Exhibit 10.7

CERTAIN INFORMATION IN THIS EXHIBIT MARKED BY ** HAS BEEN OMITTED PURSUANT TO A REQUEST FOR CONFIDENTIAL TREATMENT AND FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION.

CREDIT AGREEMENT AND GUARANTY

dated as of July 25, 2014

by and between

VARIATION BIOTECHNOLOGIES (US), INC.,

as the Borrower,

THE GUARANTORS PARTY HERETO,

and

PCOF 1, LLC,

as the Lender

TABLE OF CONTENTS

|

|

|

|

Page |

|

|

|

|

|

|

Article I |

DEFINITIONS AND ACCOUNTING TERMS |

1 | |

|

|

Section 1.1 |

Defined Terms |

1 |

|

|

Section 1.2 |

Use of Defined Terms |

18 |

|

|

Section 1.3 |

Cross-References |

18 |

|

|

Section 1.4 |

Accounting and Financial Determinations |

18 |

|

Article II |

COMMITMENT and BORROWING procedures |

18 | |

|

|

Section 2.1 |

Commitment |

18 |

|

|

Section 2.2 |

Borrowing Procedures |

18 |

|

|

Section 2.3 |

Funding |

19 |

|

|

Section 2.4 |

Reduction of the Commitment Amounts |

19 |

|

Article III |

REPAYMENTS, PREPAYMENTS, INTEREST AND FEES |

19 | |

|

|

Section 3.1 |

Repayments and Prepayments; Application |

19 |

|

|

Section 3.2 |

Repayments and Prepayments |

19 |

|

|

Section 3.3 |

Application |

20 |

|

|

Section 3.4 |

Interest Rate |

20 |

|

|

Section 3.5 |

Default Rate |

20 |

|

|

Section 3.6 |

Payment Dates |

21 |

|

|

Section 3.7 |

Exit Fee |

21 |

|

|

Section 3.8 |

Other Fees |

21 |

|

Article IV |

LIBO RATE AND OTHER PROVISIONS |

21 | |

|

|

Section 4.1 |

Increased Costs, Etc |

21 |

|

|

Section 4.2 |

Increased Capital Costs |

22 |

|

|

Section 4.3 |

Taxes |

22 |

|

|

Section 4.4 |

Payments, Computations; Proceeds of Collateral, Etc |

23 |

|

|

Section 4.5 |

Setoff |

24 |

|

|

Section 4.6 |

LIBOR Rate Not Determinable |

24 |

|

Article V |

CONDITIONS TO LOAN |

24 | |

|

|

Section 5.1 |

Initial Loan |

24 |

| Section 5.2 | Delayed Draw Loan | 28 | |

| Article VI | REPRESENTATIONS AND WARRANTIES | 29 | |

TABLE OF CONTENTS

| Page | |||

| Section 6.1 | Organization, Etc | 29 | |

| Section 6.2 | Due Authorization, Non-Contravention, Etc | 30 | |

| Section 6.3 | Government Approval, Regulation, Etc | 30 | |

| Section 6.4 | Validity, Etc | 30 | |

| Section 6.5 | Financial Information | 30 | |

| Section 6.6 | No Material Adverse Change | 31 | |

| Section 6.7 | Litigation, Labor Matters and Environmental Matters 30Section 6.8 Subsidiaries | 31 | |

| Section 6.8 | Subsidiaries | 31 | |

| Section 6.9 | Ownership of Properties | 31 | |

| Section 6.10 | Taxes | 31 | |

| Section 6.11 | Pension Plans, Etc | 32 | |

| Section 6.12 | Accuracy of Information | 32 | |

| Section 6.13 | Regulations U and X | 32 | |

| Section 6.14 | Solvency | 32 | |

| Section 6.15 | Intellectual Property | 32 | |

| Section 6.16 | Material Agreements | 33 | |

| Section 6.17 | Permits | 34 | |

| Section 6.18 | Regulatory Matters | 34 | |

| Section 6.19 | Transactions with Affiliates | 36 | |

| Section 6.20 | Investment Company Act | 36 | |

| Section 6.21 | OFAC | 36 | |

| Section 6.22 | Anti-Corruption | 36 | |

| Section 6.23 | Deposit and Disbursement Accounts | 36 | |

| Section 6.24 | Registration Rights | 37 | |

| Section 6.25 | Royalty and Other Payments | 37 | |

| Article VII | AFFIRMATIVE COVENANTS | 37 | |

| Section 7.1 | Financial Information, Reports, Notices, Etc | 37 | |

| Section 7.2 | Maintenance of Existence; Compliance with Contracts, Laws, Etc | 39 | |

| Section 7.3 | Maintenance of Properties | 39 | |

| Section 7.4 | Insurance | 39 | |

TABLE OF CONTENTS

| Page | |||

| Section 7.5 | Books and Records | 40 | |

| Section 7.6 | Environmental Law Covenant | 40 | |

| Section 7.7 | Use of Proceeds | 40 | |

| Section 7.8 | Future Guarantors, Security, Etc | 41 | |

| Section 7.9 | Obtaining of Permits, Etc | 41 | |

| Section 7.10 | Product Licenses | 41 | |

| Section 7.11 | Maintenance of Regulatory Authorizations, Contracts, Intellectual Property, Etc | 41 | |

| Section 7.12 | Inbound Licenses | 42 | |

| Section 7.13 | Cash Management | 42 | |

| Section 7.14 | Modification of Organic Documents | 43 | |

| Section 7.15 | Inconsistent Agreements | 43 | |

| Section 7.16 | Restriction of Amendments to Certain Documents | 43 | |

| Section 7.17 | PIC | 43 | |

| Section 7.18 | Required Milestones | 43 | |

| Section 7.19 | Minimum Liquidity | 43 | |

| Article VIII | NEGATIVE COVENANTS | 43 | |

| Section 8.1 | Business Activities | 44 | |

| Section 8.2 | Indebtedness | 44 | |

| Section 8.3 | Liens | 44 | |

| Section 8.4 | [INTENTIONALLY OMITTED] | 45 | |

| Section 8.5 | Investments | 45 | |

| Section 8.6 | Restricted Payments, Etc | 46 | |

| Section 8.7 | [INTENTIONALLY OMITTED] | 46 | |

| Section 8.8 | Consolidation, Merger; Permitted Acquisitions, Etc | 46 | |

| Section 8.9 | Permitted Dispositions | 46 | |

| Section 8.10 | Modification of Certain Agreements | 46 | |

| Section 8.11 | Transactions with Affiliates | 47 | |

| Section 8.12 | Restrictive Agreements, Etc | 47 | |

| Section 8.13 | Sale and Leaseback | 47 | |

| Section 8.14 | Product Sales | 47 | |

TABLE OF CONTENTS

| Page | |||

| Section 8.15 | Outbound Licenses | 47 | |

| Section 8.16 | Change in Name, Location, Executive Office, or Executive Management; Change in Fiscal Year | 47 | |

| Article IX | EVENTS OF DEFAULT | 48 | |

| Section 9.1 | Listing of Events of Default | 48 | |

| Section 9.2 | Action if Bankruptcy | 51 | |

| Section 9.3 | Action if Other Event of Default | 51 | |

| Article X | GUARANTY | 51 | |

| Section 10.1 | Guaranty | 51 | |

| Section 10.2 | Waivers | 52 | |

| Section 10.3 | Benefit of Guaranty | 52 | |

| Section 10.4 | Subordination of Subrogation, Etc | 52 | |

| Section 10.5 | Election of Remedies | 52 | |

| Section 10.6 | Limitation | 53 | |

| Section 10.7 | Liability Cumulative | 53 | |

| Article XI | MISCELLANEOUS PROVISIONS | 53 | |

| Section 11.1 | Waivers, Amendments, Etc | 53 | |

| Section 11.2 | Notices; Time | 53 | |

| Section 11.3 | Payment of Costs and Expenses | 54 | |

| Section 11.4 | Indemnification | 54 | |

| Section 11.5 | Survival | 55 | |

| Section 11.6 | Severability | 55 | |

| Section 11.7 | Headings | 55 | |

| Section 11.8 | Execution in Counterparts, Effectiveness, Etc | 55 | |

| Section 11.9 | Governing Law; Entire Agreement | 55 | |

| Section 11.10 | Successors and Assigns | 56 | |

| Section 11.11 | Other Transactions | 56 | |

| Section 11.12 | Forum Selection and Consent to Jurisdiction | 56 | |

| Section 11.13 | Waiver of Jury Trial | 57 | |

TABLE OF CONTENTS

| SCHEDULES: | |||||

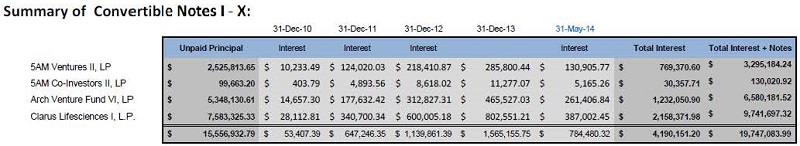

| Schedule 5.1.19 | VBI Convertible Notes | ||||

| Schedule 6.7(a) | Litigation | ||||

| Schedule 6.8 | Existing Subsidiaries | ||||

| Schedule 6.11 | Pension Plans | ||||

| Schedule 6.15(a) | Intellectual Property | ||||

| Schedule 6.16 | Material Agreements | ||||

| Schedule 6.19 | Transactions with Affiliates | ||||

| Schedule 6.23 | Deposit and Disbursement Accounts | ||||

| Schedule 6.24 | Registration Rights | ||||

| Schedule 6.25 | Royalty Payments | ||||

| Schedule 8.2(b) | Existing Indebtedness | ||||

| Schedule 8.3(b) | Existing Liens | ||||

| Schedule 8.5(a) | Investments | ||||

| Schedule 10.02 | Notice Information | ||||

|

EXHIBITS: |

|

|

|

|

Exhibit A-1 |

- |

Form of Initial Term Note |

|

|

Exhibit A-2 |

- |

Form of Delayed Draw Note |

|

|

Exhibit B |

- |

Form of Loan Request |

|

|

Exhibit C |

- |

Form of Compliance Certificate |

|

|

Exhibit D |

- |

Form of Pledge and Security Agreement |

|

|

Exhibit E |

- |

Form of Closing Date Warrant |

|

|

Exhibit F |

- |

Form of Delayed Draw Warrant |

|

|

Exhibit G |

- |

Intercompany Subordinated Note Provisions |

|

CREDIT AGREEMENT AND GUARANTY

THIS CREDIT AGREEMENT AND GUARANTY dated as of July 25, 2014 (as amended, supplemented or otherwise modified from time to time, this “Agreement”), is by and between VARIATION BIOTECHNOLOGIES (US), INC., a Delaware corporation (the “Borrower”), each Guarantor (as defined below) party hereto and PCOF 1, LLC (together with its Affiliates, successors, transferees and assignees, the “Lender”).

W I T N E S S E T H:

WHEREAS, the Borrower has requested that the Lender provide a senior term loan facility to the Borrower in an aggregate principal amount of $6,000,000 (with up to $3,000,000 available on the Closing Date and up to $3,000,000 available on the Delayed Draw Date, in each case subject to the terms and conditions set forth herein); and

WHEREAS, the Lender is willing, on the terms and subject to the conditions hereinafter set forth, to extend the Commitment and make the Loans to the Borrower.

NOW, THEREFORE, the parties hereto agree as follows:

Article I

DEFINITIONS AND ACCOUNTING TERMS

Section 1.1 Defined Terms. The following terms (whether or not underscored) when used in this Agreement, including its preamble and recitals, shall, except where the context otherwise requires, have the following meanings (such meanings to be equally applicable to the singular and plural forms thereof):

“Affiliate” of any Person means any other Person which, directly or indirectly, controls, is controlled by or is under common control with such Person. “Control” (and its correlatives) by any Person means the power of such Person, directly or indirectly, (i) to vote 10% or more of the Capital Securities (on a fully diluted basis) of another Person which Capital Securities have ordinary voting power for the election of directors, managing members or general partners (as applicable), or (ii) to direct or cause the direction of the management and policies of such other Person (whether by contract or otherwise).

“Agreement” is defined in the preamble.

“Applicable Margin” means 11.00%, as such percentage may be increased pursuant to Section 3.5.

“Authorized Officer” means, relative to each Loan Party, those of its officers, general partners or managing members (as applicable) whose signatures and incumbency shall have been certified to the Lender pursuant to Section 5.1.1.

“Benefit Plan” means any employee benefit plan, as defined in section 3(3) of ERISA, that either (i) is a Multiemployer Plan, (ii) is subject to section 412 of the Code, section 302 of ERISA or Title IV of ERISA or (iii) provides welfare benefits to terminated employees, other than to the extent required by section 4980B(f) of the Code and the corresponding provisions of ERISA or similar state law.

“BLA” means (i) (x) a biologics license application (as defined in the FD&C Act) to introduce, or deliver for introduction, a biologic product, including vaccines into commerce in the U.S., or any successor application or procedure and (y) any similar application or functional equivalent relating to biologics licensing applicable to or required by any country, jurisdiction or Governmental Authority other than the U.S. and (ii) all supplements and amendments that may be filed with respect to the foregoing.

“Borrower” is defined in the preamble.

“Business Day” means any day which is neither a Saturday nor Sunday nor a legal holiday on which banks are authorized or required to be closed in New York, New York.

“Capital Securities” means, with respect to any Person, all shares of, interests or participations in, or other equivalents in respect of (in each case however designated, whether voting or non-voting), such Person’s capital stock, whether now outstanding or issued after the Closing Date.

“Capitalized Lease Liabilities” means, with respect to any Person, all monetary obligations of such Person and its Subsidiaries under any leasing or similar arrangement which have been (or, in accordance with GAAP, should be) classified as capitalized leases, and for purposes of each Loan Document the amount of such obligations shall be the capitalized amount thereof, determined in accordance with GAAP, and the stated maturity thereof shall be the date of the last payment of rent or any other amount due under such lease prior to the first date upon which such lease may be terminated by the lessee without payment of a premium or a penalty.

“Cash Equivalent Investment” means, at any time:

(a) any direct obligation of (or unconditionally guaranteed by) the United States or a state thereof (or any agency or political subdivision thereof, to the extent such obligations are supported by the full faith and credit of the United States or a state thereof) maturing not more than one year after such time;

(b) commercial paper maturing not more than 270 days from the date of issue, which is issued by a corporation (other than an Affiliate of the Borrower or any of its Subsidiaries) organized under the laws of any state of the United States or of the District of Columbia and rated A-1 or higher by S&P or P-1 or higher by Moody’s; or

(c) any certificate of deposit, time deposit or bankers acceptance, maturing not more than one year after its date of issuance, which is issued by any bank organized under the laws of the United States (or any state thereof) and which has (x) a credit rating of A2 or higher from Moody’s or A or higher from S&P and (y) a combined capital and surplus greater than $1,000,000,000.

“Casualty Event” means the damage, destruction or condemnation, as the case may be, of property of any Person or any of its Subsidiaries.

“Change in Control” means and shall be deemed to have occurred if (i) any “person” or “group” (within the meaning of Rule 13d-5 of the Securities Exchange Act of 1934 as in effect on the date hereof) (other than the Permitted Investors) shall own, directly or indirectly, beneficially or of record, determined on a fully diluted basis, more than 37.5% of the Voting Securities of Holdco, (ii) a majority of the seats (other than vacant seats) on the board of directors (or equivalent) of Holdco shall at any time be occupied by persons who were neither (x) nominated by the board of directors of Holdco nor (y) appointed by directors so nominated, (iii) Holdco shall cease to own directly, beneficially and of record, 100% of the issued and outstanding Capital Securities of the Borrower or (iv) Holdco shall cease to own directly or indirectly, beneficially and of record, 100% of the issued and outstanding Capital Securities of each of its other Subsidiaries.

“Change in Law” means the occurrence, after the date of this Agreement, of any of the following: (i) the adoption or taking effect of any law, rule, regulation or treaty, (ii) any change in any law, rule, regulation or treaty or in the administration, interpretation, implementation or application thereof by any Governmental Authority or (iii) the making or issuance of any request, rule, guideline or directive (whether or not having the force of law) by any Governmental Authority; provided that, notwithstanding anything herein to the contrary, (x) the Dodd-Frank Wall Street Reform and Consumer Protection Act and all requests, rules, guidelines or directives thereunder or issued in connection therewith and (y) all requests, rules, guidelines or directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities, in each case pursuant to Basel III, shall in each case be deemed to be a “Change in Law”, regardless of the date enacted, adopted or issued.

“Closing Date” means the date of the making of the Initial Loan hereunder.

“Closing Date Certificate” is defined in Section 5.1.2.

“Closing Date Warrant” means the warrant dated as of the date hereof, executed and delivered by the Lender and an Authorized Officer of Holdco, substantially in the form of Exhibit E hereto, as amended, supplemented, amended and restated or otherwise modified from time to time.

“Code” means the Internal Revenue Code of 1986, and the regulations thereunder, in each case as amended, reformed or otherwise modified from time to time.

“Commitment” means the Lender’s obligation (if any) to make Loans hereunder.

“Commitment Amount” means the Initial Commitment Amount plus the Delayed Draw Commitment Amount.

“Compliance Certificate” means a certificate duly completed and executed by an Authorized Officer of the Borrower and Holdco, substantially in the form of Exhibit C hereto, together with such changes thereto as the Lender may from time to time request for the purpose of monitoring the Borrower’s compliance with the financial covenants contained herein.

“Contingent Liability” means any agreement, undertaking or arrangement by which any Person guarantees, endorses or otherwise becomes or is contingently liable upon (by direct or indirect agreement, contingent or otherwise, to provide funds for payment, to supply funds to, or otherwise to invest in, a debtor, or otherwise to assure a creditor against loss) the Indebtedness of any other Person (other than by endorsements of instruments in the course of collection), or guarantees the payment of dividends or other distributions upon the Capital Securities of any other Person. The amount of any Person’s obligation under any Contingent Liability shall (subject to any limitation set forth therein) be deemed to be the outstanding principal amount of the debt, obligation or other liability guaranteed thereby; provided that, in the event there is not an outstanding principal amount or other similar readily discernable outstanding, actual or liquidated amount with respect to such debt, obligation or other liability guaranteed thereby, then, as of any time of determination, the amount of the Contingent Liability in respect thereof shall be the amount that, in light of then existing facts and circumstances, is reasonably expected to become an actual or matured liability.

“Control” is defined within the definition of “Affiliate”.

“Controlled Account” is defined in Section 7.13(a).

“Copyrights” means all copyrights, whether statutory or common law, and all exclusive and nonexclusive licenses from third parties or rights to use copyrights owned by such third parties, along with any and all (i) renewals, revisions, extensions, derivative works, enhancements, modifications, updates and new releases thereof, (ii) income, royalties, damages, claims and payments now and hereafter due and/or payable with respect thereto, including, without limitation, damages and payments for past, present or future infringements thereof, (iii) rights to sue for past, present and future infringements thereof, and (iv) foreign copyrights and any other rights corresponding thereto throughout the world.

“Copyright Security Agreement” means any Copyright Security Agreement executed and delivered by a Grantor substantially in the form of Exhibit C to the Pledge and Security Agreement, as amended, supplemented, amended and restated or otherwise modified from time to time.

“Default” means any Event of Default or any condition, occurrence or event which, after notice or lapse of time or both, would constitute an Event of Default.

“Delayed Draw Date” means the date of the making of the Delayed Draw Loan hereunder, which shall be no sooner than the date on which each of the conditions precedent set forth in Section 5.2 shall have been satisfied.

“Delayed Draw Certificate” is defined in Section 5.2.1.

“Delayed Draw Commitment Amount” means $3,000,000.

“Delayed Draw Loan” is defined in Section 2.1(b).

“Delayed Draw Note” means a promissory note of the Borrower payable to the Lender, in the form of Exhibit A-2 hereto (as such promissory note may be amended, endorsed or otherwise modified from time to time), evidencing the aggregate Indebtedness of the Borrower to the Lender resulting from the outstanding amount of the Delayed Draw Loans, and also means all other promissory notes accepted from time to time in substitution therefor or renewal thereof.

“Delayed Draw Warrant” means the warrant dated as of the Delayed Draw Date, executed and delivered by the Lender and an Authorized Officer of Holdco, substantially in the form of Exhibit F hereto, as amended, supplemented, amended and restated or otherwise modified from time to time.

“Designated Jurisdiction” means any country or territory to the extent that such country or territory is the subject of any Sanction.

“Disposition” (or similar words, such as “Dispose”) means any sale, transfer, lease, contribution or other conveyance (including by way of merger) of, or the granting of options, warrants or other rights to, any Loan Party’s assets (including accounts receivable and Capital Securities of Subsidiaries) to any other Person (other than to Holdco or one of its wholly-owned Subsidiaries) in a single transaction or series of transactions.

“DOH” means the Department of Health (Canada) and any successor entity.

“Dollars” and the sign “$” mean lawful money of the United States.

“Early Prepayment Fee” means (i) with respect to any prepayment of any Loan during the period from the Closing Date up to (and including) the first anniversary of the Closing Date, an amount equal to 5.00% of the principal amount of the Loans being prepaid and (ii) with respect to any prepayment of any Loan during the period from the day following the first anniversary of the Closing Date up to (and including) the second anniversary of the Closing Date, an amount equal to 2.00% of the principal amount of the Loans being prepaid.

“Environmental Laws” means all federal, state, local or international laws, statutes, rules, regulations, codes, directives, treaties, requirements, ordinances, orders, decrees, judgments, injunctions, notices or binding agreements issued, promulgated or entered into by any Governmental Authority, relating in any way to the environment, natural resources, Hazardous Material or health and safety matters.

“Environmental Liability” means any liability, loss, claim, suit, action, investigation, proceeding, damage, commitment or obligation, contingent or otherwise (including any liability for damages, costs of environmental remediation, fines, penalties or indemnities), of or affecting any Loan Party directly or indirectly arising from, in connection with or based upon (i) any Environmental Law or Environmental Permit, (ii) the generation, use, handling, transportation, storage, treatment, recycling, presence, disposal, Release or threatened Release of, or exposure to, any Hazardous Materials or (iii) any contract, agreement, penalty, order, decree, settlement, injunction or other arrangement (including operation of law) pursuant to which liability is assumed, entered into, inherited or imposed with respect to any of the foregoing.

“Environmental Permit” is defined in Section 6.7(c).

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and any successor statute thereto of similar import, together with the regulations thereunder, in each case as in effect from time to time. References to Sections of ERISA also refer to any successor Sections thereto.

“ERISA Affiliate” means any person that for purposes of Title I and Title IV of ERISA and Section 412 of the Code would be deemed to be a single employer with the Borrower, pursuant to Section 414(b), (c), (m) or (o) of the Code or Section 4001 of ERISA.

“ERISA Event” means (a) any reportable event, as defined in Section 4043 of ERISA, with respect to a Pension Plan, as to which PBGC has not by regulation waived the requirement of Section 4043(a) of ERISA that it be notified of such event, (b) the filing of a notice of intent to terminate any Pension Plan, if such termination would require material additional contributions in order to be considered a standard termination within the meaning of Section 4041(b) of ERISA, the filing under Section 4041(c) of ERISA of a notice of intent to terminate any Pension Plan or the termination of any Pension Plan under Section 4041(c) of ERISA, (c) the institution of proceedings under Section 4042 of ERISA by the PBGC for the termination of, or the appointment of a trustee to administer, any Pension Plan, (d) any failure by any Pension Plan to satisfy the minimum funding requirements of Sections 412 and 430 of the Code or Section 302 of ERISA applicable to such Pension Plan, whether or not waived, (e) the failure to make a required contribution to any Pension Plan that would result in the imposition of an encumbrance on any Loan Party or any ERISA Affiliate under Section 412 or 430 of the Code or at any time prior to date hereof, a filing under Section 412 of the Code or Section 302 of ERISA of any request for a minimum funding variance with respect to any Pension Plan or Multiemployer Plan, (f) an engagement in a non-exempt prohibited transaction within the meaning of Section 4975 of the Code or Section 406 of ERISA with respect to which a Loan Party would incur liability which would reasonably be expected to have a Material Adverse Effect, (g) the complete or partial withdrawal of any Loan Party or any material ERISA Affiliate from a Multiemployer Plan, (h) any Loan Party or an ERISA Affiliate incurring any material liability under Title IV of ERISA with respect to any Pension Plan (other than premiums due and not delinquent under Section 4007 of ERISA) and (i) a determination that any Pension Plan is, or is expected to be, in “at risk” status (as defined in Section 303(i)(4) of ERISA or Section 430(i)(4) of the Code).

“Event of Default” is defined in Section 9.1.

“Event of Loss” means, with respect to any asset of any Loan Party, any of the following: (i) any loss, destruction or damage of such asset, (ii) any pending or threatened institution of any proceedings for the condemnation or seizure of such asset or of any right of eminent domain, or (iii) any actual condemnation, seizure or taking, by exercise of the power of eminent domain or otherwise, of such asset, or confiscation of such asset or requisition of the use of such asset.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Excluded Collateral” is defined in the Pledge and Security Agreement.

“Excluded Subsidiary” means any of PIC, VBI Acquisition, Paulson Investment I LLC, an Oregon limited liability company, Paulson Capital Properties LLC, an Oregon limited liability company, and PCP I LLC, an Oregon limited liability company.

“Existing Investors” means Perceptive Life Sciences Master Fund Ltd.; Titan-Perc Ltd.; 5AM Ventures II, L.P.; 5AM Co-Investors II, L.P.; ARCH Venture Fund VI, L.P.; and Clarus Lifesciences I, L.P.

“Expense Deposit” means an amount equal to $30,000 deposited by the Borrower with the Lender to be applied to the expenses of the Lender pursuant to Section 11.3.

“FDA” means the U.S. Food and Drug Administration and any successor entity.

“FD&C Act” means the U.S. Food, Drug and Cosmetic Act of 1938 (or any successor thereto), as amended from time to time, and the rules and regulations promulgated thereunder.

“Fiscal Quarter” means a quarter ending on the last day of March, June, September or December.

“Fiscal Year” means any period of twelve consecutive calendar months ending on December 31; references to a Fiscal Year with a number corresponding to any calendar year (e.g., the “2013 Fiscal Year”) refer to the Fiscal Year ending on December 31 of such calendar year.

“F.R.S. Board” means the Board of Governors of the Federal Reserve System or any successor thereto.

“GAAP” is defined in Section 1.4.

“Governmental Authority” means any national, supranational, federal, state, county, provincial, local, municipal or other government or political subdivision thereof (including any Regulatory Authority), whether domestic or foreign, and any agency, authority, commission, ministry, instrumentality, regulatory body, court, tribunal, arbitrator, central bank or other Person exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to any such government.

“Grantor” means, collectively, Holdco and each of its Subsidiaries.

“Guarantors” means, collectively, Holdco and each of its Subsidiaries (other than the Excluded Subsidiaries).

“Hazardous Material” means any material, substance, chemical, mixture or waste which is capable of damaging or causing harm to any living organism, the environment or natural resources, including all explosive, special, hazardous, polluting, toxic, industrial, dangerous, biohazardous, medical, infectious or radioactive substances, materials or wastes, noise, odor, electricity or heat, and including petroleum or petroleum products, byproducts or distillates, asbestos or asbestos-containing materials, urea formaldehyde, polychlorinated biphenyls, radon gas, ozone-depleting substances, greenhouse gases, and all other substances or wastes of any nature regulated pursuant to any Environmental Law or as to which any Governmental Authority requires investigation, reporting or remedial action.

“Hedging Obligations” means, with respect to any Person, all liabilities of such Person under currency exchange agreements, interest rate swap agreements, interest rate cap agreements and interest rate collar agreements, and all other agreements or arrangements designed to protect such Person against fluctuations in interest rates or currency exchange rates.

“herein”, “hereof”, “hereto”, “hereunder” and similar terms contained in any Loan Document refer to such Loan Document as a whole and not to any particular Section, paragraph or provision of such Loan Document.

“Holdco” means VBI Vaccines Inc., a Delaware corporation.

“Impermissible Qualification” means any qualification or exception to the opinion or certification of any independent public accountant as to any financial statement of Holdco and its Subsidiaries (i) which is of a “going concern” or similar nature, (ii) which relates to the limited scope of examination of matters relevant to such financial statement or (iii) which relates to the treatment or classification of any item in such financial statement and which, as a condition to its removal, would require an adjustment to such item the effect of which would be to cause the Borrower to be in Default.

“including” and “include” means including without limiting the generality of any description preceding such term, and, for purposes of each Loan Document, the parties hereto agree that the rule of ejusdem generis shall not be applicable to limit a general statement, which is followed by or referable to an enumeration of specific matters, to matters similar to the matters specifically mentioned.

“IND” means (i) (x) an investigational new drug application (as defined in the FD&C Act) that is required to be filed with the FDA before beginning clinical testing in human subjects, or any successor application or procedure and (y) any similar application or functional equivalent relating to any investigational new drug application applicable to or required by any country, jurisdiction or Governmental Authority other than the U.S. and (ii) all supplements and amendments that may be filed with respect to the foregoing.

“Indebtedness” of any Person means:

(a) all obligations of such Person for borrowed money or advances and all obligations of such Person evidenced by bonds, debentures, notes or similar instruments;

(b) all obligations, contingent or otherwise, relative to the face amount of all letters of credit, whether or not drawn, and banker’s acceptances issued for the account of such Person;

(c) all Capitalized Lease Liabilities of such Person;

(d) net Hedging Obligations of such Person and all obligations of such Person arising under Synthetic Leases, excluding amounts due under Synthetic Leases that may be terminated by the lessee on no more than 180 days prior notice and without penalty or further obligation in respect of the period following any notice of termination period required thereunder;

(e) all obligations issued, undertaken or assumed as the deferred purchase price of property or services, including earnouts, purchase price adjustments and seller notes in connection with acquisitions permitted hereunder (to the extent due and payable and included as a liability on the balance sheet in accordance with GAAP) (other than trade payables entered into in the ordinary course of business);

(f) whether or not so included as liabilities in accordance with GAAP, all obligations of such Person to pay the deferred purchase price of property or services (excluding trade accounts payable in the ordinary course of business which are not overdue for a period of more than 90 days or, if overdue for more than 90 days, as to which a dispute exists and adequate reserves in conformity with GAAP have been established on the books of such Person), and indebtedness secured by (or for which the holder of such indebtedness has an existing right, contingent or otherwise, to be secured by) a Lien on property owned or being acquired by such Person (including indebtedness arising under conditional sales or other title retention agreements), whether or not such indebtedness shall have been assumed by such Person or is limited in recourse; and

(g) all Contingent Liabilities of such Person in respect of any of the foregoing.

The Indebtedness of any Person shall include the Indebtedness of any other Person (including any partnership in which such Person is a general partner) to the extent such Person is liable therefor as a result of such Person’s ownership interest in or other relationship with such Person, except to the extent the terms of such Indebtedness provide that such Person is not liable therefor.

“Indemnified Liabilities” is defined in Section 11.4.

“Indemnified Parties” is defined in Section 11.4.

“Infringement” and “Infringes” mean the misappropriation of know-how, trade secrets and/or confidential information.

“Initial Commitment Amount” means $3,000,000.

“Initial Loan” is defined in Section 2.1(a).

“Initial Term Note” means a promissory note of the Borrower payable to the Lender, in the form of Exhibit A-1 hereto (as such promissory note may be amended, endorsed or otherwise modified from time to time), evidencing the aggregate Indebtedness of the Borrower to the Lender resulting from the outstanding amount of the Initial Loans, and also means all other promissory notes accepted from time to time in substitution therefor or renewal thereof.

“Intellectual Property” means all (i) Patents, (ii) Trademarks, (iii) Copyrights and other works of authorship (registered or unregistered), and all applications, registrations and renewals therefor, (iv) Product Authorizations, (v) Product Agreements, (vi) computer software, databases, data and documentation, (vii) trade secrets and confidential business information, whether patentable or unpatentable and whether or not reduced to practice, know-how, inventions, manufacturing processes and techniques, research and development information, data and other information included in or supporting Product Authorizations, (viii) financial, marketing and business data, pricing and cost information, business, finance and marketing plans, customer and prospective customer lists and information, and supplier and prospective supplier lists and information, (ix) other intellectual property or similar proprietary rights, (x) copies and tangible embodiments of any of the foregoing (in whatever form or medium) and (xi) any and all improvements to any of the foregoing.

“Intercompany Subordinated Note” means a promissory note executed and delivered by the Borrower or another Loan Party that includes subordination provisions substantially as set forth in Exhibit G hereto and is otherwise satisfactory in form and substance to the Lender.

“Intercompany Subordinated Debt” means Indebtedness of any Loan Party owing to any other Loan Party; provided that (i) such Indebtedness is unsecured and evidenced by an Intercompany Subordinated Note, (ii) such Intercompany Subordinated Note is pledged to the Lender pursuant to the Pledge and Security Agreement on a first-priority basis and (iii) such Indebtedness will not mature or otherwise become due and payable earlier than 90 days following the Maturity Date.

“Interest Period” means, (i) initially, for any Loan made hereunder, the period beginning on (and including) the date on which such Loan is made hereunder pursuant to Section 2.2 and ending on (and including) the last day of the calendar month in which such Loan was made, and (ii) thereafter, the period beginning on (and including) the first day of each succeeding calendar month and ending on the earlier of (and including) (x) the last day of such calendar month and (y) the Maturity Date.

“Investment” means, relative to any Person, (i) any loan, advance or extension of credit made by such Person to any other Person, including the purchase by such Person of any bonds, notes, debentures or other debt securities of any other Person, (ii) Contingent Liabilities in favor of any other Person and (iii) any Capital Securities held by such Person in any other Person. The amount of any Investment shall be the original principal or capital amount thereof less all returns of principal or equity thereon and shall, if made by the transfer or exchange of property other than cash, be deemed to have been made in an original principal or capital amount equal to the fair market value of such property at the time of such Investment.

“Lender” is defined in the preamble.

“Lender’s Designee” is defined in Section 5.1.20.

“LIBO Rate” means, with respect to any applicable Interest Period hereunder, the one-month London Interbank Offered Rate for deposits in Dollars at approximately 11:00 a.m. (London, England time), as determined by the Lender from the appropriate Bloomberg or Telerate page selected by the Lender (or any successor thereto or similar source reasonably determined by the Lender from time to time), which shall be that one-month London Interbank Offered Rate for deposits in Dollars in effect two Business Days prior to the first Business Day of such Interest Period rounded up to the nearest 1/16 of 1%, with such rate to be reset effective as of the first Business Day of each succeeding Interest Period. If the Initial Loan or the Delayed Draw Loan is advanced other than on the first Business Day of a Fiscal Quarter, the initial LIBO Rate for such Loan shall be that one-month London Interbank Offered Rate for deposits in Dollars in effect two Business Days prior to the date of the Initial Loan or the Delayed Draw Loan, as the case may be, which rate shall be in effect until (and including) the last Business Day of the first Interest Period relative to such Loan. The Lender’s internal records of applicable interest rates shall be determinative in the absence of manifest error. Notwithstanding the foregoing, in no event shall the LIBO Rate for any Loan at any time be greater than 5.00%.

“Lien” means any security interest, mortgage, pledge, hypothecation, assignment, deposit arrangement, encumbrance, lien (statutory or otherwise), charge against or interest in property, or other priority or preferential arrangement of any kind or nature whatsoever, to secure payment of a debt or performance of an obligation.

“Loan” means, as the context may require, the Initial Loan, the Delayed Draw Loan or both.

“Loan Documents” means, collectively, this Agreement, the Notes, the Pledge and Security Agreement, the Copyright Security Agreement, the Patent Security Agreement, the Trademark Security Agreement, each other agreement pursuant to which the Lender is granted a Lien to secure the Obligations, the Proposal Letter, the Closing Date Warrant, the Delayed Draw Warrant, and each other agreement, certificate, document or instrument delivered in connection with any Loan Document, whether or not specifically mentioned herein or therein.

“Loan Parties” means, collectively, the Borrower, Holdco and each other Guarantor.

“Loan Request” means a Loan request and certificate duly executed by an Authorized Officer of the Borrower substantially in the form of Exhibit B hereto.

“Material Adverse Effect” means a material adverse effect on (i) the business, condition (financial or otherwise), operations, performance, properties or prospects of Holdco and its Subsidiaries, taken as a whole, (ii) the rights and remedies of the Lender under any Loan Document or (iii) the ability of Holdco and its Subsidiaries to perform their respective Obligations under any Loan Document.

“Material Agreements” means (i) each contract or agreement to which any Loan Party is a party involving aggregate payments of more than $100,000, whether such payments are being made by such Loan Party to a non-Affiliated Person, or by a non-Affiliated Person to such Loan Party; and (ii) all other contracts or agreements, individually or in the aggregate, material to the business, operations, assets, prospects, conditions (financial or otherwise), performance or liabilities of the Loan Parties.

“Maturity Date” means July 25, 2017; provided that if the Delayed Draw Loan is made pursuant hereto, the Maturity Date shall be July 25, 2018.

“Merger Agreement” means the Agreement and Plan of Merger dated as of May 8, 2014, between the Borrower, Holdco and VBI Acquisition.

“Merger Transaction” means the acquisition of the Borrower by Holdco pursuant to the Merger Agreement.

“Milestone Clinical Trial” means a Phase I clinical trial for a CMV (VLP) vaccine candidate.

“MMA” has the meaning ascribed to such term in the definition of “FDA Requirements”.

“Moody’s” means Moody’s Investors Service, Inc.

“Multiemployer Plan” means a “multiemployer plan” (as defined in Section 4001(a)(3) of

ERISA) that is subject to Title IV of ERISA contributed to for any employees of a Loan Party or any ERISA Affiliate.

“NDA” means (i) (x) a new drug application (as defined in the FD&C Act) and (y) any similar application or functional equivalent relating to any new drug application applicable to or required by any country, jurisdiction or Governmental Authority other than the U.S. and (ii) all supplements and amendments that may be filed with respect to the foregoing.

“Net Cash Proceeds” means when used in respect of (i) any Disposition, (ii) any issuance of any debt or equity securities, or (iii) the receipt of any proceeds in connection with any Event of Loss suffered, in each case by any Loan Party, the gross proceeds in cash or cash equivalents received by such Person (including such proceeds subsequently received in respect of noncash consideration initially received and amounts initially placed in escrow that subsequently become available) from such Disposition, issuance or Event of Loss, less all direct costs and expenses incurred or to be incurred, and all federal, state, local and foreign Taxes assessed or to be assessed (if any), in connection therewith.

“Non-Excluded Taxes” means any Taxes other than net income and franchise Taxes imposed on the Lender or its properties by any Governmental Authority under the laws of which the Lender is organized or in which it maintains its applicable lending office.

“Note” means the Initial Term Note or the Delayed Draw Note, as the case may be.

“Obligations” means all obligations (monetary or otherwise, whether absolute or contingent, matured or unmatured) of each Loan Party arising under or in connection with a Loan Document and the principal of and premium, if any, and interest (including interest accruing during the pendency of any proceeding of the type described in Section 9.1.8, whether or not allowed in such proceeding) on the Loans.

“Organic Document” means, relative to each Loan Party, its certificate of incorporation, by-laws, certificate of partnership, partnership agreement, certificate of formation, limited liability agreement, operating agreement and all shareholder agreements, voting trusts and similar arrangements applicable to each Loan Party’s Capital Securities.

“Other Taxes” means any and all stamp, documentary or similar Taxes, or any other excise or property Taxes or similar levies that arise on account of any payment made or required to be made under any Loan Document or from the execution, delivery, registration, recording or enforcement of any Loan Document.

“Other Administrative Proceeding” means any administrative proceeding relating to a dispute involving a patent office or other relevant intellectual property registry which relates to validity, opposition, revocation, ownership or enforceability or the relevant Intellectual Property.

“Patent” means any patent, patent application and invention disclosure, including any divisions, continuations, continuations in-part, provisionals, continued prosecution applications, substitutions, reissues, reexaminations, renewals, extensions, restorations, supplemental protection certificates and other additions in connection therewith, whether in or related to the United States or any foreign country or other jurisdiction.

“Patent Security Agreement” means any Patent Security Agreement executed and delivered by a Grantor in substantially the form of Exhibit A to the Pledge and Security Agreement, as amended, supplemented, amended and restated or otherwise modified from time to time.

“PBGC” means the Pension Benefit Guaranty Corporation, or any entity succeeding to all or any of its functions under ERISA.

“PDMA” means the Prescription Drug Marketing Act.

“Pension Plan” means a “pension plan”, as such term is defined in Section 3(2) of ERISA, which is subject to Title IV of ERISA (other than a Multiemployer Plan), to which a Loan Party or any ERISA Affiliate sponsors, contributes to, or provides benefits under, or has any obligation to contribute or provide benefits under, and to which such Loan Party or ERISA Affiliate may have liability, including any liability by reason of having been a substantial employer under Section 4063 of ERISA at any time during the preceding five years, or by reason of being deemed to be a contributing sponsor under Section 4069 of ERISA.

“Permits” means all permits, licenses, registrations, certificates, orders, approvals, authorizations, consents, waivers, franchises, variances and similar rights issued by or obtained from any Governmental Authority or any other Person, including, without limitation, those relating to Environmental Laws.

“Permitted Investor” means any Existing Investor or any of its Affiliates as to which (i) such Existing Investor (or the Person that administers or manages such Existing Investor) acts as the sole managing member, general partner or equivalent of such Affiliate, and (ii) such Existing Investor (or other Person) has the power to direct or cause the direction of the management and policies of such Affiliate (whether by way of voting equity, contract or otherwise).

“Person” means any natural person, corporation, limited liability company, partnership, joint venture, association, trust or unincorporated organization, Governmental Authority or any other legal entity, whether acting in an individual, fiduciary or other capacity.

“PIC” means Paulson Investment Company, Inc.

“Pledge and Security Agreement” means the Pledge and Security Agreement executed and delivered by each Grantor, substantially in the form of Exhibit D hereto, as amended, supplemented, amended and restated or otherwise modified from time to time.

“PPSA” means the Personal Property Security Act as in effect from time to time in the Province of Ontario; provided that, if, with respect to any financing statement or by reason of any provisions of law, the perfection or the effect of perfection or non-perfection of the security interests granted to the Lender pursuant to the applicable Loan Document is governed by the Personal Property Security Act as in effect in a jurisdiction of Canada other than the Province of Ontario, then “PPSA” means the Personal Property Security Act as in effect from time to time in such other jurisdiction for purposes of the provisions of each Loan Document and any financing statement relating to such perfection or effect of perfection or non-perfection.

“Product” means any current or future product developed, manufactured, licensed, marketed, sold or otherwise commercialized by any Loan Party, including any such product in development or which may be developed.

“Product Agreement” means each agreement, license, document, instrument, interest (equity or otherwise) or the like under which one or more Persons grants or receives any right, title or interest with respect to any Product Development and Commercialization Activities in respect of one or more Products specified therein, or receives or is granted the right to exclude any third parties from engaging in any Product Development and Commercialization Activities with respect thereto, including each contract or agreement with suppliers, manufacturers, distributors, clinical research organizations, wholesalers, pharmacies or with any other Person related to any such entity.

“Product Authorizations” means any and all approvals (including applicable supplements, amendments, pre and post approvals, drug master files, governmental price and reimbursement approvals and approvals of applications for regulatory exclusivity), licenses, registrations or authorizations of any Governmental Authority necessary for the manufacture, development, distribution, use, storage, import, export, transport, promotion, marketing, sale or other commercialization of a Product in any country or jurisdiction, including without limitation INDs, NDAs and BLAs or similar applications.

“Product Development and Commercialization Activities” means, with respect to any Product, any combination of research, development, manufacture, importation, use, sale, storage, design, labeling, marketing, promotion, supply, distribution, testing, packaging, purchasing or other commercialization activities, receipt of payment in respect of any of the foregoing, or like activities the purpose of which is to commercially exploit such Product.

“Prohibited Payment” means any bribe, rebate, payoff, influence payment, kickback or other payment or gift of money or anything of value (including meals or entertainment) to any officer, employee or ceremonial office holder of any government or instrumentality thereof, political party or supra-national organization (such as the United Nations), any political candidate, any royal family member or any other person who is connected or associated personally with any of the foregoing that is prohibited under any applicable law or regulation or otherwise for the purpose of influencing any act or decision of such payee in his official capacity, inducing such payee to do or omit to do any act in violation of his lawful duty, securing any improper advantage or inducing such payee to use his influence with a government or instrumentality thereof to affect or influence any act or decision of such government or instrumentality.

“Proposal Letter” means, collectively, the proposal letter, dated as of March 18, 2014, between the Lender and the Borrower regarding the transactions contemplated hereby and the outline of proposed terms and conditions attached thereto.

“Regulatory Authority” means any Governmental Authority that is concerned with or has regulatory oversight with respect to the use, control, safety, efficacy, reliability, manufacturing, marketing, distribution, sale or other Product Development and Commercialization Activities relating to any Product of a Loan Party, including the FDA, the DOH and all equivalent of such agencies in other jurisdictions, and includes Standard Bodies.

“Regulatory Authorizations” means, with respect to the Products, all approvals, clearances, authorizations, orders, exemptions, registrations, certifications, licenses and Permits granted by any Regulatory Authorities, including all NDAs and Product Authorizations held by the Loan Parties or any of their respective licensors, as applicable, or that are pending before the FDA or equivalent non-United States Governmental Entity with respect to the Products.

“Release” means any releasing, disposing, discharging, injecting, spilling, leaking, leaching, pumping, pouring, dumping, depositing, emitting, escaping, emptying, seeping, dispersal, migrating or placing, including movement through, into or upon the environment or any natural or man-made structure.

“Required Milestone” means any event or occurrence described in Section 7.18.

“Restricted Payment” means (i) the declaration or payment of any dividend (other than dividends payable solely in Capital Securities of a Loan Party) on, or the making of any payment or distribution on account of, or setting apart assets for a sinking or other analogous fund for the purchase, redemption, defeasance, retirement or other acquisition of, any class of Capital Securities of a Loan Party or any warrants, options or other right or obligation to purchase or acquire any such Capital Securities, whether now or hereafter outstanding, (ii) the making of any other distribution in respect of such Capital Securities, in each case either directly or indirectly, whether in cash, property or obligations of a Loan Party or otherwise, or (iii) any payments to officers, directors or employees of a Loan Party, other than ordinary course wages or similar compensation or ordinary course reimbursements of customary business expenses incurred on behalf of such Loan Party or its operations.

“S&P” means Standard & Poor’s Rating Services, a division of The McGraw-Hill Companies, Inc.

“Sanction” means any international economic sanction administered or enforced by the United States Government (including, without limitation, OFAC), the United Nations Security Council, the European Union or its Member States, Her Majesty’s Treasury or other relevant sanctions authority.

“SEC” means the Securities and Exchange Commission.

“Solvent” means, with respect to the Borrower and its Subsidiaries on a particular date, that on such date (i) the fair value of the property of the Borrower and its Subsidiaries on a consolidated basis is greater than the total amount of liabilities, including Contingent Liabilities, of the Borrower and its Subsidiaries on a consolidated basis, (ii) the present fair saleable value of the assets of the Borrower and its Subsidiaries on a consolidated basis is not less than the amount that will be required to pay the probable liability of the Borrower and its Subsidiaries on a consolidated basis on its debts as they become absolute and matured, (iii) the Borrower does not intend to, and does not believe that it or its Subsidiaries will, incur debts or liabilities beyond the ability of the Borrower and its Subsidiaries to pay as such debts and liabilities mature, (iv) the Borrower and its Subsidiaries on a consolidated basis are not engaged in business or a transaction, and the Borrower and its Subsidiaries on a consolidated basis are not about to engage in a business or a transaction, for which the property of the Borrower and its Subsidiaries on a consolidated basis would constitute an unreasonably small capital and (v) the Borrower and its Subsidiaries have not executed this Agreement or any other Loan Document or made any transfer or incurred any obligations hereunder, with actual intent to hinder, delay or defraud either present or future creditors. The amount of Contingent Liabilities at any time shall be computed as the amount that, in light of all the facts and circumstances existing at such time, can reasonably be expected to become an actual or matured liability.

“Subordinated Debt” means any unsecured Indebtedness that (i) is of the type described in clause (a) of the definition of “Indebtedness”, and (ii) is permitted pursuant to Section 8.2(f).

“Subsidiary” means, with respect to any Person, any other Person of which more than 50% of the outstanding Voting Securities of such other Person (irrespective of whether at the time Capital Securities of any other class or classes of such other Person shall or might have voting power upon the occurrence of any contingency) is at the time directly or indirectly owned or controlled by such Person, by such Person and one or more other Subsidiaries of such Person, or by one or more other Subsidiaries of such Person. Unless the context otherwise specifically requires, the term “Subsidiary” shall be a reference to a Subsidiary of Holdco.

“Synthetic Lease” means, as applied to any Person, any lease (including leases that may be terminated by the lessee at any time) of any property (whether real, personal or mixed) (i) that is not a capital lease in accordance with GAAP and (ii) in respect of which the lessee retains or obtains ownership of the property so leased for federal income tax purposes, other than any such lease under which that Person is the lessor.

“Taxes” means all income, stamp or other taxes, duties, levies, imposts, charges, assessments, fees, deductions or withholdings, now or hereafter imposed, levied, collected, withheld or assessed by any Governmental Authority, and all interest, penalties or similar liabilities with respect thereto.

“Termination Date” means the date on which all Obligations (other than (i) any obligations contained in or arising out of the Closing Date Warrant or the Delayed Draw Warrant, and (ii) inchoate indemnification obligations) have been paid in full in cash and the Commitment shall have terminated.

“Trademark” means any trademark, service mark, trade name, logo, symbol, trade dress, domain name, corporate name and other indicator of source or origin, and all applications and registrations therefor, together with all of the goodwill associated with the therewith.

“Trademark Security Agreement” means any Trademark Security Agreement executed and delivered by a Grantor substantially in the form of Exhibit B to the Pledge and Security Agreement, as amended, supplemented, amended and restated or otherwise modified from time to time.

“UCC” means the Uniform Commercial Code as in effect from time to time in the State of New York; provided that, if, with respect to any financing statement or by reason of any provisions of law, the perfection or the effect of perfection or non-perfection of the security interests granted to the Lender pursuant to the applicable Loan Document is governed by the Uniform Commercial Code as in effect in a jurisdiction of the United States other than New York, then “UCC” means the Uniform Commercial Code as in effect from time to time in such other jurisdiction for purposes of the provisions of each Loan Document and any financing statement relating to such perfection or effect of perfection or non-perfection.

“United States” or “U.S.” means the United States of America, its fifty states and the District of Columbia.

“VBI Acquisition” means VBI Acquisition Corp., a Delaware corporation.

“VBI Convertible Notes” means, collectively, the convertible promissory notes listed on Schedule 5.1.19 hereto.

“Voting Securities” means, with respect to any Person, Capital Securities of any class or kind ordinarily having the power to vote for the election of directors, managers or other voting members of the governing body of such Person.

“Welfare Plan” means a “welfare plan”, as such term is defined in Section 3(1) of ERISA.

“wholly owned Subsidiary” means any direct or indirect Subsidiaries of Holdco, all of the outstanding Capital Securities of which (other than any director’s qualifying shares or investments by foreign nationals mandated by applicable laws) is owned directly or indirectly by Holdco.

Section 1.2 Use of Defined Terms. Unless otherwise defined or the context otherwise requires, terms for which meanings are provided in this Agreement shall have such meanings when used in each other Loan Document and the schedules attached hereto.

Section 1.3 Cross-References. Unless otherwise specified, references in a Loan Document to any Article or Section are references to such Article or Section of such Loan Document, and references in any Article, Section or definition to any clause are references to such clause of such Article, Section or definition.

Section 1.4 Accounting and Financial Determinations. Unless otherwise specified, all accounting terms used in each Loan Document shall be interpreted, and all accounting determinations and computations thereunder (including under Section 7.19 and any definitions used in such calculations) shall be made, in accordance with those generally accepted accounting principles (“GAAP”) applied in the preparation of the financial statements referred to in Sections 5.1.4(a). Unless otherwise expressly provided, all financial covenants and defined financial terms shall be computed on a consolidated basis for Holdco and its Subsidiaries, in each case without duplication.

Article II

COMMITMENT and BORROWING procedures

Section 2.1 Commitment.

(a) On the terms and subject to the conditions of this Agreement, the Lender agrees to make a term loan (the “Initial Loan”) to the Borrower on the Closing Date in an amount not to exceed the Initial Commitment Amount.

(b) On the terms and subject to the conditions of this Agreement, the Lender agrees to make a term loan (the “Delayed Draw Loan”) to the Borrower on the Delayed Draw Date in an amount equal to or greater than $1,000,000, not to exceed the Delayed Draw Commitment Amount.

(c) No amounts paid or prepaid with respect to any Loan may be reborrowed.

Section 2.2 Borrowing Procedures. In each case subject to the terms and conditions hereof:

(a) The Borrower may irrevocably request that the Initial Loan be made by delivering to the Lender a Loan Request on or before 10:00 a.m. on a Business Day at least three (3) (but not greater than five (5)) Business Days prior to the Closing Date; provided, however, that the Borrower and the Lender shall have mutually agreed upon the date of the Closing Date at least three (3) Business Days prior thereto, provided further that if no such agreement is reached then the Initial Loan will be funded within ten (10) days of delivery of the Loan Request.

(b) The Borrower may irrevocably request that the Delayed Draw Loan be made by delivering to the Lender a Loan Request on or before 10:00 a.m. on a Business Day at least 15 (but not greater than 20) Business Days prior to the proposed Delayed Draw Date; provided, however, that the Borrower and the Lender shall have mutually agreed upon the Delayed Draw Date at least three Business Days prior thereto, provided further that if no such agreement is reached then the Delayed Draw Loan will be funded within ten (10) days of delivery of the Loan Request.

Section 2.3 Funding. After receipt of the applicable Loan Request for the Initial Loan, the Lender shall, on the Closing Date and subject to the terms and conditions hereof, make the requested proceeds of the Initial Loan available to the Borrower by wire transfer to the account the Borrower shall have specified in its Loan Request. After receipt of the Loan Request for the Delayed Draw Loan, the Lender shall, on the Delayed Draw Date and subject to the terms and conditions hereof, make the requested proceeds of the Delayed Draw Loan available to the Borrower by wire transfer to the account the Borrower shall have specified in its Loan Request.

Section 2.4 Reduction of the Commitment Amounts. The Initial Commitment Amount shall automatically and permanently be reduced to zero immediately after the making of the Initial Loan on the Closing Date. The Delayed Draw Commitment Amount shall automatically and permanently be reduced to zero immediately after the making of the Delayed Draw Loan on the Delayed Draw Date.

Article III

REPAYMENTS, PREPAYMENTS, INTEREST AND FEES

Section 3.1 Repayments and Prepayments; Application. The Borrower agrees that the Loans, and any fees or interest accrued or accruing thereon, shall be repaid and prepaid solely in Dollars pursuant to the terms of this Article III.

Section 3.2 Repayments and Prepayments. The Borrower shall repay in full the entire unpaid principal amount of the Loans on the Maturity Date. Prior thereto, payments and prepayments of the Loans shall be made as set forth below.

(a) From the Closing Date through the first anniversary thereof, no scheduled repayment of the aggregate outstanding principal amount of the Loans shall be required. Thereafter, on the last Business Day of each calendar month, the Borrower shall make a scheduled principal payment of $75,000 on the Initial Loan and, to the extent funded, $75,000 on the Delayed Draw Loan, with the remaining unpaid balance of the Loans payable in cash on the Maturity Date.

(b) The Borrower may, upon five (5) Business Days prior written notice to the Lender, prepay the outstanding amount of the Loans in whole or in part.

(c) Upon the issuance, sale or other incurrence of any debt securities or other Indebtedness (other than Subordinated Debt or Intercompany Subordinated Debt, in either case solely to the extent expressly permitted hereunder) by any Loan Party, the Borrower shall, within three Business Days of such Person’s receipt of the proceeds thereof, prepay the outstanding principal amount of the Loans in an amount equal to 100% of the Net Cash Proceeds therefrom. The provisions of this clause shall not be deemed to be implied consent to any such issuance, sale or incurrence otherwise prohibited by the terms and conditions of this Agreement.

(d) Upon a Disposition by any Loan Party (other than a Disposition permitted pursuant to Section 8.9), the Borrower shall within three Business Days of such Person’s receipt of the proceeds thereof, prepay the outstanding principal amount of the Loans in an amount equal to 100% of the Net Cash Proceeds therefrom. The provisions of this clause shall not be deemed to be implied consent to any Disposition otherwise prohibited by the terms and conditions of this Agreement.

(e) If any Event of Loss shall occur with respect to any Loan Party, the Borrower shall prepay the outstanding principal amount of the Loans in an amount equal to 100% the Net Cash Proceeds therefrom, if any.

(f) Immediately upon any acceleration of the Maturity Date of the Loans pursuant to Section 9.2 or Section 9.3, the Borrower shall repay in full the Loans, unless, pursuant to Section 9.3, only a portion of the Loans are so accelerated (in which case the portion so accelerated shall be so repaid).

(g) If any Loan hereunder is prepaid for any reason on or prior to the date that is two (2) years after the Closing Date, (excluding, however, payments made pursuant to clause (a) of this Section 3.2), the Borrower shall pay the Early Prepayment Fee to the Lender at the time of such prepayment, together with all other fees payable hereunder (if any), including pursuant to Sections 3.7 and 3.8.

Section 3.3 Application. Amounts repaid or prepaid in respect of the Loans shall be applied as set forth in this Section 3.3.

(a) Subject to clause (b), each prepayment or repayment of the Loans shall be applied to the principal amount of the Loans then outstanding.

(b) Each prepayment of the Loans made pursuant to clauses (b), (c), (d) or (e) of Section 3.2 shall be applied in reverse order of the scheduled repayments set forth in clause (a) of Section 3.2.

Section 3.4 Interest Rate. During any applicable Interest Period, the Loans shall accrue interest during such Interest Period at a rate per annum equal to the sum of (i) the Applicable Margin plus (ii) the higher of (x) the LIBO Rate for such Interest Period and (y) 1.00%. The interest rate shall be recalculated and, if necessary, adjusted for each Interest Period, in each case pursuant to the terms hereof.

Section 3.5 Default Rate. At all times commencing upon the date any Event of Default occurs, and continuing until such Event of Default is no longer continuing, the Applicable Margin shall be increased by 4.00% per annum.

Section 3.6 Payment Dates. Interest accrued on any Loan shall be payable in cash, without duplication:

(a) on the Maturity Date therefor;

(b) on the date of any payment or prepayment, in whole or in part, of principal outstanding on such Loan on the principal amount so paid or prepaid;

(c) the last day of each Interest Period for such Loan; provided that if such day is not a Business Day, then such payment shall be made on the next succeeding Business Day; and

(d) on that portion of such Loan that is accelerated pursuant to Section 9.2 or Section 9.3, immediately upon such acceleration.

Interest accrued on any Loan or other monetary Obligations after the date such amount is due and payable (whether on the Maturity Date, upon acceleration or otherwise) shall be payable upon demand.

Section 3.7 Exit Fee. On the day when all Loans outstanding hereunder are paid in full, whether by voluntary or involuntary prepayment, scheduled amortization, acceleration, on the Maturity Date or otherwise, the Borrower will pay an exit fee equal to two percent (2%) multiplied by the sum of (i) the original principal amount of the Initial Loan and (ii) the original principal amount of the Delayed Draw Loan (if made); provided, however, that in the event that (x) the commitment for the Delayed Draw Loan has been permanently terminated and (y) all outstanding Loans have been repaid in full in cash prior to the first anniversary of the Closing Date, such exit fee shall not be payable.

Section 3.8 Other Fees and Expenses. The Borrower shall pay to the Lender all fees and expenses of the Lender as required hereby and by each other Loan Document.

Article IV

LIBO RATE AND OTHER PROVISIONS

Section 4.1 Increased Costs, Etc. If any Change in Law shall (i) impose, modify or deem applicable any reserve, special deposit, compulsory loan, insurance charge or similar requirement against assets of, deposits with or for the account of, or credit extended by, the Lender or any Person controlling the Lender (except any reserve requirement reflected in the LIBO Rate) or (ii) impose on the Lender or the London interbank market any other condition, cost or expense (other than Taxes) affecting this Agreement or Loans made by the Lender, and the result of any of the foregoing shall be to increase the cost to the Lender of making, converting to, continuing or maintaining any Loan or of maintaining its obligation to make any such Loan (whether of principal, interest or any other amount) then, upon written notice from the Lender, the Borrower shall within 30 days following receipt of such notice pay directly to the Lender such additional amount or amounts sufficient to compensate the Lender for such additional costs incurred or reduction suffered. A certificate of the Lender setting forth the amount or amounts necessary to compensate the Lender or a Person controlling the Lender, as the case may be, as specified in this Section 4.1 and delivered to the Borrower, shall be conclusive absent manifest error. Failure or delay on the part of the Lender to demand compensation pursuant to this Section 4.1 shall not constitute a waiver of the Lender’s right to demand such compensation; provided that the Borrower shall not be required to compensate the Lender pursuant to this Section 4.1 for any increased costs incurred or reductions suffered more than nine months prior to the date that the Lender notifies the Borrower of the Change in Law giving rise to such increased costs or reductions, and of the Lender’s intention to claim compensation therefor (except that, if the Change in Law giving rise to such increased costs or reductions is retroactive, then the nine-month period referred to above shall be extended to include the period of retroactive effect thereof).

Section 4.2 Increased Capital Costs. If any Change in Law affects or would affect the amount of capital required or expected to be maintained by the Lender or any Person controlling the Lender, and the Lender determines (in good faith but in its sole and absolute discretion) that the rate of return on its or such controlling Person’s capital as a consequence of the Commitment or any Loan made by it hereunder is reduced to a level below that which the Lender or such controlling Person could have achieved but for the occurrence of any such circumstance, then upon notice from time to time by the Lender to the Borrower, the Borrower shall within five days following receipt of such notice pay directly to the Lender additional amounts sufficient to compensate the Lender or such controlling Person for such reduction in rate of return. A statement of the Lender as to any such additional amount or amounts shall, in the absence of manifest error, be conclusive and binding on the Borrower. In determining such amount, the Lender may use any method of averaging and attribution that it (in its sole and absolute discretion) shall deem applicable.

Section 4.3 Taxes. The Borrower covenants and agrees as follows with respect to Taxes.

(a) Any and all payments by the Borrower under each Loan Document shall be made without setoff, counterclaim or other defense, and free and clear of, and without deduction or withholding for or on account of, any Taxes. In the event that any Taxes are imposed and required to be deducted or withheld from any payment required to be made by any Loan Party to or on behalf of the Lender under any Loan Document, then:

(i) if such Taxes are Non-Excluded Taxes, the amount of such payment shall be increased as may be necessary so that such payment is made, after withholding or deduction for or on account of such Taxes, in an amount that is not less than the amount provided for in such Loan Document; and

(ii) such Loan Party shall withhold the full amount of such Taxes from such payment (as increased pursuant to clause (a)(i) and shall pay such amount to the Governmental Authority imposing such Taxes in accordance with applicable law.

(b) In addition, the Borrower shall pay all Other Taxes imposed to the relevant Governmental Authority imposing such Other Taxes in accordance with applicable law.

(c) As promptly as practicable after the payment of any Taxes or Other Taxes, and in any event within 45 days of any such payment being due, the Borrower shall furnish to the Lender a copy of an official receipt (or a certified copy thereof) evidencing the payment of such Taxes or Other Taxes.

(d) The Borrower shall indemnify the Lender for any Non-Excluded Taxes and Other Taxes levied, imposed or assessed on (and whether or not paid directly by) the Lender whether or not such Non-Excluded Taxes or Other Taxes are correctly or legally asserted by the relevant Governmental Authority. Promptly upon having knowledge that any such Non-Excluded Taxes or Other Taxes have been levied, imposed or assessed, and promptly upon notice thereof by the Lender, the Borrower shall pay such Non-Excluded Taxes or Other Taxes directly to the relevant Governmental Authority (provided that, the Lender shall not be under any obligation to provide any such notice to the Borrower). In addition, the Borrower shall indemnify the Lender for any incremental Taxes that may become payable by the Lender as a result of any failure of the Borrower to pay any Taxes when due to the appropriate Governmental Authority or to deliver to the Lender, pursuant to clause (c), documentation evidencing the payment of Taxes or Other Taxes. With respect to indemnification for Non-Excluded Taxes and Other Taxes actually paid by the Lender or the indemnification provided in the immediately preceding sentence, such indemnification shall be made within 30 days after the date the Lender makes written demand therefor. The Borrower acknowledges that any payment made to the Lender or to any Governmental Authority in respect of the indemnification obligations of the Borrower provided in this clause shall constitute a payment in respect of which the provisions of clause (a) and this clause shall apply.

Section 4.4 Payments, Computations; Proceeds of Collateral, Etc.

(a) Unless otherwise expressly provided in a Loan Document, all payments by the Borrower pursuant to each Loan Document shall be made without setoff, deduction or counterclaim not later than 11:00 a.m. on the date due in same day or immediately available funds to such account as the Lender shall specify from time to time by notice to the Borrower. Funds received after that time shall be deemed to have been received by the Lender on the next succeeding Business Day. All interest and fees shall be computed on the basis of the actual number of days (including the first day but excluding the last day) occurring during the period for which such interest or fee is payable over a year comprised of 360 days. Payments due on other than a Business Day shall be made on the next succeeding Business Day and such extension of time shall be included in computing interest and fees in connection with that payment.