and executive officers as a group; and (4) each person or entity known to the Company to be the beneficial owner of more than 5% of the Common Stock. Except as otherwise indicated in the footnotes, each of the holders listed below has sole voting and investment power over the shares beneficially owned. As of the Record Date, there were 24,599,815 shares of Common Stock outstanding.

| |

|

Shares Beneficially Owned |

|

|

Name of Beneficial Owner

|

|

Shares

|

|

|

% (1)

|

|

|

Directors and Executive Officers (2)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Michael D. Hays

|

|

|

155,869 |

(3)(4) |

|

|

* |

|

|

Kevin R. Karas

|

|

|

54,187 |

(4)(5) |

|

|

* |

|

|

Jona S. Raasch

|

|

|

113,253 |

(4)(6) |

|

|

* |

|

|

Helen L. Hrdy

|

|

|

73,145 |

(4) |

|

|

* |

|

|

Donald M. Berwick

|

|

|

33,367 |

(4) |

|

|

* |

|

|

Parul Bhandari

|

|

|

24,156 |

(4) |

|

|

* |

|

|

Stephen H. Lockhart

|

|

|

26,189 |

(4) |

|

|

* |

|

|

John N. Nunnelly

|

|

|

73,099 |

(4) |

|

|

* |

|

|

Penny A. Wheeler

|

|

|

26,189 |

(4) |

|

|

* |

|

|

All directors, nominees and executive officers as a group (nine persons)

|

|

|

579,454 |

(4) |

|

|

2.4% |

|

| |

|

|

|

|

|

|

|

|

|

Other Holders

|

|

|

|

|

|

|

|

|

|

Amandla MK Trust and Patrick E. Beans, as the Special Holdings Direction Advisor under this Trust (7)

|

|

|

5,329,189 |

|

|

|

21.7% |

|

| |

|

|

|

|

|

|

|

|

|

Common Property Trust, Common Property Trust LLC and Thomas Richardson, as Trustee of Common Property Trust and Manager of Common Property Trust LLC(8)

|

|

|

4,772,522 |

|

|

|

19.4% |

|

| |

|

|

|

|

|

|

|

|

|

Kayne Anderson Rudnick Investment Management LLC (9)

|

|

|

3,224,166 |

|

|

|

13.1% |

|

_______________________

* Denotes less than 1%.

|

(1)

|

In accordance with applicable rules under the Securities Exchange Act of 1934, as amended, the number of shares indicated as beneficially owned by a person includes shares of common stock and shares underlying options that are currently exercisable or will be exercisable within 60 days of March 24, 2023. Shares of common stock underlying stock options that are currently exercisable or will be exercisable within 60 days of March 24, 2023 are deemed to be outstanding for purposes of computing the percentage ownership of the person holding such options, but are not deemed outstanding for purposes of computing the percentage ownership of any other person.

|

|

(2)

|

The address of all directors and officers is 1245 Q Street, Lincoln, Nebraska 68508.

|

|

(3)

|

Includes 76,095 shares of Common Stock held by Mr. Hays’ wife. Mr. Hays disclaims beneficial ownership of the shares held by his wife.

|

|

(4)

|

Includes shares of Common Stock that may be purchased under stock options which are currently exercisable or exercisable within 60 days of March 24, 2023, as follows: Mr. Hays, 34,734 shares; Mr. Karas, 48,803 shares; Ms. Raasch, 51,371 shares; Ms. Hrdy, 33,729 shares; Dr. Berwick, 33,367 options; Ms. Bhandari, 24,156 options; Dr. Lockhart, 26,189 options; Mr. Nunnelly, 46,205 options; and Dr. Wheeler, 26,189 options; and all directors, nominees and executive officers as a group, 324,743 shares.

|

|

(5)

|

Includes 17,296 shares of Common Stock pledged as security.

|

|

(6)

|

Includes 50,619 shares of Common Stock held indirectly through a trust.

|

|

(7)

|

The trustee of this Trust is The Bryn Mawr Trust Company of Delaware and its address is 20 Montchanin Road, Suite 100, Greenville, Delaware 19807. The address of the Special Holdings Direction Advisor for this Trust is 709 Pier 2, Lincoln, Nebraska 68528.

|

|

(8)

|

The address for the Common Property Trust and Common Property Trust LLC is 4535 Normal Boulevard, Suite 195, Lincoln, Nebraska 68506. The trustee of Common Property Trust and the manager of Common Property Trust LLC is Thomas Richardson. Mr. Richardson’s address is 601 Massachusetts Avenue, NW, Washington, D.C. 20001.

|

|

(9)

|

The number of shares owned set forth above in the table is as of or about December 31, 2022 as reported by Kayne Anderson Rudnick Investment Management LLC (“Kayne Anderson”) in its amended Schedule 13G filed with the Securities and Exchange Commission. The address for Kayne Anderson is 2000 Avenue of the Stars, Suite 1110, Los Angeles, California 90067. Kayne Anderson reports sole voting power with respect to 480,018 of these shares; sole dispositive power with respect to 535,249 of these shares; and shared voting and dispositive power with respect to 2,688,917 of these shares. The amended Schedule 13G further provides that the shares noted as beneficially owned by Kayne Anderson include: (i) 2,688,917 shares beneficially owned by Virtus Investment Advisers, Inc., One Financial Plaza, Hartford, Connecticut 06103, for which such person has shared voting and dispositive power, and (ii) 2,409,518 shares beneficially owned by Virtus Equity Trust, on behalf of Virtus KAR Small Cap Growth Fund, 101 Munson Street, Greenfield, Massachusetts 01301, for which such person has shared voting and dispositive power.

|

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and any owner of greater than 10% of our Common Stock to file reports with the Securities and Exchange Commission concerning their ownership of our Common Stock. Based solely upon information provided to us by individual directors and executive officers, we believe that, during the fiscal year ended December 31, 2022, all of our directors and executive officers and owners of greater than 10% of our Common Stock complied with the Section 16(a) filing requirements, except that Mr. Hays filed a late Form 4 on March 1, 2023, to report two separate gifts of shares by his spouse that occurred during the fiscal year ended December 31, 2022.

PROPOSAL NO. 2 – RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed KPMG LLP to serve as our independent registered public accounting firm for the year ending December 31, 2023.

We are asking our shareholders to ratify the appointment of KPMG LLP as our independent registered public accounting firm. Although ratification is not required, our Board is submitting the appointment of KPMG LLP to our shareholders for ratification because we value our shareholders’ views on our independent auditors and as a matter of good corporate practice. In the event that our shareholders fail to ratify the appointment, the Audit Committee will consider it as a direction to consider the appointment of a different firm. Even if the appointment is ratified, the Audit Committee in its discretion may select a different independent auditor at any time if it determines that such a change would be in the best interests of the Company and our shareholders.

Representatives of KPMG LLP are expected to participate in the Annual Meeting via the live webcast with the opportunity to make a statement if they so desire. Such representatives are also expected to be available to respond to appropriate questions.

Assuming a quorum is present at the Annual Meeting, the number of votes cast for the ratification of the Audit Committee’s appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2023 must exceed the number of votes cast against it. Abstentions and broker non-votes will be counted as present in determining whether there is a quorum; however, they will not constitute a vote “for” or “against” ratification and will be disregarded in the calculation of votes cast. A broker non-vote occurs when a broker submits a proxy card with respect to shares that the broker holds on behalf of another person but declines to vote on a particular matter, either because the broker elects not to exercise its discretionary authority to vote on the matter or does not have authority to vote on the matter.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM. SHARES OF THE COMPANY’S COMMON STOCK REPRESENTED BY EXECUTED BUT UNMARKED PROXIES WILL BE VOTED “FOR” RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion and analysis relates to the compensation of the individuals named in the Summary Compensation Table, a group we refer to as our “named executive officers.” In this discussion, the terms “we,” “our,” “us” or similar terms refer to the Company.

Overview of Executive Compensation Philosophy

Key features of our compensation program include the following:

| |

✔

|

Conservative pay policy with total named executive officer and director compensation positioned below the median

|

| |

|

|

| |

✔

|

Direct link between pay and performance that aligns business strategies with shareholder value creation

|

| |

|

|

| |

✔

|

Annual say-on-pay votes

|

| |

|

|

| |

✔

|

No tax gross-ups

|

| |

|

|

| |

✔

|

No excessive perquisites for executives

|

| |

|

|

| |

✔

|

No change of control or severance obligations to named executive officers, including no accelerated vesting of equity awards upon a change of control

|

| |

|

|

| |

✔

|

No re-pricing or back-dating of stock options or similar awards

|

| |

|

|

| |

✔

|

Appropriate balance between short- and long-term compensation that discourages short-term risk taking at the expense of long-term results

|

| |

|

|

| |

✔

|

Five year cliff vesting period for executive option grants

|

We recognize the importance of maintaining sound principles for the development and administration of our executive compensation and benefit programs. Specifically, we design our executive compensation and benefit programs to advance the following core principles:

| |

●

|

Competitive Pay for Our Market. We strive to compensate our executive officers at levels to ensure that we continue to attract and retain a highly competent, committed management team. Our Midwest headquarters provides a low cost of living that allows us to provide compensation that accomplishes this goal while keeping total compensation below that of many companies of similar size.

|

| |

●

|

Align with Shareholders. We seek to align the interests, perspectives and decision-making of our executive officers with the interests of our shareholders.

|

| |

●

|

Incentivize Performance. We link our executive officers’ compensation, particularly annual cash bonuses, to our established financial performance goals.

|

We believe that a focus on these principles will benefit us and, ultimately, our shareholders in the long term by ensuring that we can attract and retain highly-qualified executive officers who are committed to our long-term success.

Role of the Compensation and Talent Committee

The Board appoints the Compensation and Talent Committee (the “Committee”), which consists entirely of directors who are “non-employee directors” for purposes of the Securities Exchange Act of 1934, as amended. The following individuals are members of the Committee:

| |

●

|

Stephen H. Lockhart (Chairperson)

|

The Committee is responsible for discharging the Board’s responsibilities with respect to all significant aspects of our compensation policies, programs and plans, and accordingly the Committee determines compensation programs for our executive officers or recommends such programs to the full Board for approval. The Committee also reviews management’s recommendations as to the compensation to be paid to other key personnel and administers our equity-based compensation plans. Periodically, the Committee reviews and determines our compensation and benefit programs, with the objective of ensuring the executive compensation and benefits programs are consistent with our compensation philosophy. The Committee has authority to carry out the foregoing responsibilities under its charter and may delegate such authority to subcommittees of the Committee.

At the time the Committee approved our named executive officers’ 2022 compensation, our most recent review of our compensation and benefit programs was in late 2015, when the Committee engaged Aon Hewitt to review our programs before determining compensation for 2016. In determining compensation levels for our named executive officers in 2022, the Committee did not engage Aon Hewitt or any other compensation consultant to provide advice concerning executive officer compensation.

One objective of the Committee in setting compensation for our executive officers, other than our Chief Executive Officer, is to establish base salary at a level that will attract and retain highly-qualified individuals. The Committee’s considerations in setting our Chief Executive Officer’s base salary are described below. For our executive officers other than our Chief Executive Officer, we also consider individual performance, level of responsibility, skills and experience, and internal comparisons among executive officers in determining base salary levels.

The Committee administers our annual cash incentive program and long-term equity incentive plans and approves all awards made under the program and plans. For annual and long-term incentives, the Committee considers internal comparisons and other existing compensation awards or arrangements in making compensation decisions and recommendations. In its decision-making process, the Committee receives and considers the recommendations of our Chief Executive Officer as to executive compensation programs for all of the other officers. In its decision-making process for the long-term incentives for our executive officers, the Committee considers relevant factors, including our performance and shareholder return and the awards given to the executive officer in past years. The Committee makes its decisions regarding general program adjustments to future base salaries, annual incentives and long-term incentives concurrently with its assessment of the executive officers’ performance. Adjustments generally become effective in January of each year.

In fulfilling its objectives as described above, the Committee took the following steps in determining 2022 compensation levels for our named executive officers:

| |

●

|

Considered the performance of our Chief Executive Officer and determined his total compensation;

|

| |

●

|

Considered the performance of our other executive officers and other key associates (i.e., employees) with assistance from our Chief Executive Officer; and

|

| |

●

|

Determined total compensation for our named executive officers based on recommendations by our Chief Executive Officer (as to the other officers) and the Committee’s consideration of the Company’s and the individual officer’s performance.

|

2022 Say on Pay Vote

In May 2022 (after the 2022 executive compensation actions described in this Compensation Discussion and Analysis had taken place), we held our annual non-binding, advisory shareholder vote on the compensation of our named executive officers at our annual shareholders’ meeting, and, consistent with the recommendation of the Board, our shareholders approved our executive compensation, with more than 98% of votes cast in favor. Consistent with this strong vote of shareholder approval, we have not undertaken any material changes to our executive compensation programs.

Total Compensation

We intend to continue our strategy of compensating our executive officers through programs that emphasize performance-based incentive compensation in the form of cash and equity-based awards. To that end, we have structured total executive compensation to ensure that there is an appropriate balance between a focus on our long-term versus short-term performance. We believe that the total compensation paid or awarded to the executive officers during 2022 was consistent with our financial performance and the individual performance of each of our executive officers. We also believe that this total compensation was reasonable in its totality and is consistent with our compensation philosophies described above.

CEO Compensation

The Committee reviews annually the salary and total compensation levels of Michael D. Hays, our Chief Executive Officer. While Mr. Hays’ salary and overall compensation are significantly below the median level paid to chief executive officers of companies of similar size, he requested that his base salary and targeted overall compensation remain unchanged. The Committee has not proposed an increase in his salary or overall compensation since 2005.

Elements of Compensation

Base Salary

The objective of the Committee is to establish base salary, when aligned with performance incentives, to continue to attract and retain the best talent (with the exception of Mr. Hays’ salary as noted above). We have historically attempted to minimize base salary increases in order to limit our executive compensation expense if we do not meet our objectives for financial growth under our incentive compensation program.

Consistent with this practice, the Committee left base salaries unchanged in 2022 for Mr. Hays, Mr. Karas, Ms. Raasch and Ms. Hrdy, maintaining the salary levels in place since 2016 for all named executive officers with the exception of Ms. Hrdy, whose salary level has been unchanged since her appointment as Chief Growth Officer in 2020. In the case of Mr. Hays, the decision was based on his request, described above, that his salary not be increased. In the case of the other named executive officers, the decision was based on our performance and the belief that such named executive officer’s salaries were at an appropriate level to retain their talent.

Base salaries paid to our named executive officers represented the following percentages of their total compensation (as calculated for purposes of the Summary Compensation Table).

|

Base Salary as a Percentage

of Total Compensation

|

|

|

Michael D. Hays

|

|

|

70 |

% |

| |

|

|

|

|

|

Kevin R. Karas

|

|

|

71 |

% |

| |

|

|

|

|

|

Jona S. Raasch

|

|

|

71 |

% |

| |

|

|

|

|

|

Helen L. Hrdy

|

|

|

71 |

% |

For 2022, base salaries as a percentage of total compensation reflect the fact that no bonuses were earned under the 2022 incentive compensation program, as discussed below.

Annual Cash Incentive

Our executive officers are eligible for annual cash incentive awards under our incentive compensation program. Please note that, while we may refer to annual cash incentive awards as bonuses in this discussion, the award amounts are reported in the Summary Compensation Table under the column titled “Non-Equity Incentive Plan Compensation” pursuant to the Securities and Exchange Commission’s regulations.

We intend for our incentive compensation program to provide an incentive to meet and exceed our financial goals, and to promote a superior level of performance. Within the overall context of our pay philosophy and culture, the program:

| |

●

|

Provides total cash compensation to attract and retain key executive talent;

|

| |

●

|

Aligns pay with organizational performance;

|

| |

●

|

Focuses executive attention on key business metrics; and

|

| |

●

|

Provides a significant incentive for achieving and exceeding performance goals.

|

Under our incentive compensation program, the Committee establishes performance measures for our named executive officers at the beginning of each year. For 2022, the Committee used our overall revenue and net income as performance measures because the Committee believes these are key measures of our ability to deliver value to our shareholders for which our named executive officers have primary responsibility. The Committee weighted the two performance measures equally in determining bonus payouts. The Committee structured the incentive compensation program so that our named executive officers would receive a bonus based on the percentage of growth or decline in overall revenue and net income in 2022 over 2021. Consistent with past years, the Committee structured the incentive compensation program for our named executive officers to require performance representing growth in revenue or net income for any payout to be received.