UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

(Name of Registrant as specified in its charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

No fee required.

Fee paid previously with preliminary materials.

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

1

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

Date: |

Tuesday, May 9, 2023 |

|

Time: |

12:00 p.m., Eastern Time |

|

Place: |

The Company’s offices located at 16 Jonspin Road, Wilmington, MA 01887 |

|

Record Date: |

Only stockholders of record at the close of business on March 13, 2023 are entitled to vote at the meeting and any adjournment or postponement thereof for which no new record date is set. |

|

Items of Business: |

1. |

To elect the Board’s eight nominees for director to serve until the next Annual Meeting and until their successors are duly elected and qualified; |

|

2. |

To approve, on an advisory (non-binding) basis, the compensation of our named executive officers as disclosed in this proxy statement; |

|

3. |

To hold an advisory (non-binding) vote on the frequency of advisory votes on named executive officer compensation; |

|

4. |

To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 30, 2023; and |

|

5. |

To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

These items of business are described more fully below in this proxy statement. This year we will be providing access to our proxy materials via the Internet in accordance with the Securities and Exchange Commission’s “Notice and Access” rules. On or about March 30, 2023, we will be mailing to our stockholders our Notice of Internet Availability of Proxy Materials, which contains instructions for accessing our 2023 proxy statement and 2022 annual report to stockholders and how to vote online. In addition, the Notice of Internet Availability of Proxy Materials will contain instructions on how to request a paper copy of the 2023 proxy statement and 2022 annual report to stockholders.

Your vote is important. As always, we encourage you to vote your shares as soon as possible and prior to the Annual Meeting even if you plan to attend the Annual Meeting. Voting early will ensure your shares are represented at the Annual Meeting, regardless of whether you attend the Annual Meeting. You may cast your vote via the Internet, by telephone, or during the Annual Meeting. If you receive a paper copy of the proxy card by mail, you may also mark, sign, date, and return the proxy card in the accompanying postage-prepaid envelope.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD MAY 9, 2023:

This notice, the proxy statement, and the 2022 Annual Report to Stockholders are available at:

https://www.ontoinnovation.com/ar-proxy

FOR THE BOARD OF DIRECTORS

Yoon Ah E. Oh

Corporate Secretary

Wilmington, Massachusetts

March 30, 2023

2

PROXY STATEMENT

TABLE OF CONTENTS

|

Page |

Forward Looking Statements |

1 |

Proxy Summary |

2 |

Onto Innovation Proxy Statement |

5 |

Proposal 1 – Election of Directors |

6 |

Nominees For Director |

9 |

Corporate Governance Principles and Practices |

14 |

Proposal 2 – Advisory Vote to Approve Executive Officer Compensation |

25 |

Executive Officer Compensation |

26 |

Compensation Committee Report on Executive Officer Compensation |

44 |

Executive Officer Compensation Tables |

45 |

CEO Pay Ratio |

54 |

Proposal 3 -- Advisory Vote on the Frequency of Advisory Votes on Named Executive Officer Compensation |

56 |

Proposal 4 – Ratification of Appointment of Independent Registered Public Accounting Firm |

57 |

Audit Committee Report |

60 |

Executive Officer Biographies |

61 |

Security Ownership of Certain Beneficial Owners |

63 |

Equity Compensation Plan Information |

64 |

Other Matters |

64 |

Questions and Answers About the Annual Meeting |

65 |

Additional Information |

70 |

1

Forward Looking Statements

Certain statements in this proxy statement of Onto Innovation Inc. (referred to in this proxy statement, together with its consolidated subsidiaries, unless otherwise specified or suggested by the context, as the “Company,” “Onto Innovation,” “we,” “our,” or “us”) may be considered “forward-looking statements” or may be based on “forward-looking statements,” including, but not limited to, those concerning: our business momentum and future growth; technology development, product introduction and acceptance of our products and services; our manufacturing practices and ability to both deliver products and services consistent with our customers’ demands and expectations and to strengthen our market position, including our ability to source components, materials, and equipment due to supply chain delays or shortages; our expectations of the semiconductor market outlook; future revenue, gross profits, research and development and engineering expenses, selling, general and administrative expenses, and cash requirements; the effects of political, economic, legal, and regulatory changes or conflicts on our global operations; the effects of natural disasters or public health emergencies, such as the current COVID-19 pandemic, on the global economy and on our customers, suppliers, employees, and business; our dependence on certain significant customers and anticipated trends and developments in and management plans for our business and the markets in which we operate; our ability to be successful in managing our cost structure and cash expenditures and results of litigation; as well as other matters that are not purely historical data. Statements contained or incorporated by reference in this proxy statement that are not purely historical are forward-looking statements and are subject to safe harbors created under Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by words such as, but not limited to, “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “plan,” “should,” “may,” “could,” “will,” “would,” “forecast,” “project” and words or phrases of similar meaning, as they relate to our management or us. Forward-looking statements contained herein reflect our current expectations, assumptions and projections with respect to future events and are subject to certain risks, uncertainties and assumptions, such as those identified in Part I, Item 1A. “Risk Factors” of our Form 10-K for the fiscal year ended December 31, 2022. Actual results may differ materially and adversely from those included in such forward-looking statements. Forward-looking statements reflect our position as of the date of this report and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

1

PROXY SUMMARY

This summary highlights information contained elsewhere in the proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Stockholder Voting Matters |

Voting Matter |

Board Vote Recommendation |

Page Reference for more information |

Proposal 1: Election of Directors |

FOR ALL |

6 |

Proposal 2: Advisory Vote to Approve Named Executive Officer Compensation |

FOR |

25 |

Proposal 3: Advisory Vote on the Frequency of Advisory Votes on Named Executive Officer Compensation |

EVERY 1 YEAR |

56 |

Proposal 4: Ratification of Appointment of Independent Registered Public Accounting Firm for the Fiscal Year Ending December 30, 2023 |

FOR |

57 |

Corporate Governance Highlights |

Snapshot Of Board Composition

The following table presents a snapshot of the expected composition of the Onto Innovation Board of Directors (the “Board”) immediately following the 2023 Annual Meeting, assuming the election of all nominees named in the proxy statement.

Board Characteristic |

|

Onto Innovation |

Total Number of Directors |

|

8 |

Percentage of Independent Directors |

|

87.5% |

Average Age of Directors (years) |

|

63.4 |

Average Tenure of Directors (years) |

|

6.1 |

Separate Chairperson and CEO roles |

|

Yes |

Independent Chairperson |

|

Yes |

Audit Committee Financial Experts |

|

2 |

Female Director Representation |

|

37.5% |

Race/Ethnicity Diversity Representation |

|

12.5% |

2

Snapshot Of Board Governance And Compensation Policies

The following table presents a snapshot of the Onto Innovation Board governance and compensation policies currently in effect.

Policy |

Onto Innovation |

Majority Voting for All Directors |

Yes |

Regular Executive Sessions of Independent Directors |

Yes |

Annual Board, Committee, and Director Evaluations |

Yes |

Risk Oversight by Full Board and Committees |

Yes |

Independent Audit, Compensation, and Nominating & Governance Committees |

Yes |

Code of Business Conduct and Ethics for Employees and Directors |

Yes |

Financial Information Integrity Policy |

Yes |

Stock Ownership Requirement for Directors |

3x annual retainer |

Stock Ownership Requirement for CEO |

3x base salary |

Stock Ownership Requirement for other NEOs |

1x base salary |

Stock-Based Award Grant Date Policy |

Yes |

Anti-Hedging, Anti-Short Sale & Anti-Pledging Policies |

Yes |

Incentive Compensation Clawback Policy |

Yes |

No Tax Gross-Up Provisions |

Yes |

No Poison Pill |

Yes |

Stock Buyback Program |

Yes |

Double Trigger Change-in-Control Provisions for Executive Officers |

Yes |

Annual Environmental, Social, and Governance Report |

Yes |

3

Snapshot Of Board Governance And Compensation Policies Newly Implemented Or Adjusted In Past Year

The following presents a snapshot of the Onto Innovation Board governance and compensation policies that were newly implemented or adjusted in the past year.

4

__________________________________________

PROXY STATEMENT

__________________________________________

The proxy detailed herein is solicited on behalf of the Board of Directors (the “Board” or “Board of Directors”) of Onto Innovation for use at the 2023 Annual Meeting of Stockholders to be held May 9, 2023 at 12:00 p.m. Eastern Time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the Company’s principal executive offices located at 16 Jonspin Road, Wilmington, MA 01887. Directions to the Annual Meeting may be found on our website (www.ontoinnovation.com) by clicking on “Company,” “Locations,” “Massachusetts” and then accessing the interactive map. The Company’s telephone number is (978) 253-6200.

On or about March 30, 2023, we will furnish a Notice of Internet Availability of Proxy Materials (“Notice”) to our stockholders containing instructions on how to access the proxy materials online at:

https://www.ontoinnovation.com/ar-proxy

Instructions on how to vote online and to request a printed copy of the proxy materials may be found in the Notice. If you receive a Notice by mail, you will not receive a paper copy of the proxy materials unless you request such materials by following the instructions contained in the Notice. Your vote is important, regardless of the extent of your holdings.

5

PROPOSAL 1

ELECTION OF DIRECTORS

Nominees |

The Company’s Amended and Restated Certificate of Incorporation provides that directors shall be elected at each Annual Meeting of Stockholders, and that each director of the Company shall serve until the expiration of the term for which he or she is elected and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation, disqualification or removal.

Based on the recommendation of the Nominating & Governance Committee, the eight director nominees approved by the Board for inclusion in this proxy statement and for election at the Annual Meeting are:

Leo Berlinghieri Stephen D. Kelley David B. Miller Michael P. Plisinski Karen M. Rogge Christopher A. Seams May Su Christine A. Tsingos |

Each nominee is currently serving as a director of Onto Innovation. In making its recommendations, the Nominating & Governance Committee considered a number of factors, including its criteria for Board membership, which include the qualifications that must be possessed by a director candidate in order to be nominated for a position on our Board. Each nominee has indicated that he or she will serve if elected. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Company’s eight nominees. In the event that any nominee of the Company becomes unable or unavailable to serve as a director at the time of the Annual Meeting (which we do not anticipate) the proxy holders will vote the proxies for any substitute nominee who is designated by the current Board to fill the vacancy. Alternatively, the Board, in its discretion, may elect not to nominate a substitute and to reduce the size of the Board. We do not have any reason to believe that any of the nominees will be unable or will decline to serve as a director.

Board Composition And Refreshment |

A priority of the Nominating & Governance Committee and the Board as a whole is making certain that the composition of the Board reflects the desired professional experience, skills, and backgrounds in order to present an array of viewpoints and perspectives, help develop and execute strategy for the future, and effectively represent the long-term interests of stockholders. Further, the Board recognizes the importance of Board refreshment in order to continue to achieve an appropriate balance of tenure, turnover, diversity, and skills on the Board.

Vote Required |

Pursuant to the Company’s Amended and Restated Bylaws (“Bylaws”), our directors are elected by the affirmative vote of the majority of the votes cast (provided, however, that if the number of nominees exceeds the number of directors to be elected, directors will be elected by a plurality voting standard). In order for a director in an uncontested election to be elected, the number of votes cast “for” his/her election must exceed the number of votes cast “against” his/her election (with “abstentions” and “broker non-votes” not counted as a vote cast either “for” or “against” that director’s election). If a nominee who is an incumbent director receives a greater number of “against” votes for election than “for” votes in an uncontested election and is not elected, our Corporate Governance Guidelines provide that such director must promptly tender a resignation to the Board. Our Nominating & Governance Committee would then make a recommendation to the Board on whether to accept or reject the tendered resignation, or whether other action should be taken. Within 90 days after the date of the certification of the election results, our Board will act on any such tendered resignation and publicly disclose (in a press release, a filing with the SEC or other broadly disseminated means of communication) its decision regarding the tendered resignation and the rationale behind the decision.

6

Information About The Nominees And Continuing Directors |

Our Board and its Nominating & Governance Committee believe that all of the director nominees are highly qualified, have demonstrated leadership skills, and have the requisite experience and judgment in areas that are relevant to our business. We believe that their ability to challenge and stimulate management and their dedication to the affairs of the Company collectively serve the interests of the Company and its stockholders. The Company is unaware of any arrangements or understandings between any director or nominee and any other person(s) pursuant to which any director or nominee was or is to be selected.

The eight nominees for director are set forth below. All information is as of the record date.

Name |

Principal Occupation |

Board Tenure(1) |

|

Nominee Directors: |

|

|

|

Leo Berlinghieri |

Former President and Chief Executive Officer of MKS Instruments, Inc. |

|

14.5 years |

Stephen D. Kelley |

President and Chief Executive Officer of Advanced Energy Industries, Inc. |

|

<0.2 year |

David B. Miller |

Former President of DuPont Electronics & Communications |

|

7.7 years |

Michael P. Plisinski |

Chief Executive Officer of Onto Innovation Inc. |

|

7.4 years |

Karen M. Rogge |

President of RYN Group LLC, and Former Senior Vice President and |

|

1.5 years |

Christopher A. Seams |

Former Chief Executive Officer of Deca Technologies Inc. |

|

7.6 years |

May Su |

Former Chief Executive Officer of Kateeva, Inc. |

|

1.1 years |

Christine A. Tsingos |

Former Executive Vice President and Chief Financial Officer of |

|

8.9 years |

There are no family relationships between any directors or executive officers of the Company. The Nominating & Governance Committee considered the professional experience, skills, and backgrounds of the nominees and recommended the nominees to the full Board.

7

The following reflects additional information regarding the background and qualifications of our director nominees, including the experience and skills that support the Board’s determination that each director nominee should serve on our Board.

The director nominees for 2023 voluntarily self-identified with the following diversity characteristics:

8

NOMINEES FOR DIRECTOR |

Leo Berlinghieri |

|

Director Since: |

July 2008 |

Age: |

69 |

|

Independent Status: |

Independent Director |

|

Board Committee(s): |

Nominating & Governance (Chairperson), Compensation |

|

Other Public Company Boards: |

MKS Instruments, Inc. (2005-2013) |

From July 2005 to December 2013, Mr. Berlinghieri served as President and Chief Executive Officer of MKS Instruments, Inc., a critical subsystem and instrument provider to the semiconductor industry. From April 2004 to July 2005, Mr. Berlinghieri served as President and Chief Operating Officer, and prior to that served as Vice President and Chief Operating Officer from July 2003 to April 2004, at MKS Instruments, Inc. Mr. Berlinghieri also served on the Advisory Board of Unipower, LLC from 2017 to 2019, as a director on the North America Advisory Board of Semiconductor Equipment and Materials International (SEMI) from 2005 to 2013, holding the role of chairperson in 2012 and 2013, and on the Board of Directors of the Massachusetts High Technology Council, Inc. from 2006 to 2013.

Key Qualifications, Attributes, Skills and Experience

Mr. Berlinghieri has over 34 years of experience in the semiconductor industry and extensive international, financial, and operations experience through his various roles with MKS Instruments, Inc., including Chief Executive Officer, Chief Operating Officer and Vice President of Global Sales and Service.

Stephen D. Kelley |

|

Director Since: |

January 2023 |

Age: |

60 |

|

Independent Status: |

Independent Director |

|

Board Committee(s): |

Audit |

|

Other Public Company Boards: |

Advanced Energy Industries, Inc. (since March 2021) Amkor Technology, Inc. (2013-2020) |

Mr. Kelley has served President & Chief Executive Officer of Advanced Energy Industries, Inc., which designs and manufactures highly engineered power delivery systems for semiconductor wafer fabrication equipment and other mission-critical applications, since March 2021. Previously, Mr. Kelley served as President and Chief Executive Officer of Amkor Technology, Inc., a leading semiconductor package and test company, from May 2013 to June 2020. Prior to joining Amkor, Mr. Kelley served as Senior Advisor to Advanced Technology Investment Company, the Abu Dhabi-sponsored investment company that owned GlobalFoundries Inc. at the time, from June through November 2012. Mr. Kelley served as Executive Vice President and Chief Operating Officer of Cree, Inc. from 2008 to 2011. Previously, Mr. Kelley held executive leadership roles at Texas Instruments Inc. and Philips Semiconductors. Mr. Kelley holds a Bachelor of Science degree in Chemical Engineering from the Massachusetts Institute of Technology and a Juris Doctor degree from Santa Clara University.

Key Qualifications, Attributes, Skills and Experience

With over 30 years of leadership experience in the semiconductor industry, Mr. Kelley has a comprehensive understanding of our industry and extensive management experience, and also possesses first-hand knowledge of our customer base and has in-depth experience in strategic planning, business development, technology, manufacturing, and operations relevant to our business. Mr. Kelley was recommended to serve on our Board by a third-party search firm.

9

David B. Miller |

|

Director Since: |

July 2015 |

Age: |

66 |

|

Independent Status: |

Independent Director |

|

Board Committee(s): |

Compensation (Chairperson), Nominating & Governance, M&A (Chairperson) |

|

Other Public Company Boards: |

Merrimac Industries, Inc. (2002-2008) |

Mr. Miller served as Rudolph’s non-executive Chairperson from August 2018 through the Merger Date. From June 1981 to November 2015, Mr. Miller served in various positions, most recently as President, at DuPont Electronics & Communications, an electronic materials company. Mr. Miller previously served as the President of the University of Virginia School of Engineering & Applied Science Foundation from 2016 to 2018. Mr. Miller served on the board of directors of Semiconductor Equipment and Materials International (SEMI) from 2011 to 2015 and on the board of the North Carolina Chamber of Commerce from 2010 to 2015. He has also served on several electronics joint venture boards in the U.S. and Asia. Mr. Miller holds a Bachelor of Science degree in Electrical Engineering from the University of Virginia.

Specific Qualifications, Attributes, Skills and Experience

Mr. Miller has over 40 years of experience in the electronics industry. In his prior roles, including as President of DuPont Electronics & Communications, he had oversight of technology advancement, complex financial transactions, profit and loss responsibility and investor relations, and brings substantial management and market expertise to the Board. Mr. Miller also has substantial international experience, having served on several electronics joint venture boards in the U.S. and Asia as well as on the board of SEMI International.

Michael P. Plisinski |

|

Director Since: |

November 2015 |

Age: |

53 |

|

Independent Status: |

Non-Independent Director |

|

Board Committee(s): |

None |

|

Other Public Company Boards: |

None |

Mr. Plisinski has served as the Company’s Chief Executive Officer since the Merger Date and was previously Chief Executive Officer of Rudolph from November 2015 through the Merger Date. Prior to his appointment as Rudolph’s CEO, Mr. Plisinski served as Rudolph’s Executive Vice President and Chief Operating Officer from October 2014 to November 2015 and as Vice President and General Manager, Data Analysis and Review Business Unit from February 2006, when Rudolph merged with August Technology Corporation, a provider of process control equipment for thin film measurement and macro defect inspection, until October 2014. From February 2004 to February 2006, Mr. Plisinski served as August Technology’s Vice President of Engineering and, from July 2003 to February 2004, as its Director of Strategic Marketing for review and analysis products. Mr. Plisinski joined August Technology in connection with its acquisition of Counterpoint Solutions, a supplier of optical review and automated metrology equipment to the semiconductor industry, where he was both sole founder and President from June 1999 to July 2003. Since August 2020, Mr. Plisinski has served on the Board of Cognizer.AI, a software company that specializes in deep-learning powered natural language intelligence. Mr. Plisinski has a Bachelor of Science degree in Computer Science from the University of Massachusetts and has completed the Advanced Management Program from Harvard Business School.

Key Qualifications, Attributes, Skills and Experience

Mr. Plisinski brings to our Board of Directors insights based on his leadership roles at the Company and his deep knowledge of our products, markets, customers, culture, and organization.

10

Karen M. Rogge |

|

Director Since: |

September 2021 |

Age: |

68 |

|

Independent Status: |

Independent Director |

|

Board Committee(s): |

Audit, M&A |

|

Other Public Company Boards:

|

GigCapital5, Inc. (since February 2023) Rambus Inc. (since April 2021) Kemet Corporation (2018-2020) AeroCentury Corp. (2017-2018) |

Ms. Rogge is president of the RYN Group LLC, a management consulting business, which she founded in 2010. She served as the Interim Vice President and Chief Financial Officer of Applied Micro Circuits Corporation, a semiconductor company, from 2015 to 2016. Previously, Ms. Rogge served as the Senior Vice President and Chief Financial Officer of Extreme Networks, a computer network company, from 2007 to 2009. Earlier in her career, she held executive financial and operations management positions at Hewlett Packard Company and Seagate Technology. Ms. Rogge holds a Master of Business Administration degree from Santa Clara University, and a Bachelor of Science degree in business administration from California State University, Fresno. She maintains a National Association of Corporate Directors (NACD) Board Leadership Fellow credential and has attended the Stanford Directors College. Ms. Rogge also serves as a director of GigCapital6, Inc., a privately held special purpose acquisition company.

Key Qualifications, Attributes, Skills and Experience

Ms. Rogge has substantial financial and international experience gained in her roles as Chief Financial Officer of Applied Micro Circuits Corporation and Extreme Networks as well as in executive financial and operations roles at Hewlett Packard Company and Seagate Technology. From her prior roles she also gained a broad array of technological exposure, interaction, and understanding.

Christopher A. Seams |

|

Director Since: |

August 2015 |

Age: |

60 |

|

Independent Status: |

Independent Director |

|

Board Committee(s): |

Nominating & Governance, M&A |

|

Other Public Company Boards: |

Xperi Inc. (since October 2013) |

Mr. Seams served as Chief Executive Officer of Deca Technologies Inc., a wafer-level electronic interconnect solutions provider to the semiconductor industry, from June 2013 to August 2016. Prior to Deca Technologies, Mr. Seams served as Executive Vice President of sales and marketing at Cypress Semiconductor, a semiconductor design and manufacturing company, and held various technical and operational management positions in its manufacturing, development, and operations. Prior to joining Cypress in 1990, Mr. Seams worked in process development for Advanced Micro Devices and Philips Research Laboratories. Mr. Seams earned his Bachelor of Science degree in electrical engineering from Texas A&M University and his master’s degree in electrical and computer engineering from the University of Texas at Austin. Mr. Seams has a Professional Certificate in Advanced Computer Security from Stanford University and is a senior member of the Institute of Electrical and Electronics Engineers. Mr. Seams is a member of the American College of Corporate Directors (ACCD) as well as a member and Certified Director of the National Association of Corporate Directors (NACD).

Key Qualifications, Attributes, Skills and Experience

Mr. Seams has over 30 years of experience within the semiconductor industry. During that time he has gained substantial management, financial and international experience as a senior leader at multiple companies. He also brings to the Board technology and innovation experience gained through an array of technical and operational management positions in manufacturing, development, operations, and process development.

11

May Su |

|

Director Since: |

March 2022 |

Age: |

65 |

|

Independent Status: |

Independent Director |

|

Board Committee(s): |

Audit, Compensation |

|

Other Public Company Boards: |

Kateeva, Inc. (2020-2022) |

Ms. Su served as Chief Executive Officer of Kateeva, Inc., a company that builds inkjet deposition equipment solutions, from March 2020 to October 2022. Prior to becoming Chief Executive Officer, Ms. Su served as Kateeva’s Chief Marketing Officer starting in January 2018 and added the role of Senior Vice President of Sales in May 2019. Before joining Kateeva, Ms. Su was an independent consultant from 2016 to 2018. From 2012 to 2016, Ms. Su served in an array of senior management roles, including Vice President, Strategic Marketing and Vice President Strategic OEM Sales, for Brooks Automation, Inc., a provider of automation, vacuum and instrumentation equipment for multiple markets, including semiconductor manufacturing. From 2009 to 2012, Ms. Su served as Vice President and General Manager for Crossing Automation Inc., a manufacturer of fabrication and tool automation products, which was acquired by Brooks Automation in 2012. Before her role at Crossing Automation, Ms. Su was President of U.S. & European Field Operations for Nova Measuring Instrument, Inc., a provider of metrology devices for advanced process control used in semiconductor manufacturing, and held other senior management roles with Aviza Technology, Inc., New-Wave Research, KLA-Tencor Corporation and Lam Research Corporation. Ms. Su holds a Bachelor of Science degree in mechanical engineering from Cornell University, a Master of Science degree in mechanical engineering from University of California-Berkeley, and a Master of Business Administration degree from Santa Clara University, Leavey School of Business. Ms. Su also serves on the board of directors of Applied Engineering, Inc., a high-tech contract manufacturing company.

Key Qualifications, Attributes, Skills and Experience

Ms. Su has over 40 years of experience within the semiconductor capital equipment industry. During that time she has gained substantial management, international and financial experience in her role as Chief Executive Officer of Kateeva, Inc., as well as in other executive and general manager roles.

Christine A. Tsingos |

|

Director Since: |

May 2014 |

Age: |

64 |

|

Independent Status: |

Independent Director |

|

Board Committee(s): |

Audit (Chairperson), Compensation |

|

Other Public Company Boards: |

Envista Holdings Corporation (since September 2019) Varex Imaging Corporation (since February 2017) Telesis Bio Inc. (since May 2021) |

Ms. Tsingos served as the Executive Vice President and Chief Financial Officer of Bio-Rad Laboratories, a manufacturer and distributor of life science research and clinical diagnostics products, from December 2002 through May 2019. Prior to Bio-Rad, Ms. Tsingos held executive positions at Autodesk, The Cooper Companies, and Attest Systems. Ms. Tsingos earned a Bachelor of Arts degree in International Studies from the American University in Washington, D.C. and a Master of Business Administration degree in International Business from the George Washington University. In 2010, Ms. Tsingos was awarded the prestigious Bay Area CFO of the Year.

Key Qualifications, Attributes, Skills and Experience

Ms. Tsingos has over 30 years of financial and operational experience with a series of companies, including 16 years of service as Chief Financial Officer of Bio-Rad Laboratories through which she also gained comprehensive international experience. Ms. Tsingos also has significant experience and knowledge of both the Company and the semiconductor industry derived from nine years of dedicated service on the Boards of Directors of Nanometrics and the Company.

12

The Board recommends voting “FOR” |

13

CORPORATE GOVERNANCE PRINCIPLES AND PRACTICES

Onto Innovation is committed to sound and effective corporate governance practices. Having such practices is essential to running our business efficiently and maintaining our integrity in the marketplace. The major components of our corporate governance practices are described below.

Board Leadership Structure |

In accordance with our sound and effective corporate governance practices, the roles of Chief Executive Officer (“CEO”) and Chairperson of the Board are held by separate individuals. Our Board is led by Christopher A. Seams, who is an independent director and has served as Chairperson of the Board since the Merger Date. The Board’s primary responsibility is to oversee management of the company. Company management is led by Michael P. Plisinski, who has served as our CEO and a director since the Merger Date.

Our Board is currently comprised of one non-independent director, Mr. Plisinski, and seven independent directors, each of whom has been affirmatively determined by our Board to meet the criteria for independence established by the Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”). The independent directors meet periodically in executive session chaired by the Chairperson without the CEO or other management present. Furthermore, each director is encouraged to suggest items for the Board agenda in advance of any meeting and to raise at any Board meeting subjects that are not on the agenda for that meeting.

The Board believes that, at the current time, the designation of an independent Chairperson of the Board facilitates the functioning of the Board, while leaving the CEO with the responsibility for setting the strategic direction for the Company and for the day-to-day leadership and performance of the Company. The independent Chairperson of the Board:

Board Meetings |

In 2022, each incumbent director attended at least 96% of the aggregate of the total number of Board meetings and the total number of meetings of Board committees on which such director served during the time such director served on the Board. Edward J. Brown, Jr. and Bruce C. Rhine both attended 75% or more of the Board meetings and meetings of committees on which they served that were held during 2022 until the Company’s 2022 Annual Meeting date at which Messrs. Brown and Rhine did not stand for reelection to the Board. While the Company does not currently have a formal policy regarding the attendance of directors at the Annual Meeting of stockholders, directors are encouraged to attend. All members of the Board who stood for reelection at the Company’s 2022 Annual Meeting of Stockholders attended the Annual Meeting.

In 2022, the Board held a total of six Board meetings. On four occasions during 2022 the Company’s Board met in executive session in which only the independent Board members were present.

14

Board Independence |

The Board makes an annual determination as to the independence of each of our Board members under the current standards for “independence” established by the NYSE and the SEC. The Board has determined that the following nominees for election as directors to our Board are independent under the NYSE Listing Rules and SEC rules: Leo Berlinghieri, Stephen D. Kelley, David B. Miller, Karen M. Rogge, Christopher A. Seams, May Su, and Christine A. Tsingos. Michael P. Plisinski, due to his position as our CEO, is not considered to be independent. The two directors who did not stand for re-election in 2022, Edward J. Brown, Jr. and Bruce C. Rhine were both determined by the Board to be independent under applicable NYSE and SEC rules.

During 2022, none of the independent members of our Board was a party to any transactions, relationships, or arrangements that were considered by the Board to impair his or her independence.

Oversight Of Risk |

One of the Board’s primary responsibilities is reviewing the Company’s strategic plans and objectives, including oversight of the principal risk exposures of the Company. In particular, the Board is responsible for monitoring and assessing strategic risk exposure, including determining the nature and level of risk appropriate for the Company. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through the standing Board committees, which address risks inherent in their respective areas of oversight. The Audit Committee, along with the Nominating and Governance Committee, assists the Board in oversight and monitoring of the financial and legal risks facing the Company, management’s approach to addressing these risks and strategies for risk mitigation. On at least an annual basis, the Audit Committee reviews, and discusses with management, policies and systems pursuant to which management addresses risk, including risks associated with our audit, financial reporting, internal control, disclosure control, cybersecurity, regulatory compliance and investment policies. Our Compensation Committee, at least annually, reviews our compensation program to ensure that it does not encourage excessive risk-taking. Our Nominating & Governance Committee oversees risks related to governance issues, such as succession planning. It also monitors and oversees legal compliance and compliance with the Company’s Code of Business Conduct and Ethics, including the investigation and enforcement of the provisions of the Code of Business Conduct and Ethics. Each of our Committees regularly reviews with our Board any issues that arise in connection with the risk matters within the scope of its responsibilities and, in accordance with our Corporate Governance Guidelines, our full Board regularly engages in discussions of risk management to assess major risks facing our Company and review options for the mitigation of such risks. As a result of the foregoing, we believe that our CEO, together with the Chairpersons of our Audit, Compensation and Nominating & Governance Committees and our full Board, provide effective oversight of Company risk.

As part of the Company’s cybersecurity initiatives, we have established the Cyber Security Council (“CSC”), a cybersecurity oversight committee composed of members of the management team. The CSC oversees and is responsible for the executive level supervision of the Company’s cybersecurity risk, information security, and technology risk, as well as the Information Technology department’s actions to identify, assess, mitigate, and remediate cyber related issues. The CSC receives regular quarterly reports from the Vice President of Information Technology on the Company’s cybersecurity risk profile and enterprise cybersecurity program and meets with the Board’s Audit Committee on at least a quarterly basis. The CSC annually reviews and recommends the Company’s information security policy and information security program to the Board for approval. The Board reviews and discusses the Company’s technology strategy with the Vice President of Information Technology on an annual basis and approves the Company’s technology strategic plan.

15

Board Committees |

The Board has four standing committees with separate chairpersons: the Audit, Compensation, Nominating & Governance, and M&A Committees. Each of the Board committees is composed solely of independent directors and has adopted a written charter that sets forth the specific responsibilities and qualifications for membership on the committee. The charters of these committees are available on our website at https://investors.ontoinnovation.com/governance/governance-documents/.

In 2022, the composition of and number of meetings held by the Company’s Board committees were as follows:

|

Committee Chairperson |

Committee Members |

Number of Meetings Held in 2022 |

Audit Committee |

|||

|

Christine A. Tsingos |

Edward J. Brown, Jr.1 Bruce C. Rhine1 Karen M. Rogge Christopher A. Seams2 May Su3 |

10 |

Nominating & Governance Committee |

|||

|

Leo Berlinghieri |

David B. Miller Bruce C. Rhine1 Christopher A. Seams |

6 |

Compensation Committee |

|||

|

David B. Miller6 |

Edward J. Brown, Jr.4 Leo Berlinghieri May Su5 Christine A. Tsingos |

6 |

M&A Committee |

|||

|

David B. Miller |

Karen M. Rogge Christopher A. Seams |

2 |

Audit Committee |

The current members of the Audit Committee are Stephen D. Kelley, Karen M. Rogge, May Su, and Christine A. Tsingos, who also serves as the chairperson of the committee. The Audit Committee assists the Board in fulfilling its responsibilities for general oversight of the integrity of our financial statements, our accounting policies and procedures and our compliance with legal and regulatory requirements. Among its functions, the Audit Committee is responsible for:

The report of our Audit Committee is found below under the caption “Audit Committee Report.”

The Board has determined that each of the Audit Committee members meets the Audit Committee membership requirements set forth by the NYSE and the SEC, including that they be “independent” and financially literate. Furthermore, the Board has

16

determined that Ms. Tsingos and Ms. Rogge each qualify as an “Audit Committee Financial Expert” as that term is defined under SEC rules and have “accounting or related financial management expertise” as contemplated by NYSE rules.

Compensation Committee |

The current members of the Compensation Committee are Leo Berlinghieri, May Su, Christine A. Tsingos, and David B. Miller, who also serves as chairperson of the committee. The Compensation Committee is responsible for reviewing and approving the compensation of the Company’s officers, reviewing and recommending to the Board for approval the compensation policy for the Company’s non-employee directors, and administering the Company’s equity compensation plans, among other things. With respect to the compensation of the Company’s CEO, the Compensation Committee reviews and approves the various elements of the CEO’s compensation. With respect to other officers, including each of our named executive officers (“NEOs”), the Compensation Committee reviews the compensation for such individuals presented to the Compensation Committee by the CEO and the reasons therefor and, in its discretion, may approve or modify the compensation packages for such individuals. The Compensation Committee has delegated to the Company’s CEO the authority, within certain parameters, to approve the grant of restricted stock units (“RSUs”) to employees and consultants who are not directors or executive officers subject Section 16 reporting obligations.

In accordance with its charter, the Compensation Committee may form, and delegate its authority to, subcommittees when appropriate. Further, the Compensation Committee has the authority to retain independent compensation consultants and to obtain advice from internal or external legal, accounting, and other advisors to assist in the evaluation of director, officer, or employee compensation or other matters within the scope of the Compensation Committee’s responsibilities and is directly responsible for the appointment, compensation, and oversight of such consultants and other outside advisors, including their fees and other retention terms. From time to time, the Compensation Committee engages the services of such independent compensation consultants to provide advice on compensation plans and issues related to the Company’s executive officer and non-executive officer employees. In 2022, the Compensation Committee engaged Compensia, Inc. (“Compensia”) to provide such assistance to the Compensation Committee.

Each current member of our Compensation Committee is a “non-employee” director within the meaning of Rule 16b-3 under the Exchange Act. The Board has determined that each of the Compensation Committee members meets the Compensation Committee membership requirements set forth by the NYSE and the SEC, including that they be “independent.”

For further discussion of the Compensation Committee and its processes and procedures, please refer to the “Compensation Program Objectives, Design, and Practices” section in the Compensation Discussion and Analysis below. The Compensation Committee Report is included under the caption “Compensation Committee Report on Executive Officer Compensation” in this Proxy Statement.

Nominating & Governance Committee |

The current members of the Nominating & Governance Committee are David B. Miller, Christopher A. Seams, and Leo Berlinghieri, who also serves as chairperson of the committee. The responsibilities of the Nominating & Governance Committee include:

The Nominating & Governance Committee also oversees the annual evaluation of the Board, the committees of the Board and the individual directors. Among other topics, the evaluation in general assesses:

17

The goal of the evaluation is to identify and address any performance issues at the Board, committee or individual level, should they exist, identify potential gaps in the boardroom and to assure the maintenance of an appropriate mix of director skills and qualifications. Upon completion of the evaluation, the Nominating & Governance Committee provides feedback to the Board, the committees and the individual directors regarding the results of the evaluation and raises any issues that have been identified which may need to be addressed.

The Nominating & Governance Committee utilizes a variety of methods for identifying and evaluating potential candidates for joining the Board. For 2022, the Nominating & Governance Committee engaged both Spencer Stuart and ON Partners, each an executive search and leadership consulting firm, to assist with this process. The Nominating & Governance Committee’s general policy is to assess the appropriate size and needs of the Board and whether any vacancies are expected due to retirement or otherwise. In addition, candidates for director are typically reviewed in the context of the current composition of the Board, the operating requirements of the Company, the current needs of the Board, and the long-term interests of stockholders, with the goal of maintaining a balance of knowledge, experience and capability. In the event those vacancies are anticipated, or otherwise arise, the Nominating & Governance Committee will consider recommending various potential candidates to fill such vacancies. Candidates may also come to the attention of the Nominating & Governance Committee through its current members, stockholders or other persons.

The Board has determined that each of the Nominating & Governance Committee members meets the Nominating & Governance Committee membership requirements, including the independence requirements of the NYSE and the SEC.

M&A Committee |

The current members of the M&A Committee are Karen M. Rogge, Christopher A. Seams, and David B. Miller, who also serves as chairperson of the committee. The Board established the M&A Committee as a standing committee in May 2022 to assist the Board in evaluating potential acquisitions, investments, mergers, divestitures, and similar strategic transactions and to oversee management’s execution of such strategic transactions. The M&A Committee’s responsibilities include:

Other Committees |

Our Board may from time to time establish other special or standing committees to facilitate the oversight of management of the Company or to discharge specific duties delegated to the committee by the full Board.

Compensation Committee Interlocks And Insider Participation |

During fiscal year 2022, Leo Berlinghieri, Edward J. Brown, Jr., David B. Miller, May Su, and Christine A. Tsingos were each a member of the Compensation Committee. Mr. Brown ceased serving on the committee as of his retirement from the Board at the 2022 Annual Meeting. No member of our Compensation Committee was at any time during fiscal year 2022, or formerly, an officer or employee of Onto Innovation or any subsidiary of Onto Innovation. No member of our Compensation Committee had any relationship with us during fiscal year 2022 requiring disclosure under Item 404 of Regulation S-K under the Exchange Act. During fiscal year 2022, none of our executive officers served as a member of the board of directors or compensation committee (or other committee serving an equivalent function) of any entity that had one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

18

Board Membership Criteria And Nominee Identification |

The Nominating & Governance Committee of the Board determines the required selection criteria and qualifications of director nominees based upon the needs of the Company at the time nominees are considered. While the Nominating & Governance Committee has no specific minimum qualifications for director candidates, persons considered for nomination to the Board must demonstrate the following qualifications to be recommended by the Nominating & Governance Committee for election:

The Nominating & Governance Committee retains the right to modify these qualifications from time to time.

In selecting director nominees, the Nominating & Governance Committee considers, among other factors:

When current Board members are considered for nomination for reelection, the Nominating & Governance Committee also takes into consideration their prior contributions to and performance on the Board and their record of attendance.

The Nominating & Governance Committee considers the above criteria for nominees identified by the Nominating & Governance Committee itself, by stockholders, or through other sources. The Nominating & Governance Committee uses the same criteria for evaluating all nominees, regardless of the original source of nomination. The Nominating & Governance Committee may use the services of a third-party search firm to assist in the identification or evaluation of Board member candidates.

Consideration Of Director Nominees |

The Nominating & Governance Committee has a formal policy with regard to consideration of director candidates recommended by the Company’s stockholders, which is contained within the Company’s Director Candidate Policy, which may be found on our website at:

https://investors.ontoinnovation.com/governance/governance-documents/

In accordance with this policy, the Nominating & Governance Committee will consider recommendations for director candidates from stockholders holding no less than 1% of the Company’s securities for at least 12 months prior to the date of the submission of the recommendation. Stockholders wishing to recommend persons for consideration by the Nominating & Governance Committee as nominees for election to the Company’s Board can do so by writing to the Office of the General Counsel of the Company at its principal executive offices giving:

19

Stockholders also have the right to directly nominate director candidates, without any action or recommendation on the part of the Nominating & Governance Committee or the Board, by following the procedures set forth in Section 2.5 of the Company’s Bylaws.

Corporate Governance Guidelines |

Our Board has adopted Corporate Governance Guidelines, which, along with the Company’s Certificate of Incorporation and Bylaws and the Board committee charters, provide the framework for the governance of Onto Innovation. The Board follows the procedures and standards in the Corporate Governance Guidelines to fulfill its responsibilities and discharge its governance duties. A copy of the Corporate Governance Guidelines is available on our website at:

https://investors.ontoinnovation.com/governance/governance-documents/

Codes Of Ethics |

We have adopted a Code of Business Conduct and Ethics (applicable to all directors, officers, employees, consultants, and contractors) and a Financial Information Integrity Policy (applicable to our financial officers, including our CEO and Chief Financial Officer (“CFO”)) that each set forth principles of ethical and legally compliant conduct and establish procedures for reporting any violations. Copies of the Code of Business Conduct and Ethics and the Financial Information Integrity Policy may be found on our website at:

https://investors.ontoinnovation.com/governance/governance-documents

or may be requested (without charge) by writing to:

Onto Innovation Inc.

Attention: Investor Relations

16 Jonspin Road

Wilmington, Massachusetts 01887

The Company will post on its website any amendment or waiver of a provision of our Code of Business Conduct and Ethics as may be required, and within the time period specified, by applicable SEC rules.

Corporate Social Responsibility |

An important part of advancing the semiconductor industry through our innovation is being a socially responsible company. Our Company’s core values of Passion, Integrity, Collaboration, and Results underpin our commitments to sustainable growth and to making a positive contribution to people and the planet. We strive to achieve responsible and sustainable business practices and continuous improvement in our own operations, in our partnerships with our customers, across our supply chain and in our engagements with our other stakeholders. Our Company invests in environmental, social, and governance (“ESG”) initiatives across our business and integrates ESG principles into our day-to-day operations.

Business and Governance. Our Company has established a cross-functional ESG executive leadership team that is responsible for proposing goals, developing and executing strategy, and embedding ESG into our operations management. This ESG leadership team provides regular updates to the Board and engages them to discuss ESG strategy, gain alignment on goals, and report on progress. Our Board is actively engaged in the Company’s ESG oversight and has the primary responsibility for our ESG priorities. Board committees provide further guidance and oversight on relevant ESG topics including the Compensation Committee on human capital management, the Audit Committee on information security and the Nominating & Governance Committee on ethics compliance.

20

Workplace. As described in the “Social Programs” section in our 2021 ESG Report, our Company strives to provide a work environment that fosters inclusion and diversity, ensures every voice is heard, and enables employees to achieve their full potential. Our Company aims to maintain a collaborative, supportive, and opportunity-rich culture that enhances innovation and employee engagement. We strive to protect the health and safety of our personnel throughout our entire operation, including our offices, manufacturing sites, research and development (“R&D”) centers, and our field team working at customer sites.

Community. Our Company believes that positively involving our employees and giving back to our community is central to our culture and an expression of our core values. In 2021, the Company initiated RISE (Reimagining Initiatives for Society and the Environment) Teams, which have direct oversight from the ESG leadership team. These teams are formed at each location globally in order to promote local charitable giving including employee volunteer hours and employee donations. Our RISE Teams’ philanthropy and volunteerism programs provide financial and human services to improve the quality of life in the communities in which we operate. We are committed to creating positive impacts in communities around the world by contributing to local, national, and international organizations that support community needs such as hunger, food and water security, disadvantaged children and senior citizens, health improvement, and environmental protection.

Sustainable Operations. We believe that incorporating environmental sustainability into business leads to better products, more efficient operations, and added value for our customers. As the world tackles climate change and other critical environmental issues, we seek to do our part by responsibly managing our impact with global goals for energy efficiency, greenhouse gas emissions, carbon footprint per employee, water conservation, and landfill hazardous waste reduction and elimination. We carefully monitor and manage our environmental impact across our business and work to implement cost-effective best practices, focusing our efforts where we believe we can have the biggest long-term impact. Our Company looks at impacts from procurement to manufacturing, during R&D and product design, and throughout a product’s lifecycle. We carefully manage our environmental impact, set goals, and report progress annually through our annual ESG report, which is carefully reviewed and verified by our internal audit function.

Products and Customers. Our Company demands excellence in our quality and environmental performance, as demonstrated through our product and process qualification commitments, which resulted in our ISO 9001 Quality Management certification. We continuously strive to develop innovative products and solutions that help our customers improve their product yields and reduce the amount of scrapped materials. We seek to achieve this through our monitoring processes and by alerting customers via our software products before specification limits are reached, thereby helping customers avoid product test failures. In addition, our equipment meets or exceeds safety requirements and incorporates higher throughput to reduce the energy required to process customer products on a per unit basis, benefiting our customers and the environment. Our Company also strives to extend the life of our products and solutions to enable our customers to realize greater value from our products with a potentially lower environmental impact.

Responsible Supply Chain. Our Company understands the importance of an ethical, responsible, resilient, and diverse supply chain, and we engage with our suppliers to address a wide range of issues including human rights, humane treatment, freely chosen employment, labor, anti-corruption, supplier diversity, environmental impact, and responsible mineral sourcing. We are a strong proponent of supply-chain-related industry standards and endeavor to uphold the guidelines published by the Responsible Business Alliance (“RBA”). Since joining in 2021, the Company has been an affiliate member of the RBA, the world’s largest industry coalition dedicated to corporate responsibility in global supply chains. Beginning in 2022, our direct suppliers are expected to adhere to our Global Supplier Code of Conduct, which incorporates the RBA code of conduct and covers topics such as ethics, integrity, transparency, anti-corruption, conflict minerals, human trafficking, environmental sustainability, and social responsibility. Acknowledgment of and consent to adhere to our Global Supplier Code of Conduct is a mandatory requirement of our new supplier onboarding process.

For more information about our ESG efforts, please refer to our Annual ESG Report available in the Company section of our website at https://ontoinnovation.com/company/environmental-social-governance. Our ESG Report shall not be deemed “filed” with the SEC for purposes of federal securities law, and it shall not be incorporated by reference into any of the Company’s current, past or future SEC filings unless specifically noted in such filing. The information contained on our website is not part of this document and the ESG report shall not be deemed soliciting material.

Related Person Transactions Policy |

There have been no “related person transactions” from January 1, 2022 to the date of this proxy statement, nor are there any currently proposed “related person transactions,” involving any director, director nominee or executive officer of the Company, any known 5% stockholder of the Company or any immediate family member of any of the foregoing persons (which are referred to together as “related persons”). A “related person transaction” generally means a transaction involving more than $120,000 in which the Company (including any of its subsidiaries) is a participant and in which one of our executive officers, directors, director nominees or 5% shareholders (or their immediate family members), each of whom we refer to as a related person, has a direct or indirect material interest.

21

The Board has adopted written policies and procedures addressing the Company’s procedures with respect to the review, approval and ratification of “related person transactions” that are required to be disclosed pursuant to Item 404(a) of Regulation S-K. Our related person practices and policies are designed to ensure that our directors, officers and employees are proactively screened from any conflicts of interests that may interfere with their obligations to the Company. Our policies are included in the Company’s Related Parties Transaction Policy.

Pursuant to the Related Parties Transaction Policy, the Audit Committee, which consists entirely of independent directors, will review any proposed transaction in which the Company or its subsidiaries are to participate if the aggregate amount involved in the transaction will or may exceed $120,000 and any related person may have a direct or indirect material interest in the transaction. The Audit Committee will consider the facts and circumstances and may approve or ratify a proposed transaction if the Audit Committee determines that the transaction is not inconsistent with the interests of the Company and its stockholders. The Audit Committee may impose such conditions as it deems appropriate in connection with its approval.

Communications With The Board Of Directors |

We have a formal policy regarding communications with the Board, our Stockholder & Interested Party Communications Policy, which is found on our website at https://investors.ontoinnovation.com/governance/governance-documents/.

Stockholders may communicate with the Board, the Audit, Compensation, or Nominating & Governance Committee, or any of the Company’s directors by writing to:

Onto Innovation Inc.

Office of the General Counsel

16 Jonspin Road

Wilmington, Massachusetts 01887

Such communications will be forwarded to the intended recipient(s) to the extent appropriate. Prior to forwarding any communication, the General Counsel will review it and, in his or her discretion, will not forward a communication deemed to be of a commercial nature or otherwise inappropriate.

22

Compensation Of Directors |

Directors who are employees of the Company receive no compensation for their services as members of the Board. Director compensation for non-employee members of the Board is a mix of cash and equity-based compensation, which is meant to align the interests of our directors with the Company’s long-term performance and stockholder interests. The compensation during fiscal 2022 for directors who were not employees of the Company is as follows:

Board Compensation Element |

|

Amount/Value |

|

Annual Retainer |

|

$70,000 |

(1) |

Annual Equity Grant (in RSUs) |

|

$150,000 |

(2) |

Committee Chairperson Stipend |

|

|

|

Audit |

|

$20,000 |

(1) |

Compensation |

|

$15,000 |

(1) |

Nominating & Governance |

|

$10,000 |

(1) |

M&A |

|

$5,000 |

(1) |

Committee Member Stipend |

|

|

|

Audit |

|

$10,000 |

(1) |

Compensation |

|

$7,500 |

(1) |

Nominating & Governance |

|

$5,000 |

(1) |

M&A |

|

$2,500 |

(1) |

Chairperson Stipend |

|

$50,000 |

(1) |

Initial Equity Grant (in RSUs) |

|

$150,000 |

(3) |

Any initial equity grants and/or annual equity grants typically vest on the first anniversary of the grant date. Equity awards granted to directors are granted under and subject to the terms of the Onto Innovation Inc. 2020 Stock Plan (the “2020 Stock Plan”).

23

For the fiscal year ended December 31, 2022, the non-employee directors received total compensation indicated in the table below. There were no option awards, non-equity incentive plan compensation, or pension and nonqualified deferred compensation earnings granted to such directors. They did not earn any type of compensation during the year other than what is disclosed in the following table:

|

Fees Earned or |

Stock |

All Other |

|

Name |

Paid in Cash |

Awards (1) |

Compensation |

Total |

Leo Berlinghieri |

$87,500 |

$151,116 |

— |

$238,616 |

Edward J. Brown, Jr.(2) |

— |

— |

— |

— |

Stephen D. Kelley(3) |

N/A |

N/A |

N/A |

N/A |

David B. Miller |

$95,000 |

$151,116 |

— |

$246,116 |

Bruce C. Rhine(2) |

— |

— |

— |

— |

Karen M. Rogge |

$82,500 |

$151,116 |

— |

$233,616 |

Christopher A. Seams |

$127,500 |

$151,116 |

— |

$278,616 |

May Su |

$87,500 |

$151,116 |

— |

$238,616 |

Christine A. Tsingos |

$97,500 |

$151,116 |

— |

$248,616 |

Stock Ownership/Retention Guidelines For Directors |

The Company has established guidelines related to stock ownership and retention for its non-employee directors. Currently, the guidelines require that each non-employee director of the Company maintain ownership of shares of the Company’s Common Stock equal in value to at least three times the amount of the director’s annual cash retainer. For a new director, the stock holding requirement must be attained within five years of his or her initial election or appointment to the Board.

Compliance with the Company’s stock ownership and retention guidelines is reviewed annually by the Compensation Committee. As of their last review in January 2023, the Compensation Committee determined that all directors who were with the Company for more than one year were in compliance with the ownership requirements.

24

PROPOSAL 2

ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, enables our stockholders to vote to approve, on an advisory (non-binding) basis, the compensation of our named executive officers as disclosed in this proxy statement in accordance with SEC rules. Consistent with the recommendation of the Board and the preference of our stockholders as reflected in the non-binding advisory vote on the frequency of future advisory votes on named executive officer compensation held at the Nanometrics 2017 Annual Meeting of Stockholders, the Company currently holds an annual “say on pay” vote. In accordance with this policy, this year we are requesting our stockholders to approve an advisory resolution to approve the Company’s named executive officer compensation as reported in this Proxy Statement.

Our executive officer compensation arrangements are designed, consistent with our compensation philosophy and pay-for-performance principles, to provide competitive compensation packages that enable the Company to attract and retain talented executive officers, motivate executive officers to achieve the Company’s short- and long-term business strategies and objectives, align the interests of executive officers with those of stockholders, and are consistent with current market practices and good corporate governance principles. Please read the Compensation Discussion and Analysis beginning on the following page for additional details about our executive officer compensation arrangements, including information about the fiscal year 2022 compensation of our named executive officers.

We are asking our stockholders to indicate their support for our compensation arrangements as described in this proxy statement.

For the reasons discussed above, the Board recommends that stockholders vote in favor of the following resolution:

“RESOLVED, that the Company’s stockholders APPROVE, on an advisory basis, the compensation paid to the Company’s named executive officers, as disclosed in the proxy statement for this meeting pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion and other related tables and disclosures.”

Because your vote is advisory, it will not be binding upon or overrule any decisions of the Board, nor will it create any additional fiduciary duty on the part of the Board. This advisory vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and our compensation philosophy, policies, and practices described in this proxy statement, and does not seek to have the Board or Compensation Committee take any specific action. However, the Board and the Compensation Committee value the views expressed by our stockholders in their vote on this proposal and will take into account the outcome of the vote when considering executive officer compensation matters in the future.

Vote Required |

The affirmative vote, in person or by proxy, of a majority of the shares present or represented at the meeting and entitled to vote will be required to approve, on an advisory (non-binding) basis, the compensation of our named executive officers as disclosed in this proxy statement.

The Board recommends a vote “FOR” the approval of the compensation of the named executive officers as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K. |

25

EXECUTIVE OFFICER COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Introduction |

This Compensation Discussion and Analysis (“CD&A”) describes our compensation philosophy, process, plans, and practices for our executive officers and contains a discussion of the material elements of compensation awarded to, earned by, or paid to the Company’s named executive officers or “NEOs.” The Company’s NEOs for 2022 were:

Onto Innovation’s Named Executive Officers (NEOs) |

|

NEO Name |

Position |

Michael P. Plisinski |

Chief Executive Officer |

Mark R. Slicer |

Chief Financial Officer |

James (Cody) Harlow |

Chief Operating Officer |

Robert Fiordalice |

Sr. Vice President & General Manager, Metrology Business Unit |

Yoon Ah E. Oh |

Vice President, General Counsel, and Corporate Secretary |

Former Officers |

|

Steven R. Roth |

Former Sr. Vice President & Chief Financial Officer |

EXECUTIVE SUMMARY

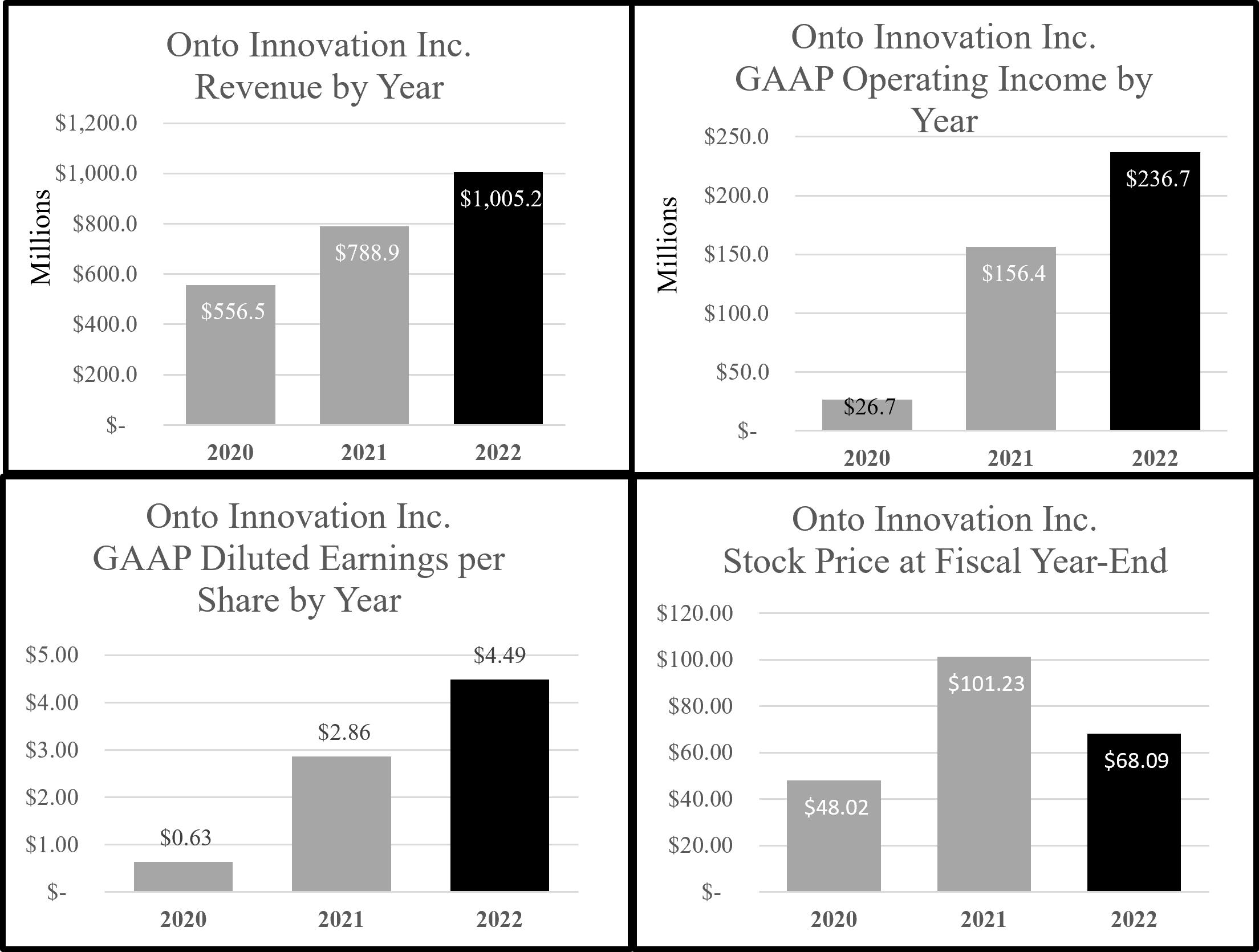

2022 Financial Highlights |

In 2022, the Company realized record financial results in critical metrics. These include, but are not limited to:

26

The following reflects some of our financial accomplishments in fiscal 2022 as compared to fiscal 2021 and 2020:

27

2022 Compensation Highlights |

Executive compensation is a key component of our corporate governance practices and our plans to drive long-term profitable growth. We’ve designed our compensation program to both attract and retain best-in-class executive management and to motivate our executive officers to achieve corporate objectives and create value for shareholders. In 2022, key features of our compensation program included the following:

Results Of The 2022 Stockholder Vote On Executive Officer Compensation |

In 2022, stockholders were provided with the opportunity to cast an advisory (non-binding) vote (a “say-on-pay” proposal) on the compensation of our NEOs for fiscal 2021. Our stockholders approved this say-on-pay proposal, with 94.2% of votes cast voting in favor of our executive compensation program. Our Compensation Committee and Board recognize the fundamental interest our stockholders have in the compensation of our executive officers. Noting the strong support for our 2021 compensation program, the Compensation Committee maintained a consistent approach to our executive officer compensation program in 2022.

The Compensation Committee will continue to consider input from our stockholders as reflected in the outcome of our annual say-on-pay vote when making executive compensation program decisions.

COMPENSATION PROGRAM OBJECTIVES, DESIGN, AND PRACTICES

Our Compensation Philosophy And Principles |

Our compensation philosophy, which serves as the framework for the Company’s executive officer compensation program, is defined by two key tenets: (1) rewarding continuous improvement in financial and operating results and (2) creation of stockholder value. The Compensation Committee acts on behalf of the Board and, by extension, on behalf of our stockholders, to establish, implement and continually monitor adherence to our compensation philosophy. Accordingly, the Compensation Committee has developed a set of core objectives and principles that it has used to develop the executive officer compensation program. The specific objectives of our executive officer compensation program are to:

Consistent with the foregoing, the Compensation Committee believes that the most effective executive officer compensation program is one that rewards the achievement of specific strategic and operating goals of the Company on both an annual and a long-term basis, and that incentivizes executive officers to create value for stockholders. The Compensation Committee evaluates both performance and compensation to ensure that the Company maintains its ability to attract and retain superior employees in key positions. Based on that evaluation, the Compensation Committee designs the compensation provided to executive officers to remain competitive with the compensation paid to similarly situated executive officers at peer group companies. The Compensation Committee believes executive officer compensation packages provided by the Company to its executive officers, including the NEOs, should include base salary, annual cash incentive opportunities, and long-term stock-based compensation, including equity incentive opportunities that reward performance as measured against pre-established goals.

28

The following principles support the objectives and design of the compensation program:

To underscore the importance of “pay-for-performance” in our compensation philosophy, the Compensation Committee has developed incentive arrangements based on performance standards that the Compensation Committee believes, at target achievement, will incentivize our executive officers to meet or exceed industry performance.

The Company also strives to promote an ownership mentality among its key leadership, in part through the guidelines described below under the heading “Stock Ownership/Retention Guidelines.” To that end, the CEO is required to maintain ownership of the Company’s Common Stock equal in value to at least three times the CEO’s year-end base salary. The other executive officers are required to maintain a minimum share ownership level equal in value to their current year-end base salary. In further support of this approach, our Board has established an anti-pledging policy to ensure that personal interests relating to the stock holdings of officers and directors do not conflict with their duties to the Company.

29

Our Compensation Practices |

The Compensation Committee has adopted the following practices and policies with respect to the Company’s executive officer compensation program:

What We Do |

|

Committee Independence |

The Compensation Committee consists of independent directors and reserves time at each meeting to meet in executive session without management present. |

Independent Compensation Consultant |

The Compensation Committee has engaged its own independent compensation consultant and annually assesses the consultant’s performance, independence, and whether any potential conflicts of interest exist. |

Independent Legal Advisor |

The Compensation Committee may engage its own independent legal advisor specializing in corporate compensation issues, as necessary. |

CEO Goal Setting and Performance |