UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

[X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

|

[ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission file number: 001-35929

National Research Corporation

(Exact name of registrant as specified in its charter)

|

Wisconsin (State or other jurisdiction of incorporation or organization) |

47-0634000 (I.R.S. Employer Identification No.) |

|

1245 Q Street Lincoln, Nebraska (Address of principal executive offices) |

68508 (Zip code) |

Registrant’s telephone number, including area code: (402) 475-2525

Securities registered pursuant to Section 12(b) of the Act:

| Title of Class | Name of Each Exchange on Which Registered |

| Class A Common Stock, $.001 par value | The NASDAQ Stock Market |

| Class B Common Stock, $.001 par value | The NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☒ | Smaller reporting company ☐ |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Emerging growth company ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(s) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes ☐ No ☒

Aggregate market value of the class A common stock and the class B common stock held by non-affiliates of the registrant at June 30, 2017: $458,611,975.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class A Common Stock, $0.001 par value, outstanding as of February 28, 2018: 20,970,575 shares

Class B Common Stock, $0.001 par value, outstanding as of February 28, 2018: 3,540,857 shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2018 Annual Meeting of Shareholders are incorporated by reference into Part III.

|

Page |

||

|

Item 1. |

1 |

|

|

Item 1A. |

8 |

|

|

Item 1B. |

13 |

|

|

Item 2. |

13 |

|

|

Item 3. |

14 |

|

|

Item 4. |

14 |

|

|

Item 5. |

15 |

|

|

Item 6. |

17 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

18 |

|

Item 7A. |

28 |

|

|

Item 8. |

29 |

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

57 |

|

Item 9A. |

57 |

|

|

Item 9B. |

57 |

|

|

Item 10. |

60 |

|

|

Item 11. |

60 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

60 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

61 |

|

Item 14. |

61 |

|

|

Item 15. |

62 |

|

|

Item 16. |

64 |

|

|

66 |

||

|

Business |

Special Note Regarding Forward-Looking Statements

Certain matters discussed in this Annual Report on Form 10-K are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can generally be identified as such because the context of the statement includes phrases such as National Research Corporation, doing business as NRC Health (“NRC Health,” the “Company,” “we,” “our,” “us” or similar terms), “believes,” “expects,” or other words of similar import. Similarly, statements that describe the Company’s future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties which could cause actual results or outcomes to differ materially from those currently anticipated. Factors that could affect actual results or outcomes include, without limitation, the following factors:

|

● |

The possibility of non-renewal of the Company’s client service contracts and retention of key clients; |

|

● |

The Company’s ability to compete in its markets, which are highly competitive, and the possibility of increased price pressure and expenses; |

|

● |

The effects of an economic downturn; |

|

● |

The impact of consolidation in the healthcare industry; |

|

● |

The impact of federal healthcare reform legislation or other regulatory changes; |

|

● |

The Company’s ability to attract and retain key managers and other personnel; |

|

● |

The possibility that the Company’s intellectual property and other proprietary information technology could be copied or independently developed by its competitors; |

|

● |

The possibility that the Company could be subject to security breaches or computer viruses; and |

|

● |

The factors set forth under the caption “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K. |

Shareholders, potential investors and other readers are urged to consider these and other factors in evaluating the forward-looking statements, and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included are only made as of the date of this Annual Report on Form 10-K and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances, except as required by the federal securities laws.

General

The Company is a leading provider of analytics and insights that facilitate measurement and improvement of the patient and employee experience while also increasing patient engagement and customer loyalty for healthcare providers, payers and other healthcare organizations. The Company’s solutions enable its clients to understand the voice of the customer with greater clarity, immediacy and depth. NRC Health’s heritage, proprietary methods, and holistic approach enable our partners to better understand the people they care for and design experiences that inspire loyalty and trust, while also facilitating regulatory compliance and the shift to population-based health management. The Company’s ability to measure what matters most and systematically capture, analyze and deliver insights based on self-reported information from patients, families and consumers is critical in today’s healthcare market. NRC Health believes that access to and analysis of its extensive consumer-driven information is becoming more valuable as healthcare providers increasingly need to more deeply understand and engage patients and consumers in an effort towards effective population-based health management.

NRC Health’s expertise includes the efficient capture, interpretation, transmittal and benchmarking of critical data elements from millions of healthcare consumers. Using its portfolio of solutions through internet-based business intelligence tools, the Company’s clients gain insights into what people think and feel about their organizations in real-time, allowing them to build on their strengths and resolve service issues with greater speed and personalization. The Company’s clients are also able to access networking groups, on-line education and an extensive library of performance improvement material that can be tailored to each of their unique needs.

The Company’s portfolio of subscription-based solutions provide actionable information and analysis to healthcare organizations and payers across a range of mission-critical, constituent-related elements, including patient experience and satisfaction, community population health risks, workforce engagement, community perceptions, and physician engagement. NRC Health partners with clients across the continuum of healthcare services. The Company’s clients range from integrated health systems and post-acute providers, such as home health, long term care and hospice, to numerous payer organizations. The Company believes this cross-continuum positioning is a unique and an increasingly important capability as evolving payment models drive healthcare providers and payers towards a more collaborative and integrated service model.

NRC Health has achieved a market leadership position through its more than 36 years of industry innovation and experience, as well as its long-term, recurring revenue relationships (solutions that are used or required by a client each year) with many of the healthcare industry’s largest organizations. Since its founding in 1981, the Company has focused on meeting the evolving information needs of the healthcare industry through internal product development, as well as select acquisitions. The Company is a Wisconsin corporation headquartered in Lincoln, Nebraska.

Industry and Market Opportunity

According to the Centers for Medicare and Medicaid Services (“CMS”), health expenditures in the United States were approximately $3.3 trillion in 2016, or $10,348 per person. In total, health spending accounted for 17.9% of the nation’s Gross Domestic Product in 2016. Addressing this growing expenditure burden continues to be a major policy priority at both federal and state levels. In addition, increased co-pays and deductibles in healthcare plans have focused even more consumer attention on health spending and affordability. In the public sector, Medicare provides health coverage for individuals aged 65 and older, while Medicaid provides coverage for low income families and other individuals in need. Both programs are administered by the CMS. With the aging of the U.S. population, Medicare enrollment has increased significantly. In addition, longer life spans and greater prevalence of chronic illnesses among both the Medicare and Medicaid populations have placed tremendous demands on the health care system.

Driven by escalating costs and a growing recognition of the challenges of chronic care and unnecessary hospitalizations, Medicare reimbursement for healthcare providers is shifting from a volume-based approach (fees paid for each element of service rendered, independent of outcome) to a more value-based model, where reimbursement is based on the value (or quality) of the healthcare service delivered. The establishment of standardized quality-focused datasets and the requirement that providers capture and transmit this data to CMS has enabled this shift.

An increasing percentage of Medicare reimbursement and reimbursement from commercial payers will be determined under value payment models, based on factors such as patient readmission rates and provider adherence to certain quality-related protocols. At the same time, many hospitals and other providers are creating new models of care delivery to improve patient experience, reduce cost and provide better clinical outcomes. These new models are based on sharing financial risk and managing the health and behaviors of large populations of patients and consumers. Certain of these new models are known as accountable care organizations, or ACOs, and medical homes, in which multiple provider organizations are coordinated in providing care and bearing shared financial risk in serving a defined patient population. This transformation towards value-based payment models and increased engagement of healthcare consumers is resulting in a greater need for providers to deliver more customer-centric healthcare.

NRC Health believes that its current portfolio of solutions is aligned to address this evolving market opportunity. The Company provides tools and solutions to capture, interpret and improve the data required by CMS as well as enhanced capabilities that capture insights about patient health risks, behaviors and perceptions. The information and analytics provided through these solutions enable payers and providers to better understand what matters most to people at key moments in their relationship with a health organization. NRC Health’s solutions enable its clients to design experiences to improve the wellbeing of the people and communities they care for. In addition, the Company’s portfolio of experience solutions helps providers address and impact the types of behaviors that could result in reduced hospital re-admission rates, and a direct and measurable impact on providers’ revenue.

Finally, the Company believes that its ability to offer these insights across the entire care continuum is particularly relevant as new reimbursement models reward collaboration amongst different types of providers. Bundled payments, medical home, ACOs and other models of reimbursement for population-based health management all require effective coordination of care both within and outside of the traditional acute care settings.

NRC Health’s Solutions

NRC Health’s portfolio of solutions are designed to help healthcare companies understand the totality of how their organizations are experienced by the people they serve. NRC Health’s solutions address specific needs around market insight, experience, transparency, and governance for healthcare providers, payers and other healthcare organizations. While each distinct solution provides discernible value on a stand-alone basis, the Company believes that in combination, its solutions provide value through a comprehensive view of healthcare consumers both within healthcare settings and outside of those settings—creating a differentiated solution set to address the emerging needs for population-based health management.

NRC Health’s Market Insights Solutions – NRC Health’s Market Insights solutions are subscription-based services that allow for improved tracking of awareness, perception, and consistency of healthcare brands; real-time assessment of competitive differentiators; and enhanced segmentation tools to evaluate the needs, wants, and behaviors of communities through real-time competitive assessments and enhanced segmentation tools. NRC Health’s Market Insights is the largest U.S. healthcare consumer database of its kind, measuring the opinions and behaviors of more than 292,000 healthcare consumers in the top 300 markets across the country annually. NRC Health’s Market Insights is a syndicated survey that provides clients with an independent third-party source of information that is used to understand consumer perception and preferences and optimize marketing strategies. NRC Health’s Market Insights solutions provide clients with on-demand tools to measure brand value and build brand equity in their markets, evaluate and optimize advertising efficacy and consumer recall, and tailor research to obtain the real time voice of customer feedback to support branding and loyalty initiatives. The Company’s Market Insights solutions were historically marketed under the Healthcare Market Guide and Ticker brands.

NRC Health’s Experience Solutions – NRC Health’s Experience solutions provide hospitals and healthcare providers the ability to receive and take action on customer and employee feedback across all care settings in real-time. Experience solutions include patient and resident experience, workforce engagement, health risk assessments, transitions, and improvement tools, which are provided through the Experience, Transitions and National Research Canada Corporation operating segments. These solutions enable clients to comply with regulatory requirements and to improve their reimbursement under value-based purchasing models. More importantly, NRC Health’s Experience solutions provide quantitative and qualitative real-time feedback, improvement plans, and coaching tools to enable clients to improve the experiences of patients, residents, physicians and staff. By illuminating the complete care journey in real time, the Company’s clients are able to ensure each individual receives the care, respect, and experience he or she deserves. Developing a longitudinal profile of what healthcare customers want and need allows for organizational improvement, increased clinician and staff engagement, loyal relationships and personal well-being.

NRC Health’s Experience solutions are provided on a subscription basis via a cross-continuum platform that collects and measures data and then delivers business intelligence that the Company’s clients utilize to improve patient experience, engagement and loyalty. Patient data can be collected on a longitudinal basis for improvement and regulatory compliance purposes as well as on a real time basis to support service recovery, rapid cycle improvement, and engagement activities. NRC Health provides these performance results and prescriptive analytics to its clients via web-based improvement planning and business intelligence portals. These solutions have previously been marketed under NRC Picker, My InnerView (“MIV”), Customer-Connect LLC (doing business as Connect), and NRC Canada.

NRC Health’s Health Risk Assessment solutions (formerly Payer Solutions) enable the Company’s clients to understand the health risks associated with populations of patients, analyze and address readmission risks, and efficiently reach out to patients to impact their behaviors outside of the healthcare provider settings. These health risk assessment solutions enable clients to effectively segment populations and manage care for those who are most at-risk, engage individuals, increase preventative care and manage wellness programs to improve patient experience and outcomes.

NRC Health’s Transitions solutions are provided to healthcare organizations on a subscription basis to drive effective communication between healthcare providers and patients in the critical 24-72 hours post discharge using a discharge call program. Through preference-based communications and real-time alerts, these solutions enable organizations to identify and manage high-risk patients to reduce readmissions, increase patient satisfaction and support safe care transitions. Tracking, trending and benchmarking tools isolate the key areas for process improvement allowing organizations to implement changes and reduce future readmissions. NRC Health’s Transitions solutions were previously provided by Connect. Connect was formed in June 2013 to develop and provide patient outreach and discharge call solutions. NRC Health originally had a 49% ownership interest in Connect but by March 2016 had acquired all of the remaining interest and subsequently dissolved Customer-Connect LLC in June 2016.

NRC Health’s Transparency Solutions – NRC Health’s Transparency solutions allow healthcare organizations to share a picture of their organization and ensure that timely and relevant content informs better consumer decision-making. NRC Health’s star ratings solution (formerly Reputation) enables clients to publish a five-star rating metric and verified patient feedback derived from actual patient survey data to complement their online physician information. Sharing this feedback not only results in better-informed consumer decision-making but also has the ability to drive new patient acquisition and grow online physician reputation. NRC Health’s reputation monitoring solution alerts clients to ratings and reviews on third-party websites and provides workflows for response and service recovery. These solutions raise physician awareness of survey results and provide access to improvement resources and educational development opportunities designed to improve the way care is delivered.

NRC Health’s Governance Solutions – NRC Health’s Governance solutions, branded as The Governance Institute (“TGI”), serves not-for-profit hospital and health system boards of directors, executives, and physician leadership. TGI’s subscription-based, value-driven membership services are provided through national conferences, publications, advisory services, and an on-line portal designed to improve the effectiveness of hospital and healthcare systems by continually strengthening their board governance, strategic planning, medical leadership, management performance, and transparency positioning. TGI also conducts research studies and tracks industry trends showcasing emerging healthcare trends and best practice solutions of healthcare boards across the country.

NRC Health’s Competitive Strengths

The Company believes that its competitive strengths include the following:

A leading provider of patient experience solutions for healthcare providers, payers and other healthcare organizations. The Company’s history is based on capturing the voice of the consumer in healthcare markets. The Company’s solutions build on the “Eight Dimensions of Patient-Centered Care,” a philosophy developed by noted patient advocate Harvey Picker, who believed patients’ experiences are integral to quality healthcare. NRC Health has extended this philosophy to include families, caregivers, employees and other stakeholders.

Premier client portfolio across the care continuum. NRC Health’s client portfolio encompasses leading healthcare organizations across the healthcare continuum, from acute care hospitals and post-acute providers to healthcare payers. The Company’s client base is diverse, with its top ten clients representing approximately 19% of total revenue for the year ended December 31, 2017 and no single client representing more than 5% of the Company’s revenue.

Highly scalable and visible revenue model. The Company’s solutions are offered to healthcare providers, payers and other healthcare organizations primarily through subscription-based service agreements. The solutions NRC Health provides are also recurring in nature, which enables an ongoing relationship with its clients. This combination of subscription-based revenue, a base of ongoing client renewals and automated platforms creates a highly visible and scalable revenue model for the Company.

Comprehensive portfolio of solutions. Since NRC Health offers solutions encompassing market insights, experience, transparency, and governance, its clients can engage with the Company at multiple levels and, over time, increase their commitment and the financial value of their business relationship.

Exclusive focus on healthcare. The Company focuses exclusively on healthcare and serving the unique needs of healthcare organizations across the continuum, which NRC Health believes gives it a distinct competitive advantage compared to other survey and analytics software providers. The Company’s platform includes features and capabilities built specifically for healthcare providers, including a library of performance improvement content which can be tailored to the provider based on their specific customer feedback profile.

Experienced senior management team led by NRC Health’s founder. NRC Health’s senior management team has extensive industry and leadership experience. Michael D. Hays, the Company’s Chief Executive Officer, founded NRC Health in 1981. Prior to launching the Company, Mr. Hays served as Vice President and as a Director of SRI Research Center, Inc. (now known as the Gallup Organization). The Chief Financial Officer, Kevin Karas, CPA, has extensive financial experience having served as CFO at two previous companies, along with healthcare experience at Rehab Designs of America, Inc. and NovaCare, Inc. Steven D. Jackson, the Company’s President, served as Chief Strategy Officer for Vocera Communications, and he also served as Chief Operating Officer for ExperiaHealth.

Competition

The healthcare information and market research services industry is highly competitive. The Company has traditionally competed with healthcare organizations’ internal marketing, market research, and/or quality improvement departments which create their own performance measurement tools, and with relatively small specialty research firms which provide survey-based healthcare market research and/or performance assessment. The Company’s primary competitors among such specialty firms include Press Ganey, which has significantly higher annual revenue than the Company, and three or four other organizations that NRC Health believes have less annual revenue than the Company. The Company, to a certain degree, currently competes with, and anticipates that in the future it may increasingly compete with, (1) market research firms and technology solutions which provide survey-based, general market research or Voice of the Customer feedback capabilities and (2) firms which provide services or products that complement healthcare performance assessments such as healthcare software or information systems. Although only a few of these competitors have offered specific services that compete directly with the Company’s solutions, many of these competitors have substantially greater financial, information gathering, and marketing resources than the Company and could decide to increase their resource commitments to the Company’s market. There are relatively few barriers to entry into the Company’s market, and the Company expects increased competition in its market which could adversely affect the Company’s operating results through pricing pressure, increased marketing expenditures, and market share losses, among other factors. There can be no assurance that the Company will continue to compete successfully against existing or new competitors.

The Company believes the primary competitive factors within its market include quality of service, timeliness of delivery, unique service capabilities, credibility of provider, industry experience, and price. NRC Health believes that its industry leadership position, exclusive focus on the healthcare industry, cross-continuum presence, comprehensive portfolio of solutions and relationships with leading healthcare payers and providers position the Company to compete in this market.

Growth Strategy

NRC Health believes that the value proposition of its current solutions, combined with the favorable alignment of its solutions with emerging market demand, positions the Company to benefit from multiple growth opportunities. The Company believes that it can accelerate its growth through (1) increasing sales of its existing solutions to its existing clients (or cross-selling), (2) winning additional new clients through market share growth in existing market segments, (3) developing and introducing new solutions to new and existing clients, and (4) pursuing acquisitions of, or investments in, firms providing products, solutions or technologies which complement those of the Company.

Selling additional solutions to existing clients. Approximately 22% of the Company’s existing clients purchase more than one of its solutions. NRC Health’s sales organization actively identifies and pursues these cross-sell opportunities in order to accelerate the growth of the Company.

Adding new clients. NRC Health believes that there is an opportunity to add new clients in each of the acute care, post-acute care and health plan market segments. The Company’s sales organization is actively identifying and engaging new client prospects in each of the segments noted above, with a focus on featuring its comprehensive cross continuum portfolio of solutions.

Adding new solutions. The need for growth, engagement and informing solutions in the market segments that NRC Health serves is evolving to align with emerging healthcare regulatory and reimbursement trends. The evolving market creates an opportunity for the Company to introduce new solutions that leverage its existing core competencies. The Company believes that there is an opportunity to drive sales growth with both existing and new clients, across all of the market segments that it serves, through the introduction of new solutions.

Pursue strategic acquisitions and investments. The Company has historically complemented its organic growth with strategic acquisitions, having completed seven such transactions over the past sixteen years. These transactions have added new capabilities and access to market segments that are adjacent and complementary to the Company’s existing solutions and market segments. NRC Health believes that additional strategic acquisition and/or investment opportunities exist for the Company to complement its organic growth by further expanding its service capabilities, technology offerings and end markets.

Sales and Marketing

The Company generates the majority of its revenue from the renewal of subscription-based client service agreements, supplemented by sales of other solutions to existing clients and the addition of new clients. NRC Health sales activities are carried out by a direct sales organization staffed with professional, trained sales associates. As compared to the typical industry practice of compensating sales associates with relatively high base pay and a relatively small sales commission, NRC Health compensates its sales staff with relatively low base pay and a relatively high commission component. The Company believes this compensation structure provides incentives to its sales associates to surpass sales goals and increases the Company’s ability to attract top-quality sales associates.

NRC Health conducts various marketing programs to generate new opportunities for its sales organization. The Company also maintains an active public relations program which includes (1) an ongoing presence in leading industry trade press and in the mainstream press, (2) public speaking at strategic industry conferences, (3) fostering relationships with key industry constituencies, and (4) annual awards programs that recognize top-ranking healthcare organizations.

Clients

NRC Health’s clients include many of the nation’s largest healthcare systems. The Company provides solutions to over 47 payer health plans and 148 of the 200 largest health systems.

The Company’s ten largest clients accounted for 19%, 17%, and 15% of the Company’s total revenue in 2017, 2016 and 2015, respectively. Approximately 4%, 5% and 5% of the Company’s revenue was derived from foreign customers in 2017, 2016, and 2015, respectively.

For financial information by geographic area, see Note 15 to the Company’s consolidated financial statements.

Intellectual Property and Other Proprietary Rights

The Company’s success depends in part upon its data collection processes, research methods, data analysis techniques and internal systems, and procedures that it has developed specifically to serve clients in the healthcare industry. The Company has no patents. Consequently, it relies on a combination of copyright and trade secret laws and associate nondisclosure agreements to protect its systems, survey instruments and procedures. There can be no assurance that the steps taken by the Company to protect its rights will be adequate to prevent misappropriation of such rights or that third parties will not independently develop functionally equivalent or superior systems or procedures. The Company believes that its systems and procedures and other proprietary rights do not infringe upon the proprietary rights of third parties. There can be no assurance, however, that third parties will not assert infringement claims against the Company in the future or that any such claims will not result in protracted and costly litigation, regardless of the merits of such claims or whether the Company is ultimately successful in defending against such claims.

Associates

As of December 31, 2017, the Company employed a total of 430 persons on a full-time basis. In addition, as of such date, the Company had 28 part-time associates primarily in its survey operations, representing approximately 14 full-time equivalent associates. None of the Company’s associates are represented by a collective bargaining unit. The Company considers its relationship with its associates to be good.

Executive Officers of the Company

The following table sets forth certain information as of February 1, 2018, regarding the executive officers of the Company:

|

Name |

Age |

Position |

|

Michael D. Hays |

63 |

Chief Executive Officer |

|

Steven D. Jackson |

42 |

President |

|

Kevin R. Karas |

60 |

Senior Vice President Finance, Chief Financial Officer, Treasurer and Secretary |

Michael D. Hays has served as Chief Executive Officer and a director since he founded the Company in 1981. He also served as President of the Company from 1981 to 2004 and from July 2008 to July 2011. Prior to founding the Company, Mr. Hays served for seven years as a Vice President and a director of SRI Research Center, Inc. (n/k/a the Gallup Organization).

Steven D. Jackson has served as President of the Company since October 2015. He served as Group President from October 2014 until September 2015, during which time he oversaw the Company’s Market Insights, Transparency, and Predictive Analytics business units. Prior to joining the Company, Mr. Jackson served as Chief Strategy Officer for Vocera Communications where he was employed from 2007 to 2014. He also served as Chief Operating Officer for ExperiaHealth, a subsidiary of Vocera. Earlier in his career, Mr. Jackson held positions of increasing responsibility at The Advisory Board Company, Neoforma, and Stockamp & Associates.

Kevin R. Karas has served as Chief Financial Officer, Treasurer and Secretary of the Company since September 2011, and as Senior Vice President Finance since he joined the Company in December 2010. From 2005 to 2010, he served as Vice President of Finance for Lifetouch Portrait Studios, Inc., a national retail photography company. Mr. Karas also previously served as Chief Financial Officer at CARSTAR, Inc., an automobile collision repair franchise business, from 2000 to 2005, Chief Financial Officer at Rehab Designs of America, Inc., a provider of orthotic and prosthetic services, from 1993 to 2000, and as a regional Vice President of Finance and Vice President of Operations at Novacare, Inc., a provider of physical rehabilitation services, from 1988 to 1993. He began his career as a Certified Public Accountant at Ernst & Young.

Executive officers of the Company are elected by and serve at the discretion of the Company’s Board of Directors. There are no family relationships between any directors or executive officers of NRC Health.

Available Information

More information regarding NRC Health is available on the Company's website at www.nrchealth.com. NRC Health is not including the information contained on or available through its website as part of, or incorporating such information by reference into, this Annual Report on Form 10-K. The Company's Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports are made available to the public at no charge through a link appearing on the Company's website. NRC Health provides access to such materials through its website as soon as reasonably practicable after electronically filing such material with, or furnishing it to, the Securities and Exchange Commission. Reports and amendments posted on the Company’s website do not include access to exhibits and supplemental schedules electronically filed with the reports or amendments.

|

Risk Factors |

You should carefully consider each of the risks described below, together with all of the other information contained in this Annual Report on Form 10-K, before making an investment decision with respect to our securities. If any of the following risks develop into actual events, our business, financial condition or results of operations could be materially and adversely affected and you may lose all or part of your investment.

We depend on contract renewals, including retention of key clients, for a large share of our revenue and our operating results could be adversely affected.

We expect that a substantial portion of our revenue for the foreseeable future will continue to be derived from renewable service contracts. Substantially all contracts are renewable annually at the option of our clients, although contracts with clients under unit-based arrangements generally have no minimum purchase commitments. Client contracts are generally cancelable on short notice without penalty, however we are entitled to payment for services through the cancellation date. To the extent that clients fail to renew or defer their renewals, we anticipate our results may be materially adversely affected. We rely on a limited number of key clients for a substantial portion of our revenue. The Company’s ten largest clients accounted for 19%, 17%, and 15% of the Company’s total revenue in 2017, 2016, and 2015, respectively. Our ability to secure renewals depends on, among other things, our ability to gather and analyze performance data in a consistent, high-quality, and timely fashion. In addition, the service needs of our clients are affected by accreditation requirements, enrollment in managed care plans, the level of use of satisfaction measures in healthcare organizations’ overall management and compensation programs, the size of operating budgets, clients’ operating performance, industry and economic conditions, and changes in management or ownership. As these factors are beyond our control, we cannot ensure that we will be able to maintain our renewal rates. Any material decline in renewal rates from existing levels would have an adverse effect on our revenue and a corresponding effect on our operating and net income.

Our operating results may fluctuate and this may cause our stock price to decline.

Our overall operating results may fluctuate as a result of a variety of factors, including the size and timing of orders from clients, client demand for our services (which, in turn, is affected by factors such as accreditation requirements, enrollment in managed care plans, operating budgets and clients’ operating performance), the hiring and training of additional staff, expense increases, and industry and general economic conditions. Because a significant portion of our overhead is fixed in the short-term, particularly some costs associated with owning and occupying our building and full-time personnel expenses, our results of operations may be materially adversely affected in any particular period if revenue falls below our expectations. These factors, among others, make it possible that in some future period our operating results may be below the expectations of securities analysts and investors which would have a material adverse effect on the market price of our class A common stock and/or our class B common stock.

We operate in a highly competitive market and could experience increased price pressure and expenses as a result.

The healthcare information and market research services industry is highly competitive. We have traditionally competed with healthcare organizations’ internal marketing, market research and/or quality improvement departments that create their own performance measurement tools, and with relatively small specialty research firms that provide survey-based healthcare market research and/or performance assessment. The Company’s primary competitors among such specialty firms include Press Ganey, which we believe has significantly higher annual revenue than us, and three or four other firms that we believe have lower annual revenue than us. To a certain degree, we currently compete with, and anticipate that in the future we may increasingly compete with, (1) market research firms and technology solutions which provide survey-based, general market research or Voice of the Customer Feedback capabilities and (2) firms which provide services or products that complement healthcare performance assessments, such as healthcare software or information systems. Although only a few of these competitors have offered specific services that compete directly with our services, many of these competitors have substantially greater financial, information gathering, and marketing resources than the Company and could decide to increase their resource commitments to our market. There are relatively few barriers to entry into the Company’s market, and we expect increased competition in our market which could adversely affect our operating results through pricing pressure, increased marketing expenditures, and market share losses, among other factors. There can be no assurance that the Company will continue to compete successfully against existing or new competitors.

Because our clients are concentrated in the healthcare industry, our revenue and operating results may be adversely affected by changes in regulations, a business downturn or consolidation with respect to the healthcare industry.

Substantially all of our revenue is derived from clients in the healthcare industry. As a result, our business, financial condition and results of operations are influenced by conditions affecting this industry, including changing political, economic, competitive and regulatory influences that may affect the procurement practices and operation of healthcare providers and payers. The 2010 Federal comprehensive healthcare reform plan, which includes provisions to control healthcare costs, improve healthcare quality and expand access to affordable health insurance, could result in lower reimbursement rates and otherwise change the environment in which providers and payers operate. In addition, large private purchasers of healthcare services are placing increasing cost pressure on providers. Healthcare providers may react to these cost pressures and other uncertainties by curtailing or deferring purchases, including purchases of our services. Moreover, there has been consolidation of companies in the healthcare industry, a trend which we believe will continue to grow. Consolidation in this industry, including the potential acquisition of certain of our clients, could adversely affect aggregate client budgets for our services or could result in the termination of a client’s relationship with us. The impact of these developments on the healthcare industry is difficult to predict and could have an adverse effect on our revenue and a corresponding effect on our operating and net income.

We rely on third parties whose actions could have a material adverse effect on our business.

We outsource certain operations and engage third parties to perform work needed to fulfill our client services. For example, we use vendors to perform certain printing, mailing, information transmittal and other services related to our survey operations. If any of these vendors cease to operate or fail to adequately perform the contracted services and alternative resources and processes are not utilized in a timely manner, our business could be adversely affected. The loss of any of our key vendors could impair our ability to perform our client services and result in lower revenues and income. It would also be time-consuming and expensive to replace, either directly or through other vendors, the services performed by these vendors, which could adversely impact revenues, expenses and net income. Furthermore, our ability to monitor and direct our vendors’ activities is limited. If their actions and business practices violate policies, regulations or procedures otherwise considered illegal, we could be subject to reputational damage or litigation which would adversely affect our business.

We face several risks relating to our ability to collect the data on which our business relies.

Our ability to provide timely and accurate performance measurement and improvement services to our clients depends on our ability to collect large quantities of high-quality data through surveys and interviews. If our mail survey operations are disrupted and we are unable to mail our surveys in a timely manner, then our revenue and net income could be negatively impacted. If receptivity to our survey and interview methods by respondents declines, or, for some other reason, their willingness to complete and return surveys declines, or if we, for any reason, cannot rely on the integrity of the data we receive, then our revenue could be adversely affected with a corresponding effect on our operating and net income. We also rely on third-party panels of pre-recruited consumer households to produce NRC Health’s Market Insights in a timely manner. If we are not able to continue to use these panels, or the time period in which we use these panels is altered and we cannot find alternative panels on a timely, cost-competitive basis, we could face an increase in our costs or an inability to effectively produce NRC Health’s Market Insights. In either case, our operating and net income could be negatively affected.

Our principal shareholder effectively controls the Company, and holders of class A common stock are not able to independently elect directors of NRC Health or control any of the Company's management policies or business decisions because the holders of class A common stock have substantially less voting power than the holders of the Company's class B common stock, a majority of which is beneficially owned by our principal shareholder.

The Company's outstanding stock is divided into two classes of common stock: class A common stock and class B common stock. The class B common stock has one vote per share on all matters and the class A common stock has one-one-hundredth (1/100th) of one vote per share. As of February 16, 2018, the class B common stock constituted approximately 94% of NRC Health's total voting power. As a result, holders of class B common stock are able to exercise a controlling influence over the Company's business, have the power to elect its directors and indirectly control decisions such as whether to issue additional shares, declare and pay dividends or enter into significant corporate transactions. A majority of the class B common stock was historically owned by Michael D. Hays, our Chief Executive Officer. However, in January and February 2018 Mr. Hays, for estate planning purposes, gifted and/or transferred all of his directly owned class B common stock and class A common stock indirectly to the Amandla MK Trust (the “New Trust”), a trust for the benefit of Mr. Hays’ family.

As of February 16, 2018, approximately 53% of the outstanding class B common stock and approximately 26% of the outstanding class A common stock was owned by the New Trust, and that collectively constituted approximately 52% of the Company's total voting power. As a result, the New Trust can control matters requiring shareholder approval, including the election of directors and the approval of significant corporate matters such as change of control transactions. The effects of such influence could be to delay or prevent a change of control of the Company unless the terms are approved by the New Trust.

The market prices of our two classes of common stock may be volatile and shareholders may be unable to resell shares at or above the price at which the shares were acquired.

The market price of stock can be highly volatile. As a result, the market prices and trading volumes of each of our two classes of common stock may also be highly volatile, and investors in our common stock may experience a decrease in the value of their shares, including decreases that are in response to factors beyond our control, including, but not limited to:

|

● |

Variations in our financial performance and that of similar companies; |

|

● |

Regulatory and other developments that may impact the demand for our services; |

|

● |

Reaction to our press releases, public announcements and filings with the Securities and Exchange Commission; |

|

● |

Client, market and industry perception of our services and performance; |

|

● |

Actions of our competitors; |

|

● |

Changes in earnings estimates or recommendations by analysts who follow our stock; |

|

● |

Loss of key personnel; |

|

● |

Investor or management team sales of our stock; |

|

● |

Changes in accounting principles; and |

|

● |

Variations in general market, economic and political conditions or financial markets. |

Any of these factors, among others, may result in changes in the trading volumes and/or market prices of each of our classes common stock. Following periods of volatility in the market price of a company’s securities, shareholders have often filed securities class-action lawsuits. Our involvement in a class-action lawsuit would result in substantial legal fees and divert our senior management’s attention from operating our business, which could harm our business and net income.

Our business and operating results could be adversely affected if we are unable to attract or retain key managers and other personnel.

Our future performance may depend, to a significant extent, upon the efforts and ability of our key personnel who have expertise in gathering, interpreting and marketing survey-based performance information for healthcare markets. Although client relationships are managed at many levels within our company, the loss of the services of Michael D. Hays, our Chief Executive Officer, or one or more of our other senior managers, could have a material adverse effect, at least in the short to medium term, on most significant aspects of our business, including strategic planning, product development, and sales and customer relations. Our success will also depend on our ability to hire, train and retain skilled personnel in all areas of our business. Currently, we do not have employment agreements with our officers or our other key personnel. Competition for qualified personnel in our industry is intense, and many of the companies that compete with us for qualified personnel have substantially greater financial and other resources than us. Furthermore, we expect competition for qualified personnel to become more intense as competition in our industry increases. We cannot assure you that we will be able to recruit, retain and motivate a sufficient number of qualified personnel to compete successfully.

If intellectual property and other proprietary information technology were copied or independently developed by our competitors, our operating results could be negatively affected.

Our success depends in part upon our data collection process, research methods, data analysis techniques, and internal systems and procedures that we have developed specifically to serve clients in the healthcare industry. We have no patents. Consequently, we rely on a combination of copyright, trade secret laws and associate nondisclosure agreements to protect our systems, survey instruments and procedures. We cannot assure you that the steps we have taken to protect our rights will be adequate to prevent misappropriation of such rights, or that third parties will not independently develop functionally equivalent or superior systems or procedures. We believe that our systems and procedures and other proprietary rights do not infringe upon the proprietary rights of third parties. We cannot assure you, however, that third parties will not assert infringement claims against us in the future, or that any such claims will not result in protracted and costly litigation, regardless of the merits of such claims, or whether we are ultimately successful in defending against such claims.

Our business and operating results could be adversely affected if we experience business interruptions or failure of our information technology and communication systems.

Our ability to provide timely and accurate performance measurement and improvement services to our clients depends on the efficient and uninterrupted operation of our information technology and communication systems, and those of our external service providers. Our systems and those of our external service providers, could be exposed to damage or interruption from fire, natural disasters, energy loss, telecommunication failure, security breach and computer viruses. An operational failure or outage in our information technology and communication systems or those of our external service providers, could result in loss of customers, damage to customer relationships, reduced revenue and profits, refunds of customer charges and damage our reputation and may result in additional expense to repair or replace damaged equipment and recover data loss resulting from the interruption. Although we have taken steps to prevent system failures and have back-up systems and procedures to prevent or reduce disruptions, such steps may not prevent an interruption of services and our disaster recovery planning may not account for all contingencies. Additionally, our insurance may not adequately compensate us for all losses or failures that may occur. Any one of the above situations could have a material adverse effect on our business, financial condition, results of operations and reputation.

Security breaches or computer viruses could harm our business.

In connection with our client services, we receive, process, store and transmit sensitive business information electronically over the internet. Computer viruses could spread throughout our systems and disrupt operations and service delivery. Unauthorized access to our computer systems or databases could result in the theft or publication of confidential information or the deletion or modification of records or could otherwise cause interruption in our operations. We cannot be certain that the technology protecting our networks and information will successfully prevent computer viruses, data thefts, release of confidential information or security breaches. A compromise in our data security systems that results in inappropriate disclosure of our associates', customers' or vendors' confidential information, could harm our reputation and expose us to regulatory action and claims. Changes in privacy and information security laws and standards may require we incur significant expense to ensure compliance due to increased technology investment and operational procedures. An inability to prevent security breaches or computer viruses or failure to comply with privacy and information security laws could result in litigation and regulatory risk, loss of customers, damage to customer relationships, reduced revenue and profits, refunds of customer charges and damage our reputation, which could adversely affect our business, financial condition, results of operations and reputation.

Reputational harm could have a material adverse effect on our business, financial condition and results of operations.

Our ability to maintain a good reputation is critical to selling our services. Our reputation could be adversely impacted by any of the following (whether or not valid): the failure to maintain high ethical and social standards; the failure to perform our client services in a timely manner; violations of laws and regulations; and the failure to maintain an effective system of internal controls or to provide accurate and timely financial information. Damage to our reputation or loss of our clients’ confidence in our services for any of these, or any other reasons, could adversely impact our business, revenues, financial condition, and results of operations, as well as require additional resources to rebuild our reputation.

Our operations are subject to laws and regulations that impose significant compliance costs and create reputational and legal risk.

Due to the nature of the services we offer, we are subject to significant commercial, trade and privacy regulations. We cannot predict the nature, scope or effect of future regulatory requirements to which our operations might be subject or the manner in which existing laws might be administered or interpreted, which could have a material and negative impact on our business and our results of operation. For example, recent years have seen an increase in the development or enforcement of legislation related to healthcare reform, privacy, trade compliance and anti-corruption. Additionally, some of the services we provide include information our clients need to fulfill regulatory reporting requirements. If our services result in errors or omissions in our clients’ regulatory reporting, we may be subject to loss of clients, reputational harm or litigation, each potentially adversely impacting our business. Furthermore, although we maintain a variety of internal policies and controls designed to educate, discourage, prevent and detect violations of such laws, we cannot guarantee that such actions will be effective or sufficient or that individual employees will not engage in inappropriate behavior in breach of our policies. Such conduct, or even an allegation of misbehavior, could result in material adverse reputational harm, costly investigations, severe criminal or civil sanctions, or could disrupt our business, and could negatively affect our results of operations or financial condition.

Failure to comply with public company regulations could adversely impact our profitability.

As a public company, we are subject to the reporting requirements of the Securities Exchange Act of 1934, the Sarbanes-Oxley Act of 2002, the Dodd-Frank Act Wall Street Reform and Consumer Protection Act, the listing requirements of NASDAQ and other applicable securities rules and regulations. Additionally, laws, regulations and standards relating to corporate governance and public disclosure are subject to varying interpretations and continue to develop and change. If we misinterpret or fail to comply with these rules and regulations, our legal and financial compliance costs and net income may be adversely affected.

Our growth strategy includes future acquisitions and/or investments which involve inherent risk.

In order to expand services or technologies to existing clients and increase our client base, we have historically, and may in the future, make strategic business acquisitions and/or investments that we believe complement our business. Acquisitions have inherent risks which may have material adverse effects on our business, financial condition, or results of operations, including, among other things: (1) failure to successfully integrate the purchased operations, technologies, products or services and maintain uniform standard controls, policies and procedures; (2) substantial unanticipated integration costs; (3) loss of key associates including those of the acquired business; (4) diversion of management’s attention from other operations; (5) failure to retain the customers of the acquired business; (6) failure to achieve any projected synergies and performance targets; (7) additional debt and/or assumption of known or unknown liabilities; (8) dilutive issuances of equity securities; and (9) a write-off of goodwill, software development costs, client lists, other intangibles and amortization of expenses. If we fail to successfully complete acquisitions or integrate acquired businesses, we may not achieve projected results and there may be a material adverse effect on our business, financial condition and results of operations.

|

Unresolved Staff Comments |

The Company has no unresolved staff comments to report pursuant to this item.

|

Properties |

The Company’s headquarters is located in an owned office building in Lincoln, Nebraska, of which 62,000 square feet are used for the Company’s operations. This facility houses all the capabilities necessary for NRC Health’s survey programming, printing and distribution, data processing, analysis and report generation, marketing, and corporate administration. The Company’s term note is secured by this property, among other things.

The Company is leasing 4,000 square feet of office space in Markham, Ontario, 3,900 square feet of office space in San Diego, California, 8,100 square feet of office space in Seattle, Washington and 6,200 square feet of office space in Atlanta, Georgia.

|

Legal Proceedings |

From time to time, the Company is involved in certain claims and litigation arising in the normal course of business. Management assesses the probability of loss for such contingencies and recognizes a liability when a loss is probable and estimable.

Since the September 2017 announcement of the original proposed recapitalization plan (see Note 13 to the Company’s consolidated financial statements), three purported class action and/or derivative complaints have been filed in state or federal courts by three individuals claiming to be shareholders of the Company. All of the complaints name as defendants the Company and the individual directors of the Company. Two of these lawsuits were filed in the United States District Court for the District of Nebraska— a putative class action lawsuit captioned Gennaro v. National Research Corporation, et al., which was filed on November 15, 2017, and a putative class and derivative action lawsuit captioned Gerson v. Hays, et al., which was filed on November 16, 2017. These lawsuits were consolidated by order of the federal court. A third lawsuit was filed the Circuit Court for Milwaukee County, Wisconsin—a putative class action lawsuit captioned Apfel v. Hays, et al, which was filed on December 1, 2017. The allegations in all of the lawsuits are very similar. The plaintiffs allege, among other things, that the defendants breached their fiduciary duties in connection with the allegedly unfair proposed transaction, at an allegedly unfair price, conducted in an allegedly unfair and conflicted process and in alleged violation of Wisconsin law and the Company’s Articles of Incorporation. One of the lawsuits also alleges the proposed transaction is a voidable “conflict of interest transaction” under Wisconsin statutes. The plaintiffs in these lawsuits seek, among other things, an injunction enjoining the defendants from consummating the original proposed recapitalization plan, damages, equitable relief and an award of attorneys’ fees and costs of litigation. The Company believes that the allegations of the complaints are without merit and intends to defend these lawsuits vigorously. Despite the changes to the original proposed recapitalization plan that culminated in the December 13, 2017 announcement of a revised proposed recapitalization plan (the “Proposed Recapitalization”), the Company expects that these shareholders or other shareholders might assert similar claims regarding the Proposed Recapitalization. The Company will defend any such lawsuits vigorously. As of December 31, 2017, no losses have been accrued as the Company does not believe the losses are probable or estimable.

|

Mine Safety Disclosures |

Not applicable.

|

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

In May 2013, the Company consummated a recapitalization (the “May 2013 Recapitalization”) pursuant to which the Company established two classes of common stock (class A common stock and class B common stock), issued a dividend of three shares of class A common stock for each share of the Company’s then existing common stock and reclassified each then existing share of common stock as one-half of one share of class B common stock. Following the May 2013 Recapitalization, the Company’s class A common stock and the Company’s class B common stock are traded on the NASDAQ Global Market under the symbols “NRCIA” and “NRCIB,” respectively.

The following table sets forth the range of high and low sales prices for, and dividends declared on the class A common stock and class B common stock for the period from January 1, 2016, through December 31, 2017:

|

Class A |

Class B |

|||||||||||||||||||||||

|

High |

Low |

Dividends Declared Per Common Share |

High |

Low |

Dividends Declared Per Common Share |

|||||||||||||||||||

|

2016 Quarter Ended: |

||||||||||||||||||||||||

|

March 31 |

$ | 16.10 | $ | 13.70 | $ | 0.08 | $ | 36.87 | $ | 32.99 | $ | 0.48 | ||||||||||||

|

June 30 |

$ | 16.67 | $ | 12.53 | $ | 0.08 | $ | 44.60 | $ | 33.19 | $ | 0.48 | ||||||||||||

|

September 30 |

$ | 17.14 | $ | 13.26 | $ | 0.08 | $ | 38.50 | $ | 32.18 | $ | 0.48 | ||||||||||||

|

December 31 |

$ | 20.00 | $ | 14.35 | $ | 0.10 | $ | 46.37 | $ | 32.57 | $ | 0.60 | ||||||||||||

|

2017 Quarter Ended |

||||||||||||||||||||||||

|

March 31 |

$ | 20.93 | $ | 16.50 | $ | 0.10 | $ | 41.73 | $ | 38.76 | $ | 0.60 | ||||||||||||

|

June 30 |

$ | 28.75 | $ | 19.15 | $ | 0.10 | $ | 49.29 | $ | 39.00 | $ | 0.60 | ||||||||||||

|

September 30 |

$ | 41.99 | $ | 26.70 | $ | 0.10 | $ | 57.21 | $ | 47.07 | $ | 0.60 | ||||||||||||

|

December 31 |

$ | 39.00 | $ | 31.40 | $ | 0.10 | $ | 58.16 | $ | 50.46 | $ | 0.60 | ||||||||||||

Cash dividends in the aggregate amount of $16.9 million were declared in 2017 with $12.7 million paid in 2017 and the remaining $4.2 million paid in January 2018. Cash dividends in the aggregate amount of $14.3 million were declared in 2016 with $10.1 million paid in 2016 and the remaining $4.2 million paid in January 2017. The payment and amount of future dividends, if any, is at the discretion of the Company’s Board of Directors and will depend on the Company’s future earnings, financial condition, general business conditions, alternative uses of the Company’s earnings and other factors.

On February 16, 2018, there were approximately 15 shareholders of record and approximately 3,863 beneficial owners of the class A common stock and approximately 11 shareholders of record and approximately 1,447 beneficial owners of the class B common stock.

In February 2006, the Board of Directors of the Company authorized the repurchase of 2,250,000 shares of class A common stock and 375,000 shares of class B common stock (on a post-May 2013 Recapitalization basis) in the open market or in privately negotiated transactions. Unless terminated earlier by resolution of the Company’s Board of Directors, the repurchase program will expire when the Company has repurchased all shares authorized for repurchase thereunder. As of February 16, 2018, 1,969,509 shares of class A common stock and 305,509 shares of class B common stock have been repurchased under that authorization. No class A or class B common stock was repurchased during the three-month period ended December 31, 2017. The remaining shares that may be purchased under that authorization are 280,491 and 69,491 for class A and class B common stock, respectively.

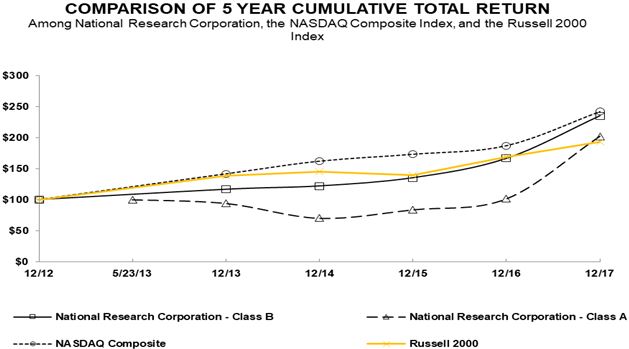

The following graph compares the cumulative 5-year total return provided shareholders on the Company’s common stock relative to the cumulative total returns of the NASDAQ Composite Index and the Russell 2000 Index. An investment of $100 (with reinvestment of all dividends) is assumed to have been made in our common stock and in each of the indexes on December 31, 2012 (or on May 23, 2013 for our class A common stock which was the first day it was traded), and its relative performance is tracked through December 31, 2017. In accordance with Securities and Exchange Commission guidance, in calculating the cumulative 5-year total return on our class B common stock, we gave retroactive effect to the May 2013 Recapitalization (i.e., as if it had occurred on December 31, 2012).

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

|

12/12 |

5/23/13 |

12/13 |

12/14 |

12/15 |

12/16 |

12/17 |

||||||||||||||||||||||

|

National Research Corporation - Class B |

100.00 | -- | 116.56 | 122.01 | 135.26 | 166.45 | 235.18 | |||||||||||||||||||||

|

National Research Corporation - Class A |

--- | 100.00 | 94.10 | 70.25 | 83.85 | 101.51 | 202.11 | |||||||||||||||||||||

|

NASDAQ Composite |

100.00 | -- | 141.63 | 162.09 | 173.33 | 187.19 | 242.29 | |||||||||||||||||||||

|

Russell 2000 |

100.00 | -- | 138.82 | 145.62 | 139.19 | 168.85 | 193.58 | |||||||||||||||||||||

|

Selected Financial Data |

The selected statement of income data for the years ended December 31, 2017, 2016 and 2015, and the selected balance sheet data at December 31, 2017 and 2016, are derived from, and are qualified by reference to, the audited consolidated financial statements of the Company included elsewhere in this Annual Report on Form 10-K. The selected statement of income data for the year ended December 31, 2014 and 2013, and the balance sheet data at December 31, 2015, 2014 and 2013, are derived from audited consolidated financial statements not included herein. The Company acquired Digital Assent, LLC on October 28, 2014 and disposed of selected assets and liabilities related to the clinical workflow product of its Predictive Analytics operating segment on December 21, 2015. The acquisition and disposal did not have a significant impact on the Company’s financial results, therefore, the historical data in the table below have not been adjusted.

|

Year Ended December 31, (a) |

||||||||||||||||||||

|

2017 |

2016 |

2015 |

2014 |

2013 |

||||||||||||||||

|

(In thousands, except per share data) |

||||||||||||||||||||

|

Statement of Income Data: |

||||||||||||||||||||

|

Revenue |

$ | 117,559 | $ | 109,384 | $ | 102,343 | $ | 98,837 | $ | 92,590 | ||||||||||

|

Operating expenses: |

||||||||||||||||||||

|

Direct |

49,068 | 45,577 | 44,610 | 41,719 | 38,844 | |||||||||||||||

|

Selling, general and administrative |

29,686 | 28,385 | 27,177 | 25,018 | 25,208 | |||||||||||||||

|

Depreciation and amortization |

4,586 | 4,225 | 4,109 | 3,804 | 3,732 | |||||||||||||||

|

Total operating expenses |

83,340 | 78,187 | 75,896 | 70,541 | 67,784 | |||||||||||||||

|

Operating income |

34,219 | 31,197 | 26,447 | 28,296 | 24,806 | |||||||||||||||

|

Other income (expense) |

64 | 159 | 913 | (204 | ) | (318 | ) | |||||||||||||

|

Income before income taxes |

34,283 | 31,356 | 27,360 | 28,092 | 24,488 | |||||||||||||||

|

Provision for income taxes |

11,340 | 10,838 | 9,750 | 9,936 | 9,004 | |||||||||||||||

|

Net income |

$ | 22,943 | $ | 20,518 | $ | 17,610 | $ | 18,156 | $ | 15,484 | ||||||||||

|

Earnings per share common stock: Basic Earnings per share: |

||||||||||||||||||||

|

Class A |

$ | 0.54 | $ | 0.49 | $ | 0.42 | $ | 0.44 | $ | 0.37 | ||||||||||

|

Class B |

$ | 3.26 | $ | 2.93 | $ | 2.52 | $ | 2.62 | $ | 2.25 | ||||||||||

|

Diluted Earnings per share: |

||||||||||||||||||||

|

Class A |

$ | 0.52 | $ | 0.48 | $ | 0.41 | $ | 0.43 | $ | 0.37 | ||||||||||

|

Class B |

$ | 3.18 | $ | 2.88 | $ | 2.49 | $ | 2.57 | $ | 2.20 | ||||||||||

| Weighted average share and share equivalents outstanding: | ||||||||||||||||||||

|

Class A – basic |

20,770 | 20,713 | 20,741 | 20,764 | 20,677 | |||||||||||||||

|

Class B – basic |

3,514 | 3,505 | 3,478 | 3,473 | 3,447 | |||||||||||||||

|

Class A – diluted |

21,627 | 21,037 | 20,981 | 21,076 | 21,099 | |||||||||||||||

|

Class B – diluted |

3,603 | 3,560 | 3,522 | 3,536 | 3,514 | |||||||||||||||

|

2017 |

2016 |

2015 |

2014 |

2013 |

||||||||||||||||

|

(In thousands) |

||||||||||||||||||||

|

Balance Sheet Data: |

||||||||||||||||||||

|

Working capital surplus (deficiency) |

$ | 19,949 | $ | 15,551 | $ | 10,890 | $ | 25,262 | $ | 12,784 | ||||||||||

|

Total assets |

127,316 | 120,624 | 128,049 | 129,510 | 111,088 | |||||||||||||||

|

Total debt and capital lease obligations, including current portion |

1,225 | 3,732 | 5,917 | 8,386 | 10,546 | |||||||||||||||

|

Total shareholders’ equity |

$ | 90,041 | $ | 82,806 | $ | 74,222 | $ | 87,748 | $ | 71,755 | ||||||||||

|

(a) |

All share and per share data have been retroactively adjusted to give effect to the May 2013 Recapitalization as further described in Item 5. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Overview

The Company is a leading provider of analytics and insights that facilitate measurement and improvement of the patient and employee experience while also increasing patient engagement and customer loyalty for healthcare providers, payers and other healthcare organizations. The Company’s solutions enable its clients to understand the voice of the customer with greater clarity, immediacy and depth. NRC Health’s heritage, proprietary methods, and holistic approach enable our partners to better understand the people they care for and design experiences that inspire loyalty and trust, while also facilitating regulatory compliance and the shift to population-based health management. The Company’s ability to measure what matters most and systematically capture, analyze and deliver insights based on self-reported information from patients, families and consumers is critical in today’s healthcare market. NRC Health believes that access to and analysis of its extensive consumer-driven information is becoming more valuable as healthcare providers increasingly need to more deeply understand and engage patients and consumers in an effort towards effective population-based health management.

The Company’s portfolio of subscription-based solutions provide actionable information and analysis to healthcare organizations and payers across a range of mission-critical, constituent-related elements, including patient experience and satisfaction, community population health risks, workforce engagement, community perceptions, and physician engagement. NRC Health partners with clients across the continuum of healthcare services. The Company’s clients range from integrated health systems and post-acute providers, such as home health, long term care and hospice, to numerous payer organizations. The Company believes this cross-continuum positioning is a unique and an increasingly important capability as evolving payment models drive healthcare providers and payers towards a more collaborative and integrated service model.

Investments

The Company makes equity investments to promote business and strategic objectives. For investments that do not have a readily determinable fair value, the Company applies either cost or equity method of accounting depending on the nature of its investment and its ability to exercise significant influence. Investments are periodically analyzed to determine whether or not there are any indicators of impairment and written down to fair value if the investment has incurred an other than temporary impairment. During 2017, the Company acquired a $1.3 million investment in convertible preferred stock of PracticingExcellence.com, Inc., a privately-held Delaware Corporation (“PX”), which is carried at cost and included in other non-current assets. The Company has a seat on PX's board of directors and the Company's investment, which is not considered to be in-substance common stock, represents approximately 15.7% of the issued and outstanding equity interests in PX.

Divestitures

On December 21, 2015, the Company completed the sale of selected assets and liabilities related to the clinical workflow product of the former Predictive Analytics operating segment, for a net cash amount of approximately $1.6 million. The Company recorded a gain of approximately $1.1 million from the sale in the fourth quarter of 2015, which is included in other income on the Consolidated Statement of Income. An additional gain was recorded in December 2016, when $223,000 was received from proceeds placed in escrow at the time of sale.

Critical Accounting Policies and Estimates