4. RELATED PARTY TRANSACTIONS

a) Loans payable to related party – Myers - LOC

The principle amount due to a related party at March 31, 2014 of $113,424, represents an unsecured promissory note (“Myers – LOC”) due to a shareholder and director of the Company. These amounts are unsecured and bear interest at the rate of 12% per annum. The note is due and payable in August 2014. Accrued interest at March was $8,054.

b) January 13, 2014 Agreement - ClassifiedRide

On January 13, 2014, the Company entered into an asset purchase agreement with Baker Myers and Associates, LLC (“Baker Myers LLC”) to acquire www.classifiedride.com, whose platform was designed to revolutionize the selling and buying platform for online automotive markets. As consideration for the sale, the Company entered into a promissory note for $3,000,000 with an interest rate calculated at $17,500 per month and issued 14,000,000 shares of the Company’s common stock. Ms. Myers is the sole managing member of Baker Myers LLC and currently serves the Company as Chief Operating Officer and director. The classifiedride.com website was officially launched to the public in February 2012. Currently, ClassifiedRide provides a classified listing platform where users can list their vehicle truck, boat (i.e. anything that has a motor) to the Company’s website either by free or paid listing options. The main premise of the website is to aid the private seller in selling or trading their vehicle. The Company, in turn, then works as the community leader to establish relationships between buyers and sellers using social media platforms and consumer customer support incentives. These relationships are used to generate revenue from private sellers, dealerships, affiliate lead providers, and third party advertisers.

c) January 15, 2014 Agreement - Autoglance

On January 15, 2014, the Company entered into an Asset Purchase Agreement with Baker Myers LLC for 51% of the membership interest of Autoglance, LLC, a Tennessee Limited Liability Company, and with it majority control over all owned assets of Autoglance, LLC, including the website www.autoglance.com (collectively “Autoglance”) for 765,000 shares the Company’s common stock as consideration. Autoglance is a search engine of used cars that prioritizes and compares inventory in individualized markets by displaying the best deals first while hiding listings that are older, more expensive, and have more mileage. Autoglance currently has a provisional patent for this method of organizing and displaying vehicles. More specifically, Autoglance’s invention groups vehicles of the same make and model in a market location to determine the best price based on the market value of the vehicle. Vehicles that are deemed worse deals are hidden from the user. The user can easily see hidden cars if he/she wishes by the click of a button.

Authorized

The Company is authorized to issue 10,000,000 shares of preferred stock, having a par value of $0.0001 per share, and 50,000,000 shares of common stock, having a par value of $0.0001 per share.

Authorized Capital Stock

Effective January 29, 2014 by Board Resolution (the “Effective Date”) pursuant to the Articles of Amendment to the Company’s Article of Incorporation, the Company adopted the following amendment to the Company’s Articles of Incorporation and affected the following changes:

|

(1)

|

decreased authorized capital stock to 60,000,000 shares (originally 500,000,000), of which 50,000,000 shares shall be common stock (originally 300,000,000), par value $0.0001, and 10,000,000 shares shall be preferred stock (originally 200,000,000), par value $0.0001.

|

Issued and Outstanding

Preferred Stock

As of March 31, 2014, the Company had not issued any preferred stock to any holder.

At March 31, 2014, shares of common stock issued and outstanding totaled 16,069,108.

During the period ended March 31, 2014, the Company issued 15,918,620 shares of common stock as follows:

On January 13, 2014, the Company issued 14,000,000 shares of the Company’s Common stock in conjunction with its asset purchase agreement to acquire www.classifiedride.com. See further discussion at Note 1.

On January 15, 2014, the Company issued 765,000 shares of the Company’s Common stock for 51% of the membership interest of Autoglance, LLC, a Tennessee Limited Liability Company. See further discussion at Note 1.

Pursuant to Stock Purchase Agreement between Mr. Charles R. Cronin (a former director) and DEDC, dated February 25, 2011 and Amendments No. 1, No. 2 and No. 3 to Stock Purchase Agreement, dated December 30, 2011, March 31, 2012 and September 26, 2012, respectively, DEDC entered into a Stock Purchase Agreement and acquired Transformation Consulting, Inc. (“TC”) for $2,000,000. Through December 31, 2012, net of refunds, made to Mr. Cronin totaled $984,638, leaving an outstanding balance of $1,015,362 remaining. On September 30, 2013, Cronin entered into an Assignment and Assumption Agreement in which Habanero became the holder of the note and was assigned the shares from warrants converted by Mr. Cronin and his related entity, TDMS, based on their strike price. The purchase price was offset by amounts due under the line of credit agreement that amounted to $189,512, and $108,788 was offset against the contingent consideration payable assigned under the terms of the Agreement to Habenero. On March 14, 2014, the Board of Directors approved the issuance of 1,153,620 shares for $115,362 to Habanero’s assignor, Rocky Road Inc., at $0.10 per share, reducing the balance owed under the note to $791,212, which is recognized as a gain of $115,247 on extinguishment of the debt.

|

|

|

As of

March 31,

2014

|

|

|

As of

December 31,

2013

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent consideration due

|

|

$ |

2,000,000

|

|

|

$ |

2,000,000

|

|

|

Less payments

|

|

|

(984,638

|

)

|

|

|

(984,638

|

)

|

|

Payment of exercise of warrants

|

|

|

(108,788

|

)

|

|

|

(108,788

|

) |

|

Conversion of contingent consideration to common stock

|

|

|

(115,362

|

) |

|

|

- |

|

| |

|

$ |

791,212

|

|

|

$ |

906,574

|

|

|

6.

|

COMMITMENTS AND CONTRACTUAL OBLIGATIONS

|

a) Birch First Capital Fund, LLC

On August 16, 2013 Birch First Capital Fund, LLC (“Birch First”) filed a complaint against the Company in the 15th judicial circuit of Florida (2013 CA 012838) alleging that the Company owes them $168,661. The Company filed a response and counterclaim against Birch First and its principal for unspecified damages relating to Birch First’s fraudulent inducement and violation of U.S. securities law. Both claims are currently pending.

On November 18, 2013 the Company became aware of litigation by Birch First and Birch First Capital Management, LLC against Mr. Charles Cronin and Dr. Earl Beaver, naming the Company as a nominal defendant. The litigation is correlated to conduct by the former board members named above in relation to energy sector technologies. A motion to dismiss has been filed by the Company concerning this derivative lawsuit, ascertaining, among other things, that Birch First’s representation of the shareholder class is inconsistent based on his position to directly recover a judgment from the company, which in turn negatively impacts the very class of shareholders Birch alleges to represent. At this point in time, the Company has no evidence that supports Birch’s litigation, but believes it is the proper party to take action in recovery if evidence to the contrary is provided in further proceedings that is in the Company’s and shareholder’s best interest.

The disputed liability amount, including accrued interest, as of March 31,2014 is $184,481.

b) ClassifiedRide.com

On January 14, 2014, the Company entered into an asset purchase agreement to acquire classifiedride.com for the purchase price of $3,000,000 in the form of a promissory note and 14,000,000 shares of the Company’s common stock. Interest under the agreement was calculated at 7% per annum under the terms of the agreement. Under the terms of the agreement, if EDS defaults on its monthly interest payments after the first year of the purchases price, a penalty of 14% of the payment added will be accumulated to the interest balance.

c) Loans payable to related party – Myers - LOC

The principle amount due to a related party at March 31,2014 of $113,424, represents an unsecured promissory note (“Myers – LOC”) due to a shareholder and director of the Company. These amounts are unsecured and bear interest at 12% per annum. These funds were used to pay for corporate expenses related to the Company’s corporate and operating expenses. As of March 14, 2014, the line of credit agreement was extended from $50,000 to $120,000 with a payable date extended to December 1, 2014. Accrued interest at March 31, 2014 was $8,054.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Basis of Presentation

The following management’s discussion and analysis is intended to provide additional information regarding the significant changes and trends which influenced our financial performance for the three-month period ended March 31, 2014. This discussion should be read in conjunction with the unaudited financial statements and notes as set forth in this report.

Overview

Elite Data Services, Inc. (hereinafter the “Company”, “Our”, “We” or “Us”) changed its name from Dynamic Energy Alliance Corporation on November 4, 2013. Prior to that, we were formerly Mammatech Corporation, and were incorporated in the State of Florida on November 23, 1981 under the name Mammathetics Corp. Through the first quarter of 2011, the Company’s business was that of a marketer of tumor detection equipment.On March 9, 2011, the Company effectively completed a merger transaction whereby it entered into a Share Exchange Agreement (“SEA”) with DEDC, a privately held corporation, with DEDC becoming a wholly-owned subsidiary of the Company, shifting its focus to the recoverable energy sector. In conjunction with the acquisition of DEDC, the Company acquired Transformation Consulting (‘TC”), a wholly-owned subsidiary of DEDC. TC provides business development, marketing, and administrative consulting services. Through a January 2010 management services and agency agreement (“Agency Agreement”), TC received revenues from a related party based on billings received from certain of TC’s direct to consumer membership club products that were transferred to the related party under the Agency Agreement. As the Company continues its operations, it has decided to focus more on the advertising and marketing plan that generated revenues in the Company’s past as evidenced by its recent purchases of classfiedride.com and 51% controlling membership interest in Autoglance, LLC.

Plan of Operations

For the last two years, the Company’s business plan has focused on developing and implementing recoverable energy technologies. As the Company has been unable to secure financing or a plant location, management has shifted its operations to focus on the marketing and advertising sector. In support of this business direction, the Company entered into two asset purchase agreements on January 14, 2014 for classifiedride.com and 51% membership interest of Autoglance, LLC. Classfiedride.com is a website where end users can search or list their vehicle, boat, RV, (anything with a motor) for sale. To offer a different approach to the car purchasing and selling market, the ClassifiedRide team works on aiding the private seller buy and trade their vehicle using social media and mobile application enhancements. The Company has been in the development of creating mobile marketing and social media tools for integrated maximum exposure to connect with traders and sellers on a more personal level. The Company’s mission is to expand its offerings to revolutionize each sector of its industries. Our management team is experienced in the advertising and marketing industry; however, the Company’s goal is to eventually penetrate different markets by utilizing the Company’s technology and network-maximizing software. Currently, the Company is intently focused on the automotive sector, yet the potential application of the Company’s software aligns to a multitude of other industries and products. Whether the industry expansion is done in-house or on a licensed/leased basis is to be determined, but the Company’s purpose with this business model is to be first to market in a complete offering of technology-oriented networks. In addition, the Company plans to create our own advertising network that will be used to generate traffic and revenue to further the Company’s operations. However, until such time, the Company is dependent on external financing and must raise capital to continue its operations. Provided below is a more detailed summary of ClassifiedRide and Autoglance.

ClassifiedRide’s mission is to establish relationships through the car buying process and help private sellers buy, trade, and sell their vehicles by connecting with other local buyers, sellers, and dealerships. Created from the demographic view point of the private seller, ClassifiedRide engages several features to help users sell their vehicle with easy-to-use (yet powerfully effective) features such as the ability to post their vehicle to popular websites such as Facebook, Twitter, Linkedin, Google+, and more with the click of a button. The overall goal that ClassifiedRide aims to fulfill is the establishment of a community network where expansion of its user base and network presence consistently grows, as this data is crucial to expansion under its business plan.

Our Strategy

We are in the early days of pursuing our mission to make the vehicle buying and selling process more open and connected. We have a significant opportunity to further enhance the value we deliver to users, advertisers, and dealerships. Key elements of our strategy are:

| |

•

|

|

Expand Our User Community and Networks. We continue to focus on growing our user base across the United States, Canada, and Europe. We intend to grow our user base by continuing our marketing and user acquisition efforts and enhancing our products and software designed to help our users reach their end goal of finding or selling their vehicle.

|

| |

•

|

|

Build Great Products and Widgets to Increase Engagement. We prioritize product development investments that we believe will create engaging interactions between our users and advertisers on our website, across the web, and on mobile devices.

|

| |

•

|

|

Provide Users with Innovative Resources and Tools. ClassifiedRide aims to provide innovative technology that is designed to aid the user reach their end goal (buying, selling, and/or trading their vehicle, boat, etc). Part of this belief is being able to support staff to help the Company grow relationships with sellers, traders, and buyers on a one on one communicational level to help understand the most important processes to build its software that engages the community and attracts a strong user base.

|

| |

•

|

|

Build Engaging Mobile Experiences. In our quest, we are devoting substantial importance to developing mobile friendly products for a wide range of platforms, including smartphones and feature phones. Reaching buyers through mobile applications is a commitment that we strive to keep on-going.

|

| |

•

|

|

Improve Ad Products for Advertisers and Users. We plan to continue to improve our ad products in order to create more value for advertisers and enhance our network over a vast array of locations to enhance our user experiences.

|

Some of Our Milestones

|

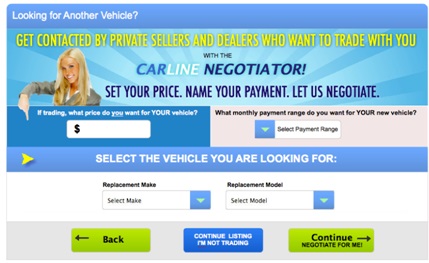

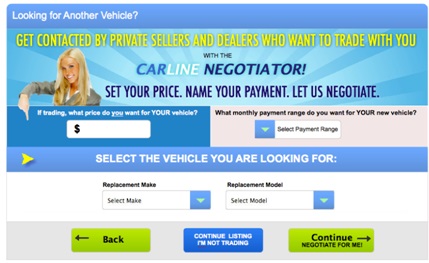

· The Carline Negotiator. As part of the user experience, our software developers have created the CarLine Negotiator that gives the end user the ability to have us help them find what vehicle they are looking for and at what price range. After talking to a majority of our users, we found that the most cumbersome process of buying a vehicle is having to provide personal information such as email addresses and phone numbers just to get a bottom line idea of certain vehicle features. As the CarLine Negotiator’s features are still in beta and being perfected, it gives an example of the type of software we aim to create that is different and unique in the automotive marketplace. |

|

· The VIP Salesmen Directory. One of the largest concerns for users is being bombarded or harassed by dealerships when they are in the stages of searching for a vehicle. To combat this problem, our software developers created the VIP Salesmen directory that enables users to view salesmen’s profile from dealerships and interact with them online before having to commit or walk onto a dealership lot. With user friendly review systems and ratings, end users can easily do research and ask questions, establishing a relationship based on community review and peer systems. |

Current Developments in Production

|

·

|

SEO and Website Reconstruction.Currently, our software developers are working on reconstructing our platform with a more stream lined database. This will aid users in functionality of classifiedride.com and also will help improve our rankings on search engines.

|

|

·

|

Network Platform. A large part of our technology is in our network platform that we are currently working to expand.

|

|

·

|

Carline Evaluator. With our user data, our software developers are working on the finishing touches of an interactive algorithm designed to help dealers evaluate their inventory by a scoring system, which is, in part, generated by buyers and sellers in dealerships’ local market. In early December 2013, the popular website craigslist began charging $5 per vehicle in the dealership section. This inspired our developers to launch the CarLine Evaluator as a special tool that would give dealerships the ability to categorize vehicles by people’s popularity based in their local market. By analyzing the algorithm with our system, the dealership’s inventory will be displayed by tier levels: Top, Tier 1, Tier 2, and Tier 3 which gives dealerships the ability to easily view and post the vehicles in their inventory that produce better response.

|

Autoglance is a search engine of used cars that prioritizes and compares inventory in individualized markets by displaying the best deals first while hiding listings that are older, more expensive, and have more mileage. Autoglance has filed a provisional patent for this method of organizing and displaying vehicles. More specifically, Autoglance’s invention groups vehicles of the same make and model in a market location to determine the best price based on the market value of the vehicle. Vehicles that are deemed worse deals are hidden from the user. The user can easily see hidden cars if he/she wishes by the click of a button.

|

As depicted in the provided picture, Autoglance’s unique method groups all vehicles in the local market and places them in a graph where a user can easily see the best deals available “in a glance” (if you hover your mouse over the car icon, a picture of the actual vehicle along with information will appear). Under this algorithm, vehicles in each retrospective market compete with one another for priority to be viewed by the end user. |

If you are interested to more of how Autoglance works, please view our video demonstration by clicking below.

Results from Operations

Our operating results for the three months ended March 31, 2014 compared to the three months ended March 31, 2013 are as follows:

| |

|

Three Months Ended March 31,

|

| |

|

2014

|

|

|

2013

|

|

Revenue

|

|

$

|

7,215

|

|

|

$

|

-

|

|

|

Operating and other expenses

|

|

|

105,370

|

|

|

|

197,920

|

|

|

Net (loss) from operations

|

|

$

|

(98,155

|

)

|

|

$

|

(197,920

|

) |

In 2013, no revenues were generated from the Company’s efforts in their business plan under the recoverable energy sector. For three month period ended March 31, 2014, the Company generated $7,215 in revenue from classifiedride.com.

Operating Expenses

Our operating expenses for the three months ended March 31, 2014 compared to the three months ended March 31, 2013 are as follows:

| |

|

Three Months Ended March 31,

|

| |

|

2014

|

|

|

2013

|

|

|

Project development costs

|

|

$ |

65,200

|

|

|

$ |

-

|

|

|

Consulting services

|

|

|

-

|

|

|

|

50,000

|

|

|

General and administrative expenses

|

|

|

40,170

|

|

|

|

147,920

|

|

|

Total Operating Expenses

|

|

$ |

105,370,

|

|

|

$ |

197,920

|

|

The increase in project development costs from 2013 to 2014 is primarily due to project activities related to development and web design of networks that started in the third quarter of 2013 and was contingent upon external financing, which the Company did not receive. The decrease in consulting services from 2013 to 2014 are primarily due to the Company budgeting its expenses. The decrease in general and administrative expenses from 2013 to 2014 is primarily due to Company budget of expenses.

Liquidity and Capital Resources

As of March 31, 2014 and December 31, 2013, the Company had cash on hand of $2,457 and $2,884, respectively. The Company had decreased cash flow of $427 for three months ended March 31, 2014 resulted primarily from the operations of the Company’s activities in the advertising and marketing sector.

Company expects significant capital expenditures during the next 12 months, contingent upon raising additional capital. We anticipate that we will need $2,000,000 for operations for the next 12 months. This capital will be needed for continued development of the Company’s network strategy and development of its website platform assets. The source of such capital is uncertain, and there is no assurance that the Company will be successful in obtaining such capital on commercially reasonable terms, or at all. Company presently does not have any available credit, bank financing or other external sources of liquidity.

| |

|

As of

March 31,

2014

|

|

|

As of

December 31,

2013

|

|

| |

|

|

|

|

|

|

|

Current assets

|

|

$

|

2,457

|

|

|

$

|

2,884

|

|

|

Current liabilities

|

|

|

1,445,236

|

|

|

|

1,408,200

|

|

|

Working capital deficit

|

|

$

|

(1,442,779

|

)

|

|

$

|

(1,405,316

|

) |

| |

|

Three Months Ended March 31,

|

|

| |

|

2014

|

|

|

2013

|

|

| |

|

|

|

|

|

|

|

|

|

Net cash used in operating activities

|

|

$

|

(76,427

|

)

|

|

$

|

(592

|

)

|

|

Net cash provided by financing activities

|

|

|

76,000

|

|

|

|

-

|

|

|

Net (increase) decrease in cash

|

|

$

|

(427)

|

|

|

$

|

(592

|

)

|

Cash Flows - Operating Activities

Cash used in operating activities of $76,427 in the period ended March 31, 2014 is primarily due to the net loss of $37,578 offset by a gain on extinguishment of debt on a loan. Cash used in operating activities of $592 in the three months ended March 31, 2013 is primarily due to net loss of $208,290, offset by non-cash warrant expenses for consulting services of $110,000 and an increase in accounts payable and accrued expenses of $93,412.

Cash Flows - Financing Activities

Cash provided by financing activities in the period ended March 31, 2014 is due to proceeds from related parties of $76,000. There were no financing activities in the three months ended March 31, 2014.

Going Concern Uncertainties

There is substantial doubt about our ability to continue as a “going concern” because the Company has incurred continuing losses for operations, and accumulated deficit of $6,505,289 at March 31, 2014. We currently have only limited working capital with which continue its operating activities. The amount of capital required to sustain operations is subject to future events and uncertainties, but the Company anticipates it will need to obtain approximately $2,000,000 in additional capital in the form of debt or equity in order to cover its current expenses over the next 12 months and continue to implement its business plan. Whether such capital will be obtainable, or obtainable on commercially reasonable terms is at this date uncertain. These circumstances raise substantial doubt about the Company's ability to continue as a going concern.

Management believes that our current financial condition, liquidity and capital resources may not satisfy our cash requirements for the next twelve months and as such we will need to either raise additional proceeds and/or our officers and/or directors will need to make additional financial commitments to our Company, neither of which is guaranteed. We plan to satisfy our future cash requirements, primarily the working capital required to execute on our objectives, including marketing and sales of our product, and legal and accounting fees, through financial commitments from future debt/equity financings, if and when possible.

Management believes that we may generate more sales revenue within the next 12 months, but that these sales revenues may not satisfy our cash requirements to implement our business plan, including, but not limited to, project acquisitions, engineering, and integration costs, and other operating expenses and corporate overhead (which is subject to change depending upon pending business opportunities and available financing).

We have no committed source for funds as of this date. No representation is made that any funds will be available when needed. In the event that funds cannot be raised when needed, we may not be able to carry out our business plan, may never achieve sales, and could fail to satisfy our future cash requirements as a result of these uncertainties.

If we are unsuccessful in raising the additional proceeds from officers and/or directors, we may then have to seek additional funds through debt financing, which would be extremely difficult for an early stage company to secure and may not be available to us. However, if such financing is available, we would likely have to pay additional costs associated with high-risk loans and be subject to above market interest rates.

Capital Expenditures

We have not incurred any material capital expenditures.

Commitments and Contractual Obligations

As a "smaller reporting company" as defined by Item 10 of Regulation S-K, the Company is not required to provide this information.

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources and would be considered material to investors.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

As a “smaller reporting company” as defined by Rule 229.10(f)(1), we are not required to provide the information required by this Item 3.

ITEM 4T. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Under the supervision and with the participation of management, including the Company’s principal executive officer and principal financial officer, the Company has evaluated the effectiveness of its disclosure controls and procedures as defined in Rule 13a-15(e) and 15d-15(e) under Securities Exchange Act of 1934, as amended (the “Exchange Act”), for the end of the period covered by this Quarterly Report on Form 10-Q. Based on that evaluation, the Company’s principal executive officer and principal financial officer have concluded that these controls and procedures are not effective in all material respects, including those to ensure that information required to be disclosed in reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the rules and forms of the Securities and Exchange Commission, and is accumulated and communicated to management, including the principal executive officer and the principal financial officer, as appropriate, to allow for timely decisions regarding required disclosure.

A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

In the first fiscal quarter ended March 31, 2014, there had been no change in the Company’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS.

On August 16, 2013 Birch First Capital Fund, LLC (“Birch First”) filed a complaint against the Company in the 15th judicial circuit of Florida (2013 CA 012838) alleging that the Company owes them $168,661. The Company filed a response and counterclaim against Birch First and its principal for unspecified damages relating to Birch First’s fraudulent inducement and violation of U.S. securities law. Both claims are currently pending.

On November 18, 2013 the Company became aware of litigation by Birch First and Birch First Capital Management, LLC against Mr. Charles Cronin and Dr. Earl Beaver, naming the Company as a nominal defendant. The litigation is correlated to conduct by the former board members named above in relation to energy sector technologies. A motion to dismiss has been filed by the Company concerning this derivative lawsuit, ascertaining, among other things, that Birch First’s representation of the shareholder class is inconsistent based on his position to directly recover a judgment from the company, which in turn negatively impacts the very class of shareholders Birch alleges to represent. At this point in time, the Company has no evidence that supports Birch’s litigation, but believes it is the proper party to take action in recovery if evidence to the contrary is provided in further proceedings that is in the Company’s and shareholder’s best interest.

ITEM 1A. RISK FACTORS .

Smaller reporting companies are not required to provide disclosure pursuant to this Item.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS.

Unregistered Sales of Equity Securities

During the period ended March 31, 2014, the Company issued 15,918,620 shares of common stock as follows:

On January 13, 2014, the Company issued 14,000,000 shares of the Company’s Common stock in conjunction with its asset purchase agreement to acquire certain assets, including www.classifiedride.com.

On January 15, 2014, the Company issued 765,000 shares of the Company’s Common stock for 51% of the membership interests of Autoglance, LLC, a Tennessee Limited Liability Company.

On March 14, 2014, the Board of Directors approved the issuance of 1,153,620 shares for $115,362 reduction of the principal balance of the contingent consideration due and payable now totaling $791,212, which is recognized as a gain of $115,247 on extinguishment of the debt

Purchases of equity securities by the issuer and affiliated purchasers

None.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES.

None.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

None.

ITEM 5. OTHER INFORMATION.

N/A

ITEM 6. EXHIBITS.

Those exhibits marked with an asterisk (*) refer to exhibits filed herewith. The other exhibits are incorporated herein by reference, as indicated in the following list.

|

Exhibit Number

|

|

Description of Exhibit

|

| |

|

|

|

3.1

|

|

Articles of Incorporation, filed with the Secretary of State of the State of Florida on November 23, 1981

|

|

3.6*

|

|

Amendment and Restatement to Articles of Incorporation, filed with the Secretary of State of the State of Florida

|

|

10.1

|

|

Share Exchange Agreement, dated March 9, 2011, by and among Dynamic Energy Development Corporation, Mammatech Corporation and Verdad Telecom (incorporated by reference to Exhibit 10.1 of the Company's Form 8-K, dated March 16, 2010).

|

|

10.7

|

|

Line of Credit with Charles R. Cronin, Jr. (incorporated by reference to Exhibit 10.1 of the Company's Form 10-Q, dated July 22, 2011)

|

|

10.8

|

|

Stock Warrant Agreement with Charles R. Cronin, Jr. (incorporated by reference to Exhibit 10.1 of the Company's Form 10-Q , dated July 22, 2011)

|

|

10.26

|

|

Assignment and Assumption Agreement between Charles R. Cronin Jr. Harvey Dale Cheek and Habanero Properties, Ltd (incorporated by reference to Exhibit 10.02 of the Company’s Form 8-K dated October 2, 2013)

|

|

10.27

|

|

Change of Address for relocation of the Company’s headquarters to 4447 N. Central Expressway Suite 110-135, Dallas, Texas 75205 (incorporated by reference to the Company’s Form 14F-1 on October 7, 2013)

|

|

10.28*

|

|

Line of Credit with Sarah Myers (incorporated by reference to the Company’s Form 10-K, dated May 12, 2014)

|

|

10.29*

|

|

Line of Credit - Amendment #1 (incorporated by reference to the Company’s 10-Q, dated May 20, 2014)

|

|

21.1

|

|

List of Subsidiaries

|

|

101**

|

|

Interactive Data File

|

|

31.1*

|

|

Certification of the registrant's Chief Executive Officer and Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (filed herewith)

|

|

32.1*

|

|

Certification of the Company's Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (filed herewith)

|

___________

* In accordance with SEC Release 33-8238, Exhibits 32.1 and 32.2 are being furnished and not filed.

** In accordance with Rule 406T of Regulation S-T, this information is deemed not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

ELITE DATA SERVICES, INC.

(formerly Dynamic Energy Alliance Corporation)

|

|

| |

|

|

|

|

Date: May 20, 2014

|

By:

|

/s/ Steven Frye

|

|

| |

|

Steven Frye

|

|

| |

|

Chief Executive Officer

|

|

| |

|

(Duly Authorized and Principal Executive Officer)

|

|

|

Date: May 20, 2014

|

By:

|

/s/ Steven Frye

|

|

| |

|

Steven Frye

|

|

| |

|

Chief Financial Officer

|

|

| |

|

(Duly Authorized and Principal Financial Officer)

|

|

24